Report Outlook

| Market Size | CAGR | Dominating Region |

|---|---|---|

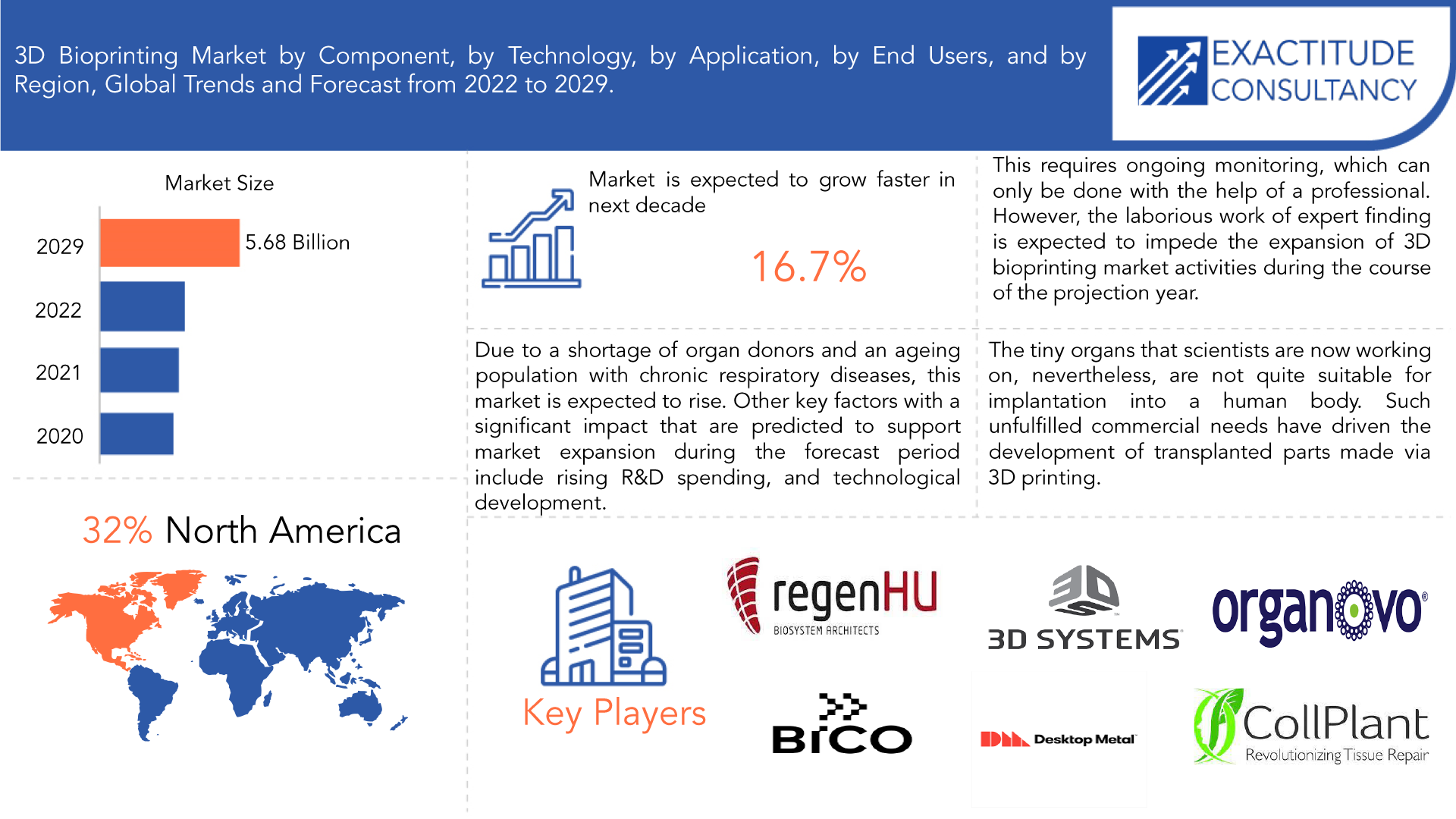

| USD 5.68 Billion by 2030 | 16.70% | North America |

| By Component | By Material | By Application | By End User |

|---|---|---|---|

|

|

|

|

SCOPE OF THE REPORT

3D Bioprinting Market Overview

The global 3D Bioprinting market, valued at USD 1.41 billion in 2024, is expected to reach USD 2.86 billion by 2030, growing at a CAGR of 11.5%.

A lung epithelial model was created by a 3D bioprinting company using the U-FAB laser printer and other biomaterials technology. The respiratory epithelium is a type of tissue that lines the bulk of the respiratory system. This epithelium protects the body from diseases and foreign items. But it also protects against tissue damage and infections with the help of the mucociliary elevators. Therefore, it is anticipated that the bioprinting business would grow as a result of the increase in demand for these respiratory epithelial models.

When the COVID-19 epidemic was at its worst, there was a huge demand for 3D bioprinting as the world struggled to find qualified medical personnel. These were especially helpful at a time when supply chain problems were occurring around the globe. As a result, 3D printers and accompanying software were heavily used by the medical community. In addition, many pharmaceutical firms use 3D bioprinting technology in the course of developing new drugs. Pharmaceutical companies can test medications at a lesser cost because to the development of 3D bioprinting. In addition, 3D bioprinting allows pharmaceutical companies to test a medicine far faster than they could with traditional methods, which could take years. Apart from that, the application of 3D printing medical devices drastically reduces the usage of animals for drug testing.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2024-2030 |

| Historical period | 2018-2020 |

| Unit | Value (USD BILLION), (THOUSAND UNITS). |

| Segmentation | By Component, By Material, By Application, By End user, By Region |

| By Component |

|

| By Material |

|

| By Application |

|

| By End User |

|

| By Region |

|

Due to a shortage of organ donors and an ageing population with chronic respiratory diseases, this market is expected to rise. Other key factors with a significant impact that are predicted to support market expansion during the forecast period include rising R&D spending, technological development, and an increase in the incidence of chronic diseases. The COVID-19 issue has prompted the 3D printing community to step up and commit to helping provide crucial medical supplies for hospitals coping with this pandemic. As a result of these developments, the market is predicted to grow more rapidly over the course of the forecast period. Many biotherapeutic companies are making use of bioprinting technologies to expedite COVID-19 research. 3D bioprinting is in high demand due to the COVID-19 infection’s quick spread. As a result, several pharmaceutical and biopharmaceutical companies are taking action to assist healthcare workers, practitioners, and researchers in any way they can.

Worldwide, there is an incredibly high demand for vital body parts for transplantation. The fact that there is a big discrepancy between the availability and demand of organs and tissues only makes things worse. For transplantation, various organs are required, including the liver, pancreas, kidneys, lungs, heart, and intestines. Similar to how there is a significant need for corneas, heart valves, blood vessels, skin, and bones for transplants. While the need for organs and tissues is growing, organ donation rates are about the same. It is a big issue for healthcare practitioners and organisations that these parts are not readily available for transplantation as it has resulted in a rise in the number of patients on the transplant waiting list. However, due to the success of various tissues created by bioprinting businesses, scientists have hypothesised that a fully functional replica may potentially be manufactured. Positives like these would drive R&D efforts to create completely functional organs for transplantation, increasing global demand for 3D bioprinters.

Additionally, new platforms in the process of drug discovery and development have been made possible by technology. Due to their unpredictability during the pre-clinical trial process, many medications are pulled from the market or are not approved by regulatory agencies because they are hazardous to certain organs, such the liver. Medication efficacy is increased and drug toxicity is predicted thanks to the tissues created during the additive manufacturing process. Because of the time savings in clinical trials, bioprinting is being employed more frequently for drug discovery. In order to evaluate their medications, biopharmaceutical companies are working with industry participants. The first steps of the drug discovery process are accelerated by testing new medications for efficacy on 3D-printed tissues.

The field of the idea is still developing in the healthcare sector and is open to further development. This is creating a great need for the use of qualified personnel who are knowledgeable about and effective enough to operate the 3D printing devices. This technique requires ongoing monitoring, which can only be done with the help of a professional. However, the laborious work of expert finding is expected to impede the expansion of 3D bioprinting market activities during the course of the projection year.

The precision of machines using the additive manufacturing approach varies because to unpredictable processing parameters and various materials. It is possible for producers to use a few monitoring approaches to rectify these alterations and meet their specific needs. Due to a lack of resources on systems integration, it has been difficult to develop complex and accurate mathematical models utilizing additive manufacturing. Planning, preproduction, and control system limitations can result in expensive errors and unsuccessful manufacturing.

3D printing is playing a more and bigger role in the medical field as technology opens the door to producing intricate solid organs like kidneys, hearts, and lungs for transplant. Compared to the conventional replacement of damaged or failed organs, which bears the danger of the human host rejecting them, 3D-printed parts are less likely to pose hazards because they use blood-derived cells. The use of 3D bioprinting by medical professionals to generate new organs during organ transplants and repair broken bones holds great potential for the future of medicine. Prosthetic limbs that can be used to replace people’s missing legs can also be printed thanks to this technology. The growth of organs and tissues can also proceed more quickly with 3D bioprinting than with the traditional method, which requires a donor and takes the same amount of time. The organ transplant waiting list grows longer every day as a result of the vast discrepancy between the demand for organs and the quantity of donors. To solve this problem, researchers are developing artificial organs. The tiny organs that scientists are now working on, nevertheless, are not quite suitable for implantation into a human body. Such unfulfilled commercial needs have driven the development of transplanted parts made via 3D printing.

The emergence of the new coronavirus has altered daily life ever since it was first discovered in China in November 2019. The epidemic has changed how individuals live their lives and how businesses operate in order to accommodate the growing demand of their target audience, which is dispersed across many different worldwide places. The market segments for 3D bioprinting are struggling as a result of the firms’ significant difficulties in addressing the demands of their target audiences. This is due to the scarcity of competent labor and the lack of, or extremely limited supply of, raw materials. Keeping up with production trends is quite difficult in their absence. The pandemic is growing at an alarming rate, which causes individuals to change their tastes, which has an impact on their way of life as well. However, the governments are taking into account the spread’s rate as well as realizing that significant action is needed to create policies that will help to revive demand and provide stability. Players in the market are producing goods, services, and solutions that promise to be beneficial to market operations throughout the forecast period of 2024-2030 in light of the growing popularity of 3D printing.

3D Bioprinting Market Segment Analysis

The 3D Bioprinting market is segmented based on component, technology, application, end user and region, global trends and forecast.

By component type, the market is bifurcated into (3D Bioprinters, Bioinks, Software, Consumables). By Material ( Living Cells, Hydrogels, Extracellular Matrices, Other Materials). By application into (Research Applications, Clinical Applications). By end user into (Medical Device Manufacturer, Research Organizations, Academic Institutes, Biopharmaceutical Companies, Hospitals) and region, global trends and forecast.

The widespread use of pharmaceutical pills to treat a number of chronic illnesses is driving growth in the 3D bioprinting business. The growing need for pharmaceuticals and the effective application of bio-drugs in this technology are other factors driving the industry. Along with an increase in industry participants, the need for pharmaceutical items is also rising. Millions of people frequently take tablets and capsules for medical reasons all around the world. As a result, it is predicted that this market segment would expand profitably over the course of the projection year. The production of organs and tissues is expected to see the industry’s fastest CAGR of 15.7% throughout the forecasted timeframe. Regenerating organs and tissues suitable for transplant is the most typical use of 3D bioprinting.

The fabrication of complex biological tissues or organs on the cultured substrate was made possible by the utilization of biomaterials utilised as bio-inks in this inkjet-based category, which had the highest revenue share of 36.9% in 2021. This market’s growth is influenced by the extensive use of inkjet printing in the healthcare sector. This study focuses on inkjet printing as a bio-applicable technique, biochemical regeneration, medication transport costs, and these topics in particular. This market segment is anticipated to expand significantly over the predicted period of time due to its higher durability and rising demand. The market for magnetically levitated objects is expected to expand at the fastest CAGR of 14.6% over the predicted time range. The profitable expansion is caused by the technology’s affordability.

With a share of 36.8% in the market by application in 2021, the clinical applications segment led the market and is predicted to expand at a CAGR of 15.6% over the forecast period. The widespread use of pharmaceutical pills to treat a variety of chronic ailments is boosting the market for 3D bioprinting. The market is also being driven by the rising demand for pharmaceuticals and their cost-effective use in bio-drugs. The demand for prescription medications is rising along with the number of players in the pharmaceutical sector. Worldwide, millions of individuals regularly consume capsules and medication pills. Therefore, during the course of the projected period, this area is anticipated to grow profitably.

The demand for 3D bioprinting among medical device producers is extremely high. One of the main elements promoting the segment’s growth is the rising demand for implants used to administer and effect treatment. Over 45% of the market is anticipated to be accounted for by it over the forecast period. The greatest hospitals and medical device makers frequently collaborate strategically. The 3D bioprinting devices are typically purchased in bulk by such hospitals whenever a tender is floated. The producers also provide other products that coordinate with 3D bioprinting technologies.

The 3D Bioprinting Market key players includes

Collplant Biotechnologies Ltd. (Israel), regenHU (Switzerland), Voxcell Bioinnovation Inc. (Canada), BICO Group AB (Sweden, 3D Systems Inc. (US), Merck KGaA (Germany), Organovo Holdings Inc (US), Prodways (France), Inventia Life Science Pty Ltd (Australia), Upnano Gmbh (Austria), UPM (Finland), 3D bioprinting solution (Russia), REGEMAT 3D, SL (Spain), Ροietis (France), Sunp Biotech (US)Aspect Biosystem Ltd. (Canada), Advanced Solutions Life Sciences, LLC (US), Cyfuse Biomedical K.K (Japan), Rokit Healthcare Inc. (South Korea), Hangzhou Genofei Biotechnology Co., Ltd. (China), Foldink (Armenia), Brinter (US), GeSim – Gesellschaft Für Silizium-Mikrosysteme Mbh (Germany), Medprin (China), Tissuelabs (Switzerland)

Recent Developments of 3D Bioprinting Industry:

- In early 2024, 3D Systems announced plans to enhance its offerings in regenerative medicine following advancements in its “Print to Perfusion” technology. This innovation allows the bioprinting of highly detailed, vascularized tissue scaffolds, aiding in drug testing and the creation of transplantable organs

- CELLINK, a part of the BICO Group, launched its DNA Studio 4 Vault software in February 2024. This software enables secure and efficient documentation, assisting researchers in translating lab work into clinical applications more quickly .

- In 2023, Organovo announced a collaboration with Yale University to explore 3D bioprinting of functional human tissues, particularly focusing on creating liver tissues for therapeutic applications. This partnership aims to advance Organovo’s expertise in liver tissue engineering.

Who Should Buy? Or Key stakeholders

- 3D Bioprinting Service provider

- Healthcare Industries

- Hospitals

- Medical Device Manufacturer

- Academic Institute

- Biopharmaceutical Industries

- Raw Materials Manufacturers

- Research Organizations

- Investors

- Regulatory Authorities

- Others

3D Bioprinting Market Regional Analysis

The 3D Bioprinting Market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

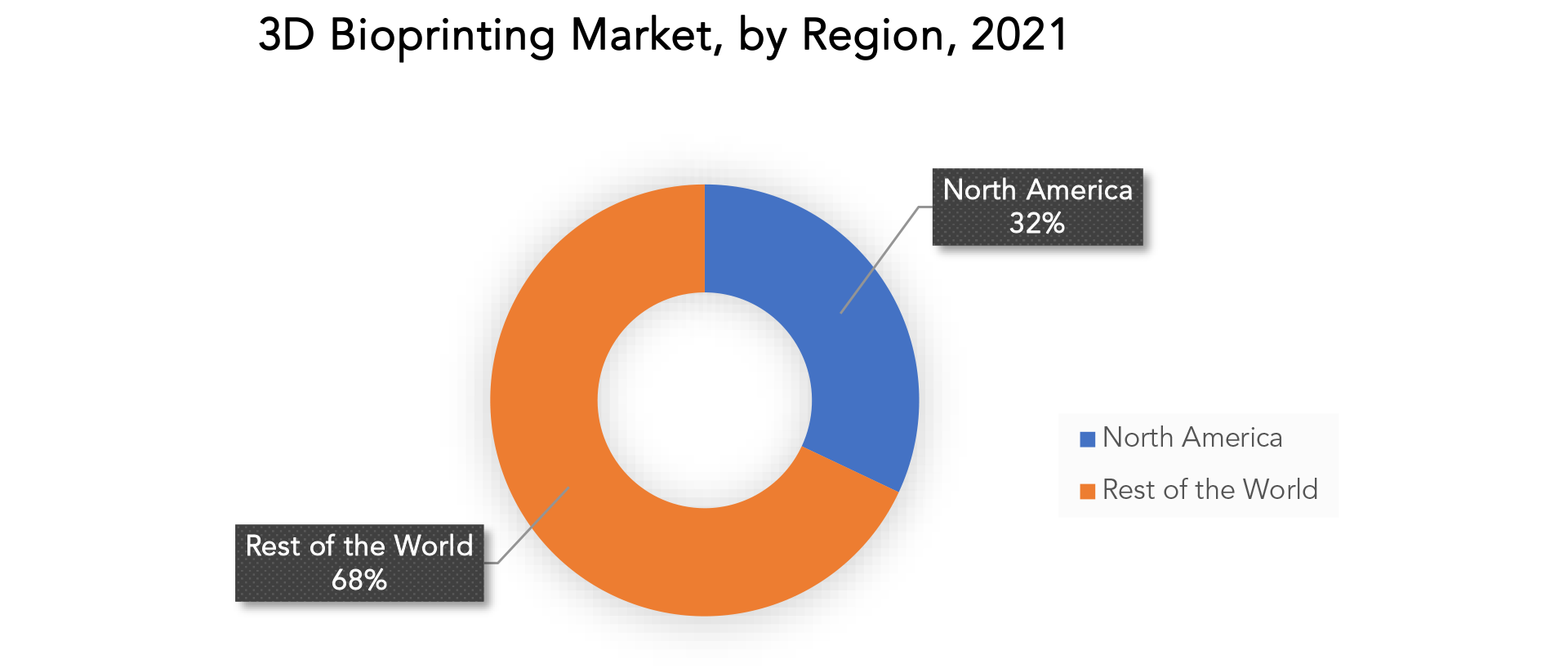

North America’s market led with a revenue share of 31.6% in 2021 and is anticipated to continue to do so for the entire forecast period. Over the course of the projected period, it is anticipated that growing IT adoption in the healthcare sector will propel market expansion. According to the Worldometer Report 2021, up until January 13th, 2021, there were about 23,369,732 active COVID-19 cases registered in the United States alone. There are more than 50 vaccine options being tested right now. The government is increasing its research and development budget in an effort to find a vaccine for this illness. This has led to a rise in the demand for 3D bioprinting, as this technology has been used for organ transplantation and drug testing.

The market in Asia Pacific accounted for 23.7% of the industry’s revenue in 2021 and is anticipated to maintain its dominance over the course of the forecast period. Due to the expanding number of COVID-19 cases and rising government investment in R&D, Japan and China accounted for the majority of the region’s revenue. Around 87,706 active COVID-19 cases were registered in China up until 13 January 2021, according to the Worldometer Report 2021. Additionally, it is predicted that the demand for 3D bioprinting in this area would be driven by the rising death rate brought on by COVID-19 and the lack of organ donors.

Market Segmentation:

By Component

- 3D Bioprinters

- Microextrusion Bioprinters

- Inkjet 3D Bioprinters

- Laser-Assisted Bioprinters

- Stereolithography-Based Bioprinters

- Magnetic 3D Bioprinters

- Other 3D Bioprinters

- Bioinks

- Natural Bioinks

- Hybrid Bioinks

- Synthetic Bioinks

- Software

- Consumables

By Material

- Living Cells

- Hydrogels

- Extracellular Matrices

- Other Materials

By Application

- Research Application

- Drug Research

- Regenerative Medicine

- 3D Cell Culture

- Clinical Applications

- Skin

- Bone and Cartilage

- Blood Vessels

- Other Clinical Applications

By End User

- Academic & Research Institutes

- Pharmaceutical & Biotechnology Companies

- Hospitals

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the 3D bioprinting market over the next 7 years?

- Who are the major players in the 3D bioprinting market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the 3D bioprinting market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the 3D bioprinting market?

- What is the current and forecasted size and growth rate of the global 3D bioprinting market?

- What are the key drivers of growth in the 3D bioprinting market?

- What are the distribution channels and supply chain dynamics in the 3D bioprinting market?

- What are the technological advancements and innovations in the 3D bioprinting market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the 3D bioprinting market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the 3D bioprinting market?

- What are the product offerings and specifications of leading players in the market?

- What is the pricing trend of 3D bioprintings in the market and what is the impact of raw material prices on the price trend?

Table of Content

-

-

-

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global 3D Bioprinting outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 on 3D Bioprinting market

- Porter’s five forces model

- Threat from new entrants

- Threat from substitutes

- Bargaining power of suppliers

- Bargaining power of customers

- Degree of competition

- Industry Value Chain Analysis

- Global 3D Bioprinting outlook

- Global 3D Bioprinting Market by Component (USD Billion) (Thousand Units) 2020-2030

- 3D Bioprinters

- Bioinks

- Software

- Consumables

- Global 3D Bioprinting Market by Material (USD Billion) (Thousand Units) 2020-2030

- Living Cells

- Hydrogels

- Extracellular Matrices

- Other Materials

- Global 3D Bioprinting Market by Application (USD Billion) (Thousand Units) 2020-2030

- Research Applications

- Clinical Applications

- Global 3D Bioprinting Market by End User (USD Billion) (Thousand Units) 2020-2030

- Academic & Research Institutes

- Pharmaceutical & BioMATERIAL Companies

- Hospitals

- Global 3D Bioprinting Market By Region (USD Billion) (Thousand Units) 2020-2030

- NORTH AMERICA

- US

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Colombia

- Rest Of South America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- India

- China

- Japan

- South Korea

- Australia

- South-East Asia

- Rest Of Asia Pacific

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest Of Middle East and Africa

- NORTH AMERICA

- Company Profiles*

- Introduction

(Business Overview, Company Snapshot, Products Offered, Recent Developments)

-

- Collplant Biotechnologies Ltd. (Israel)

- regenHU (Switzerland)

- Voxcell Bioinnovation Inc. (Canada)

- BICO Group AB (Sweden, 3D Systems Inc. (US)

- Merck KGaA (Germany)

- Organovo Holdings Inc (US)

- Prodways (France)

- Inventia Life Science Pty Ltd (Australia)

- Upnano Gmbh (Austria)

- UPM (Finland)

- 3D bioprinting solution (Russia)

- REGEMAT 3D, SL (Spain)

- Ροietis (France)

- Sunp Biotech (US)Aspect Biosystem Ltd. (Canada)

- Advanced Solutions Life Sciences, LLC (US)

- Cyfuse Biomedical K.K (Japan)

- Rokit Healthcare Inc. (South Korea)

- Hangzhou Genofei BioMATERIAL Co., Ltd. (China)

- Foldink (Armenia), Brinter (US)

- GeSim – Gesellschaft Für Silizium-Mikrosysteme Mbh (Germany)

- Medprin (China)

- Tissuelabs (Switzerland)

*The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL 3D BIOPRINTING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 2 GLOBAL 3D BIOPRINTING MARKET BY MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 3 GLOBAL 3D BIOPRINTING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 4 GLOBAL 3D BIOPRINTING MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 5 GLOBAL 3D BIOPRINTING MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 6 GLOBAL 3D BIOPRINTING MARKET BY COMPONENT (THOUSAND UNITS) 2020-2030

TABLE 7 GLOBAL 3D BIOPRINTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 8 GLOBAL 3D BIOPRINTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 9 GLOBAL 3D BIOPRINTING MARKET BY REGION (USD BILLION) 2020-2030

TABLE 10 GLOBAL 3D BIOPRINTING MARKET BY REGION (THOUSAND UNITS) 2020-2030

TABLE 11 NORTH AMERICA 3D BIOPRINTING MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 12 NORTH AMERICA 3D BIOPRINTING MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 13 NORTH AMERICA 3D BIOPRINTING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 14 NORTH AMERICA 3D BIOPRINTING MARKET BY MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 15 NORTH AMERICA 3D BIOPRINTING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 16 NORTH AMERICA 3D BIOPRINTING MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 17 NORTH AMERICA 3D BIOPRINTING MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 18 NORTH AMERICA 3D BIOPRINTING MARKET BY COMPONENT (THOUSAND UNITS) 2020-2030

TABLE 19 NORTH AMERICA 3D BIOPRINTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 20 NORTH AMERICA 3D BIOPRINTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 21 US 3D BIOPRINTING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 22 US 3D BIOPRINTING MARKET BY MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 23 US 3D BIOPRINTING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 24 US 3D BIOPRINTING MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 25 US 3D BIOPRINTING MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 26 US 3D BIOPRINTING MARKET BY COMPONENT (THOUSAND UNITS) 2020-2030

TABLE 27 US 3D BIOPRINTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 28 US 3D BIOPRINTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 29 CANADA 3D BIOPRINTING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 30 CANADA 3D BIOPRINTING MARKET BY MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 31 CANADA 3D BIOPRINTING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 32 CANADA 3D BIOPRINTING MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 33 CANADA 3D BIOPRINTING MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 34 CANADA 3D BIOPRINTING MARKET BY COMPONENT (THOUSAND UNITS) 2020-2030

TABLE 35 CANADA 3D BIOPRINTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 36 CANADA 3D BIOPRINTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 37 MEXICO 3D BIOPRINTING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 38 MEXICO 3D BIOPRINTING MARKET BY MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 39 MEXICO 3D BIOPRINTING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 40 MEXICO 3D BIOPRINTING MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 41 MEXICO 3D BIOPRINTING MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 42 MEXICO 3D BIOPRINTING MARKET BY COMPONENT (THOUSAND UNITS) 2020-2030

TABLE 43 MEXICO 3D BIOPRINTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 44 MEXICO 3D BIOPRINTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 45 SOUTH AMERICA 3D BIOPRINTING MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 46 SOUTH AMERICA 3D BIOPRINTING MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 47 SOUTH AMERICA 3D BIOPRINTING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 48 SOUTH AMERICA 3D BIOPRINTING MARKET BY MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 49 SOUTH AMERICA 3D BIOPRINTING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 50 SOUTH AMERICA 3D BIOPRINTING MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 51 SOUTH AMERICA 3D BIOPRINTING MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 52 SOUTH AMERICA 3D BIOPRINTING MARKET BY COMPONENT (THOUSAND UNITS) 2020-2030

TABLE 53 SOUTH AMERICA 3D BIOPRINTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 54 SOUTH AMERICA 3D BIOPRINTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 55 BRAZIL 3D BIOPRINTING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 56 BRAZIL 3D BIOPRINTING MARKET BY MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 57 BRAZIL 3D BIOPRINTING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 58 BRAZIL 3D BIOPRINTING MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 59 BRAZIL 3D BIOPRINTING MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 60 BRAZIL 3D BIOPRINTING MARKET BY COMPONENT (THOUSAND UNITS) 2020-2030

TABLE 61 BRAZIL 3D BIOPRINTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 62 BRAZIL 3D BIOPRINTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 63 ARGENTINA 3D BIOPRINTING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 64 ARGENTINA 3D BIOPRINTING MARKET BY MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 65 ARGENTINA 3D BIOPRINTING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 66 ARGENTINA 3D BIOPRINTING MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 67 ARGENTINA 3D BIOPRINTING MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 68 ARGENTINA 3D BIOPRINTING MARKET BY COMPONENT (THOUSAND UNITS) 2020-2030

TABLE 69 ARGENTINA 3D BIOPRINTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 70 ARGENTINA 3D BIOPRINTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 71 COLOMBIA 3D BIOPRINTING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 72 COLOMBIA 3D BIOPRINTING MARKET BY MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 73 COLOMBIA 3D BIOPRINTING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 74 COLOMBIA 3D BIOPRINTING MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 75 COLOMBIA 3D BIOPRINTING MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 76 COLOMBIA 3D BIOPRINTING MARKET BY COMPONENT (THOUSAND UNITS) 2020-2030

TABLE 77 COLOMBIA 3D BIOPRINTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 78 COLOMBIA 3D BIOPRINTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 79 REST OF SOUTH AMERICA 3D BIOPRINTING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 80 REST OF SOUTH AMERICA 3D BIOPRINTING MARKET BY MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 81 REST OF SOUTH AMERICA 3D BIOPRINTING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 82 REST OF SOUTH AMERICA 3D BIOPRINTING MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 83 REST OF SOUTH AMERICA 3D BIOPRINTING MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 84 REST OF SOUTH AMERICA 3D BIOPRINTING MARKET BY COMPONENT (THOUSAND UNITS) 2020-2030

TABLE 85 REST OF SOUTH AMERICA 3D BIOPRINTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 86 REST OF SOUTH AMERICA 3D BIOPRINTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 87 ASIA-PACIFIC 3D BIOPRINTING MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 88 ASIA-PACIFIC 3D BIOPRINTING MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 89 ASIA-PACIFIC 3D BIOPRINTING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 90 ASIA-PACIFIC 3D BIOPRINTING MARKET BY MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 91 ASIA-PACIFIC 3D BIOPRINTING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 92 ASIA-PACIFIC 3D BIOPRINTING MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 93 ASIA-PACIFIC 3D BIOPRINTING MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 94 ASIA-PACIFIC 3D BIOPRINTING MARKET BY COMPONENT (THOUSAND UNITS) 2020-2030

TABLE 95 ASIA-PACIFIC 3D BIOPRINTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 96 ASIA-PACIFIC 3D BIOPRINTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 97 INDIA 3D BIOPRINTING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 98 INDIA 3D BIOPRINTING MARKET BY MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 99 INDIA 3D BIOPRINTING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 100 INDIA 3D BIOPRINTING MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 101 INDIA 3D BIOPRINTING MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 102 INDIA 3D BIOPRINTING MARKET BY COMPONENT (THOUSAND UNITS) 2020-2030

TABLE 103 INDIA 3D BIOPRINTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 104 INDIA 3D BIOPRINTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 105 CHINA 3D BIOPRINTING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 106 CHINA 3D BIOPRINTING MARKET BY MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 107 CHINA 3D BIOPRINTING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 108 CHINA 3D BIOPRINTING MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 109 CHINA 3D BIOPRINTING MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 110 CHINA 3D BIOPRINTING MARKET BY COMPONENT (THOUSAND UNITS) 2020-2030

TABLE 111 CHINA 3D BIOPRINTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 112 CHINA 3D BIOPRINTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 113 JAPAN 3D BIOPRINTING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 114 JAPAN 3D BIOPRINTING MARKET BY MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 115 JAPAN 3D BIOPRINTING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 116 JAPAN 3D BIOPRINTING MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 117 JAPAN 3D BIOPRINTING MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 118 JAPAN 3D BIOPRINTING MARKET BY COMPONENT (THOUSAND UNITS) 2020-2030

TABLE 119 JAPAN 3D BIOPRINTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 120 JAPAN 3D BIOPRINTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 121 SOUTH KOREA 3D BIOPRINTING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 122 SOUTH KOREA 3D BIOPRINTING MARKET BY MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 123 SOUTH KOREA 3D BIOPRINTING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 124 SOUTH KOREA 3D BIOPRINTING MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 125 SOUTH KOREA 3D BIOPRINTING MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 126 SOUTH KOREA 3D BIOPRINTING MARKET BY COMPONENT (THOUSAND UNITS) 2020-2030

TABLE 127 SOUTH KOREA 3D BIOPRINTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 128 SOUTH KOREA 3D BIOPRINTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 129 AUSTRALIA 3D BIOPRINTING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 130 AUSTRALIA 3D BIOPRINTING MARKET BY MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 131 AUSTRALIA 3D BIOPRINTING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 132 AUSTRALIA 3D BIOPRINTING MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 133 AUSTRALIA 3D BIOPRINTING MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 134 AUSTRALIA 3D BIOPRINTING MARKET BY COMPONENT (THOUSAND UNITS) 2020-2030

TABLE 135 AUSTRALIA 3D BIOPRINTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 136 AUSTRALIA 3D BIOPRINTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 137 SOUTH-EAST ASIA 3D BIOPRINTING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 138 SOUTH-EAST ASIA 3D BIOPRINTING MARKET BY MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 139 SOUTH-EAST ASIA 3D BIOPRINTING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 140 SOUTH-EAST ASIA 3D BIOPRINTING MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 141 SOUTH-EAST ASIA 3D BIOPRINTING MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 142 SOUTH-EAST ASIA 3D BIOPRINTING MARKET BY COMPONENT (THOUSAND UNITS) 2020-2030

TABLE 143 SOUTH-EAST ASIA 3D BIOPRINTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 144 SOUTH-EAST ASIA 3D BIOPRINTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 145 REST OF ASIA PACIFIC 3D BIOPRINTING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 146 REST OF ASIA PACIFIC 3D BIOPRINTING MARKET BY MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 147 REST OF ASIA PACIFIC 3D BIOPRINTING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 148 REST OF ASIA PACIFIC 3D BIOPRINTING MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 149 REST OF ASIA PACIFIC 3D BIOPRINTING MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 150 REST OF ASIA PACIFIC 3D BIOPRINTING MARKET BY COMPONENT (THOUSAND UNITS) 2020-2030

TABLE 151 REST OF ASIA PACIFIC 3D BIOPRINTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 152 REST OF ASIA PACIFIC 3D BIOPRINTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 153 EUROPE 3D BIOPRINTING MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 154 EUROPE 3D BIOPRINTING MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 155 ASIA-PACIFIC 3D BIOPRINTING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 156 ASIA-PACIFIC 3D BIOPRINTING MARKET BY MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 157 ASIA-PACIFIC 3D BIOPRINTING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 158 ASIA-PACIFIC 3D BIOPRINTING MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 159 ASIA-PACIFIC 3D BIOPRINTING MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 160 ASIA-PACIFIC 3D BIOPRINTING MARKET BY COMPONENT (THOUSAND UNITS) 2020-2030

TABLE 161 ASIA-PACIFIC 3D BIOPRINTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 162 ASIA-PACIFIC 3D BIOPRINTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 163 GERMANY 3D BIOPRINTING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 164 GERMANY 3D BIOPRINTING MARKET BY MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 165 GERMANY 3D BIOPRINTING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 166 GERMANY 3D BIOPRINTING MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 167 GERMANY 3D BIOPRINTING MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 168 GERMANY 3D BIOPRINTING MARKET BY COMPONENT (THOUSAND UNITS) 2020-2030

TABLE 169 GERMANY 3D BIOPRINTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 170 GERMANY 3D BIOPRINTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 171 UK 3D BIOPRINTING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 172 UK 3D BIOPRINTING MARKET BY MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 173 UK 3D BIOPRINTING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 174 UK 3D BIOPRINTING MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 175 UK 3D BIOPRINTING MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 176 UK 3D BIOPRINTING MARKET BY COMPONENT (THOUSAND UNITS) 2020-2030

TABLE 177 UK 3D BIOPRINTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 178 UK 3D BIOPRINTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 179 FRANCE 3D BIOPRINTING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 180 FRANCE 3D BIOPRINTING MARKET BY MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 181 FRANCE 3D BIOPRINTING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 182 FRANCE 3D BIOPRINTING MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 183 FRANCE 3D BIOPRINTING MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 184 FRANCE 3D BIOPRINTING MARKET BY COMPONENT (THOUSAND UNITS) 2020-2030

TABLE 185 FRANCE 3D BIOPRINTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 186 FRANCE 3D BIOPRINTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 187 ITALY 3D BIOPRINTING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 188 ITALY 3D BIOPRINTING MARKET BY MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 189 ITALY 3D BIOPRINTING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 190 ITALY 3D BIOPRINTING MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 191 ITALY 3D BIOPRINTING MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 192 ITALY 3D BIOPRINTING MARKET BY COMPONENT (THOUSAND UNITS) 2020-2030

TABLE 193 ITALY 3D BIOPRINTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 194 ITALY 3D BIOPRINTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 195 SPAIN 3D BIOPRINTING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 196 SPAIN 3D BIOPRINTING MARKET BY MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 197 SPAIN 3D BIOPRINTING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 198 SPAIN 3D BIOPRINTING MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 199 SPAIN 3D BIOPRINTING MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 200 SPAIN 3D BIOPRINTING MARKET BY COMPONENT (THOUSAND UNITS) 2020-2030

TABLE 201 SPAIN 3D BIOPRINTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 202 SPAIN 3D BIOPRINTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 203 RUSSIA 3D BIOPRINTING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 204 RUSSIA 3D BIOPRINTING MARKET BY MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 205 RUSSIA 3D BIOPRINTING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 206 RUSSIA 3D BIOPRINTING MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 207 RUSSIA 3D BIOPRINTING MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 208 RUSSIA 3D BIOPRINTING MARKET BY COMPONENT (THOUSAND UNITS) 2020-2030

TABLE 209 RUSSIA 3D BIOPRINTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 210 RUSSIA 3D BIOPRINTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 211 REST OF EUROPE 3D BIOPRINTING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 212 REST OF EUROPE 3D BIOPRINTING MARKET BY MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 213 REST OF EUROPE 3D BIOPRINTING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 214 REST OF EUROPE 3D BIOPRINTING MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 215 REST OF EUROPE 3D BIOPRINTING MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 216 REST OF EUROPE 3D BIOPRINTING MARKET BY COMPONENT (THOUSAND UNITS) 2020-2030

TABLE 217 REST OF EUROPE 3D BIOPRINTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 218 REST OF EUROPE 3D BIOPRINTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 219 MIDDLE EAST AND AFRICA 3D BIOPRINTING MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 220 MIDDLE EAST AND AFRICA 3D BIOPRINTING MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 221 MIDDLE EAST AND AFRICA 3D BIOPRINTING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 222 MIDDLE EAST AND AFRICA 3D BIOPRINTING MARKET BY MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 223 MIDDLE EAST AND AFRICA 3D BIOPRINTING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 224 MIDDLE EAST AND AFRICA 3D BIOPRINTING MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 225 MIDDLE EAST AND AFRICA 3D BIOPRINTING MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 226 MIDDLE EAST AND AFRICA 3D BIOPRINTING MARKET BY COMPONENT (THOUSAND UNITS) 2020-2030

TABLE 227 MIDDLE EAST AND AFRICA 3D BIOPRINTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 228 MIDDLE EAST AND AFRICA 3D BIOPRINTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 229 UAE 3D BIOPRINTING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 230 UAE 3D BIOPRINTING MARKET BY MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 231 UAE 3D BIOPRINTING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 232 UAE 3D BIOPRINTING MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 233 UAE 3D BIOPRINTING MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 234 UAE 3D BIOPRINTING MARKET BY COMPONENT (THOUSAND UNITS) 2020-2030

TABLE 235 UAE 3D BIOPRINTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 236 UAE 3D BIOPRINTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 237 SAUDI ARABIA 3D BIOPRINTING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 238 SAUDI ARABIA 3D BIOPRINTING MARKET BY MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 239 SAUDI ARABIA 3D BIOPRINTING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 240 SAUDI ARABIA 3D BIOPRINTING MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 241 SAUDI ARABIA 3D BIOPRINTING MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 242 SAUDI ARABIA 3D BIOPRINTING MARKET BY COMPONENT (THOUSAND UNITS) 2020-2030

TABLE 243 SAUDI ARABIA 3D BIOPRINTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 244 SAUDI ARABIA 3D BIOPRINTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 245 SOUTH AFRICA 3D BIOPRINTING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 246 SOUTH AFRICA 3D BIOPRINTING MARKET BY MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 247 SOUTH AFRICA 3D BIOPRINTING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 248 SOUTH AFRICA 3D BIOPRINTING MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 249 SOUTH AFRICA 3D BIOPRINTING MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 250 SOUTH AFRICA 3D BIOPRINTING MARKET BY COMPONENT (THOUSAND UNITS) 2020-2030

TABLE 251 SOUTH AFRICA 3D BIOPRINTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 252 SOUTH AFRICA 3D BIOPRINTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 253 REST OF MIDDLE EAST AND AFRICA 3D BIOPRINTING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 254 REST OF MIDDLE EAST AND AFRICA 3D BIOPRINTING MARKET BY MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 255 REST OF MIDDLE EAST AND AFRICA 3D BIOPRINTING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 256 REST OF MIDDLE EAST AND AFRICA 3D BIOPRINTING MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 257 REST OF MIDDLE EAST AND AFRICA 3D BIOPRINTING MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 258 REST OF MIDDLE EAST AND AFRICA 3D BIOPRINTING MARKET BY COMPONENT (THOUSAND UNITS) 2020-2030

TABLE 259 REST OF MIDDLE EAST AND AFRICA 3D BIOPRINTING MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 260 REST OF MIDDLE EAST AND AFRICA 3D BIOPRINTING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL 3D BIOPRINTING BY COMPONENT, USD BILLION, 2020-2030

FIGURE 9 GLOBAL 3D BIOPRINTING BY MATERIAL, USD BILLION, 2020-2030

FIGURE 10 GLOBAL 3D BIOPRINTING BY APPLICATION, USD BILLION, 2020-2030

FIGURE 11 GLOBAL 3D BIOPRINTING BY END-USER, USD BILLION, 2020-2030

FIGURE 12 GLOBAL 3D BIOPRINTING BY REGION, USD BILLION, 2020-2030

FIGURE 13 GLOBAL 3D BIOPRINTING BY COMPONENT, USD BILLION, 2021

FIGURE 14 GLOBAL 3D BIOPRINTINGBY MATERIAL, USD BILLION, 2021

FIGURE 15 GLOBAL 3D BIOPRINTINGBY APPLICATION, USD BILLION, 2021

FIGURE 16 GLOBAL 3D BIOPRINTINGBY END-USER, USD BILLION, 2021

FIGURE 17 GLOBAL 3D BIOPRINTINGBY REGION, USD BILLION, 2021

FIGURE 18 PORTER’S FIVE FORCES MODEL

FIGURE 19 MARKET SHARE ANALYSIS

FIGURE 20 BICO GROUP AB: COMPANY SNAPSHOT

FIGURE 21 ORGANOVO INC.: COMPANY SNAPSHOT

FIGURE 22 3D SYSTEMS CORPORATION: COMPANY SNAPSHOT

FIGURE 23 COLLPLANT BIOTECHNOLOGIES LTD: COMPANY SNAPSHOT

FIGURE 24 REGENHU LTD: COMPANY SNAPSHOT

FIGURE 25 DESKTOP METAL INC.: COMPANY SNAPSHOT

FIGURE 26 ASPECT BIOSYSTEMS LTD.: COMPANY SNAPSHOT

FIGURE 27 ADVANCED SOLUTIONS INC.: COMPANY SNAPSHOT

FIGURE 28 CYFUSE BIOMEDICAL K.K.: COMPANY SNAPSHOT

FIGURE 29 TISSUE REGENERATION SYSTEMS INC.: COMPANY SNAPSHOT

-

-

FAQ

The global 3D bioprinting market, valued at USD 1.41 billion in 2024, is expected to reach USD 2.86 billion by 2030, growing at a CAGR of 11.5%.

North America held more than 32% of the 3D Bioprinting Market revenue share in 2022 and will witness expansion in the forecast period.

The growth of this market is attributed to a limited number of organ donors, and an increasingly aging population with chronic respiratory disease. Rising R&D investment, technological advancement, and increasing incidence of chronic diseases are other vitally impacting attributes likely to boost market growth during the forecast period. The 3D printing community has responded to the COVID-19 crisis, pledging to support the production of vital medical equipment for hospitals grappling with this pandemic.

When the COVID-19 epidemic was at its worst, there was a huge demand for 3D bioprinting as the world struggled to find qualified medical personnel. These were especially helpful at a time when supply chain problems were occurring around the globe. As a result, 3D printers and accompanying software were heavily used by the medical community. In addition, many pharmaceutical firms use 3D bioprinting technology in the course of developing new drugs. Pharmaceutical companies can test medications at a lesser cost because to the development of 3D bioprinting. In addition, 3D bioprinting allows pharmaceutical companies to test a medicine far faster than they could with traditional methods, which could take years. Apart from that, the application of 3D printing medical devices drastically reduces the usage of animals for drug testing.

North America’s market led with a revenue share of 31.6% in 2021 and is anticipated to continue to do so for the entire forecast period. Over the course of the projected period, it is anticipated that growing IT adoption in the healthcare sector will propel market expansion. According to the Worldometer Report 2021, up until January 13th, 2021, there were about 23,369,732 active COVID-19 cases registered in the United States alone. There are more than 50 vaccine options being tested right now. The government is increasing its research and development budget in an effort to find a vaccine for this illness. This has led to a rise in the demand for 3D bioprinting, as this technology has been used for organ transplantation and drug testing.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.