Base Year Value ()

CAGR ()

Forecast Year Value ()

Historical Data Period

Largest Region

Forecast Period

Mercado de pruebas metabólicas por producto (sistemas CPET, carros metabólicos, sistemas de ECG y EKG, analizadores de composición corporal, software), tecnología (análisis de VO2 Max, análisis de RMR, análisis de composición corporal), aplicación (enfermedades relacionadas con el estilo de vida, cuidados intensivos, pruebas de rendimiento humano, síndrome dismetabólico X, trastornos metabólicos), usuario final (hospitales, laboratorios, centros de entrenamiento deportivo, gimnasios) y por región Tendencias globales y pronóstico de 2023 a 2030

Instant access to hundreds of data points and trends

- Market estimates from 2014-2029

- Competitive analysis, industry segmentation, financial benchmarks

- Incorporates SWOT, Porter's Five Forces and risk management frameworks

- PDF report or online database with Word, Excel and PowerPoint export options

- 100% money back guarantee

Descripción general del mercado de pruebas metabólicas

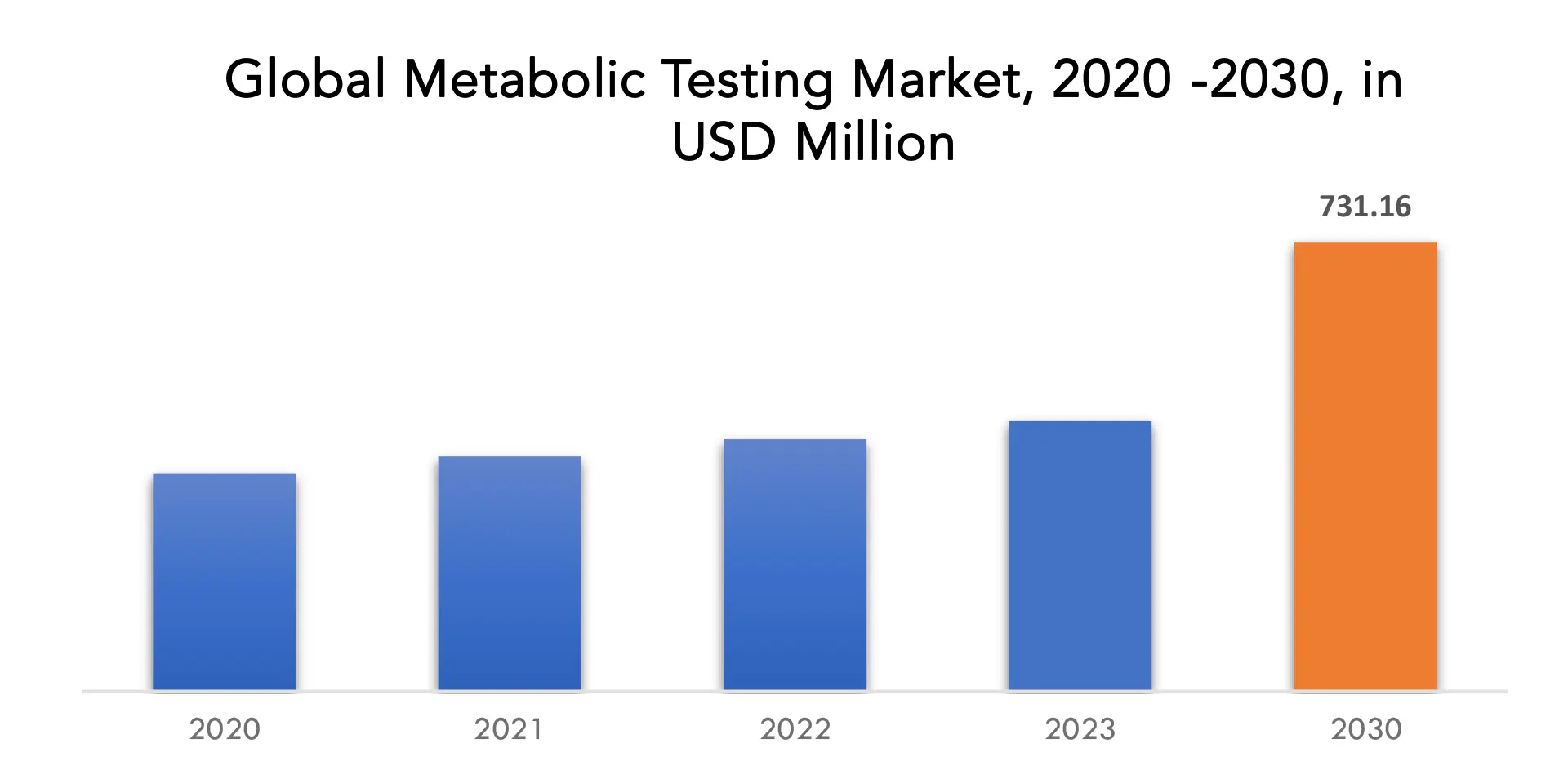

Se proyecta que el mercado mundial de pruebas metabólicas alcance los USD 731,16 millones para 2030 desde USD 440,71 millones en 2023, a una CAGR del 8,3 % entre 2023 y 2030.

El metabolismo es una reacción química y un proceso físico que implica mantener el estado de vida a través de actividades como la respiración, la circulación sanguínea, la contracción muscular, la digestión de alimentos y nutrientes, la eliminación de desechos como la orina, el control de la temperatura corporal y la función cerebral y nerviosa. Es una ruta de reacción química que comienza con una molécula específica y termina con un producto con la ayuda de una enzima específica . Las enzimas son esenciales para el metabolismo ya que permiten al organismo impulsar procesos para obtener energía. Se clasifica en dos tipos: catabolismo y anabolismo. Las pruebas metabólicas se utilizan para evaluar la salud y el bienestar de un individuo. Los equipos de pruebas metabólicas se utilizan para comprobar el funcionamiento de los órganos y trastornos como la enfermedad hepática, la diabetes , la enfermedad renal y la enfermedad cardiovascular . El metabolismo es una reacción química que se produce en el cuerpo para mantener el organismo o el cuerpo en condiciones normales. El síndrome metabólico es un conjunto de enfermedades metabólicas que incluyen presión arterial alta, niveles elevados de glucosa en ayunas y obesidad excesiva. Las pruebas metabólicas se utilizan para identificar el patrón metabólico y la capacidad metabólica con el fin de controlar estos trastornos. En el caso de los atletas, las pruebas metabólicas se utilizan para evaluar la capacidad del cuerpo para consumir oxígeno. [caption id="attachment_30430" align="aligncenter" width="1920"]

| ATRIBUTO | DETALLES |

| Periodo de estudio | 2020-2030 |

| Año base | 2022 |

| Año estimado | 2023 |

| Año pronosticado | 2023-2030 |

| Periodo histórico | 2019-2021 |

| Unidad | Valor (millones de USD) |

| Segmentación | Por producto, por tecnología, por aplicación, por usuarios finales, por región |

| Por producto |

|

| Por tecnología |

|

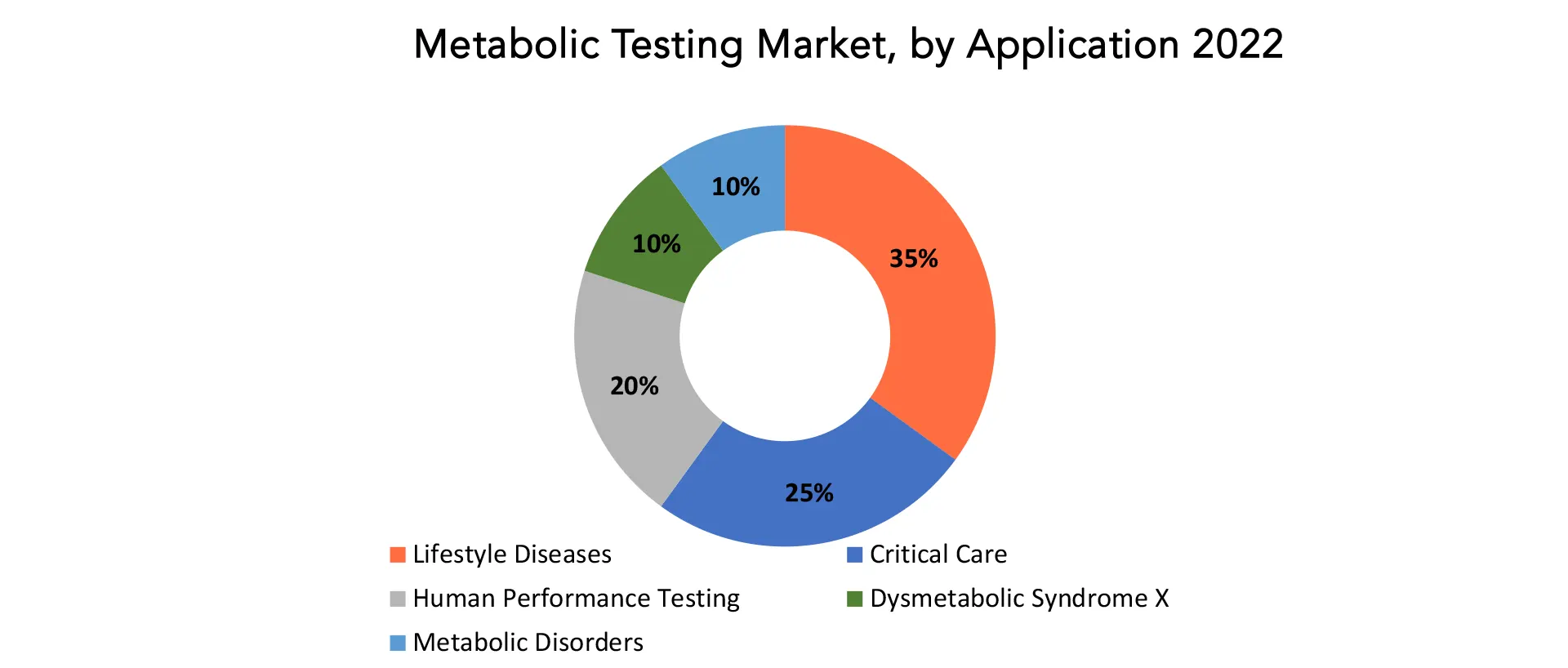

| Por aplicación |

|

| Por los usuarios finales |

|

| Por región |

|

Frequently Asked Questions

• What is the worth of the metabolic testing market?

The global metabolic testing market is projected to reach USD 731.16 million by 2030 from USD 440.71 million in 2023, at a CAGR of 8.3 % from 2023 to 2030.

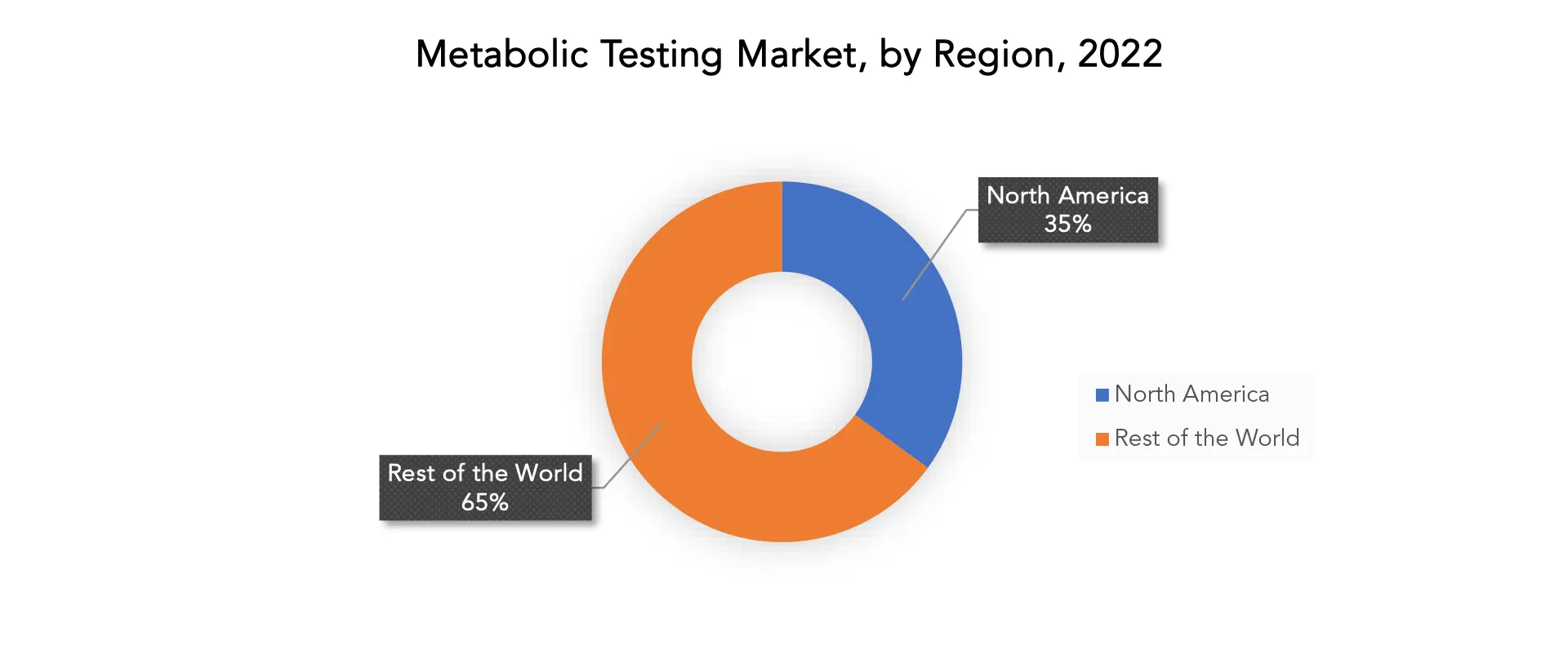

• What is the share of the North America metabolic testing market?

North America dominates the metabolic testing market, with a market share of over 35%.

• Which are the top companies to hold the market share in the metabolic testing market?

COSMED, KORR Medical Technologies, Microlife Medical Home Solutions, MGC Diagnostics, GE Healthcare, General Nutrition Centers, Inc. (GNC), Geratherm Medical AG, AEI Technologies, Inc., OSI Systems, Inc., Admera Health, Abbott, Vyaire Medical, Inc., Metabolon.

• What is the CAGR of metabolic testing market?

The global metabolic testing market registered a CAGR of 8.3 % from 2023 to 2030.

• What are the key factors driving the market?

The driving factor of the global metabolic testing market is growing sedentary lifestyle, healthcare expenditures, technological advancements and the prevalence of lifestyle associated diseases like cardiovascular disease, obesity, and diabetes.

Metabolic Testing Market Segment Analysis

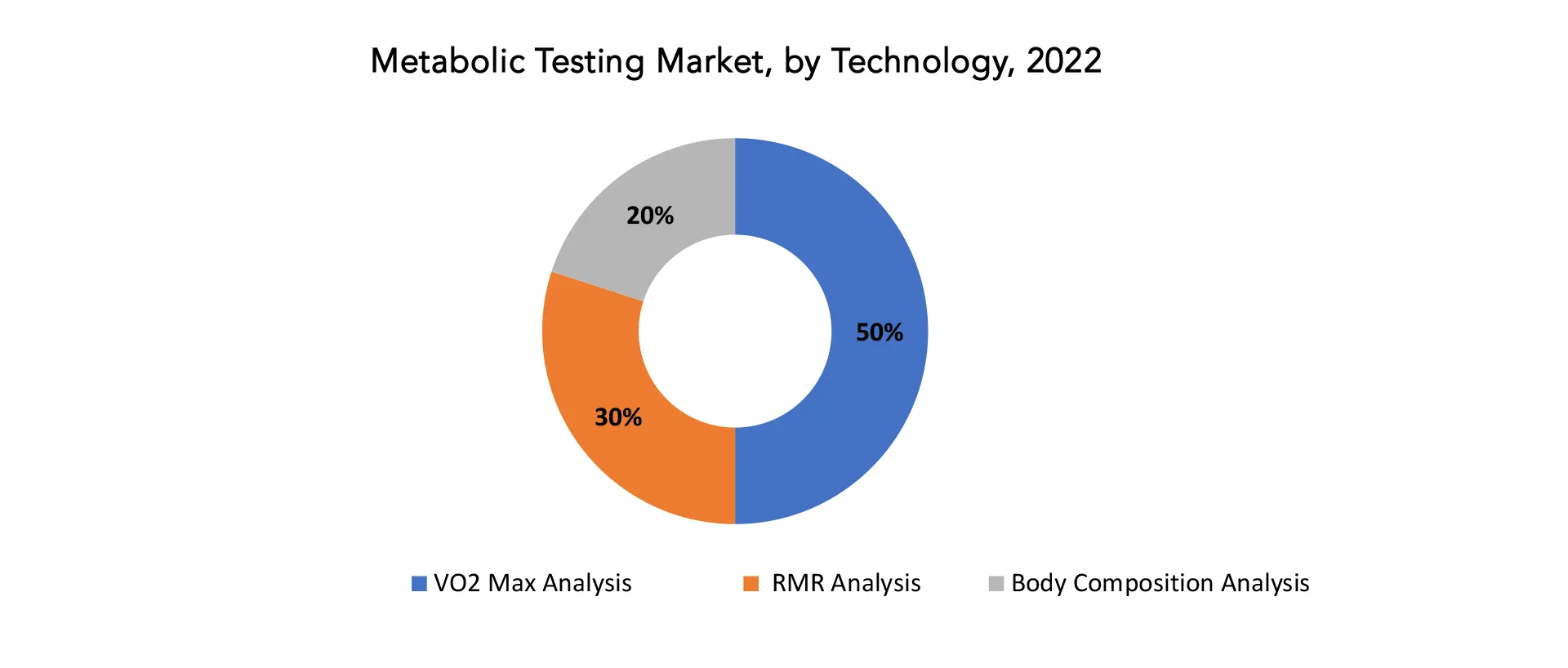

The global metabolic testing market is segmented by product, technology, application, end-user and region. Based on product, the metabolic testing market is segmented into CPET systems, metabolic carts, ECG and EKG systems, body composition analyzers, software. The ECG and EKG systems segment is anticipated to have a commanding position in the worldwide metabolic testing market throughout the projected period due to the rising prevalence of chronic illnesses. Rising healthcare costs linked to rising disposable income are accelerating the expansion of this market category. [caption id="attachment_30434" align="aligncenter" width="1920"]

Metabolic Testing Market Players

The global metabolic testing market key players include COSMED, KORR Medical Technologies, Microlife Medical Home Solutions, MGC Diagnostics, GE Healthcare, General Nutrition Centers, Inc. (GNC), Geratherm Medical AG, AEI Technologies, Inc., OSI Systems, Inc., Admera Health, Abbott, Vyaire Medical, Inc., Metabolon. Latest News: April 4, 2023: Metabolon, Inc., announced the launch of its Bile Acids and Short Chain Fatty Acids Targeted Panels that measure microbially-derived metabolites of biological significance to identify biomarkers for the prediction and early detection of disease areas, including oncology, neurology, liver, diabetes, and gastrointestinal, and gut health. April 29, 2023: At the request of the U.S. Food and Drug Administration (FDA), Abbott (NYSE: ABT) released limited quantities of metabolic nutrition formulas that were previously on hold following Abbott's recall of some powder infant formulas from its Sturgis, Mich., facility.Metabolic Testing Market Regional Analysis

The metabolic testing market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

Key Market Segments: Metabolic Testing Market

Metabolic Testing Market by Product 2020-2030, (USD Million)- CPET Systems

- Metabolic Carts

- ECG and EKG Systems

- Body Composition Analyzers

- Software

- VO2 Max Analysis

- RMR Analysis

- Body Composition Analysis

- Lifestyle Diseases

- Critical Care

- Human Performance Testing

- Dysmetabolic Syndrome X

- Metabolic Disorders

- Hospitals

- Laboratories

- Sports Training Centers

- Gyms

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Who Should Buy? Or Key stakeholders

- Healthcare Institutions

- Research Laboratories and Academic Institutions

- Pharmaceutical Companies

- Insurance Companies

- Medical Device Manufactures

- Home Healthcare Providers

- Government Healthcare Agencies

Key Question Answered

- What is the expected growth rate of the metabolic testing market over the next 7 years?

- Who are the major players in the metabolic testing market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the metabolic testing market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the metabolic testing market?

- What is the current and forecasted size and growth rate of the global metabolic testing market?

- What are the key drivers of growth in the metabolic testing market?

- What are the distribution channels and supply chain dynamics in the metabolic testing market?

- What are the technological advancements and innovations in the metabolic testing market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the metabolic testing market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the metabolic testing market?

- What are the service offerings and specifications of leading players in the market?

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

- INTRODUCCIÓN

- DEFINICIÓN DE MERCADO

- SEGMENTACIÓN DEL MERCADO

- CRONOGRAMAS DE INVESTIGACIÓN

- SUPUESTOS Y LIMITACIONES

- METODOLOGÍA DE LA INVESTIGACIÓN

- MINERÍA DE DATOS

- INVESTIGACIÓN SECUNDARIA

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- MINERÍA DE DATOS

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL METABOLIC TESTING MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON METABOLIC TESTING MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL METABOLIC TESTING MARKET OUTLOOK

- GLOBAL METABOLIC TESTING MARKET BY PRODUCT, 2020-2030, (USD MILLION)

- CPET SYSTEMS

- METABOLIC CARTS

- ECG AND EKG SYSTEMS

- BODY COMPOSITION ANALYZERS

- SOFTWARE

- GLOBAL METABOLIC TESTING MARKET BY TECHNOLOGY, 2020-2030, (USD MILLION)

- VO2 MAX ANALYSIS

- RMR ANALYSIS

- BODY COMPOSITION ANALYSIS

- GLOBAL METABOLIC TESTING MARKET BY APPLICATION, 2020-2030, (USD MILLION)

- LIFESTYLE DISEASES

- CRITICAL CARE

- HUMAN PERFORMANCE TESTING

- DYSMETABOLIC SYNDROME X

- METABOLIC DISORDERS

- GLOBAL METABOLIC TESTING MARKET BY END USER, 2020-2030, (USD MILLION)

- HOSPITALS

- LABORATORIES

- SPORTS TRAINING CENTERS

- GYMS

- GLOBAL METABOLIC TESTING MARKET BY REGION, 2020-2030, (USD MILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCT OFFERED, RECENT DEVELOPMENTS)

10.1. COSMED

10.2. KORR MEDICAL TECHNOLOGIES

10.3. MICROLIFE MEDICAL HOME SOLUTIONS

10.4. MGC DIAGNOSTICS

10.5. GE HEALTHCARE

10.6. GENERAL NUTRITION CENTERS, INC. (GNC)

10.7. GERATHERM MEDICAL AG

10.8. AEI TECHNOLOGIES, INC.

10.9. OSI SYSTEMS, INC.

10.10. ADMERA HEALTH

10.11. ABBOTT

10.12. VYAIRE MEDICAL, INC.

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL METABOLIC TESTING MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 2 GLOBAL METABOLIC TESTING MARKET BY TECHNOLOGY (USD MILLION) 2020-2030

TABLE 3 GLOBAL METABOLIC TESTING MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 4 GLOBAL METABOLIC TESTING MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 5 GLOBAL METABOLIC TESTING MARKET BY REGION (USD MILLION) 2020-2030

TABLE 6 NORTH AMERICA METABOLIC TESTING MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 7 NORTH AMERICA METABOLIC TESTING MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 8 NORTH AMERICA METABOLIC TESTING MARKET BY TECHNOLOGY (USD MILLION) 2020-2030

TABLE 9 NORTH AMERICA METABOLIC TESTING MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 10 NORTH AMERICA METABOLIC TESTING MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 11 US METABOLIC TESTING MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 12 US METABOLIC TESTING MARKET BY TECHNOLOGY (USD MILLION) 2020-2030

TABLE 13 US METABOLIC TESTING MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 14 US METABOLIC TESTING MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 15 CANADA METABOLIC TESTING MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 16 CANADA METABOLIC TESTING MARKET BY TECHNOLOGY (USD MILLION) 2020-2030

TABLE 17 CANADA METABOLIC TESTING MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 18 CANADA METABOLIC TESTING MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 19 MEXICO METABOLIC TESTING MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 20 MEXICO METABOLIC TESTING MARKET BY TECHNOLOGY (USD MILLION) 2020-2030

TABLE 21 MEXICO METABOLIC TESTING MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 22 MEXICO METABOLIC TESTING MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 23 SOUTH AMERICA METABOLIC TESTING MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 24 SOUTH AMERICA METABOLIC TESTING MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 25 SOUTH AMERICA METABOLIC TESTING MARKET BY TECHNOLOGY (USD MILLION) 2020-2030

TABLE 26 SOUTH AMERICA METABOLIC TESTING MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 27 SOUTH AMERICA METABOLIC TESTING MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 28 BRAZIL METABOLIC TESTING MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 29 BRAZIL METABOLIC TESTING MARKET BY TECHNOLOGY (USD MILLION) 2020-2030

TABLE 30 BRAZIL METABOLIC TESTING MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 31 BRAZIL METABOLIC TESTING MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 32 ARGENTINA METABOLIC TESTING MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 33 ARGENTINA METABOLIC TESTING MARKET BY TECHNOLOGY (USD MILLION) 2020-2030

TABLE 34 ARGENTINA METABOLIC TESTING MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 35 ARGENTINA METABOLIC TESTING MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 36 COLOMBIA METABOLIC TESTING MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 37 COLOMBIA METABOLIC TESTING MARKET BY TECHNOLOGY (USD MILLION) 2020-2030

TABLE 38 COLOMBIA METABOLIC TESTING MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 39 COLOMBIA METABOLIC TESTING MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 40 REST OF SOUTH AMERICA METABOLIC TESTING MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 41 REST OF SOUTH AMERICA METABOLIC TESTING MARKET BY TECHNOLOGY (USD MILLION) 2020-2030

TABLE 42 REST OF SOUTH AMERICA METABOLIC TESTING MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 43 REST OF SOUTH AMERICA METABOLIC TESTING MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 44 ASIA-PACIFIC METABOLIC TESTING MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 45 ASIA-PACIFIC METABOLIC TESTING MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 46 ASIA-PACIFIC METABOLIC TESTING MARKET BY TECHNOLOGY (USD MILLION) 2020-2030

TABLE 47 ASIA-PACIFIC METABOLIC TESTING MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 48 ASIA-PACIFIC METABOLIC TESTING MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 49 INDIA METABOLIC TESTING MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 50 INDIA METABOLIC TESTING MARKET BY TECHNOLOGY (USD MILLION) 2020-2030

TABLE 51 INDIA METABOLIC TESTING MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 52 INDIA METABOLIC TESTING MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 53 CHINA METABOLIC TESTING MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 54 CHINA METABOLIC TESTING MARKET BY TECHNOLOGY (USD MILLION) 2020-2030

TABLE 55 CHINA METABOLIC TESTING MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 56 CHINA METABOLIC TESTING MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 57 JAPAN METABOLIC TESTING MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 58 JAPAN METABOLIC TESTING MARKET BY TECHNOLOGY (USD MILLION) 2020-2030

TABLE 59 JAPAN METABOLIC TESTING MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 60 JAPAN METABOLIC TESTING MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 61 SOUTH KOREA METABOLIC TESTING MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 62 SOUTH KOREA METABOLIC TESTING MARKET BY TECHNOLOGY (USD MILLION) 2020-2030

TABLE 63 SOUTH KOREA METABOLIC TESTING MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 64 SOUTH KOREA METABOLIC TESTING MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 65 AUSTRALIA METABOLIC TESTING MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 66 AUSTRALIA METABOLIC TESTING MARKET BY TECHNOLOGY (USD MILLION) 2020-2030

TABLE 67 AUSTRALIA METABOLIC TESTING MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 68 AUSTRALIA METABOLIC TESTING MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 69 SOUTH-EAST ASIA METABOLIC TESTING MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 70 SOUTH-EAST ASIA METABOLIC TESTING MARKET BY TECHNOLOGY (USD MILLION) 2020-2030

TABLE 71 SOUTH-EAST ASIA METABOLIC TESTING MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 72 SOUTH-EAST ASIA METABOLIC TESTING MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 73 REST OF ASIA PACIFIC METABOLIC TESTING MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 74 REST OF ASIA PACIFIC METABOLIC TESTING MARKET BY TECHNOLOGY (USD MILLION) 2020-2030

TABLE 75 REST OF ASIA PACIFIC METABOLIC TESTING MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 76 REST OF ASIA PACIFIC METABOLIC TESTING MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 77 EUROPE METABOLIC TESTING MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 78 EUROPE METABOLIC TESTING MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 79 EUROPE METABOLIC TESTING MARKET BY TECHNOLOGY (USD MILLION) 2020-2030

TABLE 80 EUROPE METABOLIC TESTING MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 81 EUROPE METABOLIC TESTING MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 82 GERMANY METABOLIC TESTING MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 83 GERMANY METABOLIC TESTING MARKET BY TECHNOLOGY (USD MILLION) 2020-2030

TABLE 84 GERMANY METABOLIC TESTING MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 85 GERMANY METABOLIC TESTING MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 86 UK METABOLIC TESTING MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 87 UK METABOLIC TESTING MARKET BY TECHNOLOGY (USD MILLION) 2020-2030

TABLE 88 UK METABOLIC TESTING MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 89 UK METABOLIC TESTING MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 90 FRANCE METABOLIC TESTING MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 91 FRANCE METABOLIC TESTING MARKET BY TECHNOLOGY (USD MILLION) 2020-2030

TABLE 92 FRANCE METABOLIC TESTING MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 93 FRANCE METABOLIC TESTING MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 94 ITALY METABOLIC TESTING MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 95 ITALY METABOLIC TESTING MARKET BY TECHNOLOGY (USD MILLION) 2020-2030

TABLE 96 ITALY METABOLIC TESTING MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 97 ITALY METABOLIC TESTING MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 98 SPAIN METABOLIC TESTING MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 99 SPAIN METABOLIC TESTING MARKET BY TECHNOLOGY (USD MILLION) 2020-2030

TABLE 100 SPAIN METABOLIC TESTING MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 101 SPAIN METABOLIC TESTING MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 102 RUSSIA METABOLIC TESTING MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 103 RUSSIA METABOLIC TESTING MARKET BY TECHNOLOGY (USD MILLION) 2020-2030

TABLE 104 RUSSIA METABOLIC TESTING MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 105 RUSSIA METABOLIC TESTING MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 106 REST OF EUROPE METABOLIC TESTING MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 107 REST OF EUROPE METABOLIC TESTING MARKET BY TECHNOLOGY (USD MILLION) 2020-2030

TABLE 108 REST OF EUROPE METABOLIC TESTING MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 109 REST OF EUROPE METABOLIC TESTING MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 110 MIDDLE EAST AND AFRICA METABOLIC TESTING MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 111 MIDDLE EAST AND AFRICA METABOLIC TESTING MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 112 MIDDLE EAST AND AFRICA METABOLIC TESTING MARKET BY TECHNOLOGY (USD MILLION) 2020-2030

TABLE 113 MIDDLE EAST AND AFRICA METABOLIC TESTING MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 114 MIDDLE EAST AND AFRICA METABOLIC TESTING MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 115 UAE METABOLIC TESTING MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 116 UAE METABOLIC TESTING MARKET BY TECHNOLOGY (USD MILLION) 2020-2030

TABLE 117 UAE METABOLIC TESTING MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 118 UAE METABOLIC TESTING MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 119 SAUDI ARABIA METABOLIC TESTING MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 120 SAUDI ARABIA METABOLIC TESTING MARKET BY TECHNOLOGY (USD MILLION) 2020-2030

TABLE 121 SAUDI ARABIA METABOLIC TESTING MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 122 SAUDI ARABIA METABOLIC TESTING MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 123 SOUTH AFRICA METABOLIC TESTING MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 124 SOUTH AFRICA METABOLIC TESTING MARKET BY TECHNOLOGY (USD MILLION) 2020-2030

TABLE 125 SOUTH AFRICA METABOLIC TESTING MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 126 SOUTH AFRICA METABOLIC TESTING MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 127 REST OF MIDDLE EAST AND AFRICA METABOLIC TESTING MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 128 REST OF MIDDLE EAST AND AFRICA METABOLIC TESTING MARKET BY TECHNOLOGY (USD MILLION) 2020-2030

TABLE 129 REST OF MIDDLE EAST AND AFRICA METABOLIC TESTING MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 130 REST OF MIDDLE EAST AND AFRICA METABOLIC TESTING MARKET BY END-USER (USD MILLION) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL METABOLIC TESTING MARKET BY PRODUCT (USD MILLION) 2020-2030

FIGURE 9 GLOBAL METABOLIC TESTING MARKET BY TECHNOLOGY (USD MILLION) 2020-2030

FIGURE 10 GLOBAL METABOLIC TESTING MARKET BY APPLICATION (USD MILLION) 2020-2030

FIGURE 11 GLOBAL METABOLIC TESTING MARKET BY END-USER (USD MILLION) 2020-2030

FIGURE 12 GLOBAL METABOLIC TESTING MARKET BY REGION (USD MILLION) 2020-2030

FIGURE 13 PORTER’S FIVE FORCES MODEL

FIGURE 14 GLOBAL METABOLIC TESTING MARKET BY PRODUCT (USD MILLION) 2022

FIGURE 15 GLOBAL METABOLIC TESTING MARKET BY TECHNOLOGY (USD MILLION) 2022

FIGURE 16 GLOBAL METABOLIC TESTING MARKET BY APPLICATION (USD MILLION) 2022

FIGURE 17 GLOBAL METABOLIC TESTING MARKET BY END-USER (USD MILLION) 2022

FIGURE 18 GLOBAL METABOLIC TESTING MARKET BY REGION (USD MILLION) 2022

FIGURE 19 MARKET SHARE ANALYSIS

FIGURE 20 COSMED: COMPANY SNAPSHOT

FIGURE 21 KORR MEDICAL TECHNOLOGIES: COMPANY SNAPSHOT

FIGURE 22 MICROLIFE MEDICAL HOME SOLUTIONS: COMPANY SNAPSHOT

FIGURE 23 MGC DIAGNOSTICS: COMPANY SNAPSHOT

FIGURE 24 GE HEALTHCARE: COMPANY SNAPSHOT

FIGURE 25 GENERAL NUTRITION CENTERS, INC. (GNC): COMPANY SNAPSHOT

FIGURE 26 GERATHERM MEDICAL AG: COMPANY SNAPSHOT

FIGURE 27 AEI TECHNOLOGIES, INC.: COMPANY SNAPSHOT

FIGURE 28 OSI SYSTEMS, INC.: COMPANY SNAPSHOT

FIGURE 29 ADMERA HEALTH: COMPANY SNAPSHOT

FIGURE 30 ABBOTT: COMPANY SNAPSHOT

FIGURE 31 VYAIRE MEDICAL, INC.: COMPANY SNAPSHOT

DOWNLOAD FREE SAMPLE REPORT

License Type

SPEAK WITH OUR ANALYST

Want to know more about the report or any specific requirement?

WANT TO CUSTOMIZE THE REPORT?

Our Clients Speak

We asked them to research ‘ Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te

Yosuke Mitsui

Senior Associate Construction Equipment Sales & Marketing

We asked them to research ‘Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te