Base Year Value ()

CAGR ()

Forecast Year Value ()

Historical Data Period

Largest Region

Forecast Period

6-FDA (CAS 1107-00-2) Market By Type (Pure 6-FDA, Modified 6-FDA), By Application (Polyimide Resins, Epoxy Resins, Other Applications) and Region, Global Trends and forecast from 2023 to 2030

Instant access to hundreds of data points and trends

- Market estimates from 2014-2029

- Competitive analysis, industry segmentation, financial benchmarks

- Incorporates SWOT, Porter's Five Forces and risk management frameworks

- PDF report or online database with Word, Excel and PowerPoint export options

- 100% money back guarantee

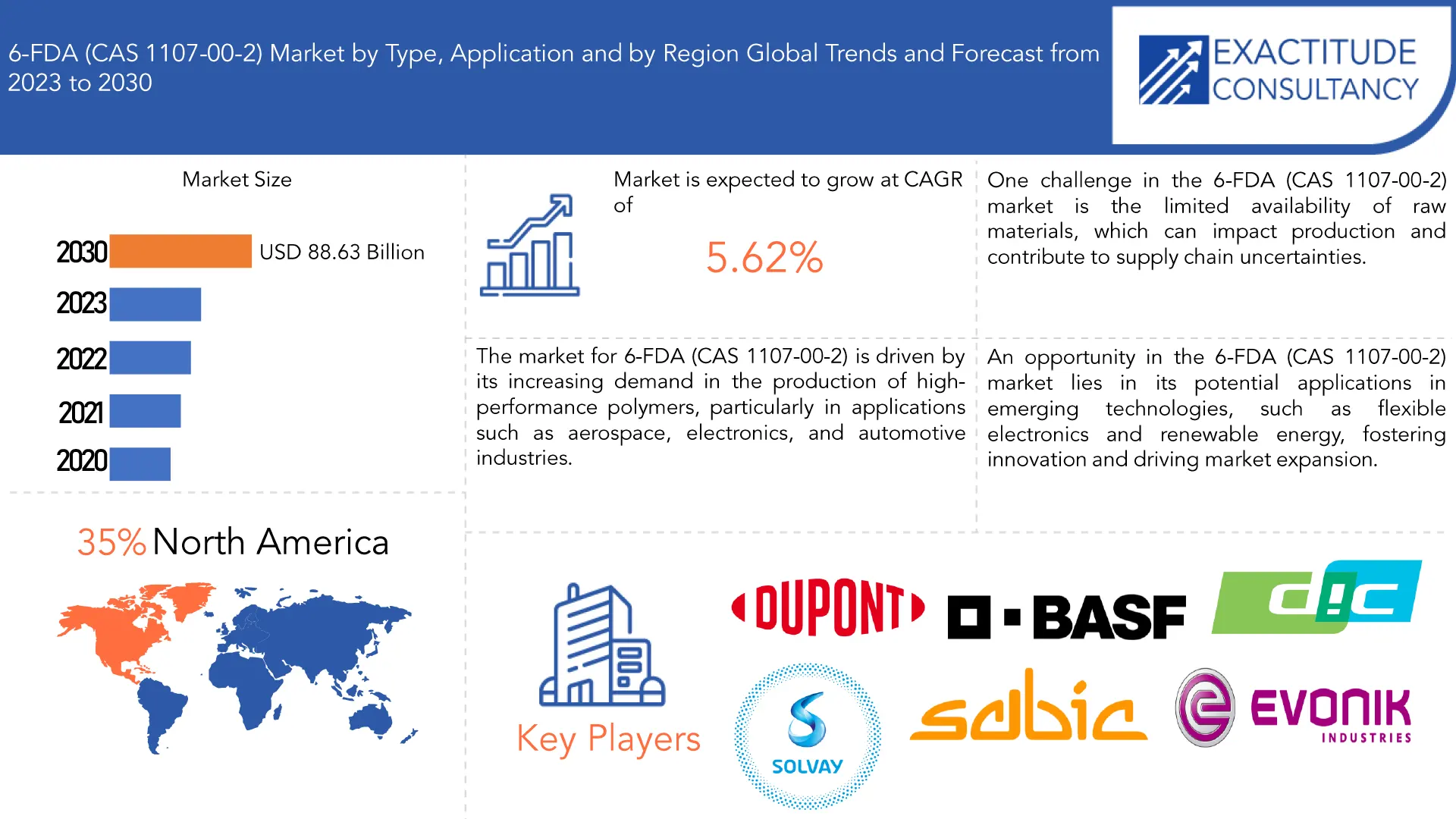

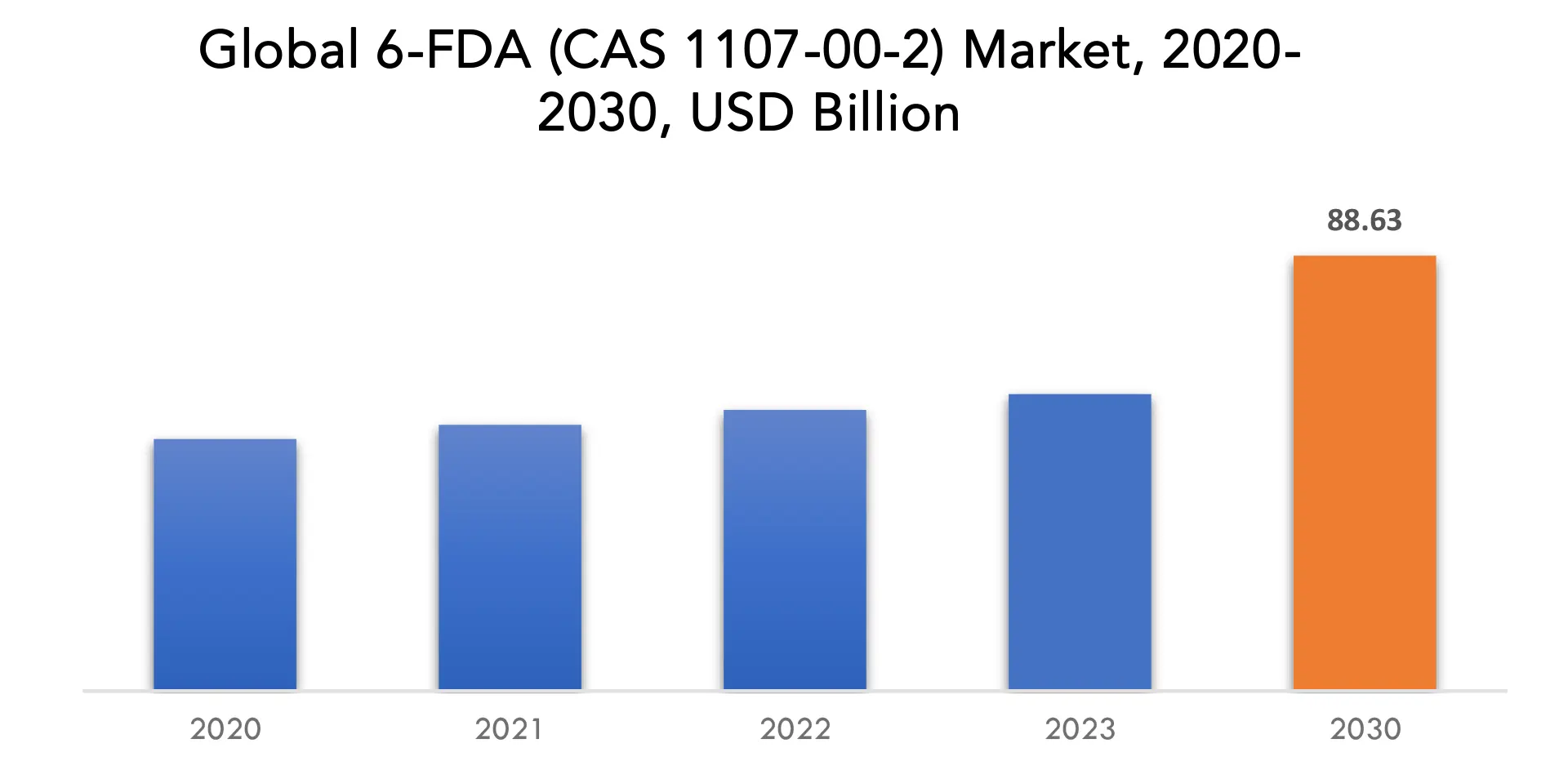

The global 6-FDA (CAS 1107-00-2) market is anticipated to grow from USD 127.85 Billion in 2023 to USD 198.42 Billion by 2030, at a CAGR of 6.48% during the forecast period.

The chemical compound 6-FDA, also known as 4,4'-hexafluoroisopropylidene Di phthalic anhydride (CAS 1107-00-2), is extensively utilized in the production of high-performance polymers. Fluorine atoms are incorporated into its molecular structure, which gives the resultant polymers remarkable chemical and thermal resilience. This compound is an essential component in the creation of cutting-edge materials used in the electronics, automotive, and aerospace sectors. Superior mechanical strength and endurance characterize the polymers generated from 6-FDA, which makes them appropriate for use in hostile situations. 6-FDA is essential to the creation of specialized polymers, which improves the dependability and performance of materials across a range of industrial applications.

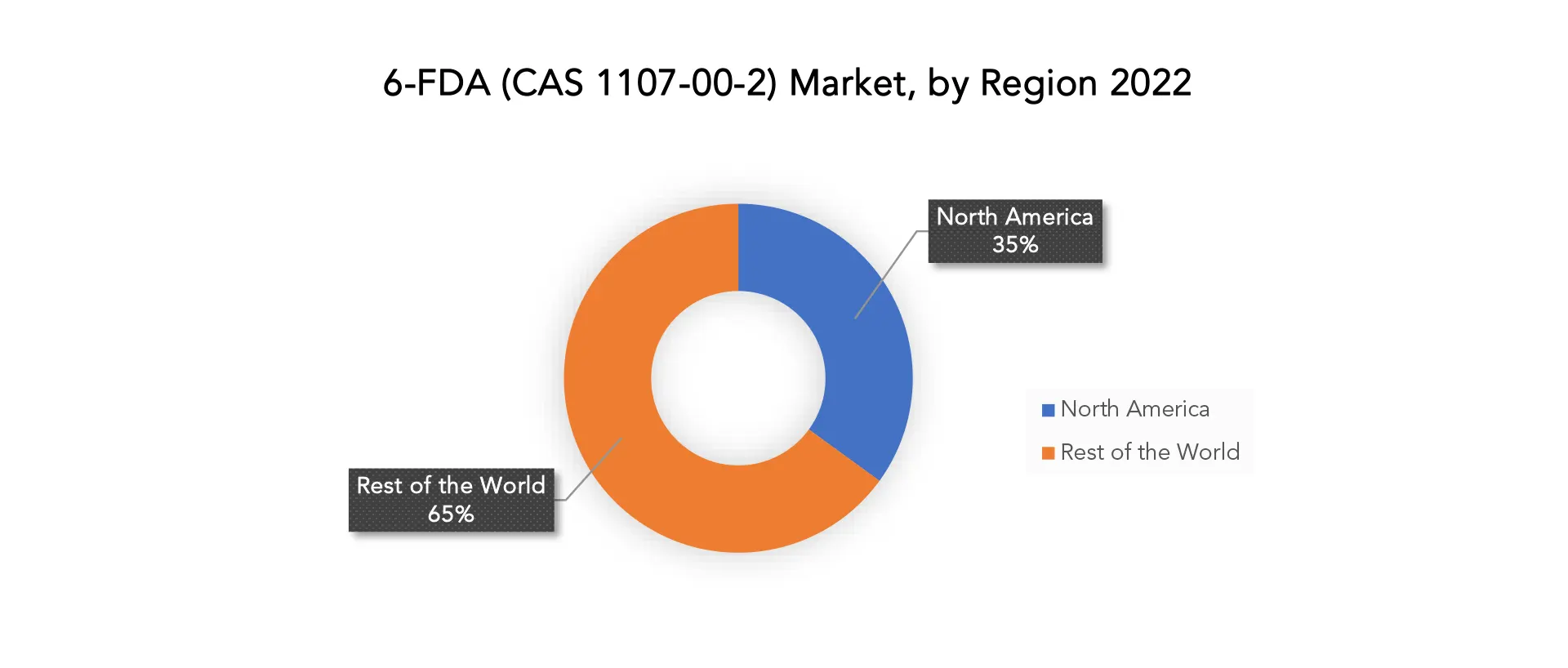

A defining feature of the 6-FDA (CAS 1107-00-2) market is the increasing importance of high-performance polymer manufacturing. 6-FDA is a crucial chemical molecule that is frequently used to create polymers with remarkable chemical and heat resistance. The market demand is being driven by the aerospace, electronics, and automotive industries, which are using the exceptional features of 6-FDA for applications in extreme circumstances. The range of uses is being broadened by ongoing technical breakthroughs and research and development initiatives, and the compound's sustainable contribution is in line with current market trends. With its strong industrial infrastructure, North America plays a significant role in the 6-FDA market and is responsible for a sizeable portion of its expanding market share. The chemical is an essential part of the high-performance polymer landscape because of its function as a building block in advanced materials.

[caption id="attachment_34207" align="aligncenter" width="1920"]

There exist many primary factors that boost the 6-FDA (CAS 1107-00-2) industry. Its application as a key component of high-performance polymers, which are distinguished by remarkable chemical and heat resistance, stimulates demand in a variety of sectors, including the automotive, electronics, and aerospace industries. The market is growing at a faster rate due to the growing emphasis on innovative materials that can survive harsh environments. The acceptance of 6-FDA in new applications is further fueled by ongoing technical advancements, especially in the fields of electronics and 3D printing. The compound's commercial appeal is increased by its alignment with industry trends in promoting environmental goals. The strong industrial infrastructure and emphasis on research and development in North America also play a major role in the 6-FDA's growing market presence.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Million) |

| Segmentation | By Type, By Application and By Region |

| By Type |

|

| By Application |

|

| By Region |

|

Frequently Asked Questions

• What is the market size for the 6-FDA (CAS 1107-00-2) market?

The global 6-FDA (CAS 1107-00-2) market is anticipated to grow from USD 127.85 Billion in 2023 to USD 198.42 Billion by 2030, at a CAGR of 6.48% during the forecast period.

• Which region is domaining in the 6-FDA (CAS 1107-00-2) market?

North America accounted for the largest market in the 6-FDA (CAS 1107-00-2) market. North America accounted for 35% market share of the global market value.

• Who are the major key players in the 6-FDA (CAS 1107-00-2) market?

DuPont, Solvay, BASF, Mitsubishi Gas Chemical Company, LG Chem, Shandong Look Chemical, Suzhou Senfeida Chemical Co., Ltd., Huntsman Corporation, SABIC, DIC Corporation, Kuraray Co., Ltd., UBE Industries, Ltd., Polynt Group, Evonik Industries AG, Tianjin Hero-Land S&T Development Co., Ltd., Zibo Jinshi Chemical Co., Ltd., Jiangsu Ruijia Chemistry Co., Ltd., Wujiang Wanshida Chemical Co., Ltd., Hangzhou Qianhong Bio-pharma Co., Ltd., Anhui Xinyuan Chemical Co., Ltd.

• What is the latest trend in the 6-FDA (CAS 1107-00-2) market?

Expanding Applications in Electronics: 6-FDA's high thermal stability, low dielectric constant, and excellent electrical insulating properties make it ideal for electronics applications. Its use in flexible electronics, high-performance printed circuit boards (PCBs), and semiconductor packaging is on the rise.

6-FDA (CAS 1107-00-2) Market Segmentation Analysis

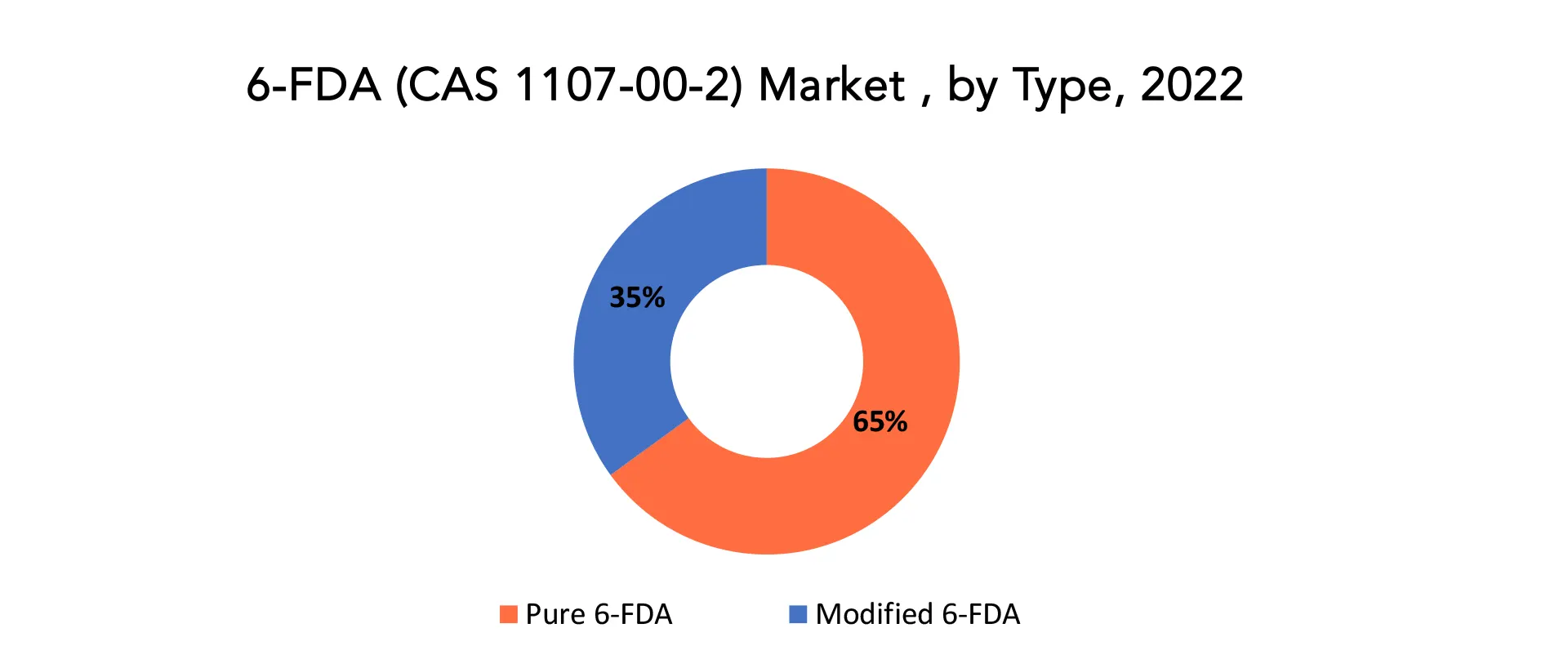

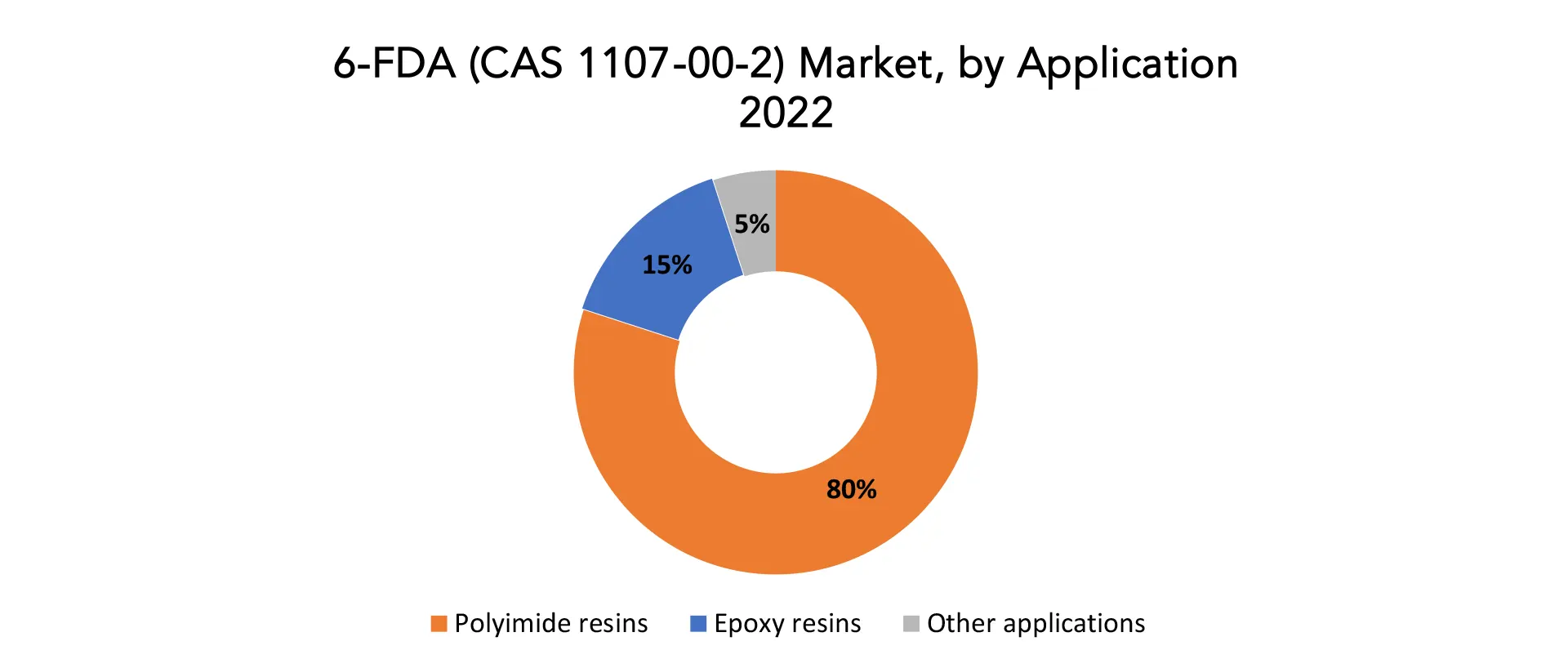

The market for 6-FDA (CAS 1107-00-2) is divided into segments according to Type, Application and region. The 6-FDA (CAS 1107-00-2) market encompasses various types, including Pure 6-FDA and Modified 6-FDA, with applications spanning Polyimide Resins, Epoxy Resins, and other diverse industrial applications. [caption id="attachment_34208" align="aligncenter" width="1920"]

6-FDA (CAS 1107-00-2) Market Dynamics

Driver Expanding uses in innovative materials because to the special qualities of 6-FDA-based polymers, including films, coatings, and composites. The remarkable and distinct properties of 6-FDA-based polymers are driving their growing applications in novel materials such films, coatings, and composites. 6-FDA's natural chemical and heat resistance helps to create high-performance films that are employed in sectors where durability is essential, such as electronics. Coatings made from 6-FDA-based polymers are useful in aerospace and automotive applications because they provide protective layers that are resistant to adverse weather conditions. Furthermore, 6-FDA's adaptability makes it easier to include into composite materials, which increases their resilience and strength. The polymer industry is characterized by a dynamic landscape of innovation, which is shown in the acceptance of 6-FDA in the production of cutting-edge materials across many industries. This adoption is further fueled by the continuous investigation of its characteristics and its compatibility with diverse substrates. Restraint Notwithstanding its exceptional qualities, 6-FDA's market expansion may be hampered by end users' ignorance of its advantages and uses. 6-FDA, also known as 6F-dianhydride, is a remarkable high-performance polymer with remarkable chemical stability and heat resistance. However, the lack of knowledge among end users about its benefits and its uses may pose obstacles to its commercial progress. Its limited comprehension by end users may cause adoption to go more slowly, despite its potential to revolutionize a number of industries, including electronics, aerospace, and automotive. In order to educate potential consumers about the material's unique properties—such as its extraordinary mechanical strength and thermal properties—effective communication and educational campaigns are essential. To fully realize the market potential of 6-FDA and make sure that industries understand and take use of its advantages for enhanced product performance and durability, it is imperative to close this knowledge gap. The demand for 6-FDA is anticipated to rise as education develops, propelling its widespread utilization across diverse sectors. Opportunities Exploring opportunities in the medical field can diversify the market for 6-FDA. 6-FDA's commercial boundaries are expanded and exciting chances arise from diversifying into the medical industry. Because of the material's remarkable chemical stability and heat resistance, it may be used in medical device applications and is reliable even in harsh settings like sterilization operations. 6. The FDA is well-suited for usage in medical devices and implants because to its biocompatibility and compatibility with a variety of sterilization techniques. With longer lifespans and fewer replacements, its great mechanical strength can help make gadgets more durable. When it comes to medical advances like implants, surgical tools, and diagnostic equipment, using 6-FDA can provide significant benefits over conventional materials. Efforts to raise awareness among medical experts of these advantages will be essential to maximizing the material's potential in the healthcare industry, promoting expansion, and solidifying 6-FDA as an important component.6-FDA (CAS 1107-00-2) Market Trends

- Growing Demand for Sustainable Materials: 6-FDA is derived from biomass, making it a sustainable alternative to traditional petroleum-based polymers. This eco-friendly aspect is driving demand from industries like packaging, textiles, and automotive. The increasing focus on environmental regulations and consumer preference for sustainable products further fuels this trend.

- Rising Adoption of Bio-based Polymers: With concerns about fossil fuel depletion and environmental pollution, there's a shift towards renewable resources. 6-FDA offers a promising bio-based alternative, leading to increased adoption in various applications. This trend is expected to accelerate market growth in the coming years.

- Advancements in Research and Development (R&D): Companies and research institutions are actively exploring new methods of synthesizing and modifying 6-FDA to enhance its properties and cater to specific industry needs. This R&D activity leads to the development of new applications and improved performance of 6-FDA-based materials.

- Expanding Applications in Electronics: 6-FDA's high thermal stability, low dielectric constant, and excellent electrical insulating properties make it ideal for electronics applications. Its use in flexible electronics, high-performance printed circuit boards (PCBs), and semiconductor packaging is on the rise.

- Increasing Competition and Market Consolidation: The 6-FDA market is becoming increasingly competitive, with new players entering and established companies expanding their offerings. This competition drives innovation and price reduction, ultimately benefiting the consumers. Some market consolidation is also observed, with mergers and acquisitions occurring to strengthen market positions.

Competitive Landscape

The competitive landscape of the 6-FDA (CAS 1107-00-2) market was dynamic, with several prominent companies competing to provide innovative and advanced 6-FDA (CAS 1107-00-2).- DuPont

- Solvay

- BASF

- Mitsubishi Gas Chemical Company

- LG Chem

- Shandong Look Chemical

- Suzhou Senfeida Chemical Co., Ltd.

- Huntsman Corporation

- SABIC

- DIC Corporation

- Kuraray Co., Ltd.

- UBE Industries, Ltd.

- Polynt Group

- Evonik Industries AG

- Tianjin Hero-Land S&T Development Co., Ltd.

- Zibo Jinshi Chemical Co., Ltd.

- Jiangsu Ruijia Chemistry Co., Ltd.

- Wujiang Wanshida Chemical Co., Ltd.

- Hangzhou Qianhong Bio-pharma Co., Ltd.

- Anhui Xinyuan Chemical Co., Ltd.

Regional Analysis

Based on regional segmentation, North America is a prominent participant in the 6-FDA (CAS 1107-00-2) market, holding a noteworthy 35% market share. This significance may be ascribed to the region's strong R&D activities, sophisticated technical infrastructure, and the presence of major semiconductor and chemical industry companies. The significant demand for 6-FDA is attributed to North America's emphasis on innovation and its leadership in the fields of electronics, materials science, and aerospace, particularly in the manufacturing of high-performance materials like polyimide resins. The region is a significant contributor to the worldwide 6-FDA market because of its dedication to technical developments and strict quality requirements. [caption id="attachment_34211" align="aligncenter" width="1920"]

Target Audience for 6-FDA (CAS 1107-00-2)

- Industrial Manufacturers

- Aerospace Industry

- Electronics Sector

- Automotive Manufacturers

- Medical Device Companies

- Research and Development Institutions

- Polymer and Material Scientists

- Chemical Engineers

- Product Designers

- Plastics and Polymers Industry

Segments Covered in the 6-FDA (CAS 1107-00-2) Market Report

6-FDA (CAS 1107-00-2) Market by Type- Pure 6-FDA

- Modified 6-FDA

- Polyimide resins

- Epoxy resins

- Other applications

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the 6-FDA (CAS 1107-00-2) market over the next 7 years?

- Who are the major players in the 6-FDA (CAS 1107-00-2) market and what is their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-pacific, the middle east, and Africa?

- How is the economic environment affecting the 6-FDA (CAS 1107-00-2) market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the 6-FDA (CAS 1107-00-2) market?

- What is the current and forecasted size and growth rate of the global 6-FDA (CAS 1107-00-2) market?

- What are the key drivers of growth in the 6-FDA (CAS 1107-00-2) market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the 6-FDA (CAS 1107-00-2) market?

- What are the technological advancements and innovations in the 6-FDA (CAS 1107-00-2) market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the 6-FDA (CAS 1107-00-2) market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the 6-FDA (CAS 1107-00-2) market?

- What are the service offered and specifications of leading players in the market?

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- 6-FDA (CAS 1107-00-2) MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON 6-FDA (CAS 1107-00-2) MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- 6-FDA (CAS 1107-00-2) MARKET OUTLOOK

- GLOBAL 6-FDA (CAS 1107-00-2) MARKET BY TYPE, 2020-2030, (USD BILLION)

- PURE 6-FDA

- MODIFIED 6-FDA

- GLOBAL 6-FDA (CAS 1107-00-2) MARKET BY APPLICATION, 2020-2030, (USD BILLION)

- POLYIMIDE RESINS

- EPOXY RESINS

- OTHER APPLICATIONS

- GLOBAL 6-FDA (CAS 1107-00-2) MARKET BY REGION, 2020-2030, (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- DUPONT

- SOLVAY

- BASF

- MITSUBISHI GAS CHEMICAL COMPANY

- LG CHEM

- SHANDONG LOOK CHEMICAL

- SUZHOU SENFEIDA CHEMICAL CO., LTD.

- HUNTSMAN CORPORATION

- SABIC

- DIC CORPORATION

- KURARAY CO., LTD.

- UBE INDUSTRIES, LTD.

- POLYNT GROUP

- EVONIK INDUSTRIES AG

- TIANJIN HERO-LAND S&T DEVELOPMENT CO., LTD.

- ZIBO JINSHI CHEMICAL CO., LTD.

- JIANGSU RUIJIA CHEMISTRY CO., LTD.

- WUJIANG WANSHIDA CHEMICAL CO., LTD.

- HANGZHOU QIANHONG BIO-PHARMA CO., LTD.

- ANHUI XINYUAN CHEMICAL CO., LTD.

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL 6-FDA (CAS 1107-00-2) MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 2 GLOBAL 6-FDA (CAS 1107-00-2) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 3 GLOBAL 6-FDA (CAS 1107-00-2) MARKET BY REGION (USD BILLION) 2020-2030

TABLE 4 NORTH AMERICA 6-FDA (CAS 1107-00-2) MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 5 NORTH AMERICA 6-FDA (CAS 1107-00-2) MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 6 NORTH AMERICA 6-FDA (CAS 1107-00-2) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 7 US 6-FDA (CAS 1107-00-2) MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 8 US 6-FDA (CAS 1107-00-2) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 9 CANADA 6-FDA (CAS 1107-00-2) MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 10 CANADA 6-FDA (CAS 1107-00-2) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 11 MEXICO 6-FDA (CAS 1107-00-2) MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 12 MEXICO 6-FDA (CAS 1107-00-2) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 13 SOUTH AMERICA 6-FDA (CAS 1107-00-2) MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 14 SOUTH AMERICA 6-FDA (CAS 1107-00-2) MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 15 SOUTH AMERICA 6-FDA (CAS 1107-00-2) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 16 BRAZIL 6-FDA (CAS 1107-00-2) MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 17 BRAZIL 6-FDA (CAS 1107-00-2) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 18 ARGENTINA 6-FDA (CAS 1107-00-2) MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 19 ARGENTINA 6-FDA (CAS 1107-00-2) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 20 COLOMBIA 6-FDA (CAS 1107-00-2) MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 21 COLOMBIA 6-FDA (CAS 1107-00-2) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 22 REST OF SOUTH AMERICA 6-FDA (CAS 1107-00-2) MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 23 REST OF SOUTH AMERICA 6-FDA (CAS 1107-00-2) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 24 ASIA-PACIFIC 6-FDA (CAS 1107-00-2) MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 25 ASIA-PACIFIC 6-FDA (CAS 1107-00-2) MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 26 ASIA-PACIFIC 6-FDA (CAS 1107-00-2) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 27 INDIA 6-FDA (CAS 1107-00-2) MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 28 INDIA 6-FDA (CAS 1107-00-2) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 29 CHINA 6-FDA (CAS 1107-00-2) MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 30 CHINA 6-FDA (CAS 1107-00-2) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 31 JAPAN 6-FDA (CAS 1107-00-2) MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 32 JAPAN 6-FDA (CAS 1107-00-2) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 33 SOUTH KOREA 6-FDA (CAS 1107-00-2) MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 34 SOUTH KOREA 6-FDA (CAS 1107-00-2) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 35 AUSTRALIA 6-FDA (CAS 1107-00-2) MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 36 AUSTRALIA 6-FDA (CAS 1107-00-2) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 37 SOUTH-EAST ASIA 6-FDA (CAS 1107-00-2) MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 38 SOUTH-EAST ASIA 6-FDA (CAS 1107-00-2) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 39 REST OF ASIA PACIFIC 6-FDA (CAS 1107-00-2) MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 40 REST OF ASIA PACIFIC 6-FDA (CAS 1107-00-2) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 41 EUROPE 6-FDA (CAS 1107-00-2) MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 42 EUROPE 6-FDA (CAS 1107-00-2) MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 43 EUROPE 6-FDA (CAS 1107-00-2) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 44 GERMANY 6-FDA (CAS 1107-00-2) MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 45 GERMANY 6-FDA (CAS 1107-00-2) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 46 UK 6-FDA (CAS 1107-00-2) MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 47 UK 6-FDA (CAS 1107-00-2) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 48 FRANCE 6-FDA (CAS 1107-00-2) MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 49 FRANCE 6-FDA (CAS 1107-00-2) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 50 ITALY 6-FDA (CAS 1107-00-2) MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 51 ITALY 6-FDA (CAS 1107-00-2) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 52 SPAIN 6-FDA (CAS 1107-00-2) MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 53 SPAIN 6-FDA (CAS 1107-00-2) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 54 RUSSIA 6-FDA (CAS 1107-00-2) MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 55 RUSSIA 6-FDA (CAS 1107-00-2) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 56 REST OF EUROPE 6-FDA (CAS 1107-00-2) MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 57 REST OF EUROPE 6-FDA (CAS 1107-00-2) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 58 MIDDLE EAST AND AFRICA 6-FDA (CAS 1107-00-2) MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 59 MIDDLE EAST AND AFRICA 6-FDA (CAS 1107-00-2) MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 60 MIDDLE EAST AND AFRICA 6-FDA (CAS 1107-00-2) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 61 UAE 6-FDA (CAS 1107-00-2) MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 62 UAE 6-FDA (CAS 1107-00-2) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 63 SAUDI ARABIA 6-FDA (CAS 1107-00-2) MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 64 SAUDI ARABIA 6-FDA (CAS 1107-00-2) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 65 SOUTH AFRICA 6-FDA (CAS 1107-00-2) MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 66 SOUTH AFRICA 6-FDA (CAS 1107-00-2) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 67 REST OF MIDDLE EAST AND AFRICA 6-FDA (CAS 1107-00-2) MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 68 REST OF MIDDLE EAST AND AFRICA 6-FDA (CAS 1107-00-2) MARKET BY APPLICATION (USD BILLION) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL 6-FDA (CAS 1107-00-2) MARKET BY TYPE, USD BILLION, 2022-2030

FIGURE 9 GLOBAL 6-FDA (CAS 1107-00-2) MARKET BY APPLICATION, USD BILLION, 2022-2030

FIGURE 10 GLOBAL 6-FDA (CAS 1107-00-2) MARKET BY REGION, USD BILLION, 2022-2030

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL 6-FDA (CAS 1107-00-2) MARKET BY TYPE, USD BILLION,2022

FIGURE 13 GLOBAL 6-FDA (CAS 1107-00-2) MARKET BY APPLICATION, USD BILLION,2022

FIGURE 14 GLOBAL 6-FDA (CAS 1107-00-2) MARKET BY REGION, USD BILLION,2022

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 DUPONT: COMPANY SNAPSHOT

FIGURE 17 SOLVAY: COMPANY SNAPSHOT

FIGURE 18 BASF: COMPANY SNAPSHOT

FIGURE 19 MITSUBISHI GAS CHEMICAL COMPANY: COMPANY SNAPSHOT

FIGURE 20 LG CHEM: COMPANY SNAPSHOT

FIGURE 21 SHANDONG LOOK CHEMICAL: COMPANY SNAPSHOT

FIGURE 22 SUZHOU SENFEIDA CHEMICAL CO., LTD.: COMPANY SNAPSHOT

FIGURE 23 HUNTSMAN CORPORATION: COMPANY SNAPSHOT

FIGURE 24 SABIC: COMPANY SNAPSHOT

FIGURE 25 DIC CORPORATION: COMPANY SNAPSHOT

FIGURE 26 KURARAY CO., LTD.: COMPANY SNAPSHOT

FIGURE 27 UBE INDUSTRIES, LTD.: COMPANY SNAPSHOT

FIGURE 28 POLYNT GROUP: COMPANY SNAPSHOT

FIGURE 29 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

FIGURE 30 TIANJIN HERO-LAND S&T DEVELOPMENT CO., LTD.: COMPANY SNAPSHOT

FIGURE 31 ZIBO JINSHI CHEMICAL CO., LTD.: COMPANY SNAPSHOT

FIGURE 32 JIANGSU RUIJIA CHEMISTRY CO., LTD.: COMPANY SNAPSHOT

FIGURE 33 WUJIANG WANSHIDA CHEMICAL CO., LTD.: COMPANY SNAPSHOT

FIGURE 34 HANGZHOU QIANHONG BIO-PHARMA CO., LTD.: COMPANY SNAPSHOT

FIGURE 35 ANHUI XINYUAN CHEMICAL CO., LTD.: COMPANY SNAPSHOT

DOWNLOAD FREE SAMPLE REPORT

License Type

SPEAK WITH OUR ANALYST

Want to know more about the report or any specific requirement?

WANT TO CUSTOMIZE THE REPORT?

Our Clients Speak

We asked them to research ‘ Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te

Yosuke Mitsui

Senior Associate Construction Equipment Sales & Marketing

We asked them to research ‘Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te