REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

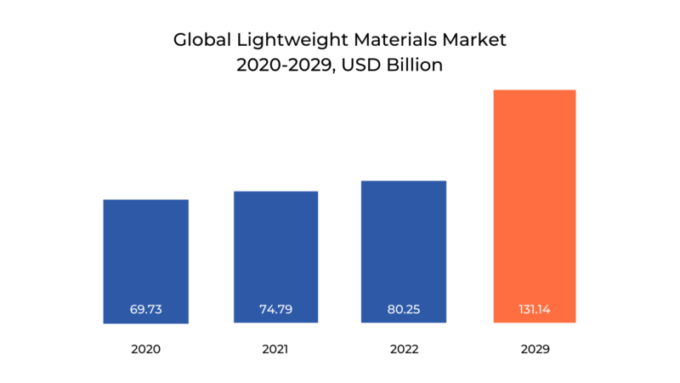

| USD 131.41 Billion by 2029 | 7.3 % | Europe |

| By material type | By vehicle type | By application |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Automotive Lightweight Materials Market Overview

The automotive lightweight materials market is expected to grow at 7.3 % CAGR from 2023 to 2029. It is expected to reach above USD 131.41 Billion by 2029 from USD 74.79 Billion in 2022.

The lightweight materials are metal alloys and composites that are used to reduce the weight of automotive, aircrafts, and windmills without affecting the strength and efficiency of the structure. The automotive lightweight materials have high strength-to-weight ratio, superior corrosion resistance properties, and substantial design flexibility.

Automotive lightweight materials are crucial for improving vehicles’ fuel efficiency. Additionally, the performance and general safety of cars are improved by these materials. Being lighter boosts a vehicle’s fuel efficiency since it takes less energy to accelerate a lighter item than a heavy one. When using automotive lightweight materials, a vehicle’s fuel efficiency may increase by 6% to 8% with a 10% weight reduction.

The weight of a vehicle can be greatly reduced by swapping out cast iron and conventional steel parts for lightweight alternatives including high-strength steel (HSS), magnesium and aluminum alloys, and polymer and carbon fiber composites. This reduces its need for fuel.

The demand for lightweight materials in the manufacturing of vehicles is increasing due to the high demand for weight reduction in performance vehicles.

| ATTRIBUTE | DETAILS |

| Study period | 2022-2029 |

| Base year | 2022 |

| Estimated year | 2022 |

| Forecasted year | 2023-2029 |

| Historical period | 2018-2022 |

| Unit | Value (USD Billion), (MILLION TONS) |

| Segmentation | By Material Type, By Application, By Application, By Region |

| By material type

|

|

| By vehicle type

|

|

| By application

|

|

| By Region

|

|

The market has grown because of rising consumer demand for automobiles with increased stability on roads as well as durability and performance of the vehicles for effective fuel consumption throughout major areas. Furthermore, manufacturers have been forced to use lightweight materials in the manufacturing process due to strict pollution regulations in North America and Europe, which has helped the market, expand. Electric cars (EVs) have been introduced to the market as a result of technological advancements and breakthroughs in the automotive industry, as well as the rising need for alternative fuel technologies. The demand for lightweight materials to improve the performance of EVs has risen with the inclusion of passenger cars, luxury cars, and trucks in this category.

Automotive manufacturers and component producers demand a variety of automotive lightweight materials for their production processes. Open contracts and agreements between car OEMs and producers of lightweight materials for automobiles are on display in this material procurement. Industry competitors must concentrate on securing the contracts and agreements in order to obtain a competitive edge and maintain long-term business possibilities in worldwide automotive lightweight market.

The cost of materials such as carbon fiber-reinforced composites, titanium and magnesium may hinder the usage of these materials. The price of carbon fiber reinforced polymers (CFRP) can go up to 3900% more than normal steel and price of titanium can go up to 900% more than normal steel. So, CFRP are mostly used in high –end cars such as BMW, Lamborghini, Bugatti, Ferrari and other racing car. The price of Glass fiber reinforced plastics (GFRP) is approximately 400% more than normal steel; the usage of this material is expected to increase as its price has decreased in last few years. The high cost of raw materials may act as restraining factor. As the cost of raw materials is high, OEMs in developing countries prefer to use conventional materials than lightweight materials.

The introduction of electric vehicles is resulted as technological revolution in the automotive industry. These vehicles have better performance than their combustion counterparts. The increase in environmental awareness, government incentives, and investments by OEMs; these factors are raising the demand for electric vehicles. Therefore the increasing demand for electric vehicles provides an opportunity for the growth of the lightweight material market.

The COVID-19 pandemic had a negative effect on the worldwide automotive lightweight materials market due to travel limitations. It has impacted the entire supply chain of automotive ecosystem. This has affected the automotive lightweight materials market as it is directly connected to the manufacturing of automotive vehicles.

Automotive Lightweight Materials Market Segment Analysis

The Automotive lightweight materials market is segmented based on Material Type, Vehicle Type, Application and Region, Global trends and forecast.

By Material Type, the market is bifurcated into Metal, Composites, Plastic, and Elastomer. By Vehicle Type market is divided into ICE, Electric, and hybrid; by Application market is divided into Interior, Body in white, Powertrain, and Others; and Region, Global trends and forecast.

Based on the material type, the metals segment holds the largest share of the automotive lightweight materials market. The market for metals is estimated to be largest by 2029. The high strength steel, aluminum, and magnesium are the three metals that are extensively used in the vehicle light weighting. These materials are lighter and stronger than steel hence these metals are expected to be use in the future.

Based on the vehicle type, ICE holds the largest share in the global market. In ICE vehicle type HCV is projected to be the fastest growing segment. OEMs such as BMW, Daimler, Dongfeng, Fiat and Isuzu are rigorously focusing on weight reduction in HCV. The use of lightweight materials helps to reduce the total weight and allows vehicle to carry additional load.

Based on the applications, the body in white segment accounted for the largest share of 25.1% in 2019 and it is expected to grow in the forecast years. Powertrain applications for these lightweight materials are inclusive of transmission components, engine parts, fuel tanks, exhaust systems, and others. Inclination towards light engine parts and durability of the vehicle components to keep intact the overall performance of the vehicle is expected to support the powertrain application segment growth. Interior and other segments are anticipated to grow in forecast years.

Automotive Lightweight Materials Market Players

The Automotive lightweight materials market key players include BASF SE, Toray Industries Inc., LyondellBasell, Novelis Inc., ArcelorMittal, Alcoa Corporation, Owens Corning, Stratasys Ltd., Tata Steel, POSCO and others.

Recent Developments

In October 2022, Lyondellbasell Industries Holdings B.V. developed a PP compound made up of PP compound material which has reduced the weight of the vehicle by 10kg. It will help in foaming of parts, reducing the density of the material, thin walling of parts, can become a substitute to metal and the paint for cars.

In August 2022, Toray Industries, Inc., has launched its 3D printer which can produce automotive parts, power tools and other equipment’s which are heat resistance, high strength, and has good precision in designing.

In May 2022, BASF SE developed the Ultradur® B4335G3 HR for the protection for sensitive electronic devices which are exposed to extreme challenging surroundings. For example, protecting sensors when exposed to different climatic condition, surface contact to water and salt.

Who Should Buy? Or Key stakeholders

- Automotive & Transportation Manufacturers

- Automotive Companies

- Industrial Supplier

- Motor Manufacturers

- Research Organizations

- Investors

- Regulatory Authorities

- Others

Automotive Lightweight Materials Market Regional Analysis

The Automotive lightweight materials market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Russia, and Rest of Europe

- South America: includes Brazil, Argentina, Colombia and Rest of South America

- Middle East & Africa: includes Turkey, Saudi Arabia, South Africa, and Rest of MEA

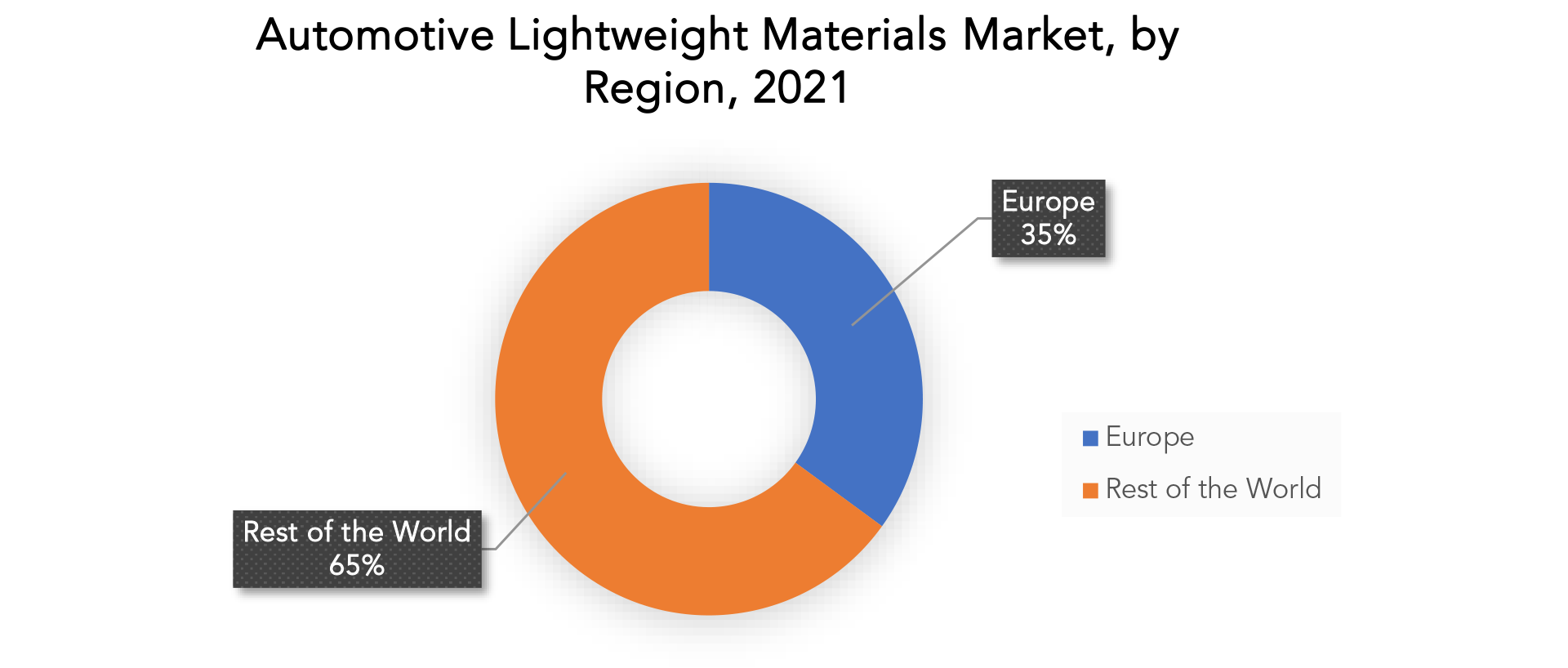

The European region is dominating the automotive lightweight materials market. In 2019 the Europe’s market share was 35% of the global market share. The presence of prominent carmakers and suppliers of the raw materials in the region has surged the market growth. Also high spending on R&D by the players is expected to increase the market growth.

The automotive market in the Asia-Pacific region is primarily driven by countries like India, China, Japan and South Korea. The abundant availability of raw materials and demand for the passenger and commercial cars is anticipated the demand for lightweight materials.

The stringent norms and regulations regarding pollution and carbon emission are expected to increase the demand for lightweight materials. Pollution control norms and high demand for fuel efficient vehicles are expected to raise the demand for light components in North American region. This region is expected to witness technological introductions in the electric vehicle market.

Key Market Segments: Automotive Lightweight Materials Market

Automotive Lightweight Materials Market By Material Type, 2022-2029, (Usd Billion), (Million Tons)

- Metal

- Composites

- Plastic

- Elastomer

Automotive Lightweight Materials Market By Vehicle Type, 2022-2029, (Usd Billion), (Million Tons)

- Ice

- Electric

- Hybrid

Automotive Lightweight Materials Market By Application, 2022-2029, (Usd Billion), (Million Tons)

- Interior

- Powertrain

- Body In White

- Others

Automotive Lightweight Materials Market By Region, 2022-2029, (Usd Billion), (Million Tons)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Key Question Answered

- What is the current size of the automotive lightweight materials market?

- What are the key factors influencing the growth of Automotive lightweight materials market?

- What is the major Application for Automotive lightweight materials market?

- Who are the major key players in the automotive lightweight materials market?

- Which region will provide more business opportunities Automotive lightweight materials market in future?

- Which segment holds the maximum share of the automotive lightweight materials market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL AUTOMOTIVE LIGHTWEIGHT MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON AUTOMOTIVE LIGHTWEIGHT MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL AUTOMOTIVE LIGHTWEIGHT MARKET OUTLOOK

- GLOBAL AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (USD BILLION, MILLION TONS), 2022-2029

- METAL

- COMPOSITES

- PLASTIC

- ELASTOMER

- GLOBAL AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (USD BILLION, MILLION TONS), 2022-2029

- ICE

- ELECTRIC

- HYBRID

- GLOBAL AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (USD BILLION, MILLION TONS), 2022-2029

- INTERIOR

- POWERTRAIN

- BODY IN WHITE

- OTHERS

- GLOBAL AUTOMOTIVE LIGHTWEIGHT MARKET BY REGION (USD BILLION, MILLION TONS), 2022-2029

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- TURKEY

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- BASF SE

- TORAY INDUSTRIES INC.

- LYONDELLBASELL

- NOVELIS INC.

- ARCELORMITTAL

- ALCOA CORPORATION

- OWENS CORNING

- STRATASYS LTD.

- TATA STEEL

- POSCO *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (USD BILLION), 2022-2029

TABLE 2 GLOBAL AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (MILLION TONS), 2022-2029

TABLE 3 GLOBAL AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (USD BILLION), 2022-2029

TABLE 4 GLOBAL AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (MILLION TONS), 2022-2029

TABLE 5 GLOBAL AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 6 GLOBAL AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (MILLION TONS), 2022-2029

TABLE 7 GLOBAL AUTOMOTIVE LIGHTWEIGHT MARKET BY REGION (USD BILLION), 2022-2029

TABLE 8 GLOBAL AUTOMOTIVE LIGHTWEIGHT MARKET BY REGION (MILLION TONS), 2022-2029

TABLE 9 NORTH AMERICA AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (USD BILLION), 2022-2029

TABLE 10 NORTH AMERICA AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (MILLION TONS), 2022-2029

TABLE 11 NORTH AMERICA AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (USD BILLION), 2022-2029

TABLE 12 NORTH AMERICA AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (MILLION TONS), 2022-2029

TABLE 13 NORTH AMERICA AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 14 NORTH AMERICA AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (MILLION TONS), 2022-2029

TABLE 15 NORTH AMERICA AUTOMOTIVE LIGHTWEIGHT MARKET BY COUNTRY (USD BILLION), 2022-2029

TABLE 16 NORTH AMERICA AUTOMOTIVE LIGHTWEIGHT MARKET BY COUNTRY (MILLION TONS), 2022-2029

TABLE 17 US AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (USD BILLION), 2022-2029

TABLE 18 US AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (MILLION TONS), 2022-2029

TABLE 19 US AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (USD BILLION), 2022-2029

TABLE 20 US AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (MILLION TONS), 2022-2029

TABLE 21 US AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 22 US AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (MILLION TONS), 2022-2029

TABLE 23 CANADA AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (BILLION), 2022-2029

TABLE 24 CANADA AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (MILLION TONS), 2022-2029

TABLE 25 CANADA AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (USD BILLION), 2022-2029

TABLE 26 CANADA AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (MILLION TONS), 2022-2029

TABLE 27 CANADA AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 28 CANADA AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (MILLION TONS), 2022-2029

TABLE 29 MEXICO AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (USD BILLION), 2022-2029

TABLE 30 MEXICO AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (MILLION TONS), 2022-2029

TABLE 31 MEXICO AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (USD BILLION), 2022-2029

TABLE 32 MEXICO AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (MILLION TONS), 2022-2029

TABLE 33 MEXICO AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 34 MEXICO AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (MILLION TONS), 2022-2029

TABLE 35 SOUTH AMERICA AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (USD BILLION), 2022-2029

TABLE 36 SOUTH AMERICA AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (MILLION TONS), 2022-2029

TABLE 37 SOUTH AMERICA AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (USD BILLION), 2022-2029

TABLE 38 SOUTH AMERICA AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (MILLION TONS), 2022-2029

TABLE 39 SOUTH AMERICA AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 40 SOUTH AMERICA AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (MILLION TONS), 2022-2029

TABLE 41 SOUTH AMERICA AUTOMOTIVE LIGHTWEIGHT MARKET BY COUNTRY (USD BILLION), 2022-2029

TABLE 42 SOUTH AMERICA AUTOMOTIVE LIGHTWEIGHT MARKET BY COUNTRY (MILLION TONS), 2022-2029

TABLE 43 BRAZIL AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (USD BILLION), 2022-2029

TABLE 44 BRAZIL AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (MILLION TONS), 2022-2029

TABLE 45 BRAZIL AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (USD BILLION), 2022-2029

TABLE 46 BRAZIL AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (MILLION TONS), 2022-2029

TABLE 47 BRAZIL AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 48 BRAZIL AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (MILLION TONS), 2022-2029

TABLE 49 ARGENTINA AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (USD BILLION), 2022-2029

TABLE 50 ARGENTINA AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (MILLION TONS), 2022-2029

TABLE 51 ARGENTINA AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (USD BILLION), 2022-2029

TABLE 52 ARGENTINA AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (MILLION TONS), 2022-2029

TABLE 53 ARGENTINA AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 54 ARGENTINA AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (MILLION TONS), 2022-2029

TABLE 55 COLOMBIA AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (USD BILLION), 2022-2029

TABLE 56 COLOMBIA AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (MILLION TONS), 2022-2029

TABLE 57 COLOMBIA AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (USD BILLION), 2022-2029

TABLE 58 COLOMBIA AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (MILLION TONS), 2022-2029

TABLE 59 COLOMBIA AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 60 COLOMBIA AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (MILLION TONS), 2022-2029

TABLE 61 REST OF SOUTH AMERICA AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (USD BILLION), 2022-2029

TABLE 62 REST OF SOUTH AMERICA AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (MILLION TONS), 2022-2029

TABLE 63 REST OF SOUTH AMERICA AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (USD BILLION), 2022-2029

TABLE 64 REST OF SOUTH AMERICA AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (MILLION TONS), 2022-2029

TABLE 65 REST OF SOUTH AMERICA AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 66 REST OF SOUTH AMERICA AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (MILLION TONS), 2022-2029

TABLE 67 ASIA-PACIFIC AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (USD BILLION), 2022-2029

TABLE 68 ASIA-PACIFIC AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (MILLION TONS), 2022-2029

TABLE 69 ASIA-PACIFIC AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (USD BILLION), 2022-2029

TABLE 70 ASIA-PACIFIC AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (MILLION TONS), 2022-2029

TABLE 71 ASIA-PACIFIC AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 72 ASIA-PACIFIC AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (MILLION TONS), 2022-2029

TABLE 73 ASIA-PACIFIC AUTOMOTIVE LIGHTWEIGHT MARKET BY COUNTRY (USD BILLION), 2022-2029

TABLE 74 ASIA-PACIFIC AUTOMOTIVE LIGHTWEIGHT MARKET BY COUNTRY (MILLION TONS), 2022-

TABLE 75 INDIA AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (USD BILLION), 2022-2029

TABLE 76 INDIA AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (MILLION TONS), 2022-2029

TABLE 77 INDIA AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (USD BILLION), 2022-2029

TABLE 78 INDIA AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (MILLION TONS), 2022-2029

TABLE 79 INDIA AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 80 INDIA AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (MILLION TONS), 2022-2029

TABLE 81 CHINA AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (USD BILLION), 2022-2029

TABLE 82 CHINA AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (MILLION TONS), 2022-2029

TABLE 83 CHINA AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (USD BILLION), 2022-2029

TABLE 84 CHINA AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (MILLION TONS), 2022-2029

TABLE 85 CHINA AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 86 CHINA AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (MILLION TONS), 2022-2029

TABLE 87 JAPAN AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (USD BILLION), 2022-2029

TABLE 88 JAPAN AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (MILLION TONS), 2022-2029

TABLE 89 JAPAN AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (USD BILLION), 2022-2029

TABLE 90 JAPAN AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (MILLION TONS), 2022-2029

TABLE 91 JAPAN AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 92 JAPAN AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (MILLION TONS), 2022-2029

TABLE 93 SOUTH KOREA AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (USD BILLION), 2022-2029

TABLE 94 SOUTH KOREA AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (MILLION TONS), 2022-2029

TABLE 95 SOUTH KOREA AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (USD BILLION), 2022-2029

TABLE 96 SOUTH KOREA AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (MILLION TONS), 2022-2029

TABLE 97 SOUTH KOREA AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 98 SOUTH KOREA AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (MILLION TONS), 2022-2029

TABLE 99 REST OF ASIA PACIFIC AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (USD BILLION), 2022-2029

TABLE 100 REST OF ASIA PACIFIC AUTOMOTIVE LIGHTWEIGHT MARKETBY MATERIAL TYPE (MILLION TONS), 2022-2029

TABLE 101 REST OF ASIA PACIFIC AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (USD BILLION), 2022-2029

TABLE 102 REST OF ASIA PACIFIC AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (MILLION TONS), 2022-2029

TABLE 103 REST OF ASIA PACIFIC AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 104 REST OF ASIA PACIFIC AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (MILLION TONS), 2022-2029

TABLE 105 EUROPE AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (USD BILLION), 2022-2029

TABLE 106 EUROPE AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (MILLION TONS), 2022-2029

TABLE 107 EUROPE AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (USD BILLION), 2022-2029

TABLE 108 EUROPE AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (MILLION TONS), 2022-2029

TABLE 109 EUROPE AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 110 EUROPE AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (MILLION TONS), 2022-2029

TABLE 111 EUROPE AUTOMOTIVE LIGHTWEIGHT MARKET BY COUNTRY (USD BILLION), 2022-2029

TABLE 112 EUROPE AUTOMOTIVE LIGHTWEIGHT MARKET BY COUNTRY (MILLION TONS), 2022-2029

TABLE 113 GERMANY AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (USD BILLION), 2022-2029

TABLE 114 GERMANY AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (MILLION TONS), 2022-2029

TABLE 115 GERMANY AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (USD BILLION), 2022-2029

TABLE 116 GERMANY AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (MILLION TONS), 2022-2029

TABLE 117 GERMANY AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 118 GERMANY AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (MILLION TONS), 2022-2029

TABLE 119 UK AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (USD BILLION), 2022-2029

TABLE 120 UK AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (MILLION TONS), 2022-2029

TABLE 121 UK AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (USD BILLION), 2022-2029

TABLE 122 UK AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (MILLION TONS), 2022-2029

TABLE 123 UK AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 124 UK AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (MILLION TONS), 2022-2029

TABLE 125 FRANCE AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (USD BILLION), 2022-2029

TABLE 126 FRANCE AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (MILLION TONS), 2022-2029

TABLE 127 FRANCE AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (USD BILLION), 2022-2029

TABLE 128 FRANCE AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (MILLION TONS), 2022-2029

TABLE 129 FRANCE AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 130 FRANCE AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (MILLION TONS), 2022-2029

TABLE 131 ITALY AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (USD BILLION), 2022-2029

TABLE 132 ITALY AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (MILLION TONS), 2022-2029

TABLE 133 ITALY AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (USD BILLION), 2022-2029

TABLE 134 ITALY AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (MILLION TONS), 2022-2029

TABLE 135 ITALY AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 136 ITALY AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (MILLION TONS), 2022-2029

TABLE 137 RUSSIA AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (USD BILLION), 2022-2029

TABLE 138 RUSSIA AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (MILLION TONS), 2022-2029

TABLE 139 RUSSIA AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (USD BILLION), 2022-2029

TABLE 140 RUSSIA AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (MILLION TONS), 2022-2029

TABLE 141 RUSSIA AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 142 RUSSIA AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (MILLION TONS), 2022-2029

TABLE 143 REST OF EUROPE AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (USD BILLION), 2022-2029

TABLE 144 REST OF EUROPE AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (MILLION TONS), 2022-2029

TABLE 145 REST OF EUROPE AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (USD BILLION), 2022-2029

TABLE 146 REST OF EUROPE AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (MILLION TONS), 2022-2029

TABLE 147 REST OF EUROPE AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 148 REST OF EUROPE AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (MILLION TONS), 2022-2029

TABLE 149 MIDDLE EAST AND AFRICA AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (USD BILLION), 2022-2029

TABLE 150 MIDDLE EAST AND AFRICA AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (MILLION TONS), 2022-2029

TABLE 151 MIDDLE EAST AND AFRICA AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (USD BILLION), 2022-2029

TABLE 152 MIDDLE EAST AND AFRICA AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (MILLION TONS), 2022-2029

TABLE 153 MIDDLE EAST AND AFRICA AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 154 MIDDLE EAST AND AFRICA AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (MILLION TONS), 2022-2029

TABLE 155 MIDDLE EAST AND AFRICA AUTOMOTIVE LIGHTWEIGHT MARKET BY COUNTRY (USD BILLION), 2022-2029

TABLE 156 MIDDLE EAST AND AFRICA AUTOMOTIVE LIGHTWEIGHT MARKET BY COUNTRY (MILLION TONS), 2022-2029

TABLE 157 TURKEY AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (USD BILLION), 2022-2029

TABLE 158 TURKEY AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (MILLION TONS), 2022-2029

TABLE 159 TURKEY AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (USD BILLION), 2022-2029

TABLE 160 TURKEY AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (MILLION TONS), 2022-2029

TABLE 161 TURKEY AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 162 TURKEY AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (MILLION TONS), 2022-2029

TABLE 163 SAUDI ARABIA AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (USD BILLION), 2022-2029

TABLE 164 SAUDI ARABIA AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (MILLION TONS), 2022-2029

TABLE 165 SAUDI ARABIA AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (USD BILLION), 2022-2029

TABLE 166 SAUDI ARABIA AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (MILLION TONS), 2022-2029

TABLE 167 SAUDI ARABIA AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 168 SAUDI ARABIA AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (MILLION TONS), 2022-2029

TABLE 169 SOUTH AFRICA AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (USD BILLION), 2022-2029

TABLE 170 SOUTH AFRICA AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (MILLION TONS), 2022-2029

TABLE 171 SOUTH AFRICA AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (USD BILLION), 2022-2029

TABLE 172 SOUTH AFRICA AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (MILLION TONS), 2022-2029

TABLE 173 SOUTH AFRICA AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 174 SOUTH AFRICA AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (MILLION TONS), 2022-2029

TABLE 175 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (USD BILLION), 2022-2029

TABLE 176 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE (MILLION TONS), 2022-2029

TABLE 177 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (USD BILLION), 2022-2029

TABLE 178 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE (MILLION TONS), 2022-2029

TABLE 179 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 180 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION (MILLION TONS), 2022-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE, USD BILLION, 2022-2029

FIGURE 9 GLOBAL AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE, USD BILLION, 2022-2029

FIGURE 10 GLOBAL AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION, USD BILLION, 2022-2029

FIGURE 11 GLOBAL AUTOMOTIVE LIGHTWEIGHT MARKET BY REGION, USD BILLION, 2022-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 AUTOMOTIVE LIGHTWEIGHT MARKET BY MATERIAL TYPE 2021

FIGURE 14 AUTOMOTIVE LIGHTWEIGHT MARKET BY VEHICLE TYPE 2021

FIGURE 15 AUTOMOTIVE LIGHTWEIGHT MARKET BY APPLICATION 2021

FIGURE 16 AUTOMOTIVE LIGHTWEIGHT MARKET BY REGION 2021

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 TORAY INDUSTRIES INC: COMPANY SNAPSHOT

FIGURE 19 BASF SE: COMPANY SNAPSHOT

FIGURE 20 LYONDELLBASELL: COMPANY SNAPSHOT

FIGURE 21 NOVELIS INC: COMPANY SNAPSHOT

FIGURE 22 ARCELORMITTAL: COMPANY SNAPSHOT

FIGURE 23 OWENS CORNING. COMPANY SNAPSHOT

FIGURE 24 ALCOA CORPORATION: COMPANY SNAPSHOT

FIGURE 25 STRATASYS LTD.: COMPANY SNAPSHOT

FIGURE 26 TATA STEEL: COMPANY SNAPSHOT

FIGURE 27 POSCO: COMPANY SNAPSHOT

FAQ

The Automotive lightweight materials market key companies include BASF SE, Toray Industries Inc., LyondellBasell, Novelis Inc., ArcelorMittal, Alcoa Corporation, Owens Corning, Stratasys Ltd., Tata Steel, POSCO and others.

Europe is expected to remain the largest region due to increasing use of lightweight materials content per vehicle coupled with stringent government regulations to reduce carbon emissions and to increase fuel efficiency. Asia Pacific is expected to witness significant growth over the forecast period because of high vehicle production and continued increase of lightweight materials content per vehicle.

The global automotive lightweight materials market is expected to reach an estimated USD 131.41 billion by 2029.

The major drivers for this market are government regulations concerning fuel economy and emissions, and increasing utilization of lightweight materials by manufacturers.

Emerging trends, which have a direct impact on the dynamics of the industry, include increasing use of aluminum in chassis and structural applications, advanced manufacturing technology, development of aluminum-air battery, third generation AHSS, and pre-oxidation to galvanize AHSS, development of recycling technologies for lightweight materials and replacement of PA 66 with cheaper and advanced PA 6.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.