Base Year Value ()

CAGR ()

Forecast Year Value ()

Historical Data Period

Largest Region

Forecast Period

Mercato delle telecamere Lidar a metano per componente (laser, sistema ottico, rilevatore, elettronica, software), applicazione (rilevamento perdite di metano, quantificazione perdite di metano, tracciamento pennacchi di metano, identificazione fonti di metano), utente finale (petrolio e gas, servizi di pubblica utilità, agricoltura, gestione rifiuti, altro) e regione, tendenze globali e previsioni dal 2023 al 2030

Instant access to hundreds of data points and trends

- Market estimates from 2014-2029

- Competitive analysis, industry segmentation, financial benchmarks

- Incorporates SWOT, Porter's Five Forces and risk management frameworks

- PDF report or online database with Word, Excel and PowerPoint export options

- 100% money back guarantee

Panoramica del mercato delle telecamere Lidar a metano

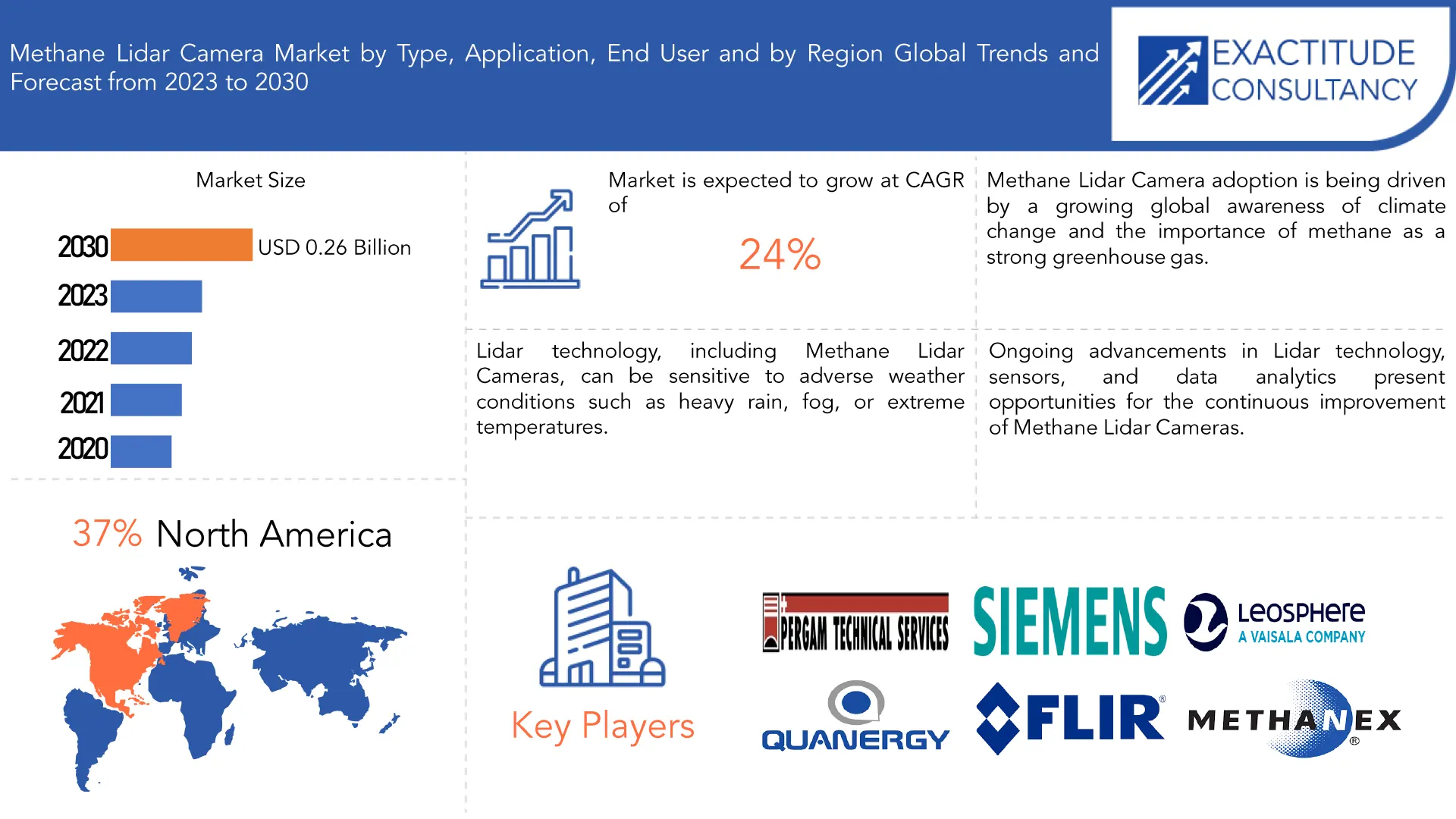

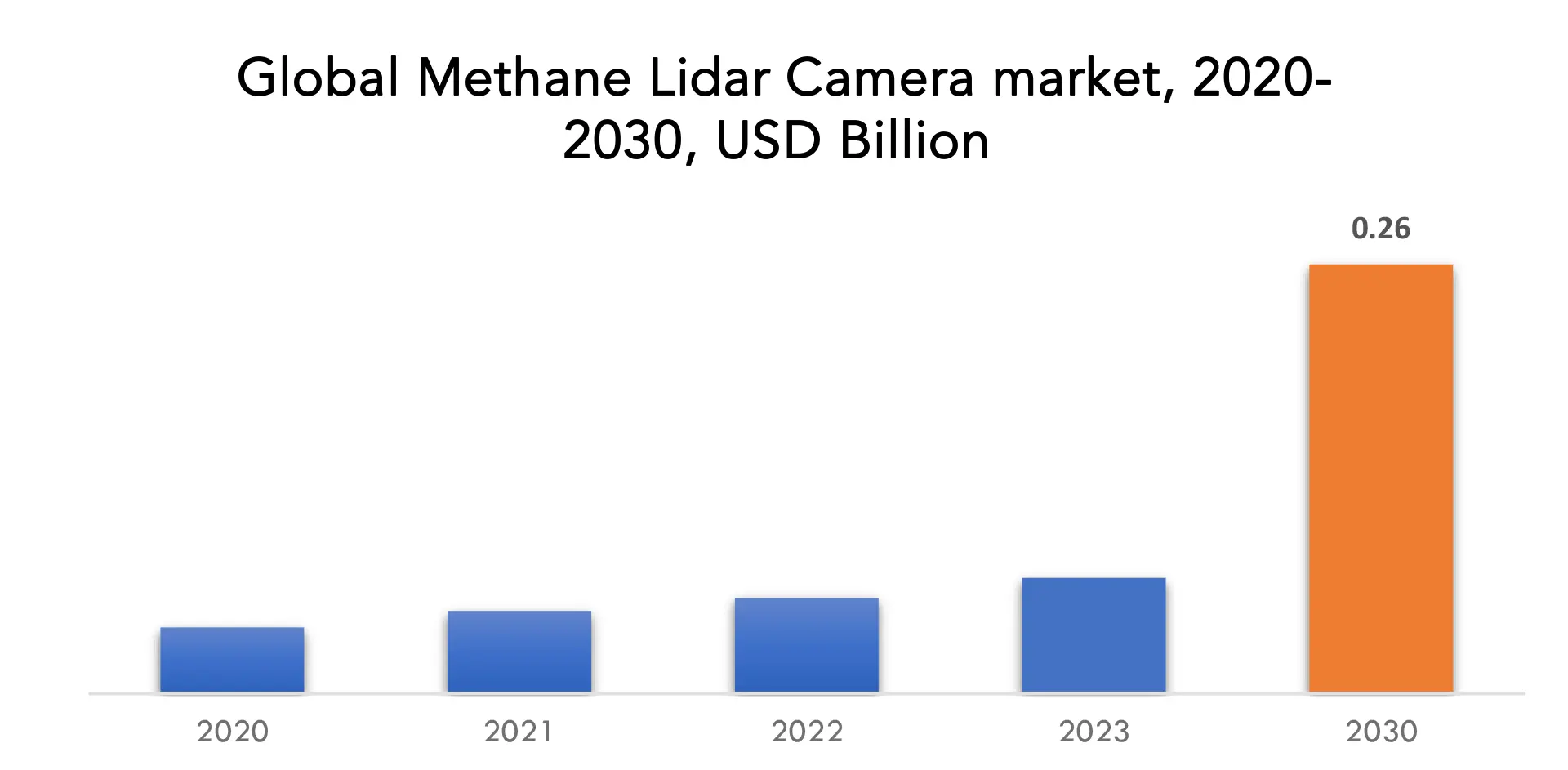

Si prevede che il mercato globale delle telecamere Lidar a metano crescerà da 0,07 miliardi di USD nel 2023 a 0,26 miliardi di USD entro il 2030, con un CAGR del 24% nel periodo di previsione.

Il lidar è un tipo di dispositivo di telerilevamento che misura le distanze usando la luce laser. Viene spesso impiegato in molte applicazioni diverse, come il monitoraggio ambientale, le auto senza conducente e la ricerca atmosferica. Poiché il metano è un forte gas serra, è importante monitorarne i livelli per applicazioni industriali , studi ambientali e ricerche sui cambiamenti climatici. La tecnologia lidar del metano misura e rileva le concentrazioni atmosferiche di metano usando i laser. Un ricevitore raccoglie la luce dispersa prodotta da un impulso laser nei dispositivi lidar del metano . I ricercatori possono calcolare la distanza dal bersaglio misurando il tempo impiegato dagli impulsi laser per andare e tornare.

[caption id="allegato_31531" align="aligncenter" width="1920"]

Il mercato delle telecamere lidar a metano è cresciuto fino a diventare una forza rivoluzionaria nella gestione delle risorse e nel monitoraggio ambientale. Queste telecamere sono realizzate per identificare e quantificare le emissioni di gas metano con una precisione mai vista prima, utilizzando la tecnologia all'avanguardia Light Detection and Ranging Lidar Drone . Essendo un potente gas serra che contribuisce in modo significativo al cambiamento climatico, il rilascio di metano deve essere attentamente monitorato per ridurre al minimo gli effetti negativi sull'ambiente. Le telecamere lidar a metano forniscono un modo efficace e non invasivo per individuare e gestire le fonti di emissione di metano per settori tra cui la gestione dei rifiuti, l'agricoltura e il petrolio e il gas. Queste telecamere a infrarossi danno ai decisori il potere di mettere in atto politiche mirate per la tutela ambientale e la riduzione delle emissioni fornendo dati in tempo reale e immagini ad alta risoluzione. Il mercato delle telecamere lidar a metano è posizionato per diventare uno strumento vitale nella spinta globale per combattere il cambiamento climatico e costruire un futuro più sostenibile, mentre governi e industrie in tutto il mondo intensificano la loro attenzione sulla sostenibilità.

| ATTRIBUTO | DETTAGLI |

| Periodo di studio | 2020-2030 |

| Anno base | 2022 |

| Anno stimato | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) Volume (Thousand Units) |

| Segmentation | By Type, Application, End user and Region |

| By Type |

|

| By Product Type |

|

| By Application |

|

| By Region |

|

Frequently Asked Questions

• What is the market size for the Methane Lidar Camera market?

The global Methane Lidar Camera market is anticipated to grow from USD 0.07 Billion in 2023 to USD 0.26 Billion by 2030, at a CAGR of 24 % during the forecast period.

• Which region is dominating in the Methane Lidar Camera market?

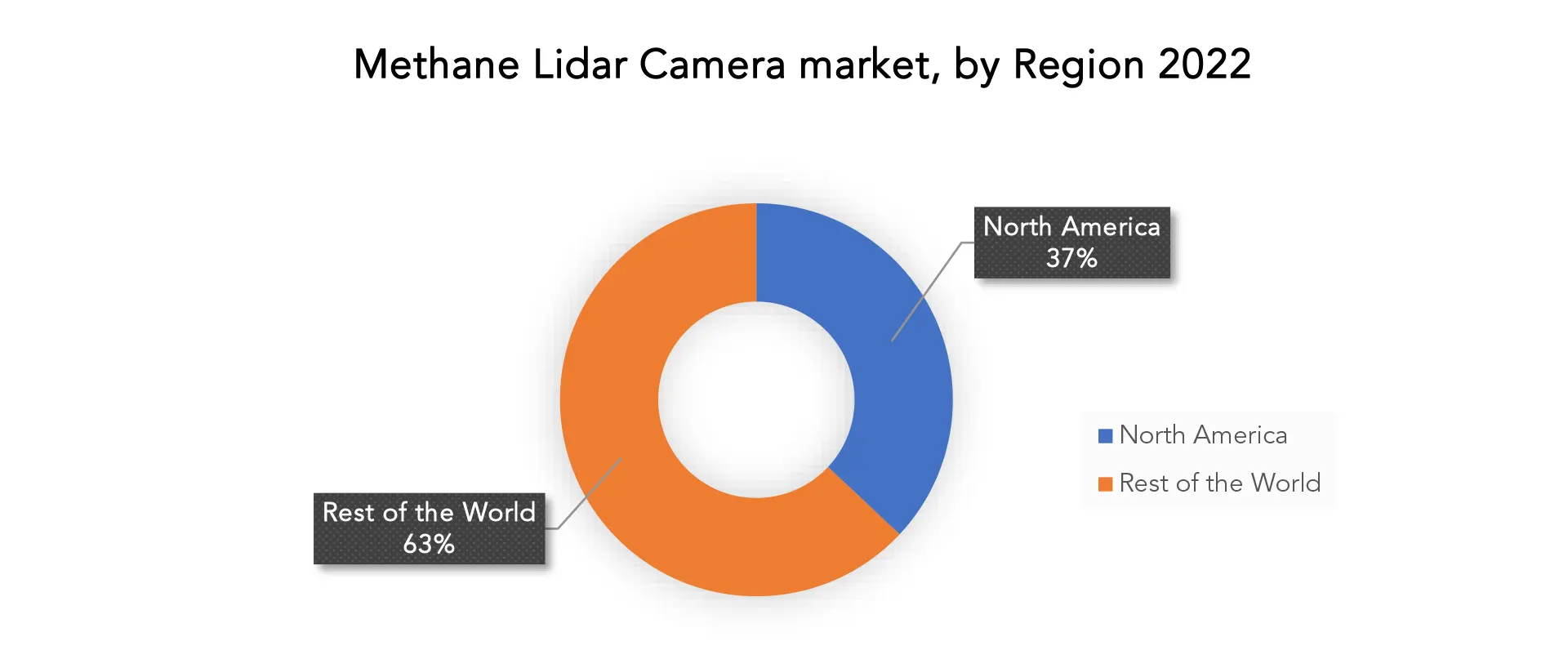

North America accounted for the largest market in the Methane Lidar Camera market. North America accounted for 37 % market share of the global market value.

• Who are the major key players in the Methane Lidar Camera market?

Quanergy Systems, Inc.,LiDAR Services International,Leosphere (A Vaisala Company),Siemens AG,Aeris Technologies, Inc.,Honeywell International Inc.,ESRI (Environmental Systems Research Institute),Laser Methane Mini (LMI) by Honeywell,Anova Analytics,Pergam Technical Services, Inc.,TopScan Ltd.,FLIR Systems, Inc.,Schneider Electric SE

• What are the key trends in the Methane Lidar Camera market?

The oil and gas industry began to recognize the value of Methane Lidar Cameras in reducing methane emissions. With the environmental impact coming under increasing attention, these cameras were proving indispensable to the industry's attempts to track and minimize methane emissions.Government initiatives and laws aimed at reducing methane emissions were driving the use of methane lidar cameras. In locations with stronger rules, industries were investing more money in advanced monitoring systems to comply with environmental requirements.

Methane Lidar Camera Market Segmentation Analysis

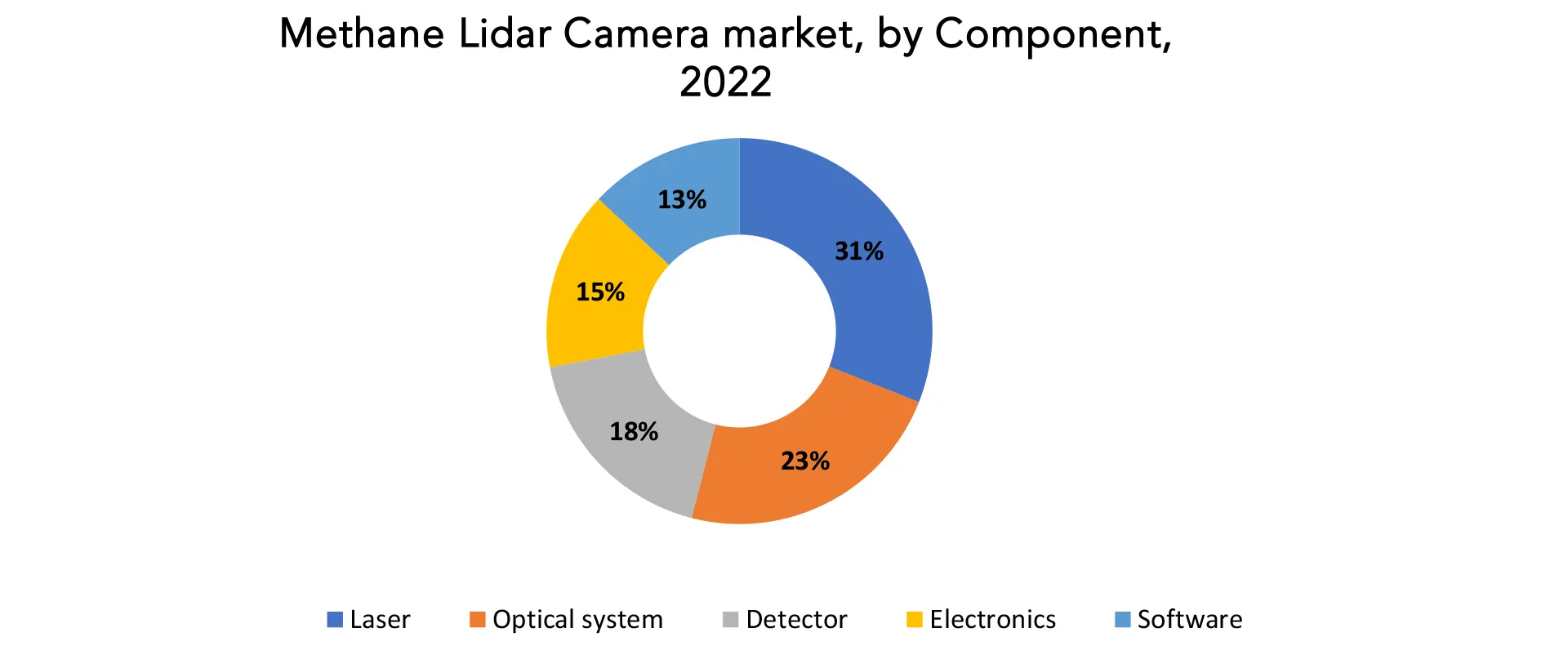

The global Methane Lidar Camera market is divided into three segments, component, application, end user and region. By Component it is divided into Laser, Optical system, Detector, Electronics, Software. The methane lidar camera's laser is its most crucial component. The laser light needed to find methane leaks is produced by it. The laser light is gathered and focused onto the detector by the optical system. The laser light is transformed into an electrical signal by the detector. The electrical signal is processed and amplified by the electronics. The data is shown and interpreted using the program.

[caption id="attachment_31541" align="aligncenter" width="1920"]

The market for methane lidar cameras is divided into several segments, each of which is essential to the complete operation of the system. Lasers, optical systems, detectors, electronics, and software are among the essential parts. The Lidar beam that is utilized to detect methane is produced by the laser, which acts as the emission source. The optical system, which consists of mirrors and lenses, focuses and guides the laser beam to provide accurate measurements. The quantitative analysis of methane concentrations is made possible by detectors, which are essential for catching the reflected signals and translating them into electrical impulses. The amplification and processing of these signals by the electrical components improves the sensitivity and accuracy of the system. The software element is essential to the interpretation of data since it allows users to view and examine data on methane concentrations. This division illustrates how Methane Lidar Cameras are all-inclusive and interconnected, with each part adding to the system's effectiveness in identifying and tracking methane emissions in a variety of settings and sectors. The methane lidar camera industry is primed for more innovation and improved environmental monitoring capabilities as long as these individual component developments persist.

[caption id="attachment_31542" align="aligncenter" width="1920"]

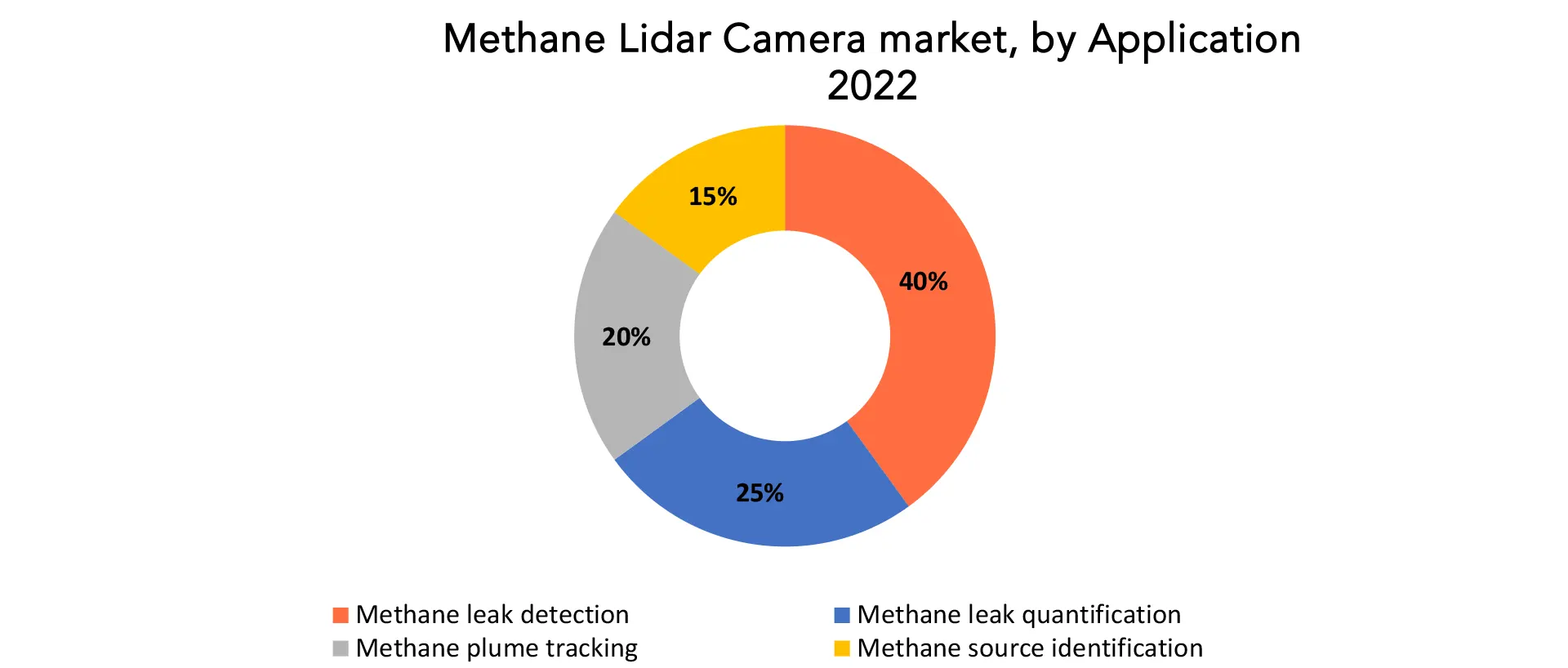

By application it is divided into Methane leak detection, Methane leak quantification, Methane plume tracking, Methane source identification.

Methane leak detection is the most common application of methane lidar cameras. It is used to identify and locate methane leaks from oil and gas facilities, pipelines, and other sources. Methane leak quantification is used to measure the amount of methane that is leaking from a source. Methane plume tracking is used to track the movement of methane plumes. Methane source identification is used to identify the source of a methane leak.

Methane Lidar Cameras are used in a variety of industrial contexts, such as pipelines, storage sites, and oil and gas facilities, for the accurate and timely detection of methane leaks. Thanks to technology, leaks may be found early, reducing their impact on the environment and improving safety procedures. Methane Lidar Cameras support proactive leak detection and response plans by supplying real-time data. In this application, the amount of methane produced during a leak is precisely measured and quantified. Methane Lidar Cameras are essential for determining the amount and concentration of methane emissions, which helps regulatory agencies and industry determine the environmental impact. For the purpose of developing focused mitigation strategies and meeting emission reduction targets, this quantitative data is crucial. Methane Lidar Cameras are used to monitor the movement and atmospheric dispersal of methane plumes. Understanding the dynamics of methane emissions over space and time is made possible by this application. Monitoring plumes facilitates the identification of emission sources, evaluation of the pollution's spread, and creation of efficient containment and reduction plans. Methane Lidar Cameras are used to identify the precise location of methane emission sources. By locating and resolving the underlying causes of methane leak, our tool helps industries put specific emission reduction measures into place. Source identification promotes sustainable practices and improves the accuracy of environmental management initiatives.

[caption id="attachment_31543" align="aligncenter" width="1920"]

Methane Lidar Camera Market Dynamics

DriverThe market for methane lidar cameras is mostly driven by strict environmental rules that aim to reduce greenhouse gas emissions, notably methane.

Globally, governments and environmental regulatory agencies have enforced strict emission rules and regulations in an effort to mitigate the effects of greenhouse gases and address climate change. Since methane contributes significantly to global warming, industries must abide by legislation requiring them to actively monitor and regulate methane emissions. Methane Lidar Cameras provide an efficient and cutting-edge compliance solution that helps enterprises comply with regulations. Many nations and sectors of the economy have set high standards for cutting greenhouse gas emissions as part of their larger objectives for environmental sustainability. By offering precise and up-to-date data on methane emissions, methane lidar cameras play a critical role in assisting enterprises in meeting these goals and enabling focused efforts to reduce and manage leaks. The need for systems that can actively monitor and manage these concerns has grown as a result of rising public and business awareness of the negative environmental effects of methane emissions. Methane Lidar Cameras complement the larger corporate and societal emphasis on environmental responsibility and sustainability. Industries invest in Methane Lidar Cameras to reduce the risk of methane leaks in addition to complying with regulations. Organizations must use proactive monitoring technologies to find leaks early and fix them since uncontrolled methane emissions pose significant safety risks as well as reputational risks. Methane Lidar Cameras are more effective due to ongoing developments in electronics, data analytics, and Lidar technology.

RestraintSignificant upfront costs for acquisition, installation, and maintenance can be a major challenge for the Methane Lidar Cameras market.

There is a lot of capital intensity in the methane lidar camera market. Purchasing the cameras and any related gear and software can come with a significant upfront cost. This capital intensity may be prohibitive, particularly for smaller companies or groups with tighter budgets. In addition to the price of purchasing the cameras, there are other costs associated with the installation procedure. This entails setting up the site, integrating it with the current infrastructure, and maybe requiring specialist technicians to guarantee correct configuration. The total upfront investment may increase dramatically with installation charges. Over the course of a methane lidar camera's lifespan, maintenance costs are a major factor. Ongoing costs are influenced by regular calibration, software upgrades, and technical support. To guarantee the accuracy and dependability of the monitoring system going forward, organizations must budget for these maintenance expenses. Due to their tight budgets, small firms may find it difficult to dedicate resources for Methane Lidar Cameras. Smaller organizations may be discouraged from investing in this technology due to the high initial expenses, which could make it more difficult for them to meet sustainability objectives or comply with environmental laws. The payback period—also referred to as the amount of time it takes an organization to recover its original investment in methane lidar cameras—can be somewhat lengthy. Industries frequently look for solutions that may show returns on investment more quickly by having shorter payback times. The apparent economic viability of implementing this technology may be impacted by the longer payback period.

OpportunitiesThe increasing awareness of methane as a potent greenhouse gas and its significant contribution to climate change creates opportunities for Methane Lidar Camera market.

Stricter environmental laws and emission reduction goals have been developed as a result of growing understanding of methane's role in climate change. Methane Lidar Cameras give businesses a useful tool for keeping an eye on and adhering to these rules, giving them the chance to adapt with changing environmental standards. Corporate plans are seeing an increase in the inclusion of sustainability goals by businesses. Because more people are aware of how methane affects the environment, businesses have the chance to show that they are committed to lowering their greenhouse gas emissions by including Methane Lidar Cameras into their sustainability programs. The acknowledgement of methane as a noteworthy contributor to the phenomenon of global warming has incentivized expenditures towards initiatives aimed at reducing methane emissions. Methane Lidar Cameras are essential to these initiatives because they offer precise monitoring and measurement capabilities, which draw interest from investors in the larger sustainable finance environment. Research and development efforts to improve methane monitoring technology are encouraged by the increasing awareness of the environmental effects of methane. As a result, there is potential for technological advancement in methane lidar cameras, which could enhance their sensitivity, accuracy, and affordability.

Methane Lidar Camera Market Trends

- Methane Lidar Cameras' capabilities were being improved by ongoing advances in Lidar technology. Enhancements in sensitivity, range, and data processing capacities were significant developments that led to more precise and effective methane monitoring.

- One noteworthy development was the combination of AI and advanced data analytics technologies with methane lidar cameras. By analyzing vast datasets, finding trends, and offering practical insights, these technologies were enhancing the effectiveness of methane monitoring and detection.

- The creation of Methane Lidar Cameras with improved remote sensing capabilities was in vogue. As a result, methane emissions could be observed over wider geographic regions, which made them useful instruments for monitoring natural gas infrastructure and leak detection.

- The significance of Methane Lidar Cameras in mitigating methane emissions was being acknowledged by the oil and gas sector. These cameras were becoming essential to the industry's efforts to track and minimize methane leaks as the environmental impact came under more and more scrutiny.

- Methane Lidar Camera usage was being driven by increasing government activities and legislation targeted at minimizing methane emissions. Industries were spending more money on sophisticated monitoring systems in order to comply with environmental restrictions in areas with stricter laws.

- There was a general trend of increased public and industry understanding of methane's negative effects on the environment. The need for tools like Methane Lidar Cameras, which could accurately monitor and measure methane emissions, was being driven by this growing knowledge.

- Governments, environmental organizations, and technology suppliers were increasingly working together. Opportunities were being created for the methane lidar camera industry by international cooperation targeted at mitigating climate change and lowering methane emissions.

- Methane Lidar Cameras are being used in fields other than the conventional industrial ones, like waste management and agriculture. Monitoring methane emissions from landfills and agricultural operations gained prominence and aided in the development of comprehensive environmental management.

Competitive Landscape

The competitive landscape of the Methane Lidar Camera market was dynamic, with several prominent companies competing to provide innovative and advanced Methane Lidar Camera solutions.

- Quanergy Systems, Inc.

- LiDAR Services International

- Leosphere (A Vaisala Company)

- Siemens AG

- Aeris Technologies, Inc.

- Honeywell International Inc.

- ESRI (Environmental Systems Research Institute)

- Laser Methane Mini (LMI) by Honeywell

- Anova Analytics

- Pergam Technical Services, Inc.

- TopScan Ltd.

- FLIR Systems, Inc.

- Schneider Electric SE

- RIEGL Laser Measurement Systems GmbH

- GroundProbe Pty Ltd.

- MethaneX by SeekOps, Inc.

- Teledyne Optech

- Bluefield Technologies

- Bridger Photonics, Inc.

- Orbital Sidekick

Regional Analysis

North America accounted for the largest market in the Methane Lidar Camera market. North America accounted for 37 % of the worldwide market value. Because of the region's strong emphasis on environmental regulations, technological innovation, and the deployment of advanced monitoring systems, North America has been an important market for methane lidar cameras. The North American market for methane lidar cameras is impacted by a number of variables, including industry norms, regulatory frameworks, and growing public awareness of methane as a potent greenhouse gas. The methane lidar camera market has been significantly influenced by stricter environmental restrictions implemented in North America with the goal of lowering greenhouse gas emissions. Advanced monitoring systems are being adopted by industries in the region as a result of growing need to monitor and manage methane emissions.

[caption id="attachment_31544" align="aligncenter" width="1920"]

Methane Lidar Cameras are becoming more and more popular among the oil and gas sector, which is one of the biggest sources of methane emissions. They are used to detect and stop leaks. The adoption of these cutting-edge monitoring solutions has been prompted by the industry's response to environmental concerns and regulatory compliance.

Numerous technological pioneers and businesses specializing in environmental monitoring call North America home. Methane Lidar Camera suppliers have potential because of government activities that promote sustainability goals and environmental monitoring. Industry investment in cutting-edge monitoring technologies may be encouraged by funding initiatives and incentives. Methane Lidar Camera use can be increased by partnerships between government organizations, businesses, and technological companies. Market expansion might come from collaborations that address particular industry issues and promote knowledge transfer.

Target Audience for Methane Lidar Camera Market

- Oil and Gas Industry

- Environmental Monitoring Agencies

- Energy and Utility Companies

- Renewable Energy Sector

- Industrial Manufacturing

- Waste Management and Landfills

- Agriculture

- Technology Providers

- Environmental Consulting Firms

- Investors and Financial Institutions

- Research and Academic Institutions

- Government Agencies and Policymakers

Import & Export Data for Methane Lidar Camera Market

Exactitude consultancy provides import and export data for the recent years. It also offers insights on production and consumption volume of the product. Understanding the import and export data is pivotal for any player in the Methane Lidar Camera market. This knowledge equips businesses with strategic advantages, such as:- Identifying emerging markets with untapped potential.

- Adapting supply chain strategies to optimize cost-efficiency and market responsiveness.

- Navigating competition by assessing major players' trade dynamics.

Key insights

- Trade volume trends: our report dissects import and export data spanning the last five years to reveal crucial trends and growth patterns within the global Methane Lidar Camera market. This data-driven exploration empowers readers with a deep understanding of the market's trajectory.

- Market players: gain insights into the leading players driving the Methane Lidar Camera trade. From established giants to emerging contenders, our analysis highlights the key contributors to the import and export landscape.

- Geographical dynamics: delve into the geographical distribution of trade activities. Uncover which regions dominate exports and which ones hold the reins on imports, painting a comprehensive picture of the industry's global footprint.

- Product breakdown: by segmenting data based on Methane Lidar Camera types –– we provide a granular view of trade preferences and shifts, enabling businesses to align strategies with the evolving technological landscape.

Segments Covered in the Methane Lidar Camera Market Report

Methane Lidar Camera Market by Component- Laser

- Optical system

- Detector

- Electronics

- Software

- Methane leak detection

- Methane leak quantification

- Methane plume tracking

- Methane source identification

- Oil and gas

- Utilities

- Agriculture

- Waste management

- Other

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the Methane Lidar Camera market over the next 7 years?

- Who are the major players in the Methane Lidar Camera market and what is their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the middle east, and Africa?

- How is the economic environment affecting the Methane Lidar Camera market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the Methane Lidar Camera market?

- What is the current and forecasted size and growth rate of the global Methane Lidar Camera market?

- What are the key drivers of growth in the Methane Lidar Camera market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the Methane Lidar Camera market?

- What are the technological advancements and innovations in the Methane Lidar Camera market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the Methane Lidar Camera market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the Methane Lidar Camera market?

- What are the product offerings and specifications of leading players in the market?

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- MAGNESIUM CHELATES MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON METHANE LIDAR CAMERA MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- MAGNESIUM CHELATES MARKET OUTLOOK

- GLOBAL METHANE LIDAR CAMERA MARKET BY COMPONENT, 2020-2030, (USD MILLION) (KILOTONS)

- LASER

- OPTICAL SYSTEM

- DETECTOR

- ELECTRONICS

- SOFTWARE

- GLOBAL METHANE LIDAR CAMERA MARKET BY APPLICATION, 2020-2030, (USD MILLION) (KILOTONS)

- METHANE LEAK DETECTION

- METHANE LEAK QUANTIFICATION

- METHANE PLUME TRACKING

- METHANE SOURCE IDENTIFICATION

- GLOBAL METHANE LIDAR CAMERA MARKET BY END USER, 2020-2030, (USD MILLION) (KILOTONS)

- OIL AND GAS

- UTILITIES

- AGRICULTURE

- WASTE MANAGEMENT

- OTHER

- GLOBAL METHANE LIDAR CAMERA MARKET BY REGION, 2020-2030, (USD MILLION) (KILOTONS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

9.1 QUANERGY SYSTEMS, INC.

9.2 LIDAR SERVICES INTERNATIONAL

9.3 LEOSPHERE (A VAISALA COMPANY)

9.4 SIEMENS AG

9.5 AERIS TECHNOLOGIES, INC.

9.6 HONEYWELL INTERNATIONAL INC.

9.7 HONEYWELL INTERNATIONAL INC.

9.8 LASER METHANE MINI (LMI) BY HONEYWELL

9.9 ANOVA ANALYTICS

9.10 PERGAM TECHNICAL SERVICES, INC.

9.11 TOPSCAN LTD.

9.12 FLIR SYSTEMS, INC.

9.13 SCHNEIDER ELECTRIC SE

9.14 RIEGL LASER MEASUREMENT SYSTEMS GMBH

9.15 GROUNDPROBE PTY LTD.

9.16 METHANEX BY SEEKOPS, INC.

9.17 TELEDYNE OPTECH

9.18 BLUEFIELD TECHNOLOGIES

9.19 BRIDGER PHOTONICS, INC.

9.20 ORBITAL SIDEKICK

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL METHANE LIDAR CAMERA MARKET BY COMPONENT (USD MILLION) 2020-2030

TABLE 2 GLOBAL METHANE LIDAR CAMERA MARKET BY COMPONENT (KILOTONS) 2020-2030

TABLE 3 GLOBAL METHANE LIDAR CAMERA MARKET BY APPLICTION (USD MILLION) 2020-2030

TABLE 4 GLOBAL METHANE LIDAR CAMERA MARKET BY APPLICTION (KILOTONS) 2020-2030

TABLE 5 GLOBAL METHANE LIDAR CAMERA MARKET BY END USER (USD MILLION) 2020-2030

TABLE 6 GLOBAL METHANE LIDAR CAMERA MARKET BY END USER (KILOTONS) 2020-2030

TABLE 7 GLOBAL METHANE LIDAR CAMERA MARKET BY REGION (USD MILLION) 2020-2030

TABLE 8 GLOBAL METHANE LIDAR CAMERA MARKET BY REGION (KILOTONS) 2020-2030

TABLE 9 NORTH AMERICA METHANE LIDAR CAMERA MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 10 NORTH AMERICA METHANE LIDAR CAMERA MARKET BY COUNTRY (KILOTONS) 2020-2030

TABLE 11 NORTH AMERICA METHANE LIDAR CAMERA MARKET BY COMPONENT (USD MILLION) 2020-2030

TABLE 12 NORTH AMERICA METHANE LIDAR CAMERA MARKET BY COMPONENT (KILOTONS) 2020-2030

TABLE 13 NORTH AMERICA METHANE LIDAR CAMERA MARKET BY APPLICTION (USD MILLION) 2020-2030

TABLE 14 NORTH AMERICA METHANE LIDAR CAMERA MARKET BY APPLICTION (KILOTONS) 2020-2030

TABLE 15 NORTH AMERICA METHANE LIDAR CAMERA MARKET BY END USER (USD MILLION) 2020-2030

TABLE 16 NORTH AMERICA METHANE LIDAR CAMERA MARKET BY END USER (KILOTONS) 2020-2030

TABLE 17 US METHANE LIDAR CAMERA MARKET BY COMPONENT (USD MILLION) 2020-2030

TABLE 18 US METHANE LIDAR CAMERA MARKET BY COMPONENT (KILOTONS) 2020-2030

TABLE 19 US METHANE LIDAR CAMERA MARKET BY APPLICTION (USD MILLION) 2020-2030

TABLE 20 US METHANE LIDAR CAMERA MARKET BY APPLICTION (KILOTONS) 2020-2030

TABLE 21 US METHANE LIDAR CAMERA MARKET BY END USER (USD MILLION) 2020-2030

TABLE 22 US METHANE LIDAR CAMERA MARKET BY END USER (KILOTONS) 2020-2030

TABLE 23 CANADA METHANE LIDAR CAMERA MARKET BY COMPONENT (USD MILLION) 2020-2030

TABLE 24 CANADA METHANE LIDAR CAMERA MARKET BY COMPONENT (KILOTONS) 2020-2030

TABLE 25 CANADA METHANE LIDAR CAMERA MARKET BY APPLICTION (USD MILLION) 2020-2030

TABLE 26 CANADA METHANE LIDAR CAMERA MARKET BY APPLICTION (KILOTONS) 2020-2030

TABLE 27 CANADA METHANE LIDAR CAMERA MARKET BY END USER (USD MILLION) 2020-2030

TABLE 28 CANADA METHANE LIDAR CAMERA MARKET BY END USER (KILOTONS) 2020-2030

TABLE 29 MEXICO METHANE LIDAR CAMERA MARKET BY COMPONENT (USD MILLION) 2020-2030

TABLE 30 MEXICO METHANE LIDAR CAMERA MARKET BY COMPONENT (KILOTONS) 2020-2030

TABLE 31 MEXICO METHANE LIDAR CAMERA MARKET BY APPLICTION (USD MILLION) 2020-2030

TABLE 32 MEXICO METHANE LIDAR CAMERA MARKET BY APPLICTION (KILOTONS) 2020-2030

TABLE 33 MEXICO METHANE LIDAR CAMERA MARKET BY END USER (USD MILLION) 2020-2030

TABLE 34 MEXICO METHANE LIDAR CAMERA MARKET BY END USER (KILOTONS) 2020-2030

TABLE 35 SOUTH AMERICA METHANE LIDAR CAMERA MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 36 SOUTH AMERICA METHANE LIDAR CAMERA MARKET BY COUNTRY (KILOTONS) 2020-2030

TABLE 37 SOUTH AMERICA METHANE LIDAR CAMERA MARKET BY COMPONENT (USD MILLION) 2020-2030

TABLE 38 SOUTH AMERICA METHANE LIDAR CAMERA MARKET BY COMPONENT (KILOTONS) 2020-2030

TABLE 39 SOUTH AMERICA METHANE LIDAR CAMERA MARKET BY APPLICTION (USD MILLION) 2020-2030

TABLE 40 SOUTH AMERICA METHANE LIDAR CAMERA MARKET BY APPLICTION (KILOTONS) 2020-2030

TABLE 41 SOUTH AMERICA METHANE LIDAR CAMERA MARKET BY END USER (USD MILLION) 2020-2030

TABLE 42 SOUTH AMERICA METHANE LIDAR CAMERA MARKET BY END USER (KILOTONS) 2020-2030

TABLE 43 BRAZIL METHANE LIDAR CAMERA MARKET BY COMPONENT (USD MILLION) 2020-2030

TABLE 44 BRAZIL METHANE LIDAR CAMERA MARKET BY COMPONENT (KILOTONS) 2020-2030

TABLE 45 BRAZIL METHANE LIDAR CAMERA MARKET BY APPLICTION (USD MILLION) 2020-2030

TABLE 46 BRAZIL METHANE LIDAR CAMERA MARKET BY APPLICTION (KILOTONS) 2020-2030

TABLE 47 BRAZIL METHANE LIDAR CAMERA MARKET BY END USER (USD MILLION) 2020-2030

TABLE 48 BRAZIL METHANE LIDAR CAMERA MARKET BY END USER (KILOTONS) 2020-2030

TABLE 49 ARGENTINA METHANE LIDAR CAMERA MARKET BY COMPONENT (USD MILLION) 2020-2030

TABLE 50 ARGENTINA METHANE LIDAR CAMERA MARKET BY COMPONENT (KILOTONS) 2020-2030

TABLE 51 ARGENTINA METHANE LIDAR CAMERA MARKET BY APPLICTION (USD MILLION) 2020-2030

TABLE 52 ARGENTINA METHANE LIDAR CAMERA MARKET BY APPLICTION (KILOTONS) 2020-2030

TABLE 53 ARGENTINA METHANE LIDAR CAMERA MARKET BY END USER (USD MILLION) 2020-2030

TABLE 54 ARGENTINA METHANE LIDAR CAMERA MARKET BY END USER (KILOTONS) 2020-2030

TABLE 55 COLOMBIA METHANE LIDAR CAMERA MARKET BY COMPONENT (USD MILLION) 2020-2030

TABLE 56 COLOMBIA METHANE LIDAR CAMERA MARKET BY COMPONENT (KILOTONS) 2020-2030

TABLE 57 COLOMBIA METHANE LIDAR CAMERA MARKET BY APPLICTION (USD MILLION) 2020-2030

TABLE 58 COLOMBIA METHANE LIDAR CAMERA MARKET BY APPLICTION (KILOTONS) 2020-2030

TABLE 59 COLOMBIA METHANE LIDAR CAMERA MARKET BY END USER (USD MILLION) 2020-2030

TABLE 60 COLOMBIA METHANE LIDAR CAMERA MARKET BY END USER (KILOTONS) 2020-2030

TABLE 61 REST OF SOUTH AMERICA METHANE LIDAR CAMERA MARKET BY COMPONENT (USD MILLION) 2020-2030

TABLE 62 REST OF SOUTH AMERICA METHANE LIDAR CAMERA MARKET BY COMPONENT (KILOTONS) 2020-2030

TABLE 63 REST OF SOUTH AMERICA METHANE LIDAR CAMERA MARKET BY APPLICTION (USD MILLION) 2020-2030

TABLE 64 REST OF SOUTH AMERICA METHANE LIDAR CAMERA MARKET BY APPLICTION (KILOTONS) 2020-2030

TABLE 65 REST OF SOUTH AMERICA METHANE LIDAR CAMERA MARKET BY END USER (USD MILLION) 2020-2030

TABLE 66 REST OF SOUTH AMERICA METHANE LIDAR CAMERA MARKET BY END USER (KILOTONS) 2020-2030

TABLE 67 ASIA-PACIFIC METHANE LIDAR CAMERA MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 68 ASIA-PACIFIC METHANE LIDAR CAMERA MARKET BY COUNTRY (KILOTONS) 2020-2030

TABLE 69 ASIA-PACIFIC METHANE LIDAR CAMERA MARKET BY COMPONENT (USD MILLION) 2020-2030

TABLE 70 ASIA-PACIFIC METHANE LIDAR CAMERA MARKET BY COMPONENT (KILOTONS) 2020-2030

TABLE 71 ASIA-PACIFIC METHANE LIDAR CAMERA MARKET BY APPLICTION (USD MILLION) 2020-2030

TABLE 72 ASIA-PACIFIC METHANE LIDAR CAMERA MARKET BY APPLICTION (KILOTONS) 2020-2030

TABLE 73 ASIA-PACIFIC METHANE LIDAR CAMERA MARKET BY END USER (USD MILLION) 2020-2030

TABLE 74 ASIA-PACIFIC METHANE LIDAR CAMERA MARKET BY END USER (KILOTONS) 2020-2030

TABLE 75 INDIA METHANE LIDAR CAMERA MARKET BY COMPONENT (USD MILLION) 2020-2030

TABLE 76 INDIA METHANE LIDAR CAMERA MARKET BY COMPONENT (KILOTONS) 2020-2030

TABLE 77 INDIA METHANE LIDAR CAMERA MARKET BY APPLICTION (USD MILLION) 2020-2030

TABLE 78 INDIA METHANE LIDAR CAMERA MARKET BY APPLICTION (KILOTONS) 2020-2030

TABLE 79 INDIA METHANE LIDAR CAMERA MARKET BY END USER (USD MILLION) 2020-2030

TABLE 80 INDIA METHANE LIDAR CAMERA MARKET BY END USER (KILOTONS) 2020-2030

TABLE 81 CHINA METHANE LIDAR CAMERA MARKET BY COMPONENT (USD MILLION) 2020-2030

TABLE 82 CHINA METHANE LIDAR CAMERA MARKET BY COMPONENT (KILOTONS) 2020-2030

TABLE 83 CHINA METHANE LIDAR CAMERA MARKET BY APPLICTION (USD MILLION) 2020-2030

TABLE 84 CHINA METHANE LIDAR CAMERA MARKET BY APPLICTION (KILOTONS) 2020-2030

TABLE 85 CHINA METHANE LIDAR CAMERA MARKET BY END USER (USD MILLION) 2020-2030

TABLE 86 CHINA METHANE LIDAR CAMERA MARKET BY END USER (KILOTONS) 2020-2030

TABLE 87 JAPAN METHANE LIDAR CAMERA MARKET BY COMPONENT (USD MILLION) 2020-2030

TABLE 88 JAPAN METHANE LIDAR CAMERA MARKET BY COMPONENT (KILOTONS) 2020-2030

TABLE 89 JAPAN METHANE LIDAR CAMERA MARKET BY APPLICTION (USD MILLION) 2020-2030

TABLE 90 JAPAN METHANE LIDAR CAMERA MARKET BY APPLICTION (KILOTONS) 2020-2030

TABLE 91 JAPAN METHANE LIDAR CAMERA MARKET BY END USER (USD MILLION) 2020-2030

TABLE 92 JAPAN METHANE LIDAR CAMERA MARKET BY END USER (KILOTONS) 2020-2030

TABLE 93 SOUTH KOREA METHANE LIDAR CAMERA MARKET BY COMPONENT (USD MILLION) 2020-2030

TABLE 94 SOUTH KOREA METHANE LIDAR CAMERA MARKET BY COMPONENT (KILOTONS) 2020-2030

TABLE 95 SOUTH KOREA METHANE LIDAR CAMERA MARKET BY APPLICTION (USD MILLION) 2020-2030

TABLE 96 SOUTH KOREA METHANE LIDAR CAMERA MARKET BY APPLICTION (KILOTONS) 2020-2030

TABLE 97 SOUTH KOREA METHANE LIDAR CAMERA MARKET BY END USER (USD MILLION) 2020-2030

TABLE 98 SOUTH KOREA METHANE LIDAR CAMERA MARKET BY END USER (KILOTONS) 2020-2030

TABLE 99 AUSTRALIA METHANE LIDAR CAMERA MARKET BY COMPONENT (USD MILLION) 2020-2030

TABLE 100 AUSTRALIA METHANE LIDAR CAMERA MARKET BY COMPONENT (KILOTONS) 2020-2030

TABLE 101 AUSTRALIA METHANE LIDAR CAMERA MARKET BY APPLICTION (USD MILLION) 2020-2030

TABLE 102 AUSTRALIA METHANE LIDAR CAMERA MARKET BY APPLICTION (KILOTONS) 2020-2030

TABLE 103 AUSTRALIA METHANE LIDAR CAMERA MARKET BY END USER (USD MILLION) 2020-2030

TABLE 104 AUSTRALIA METHANE LIDAR CAMERA MARKET BY END USER (KILOTONS) 2020-2030

TABLE 105 SOUTH-EAST ASIA METHANE LIDAR CAMERA MARKET BY COMPONENT (USD MILLION) 2020-2030

TABLE 106 SOUTH-EAST ASIA METHANE LIDAR CAMERA MARKET BY COMPONENT (KILOTONS) 2020-2030

TABLE 107 SOUTH-EAST ASIA METHANE LIDAR CAMERA MARKET BY APPLICTION (USD MILLION) 2020-2030

TABLE 108 SOUTH-EAST ASIA METHANE LIDAR CAMERA MARKET BY APPLICTION (KILOTONS) 2020-2030

TABLE 109 SOUTH-EAST ASIA METHANE LIDAR CAMERA MARKET BY END USER (USD MILLION) 2020-2030

TABLE 110 SOUTH-EAST ASIA METHANE LIDAR CAMERA MARKET BY END USER (KILOTONS) 2020-2030

TABLE 111 REST OF ASIA PACIFIC METHANE LIDAR CAMERA MARKET BY COMPONENT (USD MILLION) 2020-2030

TABLE 112 REST OF ASIA PACIFIC METHANE LIDAR CAMERA MARKET BY COMPONENT (KILOTONS) 2020-2030

TABLE 113 REST OF ASIA PACIFIC METHANE LIDAR CAMERA MARKET BY APPLICTION (USD MILLION) 2020-2030

TABLE 114 REST OF ASIA PACIFIC METHANE LIDAR CAMERA MARKET BY APPLICTION (KILOTONS) 2020-2030

TABLE 115 REST OF ASIA PACIFIC METHANE LIDAR CAMERA MARKET BY END USER (USD MILLION) 2020-2030

TABLE 116 REST OF ASIA PACIFIC METHANE LIDAR CAMERA MARKET BY END USER (KILOTONS) 2020-2030

TABLE 117 EUROPE METHANE LIDAR CAMERA MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 118 EUROPE METHANE LIDAR CAMERA MARKET BY COUNTRY (KILOTONS) 2020-2030

TABLE 119 EUROPE METHANE LIDAR CAMERA MARKET BY COMPONENT (USD MILLION) 2020-2030

TABLE 120 EUROPE METHANE LIDAR CAMERA MARKET BY COMPONENT (KILOTONS) 2020-2030

TABLE 121 EUROPE METHANE LIDAR CAMERA MARKET BY APPLICTION (USD MILLION) 2020-2030

TABLE 122 EUROPE METHANE LIDAR CAMERA MARKET BY APPLICTION (KILOTONS) 2020-2030

TABLE 123 EUROPE METHANE LIDAR CAMERA MARKET BY END USER (USD MILLION) 2020-2030

TABLE 124 EUROPE METHANE LIDAR CAMERA MARKET BY END USER (KILOTONS) 2020-2030

TABLE 125 GERMANY METHANE LIDAR CAMERA MARKET BY COMPONENT (USD MILLION) 2020-2030

TABLE 126 GERMANY METHANE LIDAR CAMERA MARKET BY COMPONENT (KILOTONS) 2020-2030

TABLE 127 GERMANY METHANE LIDAR CAMERA MARKET BY APPLICTION (USD MILLION) 2020-2030

TABLE 128 GERMANY METHANE LIDAR CAMERA MARKET BY APPLICTION (KILOTONS) 2020-2030

TABLE 129 GERMANY METHANE LIDAR CAMERA MARKET BY END USER (USD MILLION) 2020-2030

TABLE 130 GERMANY METHANE LIDAR CAMERA MARKET BY END USER (KILOTONS) 2020-2030

TABLE 131 UK METHANE LIDAR CAMERA MARKET BY COMPONENT (USD MILLION) 2020-2030

TABLE 132 UK METHANE LIDAR CAMERA MARKET BY COMPONENT (KILOTONS) 2020-2030

TABLE 133 UK METHANE LIDAR CAMERA MARKET BY APPLICTION (USD MILLION) 2020-2030

TABLE 134 UK METHANE LIDAR CAMERA MARKET BY APPLICTION (KILOTONS) 2020-2030

TABLE 135 UK METHANE LIDAR CAMERA MARKET BY END USER (USD MILLION) 2020-2030

TABLE 136 UK METHANE LIDAR CAMERA MARKET BY END USER (KILOTONS) 2020-2030

TABLE 137 FRANCE METHANE LIDAR CAMERA MARKET BY COMPONENT (USD MILLION) 2020-2030

TABLE 138 FRANCE METHANE LIDAR CAMERA MARKET BY COMPONENT (KILOTONS) 2020-2030

TABLE 139 FRANCE METHANE LIDAR CAMERA MARKET BY APPLICTION (USD MILLION) 2020-2030

TABLE 140 FRANCE METHANE LIDAR CAMERA MARKET BY APPLICTION (KILOTONS) 2020-2030

TABLE 141 FRANCE METHANE LIDAR CAMERA MARKET BY END USER (USD MILLION) 2020-2030

TABLE 142 FRANCE METHANE LIDAR CAMERA MARKET BY END USER (KILOTONS) 2020-2030

TABLE 143 ITALY METHANE LIDAR CAMERA MARKET BY COMPONENT (USD MILLION) 2020-2030

TABLE 144 ITALY METHANE LIDAR CAMERA MARKET BY COMPONENT (KILOTONS) 2020-2030

TABLE 145 ITALY METHANE LIDAR CAMERA MARKET BY APPLICTION (USD MILLION) 2020-2030

TABLE 146 ITALY METHANE LIDAR CAMERA MARKET BY APPLICTION (KILOTONS) 2020-2030

TABLE 147 ITALY METHANE LIDAR CAMERA MARKET BY END USER (USD MILLION) 2020-2030

TABLE 148 ITALY METHANE LIDAR CAMERA MARKET BY END USER (KILOTONS) 2020-2030

TABLE 149 SPAIN METHANE LIDAR CAMERA MARKET BY COMPONENT (USD MILLION) 2020-2030

TABLE 150 SPAIN METHANE LIDAR CAMERA MARKET BY COMPONENT (KILOTONS) 2020-2030

TABLE 151 SPAIN METHANE LIDAR CAMERA MARKET BY APPLICTION (USD MILLION) 2020-2030

TABLE 152 SPAIN METHANE LIDAR CAMERA MARKET BY APPLICTION (KILOTONS) 2020-2030

TABLE 153 SPAIN METHANE LIDAR CAMERA MARKET BY END USER (USD MILLION) 2020-2030

TABLE 154 SPAIN METHANE LIDAR CAMERA MARKET BY END USER (KILOTONS) 2020-2030

TABLE 155 RUSSIA METHANE LIDAR CAMERA MARKET BY COMPONENT (USD MILLION) 2020-2030

TABLE 156 RUSSIA METHANE LIDAR CAMERA MARKET BY COMPONENT (KILOTONS) 2020-2030

TABLE 157 RUSSIA METHANE LIDAR CAMERA MARKET BY APPLICTION (USD MILLION) 2020-2030

TABLE 158 RUSSIA METHANE LIDAR CAMERA MARKET BY APPLICTION (KILOTONS) 2020-2030

TABLE 159 RUSSIA METHANE LIDAR CAMERA MARKET BY END USER (USD MILLION) 2020-2030

TABLE 160 RUSSIA METHANE LIDAR CAMERA MARKET BY END USER (KILOTONS) 2020-2030

TABLE 161 REST OF EUROPE METHANE LIDAR CAMERA MARKET BY COMPONENT (USD MILLION) 2020-2030

TABLE 162 REST OF EUROPE METHANE LIDAR CAMERA MARKET BY COMPONENT (KILOTONS) 2020-2030

TABLE 163 REST OF EUROPE METHANE LIDAR CAMERA MARKET BY APPLICTION (USD MILLION) 2020-2030

TABLE 164 REST OF EUROPE METHANE LIDAR CAMERA MARKET BY APPLICTION (KILOTONS) 2020-2030

TABLE 165 REST OF EUROPE METHANE LIDAR CAMERA MARKET BY END USER (USD MILLION) 2020-2030

TABLE 166 REST OF EUROPE METHANE LIDAR CAMERA MARKET BY END USER (KILOTONS) 2020-2030

TABLE 167 MIDDLE EAST AND AFRICA METHANE LIDAR CAMERA MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 168 MIDDLE EAST AND AFRICA METHANE LIDAR CAMERA MARKET BY COUNTRY (KILOTONS) 2020-2030

TABLE 169 MIDDLE EAST AND AFRICA METHANE LIDAR CAMERA MARKET BY COMPONENT (USD MILLION) 2020-2030

TABLE 170 MIDDLE EAST AND AFRICA METHANE LIDAR CAMERA MARKET BY COMPONENT (KILOTONS) 2020-2030

TABLE 171 MIDDLE EAST AND AFRICA METHANE LIDAR CAMERA MARKET BY APPLICTION (USD MILLION) 2020-2030

TABLE 172 MIDDLE EAST AND AFRICA METHANE LIDAR CAMERA MARKET BY APPLICTION (KILOTONS) 2020-2030

TABLE 173 MIDDLE EAST AND AFRICA METHANE LIDAR CAMERA MARKET BY END USER (USD MILLION) 2020-2030

TABLE 174 MIDDLE EAST AND AFRICA METHANE LIDAR CAMERA MARKET BY END USER (KILOTONS) 2020-2030

TABLE 175 UAE METHANE LIDAR CAMERA MARKET BY COMPONENT (USD MILLION) 2020-2030

TABLE 176 UAE METHANE LIDAR CAMERA MARKET BY COMPONENT (KILOTONS) 2020-2030

TABLE 177 UAE METHANE LIDAR CAMERA MARKET BY APPLICTION (USD MILLION) 2020-2030

TABLE 178 UAE METHANE LIDAR CAMERA MARKET BY APPLICTION (KILOTONS) 2020-2030

TABLE 179 UAE METHANE LIDAR CAMERA MARKET BY END USER (USD MILLION) 2020-2030

TABLE 180 UAE METHANE LIDAR CAMERA MARKET BY END USER (KILOTONS) 2020-2030

TABLE 181 SAUDI ARABIA METHANE LIDAR CAMERA MARKET BY COMPONENT (USD MILLION) 2020-2030

TABLE 182 SAUDI ARABIA METHANE LIDAR CAMERA MARKET BY COMPONENT (KILOTONS) 2020-2030

TABLE 183 SAUDI ARABIA METHANE LIDAR CAMERA MARKET BY APPLICTION (USD MILLION) 2020-2030

TABLE 184 SAUDI ARABIA METHANE LIDAR CAMERA MARKET BY APPLICTION (KILOTONS) 2020-2030

TABLE 185 SAUDI ARABIA METHANE LIDAR CAMERA MARKET BY END USER (USD MILLION) 2020-2030

TABLE 186 SAUDI ARABIA METHANE LIDAR CAMERA MARKET BY END USER (KILOTONS) 2020-2030

TABLE 187 SOUTH AFRICA METHANE LIDAR CAMERA MARKET BY COMPONENT (USD MILLION) 2020-2030

TABLE 188 SOUTH AFRICA METHANE LIDAR CAMERA MARKET BY COMPONENT (KILOTONS) 2020-2030

TABLE 189 SOUTH AFRICA METHANE LIDAR CAMERA MARKET BY APPLICTION (USD MILLION) 2020-2030

TABLE 190 SOUTH AFRICA METHANE LIDAR CAMERA MARKET BY APPLICTION (KILOTONS) 2020-2030

TABLE 191 SOUTH AFRICA METHANE LIDAR CAMERA MARKET BY END USER (USD MILLION) 2020-2030

TABLE 192 SOUTH AFRICA METHANE LIDAR CAMERA MARKET BY END USER (KILOTONS) 2020-2030

TABLE 193 REST OF MIDDLE EAST AND AFRICA METHANE LIDAR CAMERA MARKET BY COMPONENT (USD MILLION) 2020-2030

TABLE 194 REST OF MIDDLE EAST AND AFRICA METHANE LIDAR CAMERA MARKET BY COMPONENT (KILOTONS) 2020-2030

TABLE 195 REST OF MIDDLE EAST AND AFRICA METHANE LIDAR CAMERA MARKET BY APPLICTION (USD MILLION) 2020-2030

TABLE 196 REST OF MIDDLE EAST AND AFRICA METHANE LIDAR CAMERA MARKET BY APPLICTION (KILOTONS) 2020-2030

TABLE 197 REST OF MIDDLE EAST AND AFRICA METHANE LIDAR CAMERA MARKET BY END USER (USD MILLION) 2020-2030

TABLE 198 REST OF MIDDLE EAST AND AFRICA METHANE LIDAR CAMERA MARKET BY END USER (KILOTONS) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL METHANE LIDAR CAMERA MARKET BY COMPONENT USD MILLION, 2020-2030

FIGURE 9 GLOBAL METHANE LIDAR CAMERA MARKET BY APPLICTION USD MILLION, 2020-2030

FIGURE 10 GLOBAL METHANE LIDAR CAMERA MARKET BY END USER, USD MILLION, 2020-2030

FIGURE 11 GLOBAL METHANE LIDAR CAMERA MARKET BY REGION, USD MILLION, 2020-2030

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL METHANE LIDAR CAMERA MARKET BY COMPONENT USD MILLION, 2022

FIGURE 14 GLOBAL METHANE LIDAR CAMERA MARKET BY APPLICTION, USD MILLION, 2022

FIGURE 15 GLOBAL METHANE LIDAR CAMERA MARKET BY END USER, USD MILLION, 2022

FIGURE 16 GLOBAL METHANE LIDAR CAMERA MARKET BY REGION, USD MILLION, 2022

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 QUANERGY SYSTEMS, INC.: COMPANY SNAPSHOT

FIGURE 19 LIDAR SERVICES INTERNATIONAL: COMPANY SNAPSHOT

FIGURE 20 LEOSPHERE (A VAISALA COMPANY): COMPANY SNAPSHOT

FIGURE 21 SIEMENS AG: COMPANY SNAPSHOT

FIGURE 22 AERIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

FIGURE 23 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

FIGURE 24 ESRI (ENVIRONMENTAL SYSTEMS RESEARCH INSTITUTE): COMPANY SNAPSHOT

FIGURE 25 LASER METHANE MINI (LMI) BY HONEYWELL: COMPANY SNAPSHOT

FIGURE 26 ANOVA ANALYTICS: COMPANY SNAPSHOT

FIGURE 27 PERGAM TECHNICAL SERVICES, INC.: COMPANY SNAPSHOT

FIGURE 28 TOPSCAN LTD.: COMPANY SNAPSHOT

FIGURE 29 FLIR SYSTEMS, INC.: COMPANY SNAPSHOT

FIGURE 30 SCHNEIDER ELECTRIC SE: COMPANY SNAPSHOT

FIGURE 31 RIEGL LASER MEASUREMENT SYSTEMS GMBH: COMPANY SNAPSHOT

FIGURE 32 GROUNDPROBE PTY LTD.: COMPANY SNAPSHOT

FIGURE 33 METHANEX BY SEEKOPS, INC.: COMPANY SNAPSHOT

FIGURE 34 TELEDYNE OPTECH: COMPANY SNAPSHOT

FIGURE 35 BLUEFIELD TECHNOLOGIES: COMPANY SNAPSHOT

FIGURE 36 BRIDGER PHOTONICS, INC.: COMPANY SNAPSHOT

FIGURE 37 ORBITAL SIDEKICK: COMPANY SNAPSHOT

FIGURE 38 ULTIMAKER BV: COMPANY SNAPSHOT

DOWNLOAD FREE SAMPLE REPORT

License Type

SPEAK WITH OUR ANALYST

Want to know more about the report or any specific requirement?

WANT TO CUSTOMIZE THE REPORT?

Our Clients Speak

We asked them to research ‘ Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te

Yosuke Mitsui

Senior Associate Construction Equipment Sales & Marketing

We asked them to research ‘Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te