Base Year Value ()

CAGR ()

Forecast Year Value ()

Historical Data Period

Largest Region

Forecast Period

Mercado de resina de etileno-acetato de vinilo (EVA) por tipo (EVA de baja densidad, EVA de densidad media, EVA de alta densidad), aplicación (espuma, extrusión de películas, encapsulación de células solares, moldeo por inyección, revestimientos, alambres y cables, otros) y región, tendencias globales y pronóstico de 2023 a 2030

Instant access to hundreds of data points and trends

- Market estimates from 2014-2029

- Competitive analysis, industry segmentation, financial benchmarks

- Incorporates SWOT, Porter's Five Forces and risk management frameworks

- PDF report or online database with Word, Excel and PowerPoint export options

- 100% money back guarantee

Descripción general del mercado de resina de etileno-acetato de vinilo (EVA)

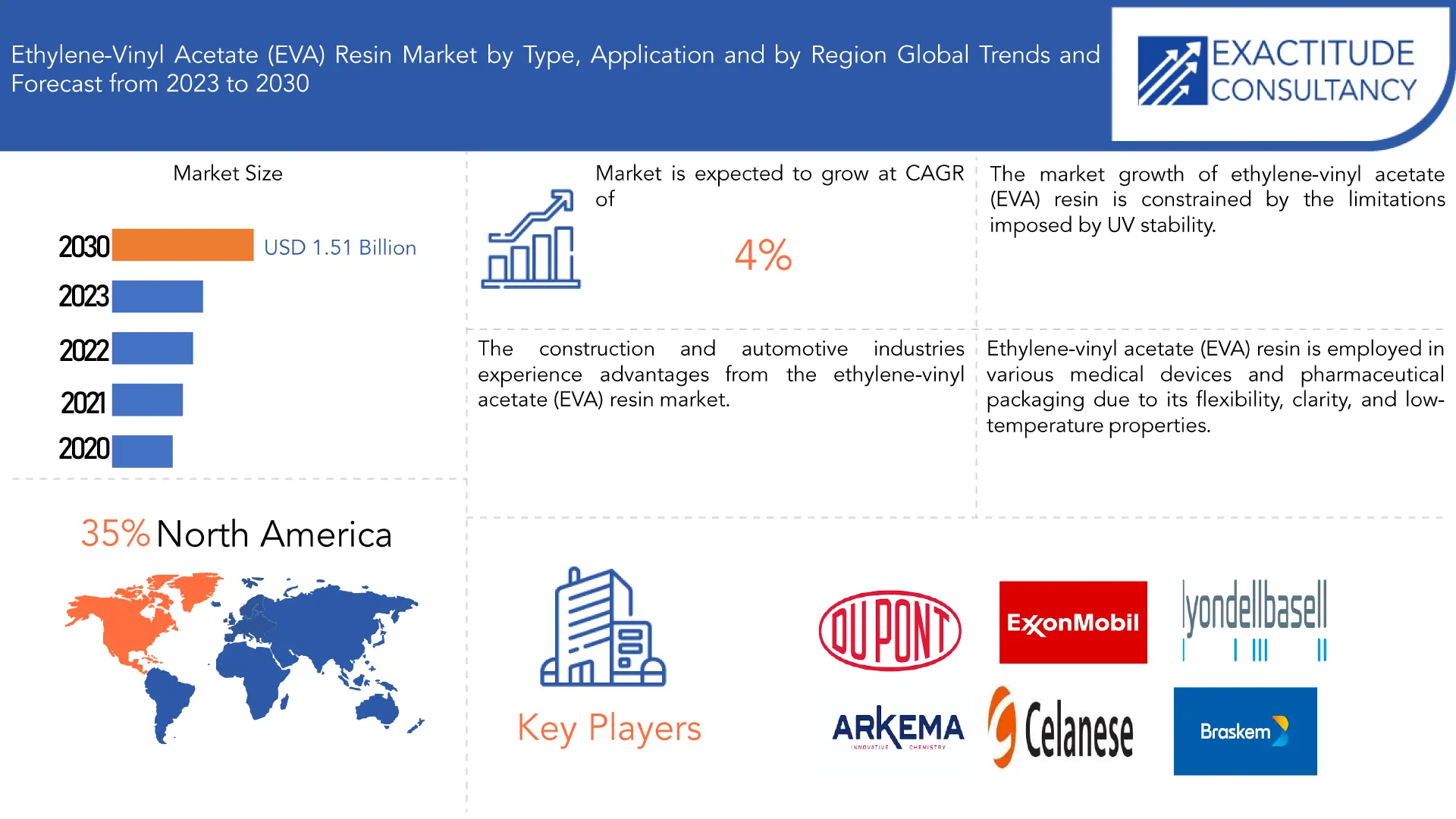

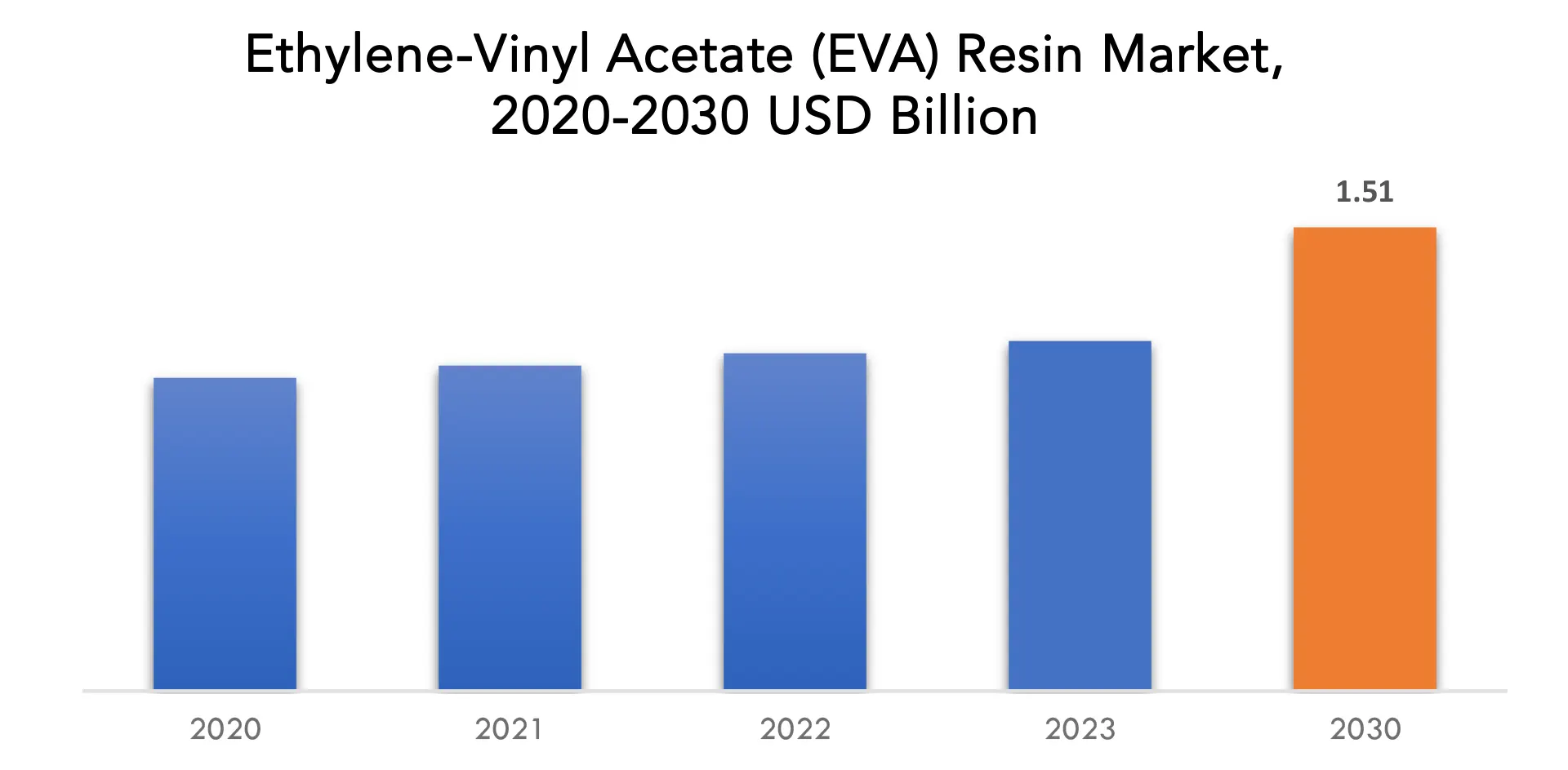

Se prevé que el mercado mundial de resina de etileno-acetato de vinilo (EVA) crezca de 1.100 millones de dólares en 2022 a 1.510 millones de dólares en 2030, a una CAGR del 4% durante el período de pronóstico.

La resina de etileno-acetato de vinilo (EVA) es un copolímero versátil y ampliamente utilizado que combina las propiedades del etileno y el acetato de vinilo. Este material termoplástico es famoso por su flexibilidad, durabilidad y elasticidad similar al caucho, lo que lo convierte en una opción ideal para diversas aplicaciones en todas las industrias. Una de las características clave de la resina EVA es su excelente resistencia al impacto, que proporciona a los productos la capacidad de absorber golpes y soportar tensiones sin comprometer la integridad estructural. Esta propiedad hace que el EVA sea particularmente valioso en la producción de calzado, donde se usa comúnmente en suelas de zapatos para mejorar la comodidad y el rendimiento. La resina EVA cuenta con buena transparencia y resistencia a los rayos UV, lo que la hace adecuada para aplicaciones al aire libre. Su facilidad de procesamiento y compatibilidad con otros polímeros contribuyen aún más a su popularidad en los procesos de fabricación. La industria del embalaje se beneficia de la versatilidad de la resina EVA, ya que se puede utilizar en la producción de películas, láminas y materiales de espuma. La espuma EVA, en particular, se utiliza ampliamente en el sector deportivo y de ocio para equipos de protección, colchonetas y acolchados debido a su naturaleza ligera y sus propiedades de amortiguación. El equilibrio de propiedades mecánicas, rentabilidad y adaptabilidad de la resina EVA la convierten en un material valioso en la creación de diversos productos, que van desde bienes de consumo hasta componentes industriales. [caption id="attachment_34790" align="aligncenter" width="1920"]

| ATRIBUTO | DETALLES |

| Periodo de estudio | 2020-2030 |

| Año base | 2022 |

| Año estimado | 2023 |

| Año pronosticado | 2023-2030 |

| Periodo histórico | 2019-2021 |

| Unidad | Valor (miles de millones de USD) (kilotones) |

| Segmentación | Por tipo, aplicación y región |

| Por tipo |

|

| Por aplicación |

|

| Por región |

|

Frequently Asked Questions

What is the market size for the ethylene-vinyl acetate (EVA) resin market?

The global ethylene-vinyl acetate (EVA) resin market is anticipated to grow from USD 1.1 Billion in 2022 to USD 1.51 Billion by 2030, at a CAGR of 4% during the forecast period.

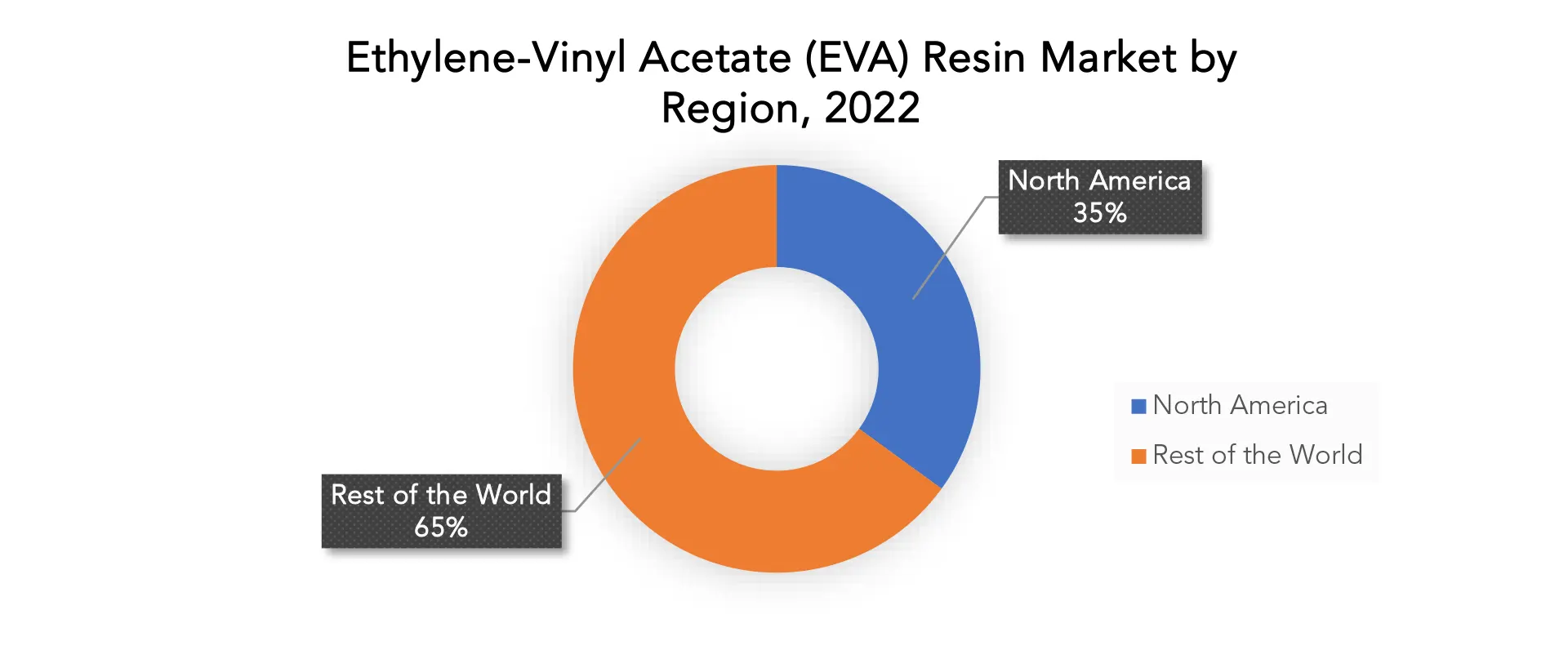

Which region is dominating in the ethylene-vinyl acetate (EVA) resin market?

North America accounted for the largest market in the Biogas purification system market. North America accounted for the 35% percent market share of the global biogas purification system market value.

Who are the major key players in the ethylene-vinyl acetate (EVA) resin market?

DuPont, ExxonMobil Corporation, LyondellBasell Industries, Braskem, Hanwha Total Petrochemical Co., Ltd., Sinopec Corporation, Versalis S.p.A., LG Chem, Formosa Plastics Corporation, USI Corporation, Celanese Corporation, Sumitomo Chemical Co., Ltd., Arkema, SABIC, Tosoh Corporation, Westlake Chemical Corporation, Mitsui Chemicals, Inc., Borealis AG, Evonik Industries, Nova Chemicals Corporation are some of the major key players of the market.

What are the opportunities in the ethylene-vinyl acetate (EVA) resin market?

Ethylene-vinyl acetate (EVA) resin presents diverse opportunities across industries. In the footwear sector, EVA's lightweight and cushioning properties make it ideal for comfortable and durable shoe soles. In packaging, its flexibility and low-temperature toughness enhance film and sheet applications. The solar energy industry benefits from EVA as a key component in photovoltaic encapsulant films, ensuring long-term solar panel durability. EVA's use extends to medical devices, where it serves in drug delivery systems and as a biocompatible material. With its versatility, resilience, and cost-effectiveness, EVA resin continues to evolve, offering innovative solutions in manufacturing, construction, and emerging technological applications.

Ethylene-vinyl Acetate (EVA) Resin Market Segmentation Analysis:

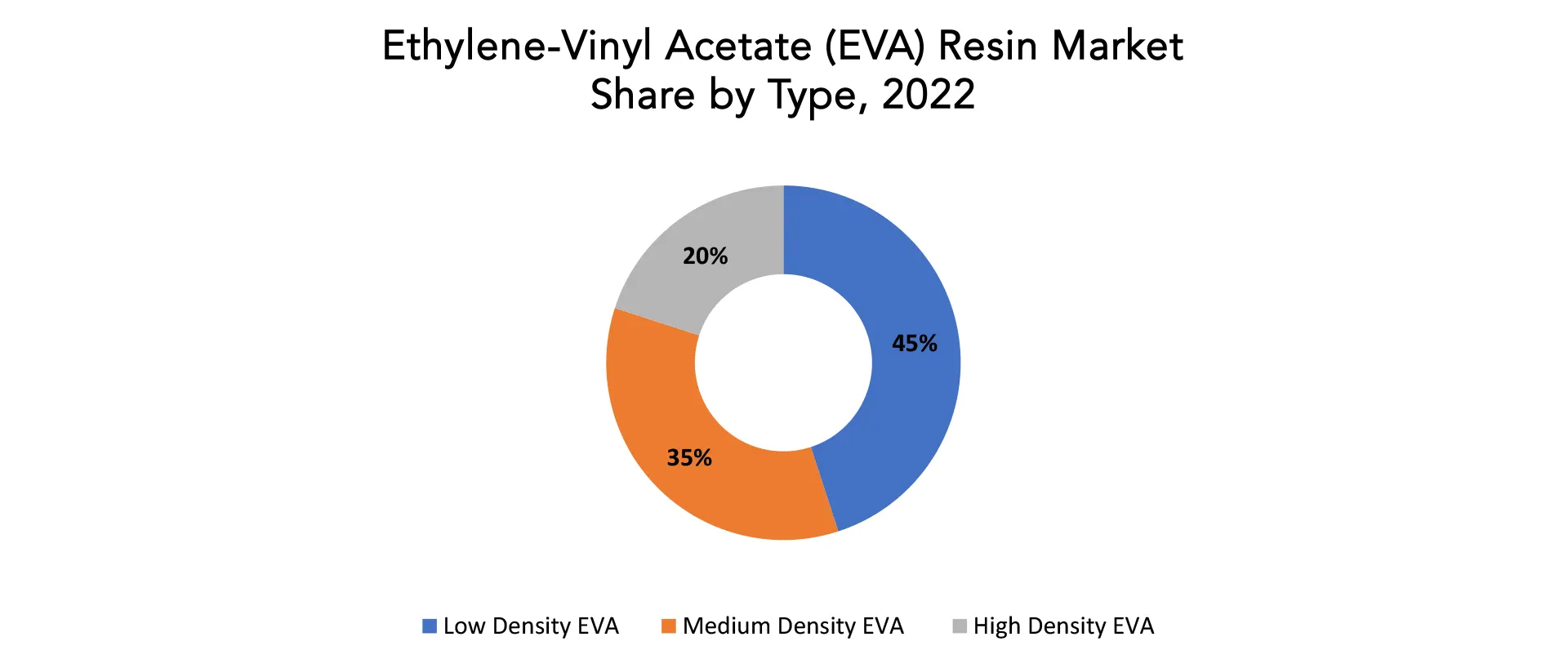

Due to the special set of qualities, low-density ethylene-vinyl acetate (EVA) resin is a widely used and adaptable polymer with applications in many different industries. The low-density version of ethylene-vinyl acetate (EVA) copolymer has clear benefits in terms of flexibility, impact resistance, and thermal stability. One of the key characteristics of low-density EVA resin is its excellent flexibility. The polymer's ethylene content contributes to its ability to bend and stretch, making it ideal for applications where flexibility is crucial. This characteristic is particularly valuable in the manufacturing of flexible packaging materials, such as films and pouches, where the material needs to conform to the shape of the contents. The thermal stability of low-density EVA resin is another noteworthy aspect. The polymer maintains its mechanical properties across a wide range of temperatures, making it suitable for applications in diverse climates. This characteristic is particularly advantageous in the production of outdoor and weather-resistant products, such as agricultural films, where exposure to varying environmental conditions is common. Low-density EVA resin possesses good adhesion properties, allowing it to bond well with various substrates. This makes it an excellent choice for use in adhesive formulations. The adhesion strength is particularly beneficial in industries such as packaging, where adhesives play a crucial role in ensuring the integrity of laminated structures and composite materials. The electrical insulation properties of low-density EVA resin make it suitable for use in wire and cable insulation. The polymer's dielectric strength and resistance to electrical conductivity contribute to its effectiveness in insulating cables, protecting them from external environmental factors and ensuring the safe transmission of electrical signals. [caption id="attachment_34815" align="aligncenter" width="1920"]

Ethylene-vinyl Acetate (EVA) Resin Market Trends

- EVA is commonly used in the packaging industry due to its excellent clarity, flexibility, and low-temperature toughness. The increasing demand for flexible packaging materials, especially in the food and pharmaceutical sectors, was driving the demand for EVA resins.

- EVA is widely used in the production of foams for footwear and construction materials. The construction industry's growth and the popularity of comfortable and lightweight footwear were contributing to the demand for EVA in these applications.

- EVA is used in the encapsulation of photovoltaic solar cells, providing protection against environmental factors while maintaining transparency. The growth of the solar energy industry was positively influencing the EVA resin market.

- Ongoing research and development activities were focused on enhancing the properties of EVA resins, such as improved durability, UV resistance, and thermal stability. Technological advancements were aimed at expanding the range of applications for EVA.

- Increasing awareness of environmental issues and the demand for sustainable materials were impacting the EVA resin market. Some manufacturers were exploring and adopting environmentally friendly production processes and incorporating recycled content into EVA formulations.

- The EVA resin market was witnessing some degree of consolidation, with companies engaging in mergers, acquisitions, and strategic partnerships to strengthen their market presence and expand their product portfolios.

Competitive Landscape

The competitive landscape of the ethylene-vinyl acetate (EVA) resin market is diverse and includes various players, from multinational corporations to artisanal and specialty brands.- DuPont

- ExxonMobil Corporation

- LyondellBasell Industries

- Braskem

- Hanwha Total Petrochemical Co., Ltd.

- Sinopec Corporation

- Versalis S.p.A.

- LG Chem

- Formosa Plastics Corporation

- USI Corporation

- Celanese Corporation

- Sumitomo Chemical Co., Ltd.

- Arkema

- SABIC

- Tosoh Corporation

- Westlake Chemical Corporation

- Mitsui Chemicals, Inc.

- Borealis AG

- Evonik Industries

- Nova Chemicals Corporation

- On 1st December 2021, Celanse Corporation, a chemical and specialty material company, acquired the Santoprene TPV elastomers business of Exxon Mobil Corporation to strengthen its portfolio.

- On December 7th 2021, Exxon Mobil Corporation acquired Materia Inc., a structural polymer company that offers a range of products for wind turbine blades, electric vehicle parts, sustainable construction and anti-corrosive coatings.

Regional Analysis

The North American ethylene-vinyl acetate (EVA) resin market has experienced significant growth and evolution in recent years, driven by a myriad of factors such as increasing demand from end-use industries, technological advancements, and sustainability considerations. EVA resin, a copolymer of ethylene and vinyl acetate, finds extensive applications in industries ranging from packaging and automotive to footwear and solar encapsulation. One of the key drivers contributing to the growth of the North American EVA resin market is the escalating demand for flexible packaging materials. EVA resins are widely used in the production of flexible films and sheets due to their excellent flexibility, clarity, and sealing properties. The packaging industry, including food packaging, pharmaceuticals, and consumer goods, has witnessed a surge in demand for EVA-based materials, driving the market's expansion. In addition to packaging, the automotive industry has emerged as a significant consumer of EVA resins. These resins are utilized in automotive interiors for various applications, including door panels, dashboard components, and insulation. The lightweight nature of EVA resin contributes to fuel efficiency, a critical consideration for the automotive sector amid increasing emphasis on sustainability and environmental concerns. The footwear industry is another major consumer of EVA resin, particularly in the manufacturing of midsoles and outsoles. The material's cushioning properties, combined with its lightweight nature, make it a preferred choice for athletic and casual footwear. As consumer preferences shift towards comfortable and performance-oriented footwear, the demand for EVA-based products continues to rise. The solar energy sector has witnessed a growing adoption of EVA resin in photovoltaic module encapsulation. EVA films play a crucial role in protecting solar cells from environmental factors while ensuring optimal light transmission. With the increasing emphasis on renewable energy sources, the demand for EVA resin in the solar industry is expected to witness steady growth. [caption id="attachment_34821" align="aligncenter" width="1920"]

Target Audience for Ethylene-Vinyl Acetate (EVA) Resin Market

- Manufacturers and Producers

- Suppliers and Distributors

- End-Use Industries

- Research and Development (R&D) Institutions

- Government Agencies and Regulatory Bodies

- Investors and Financial Institutions

- Industry Associations and Trade Organizations

- Consulting and Market Research Firms

- Environmental and Sustainability Organizations

- Educational Institutions

Import & Export Data for Ethylene-Vinyl Acetate (EVA) Resin Market

Exactitude consultancy provides import and export data for the recent years. It also offers insights on production and consumption volume of the product. Understanding the import and export data is pivotal for any player in the ethylene-vinyl acetate (EVA) resin market. This knowledge equips businesses with strategic advantages, such as:- Identifying emerging markets with untapped potential.

- Adapting supply chain strategies to optimize cost-efficiency and market responsiveness.

- Navigating competition by assessing major players' trade dynamics.

- Trade volume trends: our report dissects import and export data spanning the last five years to reveal crucial trends and growth patterns within the global ethylene-vinyl acetate (EVA) resin This data-driven exploration empowers readers with a deep understanding of the market's trajectory.

- Market players: gain insights into the leading players driving the Surgical Drill trade. From established giants to emerging contenders, our analysis highlights the key contributors to the import and export landscape.

- Geographical dynamics: delve into the geographical distribution of trade activities. Uncover which regions dominate exports and which ones hold the reins on imports, painting a comprehensive picture of the industry's global footprint.

- Product breakdown: by segmenting data based on Surgical Drill types –– we provide a granular view of trade preferences and shifts, enabling businesses to align strategies with the evolving technological landscape.

Segments Covered in the Ethylene-Vinyl Acetate (EVA) Resin Market Report

Ethylene-Vinyl Acetate (EVA) Resin Market by Type 2020-2030, USD Billion, (Kilotons)- Low Density EVA

- Medium Density EVA

- High Density EVA

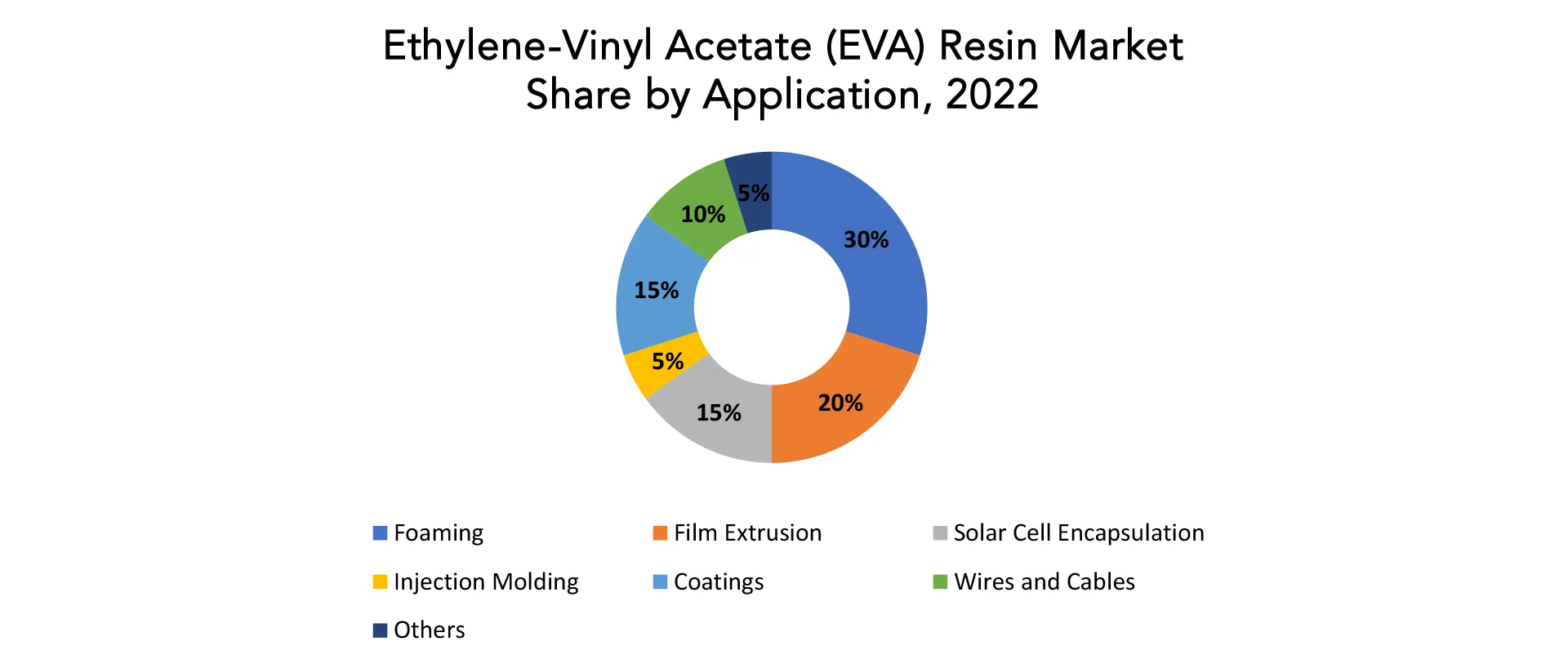

- Foaming

- Film Extrusion

- Solar Cell Encapsulation

- Injection Molding

- Coatings

- Wires and Cables

- Others

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the ethylene-vinyl acetate (EVA) resin market over the next 7 years?

- Who are the major players in the ethylene-vinyl acetate (EVA) resin market and what is their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the middle east, and Africa?

- How is the economic environment affecting the ethylene-vinyl acetate (EVA) resin market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the ethylene-vinyl acetate (EVA) resin market?

- What is the current and forecasted size and growth rate of ethylene-vinyl acetate (EVA) resin market?

- What are the key drivers of growth in ethylene-vinyl acetate (EVA) resin market?

- What are the distribution channels and supply chain dynamics in the ethylene-vinyl acetate (EVA) resin market?

- What are the technological advancements and innovations in the ethylene-vinyl acetate (EVA) resin market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the ethylene-vinyl acetate (EVA) resin market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the ethylene-vinyl acetate (EVA) resin market?

- What are the products and specifications of leading players in the market?

- INTRODUCCIÓN

- DEFINICIÓN DE MERCADO

- SEGMENTACIÓN DEL MERCADO

- CRONOGRAMAS DE INVESTIGACIÓN

- SUPUESTOS Y LIMITACIONES

- METODOLOGÍA DE LA INVESTIGACIÓN

- MINERÍA DE DATOS

- INVESTIGACIÓN SECUNDARIA

- INVESTIGACIÓN PRIMARIA

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- MINERÍA DE DATOS

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET OUTLOOK

- GLOBAL ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE, 2020-2030, (USD BILLION) (KILOTONS)

- LOW DENSITY EVA

- MEDIUM DENSITY EVA

- HIGH DENSITY EVA

- GLOBAL ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION, 2020-2030, (USD BILLION) (KILOTONS)

- FOAMING

- FILM EXTRUSION

- SOLAR CELL ENCAPSULATION

- INJECTION MOLDING

- COATINGS

- WIRES AND CABLES

- OTHERS

- GLOBAL ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY REGION, 2020-2030, (USD BILLION) (KILOTONS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, TYPES OFFERED, RECENT DEVELOPMENTS)

- DUPONT

- EXXONMOBIL CORPORATION

- LYONDELLBASELL INDUSTRIES

- BRASKEM

- HANWHA TOTAL PETROCHEMICAL CO., LTD

- SINOPEC CORPORATION

- VERSALIS S.P.A.

- LG CHEM

- FORMOSA PLASTICS CORPORATION

- USI CORPORATION

- CELANESE CORPORATION

- SUMITOMO CHEMICAL CO., LTD

- ARKEMA

- SABIC

- TOSOH CORPORATION

- WESTLAKE CHEMICAL CORPORATION

- MITSUI CHEMICALS, INC.

- BOREALIS AG

- EVONIK INDUSTRIES

- NOVA CHEMICALS CORPORATION

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 2 GLOBAL ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 3 GLOBAL ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 4 GLOBAL ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 5 GLOBAL ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY REGION (USD BILLION) 2020-2030

TABLE 6 GLOBAL ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY REGION (KILOTONS) 2020-2030

TABLE 7 NORTH AMERICA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY COUNTRY (USD BILLION)

2020-2030

TABLE 8 NORTH AMERICA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY COUNTRY (KILOTONS)

2020-2030

TABLE 9 NORTH AMERICA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 10 NORTH AMERICA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 11 NORTH AMERICA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 12 NORTH AMERICA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 13 US ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 14 US ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 15 US ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 16 US ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 17 CANADA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 18 CANADA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 19 CANADA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 20 CANADA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 21 MEXICO ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 22 MEXICO ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 23 MEXICO ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 24 MEXICO ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 25 SOUTH AMERICA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 26 SOUTH AMERICA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY COUNTRY (KILOTONS) 2020-2030

TABLE 27 SOUTH AMERICA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 28 SOUTH AMERICA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 29 SOUTH AMERICA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 30 SOUTH AMERICA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 31 BRAZIL ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 32 BRAZIL ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 33 BRAZIL ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 34 BRAZIL ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 35 ARGENTINA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 36 ARGENTINA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 37 ARGENTINA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 38 ARGENTINA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 39 COLOMBIA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 40 COLOMBIA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 41 COLOMBIA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 42 COLOMBIA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 43 REST OF SOUTH AMERICA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 44 REST OF SOUTH AMERICA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 45 REST OF SOUTH AMERICA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 46 REST OF SOUTH AMERICA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 47 ASIA-PACIFIC ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 48 ASIA-PACIFIC ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY COUNTRY (KILOTONS) 2020-2030

TABLE 49 ASIA-PACIFIC ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 50 ASIA-PACIFIC ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 51 ASIA-PACIFIC ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 52 ASIA-PACIFIC ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 53 INDIA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 54 INDIA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 55 INDIA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 56 INDIA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 57 CHINA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 58 CHINA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 59 CHINA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 60 CHINA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 61 JAPAN ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 62 JAPAN ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 63 JAPAN ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 64 JAPAN ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 65 SOUTH KOREA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 66 SOUTH KOREA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 67 SOUTH KOREA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 68 SOUTH KOREA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 69 AUSTRALIA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 70 AUSTRALIA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 71 AUSTRALIA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 72 AUSTRALIA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 73 SOUTH-EAST ASIA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 74 SOUTH-EAST ASIA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 75 SOUTH-EAST ASIA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 76 SOUTH-EAST ASIA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 77 REST OF ASIA PACIFIC ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 78 REST OF ASIA PACIFIC ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 79 REST OF ASIA PACIFIC ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 80 REST OF ASIA PACIFIC ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 81 EUROPE ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 82 EUROPE ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY COUNTRY (KILOTONS) 2020-2030

TABLE 83 EUROPE ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 84 EUROPE ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 85 EUROPE ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 86 EUROPE ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 87 GERMANY ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 88 GERMANY ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 89 GERMANY ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 90 GERMANY ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 91 UK ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 92 UK ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 93 UK ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 94 UK ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 95 FRANCE ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 96 FRANCE ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 97 FRANCE ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 98 FRANCE ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 99 ITALY ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 100 ITALY ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 101 ITALY ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 102 ITALY ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 103 SPAIN ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 104 SPAIN ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 105 SPAIN ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 106 SPAIN ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 107 RUSSIA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 108 RUSSIA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 109 RUSSIA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 110 RUSSIA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 111 REST OF EUROPE ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 112 REST OF EUROPE ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 113 REST OF EUROPE ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 114 REST OF EUROPE ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 115 MIDDLE EAST AND AFRICA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 116 MIDDLE EAST AND AFRICA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY COUNTRY (KILOTONS) 2020-2030

TABLE 117 MIDDLE EAST AND AFRICA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 118 MIDDLE EAST AND AFRICA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 119 MIDDLE EAST AND AFRICA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 120 MIDDLE EAST AND AFRICA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 121 UAE ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 122 UAE ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 123 UAE ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 124 UAE ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 125 SAUDI ARABIA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 126 SAUDI ARABIA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 127 SAUDI ARABIA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 128 SAUDI ARABIA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 129 SOUTH AFRICA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 130 SOUTH AFRICA ETHYLENE-VINYL ACETATE (EVA) RESINMARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 131 SOUTH AFRICA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 132 SOUTH AFRICA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (KILOTONS) 2020-2030

TABLE 133 REST OF MIDDLE EAST AND AFRICA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 134 REST OF MIDDLE EAST AND AFRICA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 135 REST OF MIDDLE EAST AND AFRICA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 136 REST OF MIDDLE EAST AND AFRICA ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE (KILOTONS) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION USD BILLION, 2020-2030

FIGURE 9 GLOBAL ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE, USD BILLION, 2020-2030

FIGURE 10 GLOBAL ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY REGION, USD BILLION, 2020-2030

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY APPLICATION, USD BILLION 2022

FIGURE 13 GLOBAL ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY TYPE, USD BILLION 2022

FIGURE 14 GLOBAL ETHYLENE-VINYL ACETATE (EVA) RESIN MARKET BY REGION, USD BILLION 2022

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 DUPONT: COMPANY SNAPSHOT

FIGURE 17 EXXONMOBIL CORPORATION: COMPANY SNAPSHOT

FIGURE 18 LYONDELLBASELL INDUSTRIES: COMPANY SNAPSHOT

FIGURE 19 BRASKEM: COMPANY SNAPSHOT

FIGURE 20 HANWHA TOTAL PETROCHEMICAL CO., LTD: COMPANY SNAPSHOT

FIGURE 21 SINOPEC CORPORATION: COMPANY SNAPSHOT

FIGURE 22 VERSALIS S.P.A.: COMPANY SNAPSHOT

FIGURE 23 LG CHEM: COMPANY SNAPSHOT

FIGURE 24 FORMOSA PLASTICS CORPORATION: COMPANY SNAPSHOT

FIGURE 25 USI CORPORATION: COMPANY SNAPSHOT

FIGURE 26 CELANESE CORPORATION: COMPANY SNAPSHOT

FIGURE 27 SUMITOMO CHEMICAL CO., LTD: COMPANY SNAPSHOT

FIGURE 28 ARKEMA: COMPANY SNAPSHOT

FIGURE 29 SABIC: COMPANY SNAPSHOT

FIGURE 30 TOSOH CORPORATION: COMPANY SNAPSHOT

FIGURE 31 WESTLAKE CHEMICAL CORPORATION: COMPANY SNAPSHOT

FIGURE 32 MITSUI CHEMICALS, INC.: COMPANY SNAPSHOT

FIGURE 33 BOREALIS AG: COMPANY SNAPSHOT

FIGURE 34 EVONIK INDUSTRIES: COMPANY SNAPSHOT

FIGURE 35 NOVA CHEMICALS CORPORATION: COMPANY SNAPSHOT

DOWNLOAD FREE SAMPLE REPORT

License Type

SPEAK WITH OUR ANALYST

Want to know more about the report or any specific requirement?

WANT TO CUSTOMIZE THE REPORT?

Our Clients Speak

We asked them to research ‘ Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te

Yosuke Mitsui

Senior Associate Construction Equipment Sales & Marketing

We asked them to research ‘Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te