REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

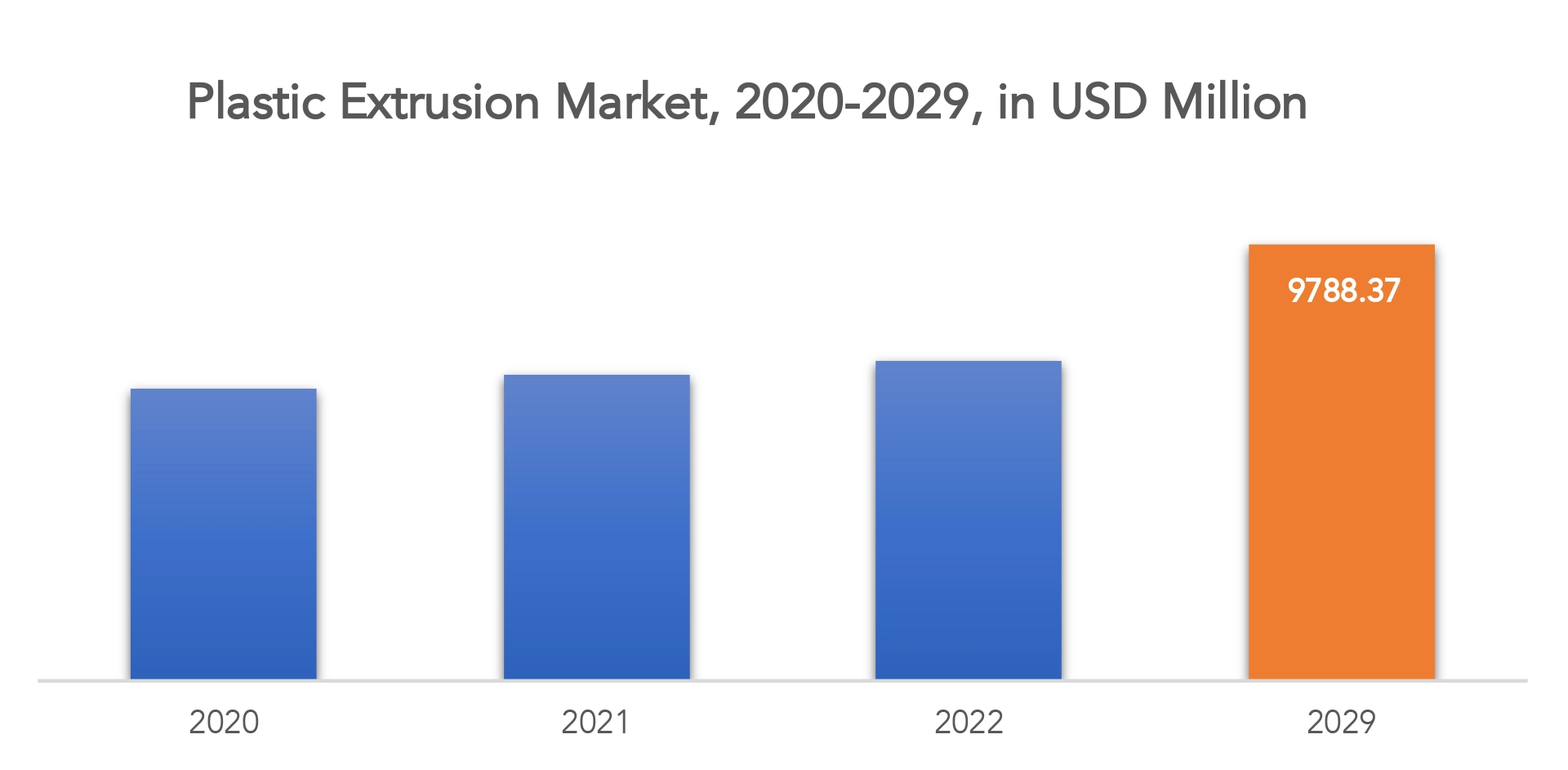

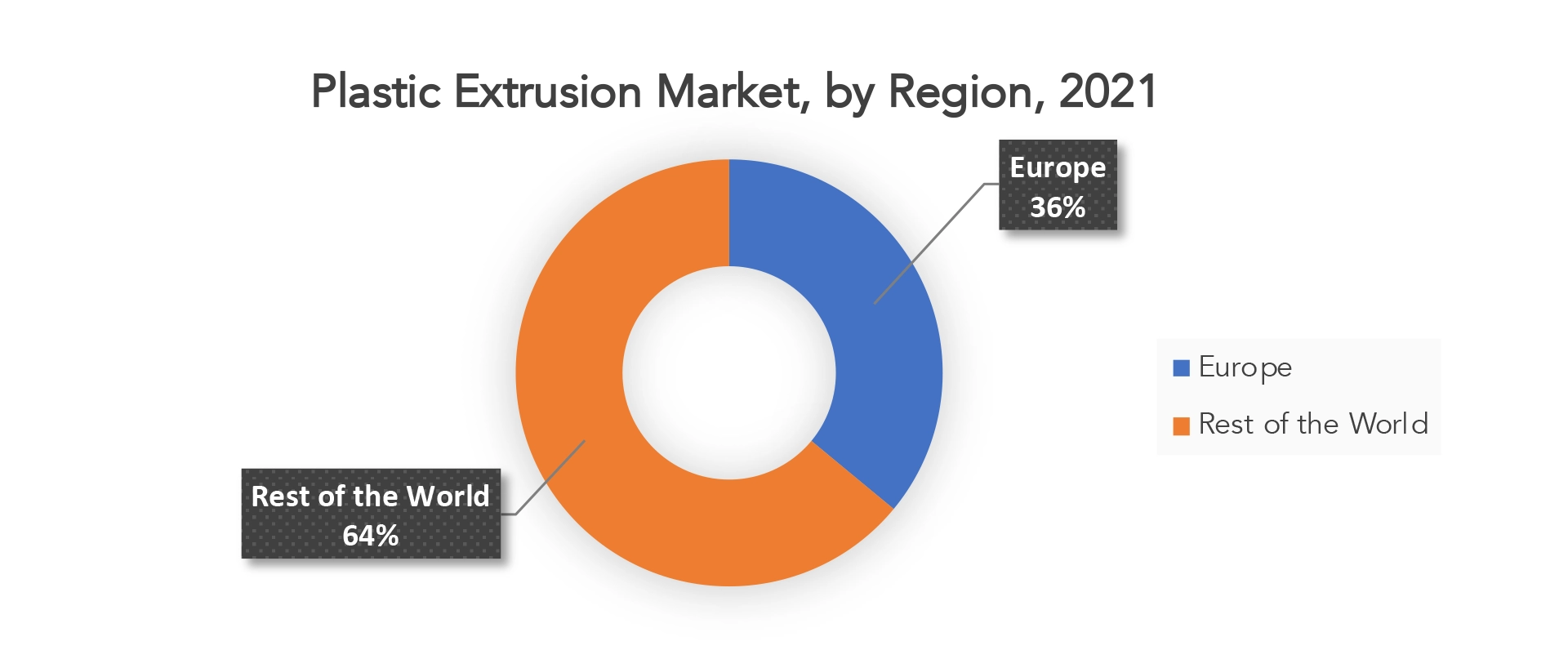

| USD 9788.3 million by 2029 | 4.5% | Europe |

| By Machine Type | By Process Type | By Solution | By Application |

|---|---|---|---|

|

|

|

|

SCOPE OF THE REPORT

Plastic Extrusion Machines Market Overview

The global plastic extrusion machines market size was valued at USD 7192.77 million in 2022, and is projected to reach USD 9788.3 million by 2029, registering a CAGR of 4.5% from 2022 to 2029.

A technique for creating consistent cross-sectional profiles is extrusion. A die with the desired shape and move-segment is used to press materials, including plastic or thermoplastic materials. The mechanical systems used to melt and change raw polymers in high-volume industrial processes are referred to as plastic extrusion machines, also known as plastic extruders. They consist of screw drives, screw drive motors, barrels, hoppers, and temperature controllers.

The Precious Plastic Extrusion machine is an open source equipment that converts waste plastic into recyclable beams, bricks, and other materials. Automotive, packaging, healthcare, and other industries have strong demand for various types of plastic extrusion machines. Plastic extrusion is a method for creating plastic items with defined cross-sectional profiles. Extruded plastic goods include weather-stripping lines, pipes, tubes, plastic films, window frames, plastic sheet, wire insulations, and thermoplastic coatings.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD MILLION) |

| Segmentation | By Machine Type, By Process Type, By Solution, By Application, By Region. |

| By Machine Type |

|

| By Process Type |

|

| By Solution |

|

| By Application |

|

| By Region |

|

The primary benefit of the plastic extrusion technique is that the plastic can be given any complex shape and moulded into any design without showing any signs of cracks or flaws because it only experiences compressive and shear stresses. In addition to that, the technique aids in producing parts and components with superb surface finishes. A barrel and screw, heaters, die, and screw drives are all components of the extruder machine. Two conditions must be applied for the extrusion machine to function: pressure.

Global awareness of energy conservation is increasing, which is driving the market for plastic extrusion machines to rise. To support the market’s expansion, twin-screw plastic extrusion machine manufacturers are progressively concentrating on producing effective and dependable machines. The TEX series of twin-screw extruders are provided by the Japan Steel Works (JSW), which guarantees high degassing and high kneading performance for direct film/sheet processing.

Consumers’ hurried lifestyles have increased their use of frozen food and, as a result, extruded plastic items, leading to an increase in demand for plastic extrusion machines. Higher manufacturing rates and faster production through plastic extrusion are expected to fuel the expansion of the global plastic extrusion machine market. Shubham Extrusion Pvt. Ltd., for example, provides a wide range of blown film plastic extrusion machines to the market, including 5-layer and 7-layer co-extrusion blown film plants, twin-die blown film plants, and others for a variety of applications such as lamination films, courier bag films, agriculture film, liner bags, and others.

The need for plastic extrusion machines in the building and construction industry is likely to fuel market expansion. Furthermore, rising demand for extruder machines in the transportation industry is propelling the growth of the plastic extrusion machine market. Plastic extrusion machines for building and construction applications are being offered by major firms such as China National Chemical Corporation Ltd., UNION Officine Meccaniche SpA, and others.

The high initial tooling and machinery costs necessary for plastic extrusion machines are projected to limit the market’s growth. On the contrary, technological advancements such as artificial intelligence-based plastic extrusion machines and software-supported plastic extrusion machines are expected to create profitable prospects for the plastic extrusion machines market to develop.

The packaging sector is always looking for plastics to satisfy their needs, and this is a major factor driving the growth of the worldwide plastic extrusion machine market. Plastics of various sorts are produced by the processing machinery during the manufacturing process. Plastic processing is gaining popularity in the packaging sectors due to the pollutant-free and toxin-resistant aspects, which is boosting the expansion of the worldwide plastic processing machines market share.

Plastic Extrusion Machines Market Segment Analysis

The global plastic extrusion machine market is segmented based on machine type, solution, process type, application, and region. Based on machine type, the market is divided into twin-screw and single screw. The twin screw segment is expected to account for major revenue share in the global market and is projected to record the highest revenue share over the 10-year forecast period. This is due to higher adoption of twin screw extrusion machinery for use in various industries such as construction and packaging.

Based on the solution, the market is bifurcated into new sales and aftermarket. The new sales segment is anticipated to dominate the global plastic extrusion machine market throughout the study period.

Based on process type, the market is divided into blown film extrusion, sheet/film extrusion, tubing extrusion, and others. In terms of revenue, the blown film extrusion segment is estimated to hold a major global plastic extrusion machine market share throughout the study period.

Based on application, the market is divided into building & construction, medical, transportation, consumer goods, and others. The building & construction segment is anticipated to dominate the global plastic extrusion machine market.

Plastic Extrusion Machines Market Players

The key players profiled in this report include Bausano & Figli SpA, Costruzioni Meccaniche Luigi Bandera SpA, Kabra ExtrusionTechnik Ltd., KraussMaffei Group, Milacron Holdings Corp., Reifenhäuser GmbH & Co. KG Maschinenfabrik, The Japan Steel Works, Toshiba Machine Co., Ltd., UNION Officine Meccaniche SpA, and Windsor Machines Limited.

Top Global Plastic Extrusion Companies:

DowDuPont, recently split into DuPont, Dow, and Cortiva Agriscience is considered the world’s largest chemical company, specialising in agriculture, material science, and specialty products. Their plastic’s division includes performance products, chemical protection, infrastructure, and consumer solutions, and continually places them on the Fortune 500 list. They have a global presence but are headquartered in Wilmington, DE.

Berry Global is a multi-MILLION-dollar plastic company, employing over 48,000 people to produce numerous packaging, stock, and custom plastic goods for a variety of industries. Clients of Berry include McDonald’s, Gillette, Coca-Cola, Wal-Mart, Hershey, and many more mega brands. Their headquarters is in Evansville, IN.

Westlake Chemical Corp of Houston, TX is a global manufacturer of material solutions for packaging, healthcare, automotive, consumer goods, and building products, among many other applications. They operate in 50+ locations throughout North America, Europe, and Asia, and specialize in olefins, polyethylene, vinyl, and specialty chemical products.

Who Should Buy? Or Key stakeholders

- Research and development

- Manufacturing

- End Use industries

- Automotive

- E-Commerce and Retail

- Industrial and Manufacturing

Plastic Extrusion Machines Market Regional Analysis

Geographically, the Plastic Extrusion Machines Market is segmented into North America, South America, Europe, APAC and MEA.

- North America: includes the US, Canada, Mexico

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

People’s preference for smooth and comfy plastic products is expected to account for a sizable market share in the Asia Pacific area, and as a result, this region’s market is anticipated to grow at the fastest rate. Due to the existence of several small to mid-level manufacturing industries, including packaging, consumer goods, automotive, and packaging, there is a significant need for plastic extrusion machines in nations like China and India. These industries demand extruded plastic products of superior quality and constant profile.

Europe controls 19.80% of the worldwide plastic extrusion machine market. Europe is expected to grow at an exponential rate due to the region’s burgeoning automobile industry. Countries such as the United Kingdom and Germany are expected to grow popular in this area due to tough pollution standards that are increasing demand for plastic materials in all vehicles worldwide.

Due to ongoing improvements in plastic extrusion techniques and quickly expanding end-use sectors, the North American industry is anticipated to have a much greater revenue share in the global market. However, tight regulatory rules put in place by the FDA, EPA, and other relevant authorities, as well as growing consumer awareness of the negative environmental implications of consuming plastic items, are predicted to have a detrimental impact on the growth of the North American market.

Key Market Segments: Plastic Extrusion Machines Market

Plastic Extrusion Machines Market By Machine Type, 2020-2029, (Usd Million)

- Single-Screw

- Twin-Screw

Plastic Extrusion Machines Market By Process, 2020-2029, (Usd Million)

- Blown Film Extrusion

- Sheet/Film Extrusion

- Tubing Extrusion

- Others

Plastic Extrusion Machines Market By Solution, 2020-2029, (Usd Million)

- New Sales

- Aftermarket

Plastic Extrusion Machines Market By Application, 2020-2029, (Usd Million)

- Building & Construction

- Medical

- Transportation

- Consumer Goods

- Others

Plastic Extrusion Machines Market By Regions, 2020-2029, (Usd Million)

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

IMPORTANT COUNTRIES IN ALL REGIONS ARE COVERED

Key Question Answered

- What is the current scenario of the global Plastic Extrusion Machines Market?

- What are the emerging technologies for the development of Plastic extrusion Machine devices?

- What are the historical size and the present size of the market segments and their future potential?

- What are the major catalysts for the market and their impact during the short, medium, and long terms?

- What are the evolving opportunities for the players in the market?

- Which are the key regions from the investment perspective?

- What are the key strategies being adopted by the major players to up their market shares?

Table of Content

-

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL PLASTIC PACKAGING MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON THE GLOBAL PLASTIC PACKAGING MARKET

- GLOBAL PLASTIC PACKAGING MARKET OUTLOOK

- GLOBAL PLASTIC PACKAGING MARKET BY PRODUCT, 2021-2029, (USD BILLION) (KILOTONS)

- RIGID

- FLEXIBLE

- GLOBAL PLASTIC PACKAGING MARKET BY TECHNOLOGY, 2021-2029, (USD BILLION) (KILOTONS)

- INJECTION MOLDING

- EXTRUSION

- BLOW MOLDING

- THERMOFORMING

- OTHERS

- GLOBAL PLASTIC PACKAGING MARKET BY APPLICATION, 2022-2029, (USD BILLION) (KILOTONS)

- FOOD & BEVERAGES

- INDUSTRIAL PACKAGING

- PHARMACEUTICALS

- PERSONAL & HOUSEHOLD CARE

- OTHERS

- GLOBAL PLASTIC PACKAGING MARKET BY REGION, (USD BILLIONS) (KILOTONS)

- INTRODUCTION

- ASIA-PACIFIC

- CHINA

- INDIA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA-PACIFIC

- NORTH AMERICA

- UNITED STATES

- CANADA

- MEXICO

- EUROPE

- GERMANY

- UNITED KINGDOM

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT OFFERED, RECENT DEVELOPMENTS)

- AMCOR PLC

- SEALED AIR

- COVERIS

- BERRY GLOBAL INC

- MONDI

- SONOCO PRODUCTS COMPANY

- WIN-PAK LTD

- CCL INDUSTRIES

- CONSTANTIA FLEXIBLES

- ALPHA PACKAGING

*THE COMPANY LIST IS INDICATIVE

- INTRODUCTION

LIST OF TABLES

TABLE 1 GLOBAL PLASTIC PACKAGING MARKET BY APPLICATION (USD BILLIONS) 2021-2029

TABLE 2 GLOBAL PLASTIC PACKAGING MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 3 GLOBAL PLASTIC PACKAGING MARKET BY PRODUCT (USD BILLIONS) 2021-2029

TABLE 4 GLOBAL PLASTIC PACKAGING MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 5 GLOBAL PLASTIC PACKAGING MARKET BY TECHNOLOGY (USD BILLIONS) 2021-2029

TABLE 6 GLOBAL PLASTIC PACKAGING MARKET BY TECHNOLOGY (KILOTONS) 2021-2029

TABLE 7 GLOBAL PLASTIC PACKAGING MARKET BY REGION (USD BILLIONS) 2021-2029

TABLE 8 GLOBAL PLASTIC PACKAGING MARKET BY REGION (KILOTONS) 2021-2029

TABLE 9 NORTH AMERICA PLASTIC PACKAGING MARKET BY COUNTRY (USD BILLIONS) 2021-2029

TABLE 10 NORTH AMERICA PLASTIC PACKAGING MARKET BY COUNTRY (KILOTONS) 2021-2029

TABLE 11 US PLASTIC PACKAGING MARKET BY APPLICATION (USD BILLIONS) 2021-2029

TABLE 12 US PLASTIC PACKAGING MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 13 US PLASTIC PACKAGING MARKET BY PRODUCT (USD BILLIONS) 2021-2029

TABLE 14 US PLASTIC PACKAGING MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 15 US PLASTIC PACKAGING MARKET BY TECHNOLOGY (USD BILLIONS) 2021-2029

TABLE 16 US PLASTIC PACKAGING MARKET BY TECHNOLOGY (KILOTONS) 2021-2029

TABLE 17 CANADA PLASTIC PACKAGING MARKET BY APPLICATION (USD BILLIONS) 2021-2029

TABLE 18 CANADA PLASTIC PACKAGING MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 19 CANADA PLASTIC PACKAGING MARKET BY PRODUCT (USD BILLIONS) 2021-2029

TABLE 20 CANADA PLASTIC PACKAGING MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 21 CANADA PLASTIC PACKAGING MARKET BY TECHNOLOGY (USD BILLIONS) 2021-2029

TABLE 22 CANADA PLASTIC PACKAGING MARKET BY TECHNOLOGY (KILOTONS) 2021-2029

TABLE 23 MEXICO PLASTIC PACKAGING MARKET BY APPLICATION (USD BILLIONS) 2021-2029

TABLE 24 MEXICO PLASTIC PACKAGING MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 25 MEXICO PLASTIC PACKAGING MARKET BY PRODUCT (USD BILLIONS) 2021-2029

TABLE 26 MEXICO PLASTIC PACKAGING MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 27 MEXICO PLASTIC PACKAGING MARKET BY TECHNOLOGY (USD BILLIONS) 2021-2029

TABLE 28 MEXICO PLASTIC PACKAGING MARKET BY TECHNOLOGY (KILOTONS) 2021-2029

TABLE 29 SOUTH AMERICA PLASTIC PACKAGING MARKET BY COUNTRY (USD BILLIONS) 2021-2029

TABLE 30 SOUTH AMERICA PLASTIC PACKAGING MARKET BY COUNTRY (KILOTONS) 2021-2029

TABLE 31 BRAZIL PLASTIC PACKAGING MARKET BY APPLICATION (USD BILLIONS) 2021-2029

TABLE 32 BRAZIL PLASTIC PACKAGING MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 33 BRAZIL PLASTIC PACKAGING MARKET BY PRODUCT (USD BILLIONS) 2021-2029

TABLE 34 BRAZIL PLASTIC PACKAGING MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 35 BRAZIL PLASTIC PACKAGING MARKET BY TECHNOLOGY (USD BILLIONS) 2021-2029

TABLE 36 BRAZIL PLASTIC PACKAGING MARKET BY TECHNOLOGY (KILOTONS) 2021-2029

TABLE 37 ARGENTINA PLASTIC PACKAGING MARKET BY APPLICATION (USD BILLIONS) 2021-2029

TABLE 38 ARGENTINA PLASTIC PACKAGING MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 39 ARGENTINA PLASTIC PACKAGING MARKET BY PRODUCT (USD BILLIONS) 2021-2029

TABLE 40 ARGENTINA PLASTIC PACKAGING MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 41 ARGENTINA PLASTIC PACKAGING MARKET BY TECHNOLOGY (USD BILLIONS) 2021-2029

TABLE 42 ARGENTINA PLASTIC PACKAGING MARKET BY TECHNOLOGY (KILOTONS) 2021-2029

TABLE 43 COLOMBIA PLASTIC PACKAGING MARKET BY APPLICATION (USD BILLIONS) 2021-2029

TABLE 44 COLOMBIA PLASTIC PACKAGING MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 45 COLOMBIA PLASTIC PACKAGING MARKET BY PRODUCT (USD BILLIONS) 2021-2029

TABLE 46 COLOMBIA PLASTIC PACKAGING MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 47 COLOMBIA PLASTIC PACKAGING MARKET BY TECHNOLOGY (USD BILLIONS) 2021-2029

TABLE 48 COLOMBIA PLASTIC PACKAGING MARKET BY TECHNOLOGY (KILOTONS) 2021-2029

TABLE 49 REST OF SOUTH AMERICA PLASTIC PACKAGING MARKET BY APPLICATION (USD BILLIONS) 2021-2029

TABLE 50 REST OF SOUTH AMERICA PLASTIC PACKAGING MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 51 REST OF SOUTH AMERICA PLASTIC PACKAGING MARKET BY PRODUCT (USD BILLIONS) 2021-2029

TABLE 52 REST OF SOUTH AMERICA PLASTIC PACKAGING MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 53 REST OF SOUTH AMERICA PLASTIC PACKAGING MARKET BY TECHNOLOGY (USD BILLIONS) 2021-2029

TABLE 54 REST OF SOUTH AMERICA PLASTIC PACKAGING MARKET BY TECHNOLOGY (KILOTONS) 2021-2029

TABLE 55 ASIA-PACIFIC PLASTIC PACKAGING MARKET BY COUNTRY (USD BILLIONS) 2021-2029

TABLE 56 ASIA-PACIFIC PLASTIC PACKAGING MARKET BY COUNTRY (KILOTONS) 2021-2029

TABLE 57 INDIA PLASTIC PACKAGING MARKET BY APPLICATION (USD BILLIONS) 2021-2029

TABLE 58 INDIA PLASTIC PACKAGING MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 59 INDIA PLASTIC PACKAGING MARKET BY PRODUCT (USD BILLIONS) 2021-2029

TABLE 60 INDIA PLASTIC PACKAGING MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 61 INDIA PLASTIC PACKAGING MARKET BY TECHNOLOGY (USD BILLIONS) 2021-2029

TABLE 62 INDIA PLASTIC PACKAGING MARKET BY TECHNOLOGY (KILOTONS) 2021-2029

TABLE 63 CHINA PLASTIC PACKAGING MARKET BY APPLICATION (USD BILLIONS) 2021-2029

TABLE 64 CHINA PLASTIC PACKAGING MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 65 CHINA PLASTIC PACKAGING MARKET BY PRODUCT (USD BILLIONS) 2021-2029

TABLE 66 CHINA PLASTIC PACKAGING MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 67 CHINA PLASTIC PACKAGING MARKET BY TECHNOLOGY (USD BILLIONS) 2021-2029

TABLE 68 CHINA PLASTIC PACKAGING MARKET BY TECHNOLOGY (KILOTONS) 2021-2029

TABLE 69 JAPAN PLASTIC PACKAGING MARKET BY APPLICATION (USD BILLIONS) 2021-2029

TABLE 70 JAPAN PLASTIC PACKAGING MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 71 JAPAN PLASTIC PACKAGING MARKET BY PRODUCT (USD BILLIONS) 2021-2029

TABLE 72 JAPAN PLASTIC PACKAGING MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 73 JAPAN PLASTIC PACKAGING MARKET BY TECHNOLOGY (USD BILLIONS) 2021-2029

TABLE 74 JAPAN PLASTIC PACKAGING MARKET BY TECHNOLOGY (KILOTONS) 2021-2029

TABLE 75 SOUTH KOREA PLASTIC PACKAGING MARKET BY APPLICATION (USD BILLIONS) 2021-2029

TABLE 76 SOUTH KOREA PLASTIC PACKAGING MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 77 SOUTH KOREA PLASTIC PACKAGING MARKET BY PRODUCT (USD BILLIONS) 2021-2029

TABLE 78 SOUTH KOREA PLASTIC PACKAGING MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 79 SOUTH KOREA PLASTIC PACKAGING MARKET BY TECHNOLOGY (USD BILLIONS) 2021-2029

TABLE 80 SOUTH KOREA PLASTIC PACKAGING MARKET BY TECHNOLOGY (KILOTONS) 2021-2029

TABLE 81 AUSTRALIA PLASTIC PACKAGING MARKET BY APPLICATION (USD BILLIONS) 2021-2029

TABLE 82 AUSTRALIA PLASTIC PACKAGING MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 83 AUSTRALIA PLASTIC PACKAGING MARKET BY PRODUCT (USD BILLIONS) 2021-2029

TABLE 84 AUSTRALIA PLASTIC PACKAGING MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 85 AUSTRALIA PLASTIC PACKAGING MARKET BY TECHNOLOGY (USD BILLIONS) 2021-2029

TABLE 86 AUSTRALIA PLASTIC PACKAGING MARKET BY TECHNOLOGY (KILOTONS) 2021-2029

TABLE 87 SOUTH-EAST ASIA PLASTIC PACKAGING MARKET BY APPLICATION (USD BILLIONS) 2021-2029

TABLE 88 SOUTH-EAST ASIA PLASTIC PACKAGING MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 89 SOUTH-EAST ASIA PLASTIC PACKAGING MARKET BY PRODUCT (USD BILLIONS) 2021-2029

TABLE 90 SOUTH-EAST ASIA PLASTIC PACKAGING MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 91 SOUTH-EAST ASIA PLASTIC PACKAGING MARKET BY TECHNOLOGY (USD BILLIONS) 2021-2029

TABLE 92 SOUTH-EAST ASIA PLASTIC PACKAGING MARKET BY TECHNOLOGY (KILOTONS) 2021-2029

TABLE 93 REST OF ASIA PACIFIC PLASTIC PACKAGING MARKET BY APPLICATION (USD BILLIONS) 2021-2029

TABLE 94 REST OF ASIA PACIFIC PLASTIC PACKAGING MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 95 REST OF ASIA PACIFIC PLASTIC PACKAGING MARKET BY PRODUCT (USD BILLIONS) 2021-2029

TABLE 96 REST OF ASIA PACIFIC PLASTIC PACKAGING MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 97 REST OF ASIA PACIFIC PLASTIC PACKAGING MARKET BY TECHNOLOGY (USD BILLIONS) 2021-2029

TABLE 98 REST OF ASIA PACIFIC PLASTIC PACKAGING MARKET BY TECHNOLOGY (KILOTONS) 2021-2029

TABLE 99 EUROPE PLASTIC PACKAGING MARKET BY COUNTRY (USD BILLIONS) 2021-2029

TABLE 100 EUROPE PLASTIC PACKAGING MARKET BY COUNTRY (KILOTONS) 2021-2029

TABLE 101 GERMANY PLASTIC PACKAGING MARKET BY APPLICATION (USD BILLIONS) 2021-2029

TABLE 102 GERMANY PLASTIC PACKAGING MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 103 GERMANY PLASTIC PACKAGING MARKET BY PRODUCT (USD BILLIONS) 2021-2029

TABLE 104 GERMANY PLASTIC PACKAGING MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 105 GERMANY PLASTIC PACKAGING MARKET BY TECHNOLOGY (USD BILLIONS) 2021-2029

TABLE 106 GERMANY PLASTIC PACKAGING MARKET BY TECHNOLOGY (KILOTONS) 2021-2029

TABLE 107 UK PLASTIC PACKAGING MARKET BY APPLICATION (USD BILLIONS) 2021-2029

TABLE 108 UK PLASTIC PACKAGING MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 109 UK PLASTIC PACKAGING MARKET BY PRODUCT (USD BILLIONS) 2021-2029

TABLE 110 UK PLASTIC PACKAGING MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 111 UK PLASTIC PACKAGING MARKET BY TECHNOLOGY (USD BILLIONS) 2021-2029

TABLE 112 UK PLASTIC PACKAGING MARKET BY TECHNOLOGY (KILOTONS) 2021-2029

TABLE 113 FRANCE PLASTIC PACKAGING MARKET BY APPLICATION (USD BILLIONS) 2021-2029

TABLE 114 FRANCE PLASTIC PACKAGING MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 115 FRANCE PLASTIC PACKAGING MARKET BY PRODUCT (USD BILLIONS) 2021-2029

TABLE 116 FRANCE PLASTIC PACKAGING MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 117 FRANCE PLASTIC PACKAGING MARKET BY TECHNOLOGY (USD BILLIONS) 2021-2029

TABLE 118 FRANCE PLASTIC PACKAGING MARKET BY TECHNOLOGY (KILOTONS) 2021-2029

TABLE 119 ITALY PLASTIC PACKAGING MARKET BY APPLICATION (USD BILLIONS) 2021-2029

TABLE 120 ITALY PLASTIC PACKAGING MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 121 ITALY PLASTIC PACKAGING MARKET BY PRODUCT (USD BILLIONS) 2021-2029

TABLE 122 ITALY PLASTIC PACKAGING MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 123 ITALY PLASTIC PACKAGING MARKET BY TECHNOLOGY (USD BILLIONS) 2021-2029

TABLE 124 ITALY PLASTIC PACKAGING MARKET BY TECHNOLOGY (KILOTONS) 2021-2029

TABLE 125 SPAIN PLASTIC PACKAGING MARKET BY APPLICATION (USD BILLIONS) 2021-2029

TABLE 126 SPAIN PLASTIC PACKAGING MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 127 SPAIN PLASTIC PACKAGING MARKET BY PRODUCT (USD BILLIONS) 2021-2029

TABLE 128 SPAIN PLASTIC PACKAGING MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 129 SPAIN PLASTIC PACKAGING MARKET BY TECHNOLOGY (USD BILLIONS) 2021-2029

TABLE 130 SPAIN PLASTIC PACKAGING MARKET BY TECHNOLOGY (KILOTONS) 2021-2029

TABLE 131 RUSSIA PLASTIC PACKAGING MARKET BY APPLICATION (USD BILLIONS) 2021-2029

TABLE 132 RUSSIA PLASTIC PACKAGING MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 133 RUSSIA PLASTIC PACKAGING MARKET BY PRODUCT (USD BILLIONS) 2021-2029

TABLE 134 RUSSIA PLASTIC PACKAGING MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 135 RUSSIA PLASTIC PACKAGING MARKET BY TECHNOLOGY (USD BILLIONS) 2021-2029

TABLE 136 RUSSIA PLASTIC PACKAGING MARKET BY TECHNOLOGY (KILOTONS) 2021-2029

TABLE 137 REST OF EUROPE PLASTIC PACKAGING MARKET BY APPLICATION (USD BILLIONS) 2021-2029

TABLE 138 REST OF EUROPE PLASTIC PACKAGING MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 139 REST OF EUROPE PLASTIC PACKAGING MARKET BY PRODUCT (USD BILLIONS) 2021-2029

TABLE 140 REST OF EUROPE PLASTIC PACKAGING MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 141 REST OF EUROPE PLASTIC PACKAGING MARKET BY TECHNOLOGY (USD BILLIONS) 2021-2029

TABLE 142 REST OF EUROPE PLASTIC PACKAGING MARKET BY TECHNOLOGY (KILOTONS) 2021-2029

TABLE 143 MIDDLE EAST AND AFRICA PLASTIC PACKAGING MARKET BY COUNTRY (USD BILLIONS) 2021-2029

TABLE 144 MIDDLE EAST AND AFRICA PLASTIC PACKAGING MARKET BY COUNTRY (KILOTONS) 2021-2029

TABLE 145 UAE PLASTIC PACKAGING MARKET BY APPLICATION (USD BILLIONS) 2021-2029

TABLE 146 UAE PLASTIC PACKAGING MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 147 UAE PLASTIC PACKAGING MARKET BY PRODUCT (USD BILLIONS) 2021-2029

TABLE 148 UAE PLASTIC PACKAGING MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 149 UAE PLASTIC PACKAGING MARKET BY TECHNOLOGY (USD BILLIONS) 2021-2029

TABLE 150 UAE PLASTIC PACKAGING MARKET BY TECHNOLOGY (KILOTONS) 2021-2029

TABLE 151 SAUDI ARABIA PLASTIC PACKAGING MARKET BY APPLICATION (USD BILLIONS) 2021-2029

TABLE 152 SAUDI ARABIA PLASTIC PACKAGING MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 153 SAUDI ARABIA PLASTIC PACKAGING MARKET BY PRODUCT (USD BILLIONS) 2021-2029

TABLE 154 SAUDI ARABIA PLASTIC PACKAGING MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 155 SAUDI ARABIA PLASTIC PACKAGING MARKET BY TECHNOLOGY (USD BILLIONS) 2021-2029

TABLE 156 SAUDI ARABIA PLASTIC PACKAGING MARKET BY TECHNOLOGY (KILOTONS) 2021-2029

TABLE 157 SOUTH AFRICA PLASTIC PACKAGING MARKET BY APPLICATION (USD BILLIONS) 2021-2029

TABLE 158 SOUTH AFRICA PLASTIC PACKAGING MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 159 SOUTH AFRICA PLASTIC PACKAGING MARKET BY PRODUCT (USD BILLIONS) 2021-2029

TABLE 160 SOUTH AFRICA PLASTIC PACKAGING MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 161 SOUTH AFRICA PLASTIC PACKAGING MARKET BY TECHNOLOGY (USD BILLIONS) 2021-2029

TABLE 162 SOUTH AFRICA PLASTIC PACKAGING MARKET BY TECHNOLOGY (KILOTONS) 2021-2029

TABLE 163 REST OF MIDDLE EAST AND AFRICA PLASTIC PACKAGING MARKET BY APPLICATION (USD BILLIONS) 2021-2029

TABLE 164 REST OF MIDDLE EAST AND AFRICA PLASTIC PACKAGING MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 165 REST OF MIDDLE EAST AND AFRICA PLASTIC PACKAGING MARKET BY PRODUCT (USD BILLIONS) 2021-2029

TABLE 166 REST OF MIDDLE EAST AND AFRICA PLASTIC PACKAGING MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 167 REST OF MIDDLE EAST AND AFRICA PLASTIC PACKAGING MARKET BY TECHNOLOGY (USD BILLIONS) 2021-2029

TABLE 168 REST OF MIDDLE EAST AND AFRICA PLASTIC PACKAGING MARKET BY TECHNOLOGY (KILOTONS) 2021-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL PLASTIC PACKAGING MARKET BY PRODUCT, (USD BILLION), 2021-2029

FIGURE 9 GLOBAL PLASTIC PACKAGING MARKET BY APPLICATION, (USD BILLION), 2021-2029

FIGURE 10 GLOBAL PLASTIC PACKAGING MARKET BY TECHNOLOGY, (USD BILLION), 2021-2029

FIGURE 11 GLOBAL PLASTIC PACKAGING MARKET BY REGION, (USD BILLION), 2021-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL PLASTIC PACKAGING MARKET BY PRODUCT, 2021

FIGURE 14 GLOBAL PLASTIC PACKAGING MARKET BY APPLICATION PRODUCT, 2021

FIGURE 15 GLOBAL PLASTIC PACKAGING MARKET BY TECHNOLOGY, 2021

FIGURE 16 PLASTIC PACKAGING MARKET BY REGION, 2021

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 AMCOR PLC: COMPANY SNAPSHOT

FIGURE 19 SEALED AIR: COMPANY SNAPSHOT

FIGURE 20 COVERIS: COMPANY SNAPSHOT

FIGURE 21 BERRY GLOBAL INC: COMPANY SNAPSHOT

FIGURE 22 MONDI: COMPANY SNAPSHOT

FIGURE 23 SONOCO PRODUCTS COMPANY: COMPANY SNAPSHOT

FIGURE 24 WIN-PAK LTD: COMPANY SNAPSHOT

FIGURE 25 CCL INDUSTRIES: COMPANY SNAPSHOT

FIGURE 26 CONSTANTIA FLEXIBLES: COMPANY SNAPSHOT

FAQ

The global plastic extrusion machines market size was valued at USD 6586.64 million in 2020 and is expected to expand at a compound annual growth rate of 4.5% from 2021 to 2028.

The upcoming trend in Plastic Extrusion Machines Market is an opportunity in enterprise applications is an opportunity for market growth.

The global Plastic Extrusion Machines Market registered a CAGR of 4.5% from 2022 to 2029.

Europe is the largest regional market with 36% of share owning in 2021.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.