| Market Size | CAGR | Dominating Region |

|---|---|---|

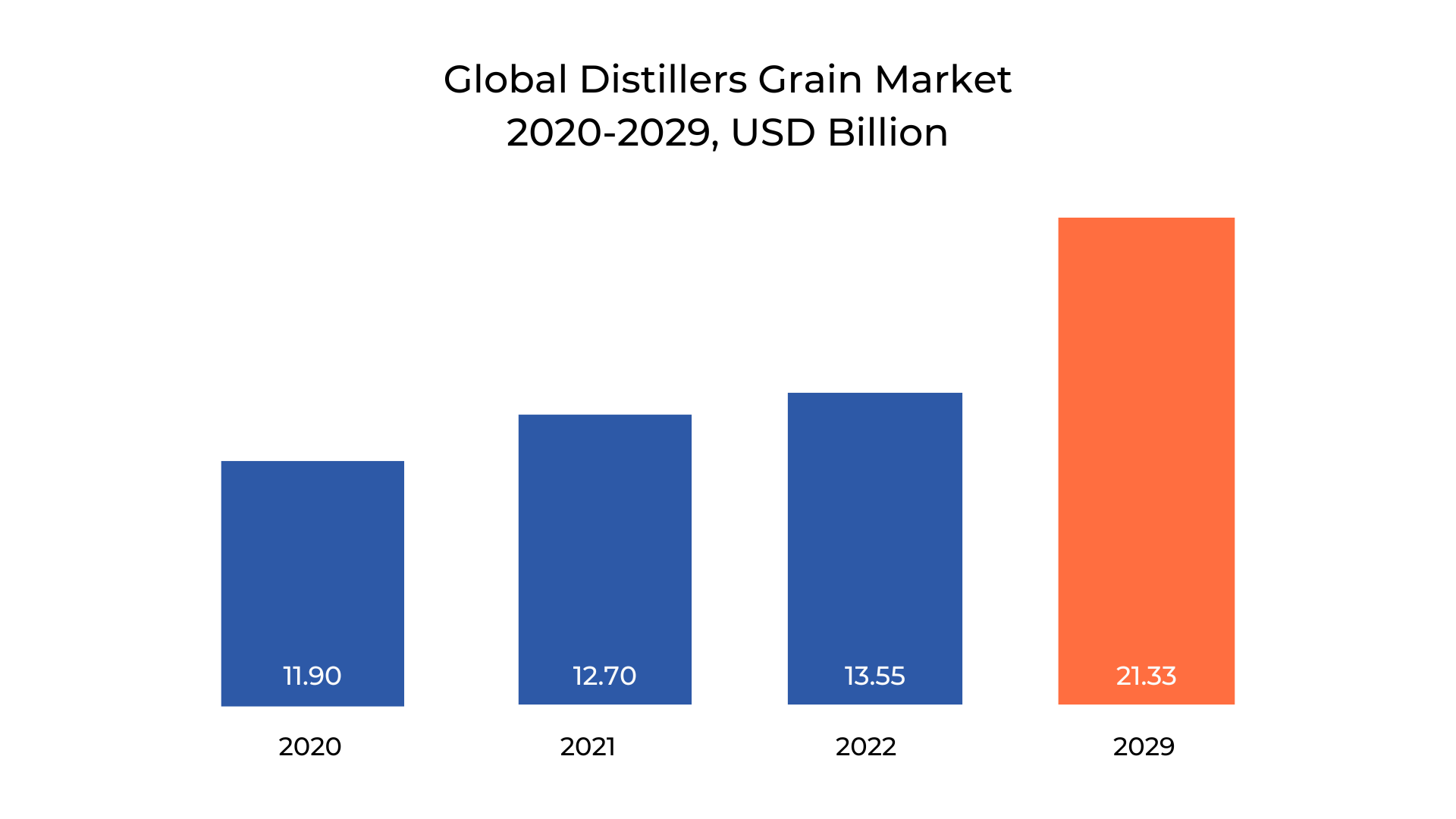

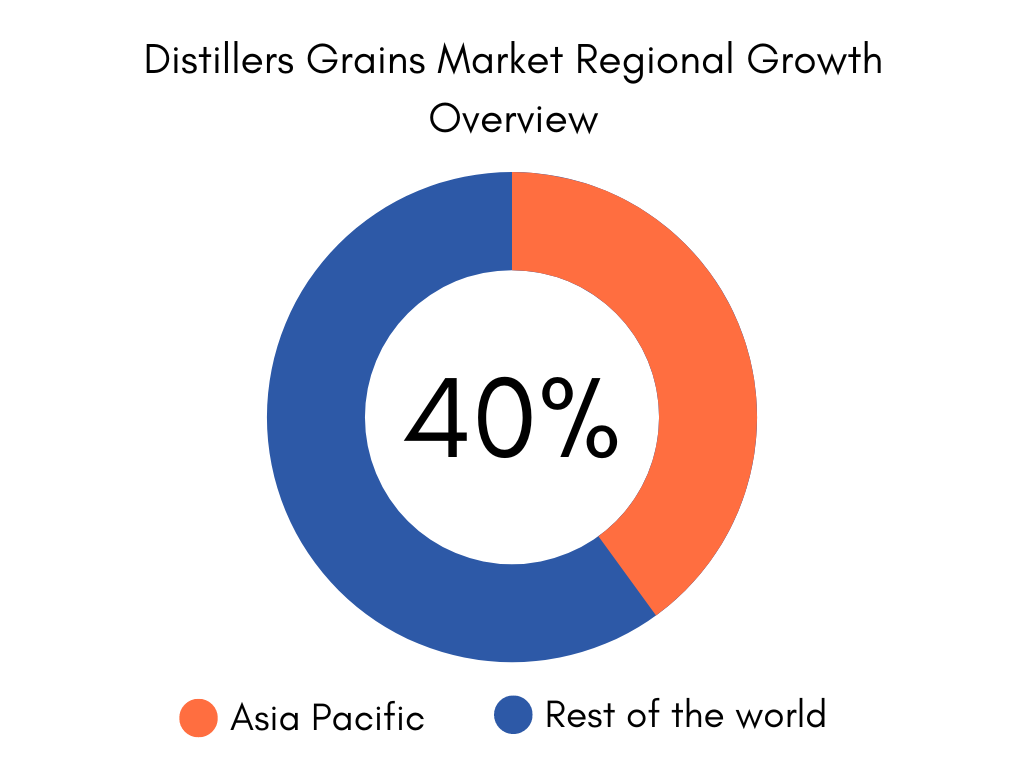

| USD 21.33 billion | 6.7% | APAC |

| By Type | By Source | By Livestock | By Regions |

|---|---|---|---|

|

|

|

|

SCOPE OF THE REPORT

Distillers Grains Market Overview

The global Distillers Grains market is expected to reach USD 21.33 billion by 2029, up from USD 11.90 billion in 2022, at a 6.7% CAGR between 2023 and 2029.

Distiller grains are cereal by-products obtained from distillation processing units or dry grind ethanol plants and are available in both dried and wet forms. These grains are produced in large quantities and serve as low-cost alternative feed ingredients. Distillers’ grain is an important part of livestock and poultry bird diets because it contains cereal proteins, fat, minerals, vitamins, fibre, oil, and amino acids. These grains come from two main sources. Brewers were the traditional sources. Recently, ethanol biofuel plants have become a growing source. It is produced in distilleries by drying mash and is then sold for a variety of purposes, most commonly as livestock fodder (especially ruminants). Corn-based distiller grains from the ethanol industry are widely sold as a high protein livestock feed that boosts efficiency and reduces the risk of subacute acidosis in beef cattle.

Recent research suggests that using dried distiller grains with soluble (DDGS) as a human food source may help reduce the risk of heart disease. The process mash contains nutrients such as protein, fibre, germ, vitamins, and minerals, and research suggests that DDG flour will work well with cookies and flatbread.

The increasing adoption of distillers’ grains over traditional grains, particularly in developed economies, is a major factor driving the global distillers’ grains market. Market growth is expected to be driven by factors such as distillers’ grains being a favorable alternative to traditional feedstock and growth in the organized livestock sector. Furthermore, because corn-based distillers’ grains are an important ingredient in ethanol production, demand is rapidly increasing, which is expected to drive the global distillers’ grains market over the forecast period.

| ATTRIBUTE | DETAILS |

| Study period | 2023-2029 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2029 |

| Historical period | 2018-2022 |

| Unit | Value (USD Billion) |

| Segmentation | By Type, By Source, By Livestock, By Region. |

| By Type

|

|

| By Source

|

|

| By Livestock

|

|

| By Region

|

|

End-user demand for nutritive feed products has boosted the Distillers Grains Market by replacing traditional expensive feed around the world. Factors such as the growing popularity of dried distillers’ grain as a long-lasting nutritive supplement for livestock that is easy to distribute and store are driving up sales of distillers’ grain around the world. Furthermore, distillers’ grain is preferred by end-users because it is a medium for improving the physical growth of livestock while also ensuring meat quality and providing excellent performance in milking and egg-laying.

Precision nutrition is becoming more popular among feed manufacturers, which will create lucrative opportunities for market players in the coming years. However, the major restraints to the growth of this market are a lack of awareness in developing countries, fluctuating grain prices, reliance on distilleries for manufacturing, insufficient storage facilities, and the negative effects of excess consumption. Furthermore, new product development, collaboration with agro-business firms, and product penetration via ecommerce are expected to create significant opportunities for the Distillers Grains Market.

Increased ethanol production in recent decades has increased the production and availability of corn dried distillers grains with soluble, DG. DG has been used as a feed ingredient in dairy rations due to its high protein and fibre content. Because of its low cost, including DG in a diet, such as replacing soybean meal, can reduce feed costs.

Feb 27, 2020, New technology that extracts additional co-products has increased the feed value of dried distillers grain.

Distillers Grains Market Segment Analysis

The market is divided into three types: Wet Distillers Grains (WDG), Dried Distillers Grains With Soluble (DDGS), and Dried Distillers Grains (DDG). The DDGS market is expected to dominate in 2019 and to be the fastest-growing segment during the forecast period. This expansion can be attributed to several properties of DDGS, including its high protein content, energy, and highly digestible phosphorus content, which are responsible for its growing use as a partial replacement for some more expensive traditional animal feeds, such as corn and soybean meal. Furthermore, DDGS has a long shelf life and can be easily and conveniently transported over long distances, which contributes to the DDGS segment’s growth.

According to Source, the market is divided into three categories: wheat, corn, and others. Because corn is a widely used grain for ethanol production, it is expected to have the highest revenue share and CAGR during the forecast period. Furthermore, it is a cost-effective substitute for various feed ingredients due to its high phosphorous and protein content, which provides energy to livestock.

The market is divided into Ruminants, Swine, Poultry, and others based on livestock. In 2019, the ruminants segment dominated. Because of their higher protein content than traditional feeds such as corn, distillers’ grains are being used in ruminant diets due to increased demand for quality milk and beef products. During the forecast period, the poultry segment is expected to grow the fastest. Global poultry production has been increasing, and with such growth in production and consumption, it has become increasingly important for meat producers to prioritise quality. This boosts the market for distillers’ grains, which are used to provide nutritional feed for poultry.

Distillers Grains Market Players

The major players operating in the global Distillers Grains industry include Purina Animal Nutrition, Valero, Pacific Ethanol, Inc., Flint Hill Resources, Green Plains Inc., Archer Daniels Midland, Husky Energy, Bunge Limited, Poet LLC, and Crop Energies AG. Mergers and acquisitions, joint ventures, capacity expansions, significant distribution, and branding decisions by established industry players to improve market share and regional presence. They are also engaged in ongoing R&D activities to develop new products and are focused on expanding the product portfolio. This is expected to increase competition and pose a threat to new entrants into the market.

- In February of 2022, The United States Department of Agriculture just produced a new report that includes up-to-date data and statistics on the importance of rivers to agriculture. The USDA’s Agricultural Marketing Service released a report titled “A Reliable Waterway System Is Important to Agriculture.” A reliable waterways transportation infrastructure is always a critical aspect when the AMS is marketing and promoting U.S. agricultural products.

- In June 2022, The Calgary Stampede and Cenovus Energy Inc. announced a new and significant long-term sponsorship deal. The four-year Champion level sponsorship builds on the Stampedes more than a decade of participation. The extended partnership includes premier sponsorship of the Saddle Bronc competition and a new fan experience with business volunteers, which will last until 2025.

Who Should Buy? Or Key Stakeholders

- Research and development

- Manufacturing

- End Use industries

- Poultry Farming

- Agriculture

- E-Commerce and Retail

- Healthcare

- Industrial and Manufacturing

Distillers Grains Market Regional Analysis

Geographically, the Distiller Grains market is segmented into North America, South America, Europe, APAC and MEA.

- North America: includes the US, Canada, Mexico

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

The Global Distillers Grains Market is divided into North America, Europe, Asia Pacific, and the Rest of the World based on regional analysis. The increased availability of byproducts in North America has pushed the use of distillers’ grain. Increased livestock numbers in Europe have increased demand for high-quality nutritional feed, propelling the region’s demand for distillers’ grain.

The Asia Pacific Distillers Grains Market has grown rapidly due to an increase in livestock population, increased product awareness among end-users, and easy availability of distillers’ grain sources. The supply of insufficient high-quality nutritive livestock feed in the Middle East and Africa, as well as the availability of lower-cost alternative feed over traditional feed, are expected to boost distillers’ grain sales during the forecast period. Similarly, South America is expected to be a profitable market during the forecast period.

Key Market Segments: Distillers Grains Market

Distillers Grains Market By Type, 2023-2029, (USD Billion)

- Wet Distillers Grains (WDG)

- Dried Distillers Grains with Soluble (DDGS)

- Dried Distillers Grains (DDG)

Distillers Grains Market By Source, 2023-2029, (USD Billion)

- Wheat

- Corn

- Others

Distillers Grains Market By Livestock, 2023-2029, (USD Billion)

- Ruminants

- Swine

- Poultry

- Others

Distillers Grains Market By Regions, 2023-2029, (USD Billion)

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Important Countries in All Regions Are Covered

Key Question Answered

- What is the current scenario of the global Distillers Grains market?

- What are the emerging technologies for the development of Distillers Grains devices?

- What are the historical size and the present size of the market segments and their future potential?

- What are the major catalysts for the market and their impact during the short, medium, and long terms?

- What are the evolving opportunities for the players in the market?

- Which are the key regions from the investment perspective?

- What are the key strategies being adopted by the major players to up their market shares?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Distiller Grains Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Distiller Grains Market

- Porter’s five forces model

- Threat from new entrants

- Threat from substitutes

- Bargaining power of suppliers

- Bargaining power of customers

- Degree of competition

- Industry value chain Analysis

- Global Distiller Grains Market Outlook

- Global Distiller Grains Market by Type, 2020-2029, (USD BILLION)

- Wet Distillers Grains (WDG)

- Dried Distillers Grains With Soluble (DDGS)

- Dried Distillers Grains (DDG)

- Global Distiller Grains Market by Source, 2020-2029, (USD BILLION)

- Wheat

- Corn

- Others

- Global Distiller Grains Market by Livestock, 2020-2029, (USD BILLIONS)

- Ruminants

- Swine

- Poultry

- Others

- Global Distiller Grains Market by Region, 2020-2029, (USD BILLION)

- North America

- US

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Colombia

- Rest Of South America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest Of Europe

- Asia Pacific

- India

- China

- Japan

- South Korea

- Australia

- South-East Asia

- Rest Of Asia Pacific

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest Of Middle East and Africa

- North America

- Company Profiles*

(Business Overview, Company Snapshot, Products Offered, Recent Developments)

9.1. Purina Animal Nutrition

9.2. Valero

9.3. Pacific Ethanol, Inc.

9.4. Flint Hill Resources

9.5. Green Plains Inc.

9.6. Archer Daniels Midland

9.7. Husky Energy

9.8. Bunge Limited

9.9. Poet LLC

9.10. Crop Energies AG

*The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL DISTILLER GRAINS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 2 GLOBAL DISTILLER GRAINS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 3 GLOBAL DISTILLER GRAINS MARKET BY LIVESTOCK (USD BILLION) 2020-2029

TABLE 4 GLOBAL DISTILLER GRAINS MARKET BY REGION (USD BILLION) 2020-2029

TABLE 5 NORTH AMERICA DISTILLER GRAINS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 6 NORTH AMERICA DISTILLER GRAINS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 7 NORTH AMERICA DISTILLER GRAINS MARKET BY LIVESTOCK (USD BILLION) 2020-2029

TABLE 8 NORTH AMERICA DISTILLER GRAINS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 9 US DISTILLER GRAINS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 10 US DISTILLER GRAINS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 11 US DISTILLER GRAINS MARKET BY LIVESTOCK (USD BILLION) 2020-2029

TABLE 12 CANADA DISTILLER GRAINS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 13 CANADA DISTILLER GRAINS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 14 CANADA DISTILLER GRAINS MARKET BY LIVESTOCK (USD BILLION) 2020-2029

TABLE 15 MEXICO DISTILLER GRAINS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 16 MEXICO DISTILLER GRAINS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 17 MEXICO DISTILLER GRAINS MARKET BY LIVESTOCK (USD BILLION) 2020-2029

TABLE 18 SOUTH AMERICA DISTILLER GRAINS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 19 SOUTH AMERICA DISTILLER GRAINS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 20 SOUTH AMERICA DISTILLER GRAINS MARKET BY LIVESTOCK (USD BILLION) 2020-2029

TABLE 21 SOUTH AMERICA DISTILLER GRAINS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 22 BRAZIL DISTILLER GRAINS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 23 BRAZIL DISTILLER GRAINS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 24 BRAZIL DISTILLER GRAINS MARKET BY LIVESTOCK (USD BILLION) 2020-2029

TABLE 25 ARGENTINA DISTILLER GRAINS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 26 ARGENTINA DISTILLER GRAINS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 27 ARGENTINA DISTILLER GRAINS MARKET BY LIVESTOCK (USD BILLION) 2020-2029

TABLE 28 COLUMBIA DISTILLER GRAINS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 29 COLUMBIA DISTILLER GRAINS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 30 COLUMBIA DISTILLER GRAINS MARKET BY LIVESTOCK (USD BILLION) 2020-2029

TABLE 31 REST OF SOUTH AMERICA DISTILLER GRAINS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 32 REST OF SOUTH AMERICA DISTILLER GRAINS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 33 REST OF SOUTH AMERICA DISTILLER GRAINS MARKET BY LIVESTOCK (USD BILLION) 2020-2029

TABLE 34 ASIA PACIFIC DISTILLER GRAINS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 35 ASIA PACIFIC DISTILLER GRAINS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 36 ASIA PACIFIC DISTILLER GRAINS MARKET BY LIVESTOCK (USD BILLION) 2020-2029

TABLE 37 ASIA PACIFIC DISTILLER GRAINS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 38 INDIA DISTILLER GRAINS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 39 INDIA DISTILLER GRAINS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 40 INDIA DISTILLER GRAINS MARKET BY LIVESTOCK (USD BILLION) 2020-2029

TABLE 41 CHINA DISTILLER GRAINS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 42 CHINA DISTILLER GRAINS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 43 CHINA DISTILLER GRAINS MARKET BY LIVESTOCK (USD BILLION) 2020-2029

TABLE 44 JAPAN DISTILLER GRAINS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 45 JAPAN DISTILLER GRAINS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 46 JAPAN DISTILLER GRAINS MARKET BY LIVESTOCK (USD BILLION) 2020-2029

TABLE 47 SOUTH KOREA DISTILLER GRAINS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 48 SOUTH KOREA DISTILLER GRAINS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 49 SOUTH KOREA DISTILLER GRAINS MARKET BY LIVESTOCK (USD BILLION) 2020-2029

TABLE 50 AUSTRALIA DISTILLER GRAINS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 51 AUSTRALIA DISTILLER GRAINS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 52 AUSTRALIA DISTILLER GRAINS MARKET BY LIVESTOCK (USD BILLION) 2020-2029

TABLE 53 SOUTH EAST ASIA DISTILLER GRAINS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 54 SOUTH EAST ASIA DISTILLER GRAINS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 55 SOUTH EAST ASIA DISTILLER GRAINS MARKET BY LIVESTOCK (USD BILLION) 2020-2029

TABLE 56 REST OF ASIA PACIFIC DISTILLER GRAINS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 57 REST OF ASIA PACIFIC DISTILLER GRAINS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 58 REST OF ASIA PACIFIC DISTILLER GRAINS MARKET BY LIVESTOCK (USD BILLION) 2020-2029

TABLE 59 EUROPE DISTILLER GRAINS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 60 EUROPE DISTILLER GRAINS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 61 EUROPE DISTILLER GRAINS MARKET BY LIVESTOCK (USD BILLION) 2020-2029

TABLE 62 EUROPE DISTILLER GRAINS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 63 GERMANY DISTILLER GRAINS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 64 GERMANY DISTILLER GRAINS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 65 GERMANY DISTILLER GRAINS MARKET BY LIVESTOCK (USD BILLION) 2020-2029

TABLE 66 UK DISTILLER GRAINS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 67 UK DISTILLER GRAINS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 68 UK DISTILLER GRAINS MARKET BY LIVESTOCK (USD BILLION) 2020-2029

TABLE 69 FRANCE DISTILLER GRAINS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 70 FRANCE DISTILLER GRAINS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 71 FRANCE DISTILLER GRAINS MARKET BY LIVESTOCK (USD BILLION) 2020-2029

TABLE 72 ITALY DISTILLER GRAINS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 73 ITALY DISTILLER GRAINS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 74 ITALY DISTILLER GRAINS MARKET BY LIVESTOCK (USD BILLION) 2020-2029

TABLE 75 SPAIN DISTILLER GRAINS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 76 SPAIN DISTILLER GRAINS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 77 SPAIN DISTILLER GRAINS MARKET BY LIVESTOCK (USD BILLION) 2020-2029

TABLE 78 RUSSIA DISTILLER GRAINS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 79 RUSSIA DISTILLER GRAINS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 80 RUSSIA DISTILLER GRAINS MARKET BY LIVESTOCK (USD BILLION) 2020-2029

TABLE 81 REST OF EUROPE DISTILLER GRAINS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 82 REST OF EUROPE DISTILLER GRAINS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 83 REST OF EUROPE DISTILLER GRAINS MARKET BY LIVESTOCK (USD BILLION) 2020-2029

TABLE 84 MIDDLE EAST & AFRICA DISTILLER GRAINS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 85 MIDDLE EAST & AFRICA DISTILLER GRAINS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 86 MIDDLE EAST & AFRICA DISTILLER GRAINS MARKET BY LIVESTOCK (USD BILLION) 2020-2029

TABLE 87 MIDDLE EAST & AFRICA DISTILLER GRAINS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 88 UAE DISTILLER GRAINS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 89 UAE DISTILLER GRAINS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 90 UAE DISTILLER GRAINS MARKET BY LIVESTOCK (USD BILLION) 2020-2029

TABLE 91 SAUDI ARABIA DISTILLER GRAINS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 92 SAUDI ARABIA DISTILLER GRAINS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 93 SAUDI ARABIA DISTILLER GRAINS MARKET BY LIVESTOCK (USD BILLION) 2020-2029

TABLE 94 SOUTH AFRICA DISTILLER GRAINS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 95 SOUTH AFRICA DISTILLER GRAINS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 96 SOUTH AFRICA DISTILLER GRAINS MARKET BY LIVESTOCK (USD BILLION) 2020-2029

TABLE 97 REST OF MIDDLE EAST & AFRICA DISTILLER GRAINS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 98 REST OF MIDDLE EAST & AFRICA DISTILLER GRAINS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 99 REST OF MIDDLE EAST & AFRICA DISTILLER GRAINS MARKET BY LIVESTOCK (USD BILLION) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL DISTILLER GRAINS MARKET BY TYPE, USD BILLION, 2020-2029

FIGURE 9 GLOBAL DISTILLER GRAINS MARKET BY SOURCE, USD BILLION, 2020-2029

FIGURE 10 GLOBAL DISTILLER GRAINS MARKET BY LIVESTOCK, USD BILLION, 2020-2029

FIGURE 11 GLOBAL DISTILLER GRAINS MARKET BY MATERIAL, USD BILLION, 2020-2029

FIGURE 12 GLOBAL DISTILLER GRAINS MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 13 PORTER’S FIVE FORCES MODEL

FIGURE 14 GLOBAL DISTILER GRAINS MARKET BY TYPE (USD BILLION), 2021

FIGURE 15 GLOBAL DISTILER GRAINS MARKET BY SOURCE (USD BILLION), 2021

FIGURE 16 GLOBAL DISTILER GRAINS MARKET BY LIVESTOCK (USD BILLION), 2021

FIGURE 17 GLOBAL DISTILER GRAINS MARKET BY MATERIAL (USD BILLION), 2021

FIGURE 18 NORTH AMERICA DISTILLER GRAINS MARKET SNAPSHOT

FIGURE 19 EUROPE DISTILLER GRAINS MARKET SNAPSHOT

FIGURE 20 SOUTH AMERICA DISTILLER GRAINS MARKET SNAPSHOT

FIGURE 21 ASIA PACIFIC DISTILLER GRAINS MARKET SNAPSHOT

FIGURE 22 MIDDLE EAST ASIA AND AFRICA DISTILLER GRAINS MARKET SNAPSHOT

FIGURE 23 MARKET SHARE ANALYSIS

FIGURE 24 PURINA ANIMAL NUTRITION: COMPANY SNAPSHOT

FIGURE 25 VALERO: COMPANY SNAPSHOT

FIGURE 26 PACIFIC ETHANOL, INC.: COMPANY SNAPSHOT

FIGURE 27 FLINT HILL RESOURCES: COMPANY SNAPSHOT

FIGURE 28 GREEN PLAINS INC.: COMPANY SNAPSHOT

FIGURE 29 ARCHER DANIELS MIDLAND: COMPANY SNAPSHOT

FIGURE 30 HUSKY ENERGY: COMPANY SNAPSHOT

FIGURE 31 BUNGE LIMITED: COMPANY SNAPSHOT

FIGURE 32 POET LLC: COMPANY SNAPSHOT

FIGURE 33 CROP ENERGIES AG: COMPANY SNAPSHOT

FAQ

The Distiller Grains market reached USD 11.90 billion in 2022 and is expected to grow at a CAGR of more than 6.7% through 2029, owing to the increasing adoption of Dried Distiller Grains with soluble segment.

The upcoming trend in the Distiller Grains market is an opportunity for market growth in enterprise applications.

The global Distillers Grains market grew at a 6.7% CAGR from 2023 to 2029. The corn distiller grain segment contributed the most to market revenue.

North America dominates the global distillers’ grains market in terms of revenue due to high production and consumption of distillers’ grains, as well as increasing government initiatives for ease of trade of products promoted by the United States Grains Council (USGC) in the region, which includes distillers’ grains.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.