Base Year Value ()

CAGR ()

Forecast Year Value ()

Historical Data Period

Largest Region

Forecast Period

저장 용량별 NFC 칩 시장(최대 64바이트, 65~168바이트, 169~180바이트, 181~540바이트, 540바이트 이상) 응용 분야(스마트폰, 랩탑 및 노트북, 스마트 카드, 텔레비전, POS 시스템, 의료 기기, 차량, 기타(스마트 웨어러블, 프린터 등)) 최종 사용 산업(자동차 및 운송, 가전 제품, 소매, BFSI, 의료, 건물 및 인프라, 기타(산업, 미디어 및 엔터테인먼트 등) 및 지역, 2024~2030년까지의 글로벌 추세 및 예측

Instant access to hundreds of data points and trends

- Market estimates from 2014-2029

- Competitive analysis, industry segmentation, financial benchmarks

- Incorporates SWOT, Porter's Five Forces and risk management frameworks

- PDF report or online database with Word, Excel and PowerPoint export options

- 100% money back guarantee

NFC 칩 시장 개요

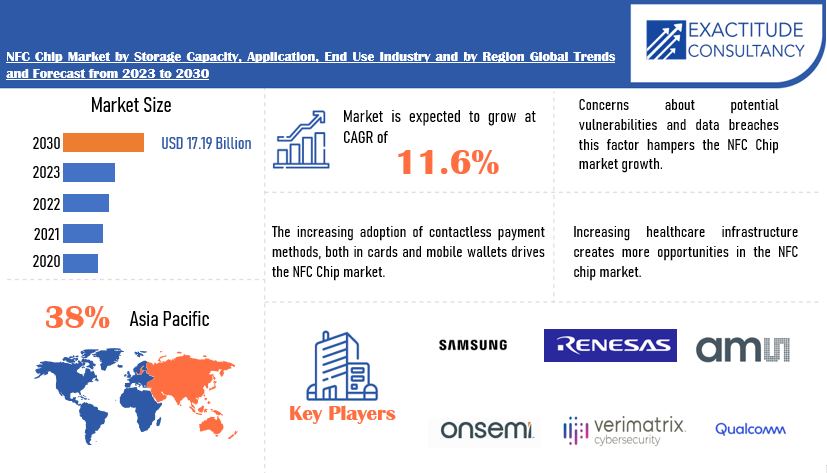

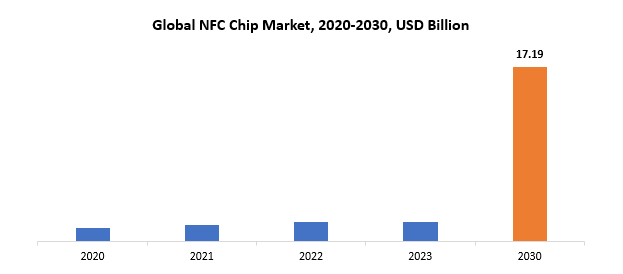

글로벌 NFC 칩 시장은 2023년 19억 1,000만 달러에서 2030년 171억 9,000만 달러로 성장할 것으로 예상되며, 예측 기간 동안 연평균 성장률은 11.6%입니다.

NFC는 Near Field Communication의 약자로, 기기가 일반적으로 몇 센티미터 또는 몇 인치 범위 내에서 서로 가까이 있을 때 데이터를 교환할 수 있는 무선 통신 기술입니다. NFC 기술은 종종 비접촉 결제, 데이터 전송 및 기기 페어링을 포함한 다양한 애플리케이션에 사용됩니다. NFC 기술은 빠르고 편리한 데이터 교환 및 거래를 가능하게 합니다. 결제, 기기 간 데이터 전송, 간단한 탭이나 흔들기로 정보에 액세스하는 등의 작업을 간소화하여 물리적 접촉이나 수동 데이터 입력이 필요 없습니다. NFC에는 암호화 및 인증과 같은 보안 기능이 포함되어 있어 안전한 거래에 적합합니다. 통신 범위가 짧아 권한이 없는 사람이 데이터를 가로채기 어렵기 때문에 보안 계층이 추가됩니다. NFC는 국제 표준을 기반으로 하여 다양한 기기 및 시스템 간의 호환성을 보장합니다. 이 표준화를 통해 다양한 NFC 지원 기기가 원활하게 함께 작동할 수 있어 보편적인 기술이 되었습니다.

많은 대중교통 시스템에서 NFC 기반 비접촉식 티켓팅을 사용하여 승객이 NFC 지원 카드나 스마트폰을 탭하기만 하면 기차, 버스 또는 지하철에 탑승할 수 있습니다. 이를 통해 실제 티켓과 현금의 필요성이 줄어듭니다. NFC는 포스터, 광고 및 제품 포장에 내장되어 소비자가 기기를 탭하여 콘텐츠와 상호 작용하거나 추가 정보를 받을 수 있습니다. 이는 마케팅 및 고객 참여에 적용됩니다. NFC 기술은 의료 분야에서 환자 식별, 약물 추적 및 의료 기록을 안전하게 관리하는 데 사용됩니다. NFC는 실제 카드, 티켓 및 인쇄물의 사용을 줄여 폐기물을 줄여 환경적 이점을 얻을 수 있습니다. NFC는 2단계 인증에 사용하거나 암호화 키 또는 생체 인식 데이터와 같은 민감한 정보를 저장하는 보안 요소로 사용할 수 있습니다.

[캡션 id="attachment_35412" 정렬="정렬센터" 너비="999"]

NFC technology is now commonly integrated into smartphones and other mobile devices. This integration has expanded the use of NFC beyond contactless payments to include various applications like mobile ticketing, access control, and data transfer. NFC technology is widely used for access control systems in buildings, hotels, and public transportation. Its security features make it suitable for applications where authentication and authorization are essential. Retailers and marketers have adopted NFC for interactive marketing campaigns, product authentication, and customer engagement. NFC tags and stickers can provide consumers with additional product information and promotions. The healthcare industry has started using NFC for patient identification, tracking medical devices, and ensuring the authenticity of pharmaceutical products.

NFC transactions are straightforward and convenient. Users can simply tap their NFC-enabled device to a compatible terminal or object to initiate actions, making it user-friendly and quick. NFC technology is well-defined and standardized, which encourages interoperability and simplifies the development of compatible devices and applications. NFC offers built-in security features, such as encryption and limited communication range, making it a secure option for various applications, especially in financial transactions. NFC technology is increasingly adopted globally, with various countries and regions embracing it for different use cases, further driving market growth. NFC technology is integrated into wearable devices like smartwatches and fitness trackers, expanding its applications for health monitoring, access control, and mobile payments. NFC technology supports paperless and contactless transactions, reducing the need for physical tickets, cards, and receipts, which aligns with environmental sustainability goals.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) (Thousand Units) |

| Segmentation | By Storage Capacity, Application, End Use Industry and By Region |

| By Storage Capacity |

|

| By Application |

|

| By End Use Industry |

|

| By Region |

|

Frequently Asked Questions

• What is the market size for the NFC Chips market?

The global NFC Chip market is anticipated to grow from USD 1.91 Billion in 2023 to USD 17.19 Billion by 2030, at a CAGR of 11.6% during the forecast period.

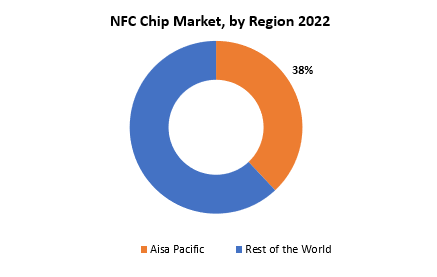

• Which region is domaining in the NFC Chips market?

Asia pacific accounted for the largest market in the NFC Chip market. Asia pacific accounted for the 38 percent market share of the global market value.

• Who are the major key players in the NFC Chips market?

NXP Semiconductors, Broadcom Inc., Texas Instruments Inc., Infineon Technologies AG, Sony Corporation, STMicroelectronics, Qualcomm Incorporated, AMS AG (formerly known as Austria microsystems), Renesas Electronics Corporation, Inside

• What is the latest trend in the NFC Chips market?

The adoption of contactless payments and digital wallets continued to rise, driven by factors like the COVID-19 pandemic and the convenience of touchless transactions. NFC technology plays a pivotal role in facilitating secure and quick contactless payments through mobile devices and contactless cards. NFC technology was increasingly being incorporated into IoT devices and applications. IoT developers leveraged NFC for device pairing, data exchange, and secure connectivity in various industries, including smart homes, healthcare, and logistics.

NFC Chips Market Segmentation Analysis

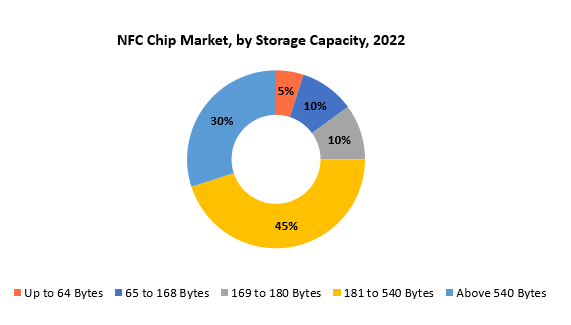

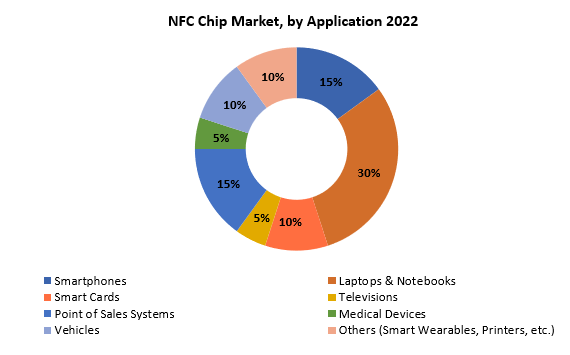

The global NFC Chip market is divided into 4 segments storage capacity, Application, End-use Industry and region. by storage capacity the market is bifurcated into Up to 64 Bytes, 65 to 168 Bytes, 169 to 180 Bytes, 181 to 540 Bytes, above 540 Bytes. By application the market is bifurcated into Smartphones, Laptops & Notebooks, Smart Cards, Televisions, Point of Sales Systems., Medical Devices, Vehicles, Others (Smart Wearables, Printers, etc.). By end use industry the market is bifurcated into Automotive & Transportation, Consumer Electronics, Retail, BFSI, Healthcare, Building & Infrastructure, Others (Industrial, Media & Entertainment, etc.).

[caption id="attachment_35444" align="aligncenter" width="720"]

Based on 181 to 540 Bytes segment dominating in the NFC Chip market. NFC chips with a memory size between 181 and 540 bytes strike a balance between storage capacity and cost-effectiveness. This range is often sufficient for storing essential data like contactless payment information, access credentials, and small data payloads for various applications. In the context of contactless payment cards and mobile payment solutions (e.g., Apple Pay, Google Pay), NFC chips within this memory range can store the necessary payment information securely. These chips can accommodate the required data for transactions without being overly expensive.

NFC chips are widely used in access control systems for secure entry into buildings, rooms, or events. The memory size within this range is typically adequate for storing access credentials and user identification data. Smart cards, including transportation cards, loyalty cards, and ID cards, often utilize NFC technology. The memory range you mentioned is suitable for storing user information and transaction data on these cards. In logistics and inventory management applications, NFC chips within this range can store unique identifiers, product information, and tracking data for individual items, making them valuable for supply chain and asset tracking solutions. NFC tags and stickers embedded in marketing materials or products often contain small amounts of data, such as URLs, promotional content, or product details. NFC chips in this memory range are sufficient for such purposes. NFC chip manufacturers may produce chips within this memory size range at a cost-effective scale due to high demand for these versatile and widely used chips. This can make them more accessible to a broader range of applications and industries. Some applications may not require larger memory sizes, and the adoption of NFC technology with smaller memory sizes may align with existing infrastructure or legacy systems.

[caption id="attachment_35442" align="aligncenter" width="720"]

Based on laptop & notebook segment dominating in the NFC Chip market. Mobile payment systems like Apple Pay, Google Pay, and Samsung Pay have made extensive use of NFC technology. The use of NFC chips in mobile devices has been accelerated by these systems, which enable consumers to make contactless payments using their cellphones. Smartphones are ubiquitous and have become an integral part of modern life. The large user base of smartphones has contributed to the widespread acceptance of NFC technology. NFC-enabled smartphones have effectively replaced physical wallets for many people. Users can store credit and debit card information, loyalty cards, transit passes, and more on their smartphones. By tapping their cellphones on NFC scanners, passengers can board buses, trains, and subways due to the widespread use of NFC in transportation networks. These are some factors that drives the segment growth for NFC chip market.

[caption id="attachment_35493" align="aligncenter" width="720"]

NFC Chips Market Trends

-

The adoption of NFC technology for contactless payments through mobile wallets like Apple Pay, Google Pay, and Samsung Pay continued to grow. NFC-enabled smartphones and wearable devices played a significant role in driving this trend.

-

NFC technology found increasing use in the Internet of Things (IoT). It was used for device pairing, configuration, and data transfer in various IoT applications, including smart home devices, wearables, and asset tracking.

-

NFC was gaining traction in the healthcare sector for patient identification, medication management, and secure access control to medical records and facilities.

-

NFC was being used in retail for interactive marketing campaigns, product authentication, and inventory management. NFC tags and stickers enabled consumers to access additional product information and promotions.

-

NFC continued to be a preferred technology for access control systems in buildings, hotels, and public transportation due to its security features.

-

NFC contributed to reducing the need for physical tickets, cards, and receipts by enabling paperless and contactless transactions, aligning with sustainability goals.

-

NFC technology was well-defined and standardized, ensuring interoperability and simplifying the development of compatible devices and applications.

Competitive Landscape

The competitive landscape of the NFC (Near Field Communication) chip market is dynamic and includes a mix of established players, semiconductor companies, and technology providers

- NXP Semiconductors

- Broadcom Inc.

- Texas Instruments Inc.

- Infineon Technologies AG

- Sony Corporation

- STMicroelectronics

- Qualcomm Incorporated

- AMS AG (formerly known as Austria micro systems)

- Renesas Electronics Corporation

- Inside Secure

- Samsung Electronics Co., Ltd.

- ON Semiconductor

- Gemalto (now part of Thales Group)

- EM Microelectronic (a subsidiary of Swatch Group)

- Identiv, Inc.

- Microchip Technology Inc.

- Impinj, Inc.

- Murata Manufacturing Co., Ltd.

- Silicon Labs

- Marvell Technology Group Ltd.

Recent Developments:

31 February 2022 - The NTAG 22x DNA family of NFC tags, introduced by NXP Semiconductors, has tamper-detection and condition-monitoring functions on a single chip. These NFC tags are made to be used with consumer goods, medical devices, and smart home accessories.

2 November 2021 - STMicroelectronics has just released an affordable NFC Type 2 Tag IC with improved NDEF and privacy capabilities. The solution delivers a new mix of cost and capability for high-volume utilization applications including customer engagement, product information, and brand protection.

Regional Analysis

Asia pacific accounted for the largest market in the NFC Chip market. Asia pacific accounted for the 38 percent market share of the global market value. Some governments in the region have actively promoted cashless and digital payment methods to enhance financial inclusion and reduce reliance on physical cash. These initiatives have contributed to the growth of NFC-based payments. Many Asian countries have modernized their retail and public transportation infrastructure to accept contactless payments, encouraging consumers to use NFC-enabled devices for convenience. Asia-Pacific has experienced a significant e-commerce boom, and NFC technology is often used for secure online payments through mobile apps and websites. The region has seen substantial growth in the Internet of Things (IoT) market, with applications in smart cities, connected devices, and industrial automation. NFC is used in various IoT applications, contributing to its demand.

[caption id="attachment_35462" align="aligncenter" width="437"]

Increasing awareness of the benefits of NFC technology for convenience and security has driven its adoption among consumers and businesses in the Asia-Pacific region. Asia-Pacific countries have made significant investments in technology infrastructure, including 5G networks and IoT deployments, creating an environment conducive to NFC technology growth. Technology companies, financial institutions, and retailers in the Asia-Pacific region have formed partnerships and collaborations to promote NFC-based payment solutions and other NFC applications.

Target Audience for NFC Chips Market

- Semiconductor Manufacturers

- NFC Device Manufacturers

- NFC Reader and Writer Hardware Providers

- Consumers and Individuals

- Businesses and Organizations

- Financial Institutions

- Payment Service Providers (PSPs)

- Retailers

- E-commerce Platforms

- Healthcare Providers

- Pharmaceutical Companies

- Transportation and Transit Authorities

- Airlines and Travel Companies

- Smart City Initiatives

- Government Agencies

- Manufacturers

- Supply Chain Companies

- Marketing and Advertising Agencies

- IoT Developers

- IoT Solution Providers

- Security and Authentication Providers

- Educational Institutions

- Event Organizers and Venue Managers

- Government Regulatory Bodies

- Standards Organizations

- Investors and Stakeholders

- Consulting and Advisory Services

Import & Export Data for NFC Chips Market

Exactitude consultancy provides import and export data for the recent years. It also offers insights on production and consumption volume of the product. Understanding the import and export data is pivotal for any player in the NFC Chips market. This knowledge equips businesses with strategic advantages, such as:

-

Identifying emerging markets with untapped potential.

-

Adapting supply chain strategies to optimize cost-efficiency and market responsiveness.

-

Navigating competition by assessing major players' trade dynamics.

Key insights

-

Trade volume trends: our report dissects import and export data spanning the last five years to reveal crucial trends and growth patterns within the global Area Scan Camera Market. This data-driven exploration empowers readers with a deep understanding of the market's trajectory.

-

Market players: gain insights into the leading players driving the Surgical Drill trade. From established giants to emerging contenders, our analysis highlights the key contributors to the import and export landscape.

-

Geographical dynamics: delve into the geographical distribution of trade activities. Uncover which regions dominate exports and which ones hold the reins on imports, painting a comprehensive picture of the industry's global footprint.

-

Product breakdown: by segmenting data based on Surgical Drill types –– we provide a granular view of trade preferences and shifts, enabling businesses to align strategies with the evolving technological landscape.

Import and export data is crucial in reports as it offers insights into global market trends, identifies emerging opportunities, and informs supply chain management. By analyzing trade flows, businesses can make informed decisions, manage risks, and tailor strategies to changing demand. This data aids governments in policy formulation and trade negotiations, while investors use it to assess market potential. Moreover, import and export data contributes to economic indicators, influences product innovation, and promotes transparency in international trade, making it an essential Storage Capacity for comprehensive and informed analyses.

Segments Covered in the NFC Chips Market Report

NFC Chips Market by Storage Capacity, 2020-2030, (USD Billion), (Thousand Units)

- Up to 64 Bytes

- 65 to 168 Bytes

- 169 to 180 Bytes

- 181 to 540 Bytes

- Above 540 Bytes

NFC Chips Market by Application, 2020-2030, (USD Billion), (Thousand Units)

- Smartphones

- Laptops & Notebooks

- Smart Cards

- Televisions

- Point of Sales Systems

- Medical Devices

- Vehicles

- Others (Smart Wearables, Printers, etc.)

NFC Chips Market by End Use Industry, 2020-2030, (USD Billion), (Thousand Units)

- Automotive & Transportation

- Consumer Electronics

- Retail

- BFSI

- Healthcare

- Building & Infrastructure

- Others (Industrial, Media & Entertainment, etc.)

NFC Chips Market by Region, 2020-2030, (USD Billion), (Thousand Units)

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

-

What is the expected growth rate of the NFC Chips market over the next 7 years?

-

Who are the major players in the NFC Chips market and what is their market share?

-

What are the end-user industries driving market demand and what is their outlook?

-

What are the opportunities for growth in emerging markets such as Asia-pacific, the middle east, and Africa?

-

How is the economic environment affecting the NFC Chips market, including factors such as interest rates, inflation, and exchange rates?

-

What is the expected impact of government policies and regulations on the NFC Chips market?

- What is the current and forecasted size and growth rate of the NFC Chips market?

-

What are the key drivers of growth in the NFC Chips market?

-

Who are the major players in the market and what is their market share?

-

What are the distribution channels and supply chain dynamics in the NFC Chips market?

-

What are the technological advancements and innovations in the NFC Chips market and their impact on product development and growth?

-

What are the regulatory considerations and their impact on the market?

-

What are the challenges faced by players in the NFC Chips market and how are they addressing these challenges?

-

What are the opportunities for growth and expansion in the NFC Chips market?

-

What are the product products and specifications of leading players in the market?

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- NFC CHIP MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON NFC CHIP MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- NFC CHIP MARKET OUTLOOK

- GLOBAL NFC CHIP MARKET BY STORAGE CAPACITY, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- UP TO 64 BYTES

- 65 TO 168 BYTES

- 169 TO 180 BYTES

- 181 TO 540 BYTES

- ABOVE 540 BYTES

- GLOBAL NFC CHIP MARKET BY APPLICATION, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- SMARTPHONES

- LAPTOPS & NOTEBOOKS

- SMART CARDS

- TELEVISIONS

- POINT OF SALES SYSTEMS

- MEDICAL DEVICES

- VEHICLES

- OTHERS (SMART WEARABLES, PRINTERS, ETC.)

- GLOBAL NFC CHIP MARKET BY END USE INDUSTRY, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- AUTOMOTIVE & TRANSPORTATION

- CONSUMER ELECTRONICS

- RETAIL

- BFSI

- HEALTHCARE

- BUILDING & INFRASTRUCTURE

- OTHERS (INDUSTRIAL, MEDIA & ENTERTAINMENT, ETC.)

- GLOBAL NFC CHIP MARKET BY REGION, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- NXP SEMICONDUCTORS

- BROADCOM INC.

- TEXAS INSTRUMENTS INC.

- INFINEON TECHNOLOGIES AG

- SONY CORPORATION

- STMICROELECTRONICS

- QUALCOMM INCORPORATED

- AMS AG (FORMERLY KNOWN AS AUSTRIA MICROSYSTEMS)

- RENESAS ELECTRONICS CORPORATION

- INSIDE SECURE

- SAMSUNG ELECTRONICS CO., LTD.

- ON SEMICONDUCTOR

- GEMALTO (NOW PART OF THALES GROUP)

- EM MICROELECTRONIC (A SUBSIDIARY OF SWATCH GROUP)

- IDENTIV, INC.

- MICROCHIP TECHNOLOGY INC.

- IMPINJ, INC.

- MURATA MANUFACTURING CO., LTD.

- SILICON LABS

- MARVELL TECHNOLOGY GROUP LTD. *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL NFC CHIP MARKET BY STORAGE CAPACITY (USD BILLION) 2020-2030

TABLE 2 GLOBAL NFC CHIP MARKET BY STORAGE CAPACITY (THOUSAND UNITS) 2020-2030

TABLE 3 GLOBAL NFC CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 4 GLOBAL NFC CHIP MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 5 GLOBAL NFC CHIP MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 6 GLOBAL NFC CHIP MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 7 GLOBAL NFC CHIP MARKET BY REGION (USD BILLION) 2020-2030

TABLE 8 GLOBAL NFC CHIP MARKET BY REGION (THOUSAND UNITS) 2020-2030

TABLE 9 NORTH AMERICA NFC CHIP MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 10 NORTH AMERICA NFC CHIP MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 11 NORTH AMERICA NFC CHIP MARKET BY STORAGE CAPACITY (USD BILLION) 2020-2030

TABLE 12 NORTH AMERICA NFC CHIP MARKET BY STORAGE CAPACITY (THOUSAND UNITS) 2020-2030

TABLE 13 NORTH AMERICA NFC CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 14 NORTH AMERICA NFC CHIP MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 15 NORTH AMERICA NFC CHIP MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 16 NORTH AMERICA NFC CHIP MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 17 US NFC CHIP MARKET BY STORAGE CAPACITY (USD BILLION) 2020-2030

TABLE 18 US NFC CHIP MARKET BY STORAGE CAPACITY (THOUSAND UNITS) 2020-2030

TABLE 19 US NFC CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 20 US NFC CHIP MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 21 US NFC CHIP MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 22 US NFC CHIP MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 23 CANADA NFC CHIP MARKET BY STORAGE CAPACITY (USD BILLION) 2020-2030

TABLE 24 CANADA NFC CHIP MARKET BY STORAGE CAPACITY (THOUSAND UNITS) 2020-2030

TABLE 25 CANADA NFC CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 26 CANADA NFC CHIP MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 27 CANADA NFC CHIP MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 28 CANADA NFC CHIP MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 29 MEXICO NFC CHIP MARKET BY STORAGE CAPACITY (USD BILLION) 2020-2030

TABLE 30 MEXICO NFC CHIP MARKET BY STORAGE CAPACITY (THOUSAND UNITS) 2020-2030

TABLE 31 MEXICO NFC CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 32 MEXICO NFC CHIP MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 33 MEXICO NFC CHIP MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 34 MEXICO NFC CHIP MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 35 SOUTH AMERICA NFC CHIP MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 36 SOUTH AMERICA NFC CHIP MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 37 SOUTH AMERICA NFC CHIP MARKET BY STORAGE CAPACITY (USD BILLION) 2020-2030

TABLE 38 SOUTH AMERICA NFC CHIP MARKET BY STORAGE CAPACITY (THOUSAND UNITS) 2020-2030

TABLE 39 SOUTH AMERICA NFC CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 40 SOUTH AMERICA NFC CHIP MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 41 SOUTH AMERICA NFC CHIP MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 42 SOUTH AMERICA NFC CHIP MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 43 BRAZIL NFC CHIP MARKET BY STORAGE CAPACITY (USD BILLION) 2020-2030

TABLE 44 BRAZIL NFC CHIP MARKET BY STORAGE CAPACITY (THOUSAND UNITS) 2020-2030

TABLE 45 BRAZIL NFC CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 46 BRAZIL NFC CHIP MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 47 BRAZIL NFC CHIP MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 48 BRAZIL NFC CHIP MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 49 ARGENTINA NFC CHIP MARKET BY STORAGE CAPACITY (USD BILLION) 2020-2030

TABLE 50 ARGENTINA NFC CHIP MARKET BY STORAGE CAPACITY (THOUSAND UNITS) 2020-2030

TABLE 51 ARGENTINA NFC CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 52 ARGENTINA NFC CHIP MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 53 ARGENTINA NFC CHIP MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 54 ARGENTINA NFC CHIP MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 55 COLOMBIA NFC CHIP MARKET BY STORAGE CAPACITY (USD BILLION) 2020-2030

TABLE 56 COLOMBIA NFC CHIP MARKET BY STORAGE CAPACITY (THOUSAND UNITS) 2020-2030

TABLE 57 COLOMBIA NFC CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 58 COLOMBIA NFC CHIP MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 59 COLOMBIA NFC CHIP MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 60 COLOMBIA NFC CHIP MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 61 REST OF SOUTH AMERICA NFC CHIP MARKET BY STORAGE CAPACITY (USD BILLION) 2020-2030

TABLE 62 REST OF SOUTH AMERICA NFC CHIP MARKET BY STORAGE CAPACITY (THOUSAND UNITS) 2020-2030

TABLE 63 REST OF SOUTH AMERICA NFC CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 64 REST OF SOUTH AMERICA NFC CHIP MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 65 REST OF SOUTH AMERICA NFC CHIP MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 66 REST OF SOUTH AMERICA NFC CHIP MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 67 ASIA-PACIFIC NFC CHIP MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 68 ASIA-PACIFIC NFC CHIP MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 69 ASIA-PACIFIC NFC CHIP MARKET BY STORAGE CAPACITY (USD BILLION) 2020-2030

TABLE 70 ASIA-PACIFIC NFC CHIP MARKET BY STORAGE CAPACITY (THOUSAND UNITS) 2020-2030

TABLE 71 ASIA-PACIFIC NFC CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 72 ASIA-PACIFIC NFC CHIP MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 73 ASIA-PACIFIC NFC CHIP MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 74 ASIA-PACIFIC NFC CHIP MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 75 INDIA NFC CHIP MARKET BY STORAGE CAPACITY (USD BILLION) 2020-2030

TABLE 76 INDIA NFC CHIP MARKET BY STORAGE CAPACITY (THOUSAND UNITS) 2020-2030

TABLE 77 INDIA NFC CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 78 INDIA NFC CHIP MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 79 INDIA NFC CHIP MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 80 INDIA NFC CHIP MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 81 CHINA NFC CHIP MARKET BY STORAGE CAPACITY (USD BILLION) 2020-2030

TABLE 82 CHINA NFC CHIP MARKET BY STORAGE CAPACITY (THOUSAND UNITS) 2020-2030

TABLE 83 CHINA NFC CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 84 CHINA NFC CHIP MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 85 CHINA NFC CHIP MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 86 CHINA NFC CHIP MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 87 JAPAN NFC CHIP MARKET BY STORAGE CAPACITY (USD BILLION) 2020-2030

TABLE 88 JAPAN NFC CHIP MARKET BY STORAGE CAPACITY (THOUSAND UNITS) 2020-2030

TABLE 89 JAPAN NFC CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 90 JAPAN NFC CHIP MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 91 JAPAN NFC CHIP MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 92 JAPAN NFC CHIP MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 93 SOUTH KOREA NFC CHIP MARKET BY STORAGE CAPACITY (USD BILLION) 2020-2030

TABLE 94 SOUTH KOREA NFC CHIP MARKET BY STORAGE CAPACITY (THOUSAND UNITS) 2020-2030

TABLE 95 SOUTH KOREA NFC CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 96 SOUTH KOREA NFC CHIP MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 97 SOUTH KOREA NFC CHIP MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 98 SOUTH KOREA NFC CHIP MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 99 AUSTRALIA NFC CHIP MARKET BY STORAGE CAPACITY (USD BILLION) 2020-2030

TABLE 100 AUSTRALIA NFC CHIP MARKET BY STORAGE CAPACITY (THOUSAND UNITS) 2020-2030

TABLE 101 AUSTRALIA NFC CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 102 AUSTRALIA NFC CHIP MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 103 AUSTRALIA NFC CHIP MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 104 AUSTRALIA NFC CHIP MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 105 SOUTH-EAST ASIA NFC CHIP MARKET BY STORAGE CAPACITY (USD BILLION) 2020-2030

TABLE 106 SOUTH-EAST ASIA NFC CHIP MARKET BY STORAGE CAPACITY (THOUSAND UNITS) 2020-2030

TABLE 107 SOUTH-EAST ASIA NFC CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 108 SOUTH-EAST ASIA NFC CHIP MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 109 SOUTH-EAST ASIA NFC CHIP MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 110 SOUTH-EAST ASIA NFC CHIP MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 111 REST OF ASIA PACIFIC NFC CHIP MARKET BY STORAGE CAPACITY (USD BILLION) 2020-2030

TABLE 112 REST OF ASIA PACIFIC NFC CHIP MARKET BY STORAGE CAPACITY (THOUSAND UNITS) 2020-2030

TABLE 113 REST OF ASIA PACIFIC NFC CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 114 REST OF ASIA PACIFIC NFC CHIP MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 115 REST OF ASIA PACIFIC NFC CHIP MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 116 REST OF ASIA PACIFIC NFC CHIP MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 117 EUROPE NFC CHIP MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 118 EUROPE NFC CHIP MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 119 EUROPE NFC CHIP MARKET BY STORAGE CAPACITY (USD BILLION) 2020-2030

TABLE 120 EUROPE NFC CHIP MARKET BY STORAGE CAPACITY (THOUSAND UNITS) 2020-2030

TABLE 121 EUROPE NFC CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 122 EUROPE NFC CHIP MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 123 EUROPE NFC CHIP MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 124 EUROPE NFC CHIP MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 125 GERMANY NFC CHIP MARKET BY STORAGE CAPACITY (USD BILLION) 2020-2030

TABLE 126 GERMANY NFC CHIP MARKET BY STORAGE CAPACITY (THOUSAND UNITS) 2020-2030

TABLE 127 GERMANY NFC CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 128 GERMANY NFC CHIP MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 129 GERMANY NFC CHIP MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 130 GERMANY NFC CHIP MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 131 UK NFC CHIP MARKET BY STORAGE CAPACITY (USD BILLION) 2020-2030

TABLE 132 UK NFC CHIP MARKET BY STORAGE CAPACITY (THOUSAND UNITS) 2020-2030

TABLE 133 UK NFC CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 134 UK NFC CHIP MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 135 UK NFC CHIP MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 136 UK NFC CHIP MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 137 FRANCE NFC CHIP MARKET BY STORAGE CAPACITY (USD BILLION) 2020-2030

TABLE 138 FRANCE NFC CHIP MARKET BY STORAGE CAPACITY (THOUSAND UNITS) 2020-2030

TABLE 139 FRANCE NFC CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 140 FRANCE NFC CHIP MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 141 FRANCE NFC CHIP MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 142 FRANCE NFC CHIP MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 143 ITALY NFC CHIP MARKET BY STORAGE CAPACITY (USD BILLION) 2020-2030

TABLE 144 ITALY NFC CHIP MARKET BY STORAGE CAPACITY (THOUSAND UNITS) 2020-2030

TABLE 145 ITALY NFC CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 146 ITALY NFC CHIP MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 147 ITALY NFC CHIP MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 148 ITALY NFC CHIP MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 149 SPAIN NFC CHIP MARKET BY STORAGE CAPACITY (USD BILLION) 2020-2030

TABLE 150 SPAIN NFC CHIP MARKET BY STORAGE CAPACITY (THOUSAND UNITS) 2020-2030

TABLE 151 SPAIN NFC CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 152 SPAIN NFC CHIP MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 153 SPAIN NFC CHIP MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 154 SPAIN NFC CHIP MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 155 RUSSIA NFC CHIP MARKET BY STORAGE CAPACITY (USD BILLION) 2020-2030

TABLE 156 RUSSIA NFC CHIP MARKET BY STORAGE CAPACITY (THOUSAND UNITS) 2020-2030

TABLE 157 RUSSIA NFC CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 158 RUSSIA NFC CHIP MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 159 RUSSIA NFC CHIP MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 160 RUSSIA NFC CHIP MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 161 REST OF EUROPE NFC CHIP MARKET BY STORAGE CAPACITY (USD BILLION) 2020-2030

TABLE 162 REST OF EUROPE NFC CHIP MARKET BY STORAGE CAPACITY (THOUSAND UNITS) 2020-2030

TABLE 163 REST OF EUROPE NFC CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 164 REST OF EUROPE NFC CHIP MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 165 REST OF EUROPE NFC CHIP MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 166 REST OF EUROPE NFC CHIP MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 167 MIDDLE EAST AND AFRICA NFC CHIP MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 168 MIDDLE EAST AND AFRICA NFC CHIP MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 169 MIDDLE EAST AND AFRICA NFC CHIP MARKET BY STORAGE CAPACITY (USD BILLION) 2020-2030

TABLE 170 MIDDLE EAST AND AFRICA NFC CHIP MARKET BY STORAGE CAPACITY (THOUSAND UNITS) 2020-2030

TABLE 171 MIDDLE EAST AND AFRICA NFC CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 172 MIDDLE EAST AND AFRICA NFC CHIP MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 173 MIDDLE EAST AND AFRICA NFC CHIP MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 174 MIDDLE EAST AND AFRICA NFC CHIP MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 175 UAE NFC CHIP MARKET BY STORAGE CAPACITY (USD BILLION) 2020-2030

TABLE 176 UAE NFC CHIP MARKET BY STORAGE CAPACITY (THOUSAND UNITS) 2020-2030

TABLE 177 UAE NFC CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 178 UAE NFC CHIP MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 179 UAE NFC CHIP MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 180 UAE NFC CHIP MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 181 SAUDI ARABIA NFC CHIP MARKET BY STORAGE CAPACITY (USD BILLION) 2020-2030

TABLE 182 SAUDI ARABIA NFC CHIP MARKET BY STORAGE CAPACITY (THOUSAND UNITS) 2020-2030

TABLE 183 SAUDI ARABIA NFC CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 184 SAUDI ARABIA NFC CHIP MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 185 SAUDI ARABIA NFC CHIP MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 186 SAUDI ARABIA NFC CHIP MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 187 SOUTH AFRICA NFC CHIP MARKET BY STORAGE CAPACITY (USD BILLION) 2020-2030

TABLE 188 SOUTH AFRICA NFC CHIP MARKET BY STORAGE CAPACITY (THOUSAND UNITS) 2020-2030

TABLE 189 SOUTH AFRICA NFC CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 190 SOUTH AFRICA NFC CHIP MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 191 SOUTH AFRICA NFC CHIP MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 192 SOUTH AFRICA NFC CHIP MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 193 REST OF MIDDLE EAST AND AFRICA NFC CHIP MARKET BY STORAGE CAPACITY (USD BILLION) 2020-2030

TABLE 194 REST OF MIDDLE EAST AND AFRICA NFC CHIP MARKET BY STORAGE CAPACITY (THOUSAND UNITS) 2020-2030

TABLE 195 REST OF MIDDLE EAST AND AFRICA NFC CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 196 REST OF MIDDLE EAST AND AFRICA NFC CHIP MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 197 REST OF MIDDLE EAST AND AFRICA NFC CHIP MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 198 REST OF MIDDLE EAST AND AFRICA NFC CHIP MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL NFC CHIP MARKET BY STORAGE CAPACITY USD BILLION, 2020-2030

FIGURE 9 GLOBAL NFC CHIP MARKET BY APPLICATION, USD BILLION, 2020-2030

FIGURE 10 GLOBAL NFC CHIP MARKET BY END USE INDUSTRY, USD BILLION, 2020-2030

FIGURE 11 GLOBAL NFC CHIP MARKET BY REGION, USD BILLION, 2020-2030

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL NFC CHIP MARKET BY STORAGE CAPACITY, USD BILLION 2022

FIGURE 14 GLOBAL NFC CHIP MARKET BY APPLICATION, USD BILLION 2022

FIGURE 15 GLOBAL NFC CHIP MARKET BY END USE INDUSTRY, USD BILLION 2022

FIGURE 16 GLOBAL NFC CHIP MARKET BY REGION, USD BILLION 2022

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 NXP SEMICONDUCTORS: COMPANY SNAPSHOT

FIGURE 19. BROADCOM INC.: COMPANY SNAPSHOT

FIGURE 20 TEXAS INSTRUMENTS INC.: COMPANY SNAPSHOT

FIGURE 21 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

FIGURE 22 SONY CORPORATION: COMPANY SNAPSHOT

FIGURE 23 STMICROELECTRONICS: COMPANY SNAPSHOT

FIGURE 24 QUALCOMM INCORPORATED: COMPANY SNAPSHOT

FIGURE 25 AMS AG: COMPANY SNAPSHOT

FIGURE 26. RENESAS ELECTRONICS CORPORATION: COMPANY SNAPSHOT

FIGURE 27 INSIDE SECURE: COMPANY SNAPSHOT

FIGURE 28 SAMSUNG ELECTRONICS CO., LTD.: COMPANY SNAPSHOT

FIGURE 29 ON SEMICONDUCTOR: COMPANY SNAPSHOT

FIGURE 30 GEMALTO: COMPANY SNAPSHOT

FIGURE 31 EM MICROELECTRONIC: COMPANY SNAPSHOT

FIGURE 32 IDENTIV, INC.: COMPANY SNAPSHOT

FIGURE 33 MICROCHIP TECHNOLOGY INC.: COMPANY SNAPSHOT

FIGURE 34 IMPINJ, INC.: COMPANY SNAPSHOT

FIGURE 35 MURATA MANUFACTURING CO., LTD.: COMPANY SNAPSHOT

FIGURE 36 SILICON LABS: COMPANY SNAPSHOT

FIGURE 37 MARVELL TECHNOLOGY GROUP LTD.: COMPANY SNAPSHOT

DOWNLOAD FREE SAMPLE REPORT

License Type

SPEAK WITH OUR ANALYST

Want to know more about the report or any specific requirement?

WANT TO CUSTOMIZE THE REPORT?

Our Clients Speak

We asked them to research ‘ Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te

Yosuke Mitsui

Senior Associate Construction Equipment Sales & Marketing

We asked them to research ‘Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te