Base Year Value ()

CAGR ()

Forecast Year Value ()

Historical Data Period

Largest Region

Forecast Period

Marché des apprêts époxy par substrat (métal, béton et maçonnerie, fibre de verre), par technologie (technologie à base de solvant, technologie à base d'eau), par application (bâtiment et construction, automobile, marine, machines et équipements) et par région, tendances mondiales et prévisions de 2023 à 2030

Instant access to hundreds of data points and trends

- Market estimates from 2014-2029

- Competitive analysis, industry segmentation, financial benchmarks

- Incorporates SWOT, Porter's Five Forces and risk management frameworks

- PDF report or online database with Word, Excel and PowerPoint export options

- 100% money back guarantee

Aperçu du marché des apprêts époxy

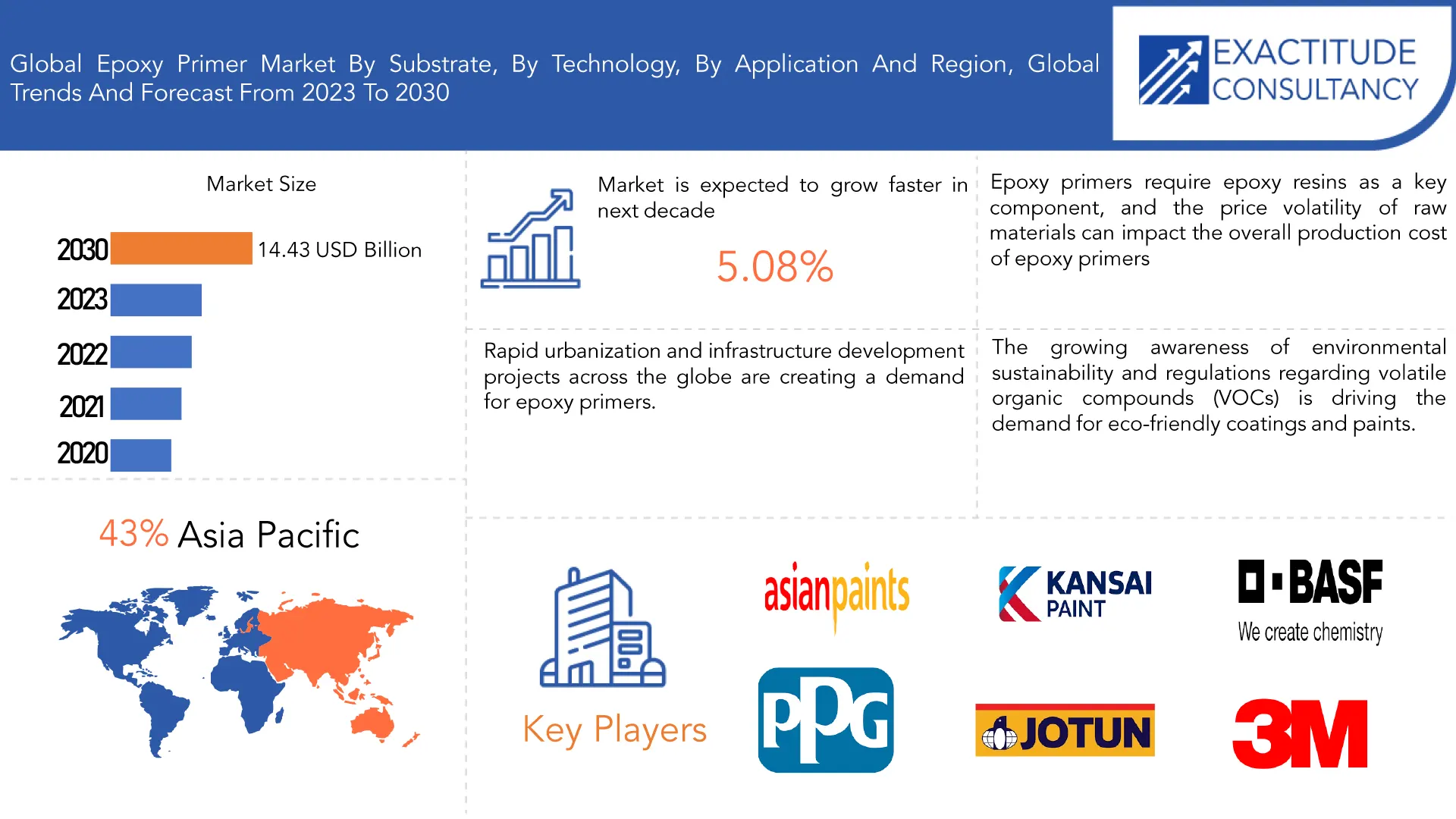

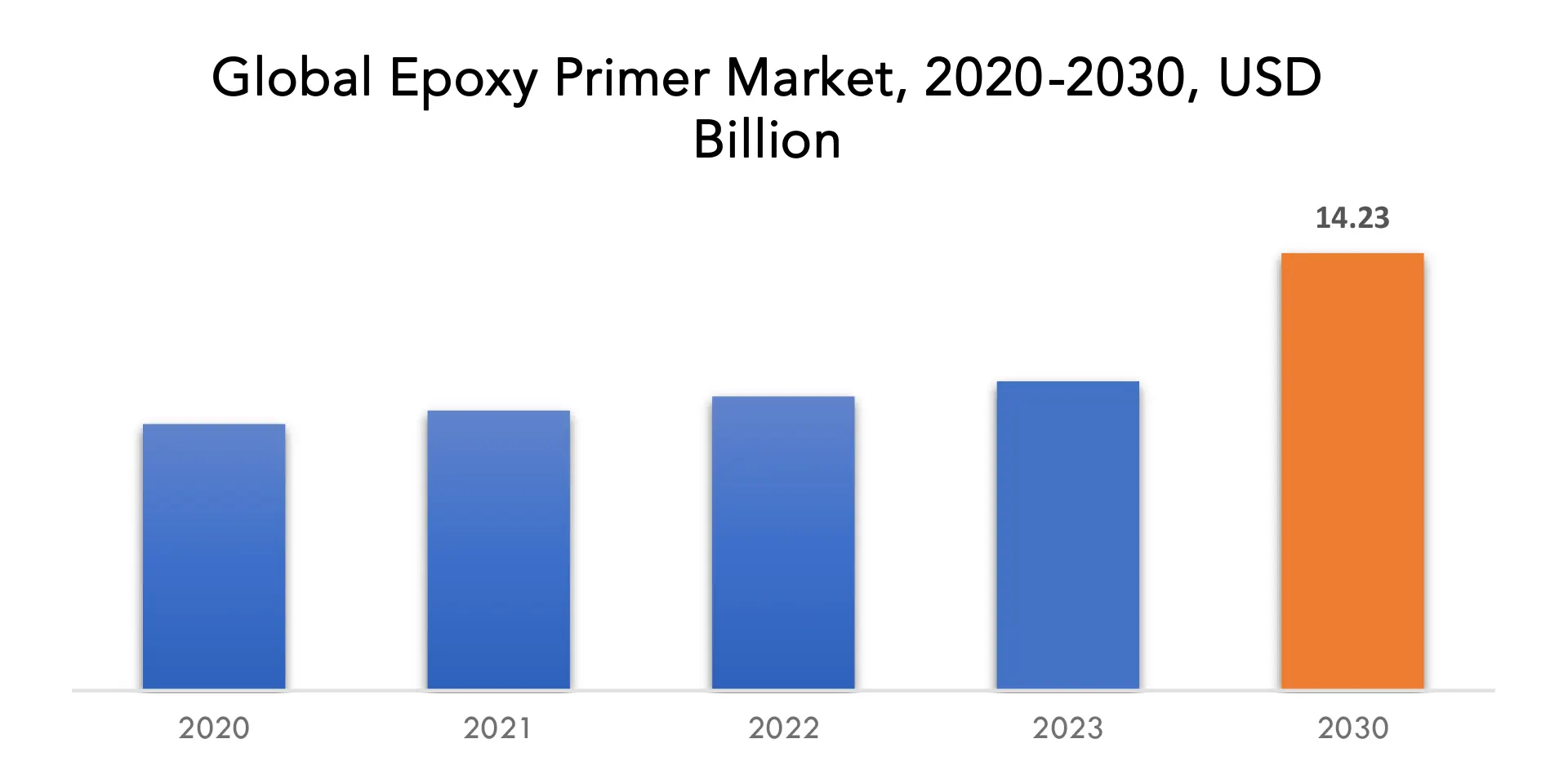

Le marché des apprêts époxy devrait croître à un TCAC de 5,08 % entre 2023 et 2030. Il devrait atteindre plus de 14,43 milliards USD d'ici 2030, contre 10,06 milliards USD en 2023.

L'apprêt époxy est un type de revêtement ou de peinture qui contient des résines époxy comme liant principal. Il est appliqué comme couche préparatoire sur les surfaces avant l'application d'une couche de finition finale. Les apprêts époxy sont connus pour leur excellente adhérence, leur résistance à la corrosion et leur durabilité. Ils sont couramment utilisés sur une variété de substrats tels que le métal, le béton, le bois et les plastiques pour améliorer la protection de surface et favoriser l'adhérence des revêtements ultérieurs. Les apprêts époxy jouent un rôle crucial dans l'amélioration des performances globales et de la longévité des revêtements appliqués.

Le développement croissant de la construction et des infrastructures est un moteur important du marché des apprêts époxy . Alors que l'urbanisation et les projets d'infrastructure continuent de se développer dans le monde entier, la demande d'apprêts époxy augmente. Les apprêts époxy jouent un rôle crucial dans les applications de construction, offrant une protection de surface, une résistance à la corrosion et une durabilité aux structures telles que les sols, les murs et les ponts. Avec la nécessité d'améliorer la longévité et les performances de ces structures, les apprêts époxy sont préférés pour leur capacité à résister à l'humidité, aux produits chimiques et à l'abrasion. La croissance du secteur de la construction, tirée par les projets résidentiels, commerciaux et industriels, crée une demande soutenue d'apprêts époxy en tant que composant essentiel des systèmes de préparation et de protection des surfaces.

[caption id="attachment_30933" align="aligncenter" width="1920"]

Volatile raw material prices act as a significant restraint for the epoxy primer market. Epoxy primers rely on epoxy resins as a key component, and fluctuations in raw material prices can impact overall production costs. The price volatility of raw materials poses challenges for manufacturers in terms of cost management and profitability. Sudden increases in raw material prices can directly affect the pricing of epoxy primers, potentially making them less competitive in the market. Additionally, manufacturers may need to constantly adjust their pricing strategies to account for fluctuations, which can create uncertainty and instability in the market. Managing raw material costs and finding alternative sourcing options are crucial for manufacturers to mitigate the impact of volatile raw material prices.

The increasing focus on sustainable solutions presents a significant opportunity for the epoxy primer market. As environmental awareness and regulations regarding volatile organic compounds (VOCs) continue to strengthen, there is a growing demand for eco-friendly coatings and paints. This trend provides an opportunity for epoxy resin manufacturers to develop low VOC and water-based formulations that align with sustainability requirements. By offering sustainable epoxy primers, manufacturers can cater to the needs of environmentally conscious customers and differentiate themselves in the market. Investing in research and development to create innovative, sustainable solutions can help manufacturers capture a larger market share and meet the evolving preferences of consumers who prioritize environmentally friendly products.

The COVID-19 pandemic had a significant negative impact on the epoxy primer market. The global economic slowdown caused by lockdowns, travel restrictions, and disrupted supply chains had affected various industries, including construction, automotive, and manufacturing, which are major consumers of epoxy primers. Construction projects were halted or delayed, leading to a decrease in demand for epoxy primers. Automotive production and sales experienced a downturn, reduced the need for epoxy primers in the sector. The uncertainty and financial strain faced by businesses and consumers had resulted in cautious spending, impacting the overall market demand. Supply chain disruptions and increased transportation costs had also affected the availability and pricing of raw materials, adding further challenges for manufacturers. However, as the global situation improves and industries recover, it is expected that the epoxy primer market will gradually rebound.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion), (Kilotons) |

| Segmentation | By Substrate, By Technology, By Application, By Region. |

| By Substrate |

|

| By Technology |

|

| By Application |

|

| By Region |

|

Frequently Asked Questions

• What is the worth of the epoxy primer market?

The epoxy primer market is expected to grow at 5.08 % CAGR from 2023 to 2030. It is expected to reach above USD 14.43 Billion by 2030 from USD 10.06 Billion in 2023.

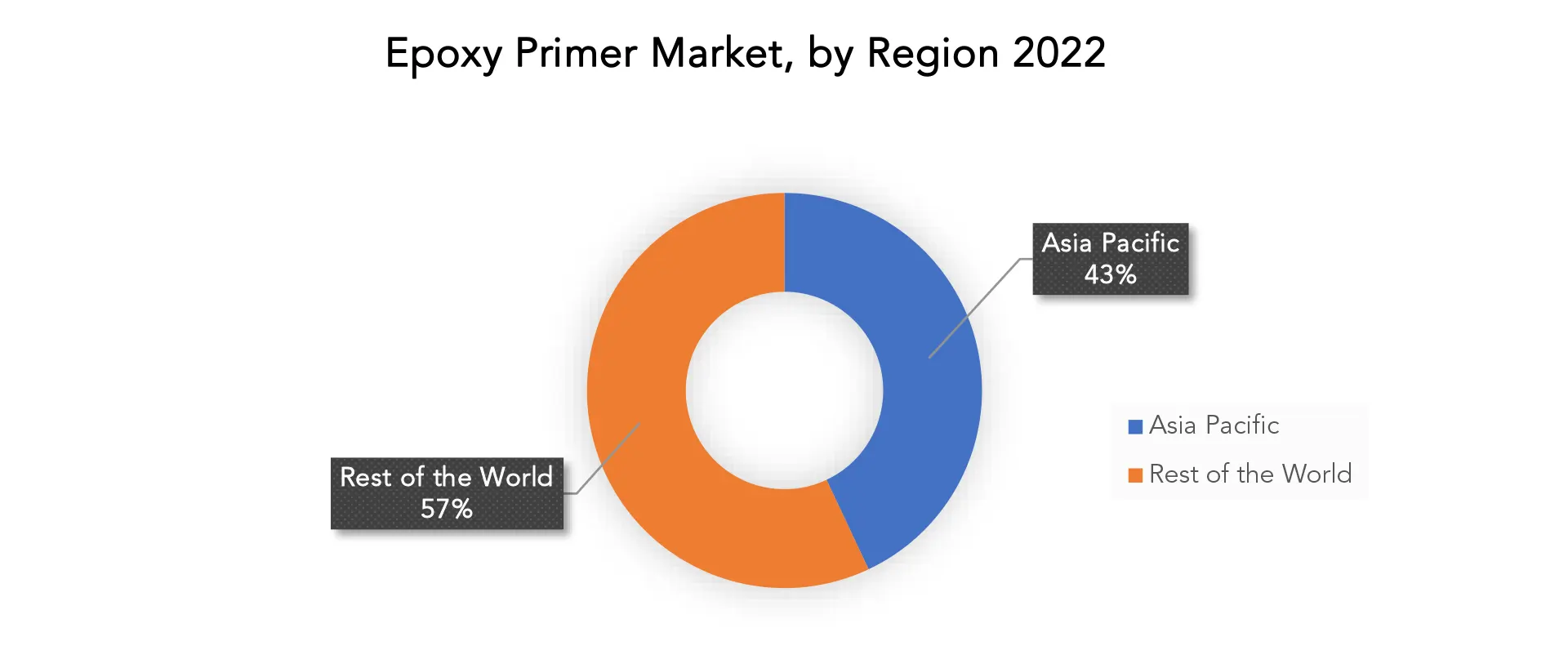

• What is the size of the Asia Pacific epoxy primer industry?

Asia Pacific held more than 43% of the epoxy primer market revenue share in 2021 and will witness expansion in the forecast period.

• What are some of the market's driving forces?

Rapid urbanization and infrastructure development projects across the globe are creating a demand for epoxy primers. Epoxy primers are extensively used in construction applications for coating floors, walls, and structures, providing protection against moisture, chemicals, and abrasion.

• Which are the top companies to hold the market share in epoxy primer market?

The epoxy primer market key players include Asian Paints Ltd, PPG Industries, Inc., Kansai Paints Co. Ltd, Jotun Group, Axalta Coating Systems, 3M Company, Sherwin-Williams, Akzo Nobel N.V., BASF SE, Nippon Paint Holdings Co. Ltd.

• What is the leading application of epoxy primer market?

The construction industry is major sector where the application of epoxy primer has seen more.

• Which is the largest regional market for epoxy primer market?

The markets largest share is in the Asia Pacific region.

Epoxy Primer Market Segment Analysis

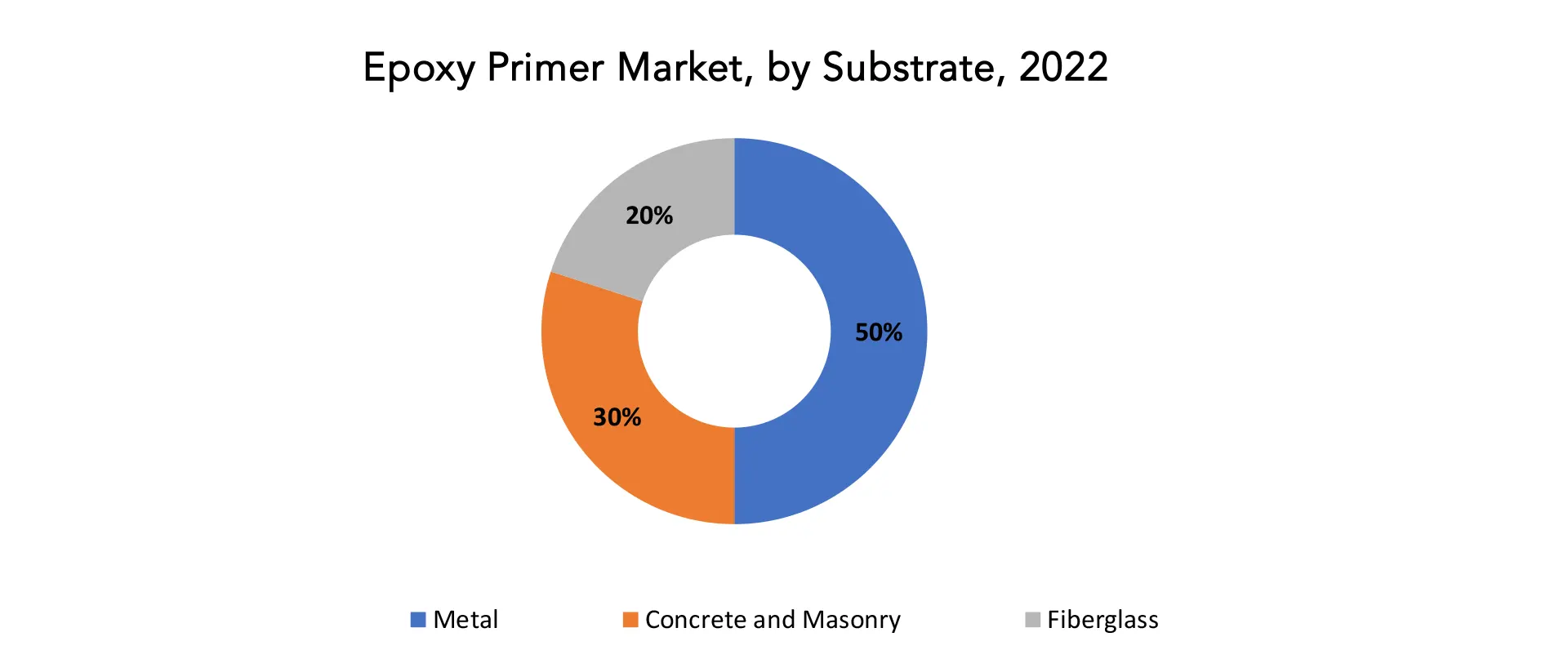

Metal substrates held a significant revenue share in the epoxy primer market. The use of epoxy primers on metal surfaces is widespread due to their excellent adhesion, corrosion resistance, and durability properties.

[caption id="attachment_30934" align="aligncenter" width="1920"]

Metal substrates are commonly found in industries such as automotive, construction, aerospace, and marine, where protection against corrosion is essential. The demand for epoxy primers for metal substrates has contributed to their sizably large revenue share in the overall market.

[caption id="attachment_30935" align="aligncenter" width="1920"]

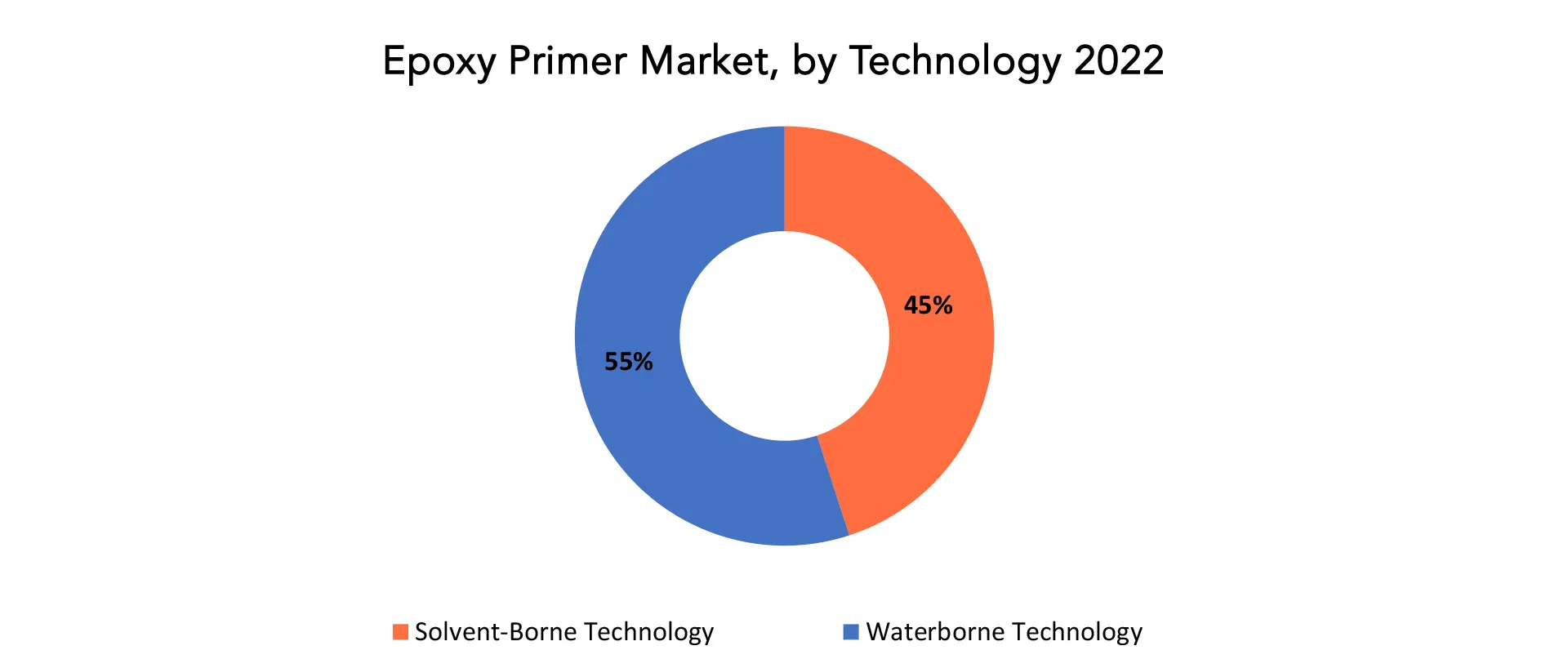

The epoxy primer market's revenue was predominantly driven by the water-based sector. Water-based epoxy primers have gained prominence due to their lower VOC emissions, environmental friendliness, and compliance with stringent regulations. These factors have led to increased adoption and preference for water-based epoxy primers over solvent-based counterparts. The growing demand for sustainable coatings and paints has contributed to the dominance of the water-based sector in the epoxy primer market's revenue.

The building and construction sector has emerged as a dominant industry in the epoxy primer market. The demand for epoxy primers in construction applications, such as coating floors, walls, and structures, has witnessed significant growth. Epoxy primers are preferred in the construction industry for their ability to enhance durability, protect against moisture and chemicals, and provide a smooth surface for subsequent coatings. The dominance of the building and construction sector is driven by the need for surface protection and corrosion resistance in various construction projects.

[caption id="attachment_30936" align="aligncenter" width="1920"]

Epoxy Primer Market Player

The epoxy primer market key players include Asian Paints Ltd, PPG Industries, Inc., Kansai Paints Co. Ltd, Jotun Group, Axalta Coating Systems, 3M Company, Sherwin-Williams, Akzo Nobel N.V., BASF SE, Nippon Paint Holdings Co. Ltd.

December 2020, PPG Industries Inc. acquired Ennis-Flint, a global leader in pavement markings and traffic safety solutions. The acquisition will expand PPG's product portfolio and strengthen its position in the coatings and adhesives market.

March 2023, PPG Expands AMERLOCK Series of Epoxy Protective Coatings With PPG AMERLOCK 600 Multipurpose Option for Shop, Field Applications.

Who Should Buy? Or Key Stakeholders

- Construction Companies

- Automotive Companies

- Raw Material Manufacturer

- Market Research

- Research and Development Institutes

- Consulting Firms

- Venture capitalists

- Investors

- Supplier and Distributor

- Others

Epoxy Primer Market Regional Analysis

The Epoxy Primer market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

Epoxy Primer Market | Exactitude Consultancy[/caption]

Epoxy Primer Market | Exactitude Consultancy[/caption]

The Asia-Pacific region is expected to dominate the epoxy primer market. Rapid industrialization, infrastructure development, and increasing construction activities in countries like China, India, and Southeast Asian nations are driving the demand for epoxy primers. The growing automotive production and rising awareness of surface protection further contribute to the market's dominance in this region. Additionally, the presence of key manufacturers and favorable government initiatives promoting construction and industrial growth also bolster the Asia-Pacific market. Factors like population growth, urbanization, and expanding economies make the region a lucrative market for epoxy primer products, positioning it as the dominant market globally.

North America is a significant region in the epoxy primer market. The region holds a substantial market share and is characterized by a mature and established market for epoxy primers. Factors contributing to North America's prominence in the market include a strong presence of key manufacturers, a robust construction industry, and a high demand for epoxy primers in various applications such as automotive, and industrial sectors. The region's emphasis on advanced infrastructure and technological advancements further drives the demand for epoxy primers. Additionally, stringent regulations regarding environmental protection and safety standards in North America have led to the adoption of eco-friendly and low VOC epoxy primer formulations.

Key Market Segments: Epoxy Primer Market

Epoxy Primer Market by Substrate, 2020-2030, (USD Billion), (Kilotons).- Metal

- Concrete and Masonry

- Fiberglass

- Solvent-Borne Technology

- Waterborne Technology

- Building & Construction

- Automotive

- Marine

- Machinery & Equipment

- North America

- Asia Pacific

- Europe

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the epoxy primer market over the next 7 years?

- Who are the major players in the epoxy primer market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-pacific, middle east, and Africa?

- How is the economic environment affecting the epoxy primer market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the epoxy primer market?

- What is the current and forecasted size and growth rate of the global epoxy primer market?

- What are the key drivers of growth in the epoxy primer market?

- What are the distribution channels and supply chain dynamics in the epoxy primer market?

- What are the technological advancements and innovations in the epoxy primer market and their impact on material development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the epoxy primer market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the epoxy primer market?

- What are the products offerings and specifications of leading players in the market?

- What is the pricing trend of epoxy primer in the market and what is the impact of raw material prices on the price trend?

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL EPOXY PRIMER MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON EPOXY PRIMER MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL EPOXY PRIMER MARKET OUTLOOK

- GLOBAL EPOXY PRIMER MARKET BY SUBSTRATE, 2020-2030, (USD BILLION), (KILOTONS)

- METAL

- CONCRETE AND MASONRY

- FIBERGLASS

- GLOBAL EPOXY PRIMER MARKET BY TECHNOLOGY, 2020-2030, (USD BILLION), (KILOTONS)

- SOLVENT-BORNE TECHNOLOGY

- WATERBORNE TECHNOLOGY

- GLOBAL EPOXY PRIMER MARKET BY APPLICATION, 2020-2030, (USD BILLION), (KILOTONS)

- BUILDING & CONSTRUCTION

- AUTOMOTIVE

- MARINE

- MACHINERY & EQUIPMENT

- GLOBAL EPOXY PRIMER MARKET BY REGION, 2020-2030, (USD BILLION), (KILOTONS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- ASIAN PAINTS LTD

- PPG INDUSTRIES INC.

- KANSAI PAINTS CO. LTD

- JOTUN GROUP

- AXALTA COATING SYSTEMS

- 3M COMPANY

- SHERWIN-WILLIAMS

- AKZO NOBEL N.V.

- BASF SE

- NIPPON PAINT HOLDINGS CO. LTD.

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL EPOXY PRIMER MARKET BY SUBSTRATE (USD BILLION) 2020-2030

TABLE 2 GLOBAL EPOXY PRIMER MARKET BY SUBSTRATE (KILOTONS) 2020-2030

TABLE 3 GLOBAL EPOXY PRIMER MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 4 GLOBAL EPOXY PRIMER MARKET BY TECHNOLOGY (KILOTONS) 2020-2030

TABLE 5 GLOBAL EPOXY PRIMER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 6 GLOBAL EPOXY PRIMER MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 7 GLOBAL EPOXY PRIMER MARKET BY REGION (USD BILLION) 2020-2030

TABLE 8 GLOBAL EPOXY PRIMER MARKET BY REGION (KILOTONS) 2020-2030

TABLE 9 NORTH AMERICA EPOXY PRIMER MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 10 NORTH AMERICA EPOXY PRIMER MARKET BY COUNTRY (KILOTONS) 2020-2030

TABLE 11 NORTH AMERICA EPOXY PRIMER MARKET BY SUBSTRATE (USD BILLION) 2020-2030

TABLE 12 NORTH AMERICA EPOXY PRIMER MARKET BY SUBSTRATE (KILOTONS) 2020-2030

TABLE 13 NORTH AMERICA EPOXY PRIMER MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 14 NORTH AMERICA EPOXY PRIMER MARKET BY TECHNOLOGY (KILOTONS) 2020-2030

TABLE 15 NORTH AMERICA EPOXY PRIMER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 16 NORTH AMERICA EPOXY PRIMER MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 17 US EPOXY PRIMER MARKET BY SUBSTRATE (USD BILLION) 2020-2030

TABLE 18 US EPOXY PRIMER MARKET BY SUBSTRATE (KILOTONS) 2020-2030

TABLE 19 US EPOXY PRIMER MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 20 US EPOXY PRIMER MARKET BY TECHNOLOGY (KILOTONS) 2020-2030

TABLE 21 US EPOXY PRIMER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 22 US EPOXY PRIMER MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 23 CANADA EPOXY PRIMER MARKET BY SUBSTRATE (USD BILLION) 2020-2030

TABLE 24 CANADA EPOXY PRIMER MARKET BY SUBSTRATE (KILOTONS) 2020-2030

TABLE 25 CANADA EPOXY PRIMER MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 26 CANADA EPOXY PRIMER MARKET BY TECHNOLOGY (KILOTONS) 2020-2030

TABLE 27 CANADA EPOXY PRIMER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 28 CANADA EPOXY PRIMER MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 29 MEXICO EPOXY PRIMER MARKET BY SUBSTRATE (USD BILLION) 2020-2030

TABLE 30 MEXICO EPOXY PRIMER MARKET BY SUBSTRATE (KILOTONS) 2020-2030

TABLE 31 MEXICO EPOXY PRIMER MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 32 MEXICO EPOXY PRIMER MARKET BY TECHNOLOGY (KILOTONS) 2020-2030

TABLE 33 MEXICO EPOXY PRIMER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 34 MEXICO EPOXY PRIMER MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 35 SOUTH AMERICA EPOXY PRIMER MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 36 SOUTH AMERICA EPOXY PRIMER MARKET BY COUNTRY (KILOTONS) 2020-2030

TABLE 37 SOUTH AMERICA EPOXY PRIMER MARKET BY SUBSTRATE (USD BILLION) 2020-2030

TABLE 38 SOUTH AMERICA EPOXY PRIMER MARKET BY SUBSTRATE (KILOTONS) 2020-2030

TABLE 39 SOUTH AMERICA EPOXY PRIMER MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 40 SOUTH AMERICA EPOXY PRIMER MARKET BY TECHNOLOGY (KILOTONS) 2020-2030

TABLE 41 SOUTH AMERICA EPOXY PRIMER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 42 SOUTH AMERICA EPOXY PRIMER MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 43 BRAZIL EPOXY PRIMER MARKET BY SUBSTRATE (USD BILLION) 2020-2030

TABLE 44 BRAZIL EPOXY PRIMER MARKET BY SUBSTRATE (KILOTONS) 2020-2030

TABLE 45 BRAZIL EPOXY PRIMER MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 46 BRAZIL EPOXY PRIMER MARKET BY TECHNOLOGY (KILOTONS) 2020-2030

TABLE 47 BRAZIL EPOXY PRIMER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 48 BRAZIL EPOXY PRIMER MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 49 ARGENTINA EPOXY PRIMER MARKET BY SUBSTRATE (USD BILLION) 2020-2030

TABLE 50 ARGENTINA EPOXY PRIMER MARKET BY SUBSTRATE (KILOTONS) 2020-2030

TABLE 51 ARGENTINA EPOXY PRIMER MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 52 ARGENTINA EPOXY PRIMER MARKET BY TECHNOLOGY (KILOTONS) 2020-2030

TABLE 53 ARGENTINA EPOXY PRIMER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 54 ARGENTINA EPOXY PRIMER MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 55 COLOMBIA EPOXY PRIMER MARKET BY SUBSTRATE (USD BILLION) 2020-2030

TABLE 56 COLOMBIA EPOXY PRIMER MARKET BY SUBSTRATE (KILOTONS) 2020-2030

TABLE 57 COLOMBIA EPOXY PRIMER MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 58 COLOMBIA EPOXY PRIMER MARKET BY TECHNOLOGY (KILOTONS) 2020-2030

TABLE 59 COLOMBIA EPOXY PRIMER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 60 COLOMBIA EPOXY PRIMER MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 61 REST OF SOUTH AMERICA EPOXY PRIMER MARKET BY SUBSTRATE (USD BILLION) 2020-2030

TABLE 62 REST OF SOUTH AMERICA EPOXY PRIMER MARKET BY SUBSTRATE (KILOTONS) 2020-2030

TABLE 63 REST OF SOUTH AMERICA EPOXY PRIMER MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 64 REST OF SOUTH AMERICA EPOXY PRIMER MARKET BY TECHNOLOGY (KILOTONS) 2020-2030

TABLE 65 REST OF SOUTH AMERICA EPOXY PRIMER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 66 REST OF SOUTH AMERICA EPOXY PRIMER MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 67 ASIA-PACIFIC EPOXY PRIMER MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 68 ASIA-PACIFIC EPOXY PRIMER MARKET BY COUNTRY (KILOTONS) 2020-2030

TABLE 69 ASIA-PACIFIC EPOXY PRIMER MARKET BY SUBSTRATE (USD BILLION) 2020-2030

TABLE 70 ASIA-PACIFIC EPOXY PRIMER MARKET BY SUBSTRATE (KILOTONS) 2020-2030

TABLE 71 ASIA-PACIFIC EPOXY PRIMER MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 72 ASIA-PACIFIC EPOXY PRIMER MARKET BY TECHNOLOGY (KILOTONS) 2020-2030

TABLE 73 ASIA-PACIFIC EPOXY PRIMER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 74 ASIA-PACIFIC EPOXY PRIMER MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 75 INDIA EPOXY PRIMER MARKET BY SUBSTRATE (USD BILLION) 2020-2030

TABLE 76 INDIA EPOXY PRIMER MARKET BY SUBSTRATE (KILOTONS) 2020-2030

TABLE 77 INDIA EPOXY PRIMER MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 78 INDIA EPOXY PRIMER MARKET BY TECHNOLOGY (KILOTONS) 2020-2030

TABLE 79 INDIA EPOXY PRIMER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 80 INDIA EPOXY PRIMER MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 81 CHINA EPOXY PRIMER MARKET BY SUBSTRATE (USD BILLION) 2020-2030

TABLE 82 CHINA EPOXY PRIMER MARKET BY SUBSTRATE (KILOTONS) 2020-2030

TABLE 83 CHINA EPOXY PRIMER MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 84 CHINA EPOXY PRIMER MARKET BY TECHNOLOGY (KILOTONS) 2020-2030

TABLE 85 CHINA EPOXY PRIMER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 86 CHINA EPOXY PRIMER MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 87 JAPAN EPOXY PRIMER MARKET BY SUBSTRATE (USD BILLION) 2020-2030

TABLE 88 JAPAN EPOXY PRIMER MARKET BY SUBSTRATE (KILOTONS) 2020-2030

TABLE 89 JAPAN EPOXY PRIMER MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 90 JAPAN EPOXY PRIMER MARKET BY TECHNOLOGY (KILOTONS) 2020-2030

TABLE 91 JAPAN EPOXY PRIMER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 92 JAPAN EPOXY PRIMER MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 93 SOUTH KOREA EPOXY PRIMER MARKET BY SUBSTRATE (USD BILLION) 2020-2030

TABLE 94 SOUTH KOREA EPOXY PRIMER MARKET BY SUBSTRATE (KILOTONS) 2020-2030

TABLE 95 SOUTH KOREA EPOXY PRIMER MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 96 SOUTH KOREA EPOXY PRIMER MARKET BY TECHNOLOGY (KILOTONS) 2020-2030

TABLE 97 SOUTH KOREA EPOXY PRIMER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 98 SOUTH KOREA EPOXY PRIMER MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 99 AUSTRALIA EPOXY PRIMER MARKET BY SUBSTRATE (USD BILLION) 2020-2030

TABLE 100 AUSTRALIA EPOXY PRIMER MARKET BY SUBSTRATE (KILOTONS) 2020-2030

TABLE 101 AUSTRALIA EPOXY PRIMER MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 102 AUSTRALIA EPOXY PRIMER MARKET BY TECHNOLOGY (KILOTONS) 2020-2030

TABLE 103 AUSTRALIA EPOXY PRIMER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 104 AUSTRALIA EPOXY PRIMER MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 105 SOUTH-EAST ASIA EPOXY PRIMER MARKET BY SUBSTRATE (USD BILLION) 2020-2030

TABLE 106 SOUTH-EAST ASIA EPOXY PRIMER MARKET BY SUBSTRATE (KILOTONS) 2020-2030

TABLE 107 SOUTH-EAST ASIA EPOXY PRIMER MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 108 SOUTH-EAST ASIA EPOXY PRIMER MARKET BY TECHNOLOGY (KILOTONS) 2020-2030

TABLE 109 SOUTH-EAST ASIA EPOXY PRIMER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 110 SOUTH-EAST ASIA EPOXY PRIMER MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 111 REST OF ASIA PACIFIC EPOXY PRIMER MARKET BY SUBSTRATE (USD BILLION) 2020-2030

TABLE 112 REST OF ASIA PACIFIC EPOXY PRIMER MARKET BY SUBSTRATE (KILOTONS) 2020-2030

TABLE 113 REST OF ASIA PACIFIC EPOXY PRIMER MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 114 REST OF ASIA PACIFIC EPOXY PRIMER MARKET BY TECHNOLOGY (KILOTONS) 2020-2030

TABLE 115 REST OF ASIA PACIFIC EPOXY PRIMER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 116 REST OF ASIA PACIFIC EPOXY PRIMER MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 117 EUROPE EPOXY PRIMER MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 118 EUROPE EPOXY PRIMER MARKET BY COUNTRY (KILOTONS) 2020-2030

TABLE 119 EUROPE EPOXY PRIMER MARKET BY SUBSTRATE (USD BILLION) 2020-2030

TABLE 120 EUROPE EPOXY PRIMER MARKET BY SUBSTRATE (KILOTONS) 2020-2030

TABLE 121 EUROPE EPOXY PRIMER MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 122 EUROPE EPOXY PRIMER MARKET BY TECHNOLOGY (KILOTONS) 2020-2030

TABLE 123 EUROPE EPOXY PRIMER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 124 EUROPE EPOXY PRIMER MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 125 GERMANY EPOXY PRIMER MARKET BY SUBSTRATE (USD BILLION) 2020-2030

TABLE 126 GERMANY EPOXY PRIMER MARKET BY SUBSTRATE (KILOTONS) 2020-2030

TABLE 127 GERMANY EPOXY PRIMER MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 128 GERMANY EPOXY PRIMER MARKET BY TECHNOLOGY (KILOTONS) 2020-2030

TABLE 129 GERMANY EPOXY PRIMER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 130 GERMANY EPOXY PRIMER MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 131 UK EPOXY PRIMER MARKET BY SUBSTRATE (USD BILLION) 2020-2030

TABLE 132 UK EPOXY PRIMER MARKET BY SUBSTRATE (KILOTONS) 2020-2030

TABLE 133 UK EPOXY PRIMER MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 134 UK EPOXY PRIMER MARKET BY TECHNOLOGY (KILOTONS) 2020-2030

TABLE 135 UK EPOXY PRIMER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 136 UK EPOXY PRIMER MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 137 FRANCE EPOXY PRIMER MARKET BY SUBSTRATE (USD BILLION) 2020-2030

TABLE 138 FRANCE EPOXY PRIMER MARKET BY SUBSTRATE (KILOTONS) 2020-2030

TABLE 139 FRANCE EPOXY PRIMER MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 140 FRANCE EPOXY PRIMER MARKET BY TECHNOLOGY (KILOTONS) 2020-2030

TABLE 141 FRANCE EPOXY PRIMER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 142 FRANCE EPOXY PRIMER MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 143 ITALY EPOXY PRIMER MARKET BY SUBSTRATE (USD BILLION) 2020-2030

TABLE 144 ITALY EPOXY PRIMER MARKET BY SUBSTRATE (KILOTONS) 2020-2030

TABLE 145 ITALY EPOXY PRIMER MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 146 ITALY EPOXY PRIMER MARKET BY TECHNOLOGY (KILOTONS) 2020-2030

TABLE 147 ITALY EPOXY PRIMER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 148 ITALY EPOXY PRIMER MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 149 SPAIN EPOXY PRIMER MARKET BY SUBSTRATE (USD BILLION) 2020-2030

TABLE 150 SPAIN EPOXY PRIMER MARKET BY SUBSTRATE (KILOTONS) 2020-2030

TABLE 151 SPAIN EPOXY PRIMER MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 152 SPAIN EPOXY PRIMER MARKET BY TECHNOLOGY (KILOTONS) 2020-2030

TABLE 153 SPAIN EPOXY PRIMER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 154 SPAIN EPOXY PRIMER MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 155 RUSSIA EPOXY PRIMER MARKET BY SUBSTRATE (USD BILLION) 2020-2030

TABLE 156 RUSSIA EPOXY PRIMER MARKET BY SUBSTRATE (KILOTONS) 2020-2030

TABLE 157 RUSSIA EPOXY PRIMER MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 158 RUSSIA EPOXY PRIMER MARKET BY TECHNOLOGY (KILOTONS) 2020-2030

TABLE 159 RUSSIA EPOXY PRIMER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 160 RUSSIA EPOXY PRIMER MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 161 REST OF EUROPE EPOXY PRIMER MARKET BY SUBSTRATE (USD BILLION) 2020-2030

TABLE 162 REST OF EUROPE EPOXY PRIMER MARKET BY SUBSTRATE (KILOTONS) 2020-2030

TABLE 163 REST OF EUROPE EPOXY PRIMER MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 164 REST OF EUROPE EPOXY PRIMER MARKET BY TECHNOLOGY (KILOTONS) 2020-2030

TABLE 165 REST OF EUROPE EPOXY PRIMER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 166 REST OF EUROPE EPOXY PRIMER MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 167 MIDDLE EAST AND AFRICA EPOXY PRIMER MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 168 MIDDLE EAST AND AFRICA EPOXY PRIMER MARKET BY COUNTRY (KILOTONS) 2020-2030

TABLE 169 MIDDLE EAST AND AFRICA EPOXY PRIMER MARKET BY SUBSTRATE (USD BILLION) 2020-2030

TABLE 170 MIDDLE EAST AND AFRICA EPOXY PRIMER MARKET BY SUBSTRATE (KILOTONS) 2020-2030

TABLE 171 MIDDLE EAST AND AFRICA EPOXY PRIMER MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 172 MIDDLE EAST AND AFRICA EPOXY PRIMER MARKET BY TECHNOLOGY (KILOTONS) 2020-2030

TABLE 173 MIDDLE EAST AND AFRICA EPOXY PRIMER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 174 MIDDLE EAST AND AFRICA EPOXY PRIMER MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 175 UAE EPOXY PRIMER MARKET BY SUBSTRATE (USD BILLION) 2020-2030

TABLE 176 UAE EPOXY PRIMER MARKET BY SUBSTRATE (KILOTONS) 2020-2030

TABLE 177 UAE EPOXY PRIMER MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 178 UAE EPOXY PRIMER MARKET BY TECHNOLOGY (KILOTONS) 2020-2030

TABLE 179 UAE EPOXY PRIMER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 180 UAE EPOXY PRIMER MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 181 SAUDI ARABIA EPOXY PRIMER MARKET BY SUBSTRATE (USD BILLION) 2020-2030

TABLE 182 SAUDI ARABIA EPOXY PRIMER MARKET BY SUBSTRATE (KILOTONS) 2020-2030

TABLE 183 SAUDI ARABIA EPOXY PRIMER MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 184 SAUDI ARABIA EPOXY PRIMER MARKET BY TECHNOLOGY (KILOTONS) 2020-2030

TABLE 185 SAUDI ARABIA EPOXY PRIMER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 186 SAUDI ARABIA EPOXY PRIMER MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 187 SOUTH AFRICA EPOXY PRIMER MARKET BY SUBSTRATE (USD BILLION) 2020-2030

TABLE 188 SOUTH AFRICA EPOXY PRIMER MARKET BY SUBSTRATE (KILOTONS) 2020-2030

TABLE 189 SOUTH AFRICA EPOXY PRIMER MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 190 SOUTH AFRICA EPOXY PRIMER MARKET BY TECHNOLOGY (KILOTONS) 2020-2030

TABLE 191 SOUTH AFRICA EPOXY PRIMER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 192 SOUTH AFRICA EPOXY PRIMER MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 193 REST OF MIDDLE EAST AND AFRICA EPOXY PRIMER MARKET BY SUBSTRATE (USD BILLION) 2020-2030

TABLE 194 REST OF MIDDLE EAST AND AFRICA EPOXY PRIMER MARKET BY SUBSTRATE (KILOTONS) 2020-2030

TABLE 195 REST OF MIDDLE EAST AND AFRICA EPOXY PRIMER MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 196 REST OF MIDDLE EAST AND AFRICA EPOXY PRIMER MARKET BY TECHNOLOGY (KILOTONS) 2020-2030

TABLE 197 REST OF MIDDLE EAST AND AFRICA EPOXY PRIMER MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 198 REST OF MIDDLE EAST AND AFRICA EPOXY PRIMER MARKET BY APPLICATION (KILOTONS) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL EPOXY PRIMER MARKET BY SUBSTRATE, USD BILLION, 2020-2030

FIGURE 9 GLOBAL EPOXY PRIMER MARKET BY TECHNOLOGY, USD BILLION, 2020-2030

FIGURE 10 GLOBAL EPOXY PRIMER MARKET BY APPLICATION, USD BILLION, 2020-2030

FIGURE 11 GLOBAL EPOXY PRIMER MARKET BY REGION, USD BILLION, 2020-2030

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL EPOXY PRIMER MARKET BY SUBSTRATE, USD BILLION, 2022

FIGURE 14 GLOBAL EPOXY PRIMER MARKET BY TECHNOLOGY, USD BILLION, 2022

FIGURE 15 GLOBAL EPOXY PRIMER MARKET BY APPLICATION, USD BILLION, 2022

FIGURE 16 GLOBAL EPOXY PRIMER MARKET BY REGION, USD BILLION, 2022

FIGURE 17 NORTH AMERICA EPOXY PRIMER MARKET SNAPSHOT

FIGURE 18 EUROPE EPOXY PRIMER MARKET SNAPSHOT

FIGURE 19 SOUTH AMERICA EPOXY PRIMER MARKET SNAPSHOT

FIGURE 20 ASIA PACIFIC EPOXY PRIMER MARKET SNAPSHOT

FIGURE 21 MIDDLE EAST ASIA AND AFRICA EPOXY PRIMER MARKET SNAPSHOT

FIGURE 22 MARKET SHARE ANALYSIS

FIGURE 23 ASIAN PAINTS LTD: COMPANY SNAPSHOT

FIGURE 24 PPG INDUSTRIES INC.: COMPANY SNAPSHOT

FIGURE 25 KANSAI PAINTS CO. LTD: COMPANY SNAPSHOT

FIGURE 26 JOTUN GROUP: COMPANY SNAPSHOT

FIGURE 27 AXALTA COATING SYSTEMS: COMPANY SNAPSHOT

FIGURE 28 3M COMPANY: COMPANY SNAPSHOT

FIGURE 29 SHERWIN-WILLIAMS: COMPANY SNAPSHOT

FIGURE 30 AKZO NOBEL N.V.: COMPANY SNAPSHOT

FIGURE 31 BASF SE: COMPANY SNAPSHOT

FIGURE 32 NIPPON PAINT HOLDINGS CO. LTD.: COMPANY SNAPSHOT

DOWNLOAD FREE SAMPLE REPORT

License Type

SPEAK WITH OUR ANALYST

Want to know more about the report or any specific requirement?

WANT TO CUSTOMIZE THE REPORT?

Our Clients Speak

We asked them to research ‘ Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te

Yosuke Mitsui

Senior Associate Construction Equipment Sales & Marketing

We asked them to research ‘Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te