Base Year Value ()

CAGR ()

Forecast Year Value ()

Historical Data Period

Largest Region

Forecast Period

스트리밍 유형(라이브, 주문형), 수익 스트림(미디어 권리, 광고, 스폰서십, 티켓 및 상품, 게임 퍼블리셔 수수료, 기타) 및 지역별 e스포츠 시장, 2023년부터 2030년까지의 글로벌 트렌드 및 예측

Instant access to hundreds of data points and trends

- Market estimates from 2014-2029

- Competitive analysis, industry segmentation, financial benchmarks

- Incorporates SWOT, Porter's Five Forces and risk management frameworks

- PDF report or online database with Word, Excel and PowerPoint export options

- 100% money back guarantee

시장 개요

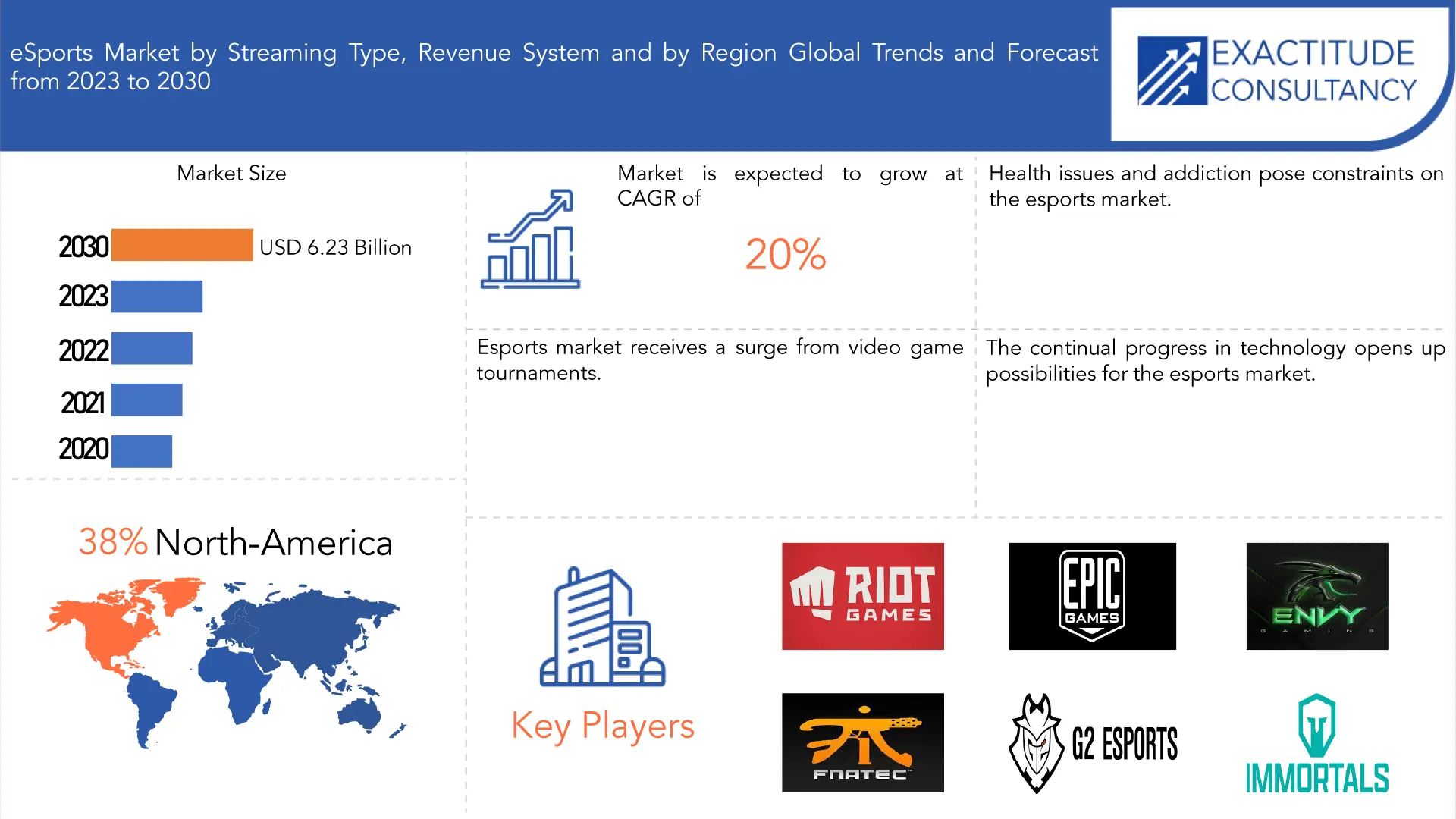

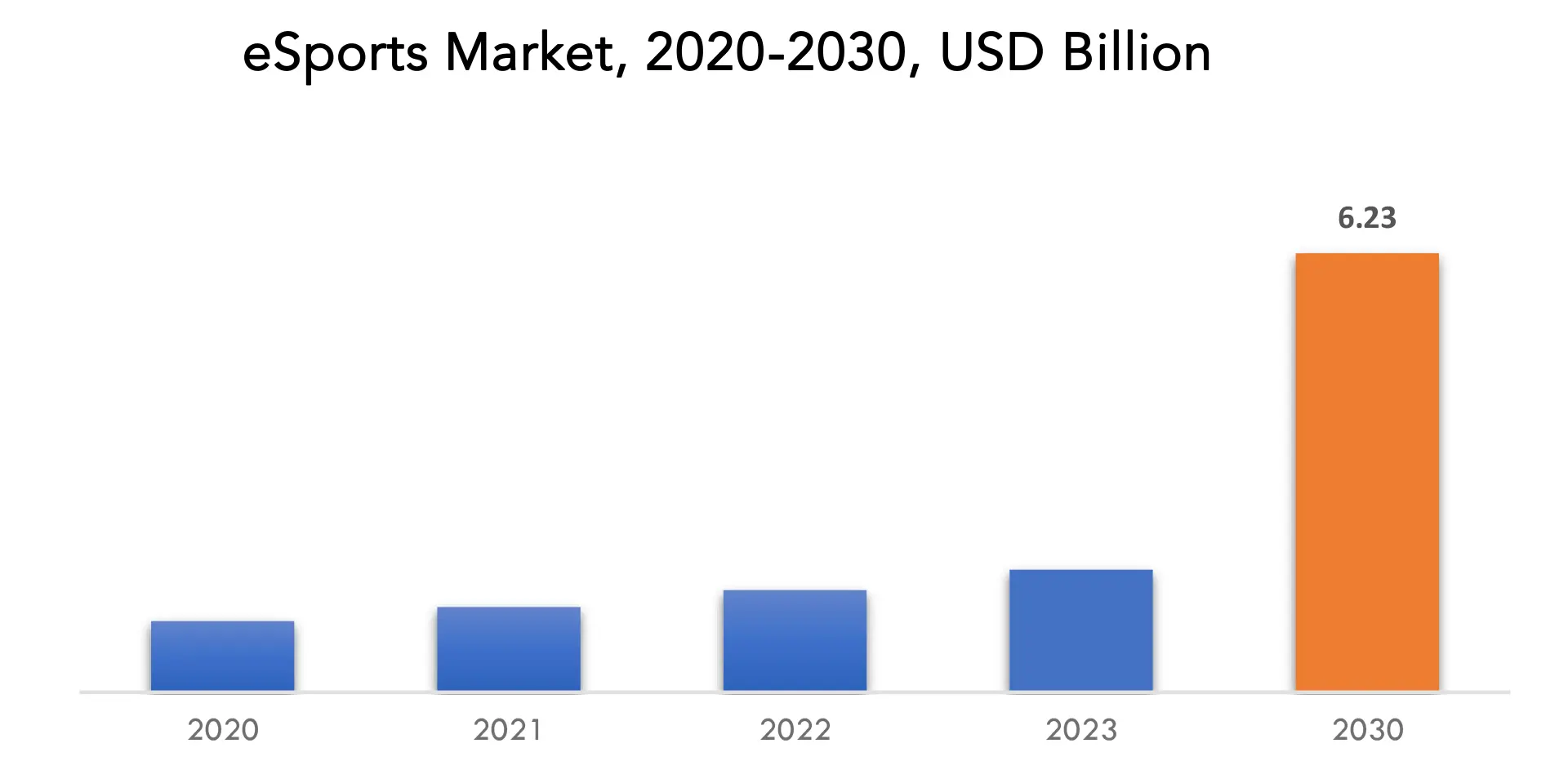

글로벌 e스포츠 시장은 2022년 14억 5천만 달러에서 2030년 62억 3 천만 달러로 성장할 것으로 예상되며, 예측 기간 동안 연평균 성장률은 20%입니다.

비디오 게임은 e스포츠(electronic sports의 줄임말)의 급속한 세계적 성장 덕분에 경쟁이 치열하고 조직적인 산업이 되었습니다. 프로 선수와 팀은 온라인 멀티플레이어 배틀 아레나 게임 , 1인칭 슈팅 게임, 실시간 전략 게임을 포함한 다양한 비디오 게임 장르의 e스포츠에서 경쟁합니다. e스포츠의 인기가 높아지면서 라이브 이벤트와 온라인 스트리밍 서비스에 많은 군중이 몰렸습니다. Dota 2의 The International과 League of Legends World Championship과 같은 주요 e스포츠 대회에서는 큰 상금이 제공되며, 이는 기존 스포츠 대회와 비슷합니다. 숙련된 선수는 이제 스폰서십, 보증 및 미디어 권리 덕분에 e스포츠를 하면서 좋은 수입을 올릴 수 있습니다. 이 산업은 또한 기존 스포츠 팀, 유명인 및 기업 스폰서로부터 투자를 유치했습니다. e스포츠의 글로벌 도달 범위는 좋아하는 팀과 선수를 열렬히 따르는 수백만 명의 팬에게까지 확대되었습니다. Twitch와 YouTube Gaming과 같은 스트리밍 플랫폼은 라이브 경기를 방송하는 데 중요한 역할을 하며, 플레이어와 시청자 간의 커뮤니티 의식과 상호 작용을 촉진합니다. e스포츠 산업은 여전히 발전 중이며, 새로운 게임 타이틀, 인프라, 기술이 지속적인 확장과 글로벌 문화적 영향력을 위한 길을 닦고 있습니다. [캡션 id="attachment_34418" align="aligncenter" width="1920"]

| 기인하다 | 세부 |

| 학습 기간 | 2020-2030 |

| 기준년도 | 2022 |

| 추정 연도 | 2023 |

| 예상 연도 | 2023-2030 |

| 역사적 기간 | 2019-2021 |

| 단위 | 가치(10억 달러) |

| 분할 | 스트리밍 유형별, 수익 스트림별 및 지역별 |

| 스트리밍 유형별 |

|

| 수익 스트림별 |

|

| 지역별로 |

|

Frequently Asked Questions

• What is the market size for the esports market?

The global esports market is anticipated to grow from USD 1.45 Billion in 2022 to USD 6.23 Billion by 2030, at a CAGR of 20% during the forecast period.

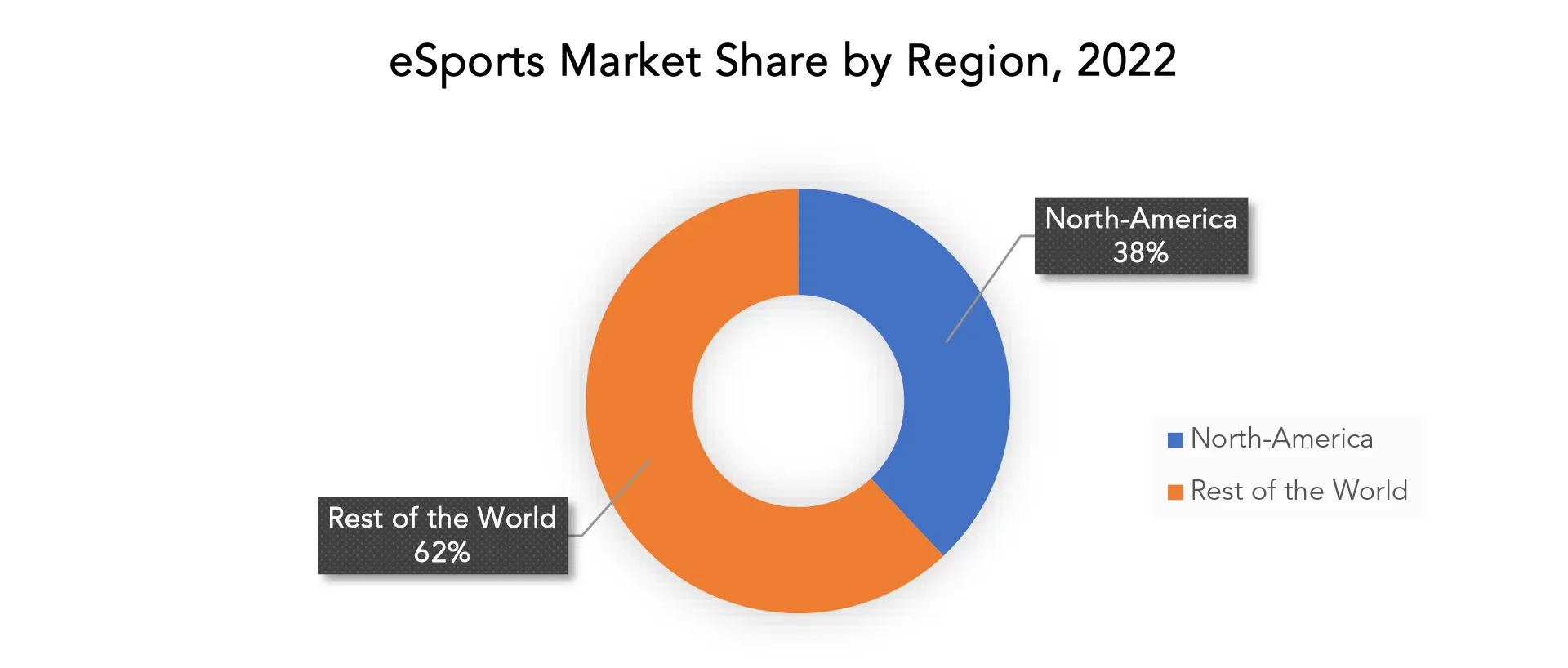

• Which region is domaining in the esports market?

North-America accounted for the largest market in the esports market. North-America accounted for the 38% percent market share of the global market value.

• Who are the major key players in the esports market?

Riot Games, Activision Blizzard, Twitch, Electronic Arts (EA), Tencent, Epic Games, Intel, Team SoloMid, Fnatic, Cloud9, Envy Gaming, G2 Esports, Immortals Gaming Club, Natus Vincere, OG (OG Esports), Astralis Group, HyperX, FACEIT, Electronic Sports League, DreamHack are some of the major key players in the esports market.

• What are the opportunities in the esports market?

The esports market presents immense opportunities driven by a global surge in online gaming. With a growing fan base, sponsorship deals, and media rights, the market offers diverse revenue streams. Brands are capitalizing on the demographic diversity of esports audiences, targeting tech-savvy youth. Furthermore, the rise of mobile gaming and virtual reality opens new avenues for engagement. Esports betting is gaining traction, creating a lucrative industry within the ecosystem. As traditional sports teams invest in esports franchises, the convergence of sports and gaming amplifies market potential. In essence, the esports market is a dynamic landscape ripe for innovation, investment, and strategic partnerships.

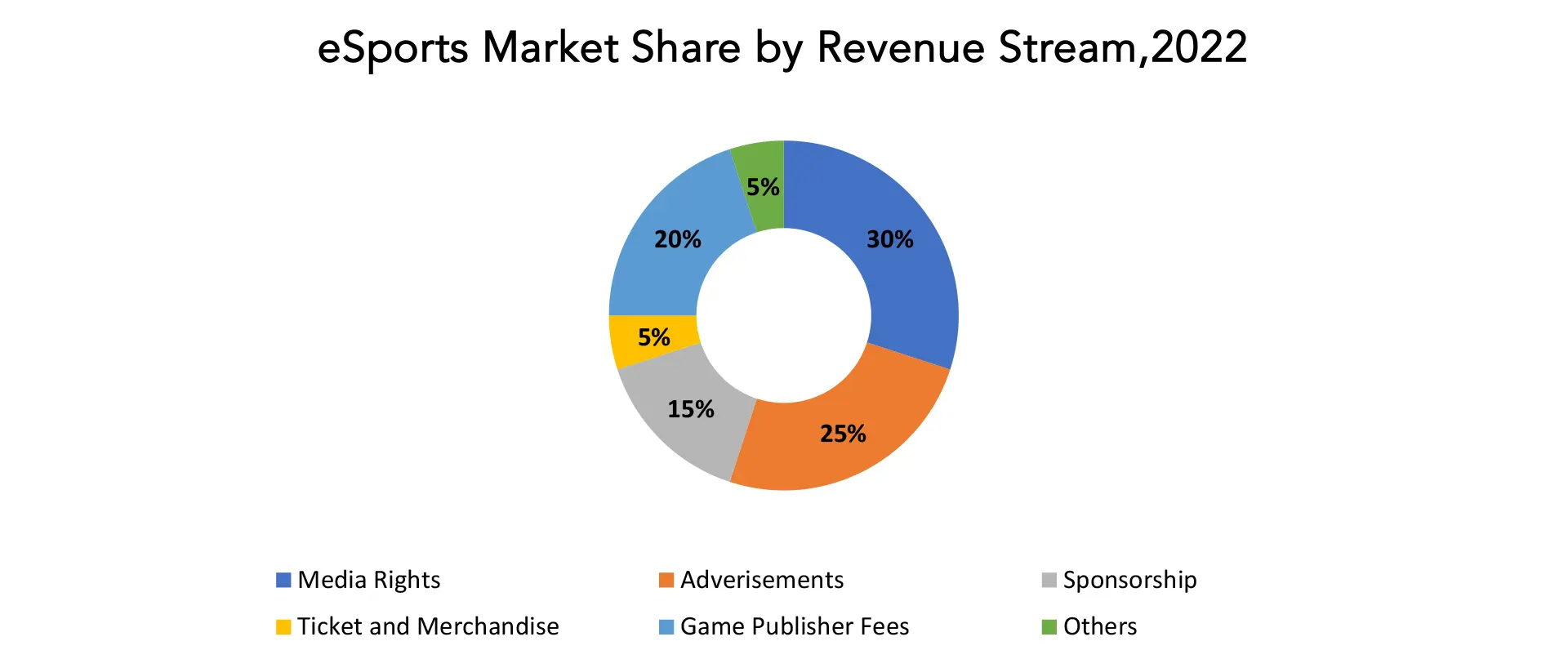

eSports Market Segmentation Analysis

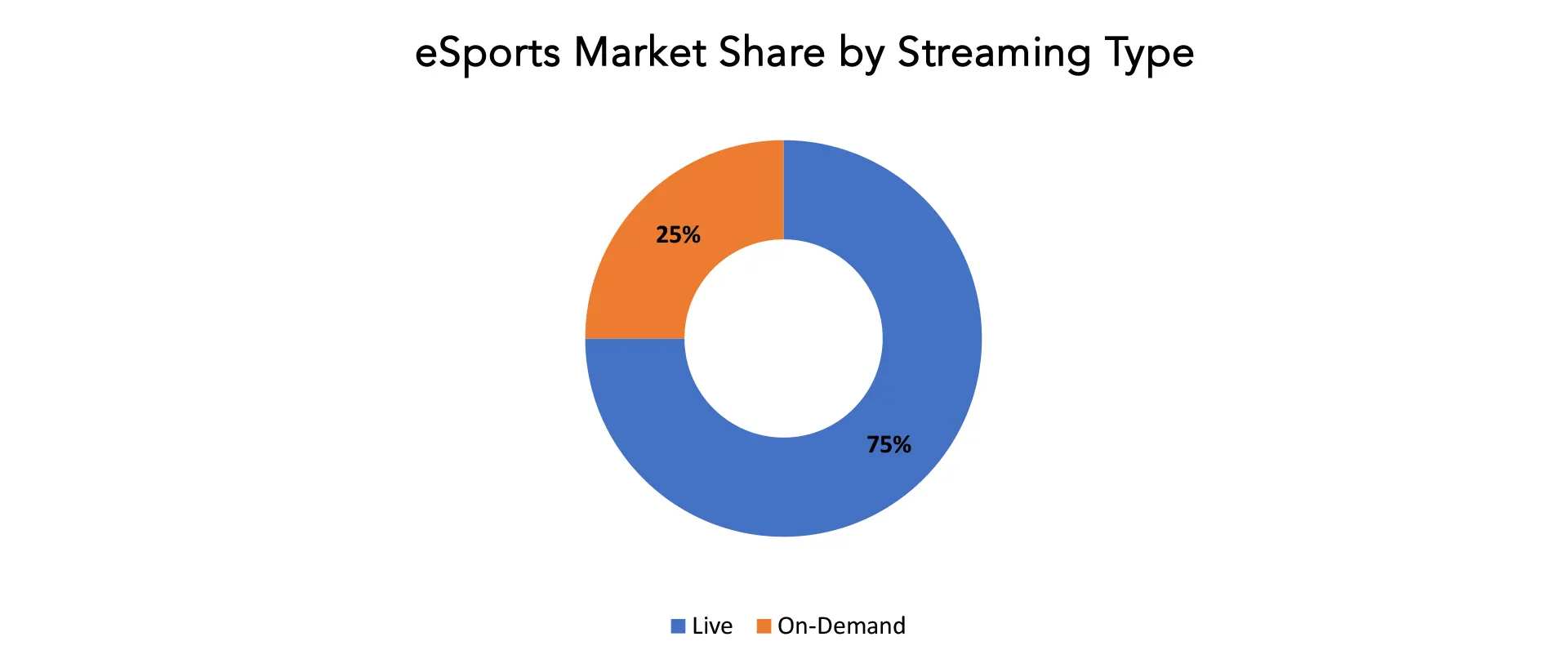

The esports system market is divided into 3 segments. By streaming type the market is bifurcated into live and on-demand. By revenue stream the market is bifurcated into media rights, advertisements, sponsorship, ticket and merchandise, game publisher fees, others. On-demand streaming dominates the streaming type segment which has revolutionized the way we consume content, and the realm of esports is no exception. Electronic sports, or esports, have become incredibly popular worldwide, drawing millions of fans. On-demand streaming services have become essential in providing competitive gaming excitement to viewers whenever and wherever they choose, as the demand for esports content continues to soar. [caption id="attachment_34420" align="aligncenter" width="1920"]

eSports Market Trends

- Esports has attracted substantial investments from traditional sports teams, celebrities, and major corporations. Sponsorship deals have become more prevalent, with companies recognizing the potential of reaching the esports audience.

- Esports has become a global phenomenon, with a growing audience not only in traditional gaming strongholds like Asia but also in North America, Europe, and other regions. International competitions and leagues have gained popularity, contributing to the globalization of esports.

- Major broadcasters and streaming platforms have entered the esports arena, securing broadcasting rights for popular tournaments and leagues. This has led to increased visibility and accessibility of esports content to a broader audience.

- Similar to traditional sports, esports has seen the rise of franchised leagues where teams represent specific cities or regions. This model aims to create a more stable and sustainable ecosystem for both players and investors.

- The popularity of mobile esports has grown significantly, with games like PUBG Mobile, Free Fire, and Mobile Legends becoming major players in the competitive gaming scene. Mobile esports have a massive user base, making them attractive for sponsors and advertisers.

- Traditional non-endemic brands outside the gaming industry have shown increased interest in sponsoring esports events and teams. This includes partnerships with companies from sectors such as automotive, food and beverage, and fashion.

- The popularity of specific game titles can significantly impact the esports landscape. New game releases or updates to existing titles can lead to shifts in player preferences and viewership patterns.

- The production quality of esports events is always rising, and to improve the spectator experience, cutting-edge technologies like augmented reality and virtual reality are being used.

- The value of inclusion and diversity in esports is becoming increasingly recognized. Initiatives to promote greater inclusivity in the industry are in the works, as are efforts to address issues pertaining to gender diversity.

- Educational institutions are increasingly recognizing esports as a legitimate field of study. Grassroots initiatives, including local tournaments and community-building efforts, play a crucial role in nurturing talent and growing the esports ecosystem.

Competitive Landscape

The competitive landscape of the esports market is diverse and includes various players, from multinational corporations to artisanal and specialty brands.- Riot Games

- Activision Blizzard

- Twitch

- Electronic Arts (EA)

- Tencent

- Epic Games

- Intel

- Team SoloMid

- Fnatic

- Cloud9

- Envy Gaming

- G2 Esports

- Immortals Gaming Club

- Natus Vincere

- OG (OG Esports)

- Astralis Group

- HyperX

- FACEIT

- Electronic Sports League

- DreamHack

- On 26th October 2022, Nike, an International sport apparel company, released its first commercial on an esport platform.

- On 2nd April 2021, Gameloft partnered with ESL Gaming, a German electronic sports production and organizer company.

- In July 2022, Twitch announced for the largest market share in 2022. The region has significant number of online gamers that is expected to drive the market growth.

Regional Analysis

Esports, or electronic sports, has emerged as a cultural phenomenon, captivating millions of enthusiasts around the world. In North America, the esports industry has experienced unprecedented growth, transforming competitive gaming into a mainstream entertainment spectacle. This rapid ascent can be attributed to various factors, including technological advancements, a burgeoning fan base, and strategic investments from both traditional sports organizations and corporate entities. [caption id="attachment_34425" align="aligncenter" width="1920"]

Target Audience for eSports Market

- Age Range

- Tech-Savvy Individuals

- Gamer Community

- Spectators and Fans

- Global Audience

- Male and Female Participants

- Urban and Online Presence

- Social Media Users

- Crossover with Traditional Sports Fans

- Advertisers and Sponsors

Import & Export Data for esports Market

Exactitude consultancy provides import and export data for the recent years. It also offers insights on production and consumption volume of the product. Understanding the import and export data is pivotal for any player in the esports market. This knowledge equips businesses with strategic advantages, such as:- Identifying emerging markets with untapped potential.

- Adapting supply chain strategies to optimize cost-efficiency and market responsiveness.

- Navigating competition by assessing major players' trade dynamics.

- Trade volume trends: our report dissects import and export data spanning the last five years to reveal crucial trends and growth patterns within the global esports market. This data-driven exploration empowers readers with a deep understanding of the market's trajectory.

- Market players: gain insights into the leading players driving the Surgical Drill trade. From established giants to emerging contenders, our analysis highlights the key contributors to the import and export landscape.

- Geographical dynamics: delve into the geographical distribution of trade activities. Uncover which regions dominate exports and which ones hold the reins on imports, painting a comprehensive picture of the industry's global footprint.

- Product breakdown: by segmenting data based on Surgical Drill types –– we provide a granular view of trade preferences and shifts, enabling businesses to align strategies with the evolving technological landscape.

Segments Covered in the eSports Market Report

eSports Market by Streaming Type, 2020-2030, USD Billion- Live

- On-Demand

- Media Rights

- Advertisements

- Sponsorships

- Ticket and Merchandise

- Game Publisher Fees

- Others

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the esports market over the next 7 years?

- Who are the major players in the esports market and what is their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the middle east, and Africa?

- How is the economic environment affecting the esports market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the esports system market?

- What is the current and forecasted size and growth rate of the esports market?

- What are the key drivers of growth in the esports market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the esports market?

- What are the technological advancements and innovations in the esports market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the esports market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the esports market?

- What are the products and specifications of leading players in the market?

- 소개

- 시장 정의

- 시장 세분화

- 연구 일정

- 가정 및 제한

- 연구 방법론

- 데이터 마이닝

- 2차 연구

- 1차 연구

- 주제별 전문가의 조언

- 품질 검사

- 최종 검토

- 데이터 삼각 측량

- 바텀업 방식

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- 데이터 마이닝

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- ESPORTS MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON ESPORTS MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- ESPORTS MARKET OUTLOOK

- GLOBAL ESPORTS MARKET BY STREAMING TYPE, 2020-2030, (USD BILLION)

- LIVE

- ON-DEMAND

- GLOBAL ESPORTS MARKET BY REVENUE STREAM, 2020-2030, (USD BILLION)

- MEDIA RIGHTS

- ADVERTISEMENTS

- SPONSORSHIP

- TICKET AND MERCHANDISE

- GAME PUBLISHER FEES

- OTHERS

- GLOBAL ESPORTS MARKET BY REGION, 2020-2030, (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, STREAMING TYPES OFFERED, RECENT DEVELOPMENTS)

- RIOT GAMES

- ACTIVISION BLIZZARD

- TWITCH

- ELECTRONIC ARTS (EA)

- TENCENT

- EPIC GAMES

- INTEL

- TEAM SOLOMID

- FNATIC

- CLOUD9

- ENVY GAMING

- G2 ESPORTS

- IMMORTALS GAMING CLUB

- NATUS VINCERE

- OG (OG ESPORTS)

- ASTRALIS GROUP

- HYPERX

- FACEIT

- ELECTRONIC SPORTS LEAGUE

- DREAMHACK

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 2 GLOBAL ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 3 GLOBAL ESPORTS MARKET BY REGION (USD BILLION) 2020-2030

TABLE 4 NORTH AMERICA ESPORTS MARKET BY COUNTRY (USD BILLION)

2020-2030

TABLE 5 NORTH AMERICA ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 6 NORTH AMERICA ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 7 US ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 8 US ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 9 CANADA ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 10 CANADA ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 11 MEXICO ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 12 MEXICO ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 13 SOUTH AMERICA ESPORTS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 14 SOUTH AMERICA ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 15 SOUTH AMERICA ESPORTSMARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 16 BRAZIL ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 17 BRAZIL ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 18 ARGENTINA ESPORTSMARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 19 ARGENTINA ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 20 COLOMBIA ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 21 COLOMBIA ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 22 REST OF SOUTH AMERICA ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 23 REST OF SOUTH AMERICA ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 24 ASIA-PACIFIC ESPORTS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 25 ASIA-PACIFIC ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 26 ASIA-PACIFIC ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 27 INDIA ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 28 INDIA ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 29 CHINA ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 30 CHINA ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 31 JAPAN ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 32 JAPAN ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 33 SOUTH KOREA ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 34 SOUTH KOREA ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 35 AUSTRALIA ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 36 AUSTRALIA ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 37 SOUTH-EAST ASIA ESPORTSMARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 38 SOUTH-EAST ASIA ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 39 REST OF ASIA PACIFIC ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 40 REST OF ASIA PACIFIC ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 41 EUROPE ESPORTS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 42 EUROPE ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 43 EUROPE ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 44 GERMANY ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 45 GERMANY ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 46 UK ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 47 UK ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 48 FRANCE ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 49 FRANCE ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 50 ITALY ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 51 ITALY ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 52 SPAIN ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 53 SPAIN ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 54 RUSSIA ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 55 RUSSIA ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 56 REST OF EUROPE ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 57 REST OF EUROPE ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 58 MIDDLE EAST AND AFRICA ESPORTS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 59 MIDDLE EAST AND AFRICA ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 60 MIDDLE EAST AND AFRICA ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 61 UAE ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 62 UAE ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 63 SAUDI ARABIA ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 64 SAUDI ARABIA ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 65 SOUTH AFRICA ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 66 SOUTH AFRICA ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 67 REST OF MIDDLE EAST AND AFRICA ESPORTSMARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 68 REST OF MIDDLE EAST AND AFRICA ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL ESPORTS MARKET BY REVENUE STREAM USD BILLION, 2020-2030

FIGURE 9 GLOBAL ESPORTS MARKET BY STREAMING TYPE, USD BILLION, 2020-2030

FIGURE 10 GLOBAL ESPORTS MARKET BY REGION, USD BILLION, 2020-2030

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL ESPORTS MARKET BY REVENUE STREAM, USD BILLION 2022

FIGURE 13 GLOBAL ESPORTS MARKET BY STREAMING TYPE, USD BILLION 2022

FIGURE 14 GLOBAL ESPORTS MARKET BY REGION, USD BILLION 2022

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 RIOT GAMES: COMPANY SNAPSHOT

FIGURE 17 ACTIVISION BLIZZARD: COMPANY SNAPSHOT

FIGURE 18 TWITCH: COMPANY SNAPSHOT

FIGURE 19 ELECTRONIC ARTS (EA): COMPANY SNAPSHOT

FIGURE 20 TENCENT: COMPANY SNAPSHOT

FIGURE 21 EPIC GAMES: COMPANY SNAPSHOT

FIGURE 22 INTEL: COMPANY SNAPSHOT

FIGURE 23 TEAM SOLOMID: COMPANY SNAPSHOT

FIGURE 24 FNATIC: COMPANY SNAPSHOT

FIGURE 25 CLOUD9: COMPANY SNAPSHOT

FIGURE 26 ENVY GAMING: COMPANY SNAPSHOT

FIGURE 27 G2 ESPORTS: COMPANY SNAPSHOT

FIGURE 28 IMMORTALS GAMING CLUB: COMPANY SNAPSHOT

FIGURE 29 NATUS VINCERE: COMPANY SNAPSHOT

FIGURE 30 OG (OG ESPORTS): COMPANY SNAPSHOT

FIGURE 31 ASTRALIS GROUP: COMPANY SNAPSHOT

FIGURE 32 HYPERX: COMPANY SNAPSHOT

FIGURE 33 FACEIT: COMPANY SNAPSHOT

FIGURE 34 ELECTRONIC SPORTS LEAGUE: COMPANY SNAPSHOT

FIGURE 35 DREAMHACK: COMPANY SNAPSHOT

DOWNLOAD FREE SAMPLE REPORT

License Type

SPEAK WITH OUR ANALYST

Want to know more about the report or any specific requirement?

WANT TO CUSTOMIZE THE REPORT?

Our Clients Speak

We asked them to research ‘ Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te

Yosuke Mitsui

Senior Associate Construction Equipment Sales & Marketing

We asked them to research ‘Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te