REPORT OUTLOOK

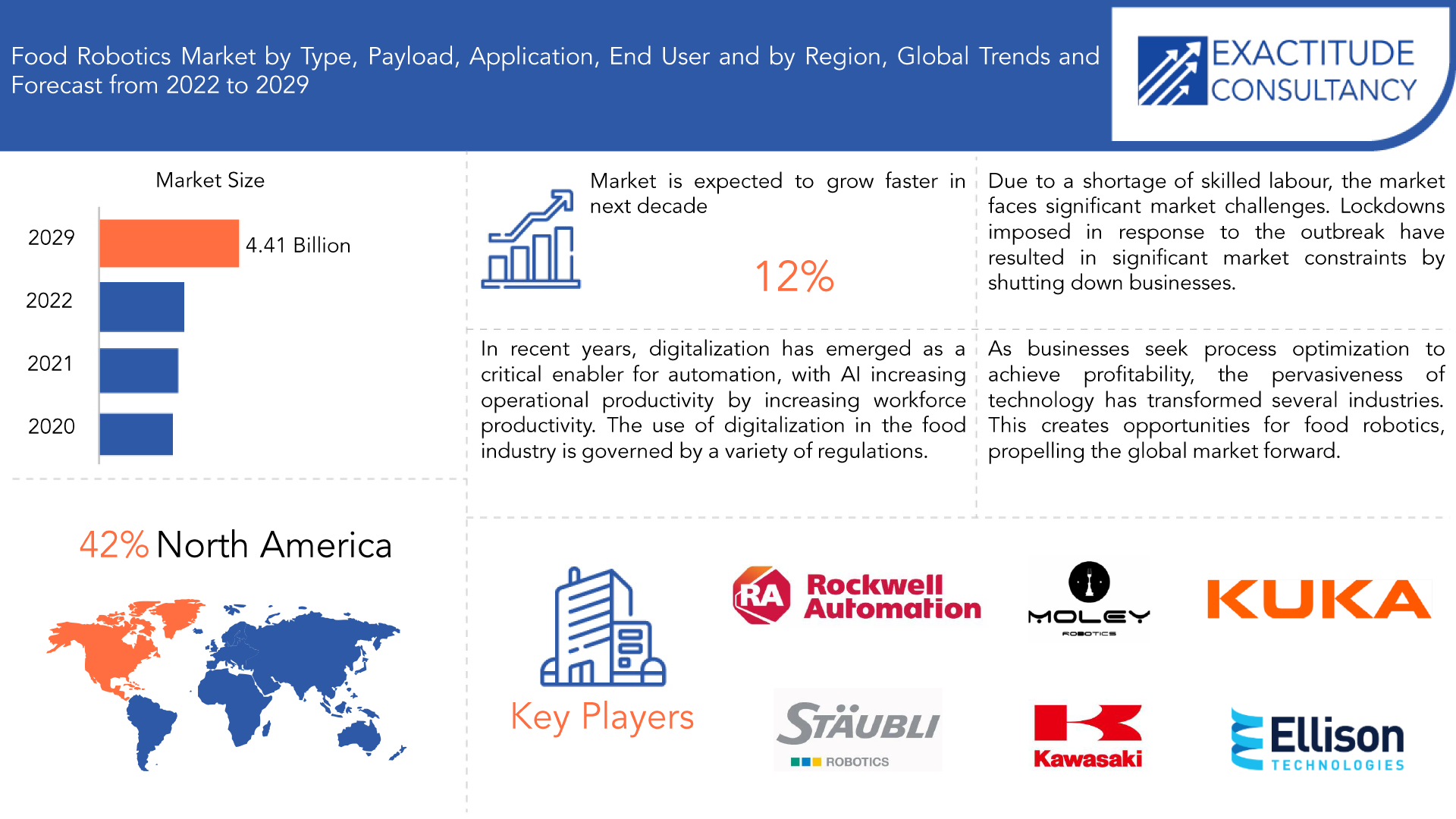

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 4.41 Billion by 2029 | 12% | North America |

| By Type | By Payload | By Application | By End User | By Region |

|---|---|---|---|---|

|

|

|

|

|

SCOPE OF THE REPORT

Food Robotics Market Overview

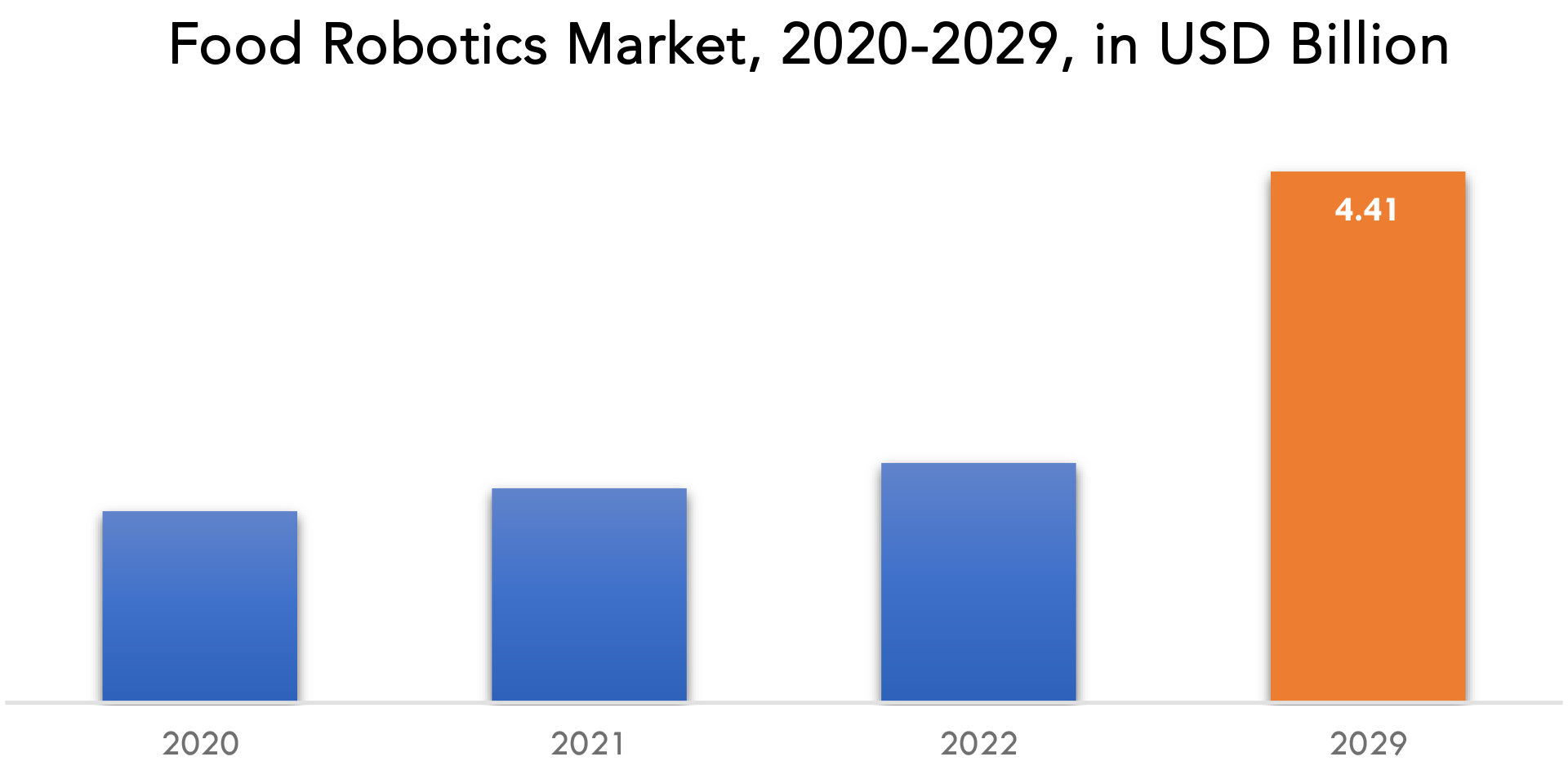

The food robotics market is expected to grow at 12% CAGR from 2021 to 2029. It is expected to reach above USD 4.41 Billion by 2029 from USD 1.59 Billion in 2020.

Food robotics refers to machines used in the food and beverage industries to perform complex tasks such as picking, packing, and palletizing. Various technological advancements in a variety of industries have made fictional robots a reality. As the demand for increased productivity grows, so does the deployment of robots to automate tasks, resulting in robots becoming an integral part of many industries.

Global consumption of processed foods has increased in recent decades. A major contributor to this increase is the world’s growing population. As a result, urban consumers have access to a much broader range of food options and better food availability than rural consumers. This urbanization trend significantly contributes to higher living standards and rising incomes, which has a greater impact on the affordability of processed food products.

The food robotics market is being driven by the transformation of the food and beverage sector with the adoption of automated technologies and the rising demand for high-quality and ready-to-eat food. The need for productivity and efficiency in food processing activities such as palletizing, packaging, and grading to meet food safety standards is a major driver of robotics demand in this sector.

Food robots perform complex manufacturing processes such as dispensing, feed placement, packaging, and casing, picking and placing products into containers, sorting raw materials, and labelling packages. They assist in performing repetitive and time-consuming production tasks at high speeds in extreme conditions such as high temperatures. They also save space and time, reduce production costs, and improve the cleanliness, safety, and efficiency of manufacturing processes. As a result, leading players in the food and beverage industry around the world are automating the food production process with food robotics technology to mass-produce products with high precision and yields.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion), Volume (Thousand Units) |

| Segmentation | By Type, By Payload, By Application, By End User, By Region |

| By Resin Payload

|

|

| By Payload

|

|

| By Application

|

|

| By End User

|

|

| By Region

|

|

The COVID-19 pandemic has resulted in widespread economic downturn. To contain the infection, several countries imposed strict lockdowns, resulting in the shutdown of food & beverages processing plants and the disruption of the food & beverages supply chain for a limited time. The shortage of food & beverages products and essential items, panic buying by consumers around the world, interruption of supply chains due to travel restrictions, and labour shortages have all had a significant impact on the food & beverages supply chain.

Major robot manufacturing companies worldwide reported a decline in revenue generation during the first and second quarters of 2020 due to lower sales caused by an economic slowdown caused by lockdown and quarantine restrictions imposed by governments worldwide, as well as a temporary drop in demand for automation. Despite qualifying as essential services during lockdowns in many countries, food and beverage companies suffered losses in some pandemic-affected developing countries. These factors have had a negative impact on the global food robotics market, resulting in revenue losses in the first two quarters of 2020.

The pandemic has had a significant impact on the entire food and beverage ecosystem, from raw material providers to food service and delivery companies. However, the industry is expected to pick up steam in 2021. As a result of the need to limit human contact in order to prevent the spread of COVID-19, robots are expected to be deployed in a variety of end-user facilities around the world.

Food Robotics Market Segment Analysis

The food robotics market is segmented based on type, payload, application, end user, and region.

On the basis of type, the market is segmented into articulates, cartesian, scara, parallel, cylindrical, collaboratives. The collaborative robot segment is expected to grow at the fastest CAGR during the forecast period. This segment’s rapid growth can be attributed to a growing awareness of the importance of working in humid greenhouses, from refrigerated rooms to tending hot ovens, relieving employees of repetitive tasks that can cause injury in unfavourable environments. As a result of rapid technological advancements and lower costs, collaborative robots are being adopted by businesses all over the world.

Based on payload, the market is segmented into low, medium, heavy. During the forecast period, the low payload segment is expected to grow at the fastest CAGR. The rapid growth of this segment is primarily due to its expertise in pick-and-place, food handling, packaging, and palletizing, sealing, labelling, and spraying, among other things. It also reduces cycle time and increases productivity.

Based on application, the market is segmented into palletizing, packaging, repackaging, pick and place, processing. During the forecast period, the packaging and repacking segment is expected to grow at the fastest CAGR. The rapid growth of this segment is primarily due to the extensive use of packaging, which reduces cycle times and increases productivity.

Based on end user, the market is segmented into beverages, meat, poultry, seafood, dairy, bakery, fruits & vegetables, confectionery. The beverages segment is expected to grow at the fastest CAGR during the forecast period. This segment’s rapid growth can be attributed to the growing need to meet consumer demand while also maintaining quality, consistency, and hygiene and optimizing production. As food and beverage companies demand greater precision and safety from their manufacturing operations, various robotic companies are developing cutting-edge solutions that reduce waste, increase profit, and improve food supply safety. Robots provide precise monitoring to ensure that the machines’ performance parameters are met, allowing for greater control over beverage quality.

Food Robotics Market Players

Mitsubishi Electric Corporation, ABB Group, Rockwell Automation Incorporated, Kawasaki Heavy Industries Ltd., Kuka AG, Fanuc Corporation, Yaskawa Electric Corporation, SeikoEpson Corporation, Staubli International AG, Universal Robotics A/S, Denso Corporation, Omron Corporation, Moley Robotics, Aurotek Corporation, Ellison Technologies Inc. are the major food robotics market players.

28 February, 2022: Mitsubishi Electric Corporation announced that it developed a teaching-less robot system technology. The technology has enabled robots to perform tasks like sorting and arrangements as fast as humans.

20 April, 2021: Rockwell Automation signed a partnership with Comau to maximize manufacturing efficiencies through unified robot control system solutions.

Who Should Buy? Or Key Stakeholders

- Retailers and Commercial traders

- Food & Beverages Industry

- Confectionery Industry

- Research and Development (R&D) Companies

- Government Research Institute

- Academic Institutes and Universities

- Investors

- Regulatory Authorities

Food Robotics Market Regional Analysis

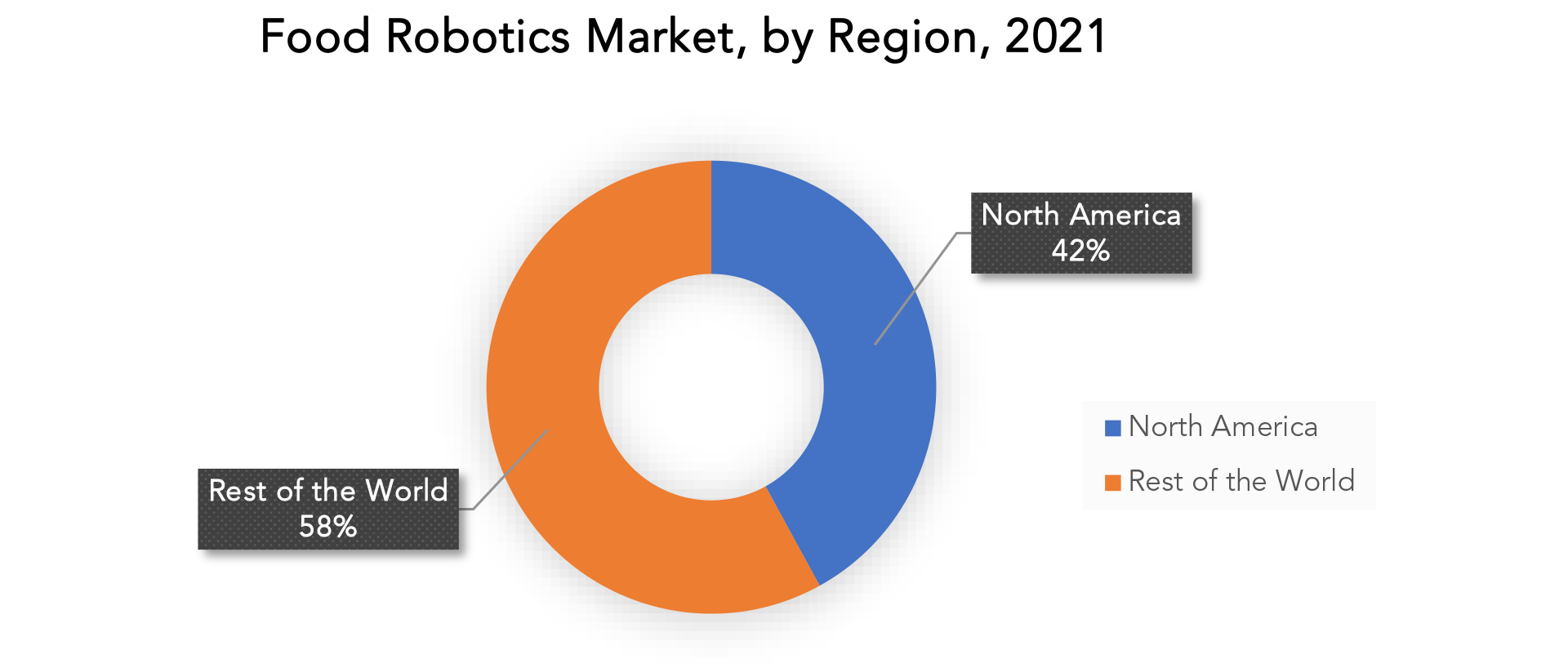

The Food Robotics market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN, and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina, and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

The North American market is expected to grow significantly during the forecast period, with a market share of 42%, as the region’s high demand for packaged food contributes to the growth of the Food Robotics market. Government regulations and rising labour costs have prompted the region’s food production to adopt robotics and automation systems. The food packaging industry is being driven by urban lifestyle changes, rising disposable income, the growing trend of nuclear families, and modern retail trade. As a result, global demand for packaged food has increased, presenting an appealing market opportunity for the food robots industry.

Many market participants employ robots in their sorting and packaging operations. Robot Systems is a company based in the United States that has developed robotic palletizing and depalletizing systems. The articulating robot arms allow for greater versatility and flexibility. Using automatic tool changers, the robot can switch between cartons, palletizing bags, pouches, drums, kegs, and barrels.

Over the forecast period, Asia Pacific is expected to be the fastest-growing market. The rising disposable income in emerging economies is increasing demand for packaged and processed foods, influencing the adoption of automation technologies to improve food production capabilities.

The European market also contributed significantly, owing to food safety regulations and rising labour costs in the region. The regulatory measures taken in the European market to ensure food safety are expected to drive demand for automated systems. In Europe, rising labour costs in the food industry are driving the market towards the adoption of automated systems.

Key Market Segments: Food Robotics Market

Food Robotics Market By Type, 2020-2029, (USD Billion) (Thousand Units)

- Articulates

- Cartesian

- Scara

- Parallel

- Cylindrical

- Collaborative

Food Robotics Market By Payload, 2020-2029, (USD Billion) (Thousand Units)

- Low

- Medium

- Heavy

Food Robotics Market By Application, 2020-2029, (USD Billion) (Thousand Units)

- Palletizing

- Packaging

- Repackaging

- Pick And Place

- Processing

Food Robotics Market By End User, 2020-2029, (USD Billion) (Thousand Units)

- Beverages

- Meat

- Poultry

- Seafood

- Dairy

- Bakery

- Fruits & Vegetables

- Confectionery

Food Robotics Market By Region, 2020-2029, (USD Billion) (Thousand Units)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the food robotics market over the next 7 years?

- Who are the major players in the food robotics market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the food robotics market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the food robotics market?

- What is the current and forecasted size and growth rate of the global food robotics market?

- What are the key drivers of growth in the food robotics market?

- What are the distribution channels and supply chain dynamics in the food robotics market?

- What are the technological advancements and innovations in the food robotics market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the food robotics market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the food robotics market?

- What are the service offerings and specifications of leading players in the market?

- What is the pricing trend of food robotics in the market and what is the impact of raw Payload prices on the price trend?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Food Robotics Market outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 on Food Robotics Market

- Porter’s five forces model

- Threat from new entrants

- Threat from substitutes

- Bargaining power of suppliers

- Bargaining power of customers

- Degree of competition

- Industry value chain Analysis

- Global Food Robotics Market outlook

- Global Food Robotics Market by Type (USD Billion, Thousand Units), 2020-2029

- Articulates

- Cartesian

- Scara

- Parallel

- Cylindrical

- Collaborative

- Global Food Robotics Market by Payload (USD Billion, Thousand Units), 2020-2029

- Low

- Medium

- Heavy

- Global Food Robotics Market by Application (USD Billion, Thousand Units), 2020-2029

- Palletizing

- Packaging

- Repackaging

- Pick and Place

- Processing

- Global Food Robotics Market by End User (USD Billion, Thousand Units), 2020-2029

- Beverages

- Meat

- Poultry

- Seafood

- Dairy

- Bakery

- Fruits & Vegetables

- Confectionery

- Global Food Robotics Market by Region (USD Billion, Thousand Units), 2020-2029

- North America

- US

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Colombia

- Rest Of South America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest Of Europe

- Asia Pacific

- India

- China

- Japan

- South Korea

- Australia

- South-East Asia

- Rest Of Asia Pacific

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest Of Middle East and Africa

- North America

- Company Profiles*

(Business Overview, Company Snapshot, Products Offered, Recent Developments)

- Mitsubishi Electric Corporation

- ABB Group

- Rockwell Automation Incorporated

- Kawasaki Heavy Industries Ltd.

- Kuka AG

- Fanuc Corporation

- Yaskawa Electric Corporation

- SeikoEpson Corporation

- Staubli International AG

- Universal Robotics A/S

- Denso Corporation

- Omron Corporation

- Moley Robotics

- Aurotek Corporation

- Ellison Technologies Inc.

*The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL FOOD ROBOTICS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 2 GLOBAL FOOD ROBOTICS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 3 GLOBAL FOOD ROBOTICS MARKET BY PAYLOAD (USD BILLION) 2020-2029

TABLE 4 GLOBAL FOOD ROBOTICS MARKET BY PAYLOAD (THOUSAND UNITS) 2020-2029

TABLE 5 GLOBAL FOOD ROBOTICS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 6 GLOBAL FOOD ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 7 GLOBAL FOOD ROBOTICS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 8 GLOBAL FOOD ROBOTICS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 9 GLOBAL FOOD ROBOTICS MARKET BY REGION (USD BILLION) 2020-2029

TABLE 10 GLOBAL FOOD ROBOTICS MARKET BY REGION (THOUSAND UNITS) 2020-2029

TABLE 11 NORTH AMERICA FOOD ROBOTICS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 12 NORTH AMERICA FOOD ROBOTICS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 13 NORTH AMERICA FOOD ROBOTICS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 14 NORTH AMERICA FOOD ROBOTICS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 15 NORTH AMERICA FOOD ROBOTICS MARKET BY PAYLOAD (USD BILLION) 2020-2029

TABLE 16 NORTH AMERICA FOOD ROBOTICS MARKET BY PAYLOAD (THOUSAND UNITS) 2020-2029

TABLE 17 NORTH AMERICA FOOD ROBOTICS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 18 NORTH AMERICA FOOD ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 19 NORTH AMERICA FOOD ROBOTICS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 20 NORTH AMERICA FOOD ROBOTICS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 21 US FOOD ROBOTICS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 22 US FOOD ROBOTICS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 23 US FOOD ROBOTICS MARKET BY PAYLOAD (USD BILLION) 2020-2029

TABLE 24 US FOOD ROBOTICS MARKET BY PAYLOAD (THOUSAND UNITS) 2020-2029

TABLE 25 US FOOD ROBOTICS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 26 US FOOD ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 27 US FOOD ROBOTICS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 28 US FOOD ROBOTICS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 29 CANADA FOOD ROBOTICS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 30 CANADA FOOD ROBOTICS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 31 CANADA FOOD ROBOTICS MARKET BY PAYLOAD (USD BILLION) 2020-2029

TABLE 32 CANADA FOOD ROBOTICS MARKET BY PAYLOAD (THOUSAND UNITS) 2020-2029

TABLE 33 CANADA FOOD ROBOTICS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 34 CANADA FOOD ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 35 CANADA FOOD ROBOTICS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 36 CANADA FOOD ROBOTICS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 37 MEXICO FOOD ROBOTICS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 38 MEXICO FOOD ROBOTICS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 39 MEXICO FOOD ROBOTICS MARKET BY PAYLOAD (USD BILLION) 2020-2029

TABLE 40 MEXICO FOOD ROBOTICS MARKET BY PAYLOAD (THOUSAND UNITS) 2020-2029

TABLE 41 MEXICO FOOD ROBOTICS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 42 MEXICO FOOD ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 43 MEXICO FOOD ROBOTICS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 44 MEXICO FOOD ROBOTICS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 45 SOUTH AMERICA FOOD ROBOTICS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 46 SOUTH AMERICA FOOD ROBOTICS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 47 SOUTH AMERICA FOOD ROBOTICS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 48 SOUTH AMERICA FOOD ROBOTICS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 49 SOUTH AMERICA FOOD ROBOTICS MARKET BY PAYLOAD (USD BILLION) 2020-2029

TABLE 50 SOUTH AMERICA FOOD ROBOTICS MARKET BY PAYLOAD (THOUSAND UNITS) 2020-2029

TABLE 51 SOUTH AMERICA FOOD ROBOTICS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 52 SOUTH AMERICA FOOD ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 53 SOUTH AMERICA FOOD ROBOTICS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 54 SOUTH AMERICA FOOD ROBOTICS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 55 BRAZIL FOOD ROBOTICS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 56 BRAZIL FOOD ROBOTICS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 57 BRAZIL FOOD ROBOTICS MARKET BY PAYLOAD (USD BILLION) 2020-2029

TABLE 58 BRAZIL FOOD ROBOTICS MARKET BY PAYLOAD (THOUSAND UNITS) 2020-2029

TABLE 59 BRAZIL FOOD ROBOTICS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 60 BRAZIL FOOD ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 61 BRAZIL FOOD ROBOTICS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 62 BRAZIL FOOD ROBOTICS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 63 ARGENTINA FOOD ROBOTICS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 64 ARGENTINA FOOD ROBOTICS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 65 ARGENTINA FOOD ROBOTICS MARKET BY PAYLOAD (USD BILLION) 2020-2029

TABLE 66 ARGENTINA FOOD ROBOTICS MARKET BY PAYLOAD (THOUSAND UNITS) 2020-2029

TABLE 67 ARGENTINA FOOD ROBOTICS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 68 ARGENTINA FOOD ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 69 ARGENTINA FOOD ROBOTICS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 70 ARGENTINA FOOD ROBOTICS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 71 COLOMBIA FOOD ROBOTICS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 72 COLOMBIA FOOD ROBOTICS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 73 COLOMBIA FOOD ROBOTICS MARKET BY PAYLOAD (USD BILLION) 2020-2029

TABLE 74 COLOMBIA FOOD ROBOTICS MARKET BY PAYLOAD (THOUSAND UNITS) 2020-2029

TABLE 75 COLOMBIA FOOD ROBOTICS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 76 COLOMBIA FOOD ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 77 COLOMBIA FOOD ROBOTICS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 78 COLOMBIA FOOD ROBOTICS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 79 REST OF SOUTH AMERICA FOOD ROBOTICS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 80 REST OF SOUTH AMERICA FOOD ROBOTICS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 81 REST OF SOUTH AMERICA FOOD ROBOTICS MARKET BY PAYLOAD (USD BILLION) 2020-2029

TABLE 82 REST OF SOUTH AMERICA FOOD ROBOTICS MARKET BY PAYLOAD (THOUSAND UNITS) 2020-2029

TABLE 83 REST OF SOUTH AMERICA FOOD ROBOTICS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 84 REST OF SOUTH AMERICA FOOD ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 85 REST OF SOUTH AMERICA FOOD ROBOTICS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 86 REST OF SOUTH AMERICA FOOD ROBOTICS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 87 ASIA-PACIFIC FOOD ROBOTICS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 88 ASIA-PACIFIC FOOD ROBOTICS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 89 ASIA-PACIFIC FOOD ROBOTICS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 90 ASIA-PACIFIC FOOD ROBOTICS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 91 ASIA-PACIFIC FOOD ROBOTICS MARKET BY PAYLOAD (USD BILLION) 2020-2029

TABLE 92 ASIA-PACIFIC FOOD ROBOTICS MARKET BY PAYLOAD (THOUSAND UNITS) 2020-2029

TABLE 93 ASIA-PACIFIC FOOD ROBOTICS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 94 ASIA-PACIFIC FOOD ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 95 ASIA-PACIFIC FOOD ROBOTICS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 96 ASIA-PACIFIC FOOD ROBOTICS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 97 INDIA FOOD ROBOTICS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 98 INDIA FOOD ROBOTICS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 99 INDIA FOOD ROBOTICS MARKET BY PAYLOAD (USD BILLION) 2020-2029

TABLE 100 INDIA FOOD ROBOTICS MARKET BY PAYLOAD (THOUSAND UNITS) 2020-2029

TABLE 101 INDIA FOOD ROBOTICS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 102 INDIA FOOD ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 103 INDIA FOOD ROBOTICS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 104 INDIA FOOD ROBOTICS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 105 CHINA FOOD ROBOTICS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 106 CHINA FOOD ROBOTICS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 107 CHINA FOOD ROBOTICS MARKET BY PAYLOAD (USD BILLION) 2020-2029

TABLE 108 CHINA FOOD ROBOTICS MARKET BY PAYLOAD (THOUSAND UNITS) 2020-2029

TABLE 109 CHINA FOOD ROBOTICS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 110 CHINA FOOD ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 111 CHINA FOOD ROBOTICS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 112 CHINA FOOD ROBOTICS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 113 JAPAN FOOD ROBOTICS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 114 JAPAN FOOD ROBOTICS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 115 JAPAN FOOD ROBOTICS MARKET BY PAYLOAD (USD BILLION) 2020-2029

TABLE 116 JAPAN FOOD ROBOTICS MARKET BY PAYLOAD (THOUSAND UNITS) 2020-2029

TABLE 117 JAPAN FOOD ROBOTICS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 118 JAPAN FOOD ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 119 JAPAN FOOD ROBOTICS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 120 JAPAN FOOD ROBOTICS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 121 SOUTH KOREA FOOD ROBOTICS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 122 SOUTH KOREA FOOD ROBOTICS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 123 SOUTH KOREA FOOD ROBOTICS MARKET BY PAYLOAD (USD BILLION) 2020-2029

TABLE 124 SOUTH KOREA FOOD ROBOTICS MARKET BY PAYLOAD (THOUSAND UNITS) 2020-2029

TABLE 125 SOUTH KOREA FOOD ROBOTICS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 126 SOUTH KOREA FOOD ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 127 SOUTH KOREA FOOD ROBOTICS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 128 SOUTH KOREA FOOD ROBOTICS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 129 AUSTRALIA FOOD ROBOTICS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 130 AUSTRALIA FOOD ROBOTICS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 131 AUSTRALIA FOOD ROBOTICS MARKET BY PAYLOAD (USD BILLION) 2020-2029

TABLE 132 AUSTRALIA FOOD ROBOTICS MARKET BY PAYLOAD (THOUSAND UNITS) 2020-2029

TABLE 133 AUSTRALIA FOOD ROBOTICS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 134 AUSTRALIA FOOD ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 135 AUSTRALIA FOOD ROBOTICS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 136 AUSTRALIA FOOD ROBOTICS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 137 SOUTH-EAST ASIA FOOD ROBOTICS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 138 SOUTH-EAST ASIA FOOD ROBOTICS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 139 SOUTH-EAST ASIA FOOD ROBOTICS MARKET BY PAYLOAD (USD BILLION) 2020-2029

TABLE 140 SOUTH-EAST ASIA FOOD ROBOTICS MARKET BY PAYLOAD (THOUSAND UNITS) 2020-2029

TABLE 141 SOUTH-EAST ASIA FOOD ROBOTICS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 142 SOUTH-EAST ASIA FOOD ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 143 SOUTH-EAST ASIA FOOD ROBOTICS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 144 SOUTH-EAST ASIA FOOD ROBOTICS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 145 REST OF ASIA PACIFIC FOOD ROBOTICS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 146 REST OF ASIA PACIFIC FOOD ROBOTICS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 147 REST OF ASIA PACIFIC FOOD ROBOTICS MARKET BY PAYLOAD (USD BILLION) 2020-2029

TABLE 148 REST OF ASIA PACIFIC FOOD ROBOTICS MARKET BY PAYLOAD (THOUSAND UNITS) 2020-2029

TABLE 149 REST OF ASIA PACIFIC FOOD ROBOTICS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 150 REST OF ASIA PACIFIC FOOD ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 151 REST OF ASIA PACIFIC FOOD ROBOTICS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 152 REST OF ASIA PACIFIC FOOD ROBOTICS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 153 EUROPE FOOD ROBOTICS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 154 EUROPE FOOD ROBOTICS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 155 EUROPE FOOD ROBOTICS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 156 EUROPE FOOD ROBOTICS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 157 EUROPE FOOD ROBOTICS MARKET BY PAYLOAD (USD BILLION) 2020-2029

TABLE 158 EUROPE FOOD ROBOTICS MARKET BY PAYLOAD (THOUSAND UNITS) 2020-2029

TABLE 159 EUROPE FOOD ROBOTICS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 160 EUROPE FOOD ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 161 EUROPE FOOD ROBOTICS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 162 EUROPE FOOD ROBOTICS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 163 GERMANY FOOD ROBOTICS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 164 GERMANY FOOD ROBOTICS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 165 GERMANY FOOD ROBOTICS MARKET BY PAYLOAD (USD BILLION) 2020-2029

TABLE 166 GERMANY FOOD ROBOTICS MARKET BY PAYLOAD (THOUSAND UNITS) 2020-2029

TABLE 167 GERMANY FOOD ROBOTICS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 168 GERMANY FOOD ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 169 GERMANY FOOD ROBOTICS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 170 GERMANY FOOD ROBOTICS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 171 UK FOOD ROBOTICS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 172 UK FOOD ROBOTICS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 173 UK FOOD ROBOTICS MARKET BY PAYLOAD (USD BILLION) 2020-2029

TABLE 174 UK FOOD ROBOTICS MARKET BY PAYLOAD (THOUSAND UNITS) 2020-2029

TABLE 175 UK FOOD ROBOTICS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 176 UK FOOD ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 177 UK FOOD ROBOTICS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 178 UK FOOD ROBOTICS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 179 FRANCE FOOD ROBOTICS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 180 FRANCE FOOD ROBOTICS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 181 FRANCE FOOD ROBOTICS MARKET BY PAYLOAD (USD BILLION) 2020-2029

TABLE 182 FRANCE FOOD ROBOTICS MARKET BY PAYLOAD (THOUSAND UNITS) 2020-2029

TABLE 183 FRANCE FOOD ROBOTICS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 184 FRANCE FOOD ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 185 FRANCE FOOD ROBOTICS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 186 FRANCE FOOD ROBOTICS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 187 ITALY FOOD ROBOTICS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 188 ITALY FOOD ROBOTICS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 189 ITALY FOOD ROBOTICS MARKET BY PAYLOAD (USD BILLION) 2020-2029

TABLE 190 ITALY FOOD ROBOTICS MARKET BY PAYLOAD (THOUSAND UNITS) 2020-2029

TABLE 191 ITALY FOOD ROBOTICS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 192 ITALY FOOD ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 193 ITALY FOOD ROBOTICS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 194 ITALY FOOD ROBOTICS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 195 SPAIN FOOD ROBOTICS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 196 SPAIN FOOD ROBOTICS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 197 SPAIN FOOD ROBOTICS MARKET BY PAYLOAD (USD BILLION) 2020-2029

TABLE 198 SPAIN FOOD ROBOTICS MARKET BY PAYLOAD (THOUSAND UNITS) 2020-2029

TABLE 199 SPAIN FOOD ROBOTICS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 200 SPAIN FOOD ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 201 SPAIN FOOD ROBOTICS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 202 SPAIN FOOD ROBOTICS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 203 RUSSIA FOOD ROBOTICS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 204 RUSSIA FOOD ROBOTICS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 205 RUSSIA FOOD ROBOTICS MARKET BY PAYLOAD (USD BILLION) 2020-2029

TABLE 206 RUSSIA FOOD ROBOTICS MARKET BY PAYLOAD (THOUSAND UNITS) 2020-2029

TABLE 207 RUSSIA FOOD ROBOTICS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 208 RUSSIA FOOD ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 209 RUSSIA FOOD ROBOTICS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 210 RUSSIA FOOD ROBOTICS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 211 REST OF EUROPE FOOD ROBOTICS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 212 REST OF EUROPE FOOD ROBOTICS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 213 REST OF EUROPE FOOD ROBOTICS MARKET BY PAYLOAD (USD BILLION) 2020-2029

TABLE 214 REST OF EUROPE FOOD ROBOTICS MARKET BY PAYLOAD (THOUSAND UNITS) 2020-2029

TABLE 215 REST OF EUROPE FOOD ROBOTICS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 216 REST OF EUROPE FOOD ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 217 REST OF EUROPE FOOD ROBOTICS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 218 REST OF EUROPE FOOD ROBOTICS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 219 MIDDLE EAST AND AFRICA FOOD ROBOTICS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 220 MIDDLE EAST AND AFRICA FOOD ROBOTICS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 221 MIDDLE EAST AND AFRICA FOOD ROBOTICS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 222 MIDDLE EAST AND AFRICA FOOD ROBOTICS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 223 MIDDLE EAST AND AFRICA FOOD ROBOTICS MARKET BY PAYLOAD (USD BILLION) 2020-2029

TABLE 224 MIDDLE EAST AND AFRICA FOOD ROBOTICS MARKET BY PAYLOAD (THOUSAND UNITS) 2020-2029

TABLE 225 MIDDLE EAST AND AFRICA FOOD ROBOTICS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 226 MIDDLE EAST AND AFRICA FOOD ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 227 MIDDLE EAST AND AFRICA FOOD ROBOTICS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 228 MIDDLE EAST AND AFRICA FOOD ROBOTICS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 229 UAE FOOD ROBOTICS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 230 UAE FOOD ROBOTICS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 231 UAE FOOD ROBOTICS MARKET BY PAYLOAD (USD BILLION) 2020-2029

TABLE 232 UAE FOOD ROBOTICS MARKET BY PAYLOAD (THOUSAND UNITS) 2020-2029

TABLE 233 UAE FOOD ROBOTICS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 234 UAE FOOD ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 235 UAE FOOD ROBOTICS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 236 UAE FOOD ROBOTICS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 237 SAUDI ARABIA FOOD ROBOTICS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 238 SAUDI ARABIA FOOD ROBOTICS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 239 SAUDI ARABIA FOOD ROBOTICS MARKET BY PAYLOAD (USD BILLION) 2020-2029

TABLE 240 SAUDI ARABIA FOOD ROBOTICS MARKET BY PAYLOAD (THOUSAND UNITS) 2020-2029

TABLE 241 SAUDI ARABIA FOOD ROBOTICS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 242 SAUDI ARABIA FOOD ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 243 SAUDI ARABIA FOOD ROBOTICS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 244 SAUDI ARABIA FOOD ROBOTICS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 245 SOUTH AFRICA FOOD ROBOTICS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 246 SOUTH AFRICA FOOD ROBOTICS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 247 SOUTH AFRICA FOOD ROBOTICS MARKET BY PAYLOAD (USD BILLION) 2020-2029

TABLE 248 SOUTH AFRICA FOOD ROBOTICS MARKET BY PAYLOAD (THOUSAND UNITS) 2020-2029

TABLE 249 SOUTH AFRICA FOOD ROBOTICS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 250 SOUTH AFRICA FOOD ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 251 SOUTH AFRICA FOOD ROBOTICS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 252 SOUTH AFRICA FOOD ROBOTICS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 253 REST OF MIDDLE EAST AND AFRICA FOOD ROBOTICS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 254 REST OF MIDDLE EAST AND AFRICA FOOD ROBOTICS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 255 REST OF MIDDLE EAST AND AFRICA FOOD ROBOTICS MARKET BY PAYLOAD (USD BILLION) 2020-2029

TABLE 256 REST OF MIDDLE EAST AND AFRICA FOOD ROBOTICS MARKET BY PAYLOAD (THOUSAND UNITS) 2020-2029

TABLE 257 REST OF MIDDLE EAST AND AFRICA FOOD ROBOTICS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 258 REST OF MIDDLE EAST AND AFRICA FOOD ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 259 REST OF MIDDLE EAST AND AFRICA FOOD ROBOTICS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 260 REST OF MIDDLE EAST AND AFRICA FOOD ROBOTICS MARKET BY END USER (THOUSAND UNITS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 3 BOTTOM-UP APPROACH

FIGURE 4 RESEARCH FLOW

FIGURE 5 GLOBAL FOOD ROBOTICS MARKET BY TYPE, USD BILLION, 2020-2029

FIGURE 6 GLOBAL FOOD ROBOTICS MARKET BY PAYLOAD, USD BILLION, 2020-2029

FIGURE 7 GLOBAL FOOD ROBOTICS MARKET BY APPLICATION, USD BILLION, 2020-2029

FIGURE 8 GLOBAL FOOD ROBOTICS MARKET BY END USER, USD BILLION, 2020-2029

FIGURE 9 GLOBAL FOOD ROBOTICS MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 10 PORTER’S FIVE FORCES MODEL

FIGURE 11 GLOBAL FOOD ROBOTICS MARKET BY TYPE, USD BILLION, 2021

FIGURE 12 GLOBAL FOOD ROBOTICS MARKET BY PAYLOAD, USD BILLION, 2021

FIGURE 13 GLOBAL FOOD ROBOTICS MARKET BY APPLICATION, USD BILLION, 2021

FIGURE 14 GLOBAL FOOD ROBOTICS MARKET BY END USER, USD BILLION, 2021

FIGURE 15 GLOBAL FOOD ROBOTICS MARKET BY REGION, USD BILLION, 2021

FIGURE 16 MARKET SHARE ANALYSIS

FIGURE 17 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

FIGURE 18 ABB GROUP: COMPANY SNAPSHOT

FIGURE 19 ROCKWELL AUTOMATION INCORPORATED: COMPANY SNAPSHOT

FIGURE 20 KAWASAKI HEAVY INDUSTRIES LTD.: COMPANY SNAPSHOT

FIGURE 21 KUKA AG: COMPANY SNAPSHOT

FIGURE 22 FANUC CORPORATION: COMPANY SNAPSHOT

FIGURE 23 YASKAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

FIGURE 24 SEIKOEPSON CORPORATION: COMPANY SNAPSHOT

FIGURE 25 STAUBLI INTERNATIONAL AG: COMPANY SNAPSHOT

FIGURE 26 UNIVERSAL ROBOTICS A/S: COMPANY SNAPSHOT

FIGURE 27 DENSO CORPORATION: COMPANY SNAPSHOT

FIGURE 28 OMRON CORPORATION: COMPANY SNAPSHOT

FIGURE 29 MOLEY ROBOTICS: COMPANY SNAPSHOT

FIGURE 30 AUROTEK CORPORATION: COMPANY SNAPSHOT

FIGURE 31 ELLISON TECHNOLOGIES INC.: COMPANY SNAPSHOT

FAQ

The Food Robotics market size had crossed USD 1.59 Billion in 2020 and will observe a CAGR of more than 12% up to 2029.

The key factors supporting the growth of the market are increasing food safety regulations, rising investments in robots for the food industry, growing adoption of digitalization across the food & beverages industry, and growing focus on efficient food packaging.

The region’s largest share is in North America. Type manufactured in nations like US and Canada that perform similarly and are inexpensively accessible to the general public have led to the increasing appeal. Also, the key players such as Mitsubishi Electric Corporation, ABB Group play important roles.

Industrialization and incorporation of advanced technologies are few of the key trends in the food robotics market.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.