REPORT OUTLOOK

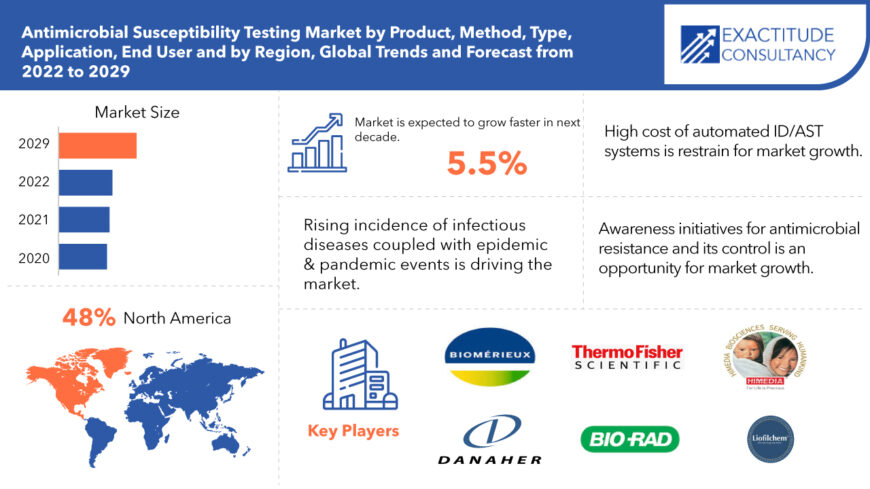

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 5.02 billion | 5.5% | North America |

| By Product | By Type | By Application |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Antimicrobial Susceptibility Testing Market Overview

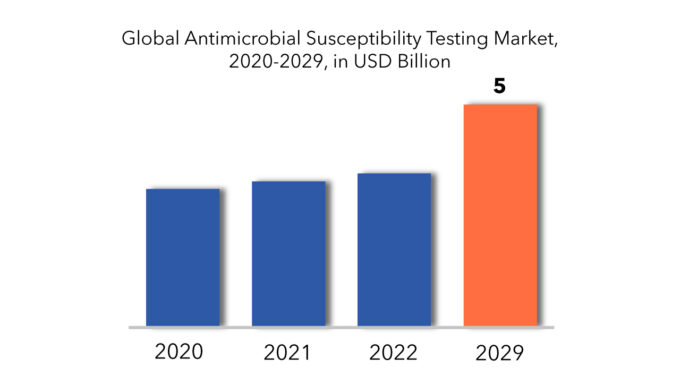

The global antimicrobial susceptibility test market is projected to reach USD 5.02 billion by 2029 from USD 3.10 billion in 2022, at a CAGR of 5.5% from 2023 to 2029.

The antimicrobial susceptibility test is a laboratory test used by qualified laboratory scientists and medical technologists to determine whether a patient’s antimicrobial regimen is effective. The basic goal of the Antimicrobial Susceptibility Test is to determine whether or not antibiotic medicine will work. To guarantee that the results can be repeated, these tests are carried out under controlled conditions. The results of this test help doctors choose the optimal antibiotic for the patient. Regular antibiotic susceptibility testing is performed to ensure that antibiotics are utilised effectively. It determines the lowest concentrations of new or existing antimicrobial medicines that prohibit consistent and detectable growth of the bacterium under research in certain test circumstances. It entails finding drug resistance in some of the most common diseases as well as determining the susceptibility of preferred treatments for certain infections.

| ATTRIBUTE | DETAILS |

| Study period | 2022-2029 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2029 |

| Historical period | 2018-2021 |

| Unit | Value (USD Billion) |

| Segmentation | By Product, By Method, By Type, By Application, By End User, By Region. |

| By Product |

|

| By Method |

|

| By Type |

|

| By Application |

|

| By Region |

|

The development of a new broad spectrum of antibacterial medications is required as the prevalence of infectious diseases rises. Governments all over the world are investing extensively in research and development for antimicrobial susceptibility test kits that generate faster results, and private firms are doing the same, which is projected to drive the antimicrobial susceptibility test market forward. Rapid test methods are emerging as a result of technological advancements in medical research, leading to the overall growth of the antimicrobial susceptibility test market over the forecast period.

This lowers the cost of antibacterial medications for pharmaceutical corporations. This lack of return on investment is hampering the worldwide market’s expansion. Antimicrobial research and development, on the other hand, takes longer and necessitates more resources and specialised methodologies. In addition, an unfavorable reimbursement scenario and a low return on investment are impeding the growth of the Antimicrobial Susceptibility Test Market. On the other hand, the high cost of these systems is a key barrier to their widespread adoption by end-users, particularly small-budget organisations.

Antimicrobial susceptibility test kits are in high demand due to infectious organisms such as haemophilus influenzae, neisseria meningitides, streptococcus pneumoniae, shigella, vibrio cholerae, neisseria gonorrhoeae, and salmonella serotype typhi. The automated antimicrobial susceptibility test devices come with a variety of modern features and functions, and they’re reasonably priced. When using automated Antimicrobial Susceptibility Test techniques, the incubation and detection times are cut in half. Antimicrobial medications, unlike other therapies for chronic illnesses that are used for the remainder of the patient’s life, are only used for a brief time to cure the patients.

Antimicrobial Susceptibility Testing Market Segment Analysis

The antimicrobial susceptibility test market is divided into automated laboratory instruments, susceptibility testing disks, manual antimicrobial susceptibility test products, MIC strips, susceptibility plates, culture and growth media, consumables based on products. Manual susceptibility testing products have dominated the antimicrobial susceptibility test market. The market is expected to grow as antimicrobial resistance develops, new products are released, and susceptibility testing equipment gain traction in emerging markets.

The market is divided into dilution, disk diffusion, ETEST, automated antimicrobial susceptibility test, genotypic method based on method. Among these approaches, the automated antimicrobial susceptibility test equipment sector had the biggest market share. The majority of the segment’s revenue comes from its speed, precision, and capacity to deliver qualitative and quantitative susceptibility data. In addition, the segment’s expansion is being fueled by technological advancements and increased R&D efforts by key rivals to provide innovative solutions to the market.

The market is divided into antibacterial testing, antifungal testing, and ant parasitic testing based on type. Among these, antibacterial susceptibility testing has the largest proportion of the market. The bulk of cases in this group are due to the abuse of broad-spectrum antibiotics and the emergence of multidrug resistance. Drug resistance develops in microorganisms as a result of the overuse of broad-spectrum antibiotics, prompting the need for better drug screening.

The market is divided into clinical diagnostics, drug discovery and development, epidemiology based on application. The clinical diagnostics segment commanded the most market share. The rising prevalence of infectious diseases, the rising incidence of HAIs, the large target patient population base (especially in emerging countries), the growing procedural volume of clinical diagnostic tests, the growing emphasis on effective and early disease diagnosis across major markets, and the introduction of various technologically advanced susceptibility testing products all contribute to this segment’s large share.

The market is divided into diagnostic centers and hospitals, pharmaceutical and biotechnology companies, contract research organizations (CROS), research and academic institutes based on end user. Antifungal test procedure done in diagnostic laboratories and hospital, and also increase in the number of hospitals in significant market. Advances in healthcare infrastructure are expected to have an impact on the antibiotic susceptibility testing sector. The installation and use of more advanced, efficient, and sophisticated antibiotic susceptibility testing equipment and procedures at healthcare facilities all over the world has been made possible by government investment on healthcare.

Antimicrobial Susceptibility Testing Market Players

The major players operating in the global antimicrobial susceptibility test industry include BioMérieux, BD, Danaher, Thermo Fisher, Bio-Rad, Hi-Media, MERLIN, Liofilchem, Accelerate, and Alifax. The presence of established industry players and is characterized by mergers and acquisitions, joint ventures, capacity expansions, substantial distribution, and branding decisions to improve market share and regional presence. Also, they are involved in continuous R&D activities to develop new products as well as are focused on expanding the product portfolio. This is expected to intensify competition and pose a potential threat to the new players entering the market.

- In 2020, Liofilchem received the US FDA approval for its Lefamulin 0.016-256 μg/mL MTS (MIC Test Strip). It is a quantitative assay for determining the Minimum Inhibitory Concentration (MIC) of lefamulin.

Who Should Buy? Or Key Stakeholders

- Research and development

- Manufacturing

- Diagnostic Centers and Hospitals

- Pharmaceutical and Biotechnology Companies

- Contract Research Organizations (CROs)

- Research and Academic Institutes

- Healthcare sector

- Specialty Clinic

- Others

Antimicrobial Susceptibility Testing Market Regional Analysis

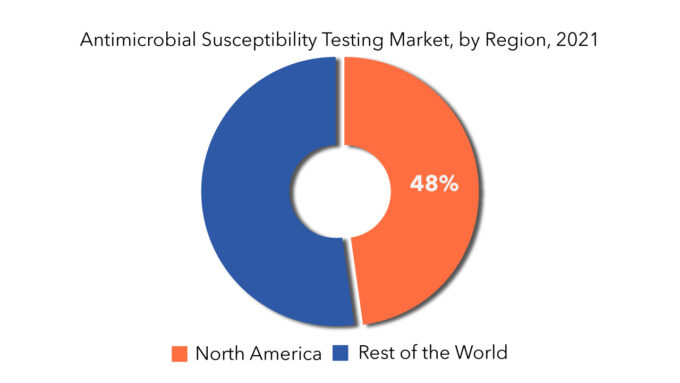

Geographically, the antimicrobial susceptibility test market is segmented into North America, South America, Europe, APAC and MEA.

- North America: includes the US, Canada, Mexico

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

North America is expected to hold the largest share of the global antimicrobial susceptibility test market. The key drivers driving market growth in North America include increased R&D to develop novel automated AST systems, rising prevalence of infectious diseases, safety concerns, and technological developments in antimicrobial susceptibility products. Furthermore, most of the world’s leading firms, including as Becton, Dickinson and Company, Danaher Corporation, Thermo Fisher Scientific, and Bruker Corporation, are located in the region or have a significant presence there. Others have concentrated on growth in order to broaden their reach and skills. Another important factor contributing to the market’s rapid expansion is this.

Key Market Segments: Antimicrobial Susceptibility Testing Market

Antimicrobial Susceptibility Testing Market by Product, 2022-2029, (USD Million)

- Automated Laboratory Instruments

- Susceptibility Testing Disks

- Manual Antimicrobial Susceptibility Test Products

- Mic Strips

- Susceptibility Plates

- Culture and Growth Media

- Consumables

Antimicrobial Susceptibility Testing Market by Method, 2022-2029, (USD Million)

- Dilution

- Disk Diffusion

- ETEST

- Automated Antimicrobial Susceptibility Test

- Genotypic Method

Antimicrobial Susceptibility Testing Market by Type, 2022-2029, (USD Million)

- Antibacterial Testing

- Antifungal Testing

- Ant Parasitic Testing

Antimicrobial Susceptibility Testing Market by Application, 2022-2029, (USD Million)

- Clinical Diagnostics

- Drug Discovery and Development

- Epidemiology

Antimicrobial Susceptibility Testing Market by End User, 2022-2029, (USD Million)

- Diagnostic Centers and Hospitals

- Pharmaceutical and Biotechnology Companies

- Contract Research Organizations (Cros)

- Research and Academic Institutes

Antimicrobial Susceptibility Testing Market by Regions, 2020-2029, (USD Million)

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Important Countries in All Regions Are Covered.

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Antimicrobial Susceptibility Testing Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Global Antimicrobial Susceptibility Testing Market

- Global Antimicrobial Susceptibility Testing Market Outlook

- Global Antimicrobial Susceptibility Testing Market by Product, (USD Million)

- Automated Laboratory Instruments

- Susceptibility Testing Disks

- Manual Antimicrobial Susceptibility Test Products

- MIC strips

- Susceptibility Plates

- Culture and Growth Media

- Consumables

- Global Antimicrobial Susceptibility Testing Market by Method, (USD Million)

- Dilution

- Disk Diffusion

- ETEST

- Automated Antimicrobial Susceptibility Test

- Genotypic Method

- Global Antimicrobial Susceptibility Testing Market by Type, (USD Million)

- Antibacterial Testing

- Antifungal Testing

- Ant Parasitic Testing

- Global Antimicrobial Susceptibility Testing Market by Application, (USD Million)

- Clinical Diagnostics

- Drug Discovery and Development

- Epidemiology

- Global Antimicrobial Susceptibility Testing Market by End Users, (USD Million)

- Diagnostic Centers and Hospitals

- Pharmaceutical and Biotechnology Companies

- Contract Research Organizations (CROs)

- Research and Academic Institutes

- Global Antimicrobial Susceptibility Testing Market by Region, (USD Million)

- Introduction

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- South-East Asia

- Rest of Asia-Pacific

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Colombia

- Rest of South America

- Middle-East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle-East and Africa

- Company Profiles* (Business Overview, Company Snapshot, Products Offered, Recent Developments)

-

-

- BioMérieux

- Danaher

- Thermo Fisher

- Bio-Rad

- Hi-Media

- MERLIN

- Liofilchem

- Accelerate

- Alifax

- Others *The Company List Is Indicative

-

LIST OF TABLES

TABLE 1 GLOBAL ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY TYPE (USD MILLIONS)

TABLE 2 GLOBAL ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 3 GLOBAL ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 4 GLOBAL ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 5 GLOBAL ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 6 GLOBAL ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY REGION (USD MILLIONS) 2020-2029

TABLE 7 US ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 8 US ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 9 US ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 10 US ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 11 US ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 12 CANADA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 13 CANADA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 14 CANADA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 15 CANADA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 16 CANADA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 17 MEXICO ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 18 MEXICO ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 19 MEXICO ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 20 MEXICO ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 21 MEXICO ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 22 BRAZIL ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 23 BRAZIL ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 24 BRAZIL ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 25 BRAZIL ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 26 BRAZIL ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 27 ARGENTINA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 28 ARGENTINA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 29 ARGENTINA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 30 ARGENTINA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 31 ARGENTINA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 32 COLOMBIA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 33 COLOMBIA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 34 COLOMBIA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 35 COLOMBIA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 36 COLOMBIA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 37 REST OF SOUTH AMERICA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 38 REST OF SOUTH AMERICA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 39 REST OF SOUTH AMERICA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 40 REST OF SOUTH AMERICA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 41 REST OF SOUTH AMERICA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 42 INDIA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 43 INDIA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 44 INDIA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 45 INDIA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 46 INDIA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 47 CHINA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 48 CHINA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 49 CHINA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 50 CHINA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 51 CHINA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 52 JAPAN ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 53 JAPAN ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 54 JAPAN ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 55 JAPAN ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 56 JAPAN ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 57 SOUTH KOREA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 58 SOUTH KOREA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 59 SOUTH KOREA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 60 SOUTH KOREA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 61 SOUTH KOREA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 62 AUSTRALIA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 63 AUSTRALIA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 64 AUSTRALIA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 65 AUSTRALIA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 66 AUSTRALIA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 67 SOUTH-EAST ASIA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 68 SOUTH-EAST ASIA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 69 SOUTH-EAST ASIA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 70 SOUTH-EAST ASIA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 71 SOUTH-EAST ASIA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 72 REST OF ASIA PACIFIC ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 73 REST OF ASIA PACIFIC ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 74 REST OF ASIA PACIFIC ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 75 REST OF ASIA PACIFIC ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 76 REST OF ASIA PACIFIC ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 77 GERMANY ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 78 GERMANY ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 79 GERMANY ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 80 GERMANY ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 81 GERMANY ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 82 UK ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 83 UK ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 84 UK ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 85 UK ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 86 UK ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 87 FRANCE ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 88 FRANCE ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 89 FRANCE ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 90 FRANCE ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 91 FRANCE ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 92 ITALY ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 93 ITALY ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 94 ITALY ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 95 ITALY ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 96 ITALY ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 97 SPAIN ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 98 SPAIN ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 99 SPAIN ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 100 SPAIN ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 101 SPAIN ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 102 RUSSIA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 103 RUSSIA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 104 RUSSIA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 105 RUSSIA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 106 RUSSIA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 107 REST OF EUROPE ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 108 REST OF EUROPE ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 109 REST OF EUROPE ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 110 REST OF EUROPE ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 111 REST OF EUROPE ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 112 UAE ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 113 UAE ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 114 UAE ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 115 UAE ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 116 UAE ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 117 SAUDI ARABIA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 118 SAUDI ARABIA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 119 SAUDI ARABIA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 120 SAUDI ARABIA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 121 SAUDI ARABIA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 122 SOUTH AFRICA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 123 SOUTH AFRICA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 124 SOUTH AFRICA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 125 SOUTH AFRICA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 126 SOUTH AFRICA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 127 REST OF MIDDLE EAST AND AFRICA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 128 REST OF MIDDLE EAST AND AFRICA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 129 REST OF MIDDLE EAST AND AFRICA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 130 REST OF MIDDLE EAST AND AFRICA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 131 REST OF MIDDLE EAST AND AFRICA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY METHOD (USD MILLIONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY PRODUCT, USD MILLION, 2020-2029

FIGURE 9 GLOBAL ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY METHOD, USD MILLION, 2020-2029

FIGURE 10 GLOBAL ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY TYPE, USD MILLION, 2020-2029

FIGURE 11 GLOBAL ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY APPLICATION, USD MILLION, 2020-2029

FIGURE 12 GLOBAL ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY END USER USD MILLION, 2020-2029

FIGURE 13 GLOBAL ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 14 PORTER’S FIVE FORCES MODEL

FIGURE 15 GLOBAL ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY PRODUCT, USD MILLION, 2020-2029

FIGURE 16 GLOBAL ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY METHOD, USD MILLION, 2020-2029

FIGURE 17 GLOBAL ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY TYPE, USD MILLION, 2020-2029

FIGURE 18 GLOBAL ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY APPLICATION, USD MILLION, 2020-2029

FIGURE 19 GLOBAL ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY END USER USD MILLION, 2020-2029

FIGURE 20 GLOBAL ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 21 ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET BY REGION 2020

FIGURE 22 MARKET SHARE ANALYSIS

FIGURE 23 BIOMÉRIEUX: COMPANY SNAPSHOT

FIGURE 24 DANAHER: COMPANY SNAPSHOT

FIGURE 25 THERMO FISHER: COMPANY SNAPSHOT

FIGURE 26 BIO-RAD: COMPANY SNAPSHOT

FIGURE 27 HI-MEDIA: COMPANY SNAPSHOT

FIGURE 28 MERLIN: COMPANY SNAPSHOT

FIGURE 29 LIOFILCHEM: COMPANY SNAPSHOT

FIGURE 30 ACCELERATE: COMPANY SNAPSHOT

FIGURE 31 ALIFAX: COMPANY SNAPSHOT

FAQ

The antimicrobial susceptibility testing market size had crossed USD 3.10 Billion in 2020 and will observe a CAGR of more than 5.5% up to 2029 driven by the rising incidence of infectious diseases coupled with epidemic & pandemic events.

The upcoming trend in antimicrobial susceptibility testing market is awareness initiatives for antimicrobial resistance and its control is an opportunity for market growth.

The global antimicrobial susceptibility testing market registered a CAGR of 5.5% from 2022 to 2029. The method segment was the highest revenue contributor to the market.

Clinical diagnostics segment is dominating the antimicrobial susceptibility testing market.

North America is the largest regional markets with 48% of share increased R&D to develop novel automated AST systems, rising prevalence of infectious diseases, safety concerns, and technological developments in antimicrobial susceptibility products.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.