SCOPE OF THE REPORT

Hepatitis Testing/Diagnosis Market Overview

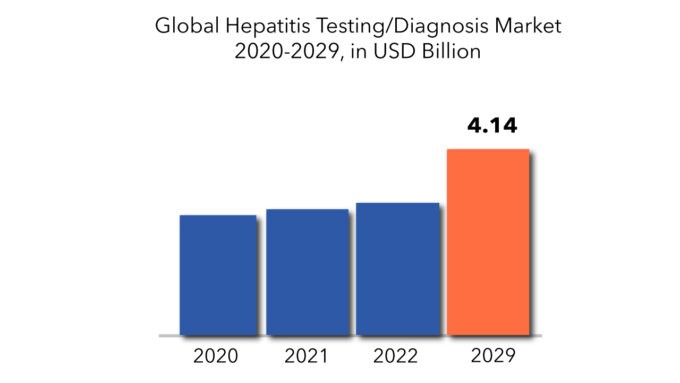

The global hepatitis testing/diagnosis market is expected to grow at a 5 % CAGR from 2022 to 2029. It is expected to reach above USD 4.14 billion by 2029 from USD 2.66 billion in 2020.

Hepatitis is a broad term that refers to liver inflammation. Hepatitis can be caused by excessive alcohol consumption, some drugs, pollutants, and certain medical problems. Hepatitis, on the other hand, is frequently caused by viral infection. Hepatitis A, hepatitis B, and hepatitis C are the three most frequent kinds of viral hepatitis. In low- and middle-income nations, the burden of HBV and HCV is disproportionately high. The majority of the worldwide population with chronic HBV infection were infected when they were born or in early childhood, and perinatal or horizontal transmission was common. The high burden of hepatitis, increased blood transfusions and donations, the benefits of POC devices and kits, and hepatitis awareness programs are all driving the worldwide hepatitis testing market forward.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Million) |

| Segmentation | By Disease Type, By Technology, By End-User |

| By Disease Type |

|

| By Technology |

|

| By End-user |

|

| By Region |

|

Due to fewer patient visits to hospitals, the COVID-19 outbreak had a detrimental influence on the hepatitis testing business. Healthcare systems have been severely strained as a result of the pandemic. To prevent the spread of the disease and conserve healthcare resources for COVID-19 patients, healthcare institutes and providers were told to halt performing elective surgical operations and medical evaluations. As a result, the volume of testing at many hepatitis testing clinical laboratories has dropped dramatically.

Rising consumer awareness of the benefits of hepatitis virus testing in determining the best course of treatment and prevention, as well as changing lifestyle and food consumption habits, rising medication side effects, excessive alcohol consumption, rising incidence of viral hepatitis and autoimmune diseases, rising disposable income of consumers, rising medical tourism, and the rising presence of large demography of hepatitis patients are all driving market growth. Furthermore, rising technological advancements and modernization in the healthcare sector, rising healthcare research and development activities, and rising emerging markets with an increasing geriatric population base will all create new opportunities for the hepatitis test solution/diagnosis market in the forecasted period.

Hepatitis market expansion is likely to be hampered by the high cost of nucleic acid testing, a lack of mandates for nucleic acid tests in emerging countries, and poor reimbursement situations. Emerging markets, rising technical breakthroughs in molecular diagnostics, and growth in the biotechnology and biopharmaceutical industries are likely to provide the market with significant potential possibilities. Changing regulatory landscapes, operational hurdles, and a scarcity of skilled personnel, on the other hand, may provide some challenges to market expansion.

Hepatitis Testing/Diagnosis Market Segment Analysis

On the basis of disease type, the market is segmented into Hepatitis B, Hepatitis C, Other Hepatitis. Based on technology, the hepatitis testing/diagnosis market is bifurcated into ELISA, RDT, PCR, INAAT. On the basis of the end-user, the market is segmented into Hospitals, Diagnostic Laboratories, Blood Banks.

The hepatitis B segment accounted for the largest share of the hepatitis testing market. The rising prevalence of hepatitis B, the availability of a large variety of hepatitis B diagnostic tests, and the growing use of nucleic acid tests for HBV diagnosis are all driving this market segment’s rise.

The ELISA segment accounted for the largest share of the hepatitis testing market in 2020. The extensive use of this test in clinical procedures to identify hepatitis is principally responsible for the substantial proportion of this category. Immunoassays are bioanalytical procedures that rely on the reaction of an antigen and an antibody to determine the concentration of an analyte. Immunoassays have been shown to offer very accurate results even with very little samples when compared to conventional testing. Immunoassay has become increasingly popular in recent years due to its wide range of applications and ease of diagnosis. In addition, with the rise in hepatitis cases, the market is likely to grow.

The hospital & diagnostic laboratories segment accounted for the largest share of the hepatitis testing market. The large share of this segment can be attributed to the large number of hepatitis diagnostic tests carried out in hospitals.

Hepatitis Testing/Diagnosis Market Players

The major players covered in the hepatitis test solution/diagnosis market are F. Hoffmann-La Roche Ltd, Abbott, Bio-Rad Laboratories Inc., Siemens, DiaSorin, QIAGEN, Danaher, bioMérieux SA, Grifols S.A., Ortho Clinical Diagnostics, FUJIREBIO Inc and Others.

These companies have adopted various organic as well as inorganic growth strategies to strengthen their position in the market. New product development, merger & acquisition, and expansion were among the key growth strategies adopted by these leading players to enhance their product offering and regional presence and meet the growing demand for hepatitis testing/diagnosis in the emerging economies.

Recent Developments

- In 2021, Abbott received FDA Emergency Use Authorization (EUA) for the Alinity m Resp-4-Plex assay.

- In 2021, F. Hoffmann-La Roche Ltd. acquired GenMark Diagnostics (US) which aimed at adding more products to Roche’s molecular diagnostics portfolio and the global distribution of products offered by GenMark Diagnostics.

- In 2021, Bio-Rad Laboratories, Inc. partnered with Seegene, Inc. (South Korea). The partnership aims at collaborative development and the commercialization of infectious disease diagnostic

Who Should Buy? Or Key Stakeholders

- Hepatitis testing/diagnosis suppliers

- Investors

- Research institutes

- Medical Institutes

- Environment, Health and Safety Professionals

Hepatitis Testing/Diagnosis Market Regional Analysis

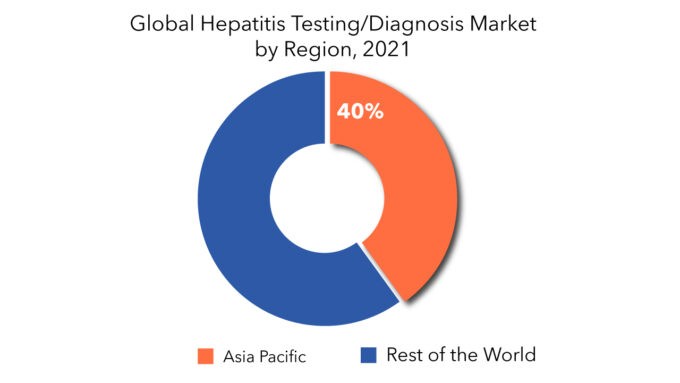

The global hepatitis testing/diagnosis market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

North America dominates the global market, and this trend is expected to continue during the forecast period. The rising prevalence of hepatitis, as well as increased research and clinical trials for hepatitis testing in the United States, are the reason for this region’s growth.

Key Market Segments: Global Hepatitis Testing/Diagnosis Market

Global Hepatitis Testing/Diagnosis Market by Disease Type, 2020-2029, (USD Million)

- Hepatitis B

- Hepatitis C

- Other Hepatitis

Global Hepatitis Testing/Diagnosis Market by Technology, 2020-2029, (USD Million)

- Elisa

- RDT

- PCR

- INAAT

Global Hepatitis Testing/Diagnosis Market by End-User, 2020-2029, (USD Million)

- Hospitals

- Diagnostic Laboratories

- Blood Banks

Global Hepatitis Testing/Diagnosis Market by Region, 2020-2029, (USD Million)

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

Important countries in all regions are covered.

Key Question Answered

- What are the growth opportunities related to the adoption of the hepatitis testing/diagnosis market across major regions in the future?

- What are the new trends and advancements in the hepatitis testing/diagnosis market?

- Which product categories are expected to have the highest growth rate in the hepatitis testing/diagnosis market?

- Which are the key factors driving the hepatitis testing/diagnosis market?

- What will the hepatitis testing/diagnosis market growth rate, growth momentum, or acceleration the market carries during the forecast period?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Hepatitis Testing/Diagnosis Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Global Hepatitis Testing/Diagnosis Market

- Global Hepatitis Testing/Diagnosis Market Outlook

- Global Hepatitis Testing/Diagnosis Market by Disease Type, (USD Million)

- Hepatitis B

- Hepatitis C

- Other Hepatitis

- Global Hepatitis Testing/Diagnosis Market by Technology, (USD Million)

- ELISA

- RDT

- PCR

- INAAT

- Global Hepatitis Testing/Diagnosis Market by End-User, (USD Million)

- Hospitals

- Diagnostic Laboratories

- Blood Banks

- Global Hepatitis Testing/Diagnosis Market by Region, (USD Million)

- Introduction

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- South-East Asia

- Rest of Asia-Pacific

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Colombia

- Rest of South America

- Middle- East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle- East and Africa

- Company Profiles* (Business Overview, Company Snapshot, PRODUCT TYPEs Offered, Recent De velopments)

-

- Hoffmann-La Roche Ltd

- Abbott

- Siemens

- DiaSorin

- QIAGEN

- Danaher

- bioMérieux SA

- Grifols S.A

- Ortho Clinical Diagnostics

- FUJIREBIO Inc

*The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL HEPATITIS TESTING/DIAGNOSIS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 2 GLOBAL HEPATITIS TESTING/DIAGNOSIS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 3 GLOBAL HEPATITIS TESTING/DIAGNOSIS MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 4 GLOBAL HEPATITIS TESTING/DIAGNOSIS MARKET BY REGION (USD MILLIONS), 2020-2029

TABLE 5 NORTH AMERICA HEPATITIS TESTING/DIAGNOSIS MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 6 NORTH AMERICA HEPATITIS TESTING/DIAGNOSIS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 7 NORTH AMERICA HEPATITIS TESTING/DIAGNOSIS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 8 NORTH AMERICA HEPATITIS TESTING/DIAGNOSIS MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 9 US HEPATITIS TESTING/DIAGNOSIS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 10 US HEPATITIS TESTING/DIAGNOSIS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 11 US HEPATITIS TESTING/DIAGNOSIS MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 12 CANADA HEPATITIS TESTING/DIAGNOSIS MARKET BY DISEASE TYPE (MILLIONS), 2020-2029

TABLE 13 CANADA HEPATITIS TESTING/DIAGNOSIS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 14 CANADA HEPATITIS TESTING/DIAGNOSIS MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 15 MEXICO HEPATITIS TESTING/DIAGNOSIS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 16 MEXICO HEPATITIS TESTING/DIAGNOSIS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 17 MEXICO HEPATITIS TESTING/DIAGNOSIS MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 18 SOUTH AMERICA HEPATITIS TESTING/DIAGNOSIS MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 19 SOUTH AMERICA HEPATITIS TESTING/DIAGNOSIS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 20 SOUTH AMERICA HEPATITIS TESTING/DIAGNOSIS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 21 SOUTH AMERICA HEPATITIS TESTING/DIAGNOSIS MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 22 BRAZIL HEPATITIS TESTING/DIAGNOSIS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 23 BRAZIL HEPATITIS TESTING/DIAGNOSIS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 24 BRAZIL HEPATITIS TESTING/DIAGNOSIS MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 25 ARGENTINA HEPATITIS TESTING/DIAGNOSIS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 26 ARGENTINA HEPATITIS TESTING/DIAGNOSIS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 27 ARGENTINA HEPATITIS TESTING/DIAGNOSIS MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 28 COLOMBIA HEPATITIS TESTING/DIAGNOSIS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 29 COLOMBIA HEPATITIS TESTING/DIAGNOSIS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 30 COLOMBIA HEPATITIS TESTING/DIAGNOSIS MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 31 REST OF SOUTH AMERICA HEPATITIS TESTING/DIAGNOSIS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 32 REST OF SOUTH AMERICA HEPATITIS TESTING/DIAGNOSIS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 33 REST OF SOUTH AMERICA HEPATITIS TESTING/DIAGNOSIS MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 34 ASIA-PACIFIC HEPATITIS TESTING/DIAGNOSIS MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 35 ASIA-PACIFIC HEPATITIS TESTING/DIAGNOSIS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 36 ASIA-PACIFIC HEPATITIS TESTING/DIAGNOSIS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 37 ASIA-PACIFIC HEPATITIS TESTING/DIAGNOSIS MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 38 INDIA HEPATITIS TESTING/DIAGNOSIS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 39 INDIA HEPATITIS TESTING/DIAGNOSIS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 40 INDIA HEPATITIS TESTING/DIAGNOSIS MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 41 CHINA HEPATITIS TESTING/DIAGNOSIS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 42 CHINA HEPATITIS TESTING/DIAGNOSIS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 43 CHINA HEPATITIS TESTING/DIAGNOSIS MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 44 JAPAN HEPATITIS TESTING/DIAGNOSIS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 45 JAPAN HEPATITIS TESTING/DIAGNOSIS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 46 JAPAN HEPATITIS TESTING/DIAGNOSIS MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 47 SOUTH KOREA HEPATITIS TESTING/DIAGNOSIS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 48 SOUTH KOREA HEPATITIS TESTING/DIAGNOSIS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 49 SOUTH KOREA HEPATITIS TESTING/DIAGNOSIS MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 50 AUSTRALIA HEPATITIS TESTING/DIAGNOSIS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 51 AUSTRALIA HEPATITIS TESTING/DIAGNOSIS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 52 AUSTRALIA HEPATITIS TESTING/DIAGNOSIS MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 53 SOUTH EAST ASIA HEPATITIS TESTING/DIAGNOSIS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 54 SOUTH EAST ASIA HEPATITIS TESTING/DIAGNOSIS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 55 SOUTH EAST ASIA HEPATITIS TESTING/DIAGNOSIS MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 56 REST OF ASIA PACIFIC HEPATITIS TESTING/DIAGNOSIS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 57 REST OF ASIA PACIFIC HEPATITIS TESTING/DIAGNOSIS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 58 REST OF ASIA PACIFIC HEPATITIS TESTING/DIAGNOSIS MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 59 EUROPE HEPATITIS TESTING/DIAGNOSIS MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 60 EUROPE HEPATITIS TESTING/DIAGNOSIS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 61 EUROPE HEPATITIS TESTING/DIAGNOSIS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 62 EUROPE HEPATITIS TESTING/DIAGNOSIS MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 63 GERMANY HEPATITIS TESTING/DIAGNOSIS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 64 GERMANY HEPATITIS TESTING/DIAGNOSIS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 65 GERMANY HEPATITIS TESTING/DIAGNOSIS MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 66 UK HEPATITIS TESTING/DIAGNOSIS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 67 UK HEPATITIS TESTING/DIAGNOSIS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 68 UK HEPATITIS TESTING/DIAGNOSIS MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 69 FRANCE HEPATITIS TESTING/DIAGNOSIS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 70 FRANCE HEPATITIS TESTING/DIAGNOSIS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 71 FRANCE HEPATITIS TESTING/DIAGNOSIS MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 72 ITALY HEPATITIS TESTING/DIAGNOSIS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 73 ITALY HEPATITIS TESTING/DIAGNOSIS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 74 ITALY HEPATITIS TESTING/DIAGNOSIS MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 75 SPAIN HEPATITIS TESTING/DIAGNOSIS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 76 SPAIN HEPATITIS TESTING/DIAGNOSIS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 77 SPAIN HEPATITIS TESTING/DIAGNOSIS MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 78 RUSSIA HEPATITIS TESTING/DIAGNOSIS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 79 RUSSIA HEPATITIS TESTING/DIAGNOSIS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 80 RUSSIA HEPATITIS TESTING/DIAGNOSIS MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 81 REST OF EUROPE HEPATITIS TESTING/DIAGNOSIS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 82 REST OF EUROPE HEPATITIS TESTING/DIAGNOSIS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 83 REST OF EUROPE HEPATITIS TESTING/DIAGNOSIS MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 84 MIDDLE EAST AND AFRICA HEPATITIS TESTING/DIAGNOSIS MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 85 MIDDLE EAST AND AFRICA HEPATITIS TESTING/DIAGNOSIS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 86 MIDDLE EAST AND AFRICA HEPATITIS TESTING/DIAGNOSIS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 87 MIDDLE EAST AND AFRICA HEPATITIS TESTING/DIAGNOSIS MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 88 UAE HEPATITIS TESTING/DIAGNOSIS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 89 UAE HEPATITIS TESTING/DIAGNOSIS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 90 UAE HEPATITIS TESTING/DIAGNOSIS MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 91 SAUDI ARABIA HEPATITIS TESTING/DIAGNOSIS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 92 SAUDI ARABIA HEPATITIS TESTING/DIAGNOSIS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 93 SAUDI ARABIA HEPATITIS TESTING/DIAGNOSIS MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 94 SOUTH AFRICA HEPATITIS TESTING/DIAGNOSIS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 95 SOUTH AFRICA HEPATITIS TESTING/DIAGNOSIS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 96 SOUTH AFRICA HEPATITIS TESTING/DIAGNOSIS MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 97 REST OF MIDDLE EAST AND AFRICA HEPATITIS TESTING/DIAGNOSIS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 98 REST OF MIDDLE EAST AND AFRICA HEPATITIS TESTING/DIAGNOSIS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 99 REST OF MIDDLE EAST AND AFRICA HEPATITIS TESTING/DIAGNOSIS MARKET BY END-USER (USD MILLIONS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL HEPATITIS TESTING/DIAGNOSIS MARKET BY DISEASE TYPE, USD MILLION, 2020-2029

FIGURE 9 GLOBAL HEPATITIS TESTING/DIAGNOSIS MARKET BY TECHNOLOGY, USD MILLION, 2020-2029

FIGURE 10 GLOBAL HEPATITIS TESTING/DIAGNOSIS MARKET BY END-USER, USD MILLION, 2020-2029

FIGURE 11 GLOBAL HEPATITIS TESTING/DIAGNOSIS MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL HEPATITIS TESTING/DIAGNOSIS MARKET BY DISEASE TYPE, USD MILLION, 2020-2029

FIGURE 14 GLOBAL HEPATITIS TESTING/DIAGNOSIS MARKET BY TECHNOLOGY, USD MILLION, 2020-2029

FIGURE 15 GLOBAL HEPATITIS TESTING/DIAGNOSIS MARKET BY END-USER, USD MILLION, 2020-2029

FIGURE 16 GLOBAL HEPATITIS TESTING/DIAGNOSIS MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 17 HEPATITIS TESTING/DIAGNOSIS MARKET BY REGION 2021

FIGURE 18 MARKET SHARE ANALYSIS

FIGURE 19 F. HOFFMANN-LA ROCHE LTD: COMPANY SNAPSHOT

FIGURE 20 ABBOTT: COMPANY SNAPSHOT

FIGURE 21 BIO-RAD LABORATORIES INC: COMPANY SNAPSHOT

FIGURE 22 SIEMENS: COMPANY SNAPSHOT

FIGURE 23 DIASORIN: COMPANY SNAPSHOT

FIGURE 24 QIAGEN: COMPANY SNAPSHOT

FIGURE 25 DANAHER: COMPANY SNAPSHOT

FIGURE 26 BIOMÉRIEUX SA: COMPANY SNAPSHOT

FIGURE 27 GRIFOLS S.A: COMPANY SNAPSHOT

FIGURE 28 ORTHO CLINICAL DIAGNOSTICS: COMPANY SNAPSHOT

FIGURE 29 FUJIREBIO INC: COMPANY SNAPSHOT

FAQ

The hepatitis testing/diagnosis market size had crossed USD 2.66 Billion in 2020 and will observe a CAGR of 5% up to 2029 driven by the high burden of hepatitis, increased blood transfusions and donations, the benefits of POC devices and kits, and hepatitis awareness programs

North America held more than 35% of the hepatitis testing/diagnosis market revenue share in 2020 and will witness expansion with the rising prevalence of hepatitis, as well as increased research and clinical trials for hepatitis testing

The upcoming trends in the hepatitis testing/diagnosis market are rising consumer awareness.

The global hepatitis testing/diagnosis market registered a CAGR of 5 % from 2022 to 2029. The hepatitis B segment was the highest revenue contributor to the market.

It is used to test/ diagnose the hepatitis virus.

North America is the largest regional market for hepatitis testing/diagnosis market

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.