Base Year Value ()

CAGR ()

Forecast Year Value ()

Historical Data Period

Largest Region

Forecast Period

Autosamplers Market by Product Type (Systems, Accessories) End User (Pharmaceutical and Biopharmaceutical Industry, Oil and Gas Industry, Environmental Testing Laboratory, Food & Beverage Industry, Other End Users) and Region, Global Trends and Forecast from 2023 to 2030

Instant access to hundreds of data points and trends

- Market estimates from 2014-2029

- Competitive analysis, industry segmentation, financial benchmarks

- Incorporates SWOT, Porter's Five Forces and risk management frameworks

- PDF report or online database with Word, Excel and PowerPoint export options

- 100% money back guarantee

Autosamplers Market Overview

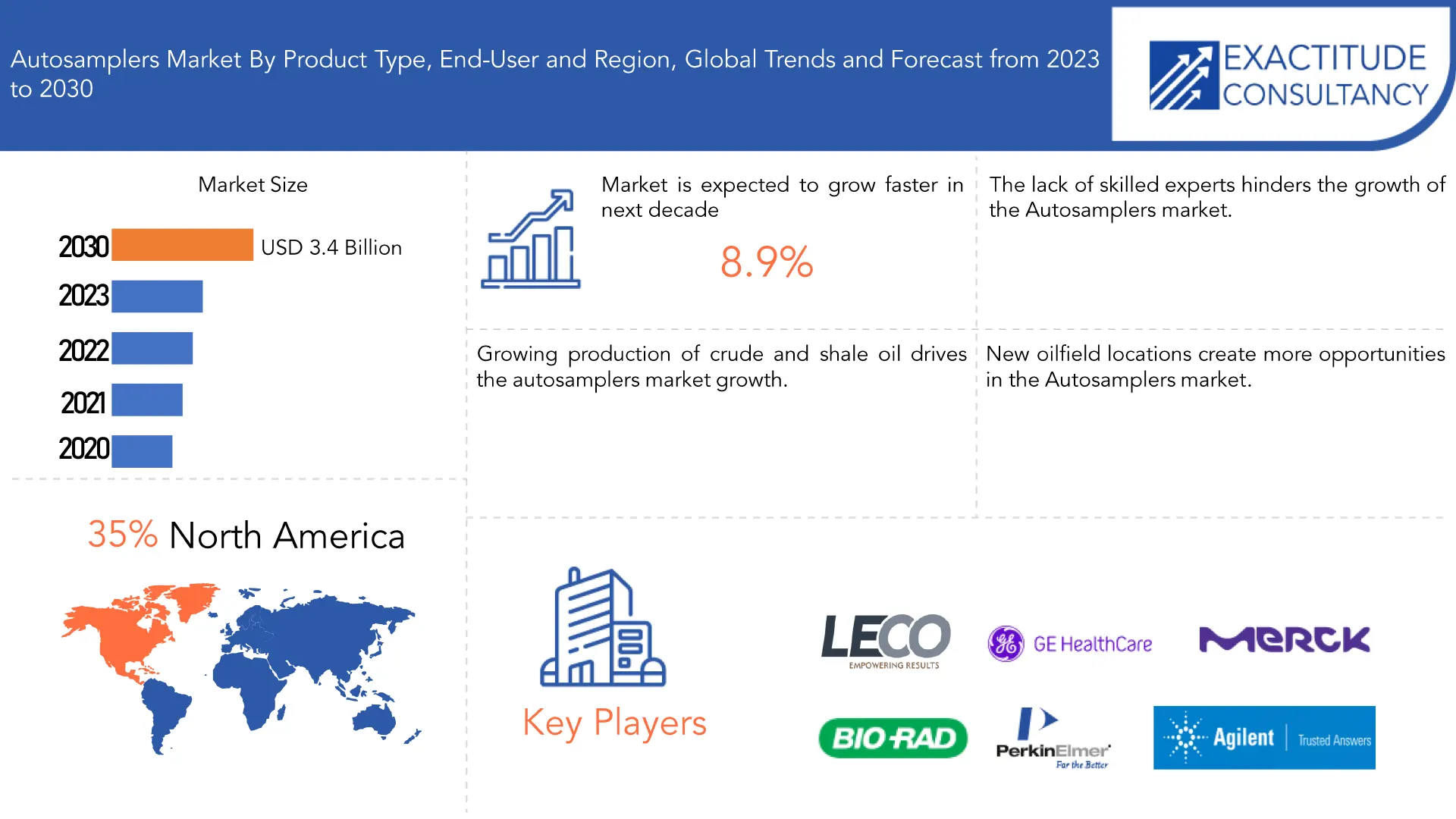

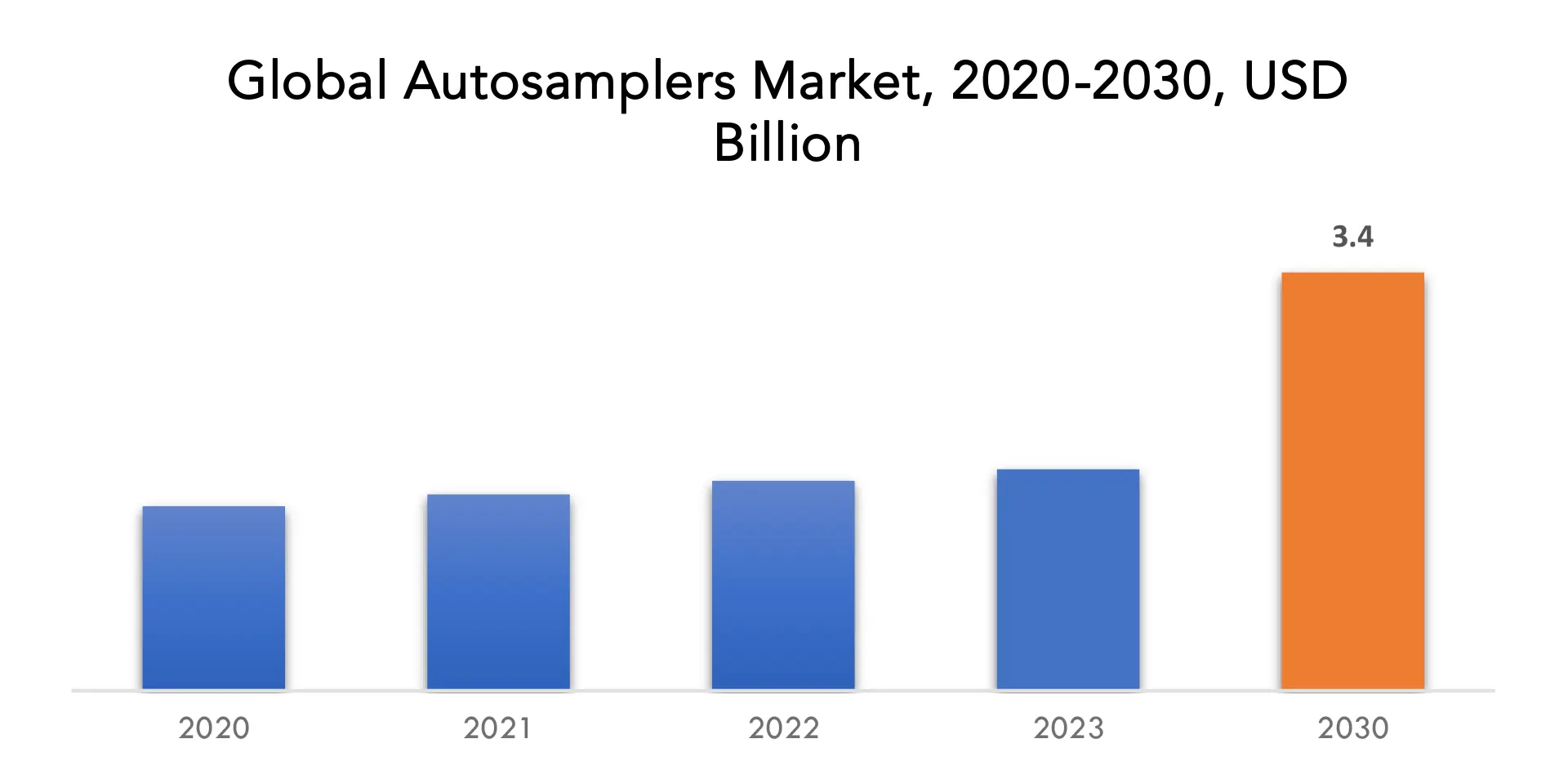

The autosamplers market is expected to grow at 8.9 % CAGR from 2023 to 2030. It is expected to reach above USD 3.4 billion by 2030 from USD 1.8 billion in 2023.

Autosamplers are devices used in analytical chemistry to automate the injection of samples into instruments such as gas chromatographs (GC) and liquid chromatography (LC). They are designed to improve the efficiency, accuracy, and precision of sample introduction in analytical workflows. The primary purpose of an autosampler is to increase sample throughput by automating the sample introduction process. Instead of manually injecting samples one by one, an autosampler can automatically draw and inject multiple samples sequentially, allowing for unattended operation and continuous analysis. Autosamplers are typically equipped with a sample tray or carousel that holds a series of vials or containers containing the samples. The tray can accommodate a large number of samples, allowing for high sample throughput. The autosampler extracts the required volume of each sample and injects it into the chromatographic instrument.

Autosamplers enable continuous and unattended operation, significantly increasing the efficiency and productivity of analytical laboratories. They can run samples overnight or during weekends, optimizing instrument utilization. By automating the injection process, autosamplers ensure consistent and reproducible sample volumes and injection rates, leading to improved accuracy and precision in analytical results. This reduces variability and enhances data reliability. Autosamplers minimize sample exposure to the environment, reducing the risk of contamination or degradation. Samples are sealed in vials or containers until injection, preserving their integrity and ensuring accurate analysis. Autosamplers often integrate with laboratory information management systems (LIMS) or sample tracking software, allowing for efficient sample tracking, identification, and data management. This enhances traceability and simplifies result interpretation. Autosamplers can accommodate different sample types and volumes, ranging from microliters to milliliters. They offer flexibility in sample handling and injection techniques, including options for temperature control, derivatization, and solid-phase microextraction (SPME). By automating sample injection, autosamplers minimize the potential for human errors associated with manual sample handling, ensuring consistent and reliable results.

[caption id="attachment_30026" align="aligncenter" width="1077"]

There is a rising demand for automation in analytical laboratories to improve productivity, reduce human errors, and streamline workflows. Autosamplers offer a solution by automating the sample introduction process, allowing for unattended operation and increased sample throughput. This automation helps laboratories achieve higher efficiency and productivity, leading to increased adoption of autosamplers. Autosamplers offer cost and time savings by improving operational efficiency in laboratories. They reduce manual labor, minimize sample handling steps, and allow for unattended operation, which leads to significant time savings. Additionally, autosamplers help optimize instrument utilization by running samples overnight or during periods of low staff presence, maximizing the productivity of expensive analytical instruments. Industries such as pharmaceuticals, environmental monitoring, and food safety are subject to stringent regulatory requirements. Autosamplers facilitate compliance by ensuring accurate and consistent sample injection, traceability, and data management. They help laboratories meet regulatory standards and requirements, driving the adoption of autosamplers in these industries. Autosampler manufacturers are continuously investing in research and development to introduce innovative features and functionalities. These advancements include improvements in sample handling, injection precision, software integration, and compatibility with a wide range of instruments. The availability of advanced autosampler technologies attracts customers looking for enhanced performance, driving market growth.

Overall, the increasing demand for automation, improved data accuracy, the complexity of analytical techniques, cost and time savings, regulatory compliance requirements, and technological advancements contribute to the growth of the autosamplers market. As analytical laboratories seek to optimize their operations and achieve higher efficiency and accuracy, the adoption of autosamplers is expected to continue to rise.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) |

| Segmentation | By Product Type, By End-Users, and By Region. |

| By Product Type

|

|

| By End-User

|

|

| By Region

|

|

Frequently Asked Questions

• What is the worth of the Autosamplers market?

The Autosamplers market is expected to grow at 8.9 % CAGR from 2023 to 2030. It is expected to reach above USD 3.4 billion by 2030 from USD 1.8 billion in 2023.

• What is the size of the North American autosamplers industry?

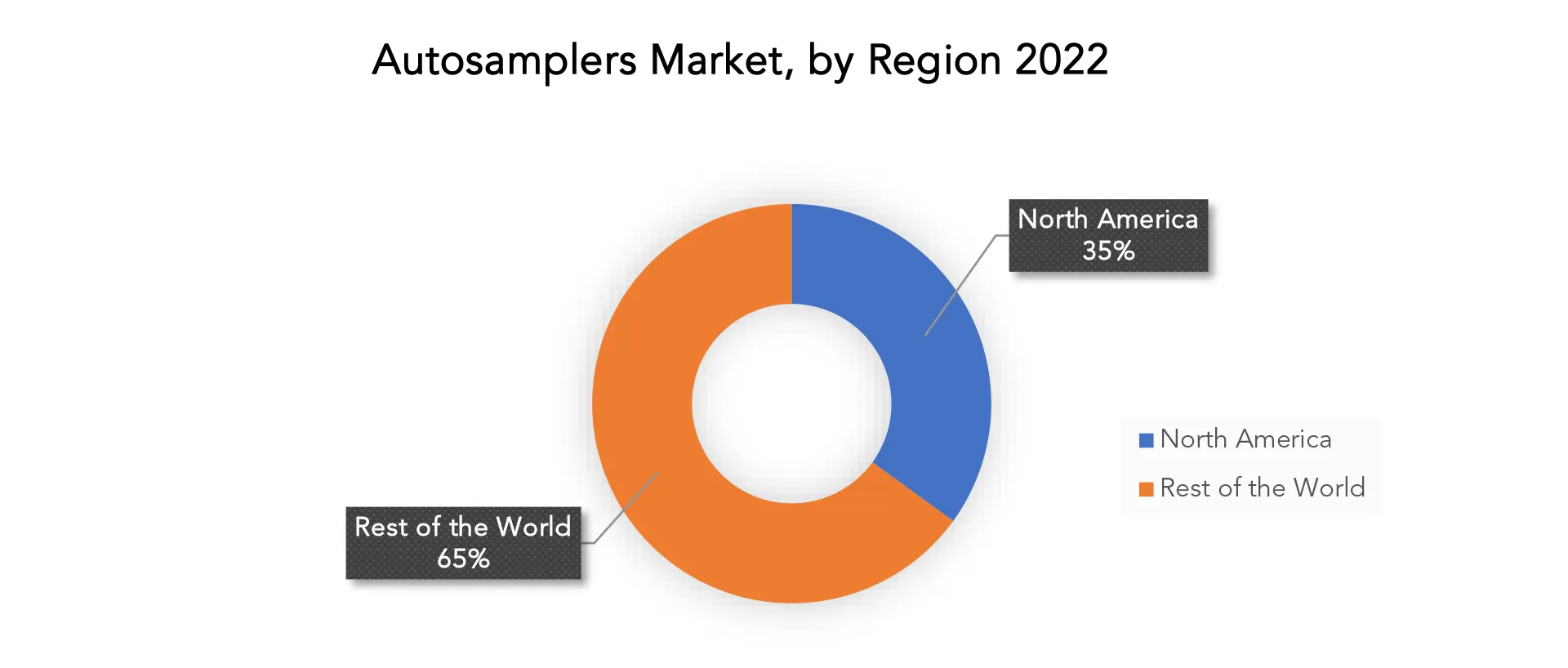

North America held more than 35% of the autosamplers market revenue share in 2022 and will witness expansion in the forecast period.

• What are some of the market's driving forces?

Growing production of crude and shale oil, and rising food safety concerns helps to people with the autosamplers market growth.

• What are the opportunities in the Autosamplers market?

New Oilfield Locations create more opportunities in the autosamplers market.

Autosamplers Market Segment Analysis

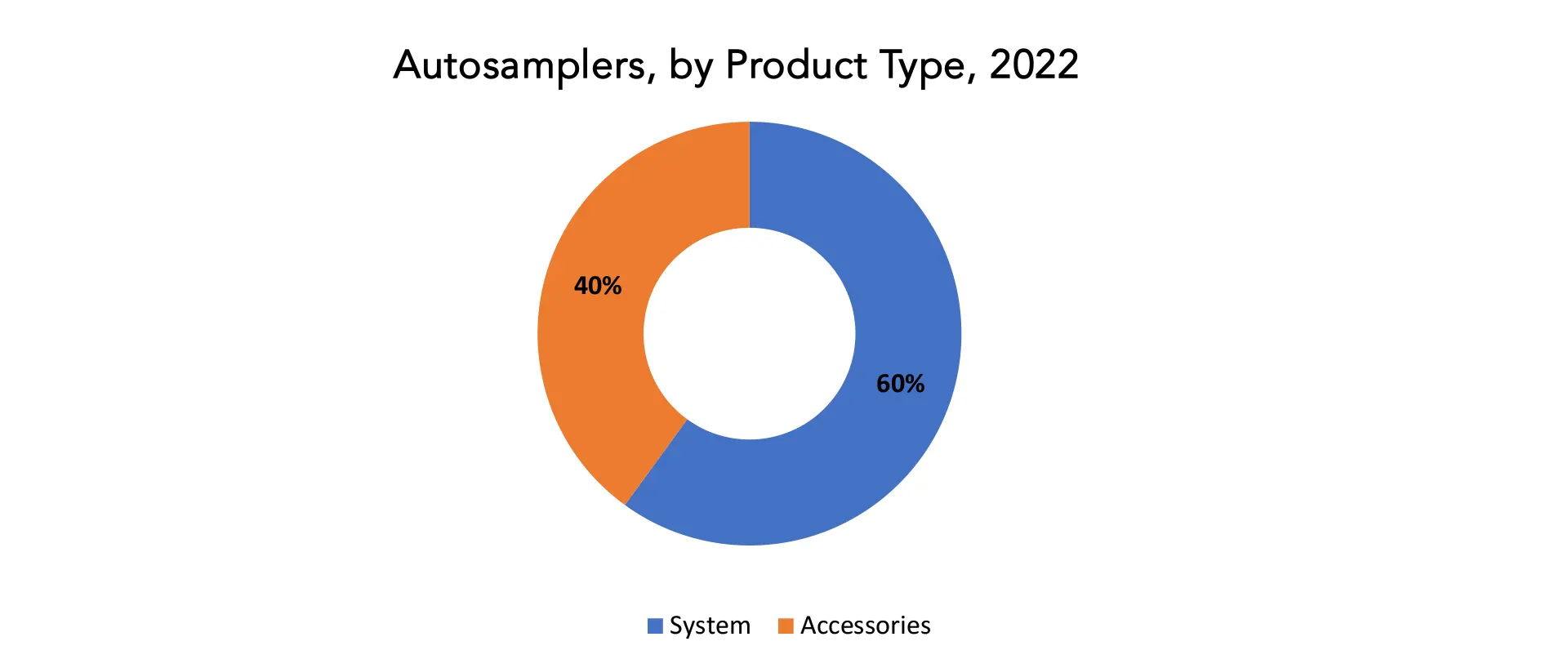

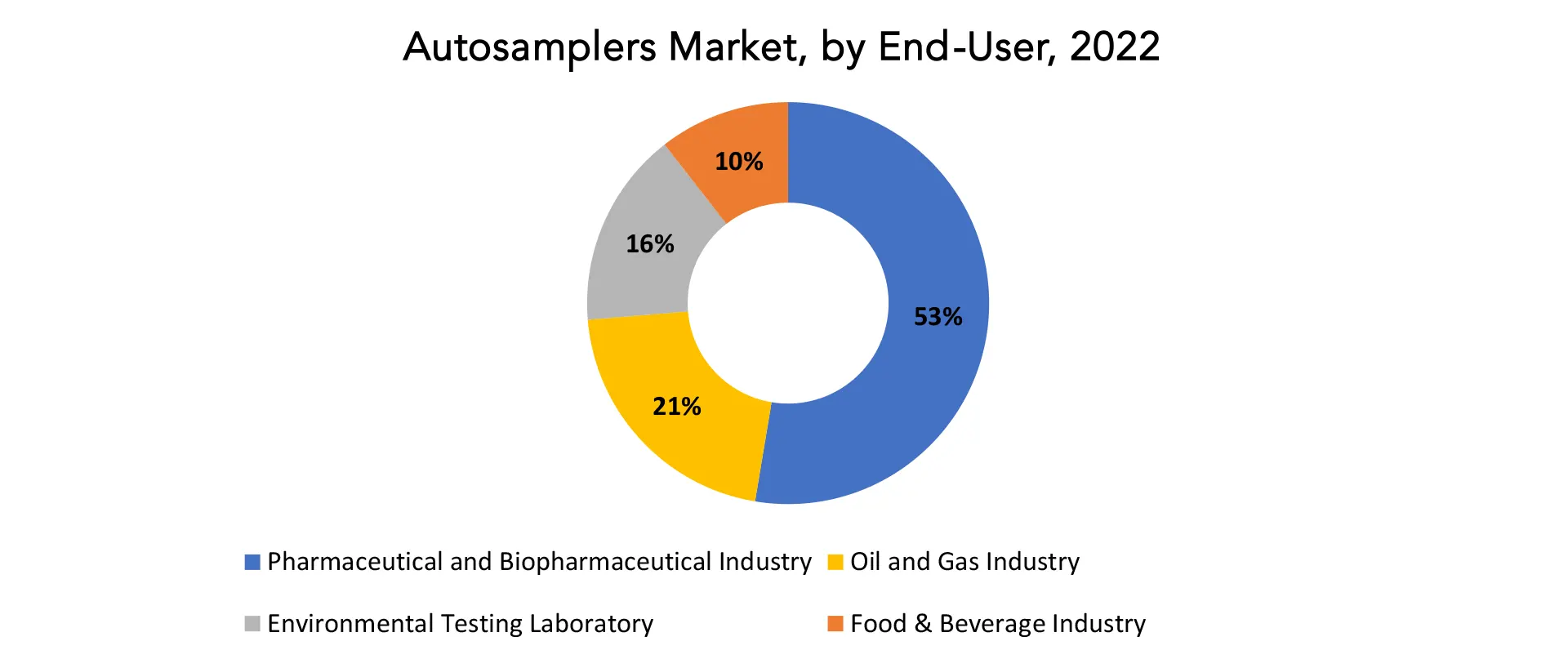

The autosamplers market is segmented based on product type, end-user, and region. Based on product type the market is bifurcated into systems and accessories. Based on the end-use industry market is bifurcated into the pharmaceutical and biopharmaceutical industry, oil and gas industry, environmental testing laboratory, food & beverage industry, and other end users. Based on product type system segment dominating in the autosamplers market. The system segment includes autosamplers that are specifically designed and integrated with chromatography systems, such as gas chromatographs (GC) and liquid chromatography (LC). These autosamplers are developed by manufacturers to seamlessly integrate with their own chromatography instruments, ensuring compatibility and optimal performance. This integration offers a cohesive and efficient workflow solution for customers, simplifying instrument setup and operation. Autosamplers integrated with chromatography systems often offer enhanced functionality and features that are tailored to the specific requirements of chromatographic analysis. They may include advanced injection techniques, precise sample handling, temperature control, multiple injection modes, and software integration. These features improve the overall performance and flexibility of the chromatography system, making it a preferred choice for customers. Autosamplers integrated with chromatography systems enable a seamless workflow from sample introduction to data acquisition and analysis. The autosampler can be controlled through the same software platform as the chromatography instrument, allowing for unified operation, data management, and result interpretation. This integration simplifies the laboratory workflow, reduces manual intervention, and enhances overall productivity. Autosamplers developed by chromatography system manufacturers are specifically optimized and tested for compatibility with their instruments. This ensures optimal performance, reliability, and precision in sample introduction. Customers often prefer autosamplers that are validated and recommended by the chromatography system manufacturer to ensure seamless integration and to leverage the technical support and expertise provided by the manufacturer. Overall, the dominance of the system segment in the autosamplers market is driven by the benefits of integrated solutions, enhanced functionality, seamless workflow, instrument compatibility and optimization, market consolidation, and customer preference for trusted brands. [caption id="attachment_30050" align="aligncenter" width="1920"]

Autosamplers market player

The Autosamplers market key players include Agilent, Waters, Shimadzu, Thermo Fisher, PerkinElmer, Merck, GE Healthcare, Bio-Rad, LECO, Restek, Gilson, JASCO, SCION, HTA srl, Falcon. Recent Development : In May 2022, Agilent Technologies Inc. and APC Ltd. agreed to collaborate on integrating their technologies to provide customers with specialized workflows that enable automated process analysis utilizing liquid chromatography (LC). In February 2022: Thermo Scientific allegedly launched its SureStart range of consumables for mass spectrometry and chromatography. Caps, vials, inserts, kits, healthy plates, and mats are among the various items offered by this line. Analysts can use the extended portfolio despite the instrument manufacturer as all add-ons and chromatography autosamplers are compatible with the SureStart product line.Who Should Buy? Or Key Stakeholders

- Pharmaceutical Industry

- Investors

- Oil and Gas Industry

- Autosamplers manufacturers, suppliers, and providers

- Academic Research

- Food & Beverage Industry

- Government Organization

- Environment protection agencies and institutes

- Others

Autosamplers Market Regional Analysis

The Autosamplers market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

Key Market Segments: Autosamplers Market

Autosamplers Market by Product Type, 2020-2030, (USD Billion)- Systems

- LC Autosamplers

- GC Autosamplers

- Liquid Autosamplers

- Headspace Autosamplers

- All-In-One Autosamplers

- Accessories

- Syringes & Needles

- Vials

- Septum

- Pharmaceutical and Biopharmaceutical Industry

- Oil and Gas Industry

- Environmental Testing Laboratory

- Food & Beverage Industry

- Other End Users

- North America

- Asia Pacific

- Europe

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the autosamplers market over the next 7 years?

- Who are the major players in the autosamplers market and what is their market share?

- What are the end-user industries driving demand for the market and what is their outlook?

- What are the opportunities for growth in emerging markets such as asia-pacific, middle east, and africa?

- How is the economic environment affecting the autosamplers market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the autosamplers market?

- What is the current and forecasted size and growth rate of the global autosamplers market?

- What are the key drivers of growth in the autosamplers market?

- What are the distribution channels and supply chain dynamics in the autosamplers market?

- What are the technological advancements and innovations in the autosamplers market and their impact on device development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the autosamplers market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the autosamplers market?

- What are the products offerings and specifications of leading players in the market?

- What is the pricing trend of autosamplers in the market and what is the impact of raw device prices on the price trend?

Exactitude Consultancy Services Key Objectives

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL AUTOSAMPLERS OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON AUTOSAMPLERS MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL AUTOSAMPLERS OUTLOOK

- GLOBAL AUTOSAMPLERS MARKET BY PRODUCT TYPE 2020-2030, (USD BILLION)

- SYSTEMS

- LC AUTOSAMPLERS

- GC AUTOSAMPLERS

- SYSTEMS

5.1.2.1. LIQUID AUTOSAMPLERS

5.1.2.2. HEADSPACE AUTOSAMPLERS

5.1.2.3. ALL-IN-ONE AUTOSAMPLERS

- ACCESSORIES

- SYRINGES & NEEDLES

- VIALS

- SEPTUM

- GLOBAL AUTOSAMPLERS MARKET BY END-USER, 2020-2030, (USD BILLION)

- PHARMACEUTICAL AND BIOPHARMACEUTICAL INDUSTRY

- OIL AND GAS INDUSTRY

- ENVIRONMENTAL TESTING LABORATORY

- FOOD & BEVERAGE INDUSTRY

- OTHER END USERS

- GLOBAL AUTOSAMPLERS MARKET BY REGION, 2020-2030, (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- AGILENT

- WATERS

- SHIMADZU

- THERMO FISHER

- PERKINELMER

- MERCK

- GE HEALTHCARE

- BIO-RAD

- LECO

- RESTEK *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL AUTOSAMPLERS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 2 GLOBAL AUTOSAMPLERS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 3 GLOBAL AUTOSAMPLERS MARKET BY REGION (USD BILLION) 2020-2030

TABLE 4 NORTH AMERICA AUTOSAMPLERS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 5 NORTH AMERICA AUTOSAMPLERS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 6 NORTH AMERICA AUTOSAMPLERS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 7 US AUTOSAMPLERS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 8 US AUTOSAMPLERS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 9 CANADA AUTOSAMPLERS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 10 CANADA AUTOSAMPLERS MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 11 MEXICO AUTOSAMPLERS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 12 MEXICO AUTOSAMPLERS MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 13 REST OF NORTH AMERICA AUTOSAMPLERS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 14 REST OF NORTH AMERICA AUTOSAMPLERS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 15 SOUTH AMERICA AUTOSAMPLERS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 16 SOUTH AMERICA AUTOSAMPLERS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 17 SOUTH AMERICA AUTOSAMPLERS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 18 BRAZIL AUTOSAMPLERS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 19 BRAZIL AUTOSAMPLERS MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 20 ARGENTINA AUTOSAMPLERS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 21 ARGENTINA AUTOSAMPLERS MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 22 COLOMBIA AUTOSAMPLERS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 23 COLOMBIA AUTOSAMPLERS MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 24 REST OF SOUTH AMERICA AUTOSAMPLERS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 25 REST OF SOUTH AMERICA AUTOSAMPLERS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 26 ASIA-PACIFIC AUTOSAMPLERS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 27 ASIA-PACIFIC AUTOSAMPLERS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 28 ASIA-PACIFIC AUTOSAMPLERS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 29 INDIA AUTOSAMPLERS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 30 INDIA AUTOSAMPLERS MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 31 CHINA AUTOSAMPLERS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 32 CHINA AUTOSAMPLERS MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 33 JAPAN AUTOSAMPLERS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 34 JAPAN AUTOSAMPLERS MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 35 SOUTH KOREA AUTOSAMPLERS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 36 SOUTH KOREA AUTOSAMPLERS MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 37 AUSTRALIA AUTOSAMPLERS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 38 AUSTRALIA AUTOSAMPLERS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 39 SOUTH-EAST ASIA AUTOSAMPLERS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 40 SOUTH-EAST ASIA AUTOSAMPLERS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 41 REST OF THE ASIA PACIFIC AUTOSAMPLERS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 42 REST OF ASIA PACIFIC AUTOSAMPLERS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 43 EUROPE AUTOSAMPLERS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 44 EUROPE AUTOSAMPLERS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 45 EUROPE AUTOSAMPLERS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 46 GERMANY AUTOSAMPLERS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 47 GERMANY AUTOSAMPLERS MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 48 UK AUTOSAMPLERS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 49 UK AUTOSAMPLERS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 50 FRANCE AUTOSAMPLERS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 51 FRANCE AUTOSAMPLERS MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 52 ITALY AUTOSAMPLERS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 53 ITALY AUTOSAMPLERS MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 54 SPAIN AUTOSAMPLERS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 55 SPAIN AUTOSAMPLERS MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 56 RUSSIA AUTOSAMPLERS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 57 RUSSIA AUTOSAMPLERS MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 58 REST OF EUROPE AUTOSAMPLERS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 59 REST OF EUROPE AUTOSAMPLERS MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 60 MIDDLE EAST AND AFRICA AUTOSAMPLERS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 61 MIDDLE EAST AND AFRICA AUTOSAMPLERS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 62 MIDDLE EAST AND AFRICA AUTOSAMPLERS MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 63 UAE AUTOSAMPLERS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 64 UAE AUTOSAMPLERS MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 65 SAUDI ARABIA AUTOSAMPLERS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 66 SAUDI ARABIA AUTOSAMPLERS MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 67 SOUTH AFRICA AUTOSAMPLERS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 68 SOUTH AFRICA AUTOSAMPLERS MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 69 REST OF THE MIDDLE EAST AND AFRICA AUTOSAMPLERS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 70 REST OF THE MIDDLE EAST AND AFRICA AUTOSAMPLERS MARKET BY END-USER (USD BILLION) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL AUTOSAMPLERS MARKET BY PRODUCT TYPE, USD BILLION, 2020-2030

FIGURE 9 GLOBAL AUTOSAMPLERS MARKET BY END-USER, USD BILLION, 2020-2030

FIGURE 10 GLOBAL AUTOSAMPLERS MARKET BY REGION, USD BILLION, 2020-2030

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL AUTOSAMPLERS MARKET BY PRODUCT TYPE, USD BILLION, 2022

FIGURE 13 GLOBAL AUTOSAMPLERS MARKET BY END-USER, USD BILLION, 2022

FIGURE 14 GLOBAL AUTOSAMPLERS MARKET BY REGION, USD BILLION, 2022

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 AGILENT: COMPANY SNAPSHOT

FIGURE 17 GLASSES OF WATER: COMPANY SNAPSHOT

FIGURE 18 SHIMADZU: COMPANY SNAPSHOT

FIGURE 19 THERMO FISHER: COMPANY SNAPSHOT

FIGURE 20 PERKINELMER: COMPANY SNAPSHOT

FIGURE 21 MERCK: COMPANY SNAPSHOT

FIGURE 22 GE HEALTHCARE: COMPANY SNAPSHOT

FIGURE 23 BIO-RAD: COMPANY SNAPSHOT

FIGURE 24. LECO: COMPANY SNAPSHOT

FIGURE 25 RESTEK: COMPANY SNAPSHOT

DOWNLOAD FREE SAMPLE REPORT

License Type

SPEAK WITH OUR ANALYST

Want to know more about the report or any specific requirement?

WANT TO CUSTOMIZE THE REPORT?

Our Clients Speak

We asked them to research ‘ Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te

Yosuke Mitsui

Senior Associate Construction Equipment Sales & Marketing

We asked them to research ‘Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te