REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 0.40 billion by 2029 | 4.4% | Asia Pacific |

| By Technology | By Industry Vertical | By Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Flat Panel Display Market Overview

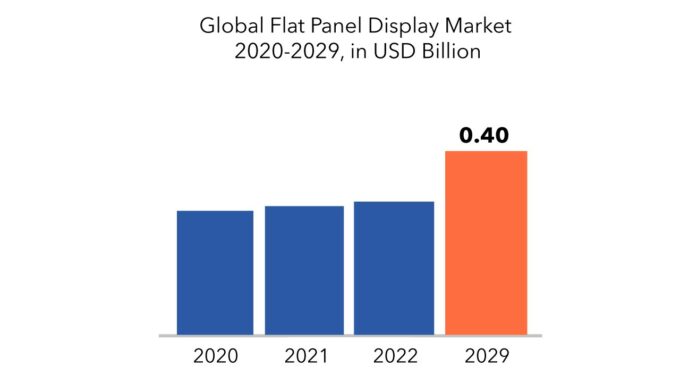

The global flat panel display market is expected to grow at 4.4% CAGR from 2020 to 2029. It is expected to reach above USD 0.40 billion by 2029 from USD 0.27 billion in 2020.

A flat panel display is a television, monitor, or other display device that replaces the classic cathode ray tube (CRT) with a thin panel design. These screens are substantially lighter and thinner than typical televisions and monitors, and they can be far more portable. In addition, they offer a greater resolution than previous versions. A flat panel display (FPD) is an electronic viewing device that lets users to view material such as text or moving images in a variety of consumer gadgets, mobile devices, and entertainment. FPDs are smaller and lighter than cathode ray tubes (CRTs), which are typically less than 10 cm in diameter. FPDs are divided into two categories: emissive displays and non-emissive displays. LEDs are examples of emissive displays, whereas LCDs are examples of non-emissive displays. TV monitors, laptop computers, portable gadgets, digital cameras, packet video games, and other devices all use these displays. FPDs have a high pixel resolution, a higher contrast setting, and use less power. The market is being driven by rising demand for automotive display technology, high adoption of OLED displays, increasing use of LED displays for digital signage applications, and rising demand for display-based equipment in the healthcare sector.

Consumer demand for large LCD televisions is expanding, smartphone screen sizes are growing, and vehicle display development is progressing, among other factors fueling demand for flat panel displays. Ultra-thin LCD televisions, high-resolution and slim smartphone designs, and improved user interface and touch screen for car displays are all being developed by companies. Over the forecast period, rising usage of FPD in mobile devices is expected to move the global flat panel display market forward. A significant driving element in the market is the rising demand for smartphones with augmented features. Smartphone makers are focusing on FPD technology to meet the growing demand for high-resolution images and clarity. With improved contrast settings and low power usage, FPD provides better picture quality.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion), (Thousand Unit) |

| Segmentation | By Technology, By Industry Vertical, By Region |

| By Technology

|

|

| By Industry Vertical

|

|

| By Region

|

|

Growth in vehicle display technology in the automotive industry, increased demand for OLED display devices in smartphones and tablets, and increased use of interactive touch-based devices in the education sector are all important factors driving the flat panel display market. The flat panel display market is hampered by the high cost of new display technologies such as transparent displays and quantum dot displays, as well as the sluggish growth of desktop PCs, laptops, and tablets. Furthermore, the global flat panel display market is likely to benefit from new applications in flexible flat panel display devices, which are expected to generate lucrative growth prospects.

Regulatory organizations have approved an increasing number of flat panels displays for usage in the healthcare business. Diagnostic screens with a high pixel density are being developed for use in healthcare. Manufacturers are also working on new surgical vision platforms with flat panel displays and ultra-high brightness to reduce glare and reflection in bright environments.

The covid-19 pandemic wreaked havoc on the global population, bringing chaos and disruption in all aspects of life. From supplier networks to customer delivery, the covid-19 epidemic impacted the flat panel display market and operations. New surgical vision platforms with flat panel displays and ultra-high brightness are being developed by flat panel display providers to eliminate glare and reflection in bright conditions. Flat panel display sales are likely to increase in the next years due to a greater focus on technological advances and increased demand for car display technologies.

Flat Panel Display Market Segment Analysis

The global flat panel display market is segmented based on technology, industry vertical. By technology, the market is bifurcated into OLED, quantum DOT, LED, LCD, and others. Organic LEDs are a new type of display technology on the market. Separate backlighting is no longer required thanks to this technology. The display panels based on this technology are thinner than those based on other display technologies. This technique is commonly employed in smartphones with OLED screens, which are becoming increasingly popular. Apple, Oppo, Vivo, LG, and Xiaomi are among the companies that have begun to use OLED panels in recent years. Furthermore, in low-light environments, an OLED may attain a better contrast ratio than other technologies.

By industry vertical, the market is divided into healthcare, retail, BFSI, military & defense, automotive, and others. Nowadays, display gadgets are also used in the car business. In response to this potential, LG Display has announced that it would begin production of a head-up display system for the car industry. LG’s vehicle display gadget is a flexible, transparent display that can be wheeled about. The heads-up display may be used in a variety of ways and has a variety of functions to improve your driving experience. Co-driver display, head-up display, center information display, back seat entertainment, and other automobile components are included in the vehicle display. The most popular display technology among the main vehicle manufacturers is OLED.

Flat Panel Display Market Players

The flat panel display market key players include AU Samsung Electronics Co., Ltd., Toshiba Mobile Display Co., Ltd., LG Display Co., Ltd., Clover Display Limited, Densitron Technologies PLC, Emerging Display Technologies Corp., Chunghwa Picture Tubes Ltd., Optronics Corp., and Chimei Innolux Corporation.

For corporate expansion, these key leaders are implementing strategic formulations such as new product development and commercialization, commercial expansion, and distribution agreements. Moreover, these participants are substantially spending in product development, which is fueling revenue generation.

- In March 2020, NEC Corporation and Sharp Corporation entered into a joint venture partnership by combining NEC Display Solutions, Ltd. (NDS), a subsidiary of NEC, with Sharp.

- In January 2021, Samsung Display, the display manufacturing arm of Samsung Electronics, announced that it will begin mass production of the world’s first 90Hz OLED panel. The South Korean company claimed that this display, with a 90Hz refresh rate, will have a high-speed driving performance on par with that of 120Hz LCDs.

Who Should Buy? Or Key Stakeholders

- Automotive Manufacturers

- Automotive Companies

- Industrial Supplier

- Monitor & Laptop Manufacturer

- Medical Device Manufacturer

- Research Organizations

- Investors

- Regulatory Authorities

- Others

Flat Panel Display Market Regional Analysis

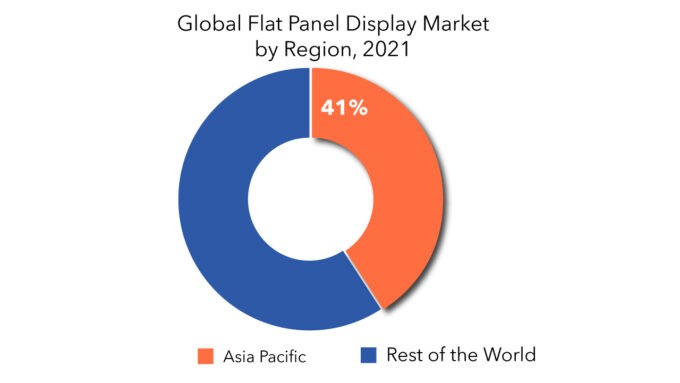

The flat panel display market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

Because of the rapid adoption of technology in the education and commercial sectors, the Asia Pacific and China areas are likely to grow at a significant rate. All display technologies would eventually transmit a certain level of lock-in, which would differ according on the degree of tractability built into the explanation, providing higher value in terms of display resolution, integration, and administrative simplicity. The key drivers for the expansion of flat panel display demand include rapid growth in consumer electronics use, increasing technological improvements in high-quality displays, lower display prices, and extensive applicability in the video games and entertainment business.

Key Market Segments: Flat Panel Display Market

Flat Panel Display Market by Technology, 2020-2029, (USD Billion), (Thousand Units)

- Oled

- Quantam Dot

- LED

- LCD

- Others

Flat Panel Display Market by Industry Vertical, 2020-2029, (USD Billion), (Thousand Units)

- Healthcare

- Retail

- BFSI

- Military & Defense

- Automotive

- Others

Flat Panel Display Market by Region, 2020-2029, (USD Billion), (Thousand Units)

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Important Countries In All Regions Are Covered.

Key Question Answered

- What is the current size of the flat panel display market?

- What are the key factors influencing the growth of flat panel display?

- What are the major applications for flat panel display?

- Who are the major key players in the flat panel display market?

- Which region will provide more business opportunities for flat panel display in future?

- Which segment holds the maximum share of the flat panel display market?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Flat Panel Display Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Flat Panel Display Market

- Porter’s five forces model

- Threat from new entrants

- Threat from substitutes

- Bargaining power of suppliers

- Bargaining power of customers

- Degree of competition

- Industry value chain Analysis

- Global Flat Panel Display Market Outlook

- Global Flat Panel Display Market by Technology, 2020-2029, (USD MILLION), (THOUSAND UNITS)

- OLED

- Quantum Dot

- LED

- LCD

- OTHERS

- Global Flat Panel Display Market by Industry Vertical, 2020-2029, (USD MILLION), (THOUSAND UNITS)

- Healthcare

- Retail

- BFSI

- Military & Defense

- Automotive

- Others

- Global Flat Panel Display Market by Region, 2020-2029, (USD MILLION), (THOUSAND UNITS)

- North America

- US

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Colombia

- Rest Of South America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest Of Europe

- Asia Pacific

- India

- China

- Japan

- South Korea

- Australia

- South-East Asia

- Rest Of Asia Pacific

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest Of Middle East and Africa

- North America

- Company Profiles*(Business Overview, Company Snapshot, Products Offered, Recent Developments)

8.1. AU Samsung Electronics Co. Ltd

8.2. Toshiba Mobile Display Co. Ltd.

8.3. LG Display Co. Ltd.

8.4. Clover Display Limited

8.5. Densitron Technologies PLC

8.6. Emerging Display Technologies Corp.

8.7. Chunghwa Picture Tubes Ltd.

8.8. Optronics Corp.

8.9. Chimei Innolux Corporation. *The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 2 GLOBAL FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (THOUSAND UNIT) 2020-2029

TABLE 3 GLOBAL FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (USD MILLIONS) 2020-2029

TABLE 4 GLOBAL FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (THOUSAND UNIT) 2020-2029

TABLE 5 GLOBAL FLAT PANEL DISPLAY MARKET BY REGION (USD MILLIONS) 2020-2029

TABLE 6 GLOBAL FLAT PANEL DISPLAY MARKET BY REGION (THOUSAND UNIT) 2020-2029

TABLE 7 US FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 8 US FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (THOUSAND UNIT) 2020-2029

TABLE 9 US FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (USD MILLIONS) 2020-2029

TABLE 10 US FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (THOUSAND UNIT) 2020-2029

TABLE 11 CANADA FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 12 CANADA FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (THOUSAND UNIT) 2020-2029

TABLE 13 CANADA FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (USD MILLIONS) 2020-2029

TABLE 14 CANADA FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (THOUSAND UNIT) 2020-2029

TABLE 15 MEXICO FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 16 MEXICO FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (THOUSAND UNIT) 2020-2029

TABLE 17 MEXICO FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (USD MILLIONS) 2020-2029

TABLE 18 MEXICO FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (THOUSAND UNIT) 2020-2029

TABLE 19 BRAZIL FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 20 BRAZIL FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (THOUSAND UNIT) 2020-2029

TABLE 21 BRAZIL FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (USD MILLIONS) 2020-2029

TABLE 22 BRAZIL FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (THOUSAND UNIT) 2020-2029

TABLE 23 ARGENTINA FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 24 ARGENTINA FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (THOUSAND UNIT) 2020-2029

TABLE 25 ARGENTINA FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (USD MILLIONS) 2020-2029

TABLE 26 ARGENTINA FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (THOUSAND UNIT) 2020-2029

TABLE 27 COLOMBIA FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 28 COLOMBIA FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (THOUSAND UNIT) 2020-2029

TABLE 29 COLOMBIA FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (USD MILLIONS) 2020-2029

TABLE 30 COLOMBIA FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (THOUSAND UNIT) 2020-2029

TABLE 31 REST OF SOUTH AMERICA FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 32 REST OF SOUTH AMERICA FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (THOUSAND UNIT) 2020-2029

TABLE 33 REST OF SOUTH AMERICA FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (USD MILLIONS) 2020-2029

TABLE 34 REST OF SOUTH AMERICA FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (THOUSAND UNIT) 2020-2029

TABLE 35 INDIA FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 36 INDIA FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (THOUSAND UNIT) 2020-2029

TABLE 37 INDIA FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (USD MILLIONS) 2020-2029

TABLE 38 INDIA FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (THOUSAND UNIT) 2020-2029

TABLE 39 CHINA FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 40 CHINA FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (THOUSAND UNIT) 2020-2029

TABLE 41 CHINA FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (USD MILLIONS) 2020-2029

TABLE 42 CHINA FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (THOUSAND UNIT) 2020-2029

TABLE 43 JAPAN FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 44 JAPAN FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (THOUSAND UNIT) 2020-2029

TABLE 45 JAPAN FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (USD MILLIONS) 2020-2029

TABLE 46 JAPAN FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (THOUSAND UNIT) 2020-2029

TABLE 47 SOUTH KOREA FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 48 SOUTH KOREA FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (THOUSAND UNIT) 2020-2029

TABLE 49 SOUTH KOREA FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (USD MILLIONS) 2020-2029

TABLE 50 SOUTH KOREA FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (THOUSAND UNIT) 2020-2029

TABLE 51 AUSTRALIA FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 52 AUSTRALIA FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (THOUSAND UNIT) 2020-2029

TABLE 53 AUSTRALIA FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (USD MILLIONS) 2020-2029

TABLE 54 AUSTRALIA FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (THOUSAND UNIT) 2020-2029

TABLE 55 SOUTH-EAST ASIA FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 56 SOUTH-EAST ASIA FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (THOUSAND UNIT) 2020-2029

TABLE 57 SOUTH-EAST ASIA FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (USD MILLIONS) 2020-2029

TABLE 58 SOUTH-EAST ASIA FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (THOUSAND UNIT) 2020-2029

TABLE 59 REST OF ASIA PACIFIC FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 60 REST OF ASIA PACIFIC FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (THOUSAND UNIT) 2020-2029

TABLE 61 REST OF ASIA PACIFIC FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (USD MILLIONS) 2020-2029

TABLE 62 REST OF ASIA PACIFIC FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (THOUSAND UNIT) 2020-2029

TABLE 63 GERMANY FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 64 GERMANY FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (THOUSAND UNIT) 2020-2029

TABLE 65 GERMANY FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (USD MILLIONS) 2020-2029

TABLE 66 GERMANY FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (THOUSAND UNIT) 2020-2029

TABLE 67 UK FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 68 UK FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (THOUSAND UNIT) 2020-2029

TABLE 69 UK FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (USD MILLIONS) 2020-2029

TABLE 70 UK FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (THOUSAND UNIT) 2020-2029

TABLE 71 FRANCE FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 72 FRANCE FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (THOUSAND UNIT) 2020-2029

TABLE 73 FRANCE FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (USD MILLIONS) 2020-2029

TABLE 74 FRANCE FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (THOUSAND UNIT) 2020-2029

TABLE 75 ITALY FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 76 ITALY FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (THOUSAND UNIT) 2020-2029

TABLE 77 ITALY FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (USD MILLIONS) 2020-2029

TABLE 78 ITALY FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (THOUSAND UNIT) 2020-2029

TABLE 79 SPAIN FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 80 SPAIN FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (THOUSAND UNIT) 2020-2029

TABLE 81 SPAIN FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (USD MILLIONS) 2020-2029

TABLE 82 SPAIN FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (THOUSAND UNIT) 2020-2029

TABLE 83 RUSSIA FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 84 RUSSIA FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (THOUSAND UNIT) 2020-2029

TABLE 85 RUSSIA FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (USD MILLIONS) 2020-2029

TABLE 86 RUSSIA FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (THOUSAND UNIT) 2020-2029

TABLE 87 REST OF EUROPE FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 88 REST OF EUROPE FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (THOUSAND UNIT) 2020-2029

TABLE 89 REST OF EUROPE FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (USD MILLIONS) 2020-2029

TABLE 90 REST OF EUROPE FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (THOUSAND UNIT) 2020-2029

TABLE 91 UAE FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 92 UAE FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (THOUSAND UNIT) 2020-2029

TABLE 93 UAE FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (USD MILLIONS) 2020-2029

TABLE 94 UAE FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (THOUSAND UNIT) 2020-2029

TABLE 95 SAUDI ARABIA FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 96 SAUDI ARABIA FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (THOUSAND UNIT) 2020-2029

TABLE 97 SAUDI ARABIA FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (USD MILLIONS) 2020-2029

TABLE 98 SAUDI ARABIA FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (THOUSAND UNIT) 2020-2029

TABLE 99 SOUTH AFRICA FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 100 SOUTH AFRICA FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (THOUSAND UNIT) 2020-2029

TABLE 101 SOUTH AFRICA FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (USD MILLIONS) 2020-2029

TABLE 102 SOUTH AFRICA FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (THOUSAND UNIT) 2020-2029

TABLE 103 REST OF MIDDLE EAST AND AFRICA FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 104 REST OF MIDDLE EAST AND AFRICA FLAT PANEL DISPLAY MARKET BY TECHNOLOGY (THOUSAND UNIT) 2020-2029

TABLE 105 REST OF MIDDLE EAST AND AFRICA FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (USD MILLIONS) 2020-2029

TABLE 106 REST OF MIDDLE EAST AND AFRICA FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL (THOUSAND UNIT) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL FLAT PANEL DISPLAY MARKET BY TECHNOLOGY, USD MILLION, 2020-2029

FIGURE 9 GLOBAL FLAT PANEL DISPLAY MARKET BY INDUSTRY VERTICAL, USD MILLION, 2020-2029

FIGURE 10 GLOBAL FLAT PANEL DISPLAY MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 NORTH AMERICA FLAT PANEL DISPLAY MARKET SNAPSHOT

FIGURE 13 EUROPE FLAT PANEL DISPLAY MARKET SNAPSHOT

FIGURE 14 SOUTH AMERICA FLAT PANEL DISPLAY MARKET SNAPSHOT

FIGURE 15 ASIA PACIFIC FLAT PANEL DISPLAY MARKET SNAPSHOT

FIGURE 16 MIDDLE EAST ASIA AND AFRICA FLAT PANEL DISPLAY MARKET SNAPSHOT

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 AU SAMSUNG ELECTRONICS CO. LTD: COMPANY SNAPSHOT

FIGURE 19 TOSHIBA MOBILE DISPLAY CO. LTD.: COMPANY SNAPSHOT

FIGURE 20 LG DISPLAY CO. LTD.: COMPANY SNAPSHOT

FIGURE 21 CLOVER DISPLAY LIMITED: COMPANY SNAPSHOT

FIGURE 22 DENSITRON TECHNOLOGIES PLC: COMPANY SNAPSHOT

FIGURE 23 EMERGING DISPLAY TECHNOLOGIES CORP.: COMPANY SNAPSHOT

FIGURE 24 CHUNGHWA PICTURE TUBES LTD.: COMPANY SNAPSHOT

FIGURE 25 OPTRONICS CORP.: COMPANY SNAPSHOT

FIGURE 26 CHIMEI INNOLUX CORPORATION.: COMPANY SNAPSHOT

FAQ

The flat panel display market size had crossed USD 0.27 billion in 2020 and will observe a CAGR of more than 4.4 % up to 2029 driven by the rising demand for automotive display technology, high adoption of OLED displays, increasing use of LED displays for digital signage applications, and rising demand for display-based equipment in the healthcare sector.

Asia Pacific held more than 41% of the flat panel display market revenue share in 2020 and will witness expansion of flat panel display demand include rapid growth in consumer electronics use, increasing technological improvements in high-quality displays, lower display prices, and extensive applicability in the video games and entertainment business.

Increasing government backing for the FPD industry is likely to propel market expansion throughout the forecast period. One of the major rising trends in the market is the growing adoption of plastic OLED displays. These are the market’s driving forces.

Over the forecast period, the worldwide flat panel display market is expected to rise due to the increasing acceptance of FPD in mobile devices. A significant driving element in the market is the rising demand for smartphones with augmented features. Smartphone makers are focusing on FPD technology to meet the growing demand for high-resolution images and clarity. With improved contrast settings and low power usage, FPD provides better picture quality.

The Asia Pacific and China regions are expected to develop at a substantial rate due to the increased adoption of technology in the education and commercial sectors. All display technologies would eventually communicate a level of lock-in, which would vary according on the degree of tractability incorporated into the explanation, resulting in higher value in terms of display resolution, integration, and administrative simplicity.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.