Base Year Value ()

CAGR ()

Forecast Year Value ()

Historical Data Period

Largest Region

Forecast Period

Polyolefin Catalyst Market by Classification (Polypropylene, Polyethylene), Catalyst (Ziegler-Natta, Single Site Catalyst, Chromium, Other), Application (Blow Molding, Film, Fiber, Injection Molding, Others) and Region, Global trends and forecast from 2022 to 2029

Instant access to hundreds of data points and trends

- Market estimates from 2014-2029

- Competitive analysis, industry segmentation, financial benchmarks

- Incorporates SWOT, Porter's Five Forces and risk management frameworks

- PDF report or online database with Word, Excel and PowerPoint export options

- 100% money back guarantee

Polyolefin Catalyst Market Overview

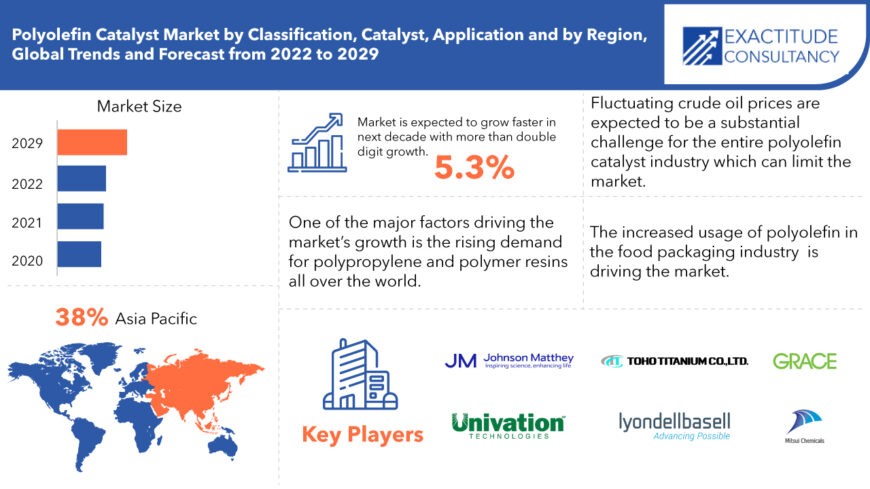

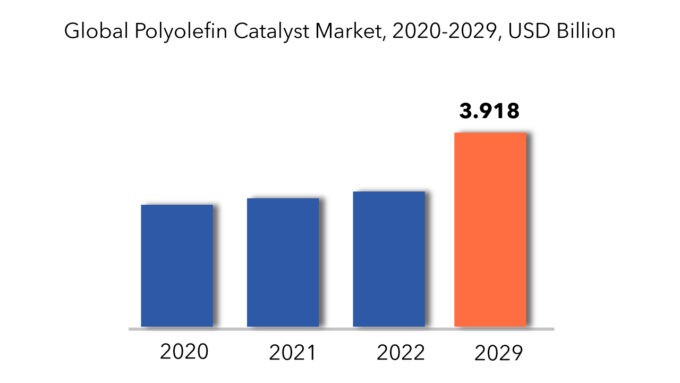

The market for Polyolefin Catalysts was valued at USD 2.46 billion in 2020, and is predicted to reach at USD 3.91 billion in 2029 grow at a CAGR of 5.3 % over the forecast period from 2022-2029.

Most polyolefin are made by treating the monomer with metal-containing catalysts. Polyolefin is a polymer made mostly from alkene monomers. The majority of polyolefins are produced on a big scale in an industrial setting. The Ziegler-Natta catalyst, chromium-based catalyst, metallocene single site catalyst, and post metallocene SSC are the four types of polyolefin catalysts. One of the main factors driving demand for polyolefin catalysts is the growing use of polyolefin in the food packaging industry.

A polyolefin catalyst is a molecule that is used to speed up chemical reactions in the synthesis of simple olefins. It is made by joining monomers through a chemical reaction between catalysts in both solid and liquid structures. Polyethylene, polypropylene, polybutene, and polymethyl pentene are some of the more popular types, as are other elastomers including ethylene propylene diene monomer rubber, ethylene-propylene rubber, and polyisobutylene. Films, fibers, tubes, packaging trays, home items, battery cases, medical gadgets, and injection molded products all use polyolefin catalysts. They have a wide range of uses in industries such as automotive, packaging, medical, and textiles.

Since the last decade, there has been a huge increase in demand for consumer products, owing to the fast-growing population. The market is primarily driven by an increase in demand for plastic films, goods, and packaging materials. Furthermore, technological advancements in the fluid catalytic cracking unit, which is increasing polyolefin production, are expected to boost market growth.

Polyolefin polymerization employing Ziegler-Natta catalysts has made polyolefin one of the most widely used polymers in industry. Catalysis has traditionally relied on polyethylene, polypropylene, and ethylene propylene diene monomer (EPDM) rubber. The Food Packaging Film industry's fast expansion has increased demand for polyolefin catalysts, boosting overall market growth. In addition, increased R&D investment on new manufacturing technologies, along with capacity expansion for polyolefin plants, would also boost product demand in the coming years. Moreover, the growing automotive and packaging industries are projected to have a significant impact on the polyolefin catalyst market over the forecast period.

[caption id="attachment_4891" align="aligncenter" width="870"]

Furthermore, the implementation of strict pollution control requirements on automobiles encourages automakers to adopt lightweight, strong, and adaptable materials in their production. This trend has resulted in a considerable increase in the demand for polyolefin materials in automotive parts, as well as an increase in the demand for polyolefin catalysts.

In emerging economies, consumer demand is fast expanding. In addition, technological advancements have increased demand for plastic films, packaged items, and construction materials. High severity fluid catalytic cracking units, for example, have enhanced yield by 27 percent to 28 percent when linked with an olefin conversion unit, and by about five times when combined with fluid catalytic cracking.

Over the study period, the development of new-generation catalyst for improving the polymerization process will also favorably contribute to the polyolefin catalyst market share. India, China, and Brazil are predicted to drive development in polyolefin goods and materials consumption, while Japan is expected to be a prominent market, owing to its developed economy and high polymer consumption.

One of the primary reasons driving the market's growth is the rising demand for polypropylene and polymer resins over the world. Furthermore, as the COVID-19 continues to spread around the world, the demand for protective masks and coverings has increased significantly, propelling the market forward.

However, due to COVID-19, the usage of polyolefin catalysts for injection molding, such as single-site catalyst and Ziegler Natta catalyst, came to a halt as well, adding to a significant drop in the polyolefin catalysts market. As a result of the pandemic, there was a disturbance in the supply and demand of packaging materials, which had a significant influence on the polyolefin catalyst market.

However, fluctuating crude oil prices are projected to represent a significant concern for the overall polyolefin catalyst business during the evaluation period. Changes in feedstock pricing have a negative impact on overall output, which has a negative impact on catalyst demand because polyethylene and polypropylene are both manufactured from crude oil.

[caption id="attachment_4893" align="aligncenter" width="680"]

Polyolefin Catalyst Market Segment Analysis

Based on classification, market is segmented into polypropylene and polyethylene. Based on catalyst the market is segmented into Ziegler-Natta, Single site catalyst, chromium, and others. Based on, application, market is segmented into blow molding, film, fiber, injection molding and others. The polypropylene and polyethylene segment held a significant share in the polyolefin catalyst market.

Polypropylene is used in a variety of applications, including drinking straws, food containers, and reusable water bottles, as well as thermal underwear, roofing materials, marine ropes, and carpet. Polypropylene, which is a polymerized version of propylene, is rigid and adaptable (thus its usage in drinking straws), heat resistant (hence its use in laboratory research applications), and lightweight. Polyethylene (PE) is created by polymerizing ethylene. Plastic bags and bottles, as well as electrical wire insulation and water pipes, are all made of this sort of plastic. The segment's expansion is being fueled by the widespread use of polypropylene and polyethylene.

Based on catalyst, the Ziegler-Natta catalyst segment held the largest share in the polyolefin catalyst market. Ziegler-Natta catalysts are the most widely used in the synthesis of polypropylene, high density polyethylene, and linear low-density polyethylene. Over 90% of global polypropylene production uses the Ziegler-Natta catalyst, whereas more than half of all polyethylene production uses the Ziegler-Natta catalyst. Based on application, the film segment held the largest share in the polyolefin catalyst market.

Polyolefin Catalyst Market Players

Major players in the polyolefin catalyst market are W.R. Grace, Univation Technologies, LLC, LyondellBasell Industries N.V., Johnson Matthey Inc., TOHO Titanium Company Limited, Idemitsu Kosan Co., Ltd., INEOS Group, Mitsui Chemicals, Inc, Clariant AG, Evonik Industries, DuPont, Inc., DORF-KETAL Chemicals India Private Limited, AGC Chemicals Inc., and NOVA Chemicals Corporation. Acquisitions/Technology Launches Major market players are engaged in research and development for producing colors of superior quality to provide enhanced features.

- W.R. Grace & Co., also called Grace, American industrial company, with international interests in specialty chemicals, construction materials, coatings, and sealants. It is headquartered in Columbia, Maryland.

- Univation Technologies is the leading technology licensor to the worldwide PE industry. They also supply innovative catalysts, unparalleled experience and value-producing services to help PE producers seize opportunities and operate profitably.

- Johnson Matthey is a British multinational specialty chemicals and sustainable technologies company headquartered in London, England.

Who Should Buy? Or Key Stakeholders

- Chemical Industry

- Pharmaceutical Industry

- Packaging Industry

- Construction Industry

- Investors

- Manufacturing companies

- Scientific Research and Development

- End user companies

Polyolefin Catalyst Market Regional Analysis

The global polyolefin catalyst market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

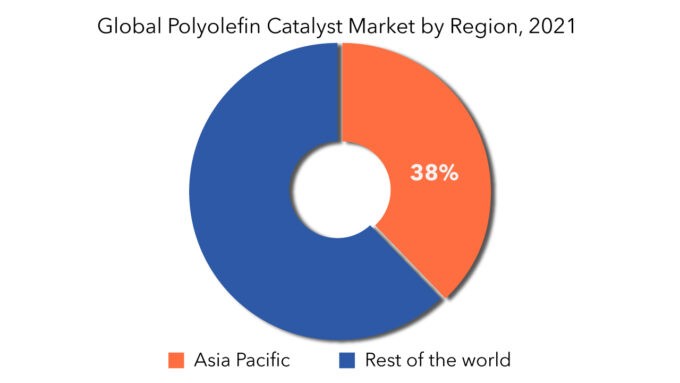

Due to the expanding food and beverage industry, which is raising demand for packaging materials in the region, the Asia-Pacific region maintained the highest position in the polyolefin catalyst market, up to 38 percent. In several countries, rising disposable income has resulted in increased demand for the food and beverage industry, which is driving the expansion of packaging materials in the region. With the rising demand for packaging materials in the region, the demand for polyolefin to make packaging materials will skyrocket, propelling the polyolefin market in Asia Pacific to new heights over the forecast period.

[caption id="attachment_4894" align="alignleft" width="680"]

Key Market Segments: Polyolefin Catalyst Market

Polyolefin Catalyst Market by Classification, 2020-2029, (USD Million) (Kilotons)- Polypropylene

- Polyethylene

- Ziegler-Natta

- Single Site Catalyst

- Chromium

- Blow Molding

- Film

- Fiber

- Injection Molding

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What are the growth opportunities related to the adoption of polyolefin catalyst across major regions in the future?

- What are the new trends and advancements in the polyolefin catalyst market?

- Which product categories are expected to have highest growth rate in the polyolefin catalyst market?

- Which are the key factors driving the polyolefin catalyst market?

- What will the market growth rate, growth momentum or acceleration the market carries during the forecast period?

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Polyolefin Catalyst Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Global Polyolefin Catalyst Market

- Global Polyolefin Catalyst Market Outlook

- Global Polyolefin Catalyst Market by Classification, (USD Million) (Kilotons)

- Polypropylene

- Polyethylene

- Global Polyolefin Catalyst Market by Application, (USD Million) (Kilotons)

- Blow Molding

- Film

- Fiber

- Injection Molding

- Global Polyolefin Catalyst Market by Catalyst, (USD Million) (Kilotons)

- Ziegler-Natta

- Single Site Catalyst

- Chromium

- Global Polyolefin Catalyst Market by Region, (USD Million) (Kilotons)

- Introduction

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- South-East Asia

- Rest of Asia-Pacific

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Colombia

- Rest of South America

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East and Africa

- Company Profiles* (Business Overview, Company Snapshot, Products Offered, Recent Developments)

- R. Grace

- Univation Technologies, LLC

- LyondellBasell Industries N.V.

- Johnson Matthey Inc.

- TOHO Titanium Company Limited

- Idemitsu Kosan Co., Ltd.

- INEOS Group

- Mitsui Chemicals, Inc

- Clariant AG

- Evonik Industries

- DuPont, Inc

- Others *The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL POLYOLEFIN CATALYST MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 2 GLOBAL POLYOLEFIN CATALYST MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 3 GLOBAL POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (USD MILLIONS) 2020-2029

TABLE 4 GLOBAL POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (KILOTONS) 2020-2029

TABLE 5 GLOBAL POLYOLEFIN CATALYST MARKET BY CATALYST (USD MILLIONS) 2020-2029

TABLE 6 GLOBAL POLYOLEFIN CATALYST MARKET BY CATALYST (KILOTONS) 2020-2029

TABLE 7 GLOBAL POLYOLEFIN CATALYST MARKET BY REGION (USD MILLIONS) 2020-2029

TABLE 8 GLOBAL POLYOLEFIN CATALYST MARKET BY REGION (KILOTONS) 2020-2029

TABLE 9 US POLYOLEFIN CATALYST MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 10 US POLYOLEFIN CATALYST MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 11 US POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (USD MILLIONS) 2020-2029

TABLE 12 US POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (KILOTONS) 2020-2029

TABLE 13 US POLYOLEFIN CATALYST MARKET BY CATALYST (USD MILLIONS) 2020-2029

TABLE 14 US POLYOLEFIN CATALYST MARKET BY CATALYST (KILOTONS) 2020-2029

TABLE 15 CANADA POLYOLEFIN CATALYST MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 16 CANADA POLYOLEFIN CATALYST MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 17 CANADA POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (USD MILLIONS) 2020-2029

TABLE 18 CANADA POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (KILOTONS) 2020-2029

TABLE 19 CANADA POLYOLEFIN CATALYST MARKET BY CATALYST (USD MILLIONS) 2020-2029

TABLE 20 CANADA POLYOLEFIN CATALYST MARKET BY CATALYST (KILOTONS) 2020-2029

TABLE 21 MEXICO POLYOLEFIN CATALYST MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 22 MEXICO POLYOLEFIN CATALYST MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 23 MEXICO POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (USD MILLIONS) 2020-2029

TABLE 24 MEXICO POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (KILOTONS) 2020-2029

TABLE 25 MEXICO POLYOLEFIN CATALYST MARKET BY CATALYST (USD MILLIONS) 2020-2029

TABLE 26 MEXICO POLYOLEFIN CATALYST MARKET BY CATALYST (KILOTONS) 2020-2029

TABLE 27 BRAZIL POLYOLEFIN CATALYST MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 28 BRAZIL POLYOLEFIN CATALYST MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 29 BRAZIL POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (USD MILLIONS) 2020-2029

TABLE 30 BRAZIL POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (KILOTONS) 2020-2029

TABLE 31 BRAZIL POLYOLEFIN CATALYST MARKET BY CATALYST (USD MILLIONS) 2020-2029

TABLE 32 BRAZIL POLYOLEFIN CATALYST MARKET BY CATALYST (KILOTONS) 2020-2029

TABLE 33 ARGENTINA POLYOLEFIN CATALYST MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 34 ARGENTINA POLYOLEFIN CATALYST MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 35 ARGENTINA POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (USD MILLIONS) 2020-2029

TABLE 36 ARGENTINA POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (KILOTONS) 2020-2029

TABLE 37 ARGENTINA POLYOLEFIN CATALYST MARKET BY CATALYST (USD MILLIONS) 2020-2029

TABLE 38 ARGENTINA POLYOLEFIN CATALYST MARKET BY CATALYST (KILOTONS) 2020-2029

TABLE 39 COLOMBIA POLYOLEFIN CATALYST MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 40 COLOMBIA POLYOLEFIN CATALYST MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 41 COLOMBIA POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (USD MILLIONS) 2020-2029

TABLE 42 COLOMBIA POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (KILOTONS) 2020-2029

TABLE 43 COLOMBIA POLYOLEFIN CATALYST MARKET BY CATALYST (USD MILLIONS) 2020-2029

TABLE 44 COLOMBIA POLYOLEFIN CATALYST MARKET BY CATALYST (KILOTONS) 2020-2029

TABLE 45 REST OF SOUTH AMERICA POLYOLEFIN CATALYST MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 46 REST OF SOUTH AMERICA POLYOLEFIN CATALYST MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 47 REST OF SOUTH AMERICA POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (USD MILLIONS) 2020-2029

TABLE 48 REST OF SOUTH AMERICA POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (KILOTONS) 2020-2029

TABLE 49 REST OF SOUTH AMERICA POLYOLEFIN CATALYST MARKET BY CATALYST (USD MILLIONS) 2020-2029

TABLE 50 REST OF SOUTH AMERICA POLYOLEFIN CATALYST MARKET BY CATALYST (KILOTONS) 2020-2029

TABLE 51 INDIA POLYOLEFIN CATALYST MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 52 INDIA POLYOLEFIN CATALYST MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 53 INDIA POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (USD MILLIONS) 2020-2029

TABLE 54 INDIA POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (KILOTONS) 2020-2029

TABLE 55 INDIA POLYOLEFIN CATALYST MARKET BY CATALYST (USD MILLIONS) 2020-2029

TABLE 56 INDIA POLYOLEFIN CATALYST MARKET BY CATALYST (KILOTONS) 2020-2029

TABLE 57 CHINA POLYOLEFIN CATALYST MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 58 CHINA POLYOLEFIN CATALYST MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 59 CHINA POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (USD MILLIONS) 2020-2029

TABLE 60 CHINA POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (KILOTONS) 2020-2029

TABLE 61 CHINA POLYOLEFIN CATALYST MARKET BY CATALYST (USD MILLIONS) 2020-2029

TABLE 62 CHINA POLYOLEFIN CATALYST MARKET BY CATALYST (KILOTONS) 2020-2029

TABLE 63 JAPAN POLYOLEFIN CATALYST MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 64 JAPAN POLYOLEFIN CATALYST MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 65 JAPAN POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (USD MILLIONS) 2020-2029

TABLE 66 JAPAN POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (KILOTONS) 2020-2029

TABLE 67 JAPAN POLYOLEFIN CATALYST MARKET BY CATALYST (USD MILLIONS) 2020-2029

TABLE 68 JAPAN POLYOLEFIN CATALYST MARKET BY CATALYST (KILOTONS) 2020-2029

TABLE 69 SOUTH KOREA POLYOLEFIN CATALYST MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 70 SOUTH KOREA POLYOLEFIN CATALYST MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 71 SOUTH KOREA POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (USD MILLIONS) 2020-2029

TABLE 72 SOUTH KOREA POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (KILOTONS) 2020-2029

TABLE 73 SOUTH KOREA POLYOLEFIN CATALYST MARKET BY CATALYST (USD MILLIONS) 2020-2029

TABLE 74 SOUTH KOREA POLYOLEFIN CATALYST MARKET BY CATALYST (KILOTONS) 2020-2029

TABLE 75 AUSTRALIA POLYOLEFIN CATALYST MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 76 AUSTRALIA POLYOLEFIN CATALYST MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 77 AUSTRALIA POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (USD MILLIONS) 2020-2029

TABLE 78 AUSTRALIA POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (KILOTONS) 2020-2029

TABLE 79 AUSTRALIA POLYOLEFIN CATALYST MARKET BY CATALYST (USD MILLIONS) 2020-2029

TABLE 80 AUSTRALIA POLYOLEFIN CATALYST MARKET BY CATALYST (KILOTONS) 2020-2029

TABLE 81 SOUTH-EAST ASIA POLYOLEFIN CATALYST MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 82 SOUTH-EAST ASIA POLYOLEFIN CATALYST MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 83 SOUTH-EAST ASIA POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (USD MILLIONS) 2020-2029

TABLE 84 SOUTH-EAST ASIA POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (KILOTONS) 2020-2029

TABLE 85 SOUTH-EAST ASIA POLYOLEFIN CATALYST MARKET BY CATALYST (USD MILLIONS) 2020-2029

TABLE 86 SOUTH-EAST ASIA POLYOLEFIN CATALYST MARKET BY CATALYST (KILOTONS) 2020-2029

TABLE 87 REST OF ASIA PACIFIC POLYOLEFIN CATALYST MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 88 REST OF ASIA PACIFIC POLYOLEFIN CATALYST MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 89 REST OF ASIA PACIFIC POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (USD MILLIONS) 2020-2029

TABLE 90 REST OF ASIA PACIFIC POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (KILOTONS) 2020-2029

TABLE 91 REST OF ASIA PACIFIC POLYOLEFIN CATALYST MARKET BY CATALYST (USD MILLIONS) 2020-2029

TABLE 92 REST OF ASIA PACIFIC POLYOLEFIN CATALYST MARKET BY CATALYST (KILOTONS) 2020-2029

TABLE 93 GERMANY POLYOLEFIN CATALYST MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 94 GERMANY POLYOLEFIN CATALYST MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 95 GERMANY POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (USD MILLIONS) 2020-2029

TABLE 96 GERMANY POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (KILOTONS) 2020-2029

TABLE 97 GERMANY POLYOLEFIN CATALYST MARKET BY CATALYST (USD MILLIONS) 2020-2029

TABLE 98 GERMANY POLYOLEFIN CATALYST MARKET BY CATALYST (KILOTONS) 2020-2029

TABLE 99 UK POLYOLEFIN CATALYST MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 100 UK POLYOLEFIN CATALYST MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 101 UK POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (USD MILLIONS) 2020-2029

TABLE 102 UK POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (KILOTONS) 2020-2029

TABLE 103 UK POLYOLEFIN CATALYST MARKET BY CATALYST (USD MILLIONS) 2020-2029

TABLE 104 UK POLYOLEFIN CATALYST MARKET BY CATALYST (KILOTONS) 2020-2029

TABLE 105 FRANCE POLYOLEFIN CATALYST MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 106 FRANCE POLYOLEFIN CATALYST MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 107 FRANCE POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (USD MILLIONS) 2020-2029

TABLE 108 FRANCE POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (KILOTONS) 2020-2029

TABLE 109 FRANCE POLYOLEFIN CATALYST MARKET BY CATALYST (USD MILLIONS) 2020-2029

TABLE 110 FRANCE POLYOLEFIN CATALYST MARKET BY CATALYST (KILOTONS) 2020-2029

TABLE 111 ITALY POLYOLEFIN CATALYST MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 112 ITALY POLYOLEFIN CATALYST MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 113 ITALY POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (USD MILLIONS) 2020-2029

TABLE 114 ITALY POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (KILOTONS) 2020-2029

TABLE 115 ITALY POLYOLEFIN CATALYST MARKET BY CATALYST (USD MILLIONS) 2020-2029

TABLE 116 ITALY POLYOLEFIN CATALYST MARKET BY CATALYST (KILOTONS) 2020-2029

TABLE 117 SPAIN POLYOLEFIN CATALYST MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 118 SPAIN POLYOLEFIN CATALYST MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 119 SPAIN POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (USD MILLIONS) 2020-2029

TABLE 120 SPAIN POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (KILOTONS) 2020-2029

TABLE 121 SPAIN POLYOLEFIN CATALYST MARKET BY CATALYST (USD MILLIONS) 2020-2029

TABLE 122 SPAIN POLYOLEFIN CATALYST MARKET BY CATALYST (KILOTONS) 2020-2029

TABLE 123 RUSSIA POLYOLEFIN CATALYST MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 124 RUSSIA POLYOLEFIN CATALYST MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 125 RUSSIA POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (USD MILLIONS) 2020-2029

TABLE 126 RUSSIA POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (KILOTONS) 2020-2029

TABLE 127 RUSSIA POLYOLEFIN CATALYST MARKET BY CATALYST (USD MILLIONS) 2020-2029

TABLE 128 RUSSIA POLYOLEFIN CATALYST MARKET BY CATALYST (KILOTONS) 2020-2029

TABLE 129 REST OF EUROPE POLYOLEFIN CATALYST MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 130 REST OF EUROPE POLYOLEFIN CATALYST MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 131 REST OF EUROPE POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (USD MILLIONS) 2020-2029

TABLE 132 REST OF EUROPE POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (KILOTONS) 2020-2029

TABLE 133 REST OF EUROPE POLYOLEFIN CATALYST MARKET BY CATALYST (USD MILLIONS) 2020-2029

TABLE 134 REST OF EUROPE POLYOLEFIN CATALYST MARKET BY CATALYST (KILOTONS) 2020-2029

TABLE 135 UAE POLYOLEFIN CATALYST MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 136 UAE POLYOLEFIN CATALYST MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 137 UAE POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (USD MILLIONS) 2020-2029

TABLE 138 UAE POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (KILOTONS) 2020-2029

TABLE 139 UAE POLYOLEFIN CATALYST MARKET BY CATALYST (USD MILLIONS) 2020-2029

TABLE 140 UAE POLYOLEFIN CATALYST MARKET BY CATALYST (KILOTONS) 2020-2029

TABLE 141 SAUDI ARABIA POLYOLEFIN CATALYST MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 142 SAUDI ARABIA POLYOLEFIN CATALYST MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 143 SAUDI ARABIA POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (USD MILLIONS) 2020-2029

TABLE 144 SAUDI ARABIA POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (KILOTONS) 2020-2029

TABLE 145 SAUDI ARABIA POLYOLEFIN CATALYST MARKET BY CATALYST (USD MILLIONS) 2020-2029

TABLE 146 SAUDI ARABIA POLYOLEFIN CATALYST MARKET BY CATALYST (KILOTONS) 2020-2029

TABLE 147 SOUTH AFRICA POLYOLEFIN CATALYST MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 148 SOUTH AFRICA POLYOLEFIN CATALYST MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 149 SOUTH AFRICA POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (USD MILLIONS) 2020-2029

TABLE 150 SOUTH AFRICA POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (KILOTONS) 2020-2029

TABLE 151 SOUTH AFRICA POLYOLEFIN CATALYST MARKET BY CATALYST (USD MILLIONS) 2020-2029

TABLE 152 SOUTH AFRICA POLYOLEFIN CATALYST MARKET BY CATALYST (KILOTONS) 2020-2029

TABLE 153 REST OF MIDDLE EAST AND AFRICA POLYOLEFIN CATALYST MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 154 REST OF MIDDLE EAST AND AFRICA POLYOLEFIN CATALYST MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 155 REST OF MIDDLE EAST AND AFRICA POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (USD MILLIONS) 2020-2029

TABLE 156 REST OF MIDDLE EAST AND AFRICA POLYOLEFIN CATALYST MARKET BY CLASSIFICATION (KILOTONS) 2020-2029

TABLE 157 REST OF MIDDLE EAST AND AFRICA POLYOLEFIN CATALYST MARKET BY CATALYST (USD MILLIONS) 2020-2029

TABLE 158 REST OF MIDDLE EAST AND AFRICA POLYOLEFIN CATALYST MARKET BY CATALYST (KILOTONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL POLYOLEFIN CATALYST MARKETBY CLASSIFICATION, USD MILLION, 2020-2029

FIGURE 10 GLOBAL POLYOLEFIN CATALYST MARKETBY APPLICATION, USD MILLION, 2020-2029

FIGURE 11 GLOBAL POLYOLEFIN CATALYST MARKETBY CATALYST, USD MILLION, 2020-2029

FIGURE 12 GLOBAL POLYOLEFIN CATALYST MARKETBY REGION, USD MILLION, 2020-2029

FIGURE 13 PORTER’S FIVE FORCES MODEL

FIGURE 14 GLOBAL POLYOLEFIN CATALYST MARKETBY CLASSIFICATION, 2020

FIGURE 15 GLOBAL POLYOLEFIN CATALYST MARKETBY APPLICATION 2020

FIGURE 16 GLOBAL POLYOLEFIN CATALYST MARKETBY CATALYST 2020

FIGURE 17 POLYOLEFIN CATALYST MARKETBY REGION 2020

FIGURE 18 MARKET SHARE ANALYSIS

FIGURE 19 W.R. GRACE: COMPANY SNAPSHOT

FIGURE 20 UNIVATION TECHNOLOGIES, LLC: COMPANY SNAPSHOT

FIGURE 21 LYONDELLBASELL INDUSTRIES N.V.: COMPANY SNAPSHOT

FIGURE 22 JOHNSON MATTHEY INC.: COMPANY SNAPSHOT

FIGURE 23 TOHO TITANIUM COMPANY LIMITED: COMPANY SNAPSHOT

FIGURE 24 IDEMITSU KOSAN CO., LTD.: COMPANY SNAPSHOT

FIGURE 25 INEOS GROUP: COMPANY SNAPSHOT

FIGURE 26 MITSUI CHEMICALS, INC: COMPANY SNAPSHOT

FIGURE 27 CLARIANT AG: COMPANY SNAPSHOT

FIGURE 28 EVONIK INDUSTRIES: COMPANY SNAPSHOT

FIGURE 29 DUPONT, INC: COMPANY SNAPSHOT

DOWNLOAD FREE SAMPLE REPORT

License Type

SPEAK WITH OUR ANALYST

Want to know more about the report or any specific requirement?

WANT TO CUSTOMIZE THE REPORT?

Our Clients Speak

We asked them to research ‘ Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te

Yosuke Mitsui

Senior Associate Construction Equipment Sales & Marketing

We asked them to research ‘Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te