Base Year Value ()

CAGR ()

Forecast Year Value ()

Historical Data Period

Largest Region

Forecast Period

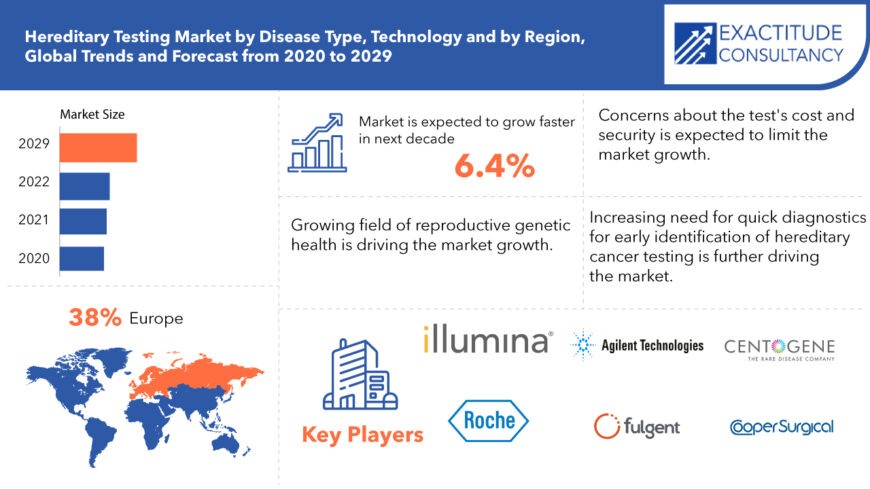

Hereditary Testing Market by Disease Type (Hereditary Cancer Testing, Hereditary Non-Cancer Testing); By Technology (Cytogenetic, Biochemical, Molecular Testing); & Region, Global trends and forecast from 2022 to 2029

Instant access to hundreds of data points and trends

- Market estimates from 2014-2029

- Competitive analysis, industry segmentation, financial benchmarks

- Incorporates SWOT, Porter's Five Forces and risk management frameworks

- PDF report or online database with Word, Excel and PowerPoint export options

- 100% money back guarantee

Hereditary Testing Market Overview

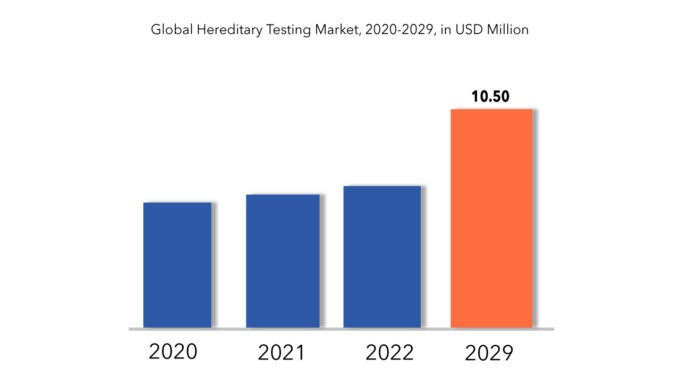

The global hereditary testing market size was valued at USD 6 billion in 2020 and is projected to register at a CAGR of 6.4% and expected to reach at USD 10.50 billion in 2029 during the forecast period 2022 to 2029.

In genetic testing, specific inherited variations within an individual's genes undergo alteration. These genetic variations can have varied effects on the likelihood of developing diseases, ranging from negative to positive, neutral, or ambiguous. There is evidence indicating that certain genes with harmful mutations increase the risk of cancer development, accounting for an estimated 5 to 10% of all cancer cases.

Cancer, a genetic disorder, arises from distinct gene alterations that regulate cell functions, particularly influencing their growth and replication. Approximately 5–10% of cancer cases stem from hereditary genetic mutations. Researchers have associated mutations in specific genes with over 50 hereditary cancer syndromes, predisposing individuals to certain types of cancer.

Breast cancer stands as one of the most prevalent cancers globally, affecting nearly 12.5% of women during their lifetime, with 5%–10% having a hereditary form. While BRCA1 and BRCA2 genes are the most commonly mutated, additional genes linked to hereditary breast cancer continue to emerge. Advancements in genomic technologies have enabled simultaneous testing of multiple genes.

[caption id="attachment_3738" align="aligncenter" width="870"]

Genetic mutations play a crucial role in early detection of hereditary cancer, thereby driving market growth. Concurrently, factors such as efficiency and cost-effectiveness compared to traditional testing methods contribute to market expansion. Furthermore, there is increasing demand for accurate initial detection and precise analysis, further propelling market growth.

The burgeoning field of reproductive genetic health serves as a significant market driver. Major players like Natera report a consistent rise in test volumes for women's health genetic testing for inherited conditions, reflecting growing public acceptance of hereditary tests and accelerating revenue growth. However, the COVID-19 pandemic had a detrimental impact on the market, with governments worldwide implementing lockdowns and social distancing measures, leading to disruptions, challenges, and adjustments across industries.

[caption id="attachment_3740" align="aligncenter" width="680"]

Hereditary testing market is broadly classified into disease type, technology and region. Based on disease type, the market is further segmented into hereditary cancer testing and hereditary non-cancer testing. Based on disease type, the cancer hereditary testing category is predicted to grow at fastest rate. The number of product and service options for various hereditary cancer diagnostics continues to expand. The quick introduction of large corporations, such as Quest, into this field has exploded the genetic testing industry. Businesses are concentrating on commercial strategies to strengthen their position in this field, considering breast cancer genomic screening as a lucrative revenue stream.

Based on technology, the molecular hereditary testing category had 54.2 percent of the revenue market share, and this dominance is likely to continue during the forecast period. The fact that genetic analysis is the most extensively used tool for hereditary genetic screening accounts for the market's growth.

Hereditary Testing Market Key Players

Some of the major market players operating in the global hereditary testing market are Agilent Technologies, Inc., Centogene N.V., CooperSurgical, Inc., F. Hoffmann-La Roche Ltd, Fulgent Genetics, Inc., Illumina, Inc., Invitae Corporation, Laboratory Corporation of America Holdings, Medgenome, Myriad Genetics, Inc., Natera, Inc., Quest Diagnostics Incorporated, Sophia Genetics, Thermo Fisher Scientific, Inc, and Twist Bioscience.

- Agilent is a leader in life sciences, diagnostics and applied chemical markets. The company provides laboratories worldwide with instruments, services, consumables, applications and expertise, enabling customers to gain the insights they seek.

- CENTOGENE is a rare disease company focused on transforming clinical, genetic, and biochemical data into medical solutions for patients. CENTOGENE is a world leader in the field of genetic diagnostics for rare diseases dedicated to improve patients' lives every day.

- CooperSurgical is committed to advancing the health of women, babies and families with its diversified portfolio of products and services focusing on medical devices and fertility & genomics.

Who Should Buy? Or Key stakeholders

- Healthcare Industry

- Pharmaceutical Industry

- Hospitals and Clinics

- Medical Laboratories

- Investors

- Manufacturing companies

- Scientific Research and Development

- End user companies

- Others

- The global hereditary testing market size is projected to register at a CAGR of 6.4%

- Based on disease type, the cancer hereditary testing category is predicted to grow at fastest rate.

- Based on technology, the molecular hereditary testing category had 54.2 percent of the revenue market share.

- Europe is predicted to provide the greatest revenue market share.

- The hereditary testing market is witnessing a growing trend towards increased adoption and innovation.

Hereditary Testing Market Regional Analysis

The global hereditary testing market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

Europe is predicted to provide the greatest revenue market share, and this dominance is expected to continue throughout the forecast period. It can be attributed to the existence of large companies that offer genetic tests, the widespread use of modern medications, and government regulations that ensure the integrity of hereditary testing screening. The North American market is expected to account for a major portion of global sales. Numerous regulatory regimes, a high frequency and awareness of the negative impacts and financial significance of genetic disorders, and commercial acceptance of hereditary testing are all factors in the region's growth.

Key Market Segments: Hereditary Testing Market

Hereditary Testing Market By Disease Type, 2020-2029, (USD Million)- Hereditary Cancer Testing

- Hereditary Non-Cancer Testing

- Cytogenetic

- Biochemical

- Molecular Testing

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

Key Question Answered

- What are the growth opportunities related to the adoption of hereditary testing across major regions in the future?

- What are the new trends and advancements in the hereditary testing market?

- Which product categories are expected to have highest growth rate in the hereditary testing market?

- Which are the key factors driving the hereditary testing market?

- What will the market growth rate, growth momentum or acceleration the market carries during the forecast period?

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Hereditary Testing Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Hereditary Testing Market

- Porter’s five forces model

- Threat from new entrants

- Threat from substitutes

- Bargaining power of suppliers

- Bargaining power of customers

- Degree of competition

- Industry value chain Analysis

- Global Hereditary Testing Market Outlook

- Global Hereditary Testing Market by Disease Type (USD Million)

- Hereditary Cancer Testing

- Hereditary Non-Cancer Testing

- Global Hereditary Testing Market by Technology (USD Million)

- Cytogenetic

- Biochemical

- Molecular Testing

- Global Hereditary Testing Market by Region (USD Million)

- North America

- US

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Colombia

- Rest Of South America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest Of Europe

- Asia Pacific

- India

- China

- Japan

- South Korea

- Australia

- South-East Asia

- Rest Of Asia Pacific

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest Of Middle East and Africa

- North America

- Company Profiles* (Business Overview, Company Snapshot, Products Offered, Recent Developments)

- Agilent Technologies, Inc.

- Centogene N.V.

- CooperSurgical, Inc.

- Hoffmann-La Roche Ltd

- Fulgent Genetics, Inc., Illumina, Inc.

- Invitae Corporation

- Laboratory Corporation of America Holdings

- Medgenome

- Myriad Genetics, Inc.

- Natera, Inc.

*The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL HEREDITARY TESTING MARKET BY DISEASE TYPE (USD MILLIONS) 2020-2029

TABLE 2 GLOBAL HEREDITARY TESTING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 3 GLOBAL HEREDITARY TESTING MARKET BY REGION (USD MILLIONS) 2020-2029

TABLE 4 US HEREDITARY TESTING MARKET BY DISEASE TYPE (USD MILLIONS) 2020-2029

TABLE 5 US HEREDITARY TESTING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 6 CANADA HEREDITARY TESTING MARKET BY DISEASE TYPE (USD MILLIONS) 2020-2029

TABLE 7 CANADA HEREDITARY TESTING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 8 MEXICO HEREDITARY TESTING MARKET BY DISEASE TYPE (USD MILLIONS) 2020-2029

TABLE 9 MEXICO HEREDITARY TESTING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 10 BRAZIL HEREDITARY TESTING MARKET BY DISEASE TYPE (USD MILLIONS) 2020-2029

TABLE 11 BRAZIL HEREDITARY TESTING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 12 ARGENTINA HEREDITARY TESTING MARKET BY DISEASE TYPE (USD MILLIONS) 2020-2029

TABLE 13 ARGENTINA HEREDITARY TESTING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 14 COLOMBIA HEREDITARY TESTING MARKET BY DISEASE TYPE (USD MILLIONS) 2020-2029

TABLE 15 COLOMBIA HEREDITARY TESTING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 16 REST OF SOUTH AMERICA HEREDITARY TESTING MARKET BY DISEASE TYPE (USD MILLIONS) 2020-2029

TABLE 17 REST OF SOUTH AMERICA HEREDITARY TESTING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 18 INDIA HEREDITARY TESTING MARKET BY DISEASE TYPE (USD MILLIONS) 2020-2029

TABLE 19 INDIA HEREDITARY TESTING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 20 CHINA HEREDITARY TESTING MARKET BY DISEASE TYPE (USD MILLIONS) 2020-2029

TABLE 21 CHINA HEREDITARY TESTING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 22 JAPAN HEREDITARY TESTING MARKET BY DISEASE TYPE (USD MILLIONS) 2020-2029

TABLE 23 JAPAN HEREDITARY TESTING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 24 SOUTH KOREA HEREDITARY TESTING MARKET BY DISEASE TYPE (USD MILLIONS) 2020-2029

TABLE 25 SOUTH KOREA HEREDITARY TESTING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 26 AUSTRALIA HEREDITARY TESTING MARKET BY DISEASE TYPE (USD MILLIONS) 2020-2029

TABLE 27 AUSTRALIA HEREDITARY TESTING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 28 SOUTH-EAST ASIA HEREDITARY TESTING MARKET BY DISEASE TYPE (USD MILLIONS) 2020-2029

TABLE 29 SOUTH-EAST ASIA HEREDITARY TESTING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 30 REST OF ASIA PACIFIC HEREDITARY TESTING MARKET BY DISEASE TYPE (USD MILLIONS) 2020-2029

TABLE 31 REST OF ASIA PACIFIC HEREDITARY TESTING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 32 GERMANY HEREDITARY TESTING MARKET BY DISEASE TYPE (USD MILLIONS) 2020-2029

TABLE 33 GERMANY HEREDITARY TESTING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 34 UK HEREDITARY TESTING MARKET BY DISEASE TYPE (USD MILLIONS) 2020-2029

TABLE 35 UK HEREDITARY TESTING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 36 FRANCE HEREDITARY TESTING MARKET BY DISEASE TYPE (USD MILLIONS) 2020-2029

TABLE 37 FRANCE HEREDITARY TESTING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 38 ITALY HEREDITARY TESTING MARKET BY DISEASE TYPE (USD MILLIONS) 2020-2029

TABLE 39 ITALY HEREDITARY TESTING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 40 SPAIN HEREDITARY TESTING MARKET BY DISEASE TYPE (USD MILLIONS) 2020-2029

TABLE 41 SPAIN HEREDITARY TESTING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 42 RUSSIA HEREDITARY TESTING MARKET BY DISEASE TYPE (USD MILLIONS) 2020-2029

TABLE 43 RUSSIA HEREDITARY TESTING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 44 REST OF EUROPE HEREDITARY TESTING MARKET BY DISEASE TYPE (USD MILLIONS) 2020-2029

TABLE 45 REST OF EUROPE HEREDITARY TESTING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 46 UAE HEREDITARY TESTING MARKET BY DISEASE TYPE (USD MILLIONS) 2020-2029

TABLE 47 UAE HEREDITARY TESTING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 48 SAUDI ARABIA HEREDITARY TESTING MARKET BY DISEASE TYPE (USD MILLIONS) 2020-2029

TABLE 49 SAUDI ARABIA HEREDITARY TESTING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 50 SOUTH AFRICA HEREDITARY TESTING MARKET BY DISEASE TYPE (USD MILLIONS) 2020-2029

TABLE 51 SOUTH AFRICA HEREDITARY TESTING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 52 REST OF MIDDLE EAST AND AFRICA HEREDITARY TESTING MARKET BY DISEASE TYPE (USD MILLIONS) 2020-2029

TABLE 53 REST OF MIDDLE EAST AND AFRICA HEREDITARY TESTING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL HEREDITARY TESTING MARKET BY DISEASE TYPE, USD MILLION, 2020-2029

FIGURE 9 GLOBAL HEREDITARY TESTING MARKET BY TECHNOLOGY, USD MILLION, 2020-2029

FIGURE 10 GLOBAL HEREDITARY TESTING MARKET BY TECHNOLOGY, USD MILLION, 2020-2029

FIGURE 11 GLOBAL HEREDITARY TESTING MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 NORTH AMERICA HEREDITARY TESTING MARKET SNAPSHOT

FIGURE 14 EUROPE HEREDITARY TESTING MARKET SNAPSHOT

FIGURE 15 ASIA PACIFIC HEREDITARY TESTING MARKET SNAPSHOT

FIGURE 16 SOUTH AMERICA HEREDITARY TESTING MARKET SNAPSHOT

FIGURE 17 MIDDLE EAST & AFRICA HEREDITARY TESTING MARKET SNAPSHOT

FIGURE 18 AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT

FIGURE 19 CENTOGENE N.V.: COMPANY SNAPSHOT

FIGURE 20 COOPERSURGICAL, INC.: COMPANY SNAPSHOT

FIGURE 21 F. HOFFMANN-LA ROCHE LTD: COMPANY SNAPSHOT

FIGURE 22 FULGENT GENETICS, INC., ILLUMINA, INC.: COMPANY SNAPSHOT

FIGURE 23 INVITAE CORPORATION: COMPANY SNAPSHOT

FIGURE 24 LABORATORY CORPORATION OF AMERICA HOLDINGS: COMPANY SNAPSHOT

FIGURE 25 MEDGENOME: COMPANY SNAPSHOT

FIGURE 26 MYRIAD GENETICS, INC.: COMPANY SNAPSHOT

FIGURE 27 NATERA, INC.: COMPANY SNAPSHOT

DOWNLOAD FREE SAMPLE REPORT

License Type

SPEAK WITH OUR ANALYST

Want to know more about the report or any specific requirement?

WANT TO CUSTOMIZE THE REPORT?

Our Clients Speak

We asked them to research ‘ Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te

Yosuke Mitsui

Senior Associate Construction Equipment Sales & Marketing

We asked them to research ‘Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te