Base Year Value ()

CAGR ()

Forecast Year Value ()

Historical Data Period

Largest Region

Forecast Period

Offshore Supply Vessel (OSV) Market by Vessel Type (Anchor Handling Tug Supply (AHTS), Platform Supply Vessel (PSV), Multipurpose Support Vessel (MSV), Standby & Rescue Vessel (SRV), Others), By Application (Shallow Water, Deep Water) and Region, Global trends and forecast from 2024 to 2030

Instant access to hundreds of data points and trends

- Market estimates from 2014-2029

- Competitive analysis, industry segmentation, financial benchmarks

- Incorporates SWOT, Porter's Five Forces and risk management frameworks

- PDF report or online database with Word, Excel and PowerPoint export options

- 100% money back guarantee

Offshore Supply Vessel (OSV) Market Overview

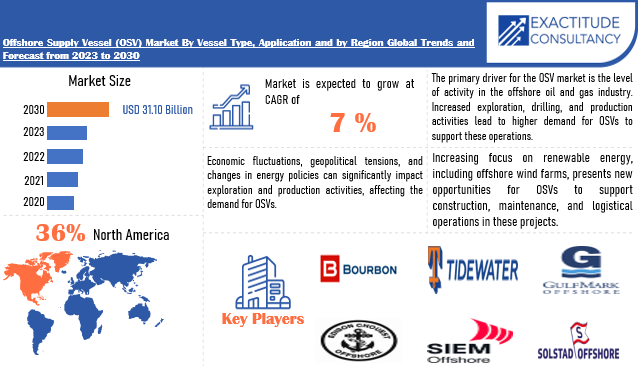

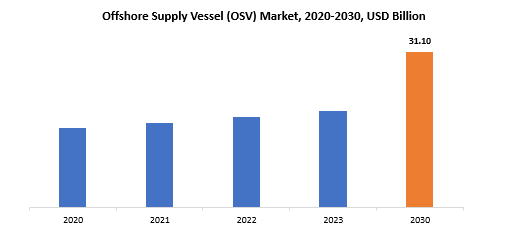

The global Offshore Supply Vessel (OSV) market is anticipated to grow from USD 19.37 Billion in 2023 to USD 31.10 Billion by 2030, at a CAGR of 7 % during the forecast period.

Within the larger maritime industry, the Offshore Supply Vessel (OSV) market is a subset that specializes in meeting the operational and logistical requirements of offshore oil and gas exploration and production activities. These boats are vital to offshore operations because they carry personnel, equipment, and supplies to and from drilling rigs, offshore platforms, and other installations that are situated in difficult-to-reach maritime environments. Offshore Supply Vessels are known for their sturdy construction and sophisticated functionalities. They can carry out a wide range of duties, such as bulk cargo, drilling fluids, and specialized equipment needed for exploration and extraction operations.

[caption id="attachment_38091" align="aligncenter" width="1237"]

They enhance the security and safety of offshore installations by acting as staging areas for rescue and emergency response activities. The offshore supply vessel (OSV) market comprises a wide variety of vessels, including multipurpose support vessels, anchor handling tug supply vessels, and platform supply vessels (PSVs), all of which are customized to meet particular operational needs. The trends and advancements in the global oil and gas industry have a significant impact on the dynamics of the OSV market. The demand for OSVs is influenced by changes in exploration and production activities, changes in oil prices, and advancements in offshore technologies. In order to meet the changing demands of the offshore industry, the OSV market keeps up with the changes in the offshore energy sector. Innovations in vessel design, environmental sustainability, and operational efficiency are all part of this adaptation.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) |

| Segmentation | By Vessel Type, Application and Region |

| By Vessel Type |

|

| By Application |

|

| By Region |

|

Frequently Asked Questions

• What is the market size for the Offshore Supply Vessel (OSV) market?

The global Offshore Supply Vessel (OSV) market is anticipated to grow from USD 19.37 Billion in 2023 to USD 31.10 Billion by 2030, at a CAGR of 7 % during the forecast period

• Which region is dominating in the Offshore Supply Vessel (OSV) market?

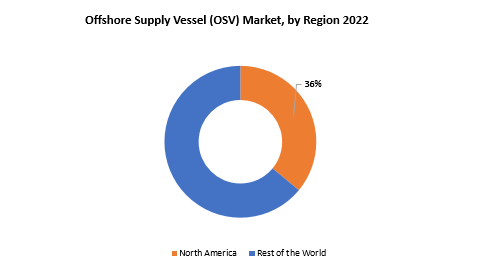

North America accounted for the largest market in the Offshore Supply Vessel (OSV) market. North America accounted for 36 % market share of the global market value.

• Who are the major key players in the Offshore Supply Vessel (OSV) market?

Bourbon Offshore, Tidewater Inc., Edison Chouest Offshore, Siem Offshore, Hornbeck Offshore Services, Swire Pacific Offshore, GulfMark Offshore, Vroon Offshore Services, Solstad Offshore

• What are the key trends in the Offshore Supply Vessel (OSV) market?

In order to take advantage of new opportunities, operators are increasing their presence across various regions, contributing to the growing globalization of the OSV market. Consolidation of the market is happening concurrently as businesses combine or buy out others in order to gain economies of scale and become more competitive. Because offshore operations are difficult, safety is still the top concern for the OSV sector. Investing in technologies and training programs that improve crew competency, emergency response capabilities, and general safety precautions is becoming more common.

Offshore Supply Vessel (OSV) Market Segmentation Analysis

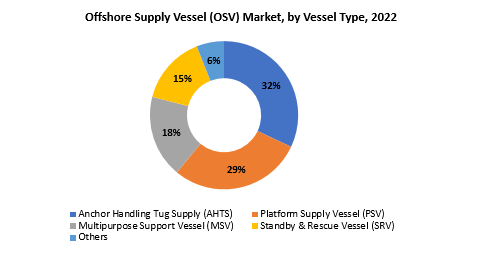

The global Offshore Supply Vessel (OSV) market is divided into three segments by Vessel Type, Application and region. By Vessel Type it is divided as Anchor Handling Tug Supply (AHTS), Platform Supply Vessel (PSV), Multipurpose Support Vessel (MSV), Standby & Rescue Vessel (SRV), Others. Cloud Based holds the largest market share. Vessels operated by Anchor Handling Tug Supply (AHTS) are dedicated to anchor handling, towage, and offshore structure positioning, including production platforms and drilling rigs. They are crucial for guaranteeing the stability and accurate positioning of offshore installations because they have strong towing winches and can manage large anchors.

[caption id="attachment_38094" align="aligncenter" width="722"]

Multipurpose Support Vessels, or MSVs for short, are adaptable vessels that can be used for a variety of tasks, such as subsea construction, maintenance, and repair. Their feature set allows them to be flexible in supporting offshore projects with different needs because they can adapt to a variety of tasks. The primary goal of Standby & Rescue Vessels (SRVs) is to protect personnel and offshore installations. These boats are positioned carefully to enable quick reaction in the event of an emergency, including fires, medical crises, or evacuation scenarios. Specialized equipment and personnel trained in emergency response and rescue operations are fitted into SRVs.

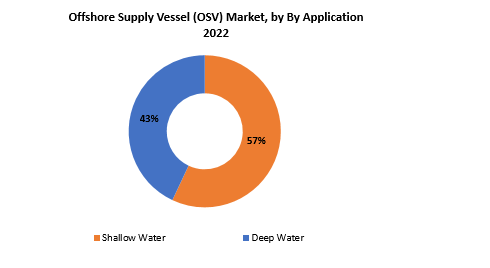

By application it is divided as Shallow Water, Deep Water. Shallow Water holds the largest market share. OSVs are utilized in offshore regions with comparatively shallow depths for shallow water applications. The water depths in these areas, which are usually nearer the coast, can vary from a few meters to several hundred meters. Shallow water off-shore vessels (OSVs) are engineered to navigate and function efficiently in these less demanding maritime environments. They are essential to a number of operations, including production, drilling, and exploration in nearshore and relatively shallow offshore fields.

[caption id="attachment_38096" align="aligncenter" width="754"]

Deep water applications pertain to offshore regions that have significant water depths, frequently surpassing several hundred meters and reaching deep into the ocean. Deep-water off-shore support vessels (OSVs) are designed with specificity to tackle the distinct obstacles presented by these environments. These challenges include severe weather, elevated pressures, and intricate logistical needs. These vessels can support operations like deep-sea drilling and production because they are outfitted with cutting-edge technology and can operate in farther-flung and deeper offshore locations.

[caption id="attachment_38098" align="aligncenter" width="761"]

Offshore Supply Vessel (OSV) Market Dynamics

DriverCapital investments in offshore exploration and production projects drive demand for OSVs.

Significant infrastructure development is needed for offshore E&P projects, including the construction of production platforms, subsea facilities, and drilling rigs. These structures require significant capital outlays to build and maintain, and OSVs are vital for moving supplies, machinery, and people to and from these offshore sites. When it comes to offshore projects, capital expenditures are especially high during the exploration and drilling stages. Prospective reserves are surveyed during exploration, and rigs and related equipment must be deployed during drilling. OSVs play a crucial role in the delivery of personnel, supplies, and drilling rigs to offshore drilling locations. After drilling and exploration prove successful, capital expenditures carry over into the production stage. In order to extract and process oil and gas, production platforms, pipelines, and other facilities must be established.

The need for OSVs is fueled in part by ongoing maintenance and the eventual decommissioning of offshore facilities, in addition to the original capital investments. These boats play a crucial role in the transportation of equipment, replacement parts, and maintenance personnel needed to keep offshore facilities operating continuously. OSVs are used to transport workers and equipment during the final stages of decommissioning. Expansion of current operations or geographical exploration are common capital investments in offshore E&P projects. OSVs are essential for supporting exploration and production activities in a variety of geographic regions because they are adaptable and made to function in a variety of offshore environments, including deepwater and remote areas. The degree of capital investments in the oil and gas industry is determined by the state of the economy, the level of market confidence, and worldwide oil prices.

RestraintFluctuations in oil prices can have a direct impact on the financial health of oil and gas companies.

The sale of natural gas and crude oil is the main source of income for oil and gas companies. These businesses see an increase in sales and earnings per barrel when oil prices rise. In contrast, revenues and profits are lower during times when oil prices are low. Significant capital expenditures are made by oil and gas companies for infrastructure development, drilling, and exploration. Companies have more money available to invest in new projects when oil prices are high. On the other hand, low oil prices may result in fewer capital projects being undertaken, or in the postponement or cancellation of exploration and production initiatives. Depending on the price of crude, the cost of extracting, processing, and transporting gas and oil can change. Low oil prices can make it difficult for businesses to pay for their operations, which could result in reduced profitability or even financial losses.

The price of oil is directly correlated with the stock prices of oil and gas companies. Considerable variations in oil prices have the potential to cause stock market volatility, which in turn impacts these companies' market valuations. Companies that produce oil and gas frequently incur large debt in order to fund their operations. Companies may find it difficult to pay down their debt in the event of a drop in oil prices, which would put them under more financial strain. Companies may adopt cost-cutting strategies, such as staff reductions and layoffs, in response to protracted low oil prices in order to preserve financial stability. The price of commodities has a significant impact on the cash flow of oil and gas companies. Reduced cash flow brought on by low oil prices may have an effect on these businesses' liquidity and their capacity to pay debts.

OpportunitiesReplacement of older vessels with more technologically advanced and environmentally friendly ones can create opportunities for vessel manufacturers and service providers.

Demand for boats that abide by more stringent environmental standards is rising. Ship designers and manufacturers who can create vessels with reduced emissions, increased fuel efficiency, and environmentally friendly features are likely to draw interest from consumers. Shipbuilders can take the lead in the shift to more environmentally friendly shipping by concentrating on creating vessels that are more fuel-efficient or that can run on alternative fuels like LNG or electric power. The integration of cutting-edge technologies such as automation, digitalization, and smart systems into vessel designs has the potential to boost overall performance, lower maintenance costs, and increase operational efficiency. Existing vessel retrofitting and new build servicing present opportunities for service providers offering solutions in these areas.

Offering vessel retrofitting services, service providers can collaborate with shipowners to update their current fleets to comply with contemporary environmental regulations. This can involve integrating digital solutions, maximizing energy use, and installing cleaner propulsion systems. A niche market for specialized services can be created by service providers who specialize in environmental compliance, emission monitoring, and regulatory consulting. These providers can assist vessel owners in making sure that their fleets comply with local and international environmental standards. Innovation can be fuelled by cooperation between technology suppliers, service providers, and vessel manufacturers. Partnerships or joint ventures can result in the creation of innovative, eco-friendly vessel solutions.

Offshore Supply Vessel (OSV) Market Trends

-

The need for OSVs has increased due to the growing emphasis on renewable energy, especially offshore wind farms. These boats are used to transport workers, supplies, and equipment to and from offshore renewable energy facilities.

-

The OSV industry is changing as a result of automation and digital technology integration. Modern navigation systems, dynamic positioning, and real-time monitoring tools improve operational effectiveness and safety on board. For OSV operators, automation also helps to lower overall operating costs.

-

In the OSV market, eco-friendly and sustainable practices are becoming more and more important due to regulatory pressures and environmental concerns. Cleaner propulsion technologies, like LNG and hybrid systems, are being adopted by the industry to meet strict environmental regulations and minimize emissions.

-

There is a trend toward modernizing current OSV fleets and building vessels with specialized capabilities to meet changing industry requirements. Operators are increasingly using vessels built for specialized functions, like emergency response, well intervention, or subsea operations, in an effort to offer customized solutions to their clientele.

-

In order to take advantage of new opportunities, operators are increasing their presence across various regions, contributing to the growing globalization of the OSV market. Consolidation of the market is happening concurrently as businesses combine or buy out others in order to gain economies of scale and become more competitive.

-

Because offshore operations are difficult, safety is still the top concern for the OSV sector. Investing in technologies and training programs that improve crew competency, emergency response capabilities, and general safety precautions is becoming more common.

Competitive Landscape

The competitive landscape of the Offshore Supply Vessel (OSV) market was dynamic, with several prominent companies competing to provide innovative and advanced Offshore Supply Vessel (OSV) solutions.

- Bourbon Offshore

- Tidewater Inc.

- Edison Chouest Offshore

- Siem Offshore

- Hornbeck Offshore Services

- Swire Pacific Offshore

- GulfMark Offshore

- Vroon Offshore Services

- Solstad Offshore

- DOF ASA

- Farstad Shipping

- Havila Shipping

- Island Offshore

- Maersk Supply Service

- Nam Cheong Limited

- Rem Maritime

- Pacific Radiance

- Bumi Armada Berhad

- Simon Møkster Shipping

- Topaz Energy and Marine

January 9, 2024: With the successful installation this autumn of a Floating Electrical Hub (FEH) off Port-la-Nouvelle (southern France), Bourbon Subsea Services teams have laid the foundation stone for the Eolmed project, a pilot floating wind farm located off Gruissan in the Mediterranean. This project will involve three wind turbines producing more than 110 million KwH/year by 2025, which is equivalent to the consumption of 50,000 inhabitants. The FEH is a floating infrastructure that will be connected to the three wind turbines on one side and the shore connection cable on the other, enabling the transportation of electricity to the power grid.

May 07, 2023: Tidewater Inc. (NYSE: TDW) (the “Company”) today announced the closing of its acquisition of 37 platform supply vessels and related assets from Solstad Offshore ASA. In connection with the Company’s financing of the Solstad acquisition, the Company completed its previously announced bond offering in the Nordic bond market on July 3, 2023. The purchase price of approximately $580.0 million consists of the previously announced $577.0 million base purchase price along with an initial $3.0 million purchase price adjustment, that will be adjusted for bunkers and other consumables within the next fourteen days. The purchase price was funded through a combination of cash on hand, net proceeds from the $250.0 million Nordic bond issuance and net proceeds from the $325.0 million senior secured term loan made pursuant to a Credit Agreement dated June 30, 2023 with DNB Bank ASA, New York Branch, as facility agent, and other lenders.

Regional Analysis

North America accounted for the largest market in the Offshore Supply Vessel (OSV) market. It accounted for 36% of the worldwide market value. Technological developments and increased attention to offshore renewable energy sources, like wave and wind energy, have given the OSV market in North America a new angle in recent years. OSV deployments for servicing offshore wind farms and providing logistical support for renewable energy projects along the region's coastlines have increased. This range of applications highlights how flexible and adaptable OSVs are in responding to changing market needs.

[caption id="attachment_38104" align="aligncenter" width="658"]

Moreover, the North American OSV market has been impacted by legislative modifications and environmental factors. The OSV fleet in the region has embraced cleaner propulsion systems and environmentally friendly technologies as a result of stricter environmental regulations and a greater focus on sustainable practices. This change encourages the development of more energy-efficient vessels and is in line with international efforts to lessen the environmental impact of maritime activities. The dynamics of the OSV market are also influenced by North America's economic environment. Geopolitical unpredictability, changes in oil prices, and market volatility can all affect investment choices and the overall demand for off-road vehicles. The ability of industry participants to navigate these economic variables and modify their strategies as necessary will determine how resilient the OSV market is in North America.

Target Audience for Offshore Supply Vessel (OSV) Market

- Offshore drilling contractors

- Oil and gas production companies

- Marine logistics and transportation companies

- Offshore construction firms

- Maritime shipping companies

- Port authorities

- Naval forces and defense organizations

- Offshore wind energy developers

- Subsea service providers

- Oilfield services companies

- Government regulatory bodies

- Environmental monitoring agencies

Import & Export Data for Offshore Supply Vessel (OSV) Market

- Identifying emerging markets with untapped potential.

- Adapting supply chain strategies to optimize cost-efficiency and market responsiveness.

- Navigating competition by assessing major players' trade dynamics.

Key insights

Trade volume trends: our report dissects import and export data spanning the last five years to reveal crucial trends and growth patterns within the global Offshore Supply Vessel (OSV) market. This data-driven exploration empowers readers with a deep understanding of the market's trajectory. Market players: gain insights into the leading players driving the Offshore Supply Vessel (OSV) trade. From established giants to emerging contenders, our analysis highlights the key contributors to the import and export landscape. Geographical dynamics: delve into the geographical distribution of trade activities. Uncover which regions dominate exports and which ones hold the reins on imports, painting a comprehensive picture of the industry's global footprint. Product breakdown: by segmenting data based on Offshore Supply Vessel (OSV) types –– we provide a granular view of trade preferences and shifts, enabling businesses to align strategies with the evolving technological landscape.

Segments Covered in the Offshore Supply Vessel (OSV) Market Report

Offshore Supply Vessel (OSV) Market by Vessel Type, Value (USD Billion) (Thousand Units)- Anchor Handling Tug Supply (AHTS)

- Platform Supply Vessel (PSV)

- Multipurpose Support Vessel (MSV)

- Standby & Rescue Vessel (SRV)

- Others

- Shallow Water

- Deep Water

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the Offshore Supply Vessel (OSV) market over the next 7 years?

- Who are the major players in the Offshore Supply Vessel (OSV) market and what is their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the middle east, and Africa?

- How is the economic environment affecting the Offshore Supply Vessel (OSV) market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the Offshore Supply Vessel (OSV) market?

- What is the current and forecasted size and growth rate of the global Offshore Supply Vessel (OSV) market?

- What are the key drivers of growth in the Offshore Supply Vessel (OSV) market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the Offshore Supply Vessel (OSV) market?

- What are the technological advancements and innovations in the Offshore Supply Vessel (OSV) market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the Offshore Supply Vessel (OSV) market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the Offshore Supply Vessel (OSV) market?

- What are the product offerings and specifications of leading players in the market?

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL OFFSHORE SUPPLY VESSEL (OSV) MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON OFFSHORE SUPPLY VESSEL (OSV) MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL OFFSHORE SUPPLY VESSEL (OSV) MARKET OUTLOOK

- GLOBAL OFFSHORE SUPPLY VESSEL (OSV) MARKET BY VESSEL TYPE, 2020-2030, (USD BILLION)

- ANCHOR HANDLING TUG SUPPLY (AHTS)

- PLATFORM SUPPLY VESSEL (PSV)

- MULTIPURPOSE SUPPORT VESSEL (MSV)

- STANDBY & RESCUE VESSEL (SRV)

- OTHERS

- GLOBAL OFFSHORE SUPPLY VESSEL (OSV) MARKET BY APPLICATION, 2020-2030, (USD BILLION)

- SHALLOW WATER

- DEEP WATER

- GLOBAL OFFSHORE SUPPLY VESSEL (OSV) MARKET BY REGION, 2020-2030, (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCT OFFERED, RECENT DEVELOPMENTS)

- BOURBON OFFSHORE

- TIDEWATER INC.

- EDISON CHOUEST OFFSHORE

- SIEM OFFSHORE

- HORNBECK OFFSHORE SERVICES

- SWIRE PACIFIC OFFSHORE

- GULFMARK OFFSHORE

- VROON OFFSHORE SERVICES

- SOLSTAD OFFSHORE

- DOF ASA

- FARSTAD SHIPPING

- HAVILA SHIPPING

- ISLAND OFFSHORE

- MAERSK SUPPLY SERVICE

- NAM CHEONG LIMITED

- REM MARITIME

- PACIFIC RADIANCE

- BUMI ARMADA BERHAD

- SIMON MØKSTER SHIPPING

- TOPAZ ENERGY AND MARINE *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL OFFSHORE SUPPLY VESSEL (OSV) MARKET BY VESSEL TYPE (USD BILLION) 2020-2030

TABLE 2 GLOBAL OFFSHORE SUPPLY VESSEL (OSV) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 3 GLOBAL OFFSHORE SUPPLY VESSEL (OSV) MARKET BY REGION (USD BILLION) 2020-2030

TABLE 4 NORTH AMERICA OFFSHORE SUPPLY VESSEL (OSV) MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 5 NORTH AMERICA OFFSHORE SUPPLY VESSEL (OSV) MARKET BY VESSEL TYPE (USD BILLION) 2020-2030

TABLE 6 NORTH AMERICA OFFSHORE SUPPLY VESSEL (OSV) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 7 US OFFSHORE SUPPLY VESSEL (OSV) MARKET BY VESSEL TYPE (USD BILLION) 2020-2030

TABLE 8 US OFFSHORE SUPPLY VESSEL (OSV) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 9 CANADA OFFSHORE SUPPLY VESSEL (OSV) MARKET BY VESSEL TYPE (USD BILLION) 2020-2030

TABLE 10 CANADA OFFSHORE SUPPLY VESSEL (OSV) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 11 MEXICO OFFSHORE SUPPLY VESSEL (OSV) MARKET BY VESSEL TYPE (USD BILLION) 2020-2030

TABLE 12 MEXICO OFFSHORE SUPPLY VESSEL (OSV) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 13 SOUTH AMERICA OFFSHORE SUPPLY VESSEL (OSV) MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 14 SOUTH AMERICA OFFSHORE SUPPLY VESSEL (OSV) MARKET BY VESSEL TYPE (USD BILLION) 2020-2030

TABLE 15 SOUTH AMERICA OFFSHORE SUPPLY VESSEL (OSV) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 16 BRAZIL OFFSHORE SUPPLY VESSEL (OSV) MARKET BY VESSEL TYPE (USD BILLION) 2020-2030

TABLE 17 BRAZIL OFFSHORE SUPPLY VESSEL (OSV) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 18 ARGENTINA OFFSHORE SUPPLY VESSEL (OSV) MARKET BY VESSEL TYPE (USD BILLION) 2020-2030

TABLE 19 ARGENTINA OFFSHORE SUPPLY VESSEL (OSV) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 20 COLOMBIA OFFSHORE SUPPLY VESSEL (OSV) MARKET BY VESSEL TYPE (USD BILLION) 2020-2030

TABLE 21 COLOMBIA OFFSHORE SUPPLY VESSEL (OSV) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 22 REST OF SOUTH AMERICA OFFSHORE SUPPLY VESSEL (OSV) MARKET BY VESSEL TYPE (USD BILLION) 2020-2030

TABLE 23 REST OF SOUTH AMERICA OFFSHORE SUPPLY VESSEL (OSV) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 24 ASIA-PACIFIC OFFSHORE SUPPLY VESSEL (OSV) MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 25 ASIA-PACIFIC OFFSHORE SUPPLY VESSEL (OSV) MARKET BY VESSEL TYPE (USD BILLION) 2020-2030

TABLE 26 ASIA-PACIFIC OFFSHORE SUPPLY VESSEL (OSV) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 27 INDIA OFFSHORE SUPPLY VESSEL (OSV) MARKET BY VESSEL TYPE (USD BILLION) 2020-2030

TABLE 28 INDIA OFFSHORE SUPPLY VESSEL (OSV) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 29 CHINA OFFSHORE SUPPLY VESSEL (OSV) MARKET BY VESSEL TYPE (USD BILLION) 2020-2030

TABLE 30 CHINA OFFSHORE SUPPLY VESSEL (OSV) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 31 JAPAN OFFSHORE SUPPLY VESSEL (OSV) MARKET BY VESSEL TYPE (USD BILLION) 2020-2030

TABLE 32 JAPAN OFFSHORE SUPPLY VESSEL (OSV) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 33 SOUTH KOREA OFFSHORE SUPPLY VESSEL (OSV) MARKET BY VESSEL TYPE (USD BILLION) 2020-2030

TABLE 34 SOUTH KOREA OFFSHORE SUPPLY VESSEL (OSV) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 35 AUSTRALIA OFFSHORE SUPPLY VESSEL (OSV) MARKET BY VESSEL TYPE (USD BILLION) 2020-2030

TABLE 36 AUSTRALIA OFFSHORE SUPPLY VESSEL (OSV) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 37 SOUTH-EAST ASIA OFFSHORE SUPPLY VESSEL (OSV) MARKET BY VESSEL TYPE (USD BILLION) 2020-2030

TABLE 38 SOUTH-EAST ASIA OFFSHORE SUPPLY VESSEL (OSV) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 39 REST OF ASIA PACIFIC OFFSHORE SUPPLY VESSEL (OSV) MARKET BY VESSEL TYPE (USD BILLION) 2020-2030

TABLE 40 REST OF ASIA PACIFIC OFFSHORE SUPPLY VESSEL (OSV) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 41 EUROPE OFFSHORE SUPPLY VESSEL (OSV) MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 42 EUROPE OFFSHORE SUPPLY VESSEL (OSV) MARKET BY VESSEL TYPE (USD BILLION) 2020-2030

TABLE 43 EUROPE OFFSHORE SUPPLY VESSEL (OSV) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 44 GERMANY OFFSHORE SUPPLY VESSEL (OSV) MARKET BY VESSEL TYPE (USD BILLION) 2020-2030

TABLE 45 GERMANY OFFSHORE SUPPLY VESSEL (OSV) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 46 UK OFFSHORE SUPPLY VESSEL (OSV) MARKET BY VESSEL TYPE (USD BILLION) 2020-2030

TABLE 47 UK OFFSHORE SUPPLY VESSEL (OSV) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 48 FRANCE OFFSHORE SUPPLY VESSEL (OSV) MARKET BY VESSEL TYPE (USD BILLION) 2020-2030

TABLE 49 FRANCE OFFSHORE SUPPLY VESSEL (OSV) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 50 ITALY OFFSHORE SUPPLY VESSEL (OSV) MARKET BY VESSEL TYPE (USD BILLION) 2020-2030

TABLE 51 ITALY OFFSHORE SUPPLY VESSEL (OSV) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 52 SPAIN OFFSHORE SUPPLY VESSEL (OSV) MARKET BY VESSEL TYPE (USD BILLION) 2020-2030

TABLE 53 SPAIN OFFSHORE SUPPLY VESSEL (OSV) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 54 RUSSIA OFFSHORE SUPPLY VESSEL (OSV) MARKET BY VESSEL TYPE (USD BILLION) 2020-2030

TABLE 55 RUSSIA OFFSHORE SUPPLY VESSEL (OSV) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 56 REST OF EUROPE OFFSHORE SUPPLY VESSEL (OSV) MARKET BY VESSEL TYPE (USD BILLION) 2020-2030

TABLE 57 REST OF EUROPE OFFSHORE SUPPLY VESSEL (OSV) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 58 MIDDLE EAST AND AFRICA OFFSHORE SUPPLY VESSEL (OSV) MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 59 MIDDLE EAST AND AFRICA OFFSHORE SUPPLY VESSEL (OSV) MARKET BY VESSEL TYPE (USD BILLION) 2020-2030

TABLE 60 MIDDLE EAST AND AFRICA OFFSHORE SUPPLY VESSEL (OSV) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 61 UAE OFFSHORE SUPPLY VESSEL (OSV) MARKET BY VESSEL TYPE (USD BILLION) 2020-2030

TABLE 62 UAE OFFSHORE SUPPLY VESSEL (OSV) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 63 SAUDI ARABIA OFFSHORE SUPPLY VESSEL (OSV) MARKET BY VESSEL TYPE (USD BILLION) 2020-2030

TABLE 64 SAUDI ARABIA OFFSHORE SUPPLY VESSEL (OSV) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 65 SOUTH AFRICA OFFSHORE SUPPLY VESSEL (OSV) MARKET BY VESSEL TYPE (USD BILLION) 2020-2030

TABLE 66 SOUTH AFRICA OFFSHORE SUPPLY VESSEL (OSV) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 67 REST OF MIDDLE EAST AND AFRICA OFFSHORE SUPPLY VESSEL (OSV) MARKET BY VESSEL TYPE (USD BILLION) 2020-2030

TABLE 68 REST OF MIDDLE EAST AND AFRICA OFFSHORE SUPPLY VESSEL (OSV) MARKET BY APPLICATION (USD BILLION) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL OFFSHORE SUPPLY VESSEL (OSV) MARKET BY VESSEL TYPE (USD BILLION) 2020-2030

FIGURE 9 GLOBAL OFFSHORE SUPPLY VESSEL (OSV) MARKET BY APPLICATION (USD BILLION) 2020-2030

FIGURE 11 GLOBAL OFFSHORE SUPPLY VESSEL (OSV) MARKET BY REGION (USD BILLION) 2020-2030

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL OFFSHORE SUPPLY VESSEL (OSV) MARKET BY VESSEL TYPE (USD BILLION) 2021

FIGURE 14 GLOBAL OFFSHORE SUPPLY VESSEL (OSV) MARKET BY APPLICATION (USD BILLION) 2021

FIGURE 16 GLOBAL OFFSHORE SUPPLY VESSEL (OSV) MARKET BY REGION (USD BILLION) 2021

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 BOURBON OFFSHORE: COMPANY SNAPSHOT

FIGURE 19 TIDEWATER INC.: COMPANY SNAPSHOT

FIGURE 20 EDISON CHOUEST OFFSHORE: COMPANY SNAPSHOT

FIGURE 21 SIEM OFFSHORE: COMPANY SNAPSHOT

FIGURE 22 HORNBECK OFFSHORE SERVICES: COMPANY SNAPSHOT

FIGURE 23 SWIRE PACIFIC OFFSHORE: COMPANY SNAPSHOT

FIGURE 24 GULFMARK OFFSHORE: COMPANY SNAPSHOT

FIGURE 25 VROON OFFSHORE SERVICES: COMPANY SNAPSHOT

FIGURE 26 SOLSTAD OFFSHORE: COMPANY SNAPSHOT

FIGURE 27 DOF ASA: COMPANY SNAPSHOT

FIGURE 28 FARSTAD SHIPPING: COMPANY SNAPSHOT

FIGURE 29 HAVILA SHIPPING: COMPANY SNAPSHOT

FIGURE 30 ISLAND OFFSHORE: COMPANY SNAPSHOT

FIGURE 31 MAERSK SUPPLY SERVICE: COMPANY SNAPSHOT

FIGURE 32 NAM CHEONG LIMITED: COMPANY SNAPSHOT

FIGURE 33 REM MARITIME: COMPANY SNAPSHOT

FIGURE 34 PACIFIC RADIANCE: COMPANY SNAPSHOT

FIGURE 35 BUMI ARMADA BERHAD: COMPANY SNAPSHOT

FIGURE 36 SIMON MØKSTER SHIPPING: COMPANY SNAPSHOT

FIGURE 37 TOPAZ ENERGY AND MARINE: COMPANY SNAPSHOT

DOWNLOAD FREE SAMPLE REPORT

License Type

SPEAK WITH OUR ANALYST

Want to know more about the report or any specific requirement?

WANT TO CUSTOMIZE THE REPORT?

Our Clients Speak

We asked them to research ‘ Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te

Yosuke Mitsui

Senior Associate Construction Equipment Sales & Marketing

We asked them to research ‘Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te