Base Year Value ()

CAGR ()

Forecast Year Value ()

Historical Data Period

Largest Region

Forecast Period

Deep Packet Inspection (DPI) Market By Product (Standalone, Integrated), By Deployment Mode (On-Premise, Cloud Based), By End-User (BFSI, Government and Defence, Healthcare, IT and Telecom, Retail and Ecommerce, Manufacturing, Others) and Region, Global Trends and forecast from 2024 to 2030

Instant access to hundreds of data points and trends

- Market estimates from 2014-2029

- Competitive analysis, industry segmentation, financial benchmarks

- Incorporates SWOT, Porter's Five Forces and risk management frameworks

- PDF report or online database with Word, Excel and PowerPoint export options

- 100% money back guarantee

Market Overview

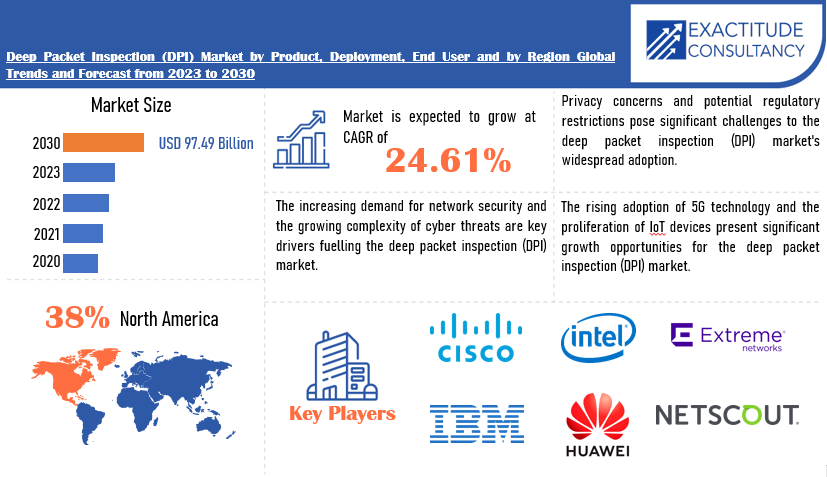

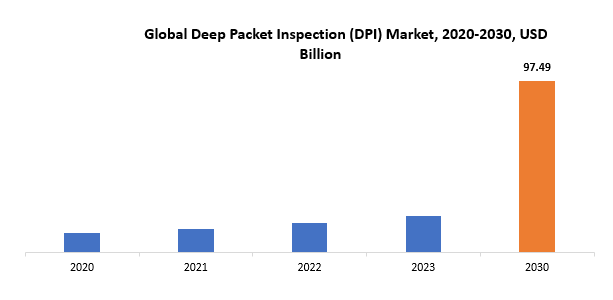

The global deep packet inspection (DPI) market is anticipated to grow from USD 20.9 Billion in 2023 to USD 97.49 Billion by 2030, at a CAGR of 24.61% during the forecast period.

In a computer network, deep packet inspection (DPI) is a kind of packet filtering that looks at data as it goes through a checkpoint, including the data packet's header. With thorough packet inspection and processing, developers may delve deeper into network packets and gain a better understanding of network flows. IT specialists can further avoid malware and enhance data center security with DPI. Additionally, it makes network monitoring, load balancing, and other devices based on network flow detection affordable. Due to the rising demand for malware detection, stricter internet security regulations, and improved management of expanding data traffic, the deep packet inspection market has experienced tremendous development in recent years.

The market for deep packet inspection is expanding significantly, particularly in order to improve network security. One technique that looks into these actions in detail is called deep packet inspection. One kind of data processing that looks over and controls network traffic is called deep packet inspection. It safeguards all data and averts widespread viral attacks. The rate of cybercrime is continuously rising. Cybercrime has developed significantly over the years and is still growing at a quicker pace. This element can have an impact on the Deep Packet Inspection market's growth rate. Over the projected period, the global deep packet inspection (DPI) market is expected to increase at a substantial rate. The causes include an increase in cybercrimes and online traffic, as well as the growing need for Deep Packet Inspection (DPI) across many industrial sectors. Deep packet inspection (DPI), a sort of packet filtering, is frequently used by companies and internet service providers (ISPs) to track user behavior, halt malware, battle traffic patterns, and discover and stop cyberattacks. Deep packet inspection technology will be in high demand shortly due to an increase in cybercrime and web attacks.

[caption id="attachment_37080" align="aligncenter" width="827"]

Furthermore, the number of cybercrimes and online attacks is rising, demonstrating how difficult it is to maintain web security. Hackers are eager to breach people's website security and take down the web application they spent a lot of time and effort creating. In addition, as time goes on, cyberattacks get more sophisticated, and internet companies must protect themselves from them in order to continue operating. One of the most effective tools for web security is deep packet inspection (DPI), which may thwart contemporary online threats. Modern online security procedures are based on the DPI parameters, which include security features, user service, and network management. Large corporations, international telecom providers, governments, and other online industry sectors all firmly believe that a flexible web security layer is essential. The Internet of Things (IoT) is evolving into a necessary evil for the modern world as it promotes the development of new cyberattacks.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) |

| Segmentation | By Product, By Deployment Mode, By End User, and By Region |

| By Product |

|

| By Deployment Mode |

|

| By End User |

|

|

By Region |

|

Frequently Asked Questions

• What is the market size for the Deep Packet Inspection (DPI) market?

The global deep packet inspection (DPI) market is anticipated to grow from USD 20.9 Billion in 2023 to USD 97.49 Billion by 2030, at a CAGR of 24.61% during the forecast period.

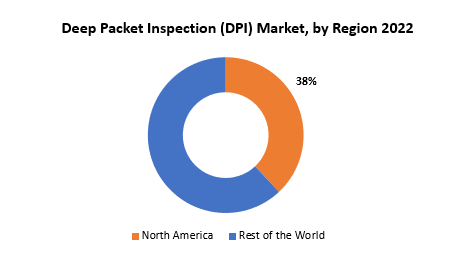

• Which region is dominant in the Deep Packet Inspection (DPI) market?

North America accounted for the largest market in the deep packet inspection (DPI) market. North America accounted for 38% market share of the global market value.

• Who are the major key players in the Deep Packet Inspection (DPI) market?

Cisco Systems, International Business Machine (IBM), Intel, NortonLifeLock (Symantec), Palo Alto Networks, Check Point Software Technologies, Extreme Networks, Netscout Systems, Procera Networks(Sandvine), Viavi Solutions, Allot Communications, Bivio Networks, Cpacket Networks, Enea, Huawei, Extreme Networks, Juniper Networks, NetScout, Allot Communication

• What is the latest trend in the Deep Packet Inspection (DPI) market?

Security and Threat Intelligence: The growing sophistication of cyber threats has led to an increased demand for DPI solutions that provide advanced threat intelligence and detection capabilities, helping organizations to enhance their cybersecurity measures.

Deep Packet Inspection (DPI) Market Segmentation Analysis

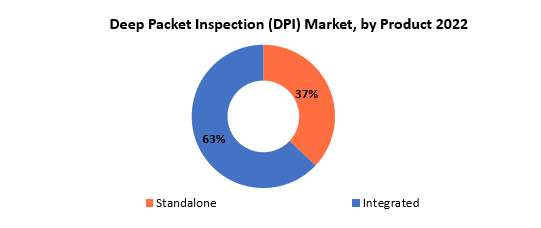

The market for Deep Packet Inspection (DPI) is divided into four segments according to product, deployment mode, end user and region. The Deep Packet Inspection (DPI) market offers standalone and integrated products, available through on premise and cloud-based deployment modes, catering to various end-user sectors such as BFSI, Government and defense, healthcare, it and telecom, retail and e-commerce, manufacturing, and others.

[caption id="attachment_37081" align="aligncenter" width="576"]

The market is divided into Integrated DPI and Standalone DPI segments based on product. With a 63% market share, the Integrated DPI category is expected to increase at a compound annual growth rate (CAGR) of 23.40% throughout the course of the projection period. An integrated DPI system includes GGSN devices or 4G/3G wireless gateways with DPI capabilities. Because it deals with fewer network elements, integrated DPI is an innovative, cost-effective method that drastically reduces mistake risk. Integrated DPI solutions are offered by the major telecom and networking infrastructure suppliers including Cisco and Huawei. Integrating DPI capabilities with a wireless network node simplifies the process of gathering and integrating essential RAN data.

Standalone products in the Deep Packet Inspection (DPI) market are those that function on their own without requiring system integration. With their ability to examine and analyses network data at a finer level, standalone DPI technologies offer comprehensive insights into the contents of individual packets. Real-time data detection and analysis capabilities of these technologies enable accurate identification of protocols, applications, and any security risks. Standalone DPI solutions are useful for enterprises looking for focused and effective packet inspection capabilities inside their network architecture because of their adaptability and capacity to serve as specialized tools for particular jobs.

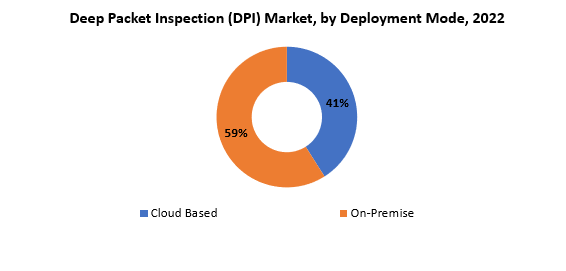

[caption id="attachment_37082" align="aligncenter" width="578"]

Based on deployment types, the deep packet inspection market is divided into cloud-based and on-premises segments. The deep packet inspection and processing market is dominated by the cloud sector, which is expected to grow at a compound annual growth rate (CAGR) of 6.6% from 2023 to 2030. Data security, ease of access, and simplicity of implementation are the main drivers of this segment's strong sales. Businesses are now able to concentrate on their core skills thanks to the larger area and quick transfer. Deep packet inspection and processing unit sales are fueled by these. Because cloud-based services are so easy to use, consumers may access information whenever they want and at their convenience. The cloud environment presents special security risks, such as unsecured access, data breaches, distributed denial of service (DDoS) assaults, and data losses. Monitored machines are virtual in nature, and can be added and removed easily, which tend to change security requirements. Cloud-based deep packet inspection and processing solutions enable enterprises to gain more control over servers, infrastructure, and systems, which can be configured as per business requirements.

Installing and running Deep Packet Inspection (DPI) solutions inside an organization's infrastructure is known as the on premise deployment mode in the DPI industry. By giving enterprises total ownership and control over the DPI implementation, this method enables customization and adherence to certain security and compliance needs. Organizations with sensitive data or regulatory concerns usually prefer on premise DPI systems because they provide more privacy and control over the inspection process. On-premise implementation, however, might need a large upfront hardware and maintenance expenditure, therefore it's critical for organizations to balance the control advantages against these expenses.

[caption id="attachment_37083" align="aligncenter" width="590"]

Deep Packet Inspection (DPI) Market Dynamics

DriverThe major factors driving the deep packet inspection and processing market are technological advancements in the corporate structure, rising cyber-attacks.

The market for deep packet inspection and processing is expanding significantly due to a number of important considerations. The market is driven primarily by technological developments made inside corporate organizations, such as the adoption of complex communication protocols and the integration of modern networking technology. Deep packet inspection is being used by more and more organizations to guarantee the effectiveness and security of their network infrastructure. The increasing prevalence and complexity of cyberattacks worldwide have served as a significant driving force behind the use of deep packet inspection and processing systems. Through the examination of packet-level data, the detection of abnormalities, and the prevention of malicious activity, these technologies empower organizations to identify and mitigate possible risks. The need for sophisticated deep packet inspection solutions is growing as cyber threats continue to change, offering a proactive approach to cybersecurity. The market growth is further accelerated by the need for robust data protection and compliance with stringent regulations, compelling businesses to invest in cutting-edge packet inspection technologies.

RestraintHigh capital investments needed for the implementation and maintenance of deep packet inspection and processing are the major factor that hinders the growth of the market.

The deep packet inspection and processing technologies' large capital expenditure requirements for their deployment as well as continuous maintenance pose a major barrier to the market's expansion. The initial setup expenses cover the expenditures of hiring qualified staff, purchasing specialized hardware and software, and deploying and integrating these advanced systems into pre-existing network infrastructures. In addition, companies typically have to spend a large amount of money on staff training courses in order to guarantee that deep packet inspection technologies are used and operated effectively. Small and medium-sized businesses with tight resources may find it prohibitive to purchase and maintain such expensive equipment, which would limit their capacity to implement these cutting-edge security measures. Furthermore, deep packet inspection systems must be updated and upgraded often due to the ongoing growth of cyber threats, which adds to the financial burden on organizations. The ongoing operational expenses, including licensing fees, monitoring, and regular system updates, contribute to the overall cost of ownership, making it challenging for certain businesses to justify and sustain such investments.

OpportunitiesDPI's capabilities extend beyond traditional network security, offering opportunities for applications in industries such as healthcare, finance.

Beyond traditional network security, Deep Packet Inspection (DPI) opens up a variety of potential in sectors including banking and healthcare. By guaranteeing the safe transfer of private medical data, DPI can improve patient data security and expedite effective telemedicine in the healthcare industry. DPI makes it possible for the banking industry to implement strong cybersecurity safeguards that safeguard financial transactions, identify fraudulent activity, and guarantee adherence to strict regulatory standards. Additionally, DPI's traffic analysis tools may be used to optimize network performance in financial and healthcare institutions, which will increase operational efficiency. In industries where data integrity and dependability are vital, DPI's capacity to recognize and rank key data packets facilitates efficient communication and data management. All things considered, DPI's many uses go beyond security, providing customized solutions that cater to the unique demands of healthcare, finance, and various other industries.

Deep Packet Inspection (DPI) Market Trends

-

5G Integration: With the global rollout of 5G networks, there has been an increased focus on DPI solutions capable of efficiently handling the higher data speeds and volumes associated with 5G technology.

-

Security and Threat Intelligence: The growing sophistication of cyber threats has led to an increased demand for DPI solutions that provide advanced threat intelligence and detection capabilities, helping organizations to enhance their cybersecurity measures.

-

Cloud-Based DPI Solutions: The shift towards cloud computing has influenced DPI solutions to move towards cloud-based deployment models. This trend allows for more flexibility, scalability, and ease of management for organizations.

-

Application Visibility and Control: DPI is increasingly being used for granular visibility into network traffic and application usage. Organizations are leveraging DPI to gain insights into the types of applications running on their networks and to implement policies for efficient bandwidth management.

-

Regulatory Compliance and Data Privacy: As data privacy regulations become more stringent, DPI solutions are evolving to comply with these regulations. Ensuring that DPI practices align with privacy laws is crucial for businesses in various industries.

-

IoT Security: With the proliferation of Internet of Things (IoT) devices, DPI is being used to monitor and secure the traffic generated by these devices. This includes identifying and mitigating potential security risks associated with IoT communication.

-

Machine Learning Integration: DPI solutions are incorporating machine learning and artificial intelligence to enhance their ability to identify and respond to evolving threats. This improves the efficiency and accuracy of threat detection.

Competitive Landscape

The competitive landscape of the deep packet inspection (DPI) market was dynamic, with several prominent companies competing to provide innovative and advanced deep packet inspection (DPI).

- Cisco Systems

- International Business Machine (IBM)

- Intel

- NortonLifeLock (Symantec)

- Palo Alto Networks

- Check Point Software Technologies

- Extreme Networks

- Netscout Systems

- Procera Networks(Sandvine)

- Viavi Solutions

- Allot Communications

- Bivio Networks

- Cpacket Networks

- Enea

- Huawei

- Extreme Networks

- Juniper Networks

- NetScout

- Allot Communication

January 17, 2024 - IBM (NYSE: IBM) Consulting is rolling out IBM Consulting Advantage, an AI services platform designed to support IBM consultants in delivering consistency, repeatability and speed for our clients. It includes a portfolio of proprietary methods, assets and Assistants that leverage technology from IBM and strategic partners. When using aspects of IBM Consulting Advantage in an application design, development and testing client pilot, early adopter teams saw productivity improvements of up to 50%.

December 21, 2023 — Cisco (NASDAQ: CSCO) announced the intent to acquire Isovalent, a leader in open source cloud native networking and security, to bolster its secure networking capabilities across public clouds. The acquisition of Isovalent will build on the Cisco Security Cloud vision, an AI-driven, cloud delivered, integrated security platform for organizations of any shape and size.

Regional Analysis

North America held the highest market share in 2022 and is expected to expand at a noteworthy compound annual growth rate (CAGR) of 25.85% over the forecast period. In practically every industry, including manufacturing, technology, infrastructure, healthcare, life sciences, and communication, North America is the most developed area in the world. Throughout the projected period, North America will hold the largest market share due to a number of driving factors, such as the growing demand for workable networks across the region's industries, the expansion of e-business adoption, the growing threat of cybercrimes and data security, the expansion of compatible device adoption, the region's population's increasing internet penetration, and others. Additionally, e-commerce sites are expanding all throughout the continent of North America. The major e-commerce platforms across the region including Amazon, Walmart, eBay, Home Depot, and Wayfair, amongst others are aiding the growth of the North American Deep Packet Inspection (DPI) Market.

[caption id="attachment_37088" align="aligncenter" width="552"]

With the second-largest market share is the deep packet inspection market in Europe. Because technical developments usually take place in this region, if this region embraced the technology early on, it would have the biggest income share among other areas. In addition, the deep packet inspection market in Germany had the most market share, while the deep packet inspection market in the UK was expanding at the quickest rate in the European Union. From 2023 to 2030, the deep packet inspection market in Asia-Pacific is anticipated to expand at the quickest rate. The availability and presence of foreign brands, the challenges they encounter from either fierce or mild competition from local and domestic brands, the effect of domestic tariffs, and trade routes are all taken into account when offering prediction analysis of the country data. Additionally, China's deep packet inspection market held the largest market share, and the Indian deep packet inspection market was the fastest-growing market in the Asia-Pacific region.

Target Audience for Deep Packet Inspection (DPI)

- Internet Service Providers (ISPs)

- Telecommunication Companies

- Cybersecurity Solution Providers

- Government and Defense Agencies

- Banking, Financial Services, and Insurance (BFSI) Sector

- Healthcare Organizations

- Information Technology (IT) Companies

- E-commerce and Retail Sector

- Manufacturing Industry

- Enterprises with Large Network Infrastructures

Segments Covered in the Deep Packet Inspection (DPI) Market Report

Deep Packet Inspection (DPI) Market by Product- Standalone

- Integrated

- Standalone

- Integrated

- BFSI

- Government and Defense

- Healthcare

- IT and Telecom

- Retail and Ecommerce

- Manufacturing

- Others

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the deep packet inspection (DPI) market over the next 7 years?

- Who are the major players in the deep packet inspection (DPI) market and what is their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-pacific, the Middle East, and Africa?

- How is the economic environment affecting the deep packet inspection (DPI) market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the deep packet inspection (DPI) market?

- What is the current and forecasted size and growth rate of the global deep packet inspection (DPI) market?

- What are the key drivers of growth in the deep packet inspection (DPI) market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the deep packet inspection (DPI) market?

- What are the technological advancements and innovations in the deep packet inspection (DPI) market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the deep packet inspection (DPI) market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the deep packet inspection (DPI) market?

- What are the services offered and specifications of leading players in the market?

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DEEP PACKET INSPECTION (DPI) PRODUCTS

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- DEEP PACKET INSPECTION (DPI) MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON DEEP PACKET INSPECTION (DPI) MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- DEEP PACKET INSPECTION (DPI) MARKET OUTLOOK

- GLOBAL DEEP PACKET INSPECTION (DPI) MARKET BY DEEP PACKET INSPECTION (DPI) PRODUCT, 2020-2030, (USD BILLION)

- STANDALONE

- INTEGRATED

- GLOBAL DEEP PACKET INSPECTION (DPI) MARKET BY DEPLOYMENT MODE, 2020-2030, (USD BILLION)

- ON-PREMISES

- CLOUD-BASED

- GLOBAL DEEP PACKET INSPECTION (DPI) MARKET BY END USER, 2020-2030, (USD BILLION)

- BFSI

- GOVERNMENT AND DEFENSE

- HEALTHCARE

- IT AND TELECOM

- RETAIL AND ECOMMERCE

- MANUFACTURING

- OTHERS

- GLOBAL DEEP PACKET INSPECTION (DPI) MARKET BY REGION, 2020-2030, (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- CISCO SYSTEMS

- INTERNATIONAL BUSINESS MACHINE (IBM)

- INTEL

- NORTONLIFELOCK (SYMANTEC)

- PALO ALTO NETWORKS

- CHECK POINT SOFTWARE TECHNOLOGIES

- EXTREME NETWORKS

- NETSCOUT SYSTEMS

- PROCERA NETWORKS(SANDVINE)

- VIAVI SOLUTIONS

- ALLOT COMMUNICATIONS

- BIVIO NETWORKS

- CPACKET NETWORKS

- ENEA

- HUAWEI

- EXTREME NETWORKS

- JUNIPER NETWORKS

- NETSCOUT

- ALLOT COMMUNICATION *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL DEEP PACKET INSPECTION (DPI) MARKET BY DEEP PACKET INSPECTION (DPI) PRODUCT (USD BILLION) 2020-2030

TABLE 2 GLOBAL DEEP PACKET INSPECTION (DPI) MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 3 GLOBAL DEEP PACKET INSPECTION (DPI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 4 GLOBAL DEEP PACKET INSPECTION (DPI) MARKET BY REGIONS (USD BILLION) 2020-2030

TABLE 5 NORTH AMERICA DEEP PACKET INSPECTION (DPI) MARKET BY DEEP PACKET INSPECTION (DPI) PRODUCT (USD BILLION) 2020-2030

TABLE 6 NORTH AMERICA DEEP PACKET INSPECTION (DPI) MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 7 NORTH AMERICA DEEP PACKET INSPECTION (DPI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 8 NORTH AMERICA DEEP PACKET INSPECTION (DPI) MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 9 US DEEP PACKET INSPECTION (DPI) MARKET BY DEEP PACKET INSPECTION (DPI) PRODUCT (USD BILLION) 2020-2030

TABLE 10 US DEEP PACKET INSPECTION (DPI) MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 11 US DEEP PACKET INSPECTION (DPI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 12 CANADA DEEP PACKET INSPECTION (DPI) MARKET BY DEEP PACKET INSPECTION (DPI) PRODUCT (USD BILLION) 2020-2030

TABLE 13 CANADA DEEP PACKET INSPECTION (DPI) MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 14 CANADA DEEP PACKET INSPECTION (DPI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 15 MEXICO DEEP PACKET INSPECTION (DPI) MARKET BY DEEP PACKET INSPECTION (DPI) PRODUCT (USD BILLION) 2020-2030

TABLE 16 MEXICO DEEP PACKET INSPECTION (DPI) MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 17 MEXICO DEEP PACKET INSPECTION (DPI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 18 SOUTH AMERICA DEEP PACKET INSPECTION (DPI) MARKET BY DEEP PACKET INSPECTION (DPI) PRODUCT (USD BILLION) 2020-2030

TABLE 19 SOUTH AMERICA DEEP PACKET INSPECTION (DPI) MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 20 SOUTH AMERICA DEEP PACKET INSPECTION (DPI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 21 SOUTH AMERICA DEEP PACKET INSPECTION (DPI) MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 22 BRAZIL DEEP PACKET INSPECTION (DPI) MARKET BY DEEP PACKET INSPECTION (DPI) PRODUCT (USD BILLION) 2020-2030

TABLE 23 BRAZIL DEEP PACKET INSPECTION (DPI) MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 24 BRAZIL DEEP PACKET INSPECTION (DPI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 25 ARGENTINA DEEP PACKET INSPECTION (DPI) MARKET BY DEEP PACKET INSPECTION (DPI) PRODUCT (USD BILLION) 2020-2030

TABLE 26 ARGENTINA DEEP PACKET INSPECTION (DPI) MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 27 ARGENTINA DEEP PACKET INSPECTION (DPI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 28 COLOMBIA DEEP PACKET INSPECTION (DPI) MARKET BY DEEP PACKET INSPECTION (DPI) PRODUCT (USD BILLION) 2020-2030

TABLE 29 COLOMBIA DEEP PACKET INSPECTION (DPI) MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 30 COLOMBIA DEEP PACKET INSPECTION (DPI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 31 REST OF SOUTH AMERICA DEEP PACKET INSPECTION (DPI) MARKET BY DEEP PACKET INSPECTION (DPI) PRODUCT (USD BILLION) 2020-2030

TABLE 32 REST OF SOUTH AMERICA DEEP PACKET INSPECTION (DPI) MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 33 REST OF SOUTH AMERICA DEEP PACKET INSPECTION (DPI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 34 ASIA-PACIFIC DEEP PACKET INSPECTION (DPI) MARKET BY DEEP PACKET INSPECTION (DPI) PRODUCT (USD BILLION) 2020-2030

TABLE 35 ASIA-PACIFIC DEEP PACKET INSPECTION (DPI) MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 36 ASIA-PACIFIC DEEP PACKET INSPECTION (DPI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 37 ASIA-PACIFIC DEEP PACKET INSPECTION (DPI) MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 38 INDIA DEEP PACKET INSPECTION (DPI) MARKET BY DEEP PACKET INSPECTION (DPI) PRODUCT (USD BILLION) 2020-2030

TABLE 39 INDIA DEEP PACKET INSPECTION (DPI) MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 40 INDIA DEEP PACKET INSPECTION (DPI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 41 CHINA DEEP PACKET INSPECTION (DPI) MARKET BY DEEP PACKET INSPECTION (DPI) PRODUCT (USD BILLION) 2020-2030

TABLE 42 CHINA DEEP PACKET INSPECTION (DPI) MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 43 CHINA DEEP PACKET INSPECTION (DPI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 44 JAPAN DEEP PACKET INSPECTION (DPI) MARKET BY DEEP PACKET INSPECTION (DPI) PRODUCT (USD BILLION) 2020-2030

TABLE 45 JAPAN DEEP PACKET INSPECTION (DPI) MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 46 JAPAN DEEP PACKET INSPECTION (DPI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 47 SOUTH KOREA DEEP PACKET INSPECTION (DPI) MARKET BY DEEP PACKET INSPECTION (DPI) PRODUCT (USD BILLION) 2020-2030

TABLE 48 SOUTH KOREA DEEP PACKET INSPECTION (DPI) MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 49 SOUTH KOREA DEEP PACKET INSPECTION (DPI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 50 AUSTRALIA DEEP PACKET INSPECTION (DPI) MARKET BY DEEP PACKET INSPECTION (DPI) PRODUCT (USD BILLION) 2020-2030

TABLE 51 AUSTRALIA DEEP PACKET INSPECTION (DPI) MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 52 AUSTRALIA DEEP PACKET INSPECTION (DPI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 53 SOUTH-EAST ASIA DEEP PACKET INSPECTION (DPI) MARKET BY DEEP PACKET INSPECTION (DPI) PRODUCT (USD BILLION) 2020-2030

TABLE 54 SOUTH-EAST ASIA DEEP PACKET INSPECTION (DPI) MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 55 SOUTH-EAST ASIA DEEP PACKET INSPECTION (DPI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 56 REST OF ASIA PACIFIC DEEP PACKET INSPECTION (DPI) MARKET BY DEEP PACKET INSPECTION (DPI) PRODUCT (USD BILLION) 2020-2030

TABLE 57 REST OF ASIA PACIFIC DEEP PACKET INSPECTION (DPI) MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 58 REST OF ASIA PACIFIC DEEP PACKET INSPECTION (DPI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 59 EUROPE DEEP PACKET INSPECTION (DPI) MARKET BY DEEP PACKET INSPECTION (DPI) PRODUCT (USD BILLION) 2020-2030

TABLE 60 EUROPE DEEP PACKET INSPECTION (DPI) MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 61 EUROPE DEEP PACKET INSPECTION (DPI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 62 EUROPE DEEP PACKET INSPECTION (DPI) MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 63 GERMANY DEEP PACKET INSPECTION (DPI) MARKET BY DEEP PACKET INSPECTION (DPI) PRODUCT (USD BILLION) 2020-203

TABLE 64 GERMANY DEEP PACKET INSPECTION (DPI) MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 65 GERMANY DEEP PACKET INSPECTION (DPI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 66 UK DEEP PACKET INSPECTION (DPI) MARKET BY DEEP PACKET INSPECTION (DPI) PRODUCT (USD BILLION) 2020-2030

TABLE 67 UK DEEP PACKET INSPECTION (DPI) MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 68 UK DEEP PACKET INSPECTION (DPI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 69 FRANCE DEEP PACKET INSPECTION (DPI) MARKET BY DEEP PACKET INSPECTION (DPI) PRODUCT (USD BILLION) 2020-2030

TABLE 70 FRANCE DEEP PACKET INSPECTION (DPI) MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 71 FRANCE DEEP PACKET INSPECTION (DPI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 72 ITALY DEEP PACKET INSPECTION (DPI) MARKET BY DEEP PACKET INSPECTION (DPI) PRODUCT (USD BILLION) 2020-2030

TABLE 73 ITALY DEEP PACKET INSPECTION (DPI) MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 74 ITALY DEEP PACKET INSPECTION (DPI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 75 SPAIN DEEP PACKET INSPECTION (DPI) MARKET BY DEEP PACKET INSPECTION (DPI) PRODUCT (USD BILLION) 2020-2030

TABLE 76 SPAIN DEEP PACKET INSPECTION (DPI) MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 77 SPAIN DEEP PACKET INSPECTION (DPI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 78 RUSSIA DEEP PACKET INSPECTION (DPI) MARKET BY DEEP PACKET INSPECTION (DPI) PRODUCT (USD BILLION) 2020-2030

TABLE 79 RUSSIA DEEP PACKET INSPECTION (DPI) MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 80 RUSSIA DEEP PACKET INSPECTION (DPI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 81 REST OF EUROPE DEEP PACKET INSPECTION (DPI) MARKET BY DEEP PACKET INSPECTION (DPI) PRODUCT (USD BILLION) 2020-2030

TABLE 82 REST OF EUROPE DEEP PACKET INSPECTION (DPI) MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 83 REST OF EUROPE DEEP PACKET INSPECTION (DPI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 84 MIDDLE EAST AND AFRICA DEEP PACKET INSPECTION (DPI) MARKET BY DEEP PACKET INSPECTION (DPI) PRODUCT (USD BILLION) 2020-2030

TABLE 85 MIDDLE EAST AND AFRICA DEEP PACKET INSPECTION (DPI) MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 86 MIDDLE EAST AND AFRICA DEEP PACKET INSPECTION (DPI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 87 MIDDLE EAST AND AFRICA DEEP PACKET INSPECTION (DPI) MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 88 UAE DEEP PACKET INSPECTION (DPI) MARKET BY DEEP PACKET INSPECTION (DPI) PRODUCT (USD BILLION) 2020-2030

TABLE 89 UAE DEEP PACKET INSPECTION (DPI) MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 90 UAE DEEP PACKET INSPECTION (DPI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 91 SAUDI ARABIA DEEP PACKET INSPECTION (DPI) MARKET BY DEEP PACKET INSPECTION (DPI) PRODUCT (USD BILLION) 2020-2030

TABLE 92 SAUDI ARABIA DEEP PACKET INSPECTION (DPI) MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 93 SAUDI ARABIA DEEP PACKET INSPECTION (DPI) MARKET BY END USER (USD BILLION) 2020-203

TABLE 94 SOUTH AFRICA DEEP PACKET INSPECTION (DPI) MARKET BY DEEP PACKET INSPECTION (DPI) PRODUCT (USD BILLION) 2020-2030

TABLE 95 SOUTH AFRICA DEEP PACKET INSPECTION (DPI) MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 96 SOUTH AFRICA DEEP PACKET INSPECTION (DPI) MARKET BY END USER (USD BILLION) 2020-203

TABLE 97 REST OF MIDDLE EAST AND AFRICA DEEP PACKET INSPECTION (DPI) MARKET BY DEEP PACKET INSPECTION (DPI) PRODUCT (USD BILLION) 2020-2030

TABLE 98 REST OF MIDDLE EAST AND AFRICA DEEP PACKET INSPECTION (DPI) MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 99 REST OF MIDDLE EAST AND AFRICA DEEP PACKET INSPECTION (DPI) MARKET BY END USER (USD BILLION) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL DEEP PACKET INSPECTION (DPI) BY DEEP PACKET INSPECTION (DPI) PRODUCT, USD BILLION, 2020-2030

FIGURE 9 GLOBAL DEEP PACKET INSPECTION (DPI) BY DEPLOYMENT MODE, USD BILLION, 2020-2030

FIGURE 10 GLOBAL DEEP PACKET INSPECTION (DPI) BY END USER, USD BILLION, 2020-2030

FIGURE 11 GLOBAL DEEP PACKET INSPECTION (DPI) BY REGION, USD BILLION, 2020-2030

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL DEEP PACKET INSPECTION (DPI) BY DEEP PACKET INSPECTION (DPI) PRODUCT, USD BILLION, 2022

FIGURE 14 GLOBAL DEEP PACKET INSPECTION (DPI) BY DEPLOYMENT MODE, USD BILLION, 2022

FIGURE 15 GLOBAL DEEP PACKET INSPECTION (DPI) BY END USER, USD BILLION, 2022

FIGURE 16 GLOBAL DEEP PACKET INSPECTION (DPI) BY REGION, USD BILLION, 2022

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 CISCO SYSTEMS: COMPANY SNAPSHOT

FIGURE 19 INTERNATIONAL BUSINESS MACHINE (IBM): COMPANY SNAPSHOT

FIGURE 20 INTEL: COMPANY SNAPSHOT

FIGURE 21 NORTONLIFELOCK (SYMANTEC): COMPANY SNAPSHOT

FIGURE 22 PALO ALTO NETWORKS: COMPANY SNAPSHOT

FIGURE 23 CHECK POINT SOFTWARE TECHNOLOGIES: COMPANY SNAPSHOT

FIGURE 24 EXTREME NETWORKS: COMPANY SNAPSHOT

FIGURE 25 NETSCOUT SYSTEMS: COMPANY SNAPSHOT

FIGURE 26 PROCERA NETWORKS (SANDVINE): COMPANY SNAPSHOT

FIGURE 27 VIAVI SOLUTIONS: COMPANY SNAPSHOT

FIGURE 28 ALLOT COMMUNICATIONS: COMPANY SNAPSHOT

FIGURE 29 BIVIO NETWORKS: COMPANY SNAPSHOT

FIGURE 30 CPACKET NETWORKS: COMPANY SNAPSHOT

FIGURE 31 ENEA: COMPANY SNAPSHOT

FIGURE 32 HUAWEI: COMPANY SNAPSHOT

FIGURE 33 EXTREME NETWORKS: COMPANY SNAPSHOT

FIGURE 34 JUNIPER NETWORKS: COMPANY SNAPSHOT

FIGURE 35 NETSCOUT: COMPANY SNAPSHOT

FIGURE 36 ALLOT COMMUNICATION: COMPANY SNAPSHOT

DOWNLOAD FREE SAMPLE REPORT

License Type

SPEAK WITH OUR ANALYST

Want to know more about the report or any specific requirement?

WANT TO CUSTOMIZE THE REPORT?

Our Clients Speak

We asked them to research ‘ Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te

Yosuke Mitsui

Senior Associate Construction Equipment Sales & Marketing

We asked them to research ‘Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te