Report Outlook

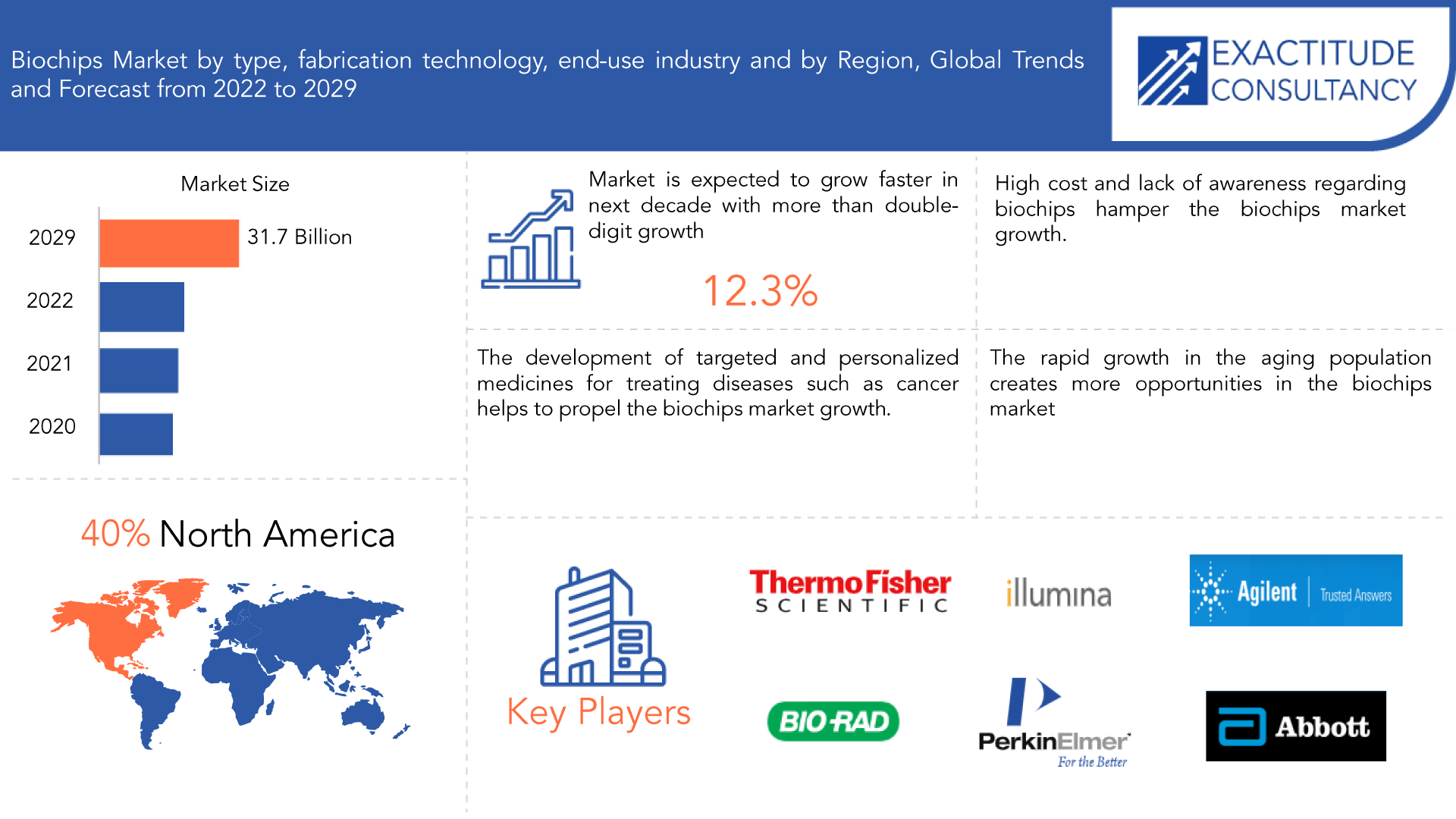

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 31.7 billion by 2029 | 12.3% | North America |

| By Type | By Fabrication Technology | By End-Use Industry | By Region |

|---|---|---|---|

|

|

|

|

SCOPE OF THE REPORT

Biochips Market Overview

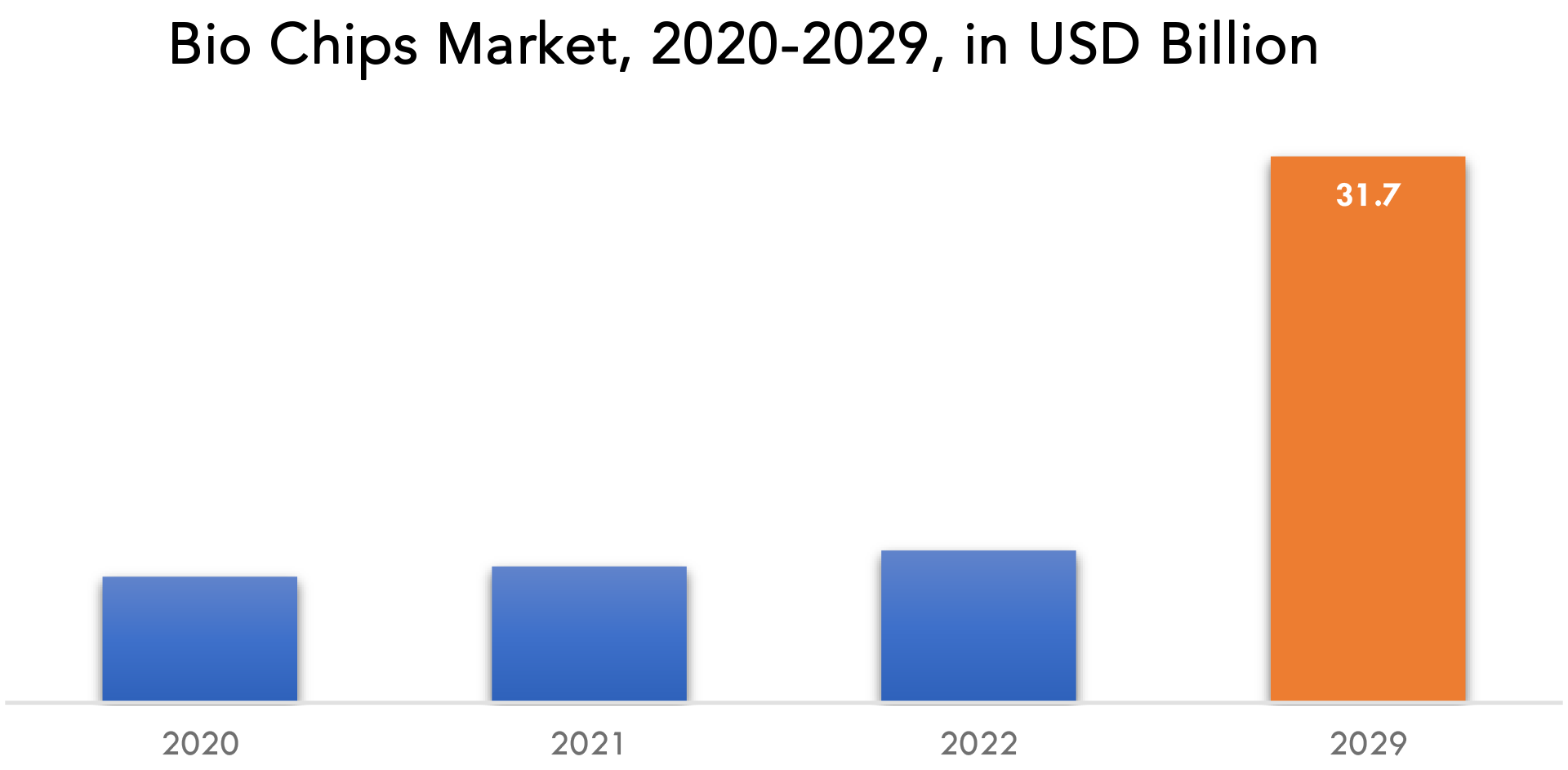

The global biochips market is expected to grow at 12.3% CAGR from 2020 to 2029. It is expected to reach above USD 31.7 billion by 2029 from USD 7.3 billion in 2020.

A biochip is a tiny lab that can carry out thousands of simultaneous biochemical operations. It is made up of several micro-test sites, also known as microarrays, that are organized on the surface of a solid substrate. Its purpose is to run several tests simultaneously to increase throughput and speed. In molecular laboratories, a biochip is a little medical gadget that can perform multiple biochemical processes at once. It is capable of quickly screening a variety of biological analytes for a range of uses, including the diagnosis of diseases and the identification of dangerous biological agents in a system. Millions of sensor components or biosensors make up this device. These are not electronic devices, unlike microchips. Every single biochip can be viewed as a tiny microreactor that is capable of detecting a specific analyte, such as an enzyme, protein, DNA molecule, biological molecule, or antibody. This chip’s primary purpose is to carry out hundreds of biological processes in a matter of seconds, such as gene decoding (a sequence of DNA). Biochips are used to rescue the sick and it is very small in size, powerful, and faster. Biochips are also useful in finding lost people. Biochips perform thousands of biological reactions in a few seconds. These are some advantages of the biochips market.

Biochips based on microarray and microfluidic technologies, the most effective of which is the digital microfluid biochip and have grown significantly in popularity in the biochemical sector. A new kind of bio-security miniature medical gadget called a biochip is utilized in molecular biology to precisely track information. In just a few seconds, biochips may carry out hundreds of biological processes.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion), (Thousand Units) |

| Segmentation | By Type, By Fabrication Technology, By End-User, By Region |

| By Type

|

|

| By Fabrication Technology

|

|

| By End-User

|

|

| By Region

|

|

The COVID-19 pandemic’s influence on public health and the biochip supply chain led to an imbalance in supply and demand. With assistance from academic institutions and biopharma businesses, product demand expanded. For instance, a team of scientists from The Czech Academy of Sciences (CAS) created a device with a biochip to identify the COVID-19 virus in January 2022. The researchers claim that a biochip is equally accurate and as quick as a PCR test. It is anticipated that the use of biochip technology in a variety of applications will accelerate industrial growth.

The market is expanding as a result of factors like rising clinical research spending and an increase in cancer patients. The rise in cancer cases, immune system problems, and viral infections are the main factors propelling the worldwide biochips market’s expansion. Growth in the elderly population, the variety of biochip applications, and the widespread use of tailored pharmaceuticals are further drivers driving market expansion. However, barriers to business expansion include the expensive cost of biochips and widespread ignorance of them, particularly in developing countries. On the other hand, rising government financing, R&D investment, and the enormous potential of underserved markets in emerging nations are anticipated to create significant growth opportunities for the industry.

Biochips Market Segment Analysis

The global Bio Chips market is segmented based on type, fabrication technology, and end-use industry and region. Based on type, the market is bifurcated into DNA Chips, Lab-On-A-Chip, Protein Chips, and Other Arrays. Based on fabrication technology, the market is bifurcated into Microarrays, Microfluidics. Based on end-use industries, the market is bifurcated into Biotechnology and Pharmaceutical Companies, Hospitals and Diagnostics Centers, Academic & Research Institutes, and others.

Based on type DNA chip segment is dominating the market. In 2021, the DNA chips market category held the largest market share, contributing more than 39.50% of the total revenue. They are mostly employed in clinical diagnostic procedures for various disorders and academic research. For instance, a molecular microchip that can take an individual’s molecule and analyze it will be developed by Roswell Biotechnologies in November 2021, a biotech business in San Diego. The procedures for disease detection, medicine development, and health monitoring are expected to alter as a result of technology. The chip will be improved DNA sequencing, according to the business. The cancer diagnosis and treatment market had a sizable portion of DNA chips in 2021. It is anticipated that traditional medical diagnostic procedures, such as cancer detection, would be replaced by biochips.

Based on the end-use industry biotechnology and pharmaceutical companies segment dominating the market. The biotechnology and pharmaceutical companies segment accounted for the maximum revenue share of more than 56.20% in 2021. To incorporate biochip technology into numerous health applications, corporations are engaging in extensive R&D projects. Companies cannot afford to spend a lot of money developing treatments that may not receive FDA approval given the fierce competition in the pharmaceutical industry. Biochips, however, are thought to provide a route for medication discovery and development. Specifically for Single Nucleotide Polymorphism (SNP) analysis and gene expression profiling, biochips are used in the drug discovery process to create biomarkers.

Biochips Market Key Players

The Bio Chips market key players include Abbott Laboratories, Agilent Technologies, PerkinElmer Inc., Fluidigm Corporation, Illumina, GE Healthcare, Bio-Rad Laboratories Inc, Thermo Fisher Scientific, F. Hoffmann-La Roche AG, Hologic, Inc, General Electric, Agilent Technologies.

Moreover, these participants are substantially spending on product development, which is fueling revenue generation.

Agilent Technologies, a market leader in the life sciences, diagnostics, and applied chemical industries, announced the release of three new microarrays in March 2020 to address the requirements of cytogenetic laboratories undertaking prenatal and postnatal research.

In April 2020, Celsee, Inc., a provider of tools and supplies for the separation, detection, and analysis of single cells, was acquired by Bio-Rad Laboratories, Inc., a leading provider of life science research and clinical diagnostic products worldwide.

Who Should Buy? Or Key Stakeholders

- Bio Chips Supplier

- Pharmaceutical Industry

- Research Organizations

- Investors

- Academic & Research Institutes

- Hospitals and Diagnostics Centers

- Regulatory Authorities

- Others

Biochips Market Regional Analysis

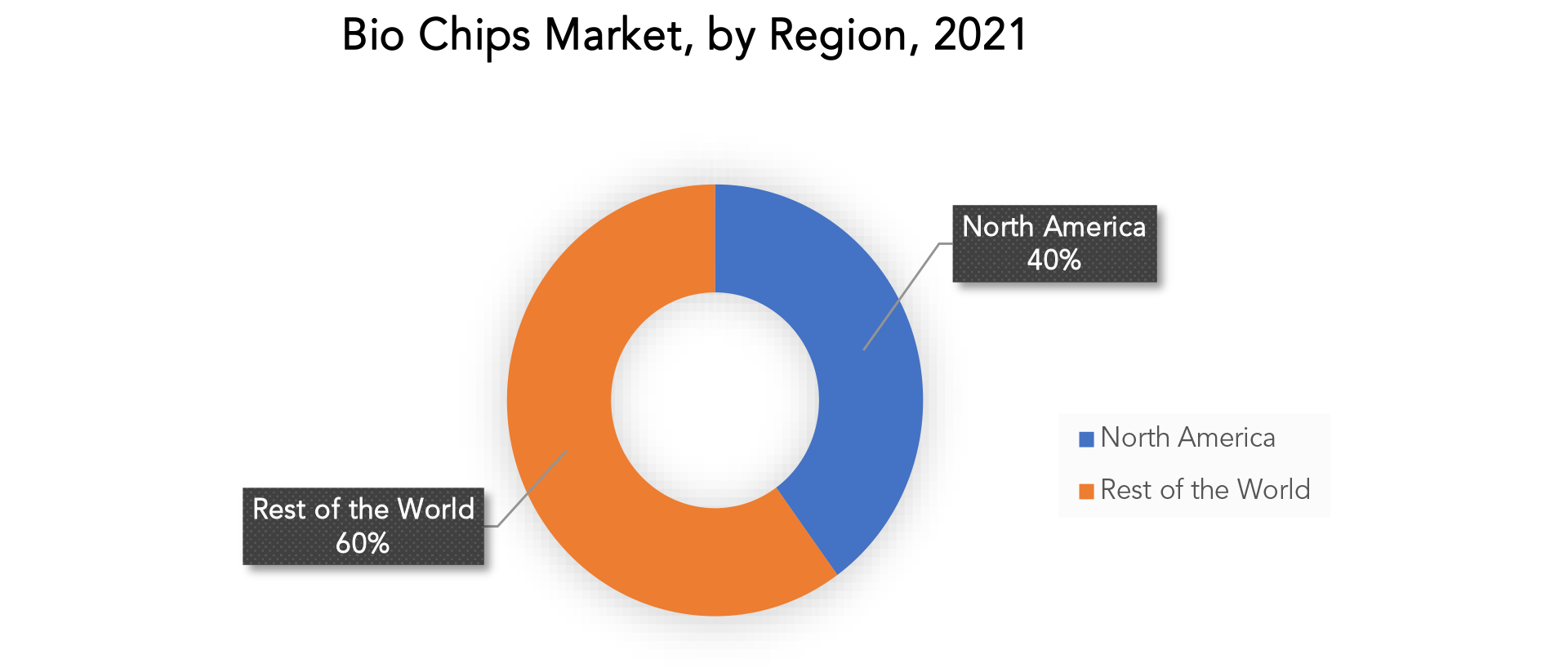

The Bio Chips market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN, and the Rest of APAC

- Europe: includes the UK, Germany, France, Italy, Spain, Russia, the and Rest of Europe

- South America: includes Brazil, Argentina, and the Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and the Rest of MEA

In 2021, North America dominated the global industry and generated more than 40.40% of the total revenue. Due to the growing government attempts to boost R&D through tax incentives, the area is anticipated to maintain its industrial position during the projection period. It is projected that the high concentration of biotechnology businesses, coupled with academic and research organizations, in the area will accelerate future technological developments in biochip applications. R&D tax credits are a budgetary advantage offered by the federal government in the United States to businesses that research to develop, improve, or innovate on goods, services, formulas, or software.

Asia Pacific accounted for the second largest market in the biochips market. During the anticipated period, it is predicted that the Asia-Pacific area will grow at the fastest rate. China and India will be the key drivers of this region’s rapid expansion. The region’s primary drivers of industry expansion are expanding access to technologies, a sizable patient base, and advancements in the healthcare system. Another important aspect influencing the expansion of the region is the growing use of biochip technology, which mature businesses are outsourcing to emerging economies to reduce overall production costs.

Key Market Segments: Bio Chips Market

Biochips Market By Type, 2020-2029, (Usd Billion), (Thousand Units)

- DNA Chips

- Lab-On-A-Chip

- Protein Chips

- Other Arrays

Biochips Market By Fabrication Technology, 2020-2029, (Usd Billion), (Thousand Units)

- Microarrays

- Microfluidics

Biochips Market By End-Use Industry, 2020-2029, (Usd Billion), (Thousand Units)

- Biotechnology And Pharmaceutical Companies

- Hospitals And Diagnostics Centers

- Academic & Research Institutes

- Other End Users

Biochips Market By Region, 2020-2029, (Usd Billion), (Thousand Units)

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Important Countries in All Regions Are Covered.

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the current size of the biochips market?

- What is the expected growth rate of the biochips market over the next 7 years?

- Who are the major players in the biochips market and what is their market share?

- What are the end-user industries driving demand for the market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-pacific, the middle east, and Africa?

- How is the economic environment affecting the biochips market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the biochips market?

- What is the current and forecasted size and growth rate of the global biochips market?

- What are the key drivers of growth in the biochips market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the biochips market?

- What are the technological advancements and innovations in the biochips market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the biochips market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the biochips market?

- What are the service offerings specifications of leading players in the market?

- What is the pricing trend of biochips in the market?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Biochips Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On the Biochips Market

- Porter’s five forces model

- Threat from new entrants

- Threat from substitutes

- Bargaining power of suppliers

- Bargaining power of customers

- Degree of competition

- Industry value chain Analysis

- Global Biochips Market Outlook

- Global Biochips Market by Type, 2020-2029, (USD Billion), (Thousand Units)

- DNA Chips

- Lab-On-A-Chip

- Protein Chips

- Other Array

- Global Biochips Market by Fabrication Technology, 2020-2029, (USD Billion), (Thousand Units)

- Microarrays

- Microfluidics

- Global Biochips Market by End-Use Industry, 2020-2029, (USD Billion), (Thousand Units)

- Biotechnology And Pharmaceutical Companies

- Hospitals And Diagnostics Centers

- Academic & Research Institutes

- Other End-Use Industry

- Global Biochips Market by Region, 2020-2029, (USD Billion), (Thousand Units)

- North America

- US

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Colombia

- Rest Of South America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest Of Europe

- Asia Pacific

- India

- China

- Japan

- South Korea

- Australia

- South-East Asia

- Rest Of Asia Pacific

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest Of Middle East and Africa

- North America

- Company Profiles*

(Business Overview, Company Snapshot, Products Offered, Recent Developments)

8.1. Abbott Laboratories

8.2. Agilent Technologies

8.3. PerkinElmer Inc

8.4. Fluidigm Corporation

8.5. Illumina

8.6. GE Healthcare

8.7. Bio-Rad Laboratories Inc

8.8. Thermo Fisher Scientific

8.9. F. Hoffmann-La Roche AG

8.10. Hologic

8.11. General Electric

*The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL BIOCHIPS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 2 GLOBAL BIOCHIPS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 3 GLOBAL BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (USD BILLION) 2020-2029

TABLE 4 GLOBAL BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (KILOTONS) 2020-2029

TABLE 5 GLOBAL BIOCHIPS MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 6 GLOBAL BIOCHIPS MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 7 GLOBAL BIOCHIPS MARKET BY REGION (USD BILLION) 2020-2029

TABLE 8 GLOBAL BIOCHIPS MARKET BY REGION (KILOTONS) 2020-2029

TABLE 9 NORTH AMERICA BIOCHIPS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 10 NORTH AMERICA BIOCHIPS MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 11 NORTH AMERICA BIOCHIPS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 12 NORTH AMERICA BIOCHIPS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 13 NORTH AMERICA BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (USD BILLION) 2020-2029

TABLE 14 NORTH AMERICA BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (KILOTONS) 2020-2029

TABLE 15 NORTH AMERICA BIOCHIPS MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 16 NORTH AMERICA BIOCHIPS MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 17 US BIOCHIPS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 18 US BIOCHIPS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 19 US BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (USD BILLION) 2020-2029

TABLE 20 US BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (KILOTONS) 2020-2029

TABLE 21 US BIOCHIPS MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 22 US BIOCHIPS MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 23 CANADA BIOCHIPS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 24 CANADA BIOCHIPS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 25 CANADA BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (USD BILLION) 2020-2029

TABLE 26 CANADA BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (KILOTONS) 2020-2029

TABLE 27 CANADA BIOCHIPS MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 28 CANADA BIOCHIPS MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 29 MEXICO BIOCHIPS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 30 MEXICO BIOCHIPS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 31 MEXICO BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (USD BILLION) 2020-2029

TABLE 32 MEXICO BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (KILOTONS) 2020-2029

TABLE 33 MEXICO BIOCHIPS MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 34 MEXICO BIOCHIPS MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 35 SOUTH AMERICA BIOCHIPS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 36 SOUTH AMERICA BIOCHIPS MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 37 SOUTH AMERICA BIOCHIPS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 38 SOUTH AMERICA BIOCHIPS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 39 SOUTH AMERICA BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (USD BILLION) 2020-2029

TABLE 40 SOUTH AMERICA BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (KILOTONS) 2020-2029

TABLE 41 SOUTH AMERICA BIOCHIPS MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 42 SOUTH AMERICA BIOCHIPS MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 43 BRAZIL BIOCHIPS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 44 BRAZIL BIOCHIPS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 45 BRAZIL BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (USD BILLION) 2020-2029

TABLE 46 BRAZIL BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (KILOTONS) 2020-2029

TABLE 47 BRAZIL BIOCHIPS MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 48 BRAZIL BIOCHIPS MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 49 ARGENTINA BIOCHIPS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 50 ARGENTINA BIOCHIPS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 51 ARGENTINA BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (USD BILLION) 2020-2029

TABLE 52 ARGENTINA BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (KILOTONS) 2020-2029

TABLE 53 ARGENTINA BIOCHIPS MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 54 ARGENTINA BIOCHIPS MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 55 COLOMBIA BIOCHIPS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 56 COLOMBIA BIOCHIPS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 57 COLOMBIA BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (USD BILLION) 2020-2029

TABLE 58 COLOMBIA BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (KILOTONS) 2020-2029

TABLE 59 COLOMBIA BIOCHIPS MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 60 COLOMBIA BIOCHIPS MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 61 REST OF SOUTH AMERICA BIOCHIPS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 62 REST OF SOUTH AMERICA BIOCHIPS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 63 REST OF THE SOUTH AMERICA BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (USD BILLION) 2020-2029

TABLE 64 REST OF SOUTH AMERICA BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (KILOTONS) 2020-2029

TABLE 65 REST OF SOUTH AMERICA BIOCHIPS MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 66 REST OF SOUTH AMERICA BIOCHIPS MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 67 ASIA-PACIFIC BIOCHIPS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 68 ASIA-PACIFIC BIOCHIPS MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 69 ASIA-PACIFIC BIOCHIPS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 70 ASIA-PACIFIC BIOCHIPS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 71 ASIA-PACIFIC BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (USD BILLION) 2020-2029

TABLE 72 ASIA-PACIFIC BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (KILOTONS) 2020-2029

TABLE 73 ASIA-PACIFIC BIOCHIPS MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 74 ASIA-PACIFIC BIOCHIPS MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 75 INDIA BIOCHIPS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 76 INDIA BIOCHIPS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 77 INDIA BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (USD BILLION) 2020-2029

TABLE 78 INDIA BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (KILOTONS) 2020-2029

TABLE 79 INDIA BIOCHIPS MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 80 INDIA BIOCHIPS MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 81 CHINA BIOCHIPS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 82 CHINA BIOCHIPS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 83 CHINA BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (USD BILLION) 2020-2029

TABLE 84 CHINA BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (KILOTONS) 2020-2029

TABLE 85 CHINA BIOCHIPS MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 86 CHINA BIOCHIPS MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 87 JAPAN BIOCHIPS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 88 JAPAN BIOCHIPS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 89 JAPAN BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (USD BILLION) 2020-2029

TABLE 90 JAPAN BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (KILOTONS) 2020-2029

TABLE 91 JAPAN BIOCHIPS MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 92 JAPAN BIOCHIPS MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 93 SOUTH KOREA BIOCHIPS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 94 SOUTH KOREA BIOCHIPS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 95 SOUTH KOREA BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (USD BILLION) 2020-2029

TABLE 96 SOUTH KOREA BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (KILOTONS) 2020-2029

TABLE 97 SOUTH KOREA BIOCHIPS MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 98 SOUTH KOREA BIOCHIPS MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 99 AUSTRALIA BIOCHIPS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 100 AUSTRALIA BIOCHIPS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 101 AUSTRALIA BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (USD BILLION) 2020-2029

TABLE 102 AUSTRALIA BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (KILOTONS) 2020-2029

TABLE 103 AUSTRALIA BIOCHIPS MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 104 AUSTRALIA BIOCHIPS MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 105 SOUTH-EAST ASIA BIOCHIPS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 106 SOUTH-EAST ASIA BIOCHIPS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 107 SOUTH-EAST ASIA BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (USD BILLION) 2020-2029

TABLE 108 SOUTH-EAST ASIA BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (KILOTONS) 2020-2029

TABLE 109 SOUTH-EAST ASIA BIOCHIPS MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 110 SOUTH-EAST ASIA BIOCHIPS MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 111 REST OF ASIA PACIFIC BIOCHIPS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 112 REST OF THE ASIA PACIFIC BIOCHIPS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 113 REST OF ASIA PACIFIC BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (USD BILLION) 2020-2029

TABLE 114 REST OF THE ASIA PACIFIC BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (KILOTONS) 2020-2029

TABLE 115 REST OF THE ASIA PACIFIC BIOCHIPS MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 116 REST OF THE ASIA PACIFIC BIOCHIPS MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 117 EUROPE BIOCHIPS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 118 EUROPE BIOCHIPS MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 119 ASIA-PACIFIC BIOCHIPS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 120 ASIA-PACIFIC BIOCHIPS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 121 ASIA-PACIFIC BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (USD BILLION) 2020-2029

TABLE 122 ASIA-PACIFIC BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (KILOTONS) 2020-2029

TABLE 123 ASIA-PACIFIC BIOCHIPS MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 124 ASIA-PACIFIC BIOCHIPS MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 125 GERMANY BIOCHIPS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 126 GERMANY BIOCHIPS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 127 GERMANY BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (USD BILLION) 2020-2029

TABLE 128 GERMANY BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (KILOTONS) 2020-2029

TABLE 129 GERMANY BIOCHIPS MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 130 GERMANY BIOCHIPS MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 131 UK BIOCHIPS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 132 UK BIOCHIPS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 133 UK BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (USD BILLION) 2020-2029

TABLE 134 UK BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (KILOTONS) 2020-2029

TABLE 135 UK BIOCHIPS MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 136 UK BIOCHIPS MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 137 FRANCE BIOCHIPS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 138 FRANCE BIOCHIPS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 139 FRANCE BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (USD BILLION) 2020-2029

TABLE 140 FRANCE BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (KILOTONS) 2020-2029

TABLE 141 FRANCE BIOCHIPS MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 142 FRANCE BIOCHIPS MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 143 ITALY BIOCHIPS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 144 ITALY BIOCHIPS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 145 ITALY BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (USD BILLION) 2020-2029

TABLE 146 ITALY BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (KILOTONS) 2020-2029

TABLE 147 ITALY BIOCHIPS MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 148 ITALY BIOCHIPS MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 149 SPAIN BIOCHIPS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 150 SPAIN BIOCHIPS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 151 SPAIN BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (USD BILLION) 2020-2029

TABLE 152 SPAIN BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (KILOTONS) 2020-2029

TABLE 153 SPAIN BIOCHIPS MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 154 SPAIN BIOCHIPS MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 155 RUSSIA BIOCHIPS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 156 RUSSIA BIOCHIPS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 157 RUSSIA BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (USD BILLION) 2020-2029

TABLE 158 RUSSIA BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (KILOTONS) 2020-2029

TABLE 159 RUSSIA BIOCHIPS MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 160 RUSSIA BIOCHIPS MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 161 REST OF EUROPE BIOCHIPS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 162 REST OF EUROPE BIOCHIPS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 163 REST OF EUROPE BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (USD BILLION) 2020-2029

TABLE 164 REST OF EUROPE BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (KILOTONS) 2020-2029

TABLE 165 REST OF EUROPE BIOCHIPS MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 166 REST OF EUROPE BIOCHIPS MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 167 MIDDLE EAST AND AFRICA BIOCHIPS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 168 MIDDLE EAST AND AFRICA BIOCHIPS MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 169 MIDDLE EAST AND AFRICA BIOCHIPS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 170 MIDDLE EAST AND AFRICA BIOCHIPS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 171 MIDDLE EAST AND AFRICA BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (USD BILLION) 2020-2029

TABLE 172 MIDDLE EAST AND AFRICA BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (KILOTONS) 2020-2029

TABLE 173 MIDDLE EAST AND AFRICA BIOCHIPS MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 174 MIDDLE EAST AND AFRICA BIOCHIPS MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 175 UAE BIOCHIPS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 176 UAE BIOCHIPS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 177 UAE BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (USD BILLION) 2020-2029

TABLE 178 UAE BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (KILOTONS) 2020-2029

TABLE 179 UAE BIOCHIPS MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 180 UAE BIOCHIPS MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 181 SAUDI ARABIA BIOCHIPS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 182 SAUDI ARABIA BIOCHIPS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 183 SAUDI ARABIA BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (USD BILLION) 2020-2029

TABLE 184 SAUDI ARABIA BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (KILOTONS) 2020-2029

TABLE 185 SAUDI ARABIA BIOCHIPS MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 186 SAUDI ARABIA BIOCHIPS MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 187 SOUTH AFRICA BIOCHIPS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 188 SOUTH AFRICA BIOCHIPS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 189 SOUTH AFRICA BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (USD BILLION) 2020-2029

TABLE 190 SOUTH AFRICA BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (KILOTONS) 2020-2029

TABLE 191 SOUTH AFRICA BIOCHIPS MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 192 SOUTH AFRICA BIOCHIPS MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 193 REST OF THE MIDDLE EAST AND AFRICA BIOCHIPS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 194 REST OF THE MIDDLE EAST AND AFRICA BIOCHIPS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 195 REST OF THE MIDDLE EAST AND AFRICA BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (USD BILLION) 2020-2029

TABLE 196 REST OF THE MIDDLE EAST AND AFRICA BIOCHIPS MARKET BY FABRICATION TECHNOLOGY (KILOTONS) 2020-2029

TABLE 197 REST OF THE MIDDLE EAST AND AFRICA BIOCHIPS MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 198 REST OF THE MIDDLE EAST AND AFRICA BIOCHIPS MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL BIOCHIPS MARKET BY TYPE, USD BILLION, 2020-2029

FIGURE 9 GLOBAL BIOCHIPS MARKET BY FABRICATION TECHNOLOGY, USD BILLION, 2020-2029

FIGURE 10 GLOBAL BIOCHIPS MARKET BY END-USE INDUSTRY, USD BILLION, 2020-2029

FIGURE 11 GLOBAL BIOCHIPS MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL BIOCHIPS MARKET BY TYPE, USD BILLION, 2021

FIGURE 14 GLOBAL BIOCHIPS MARKET BY FABRICATION TECHNOLOGY, USD BILLION, 2021

FIGURE 15 GLOBAL BIOCHIPS MARKET BY END-USE INDUSTRY, USD BILLION, 2021

FIGURE 16 GLOBAL BIOCHIPS MARKET BY REGION, USD BILLION, 2021

FIGURE 17 NORTH AMERICA BIOCHIPS MARKET SNAPSHOT

FIGURE 18 EUROPE BIOCHIPS MARKET SNAPSHOT

FIGURE 19 SOUTH AMERICA BIOCHIPS MARKET SNAPSHOT

FIGURE 20 ASIA PACIFIC BIOCHIPS MARKET SNAPSHOT

FIGURE 21 MIDDLE EAST ASIA AND AFRICA BIOCHIPS MARKET SNAPSHOT

FIGURE 22 MARKET SHARE ANALYSIS

FIGURE 23 ABBOTT LABORATORIES: COMPANY SNAPSHOT

FIGURE 24 AGILENT TECHNOLOGIES: COMPANY SNAPSHOT

FIGURE 25 PERKINELMER INC: COMPANY SNAPSHOT

FIGURE 26 FLUIDIGM CORPORATION: COMPANY SNAPSHOT

FIGURE 27 ILLUMINA: COMPANY SNAPSHOT

FIGURE 28 GE HEALTHCARE: COMPANY SNAPSHOT

FIGURE 29 BIO-RAD LABORATORIES INC: COMPANY SNAPSHOT

FIGURE 30 THERMO FISHER SCIENTIFIC: COMPANY SNAPSHOT

FIGURE 31 HOLOGIC: COMPANY SNAPSHOT

FIGURE 32 GENERAL ELECTRIC: COMPANY SNAPSHOT

FAQ

The global biochips market is expected to grow at 12.3% CAGR from 2020 to 2029. It is expected to reach above USD 31.7 billion by 2029 from USD 7.3 billion in 2020.

North America accounted for the largest market in the biochips market. North America held more than 40% of the Bio Chips market revenue share in 2020

The prime factor to drive the biochips market ahead is technological development.

The biochips market report has technologies like microarrays and microfluidics for discussion.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.