Base Year Value ()

CAGR ()

Forecast Year Value ()

Historical Data Period

Largest Region

Forecast Period

Mercato della carne coltivata per fonte (pollame, manzo, frutti di mare, maiale, anatra), tecnica di produzione (tecnica basata su impalcature, tecnica di auto-organizzazione, terreni di coltura cellulare, altri), utilizzo finale (nugget, hamburger, polpette, hot dog, salsicce, altri) e regione, tendenze globali e previsioni dal 2022 al 2029.

Instant access to hundreds of data points and trends

- Market estimates from 2014-2029

- Competitive analysis, industry segmentation, financial benchmarks

- Incorporates SWOT, Porter's Five Forces and risk management frameworks

- PDF report or online database with Word, Excel and PowerPoint export options

- 100% money back guarantee

Panoramica del mercato della carne coltivata

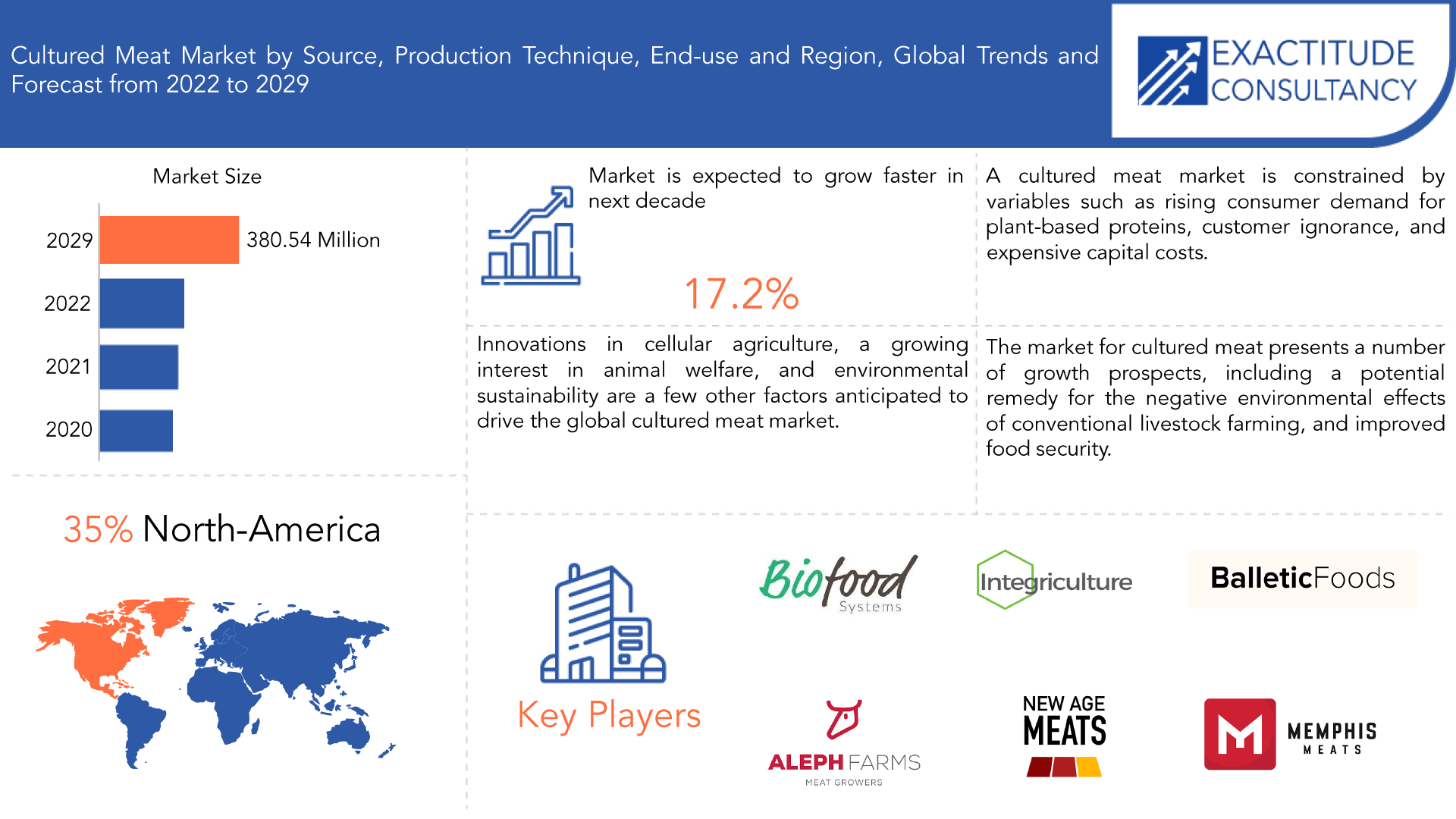

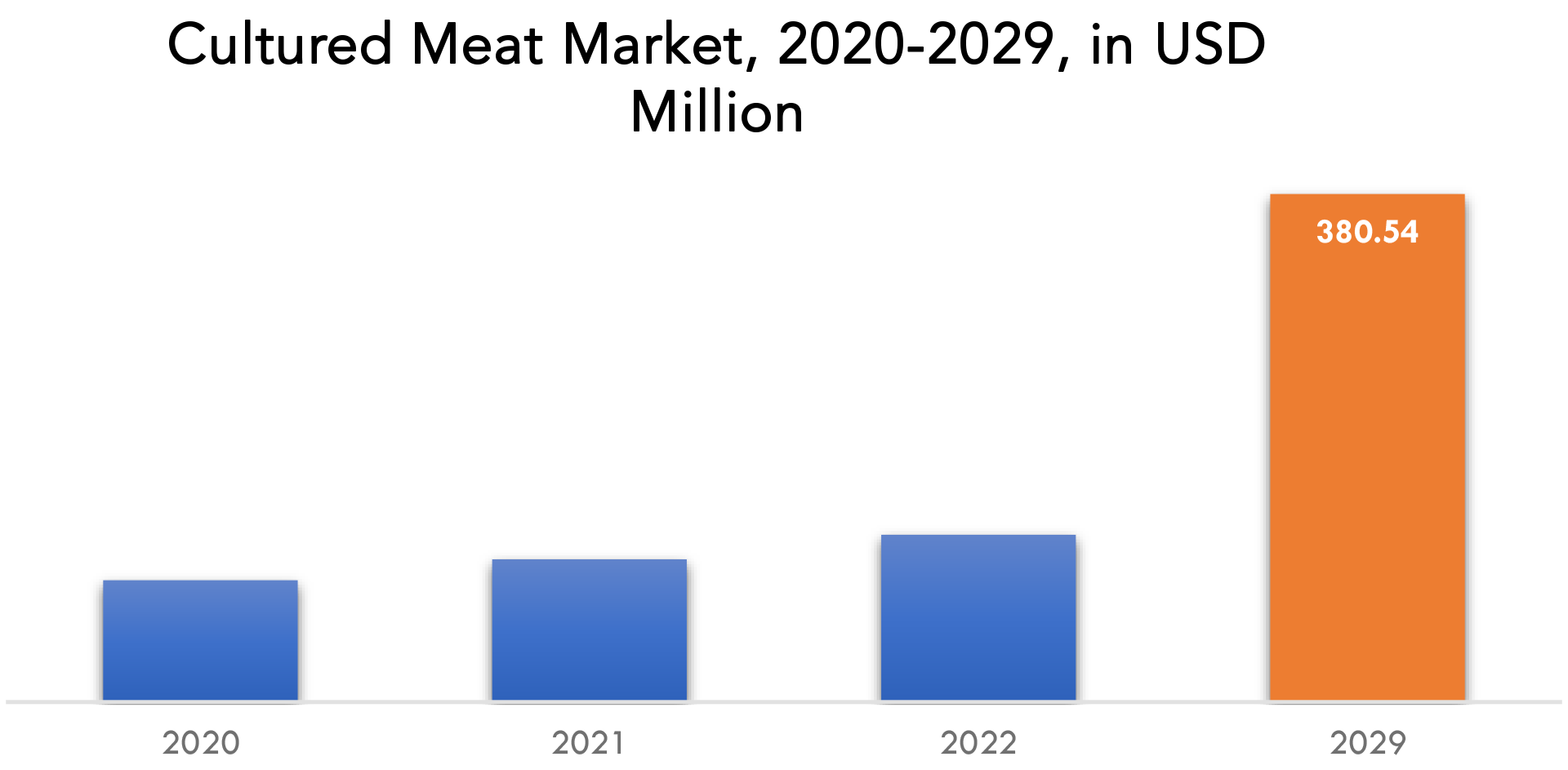

Si prevede che il mercato della carne coltivata crescerà al 17,2% di CAGR dal 2022 al 2029. Si prevede che raggiungerà oltre 380,54 milioni di USD entro il 2029 dai 106,9 milioni di USD del 2021.

La carne coltivata è un tipo di carne creata coltivando tessuto muscolare animale in un ambiente di laboratorio. È anche chiamata carne a base di cellule, carne coltivata in laboratorio o carne sintetica. Un piccolo campione di cellule animali viene utilizzato per generare questa carne, che viene poi replicata e moltiplicata tramite biotecnologia . Diversi problemi con l'allevamento convenzionale di animali, come quelli che riguardano il benessere degli animali, l'ambiente e i pericoli per la salute pubblica posti dall'ingestione di carne convenzionale, sono stati collegati alla carne coltivata come potenziale soluzione. Sebbene la tecnologia per creare carne coltivata sia ancora agli inizi, sono stati fatti progressi sostanziali di recente e diverse aziende stanno ora producendo prodotti a base di carne coltivata in quantità limitate. Tuttavia, prima che la carne coltivata sia generalmente accessibile ai consumatori, devono ancora essere risolti diversi problemi legislativi, tecnici ed economici.

Sebbene sia attualmente nelle sue prime fasi di sviluppo, il mercato della carne coltivata ha il potenziale per modificare completamente il modo in cui produciamo e consumiamo la carne. Le preoccupazioni sul benessere degli animali, gli effetti ambientali dell'allevamento convenzionale e i potenziali problemi di salute correlati al consumo di carne convenzionale sono alcuni dei problemi che stanno guidando la domanda di carne coltivata. Tuttavia, man mano che più clienti diventano consapevoli dei potenziali vantaggi di questa nuova tecnologia, si prevede che il mercato della carne coltivata si espanderà rapidamente negli anni a venire.

| ATTRIBUTO | DETTAGLI |

| Periodo di studio | 2020-2029 |

| Anno base | 2021 |

| Anno stimato | 2022 |

| Anno previsto | 2022-2029 |

| Periodo storico | 2018-2020 |

| Unità | Valore (milioni di USD), Valore (tonnellate) |

| Segmentazione | Per fonte, Per tecnica di prodotto, Per uso finale, Per regione |

| Per fonte |

|

| Per tecnica del prodotto |

|

| Per uso finale |

|

| Per regione |

|

The market for cultured meat is expanding as meat consumption rises in all parts of the world. Since cultured meat is less polluted than animal meat, it is used as a nutritious substitute for meat from animals. Due to a greater demand for protein consumption and rising disposable income, more meat is being consumed globally than ever before. Global meat consumption is anticipated to expand by 12% between 2020 and 2029, according to the Organization for Economic Co-operation and Development - Food and Agricultural Organization (OECD-FAO) Agriculture Outlook 2020-2029. The World Counts research also states that between 460 and 570 million tons of meat would be consumed worldwide by 2050. As a result, the market for cultured meat is driven by rising meat and meat-related product consumption.

The market for cultured meat may be constrained by a number of factors. The high cost of production is one of the main obstacles to the broad acceptance of cultured meat at the moment. While the technology is still developing and there are technological challenges to be solved, scaling up manufacturing to commercial levels is also a major difficulty. Also, given that the production and marketing of cultured meat are not yet completely controlled, there might be regulatory obstacles to surmount in some nations. Finally, a hindrance to market expansion may be consumer acceptability and willingness to pay a premium for cultured beef products.

The market for cultured meat presents a number of growth prospects, including a potential remedy for the negative environmental effects of conventional livestock farming, improved food security, and the capacity to satisfy the rising demand for meat without the moral dilemmas connected with animal slaughter. Furthermore, cultured beef may improve health and lower the chance of contracting foodborne infections. The market for cultured meat is anticipated to expand dramatically over the next few years as a result of rising research and development spending, technological developments, and legislative support. This will create commercial opportunities and help to create a more sustainable future.

Global socio-economic crisis brought on by the COVID-19 pandemic as a result of major effects on meat production, value chain management, and meat prices. During the first several months of the virus pandemic, panic buying increased the price of meat and animal products. Later, however, due to tightening regulations and customers' diminishing purchasing power, production and demand for meat dramatically decreased, which reduced the amount of product demand. However, the problem was made worse by the unprecedented closure of in vitro meat labs and facilities due to tight conditions and a labor shortage. The local and international export markets' altered laws greatly interrupted business operations, which further hampered industry revenue streams.

[caption id="allegato_21830" align="aligncenter" width="1920"]

Frequently Asked Questions

• What is the projected market size & growth rate of the cultured meat market?

Cultured meat market was valued at USD 106.9 million in 2022 and is projected to reach USD 380.54 million by 2029, growing at a CAGR of 17.2% from 2022 to 2029.

• What are the factors driving the cultured meat market?

Key factors that are driving the cultured meat market growth include the growing vegan population and consumer sentiment toward animal welfare along with the growing technological advancements in the alternative proteins space.

• What are the top players operating in the cultured meat market?

The major players are Biofood Systems LTD., Integriculture Inc., New Age Meats, Balletic Foods, Memphis Meats, Aleph Farms Ltd., Seafuture Sustainable Biotech, Mosa Meat, Avant Meats Company Limited, Appleton Meats, Cubiq Foods.

• What segments are covered in the Cultured Meat Market report?

The global cultured meat market is segmented on the basis of product technique, source, end-use, and geography.

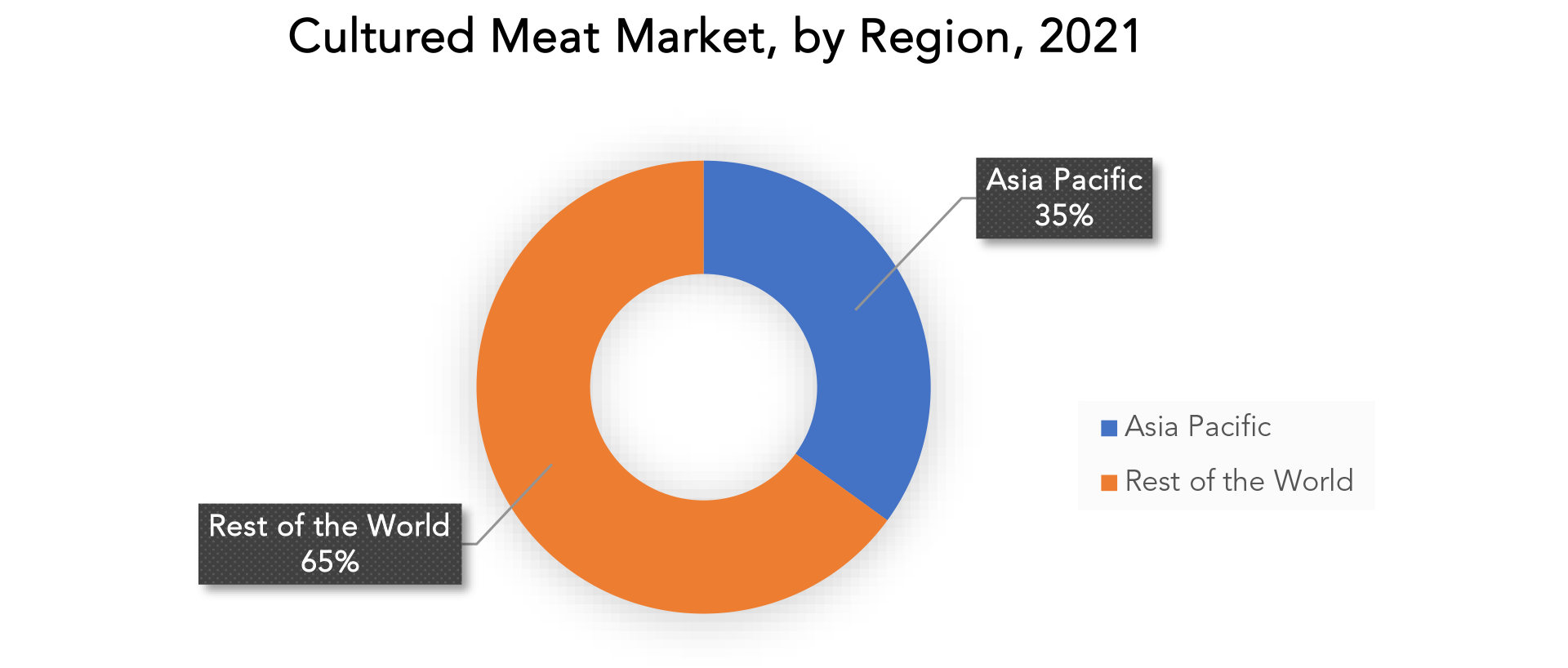

• Which region held the largest share of cultured meat market in 2021?

North-America held the largest share of cultured meat market in 2021.

Cultured Meat Market Segment Analysis

The cultured meat market is segmented based on raw material, source, application and region. By source market is segmented into poultry, beef, seafood, pork, duck; by product technique market is segmented into scaffold-based technique, self-organizing technique, cell culture media, others; by end-use market is segmented into nuggets, burgers, meatballs, hotdogs, sausages, others, and region.

Poultry dominated the market in terms of revenue in 2021. For the past 50 years, chicken consumption has increased throughout North America. The expansion of the poultry industry is being aided by the increase in startups and new market players who are investing in cellular agriculture technology to create goods made from chicken. One of the most common meats consumed worldwide is pork, which the United States Department of Agriculture (USDA) classifies as red meat. The growth of the pork market is also attributable to the growing number of new businesses and existing firms in the industry testing grown meat made from pig cells.

cThe multiplication of isolated muscle satellite cells in a bioreactor using a culture medium is one of the scaffold-based production techniques. The generation of cultured meat with basic structures for hamburgers and sausages uses scaffold culturing techniques. Its application is constrained when making complex items like steak, though.

Burgers dominated the market in 2021 in terms of sales. Due to rising consumer demand for ethical and sustainable beef substitutes, the cultured burger market is predicted to rise. Burgers made from cultured meat may help the meat business have a smaller negative impact on the environment. Cultivated meat is being tested by a number of startups and major players, which is also anticipated to assist the segment's growth. Over the projection period, the meatballs sector is anticipated to grow. Consumers frequently purchase processed meat items like meatballs from stores. The consumer base of the sector has grown as a result of the rising knowledge of the alleged health benefits of cultured meats.

[caption id="attachment_21834" align="aligncenter" width="1920"]

Cultured Meat Market Players

The Cultured Meat Market key players include Biofood Systems LTD., Integriculture Inc., New Age Meats, Balletic Foods, Memphis Meats, Aleph Farms Ltd., Seafuture Sustainable Biotech, Mosa Meat, Avant Meats Company Limited, Appleton Meats, Cubiq Foods, and others. Recent Developments:- 20 September 2021: A research partnership between Avant and A*STAR's Bioprocessing Technologies Institute (BTI) signed in order to advance the scaling up of Avant's unique technology and enable the affordable, high-quality production of cultured fish in Singapore and elsewhere.

- 15 February 2021: Avant announced the launch of Zellulin, an ethically and sustainably sourced bioactive ingredient produced in a fully traceable and controlled environment, using Avant's cell culture biotechnology.

Who Should Buy? Or Key stakeholders

- Manufacturers

- Food Industry

- Traders and distributors

- End-users companies

- Government organizations

- Research organizations

- Investment research firms

- Others

Cultured Meat Market Regional Analysis

The cultured meat market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico, Rest of North America

- Asia Pacific: includes China, Japan, South Korea, India, Australia, and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Russia, Spain, and Rest of Europe

- South America: includes Brazil, Argentina, Colombia and Rest of South America

- Middle East & Africa: includes UAE, Saudi Arabia, South Africa, and Rest of MEA

With a market share of more than 35% in 2021, North America dominated the cultured meat industry. The rise is being supported by rising consumer demand for ethically produced meat and poultry products as well as the presence of important firms in the area. To produce cultivated meats in the area, a number of US businesses, like Fork & Goode and BlueNalu, are progressively investing in cell-agriculture technologies. The desire for items made from cultured poultry is also being fueled by the region's favourable regulatory laws for cultured meat. Using cultured cells from poultry and cattle, the U.S. Department of Agriculture (USDA) and the Food and Drug Administration (FDA) decided to regulate the manufacture of chicken and meat products in March 2019.

Europe is another sizable market for cultured meat, and there are a lot of businesses and research centres there. The European Union has funded in the study and development of cultured meat and has backed alternative protein sources.

With a number of businesses and research institutions situated in nations like Singapore, Japan, and South Korea, the Asia-Pacific area is developing as a potential hub for cultured meat. The region is a desirable market for cultured meat due to its expanding population, high meat demand, and worries about sustainability and food security.

[caption id="attachment_21836" align="aligncenter" width="1920"]

- Poultry

- Beef

- Seafood

- Pork

- Duck

- Scaffold-Based Technique

- Self-Organizing Technique

- Cell Culture Media

- Others

- Nuggets

- Burgers

- Meatballs

- Hotdogs

- Sausages

- Others

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Exactitude Consultancy Services Key Objectives

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the cultured meat market over the next 7 years?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-pacific, Middle East, and Africa?

- How is the economic environment affecting the cultured meat market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the cultured meat market?

- What is the current and forecasted size and growth rate of the global cultured meat market?

- What are the key drivers of growth in the cultured meat market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the cultured meat market?

- What are the technological advancements and innovations in the cultured meat market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the cultured meat market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the cultured meat market?

- What are the service offerings and specifications of leading players in the market?

- What is the pricing trend of cultured meat in the market and what is the impact of raw material prices on the price trend?

- INTRODUZIONE

- DEFINIZIONE DI MERCATO

- SEGMENTAZIONE DEL MERCATO

- TEMPI DI RICERCA

- ASSUNZIONI E LIMITAZIONI

- METODOLOGIA DI RICERCA

- ESTRAZIONE DATI

- RICERCA SECONDARIA

- RICERCA PRIMARIA

- PARERI DEGLI ESPERTI IN MATERIA

- CONTROLLI DI QUALITÀ

- RECENSIONE FINALE

- TRIANGOLAZIONE DEI DATI

- APPROCCIO DAL BASSO VERSO L'ALTO

- APPROCCIO TOP-DOWN

- FLUSSO DI RICERCA

- FONTI DEI DATI

- ESTRAZIONE DATI

- SINTESI

- PANORAMICA DEL MERCATO

- PROSPETTIVE DEL MERCATO GLOBALE DELLA CARNE COLTIVATA

- FATTORI DI MERCATO

- LIMITAZIONI DI MERCATO

- OPPORTUNITÀ DI MERCATO

- IMPATTO DEL COVID-19 SUL MERCATO DELLA CARNE COLTIVATA

- MODELLO DELLE CINQUE FORZE DI PORTER

- MINACCIA DAI NUOVI ENTRANSI

- MINACCIA DA SOSTITUTI

- POTERE CONTRATTUALE DEI FORNITORI

- POTERE CONTRATTUALE DEI CLIENTI

- GRADO DI COMPETIZIONE

- ANALISI DELLA CATENA DEL VALORE DEL SETTORE

- PROSPETTIVE DEL MERCATO GLOBALE DELLA CARNE COLTIVATA

- MERCATO GLOBALE DELLA CARNE COLTIVATA PER FONTE (MILIONI DI DOLLARI, TONNELLATE), 2020-2029

- POLLAME

- MANZO

- FRUTTI DI MARE

- MAIALE

- ANATRA

- MERCATO GLOBALE DELLA CARNE COLTIVATA PER TECNICA DI PRODOTTO (MILIONI DI USD, TONNELLATE), 2020-2029

- TECNICA BASATA SU IMPALCATURE

- TECNICA DI AUTO-ORGANIZZAZIONE

- TERRENI DI COLTURA CELLULARE

- ALTRI

- MERCATO GLOBALE DELLA CARNE COLTIVATA PER USO FINALE (MILIONI DI USD, TONNELLATE), 2020-2029

- PEPITE

- HAMBURGER

- POLPETTE

- HOT DOG

- SALSICCE

- ALTRI

- MERCATO GLOBALE DELLA CARNE COLTIVATA PER REGIONE (MILIONI DI DOLLARI, TONNELLATE), 2020-2029

- AMERICA DEL NORD

- NOI

- CANADA

- MESSICO

- RESTO DEL NORD AMERICA

- SUD AMERICA

- BRASILE

- ARGENTINA

- COLOMBIA

- RESTO DEL SUD AMERICA

- EUROPA

- GERMANIA

- Regno Unito

- FRANCIA

- ITALIA

- SPAGNA

- RUSSIA

- RESTO D'EUROPA

- ASIA PACIFICO

- INDIA

- CINA

- GIAPPONE

- COREA DEL SUD

- AUSTRALIA

- RESTO DELL'ASIA PACIFICO

- MEDIO ORIENTE E AFRICA

- Emirati Arabi Uniti

- ARABIA SAUDITA

- SUDAFRICA

- RESTO DEL MEDIO ORIENTE E AFRICA

- AMERICA DEL NORD

- PROFILI AZIENDALI* (PANORAMICA AZIENDALE, PANORAMICA AZIENDALE, PRODOTTI OFFERTI, SVILUPPI RECENTI)

- SISTEMI BIOLOGICI LTD.

- INTEGRICOLTURA INC.

- CARNI NEW AGE

- CIBI BALLETICI

- CARNI DI MEMPHIS

- AZIENDE AGRICOLE ALEPH LTD.

- BIOTECH SOSTENIBILE SEAFUTURE

- CARNE DI MOSA

- AZIENDA DI CARNI AVANT LIMITED

- CARNI DI APPLETON

- CUBIQ FOODS *L'ELENCO DELLE AZIENDE È INDICATIVO

ELENCO DELLE TABELLE

TABLE 1 GLOBAL CULTURED MEAT MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 2 GLOBAL CULTURED MEAT MARKET BY SOURCE (TONS), 2020-2029

TABLE 3 GLOBAL CULTURED MEAT MARKETBY PRODUCT TECHNIQUE (USD MILLION), 2020-2029

TABLE 4 GLOBAL CULTURED MEAT MARKET BY PRODUCT TECHNIQUE (TONS), 2020-2029

TABLE 5 GLOBAL CULTURED MEAT MARKET BY END-USE (USD MILLION), 2020-2029

TABLE 6 GLOBAL CULTURED MEAT MARKET BY END-USE (TONS), 2020-2029

TABLE 7 GLOBAL CULTURED MEAT MARKET BY REGION (USD MILLION), 2020-2029

TABLE 8 GLOBAL CULTURED MEAT MARKET BY REGION (TONS), 2020-2029

TABLE 9 NORTH AMERICA CULTURED MEAT MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 10 NORTH AMERICA CULTURED MEAT MARKET BY SOURCE (TONS), 2020-2029

TABLE 11 NORTH AMERICA CULTURED MEAT MARKETBY PRODUCT TECHNIQUE (USD MILLION), 2020-2029

TABLE 12 NORTH AMERICA CULTURED MEAT MARKET BY PRODUCT TECHNIQUE (TONS), 2020-2029

TABLE 13 NORTH AMERICA CULTURED MEAT MARKET BY END-USE (USD MILLION), 2020-2029

TABLE 14 NORTH AMERICA CULTURED MEAT MARKET BY END-USE (TONS), 2020-2029

TABLE 15 NORTH AMERICA CULTURED MEAT MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 16 NORTH AMERICA CULTURED MEAT MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 17 US CULTURED MEAT MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 18 US CULTURED MEAT MARKET BY SOURCE (TONS), 2020-2029

TABLE 19 US CULTURED MEAT MARKETBY PRODUCT TECHNIQUE (USD MILLION), 2020-2029

TABLE 20 US CULTURED MEAT MARKET BY PRODUCT TECHNIQUE (TONS), 2020-2029

TABLE 21 US CULTURED MEAT MARKET BY END-USE (USD MILLION), 2020-2029

TABLE 22 US CULTURED MEAT MARKET BY END-USE (TONS), 2020-2029

TABLE 23 CANADA CULTURED MEAT MARKET BY SOURCE (MILLION), 2020-2029

TABLE 24 CANADA CULTURED MEAT MARKET BY SOURCE (TONS), 2020-2029

TABLE 25 CANADA CULTURED MEAT MARKETBY PRODUCT TECHNIQUE (USD MILLION), 2020-2029

TABLE 26 CANADA CULTURED MEAT MARKET BY PRODUCT TECHNIQUE (TONS), 2020-2029

TABLE 27 CANADA CULTURED MEAT MARKET BY END-USE (USD MILLION), 2020-2029

TABLE 28 CANADA CULTURED MEAT MARKET BY END-USE (TONS), 2020-2029

TABLE 29 MEXICO CULTURED MEAT MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 30 MEXICO CULTURED MEAT MARKET BY SOURCE (TONS), 2020-2029

TABLE 31 MEXICO CULTURED MEAT MARKETBY PRODUCT TECHNIQUE (USD MILLION), 2020-2029

TABLE 32 MEXICO CULTURED MEAT MARKET BY PRODUCT TECHNIQUE (TONS), 2020-2029

TABLE 33 MEXICO CULTURED MEAT MARKET BY END-USE (USD MILLION), 2020-2029

TABLE 34 MEXICO CULTURED MEAT MARKET BY END-USE (TONS), 2020-2029

TABLE 35 REST OF NORTH AMERICA CULTURED MEAT MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 36 REST OF NORTH AMERICA CULTURED MEAT MARKET BY SOURCE (TONS), 2020-2029

TABLE 37 REST OF NORTH AMERICA CULTURED MEAT MARKETBY PRODUCT TECHNIQUE (USD MILLION), 2020-2029

TABLE 38 REST OF NORTH AMERICA CULTURED MEAT MARKET BY PRODUCT TECHNIQUE (TONS), 2020-2029

TABLE 39 REST OF NORTH AMERICA CULTURED MEAT MARKET BY END-USEN (USD MILLION), 2020-2029

TABLE 40 REST OF NORTH AMERICA CULTURED MEAT MARKET BY END-USEN (TONS), 2020-2029

TABLE 41 SOUTH AMERICA CULTURED MEAT MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 42 SOUTH AMERICA CULTURED MEAT MARKET BY SOURCE (TONS), 2020-2029

TABLE 43 SOUTH AMERICA CULTURED MEAT MARKETBY PRODUCT TECHNIQUE (USD MILLION), 2020-2029

TABLE 44 SOUTH AMERICA CULTURED MEAT MARKET BY PRODUCT TECHNIQUE (TONS), 2020-2029

TABLE 45 SOUTH AMERICA CULTURED MEAT MARKET BY END-USE (USD MILLION), 2020-2029

TABLE 46 SOUTH AMERICA CULTURED MEAT MARKET BY END-USE (TONS), 2020-2029

TABLE 47 SOUTH AMERICA CULTURED MEAT MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 48 SOUTH AMERICA CULTURED MEAT MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 49 BRAZIL CULTURED MEAT MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 50 BRAZIL CULTURED MEAT MARKET BY SOURCE (TONS), 2020-2029

TABLE 51 BRAZIL CULTURED MEAT MARKETBY PRODUCT TECHNIQUE (USD MILLION), 2020-2029

TABLE 52 BRAZIL CULTURED MEAT MARKET BY PRODUCT TECHNIQUE (TONS), 2020-2029

TABLE 53 BRAZIL CULTURED MEAT MARKET BY END-USE (USD MILLION), 2020-2029

TABLE 54 BRAZIL CULTURED MEAT MARKET BY END-USE (TONS), 2020-2029

TABLE 55 ARGENTINA CULTURED MEAT MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 56 ARGENTINA CULTURED MEAT MARKET BY SOURCE (TONS), 2020-2029

TABLE 57 ARGENTINA CULTURED MEAT MARKETBY PRODUCT TECHNIQUE (USD MILLION), 2020-2029

TABLE 58 ARGENTINA CULTURED MEAT MARKET BY PRODUCT TECHNIQUE (TONS), 2020-2029

TABLE 59 ARGENTINA CULTURED MEAT MARKET BY END-USE (USD MILLION), 2020-2029

TABLE 60 ARGENTINA CULTURED MEAT MARKET BY END-USE (TONS), 2020-2029

TABLE 61 COLOMBIA CULTURED MEAT MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 62 COLOMBIA CULTURED MEAT MARKET BY SOURCE (TONS), 2020-2029

TABLE 63 COLOMBIA CULTURED MEAT MARKETBY PRODUCT TECHNIQUE (USD MILLION), 2020-2029

TABLE 64 COLOMBIA CULTURED MEAT MARKET BY PRODUCT TECHNIQUE (TONS), 2020-2029

TABLE 65 COLOMBIA CULTURED MEAT MARKET BY END-USE (USD MILLION), 2020-2029

TABLE 66 COLOMBIA CULTURED MEAT MARKET BY END-USE (TONS), 2020-2029

TABLE 67 REST OF SOUTH AMERICA CULTURED MEAT MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 68 REST OF SOUTH AMERICA CULTURED MEAT MARKET BY SOURCE (TONS), 2020-2029

TABLE 69 REST OF SOUTH AMERICA CULTURED MEAT MARKETBY PRODUCT TECHNIQUE (USD MILLION), 2020-2029

TABLE 70 REST OF SOUTH AMERICA CULTURED MEAT MARKET BY PRODUCT TECHNIQUE (TONS), 2020-2029

TABLE 71 REST OF SOUTH AMERICA CULTURED MEAT MARKET BY END-USEN (USD MILLION), 2020-2029

TABLE 72 REST OF SOUTH AMERICA CULTURED MEAT MARKET BY END-USEN (TONS), 2020-2029

TABLE 73 ASIA -PACIFIC CULTURED MEAT MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 74 ASIA -PACIFIC CULTURED MEAT MARKET BY SOURCE (TONS), 2020-2029

TABLE 75 ASIA -PACIFIC CULTURED MEAT MARKETBY PRODUCT TECHNIQUE (USD MILLION), 2020-2029

TABLE 76 ASIA -PACIFIC CULTURED MEAT MARKET BY PRODUCT TECHNIQUE (TONS), 2020-2029

TABLE 77 ASIA -PACIFIC CULTURED MEAT MARKET BY END-USE (USD MILLION), 2020-2029

TABLE 78 ASIA -PACIFIC CULTURED MEAT MARKET BY END-USE (TONS), 2020-2029

TABLE 79 ASIA -PACIFIC CULTURED MEAT MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 80 ASIA -PACIFIC CULTURED MEAT MARKET BY COUNTRY (TONS), 2020-2029

TABLE 81 INDIA CULTURED MEAT MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 82 INDIA CULTURED MEAT MARKET BY SOURCE (TONS), 2020-2029

TABLE 83 INDIA CULTURED MEAT MARKETBY PRODUCT TECHNIQUE (USD MILLION), 2020-2029

TABLE 84 INDIA CULTURED MEAT MARKET BY PRODUCT TECHNIQUE (TONS), 2020-2029

TABLE 85 INDIA CULTURED MEAT MARKET BY END-USE (USD MILLION), 2020-2029

TABLE 86 INDIA CULTURED MEAT MARKET BY END-USE (TONS), 2020-2029

TABLE 87 CHINA CULTURED MEAT MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 88 CHINA CULTURED MEAT MARKET BY SOURCE (TONS), 2020-2029

TABLE 89 CHINA CULTURED MEAT MARKETBY PRODUCT TECHNIQUE (USD MILLION), 2020-2029

TABLE 90 CHINA CULTURED MEAT MARKET BY PRODUCT TECHNIQUE (TONS), 2020-2029

TABLE 91 CHINA CULTURED MEAT MARKET BY END-USE (USD MILLION), 2020-2029

TABLE 92 CHINA CULTURED MEAT MARKET BY END-USE (TONS), 2020-2029

TABLE 93 JAPAN CULTURED MEAT MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 94 JAPAN CULTURED MEAT MARKET BY SOURCE (TONS), 2020-2029

TABLE 95 JAPAN CULTURED MEAT MARKETBY PRODUCT TECHNIQUE (USD MILLION), 2020-2029

TABLE 96 JAPAN CULTURED MEAT MARKET BY PRODUCT TECHNIQUE (TONS), 2020-2029

TABLE 97 JAPAN CULTURED MEAT MARKET BY END-USE (USD MILLION), 2020-2029

TABLE 98 JAPAN CULTURED MEAT MARKET BY END-USE (TONS), 2020-2029

TABLE 99 SOUTH KOREA CULTURED MEAT MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 100 SOUTH KOREA CULTURED MEAT MARKET BY SOURCE (TONS), 2020-2029

TABLE 101 SOUTH KOREA CULTURED MEAT MARKETBY PRODUCT TECHNIQUE (USD MILLION), 2020-2029

TABLE 102 SOUTH KOREA CULTURED MEAT MARKET BY PRODUCT TECHNIQUE (TONS), 2020-2029

TABLE 103 SOUTH KOREA CULTURED MEAT MARKET BY END-USE (USD MILLION), 2020-2029

TABLE 104 SOUTH KOREA CULTURED MEAT MARKET BY END-USE (TONS), 2020-2029

TABLE 105 AUSTRALIA CULTURED MEAT MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 106 AUSTRALIA CULTURED MEAT MARKET BY PRODUCT TECHNIQUEBY SOURCE (TONS), 2020-2029

TABLE 107 AUSTRALIA CULTURED MEAT MARKETBY PRODUCT TECHNIQUE (USD MILLION), 2020-2029

TABLE 108 AUSTRALIA CULTURED MEAT MARKET BY PRODUCT TECHNIQUE (TONS), 2020-2029

TABLE 109 AUSTRALIA CULTURED MEAT MARKET BY END-USE (USD MILLION), 2020-2029

TABLE 110 AUSTRALIA CULTURED MEAT MARKET BY END-USE (TONS), 2020-2029

TABLE 111 REST OF ASIA PACIFIC CULTURED MEAT MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 112 REST OF ASIA PACIFIC CULTURED MEAT MARKET BY PRODUCT TECHNIQUEBY SOURCE (TONS), 2020-2029

TABLE 113 REST OF ASIA PACIFIC CULTURED MEAT MARKETBY PRODUCT TECHNIQUE (USD MILLION), 2020-2029

TABLE 114 REST OF ASIA PACIFIC CULTURED MEAT MARKET BY PRODUCT TECHNIQUE (TONS), 2020-2029

TABLE 115 REST OF ASIA PACIFIC CULTURED MEAT MARKET BY END-USE (USD MILLION), 2020-2029

TABLE 116 REST OF ASIA PACIFIC CULTURED MEAT MARKET BY END-USE (TONS), 2020-2029

TABLE 117 EUROPE CULTURED MEAT MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 118 EUROPE CULTURED MEAT MARKET BY SOURCE (TONS), 2020-2029

TABLE 119 EUROPE CULTURED MEAT MARKETBY PRODUCT TECHNIQUE (USD MILLION), 2020-2029

TABLE 120 EUROPE CULTURED MEAT MARKET BY PRODUCT TECHNIQUE (TONS), 2020-2029

TABLE 121 EUROPE CULTURED MEAT MARKET BY END-USE (USD MILLION), 2020-2029

TABLE 122 EUROPE CULTURED MEAT MARKET BY END-USE (TONS), 2020-2029

TABLE 123 EUROPE CULTURED MEAT MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 124 EUROPE CULTURED MEAT MARKET BY COUNTRY (TONS), 2020-2029

TABLE 125 GERMANY CULTURED MEAT MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 126 GERMANY CULTURED MEAT MARKET BY SOURCE (TONS), 2020-2029

TABLE 127 GERMANY CULTURED MEAT MARKETBY PRODUCT TECHNIQUE (USD MILLION), 2020-2029

TABLE 128 GERMANY CULTURED MEAT MARKET BY PRODUCT TECHNIQUE (TONS), 2020-2029

TABLE 129 GERMANY CULTURED MEAT MARKET BY END-USE (USD MILLION), 2020-2029

TABLE 130 GERMANY CULTURED MEAT MARKET BY END-USE (TONS), 2020-2029

TABLE 131 UK CULTURED MEAT MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 132 UK CULTURED MEAT MARKET BY SOURCE (TONS), 2020-2029

TABLE 133 UK CULTURED MEAT MARKETBY PRODUCT TECHNIQUE (USD MILLION), 2020-2029

TABLE 134 UK CULTURED MEAT MARKET BY PRODUCT TECHNIQUE (TONS), 2020-2029

TABLE 135 UK CULTURED MEAT MARKET BY END-USE (USD MILLION), 2020-2029

TABLE 136 UK CULTURED MEAT MARKET BY END-USE (USD MILLION), 2020-2029

TABLE 137 FRANCE CULTURED MEAT MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 138 FRANCE CULTURED MEAT MARKET BY SOURCE (TONS), 2020-2029

TABLE 139 FRANCE CULTURED MEAT MARKETBY PRODUCT TECHNIQUE (USD MILLION), 2020-2029

TABLE 140 FRANCE CULTURED MEAT MARKET BY PRODUCT TECHNIQUE (TONS), 2020-2029

TABLE 141 FRANCE CULTURED MEAT MARKET BY END-USE (USD MILLION), 2020-2029

TABLE 142 FRANCE CULTURED MEAT MARKET BY END-USE (TONS), 2020-2029

TABLE 143 ITALY CULTURED MEAT MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 144 ITALY CULTURED MEAT MARKET BY SOURCE (TONS), 2020-2029

TABLE 145 ITALY CULTURED MEAT MARKETBY PRODUCT TECHNIQUE (USD MILLION), 2020-2029

TABLE 146 ITALY CULTURED MEAT MARKET BY PRODUCT TECHNIQUE (TONS), 2020-2029

TABLE 147 ITALY CULTURED MEAT MARKET BY END-USE (USD MILLION), 2020-2029

TABLE 148 ITALY CULTURED MEAT MARKET BY END-USE (TONS), 2020-2029

TABLE 149 SPAIN CULTURED MEAT MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 150 SPAIN CULTURED MEAT MARKET BY SOURCE (TONS), 2020-2029

TABLE 151 SPAIN CULTURED MEAT MARKETBY PRODUCT TECHNIQUE (USD MILLION), 2020-2029

TABLE 152 SPAIN CULTURED MEAT MARKET BY PRODUCT TECHNIQUE (TONS), 2020-2029

TABLE 153 SPAIN CULTURED MEAT MARKET BY END-USE (USD MILLION), 2020-2029

TABLE 154 SPAIN CULTURED MEAT MARKET BY END-USE (TONS), 2020-2029

TABLE 155 RUSSIA CULTURED MEAT MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 156 RUSSIA CULTURED MEAT MARKET BY SOURCE (TONS), 2020-2029

TABLE 157 RUSSIA CULTURED MEAT MARKETBY PRODUCT TECHNIQUE (USD MILLION), 2020-2029

TABLE 158 RUSSIA CULTURED MEAT MARKET BY PRODUCT TECHNIQUE (TONS), 2020-2029

TABLE 159 RUSSIA CULTURED MEAT MARKET BY END-USE (USD MILLION), 2020-2029

TABLE 160 RUSSIA CULTURED MEAT MARKET BY END-USE (TONS), 2020-2029

TABLE 161 REST OF EUROPE CULTURED MEAT MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 162 REST OF EUROPE CULTURED MEAT MARKET BY SOURCE (TONS), 2020-2029

TABLE 163 REST OF EUROPE CULTURED MEAT MARKETBY PRODUCT TECHNIQUE (USD MILLION), 2020-2029

TABLE 164 REST OF EUROPE CULTURED MEAT MARKET BY PRODUCT TECHNIQUE (TONS), 2020-2029

TABLE 165 REST OF EUROPE CULTURED MEAT MARKET BY END-USEN (USD MILLION), 2020-2029

TABLE 166 REST OF EUROPE CULTURED MEAT MARKET BY END-USEN (TONS), 2020-2029

TABLE 167 MIDDLE EAST AND AFRICA CULTURED MEAT MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 168 MIDDLE EAST AND AFRICA CULTURED MEAT MARKET BY SOURCE (TONS), 2020-2029

TABLE 169 MIDDLE EAST AND AFRICA CULTURED MEAT MARKETBY PRODUCT TECHNIQUE (USD MILLION), 2020-2029

TABLE 170 MIDDLE EAST AND AFRICA CULTURED MEAT MARKET BY PRODUCT TECHNIQUE (TONS), 2020-2029

TABLE 171 MIDDLE EAST AND AFRICA CULTURED MEAT MARKET BY END-USE (USD MILLION), 2020-2029

TABLE 172 MIDDLE EAST AND AFRICA CULTURED MEAT MARKET BY END-USE (TONS), 2020-2029

TABLE 173 MIDDLE EAST ABD AFRICA CULTURED MEAT MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 174 MIDDLE EAST ABD AFRICA CULTURED MEAT MARKET BY COUNTRY (TONS), 2020-2029

TABLE 175 UAE CULTURED MEAT MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 176 UAE CULTURED MEAT MARKET BY SOURCE (TONS), 2020-2029

TABLE 177 UAE CULTURED MEAT MARKETBY PRODUCT TECHNIQUE (USD MILLION), 2020-2029

TABLE 178 UAE CULTURED MEAT MARKET BY PRODUCT TECHNIQUE (TONS), 2020-2029

TABLE 179 UAE CULTURED MEAT MARKET BY END-USE (USD MILLION), 2020-2029

TABLE 180 UAE CULTURED MEAT MARKET BY END-USE (TONS), 2020-2029

TABLE 181 SAUDI ARABIA CULTURED MEAT MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 182 SAUDI ARABIA CULTURED MEAT MARKET BY SOURCE (TONS), 2020-2029

TABLE 183 SAUDI ARABIA CULTURED MEAT MARKETBY PRODUCT TECHNIQUE (USD MILLION), 2020-2029

TABLE 184 SAUDI ARABIA CULTURED MEAT MARKET BY PRODUCT TECHNIQUE (TONS), 2020-2029

TABLE 185 SAUDI ARABIA CULTURED MEAT MARKET BY END-USE (USD MILLION), 2020-2029

TABLE 186 SAUDI ARABIA CULTURED MEAT MARKET BY END-USE (TONS), 2020-2029

TABLE 187 SOUTH AFRICA CULTURED MEAT MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 188 SOUTH AFRICA CULTURED MEAT MARKET BY SOURCE (TONS), 2020-2029

TABLE 189 SOUTH AFRICA CULTURED MEAT MARKETBY PRODUCT TECHNIQUE (USD MILLION), 2020-2029

TABLE 190 SOUTH AFRICA CULTURED MEAT MARKET BY PRODUCT TECHNIQUE (TONS), 2020-2029

TABLE 191 SOUTH AFRICA CULTURED MEAT MARKET BY END-USE (USD MILLION), 2020-2029

TABLE 192 SOUTH AFRICA CULTURED MEAT MARKET BY END-USE (TONS), 2020-2029

TABLE 193 REST OF MIDDLE EAST AND AFRICA CULTURED MEAT MARKET BY SOURCE (USD MILLION), 2020-2029

TABLE 194 REST OF MIDDLE EAST AND AFRICA CULTURED MEAT MARKET BY SOURCE (TONS), 2020-2029

TABLE 195 REST OF MIDDLE EAST AND AFRICA CULTURED MEAT MARKETBY PRODUCT TECHNIQUE (USD MILLION), 2020-2029

TABLE 196 REST OF MIDDLE EAST AND AFRICA CULTURED MEAT MARKET BY PRODUCT TECHNIQUE (TONS), 2020-2029

TABLE 197 REST OF MIDDLE EAST AND AFRICA CULTURED MEAT MARKET BY END-USE (USD MILLION), 2020-2029

TABLE 198 REST OF MIDDLE EAST AND AFRICA CULTURED MEAT MARKET BY END-USE (TONS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL CULTURED MEAT MARKET BY RAW MATERIAL, USD MILLION, 2020-2029

FIGURE 9 GLOBAL CULTURED MEAT MARKET BY SOURCE, USD MILLION, 2020-2029

FIGURE 10 GLOBAL CULTURED MEAT MARKET BY END-USE, USD MILLION, 2021

FIGURE 11 GLOBAL CULTURED MEAT MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL CULTURED MEAT MARKET BY RAW MATERIAL, USD MILLION, 2021

FIGURE 14 GLOBAL CULTURED MEAT MARKET BY SOURCE, USD MILLION, 2021

FIGURE 15 GLOBAL CULTURED MEAT MARKET BY END-USE, USD MILLION, 2021

FIGURE 16 GLOBAL CULTURED MEAT MARKET BY REGION, USD MILLION, 2021

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 BIOFOOD SYSTEMS LTD.: COMPANY SNAPSHOT

FIGURE 19 INTEGRICULTURE INC.: COMPANY SNAPSHOT

FIGURE 20 NEW AGE MEATS: COMPANY SNAPSHOT

FIGURE 21 BALLETIC FOODS: COMPANY SNAPSHOT

FIGURE 22 MEMPHIS MEATS: COMPANY SNAPSHOT

FIGURE 23 ALEPH FARMS LTD.: COMPANY SNAPSHOT

FIGURE 24 SEAFUTURE SUSTAINABLE BIOTECH: COMPANY SNAPSHOT

FIGURE 25 MOSA MEAT: COMPANY SNAPSHOT

FIGURE 26 AVANT MEATS COMPANY LIMITED: COMPANY SNAPSHOT

FIGURE 27 APPLETON MEATS: COMPANY SNAPSHOT

FIGURE 28 CUBIQ FOODS: COMPANY SNAPSHOT

DOWNLOAD FREE SAMPLE REPORT

License Type

SPEAK WITH OUR ANALYST

Want to know more about the report or any specific requirement?

WANT TO CUSTOMIZE THE REPORT?

Our Clients Speak

We asked them to research ‘ Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te

Yosuke Mitsui

Senior Associate Construction Equipment Sales & Marketing

We asked them to research ‘Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te