Report Outlook

| Market Size | CAGR | Dominating Region |

|---|---|---|

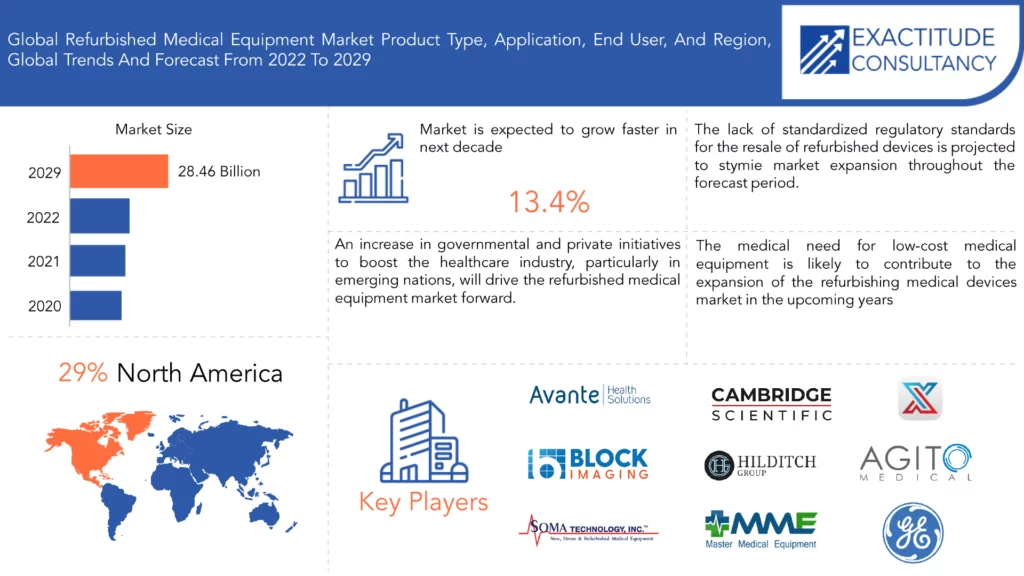

| USD 28.46 billion by 2029 | 13.4% | North America |

| By Product Type | By Application | By End User |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Refurbished Medical Equipment Market Overview

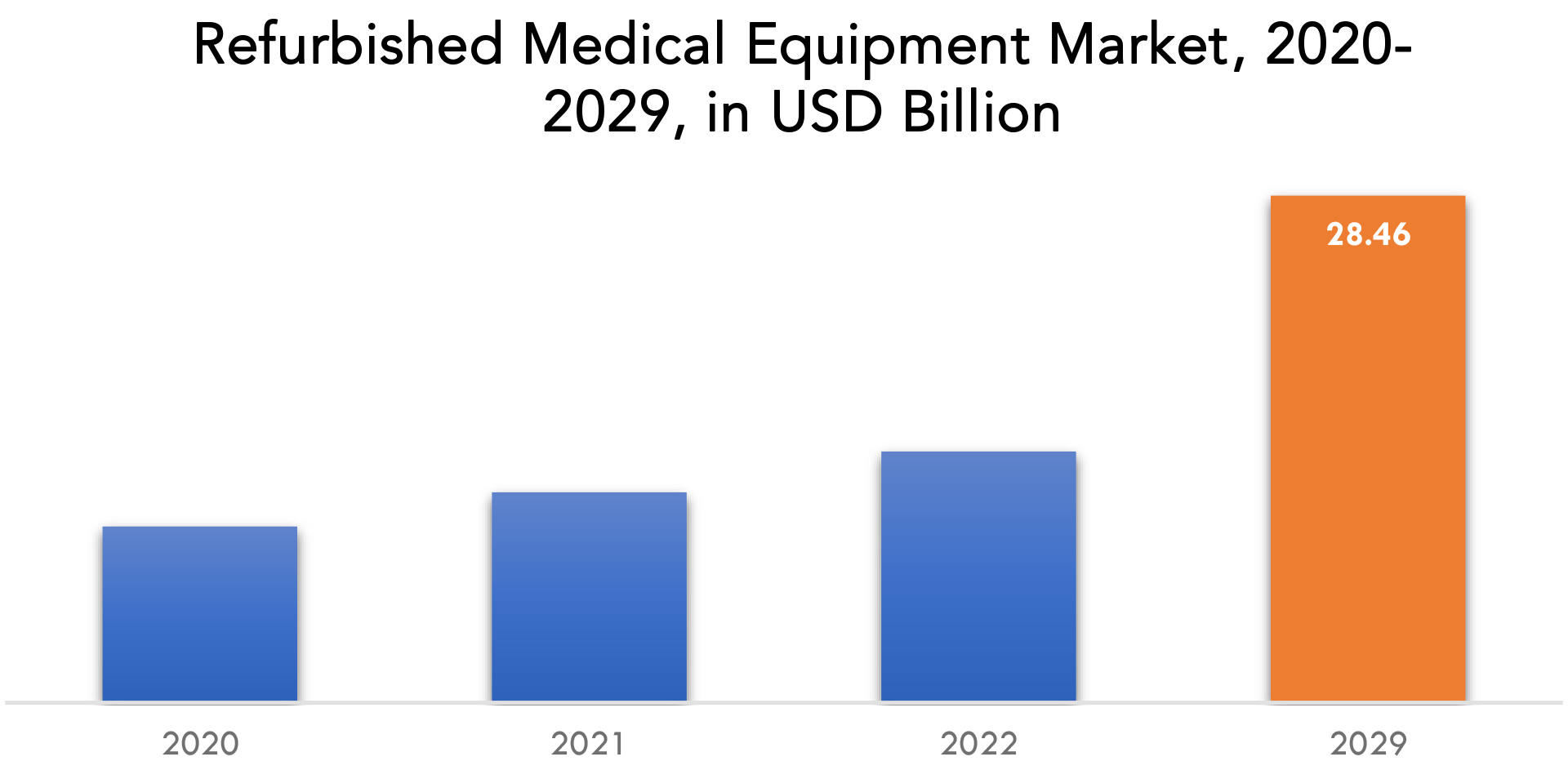

The global refurbished medical equipment market is expected to grow at 13.4% CAGR from 2021 to 2029. It is expected to reach above USD 28.46 billion by 2029 from USD 11.8 billion in 2021.

Refurbished medical equipment is a form of reuse and waste reduction. This also saves energy and resources required in the manufacture of a new gadget. Refurbished is the process of subjecting a device to a systematic procedure to assure its safety and efficacy without materially altering the equipment’s or medical device’s performance, safety requirements, or intended usage as per its initial registration. In a recycling economy, conserving assets is a core element of ecological philosophy. Refurbished fulfills the rising need for low-cost, dependable products. Customers of refurbished medical gadgets include not just tiny hospitals with limited finances, but also prestigious medical institutions. Refurbished is a long-standing component of the global healthcare industry.

The lifespan of the product varies based on the original manufacturer. The quality of the reconditioned goods may be comparable to that of new equipment, but its durability is unknown. In addition, the perceived dangers connected with secondhand equipment restrict expansion. The varying precision and quality of output influence major corporate hospitals to purchase only brand-new equipment.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion, Thousand Units) |

| Segmentation | By Product Type, Application, End User, and region. |

| By Product Type |

|

| By Application |

|

| By End User |

|

| By Region |

|

Furthermore, factors such as an increase in the number of private hospitals purchasing refurbished devices due to budget constraints, unfavorable reimbursement scenarios for various medical treatments, and increasing initiatives taken by leading medical device manufacturers to establish refurbished accommodations in both developed and developing countries have fueled demand for refurbished equipment.

The lack of standardized regulatory standards for the resale of refurbished devices is projected to stymie market expansion throughout the forecast period. Furthermore, negative perceptions about refurbished products are likely to be a significant impediment to the growth of the refurbished medical equipment market.

COVID-19 is an unprecedented worldwide public health disaster that has impacted nearly every business, and the long-term impacts are expected to have an influence on industry growth throughout the projection period. The global solicitation of ideas by governments and public-private partnerships to limit the effect of the COVID-19 pandemic is driving the growth of the Used & Refurbished Medical Equipment market.

The medical need for low-cost medical equipment is likely to contribute to the expansion of the refurbishing medical devices market in the upcoming years. Due to the region’s low disposable income, demand for refurbished medical gadgets is stronger in low-income nations. The high cost of big and advanced equipment is also expected to have a significant influence on the growth of the refurbishing equipment market.

Refurbished Medical Equipment Segment Analysis

The refurbished medical equipment market is segmented into product type, application, end user, region. These segments are further divided into product type such as medical imaging systems, operating equipment and surgical devices, and others; application as diagnostic imaging systems, minimally invasive devices, biotechnology instruments, and others; end user such as hospitals and clinics, diagnostic centers, ambulatory surgical centers, others.

Medical imaging refers to the use of technology to image the human body in order to diagnose, monitor, or treat medical diseases. Each technology provides information on a certain area of the body. The high cost of medical imaging equipment, as well as the existence of a wide number of vendors, are expected to fuel segment expansion over the projection period. Medical imaging equipment aids in the creation of a database on the normal morphology and physiology of internal organs, allowing any anomaly to be detected quickly. As a result, as their technological sophistication grows, so does the total cost of the gadgets. As a result, the high cost of medical imaging devices is projected to drive market expansion.

During the projection period, the hospital segment will account for the most additional increase. Hospitals use the most medical equipment of any type of healthcare facility. Diagnostics are the major technique of screening in hospitals, which are the initial point of contact for any illness or disease. The growing number of persons infected with numerous infectious illnesses pushes clinicians to employ diagnostic imaging technology, boosting their demand. Furthermore, the growing global population suffering from critical illnesses such as cancer and cardiovascular diseases (CVDs) is fueling market expansion. Due to economic restrictions, private hospitals in developing countries are increasingly using secondhand equipment.

Refurbished Medical Equipment Market Players

Key market players covered by the refurbished medical equipment market analysis are Agito Medical AS, Avante Health Solutions, Block Imaging International Inc., Everx Pvt. Ltd., GE Healthcare, Integrity Medical Systems Inc., Koninklijke Philips NV, Radio Oncology Systems Inc., Siemens Healthcare Systems, Soma Technology, Hilditch Group, Master Medical Equipment, Cambridge Scientific Products, Johnson & Johnson, Canon Medical Systems.

Industry Development:

- November 26, 2022: Block Imaging purchased Reliable Healthcare Imaging in order to construct a new CT scanner tube and HV tank repair and reprocessing plant.

- May 03, 2021: Hermes Medical Solutions Partners with Radiology Oncology Systems to Increase Access to Molecular Imaging’s Advancements within Cancer Care in the USA.

- July 29, 2021: Avante Health Solutions is pleased to announce that it has been awarded a group purchasing agreement with Premier to provide refurbished diagnostic imaging equipment. Premier is a major healthcare improvement organization that has brought together an alliance of over 4,100 hospitals in the United States and 200,000 additional providers to reform healthcare. Premier offers better treatment and results at a lesser cost through integrated data and analytics, collaboratives, supply chain solutions, and consulting and other services.

Who Should Buy? Or Key stakeholders

- Medical Equipment Manufactures

- Hospitals

- Suppliers

- Healthcare Industry

- Government and Research Organization

- Investors

- Diagnostic Centers

- Ambulatory Surgical Centers

- Pharmaceutical Industry

- Scientific research Industry

- Trade Associations

- Others

Refurbished Medical Equipment Market Regional Analysis

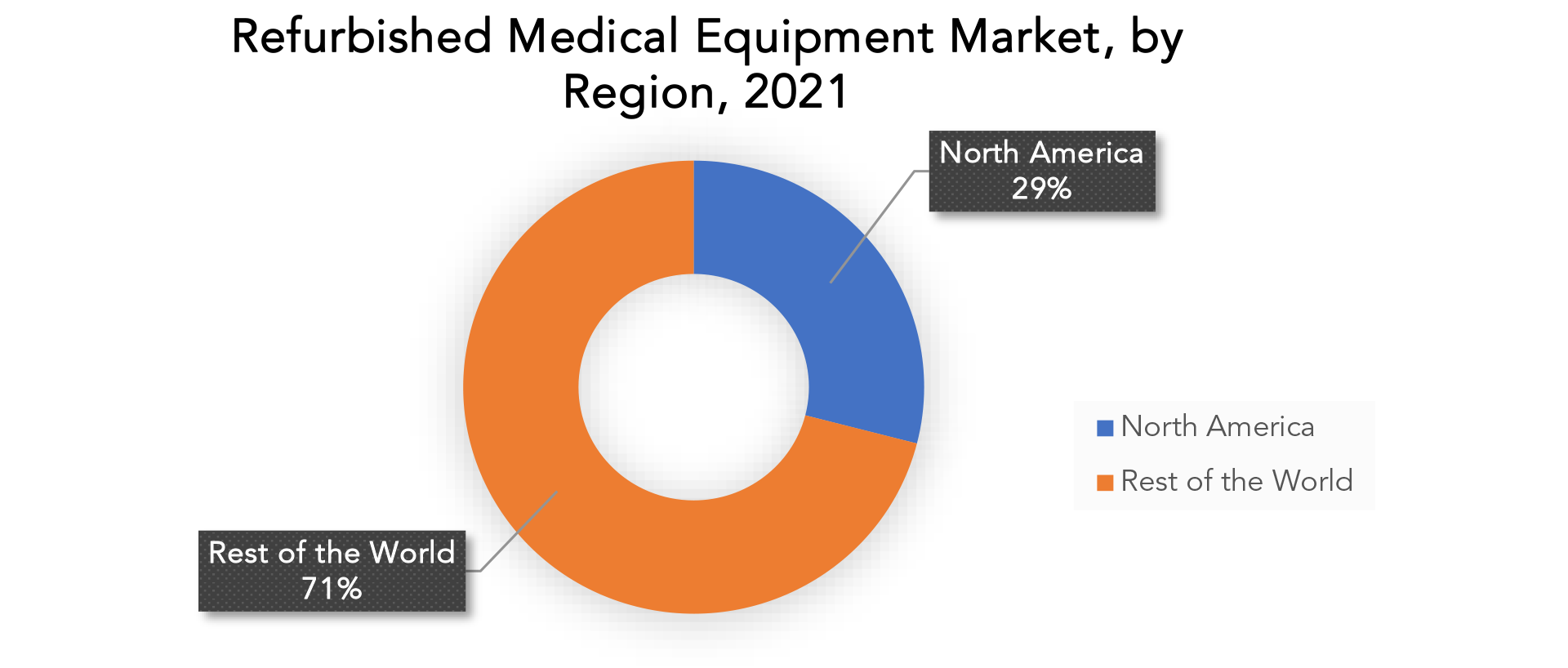

The refurbished medical equipment market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN, and Rest of APAC

- Europe: includes the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe

- South America: includes Brazil, Argentina, and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and the Rest of MEA

North America is a significant growth in the refurbished medical equipment. North America has the largest revenue share in the worldwide market for reconditioned medical equipment. The growing incidence of chronic illnesses, which is raising the rate of hospital admissions, the expanding number of imaging and surgical operations, and the exorbitant cost of medical equipment are all driving up demand for refurbished medical equipment in North America.

Key Market Segments: Refurbished Medical Equipment Market

Refurbished Medical Equipment Market By Product Type, 2020-2029, (USD Billion)

- Medical Imaging Systems

- Operating Equipment and Surgical Devices

- Others

Refurbished Medical Equipment Market By Application, 2020-2029, (USD Billion, Thousand Units)

- Diagnostic Imaging Systems

- Minimally Invasive Instruments

- Biotechnology Instruments

- Others

Refurbished Medical Equipment Market By End User, 2020-2029, (USD Billion, Thousand Units)

- Hospitals And Clinics

- Diagnostic Centers

- Ambulatory Surgical Centers

- Others

Refurbished Medical Equipment Market By Region, 2020-2029, (USD Billion, Thousand Units)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- Who are the major players in the refurbished medical equipment market and what is their market share?

- What are the end-user industries driving demand for the market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the refurbished medical equipment market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the refurbished medical equipment market?

- What are the key drivers of growth in the refurbished medical equipment market?

- What are the distribution channels and supply chain dynamics in the refurbished medical equipment market?

- What are the technological advancements and innovations in the refurbished medical equipment market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the refurbished medical equipment market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the refurbished medical equipment market?

- What are the product offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL REFURBISHED MEDICAL EQUIPMENT MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON REFURBISHED MEDICAL EQUIPMENT MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL REFURBISHED MEDICAL EQUIPMENT MARKET OUTLOOK

- GLOBAL REFURBISHED MEDICAL EQUIPMENT MARKET BY PRODUCT TYPE, 2020-2029, (USD BILLION, THOUSAND UNITS)

- MEDICAL IMAGING SYSTEMS

- OPERATING EQUIPMENT INSTRUMENTS

- BIOTECHNOLOGY INSTRUMENTS

- OTHERS

- GLOBAL REFURBISHED MEDICAL EQUIPMENT MARKET BY APPLICATION, 2020-2029, (USD BILLION, THOUSAND UNITS)

- DIAGNOSTIC IMAGING SYSTEMS

- MINIMALLY INVASIVE INSTRUMENTS

- BIOTECHNOLOGY INSTRUMENTS

- OTHERS

- GLOBAL REFURBISHED MEDICAL EQUIPMENT MARKET BY END USER, 2020-2029, (USD BILLION, THOUSAND UNITS)

- HOSPITALS AND CLINICS

- DIAGNOSTIC CENTERS

- AMBULATORY SURGICAL CENTERS

- OTHERS

- GLOBAL REFURBISHED MEDICAL EQUIPMENT MARKET BY REGION, 2020-2029, (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

9.1. AGITO MEDICAL AS

9.2. AVANTE HEALTH SOLUTIONS

9.3. BLOCK IMAGING INTERNATIONAL INC.

9.4. EVERX PVT. LTD.

9.5. GE HEALTHCARE SYSTEMS

9.6. SOMA TECHNOLOGY

9.7. HILDITCH GROUP

9.8. MASTER MEDICAL EQUIPMENT

9.9. CAMBRIDGE SCIENTIFIC PRODUCTS

9.10. JOHNSON & JOHNSON

9.11. CANON MEDICAL SYSTEMS

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 2 GLOBAL COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 3 GLOBAL COMPOSITE REPAIRS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 4 GLOBAL COMPOSITE REPAIRS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 5 GLOBAL COMPOSITE REPAIRS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 6 GLOBAL COMPOSITE REPAIRS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 7 GLOBAL COMPOSITE REPAIRS MARKET BY REGION (USD BILLION), 2020-2029

TABLE 8 GLOBAL COMPOSITE REPAIRS MARKET BY REGION (THOUSAND UNITS), 2020-2029

TABLE 9 NORTH AMERICA COMPOSITE REPAIRS BY COUNTRY (USD BILLION), 2020-2029

TABLE 10 NORTH AMERICA COMPOSITE REPAIRS BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 11 NORTH AMERICA COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 12 NORTH AMERICA COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 13 NORTH AMERICA COMPOSITE REPAIRS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 14 NORTH AMERICA COMPOSITE REPAIRS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 15 NORTH AMERICA COMPOSITE REPAIRS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 16 NORTH AMERICA COMPOSITE REPAIRS MARKET BY END USER INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 17 US COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 18 US COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 19 US COMPOSITE REPAIRS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 20 US COMPOSITE REPAIRS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 21 US COMPOSITE REPAIRS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 22 US COMPOSITE REPAIRS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 23 CANADA COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 24 CANADA COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 25 CANADA COMPOSITE REPAIRS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 26 CANADA COMPOSITE REPAIRS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 27 CANADA COMPOSITE REPAIRS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 28 CANADA COMPOSITE REPAIRS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 29 MEXICO COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 30 MEXICO COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 31 MEXICO COMPOSITE REPAIRS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 32 MEXICO COMPOSITE REPAIRS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 33 MEXICO COMPOSITE REPAIRS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 34 MEXICO COMPOSITE REPAIRS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 35 SOUTH AMERICA COMPOSITE REPAIRS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 36 SOUTH AMERICA COMPOSITE REPAIRS MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 37 SOUTH AMERICA COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 38 SOUTH AMERICA COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 39 SOUTH AMERICA COMPOSITE REPAIRS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 40 SOUTH AMERICA COMPOSITE REPAIRS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 41 SOUTH AMERICA COMPOSITE REPAIRS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 42 SOUTH AMERICA COMPOSITE REPAIRS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 43 BRAZIL COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 44 BRAZIL COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 45 BRAZIL COMPOSITE REPAIRS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 46 BRAZIL COMPOSITE REPAIRS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 47 BRAZIL COMPOSITE REPAIRS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 48 BRAZIL COMPOSITE REPAIRS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 49 ARGENTINA COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 50 ARGENTINA COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 51 ARGENTINA COMPOSITE REPAIRS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 52 ARGENTINA COMPOSITE REPAIRS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 53 ARGENTINA COMPOSITE REPAIRS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 54 ARGENTINA COMPOSITE REPAIRS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 55 COLOMBIA COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 56 COLOMBIA COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 57 COLOMBIA COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 58 COLOMBIA COMPOSITE REPAIRS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 59 COLOMBIA COMPOSITE REPAIRS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 60 COLOMBIA COMPOSITE REPAIRS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 61 COLOMBIA COMPOSITE REPAIRS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 62 REST OF SOUTH AMERICA COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 63 REST OF SOUTH AMERICA COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 64 REST OF SOUTH AMERICA COMPOSITE REPAIRS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 65 REST OF SOUTH AMERICA COMPOSITE REPAIRS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 66 REST OF SOUTH AMERICA COMPOSITE REPAIRS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 67 REST OF SOUTH AMERICA COMPOSITE REPAIRS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 68 ASIA-PACIFIC COMPOSITE REPAIRS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 69 ASIA-PACIFIC COMPOSITE REPAIRS MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 70 ASIA-PACIFIC COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 71 ASIA-PACIFIC COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 72 ASIA-PACIFIC COMPOSITE REPAIRS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 73 ASIA-PACIFIC COMPOSITE REPAIRS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 74 ASIA-PACIFIC COMPOSITE REPAIRS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 75 ASIA-PACIFIC COMPOSITE REPAIRS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 76 INDIA COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 77 INDIA COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 78 INDIA COMPOSITE REPAIRS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 79 INDIA COMPOSITE REPAIRS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 80 INDIA COMPOSITE REPAIRS MARKET BY END-USER INDUTRY (USD BILLION), 2020-2029

TABLE 81 INDIA COMPOSITE REPAIRS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 82 CHINA COMPOSITE REPAIRS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 83 CHINA COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 84 CHINA COMPOSITE REPAIRS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 85 CHINA COMPOSITE REPAIRS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 86 CHINA COMPOSITE REPAIRS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 87 CHINA COMPOSITE REPAIRS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 88 JAPAN COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 89 JAPAN COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 90 JAPAN COMPOSITE REPAIRS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 91 JAPAN COMPOSITE REPAIRS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 92 JAPAN COMPOSITE REPAIRS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 93 JAPAN COMPOSITE REPAIRS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 94 SOUTH KOREA COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 95 SOUTH KOREA COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 96 SOUTH KOREA COMPOSITE REPAIRS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 97 SOUTH KOREA COMPOSITE REPAIRS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 98 SOUTH KOREA COMPOSITE REPAIRS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 99 SOUTH KOREA COMPOSITE REPAIRS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 100 AUSTRALIA COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 101 AUSTRALIA COMPOSITE REPAIRS BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 102 AUSTRALIA COMPOSITE REPAIRS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 103 AUSTRALIA COMPOSITE REPAIRS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 104 AUSTRALIA COMPOSITE REPAIRS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 105 AUSTRALIA COMPOSITE REPAIRS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 106 SOUTH EAST ASIA COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (USD MI LLION), 2020-2029

TABLE 107 SOUTH EAST ASIA COMPOSITE REPAIRS BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 108 SOUTH EAST ASIA COMPOSITE REPAIRS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 109 SOUTH EAST ASIA COMPOSITE REPAIRS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 110 SOUTH EAST ASIA COMPOSITE REPAIRS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 111 SOUTH EAST ASIA COMPOSITE REPAIRS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 112 REST OF ASIA PACIFIC COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 113 REST OF ASIA PACIFIC COMPOSITE REPAIRS BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 114 REST OF ASIA PACIFIC COMPOSITE REPAIRS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 115 REST OF ASIA PACIFIC COMPOSITE REPAIRS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 116 REST OF ASIA PACIFIC COMPOSITE REPAIRS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 117 REST OF ASIA PACIFIC COMPOSITE REPAIRS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 118 EUROPE COMPOSITE REPAIRS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 119 EUROPE COMPOSITE REPAIRS MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 120 EUROPE COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 121 EUROPE COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 122 EUROPE COMPOSITE REPAIRS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 123 EUROPE COMPOSITE REPAIRS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 124 EUROPE COMPOSITE REPAIRS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 125 EUROPE COMPOSITE REPAIRS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 126 GERMANY COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 127 GERMANY COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 128 GERMANY COMPOSITE REPAIRS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 129 GERMANY COMPOSITE REPAIRS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 130 GERMANY COMPOSITE REPAIRS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 131 GERMANY COMPOSITE REPAIRS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 132 UK COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 133 UK COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 134 UK COMPOSITE REPAIRS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 135 UK COMPOSITE REPAIRS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 136 UK COMPOSITE REPAIRS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 137 UK COMPOSITE REPAIRS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 138 FRANCE COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 139 FRANCE COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 140 FRANCE COMPOSITE REPAIRS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 141 FRANCE COMPOSITE REPAIRS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 142 FRANCE COMPOSITE REPAIRS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 143 FRANCE COMPOSITE REPAIRS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 144 ITALY COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 145 ITALY COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 146 ITALY COMPOSITE REPAIRS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 147 ITALY COMPOSITE REPAIRS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 148 ITALY COMPOSITE REPAIRS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 149 ITALY COMPOSITE REPAIRS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 150 SPAIN COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 151 SPAIN COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 152 SPAIN COMPOSITE REPAIRS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 153 SPAIN COMPOSITE REPAIRS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 154 SPAIN COMPOSITE REPAIRS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 155 SPAIN COMPOSITE REPAIRS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 156 RUSSIA COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 157 RUSSIA COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 158 RUSSIA COMPOSITE REPAIRS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 159 RUSSIA COMPOSITE REPAIRS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 160 RUSSIA COMPOSITE REPAIRS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 161 RUSSIA COMPOSITE REPAIRS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 162 REST OF EUROPE COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 163 REST OF EUROPE COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 164 REST OF EUROPE COMPOSITE REPAIRS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 165 REST OF EUROPE COMPOSITE REPAIRS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 166 REST OF EUROPE COMPOSITE REPAIRS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 167 REST OF EUROPE COMPOSITE REPAIRS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 168 MIDDLE EAST AND AFRICA COMPOSITE REPAIRS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 169 MIDDLE EAST AND AFRICA COMPOSITE REPAIRS MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 170 MIDDLE EAST AND AFRICA COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 171 MIDDLE EAST AND AFRICA COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 172 MIDDLE EAST AND AFRICA COMPOSITE REPAIRS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 173 MIDDLE EAST AND AFRICA COMPOSITE REPAIRS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 174 MIDDLE EAST AND AFRICA COMPOSITE REPAIRS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 175 MIDDLE EAST AND AFRICA COMPOSITE REPAIRS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 176 UAE COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 177 UAE COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 178 UAE COMPOSITE REPAIRS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 179 UAE COMPOSITE REPAIRS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 180 UAE COMPOSITE REPAIRS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 181 UAE COMPOSITE REPAIRS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 182 SAUDI ARABIA COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 183 SAUDI ARABIA COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 184 SAUDI ARABIA COMPOSITE REPAIRS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 185 SAUDI ARABIA COMPOSITE REPAIRS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 186 SAUDI ARABIA COMPOSITE REPAIRS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 187 SAUDI ARABIA COMPOSITE REPAIRS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 188 SOUTH AFRICA COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 189 SOUTH AFRICA COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 190 SOUTH AFRICA COMPOSITE REPAIRS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 191 SOUTH AFRICA COMPOSITE REPAIRS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 192 SOUTH AFRICA COMPOSITE REPAIRS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 193 SOUTH AFRICA COMPOSITE REPAIRS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 194 REST OF MIDDLE EAST AND AFRICA COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 195 REST OF MIDDLE EAST AND AFRICA COMPOSITE REPAIRS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 196 REST OF MIDDLE EAST AND AFRICA COMPOSITE REPAIRS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 197 REST OF MIDDLE EAST AND AFRICA COMPOSITE REPAIRS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 198 REST OF MIDDLE EAST AND AFRICA COMPOSITE REPAIRS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 199 REST OF MIDDLE EAST AND AFRICA COMPOSITE REPAIRS MARKET BY END USER (THOUSAND UNITS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL REFURBISHED MEDICAL EQUIPMENT MARKET BY PRODUCT TYPE, USD BILLION, 2020-2029

FIGURE 9 GLOBAL REFURBISHED MEDICAL EQUIPMENT MARKET BY APPLICATION, USD BILLION, 2020-2029

FIGURE 10 GLOBAL REFURBISHED MEDICAL EQUIPMENT MARKET BY END USER, USD BILLION, 2020-2029

FIGURE 12 GLOBAL REFURBISHED MEDICAL EQUIPMENT MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 13 PORTER’S FIVE FORCES MODEL

FIGURE 14 GLOBAL REFURBISHED MEDICAL EQUIPMENT MARKET BY PRODUCT TYPE, 2021

FIGURE 15 GLOBAL REFURBISHED MEDICAL EQUIPMENT MARKET BY APPLICATION, 2021

FIGURE 16 GLOBAL REFURBISHED MEDICAL EQUIPMENT MARKET BY END USER, 2021

FIGURE 17 GLOBAL REFURBISHED MEDICAL EQUIPMENT MARKET BY REGION, 2021

FIGURE 18 MARKET SHARE ANALYSIS

FIGURE 19 AGITO MEDICAL AS: COMPANY SNAPSHOT

FIGURE 20 AVANTE HEALTH SOLUTIONS: COMPANY SNAPSHOT

FIGURE 21 BLOCK IMAGING INTRNATIONAL INC.: COMPANY SNAPSHOT

FIGURE 22 EVERX PVT. LTD.: COMPANY SNAPSHOT

FIGURE 23 GE HEALTHCARE: COMPANY SNAPSHOT

FIGURE 24 INTEGRITY MEDICAL SYSTEMS INC.: COMPANY SNAPSHOT

FIGURE 25 KONINKLIJKE PHILIPS NV: COMPANY SNAPSHOT

FIGURE 26 RADIO ONCOLOGY SYSTEMS INC.: COMPANY SNAPSHOT

FIGURE 27 SIEMENS HEALTHCARE SYSTEMS: COMPANY SNAPSHOT

FIGURE 28 SOMA TECHNOLOGY: COMPANY SNAPSHOT

FIGURE 29 HILDITCH GROUP: COMPANY SNAPSHOT

FIGURE 30 MASTER MEDICAL EQUIPMENT: COMPANY SNAPSHOT

FIGURE 31 CAMBRIDGE SCIENTIFIC PRODUCTS: COMPANY SNAPSHOT

FIGURE 32 JOHNSON & JOHNSON: COMPANY SNAPSHOT

FIGURE 33 CANON MEDICAL SYSTEMS: COMPANY SNAPSHOT

FAQ

The global refurbished medical equipment market is expected to grow at 13.4% CAGR from 2021 to 2029. It is expected to reach above USD 28.46 billion by 2029 from USD 11.8 billion in 2021.

North America is a significant growth in the refurbished medical equipment. North America has the largest revenue share in the worldwide market for reconditioned medical equipment. The growing incidence of chronic illnesses, which is raising the rate of hospital admissions, the expanding number of imaging and surgical operations, and the exorbitant cost of medical equipment are all driving up demand for refurbished medical equipment in North America.

Key market players covered by the refurbished medical equipment market analysis are Agito Medical AS, Avante Health Solutions, Block Imaging International Inc., Everx Pvt. Ltd., GE Healthcare, Integrity Medical Systems Inc., Koninklijke Philips NV, Radio Oncology Systems Inc., Siemens Healthcare Systems, Soma Technology, Hilditch Group, Master Medical Equipment, Cambridge Scientific Products, Johnson & Johnson, Canon Medical Systems.

The medical need for low-cost medical equipment is likely to contribute to the expansion of the refurbishing medical devices market in the upcoming years. Due to the region’s low disposable income, demand for refurbished medical gadgets is stronger in low-income nations. The high cost of big and advanced equipment is also expected to have a significant influence on the growth of the refurbishing equipment market.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.