Base Year Value ()

CAGR ()

Forecast Year Value ()

Historical Data Period

Largest Region

Forecast Period

オフショア掘削リグ市場 - リグタイプ別(ジャッキアップリグ、半潜水型、掘削船)、水深別(浅水、深水、超深水)および地域別、2023年から2030年までの世界的動向と予測

Instant access to hundreds of data points and trends

- Market estimates from 2014-2029

- Competitive analysis, industry segmentation, financial benchmarks

- Incorporates SWOT, Porter's Five Forces and risk management frameworks

- PDF report or online database with Word, Excel and PowerPoint export options

- 100% money back guarantee

オフショア掘削リグ市場の概要

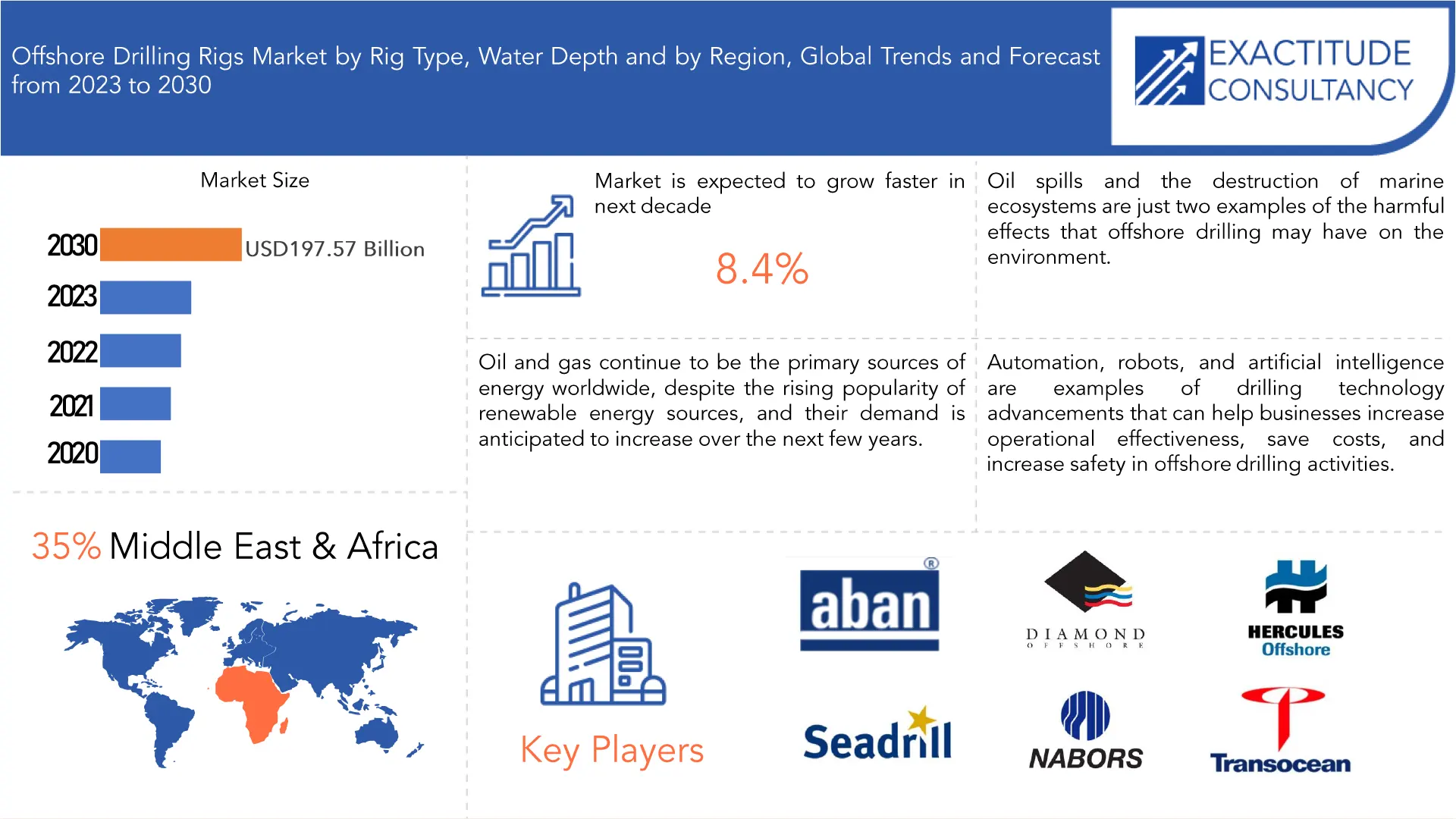

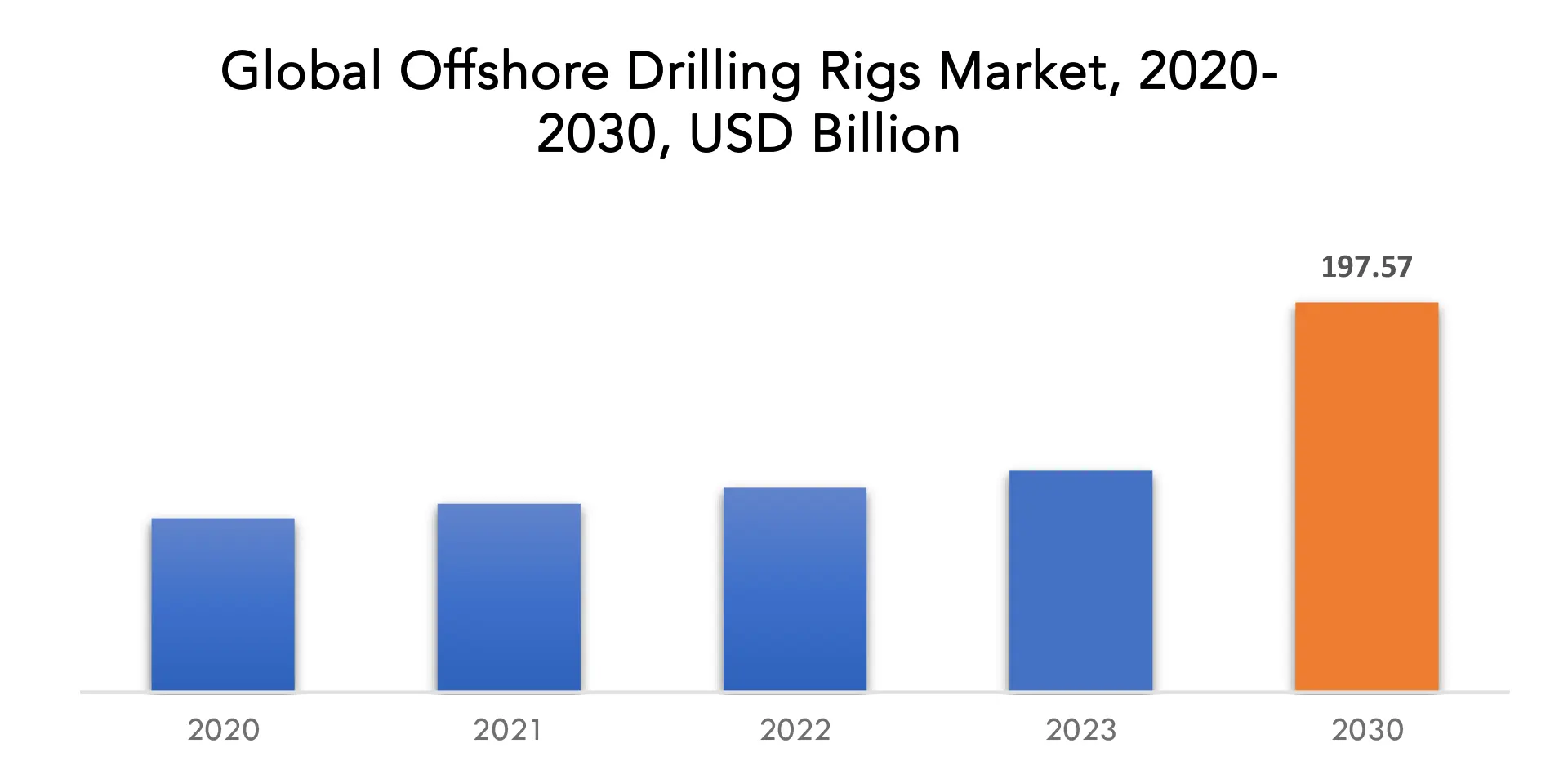

オフショア掘削リグ市場は、2022年から2030年にかけて8.4%のCAGRで成長すると予想されています。2023年の1123.3億米ドルから2030年までに1975.7億米ドルを超えると予想されています。

オフショア掘削リグと呼ばれる大型構造物は、石油や天然ガスの抽出、精製、保管を容易にするために作られました。これらのリグは、井戸の掘削、石油とガスの抽出と処理、そして陸に上がってから精製して販売する準備ができるまで商品を保管するために使用されます。オフショア掘削リグは、海底の下を掘削するために必要です。掘削技術を使用して、地球から天然ガスと石油を採掘することができます。オフショアの石油とガスの操業の急速な成長により、世界中でオフショア掘削リグの需要が高まると予想されています。また、新しい探査サイトの開発と現在の埋蔵量の改善が市場拡大にプラスの影響を与えることも実証されています。オフショア掘削リグ市場は競争が激しく、数社の大手メーカーが独占しており、大手石油・ガス会社、独立事業者、国営石油会社など、さまざまな顧客に対応しています。この業界では、探査、掘削、生産などのさまざまなサービスを提供しています。沖合掘削の経済性と実現可能性は、ライセンスや許可の費用、安全性や環境基準など、さまざまな環境および規制要因によって左右されます。これらの課題にもかかわらず、石油とガスの需要は依然として高く、業界では沖合掘削作業の効率と生産性を高めるための新しいイノベーションとテクノロジーの開発が継続的に行われています。

[キャプション id="attachment_31250" align="aligncenter" width="1920"]

The rise in offshore operations, rising demand for oil and gas, and strict rules for onshore drilling projects are all contributing to the anticipated growth of the global offshore drilling rigs market. High expenditures on exploration and production are additional key factors in the market's expansion. The market is expanding as a result of the rising number of exploratory wells, technical advancements, and rising need for energy security. However, the market's expansion is being constrained by the government's stringent regulations as well as expensive installation and operational costs. Many offshore drilling projects have been delayed or abandoned as a result of the pandemic as travel restrictions, supply chain problems, and social isolation policies have made it challenging for businesses to conduct exploration and production activities. A global economic downturn brought on by the pandemic has decreased demand for oil and gas, lowered prices, and reduced investment in offshore drilling projects.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion), Volume (Thousand units) |

| Segmentation | By Rig type, By Water depth, By Region |

| By Rig Type |

|

| By Water Depth |

|

| By Region |

|

Frequently Asked Questions

• What is the worth of offshore drilling rigs market?

The offshore drilling rigs market is expected to grow at 8.4% CAGR from 2022 to 2030. It is expected to reach above USD 197.57 Billion by 2030 from USD 112.33 Billion in 2023.

• What are some of the market's driving forces?

The demand for energy fuels is rising per year due to rising industrialization, concerns related to energy security, globalization, and growing economic wealth of developing countries.

• Which are the top companies to hold the market share in offshore drilling rigs market?

The offshore drilling rigs Market Key players include Aban Offshore Limited, Diamond Offshore Drilling Inc., Ensco PLC, Hercules Offshore Inc., KCA Deutag, China Oilfield Services Limited., Maersk Drilling, Pacific Drilling, Seadrill Limited, Vantage Drilling, Atwood Oceanics, Nabors Industries Ltd, Rowan Companies PLC, Transocean Ltd., Halliburton, Schlumberger, Weatherford International Inc.

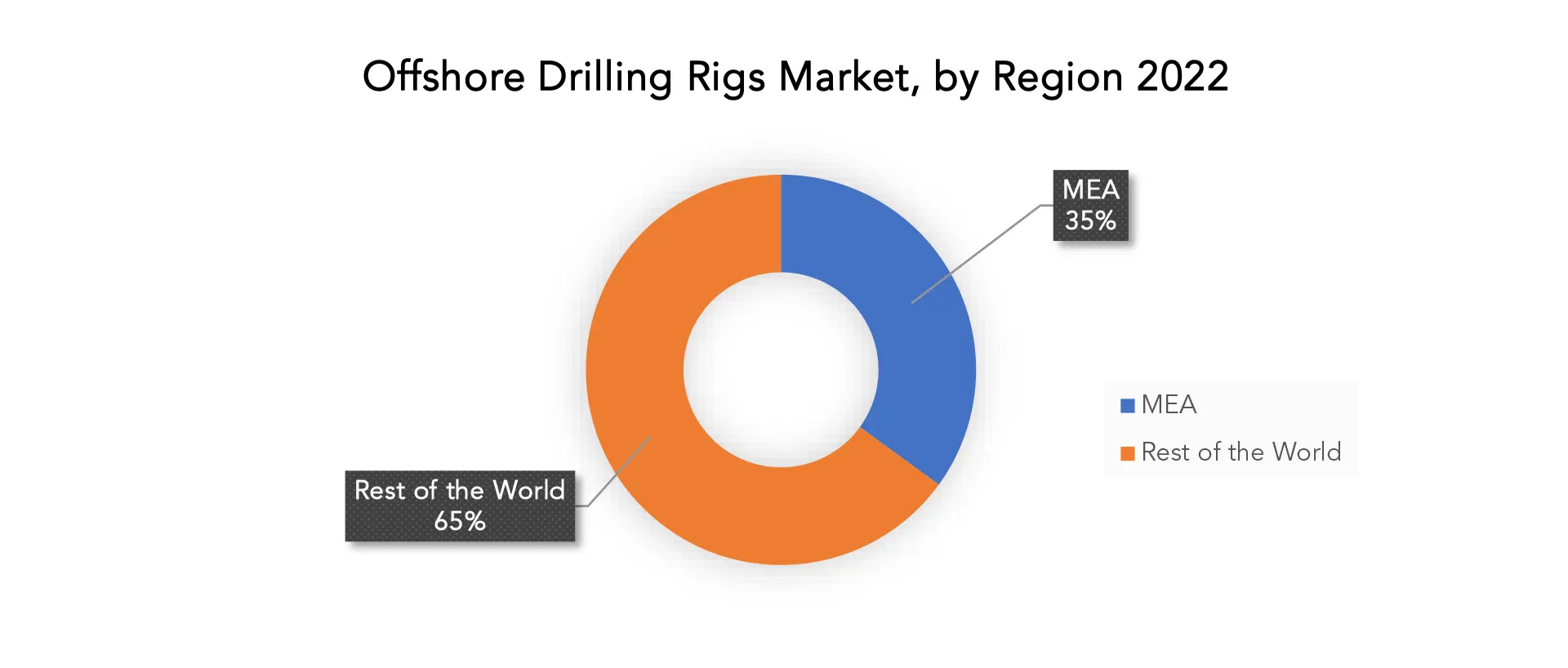

• Which is the largest regional market for offshore drilling rigs market?

The region's largest share is in MEA. Products manufactured in nations like UAE and Saudi Arabia that perform similarly and are inexpensively accessible to the general public have led to the increasing appeal.

Offshore Drilling Rigs Market Segment Analysis

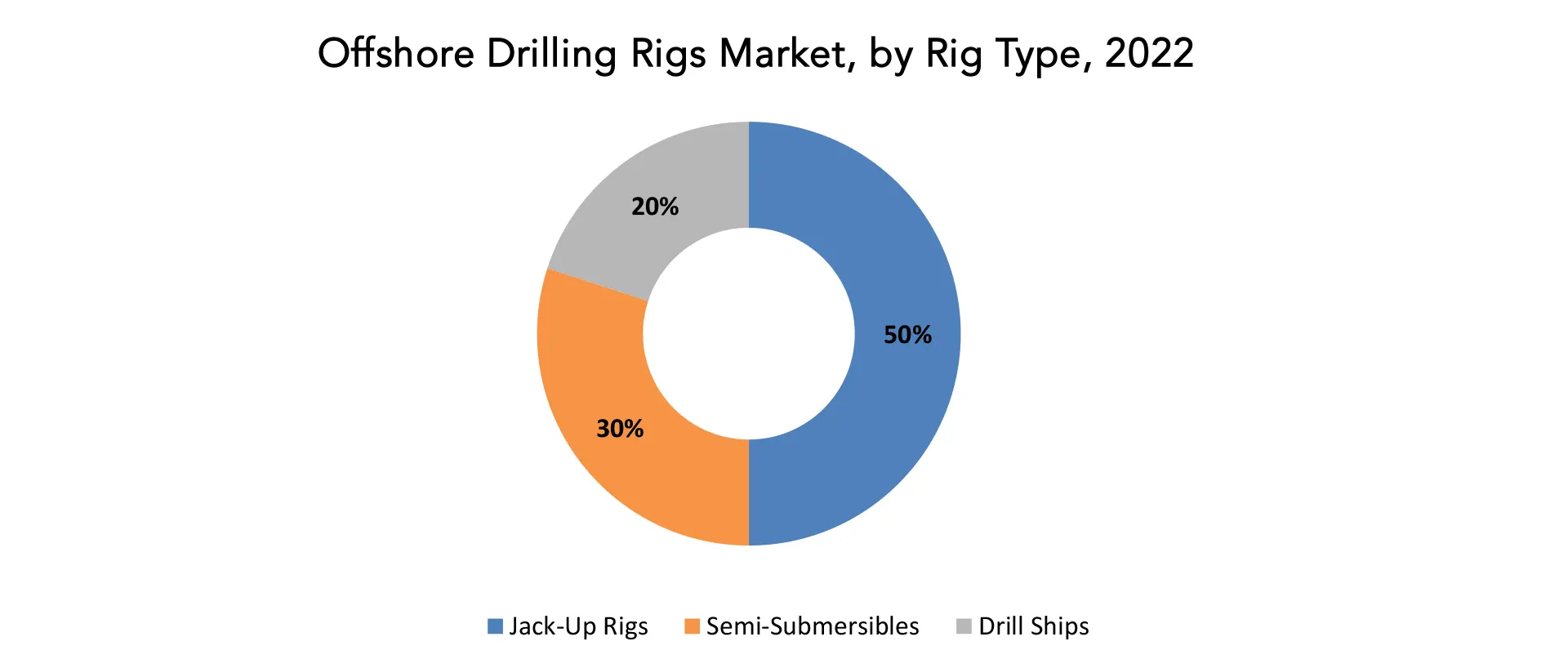

The offshore drilling rigs market is segmented based on rig type, water depth and region. [caption id="attachment_31264" align="aligncenter" width="1920"]

Based on rig type, the market is segmented into jack-up rigs, semi-submersibles, drill ships. Due to their excellent resistance to adverse weather and rising shallow-water exploration, jack-ups are anticipated to grow the most during the expected period compared to other segments. Jack-Up rigs are self-elevating, transportable, mobile drilling platforms that may be transported to a drilling site and then moored to the seafloor using retractable legs. When the platform is anchored, the legs are extended to raise it above the water, creating a stable platform for drilling operations. Jack-up rigs can be modified to meet unique drilling needs and are frequently used for drilling in water depths up to 400 feet (122 metres).

A variety of drilling tools and apparatus, such as drilling derricks, mud pumps, and blowout preventers, can be installed on jack-up rigs. Additionally, they can support various drilling activities like cementing and completion operations and have crew accommodations on board. Due to their adaptability, affordability, and effectiveness in shallow water drilling operations, jack-up rigs are common in the offshore drilling sector.

[caption id="attachment_31265" align="aligncenter" width="1920"]

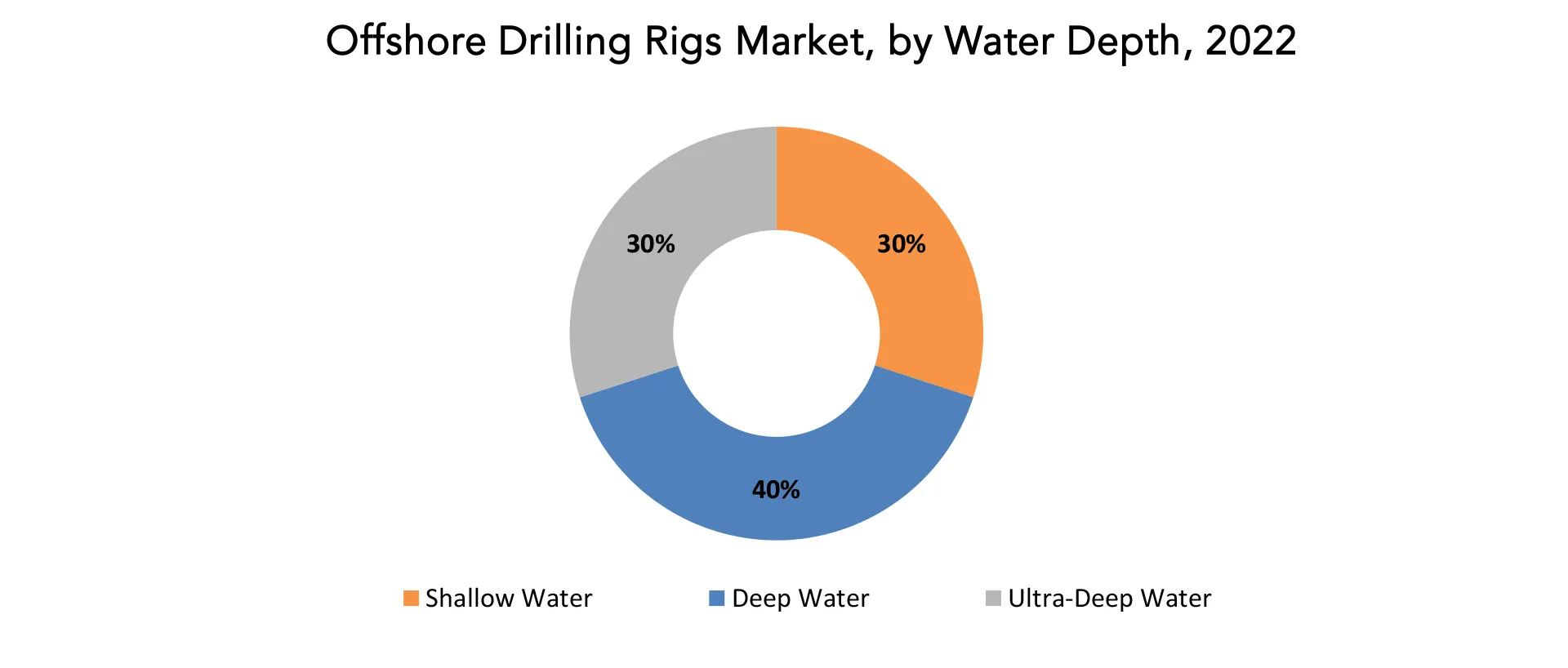

Based on water depth, the market is segmented into shallow water, deep water, ultra-deep water. Due to an increase in deep-water activities, technological advancements, and rising demand for crude oil, the deep and ultra-deep water segment is anticipated to grow the most during the forecasted period. Deep Water Offshore Drilling is the practice of conducting drilling operations in waters deeper than 400 feet (122 metres). These depths can go down to or beyond 12,000 feet (3,657 metres). Specialized drilling rigs, including semi-submersible rigs or drill ships, are employed to do deepwater drilling. These rigs can resist severe weather conditions including strong currents and large waves because they are built to operate in deepwater areas. Deepwater drilling necessitates cutting-edge tools and technology, such as subsea wellheads, riser systems, and blowout preventers. These elements are required to keep the well under control and avoid mishaps like oil leaks and blowouts.

Deepwater drilling presents a number of difficulties, including technological difficulty, expense, and safety. Due to the necessity for specialized machinery and technology, deepwater drilling rigs often have greater operational costs than shallow water rigs. As depth increases, so do safety threats, making it crucial to uphold high safety and environmental standards. Deepwater drilling is crucial to the offshore drilling industry despite these difficulties since it provides access to previously untapped oil and gas sources.

[caption id="attachment_31261" align="aligncenter" width="1920"]

Offshore Drilling Rigs Market Players

The offshore drilling rigs Market Key players include Aban Offshore Limited, Diamond Offshore Drilling Inc., Ensco PLC, Hercules Offshore Inc., KCA Deutag, China Oilfield Services Limited., Maersk Drilling, Pacific Drilling, Seadrill Limited, Vantage Drilling, Atwood Oceanics, Nabors Industries Ltd, Rowan Companies PLC, Transocean Ltd., Halliburton, Schlumberger, Weatherford International Inc.

Recent Developments19 April, 2023: Transocean Ltd. And Eneti Inc. announced the execution of a non-binding memorandum of understanding through the respective subsidiary companies indicating their intention to form a joint venture company that will be engaged in offshore wind foundation installation activities.

03 April, 2023: Seadrill Limited announced the completion of acquisition of Aquadrill LLC, and thus Aquadrill became a wholly owned subsidiary of Seadrill Inc.

Who Should Buy? Or Key stakeholders

- Oil and Gas Companies

- Drilling Rig Manufacturers

- Oilfield Services Companies

- Oil and Gas Resources Distributors

- Government & Regional Agencies

- Research Organizations

- Investors

- Regulatory Authorities

Offshore Drilling Rigs Market Regional Analysis

The offshore drilling rigs Market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

The Middle East, which has historically been a significant hub for offshore oil and gas production, is expected to be the dominant area for the offshore drilling rigs market in 2022 and the projected period also. In the upcoming years, the Middle East is anticipated to account for the majority of new offshore drilling activity, led by significant projects in nations like Saudi Arabia, the UAE, and Qatar. The demand for drilling rigs can alter depending on a number of variables, including oil and gas prices, geopolitical developments, and regulatory changes. The offshore drilling market is a global one. As a result, it's crucial to take a variety of criteria into account when determining which area will dominate the offshore drilling industry in a particular year.

The Asia-Pacific region is anticipated to have the offshore drilling rigs market's fastest growth in 2022. Due to rising energy demand, sizable offshore reserves, and favourable government policies, offshore drilling activity is anticipated to increase significantly in the Asia-Pacific region over the next few years. Australia, China, and India are anticipated to be the main forces behind regional growth. With the government aggressively encouraging offshore exploration and production activities to lessen the nation's reliance on imported energy, India in particular is predicted to experience a large increase in offshore drilling activity. With numerous significant projects either underway or planned in the nation's offshore waters, Australia is also anticipated to maintain its position as a major hub for offshore drilling. Additionally, more offshore drilling is anticipated in China, particularly in the South China Sea, which has sizable oil and gas reserves.

Key Market Segments: Offshore Drilling Rigs Market

Offshore Drilling Rigs Market By Rig Type, 2020-2030, (USD Billion, Thousand Units)- Jack-Up Rigs

- Semi-Submersibles

- Drill Ships

- Shallow Water

- Deep Water

- Ultra-Deep Water

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Exactitude Consultancy drill ships Key Objectives:

- Increasing sales and market share

- Developing new water depth

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the offshore drilling rigs market over the next 7 years?

- Who are the major players in the offshore drilling rigs market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the offshore drilling rigs market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the offshore drilling rigs market?

- What is the current and forecasted size and growth rate of the global offshore drilling rigs market?

- What are the key drivers of growth in the offshore drilling rigs market?

- Who are the major players in the market and what is their market share?

- What are the end users and supply chain dynamics in the offshore drilling rigs market?

- What are the technological advancements and innovations in the offshore drilling rigs market and their impact on water depth development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the offshore drilling rigs market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the offshore drilling rigs market?

- What are the water depth rig type and specifications of leading players in the market?

- What is the pricing trend of offshore drilling rigs in the market and what is the impact of raw material prices on the price trend?

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL OFFSHORE DRILLING RIGS MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON OFFSHORE DRILLING RIGS MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL OFFSHORE DRILLING RIGS MARKET OUTLOOK

- GLOBAL OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (USD BILLION, THOUSAND UNITS), 2020-2030

- JACK-UP RIGS

- SEMI-SUBMERSIBLES

- DRILL SHIPS

- GLOBAL OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (USD BILLION, THOUSAND UNITS), 2020-2030

- SHALLOW WATER

- DEEP WATER

- ULTRA-DEEP WATER

- GLOBAL OFFSHORE DRILLING RIGS MARKET BY REGION (USD BILLION, THOUSAND UNITS), 2020-2030

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- ABAN OFFSHORE LIMITED

- DIAMOND OFFSHORE DRILLING INC.

- ENSCO PLC

- HERCULES OFFSHORE INC.

- KCA DEUTAG

- CHINA OILFIELD SERVICES LIMITED.

- MAERSK DRILLING

- PACIFIC DRILLING

- SEADRILL LIMITED

- VANTAGE DRILLING

- ATWOOD OCEANICS

- NABORS INDUSTRIES LTD

- ROWAN COMPANIES PLC

- TRANSOCEAN LTD.

- HALLIBURTON

- SCHLUMBERGER

- WEATHERFORD INTERNATIONAL INC. *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (USD BILLION) 2020-2030

TABLE 2 GLOBAL OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (THOUSAND UNITS) 2020-2030

TABLE 3 GLOBAL OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (USD BILLION) 2020-2030

TABLE 4 GLOBAL OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (THOUSAND UNITS) 2020-2030

TABLE 5 GLOBAL OFFSHORE DRILLING RIGS MARKET BY REGION (USD BILLION) 2020-2030

TABLE 6 GLOBAL OFFSHORE DRILLING RIGS MARKET BY REGION (THOUSAND UNITS) 2020-2030

TABLE 7 NORTH AMERICA OFFSHORE DRILLING RIGS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 8 NORTH AMERICA OFFSHORE DRILLING RIGS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 9 NORTH AMERICA OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (USD BILLION) 2020-2030

TABLE 10 NORTH AMERICA OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (THOUSAND UNITS) 2020-2030

TABLE 11 NORTH AMERICA OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (USD BILLION) 2020-2030

TABLE 12 NORTH AMERICA OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (THOUSAND UNITS) 2020-2030

TABLE 13 US OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (USD BILLION) 2020-2030

TABLE 14 US OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (THOUSAND UNITS) 2020-2030

TABLE 15 US OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (USD BILLION) 2020-2030

TABLE 16 US OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (THOUSAND UNITS) 2020-2030

TABLE 17 CANADA OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (USD BILLION) 2020-2030

TABLE 18 CANADA OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (THOUSAND UNITS) 2020-2030

TABLE 19 CANADA OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (USD BILLION) 2020-2030

TABLE 20 CANADA OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (THOUSAND UNITS) 2020-2030

TABLE 21 MEXICO OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (USD BILLION) 2020-2030

TABLE 22 MEXICO OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (THOUSAND UNITS) 2020-2030

TABLE 23 MEXICO OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (USD BILLION) 2020-2030

TABLE 24 MEXICO OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (THOUSAND UNITS) 2020-2030

TABLE 25 SOUTH AMERICA OFFSHORE DRILLING RIGS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 26 SOUTH AMERICA OFFSHORE DRILLING RIGS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 27 SOUTH AMERICA OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (USD BILLION) 2020-2030

TABLE 28 SOUTH AMERICA OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (THOUSAND UNITS) 2020-2030

TABLE 29 SOUTH AMERICA OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (USD BILLION) 2020-2030

TABLE 30 SOUTH AMERICA OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (THOUSAND UNITS) 2020-2030

TABLE 31 BRAZIL OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (USD BILLION) 2020-2030

TABLE 32 BRAZIL OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (THOUSAND UNITS) 2020-2030

TABLE 33 BRAZIL OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (USD BILLION) 2020-2030

TABLE 34 BRAZIL OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (THOUSAND UNITS) 2020-2030

TABLE 35 ARGENTINA OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (USD BILLION) 2020-2030

TABLE 36 ARGENTINA OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (THOUSAND UNITS) 2020-2030

TABLE 37 ARGENTINA OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (USD BILLION) 2020-2030

TABLE 38 ARGENTINA OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (THOUSAND UNITS) 2020-2030

TABLE 39 COLOMBIA OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (USD BILLION) 2020-2030

TABLE 40 COLOMBIA OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (THOUSAND UNITS) 2020-2030

TABLE 41 COLOMBIA OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (USD BILLION) 2020-2030

TABLE 42 COLOMBIA OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (THOUSAND UNITS) 2020-2030

TABLE 43 REST OF SOUTH AMERICA OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (USD BILLION) 2020-2030

TABLE 44 REST OF SOUTH AMERICA OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (THOUSAND UNITS) 2020-2030

TABLE 45 REST OF SOUTH AMERICA OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (USD BILLION) 2020-2030

TABLE 46 REST OF SOUTH AMERICA OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (THOUSAND UNITS) 2020-2030

TABLE 47 ASIA-PACIFIC OFFSHORE DRILLING RIGS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 48 ASIA-PACIFIC OFFSHORE DRILLING RIGS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 49 ASIA-PACIFIC OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (USD BILLION) 2020-2030

TABLE 50 ASIA-PACIFIC OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (THOUSAND UNITS) 2020-2030

TABLE 51 ASIA-PACIFIC OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (USD BILLION) 2020-2030

TABLE 52 ASIA-PACIFIC OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (THOUSAND UNITS) 2020-2030

TABLE 53 INDIA OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (USD BILLION) 2020-2030

TABLE 54 INDIA OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (THOUSAND UNITS) 2020-2030

TABLE 55 INDIA OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (USD BILLION) 2020-2030

TABLE 56 INDIA OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (THOUSAND UNITS) 2020-2030

TABLE 57 CHINA OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (USD BILLION) 2020-2030

TABLE 58 CHINA OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (THOUSAND UNITS) 2020-2030

TABLE 59 CHINA OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (USD BILLION) 2020-2030

TABLE 60 CHINA OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (THOUSAND UNITS) 2020-2030

TABLE 61 JAPAN OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (USD BILLION) 2020-2030

TABLE 62 JAPAN OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (THOUSAND UNITS) 2020-2030

TABLE 63 JAPAN OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (USD BILLION) 2020-2030

TABLE 64 JAPAN OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (THOUSAND UNITS) 2020-2030

TABLE 65 SOUTH KOREA OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (USD BILLION) 2020-2030

TABLE 66 SOUTH KOREA OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (THOUSAND UNITS) 2020-2030

TABLE 67 SOUTH KOREA OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (USD BILLION) 2020-2030

TABLE 68 SOUTH KOREA OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (THOUSAND UNITS) 2020-2030

TABLE 69 AUSTRALIA OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (USD BILLION) 2020-2030

TABLE 70 AUSTRALIA OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (THOUSAND UNITS) 2020-2030

TABLE 71 AUSTRALIA OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (USD BILLION) 2020-2030

TABLE 72 AUSTRALIA OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (THOUSAND UNITS) 2020-2030

TABLE 73 SOUTH-EAST ASIA OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (USD BILLION) 2020-2030

TABLE 74 SOUTH-EAST ASIA OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (THOUSAND UNITS) 2020-2030

TABLE 75 SOUTH-EAST ASIA OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (USD BILLION) 2020-2030

TABLE 76 SOUTH-EAST ASIA OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (THOUSAND UNITS) 2020-2030

TABLE 77 REST OF ASIA PACIFIC OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (USD BILLION) 2020-2030

TABLE 78 REST OF ASIA PACIFIC OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (THOUSAND UNITS) 2020-2030

TABLE 79 REST OF ASIA PACIFIC OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (USD BILLION) 2020-2030

TABLE 80 REST OF ASIA PACIFIC OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (THOUSAND UNITS) 2020-2030

TABLE 81 EUROPE OFFSHORE DRILLING RIGS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 82 EUROPE OFFSHORE DRILLING RIGS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 83 EUROPE OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (USD BILLION) 2020-2030

TABLE 84 EUROPE OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (THOUSAND UNITS) 2020-2030

TABLE 85 EUROPE OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (USD BILLION) 2020-2030

TABLE 86 EUROPE OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (THOUSAND UNITS) 2020-2030

TABLE 87 GERMANY OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (USD BILLION) 2020-2030

TABLE 88 GERMANY OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (THOUSAND UNITS) 2020-2030

TABLE 89 GERMANY OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (USD BILLION) 2020-2030

TABLE 90 GERMANY OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (THOUSAND UNITS) 2020-2030

TABLE 91 UK OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (USD BILLION) 2020-2030

TABLE 92 UK OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (THOUSAND UNITS) 2020-2030

TABLE 93 UK OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (USD BILLION) 2020-2030

TABLE 94 UK OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (THOUSAND UNITS) 2020-2030

TABLE 95 FRANCE OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (USD BILLION) 2020-2030

TABLE 96 FRANCE OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (THOUSAND UNITS) 2020-2030

TABLE 97 FRANCE OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (USD BILLION) 2020-2030

TABLE 98 FRANCE OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (THOUSAND UNITS) 2020-2030

TABLE 99 ITALY OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (USD BILLION) 2020-2030

TABLE 100 ITALY OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (THOUSAND UNITS) 2020-2030

TABLE 101 ITALY OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (USD BILLION) 2020-2030

TABLE 102 ITALY OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (THOUSAND UNITS) 2020-2030

TABLE 103 SPAIN OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (USD BILLION) 2020-2030

TABLE 104 SPAIN OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (THOUSAND UNITS) 2020-2030

TABLE 105 SPAIN OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (USD BILLION) 2020-2030

TABLE 106 SPAIN OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (THOUSAND UNITS) 2020-2030

TABLE 107 RUSSIA OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (USD BILLION) 2020-2030

TABLE 108 RUSSIA OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (THOUSAND UNITS) 2020-2030

TABLE 109 RUSSIA OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (USD BILLION) 2020-2030

TABLE 110 RUSSIA OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (THOUSAND UNITS) 2020-2030

TABLE 111 REST OF EUROPE OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (USD BILLION) 2020-2030

TABLE 112 REST OF EUROPE OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (THOUSAND UNITS) 2020-2030

TABLE 113 REST OF EUROPE OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (USD BILLION) 2020-2030

TABLE 114 REST OF EUROPE OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (THOUSAND UNITS) 2020-2030

TABLE 115 MIDDLE EAST AND AFRICA OFFSHORE DRILLING RIGS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 116 MIDDLE EAST AND AFRICA OFFSHORE DRILLING RIGS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 117 MIDDLE EAST AND AFRICA OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (USD BILLION) 2020-2030

TABLE 118 MIDDLE EAST AND AFRICA OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (THOUSAND UNITS) 2020-2030

TABLE 119 MIDDLE EAST AND AFRICA OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (USD BILLION) 2020-2030

TABLE 120 MIDDLE EAST AND AFRICA OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (THOUSAND UNITS) 2020-2030

TABLE 121 UAE OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (USD BILLION) 2020-2030

TABLE 122 UAE OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (THOUSAND UNITS) 2020-2030

TABLE 123 UAE OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (USD BILLION) 2020-2030

TABLE 124 UAE OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (THOUSAND UNITS) 2020-2030

TABLE 125 SAUDI ARABIA OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (USD BILLION) 2020-2030

TABLE 126 SAUDI ARABIA OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (THOUSAND UNITS) 2020-2030

TABLE 127 SAUDI ARABIA OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (USD BILLION) 2020-2030

TABLE 128 SAUDI ARABIA OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (THOUSAND UNITS) 2020-2030

TABLE 129 SOUTH AFRICA OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (USD BILLION) 2020-2030

TABLE 130 SOUTH AFRICA OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (THOUSAND UNITS) 2020-2030

TABLE 131 SOUTH AFRICA OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (USD BILLION) 2020-2030

TABLE 132 SOUTH AFRICA OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (THOUSAND UNITS) 2020-2030

TABLE 133 REST OF MIDDLE EAST AND AFRICA OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (USD BILLION) 2020-2030

TABLE 134 REST OF MIDDLE EAST AND AFRICA OFFSHORE DRILLING RIGS MARKET BY RIG TYPE (THOUSAND UNITS) 2020-2030

TABLE 135 REST OF MIDDLE EAST AND AFRICA OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (USD BILLION) 2020-2030

TABLE 136 REST OF MIDDLE EAST AND AFRICA OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH (THOUSAND UNITS) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 3 BOTTOM-UP APPROACH

FIGURE 4 RESEARCH FLOW

FIGURE 5 GLOBAL OFFSHORE DRILLING RIGS MARKET BY RIG TYPE, USD BILLION, 2020-2030

FIGURE 6 GLOBAL OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH, USD BILLION, 2020-2030

FIGURE 7 GLOBAL OFFSHORE DRILLING RIGS MARKET BY REGION, USD BILLION, 2020-2030

FIGURE 8 PORTER’S FIVE FORCES MODEL

FIGURE 9 GLOBAL OFFSHORE DRILLING RIGS MARKET BY RIG TYPE, USD BILLION, 2022

FIGURE 10 GLOBAL OFFSHORE DRILLING RIGS MARKET BY WATER DEPTH, USD BILLION, 2022

FIGURE 11 GLOBAL OFFSHORE DRILLING RIGS MARKET BY REGION, USD BILLION, 2022

FIGURE 12 MARKET SHARE ANALYSIS

FIGURE 13 ABAN OFFSHORE LIMITED: COMPANY SNAPSHOT

FIGURE 14 DIAMOND OFFSHORE DRILLING INC.: COMPANY SNAPSHOT

FIGURE 15 ENSCO PLC: COMPANY SNAPSHOT

FIGURE 16 HERCULES OFFSHORE INC.: COMPANY SNAPSHOT

FIGURE 17 KCA DEUTAG: COMPANY SNAPSHOT

FIGURE 18 CHINA OILFIELD SERVICES LIMITED.: COMPANY SNAPSHOT

FIGURE 19 MAERSK DRILLING: COMPANY SNAPSHOT

FIGURE 20 PACIFIC DRILLING: COMPANY SNAPSHOT

FIGURE 21 SEADRILL LIMITED: COMPANY SNAPSHOT

FIGURE 22 VANTAGE DRILLING: COMPANY SNAPSHOT

FIGURE 23 ATWOOD OCEANICS: COMPANY SNAPSHOT

FIGURE 24 NABORS INDUSTRIES LTD: COMPANY SNAPSHOT

FIGURE 25 ROWAN COMPANIES PLC: COMPANY SNAPSHOT

FIGURE 26 SCHLUMBERGER: COMPANY SNAPSHOT

FIGURE 27 TRANSOCEAN LTD.: COMPANY SNAPSHOT

FIGURE 25 HALLIBURTON: COMPANY SNAPSHOT

FIGURE 26 DRESSER-RAND: COMPANY SNAPSHOT

FIGURE 27 WEATHERFORD INTERNATIONAL INC.: COMPANY SNAPSHOT

DOWNLOAD FREE SAMPLE REPORT

License Type

SPEAK WITH OUR ANALYST

Want to know more about the report or any specific requirement?

WANT TO CUSTOMIZE THE REPORT?

Our Clients Speak

We asked them to research ‘ Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te

Yosuke Mitsui

Senior Associate Construction Equipment Sales & Marketing

We asked them to research ‘Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te