Base Year Value ()

CAGR ()

Forecast Year Value ()

Historical Data Period

Largest Region

Forecast Period

Impact Investing Market By Sector (Education, Agriculture, Healthcare, Energy, Housing, Others), By Investor (Individual Investors, Institutional Investor, Others) And Region, Global Trends And Forecast From 2022 To 2029

Instant access to hundreds of data points and trends

- Market estimates from 2014-2029

- Competitive analysis, industry segmentation, financial benchmarks

- Incorporates SWOT, Porter's Five Forces and risk management frameworks

- PDF report or online database with Word, Excel and PowerPoint export options

- 100% money back guarantee

Impact Investing Market Overview

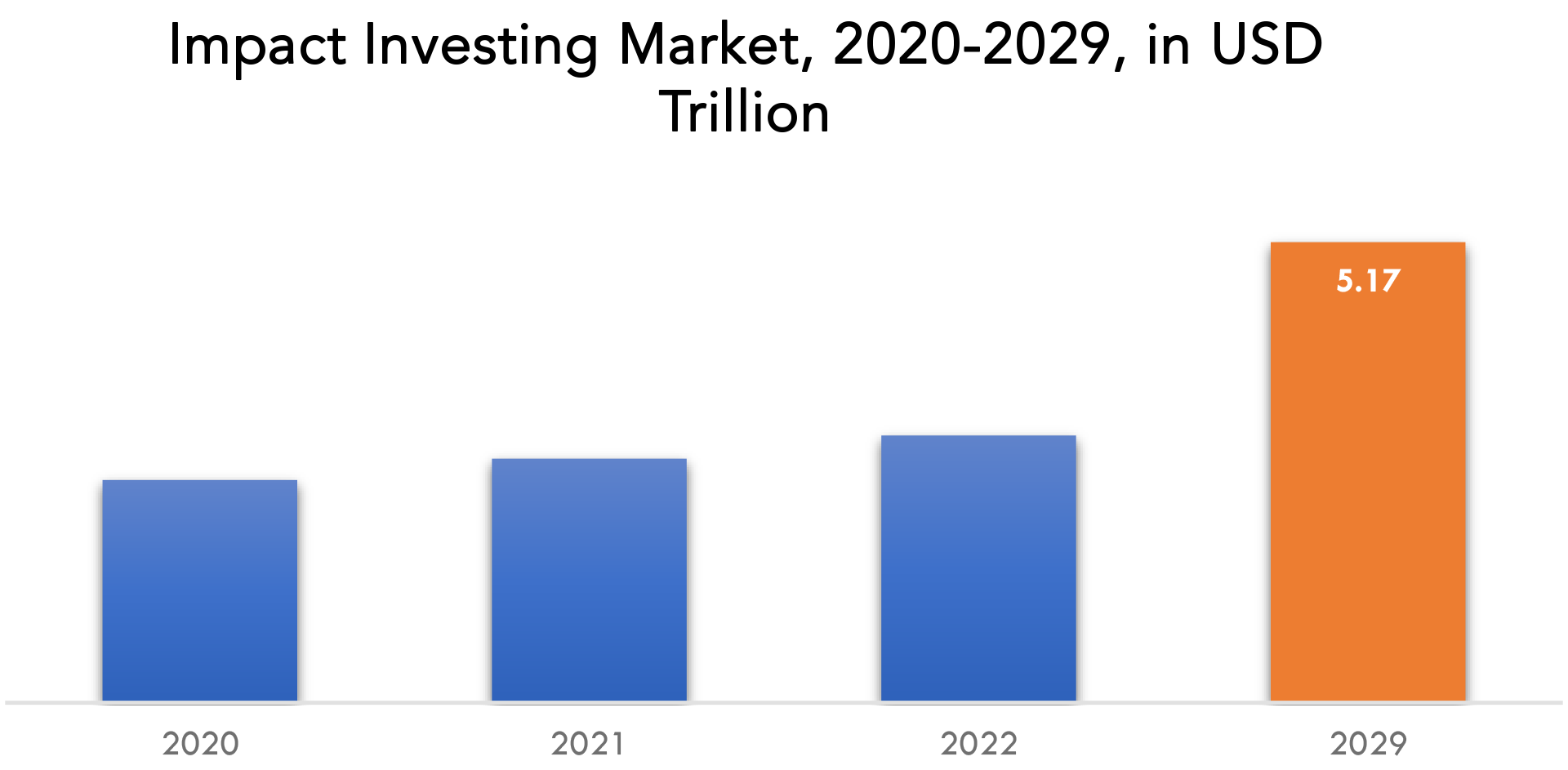

The impact investing market is expected to grow at 9.5% CAGR from 2022 to 2029. It is expected to reach above USD 5.17 trillion by 2029 from USD 2.5 trillion in 2020.

Impact investments are ones that aim to produce both a beneficial, quantifiable social and environmental benefit and a financial return. Impact investments can be done in both emerging and mature economies, and depending on the strategic objectives of the investor, they can aim for returns that range from below market to market rate. Impact investors assess their success in terms of both their financial gains and the favourable social or environmental consequences they contribute to.

The demand from investors seeking both financial returns and social or environmental impact is increasing, which is a major factor driving the market for impact investments. For example, investing in renewable energy can help reduce greenhouse gas emissions and mitigate climate change, while investing in affordable housing can help address the problem of homelessness. Also, a significant barrier to the growth of the impact investing business is the general public's and investors' low awareness of impact investing. On the other hand, it is anticipated that an increase in demand for impact investment products from high-net-worth individuals and institutional investors would create significant, lucrative potential for the market's expansion.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD TRILLION). |

| Segmentation | By Sector, By Investor, By Region |

| By Sector |

|

| By Investor |

|

| By Region |

|

Impact investing has been more popular in recent years as a result of an increase in investor desire for both financial returns and social or environmental effect. As a means of balancing their principles and financial objectives, impact investing is growing in popularity. Investments in community development projects, sustainable agriculture, affordable housing, and renewable energy projects are just a few examples of the numerous ways that impact investments can be made. These characteristics have influenced the market for impact investing's rising popularity and rising demand.

Impact investing can be difficult to achieve both financial returns and social or environmental effect since it entails juggling the requirement for profitability with the goal to provide beneficial social or environmental consequences. Products must be able to fulfil a variety of institutional needs, such as the capacity to take on sizable capital pools, sufficient liquidity, and strong risk management procedures, while also producing quantifiable returns and impact, in order for impact investing to scale. The social or environmental impact of an investment is also challenging to quantify, and impact measurement and reporting practices may not be uniform. As a result, one of the main factors impeding the expansion of the impact investing sector is the difficulties associated with generating both financial returns and social or environmental impact.

In recent years, high-net-worth individuals and institutional investors have increased their demand for impact investment products. Several variables, including the desire to link investments with values and impressions, the knowledge that impact investing has the ability to generate competitive financial returns, and the expanding accessibility of impact investment products and services, all contribute to this. High-net-worth individuals are also becoming more and more interested in impact investing due to they have the financial means to make sizable commitments and are frequently driven by the desire to have a positive social or environmental impact. Furthermore, due to they have a long-term investment horizon and a focus on sustainable and responsible investment methods, institutional investors like pension funds and endowments have been particularly active in impact finance. As a result, the rising demand for impact investment products from institutional investors and high-net-worth people is a good trend that will likely allow impact investing to be scaled up and lead to favourable social and environmental results.

The COVID-19 epidemic has had a substantial effect on the market for impact investing. On the one hand, the pandemic has made it clear how important it is to fund social and environmental initiatives, and it has increased interest in impact investing among investors looking to aid in the response to and recovery from the pandemic. Overall, the full effects of COVID-19 on the market for impact investing are still unknown, but they have undoubtedly presented opportunities and problems for these investors.

[caption id="attachment_21353" align="aligncenter" width="1920"]

Frequently Asked Questions

What is the worth of impact investing market?

The impact investing market is expected to grow at 9.5% CAGR from 2022 to 2029. It is expected to reach above USD 5.17 Trillion by 2029 from USD 2.5 Trillion in 2020.

What is the size of the North America impact investing industry?

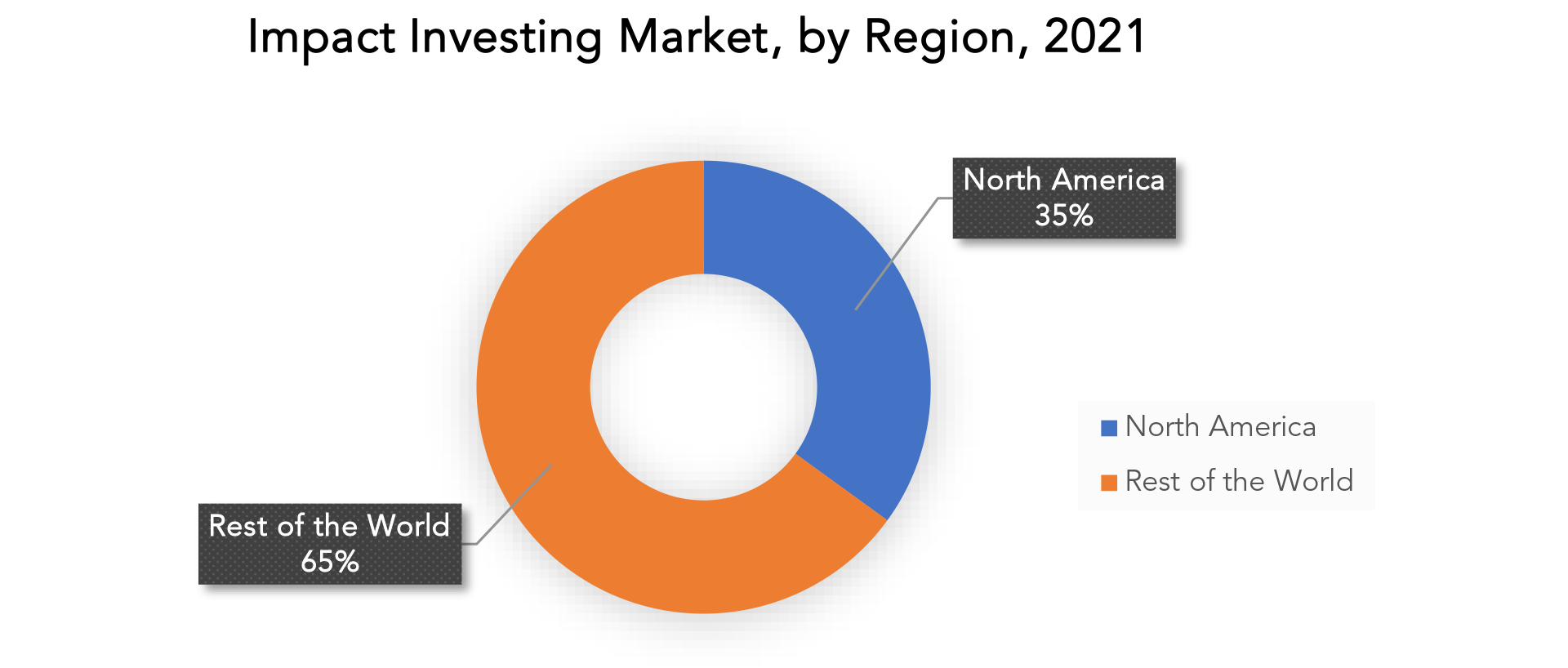

North America held more than 35% of the impact investing market revenue share in 2021 and will witness expansion in the forecast period.

What are some of the market's driving forces?

Impact investing has been more popular in recent years as a result of an increase in investor desire for both financial returns and social or environmental effect. As a means of balancing their principles and financial objectives, impact investing is growing in popularity. Investments in community development projects, sustainable agriculture, affordable housing, and renewable energy projects are just a few examples of the numerous ways that impact investments can be made.

Which are the top companies to hold the market share in impact investing market?

The impact investing market key players includes Acumen Fund, Inc., Intellecap Advisory Services Pvt. Ltd., LAVCA, Leapfrog Investments, Omidyar Network, Revolution Foods, Sarona Asset Management Inc, Triodos Bank N.V., Unitus, Vasham, Vestergaard Frandsen S.A., Waterhealth International.

What is the leading sector of impact investing market?

Education, agriculture, healthcare, energy, and housing are some specific sectors that are frequently taken into account in the impact investment market, which can be split by industry. Investments in businesses or initiatives that priorities expanding educational opportunities, raising educational attainment levels, and enhancing educational quality often fall under the category of impact investing in the education sector.

Which is the largest regional market for impact investing market?

North America had the impact investing market's greatest growth rate by region in 2021, thanks to growing investor interest in aligning their investments with social and environmental principles. The area has an established network of middlemen, impact investors, and businesses that are driven by social or environmental effect.

Impact Investing Market Segment Analysis

The impact investing market is segmented based on sector, investor and region. Education, agriculture, healthcare, energy, and housing are some specific sectors that are frequently taken into account in the impact investment market, which can be split by industry. Investments in businesses or initiatives that priorities expanding educational opportunities, raising educational attainment levels, and enhancing educational quality often fall under the category of impact investing in the education sector.

According to investor, the market for impact investment saw the highest growth sector in 2021 among institutional investors. Its development can be linked to institutional investors' growing desire to devote a portion of their holdings such as pension funds and endowments—to impact investments. Institutional investors are becoming more aware of the significance of social and environmental considerations when making investment decisions, and impact investments offer a means of generating both financial returns and social and environmental advantages.

[caption id="attachment_21362" align="aligncenter" width="1920"]

Impact Investing Market Key Players:

The impact investing market key players includes Acumen Fund, Inc., Intellecap Advisory Services Pvt. Ltd., LAVCA, Leapfrog Investments, Omidyar Network, Revolution Foods, Sarona Asset Management Inc, Triodos Bank N.V., Unitus, Vasham, Vestergaard Frandsen S.A., Waterhealth International.

Industry News: 16 December 2022: Regional Media Print Coverage of Intellecap and Transform Rural India Foundation’s launched the Climate Action Platform on 13th Dec with support of Jharkhand State Government 09 August 2022: Intellecap and Transform Rural India Foundation (TRIF) on Monday announced the launch of a national platform that will help Indian smallholder farmers leverage climate/carbon finance for sustainable agro-forestry, climate smart agriculture and other activities that can result in carbon sequestration and mitigation.Who Should Buy? Or Key Stakeholders

- Investors

- Fund Managers

- Social Enterprises

- Non-Governmental Organizations (NGOs)

- Impact Measurement and Verification Service Providers

- Academics and Researchers

- Advocacy Groups

- Regulatory Authorities

- Others

Impact investing Market Regional Analysis

The impact investing market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

North America had the impact investing market's greatest growth rate by region in 2021, thanks to growing investor interest in aligning their investments with social and environmental principles. The area has an established network of middlemen, impact investors, and businesses that are driven by social or environmental effect. On the other hand, it is anticipated that during the projected period, the Asia-Pacific area will have the fastest growth.

Given the enormous and quickly growing population, expanding middle class, and considerable development difficulties in the region, the Asia-Pacific region offers impact investors a significant potential to make a difference while earning excellent profits. As a result, in the years to come, impact investors are anticipated to concentrate more on the Asia-Pacific region.

Key Market Segments: Impact Investing Market

Impact Investing Market By Sector, 2020-2029, (USD Trillion).- Education

- Agriculture

- Healthcare

- Energy

- Housing

- Others

- Individual Investors

- Institutional Investor

- Others

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the impact investing market over the next 7 years?

- Who are the major players in the impact investing market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such As Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the impact investing market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the impact investing market?

- What is the current and forecasted size and growth rate of the global impact investing market?

- What are the key drivers of growth in the impact investing market?

- What are the distribution channels and supply chain dynamics in the impact investing market?

- What are the technological advancements and innovations in the impact investing market and their impact on form development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the impact investing market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the impact investing market?

- What are the services offerings and specifications of leading players in the market?

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL IMPACT INVESTING OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON IMPACT INVESTING MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL IMPACT INVESTING OUTLOOK

- GLOBAL IMPACT INVESTING MARKET BY SECTOR (USD TRILLION), 2020-2029

- EDUCATION

- AGRICULTURE

- HEALTHCARE

- ENERGY

- HOUSING

- OTHERS

- GLOBAL IMPACT INVESTING MARKET BY INVESTOR (USD TRILLION), 2020-2029

- INDIVIDUAL INVESTORS

- INSTITUTIONAL INVESTOR

- OTHERS

- GLOBAL IMPACT INVESTING MARKET BY REGION (USD TRILLION), 2020-2029

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- ACUMEN FUND, INC.

- INTELLECAP ADVISORY SERVICES PVT. LTD.

- LAVCA

- LEAPFROG INVESTMENTS

- OMIDYAR NETWORK

- REVOLUTION FOODS

- SARONA ASSET MANAGEMENT INC.

- TRIODOS BANK N.V.

- UNITUS

- VASHAM

- VESTERGAARD FRANDSEN S.A.

- WATERHEALTH INTERNATIONAL *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL IMPACT INVESTING MARKET BY SECTOR (USD TRILLION), 2020-2029

TABLE 2 GLOBAL IMPACT INVESTING MARKET BY INVESTOR (USD TRILLION), 2020-2029

TABLE 3 GLOBAL IMPACT INVESTING MARKET BY REGION (USD TRILLION), 2020-2029

TABLE 4 NORTH AMERICA IMPACT INVESTING MARKET BY SECTOR (USD TRILLION), 2020-2029

TABLE 5 NORTH AMERICA IMPACT INVESTING MARKET BY INVESTOR (USD TRILLION), 2020-2029

TABLE 6 NORTH AMERICA IMPACT INVESTING MARKET BY COUNTRY (USD TRILLION), 2020-2029

TABLE 7 US IMPACT INVESTING MARKET BY SECTOR (USD TRILLION), 2020-2029

TABLE 8 US IMPACT INVESTING MARKET BY INVESTOR (USD TRILLION), 2020-2029

TABLE 9 CANADA IMPACT INVESTING MARKET BY SECTOR (TRILLION), 2020-2029

TABLE 10 CANADA IMPACT INVESTING MARKET BY INVESTOR (USD TRILLION), 2020-2029

TABLE 11 MEXICO IMPACT INVESTING MARKET BY SECTOR (USD TRILLION), 2020-2029

TABLE 12 MEXICO IMPACT INVESTING MARKET BY INVESTOR (USD TRILLION), 2020-2029

TABLE 13 SOUTH AMERICA IMPACT INVESTING MARKET BY SECTOR (USD TRILLION), 2020-2029

TABLE 14 SOUTH AMERICA IMPACT INVESTING MARKET BY INVESTOR (USD TRILLION), 2020-2029

TABLE 15 SOUTH AMERICA IMPACT INVESTING MARKET BY COUNTRY (USD TRILLION), 2020-2029

TABLE 16 BRAZIL IMPACT INVESTING MARKET BY SECTOR (USD TRILLION), 2020-2029

TABLE 17 BRAZIL IMPACT INVESTING MARKET BY INVESTOR (USD TRILLION), 2020-2029

TABLE 18 ARGENTINA IMPACT INVESTING MARKET BY SECTOR (USD TRILLION), 2020-2029

TABLE 19 ARGENTINA IMPACT INVESTING MARKET BY INVESTOR (USD TRILLION), 2020-2029

TABLE 20 REST OF SOUTH AMERICA IMPACT INVESTING MARKET BY SECTOR (USD TRILLION), 2020-2029

TABLE 21 REST OF SOUTH AMERICA IMPACT INVESTING MARKET BY INVESTOR (USD TRILLION), 2020-2029

TABLE 22 ASIA -PACIFIC IMPACT INVESTING MARKET BY SECTOR (USD TRILLION), 2020-2029

TABLE 23 ASIA -PACIFIC IMPACT INVESTING MARKET BY INVESTOR (USD TRILLION), 2020-2029

TABLE 24 ASIA -PACIFIC IMPACT INVESTING MARKET BY COUNTRY (USD TRILLION), 2020-2029

TABLE 25 INDIA IMPACT INVESTING MARKET BY SECTOR (USD TRILLION), 2020-2029

TABLE 26 INDIA IMPACT INVESTING MARKET BY INVESTOR (USD TRILLION), 2020-2029

TABLE 27 CHINA IMPACT INVESTING MARKET BY SECTOR (USD TRILLION), 2020-2029

TABLE 28 CHINA IMPACT INVESTING MARKET BY INVESTOR (USD TRILLION), 2020-2029

TABLE 29 JAPAN IMPACT INVESTING MARKET BY SECTOR (USD TRILLION), 2020-2029

TABLE 30 JAPAN IMPACT INVESTING MARKET BY INVESTOR (USD TRILLION), 2020-2029

TABLE 31 SOUTH KOREA IMPACT INVESTING MARKET BY SECTOR (USD TRILLION), 2020-2029

TABLE 32 SOUTH KOREA IMPACT INVESTING MARKET BY INVESTOR (USD TRILLION), 2020-2029

TABLE 33 AUSTRALIA IMPACT INVESTING MARKET BY SECTOR (USD TRILLION), 2020-2029

TABLE 34 AUSTRALIA HYBRID FUNCTIONBY INVESTOR (USD TRILLION), 2020-2029

TABLE 35 AUSTRALIA IMPACT INVESTING MARKET BY FUNCTION (USD TRILLION), 2020-2029

TABLE 36 AUSTRALIA IMPACT INVESTING MARKET BY ORGANIZATION SIZE (USD TRILLION), 2020-2029

TABLE 37 REST OF ASIA PACIFIC IMPACT INVESTING MARKET BY SECTOR (USD TRILLION), 2020-2029

TABLE 38 REST OF ASIA PACIFIC HYBRID FUNCTIONBY INVESTOR (USD TRILLION), 2020-2029

TABLE 39 EUROPE IMPACT INVESTING MARKET BY SECTOR (USD TRILLION), 2020-2029

TABLE 40 EUROPE IMPACT INVESTING MARKET BY INVESTOR (USD TRILLION), 2020-2029

TABLE 41 EUROPE IMPACT INVESTING MARKET BY COUNTRY (USD TRILLION), 2020-2029

TABLE 42 GERMANY IMPACT INVESTING MARKET BY SECTOR (USD TRILLION), 2020-2029

TABLE 43 GERMANY IMPACT INVESTING MARKET BY INVESTOR (USD TRILLION), 2020-2029

TABLE 44 UK IMPACT INVESTING MARKET BY SECTOR (USD TRILLION), 2020-2029

TABLE 45 UK IMPACT INVESTING MARKET BY INVESTOR (USD TRILLION), 2020-2029

TABLE 46 FRANCE IMPACT INVESTING MARKET BY SECTOR (USD TRILLION), 2020-2029

TABLE 47 FRANCE IMPACT INVESTING MARKET BY INVESTOR (USD TRILLION), 2020-2029

TABLE 48 ITALY IMPACT INVESTING MARKET BY SECTOR (USD TRILLION), 2020-2029

TABLE 49 ITALY IMPACT INVESTING MARKET BY INVESTOR (USD TRILLION), 2020-2029

TABLE 50 SPAIN IMPACT INVESTING MARKET BY SECTOR (USD TRILLION), 2020-2029

TABLE 51 SPAIN IMPACT INVESTING MARKET BY INVESTOR (USD TRILLION), 2020-2029

TABLE 52 REST OF EUROPE IMPACT INVESTING MARKET BY SECTOR (USD TRILLION), 2020-2029

TABLE 53 REST OF EUROPE IMPACT INVESTING MARKET BY INVESTOR (USD TRILLION), 2020-2029

TABLE 54 MIDDLE EAST AND AFRICA IMPACT INVESTING MARKET BY SECTOR (USD TRILLION), 2020-2029

TABLE 55 MIDDLE EAST AND AFRICA IMPACT INVESTING MARKET BY INVESTOR (USD TRILLION), 2020-2029

TABLE 56 MIDDLE EAST AND AFRICA IMPACT INVESTING MARKET BY COUNTRY (USD TRILLION), 2020-2029

TABLE 57 UAE IMPACT INVESTING MARKET BY SECTOR (USD TRILLION), 2020-2029

TABLE 58 UAE IMPACT INVESTING MARKET BY INVESTOR (USD TRILLION), 2020-2029

TABLE 59 SOUTH AFRICA IMPACT INVESTING MARKET BY SECTOR (USD TRILLION), 2020-2029

TABLE 60 SOUTH AFRICA IMPACT INVESTING MARKET BY INVESTOR (USD TRILLION), 2020-2029

TABLE 61 REST OF MIDDLE EAST AND AFRICA IMPACT INVESTING MARKET BY SECTOR (USD TRILLION), 2020-2029

TABLE 62 REST OF MIDDLE EAST AND AFRICA IMPACT INVESTING MARKET BY INVESTOR (USD TRILLION), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL IMPACT INVESTING MARKET BY SECTOR, USD TRILLION, 2020-2029

FIGURE 9 GLOBAL IMPACT INVESTING MARKET BY INVESTOR, USD TRILLION, 2020-2029

FIGURE 10 GLOBAL IMPACT INVESTING MARKET BY REGION, USD TRILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL IMPACT INVESTING MARKET BY SECTOR, USD TRILLION, 2021

FIGURE 13 GLOBAL IMPACT INVESTING MARKET BY INVESTOR, USD TRILLION, 2021

FIGURE 14 GLOBAL IMPACT INVESTING MARKET BY REGION, USD TRILLION, 2021

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 ACUMEN FUND, INC.: COMPANY SNAPSHOT

FIGURE 17 INTELLECAP ADVISORY SERVICES PVT. LTD.: COMPANY SNAPSHOT

FIGURE 18 LAVCA: COMPANY SNAPSHOT

FIGURE 19 LEAPFROG INVESTMENTS: COMPANY SNAPSHOT

FIGURE 20 OMIDYAR NETWORK: COMPANY SNAPSHOT

FIGURE 21 REVOLUTION FOODS: COMPANY SNAPSHOT

FIGURE 22 SARONA ASSET MANAGEMENT INC: COMPANY SNAPSHOT

FIGURE 23 TRIODOS BANK N.V.: COMPANY SNAPSHOT

FIGURE 24 UNITUS: COMPANY SNAPSHOT

FIGURE 25 VASHAM: COMPANY SNAPSHOT

FIGURE 26 VESTERGAARD FRANDSEN S.A.: COMPANY SNAPSHOT

FIGURE 27 WATERHEALTH INTERNATIONAL: COMPANY SNAPSHOT

DOWNLOAD FREE SAMPLE REPORT

License Type

SPEAK WITH OUR ANALYST

Want to know more about the report or any specific requirement?

WANT TO CUSTOMIZE THE REPORT?

Our Clients Speak

We asked them to research ‘ Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te

Yosuke Mitsui

Senior Associate Construction Equipment Sales & Marketing

We asked them to research ‘Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te