Base Year Value ()

CAGR ()

Forecast Year Value ()

Historical Data Period

Largest Region

Forecast Period

DNA Data Storage Market by Product Type (Commercial Research & Prototyping) Deployment (Cloud, On-Premise) By Application ( Archival, Quality Control Research & Prototyping) Sequencing Platform (Next-Generation Sequencing, Nanopore Sequencing) By Synthesis Platform (Chemical-Column Based, Chemical-Microchip Based, Enzymatic) End User (Banking, Financial Services & Insurance, Government & Defense, Healthcare & Pharma, Media & Entertainment, Other) and Region, Global Trends and forecast from 2023 to 2030

Instant access to hundreds of data points and trends

- Market estimates from 2014-2029

- Competitive analysis, industry segmentation, financial benchmarks

- Incorporates SWOT, Porter's Five Forces and risk management frameworks

- PDF report or online database with Word, Excel and PowerPoint export options

- 100% money back guarantee

DNA Data Storage Market Overview

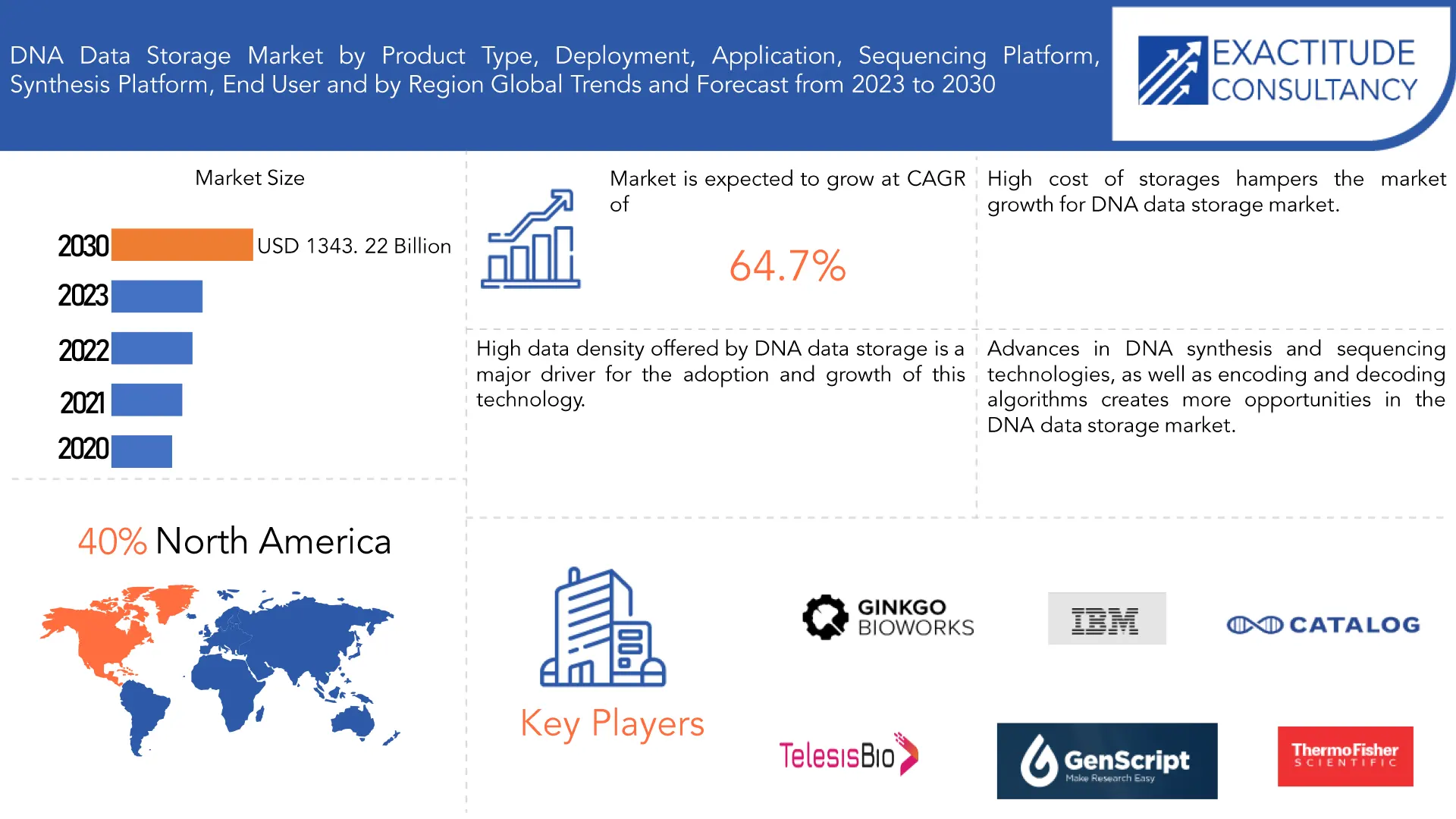

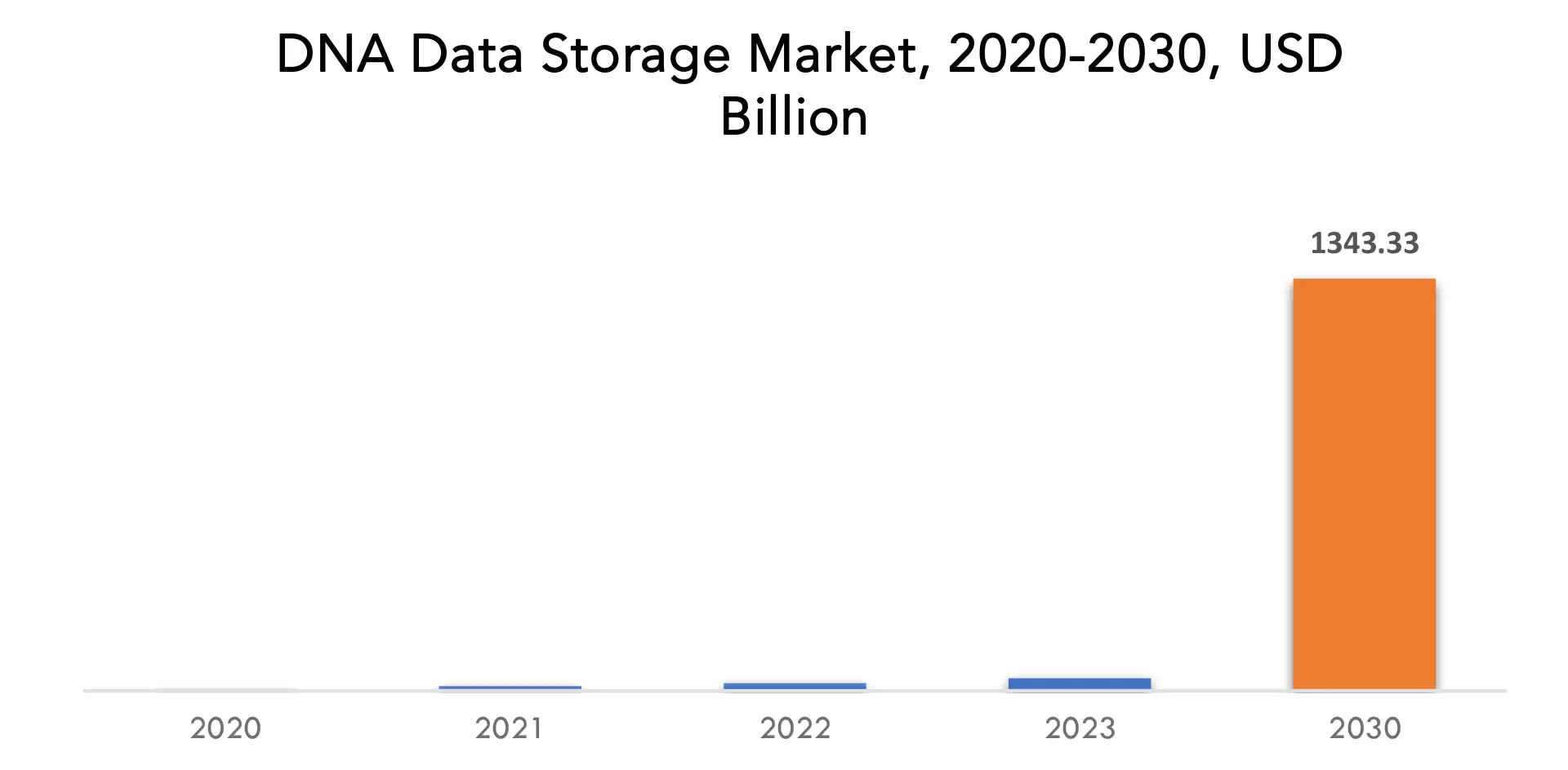

The global DNA Data Storage market is anticipated to grow from USD 40.9 billion in 2023 to USD 1343.33 billion by 2030, at a CAGR of 17.0 % during the forecast period.

DNA data storage is an emerging and innovative method of storing digital information in the form of DNA molecules. DNA, the molecule that encodes genetic instructions for all living organisms, has the potential to store vast amounts of data in a highly compact and durable format. DNA is a highly dense and efficient medium for data storage. A single gram of DNA can theoretically store petabytes (millions of gigabytes) of data, making it far more space-efficient than traditional storage media like hard drives and optical discs. DNA-based data storage has the potential to offer high levels of data security. DNA-encoded data can be encrypted and protected with biological mechanisms, making it extremely difficult for unauthorized access. As technology evolves, digital storage formats can become obsolete. DNA data storage, however, can be immune to such obsolescence, as reading DNA-encoded data relies on fundamental biochemical processes rather than specific technologies. DNA data storage has applications in various fields, including science, healthcare, education, cultural preservation, and beyond. It can enable new possibilities for data-intensive research and innovation.

[caption id="attachment_34569" align="aligncenter" width="1920"]

DNA data storage has been proposed as a more environmentally friendly alternative to traditional data centers that require significant energy consumption and cooling. DNA molecules can be stored at room temperature, reducing the need for energy-intensive infrastructure. DNA data storage can be inherently secure because it involves biological material. This makes it less susceptible to hacking and cyberattacks, offering an additional layer of data security. Both public and private sector investments are pouring into DNA data storage research and development. Government agencies, research institutions, and tech companies are funding projects aimed at advancing the technology. While not yet widely adopted, DNA data storage is finding applications in specific use cases. For example, it has been explored for preserving historical and cultural data, scientific research data, and specialized data storage needs in space exploration. As awareness of DNA data storage grows, more organizations and industries are exploring its potential benefits. Education and outreach efforts are helping to disseminate information about the technology and its capabilities. The increasing number of companies and startups entering the DNA data storage market is driving competition and innovation. Competition often leads to advancements and cost reductions. Some regions and governments are supporting DNA data storage research and development through grants and favorable regulatory environments. This support encourages further investment and growth in the market.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) |

| Segmentation | By Clutch Actuation Type, By Vehicle Type, By Propulsion, By Technology and by region |

| By Product Type |

|

| By Deployment |

|

| By Application |

|

| By Sequencing Platform |

|

| By Synthesis Platform |

|

| By End User |

|

| By Region

|

|

Frequently Asked Questions

• What is the market size for the DNA Data Storage market?

The global DNA Data Storage market is anticipated to grow from USD 40.9 billion in 2023 to USD 1343.33 billion by 2030, at a CAGR of 17.0 % during the forecast period.

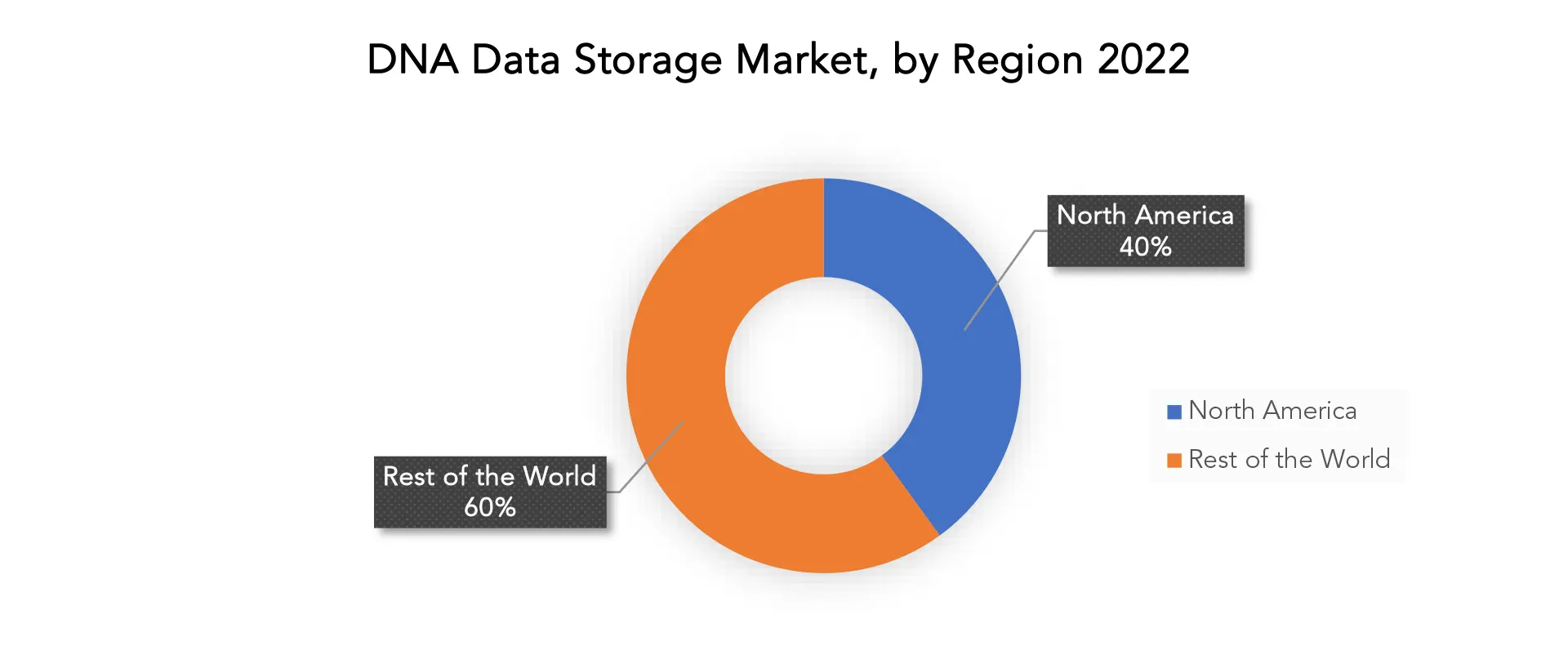

• Which region is domaining in the DNA Data Storage market?

North America accounted for the largest market in the DNA Data Storage market. North America accounted for 40 % market share of the global market value.

• Who are the major key players in the DNA Data Storage market?

Twist Bioscience, Catalog Technologies, Microsoft, IBM, Molecular Assemblies, GenScript, Zymergen, Nanochip Biotechnology.

• What are the opportunities in the DNA Data Storage market?

Long-Term Data Preservation, Environmental Sustainability creates more Opportunties in the DNA data storage market.

DNA Data Storage Market Segmentation Analysis

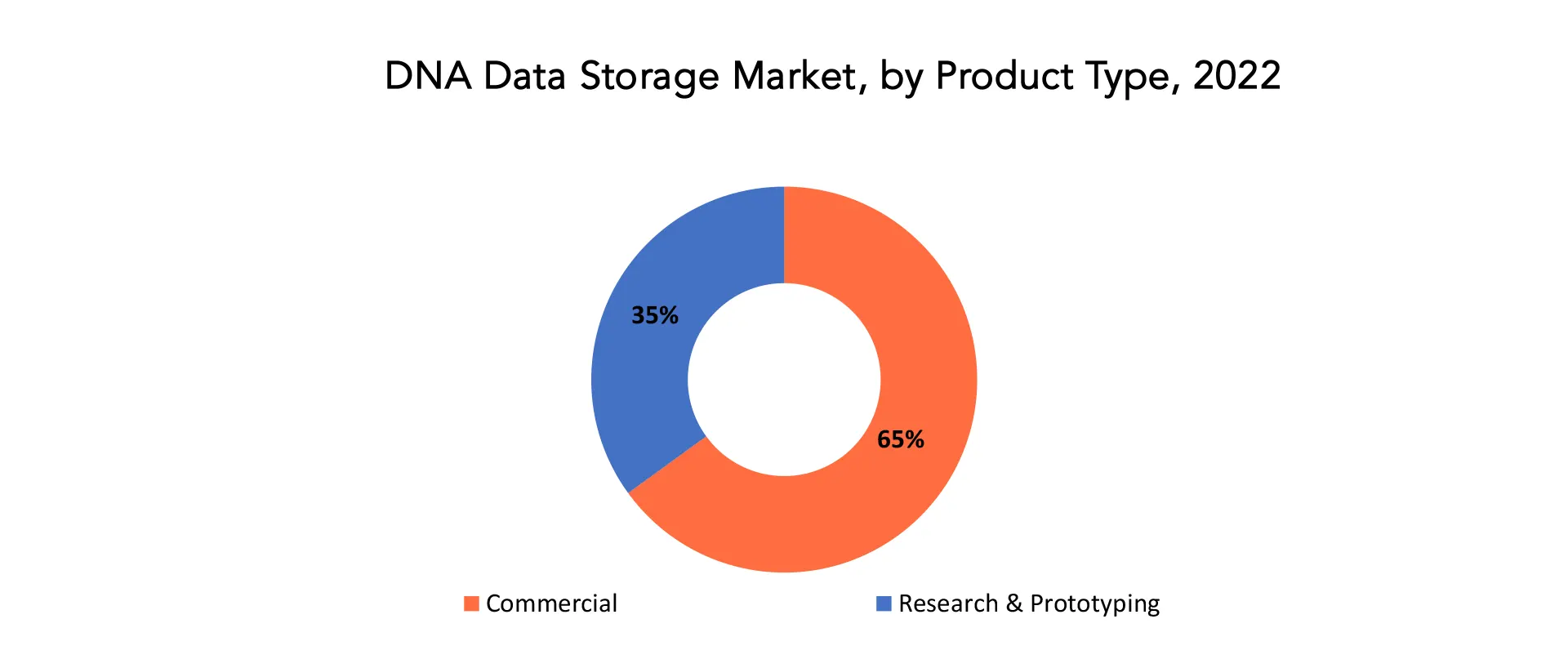

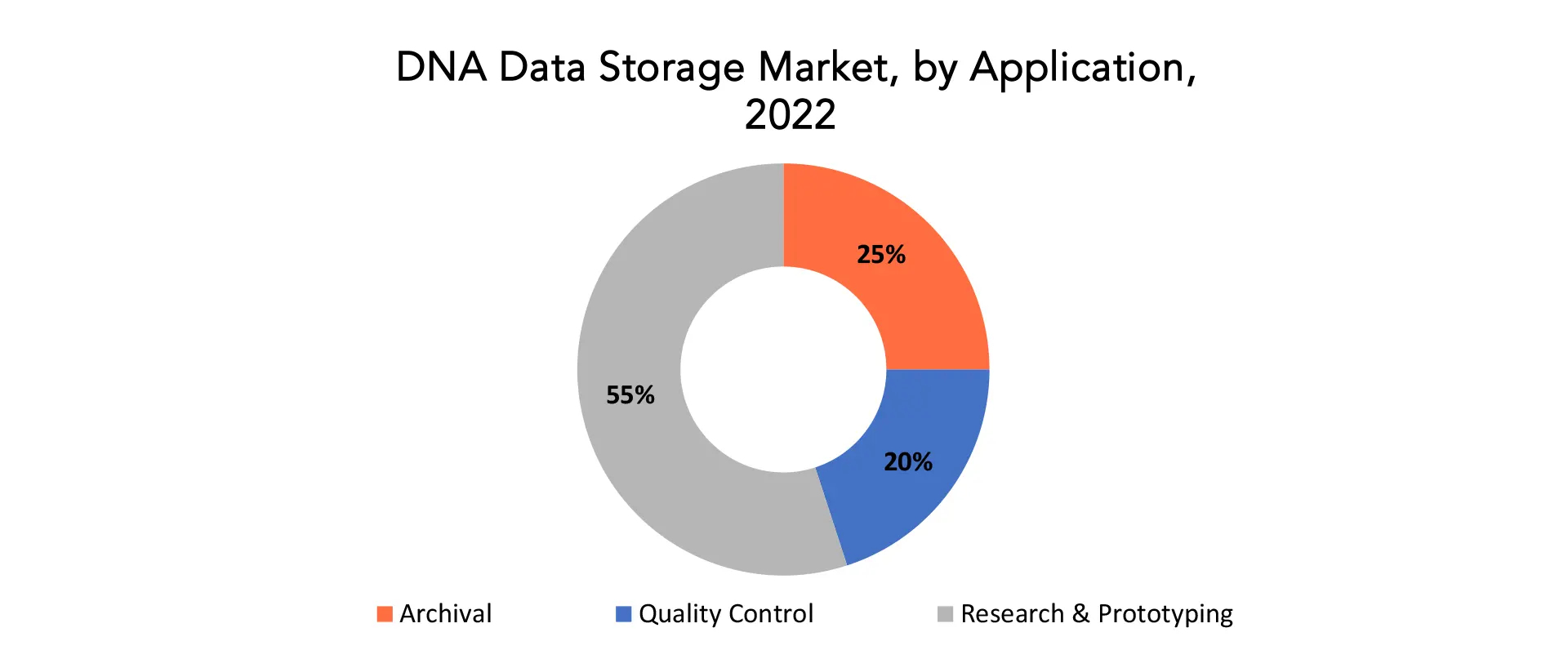

The global DNA Data Storage market is divided into 7 segments Product Type, Deployment, Application, Sequencing Platform, Synthesis Platform, End User and region. by Product Type the market is bifurcated into Commercial, Research & Prototyping. By Deployment the market is bifurcated into Cloud, On-Premise. By Application the market is bifurcated into Archival, Quality Control, Research & Prototyping. By sequencing platform, the market is bifurcated into Next-Generation Sequencing, Nanopore Sequencing. By synthesis platform the market is bifurcated into Chemical-Column Based, Chemical-Microchip Based, Enzymatic. By end user the market is bifurcated into Banking, Financial Services & Insurance, Government & Defense, Healthcare & Pharma, Media & Entertainment, Other. [caption id="attachment_34599" align="aligncenter" width="1920"]

DNA Data Storage Market Competitive Landscape

the competitive landscape of the DNA data storage market was still evolving, and it was characterized by a mix of established companies, startups, research institutions, and collaborations. The market was relatively small and concentrated, with several key players leading the way. Please note that this landscape may have evolved since then, with new entrants and developments.- Twist Bioscience

- Catalog Technologies

- Microsoft

- IBM

- Molecular Assemblies

- GenScript

- Zymergen

- Nanochip Biotechnology

- Codex DNA

- BioArchive Technologies

- Quantapore Inc.

- NEC Corporation

- Oxford Genetics

- Evonetix

- Cambridge Consultants

- DigiPulse

- Arbor Biosciences

- Write DNA

- Locus Biosciences

- BioSplice BioBots

DNA Data Storage Market Dynamics

Driver: High data density offered by DNA data storage is a major driver for the adoption and growth of this technology. Early Stage of Development: DNA data storage is still in its early stages of development as a commercial technology. Researchers and companies are primarily focused on exploring its feasibility and refining the underlying processes. This early phase naturally emphasizes research and prototyping efforts. DNA data storage involves highly complex processes for encoding, synthesizing, storing, and decoding data in DNA molecules. Researchers need to work on improving the efficiency and reliability of each step before the technology can be scaled up for commercial use. DNA data storage has historically been an expensive technology to develop and implement. Researchers need to find cost-effective methods for DNA synthesis, sequencing, and storage to make it commercially viable. Prototyping helps identify cost-saving techniques. Continuous research and prototyping efforts lead to technological advancements in the field. As researchers gain more insights and expertise, they can develop more efficient and reliable DNA data storage solutions. Before companies can commit substantial resources to commercialization, they often prefer to mitigate the technical and market risks associated with a new technology. Extensive research and prototyping help identify and address potential challenges. Collaboration and knowledge sharing among researchers and institutions are common in the early stages of developing a new technology. Sharing findings and best practices can accelerate progress in the field. DNA data storage involves handling genetic material, which raises regulatory and ethical concerns. Researchers must navigate these considerations and ensure that the technology is developed responsibly Restraint High cost of storages hampers the market growth for DNA data storage market. One of the major cost drivers in DNA data storage is the process of synthesizing DNA molecules to encode digital information. DNA synthesis involves complex chemical processes and specialized equipment, making it an expensive part of the overall storage process DNA data storage requires highly skilled personnel with expertise in molecular biology, genetics, and related fields. The expertise of researchers and technicians adds to the overall cost. Ensuring the accuracy and integrity of data stored in DNA is crucial. Quality control and error correction processes can be resource-intensive, contributing to costs. As mentioned earlier, much of the work in the DNA data storage field is research and prototyping, which involves experimentation and testing. These activities require funding and resources. Scaling up DNA data storage from small-scale research and prototyping to large-scale commercial applications can introduce economies of scale, potentially reducing costs. However, achieving this scaling while maintaining data integrity and reliability is a complex challenge. While DNA itself is a stable and long-lasting storage medium, the physical infrastructure required for storing DNA samples, including proper containment and environmental conditions, contributes to storage costs. The DNA data storage market is relatively small compared to traditional data storage markets, which can limit competition and the resulting price reductions. Opportunities: Advances in DNA synthesis and sequencing technologies, as well as encoding and decoding algorithms creates more opportunities in the DNA data storage market. More efficient DNA synthesis and sequencing methods can lead to cost reductions in the production and retrieval of DNA-based storage. Lower costs can make DNA data storage more economically viable for a broader range of applications and industries. Advances in DNA sequencing technologies can result in faster data retrieval from DNA storage. This improvement in read speeds makes DNA data storage more competitive with traditional electronic storage in terms of data access times. Improved encoding and decoding algorithms can enhance the efficiency of data representation in DNA sequences. This means that even more data can be stored in a given volume of DNA, further maximizing the high data density advantage. Better algorithms for error correction during DNA synthesis and sequencing can enhance the reliability and accuracy of data storage. This is crucial for ensuring that data remains intact and retrievable over extended periods. Advancements in DNA synthesis techniques can support the scalability of DNA data storage. This scalability is essential as organizations and industries generate increasingly large datasets.DNA Data Storage Market Trends

- Researchers were developing more efficient and error-resistant algorithms for encoding and decoding data into DNA sequences. Enhanced algorithms contributed to greater data density and reliability.

- Industry standards for DNA data storage were being explored and developed. Establishing standards was crucial for interoperability, data portability, and ensuring the technology's widespread adoption.

- A growing number of startups and companies were entering the DNA data storage market, indicating increased commercial interest. These companies were working on turning DNA data storage into viable products and services.

- The emphasis on long-term data archiving and preservation was driving interest in DNA storage, particularly in sectors such as cultural heritage, libraries, and archives.

- Hybrid data storage solutions that combined traditional electronic storage with DNA data storage were being explored. This approach allowed organizations to leverage the benefits of both technologies.

- Efforts were being made to integrate DNA data storage into cloud computing and edge computing environments, making it part of broader data management strategies.

COVID-19 Impact on the DNA Data Storage Market

- The pandemic disrupted research activities in many laboratories and research institutions, including those engaged in DNA data storage research. Shutdowns, restrictions, and safety measures impacted the pace of research and development efforts.

- Economic uncertainties caused by the pandemic led to budget constraints in both public and private sectors. Some research projects related to DNA data storage may have faced delays or reduced funding.

- The DNA synthesis and sequencing processes heavily rely on specialized equipment and materials. Disruptions in supply chains due to lockdowns and restrictions could have affected the availability of critical components for DNA data storage research.

- Many researchers and scientists transitioned to remote work and virtual collaboration, which required adjustments in laboratory procedures and data sharing. This shift may have impacted the pace of research.

- The pandemic led to a redirection of resources and attention toward healthcare and life sciences research related to COVID-19. While this was important, it could have temporarily diverted focus from other research areas, including DNA data storage.

- The pandemic accelerated digital transformation efforts across various industries. This could indirectly influence the adoption of data storage solutions, including DNA data storage, as organizations increasingly relied on digital data.

- Interest in Long-Term Data Preservation: The need for long-term data preservation became more apparent during the pandemic, particularly for critical healthcare and scientific data. This interest in data preservation could potentially benefit DNA data storage, which offers durability and longevity.

- Regulatory and Ethical Considerations: The pandemic highlighted the importance of data privacy and ethics in healthcare and research. These considerations may also apply to DNA data storage, raising awareness about responsible data handling.

DNA Data Storage Market Regional Analysis:

North America accounted for the largest market in the DNA Data Storage market. North America accounted for the 40 % market share of the value. North America, particularly the United States, is a global hub for research and invention in biotechnology and genomics. The presence of leading universities, research institutions, and biotech companies in the region fosters a conducive environment for exploring cutting-edge technologies like DNA data storage. [caption id="attachment_34608" align="aligncenter" width="1920"]

Target Audience for DNA Data Storage Market

- IT Managers and Professionals

- Data Center Operators

- Scientists and Researchers in Molecular Biology

- Educational Institutions

- DNA Synthesis and Storage Technology Companies

- Startup Companies in DNA Data Storage

- Libraries, Museums, and Archives

- Government and Defense Agencies

- Biotechnology and Pharmaceutical Companies

- Cloud Service Providers

- Environmental and Sustainability Organizations

- Regulatory Bodies and Standards Organizations

- Investors and Venture Capitalists

- Data Privacy and Security Experts

- Data Scientists and Analysts

- Innovators and Entrepreneurs

- Educational and Outreach Organizations

- End Users (Individuals and Organizations)

Segments Covered in the DNA Data Storage Market

DNA Data Storage Market by Product Type- Commercial

- Research & Prototyping

- Cloud

- On-Premise

- Archival

- Quality Control

- Research & Prototyping

- Next-Generation Sequencing

- Nanopore Sequencing

- Chemical-Column Based

- Chemical-Microchip Based

- Enzymatic

- Banking

- Financial Services & Insurance

- Government & Defense

- Healthcare & Pharma

- Media & Entertainment

- Other

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the DNA data storage market over the next 7 years?

- Who are the major players in the DNA data storage market and what is their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-pacific, the middle east, and africa?

- How is the economic environment affecting the DNA data storage market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the DNA data storage market?

- What is the current and forecasted size and growth rate of the global cleanroom wipes market?

- What are the key drivers of growth in the DNA data storage market?

- Who are the major players in the market and what is their market share?

- What are the disease types and supply chain dynamics in the DNA data storage market?

- What are the technological advancements and innovations in the DNA data storage market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the DNA data storage market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the DNA data storage market?

- What are the product products and specifications of leading players in the market?

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- DNA DATA STORAGE MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON DNA DATA STORAGE MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- DNA DATA STORAGE MARKET OUTLOOK

- GLOBAL DNA DATA STORAGE MARKET BY PRODUCT TYPE, 2020-2030, (USD BILLION)

- COMMERCIAL

- RESEARCH & PROTOTYPING

- GLOBAL DNA DATA STORAGE MARKET BY DEPLOYMENT, 2020-2030, (USD BILLION)

- CLOUD

- ON-PREMISE

- GLOBAL DNA DATA STORAGE MARKET BY APPLICATION, 2020-2030, (USD BILLION)

- ARCHIVAL

- QUALITY CONTROL

- RESEARCH & PROTOTYPING

- GLOBAL DNA DATA STORAGE MARKET BY SEQUENCING PLATFORM, 2020-2030, (USD BILLION)

- ACTIVE DNA DATA STORAGE SYSTEM (ATVS)

- PASSIVE DNA DATA STORAGE SYSTEM (PTVS)

- GLOBAL DNA DATA STORAGE MARKET BY SEQUENCING PLATFORM, 2020-2030, (USD BILLION)

- CHEMICAL-COLUMN BASED

- CHEMICAL-MICROCHIP BASED

- ENZYMATIC

- GLOBAL DNA DATA STORAGE MARKET BY END USER, 2020-2030, (USD BILLION)

- BANKING

- FINANCIAL SERVICES & INSURANCE

- GOVERNMENT & DEFENSE

- HEALTHCARE & PHARMA

- MEDIA & ENTERTAINMENT

- OTHER

- GLOBAL DNA DATA STORAGE MARKET BY REGION, 2020-2030, (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- TWIST BIOSCIENCE

- CATALOG TECHNOLOGIES

- MICROSOFT

- IBM

- MOLECULAR ASSEMBLIES

- GENSCRIPT

- ZYMERGEN

- NANOCHIP BIOTECHNOLOGY

- CODEX DNA

- BIOARCHIVE TECHNOLOGIES

- QUANTAPORE INC.

- NEC CORPORATION

- OXFORD GENETICS

- EVONETIX

- CAMBRIDGE CONSULTANTS

- DIGI PULSE

- ARBOR BIOSCIENCES

- WRITE DNA

- LOCUS BIOSCIENCES

- BIOSPLICE BIOBOTS

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL DNA DATA STORAGE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 2 GLOBAL DNA DATA STORAGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 3 GLOBAL DNA DATA STORAGE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 4 GLOBAL DNA DATA STORAGE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 5 GLOBAL DNA DATA STORAGE MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 6 GLOBAL DNA DATA STORAGE MARKET BY SYNTHESIS PLAT FORM (USD BILLION) 2020-2030

TABLE 7 GLOBAL DNA DATA STORAGE MARKET BY SEQUENCING PLAT SEQUENCING PLAT FORM (USD BILLION) 2020-2030

TABLE 8 GLOBAL DNA DATA STORAGE MARKET BY REGION (USD BILLION) 2020-2030

TABLE 9 NORTH AMERICA DNA DATA STORAGE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 10 NORTH AMERICA DNA DATA STORAGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 11 NORTH AMERICA DNA DATA STORAGE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 12 NORTH AMERICA DNA DATA STORAGE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 13 NORTH AMERICA DNA DATA STORAGE MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 14 NORTH AMERICA DNA DATA STORAGE MARKET BY SYNTHESIS PLAT FORM (USD BILLION) 2020-2030

TABLE 15 NORTH AMERICA DNA DATA STORAGE MARKET BY SEQUENCING PLAT SEQUENCING PLAT FORM (USD BILLION) 2020-2030

TABLE 16 US DNA DATA STORAGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 17 US DNA DATA STORAGE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 18 US DNA DATA STORAGE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 19 US DNA DATA STORAGE MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 20 US DNA DATA STORAGE MARKET BY SYNTHESIS PLAT FORM (USD BILLION) 2020-2030

TABLE 21 US DNA DATA STORAGE MARKET BY SEQUENCING PLAT SEQUENCING PLAT FORM (USD BILLION) 2020-2030

TABLE 22 CANADA DNA DATA STORAGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 23 CANADA DNA DATA STORAGE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 24 CANADA DNA DATA STORAGE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 25 CANADA DNA DATA STORAGE MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 26 CANADA DNA DATA STORAGE MARKET BY SYNTHESIS PLAT FORM (USD BILLION) 2020-2030

TABLE 27 CANADA DNA DATA STORAGE MARKET BY SEQUENCING PLAT SEQUENCING PLAT FORM (USD BILLION) 2020-2030

TABLE 28 MEXICO DNA DATA STORAGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 29 MEXICO DNA DATA STORAGE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 30 MEXICO DNA DATA STORAGE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 31 MEXICO DNA DATA STORAGE MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 32 MEXICO DNA DATA STORAGE MARKET BY SYNTHESIS PLAT FORM (USD BILLION) 2020-2030

TABLE 33 MEXICO DNA DATA STORAGE MARKET BY SEQUENCING PLAT SEQUENCING PLAT FORM (USD BILLION) 2020-2030

TABLE 34 SOUTH AMERICA DNA DATA STORAGE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 35 SOUTH AMERICA DNA DATA STORAGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 36 SOUTH AMERICA DNA DATA STORAGE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 37 SOUTH AMERICA DNA DATA STORAGE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 38 SOUTH AMERICA DNA DATA STORAGE MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 39 SOUTH AMERICA DNA DATA STORAGE MARKET BY SYNTHESIS PLAT FORM (USD BILLION) 2020-2030

TABLE 40 SOUTH AMERICA DNA DATA STORAGE MARKET BY SEQUENCING PLAT SEQUENCING PLAT FORM (USD BILLION) 2020-2030

TABLE 41 BRAZIL DNA DATA STORAGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 42 BRAZIL DNA DATA STORAGE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 43 BRAZIL DNA DATA STORAGE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 44 BRAZIL DNA DATA STORAGE MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 45 BRAZIL DNA DATA STORAGE MARKET BY SYNTHESIS PLAT FORM (USD BILLION) 2020-2030

TABLE 46 BRAZIL DNA DATA STORAGE MARKET BY SEQUENCING PLAT SEQUENCING PLAT FORM (USD BILLION) 2020-2030

TABLE 47 ARGENTINA DNA DATA STORAGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 48 ARGENTINA DNA DATA STORAGE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 49 ARGENTINA DNA DATA STORAGE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 50 ARGENTINA DNA DATA STORAGE MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 51 ARGENTINA DNA DATA STORAGE MARKET BY SYNTHESIS PLAT FORM (USD BILLION) 2020-2030

TABLE 52 ARGENTINA DNA DATA STORAGE MARKET BY SEQUENCING PLAT SEQUENCING PLAT FORM (USD BILLION) 2020-2030

TABLE 53 COLOMBIA DNA DATA STORAGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 54 COLOMBIA DNA DATA STORAGE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 55 COLOMBIA DNA DATA STORAGE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 56 COLOMBIA DNA DATA STORAGE MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 57 COLOMBIA DNA DATA STORAGE MARKET BY SYNTHESIS PLAT FORM (USD BILLION) 2020-2030

TABLE 58 COLOMBIA DNA DATA STORAGE MARKET BY SEQUENCING PLAT SEQUENCING PLAT FORM (USD BILLION) 2020-2030

TABLE 59 REST OF SOUTH AMERICA DNA DATA STORAGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 60 REST OF SOUTH AMERICA DNA DATA STORAGE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 61 REST OF SOUTH AMERICA DNA DATA STORAGE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 62 REST OF SOUTH AMERICA DNA DATA STORAGE MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 63 REST OF SOUTH AMERICA DNA DATA STORAGE MARKET BY SYNTHESIS PLAT FORM (USD BILLION) 2020-2030

TABLE 64 REST OF SOUTH AMERICA DNA DATA STORAGE MARKET BY SEQUENCING PLAT SEQUENCING PLAT FORM (USD BILLION) 2020-2030

TABLE 65 ASIA-PACIFIC DNA DATA STORAGE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 66 ASIA-PACIFIC DNA DATA STORAGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 67 ASIA-PACIFIC DNA DATA STORAGE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 68 ASIA-PACIFIC DNA DATA STORAGE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 69 ASIA-PACIFIC DNA DATA STORAGE MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 70 ASIA-PACIFIC DNA DATA STORAGE MARKET BY SYNTHESIS PLAT FORM (USD BILLION) 2020-2030

TABLE 71 ASIA-PACIFIC DNA DATA STORAGE MARKET BY SEQUENCING PLAT SEQUENCING PLAT FORM (USD BILLION) 2020-2030

TABLE 72 INDIA DNA DATA STORAGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 73 INDIA DNA DATA STORAGE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 74 INDIA DNA DATA STORAGE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 75 INDIA DNA DATA STORAGE MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 76 INDIA DNA DATA STORAGE MARKET BY SYNTHESIS PLAT FORM (USD BILLION) 2020-2030

TABLE 77 INDIA DNA DATA STORAGE MARKET BY SEQUENCING PLAT SEQUENCING PLAT FORM (USD BILLION) 2020-2030

TABLE 78 CHINA DNA DATA STORAGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 79 CHINA DNA DATA STORAGE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 80 CHINA DNA DATA STORAGE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 81 CHINA DNA DATA STORAGE MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 82 CHINA DNA DATA STORAGE MARKET BY SYNTHESIS PLAT FORM (USD BILLION) 2020-2030

TABLE 83 CHINA DNA DATA STORAGE MARKET BY SEQUENCING PLAT SEQUENCING PLAT FORM (USD BILLION) 2020-2030

TABLE 84 JAPAN DNA DATA STORAGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 85 JAPAN DNA DATA STORAGE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 86 JAPAN DNA DATA STORAGE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 87 JAPAN DNA DATA STORAGE MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 88 JAPAN DNA DATA STORAGE MARKET BY SYNTHESIS PLAT FORM (USD BILLION) 2020-2030

TABLE 89 JAPAN DNA DATA STORAGE MARKET BY SEQUENCING PLAT SEQUENCING PLAT FORM (USD BILLION) 2020-2030

TABLE 90 SOUTH KOREA DNA DATA STORAGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 91 SOUTH KOREA DNA DATA STORAGE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 92 SOUTH KOREA DNA DATA STORAGE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 93 SOUTH KOREA DNA DATA STORAGE MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 94 SOUTH KOREA DNA DATA STORAGE MARKET BY SYNTHESIS PLAT FORM (USD BILLION) 2020-2030

TABLE 95 SOUTH KOREA DNA DATA STORAGE MARKET BY SEQUENCING PLAT SEQUENCING PLAT FORM (USD BILLION) 2020-2030

TABLE 96 AUSTRALIA DNA DATA STORAGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 97 AUSTRALIA DNA DATA STORAGE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 98 AUSTRALIA DNA DATA STORAGE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 99 AUSTRALIA DNA DATA STORAGE MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 100 AUSTRALIA DNA DATA STORAGE MARKET BY SYNTHESIS PLAT FORM (USD BILLION) 2020-2030

TABLE 101 AUSTRALIA DNA DATA STORAGE MARKET BY SEQUENCING PLAT SEQUENCING PLAT FORM (USD BILLION) 2020-2030

TABLE 102 SOUTH-EAST ASIA DNA DATA STORAGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 103 SOUTH-EAST ASIA DNA DATA STORAGE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 104 SOUTH-EAST ASIA DNA DATA STORAGE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 105 SOUTH-EAST ASIA DNA DATA STORAGE MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 106 SOUTH-EAST ASIA DNA DATA STORAGE MARKET BY SYNTHESIS PLAT FORM (USD BILLION) 2020-2030

TABLE 107 SOUTH-EAST ASIA DNA DATA STORAGE MARKET BY SEQUENCING PLAT SEQUENCING PLAT FORM (USD BILLION) 2020-2030

TABLE 108 REST OF ASIA PACIFIC DNA DATA STORAGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 109 REST OF ASIA PACIFIC DNA DATA STORAGE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 110 REST OF ASIA PACIFIC DNA DATA STORAGE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 111 REST OF ASIA PACIFIC DNA DATA STORAGE MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 112 REST OF ASIA PACIFIC DNA DATA STORAGE MARKET BY SYNTHESIS PLAT FORM (USD BILLION) 2020-2030

TABLE 113 REST OF ASIA PACIFIC DNA DATA STORAGE MARKET BY SEQUENCING PLAT SEQUENCING PLAT FORM (USD BILLION) 2020-2030

TABLE 114 EUROPE DNA DATA STORAGE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 115 EUROPE DNA DATA STORAGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 116 EUROPE DNA DATA STORAGE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 117 EUROPE DNA DATA STORAGE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 118 EUROPE DNA DATA STORAGE MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 119 EUROPE DNA DATA STORAGE MARKET BY SYNTHESIS PLAT FORM (USD BILLION) 2020-2030

TABLE 120 EUROPE DNA DATA STORAGE MARKET BY SEQUENCING PLAT SEQUENCING PLAT FORM (USD BILLION) 2020-2030

TABLE 121 GERMANY DNA DATA STORAGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 122 GERMANY DNA DATA STORAGE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 123 GERMANY DNA DATA STORAGE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 124 GERMANY DNA DATA STORAGE MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 125 GERMANY DNA DATA STORAGE MARKET BY SYNTHESIS PLAT FORM (USD BILLION) 2020-2030

TABLE 126 GERMANY DNA DATA STORAGE MARKET BY SEQUENCING PLAT SEQUENCING PLAT FORM (USD BILLION) 2020-2030

TABLE 127 UK DNA DATA STORAGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 128 UK DNA DATA STORAGE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 129 UK DNA DATA STORAGE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 130 UK DNA DATA STORAGE MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 131 UK DNA DATA STORAGE MARKET BY SYNTHESIS PLAT FORM (USD BILLION) 2020-2030

TABLE 132 UK DNA DATA STORAGE MARKET BY SEQUENCING PLAT SEQUENCING PLAT FORM (USD BILLION) 2020-2030

TABLE 133 FRANCE DNA DATA STORAGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 134 FRANCE DNA DATA STORAGE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 135 FRANCE DNA DATA STORAGE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 136 FRANCE DNA DATA STORAGE MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 137 FRANCE DNA DATA STORAGE MARKET BY SYNTHESIS PLAT FORM (USD BILLION) 2020-2030

TABLE 138 FRANCE DNA DATA STORAGE MARKET BY SEQUENCING PLAT SEQUENCING PLAT FORM (USD BILLION) 2020-2030

TABLE 139 ITALY DNA DATA STORAGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 140 ITALY DNA DATA STORAGE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 141 ITALY DNA DATA STORAGE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 142 ITALY DNA DATA STORAGE MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 143 ITALY DNA DATA STORAGE MARKET BY SYNTHESIS PLAT FORM (USD BILLION) 2020-2030

TABLE 144 ITALY DNA DATA STORAGE MARKET BY SEQUENCING PLAT SEQUENCING PLAT FORM (USD BILLION) 2020-2030

TABLE 145 SPAIN DNA DATA STORAGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 146 SPAIN DNA DATA STORAGE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 147 SPAIN DNA DATA STORAGE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 148 SPAIN DNA DATA STORAGE MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 149 SPAIN DNA DATA STORAGE MARKET BY SYNTHESIS PLAT FORM (USD BILLION) 2020-2030

TABLE 150 SPAIN DNA DATA STORAGE MARKET BY SEQUENCING PLAT SEQUENCING PLAT FORM (USD BILLION) 2020-2030

TABLE 151 RUSSIA DNA DATA STORAGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 152 RUSSIA DNA DATA STORAGE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 153 RUSSIA DNA DATA STORAGE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 154 RUSSIA DNA DATA STORAGE MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 155 RUSSIA DNA DATA STORAGE MARKET BY SYNTHESIS PLAT FORM (USD BILLION) 2020-2030

TABLE 156 RUSSIA DNA DATA STORAGE MARKET BY SEQUENCING PLAT SEQUENCING PLAT FORM (USD BILLION) 2020-2030

TABLE 157 REST OF EUROPE DNA DATA STORAGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 158 REST OF EUROPE DNA DATA STORAGE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 159 REST OF EUROPE DNA DATA STORAGE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 160 REST OF EUROPE DNA DATA STORAGE MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 161 REST OF EUROPE DNA DATA STORAGE MARKET BY SYNTHESIS PLAT FORM (USD BILLION) 2020-2030

TABLE 162 REST OF EUROPE DNA DATA STORAGE MARKET BY SEQUENCING PLAT SEQUENCING PLAT FORM (USD BILLION) 2020-2030

TABLE 163 MIDDLE EAST AND AFRICA DNA DATA STORAGE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 164 MIDDLE EAST AND AFRICA DNA DATA STORAGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 165 MIDDLE EAST AND AFRICA DNA DATA STORAGE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 166 MIDDLE EAST AND AFRICA DNA DATA STORAGE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 167 MIDDLE EAST AND AFRICA DNA DATA STORAGE MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 168 MIDDLE EAST AND AFRICA DNA DATA STORAGE MARKET BY SYNTHESIS PLAT FORM (USD BILLION) 2020-2030

TABLE 169 MIDDLE EAST AND AFRICA DNA DATA STORAGE MARKET BY SEQUENCING PLAT SEQUENCING PLAT FORM (USD BILLION) 2020-2030

TABLE 170 UAE DNA DATA STORAGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 171 UAE DNA DATA STORAGE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 172 UAE DNA DATA STORAGE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 173 UAE DNA DATA STORAGE MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 174 UAE DNA DATA STORAGE MARKET BY SYNTHESIS PLAT FORM (USD BILLION) 2020-2030

TABLE 175 UAE DNA DATA STORAGE MARKET BY SEQUENCING PLAT SEQUENCING PLAT FORM (USD BILLION) 2020-2030

TABLE 176 SAUDI ARABIA DNA DATA STORAGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 177 SAUDI ARABIA DNA DATA STORAGE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 178 SAUDI ARABIA DNA DATA STORAGE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 179 SAUDI ARABIA DNA DATA STORAGE MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 180 SAUDI ARABIA DNA DATA STORAGE MARKET BY SYNTHESIS PLAT FORM (USD BILLION) 2020-2030

TABLE 181 SAUDI ARABIA DNA DATA STORAGE MARKET BY SEQUENCING PLAT SEQUENCING PLAT FORM (USD BILLION) 2020-2030

TABLE 182 SOUTH AFRICA DNA DATA STORAGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 183 SOUTH AFRICA DNA DATA STORAGE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 184 SOUTH AFRICA DNA DATA STORAGE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 185 SOUTH AFRICA DNA DATA STORAGE MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 186 SOUTH AFRICA DNA DATA STORAGE MARKET BY SYNTHESIS PLAT FORM (USD BILLION) 2020-2030

TABLE 187 SOUTH AFRICA DNA DATA STORAGE MARKET BY SEQUENCING PLAT SEQUENCING PLAT FORM (USD BILLION) 2020-2030

TABLE 188 REST OF MIDDLE EAST AND AFRICA DNA DATA STORAGE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 189 REST OF MIDDLE EAST AND AFRICA DNA DATA STORAGE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 190 REST OF MIDDLE EAST AND AFRICA DNA DATA STORAGE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 191 REST OF MIDDLE EAST AND AFRICA DNA DATA STORAGE MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 192 REST OF MIDDLE EAST AND AFRICA DNA DATA STORAGE MARKET BY SYNTHESIS PLAT FORM (USD BILLION) 2020-2030

TABLE 193 REST OF MIDDLE EAST AND AFRICA DNA DATA STORAGE MARKET BY SEQUENCING PLAT SEQUENCING PLAT FORM (USD BILLION) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL DNA DATA STORAGE MARKET BY PRODUCT TYPE USD BILLION, 2020-2030

FIGURE 9 GLOBAL DNA DATA STORAGE MARKET BY DEPLOYMENT USD BILLION, 2020-2030

FIGURE 10 GLOBAL DNA DATA STORAGE MARKET BY APPLICATION USD BILLION, 2020-2030

FIGURE 11 GLOBAL DNA DATA STORAGE MARKET BY SEQUENCING PLATFORM USD BILLION, 2020-2030

FIGURE 12 GLOBAL DNA DATA STORAGE MARKET BY SYNTHESIS PLATFORM USD BILLION, 2020-2030

FIGURE 13 GLOBAL DNA DATA STORAGE MARKET BY END USER USD BILLION, 2020-2030

FIGURE 14 GLOBAL DNA DATA STORAGE MARKET BY REGION USD BILLION, 2020-2030

FIGURE 15 PORTER’S FIVE FORCES MODEL

FIGURE 16 GLOBAL DNA DATA STORAGE MARKET BY PRODUCT TYPE USD BILLION, 2022

FIGURE 17 GLOBAL DNA DATA STORAGE MARKET BY DEPLOYMENT USD BILLION, 2022

FIGURE 18 GLOBAL DNA DATA STORAGE MARKET BY APPLICATION USD BILLION, 2022

FIGURE 19 GLOBAL DNA DATA STORAGE MARKET BY SEQUENCING PLATFORM USD BILLION, 2022

FIGURE 19 GLOBAL DNA DATA STORAGE MARKET BY SYNTHESIS PLATFORM USD BILLION, 2022

FIGURE 20 GLOBAL DNA DATA STORAGE MARKET BY REGION USD BILLION, 2022

FIGURE 21 MARKET SHARE ANALYSIS

FIGURE 22 TWIST BIOSCIENCE: COMPANY SNAPSHOT

FIGURE 23 CEUTA HEALTHCARE LIMITED: COMPANY SNAPSHOT

FIGURE 24 MICROSOFT: COMPANY SNAPSHOT

FIGURE 25 IBM: COMPANY SNAPSHOT

FIGURE 25 GENSCRIPT: COMPANY SNAPSHOT

FIGURE 22 ZYMERGEN: COMPANY SNAPSHOT

FIGURE 23 NANOCHIP BIOTECHNOLOGY: COMPANY SNAPSHOT

FIGURE 24 CODEX DNA: COMPANY SNAPSHOT

FIGURE 25 BIO ARCHIVE TECHNOLOGIES: COMPANY SNAPSHOT

FIGURE 26 QUANTA PORE INC.: COMPANY SNAPSHOT

FIGURE 27 NEC CORPORATION: COMPANY SNAPSHOT

FIGURE 28 OXFORD GENETICS: COMPANY SNAPSHOT

FIGURE 29 EVONETIX: COMPANY SNAPSHOT

FIGURE 30 CAMBRIDGE CONSULTANTS: COMPANY SNAPSHOT

FIGURE 31 DIGI PULSE: COMPANY SNAPSHOT

FIGURE 32 ARBOR BIOSCIENCES: COMPANY SNAPSHOT

DOWNLOAD FREE SAMPLE REPORT

License Type

SPEAK WITH OUR ANALYST

Want to know more about the report or any specific requirement?

WANT TO CUSTOMIZE THE REPORT?

Our Clients Speak

We asked them to research ‘ Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te

Yosuke Mitsui

Senior Associate Construction Equipment Sales & Marketing

We asked them to research ‘Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te