Base Year Value ()

CAGR ()

Forecast Year Value ()

Historical Data Period

Largest Region

Forecast Period

Mercado de etiquetado de ácidos nucleicos por producto (reactivo, kits, servicios), por técnica (PCR, traducción de mellas, cebador aleatorio, transcripción in vitro, transcripción inversa, etiquetado final), por aplicación (secuenciación de ADN, reacción en cadena de la polimerasa, hibridación in situ con fluorescencia (FISH), microarrays, transferencia, hibridación in situ, otros) y región, tendencias globales y pronóstico de 2023 a 2030.

Instant access to hundreds of data points and trends

- Market estimates from 2014-2029

- Competitive analysis, industry segmentation, financial benchmarks

- Incorporates SWOT, Porter's Five Forces and risk management frameworks

- PDF report or online database with Word, Excel and PowerPoint export options

- 100% money back guarantee

Descripción general del mercado de etiquetado de ácidos nucleicos

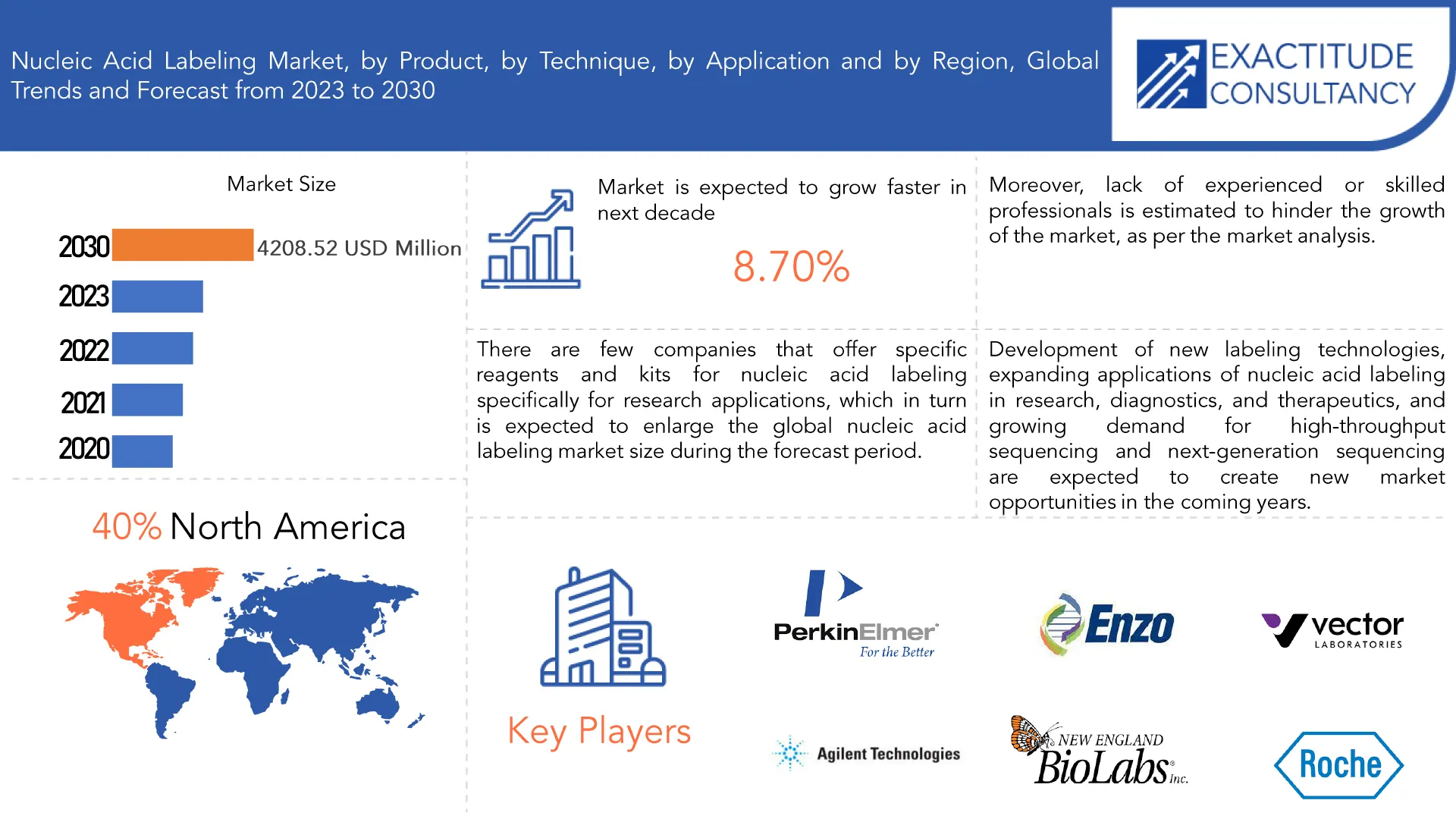

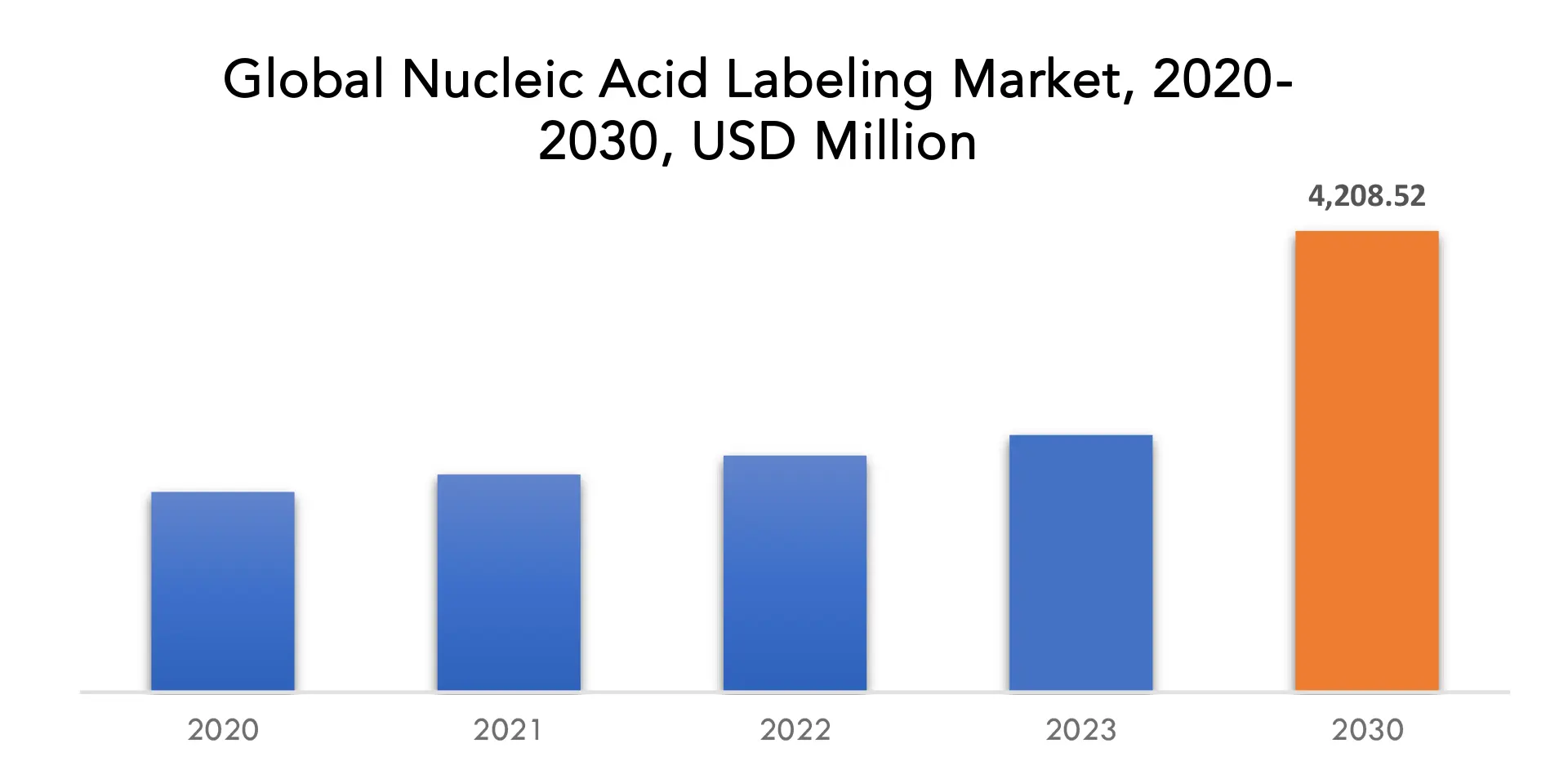

Se espera que el mercado de etiquetado de ácidos nucleicos crezca a una tasa de crecimiento anual compuesta (CAGR) del 8,70 % entre 2023 y 2030. Se espera que alcance más de 4208,52 millones de dólares en 2030, frente a los 2347,05 millones de dólares en 2023. Numerosos estudios sugieren estudiar su dinámica y sus funciones in vitro, y se requiere el etiquetado de ácidos nucleicos para las células. Se añadirán etiquetas que permitan detectar o purificar ácidos nucleicos durante la transformación. Las sondas de ácidos nucleicos generadas se aplicarán para identificar o recuperar moléculas interactuantes adicionales. Los fosfatos calientes, la biotina, los fluoróforos y las enzimas son materiales comunes que se utilizan para fabricar sondas de supermoléculas. Para mejorar la administración o inmovilización dirigidas, las técnicas de bioconjugación para la producción de sondas de supermoléculas podrían modificarse para incorporar ácidos nucleicos en otras moléculas o superficies. [caption id="attachment_30654" align="aligncenter" width="1920"]

| ATRIBUTO | DETALLES |

| Periodo de estudio | 2020-2030 |

| Año base | 2022 |

| Año estimado | 2023 |

| Año pronosticado | 2023-2030 |

| Periodo histórico | 2019-2021 |

| Unidad | Valor (USD Millones). |

| Segmentación | Por producto, por técnica, por aplicación, por región. |

| Por producto |

|

| Por técnica |

|

| Por aplicación |

|

| By Region |

|

Frequently Asked Questions

• What is the worth of nucleic acid labeling market?

The nucleic acid labeling market is expected to grow at 8.70 % CAGR from 2023 to 2030. It is expected to reach above USD 4208.52 million by 2030 from USD 2347.05 million in 2023.

• What is the size of the North America nucleic acid labeling industry?

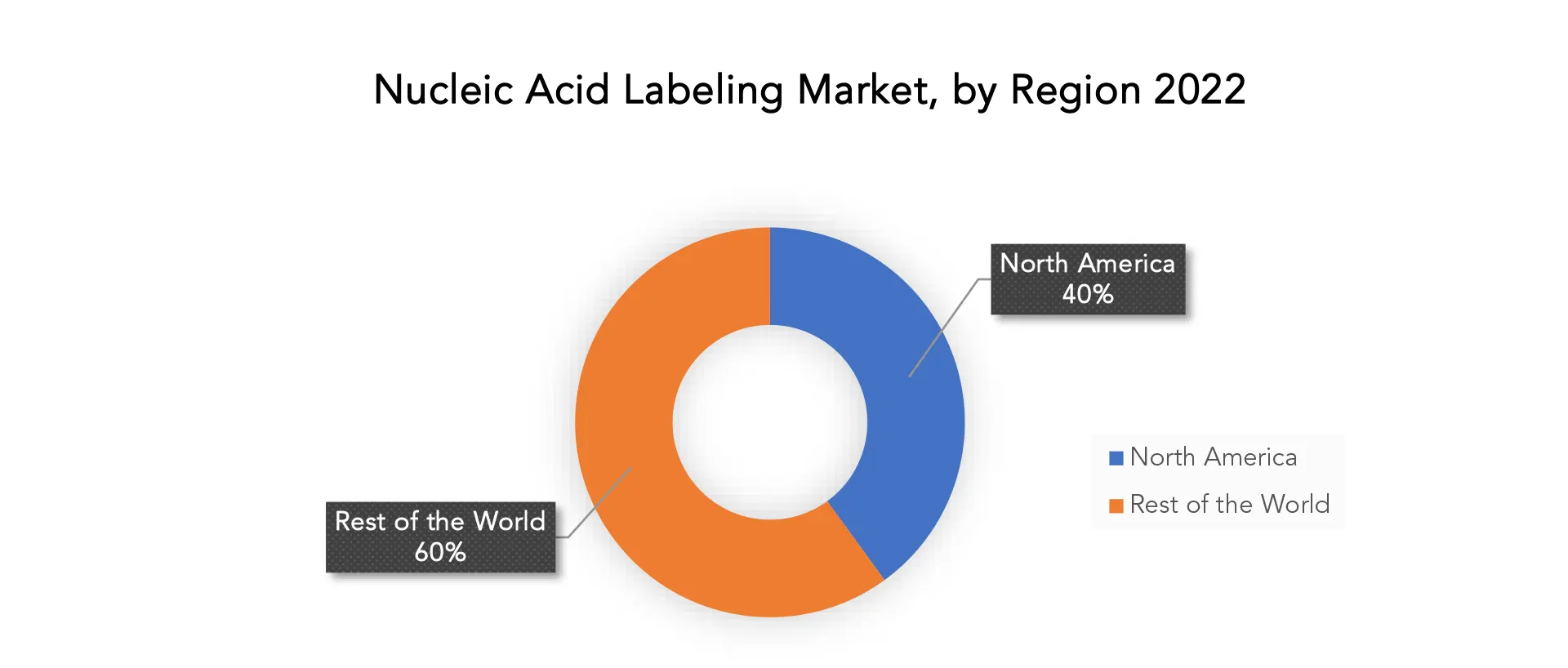

North America held more than 40 % of the nucleic acid labeling market revenue share in 2022 and will witness expansion in the forecast period.

• What are some of the market's driving forces?

The development of technologies for designing synthetic genomes and the rise in genomic and enzymology research are the main factors driving the global nucleic acid labelling market. The market is expanding as a result of people's growing health consciousness about healthcare issues. Additionally, the market is expanding as a result of expanding government programmes and expenditures on molecular biology R&D.

• Which are the top companies to hold the market share in nucleic acid labeling market?

The nucleic acid labeling market key players includes PerkinElmer, Inc., Enzo Biochem Inc, Vector Laboratories, Inc., F. Hoffmann LA-Roche AG, New England Biolabs, Cytiva, Promega Corporation, Thermo Fisher Scientific Inc., Agilent Technologies, Inc., Merck KGaA.

• What is the leading application of nucleic acid labeling market?

For the projection period, the In Situ Hybridization segment is anticipated to see the greatest CAGR. The causes driving the segment's expansion are linked to the expanding use of ISH techniques for diagnosing genetic diseases include Cri-du-chat, 22q13 deletion syndrome, Angelman syndrome, and chronic myelogenous leukaemia.

• Which is the largest regional market for nucleic acid labeling market?

With a 40 percent share of the market in 2022, North America led the way and is expected to do so throughout the anticipated period. important factors influencing the growth of the regional market include the presence of an established healthcare infrastructure, favourable reimbursement scenarios, and high accessibility to novel diagnostic technologies due to of the significant presence of important market participants in the region.

Nucleic Acid Labeling Market Segment Analysis

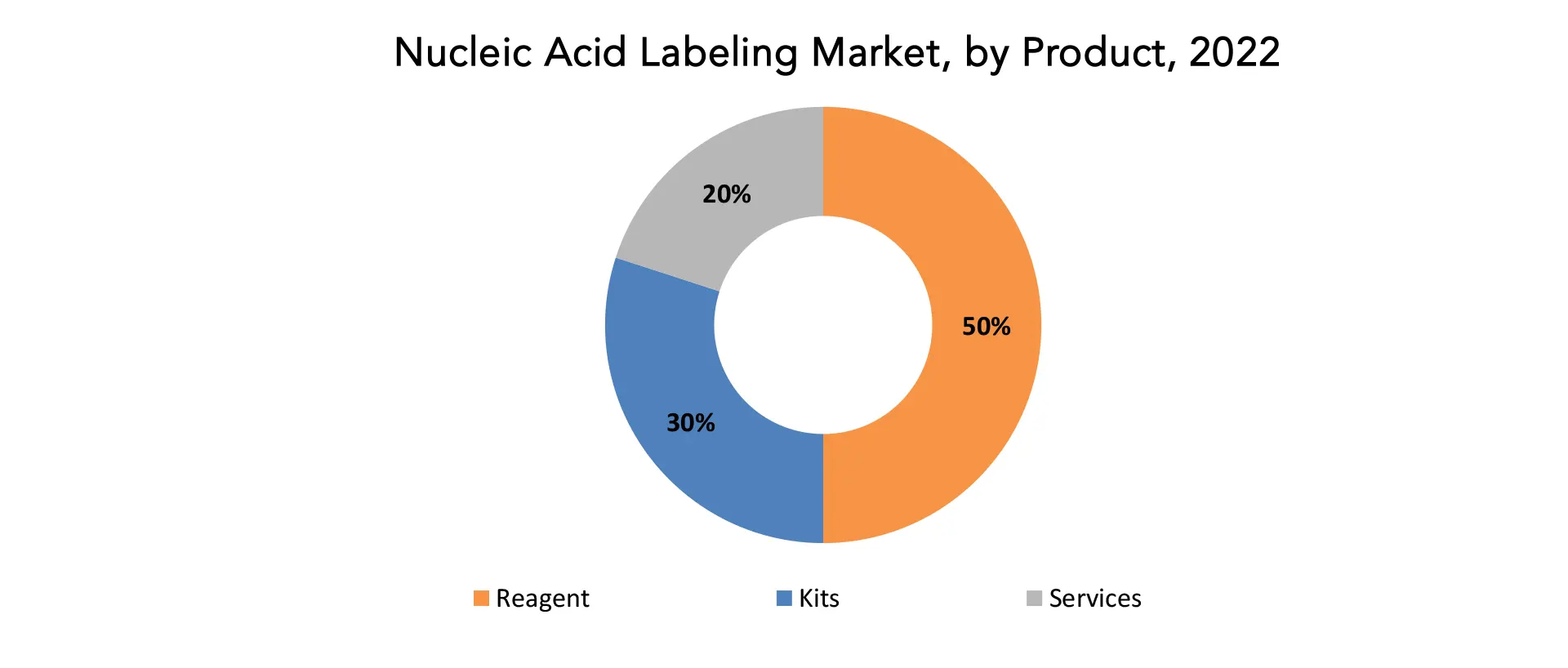

The nucleic acid labeling market is segmented based on product, technique and application. Reagents, kits, and services make up the market's three product segments. The market segment for reagents is anticipated to see the greatest CAGR during the forecast period. The variables that contribute to the segment's expansion include those that are related to the regular use of these items in labelling protocols, as well as ongoing research and development efforts to increase the protocol's effectiveness. [caption id="attachment_30663" align="aligncenter" width="1920"]

Nucleic Acid Labeling Market Player

The nucleic acid labeling market key players includes PerkinElmer, Inc., Enzo Biochem Inc, Vector Laboratories, Inc., F. Hoffmann LA-Roche AG, New England Biolabs, Cytiva, Promega Corporation, Thermo Fisher Scientific Inc., Agilent Technologies, Inc., Merck KGaA. 26 April 2023: Agilent Technologies Inc. (NYSE: A) announced the recent signing of a Memorandum of Understanding (MOU) with Theragen Bio in South Korea to boost precision oncology through advancing bioinformatic (BI) solutions. 14 December 2022: Fluid Management Systems (FMS), a leader in automated sample preparation systems, announced a co-marketing agreement with Agilent Technologies to create and market workflows for the testing and analysis of persistent organic pollutants (POPs).Who Should Buy? Or Key Stakeholders

- Nucleic acid labeling manufacturers

- Nucleic acid labeling suppliers

- Nucleic acid labeling distributors

- Organizations

- Government bodies

- Others

Nucleic Acid Labeling Market Regional Analysis

The nucleic acid labeling market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

Key Market Segments: Nucleic Acid Labeling Market

Nucleic Acid Labeling Market By Product, 2020-2030, (USD Million).- Reagent

- Kits

- Services

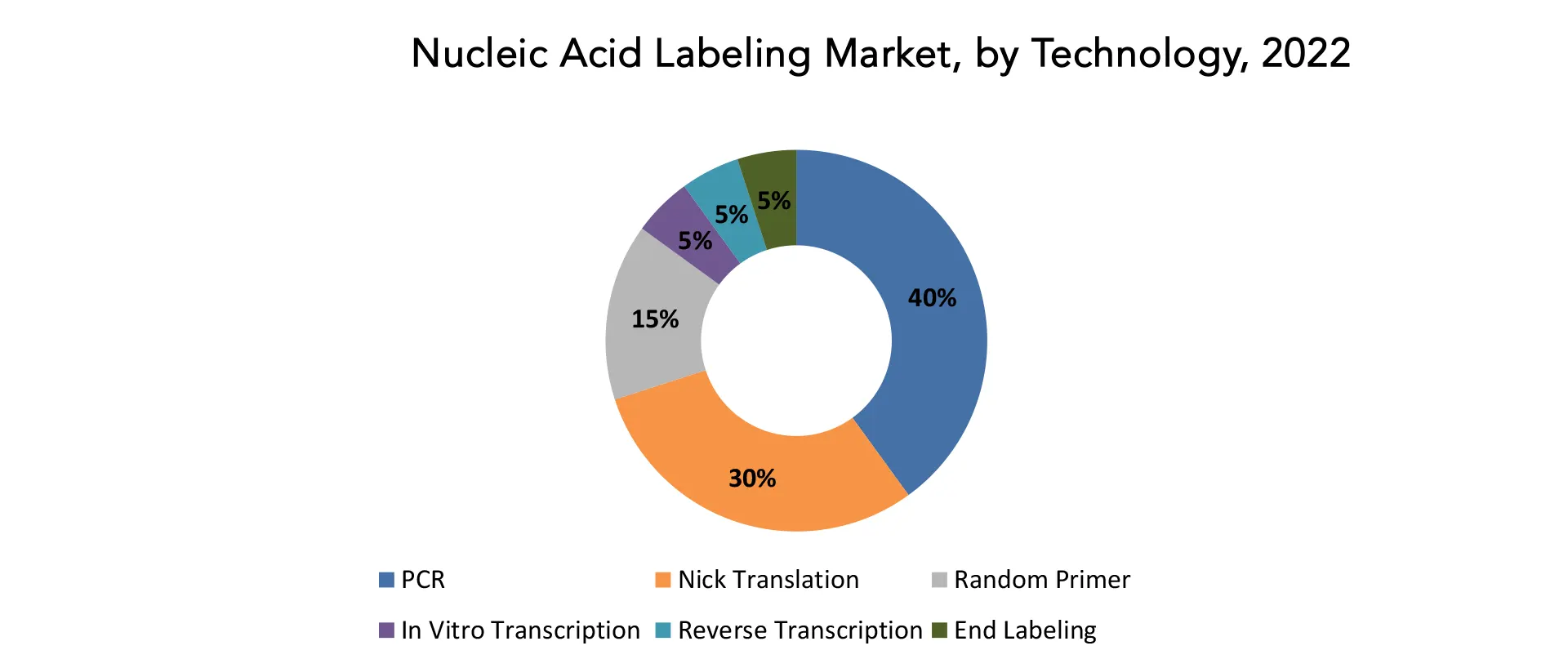

- PCR

- Nick Translation

- Random Primer

- In Vitro Transcription

- Reverse Transcription

- End Labeling

- DNA Sequencing

- Polymerase Chain Reaction

- Fluorescence In Situ Hybridization (FISH)

- Microarrays

- Blotting

- In Situ Hybridization

- Others

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the nucleic acid labeling market over the next 7 years?

- Who are the major players in the nucleic acid labeling market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such As Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the nucleic acid labeling market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the nucleic acid labeling market?

- What is the current and forecasted size and growth rate of the global nucleic acid labeling market?

- What are the key drivers of growth in the nucleic acid labeling market?

- What are the distribution channels and supply chain dynamics in the nucleic acid labeling market?

- What are the technological advancements and innovations in the nucleic acid labeling market and their impact on material development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the nucleic acid labeling market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the nucleic acid labeling market?

- What are the service offerings and specifications of leading players in the market?

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL NUCLEIC ACID LABELING MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON NUCLEIC ACID LABELING MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL NUCLEIC ACID LABELING MARKET OUTLOOK

- GLOBAL NUCLEIC ACID LABELING MARKET BY PRODUCT (USD MILLION), 2020-2030

- REAGENT

- KITS

- SERVICES

- GLOBAL NUCLEIC ACID LABELING MARKET BY TECHNIQUE (USD MILLION),2020-2030

- PCR

- NICK TRANSLATION

- RANDOM PRIMER

- IN VITRO TRANSCRIPTION

- REVERSE TRANSCRIPTION

- END LABELING

- GLOBAL NUCLEIC ACID LABELING MARKET BY APPLICATION (USD MILLION),2020-2030

- DNA SEQUENCING

- POLYMERASE CHAIN REACTION

- FLUORESCENCE IN SITU HYBRIDIZATION (FISH)

- MICROARRAYS

- BLOTTING

- IN SITU HYBRIDIZATION

- OTHERS

- GLOBAL NUCLEIC ACID LABELING MARKET BY REGION (USD MILLION),2020-2030

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- PERKINELMER, INC.

- ENZO BIOCHEM INC

- VECTOR LABORATORIES, INC.

- HOFFMANN LA-ROCHE AG

- NEW ENGLAND BIOLABS

- CYTIVA

- PROMEGA CORPORATION

- THERMO FISHER SCIENTIFIC INC.

- AGILENT TECHNOLOGIES, INC.

- MERCK KGAA

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL NUCLEIC ACID LABELING MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 2 GLOBAL NUCLEIC ACID LABELING MARKET BY TECHNIQUE (USD MILLION) 2020-2030

TABLE 3 GLOBAL NUCLEIC ACID LABELING MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 4 GLOBAL NUCLEIC ACID LABELING MARKET BY REGION (USD MILLION) 2020-2030

TABLE 5 NORTH AMERICA NUCLEIC ACID LABELING MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 6 NORTH AMERICA NUCLEIC ACID LABELING MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 7 NORTH AMERICA NUCLEIC ACID LABELING MARKET BY TECHNIQUE (USD MILLION) 2020-2030

TABLE 8 NORTH AMERICA NUCLEIC ACID LABELING MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 9 US NUCLEIC ACID LABELING MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 10 US NUCLEIC ACID LABELING MARKET BY TECHNIQUE (USD MILLION) 2020-2030

TABLE 11 US NUCLEIC ACID LABELING MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 12 CANADA NUCLEIC ACID LABELING MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 13 CANADA NUCLEIC ACID LABELING MARKET BY TECHNIQUE (USD MILLION) 2020-2030

TABLE 14 CANADA NUCLEIC ACID LABELING MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 15 MEXICO NUCLEIC ACID LABELING MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 16 MEXICO NUCLEIC ACID LABELING MARKET BY TECHNIQUE (USD MILLION) 2020-2030

TABLE 17 MEXICO NUCLEIC ACID LABELING MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 18 SOUTH AMERICA NUCLEIC ACID LABELING MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 19 SOUTH AMERICA NUCLEIC ACID LABELING MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 20 SOUTH AMERICA NUCLEIC ACID LABELING MARKET BY TECHNIQUE (USD MILLION) 2020-2030

TABLE 21 SOUTH AMERICA NUCLEIC ACID LABELING MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 22 BRAZIL NUCLEIC ACID LABELING MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 23 BRAZIL NUCLEIC ACID LABELING MARKET BY TECHNIQUE (USD MILLION) 2020-2030

TABLE 24 BRAZIL NUCLEIC ACID LABELING MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 25 ARGENTINA NUCLEIC ACID LABELING MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 26 ARGENTINA NUCLEIC ACID LABELING MARKET BY TECHNIQUE (USD MILLION) 2020-2030

TABLE 27 ARGENTINA NUCLEIC ACID LABELING MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 28 COLOMBIA NUCLEIC ACID LABELING MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 29 COLOMBIA NUCLEIC ACID LABELING MARKET BY TECHNIQUE (USD MILLION) 2020-2030

TABLE 30 COLOMBIA NUCLEIC ACID LABELING MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 31 REST OF SOUTH AMERICA NUCLEIC ACID LABELING MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 32 REST OF SOUTH AMERICA NUCLEIC ACID LABELING MARKET BY TECHNIQUE (USD MILLION) 2020-2030

TABLE 33 REST OF SOUTH AMERICA NUCLEIC ACID LABELING MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 34 ASIA-PACIFIC NUCLEIC ACID LABELING MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 35 ASIA-PACIFIC NUCLEIC ACID LABELING MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 36 ASIA-PACIFIC NUCLEIC ACID LABELING MARKET BY TECHNIQUE (USD MILLION) 2020-2030

TABLE 37 ASIA-PACIFIC NUCLEIC ACID LABELING MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 38 INDIA NUCLEIC ACID LABELING MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 39 INDIA NUCLEIC ACID LABELING MARKET BY TECHNIQUE (USD MILLION) 2020-2030

TABLE 40 INDIA NUCLEIC ACID LABELING MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 41 CHINA NUCLEIC ACID LABELING MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 42 CHINA NUCLEIC ACID LABELING MARKET BY TECHNIQUE (USD MILLION) 2020-2030

TABLE 43 CHINA NUCLEIC ACID LABELING MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 44 JAPAN NUCLEIC ACID LABELING MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 45 JAPAN NUCLEIC ACID LABELING MARKET BY TECHNIQUE (USD MILLION) 2020-2030

TABLE 46 JAPAN NUCLEIC ACID LABELING MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 47 SOUTH KOREA NUCLEIC ACID LABELING MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 48 SOUTH KOREA NUCLEIC ACID LABELING MARKET BY TECHNIQUE (USD MILLION) 2020-2030

TABLE 49 SOUTH KOREA NUCLEIC ACID LABELING MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 50 AUSTRALIA NUCLEIC ACID LABELING MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 51 AUSTRALIA NUCLEIC ACID LABELING MARKET BY TECHNIQUE (USD MILLION) 2020-2030

TABLE 52 AUSTRALIA NUCLEIC ACID LABELING MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 53 SOUTH-EAST ASIA NUCLEIC ACID LABELING MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 54 SOUTH-EAST ASIA NUCLEIC ACID LABELING MARKET BY TECHNIQUE (USD MILLION) 2020-2030

TABLE 55 SOUTH-EAST ASIA NUCLEIC ACID LABELING MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 56 REST OF ASIA PACIFIC NUCLEIC ACID LABELING MARKET BY PRODUCT (USD MILLION) 2020-2030

TABLE 57 REST OF ASIA PACIFIC NUCLEIC ACID LABELING MARKET BY TECHNIQUE (USD MILLION) 2020-2030

TABLE 58 REST OF ASIA PACIFIC NUCLEIC ACID LABELING MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 59 EUROPE NUCLEIC ACID LABELING MARKET BY PRODUCT (USD MILLION), 2020-2030

TABLE 60 EUROPE NUCLEIC ACID LABELING MARKET BY TECHNIQUE (USD MILLION), 2020-2030

TABLE 61 EUROPE NUCLEIC ACID LABELING MARKET BY APPLICATION (USD MILLION), 2020-2030

TABLE 62 EUROPE NUCLEIC ACID LABELING MARKET BY COUNTRY (USD MILLION), 2020-2030

TABLE 63 GERMANY NUCLEIC ACID LABELING MARKET BY PRODUCT (USD MILLION), 2020-2030

TABLE 64 GERMANY NUCLEIC ACID LABELING MARKET BY TECHNIQUE (USD MILLION), 2020-2030

TABLE 65 GERMANY NUCLEIC ACID LABELING MARKET BY APPLICATION (USD MILLION), 2020-2030

TABLE 66 UK NUCLEIC ACID LABELING MARKET BY PRODUCT (USD MILLION), 2020-2030

TABLE 67 UK NUCLEIC ACID LABELING MARKET BY TECHNIQUE (USD MILLION), 2020-2030

TABLE 68 UK NUCLEIC ACID LABELING MARKET BY APPLICATION (USD MILLION), 2020-2030

TABLE 69 FRANCE NUCLEIC ACID LABELING MARKET BY PRODUCT (USD MILLION), 2020-2030

TABLE 70 FRANCE NUCLEIC ACID LABELING MARKET BY TECHNIQUE (USD MILLION), 2020-2030

TABLE 71 FRANCE NUCLEIC ACID LABELING MARKET BY APPLICATION (USD MILLION), 2020-2030

TABLE 72 ITALY NUCLEIC ACID LABELING MARKET BY PRODUCT (USD MILLION), 2020-2030

TABLE 73 ITALY NUCLEIC ACID LABELING MARKET BY TECHNIQUE (USD MILLION), 2020-2030

TABLE 74 ITALY NUCLEIC ACID LABELING MARKET BY APPLICATION (USD MILLION), 2020-2030

TABLE 75 SPAIN NUCLEIC ACID LABELING MARKET BY PRODUCT (USD MILLION), 2020-2030

TABLE 76 SPAIN NUCLEIC ACID LABELING MARKET BY TECHNIQUE (USD MILLION), 2020-2030

TABLE 77 SPAIN NUCLEIC ACID LABELING MARKET BY APPLICATION (USD MILLION), 2020-2030

TABLE 78 RUSSIA NUCLEIC ACID LABELING MARKET BY PRODUCT (USD MILLION), 2020-2030

TABLE 79 RUSSIA NUCLEIC ACID LABELING MARKET BY TECHNIQUE (USD MILLION), 2020-2030

TABLE 80 RUSSIA NUCLEIC ACID LABELING MARKET BY APPLICATION (USD MILLION), 2020-2030

TABLE 81 REST OF EUROPE NUCLEIC ACID LABELING MARKET BY PRODUCT (USD MILLION), 2020-2030

TABLE 82 REST OF EUROPE NUCLEIC ACID LABELING MARKET BY TECHNIQUE (USD MILLION), 2020-2030

TABLE 83 REST OF EUROPE NUCLEIC ACID LABELING MARKET BY APPLICATION (USD MILLION), 2020-2030

TABLE 84 MIDDLE EAST AND AFRICA NUCLEIC ACID LABELING MARKET BY PRODUCT (USD MILLION), 2020-2030

TABLE 85 MIDDLE EAST AND AFRICA NUCLEIC ACID LABELING MARKET BY TECHNIQUE (USD MILLION), 2020-2030

TABLE 86 MIDDLE EAST AND AFRICA NUCLEIC ACID LABELING MARKET BY APPLICATION (USD MILLION), 2020-2030

TABLE 87 MIDDLE EAST AND AFRICA NUCLEIC ACID LABELING MARKET BY COUNTRY (USD MILLION), 2020-2030

TABLE 88 UAE NUCLEIC ACID LABELING MARKET BY PRODUCT (USD MILLION), 2020-2030

TABLE 89 UAE NUCLEIC ACID LABELING MARKET BY TECHNIQUE (USD MILLION), 2020-2030

TABLE 90 UAE NUCLEIC ACID LABELING MARKET BY APPLICATION (USD MILLION), 2020-2030

TABLE 91 SAUDI ARABIA NUCLEIC ACID LABELING MARKET BY PRODUCT (USD MILLION), 2020-2030

TABLE 92 SAUDI ARABIA NUCLEIC ACID LABELING MARKET BY TECHNIQUE (USD MILLION), 2020-2030

TABLE 93 SAUDI ARABIA NUCLEIC ACID LABELING MARKET BY APPLICATION (USD MILLION), 2020-2030

TABLE 94 SOUTH AFRICA NUCLEIC ACID LABELING MARKET BY PRODUCT (USD MILLION), 2020-2030

TABLE 95 SOUTH AFRICA NUCLEIC ACID LABELING MARKET BY TECHNIQUE (USD MILLION), 2020-2030

TABLE 96 SOUTH AFRICA NUCLEIC ACID LABELING MARKET BY APPLICATION (USD MILLION), 2020-2030

TABLE 97 REST OF MIDDLE EAST AND AFRICA NUCLEIC ACID LABELING MARKET BY PRODUCT (USD MILLION), 2020-2030

TABLE 98 REST OF MIDDLE EAST AND AFRICA NUCLEIC ACID LABELING MARKET BY TECHNIQUE (USD MILLION), 2020-2030

TABLE 99 REST OF MIDDLE EAST AND AFRICA NUCLEIC ACID LABELING MARKET BY APPLICATION (USD MILLION), 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL NUCLEIC ACID LABELING MARKET BY PRODUCT, USD MILLION, 2020-2030

FIGURE 9 GLOBAL NUCLEIC ACID LABELING MARKET BY TECHNIQUE, USD MILLION, 2020-2030

FIGURE 10 GLOBAL NUCLEIC ACID LABELING MARKET BY APPLICATION, USD MILLION, 2020-2030

FIGURE 11 GLOBAL NUCLEIC ACID LABELING MARKET BY REGION, USD MILLION, 2020-2030

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL NUCLEIC ACID LABELING MARKET BY PRODUCT, USD MILLION, 2022

FIGURE 14 GLOBAL NUCLEIC ACID LABELING MARKET BY TECHNIQUE, USD MILLION, 2022

FIGURE 15 GLOBAL NUCLEIC ACID LABELING MARKET BY APPLICATION, USD MILLION, 2022

FIGURE 16 GLOBAL NUCLEIC ACID LABELING MARKET BY REGION 2022

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 PERKINELMER, INC.: COMPANY SNAPSHOT

FIGURE 19 ENZO BIOCHEM INC.: COMPANY SNAPSHOT

FIGURE 20 VECTOR LABORATORIES, INC.: COMPANY SNAPSHOT

FIGURE 21 F. HOFFMANN LA-ROCHE AG: COMPANY SNAPSHOT

FIGURE 22 NEW ENGLAND BIOLABS: COMPANY SNAPSHOT

FIGURE 23 CYTIVA: COMPANY SNAPSHOT

FIGURE 24 PROMEGA CORPORATION: COMPANY SNAPSHOT

FIGURE 25 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT

FIGURE 26 AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT

FIGURE 27 MERCK KGAA: COMPANY SNAPSHOT

DOWNLOAD FREE SAMPLE REPORT

License Type

SPEAK WITH OUR ANALYST

Want to know more about the report or any specific requirement?

WANT TO CUSTOMIZE THE REPORT?

Our Clients Speak

We asked them to research ‘ Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te

Yosuke Mitsui

Senior Associate Construction Equipment Sales & Marketing

We asked them to research ‘Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te