Base Year Value ()

CAGR ()

Forecast Year Value ()

Historical Data Period

Largest Region

Forecast Period

Mercato delle biobanche per prodotto (attrezzature, materiali di consumo, servizi, software), per tipo di campione (prodotti sanguigni, tessuti umani, linee cellulari, acidi nucleici), per applicazione (medicina rigenerativa, scienze della vita, ricerca clinica) e regione, tendenze globali e previsioni dal 2023 al 2030.

Instant access to hundreds of data points and trends

- Market estimates from 2014-2029

- Competitive analysis, industry segmentation, financial benchmarks

- Incorporates SWOT, Porter's Five Forces and risk management frameworks

- PDF report or online database with Word, Excel and PowerPoint export options

- 100% money back guarantee

Panoramica del mercato della biobanca

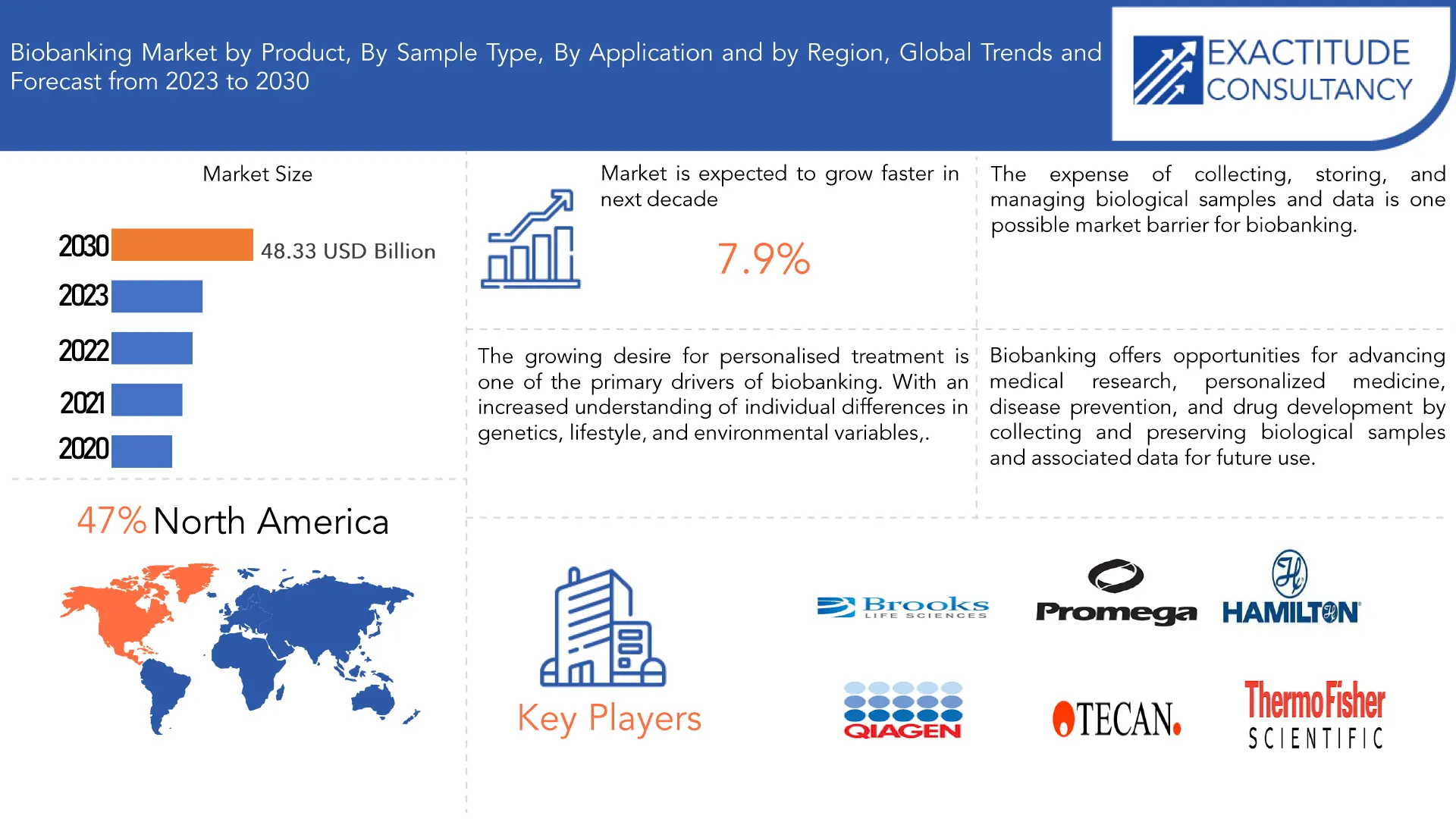

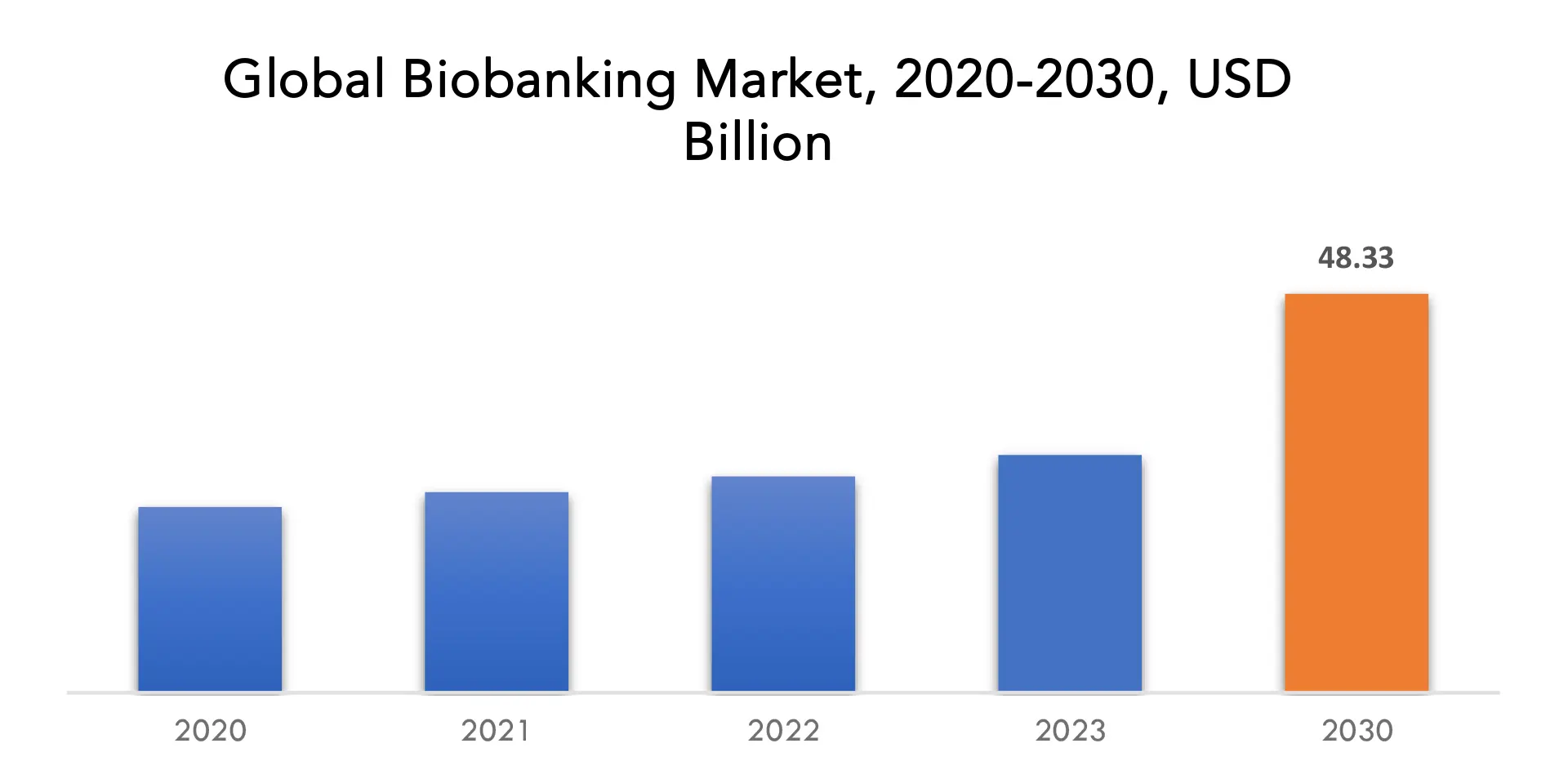

Si prevede che il mercato delle biobanche crescerà al 7,9% di CAGR dal 2023 al 2030. Si prevede che raggiungerà oltre 48,33 miliardi di USD entro il 2030 dai 28,80 miliardi di USD nel 2023.

Il processo di raccolta, conservazione e gestione di campioni biologici e dati associati per l'uso in applicazioni di ricerca e terapeutiche è denominato biobanking. Le biobanche possono raccogliere una varietà di campioni, come sangue, tessuti e fluidi corporei, nonché dati clinici, come anamnesi e dati sullo stile di vita. Questi campioni e dati sono spesso conservati in biobanche, che sono strutture specializzate.

Le biobanche sono sempre più utilizzate nella ricerca biomedica e nei trattamenti personalizzati. Le biobanche forniscono ai ricercatori l'accesso a grandi e diversificate raccolte di campioni biologici e dati, che possono aiutare nella scoperta di biomarcatori per la rilevazione e la diagnosi delle malattie , nello sviluppo di trattamenti personalizzati basati sul corredo genetico di un individuo e nel progresso della medicina di precisione. Le biobanche pongono anche problemi etici e legali sulla raccolta, la conservazione e l'utilizzo dei campioni, come la privacy dei donatori e il requisito di un'autorizzazione informata.

[caption id="allegato_30006" align="aligncenter" width="1920"]

Il crescente desiderio di un trattamento personalizzato è uno dei principali motori del biobanking. Con una maggiore comprensione delle differenze individuali in genetica, stile di vita e variabili ambientali, la medicina personalizzata sta diventando sempre più cruciale per la prevenzione e il trattamento delle malattie. Le biobanche sono un'importante fonte di dati e campioni biologici per lo sviluppo della medicina personalizzata e si prevede che la domanda di servizi di biobanking aumenterà negli anni a venire.

La crescente prevalenza di malattie croniche come cancro, diabete e malattie cardiovascolari è un altro motore del business delle biobanche. Queste malattie rappresentano un peso considerevole per i sistemi sanitari a livello globale e si prevede che la loro prevalenza aumenterà nei prossimi anni con l'invecchiamento della popolazione e il cambiamento degli stili di vita. I ricercatori possono utilizzare le biobanche per esaminare le cause sottostanti di vari disturbi, scoprire biomarcatori per la diagnosi e la diagnosi precoce e sviluppare nuovi trattamenti.

The expense of collecting, storing, and managing biological samples and data is one possible market barrier for biobanking. Biobanks necessitate large expenditures in infrastructure, equipment, and employees, which might be prohibitively expensive for smaller organizations or research institutes with limited resources. Furthermore, ethical and legal problems about privacy, ownership, and consent may complicate the process of obtaining and using biological samples for research purposes.

The high cost of adopting and maintaining these systems is a major limitation in the Biobanking business. The initial investment in technology and software can be substantial, particularly for smaller healthcare facilities. Furthermore, the complexity of these systems can result in increased training costs and potential user adoption concerns. Concerns about regulatory and data privacy can also be a problem, especially with the rising usage of cloud-based solutions and the need to comply with various data protection standards.

The COVID-19 pandemic has had an impact on the biobanking sector, both positively and negatively. On the one hand, the pandemic has boosted the focus on vaccine and treatment research and development, raising demand for biobanking services and samples. On the other side, supply chain interruptions, restrictions on research efforts, and budget cuts have all had a detrimental impact on the market. In reaction to the epidemic, there has also been a shift towards virtual biobanking systems, as well as a greater emphasis on data management and sharing.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) |

| Segmentation | By Product, By Sample Type, By Application, By Region |

| By Product |

|

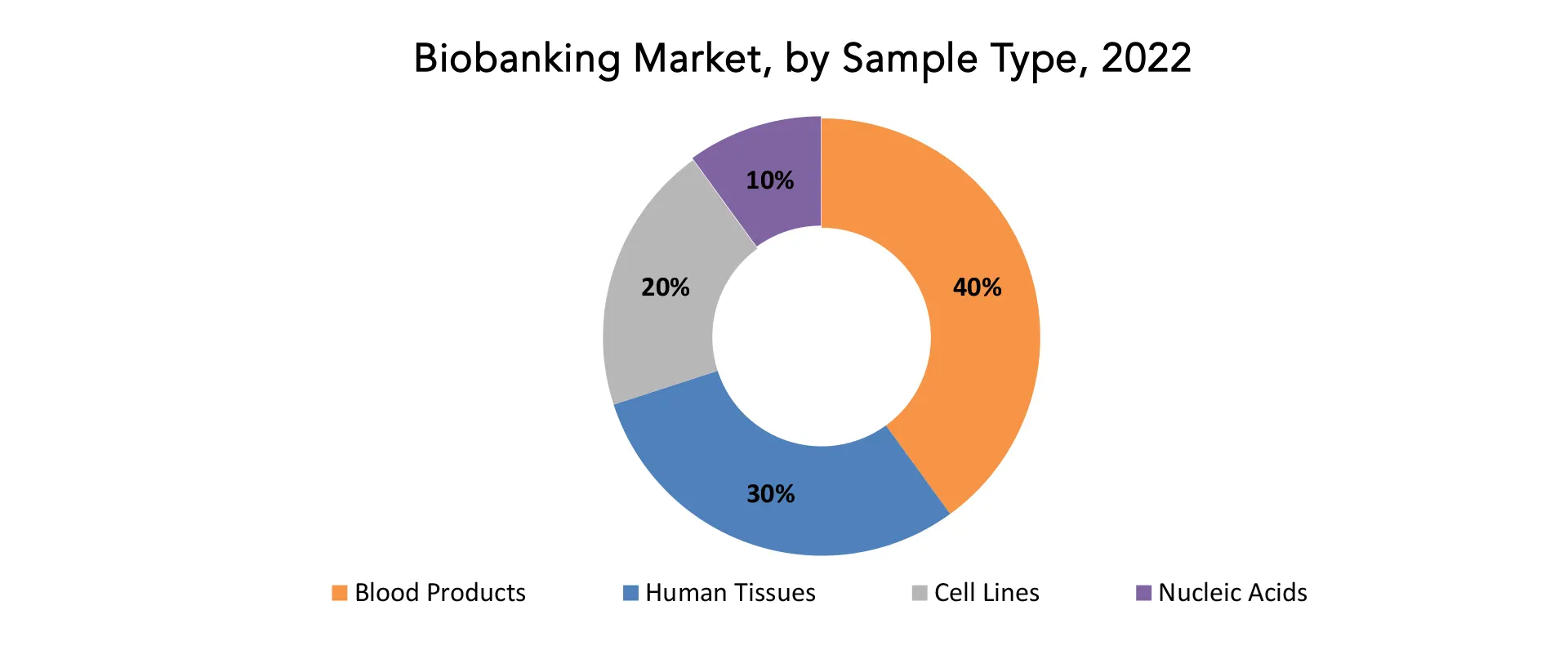

| By Sample Type |

|

| By Application |

|

| By Region |

|

Frequently Asked Questions

• What is the worth of medical biobanking market?

The biobanking is expected to grow at 7.9% CAGR from 2023 to 2030. It is expected to reach above USD 44.6 billion by 2029 from USD 22.5 billion in 2020.

• What is the size of the north america medical biobanking market industry?

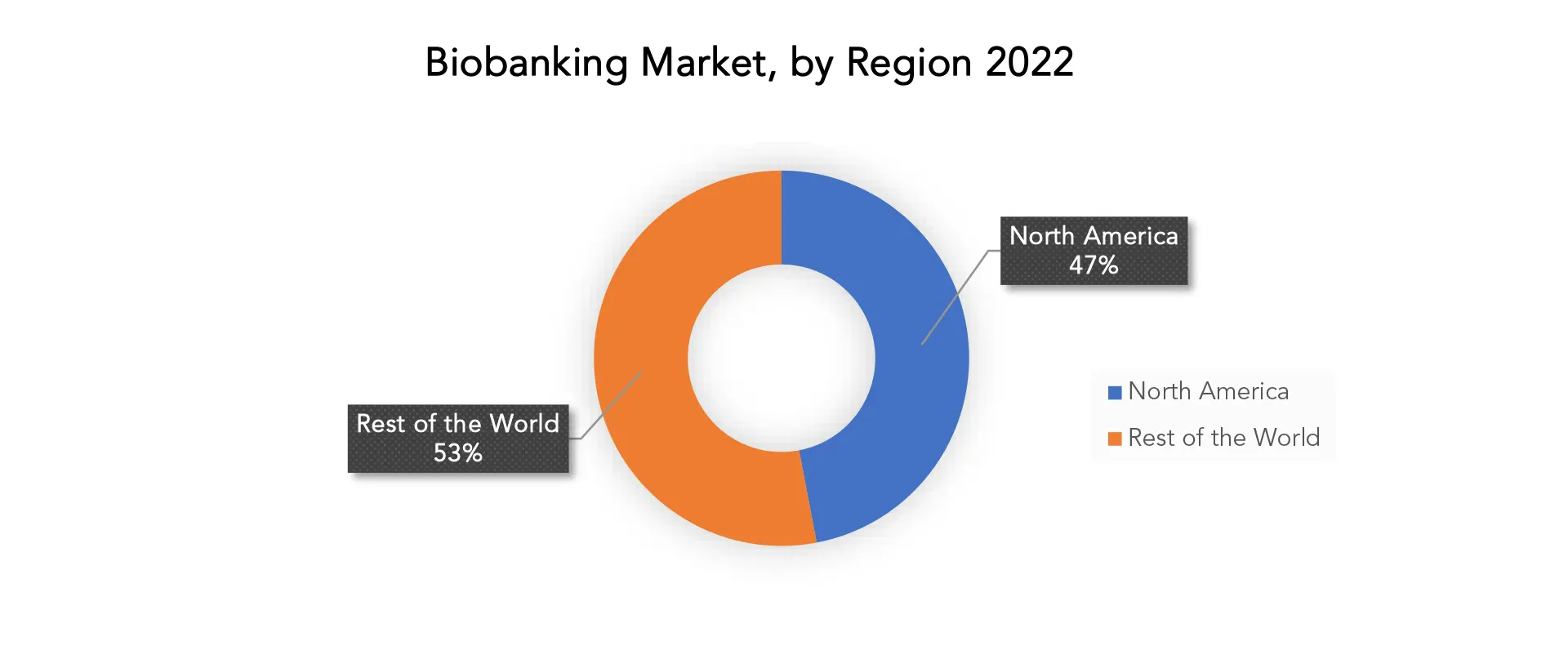

North America held more than 47% of the biobanking revenue share in 2022 and will witness expansion in the forecast period.

• What are some of the biobanking market's driving forces?

The growing desire for personalised treatment is one of the primary drivers of biobanking. With an increased understanding of individual differences in genetics, lifestyle, and environmental variables, personalised medicine is becoming increasingly crucial for illness prevention and treatment. Biobanks are an important source of data and biological samples for the development of personalised medicine, and demand for biobanking services is projected to increase in the future years.

• Which are the top companies to hold the market share in medical biobanking market?

The Biobanking key Thermo Fisher Scientific, Qiagen, Hamilton Company, Brooks Life Sciences, Tecan Group, VWR International, Promega Corporation, Chart Industries, Bio Life Solutions, Panasonic Healthcare Holdings, Micronics.

• What is the leading product of biobanking market?

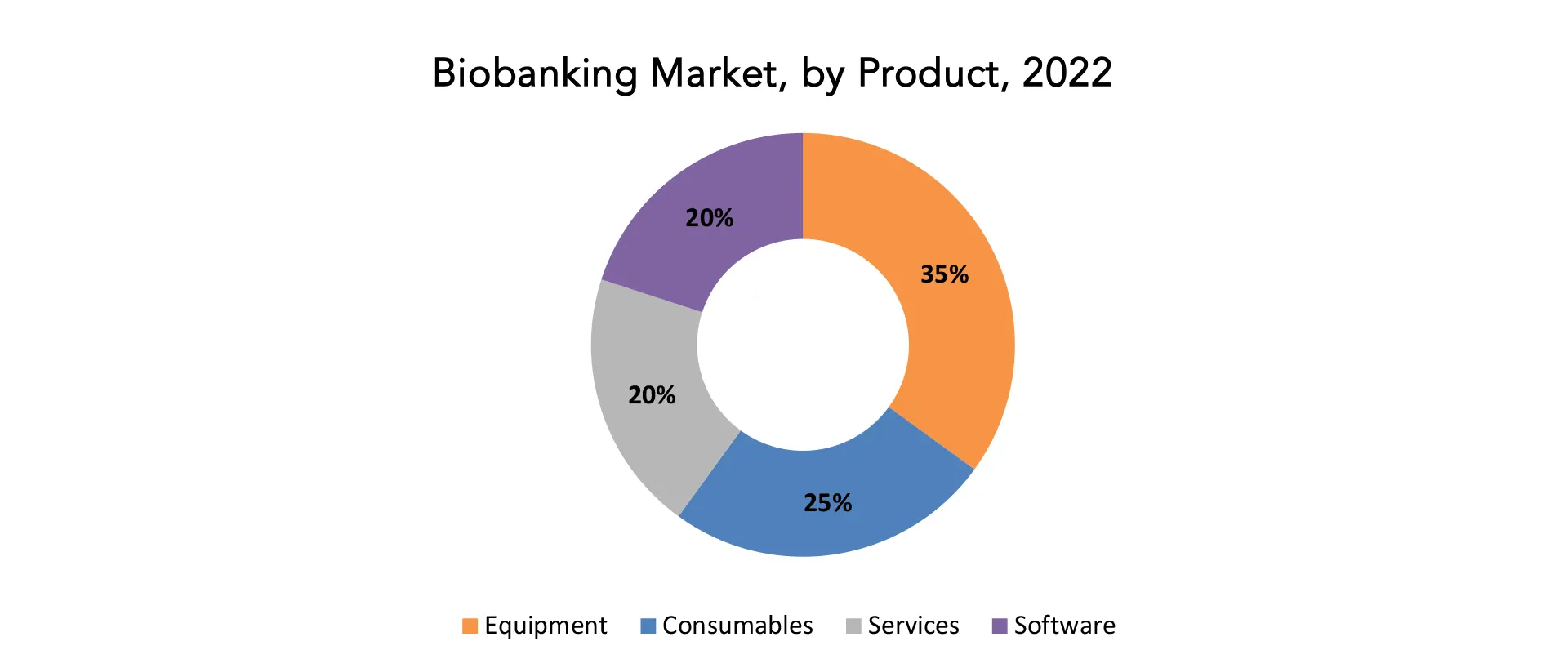

Based on product, the biobanking market can be segmented based on equipment, consumables, services, and software. The equipment segment includes freezers, storage systems, and sample management systems. The consumables segment includes storage tubes, sample containers, and other consumables. The services segment includes biorepository, sample processing, and storage services. The software segment includes data management and inventory management software.

• Which is the largest regional market for biobanking market?

The North America region dominated the biobanking by accounting for over 47% of the market share. The biobanking market in North America is expected to grow significantly in the coming years due to increasing investment in research and development activities, advancements in personalized medicine, and rising demand for high-quality biological samples. The United States dominates the market due to its well-established healthcare infrastructure, favorable regulatory policies, and high healthcare spending. Key players in the North American biobanking market include Thermo Fisher Scientific, Qiagen, Incision, and Hamilton Company, among others.

Biobanking Market Segment Analysis

The biobanking market is segmented based on product, sample type, application, and region. [caption id="attachment_30010" align="aligncenter" width="1920"]

Biobanking Market Players

The biobanking market key market players are Thermo Fisher Scientific, Qiagen, Hamilton Company, Brooks Life Sciences, Tecan Group, VWR International, Promega Corporation, Chart Industries, Bio Life Solutions, Panasonic Healthcare Holdings, Micronics. Industry Development- 24-April -2023: - QIAGEN (NYSE: QGEN; Frankfurt Prime Standard: QIA) announced on a specific date in the past that its QIAstat-Dx syndromic testing solution was expected to be available soon for use in Japan with a SARS-CoV-2 Respiratory Panel that could detect more than 20 pathogens from a single patient sample.

- 05-Januray-2023: - QIAGEN (NYSE: QGEN; Frankfurt Prime Standard: QIA) announced an exclusive strategic partnership with California-based population genomics leader Helix to advance companion diagnostics for hereditary diseases in the past..

Who Should Buy? Or Key stakeholders

- Researchers

- Government

- Medical Professionals

- Medical Instruments

- Clinical Laboratories

- Clinics

- Others

Biobanking Market Regional Analysis

The biobanking market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

The North America region dominated the biobanking by accounting for over 47% of the market share. The biobanking market in North America is expected to grow significantly in the coming years due to increasing investment in research and development activities, advancements in personalized medicine, and rising demand for high-quality biological samples. The United States dominates the market due to its well-established healthcare infrastructure, favorable regulatory policies, and high healthcare spending. Key players in the North American biobanking market include Thermo Fisher Scientific, Qiagen, Incision, and Hamilton Company, among others.

[caption id="attachment_30015" align="aligncenter" width="1920"] Biobanking Market | Exactitude Consultancy[/caption]

Biobanking Market | Exactitude Consultancy[/caption]

The biobanking market in Europe is projected to grow at a compound annual growth rate of 7.4% from 2023 to 2030. This growth is driven by the increasing demand for personalized medicine, advancements in biobanking technology, and the rising prevalence of chronic diseases. The UK, Germany, and France are the leading countries in the European biobanking market.

Key Market Segments: Biobanking market

Biobanking by Product, 2020-2030, (USD Billion)- Equipment

- Consumables

- Services

- Software

- Blood Products

- Human Tissues

- Cell Lines

- Nucleic Acids

- Regenerative Medicine

- Life Science

- Clinical Research

- North America

- Asia Pacific

- Europe

- South America

- Middle East and Africa

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the biobanking market over the next 7 years?

- Who are the major players in the biobanking market and what is their market share?

- What are the application industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, And Africa?

- How is the economic environment affecting the biobanking market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the biobanking market?

- What is the current and forecasted size and growth rate of the global biobanking market?

- What are the key drivers of growth in the biobanking market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the biobanking market?

- What are the technological advancements and innovations in the biobanking market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the biobanking market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the biobanking market?

- What are the service offerings and specifications of leading players in the market?

- What is the pricing trend of biobanking market in the market and what is the impact of raw process prices on the price trend?

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL BIOBANKING OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON BIOBANKING MARKET

- PORTER’S FIVE FORCES SAMPLE TYPEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL BIOBANKING OUTLOOK

- GLOBAL BIOBANKING MARKET BY PRODUCT (USD BILLION) 2020-2030

- EQIPMENT

- CONSUMABLES

- SERVICES

- SOFTWARE

- GLOBAL BIOBANKING MARKET BY SAMPLE TYPE (USD BILLION) 2020-2030

- BLOOD PRODUCTS

- HUMAN TISSUES

- CELL LINES

- NUCLEIC ACIDS

- GLOBAL BIOBANKING MARKET BY APPLICATION (USD BILLION) 2020-2030

- REGENERATIVE MEDICINE

- LIFE SCIENCE

- CLINICAL RESEARCH

- GLOBAL BIOBANKING MARKET BY REGION (USD BILLION) 2020-2030

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- THERMO FISHER SCIENTIFIC

- QIAGEN

- HAMILTON COMPANY

- BROOKS LIFE SCIENCES

- TECAN GROUP

- VWR INTERNATIONAL

- PROMEGA CORPORATION

- CHART INDUSTRIES

- BIO LIFE SOLUTIONS

- PANASONIC HEALTHCARE HOLDINGS

- MICRONICS

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL BIOBANKING MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 2 GLOBAL BIOBANKING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 3 GLOBAL BIOBANKING MARKET BY SMAPLE TYPE (USD BILLION) 2020-2030

TABLE 4 GLOBAL BIOBANKING MARKET BY REGION (USD BILLION) 2020-2030

TABLE 5 NORTH AMERICA BIOBANKING MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 6 NORTH AMERICA BIOBANKING MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 7 NORTH AMERICA BIOBANKING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 8 NORTH AMERICA BIOBANKING MARKET BY SMAPLE TYPE (USD BILLION) 2020-2030

TABLE 9 US BIOBANKING MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 10 US BIOBANKING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 11 US BIOBANKING MARKET BY SMAPLE TYPE (USD BILLION) 2020-2030

TABLE 12 CANADA BIOBANKING MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 13 CANADA BIOBANKING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 14 CANADA BIOBANKING MARKET BY SMAPLE TYPE (USD BILLION) 2020-2030

TABLE 15 MEXICO BIOBANKING MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 16 MEXICO BIOBANKING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 17 MEXICO BIOBANKING MARKET BY SMAPLE TYPE (USD BILLION) 2020-2030

TABLE 18 SOUTH AMERICA BIOBANKING MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 19 SOUTH AMERICA BIOBANKING MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 20 SOUTH AMERICA BIOBANKING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 21 SOUTH AMERICA BIOBANKING MARKET BY SMAPLE TYPE (USD BILLION) 2020-2030

TABLE 22 BRAZIL BIOBANKING MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 23 BRAZIL BIOBANKING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 24 BRAZIL BIOBANKING MARKET BY SMAPLE TYPE (USD BILLION) 2020-2030

TABLE 25 ARGENTINA BIOBANKING MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 26 ARGENTINA BIOBANKING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 27 ARGENTINA BIOBANKING MARKET BY SMAPLE TYPE (USD BILLION) 2020-2030

TABLE 28 COLOMBIA BIOBANKING MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 29 COLOMBIA BIOBANKING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 30 COLOMBIA BIOBANKING MARKET BY SMAPLE TYPE (USD BILLION) 2020-2030

TABLE 31 REST OF SOUTH AMERICA BIOBANKING MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 32 REST OF SOUTH AMERICA BIOBANKING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 33 REST OF SOUTH AMERICA BIOBANKING MARKET BY SMAPLE TYPE (USD BILLION) 2020-2030

TABLE 34 ASIA-PACIFIC BIOBANKING MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 35 ASIA-PACIFIC BIOBANKING MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 36 ASIA-PACIFIC BIOBANKING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 37 ASIA-PACIFIC BIOBANKING MARKET BY SMAPLE TYPE (USD BILLION) 2020-2030

TABLE 38 INDIA BIOBANKING MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 39 INDIA BIOBANKING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 40 INDIA BIOBANKING MARKET BY SMAPLE TYPE (USD BILLION) 2020-2030

TABLE 41 CHINA BIOBANKING MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 42 CHINA BIOBANKING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 43 CHINA BIOBANKING MARKET BY SMAPLE TYPE (USD BILLION) 2020-2030

TABLE 44 JAPAN BIOBANKING MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 45 JAPAN BIOBANKING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 46 JAPAN BIOBANKING MARKET BY SMAPLE TYPE (USD BILLION) 2020-2030

TABLE 47 SOUTH KOREA BIOBANKING MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 48 SOUTH KOREA BIOBANKING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 49 SOUTH KOREA BIOBANKING MARKET BY SMAPLE TYPE (USD BILLION) 2020-2030

TABLE 50 AUSTRALIA BIOBANKING MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 51 AUSTRALIA BIOBANKING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 52 AUSTRALIA BIOBANKING MARKET BY SMAPLE TYPE (USD BILLION) 2020-2030

TABLE 53 SOUTH-EAST ASIA BIOBANKING MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 54 SOUTH-EAST ASIA BIOBANKING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 55 SOUTH-EAST ASIA BIOBANKING MARKET BY SMAPLE TYPE (USD BILLION) 2020-2030

TABLE 56 REST OF ASIA PACIFIC BIOBANKING MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 57 REST OF ASIA PACIFIC BIOBANKING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 58 REST OF ASIA PACIFIC BIOBANKING MARKET BY SMAPLE TYPE (USD BILLION) 2020-2030

TABLE 59 EUROPE BIOBANKING MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 60 EUROPE BIOBANKING MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 61 EUROPE BIOBANKING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 62 EUROPE C BIOBANKING MARKET BY SMAPLE TYPE (USD BILLION) 2020-2030

TABLE 63 GERMANY BIOBANKING MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 64 GERMANY BIOBANKING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 65 GERMANY BIOBANKING MARKET BY SMAPLE TYPE (USD BILLION) 2020-2030

TABLE 66 UK BIOBANKING MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 67 UK BIOBANKING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 68 UK BIOBANKING MARKET BY SMAPLE TYPE (USD BILLION) 2020-2030

TABLE 69 FRANCE BIOBANKING MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 70 FRANCE BIOBANKING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 71 FRANCE BIOBANKING MARKET BY SMAPLE TYPE (USD BILLION) 2020-2030

TABLE 72 ITALY BIOBANKING MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 73 ITALY BIOBANKING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 74 ITALY BIOBANKING MARKET BY SMAPLE TYPE (USD BILLION) 2020-2030

TABLE 75 SPAIN BIOBANKING MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 76 SPAIN BIOBANKING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 77 SPAIN BIOBANKING MARKET BY SMAPLE TYPE (USD BILLION) 2020-2030

TABLE 78 RUSSIA BIOBANKING MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 79 RUSSIA BIOBANKING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 80 RUSSIA BIOBANKING MARKET BY SMAPLE TYPE (USD BILLION) 2020-2030

TABLE 81 REST OF EUROPE BIOBANKING MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 82 REST OF EUROPE BIOBANKING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 83 REST OF EUROPE BIOBANKING MARKET BY SMAPLE TYPE (USD BILLION) 2020-2030

TABLE 84 MIDDLE EAST AND AFRICA BIOBANKING MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 85 MIDDLE EAST AND AFRICA BIOBANKING MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 86 MIDDLE EAST AND AFRICA BIOBANKING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 87 MIDDLE EAST AND AFRICA BIOBANKING MARKET BY SMAPLE TYPE (USD BILLION) 2020-2030

TABLE 88 UAE BIOBANKING MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 89 UAE BIOBANKING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 90 UAE BIOBANKING MARKET BY SMAPLE TYPE (USD BILLION) 2020-2030

TABLE 91 SAUDI ARABIA BIOBANKING MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 92 SAUDI ARABIA BIOBANKING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 93 SAUDI ARABIA BIOBANKING MARKET BY SMAPLE TYPE (USD BILLION) 2020-2030

TABLE 94 SOUTH AFRICA BIOBANKING MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 95 SOUTH AFRICA BIOBANKING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 96 SOUTH AFRICA BIOBANKING MARKET BY SMAPLE TYPE (USD BILLION) 2020-2030

TABLE 97 REST OF MIDDLE EAST AND AFRICA BIOBANKING MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 98 REST OF MIDDLE EAST AND AFRICA BIOBANKING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 99 REST OF MIDDLE EAST AND AFRICA BIOBANKING MARKET BY SMAPLE TYPE (USD BILLION) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL BIOBANKING BY PRODUCT, USD BILLION, 2020-2030

FIGURE 9 GLOBAL BIOBANKING BY CELL TYPE, USD BILLION, 2020-2030

FIGURE 10 GLOBAL BIOBANKING BY END-USER, USD BILLION, 2020-2030

FIGURE 11 GLOBAL BIOBANKING BY REGION, USD BILLION, 2020-2030

FIGURE 12 GLOBAL BIOBANKING BY PRODUCT, USD BILLION, 2022

FIGURE 13 GLOBAL BIOBANKING BY CELL TYPE, USD BILLION, 2022

FIGURE 14 GLOBAL BIOBANKING BY END-USER, USD BILLION, 2022

FIGURE 15 GLOBAL BIOBANKING BY REGION, USD BILLION, 2022

FIGURE 16 PORTER’S FIVE FORCES SMAPLE TYPEL

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 THERMO FISHER SCIENTIFIC: COMPANY SNAPSHOT

FIGURE 19 QIAGEN: COMPANY SNAPSHOT

FIGURE 20 HAMILTON COMPANY: COMPANY SNAPSHOT

FIGURE 21 BROOKS LIFE SCIENCES: COMPANY SNAPSHOT

FIGURE 22 TECAN GROUP: COMPANY SNAPSHOT

FIGURE 23 VWR INTERNATIONAL: COMPANY SNAPSHOT

FIGURE 24 PROMEGA CORPORATION: COMPANY SNAPSHOT

FIGURE 25 CHART INDUSTRIES: COMPANY SNAPSHOT

FIGURE 26 BIO LIFE SOLUTIONS: COMPANY SNAPSHOT

FIGURE 27 PANASONIC HEALTHCARE HOLDINGS: COMPANY SNAPSHOT

FIGURE 28 MICRONICS: COMPANY SNAPSHOT

DOWNLOAD FREE SAMPLE REPORT

License Type

SPEAK WITH OUR ANALYST

Want to know more about the report or any specific requirement?

WANT TO CUSTOMIZE THE REPORT?

Our Clients Speak

We asked them to research ‘ Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te

Yosuke Mitsui

Senior Associate Construction Equipment Sales & Marketing

We asked them to research ‘Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te