REPORT OUTLOOK

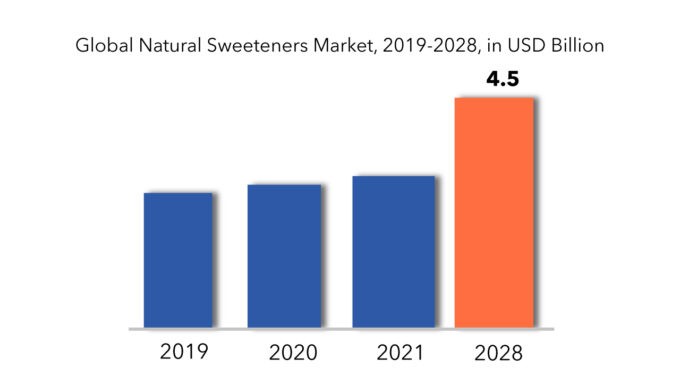

| Market Size | CAGR | Dominating Region |

|---|---|---|

| 3.8 Bilion | 6.1% | Asia Pacific |

| by Type | by End-Use Sector | by Regions |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Natural Sweeteners Market Overview

The global natural sweeteners market size is estimated to be valued at USD 2.8 billion in 2020 and projected to reach USD 3.8 billion by 2028, recording a CAGR of 6.1% during the forecast period.

The increasing popularity of sweeteners derived from natural sources and possessing low caloric content is evident among consumers and within the food and beverage industry. Natural sweeteners encompass products sourced from various natural origins, including stevia leaves, honey, dates, fruits, vegetables, and others. Prominent examples available in the market include honey, stevia, molasses, dates, coconut sugar, and agave syrup. This surge in demand for such sweeteners in recent years can be attributed to heightened consumer awareness regarding the adverse effects associated with artificial sweeteners. Sweeteners like stevia and sugar alcohols are frequently incorporated into food products and marketed as “sugar-free” or “diet” options.

Manufacturers are actively embracing novel technologies to extract and develop new sweeteners to cater to the escalating market demand. These technologies aid companies in isolating novel sweeteners sourced from natural origins, facilitating the substitution of conventional sugar and recently introduced artificial sweeteners. Notably, in 2023, MycoTechnology successfully extracted honey from a white honey truffle discovered in Hungary. This development has garnered interest from numerous commercial food manufacturers seeking collaborations to introduce innovative products to the market. Collaborative endeavors of this nature enable food and beverage manufacturers to introduce clean-label, health-conscious products.

According to statistics from the World Health Organization (WHO), approximately 422 million individuals worldwide are afflicted with diabetes. Consequently, the consumption of such products is witnessing an annual increase. Therefore, manufacturers are channeling investments into enhancing plant production and requisite infrastructure for the cultivation and processing of plants required for deriving these sweeteners.

Natural Sweeteners Market Segment Analysis

On the basis of type, natural sweeteners market is sub-segmented into stevia, sorbitol, xylitol, mannitol, erythritol, sweet proteins, and others. The stevia segment is expected to experience the fastest growth in the global market, on the basis of type, in 2019. The sweet-tasting components of stevia are called steviol glycosides, which are naturally present in the stevia leaf. Owing to this, people with diabetes can consume a wider variety of foods and comply with a healthy meal plan by substituting sugar with stevia.

On the basis of end-use sector, natural sweeteners market is sub-segmented into food & beverage, pharmaceutical, direct sales, and others. The food & beverage segment accounted for the fastest growing segment in the global market, in 2019, in terms of value. Sugars are largely consumed to offer a sweetening taste in an array of food & beverage products. Owing to this, most of the consumption of natural sweeteners is also witnessed in the food & beverage industry.

Natural Sweeteners Market Players

Market players focus on growth strategies, such as new product launches, collaborations, partnerships, operational expansion, mergers & acquisitions, and awareness campaigns. Companies operating the target market can focus on partnerships and collaborations, in order to develop advanced products which in turn create lucrative growth opportunities. Few of the important market players include Dupont, ADM, Tate & Lyle, Ingredion incorporated, Cargill incorporated, Roquette frères, Purecircle ltd, Macandrews & Forbes holdings inc, Foodchem international corporation and Ecogreen oleochemicals pvt ltd.

Companies are mainly in the coatings manufacturing and they are competing closely with each other. Innovation is one of the most important and key strategy as it has to be for any market. However, companies in the market have also opted and successfully driven inorganic growth strategies like mergers & acquisition and so on.

- In July 2020, Tate & Lyle launched the VANTAGE sweetener solution design tools. It is a set of new and innovative sweetener solution design tools along with an education program, which is designed for creating sugar-reduced food and drinks using low-calorie sweeteners.

In July 2018, ADM and Aston Foods (Russia) entered into a joint venture of sweeteners and starches in Russia. This helped the company in expanding its footprint in the Russian natural sweeteners market.

Who Should Buy? Or Key Stakeholders

- Natural sweeteners Companies

- Natural sweeteners Consulting firms

- Research Organizations

- Investors

- Manufacturing companies

- Regulatory Authorities

- Others

Natural Sweeteners Market Regional Analysis

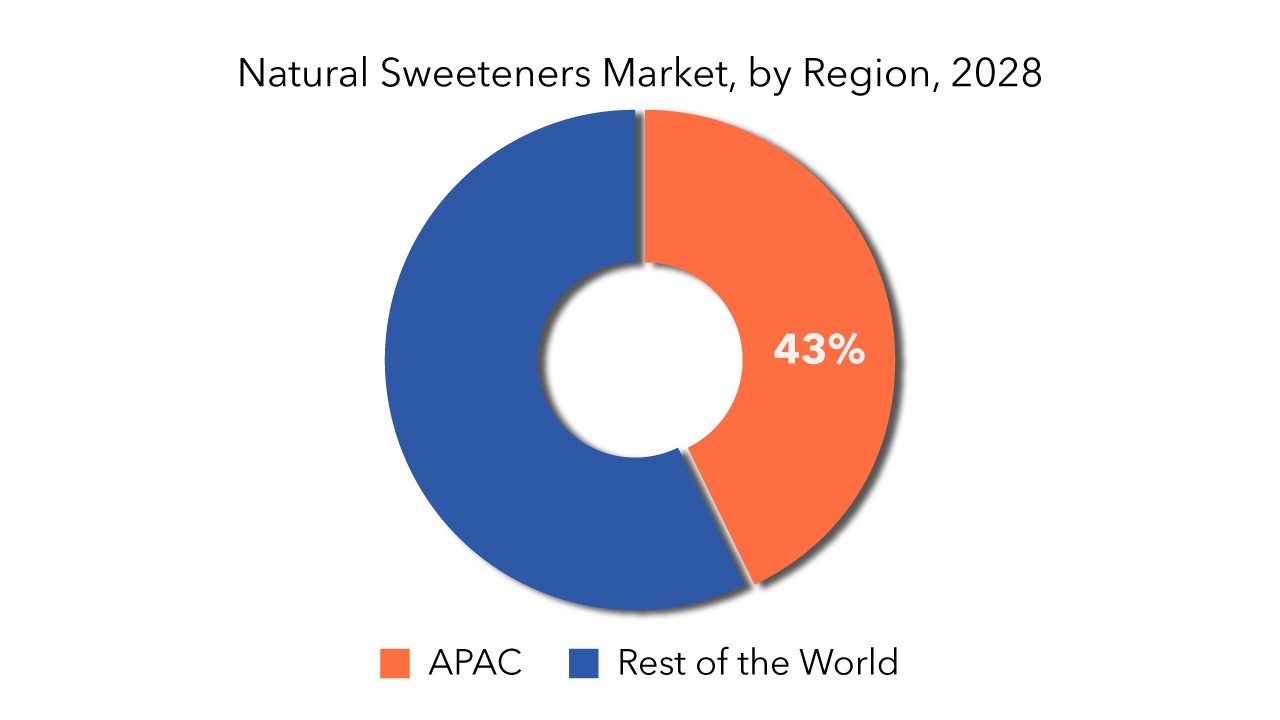

The natural sweeteners market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes US, Canada and Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

The major share is expected to be occupied by Asia Pacific for global natural sweeteners market during the forecast period. The market in the Asia Pacific region is growing due to the change in the lifestyle of customers and the increase in health consciousness among them. The market in this region is witnessing a drastic transformation regarding diet diversification, rapid urbanization, and liberal trade policies in the food sector.

Key Market Segments:

Natural Sweeteners Market by Type, 2019-2028, (In USD Million)

- Stevia

- Sorbitol

- Xylitol

- Mannitol

- Erythritol

- Sweet Proteins

- Others

Global Market by End-Use Sector, 2019-2028, (In USD Million)

- Food & Beverage

- Pharmaceutical

- Direct Sales

- Others

Global Market by Regions, 2019-2028, (In USD Million)

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Key Question Answered

- What is the current market size of this high growth market?

- What is the overall growth rate?

- What are the key growth areas, applications, end uses and types?

- Key reasons for growth

- Challenges for growth

- Who are the important market players in this market?

- What are the key strategies of these players?

- What technological developments are happening in this area?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Natural Sweeteners Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact Of Covid-19 On Global Natural Sweeteners Market

- Global Natural Sweeteners Market Outlook

- Global Natural Sweeteners Market By Type, (USD Million)

- Stevia

- Sorbitol

- Xylitol

- Mannitol

- Erythritol

- Sweet Proteins

- Global Natural Sweeteners Market By End-use Sector, (USD Million)

- Food & Beverage

- Pharmaceutical

- Direct Sales

- Global Natural Sweeteners Market By Region, (USD Million)

- Introduction

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- South-East Asia

- Rest Of Asia-Pacific

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Rest Of Europe

- South America

- Brazil

- Argentina

- Colombia

- Rest Of South America

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest Of Middle East and Africa

- Company Profiles* (Business Overview, Company Snapshot, Products Offered, Recent Developments)

- Dupont

- ADM

- Tate & Lyle

- Ingredion incorporated

- Cargill incorporated

- Roquette frères

- Purecircle ltd

- Macandrews & Forbes holdings inc

- Foodchem international corporation

- Ecogreen oleochemicals pvt ltd

- Others

*The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL FOOD COLORS AND FLAVORS MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 2 GLOBAL FOOD COLORS AND FLAVORS MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 3 GLOBAL FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (USD MILLIONS), 2019-2028

TABLE 4 GLOBAL FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (KILOTONS), 2019-2028

TABLE 5 GLOBAL FOOD COLORS AND FLAVORS MARKET BY REGION (USD MILLIONS), 2019-2028

TABLE 6 GLOBAL FOOD COLORS AND FLAVORS MARKET BY REGION (KILOTONS), 2019-2028

TABLE 7 NORTH AMERICA FOOD COLORS AND FLAVORS MARKET BY COUNTRY (USD MILLIONS), 2019-2028

TABLE 8 NORTH AMERICA FOOD COLORS AND FLAVORS MARKET BY COUNTRY (KILOTONS), 2019-2028

TABLE 9 US FOOD COLORS AND FLAVORS MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 10 US FOOD COLORS AND FLAVORS MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 11 US FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (USD MILLIONS), 2019-2028

TABLE 12 US FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (KILOTONS), 2019-2028

TABLE 13 CANADA FOOD COLORS AND FLAVORS MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 14 CANADA FOOD COLORS AND FLAVORS MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 15 CANADA FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (USD MILLIONS), 2019-2028

TABLE 16 CANADA FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (KILOTONS), 2019-2028

TABLE 17 MEXICO FOOD COLORS AND FLAVORS MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 18 MEXICO FOOD COLORS AND FLAVORS MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 19 MEXICO FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (USD MILLIONS), 2019-2028

TABLE 20 MEXICO FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (KILOTONS), 2019-2028

TABLE 21 SOUTH AMERICA FOOD COLORS AND FLAVORS MARKET BY COUNTRY (USD MILLIONS), 2019-2028

TABLE 22 SOUTH AMERICA FOOD COLORS AND FLAVORS MARKET BY COUNTRY (KILOTONS), 2019-2028

TABLE 23 BRAZIL FOOD COLORS AND FLAVORS MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 24 BRAZIL FOOD COLORS AND FLAVORS MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 25 BRAZIL FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (USD MILLIONS), 2019-2028

TABLE 26 BRAZIL FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (KILOTONS), 2019-2028

TABLE 27 ARGENTINA FOOD COLORS AND FLAVORS MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 28 ARGENTINA FOOD COLORS AND FLAVORS MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 29 ARGENTINA FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (USD MILLIONS), 2019-2028

TABLE 30 ARGENTINA FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (KILOTONS), 2019-2028

TABLE 31 COLOMBIA FOOD COLORS AND FLAVORS MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 32 COLOMBIA FOOD COLORS AND FLAVORS MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 33 COLOMBIA FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (USD MILLIONS), 2019-2028

TABLE 34 COLOMBIA FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (KILOTONS), 2019-2028

TABLE 35 REST OF SOUTH AMERICA FOOD COLORS AND FLAVORS MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 36 REST OF SOUTH AMERICA FOOD COLORS AND FLAVORS MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 37 REST OF SOUTH AMERICA FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (USD MILLIONS), 2019-2028

TABLE 38 REST OF SOUTH AMERICA FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (KILOTONS), 2019-2028

TABLE 39 ASIA-PACIFIC FOOD COLORS AND FLAVORS MARKET BY COUNTRY (USD MILLIONS), 2019-2028

TABLE 40 ASIA-PACIFIC FOOD COLORS AND FLAVORS MARKET BY COUNTRY (KILOTONS), 2019-2028

TABLE 41 INDIA FOOD COLORS AND FLAVORS MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 42 INDIA FOOD COLORS AND FLAVORS MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 43 INDIA FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (USD MILLIONS), 2019-2028

TABLE 44 INDIA FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (KILOTONS), 2019-2028

TABLE 45 CHINA FOOD COLORS AND FLAVORS MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 46 CHINA FOOD COLORS AND FLAVORS MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 47 CHINA FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (USD MILLIONS), 2019-2028

TABLE 48 CHINA FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (KILOTONS), 2019-2028

TABLE 49 JAPAN FOOD COLORS AND FLAVORS MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 50 JAPAN FOOD COLORS AND FLAVORS MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 51 JAPAN FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (USD MILLIONS), 2019-2028

TABLE 52 JAPAN FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (KILOTONS), 2019-2028

TABLE 53 SOUTH KOREA FOOD COLORS AND FLAVORS MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 54 SOUTH KOREA FOOD COLORS AND FLAVORS MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 55 SOUTH KOREA FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (USD MILLIONS), 2019-2028

TABLE 56 SOUTH KOREA FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (KILOTONS), 2019-2028

TABLE 57 AUSTRALIA FOOD COLORS AND FLAVORS MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 58 AUSTRALIA FOOD COLORS AND FLAVORS MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 59 AUSTRALIA FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (USD MILLIONS), 2019-2028

TABLE 60 AUSTRALIA FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (KILOTONS), 2019-2028

TABLE 61 SOUTH-EAST ASIA FOOD COLORS AND FLAVORS MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 62 SOUTH-EAST ASIA FOOD COLORS AND FLAVORS MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 63 SOUTH-EAST ASIA FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (USD MILLIONS), 2019-2028

TABLE 64 SOUTH-EAST ASIA FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (KILOTONS), 2019-2028

TABLE 65 REST OF ASIA PACIFIC FOOD COLORS AND FLAVORS MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 66 REST OF ASIA PACIFIC FOOD COLORS AND FLAVORS MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 67 REST OF ASIA PACIFIC FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (USD MILLIONS), 2019-2028

TABLE 68 REST OF ASIA PACIFIC FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (KILOTONS), 2019-2028

TABLE 69 EUROPE FOOD COLORS AND FLAVORS MARKET BY COUNTRY (USD MILLIONS), 2019-2028

TABLE 70 EUROPE FOOD COLORS AND FLAVORS MARKET BY COUNTRY (KILOTONS), 2019-2028

TABLE 71 GERMANY FOOD COLORS AND FLAVORS MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 72 GERMANY FOOD COLORS AND FLAVORS MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 73 GERMANY FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (USD MILLIONS), 2019-2028

TABLE 74 GERMANY FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (KILOTONS), 2019-2028

TABLE 75 UK FOOD COLORS AND FLAVORS MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 76 UK FOOD COLORS AND FLAVORS MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 77 UK FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (USD MILLIONS), 2019-2028

TABLE 78 UK FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (KILOTONS), 2019-2028

TABLE 79 FRANCE FOOD COLORS AND FLAVORS MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 80 FRANCE FOOD COLORS AND FLAVORS MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 81 FRANCE FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (USD MILLIONS), 2019-2028

TABLE 82 FRANCE FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (KILOTONS), 2019-2028

TABLE 83 ITALY FOOD COLORS AND FLAVORS MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 84 ITALY FOOD COLORS AND FLAVORS MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 85 ITALY FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (USD MILLIONS), 2019-2028

TABLE 86 ITALY FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (KILOTONS), 2019-2028

TABLE 87 SPAIN FOOD COLORS AND FLAVORS MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 88 SPAIN FOOD COLORS AND FLAVORS MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 89 SPAIN FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (USD MILLIONS), 2019-2028

TABLE 90 SPAIN FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (KILOTONS), 2019-2028

TABLE 91 RUSSIA FOOD COLORS AND FLAVORS MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 92 RUSSIA FOOD COLORS AND FLAVORS MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 93 RUSSIA FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (USD MILLIONS), 2019-2028

TABLE 94 RUSSIA FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (KILOTONS), 2019-2028

TABLE 95 REST OF EUROPE FOOD COLORS AND FLAVORS MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 96 REST OF EUROPE FOOD COLORS AND FLAVORS MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 97 REST OF EUROPE FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (USD MILLIONS), 2019-2028

TABLE 98 REST OF EUROPE FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (KILOTONS), 2019-2028

TABLE 99 MIDDLE EAST AND AFRICA FOOD COLORS AND FLAVORS MARKET BY COUNTRY (USD MILLIONS), 2019-2028

TABLE 100 MIDDLE EAST AND AFRICA FOOD COLORS AND FLAVORS MARKET BY COUNTRY (KILOTONS), 2019-2028

TABLE 101 UAE FOOD COLORS AND FLAVORS MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 102 UAE FOOD COLORS AND FLAVORS MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 103 UAE FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (USD MILLIONS), 2019-2028

TABLE 104 UAE FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (KILOTONS), 2019-2028

TABLE 105 SAUDI ARABIA FOOD COLORS AND FLAVORS MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 106 SAUDI ARABIA FOOD COLORS AND FLAVORS MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 107 SAUDI ARABIA FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (USD MILLIONS), 2019-2028

TABLE 108 SAUDI ARABIA FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (KILOTONS), 2019-2028

TABLE 109 SOUTH AFRICA FOOD COLORS AND FLAVORS MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 110 SOUTH AFRICA FOOD COLORS AND FLAVORS MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 111 SOUTH AFRICA FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (USD MILLIONS), 2019-2028

TABLE 112 SOUTH AFRICA FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (KILOTONS), 2019-2028

TABLE 113 REST OF MIDDLE EAST AND AFRICA FOOD COLORS AND FLAVORS MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 114 REST OF MIDDLE EAST AND AFRICA FOOD COLORS AND FLAVORS MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 115 REST OF MIDDLE EAST AND AFRICA FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (USD MILLIONS), 2019-2028

TABLE 116 REST OF MIDDLE EAST AND AFRICA FOOD COLORS AND FLAVORS MARKET BY END-USE SECTOR (KILOTONS), 2019-2028

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL NATURAL SWEETENERS MARKET BY TYPE, USD MILLION, 2019-2028

FIGURE 9 GLOBAL NATURAL SWEETENERS MARKET BY APPLICATION, USD MILLION, 2019-2028

FIGURE 10 GLOBAL NATURAL SWEETENERS MARKET BY REGION, USD MILLION, 2019-2028

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL NATURAL SWEETENERS MARKET BY TYPE, USD MILLION, 2019-2028

FIGURE 13 GLOBAL NATURAL SWEETENERS MARKET BY APPLICATION, USD MILLION, 2019-2028

FIGURE 14 GLOBAL NATURAL SWEETENERS MARKET BY REGION, USD MILLION, 2019-2028

FIGURE 15 NATURAL SWEETENERS MARKET BY REGION 2020

FIGURE 16 MARKET SHARE ANALYSIS

FIGURE 17 ARCHER DANIELS MIDLAND: COMPANY SNAPSHOT

FIGURE 18 CARGILL: COMPANY SNAPSHOT

FIGURE 19 DUPONT: COMPANY SNAPSHOT

FIGURE 20 TATE & LYLE: COMPANY SNAPSHOT

FIGURE 21 INGREDION INCORPORATED: COMPANY SNAPSHOT

FIGURE 22 ROQUETTE FRERES: COMPANY SNAPSHOT

FIGURE 23 PURECIRCLE LTD: COMPANY SNAPSHOT

FIGURE 24 MACANDREWS & FORBES HOLDINGS INC: COMPANY SNAPSHOT

FIGURE 25 FOODCHEM INTERNATIONAL CORPORATION: COMPANY SNAPSHOT

FIGURE 26 ECOGREEN OLEOCHEMICALS PVT LTD: COMPANY SNAPSHOT

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.