Base Year Value ()

CAGR ()

Forecast Year Value ()

Historical Data Period

Largest Region

Forecast Period

자동차 4D 이미징 레이더 시장 유형별(MIMO 칩 캐스케이드, 레이더 칩셋), 차량 유형별(승용차, 상용차, 전기 자동차(EV), 자율 주행차(AV), 기타) 범위(단거리 레이더, 중거리 레이더, 장거리 레이더), 주파수(24GHz~24.25GHz, 21GHz~26GHz, 76GHz~77GHz, 77GHz~81GHz) 및 지역, 2024~2030년까지의 글로벌 추세 및 예측

Instant access to hundreds of data points and trends

- Market estimates from 2014-2029

- Competitive analysis, industry segmentation, financial benchmarks

- Incorporates SWOT, Porter's Five Forces and risk management frameworks

- PDF report or online database with Word, Excel and PowerPoint export options

- 100% money back guarantee

자동차 4D 이미징 레이더 시장 개요

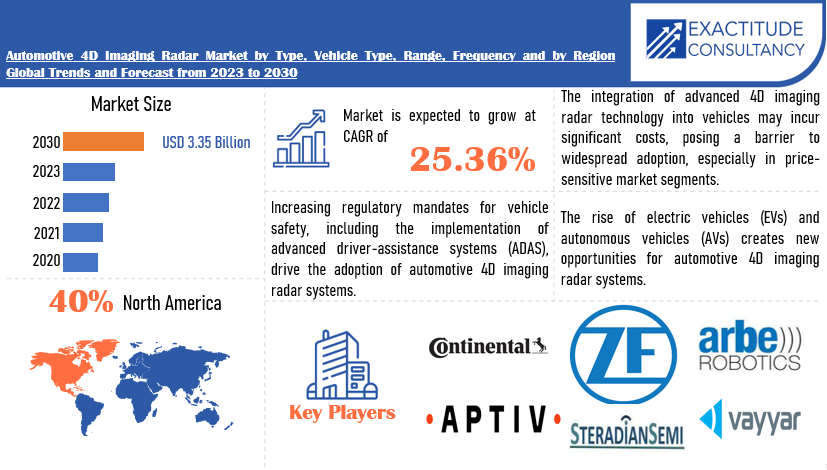

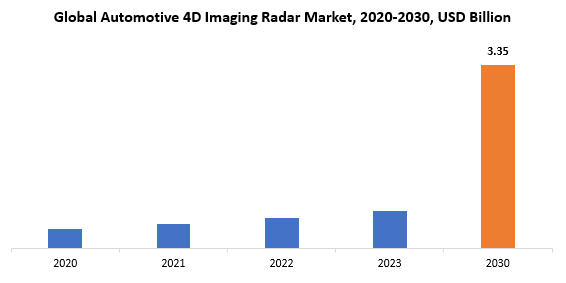

글로벌 자동차 4D 이미징 레이더 시장은 예측 기간 동안 연평균 성장률(CAGR) 25.36%로 2023년 6억 9천만 달러에서 2030년 33억 5천만 달러로 성장할 것으로 예상됩니다.

자동차 4D 이미징 레이더는 도로에서 안전성, 자율성 및 상황 인식을 강화하기 위해 차량에 사용되는 고급 센서 기술입니다. 주변 물체에 대한 2D 또는 3D 정보만 제공하는 기존 레이더 시스템과 달리 4D 이미징 레이더는 시간의 차원을 추가하여 동적 환경에 대한 포괄적인 이해를 가능하게 합니다. 이 기술은 전파를 사용하여 물체를 감지하고 거리, 속도 및 궤적을 측정하고 차량 주변의 자세한 지도를 실시간으로 만듭니다. 4D 이미징 레이더 시스템은 공간 및 시간 데이터를 모두 캡처하여 안개, 비 또는 눈과 같은 어려운 기상 조건에서도 차량, 보행자, 자전거 타는 사람 및 기타 장애물을 포함하여 여러 물체를 동시에 정확하게 식별하고 추적할 수 있습니다.

4D 레이더의 고해상도 이미징 기능은 물체의 정확한 위치 파악 및 분류를 가능하게 하여 충돌 회피, 적응형 크루즈 컨트롤, 차선 유지 지원 및 자율 주행과 같은 첨단 운전자 지원 시스템 (ADAS) 기능을 용이하게 합니다. 또한 자동차 4D 이미징 레이더는 차세대 안전 기능과 자율 주행차 기술을 가능하게 하는 데 중요한 역할을 하며 스마트하고 연결된 교통 시스템의 진화에 기여합니다.

자동차 4D 이미징 레이더 시장은 도로에서 안전성, 자율성 및 효율성을 향상시키는 데 중요한 역할을 하기 때문에 자동차 산업과 광범위한 운송 부문에서 상당한 중요성을 차지합니다. 차량이 점점 더 복잡하고 연결됨에 따라 4D 이미징 레이더와 같은 고급 센서 기술에 대한 수요가 계속 증가하고 있습니다. 이러한 레이더 시스템은 공간 및 시간 데이터를 캡처하여 차량이 주변 환경을 포괄적으로 이해하도록 하여 실시간으로 물체를 정확하게 감지, 추적 및 분류할 수 있도록 합니다. 이러한 수준의 상황 인식은 충돌을 방지하고 위험을 완화하며 전반적인 도로 안전을 개선하는 데 도움이 될 수 있는 고급 운전자 지원 시스템( ADAS )을 구현하는 데 필수적입니다. 또한 4D 이미징 레이더는 자율 주행 기능을 구현하는 데 중요한 역할을 하며 차량이 복잡한 주행 환경에서 안전하게 주행하고 정보에 입각한 결정을 내리는 데 필요한 인식 기능을 제공합니다.

[캡션 id="attachment_41448" 정렬="정렬센터" 너비="827"]

엄격한 안전 규정과 전 세계적으로 차량 안전 기준에 대한 강조가 커지면서 자동차 제조업체는 첨단 운전자 지원 시스템(ADAS)을 차량에 통합해야 합니다. 자동차 4D 이미징 레이더는 차량 주변 환경에 대한 정확하고 실시간 데이터를 제공하여 충돌 회피, 보행자 감지, 적응형 크루즈 컨트롤과 같은 기능을 활성화함으로써 이러한 시스템에서 중요한 역할을 합니다.

또한, 자율주행차 (AV) 에 대한 수요가 증가함에 따라 주변 환경을 정확하게 인식하고 해석할 수 있는 정교한 센서 기술에 대한 필요성도 커지고 있습니다. 높은 정밀도와 안정성으로 물체를 감지하고 추적할 수 있는 4D 이미징 레이더 시스템은 AV 개발 및 배포에 필수적인 구성 요소로, 시장 성장을 촉진합니다.

게다가 도로와 주행 환경이 점점 더 복잡해지고 전기 자동차 (EV)와 커넥티드 차량이 급속히 확산되면서 4D 이미징 레이더와 같은 첨단 센서 시스템이 안전성, 효율성, 자율성을 강화하는 데 중요하다는 사실이 더욱 부각되고 있습니다.

| 기인하다 | 세부 |

| 학습 기간 | 2020-2030 |

| 기준년도 | 2022 |

| 추정 연도 | 2023 |

| 예상 연도 | 2023-2030 |

| 역사적 기간 | 2019-2021 |

| 단위 | 가치(10억 달러) |

| 분할 | 유형 , 차량 유형 , 범위 , 빈도 및 지역별 |

| 유형별 로 |

|

| 차량 유형별 |

|

| 주파수 별로 |

|

| 범위 별로 |

|

| By Region |

|

Frequently Asked Questions

• What is the market size for the automotive 4D imaging radar market?

The global automotive 4D imaging radar market is expected to grow from USD 0.46 Billion in 2023 to USD 1.36 Billion by 2030, at a Compound Annual Growth Rate (CAGR) of 16.73 % during the forecast period.

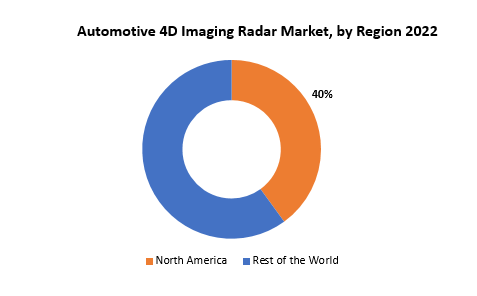

• Which region is dominating in the automotive 4D imaging radar market?

North America accounted for the largest market in the automotive 4D imaging radar market. North America accounted for 40% market share of the global market value.

• Who are the major key players in the automotive 4D imaging radar market?

Continental AG, ZF Friedrichshafen AG, Arbe Robotics, Aptiv, Steradian, Vayyar Imaging, Innoviz Technologies, Oculii, Hella Aglaia Mobile Vision GmbH, Smart Radar Systems, Blackmore Sensors and Analytics, Ainstein, Metawave Corporation, Texas Instruments, NXP Semiconductors, Infineon Technologies AG, Xilinx, RadSee, Uhnder, Zadar Labs.

• What are the opportunity in the automotive 4D imaging radar market?

Opportunities in the automotive 4D imaging radar market abound as advancements in radar technology continue to enhance performance and reliability. With the rising demand for autonomous vehicles and advanced driver-assistance systems, there is a significant opportunity for 4D imaging radar to play a crucial role in enabling safer and more efficient transportation solutions. Additionally, the expansion of electric vehicles, smart city initiatives, and increasing regulatory focus on vehicle safety present avenues for market growth and innovation within the automotive 4D imaging radar sector.

Automotive 4D Imaging Radar Market Segmentation Analysis

The automotive 4D imaging radar market offers a range of segments are by type the market is divided into MIMO Chip Cascade, Radar Chipset. By Vehicle Type, the market is divided into up to Passenger Cars, Commercial Vehicles, Electric Vehicles (EVs), Autonomous Vehicles (AVs), Others. By Range the market is classified into Short Range Radar, Medium Range Radar, Long Range Radar. By Frequency 24 GHz to 24.25 GHz, 21 GHz to 26 GHz, 76 GHz to 77 GHz, 77 GHz to 81 GHz.

[caption id="attachment_41454" align="aligncenter" width="618"]

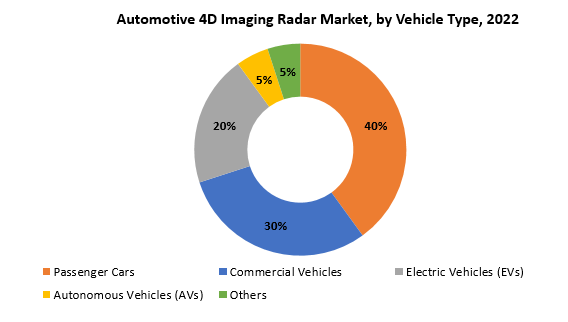

Based on vehicle type, passenger cars segment dominating in the automotive 4D imaging radar market. Passenger cars, encompassing a wide range of vehicle types from sedans to SUVs, represent the largest segment of the automotive market globally. As consumers increasingly prioritize safety features and convenience in their vehicles, automotive manufacturers are equipping passenger cars with sophisticated sensor technologies like 4D imaging radar to enhance driver safety and improve overall driving experience. These radar systems provide passenger cars with an unparalleled level of situational awareness, enabling features such as collision avoidance, pedestrian detection, adaptive cruise control, and lane-keeping assistance.

[caption id="attachment_41455" align="aligncenter" width="564"]

The integration of 4D imaging radar in passenger cars is particularly crucial due to the diverse and dynamic driving environments they encounter, including urban streets, highways, and rural roads. Additionally, advancements in vehicle connectivity and autonomous driving technologies are further driving the demand for 4D imaging radar in passenger cars, as these systems play a fundamental role in enabling the transition towards semi-autonomous and fully autonomous driving capabilities. Moreover, government regulations mandating the inclusion of safety features in passenger vehicles, along with increasing consumer awareness about the benefits of ADAS technologies, are contributing to the widespread adoption of 4D imaging radar in the passenger cars segment.

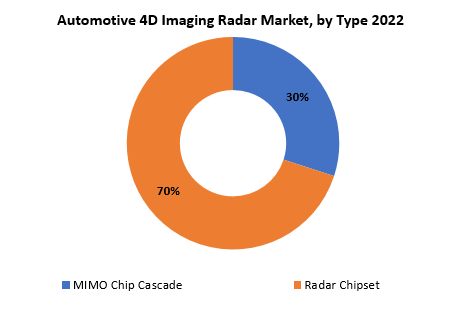

Based on type, radar chipset segment dominating in the automotive 4D imaging radar market. Radar chipsets represent a critical component in 4D imaging radar systems, enabling vehicles to accurately detect, track, and interpret the surrounding environment in real-time. Unlike traditional radar systems, which rely on discrete radar modules, radar chipsets integrate multiple radar sensors into a single compact package, offering enhanced performance, efficiency, and scalability. This consolidation of radar functionality into chipsets streamlines the integration process for automotive manufacturers, reducing costs and complexity while improving overall system reliability and robustness. As a result, radar chipsets have become the preferred choice for implementing 4D imaging radar systems in modern vehicles across various automotive applications.

Additionally, advancements in semiconductor technology have led to the development of highly integrated radar chipsets capable of supporting advanced features such as high-resolution imaging, multi-target tracking, and interference mitigation. These capabilities are essential for enabling critical safety functionalities such as collision avoidance, pedestrian detection, and adaptive cruise control, making radar chipsets indispensable for the realization of advanced driver-assistance systems (ADAS) and autonomous driving technologies.

Furthermore, the growing demand for radar chipsets is driven by the increasing sophistication of vehicle architectures, the proliferation of electric and autonomous vehicles, and stringent safety regulations mandating the inclusion of ADAS features in vehicles.

[caption id="attachment_41456" align="aligncenter" width="628"]

Automotive 4D Imaging Radar Market Dynamics

DriverStringent safety regulations mandating the integration of advanced driver assistance systems (ADAS) in vehicles drive the demand for automotive 4D imaging radar.

Stringent safety regulations mandating the integration of advanced driver assistance systems (ADAS) in vehicles are a primary driver fueling the demand for automotive 4D imaging radar. These regulations are implemented by governmental bodies worldwide with the aim of reducing road accidents, fatalities, and injuries by enhancing vehicle safety standards. ADAS, which encompasses a range of safety features such as collision avoidance, lane departure warning, adaptive cruise control, and pedestrian detection, relies heavily on sensor technologies like 4D imaging radar to accurately perceive the vehicle's surroundings in real-time.

4D imaging radar offers unique capabilities that make it indispensable for ADAS applications. Unlike traditional radar systems, which provide only range and azimuth information, 4D imaging radar delivers additional depth and velocity data, enabling a comprehensive understanding of the vehicle's environment. This enhanced perception allows ADAS systems to detect and track objects with greater accuracy, even in challenging conditions such as low visibility, adverse weather, or complex traffic scenarios. Moreover, 4D imaging radar's ability to provide real-time, high-resolution images of the vehicle's surroundings allows for more precise object detection and classification. This level of detail is essential for implementing advanced ADAS functionalities like autonomous emergency braking, blind-spot detection, and cross-traffic alert systems, which rely on accurate perception of nearby objects and potential hazards.

The integration of 4D imaging radar in vehicles not only helps automakers comply with safety regulations but also enhances their competitiveness in the market. As consumer demand for safer vehicles grows, automakers are under pressure to equip their vehicles with advanced safety features to achieve higher safety ratings and market differentiation. RestraintThe high cost associated with 4D imaging radar technology poses a significant barrier to mass adoption, particularly in the mainstream automotive market.

The complexity of 4D imaging radar systems and their sophisticated underlying technology significantly contributes to their high production costs. Unlike traditional radar systems that provide basic range and azimuth information, 4D imaging radar captures additional depth and velocity data, offering a more comprehensive understanding of the vehicle's surroundings. This level of complexity requires the integration of advanced components, including high-resolution sensors, signal processing units, and computational hardware, driving up the overall cost of the system.

Moreover, the development and manufacturing of 4D imaging radar technology involve extensive research, engineering, and testing processes, which further add to the cost of production. Designing radar systems capable of accurately perceiving and imaging objects in real-time requires significant investment in R&D efforts, simulation tools, and prototype testing, contributing to the overall cost structure.

Additionally, economies of scale play a crucial role in determining the cost-effectiveness of 4D imaging radar technology. As the demand for these radar systems remains relatively low compared to traditional radar solutions, manufacturers face challenges in achieving production volumes that would drive down unit costs through mass production. Limited economies of scale result in higher per-unit manufacturing costs, making 4D imaging radar technology prohibitively expensive for widespread adoption, particularly in the mainstream automotive market where cost considerations are paramount.

OpportunitiesThe growing market penetration of electric vehicles (EVs) and autonomous vehicles presents significant opportunities for the automotive 4D imaging radar market.

The growing market penetration of electric vehicles (EVs) and autonomous vehicles represents a transformative shift in the automotive industry, presenting significant opportunities for the automotive 4D imaging radar market. Both EVs and autonomous vehicles rely heavily on advanced sensor technologies to perceive their surroundings accurately, navigate complex environments, and ensure safe operation. In this context, 4D imaging radar emerges as a critical enabler for these next-generation vehicles, offering unique capabilities that address the evolving needs and challenges of electric and autonomous mobility.

For electric vehicles, the integration of 4D imaging radar technology enhances safety, efficiency, and driving experience. Electric vehicles, with their silent operation and instant torque delivery, pose unique challenges for pedestrian and cyclist awareness, particularly in urban environments. 4D imaging radar systems provide precise object detection and tracking capabilities, enabling EVs to detect and react to potential hazards in real-time, thereby enhancing pedestrian safety and reducing the risk of accidents. Additionally, 4D imaging radar assists EVs in navigating complex traffic scenarios, optimizing energy consumption, and improving overall driving dynamics, contributing to enhanced performance and user satisfaction.Similarly, autonomous vehicles rely on a suite of sensors, including 4D imaging radar, to perceive their surroundings and make informed decisions in real-time. 4D imaging radar technology offers several advantages for autonomous vehicles, including enhanced object detection, accurate depth perception, and robust performance in adverse weather conditions. These capabilities are essential for ensuring the safety and reliability of autonomous driving systems, particularly in complex urban environments, highway scenarios, and challenging weather conditions.

Automotive 4D Imaging Radar Market Trends

-

Automotive 4D imaging radar systems are increasingly integrating with other sensing modalities such as LiDAR and cameras to provide comprehensive environmental perception, enhancing safety and enabling more robust autonomous driving capabilities.

-

The integration of 4D imaging radar with V2X communication systems enables vehicles to exchange real-time data with infrastructure and other vehicles, enhancing situational awareness and improving overall traffic management and safety.

-

The adoption of silicon-based radar chips is growing, driven by their lower cost, smaller form factor, and improved performance compared to traditional gallium arsenide (GaAs) chips, enabling broader deployment of radar-based ADAS solutions in mass-market vehicles.

-

The growing connectivity of vehicles, there's an increased focus on automotive cybersecurity in 4D imaging radar systems to prevent cyber threats and ensure the integrity and reliability of radar-based ADAS functionalities.

-

Radar integration within the vehicle cockpit, including heads-up displays (HUDs) and instrument clusters, enhances driver awareness by providing real-time visual and auditory feedback on surrounding objects and potential hazards detected by the radar system.

-

Recent advancements in automotive 4D imaging radar technology focus on improving weather and environmental resistance, ensuring reliable performance in adverse weather conditions such as rain, fog, and snow, as well as in challenging environments like urban canyons and tunnels.

-

Advanced radar systems are incorporating adaptive beamforming and beam steering technologies to dynamically adjust radar beam direction and shape, optimizing object detection and tracking performance in complex driving scenarios with varying traffic conditions and obstacles.

Competitive Landscape

The competitive landscape of the automotive 4D imaging radar market was dynamic, with several prominent companies competing to provide innovative and advanced automotive 4D imaging radar solutions.

- Continental AG

- ZF Friedrichshafen AG

- Arbe Robotics

- Aptiv

- Steradian

- Vayyar Imaging

- Innoviz Technologies

- Oculii

- Hella Aglaia Mobile Vision GmbH

- Smart Radar Systems

- Blackmore Sensors and Analytics

- Ainstein

- Metawave Corporation

- Texas Instruments

- NXP Semiconductors

- Infineon Technologies AG

- Xilinx

- RadSee

- Uhnder

- Zadar Labs

January 29, 2024: Arbe Robotics Ltd. a global leader in Perception Radar Solutions, today announces that its tier 1, HiRain Technologies, a leading provider of intelligent driving solutions to car manufacturers in China, announced that it will begin the mass production of state-of-the-art 4D Imaging Radars by the end of 2024.

May 02, 2023: NXP Semiconductors N.V. announced NIO Inc., a leading brand in the global premium smart electric vehicle market, will leverage NXP’s leading automotive radar technology, including its ground-breaking imaging radar solution. NXP’s latest 4D imaging radar solution is a powerful technology that allows benefits far beyond traditional radar.

Regional Analysis

North America accounted for the largest market in the automotive 4D imaging radar market. North America has consistently held a prominent position as the largest market in the ride-hailing industry. North America is home to some of the world's leading automotive manufacturers, technology companies, and research institutions, fostering a vibrant ecosystem for innovation and development in the automotive sector. These industry players have been at the forefront of integrating advanced driver-assistance systems (ADAS) and autonomous driving technologies into vehicles, driving the demand for sophisticated sensor technologies like 4D imaging radar. Secondly, the region's robust regulatory framework, including stringent safety standards and emissions regulations, has propelled the adoption of safety-critical technologies in vehicles.

Governments and regulatory bodies in North America have mandated the inclusion of ADAS features in vehicles to enhance road safety and reduce traffic accidents, further driving the demand for 4D imaging radar systems. Additionally, North America boasts a high level of consumer awareness and acceptance of advanced automotive technologies, with consumers increasingly prioritizing safety features and convenience in their vehicles. This consumer demand, coupled with the region's strong purchasing power, has contributed to the widespread adoption of 4D imaging radar systems in North American vehicles.

Moreover, the region's diverse and dynamic driving environments, including urban centers, highways, and rural roads, present unique challenges and opportunities for advanced sensor technologies like 4D imaging radar to demonstrate their effectiveness and reliability.

[caption id="attachment_41461" align="aligncenter" width="477"]

In Europe, the market is buoyed by stringent safety regulations, a strong automotive manufacturing base, and a culture of innovation. European countries are leading the way in implementing advanced driver-assistance systems (ADAS) and autonomous driving technologies, creating a high demand for 4D imaging radar systems. Moreover, Europe's complex road infrastructure and dense urban environments necessitate sophisticated sensor solutions to ensure safe and efficient navigation, further fueling the adoption of 4D radar technology.

In the Asia-Pacific region, the automotive 4D imaging radar market is propelled by rapid urbanization, expanding middle-class populations, and increasing vehicle sales. Countries like China, Japan, and South Korea are at the forefront of automotive innovation, investing heavily in autonomous driving initiatives and smart transportation infrastructure. As the largest automotive market globally, the Asia-Pacific region presents immense opportunities for radar technology providers to meet the growing demand for advanced safety features and autonomous capabilities. Additionally, the emergence of electric vehicles (EVs) and shared mobility services in Asia-Pacific further accelerates the adoption of radar-based sensor systems, as these technologies play a crucial role in enhancing safety and efficiency.

Target Audience for Automotive 4D Imaging Radar Market

- Automotive Manufacturers

- Automotive Component Suppliers

- Technology Providers

- Research and Development Organizations

- Regulatory Authorities

- Investors and Financial Institutions

- Government Agencies

- Industry Associations

- Automotive Engineers and Designers

- Automotive Safety Advocates

- Market Analysts and Consultants

Segments Covered in the Automotive 4D Imaging Radar Market Report

Automotive 4D Imaging Radar Market by Type- MIMO Chip Cascade

- Radar Chipset

- 24 GHz to 24.25 GHz

- 21 GHz to 26 GHz

- 76 GHz to 77 GHz

- 77 GHz to 81 GHz

- Short Range Radar

- Medium Range Radar

- Long Range Radar

- Passenger Cars

- Commercial Vehicles

- Electric Vehicles (EVs)

- Autonomous Vehicles (AVs)

- Others

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the automotive 4D imaging radar market over the next 7 years?

- Who are the major players in the automotive 4D imaging radar market and what is their market share?

- What are the end user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the middle east, and Africa?

- How is the economic environment affecting the automotive 4D imaging radar market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the automotive 4D imaging radar market?

- What is the current and forecasted size and growth rate of the global automotive 4D imaging radar market?

- What are the key drivers of growth in the automotive 4D imaging radar market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the automotive 4D imaging radar market?

- What are the technological advancements and innovations in the automotive 4D imaging radar market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the automotive 4D imaging radar market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the automotive 4D imaging radar market?

- What are the service offerings and specifications of leading players in the market?

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL AUTOMOTIVE 4D IMAGING RADAR MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON AUTOMOTIVE 4D IMAGING RADAR MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- FREQUENCY VALUE CHAIN ANALYSIS

- GLOBAL AUTOMOTIVE 4D IMAGING RADAR MARKET OUTLOOK

- GLOBAL AUTOMOTIVE 4D IMAGING RADAR MARKET BY TYPE, 2020-2030, (USD BILLION)

- MIMO CHIP CASCADE

- RADAR CHIPSET

- GLOBAL AUTOMOTIVE 4D IMAGING RADAR MARKET BY VEHICLE TYPE, 2020-2030, (USD BILLION)

- PASSENGER CARS

- COMMERCIAL VEHICLES

- ELECTRIC VEHICLES (EVS)

- AUTONOMOUS VEHICLES (AVS)

- OTHERS

- GLOBAL AUTOMOTIVE 4D IMAGING RADAR MARKET BY RANGE, 2020-2030, (USD BILLION)

- SHORT RANGE RADAR

- MEDIUM RANGE RADAR

- LONG RANGE RADAR

- GLOBAL AUTOMOTIVE 4D IMAGING RADAR MARKET BY FREQUENCY, 2020-2030, (USD BILLION)

- 24 GHZ TO 24.25 GHZ

- 21 GHZ TO 26 GHZ

- 76 GHZ TO 77 GHZ

- 77 GHZ TO 81 GHZ

- GLOBAL AUTOMOTIVE 4D IMAGING RADAR MARKET BY REGION, 2020-2030, (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCT OFFERED, RECENT DEVELOPMENTS)

- CONTINENTAL AG

- ZF FRIEDRICHSHAFEN AG

- ARBE ROBOTICS

- APTIV

- STERADIAN

- VAYYAR IMAGING

- INNOVIZ TECHNOLOGIES

- OCULII

- HELLA AGLAIA MOBILE VISION GMBH

- SMART RADAR SYSTEMS

- BLACKMORE SENSORS AND ANALYTICS

- AINSTEIN

- METAWAVE CORPORATION

- TEXAS INSTRUMENTS

- NXP SEMICONDUCTORS

- INFINEON TECHNOLOGIES AG

- XILINX

- RADSEE

- UHNDER

- ZADAR LABS *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL AUTOMOTIVE 4D IMAGING RADAR MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 2 GLOBAL AUTOMOTIVE 4D IMAGING RADAR MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 3 GLOBAL AUTOMOTIVE 4D IMAGING RADAR MARKET BY RANGE (USD BILLION) 2020-2030

TABLE 4 GLOBAL AUTOMOTIVE 4D IMAGING RADAR MARKET BY FREQUENCY (USD BILLION) 2020-2030

TABLE 5 GLOBAL AUTOMOTIVE 4D IMAGING RADAR MARKET BY REGION (USD BILLION) 2020-2030

TABLE 6 NORTH AMERICA AUTOMOTIVE 4D IMAGING RADAR MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 7 NORTH AMERICA AUTOMOTIVE 4D IMAGING RADAR MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 8 NORTH AMERICA AUTOMOTIVE 4D IMAGING RADAR MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 9 NORTH AMERICA AUTOMOTIVE 4D IMAGING RADAR MARKET BY RANGE (USD BILLION) 2020-2030

TABLE 10 NORTH AMERICA AUTOMOTIVE 4D IMAGING RADAR MARKET BY FREQUENCY (USD BILLION) 2020-2030

TABLE 11 US AUTOMOTIVE 4D IMAGING RADAR MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 12 US AUTOMOTIVE 4D IMAGING RADAR MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 13 US AUTOMOTIVE 4D IMAGING RADAR MARKET BY RANGE (USD BILLION) 2020-2030

TABLE 14 US AUTOMOTIVE 4D IMAGING RADAR MARKET BY FREQUENCY (USD BILLION) 2020-2030

TABLE 15 CANADA AUTOMOTIVE 4D IMAGING RADAR MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 16 CANADA AUTOMOTIVE 4D IMAGING RADAR MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 17 CANADA AUTOMOTIVE 4D IMAGING RADAR MARKET BY RANGE (USD BILLION) 2020-2030

TABLE 18 CANADA AUTOMOTIVE 4D IMAGING RADAR MARKET BY FREQUENCY (USD BILLION) 2020-2030

TABLE 19 MEXICO AUTOMOTIVE 4D IMAGING RADAR MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 20 MEXICO AUTOMOTIVE 4D IMAGING RADAR MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 21 MEXICO AUTOMOTIVE 4D IMAGING RADAR MARKET BY RANGE (USD BILLION) 2020-2030

TABLE 22 MEXICO AUTOMOTIVE 4D IMAGING RADAR MARKET BY FREQUENCY (USD BILLION) 2020-2030

TABLE 23 SOUTH AMERICA AUTOMOTIVE 4D IMAGING RADAR MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 24 SOUTH AMERICA AUTOMOTIVE 4D IMAGING RADAR MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 25 SOUTH AMERICA AUTOMOTIVE 4D IMAGING RADAR MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 26 SOUTH AMERICA AUTOMOTIVE 4D IMAGING RADAR MARKET BY RANGE (USD BILLION) 2020-2030

TABLE 27 SOUTH AMERICA AUTOMOTIVE 4D IMAGING RADAR MARKET BY FREQUENCY (USD BILLION) 2020-2030

TABLE 28 BRAZIL AUTOMOTIVE 4D IMAGING RADAR MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 29 BRAZIL AUTOMOTIVE 4D IMAGING RADAR MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 30 BRAZIL AUTOMOTIVE 4D IMAGING RADAR MARKET BY RANGE (USD BILLION) 2020-2030

TABLE 31 BRAZIL AUTOMOTIVE 4D IMAGING RADAR MARKET BY FREQUENCY (USD BILLION) 2020-2030

TABLE 32 ARGENTINA AUTOMOTIVE 4D IMAGING RADAR MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 33 ARGENTINA AUTOMOTIVE 4D IMAGING RADAR MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 34 ARGENTINA AUTOMOTIVE 4D IMAGING RADAR MARKET BY RANGE (USD BILLION) 2020-2030

TABLE 35 ARGENTINA AUTOMOTIVE 4D IMAGING RADAR MARKET BY FREQUENCY (USD BILLION) 2020-2030

TABLE 36 COLOMBIA AUTOMOTIVE 4D IMAGING RADAR MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 37 COLOMBIA AUTOMOTIVE 4D IMAGING RADAR MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 38 COLOMBIA AUTOMOTIVE 4D IMAGING RADAR MARKET BY RANGE (USD BILLION) 2020-2030

TABLE 39 COLOMBIA AUTOMOTIVE 4D IMAGING RADAR MARKET BY FREQUENCY (USD BILLION) 2020-2030

TABLE 40 REST OF SOUTH AMERICA AUTOMOTIVE 4D IMAGING RADAR MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 41 REST OF SOUTH AMERICA AUTOMOTIVE 4D IMAGING RADAR MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 42 REST OF SOUTH AMERICA AUTOMOTIVE 4D IMAGING RADAR MARKET BY RANGE (USD BILLION) 2020-2030

TABLE 43 REST OF SOUTH AMERICA AUTOMOTIVE 4D IMAGING RADAR MARKET BY FREQUENCY (USD BILLION) 2020-2030

TABLE 44 ASIA-PACIFIC AUTOMOTIVE 4D IMAGING RADAR MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 45 ASIA-PACIFIC AUTOMOTIVE 4D IMAGING RADAR MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 46 ASIA-PACIFIC AUTOMOTIVE 4D IMAGING RADAR MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 47 ASIA-PACIFIC AUTOMOTIVE 4D IMAGING RADAR MARKET BY RANGE (USD BILLION) 2020-2030

TABLE 48 ASIA-PACIFIC AUTOMOTIVE 4D IMAGING RADAR MARKET BY FREQUENCY (USD BILLION) 2020-2030

TABLE 49 INDIA AUTOMOTIVE 4D IMAGING RADAR MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 50 INDIA AUTOMOTIVE 4D IMAGING RADAR MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 51 INDIA AUTOMOTIVE 4D IMAGING RADAR MARKET BY RANGE (USD BILLION) 2020-2030

TABLE 52 INDIA AUTOMOTIVE 4D IMAGING RADAR MARKET BY FREQUENCY (USD BILLION) 2020-2030

TABLE 53 CHINA AUTOMOTIVE 4D IMAGING RADAR MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 54 CHINA AUTOMOTIVE 4D IMAGING RADAR MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 55 CHINA AUTOMOTIVE 4D IMAGING RADAR MARKET BY RANGE (USD BILLION) 2020-2030

TABLE 56 CHINA AUTOMOTIVE 4D IMAGING RADAR MARKET BY FREQUENCY (USD BILLION) 2020-2030

TABLE 57 JAPAN AUTOMOTIVE 4D IMAGING RADAR MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 58 JAPAN AUTOMOTIVE 4D IMAGING RADAR MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 59 JAPAN AUTOMOTIVE 4D IMAGING RADAR MARKET BY RANGE (USD BILLION) 2020-2030

TABLE 60 JAPAN AUTOMOTIVE 4D IMAGING RADAR MARKET BY FREQUENCY (USD BILLION) 2020-2030

TABLE 61 SOUTH KOREA AUTOMOTIVE 4D IMAGING RADAR MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 62 SOUTH KOREA AUTOMOTIVE 4D IMAGING RADAR MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 63 SOUTH KOREA AUTOMOTIVE 4D IMAGING RADAR MARKET BY RANGE (USD BILLION) 2020-2030

TABLE 64 SOUTH KOREA AUTOMOTIVE 4D IMAGING RADAR MARKET BY FREQUENCY (USD BILLION) 2020-2030

TABLE 65 AUSTRALIA AUTOMOTIVE 4D IMAGING RADAR MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 66 AUSTRALIA AUTOMOTIVE 4D IMAGING RADAR MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 67 AUSTRALIA AUTOMOTIVE 4D IMAGING RADAR MARKET BY RANGE (USD BILLION) 2020-2030

TABLE 68 AUSTRALIA AUTOMOTIVE 4D IMAGING RADAR MARKET BY FREQUENCY (USD BILLION) 2020-2030

TABLE 69 SOUTH-EAST ASIA AUTOMOTIVE 4D IMAGING RADAR MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 70 SOUTH-EAST ASIA AUTOMOTIVE 4D IMAGING RADAR MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 71 SOUTH-EAST ASIA AUTOMOTIVE 4D IMAGING RADAR MARKET BY RANGE (USD BILLION) 2020-2030

TABLE 72 SOUTH-EAST ASIA AUTOMOTIVE 4D IMAGING RADAR MARKET BY FREQUENCY (USD BILLION) 2020-2030

TABLE 73 REST OF ASIA PACIFIC AUTOMOTIVE 4D IMAGING RADAR MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 74 REST OF ASIA PACIFIC AUTOMOTIVE 4D IMAGING RADAR MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 75 REST OF ASIA PACIFIC AUTOMOTIVE 4D IMAGING RADAR MARKET BY RANGE (USD BILLION) 2020-2030

TABLE 76 REST OF ASIA PACIFIC AUTOMOTIVE 4D IMAGING RADAR MARKET BY FREQUENCY (USD BILLION) 2020-2030

TABLE 77 EUROPE AUTOMOTIVE 4D IMAGING RADAR MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 78 EUROPE AUTOMOTIVE 4D IMAGING RADAR MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 79 EUROPE AUTOMOTIVE 4D IMAGING RADAR MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 80 EUROPE AUTOMOTIVE 4D IMAGING RADAR MARKET BY RANGE (USD BILLION) 2020-2030

TABLE 81 EUROPE AUTOMOTIVE 4D IMAGING RADAR MARKET BY FREQUENCY (USD BILLION) 2020-2030

TABLE 82 GERMANY AUTOMOTIVE 4D IMAGING RADAR MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 83 GERMANY AUTOMOTIVE 4D IMAGING RADAR MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 84 GERMANY AUTOMOTIVE 4D IMAGING RADAR MARKET BY RANGE (USD BILLION) 2020-2030

TABLE 85 GERMANY AUTOMOTIVE 4D IMAGING RADAR MARKET BY FREQUENCY (USD BILLION) 2020-2030

TABLE 86 UK AUTOMOTIVE 4D IMAGING RADAR MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 87 UK AUTOMOTIVE 4D IMAGING RADAR MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 88 UK AUTOMOTIVE 4D IMAGING RADAR MARKET BY RANGE (USD BILLION) 2020-2030

TABLE 89 UK AUTOMOTIVE 4D IMAGING RADAR MARKET BY FREQUENCY (USD BILLION) 2020-2030

TABLE 90 FRANCE AUTOMOTIVE 4D IMAGING RADAR MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 91 FRANCE AUTOMOTIVE 4D IMAGING RADAR MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 92 FRANCE AUTOMOTIVE 4D IMAGING RADAR MARKET BY RANGE (USD BILLION) 2020-2030

TABLE 93 FRANCE AUTOMOTIVE 4D IMAGING RADAR MARKET BY FREQUENCY (USD BILLION) 2020-2030

TABLE 94 ITALY AUTOMOTIVE 4D IMAGING RADAR MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 95 ITALY AUTOMOTIVE 4D IMAGING RADAR MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 96 ITALY AUTOMOTIVE 4D IMAGING RADAR MARKET BY RANGE (USD BILLION) 2020-2030

TABLE 97 ITALY AUTOMOTIVE 4D IMAGING RADAR MARKET BY FREQUENCY (USD BILLION) 2020-2030

TABLE 98 SPAIN AUTOMOTIVE 4D IMAGING RADAR MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 99 SPAIN AUTOMOTIVE 4D IMAGING RADAR MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 100 SPAIN AUTOMOTIVE 4D IMAGING RADAR MARKET BY RANGE (USD BILLION) 2020-2030

TABLE 101 SPAIN AUTOMOTIVE 4D IMAGING RADAR MARKET BY FREQUENCY (USD BILLION) 2020-2030

TABLE 102 RUSSIA AUTOMOTIVE 4D IMAGING RADAR MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 103 RUSSIA AUTOMOTIVE 4D IMAGING RADAR MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 104 RUSSIA AUTOMOTIVE 4D IMAGING RADAR MARKET BY RANGE (USD BILLION) 2020-2030

TABLE 105 RUSSIA AUTOMOTIVE 4D IMAGING RADAR MARKET BY FREQUENCY (USD BILLION) 2020-2030

TABLE 106 REST OF EUROPE AUTOMOTIVE 4D IMAGING RADAR MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 107 REST OF EUROPE AUTOMOTIVE 4D IMAGING RADAR MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 108 REST OF EUROPE AUTOMOTIVE 4D IMAGING RADAR MARKET BY RANGE (USD BILLION) 2020-2030

TABLE 109 REST OF EUROPE AUTOMOTIVE 4D IMAGING RADAR MARKET BY FREQUENCY (USD BILLION) 2020-2030

TABLE 110 MIDDLE EAST AND AFRICA AUTOMOTIVE 4D IMAGING RADAR MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 111 MIDDLE EAST AND AFRICA AUTOMOTIVE 4D IMAGING RADAR MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 112 MIDDLE EAST AND AFRICA AUTOMOTIVE 4D IMAGING RADAR MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 113 MIDDLE EAST AND AFRICA AUTOMOTIVE 4D IMAGING RADAR MARKET BY RANGE (USD BILLION) 2020-2030

TABLE 114 MIDDLE EAST AND AFRICA AUTOMOTIVE 4D IMAGING RADAR MARKET BY FREQUENCY (USD BILLION) 2020-2030

TABLE 115 UAE AUTOMOTIVE 4D IMAGING RADAR MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 116 UAE AUTOMOTIVE 4D IMAGING RADAR MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 117 UAE AUTOMOTIVE 4D IMAGING RADAR MARKET BY RANGE (USD BILLION) 2020-2030

TABLE 118 UAE AUTOMOTIVE 4D IMAGING RADAR MARKET BY FREQUENCY (USD BILLION) 2020-2030

TABLE 119 SAUDI ARABIA AUTOMOTIVE 4D IMAGING RADAR MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 120 SAUDI ARABIA AUTOMOTIVE 4D IMAGING RADAR MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 121 SAUDI ARABIA AUTOMOTIVE 4D IMAGING RADAR MARKET BY RANGE (USD BILLION) 2020-2030

TABLE 122 SAUDI ARABIA AUTOMOTIVE 4D IMAGING RADAR MARKET BY FREQUENCY (USD BILLION) 2020-2030

TABLE 123 SOUTH AFRICA AUTOMOTIVE 4D IMAGING RADAR MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 124 SOUTH AFRICA AUTOMOTIVE 4D IMAGING RADAR MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 125 SOUTH AFRICA AUTOMOTIVE 4D IMAGING RADAR MARKET BY RANGE (USD BILLION) 2020-2030

TABLE 126 SOUTH AFRICA AUTOMOTIVE 4D IMAGING RADAR MARKET BY FREQUENCY (USD BILLION) 2020-2030

TABLE 127 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE 4D IMAGING RADAR MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 128 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE 4D IMAGING RADAR MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

TABLE 129 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE 4D IMAGING RADAR MARKET BY RANGE (USD BILLION) 2020-2030

TABLE 130 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE 4D IMAGING RADAR MARKET BY FREQUENCY (USD BILLION) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL AUTOMOTIVE 4D IMAGING RADAR MARKET BY TYPE (USD BILLION) 2020-2030

FIGURE 9 GLOBAL AUTOMOTIVE 4D IMAGING RADAR MARKET BY VEHICLE TYPE (USD BILLION) 2020-2030

FIGURE 10 GLOBAL AUTOMOTIVE 4D IMAGING RADAR MARKET BY RANGE (USD BILLION) 2020-2030

FIGURE 11 GLOBAL AUTOMOTIVE 4D IMAGING RADAR MARKET BY FREQUENCY (USD BILLION) 2020-2030

FIGURE 12 GLOBAL AUTOMOTIVE 4D IMAGING RADAR MARKET BY REGION (USD BILLION) 2020-2030

FIGURE 13 PORTER’S FIVE FORCES MODEL

FIGURE 14 GLOBAL AUTOMOTIVE 4D IMAGING RADAR MARKET BY TYPE (USD BILLION) 2022

FIGURE 15 GLOBAL AUTOMOTIVE 4D IMAGING RADAR MARKET BY VEHICLE TYPE (USD BILLION) 2022

FIGURE 16 GLOBAL AUTOMOTIVE 4D IMAGING RADAR MARKET BY RANGE (USD BILLION) 2022

FIGURE 17 GLOBAL AUTOMOTIVE 4D IMAGING RADAR MARKET BY FREQUENCY (USD BILLION) 2022

FIGURE 18 GLOBAL AUTOMOTIVE 4D IMAGING RADAR MARKET BY REGION (USD BILLION) 2022

FIGURE 19 MARKET SHARE ANALYSIS

FIGURE 20 CONTINENTAL AG: COMPANY SNAPSHOT

FIGURE 21 ZF FRIEDRICHSHAFEN AG: COMPANY SNAPSHOT

FIGURE 22 ARBE ROBOTICS: COMPANY SNAPSHOT

FIGURE 23 APTIV: COMPANY SNAPSHOT

FIGURE 24 STERADIAN: COMPANY SNAPSHOT

FIGURE 25 VAYYAR IMAGING: COMPANY SNAPSHOT

FIGURE 26 INNOVIZ TECHNOLOGIES: COMPANY SNAPSHOT

FIGURE 27 OCULII: COMPANY SNAPSHOT

FIGURE 28 HELLA AGLAIA MOBILE VISION GMBH: COMPANY SNAPSHOT

FIGURE 29 SMART RADAR SYSTEMS: COMPANY SNAPSHOT

FIGURE 30 BLACKMORE SENSORS AND ANALYTICS: COMPANY SNAPSHOT

FIGURE 31 AINSTEIN: COMPANY SNAPSHOT

FIGURE 32 METAWAVE CORPORATION: COMPANY SNAPSHOT

FIGURE 33 TEXAS INSTRUMENTS: COMPANY SNAPSHOT

FIGURE 34 NXP SEMICONDUCTORS: COMPANY SNAPSHOT

FIGURE 35 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

FIGURE 36 XILINX: COMPANY SNAPSHOT

FIGURE 37 RADSEE: COMPANY SNAPSHOT

FIGURE 38 UHNDER: COMPANY SNAPSHOT

FIGURE 39 ZADAR LABS: COMPANY SNAPSHOT

DOWNLOAD FREE SAMPLE REPORT

License Type

SPEAK WITH OUR ANALYST

Want to know more about the report or any specific requirement?

WANT TO CUSTOMIZE THE REPORT?

Our Clients Speak

We asked them to research ‘ Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te

Yosuke Mitsui

Senior Associate Construction Equipment Sales & Marketing

We asked them to research ‘Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te