| Market Size | CAGR | Dominating Region |

|---|---|---|

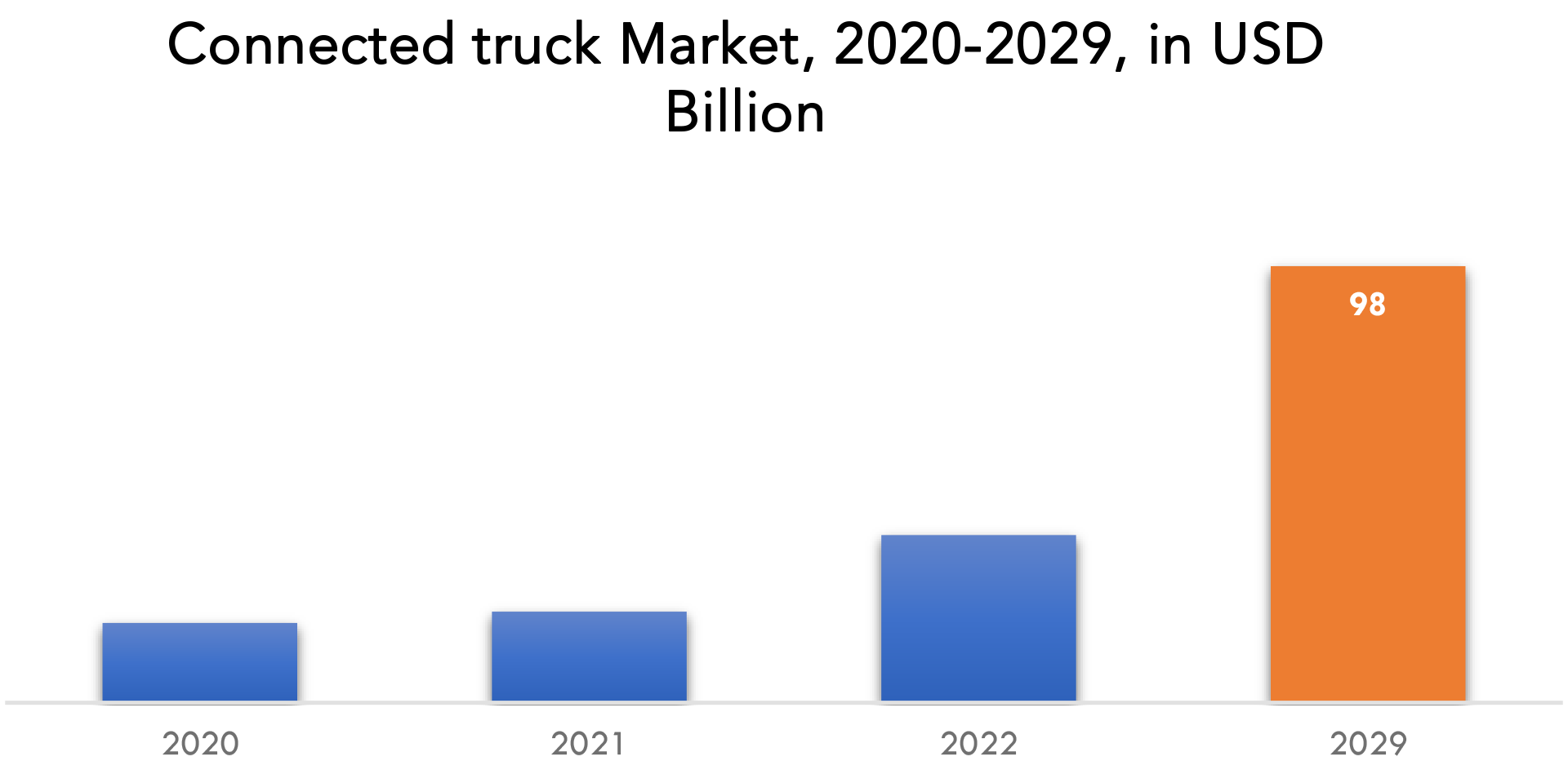

| USD 98 billion | 16.7% | North America |

| By Vehicle Type | By Range | By Communication Type | By Region |

|---|---|---|---|

|

|

|

|

SCOPE OF THE REPORT

Connected Truck Market Overview

The connected truck market is expected to grow at 16.7% CAGR from 2023 to 2029. It is expected to reach above USD 98 billion by 2029 from USD 17.9 billion in 2022.

A connected truck consists of various sensors and is equipped with advanced technologies such as fleet management system and an advanced driver assistance system that displays the vehicle related information like vehicle improvements, driver support systems and fuel management on the screen.

It has internet connectivity that aids in the direction of their fleets and decreases the associated downtime. With the rise of the e-commerce industry and the application of IoT in the trucking industry, remote monitoring of fleets for performance, predictive maintenance, and fuel efficiency reasons is expected to boost the growth of the connected truck market. With connected truck technology, the fleet operator expects optimization factors such as fuel, maintenance, and driver wages, which together account for more than 60% of his total cost of ownership.

Technological improvements are leading fleet managers to see the need for connected trucks as smart roads and smart cities are being built in various countries. The latest trends in the market include artificial intelligence, autonomous technology, 3D printing and their impact and value proposition for the global logistics industry.

Increased use of telematics in trucks is also one of the main trends in the market. Within the next five years, more than 35 BILLION trucks will be networked worldwide.

| ATTRIBUTE | DETAILS |

| Study period | 2023-2029 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2029 |

| Historical period | 2018-2022 |

| Unit | Value (USD BILLION), (THOUSAND UNITS) |

| Segmentation | By vehicle type, by range, by communication type, by region |

| By Vehicle type

|

|

| By Range

|

|

| By Communication type

|

|

| By Region

|

|

The rising demand for vehicle connectivity in the logistics & transportation business along with growing information & telecommunication infrastructure is expected to fuel the market growth over the forecasted period. Rise in digitization and an increase in value-added integration is also expected to uplift the market in the coming years. Connectivity offered by this automotive technology is shifting the focus of truck manufacturers from a business centered on the product to one centered on service and is dramatically improving vehicle utilization and uptime for fleets.

Fleet managers have begun to shift focus from traditional vehicle monitoring to a more advanced and all-inclusive fleet management service providing a driver, vehicles, and the whole logistical network into a single equation in real-time to attain a return on investment and enhanced optimization. Connected Trucks operate in a way, where trucks at the back of the formation can automatically and thoroughly follow a lead vehicle.

However, on the other hand, threat to cybersecurity, lack of uninterrupted & seamless internet connectivity and lack of proper infrastructure in certain underdeveloped and developing countries acts a major restraint on the market growth.

Development of self-driving or autonomous trucks is the factor expected to offer growth opportunities during the forecast period, development of autonomous trucks is attractive to the trucking industry as it offers many benefits to routine trucking practices. This allows for fewer breaks and stops than if the car were stopped by the driver alone and allows continuous driving for long periods of time without restrictions.

COVID-19 led to a global economic crash; it had a significant impact on the connected truck market. Due to a global shutdown the manufacturing and sales of connected trucks experienced a major downturn.

The pandemic led to disruptions in supply chain and there was a severe lack in the raw materials needed for the manufacturing of the vehicle parts needed for building these types of trucks. Several operational constraints were observed such as delivery delays, congestion, and higher freight rates. The pandemic related uncertainty exerted a downward pressure on revenues. Post pandemic manufacturers focused on the reduction of expenses, local management, and new market opportunities to recover from the losses.

Connected Truck Market Segment Analysis

The connected truck market is segmented based on vehicle type, range, communication type and region, global trends and forecast.

By vehicle type, the market is bifurcated into light commercial vehicle and heavy commercial vehicle. By range into dedicated short-range communication (ADAS) and long-range (telematics control unit). By communication type into vehicle-to-vehicle (V2V), vehicle-to-cloud (V2C), and vehicle-to-infrastructure (V2I).

In terms of vehicle type, the light commercial vehicle segment held the largest share in the overall market. The light commercial market held around 74.47% share in 2021, this segment is expected to dominate the market during the forecasted period.

In terms of communication type, the V2V segment dominates the market it held around 42.68% of the market followed by V2C that held 29.66% of total share in 2021. In this communication type, the vehicle can create ad-hoc mesh network on the go and can transfer data through that ad-hoc network.

Connected Truck Market Players

The connected truck market key players include Robert Bosch GmbH, Continental AG, ZF Friedrichshafen AG, Daimler AG, Volvo AB, Delphi Technologies, Denso Corporation, HARMAN International, Sierra Wireless, Inc., Magna International Inc.

- In September 2022, Tata Motors launched the latest versions of the Prima truck range equipped with ADAS features. Tata Prima is the first ADAS-enabled truck to be launched in India.

- In August 2022, MiX Telematics, a leading provider of fleet and asset management solutions, announced its partnership with Hino trucks. This partnership is expected to provide MiX customers in North America that operate Hino trucks with rich data sets, informing intelligent decision-making regarding vehicle maintenance, safety, efficiency, and compliance.

- In May 2022, Volvo Trucks and DHL teamed up to pilot a hub-to-hub autonomous trucking service in North America. This service is designed to serve shippers, carriers, logistics service providers, and freight brokers.

- In March 2022, Daimler India Commercial Vehicles, which manufactures and sells trucks and buses under the BharatBenz brand and is a wholly owned subsidiary of Daimler Truck SE, officially launched the Daimler Truck Innovation Center India (DTICI), a fully-owned incubator to develop scalable digital connectivity innovations for the company’s global product portfolio.

Who Should Buy? Or Key Stakeholders

- Connected Truck Suppliers

- Raw Materials Manufacturers

- Research Organizations

- Investors

- Regulatory Authorities

- Others

Connected Truck Market Regional Analysis

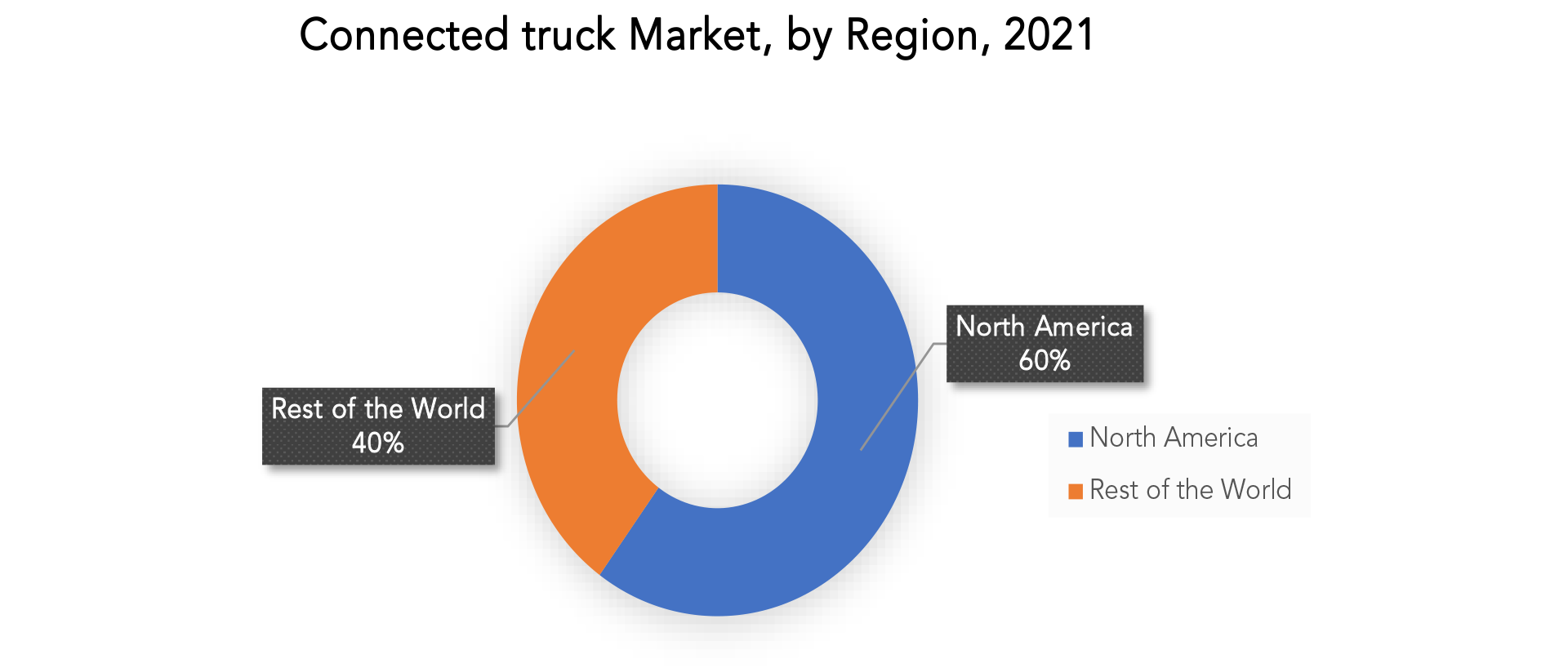

The connected truck market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina, and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

North America region is forecasted to account for the maximum share and continue the trend during the forecast period. North America connected truck market was sized 7.90 billion in 2020 and is expected to grow at a CAGR of 14.8% to USD 23.31 billion by 2029. The North America connected truck market is experiencing rapid growth due to factors such as increased connected vehicular activities, extensive digitization, and advanced cybersecurity upgrades.

Key Market Segments: Connected Truck Market

Connected Truck Market By Vehicle Type, 2023-2029, (USD Billion), (Thousand Units)

- Light Commercial Vehicle

- Heavy Commercial Vehicle

Connected Truck Market By Range, 2023-2029, (USD Billion), (Thousand Units)

- Dedicated Short-Range Communication (ADAS)

- Long-Range (Telematics Control Unit)

Connected Truck Market By Communication Type, 2023-2029, (USD Billion), (Thousand Units)

- Vehicle-To-Vehicle (V2V)

- Vehicle-To-Cloud (V2C)

- Vehicle-To-Infrastructure (V2I)

Connected Truck Market By Region, 2023-2029, (USD Billion), (Thousand Units)

- North America

- Asia Pacific

- Europe

- South America

- Middle East and Africa

Important Countries in All Regions Are Covered.

Key Question Answered

- What is the current size of the connected truck market?

- What are the key factors influencing the growth of connected truck?

- What are the major applications for connected truck?

- Who are the major key players in the connected truck market?

- Which region will provide more business opportunities connected truck in future?

- Which segment holds the maximum share of the connected truck market?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global connected truck outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 on connected truck

- Porter’s five forces model

- Threat from new entrants

- Threat from substitutes

- Bargaining power of suppliers

- Bargaining power of customers

- Degree of competition

- Industry value chain Analysis

- Global connected truck outlook

- Global Connected Truck Market By Vehicle Type (USD Billion ,Thousand Units), 2020-2029

- Light commercial vehicle

- Heavy commercial vehicle

- Global Connected Truck Market By Range (USD Billion ,Thousand Units), 2020-2029

- Dedicated short-range communication (ADAS)

- Long-range (telematics control unit)

- Global Connected Truck Market By Communication Type (USD Billion ,Thousand Units), 2020-2029

- Vehicle-to-vehicle (V2V)

- Vehicle-to-cloud (V2C)

- Vehicle-to-infrastructure (V2I)

- Global Connected Truck Market By Region (USD Billion ,Thousand Units), 2020-2029

- North America

- US

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Colombia

- Rest Of South America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest Of Europe

- Asia Pacific

- India

- China

- Japan

- South Korea

- Australia

- South-East Asia

- Rest Of Asia Pacific

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest Of Middle East and Africa

- North America

- Company Profiles*

(Business Overview, Company Snapshot, Products Offered, Recent Developments)

- Robert Bosch GmbH

- Continental AG

- ZF Friedrichshafen AG

- Daimler AG

- Volvo AB

- Delphi Technologies

- Denso Corporation

- HARMAN International

- Sierra Wireless, Inc.

- Magna International

*The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL CONNECTED TRUCK MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 2 GLOBAL CONNECTED TRUCK MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 3 GLOBAL CONNECTED TRUCK MARKET BY RANGE (USD MILLION), 2020-2029

TABLE 4 GLOBAL CONNECTED TRUCK MARKET BY RANGE (THOUSAND UNITS), 2020-2029

TABLE 5 GLOBAL CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (USD MILLION), 2020-2029

TABLE 6 GLOBAL CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (THOUSAND UNITS), 2020-2029

TABLE 7 NORTH AMERICA CONNECTED TRUCK MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 8 NORTH AMERICA CONNECTED TRUCK MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 9 NORTH AMERICA CONNECTED TRUCK MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 10 NORTH AMERICA CONNECTED TRUCK MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 11 NORTH AMERICA CONNECTED TRUCK MARKET BY RANGE (USD MILLION), 2020-2029

TABLE 12 NORTH AMERICA CONNECTED TRUCK MARKET BY RANGE (THOUSAND UNITS), 2020-2029

TABLE 13 NORTH AMERICA CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (USD MILLION), 2020-2029

TABLE 14 NORTH AMERICA CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (THOUSAND UNITS), 2020-2029

TABLE 15 US CONNECTED TRUCK MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 16 US CONNECTED TRUCK MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 17 US CONNECTED TRUCK MARKET BY RANGE (USD MILLION), 2020-2029

TABLE 18 US CONNECTED TRUCK MARKET BY RANGE (THOUSAND UNITS), 2020-2029

TABLE 19 US CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (USD MILLION), 2020-2029

TABLE 20 US CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (THOUSAND UNITS), 2020-2029

TABLE 21 CANADA CONNECTED TRUCK MARKET BY VEHICLE TYPE (MILLION), 2020-2029

TABLE 22 CANADA CONNECTED TRUCK MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 23 CANADA CONNECTED TRUCK MARKET BY RANGE (USD MILLION), 2020-2029

TABLE 24 CANADA CONNECTED TRUCK MARKET BY RANGE (THOUSAND UNITS), 2020-2029

TABLE 25 CANADA CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (USD MILLION), 2020-2029

TABLE 26 CANADA CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (THOUSAND UNITS),

2020-2029

TABLE 27 MEXICO CONNECTED TRUCK MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 28 MEXICO CONNECTED TRUCK MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 29 MEXICO CONNECTED TRUCK MARKET BY RANGE (USD MILLION), 2020-2029

TABLE 30 MEXICO CONNECTED TRUCK MARKET BY RANGE (THOUSAND UNITS), 2020-2029

TABLE 31 MEXICO CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (USD MILLION), 2020-2029

TABLE 32 MEXICO CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (THOUSAND UNITS), 2020-2029

TABLE 33 SOUTH AMERICA CONNECTED TRUCK MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 34 SOUTH AMERICA CONNECTED TRUCK MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 35 SOUTH AMERICA CONNECTED TRUCK MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 36 SOUTH AMERICA CONNECTED TRUCK MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 37 SOUTH AMERICA CONNECTED TRUCK MARKET BY RANGE (USD MILLION), 2020-2029

TABLE 38 SOUTH AMERICA CONNECTED TRUCK MARKET BY RANGE (THOUSAND UNITS), 2020-2029

TABLE 39 SOUTH AMERICA CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (USD MILLION),

2020-2029

TABLE 40 SOUTH AMERICA CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (THOUSAND UNITS), 2020-2029

TABLE 41 BRAZIL CONNECTED TRUCK MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 42 BRAZIL CONNECTED TRUCK MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 43 BRAZIL CONNECTED TRUCK MARKET BY RANGE (USD MILLION), 2020-2029

TABLE 44 BRAZIL CONNECTED TRUCK MARKET BY RANGE (THOUSAND UNITS), 2020-2029

TABLE 45 BRAZIL CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (USD MILLION), 2020-2029

TABLE 46 BRAZIL CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (THOUSAND UNITS), 2020-2029

TABLE 47 ARGENTINA CONNECTED TRUCK MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 48 ARGENTINA CONNECTED TRUCK MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 49 ARGENTINA CONNECTED TRUCK MARKET BY RANGE (USD MILLION), 2020-2029

TABLE 50 ARGENTINA CONNECTED TRUCK MARKET BY RANGE (THOUSAND UNITS), 2020-2029

TABLE 51 ARGENTINA CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (USD MILLION), 2020-2029

TABLE 52 ARGENTINA CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (THOUSAND UNITS), 2020-2029

TABLE 53 COLOMBIA CONNECTED TRUCK MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 54 COLOMBIA CONNECTED TRUCK MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 55 COLOMBIA CONNECTED TRUCK MARKET BY RANGE (USD MILLION), 2020-2029

TABLE 56 COLOMBIA CONNECTED TRUCK MARKET BY RANGE (THOUSAND UNITS), 2020-2029

TABLE 57 COLOMBIA CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (USD MILLION), 2020-2029

TABLE 58 COLOMBIA CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (THOUSAND UNITS), 2020-2029

TABLE 59 REST OF SOUTH AMERICA CONNECTED TRUCK MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 60 REST OF SOUTH AMERICA CONNECTED TRUCK MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 61 REST OF SOUTH AMERICA CONNECTED TRUCK MARKET BY RANGE (USD MILLION), 2020-2029

TABLE 62 REST OF SOUTH AMERICA CONNECTED TRUCK MARKET BY RANGE (THOUSAND UNITS), 2020-2029

TABLE 63 REST OF SOUTH AMERICA CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (USD MILLION), 2020-2029

TABLE 64 REST OF SOUTH AMERICA CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (THOUSAND UNITS), 2020-2029

TABLE 65 ASIA-PACIFIC CONNECTED TRUCK MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 66 ASIA-PACIFIC CONNECTED TRUCK MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 67 ASIA-PACIFIC CONNECTED TRUCK MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 68 ASIA-PACIFIC CONNECTED TRUCK MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 69 ASIA-PACIFIC CONNECTED TRUCK MARKET BY RANGE (USD MILLION), 2020-2029

TABLE 70 ASIA-PACIFIC CONNECTED TRUCK MARKET BY RANGE (THOUSAND UNITS), 2020-2029

TABLE 71 ASIA-PACIFIC CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (USD MILLION), 2020-2029

TABLE 72 ASIA-PACIFIC CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (THOUSAND UNITS), 2020-2029

TABLE 73 INDIA CONNECTED TRUCK MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 74 INDIA CONNECTED TRUCK MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 75 INDIA CONNECTED TRUCK MARKET BY RANGE (USD MILLION), 2020-2029

TABLE 76 INDIA CONNECTED TRUCK MARKET BY RANGE (THOUSAND UNITS), 2020-2029

TABLE 77 INDIA CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (USD MILLION), 2020-2029

TABLE 78 INDIA CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (THOUSAND UNITS), 2020-2029

TABLE 79 CHINA CONNECTED TRUCK MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 80 CHINA CONNECTED TRUCK MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 81 CHINA CONNECTED TRUCK MARKET BY RANGE (USD MILLION), 2020-2029

TABLE 82 CHINA CONNECTED TRUCK MARKET BY RANGE (THOUSAND UNITS), 2020-2029

TABLE 83 CHINA CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (USD MILLION), 2020-2029

TABLE 84 CHINA CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (THOUSAND UNITS), 2020-2029

TABLE 85 JAPAN CONNECTED TRUCK MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 86 JAPAN CONNECTED TRUCK MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 87 JAPAN CONNECTED TRUCK MARKET BY RANGE (USD MILLION), 2020-2029

TABLE 88 JAPAN CONNECTED TRUCK MARKET BY RANGE (THOUSAND UNITS), 2020-2029

TABLE 89 JAPAN CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (USD MILLION), 2020-2029

TABLE 90 JAPAN CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (THOUSAND UNITS), 2020-2029

TABLE 91 SOUTH KOREA CONNECTED TRUCK MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 92 SOUTH KOREA CONNECTED TRUCK MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 93 SOUTH KOREA CONNECTED TRUCK MARKET BY RANGE (USD MILLION), 2020-2029

TABLE 94 SOUTH KOREA CONNECTED TRUCK MARKET BY RANGE (THOUSAND UNITS), 2020-2029

TABLE 95 SOUTH KOREA CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (USD MILLION), 2020-2029

TABLE 96 SOUTH KOREA CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (THOUSAND UNITS), 2020-2029

TABLE 97 AUSTRALIA CONNECTED TRUCK MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 98 AUSTRALIA CONNECTED TRUCKBY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 99 AUSTRALIA CONNECTED TRUCK MARKET BY RANGE (USD MILLION), 2020-2029

TABLE 100 AUSTRALIA CONNECTED TRUCK MARKET BY RANGE (THOUSAND UNITS), 2020-2029

TABLE 101 AUSTRALIA CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (USD MILLION), 2020-2029

TABLE 102 AUSTRALIA CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (THOUSAND UNITS), 2020-2029

TABLE 103 SOUTH EAST ASIA CONNECTED TRUCK MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 104 SOUTH EAST ASIA CONNECTED TRUCKBY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 105 SOUTH EAST ASIA CONNECTED TRUCK MARKET BY RANGE (USD MILLION), 2020-2029

TABLE 106 SOUTH EAST ASIA CONNECTED TRUCK MARKET BY RANGE (THOUSAND UNITS), 2020-2029

TABLE 107 SOUTH EAST ASIA CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (USD MILLION), 2020-2029

TABLE 108 SOUTH EAST ASIA CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (THOUSAND UNITS), 2020-2029

TABLE 109 REST OF ASIA PACIFIC CONNECTED TRUCK MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 110 REST OF ASIA PACIFIC CONNECTED TRUCKBY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 111 REST OF ASIA PACIFIC CONNECTED TRUCK MARKET BY RANGE (USD MILLION), 2020-2029

TABLE 112 REST OF ASIA PACIFIC CONNECTED TRUCK MARKET BY RANGE (THOUSAND UNITS), 2020-2029

TABLE 113 REST OF ASIA PACIFIC CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (USD MILLION), 2020-2029

TABLE 114 REST OF ASIA PACIFIC CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (THOUSAND UNITS), 2020-2029

TABLE 115 EUROPE CONNECTED TRUCK MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 116 EUROPE CONNECTED TRUCK MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 117 EUROPE CONNECTED TRUCK MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 118 EUROPE CONNECTED TRUCK MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 119 EUROPE CONNECTED TRUCK MARKET BY RANGE (USD MILLION), 2020-2029

TABLE 120 EUROPE CONNECTED TRUCK MARKET BY RANGE (THOUSAND UNITS), 2020-2029

TABLE 121 EUROPE CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (USD MILLION), 2020-2029

TABLE 122 EUROPE CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (THOUSAND UNITS), 2020-2029

TABLE 123 GERMANY CONNECTED TRUCK MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 124 GERMANY CONNECTED TRUCK MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 125 GERMANY CONNECTED TRUCK MARKET BY RANGE (USD MILLION), 2020-2029

TABLE 126 GERMANY CONNECTED TRUCK MARKET BY RANGE (THOUSAND UNITS), 2020-2029

TABLE 127 GERMANY CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (USD MILLION), 2020-2029

TABLE 128 GERMANY CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (THOUSAND UNITS), 2020-2029

TABLE 129 UK CONNECTED TRUCK MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 130 UK CONNECTED TRUCK MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 131 UK CONNECTED TRUCK MARKET BY RANGE (USD MILLION), 2020-2029

TABLE 132 UK CONNECTED TRUCK MARKET BY RANGE (THOUSAND UNITS), 2020-2029

TABLE 133 UK CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (USD MILLION), 2020-2029

TABLE 134 UK CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (THOUSAND UNITS), 2020-2029

TABLE 135 FRANCE CONNECTED TRUCK MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 136 FRANCE CONNECTED TRUCK MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 137 FRANCE CONNECTED TRUCK MARKET BY RANGE (USD MILLION), 2020-2029

TABLE 138 FRANCE CONNECTED TRUCK MARKET BY RANGE (THOUSAND UNITS), 2020-2029

TABLE 139 FRANCE CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (USD MILLION), 2020-2029

TABLE 140 FRANCE CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (THOUSAND UNITS), 2020-2029

TABLE 141 ITALY CONNECTED TRUCK MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 142 ITALY CONNECTED TRUCK MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 143 ITALY CONNECTED TRUCK MARKET BY RANGE (USD MILLION), 2020-2029

TABLE 144 ITALY CONNECTED TRUCK MARKET BY RANGE (THOUSAND UNITS), 2020-2029

TABLE 145 ITALY CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (USD MILLION), 2020- 2029

TABLE 146 ITALY CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (THOUSAND UNITS), 2020-2029

TABLE 147 SPAIN CONNECTED TRUCK MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 148 SPAIN CONNECTED TRUCK MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 149 SPAIN CONNECTED TRUCK MARKET BY RANGE (USD MILLION), 2020-2029

TABLE 150 SPAIN CONNECTED TRUCK MARKET BY RANGE (THOUSAND UNITS), 2020-2029

TABLE 151 SPAIN CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (USD MILLION), 2020-2029

TABLE 152 SPAIN CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (THOUSAND UNITS), 2020-2029

TABLE 153 RUSSIA CONNECTED TRUCK MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 154 RUSSIA CONNECTED TRUCK MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 155 RUSSIA CONNECTED TRUCK MARKET BY RANGE (USD MILLION), 2020-2029

TABLE 156 RUSSIA CONNECTED TRUCK MARKET BY RANGE (THOUSAND UNITS), 2020-2029

TABLE 157 RUSSIA CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (USD MILLION), 2020-2029

TABLE 158 RUSSIA CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (THOUSAND UNITS), 2020-2029

TABLE 159 REST OF EUROPE CONNECTED TRUCK MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 160 REST OF EUROPE CONNECTED TRUCK MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 161 REST OF EUROPE CONNECTED TRUCK MARKET BY RANGE (USD MILLION), 2020-2029

TABLE 162 REST OF EUROPE CONNECTED TRUCK MARKET BY RANGE (THOUSAND UNITS), 2020-2029

TABLE 163 REST OF EUROPE CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (USD MILLION), 2020-2029

TABLE 164 REST OF EUROPE CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (THOUSAND UNITS), 2020-2029

TABLE 165 MIDDLE EAST AND AFRICA CONNECTED TRUCK MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 166 MIDDLE EAST AND AFRICA CONNECTED TRUCK MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 167 MIDDLE EAST AND AFRICA CONNECTED TRUCK MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 168 MIDDLE EAST AND AFRICA CONNECTED TRUCK MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 169 MIDDLE EAST AND AFRICA CONNECTED TRUCK MARKET BY RANGE (USD MILLION), 2020-2029

TABLE 170 MIDDLE EAST AND AFRICA CONNECTED TRUCK MARKET BY RANGE (THOUSAND UNITS), 2020-2029

TABLE 171 MIDDLE EAST AND AFRICA CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (USD MILLION), 2020-2029

TABLE 172 MIDDLE EAST AND AFRICA CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (THOUSAND UNITS), 2020-2029

TABLE 173 UAE CONNECTED TRUCK MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 174 UAE CONNECTED TRUCK MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 175 UAE CONNECTED TRUCK MARKET BY RANGE (USD MILLION), 2020-2029

TABLE 176 UAE CONNECTED TRUCK MARKET BY RANGE (THOUSAND UNITS), 2020-2029

TABLE 177 UAE CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (USD MILLION), 2020-2029

TABLE 178 UAE CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (THOUSAND UNITS), 2020-2029

TABLE 179 SAUDI ARABIA CONNECTED TRUCK MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 180 SAUDI ARABIA CONNECTED TRUCK MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 181 SAUDI ARABIA CONNECTED TRUCK MARKET BY RANGE (USD MILLION), 2020-2029

TABLE 182 SAUDI ARABIA CONNECTED TRUCK MARKET BY RANGE (THOUSAND UNITS), 2020-2029

TABLE 183 SAUDI ARABIA CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (USD MILLION), 2020-2029

TABLE 184 SAUDI ARABIA CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (THOUSAND UNITS), 2020-2029

TABLE 185 SOUTH AFRICA CONNECTED TRUCK MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 186 SOUTH AFRICA CONNECTED TRUCK MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 187 SOUTH AFRICA CONNECTED TRUCK MARKET BY RANGE (USD MILLION), 2020-2029

TABLE 188 SOUTH AFRICA CONNECTED TRUCK MARKET BY RANGE (THOUSAND UNITS), 2020-2029

TABLE 189 SOUTH AFRICA CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (USD MILLION), 2020-2029

TABLE 190 SOUTH AFRICA CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (THOUSAND UNITS), 2020-2029

TABLE 191 REST OF MIDDLE EAST AND AFRICA CONNECTED TRUCK MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 192 REST OF MIDDLE EAST AND AFRICA CONNECTED TRUCK MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 193 REST OF MIDDLE EAST AND AFRICA CONNECTED TRUCK MARKET BY RANGE (USD MILLION), 2020-2029

TABLE 194 REST OF MIDDLE EAST AND AFRICA CONNECTED TRUCK MARKET BY RANGE (THOUSAND UNITS), 2020-2029

TABLE 195 REST OF MIDDLE EAST AND AFRICA CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (USD MILLION), 2020-2029

TABLE 196 REST OF MIDDLE EAST AND AFRICA CONNECTED TRUCK MARKET BY COMMUNICATION TYPE (THOUSAND UNITS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL CONNECTED TRUCKBY TYPE, USD BILLION , 2020-2029

FIGURE 9 GLOBAL CONNECTED TRUCKBY TECHNOLOGY, USD BILLION, 2020-2029

FIGURE 10 GLOBAL CONNECTED TRUCKBY APPLICATION, USD BILLION, 2020-2029

FIGURE 11 GLOBAL CONNECTED TRUCKBY REGION, USD BILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL CONNECTED TRUCKBY TYPE, USD BILLION , 2021

FIGURE 14 GLOBAL CONNECTED TRUCKBY TECHNOLOGY, USD BILLION, 2021

FIGURE 15 GLOBAL CONNECTED TRUCKBY APPLICATION, USD BILLION, 2021

FIGURE 16 GLOBAL CONNECTED TRUCKBY REGION, USD BILLION, 2021

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 ROBERT BOSCH GMBH.: COMPANY SNAPSHOT

FIGURE 19 CONTINENTAL AG: COMPANY SNAPSHOT

FIGURE 20 ZF FRIEDRICHSHAFEN AG: COMPANY SNAPSHOT

FIGURE 21 DAIMLER AG: COMPANY SNAPSHOT

FIGURE 22 VOLVO AB: COMPANY SNAPSHOT

FIGURE 23 MOLESKINE: COMPANY SNAPSHOT

FIGURE 24 DELPHI TECHNOLOGIES: COMPANY SNAPSHOT

FIGURE 25 DENSO CORPORATION: COMPANY SNAPSHOT

FIGURE 26 HARMAN INTERNATIONAL: COMPANY SNAPSHOT

FIGURE 27 SIERRA WIRELESS, INC.: COMPANY SNAPSHOT

FIGURE 28 MAGNA INTERNATIONAL INC.: COMPANY SNAPSHOT

FAQ

The connected truck market is worth USD 17.9 billion and is expected to reach above USD 98 billion by 2029.

North America connected truck market was sized 7.90 billion in 2022 and is expected to grow at a CAGR of 14.8% to USD 23.31 billion by 2029.

The rising demand for vehicle connectivity in the logistics & transportation business along with growing information & telecommunication infrastructure is expected to fuel the market growth over the forecasted period.

Development of self-driving or autonomous trucks is the factor expected to offer growth opportunities during the forecast period, development of autonomous trucks is attractive to the trucking industry as it offers many benefits to routine trucking practices.

North America region is forecasted to account for the maximum share and continue the trend during the forecast period. North America connected truck market was sized 7.90 billion in 2022 and is expected to grow at a CAGR of 14.8% to USD 23.31 billion by 2029. The North America connected truck market is experiencing rapid growth due to factors such as increased connected vehicular activities, extensive digitization, and advanced cybersecurity upgrades.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.