REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 17.92 billion by 2029 | 12.2% | Asia Pacific |

| By Product Type | By Component | By Application |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Automotive Robotics Market Overview

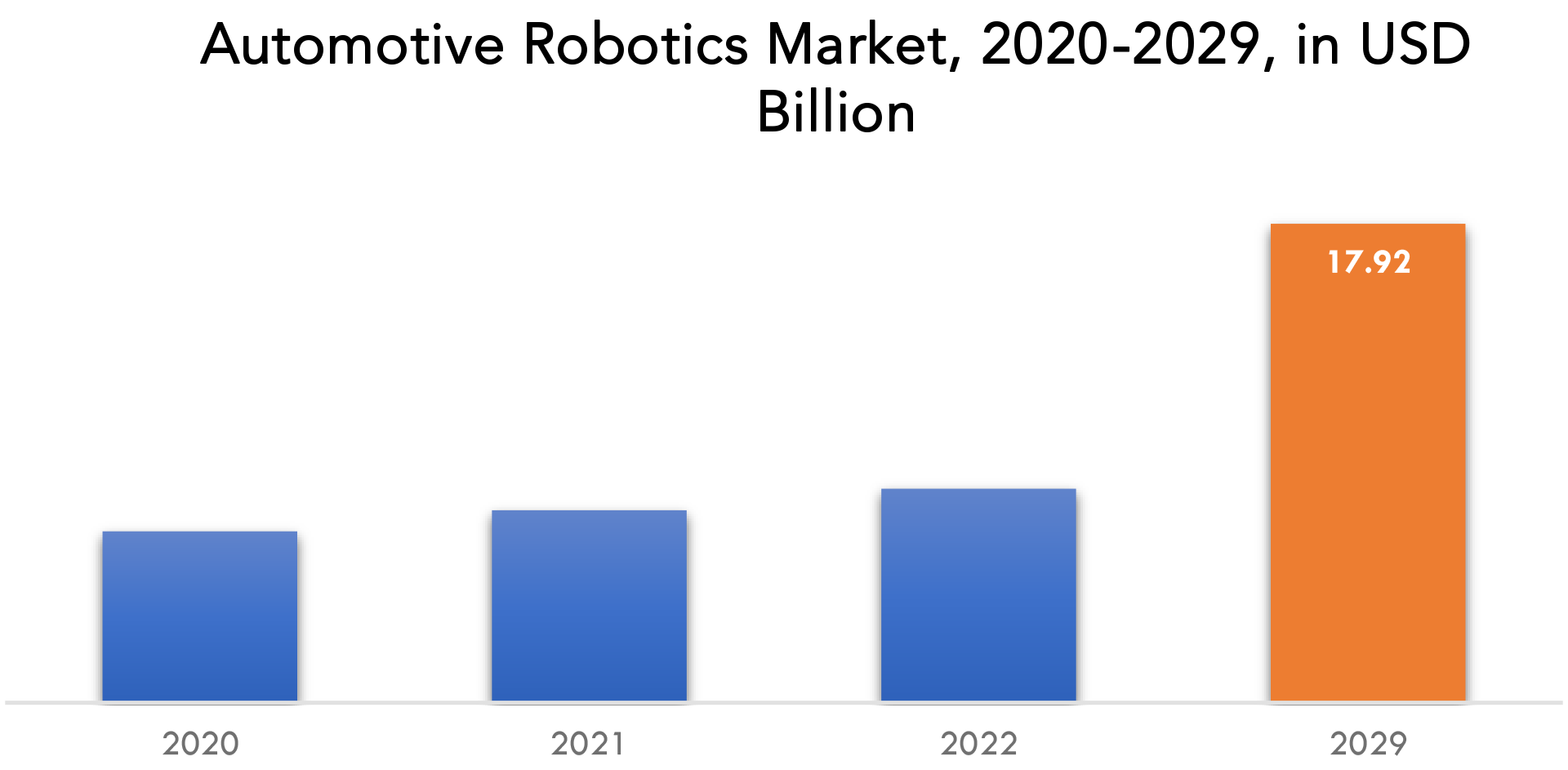

The automotive robotics market is expected to grow at 12.2% CAGR from 2023 to 2029. It is expected to reach above USD 17.92 billion by 2029 from USD 6.41 billion in 2022.

Robots for the automotive sector are designed to assist in the production of automobiles. The unprecedented increase in electric vehicle sales is encouraging the deployment of robotics to fill the market’s rising demand from consumers. Industrial robots have been used in the manufacturing process of the car industry for many years.

The majority of robots used in the automotive sector is articulated robots. Given that they can do tasks faster than human counterparts, robotic systems in the automobile sector are economical, effective, and safe.

The automation sector is being driven by a number of businesses that prioritize lowering costs, saving time, generating high-quality products, and improving productivity with low error rates. Automotive robots are used in the production plant to automate internal procedures, reducing the workload of people and fostering worker collaboration to increase productivity.

| ATTRIBUTE | DETAILS |

| Study period | 2022-2029 |

| Base year | 2022 |

| Estimated year | 2022 |

| Forecasted year | 2023-2029 |

| Historical period | 2018-2022 |

| Unit | Value (USD BILLION), (THOUSAND UNITS) |

| Segmentation | By Product Type, By Component, By Application, and By Region |

|

By Product Type

|

|

|

By Component

|

|

|

By Application

|

|

|

By Region

|

|

The primary market growth drivers are increasing vehicle production, improving cost competitiveness, and wage inflation. The market is expanding as a result of rapid technical developments including the integration of the Internet of Things (IoT), cloud services, and autonomous intelligent vehicles (AIVs) for transporting components and materials safely from one location to another.

Several vocations in the automotive industry are dangerous by nature. For instance, pouring molten metal in a foundry is obviously dangerous. Musculoskeletal diseases brought on by twisting, lifting, and repetitive motions are another risk factor for some employment. Robotics can be used to lessen these dangers. Robots keep workers safe from welding, painting, and stamping press fumes, noise, and weld flash during car assembly. The use of automotive robotics significantly decreased the number of injury claims and accidents by limiting worker exposure to risky situations and unsanitary operations. These elements will therefore fuel the expansion of the automotive robotics market.

High penetration in the automobile sector limits market expansion. Numerous businesses cited the high cost of integration as a deterrent to greater deployment. Large enterprises may find it difficult to combine new robotic technology with infrastructure that is 15 to 20 years old, and high integration costs are prohibitive for SMEs with smaller production numbers. These factors will therefore limit the market’s expansion.

Opportunities for the market to expand include productivity optimization, the Industry 4.0 and Made in China 2025 Industrial Plans, and the low robot density in the Chinese automobile industry. US automotive industry’s slow growth and heavy initial expenditure are obstacles to the market’s expansion.

Major corporations stopped producing as a result of the lockdowns imposed by governments around the world during the first half of 2022, which had a negative effect on market growth. Nevertheless, after the epidemic, demand began to pick up steam as a result of favorable government relaxations and policies put in place to recommence production and meet the rising demand for new cars.

Automotive Robotics Market Segment Analysis

Automotive businesses utilize robots for a variety of tasks. The automotive robotics market segments include product type, component, application, and region.

The market is segmented by product type into articulated robots, cartesian robots, cylindrical robots, SCARA robots, and others. SCARA robots are utilized for part transfer and assembly, heavy work component stacking and dumping, and vertical assembly. Different robots, including Cartesian, Cylindrical, and Articulated ones, are employed in painting, and applications requiring pick and place will call for a modest payload but a wide development area. Although an assembly robot takes up very little space, it is extremely accurate and quick. The automotive robot will be programmed to carry out certain tasks depending on its intended function.

Based on component the market is segmented into Controller, Robotics Arm, End Effector, Drive, and Sensor. The controller market share is anticipated to be the highest in terms of value. The market is being driven in large part by the increase in sales of all types of robots that employ controllers.

The market is further segmented by application into primary manufacturing process robots and secondary manufacturing process robots. Spot welding is a common application for robots in the automotive sector, and as consumer interest in cars has increased, so has the use of robots in the welding process. Due to their well-organized frameworks that allow the machine’s arms to be coordinated, SCARA and Cartesian robots are employed in the welding process. The term “material handling” refers to a wide range of activities, including picking out parts, moving them, packaging, palletizing, stacking and dumping, machine feeding, and withdrawal.

Automotive Robotics Market Players

The automotive robotics market key players include ABB Ltd., Yaskawa Electric Corporation, Kawasaki Heavy Industries, KUKA AG, Denso Wave Incorporated, Comau SPA, Nachi-Fujikoshi Corp., FANUC Corporation, Rockwell Automation, Inc., Seiko Epson Corporation (Nagano, Japan), Dürr AG, Harmonic Drive System, Nabtesco Motion Control, Inc., and Others.

Recent Developments:

In October 2016, NVIDIA and FANUC Corporation had announced a collaboration for implementation of artificial intelligence on the FANUC Intelligent Edge Link and Drive (FIELD) system. This would lead to a growth in productivity of robots and enhance capabilities of automated factories worldwide.

In November 2016, KUKA Robotics System launched 3D Metal Printing robotics technology at FABTECH 2016. This process uses 3D design data to build components in layers by depositing material.

In May 2016, ABB acquired SVIA automation solutions (Sweden) to expand its robotics operations. As of now, this collaborative operation will be limited to ABB’s Discrete Automation and Motion division, later it will make its global application center for machine-tending.

Who Should Buy? Or Key stakeholders

- Automotive Robotics Market Suppliers

- Raw Material Manufacturers

- Research Organizations

- Investors

- Regulatory Authorities

- Others

Automotive Robotics Market Regional Analysis

The automotive robotics market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA.

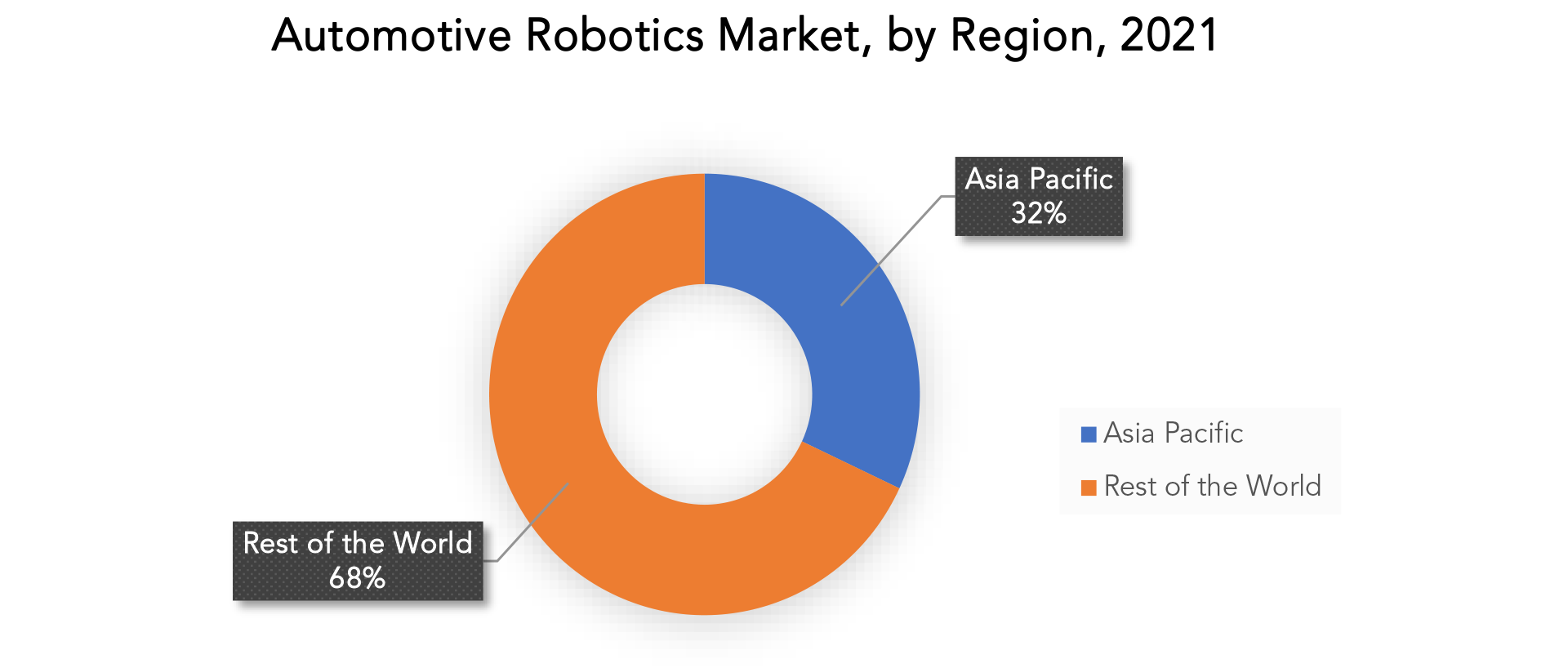

In 2022, Asia Pacific accounted for the largest market share for automotive robotics. The growing use of robotics in the automotive industry is ascribed to factors including China’s ageing workforce and rising labour expenses.

It is projected that North America would increase significantly during the forecast period. Approximately 80% of manufacturers were having trouble filling more than 400,000 unfilled positions as of January 2022, according to the US Department of Labor Job Openings and Labor Turnover. However, thanks to the development of automotive robots’ systems, manufacturers may now begin to slowly address the deficit. Major American automakers have made significant investments in automotive robotics, including Ford, Tesla, and General Motors. It not only boosts employee productivity, but it also gives them better-paying, more specialised jobs. Therefore, these elements will fuel the market’s expansion in the area.

Europe is also anticipated to have significant market expansion. The need for automotive robotics in this area will be driven by a significant post-pandemic restructuring of the supply chain with an emphasis on increasing local output throughout the auto manufacturing value chain.

Key Market Segments: Automotive Robotics Market

Automotive Robotics Market By Product Type, 2022-2029, (Usd Billion), (Thousand Units)

- Articulated Robots

- Cartesian Robots

- Cylindrical Robots

- Scara Robots

- Others

Automotive Robotics Market By Component 2022-2029, (Usd Billion), (Thousand Units)

- Controller

- Robotics Arm

- End Effector

- Drive

- Sensor

Automotive Robotics Market By Application, 2022-2029, (Usd Billion), (Thousand Units)

- Primary Manufacturing Process Robots

- Welding

- Painting

- Cutting

- Secondary Manufacturing Process Robots

- Material Handling, Palletizing & Packaging

- Assembly/Disassembly

Automotive Robotics Market By Region, 2022-2029, (Usd Billion), (Thousand Units)

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Key Question Answered

- What is the current size of the automotive robotics market?

- What are the key factors influencing the growth of automotive robotics market?

- What are the major applications for automotive robotics market?

- Who are the major key players in the automotive robotics market?

- Which region will provide more business opportunities automotive robotics market in future?

- Which segment holds the maximum share of the automotive robotics market?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Automotive Robotics Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Automotive Robotics Market

- Porter’s five forces model

- Threat from new entrants

- Threat from substitutes

- Bargaining power of suppliers

- Bargaining power of customers

- Degree of competition

- Industry value chain Analysis

- Global Automotive Robotics Market Outlook

- Global Automotive Robotics Market by PRODUCT TYPE, 2022-2029, (USD BILLION), (THOUSAND UNITS)

- Articulated Robots

- Cartesian Robots

- Cylindrical Robots

- SCARA Robots

- Others

- Global Automotive Robotics Market by Component, 2022-2029, (USD BILLION), (THOUSAND UNITS)

- Controller

- Robotics Arm

- End Effector

- Drive

- Sensor

- Global Automotive Robotics Market by Application, 2022-2029, (USD BILLION), (THOUSAND UNITS)

- Primary Manufacturing Process Robots

- Welding

- Painting

- Cutting

- Secondary Manufacturing Process Robots

- Material Handling, Palletizing & Packaging

- Assembly/Disassembly

- Primary Manufacturing Process Robots

- Global Automotive Robotics Market by Region, 2022-2029, (USD BILLION), (THOUSAND UNITS)

- North America

- US

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Colombia

- Rest Of South America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest Of Europe

- Asia Pacific

- India

- China

- Japan

- South Korea

- Australia

- South-East Asia

- Rest Of Asia Pacific

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest Of Middle East and Africa

- North America

- Company Profiles* (Business Overview, Company Snapshot, Products Offered, Recent Developments)

- ABB Ltd.

- Kuka Ag

- Fanuc Corporation

- Yaskawa Electric Corporation

- Kawasaki Heavy Industries

- Denso Wave Incorporated

- Comau Spa

- Nachi-Fujikoshi Corp.

- Rockwell Automation, Inc.

- Seiko Epson Corporation

- Dürr Ag

- Harmonic Drive System

- Nabtesco Motion Control, Inc. *The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL AUTOMOTIVE ROBOTICS MARKET BY PRODUCT TYPE (USD BILLION) 2022-2029

TABLE 2 GLOBAL AUTOMOTIVE ROBOTICS MARKET BY COMPONENT (THOUSAND UNITS) 2022-2029

TABLE 3 GLOBAL AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2022-2029

TABLE 4 GLOBAL AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 5 GLOBAL AUTOMOTIVE ROBOTICS MARKET BY REGION (USD BILLION) 2022-2029

TABLE 6 GLOBAL AUTOMOTIVE ROBOTICS MARKET BY REGION (THOUSAND UNITS) 2022-2029

TABLE 7 NORTH AMERICA AUTOMOTIVE ROBOTICS MARKET BY COUNTRY (USD BILLION) 2022-2029

TABLE 8 NORTH AMERICA AUTOMOTIVE ROBOTICS MARKET BY COUNTRY (THOUSAND UNITS) 2022-2029

TABLE 9 NORTH AMERICA AUTOMOTIVE ROBOTICS MARKET BY PRODUCT TYPE (USD BILLION) 2022-2029

TABLE 10 NORTH AMERICA AUTOMOTIVE ROBOTICS MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2022-2029

TABLE 11 NORTH AMERICA AUTOMOTIVE ROBOTICS MARKET BY COMPONENT (USD BILLION) 2022-2029

TABLE 12 NORTH AMERICA AUTOMOTIVE ROBOTICS MARKET BY COMPONENT (THOUSAND UNITS) 2022-2029

TABLE 13 NORTH AMERICA AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 14 NORTH AMERICA AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2022-2029

TABLE 15 US AUTOMOTIVE ROBOTICS MARKET BY PRODUCT TYPE (USD BILLION) 2022-2029

TABLE 16 US AUTOMOTIVE ROBOTICS MARKET BY COMPONENT (THOUSAND UNITS) 2022-2029

TABLE 17 US AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2022-2029

TABLE 18 US AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 19 CANADA AUTOMOTIVE ROBOTICS MARKET BY PRODUCT TYPE (USD BILLION) 2022-2029

TABLE 20 CANADA AUTOMOTIVE ROBOTICS MARKET BY COMPONENT (THOUSAND UNITS) 2022-2029

TABLE 21 CANADA AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2022-2029

TABLE 22 CANADA AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 23 MEXICO AUTOMOTIVE ROBOTICS MARKET BY PRODUCT TYPE (USD BILLION) 2022-2029

TABLE 24 MEXICO AUTOMOTIVE ROBOTICS MARKET BY COMPONENT (THOUSAND UNITS) 2022-2029

TABLE 25 MEXICO AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2022-2029

TABLE 26 MEXICO AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 27 SOUTH AMERICA AUTOMOTIVE ROBOTICS MARKET BY COUNTRY (USD BILLION) 2022-2029

TABLE 28 SOUTH AMERICA AUTOMOTIVE ROBOTICS MARKET BY COUNTRY (THOUSAND UNITS) 2022-2029

TABLE 29 SOUTH AMERICA AUTOMOTIVE ROBOTICS MARKET BY PRODUCT TYPE (USD BILLION) 2022-2029

TABLE 30 SOUTH AMERICA AUTOMOTIVE ROBOTICS MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2022-2029

TABLE 31 SOUTH AMERICA AUTOMOTIVE ROBOTICS MARKET BY COMPONENT (USD BILLION) 2022-2029

TABLE 32 SOUTH AMERICA AUTOMOTIVE ROBOTICS MARKET BY COMPONENT (THOUSAND UNITS) 2022-2029

TABLE 33 SOUTH AMERICA AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 34 SOUTH AMERICA AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2022-2029

TABLE 35 BRAZIL AUTOMOTIVE ROBOTICS MARKET BY PRODUCT TYPE (USD BILLION) 2022-2029

TABLE 36 BRAZIL AUTOMOTIVE ROBOTICS MARKET BY COMPONENT (THOUSAND UNITS) 2022-2029

TABLE 37 BRAZIL AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2022-2029

TABLE 38 BRAZIL AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 39 ARGENTINA AUTOMOTIVE ROBOTICS MARKET BY PRODUCT TYPE (USD BILLION) 2022-2029

TABLE 40 ARGENTINA AUTOMOTIVE ROBOTICS MARKET BY COMPONENT (THOUSAND UNITS) 2022-2029

TABLE 41 ARGENTINA AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2022-2029

TABLE 42 ARGENTINA AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 43 COLOMBIA AUTOMOTIVE ROBOTICS MARKET BY PRODUCT TYPE (USD BILLION) 2022-2029

TABLE 44 COLOMBIA AUTOMOTIVE ROBOTICS MARKET BY COMPONENT (THOUSAND UNITS) 2022-2029

TABLE 45 COLOMBIA AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2022-2029

TABLE 46 COLOMBIA AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 47 REST OF SOUTH AMERICA AUTOMOTIVE ROBOTICS MARKET BY PRODUCT TYPE (USD BILLION) 2022-2029

TABLE 48 REST OF SOUTH AMERICA AUTOMOTIVE ROBOTICS MARKET BY COMPONENT (THOUSAND UNITS) 2022-2029

TABLE 49 REST OF SOUTH AMERICA AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2022-2029

TABLE 50 REST OF SOUTH AMERICA AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 51 ASIA-PACIFIC AUTOMOTIVE ROBOTICS MARKET BY COUNTRY (USD BILLION) 2022-2029

TABLE 52 ASIA-PACIFIC AUTOMOTIVE ROBOTICS MARKET BY COUNTRY (THOUSAND UNITS) 2022-2029

TABLE 53 ASIA-PACIFIC AUTOMOTIVE ROBOTICS MARKET BY PRODUCT TYPE (USD BILLION) 2022-2029

TABLE 54 ASIA-PACIFIC AUTOMOTIVE ROBOTICS MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2022-2029

TABLE 55 ASIA-PACIFIC AUTOMOTIVE ROBOTICS MARKET BY COMPONENT (USD BILLION) 2022-2029

TABLE 56 ASIA-PACIFIC AUTOMOTIVE ROBOTICS MARKET BY COMPONENT (THOUSAND UNITS) 2022-2029

TABLE 57 ASIA-PACIFIC AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 58 ASIA-PACIFIC AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2022-2029

TABLE 59 INDIA AUTOMOTIVE ROBOTICS MARKET BY PRODUCT TYPE (USD BILLION) 2022-2029

TABLE 60 INDIA AUTOMOTIVE ROBOTICS MARKET BY COMPONENT (THOUSAND UNITS) 2022-2029

TABLE 61 INDIA AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2022-2029

TABLE 62 INDIA AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 63 CHINA AUTOMOTIVE ROBOTICS MARKET BY PRODUCT TYPE (USD BILLION) 2022-2029

TABLE 64 CHINA AUTOMOTIVE ROBOTICS MARKET BY COMPONENT (THOUSAND UNITS) 2022-2029

TABLE 65 CHINA AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2022-2029

TABLE 66 CHINA AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 67 JAPAN AUTOMOTIVE ROBOTICS MARKET BY PRODUCT TYPE (USD BILLION) 2022-2029

TABLE 68 JAPAN AUTOMOTIVE ROBOTICS MARKET BY COMPONENT (THOUSAND UNITS) 2022-2029

TABLE 69 JAPAN AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2022-2029

TABLE 70 JAPAN AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 71 SOUTH KOREA AUTOMOTIVE ROBOTICS MARKET BY PRODUCT TYPE (USD BILLION) 2022-2029

TABLE 72 SOUTH KOREA AUTOMOTIVE ROBOTICS MARKET BY COMPONENT (THOUSAND UNITS) 2022-2029

TABLE 73 SOUTH KOREA AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2022-2029

TABLE 74 SOUTH KOREA AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 75 AUSTRALIA AUTOMOTIVE ROBOTICS MARKET BY PRODUCT TYPE (USD BILLION) 2022-2029

TABLE 76 AUSTRALIA AUTOMOTIVE ROBOTICS MARKET BY COMPONENT (THOUSAND UNITS) 2022-2029

TABLE 77 AUSTRALIA AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2022-2029

TABLE 78 AUSTRALIA AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 79 SOUTH-EAST ASIA AUTOMOTIVE ROBOTICS MARKET BY PRODUCT TYPE (USD BILLION) 2022-2029

TABLE 80 SOUTH-EAST ASIA AUTOMOTIVE ROBOTICS MARKET BY COMPONENT (THOUSAND UNITS) 2022-2029

TABLE 81 SOUTH-EAST ASIA AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2022-2029

TABLE 82 SOUTH-EAST ASIA AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 83 REST OF ASIA PACIFIC AUTOMOTIVE ROBOTICS MARKET BY PRODUCT TYPE (USD BILLION) 2022-2029

TABLE 84 REST OF ASIA PACIFIC AUTOMOTIVE ROBOTICS MARKET BY COMPONENT (THOUSAND UNITS) 2022-2029

TABLE 85 REST OF ASIA PACIFIC AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2022-2029

TABLE 86 REST OF ASIA PACIFIC AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 87 EUROPE AUTOMOTIVE ROBOTICS MARKET BY COUNTRY (USD BILLION) 2022-2029

TABLE 88 EUROPE AUTOMOTIVE ROBOTICS MARKET BY COUNTRY (THOUSAND UNITS) 2022-2029

TABLE 89 EUROPE AUTOMOTIVE ROBOTICS MARKET BY PRODUCT TYPE (USD BILLION) 2022-2029

TABLE 90 EUROPE AUTOMOTIVE ROBOTICS MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2022-2029

TABLE 91 EUROPE AUTOMOTIVE ROBOTICS MARKET BY COMPONENT (USD BILLION) 2022-2029

TABLE 92 EUROPE AUTOMOTIVE ROBOTICS MARKET BY COMPONENT (THOUSAND UNITS) 2022-2029

TABLE 93 EUROPE AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 94 EUROPE AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2022-2029

TABLE 95 GERMANY AUTOMOTIVE ROBOTICS MARKET BY PRODUCT TYPE (USD BILLION) 2022-2029

TABLE 96 GERMANY AUTOMOTIVE ROBOTICS MARKET BY COMPONENT (THOUSAND UNITS) 2022-2029

TABLE 97 GERMANY AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2022-2029

TABLE 98 GERMANY AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 99 UK AUTOMOTIVE ROBOTICS MARKET BY PRODUCT TYPE (USD BILLION) 2022-2029

TABLE 100 UK AUTOMOTIVE ROBOTICS MARKET BY COMPONENT (THOUSAND UNITS) 2022-2029

TABLE 101 UK AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2022-2029

TABLE 102 UK AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 103 FRANCE AUTOMOTIVE ROBOTICS MARKET BY PRODUCT TYPE (USD BILLION) 2022-2029

TABLE 104 FRANCE AUTOMOTIVE ROBOTICS MARKET BY COMPONENT (THOUSAND UNITS) 2022-2029

TABLE 105 FRANCE AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2022-2029

TABLE 106 FRANCE AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 107 ITALY AUTOMOTIVE ROBOTICS MARKET BY PRODUCT TYPE (USD BILLION) 2022-2029

TABLE 108 ITALY AUTOMOTIVE ROBOTICS MARKET BY COMPONENT (THOUSAND UNITS) 2022-2029

TABLE 109 ITALY AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2022-2029

TABLE 110 ITALY AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 111 SPAIN AUTOMOTIVE ROBOTICS MARKET BY PRODUCT TYPE (USD BILLION) 2022-2029

TABLE 112 SPAIN AUTOMOTIVE ROBOTICS MARKET BY COMPONENT (THOUSAND UNITS) 2022-2029

TABLE 113 SPAIN AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2022-2029

TABLE 114 SPAIN AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 115 RUSSIA AUTOMOTIVE ROBOTICS MARKET BY PRODUCT TYPE (USD BILLION) 2022-2029

TABLE 116 RUSSIA AUTOMOTIVE ROBOTICS MARKET BY COMPONENT (THOUSAND UNITS) 2022-2029

TABLE 117 RUSSIA AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2022-2029

TABLE 118 RUSSIA AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 119 REST OF EUROPE AUTOMOTIVE ROBOTICS MARKET BY PRODUCT TYPE (USD BILLION) 2022-2029

TABLE 120 REST OF EUROPE AUTOMOTIVE ROBOTICS MARKET BY COMPONENT (THOUSAND UNITS) 2022-2029

TABLE 121 REST OF EUROPE AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2022-2029

TABLE 122 REST OF EUROPE AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 123 MIDDLE EAST AND AFRICA AUTOMOTIVE ROBOTICS MARKET BY COUNTRY (USD BILLION) 2022-2029

TABLE 124 MIDDLE EAST AND AFRICA AUTOMOTIVE ROBOTICS MARKET BY COUNTRY (THOUSAND UNITS) 2022-2029

TABLE 125 MIDDLE EAST AND AFRICA AUTOMOTIVE ROBOTICS MARKET BY PRODUCT TYPE (USD BILLION) 2022-2029

TABLE 126 MIDDLE EAST AND AFRICA AUTOMOTIVE ROBOTICS MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2022-2029

TABLE 127 MIDDLE EAST AND AFRICA AUTOMOTIVE ROBOTICS MARKET BY COMPONENT (USD BILLION) 2022-2029

TABLE 128 MIDDLE EAST AND AFRICA AUTOMOTIVE ROBOTICS MARKET BY COMPONENT (THOUSAND UNITS) 2022-2029

TABLE 129 MIDDLE EAST AND AFRICA AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 130 MIDDLE EAST AND AFRICA AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2022-2029

TABLE 131 UAE AUTOMOTIVE ROBOTICS MARKET BY PRODUCT TYPE (USD BILLION) 2022-2029

TABLE 132 UAE AUTOMOTIVE ROBOTICS MARKET BY COMPONENT (THOUSAND UNITS) 2022-2029

TABLE 133 UAE AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2022-2029

TABLE 134 UAE AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 135 SAUDI ARABIA AUTOMOTIVE ROBOTICS MARKET BY PRODUCT TYPE (USD BILLION) 2022-2029

TABLE 136 SAUDI ARABIA AUTOMOTIVE ROBOTICS MARKET BY COMPONENT (THOUSAND UNITS) 2022-2029

TABLE 137 SAUDI ARABIA AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2022-2029

TABLE 138 SAUDI ARABIA AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 139 SOUTH AFRICA AUTOMOTIVE ROBOTICS MARKET BY PRODUCT TYPE (USD BILLION) 2022-2029

TABLE 140 SOUTH AFRICA AUTOMOTIVE ROBOTICS MARKET BY COMPONENT (THOUSAND UNITS) 2022-2029

TABLE 141 SOUTH AFRICA AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2022-2029

TABLE 142 SOUTH AFRICA AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 143 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE ROBOTICS MARKET BY PRODUCT TYPE (USD BILLION) 2022-2029

TABLE 144 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE ROBOTICS MARKET BY COMPONENT (THOUSAND UNITS) 2022-2029

TABLE 145 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (THOUSAND UNITS) 2022-2029

TABLE 146 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE ROBOTICS MARKET BY APPLICATION (USD BILLION) 2022-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 AUTOMOTIVE ROBOTICS MARKET BY TYPE, USD BILLION, 2020-2029

FIGURE 9 AUTOMOTIVE ROBOTICS MARKET BY COMPONENT, USD BILLION, 2020-2029

FIGURE 10 AUTOMOTIVE ROBOTICS MARKET BY APPLICATION, USD BILLION, 2020-2029

FIGURE 11 AUTOMOTIVE ROBOTICS MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 AUTOMOTIVE ROBOTICS MARKET BY TYPE, USD BILLION, 2021

FIGURE 14 AUTOMOTIVE ROBOTICS MARKET BY COMPONENT, USD BILLION, 2021

FIGURE 15 AUTOMOTIVE ROBOTICS MARKET BY APPLICATION, USD BILLION, 2021

FIGURE 16 AUTOMOTIVE ROBOTICS MARKET BY REGION, USD BILLION, 2021

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 ABB LTD.: COMPANY SNAPSHOT

FIGURE 19 KUKA AG: COMPANY SNAPSHOT

FIGURE 20 FANUC CORPORATION: COMPANY SNAPSHOT

FIGURE 21 YASKAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

FIGURE 22 KAWASAKI HEAVY INDUSTRIES: COMPANY SNAPSHOT

FIGURE 23 DENSO WAVE INCORPORATED: COMPANY SNAPSHOT

FIGURE 24 COMAU SPA: COMPANY SNAPSHOT

FIGURE 25 NACHI-FUJIKOSHI CORP.: COMPANY SNAPSHOT

FIGURE 26 ROCKWELL AUTOMATION, INC.: COMPANY SNAPSHOT

FIGURE 27 SEIKO EPSON CORPORATION: COMPANY SNAPSHOT

FIGURE 28 DÜRR AG: COMPANY SNAPSHOT

FIGURE 29 HARMONIC DRIVE SYSTEM: COMPANY SNAPSHOT

FIGURE 30 NABTESCO MOTION CONTROL, INC.: COMPANY SNAPSHOT

FAQ

The automotive robotics market is expected to grow at 12.2% CAGR from 2022 to 2029. It is expected to reach above USD 17.92 billion by 2029 from USD 6.41 billion in 2022.

Asia Pacific held more than 32% of the automotive robotics market revenue share in 2022 and will witness expansion in the forecast period.

The primary market growth drivers are increasing vehicle production, improving cost competitiveness, and wage inflation.

Asia Pacific is the largest regional market for automotive robotics market.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.