REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 11.89billion by 2029 | 10.4% | North America |

| By Product | By Source | By Application | By End-User | By Cell Type | By Region |

|---|---|---|---|---|---|

|

|

|

|

|

|

SCOPE OF THE REPORT

Market Overview

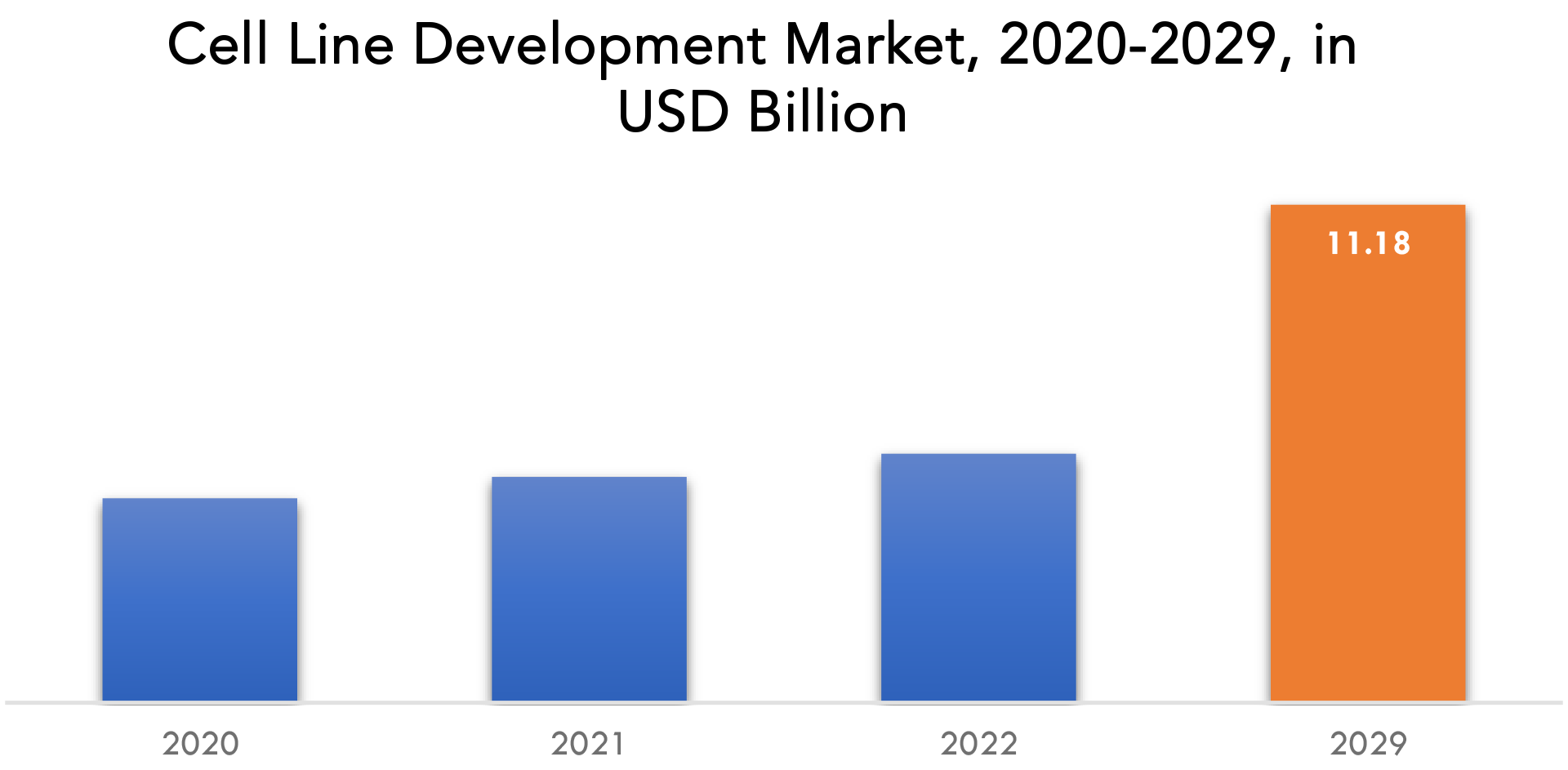

The cell line development market is expected to grow at 10.4% CAGR from 2023 to 2029. It is expected to reach above USD 11.89billion by 2029 from USD 4.59 billion in 2020.

The process of creating highly effective, stable cell lines, which are necessary for the creation and manufacturing of biotherapeutics, is known as cell line development. These are produced from single cells and are used to make fusion proteins, monoclonal antibodies, and vaccinations. During the development phase, hundreds of clones are screened to identify those that yield a large amount of biproduct and display necessary essential quality traits. The utilization of cell lines in the manufacture of biological pharmacological compounds is increased by these characteristics. The need for cell line generation is increased by such conditions.

The act of transfecting a cell involves inserting foreign DNA (encoding the desired recombinant protein) into the host cell. Stably transfected cells are a limited population of cells that have the foreign DNA integrated into their genome and may express recombinant protein for an extended period of time. Identification and selection of high-value clones from a transfected cell pool by antibody screening and titer ranking. Finding rare high-affinity binders or high producers will be more likely if huge populations are screened by measuring cell surface expression of target proteins or secreting antibodies (titer ranking). Cell viability and single-cell isolation – To verify that the cell population is genetically similar and to drastically lower heterogeneity of expression, single, viable cells must be extracted and cloned. Assurance of monoclonality: When creating cell lines for biotherapeutics, it is essential from a quality and regulatory standpoint to make sure the cell line is monoclonal and descended from a single progenitor. In order to properly document monoclonality—a regulatory measure for therapeutic cell lines—regulatory filings frequently contain a picture of a single cell. The clonally generated cell line’s production of recombinant proteins or antibodies is measured using a technique called clone productivity screening and titer.

Cell development is a life science byproduct that is commonly used in a range of essential applications. Recombinant protein production is aided by cell live development. By supplying high yield cells, cell live development enables time, labor, and financial savings.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion) |

| Segmentation | By Product, By Sources, By, Application, By End-User By Region |

| By Product

|

|

| By Source

|

|

| By Applications

|

|

| By End-user

|

|

| By Region

|

|

The market is fueled by the expanding biopharmaceutical sector, increasing demand for cancer therapies and monoclonal antibodies, and rising biosimilar production as a result of the patent expiry of branded pharmaceuticals. Over the past ten years, cancer has become more widespread as a result of changes in eating habits, a lack of physical activity, and overall changes in lifestyle. Additionally, as vaccine production increases and technology develop, there will be a greater demand for cell line creation.

The patent expiration of branded pharmaceuticals will increase the manufacture of biosimilars, which is anticipated to fuel market expansion. The creation of cell lines is crucial to the production and development of biosimilars. Biosimilars boost market competition and make it easier for patients to get access to life-saving drugs. Lowering treatment costs is the main goal of biosimilar makers. The market for cell line development is anticipated to increase as a result of rising R&D expenditures by pharmaceutical and biotechnology firms and rising use of regenerative therapies.

However, the market for cell line creation would be hampered by high capital costs and large expenditures needed for research and development skills. The difficulty in creating stable cell lines will make the market growth rate much more difficult. The market growth rate will also be slowed down by an unfavorable and insufficient reimbursement scenario in developing and underdeveloped economies.

According to the World Health Organization (WHO), COVID-19 is a pandemic. The death rate from chronic diseases has significantly increased since that period. COVID-19 is believed to have a favorable impact on the cell line development business as a result of the increased need for vaccine development. Researchers have described the development of a suitable human cell line for the high-throughput testing of antiviral drugs that target the coronavirus 2 that causes severe acute respiratory syndrome in the study titled “Scientists develop suitable human cell line for anti-SARS-CoV-2 drug screening” published in the Journal of Virus in March 2022. Two crucial host proteins needed for viral entry, angiotensin-converting enzyme 2 and transmembrane serine protease 2, were designed to express highly in human lung cancer. In order to handle COVID-19, which had a large impact on the market under research during the pandemic, more cell lines are being created.

Cell Line Development Market Segment Analysis

The enterprise file sync and share market is segmented based on component, Source, Applications, End-user and Region, Global trends and forecast.

by Product (Reagents and Media, Equipment, Finished Cells), By Source (Mammalian Cell Line, Non-Mammalian Cell Line), by Applications (Recombinant protein, Expression, Hybridomas Technology, Vaccine Production, Drug Discovery), by End-user (Pharmaceutical Companies, Academics and Research) And Region, Global Trends and Forecast.

Based on product, Reagents and media accounted for the largest revenue share due to increasing bio-production that requires these products from incubation to preservation. Equipment used are incubators, bioreactors, storage equipment, centrifuge, and microscopes. Bioreactors held the dominant share in the equipment segment due to its usage in large-scale manufacturing of biologics. The introduction of single-use bioreactors is a major driver contributing to the growth of the bioreactor segment over the forecast period.

Based on Applications, Cell line development found the largest significance and application in the bio-production of biosimilars, biologics, vaccines, a therapeutic protein. The bioproduction segment accounted for the largest revenue share wing to increasing antibiotic and vaccine production. The bioproduction segment is driven by factors such as increasing in-vitro research activities, safety and efficacy concerns about the product, introduction of biosimilars, and high demand for cellular medicines.

Cell Line Development Market Players

Key companies in the global market Advanced instruments, LLC, AGC Biologics, Catalent, Corning Inc, Cyagen, Cytiva, Eurofins, FUJIFILM Diosynth Biotechnologies, Horizon Discovery, Genscript biotech corporation, Imgenex, Lonza, Selexis SA

13-02-2023: – Cycle Pharmaceuticals Ltd (Cycle) has today announced the launch of TASCENSO ODT, its first product to treat MS patients in the US. The launch ensures MS patients in the US currently benefitting from Gilenya, or generic fingolimod, can access appropriate patient support services alongside the bioequivalent, non-generic, TASCENSO ODT. Gilenya patient support services are scheduled to be withdrawn on March 31st 2023.

24-01-2023: – Catalent, the leader in enabling the development and supply of better treatments for patients worldwide, today announced the launch of its new Case Management Service, which has been specifically designed to address the unique challenges associated with the safe and timely delivery of advanced therapies to patients by providing professional supply chain oversight from program start to finish

Who Should Buy? Or Key Stakeholders

- Cell line development Suppliers

- Hospitals

- Laboratories

- Vaccines lab

- Investors

- Research

- Others

Cell Line Development Market Regional Analysis

The Cell Line Development market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

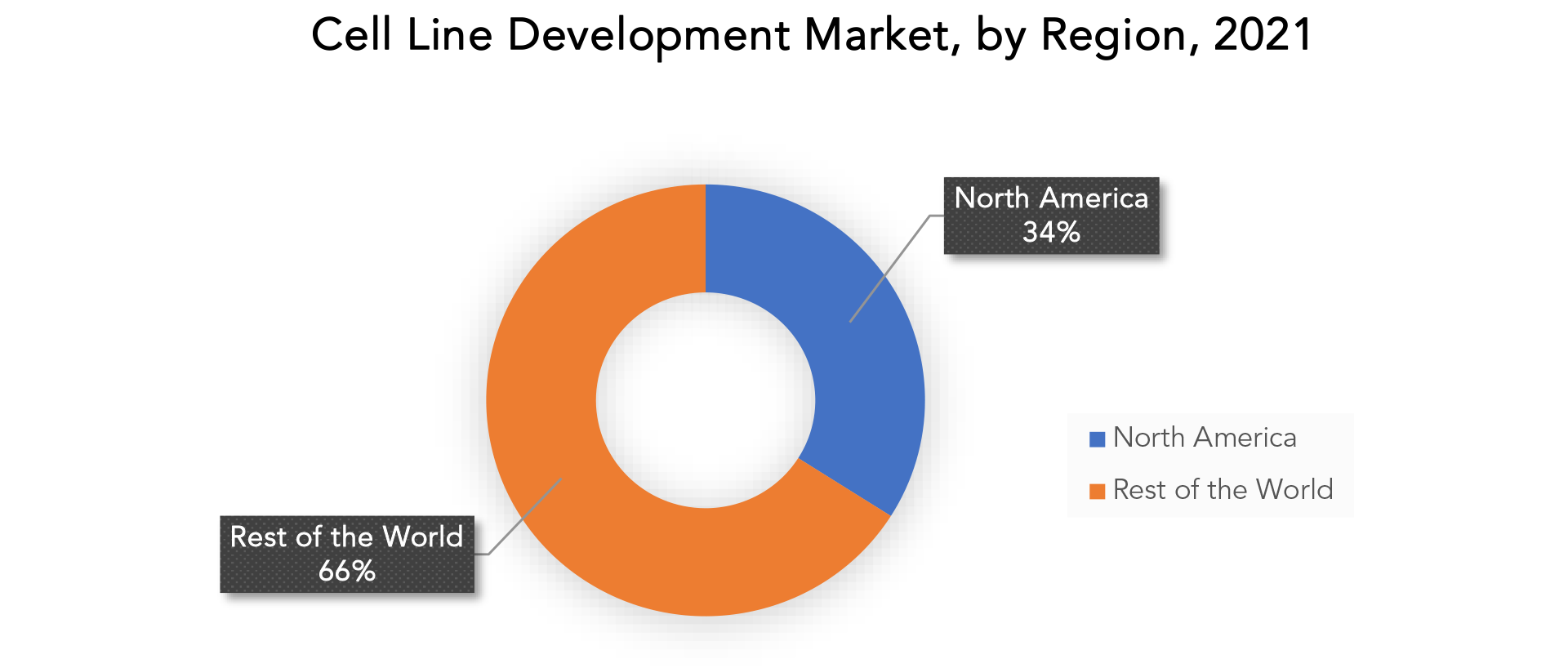

During the projected period, north America is the largest market in 2021 accounted for more revenue generation of worldwide sales. It is due to the presence of constant technological developments followed by new discoveries triggering the adoption of novel procedures for bioproduction.

Over the projection period, North America will continue to rule the cell line development market. Compared to most developed nations, the United States has a better healthcare infrastructure. The main driver of the market analyzed in the country’s growth is the existence of big players in the United States. The need for cell line development and technological developments has been boosted by the US government’s support for accelerating research in the biotechnology and biopharmaceutical industries, and higher regional growth has been facilitated by higher R&D spending.

Due to rising healthcare spending by the public and private sectors, the Asia Pacific region’s market is predicted to grow profitably. During the projection period, it is anticipated that the biotechnology sector in developing nations would experience significant expansion. Government measures like public healthcare programs and enhanced healthcare infrastructure in developing nations are fostering the sector’s expansion.

Key Market Segments: Cell Line Development Market

Cell Line Development Market By Product, 2020-2029, (USD Billion)

- Reagents And Media

- Equipment

- Finished Cells

Cell Line Development Market By Source, 2020-2029, (USD Billion)

- Mammalian Cell Line

- Non-Mammmalian Cell Line

Cell Line Development Market By Application 2020-2029, (USD Billion)

- Recombinent Protein

- Expression

- Hybridos Technology

- Vaccine Production

- Drug Discovery

Cell Line Development Market By End-User, 2020-2029, (USD Billion)

- Pharmaceutical Companies

- Academics And Research

Cell Line Development Market By Cell Type, 2020-2029, (USD Billion)

- Recombinant Cell Lines

- Hybridomas

- Primary Cell Lines

- Continuous Cell Lines

Cell Line Development Market By Region, 2020-2029, (USD Billion)

- North America

- Asia Pacific

- Europe

- South America

- Middle East and Africa

Important Countries in All Regions Are Covered.

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the cell line development market over the next 7 years?

- Who are the major players in the cell line development market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the cell line development market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the cell line development market?

- What is the current and forecasted size and growth rate of the global cell line development market?

- What are the key drivers of growth in the cell line development market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the cell line development market?

- What are the technological advancements and innovations in the cell line development market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the cell line development market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the cell line development market?

- What are the service offerings and specifications of leading players in the market?

- What is the pricing trend of cell line developments in the market and what is the impact of raw material prices on the price trend?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Cell line development outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 on cell line development market

- Porter’s five forces model

- Threat from new entrants

- Threat from substitutes

- Bargaining power of suppliers

- Bargaining power of customers

- Degree of competition

- Industry Value Chain Analysis

- Global Cell line development outlook

- Global Cell Line Development Market By Product (USD Billion) 2020-2029

- Reagents and Media

- Equipment

- Finished Cells

- Global Cell line Development Market By Source (USD Billion) 2020-2029

- Mammalian Cell Line

- Non-Mammalian Cell Line

- Global Cell Line Development Market By Application (USD Billion) 2020-2029

- Recombinant Protein

- Expression

- Hybridomas Technology

- Vaccine Production

- Drug Discovery

- Global Cell Line Development Market By End User (USD Billion) 2020-2029

- Pharmaceutical Companies

- Academics and Research

- Global Cell Line Development Market By Region (USD Billion) 2020-2029

- NORTH AMERICA

- US

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Colombia

- Rest Of South America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- India

- China

- Japan

- South Korea

- Australia

- South-East Asia

- Rest Of Asia Pacific

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest Of Middle East and Africa

- NORTH AMERICA

- Company Profiles*

(Business Overview, Company Snapshot, Products Offered, Recent Developments)

- Advanced Instruments

- LLC

- AGC Biologics

- Catalent

- Corning inc

- Cyagen

- Cytiva

- Eurofins

- FUJIFILM Diosynth Biotechnologies

- Horizon Discovery

- Genscript Biotech Corporation

- Imgenex

- Lonza

- Selexis SA

*The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL CELL LINE DEVELOPMENT MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 2 GLOBAL CELL LINE DEVELOPMENT MARKET BY END USER (USD BILLION) 2020-2029

TABLE 3 GLOBAL CELL LINE DEVELOPMENT MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 4 GLOBAL CELL LINE DEVELOPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 5 GLOBAL CELL LINE DEVELOPMENT MARKET BY REGION (USD BILLION) 2020-2029

TABLE 6 NORTH AMERICA CELL LINE DEVELOPMENT MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 7 NORTH AMERICA CELL LINE DEVELOPMENT MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 8 NORTH AMERICA CELL LINE DEVELOPMENT MARKET BY END USER (USD BILLION) 2020-2029

TABLE 9 NORTH AMERICA CELL LINE DEVELOPMENT MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 10 NORTH AMERICA CELL LINE DEVELOPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 11 US CELL LINE DEVELOPMENT MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 12 US CELL LINE DEVELOPMENT MARKET BY END USER (USD BILLION) 2020-2029

TABLE 13 US CELL LINE DEVELOPMENT MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 14 US CELL LINE DEVELOPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 15 CANADA CELL LINE DEVELOPMENT MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 16 CANADA CELL LINE DEVELOPMENT MARKET BY END USER (USD BILLION) 2020-2029

TABLE 17 CANADA CELL LINE DEVELOPMENT MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 18 CANADA CELL LINE DEVELOPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 19 MEXICO CELL LINE DEVELOPMENT MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 20 MEXICO CELL LINE DEVELOPMENT MARKET BY END USER (USD BILLION) 2020-2029

TABLE 21 MEXICO CELL LINE DEVELOPMENT MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 22 MEXICO CELL LINE DEVELOPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 23 SOUTH AMERICA CELL LINE DEVELOPMENT MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 24 SOUTH AMERICA CELL LINE DEVELOPMENT MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 25 SOUTH AMERICA CELL LINE DEVELOPMENT MARKET BY END USER (USD BILLION) 2020-2029

TABLE 26 SOUTH AMERICA CELL LINE DEVELOPMENT MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 27 SOUTH AMERICA CELL LINE DEVELOPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 28 BRAZIL CELL LINE DEVELOPMENT MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 29 BRAZIL CELL LINE DEVELOPMENT MARKET BY END USER (USD BILLION) 2020-2029

TABLE 30 BRAZIL CELL LINE DEVELOPMENT MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 31 BRAZIL CELL LINE DEVELOPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 32 ARGENTINA CELL LINE DEVELOPMENT MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 33 ARGENTINA CELL LINE DEVELOPMENT MARKET BY END USER (USD BILLION) 2020-2029

TABLE 34 ARGENTINA CELL LINE DEVELOPMENT MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 35 ARGENTINA CELL LINE DEVELOPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 36 COLOMBIA CELL LINE DEVELOPMENT MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 37 COLOMBIA CELL LINE DEVELOPMENT MARKET BY END USER (USD BILLION) 2020-2029

TABLE 38 COLOMBIA CELL LINE DEVELOPMENT MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 39 COLOMBIA CELL LINE DEVELOPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 40 REST OF SOUTH AMERICA CELL LINE DEVELOPMENT MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 41 REST OF SOUTH AMERICA CELL LINE DEVELOPMENT MARKET BY END USER (USD BILLION) 2020-2029

TABLE 42 REST OF SOUTH AMERICA CELL LINE DEVELOPMENT MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 43 REST OF SOUTH AMERICA CELL LINE DEVELOPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 44 ASIA-PACIFIC CELL LINE DEVELOPMENT MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 45 ASIA-PACIFIC CELL LINE DEVELOPMENT MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 46 ASIA-PACIFIC CELL LINE DEVELOPMENT MARKET BY END USER (USD BILLION) 2020-2029

TABLE 47 ASIA-PACIFIC CELL LINE DEVELOPMENT MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 48 ASIA-PACIFIC CELL LINE DEVELOPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 49 INDIA CELL LINE DEVELOPMENT MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 50 INDIA CELL LINE DEVELOPMENT MARKET BY END USER (USD BILLION) 2020-2029

TABLE 51 INDIA CELL LINE DEVELOPMENT MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 52 INDIA CELL LINE DEVELOPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 53 CHINA CELL LINE DEVELOPMENT MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 54 CHINA CELL LINE DEVELOPMENT MARKET BY END USER (USD BILLION) 2020-2029

TABLE 55 CHINA CELL LINE DEVELOPMENT MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 56 CHINA CELL LINE DEVELOPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 57 JAPAN CELL LINE DEVELOPMENT MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 58 JAPAN CELL LINE DEVELOPMENT MARKET BY END USER (USD BILLION) 2020-2029

TABLE 59 JAPAN CELL LINE DEVELOPMENT MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 60 JAPAN CELL LINE DEVELOPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 61 SOUTH KOREA CELL LINE DEVELOPMENT MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 62 SOUTH KOREA CELL LINE DEVELOPMENT MARKET BY END USER (USD BILLION) 2020-2029

TABLE 63 SOUTH KOREA CELL LINE DEVELOPMENT MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 64 SOUTH KOREA CELL LINE DEVELOPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 65 AUSTRALIA CELL LINE DEVELOPMENT MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 66 AUSTRALIA CELL LINE DEVELOPMENT MARKET BY END USER (USD BILLION) 2020-2029

TABLE 67 AUSTRALIA CELL LINE DEVELOPMENT MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 68 AUSTRALIA CELL LINE DEVELOPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 69 SOUTH-EAST ASIA CELL LINE DEVELOPMENT MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 70 SOUTH-EAST ASIA CELL LINE DEVELOPMENT MARKET BY END USER (USD BILLION) 2020-2029

TABLE 71 SOUTH-EAST ASIA CELL LINE DEVELOPMENT MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 72 SOUTH-EAST ASIA CELL LINE DEVELOPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 73 REST OF ASIA PACIFIC CELL LINE DEVELOPMENT MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 74 REST OF ASIA PACIFIC CELL LINE DEVELOPMENT MARKET BY END USER (USD BILLION) 2020-2029

TABLE 75 REST OF ASIA PACIFIC CELL LINE DEVELOPMENT MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 76 REST OF ASIA PACIFIC CELL LINE DEVELOPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 77 EUROPE CELL LINE DEVELOPMENT MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 78 ASIA-PACIFIC CELL LINE DEVELOPMENT MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 79 ASIA-PACIFIC CELL LINE DEVELOPMENT MARKET BY END USER (USD BILLION) 2020-2029

TABLE 80 ASIA-PACIFIC CELL LINE DEVELOPMENT MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 81 ASIA-PACIFIC CELL LINE DEVELOPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 82 GERMANY CELL LINE DEVELOPMENT MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 83 GERMANY CELL LINE DEVELOPMENT MARKET BY END USER (USD BILLION) 2020-2029

TABLE 84 GERMANY CELL LINE DEVELOPMENT MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 85 GERMANY CELL LINE DEVELOPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 86 UK CELL LINE DEVELOPMENT MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 87 UK CELL LINE DEVELOPMENT MARKET BY END USER (USD BILLION) 2020-2029

TABLE 88 UK CELL LINE DEVELOPMENT MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 89 UK CELL LINE DEVELOPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 90 FRANCE CELL LINE DEVELOPMENT MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 91 FRANCE CELL LINE DEVELOPMENT MARKET BY END USER (USD BILLION) 2020-2029

TABLE 92 FRANCE CELL LINE DEVELOPMENT MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 93 FRANCE CELL LINE DEVELOPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 94 ITALY CELL LINE DEVELOPMENT MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 95 ITALY CELL LINE DEVELOPMENT MARKET BY END USER (USD BILLION) 2020-2029

TABLE 96 ITALY CELL LINE DEVELOPMENT MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 97 ITALY CELL LINE DEVELOPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 98 SPAIN CELL LINE DEVELOPMENT MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 99 SPAIN CELL LINE DEVELOPMENT MARKET BY END USER (USD BILLION) 2020-2029

TABLE 100 SPAIN CELL LINE DEVELOPMENT MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 101 SPAIN CELL LINE DEVELOPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 102 RUSSIA CELL LINE DEVELOPMENT MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 103 RUSSIA CELL LINE DEVELOPMENT MARKET BY END USER (USD BILLION) 2020-2029

TABLE 104 RUSSIA CELL LINE DEVELOPMENT MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 105 RUSSIA CELL LINE DEVELOPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 106 REST OF EUROPE CELL LINE DEVELOPMENT MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 107 REST OF EUROPE CELL LINE DEVELOPMENT MARKET BY END USER (USD BILLION) 2020-2029

TABLE 108 REST OF EUROPE CELL LINE DEVELOPMENT MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 109 REST OF EUROPE CELL LINE DEVELOPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 110 MIDDLE EAST AND AFRICA CELL LINE DEVELOPMENT MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 111 MIDDLE EAST AND AFRICA CELL LINE DEVELOPMENT MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 112 MIDDLE EAST AND AFRICA CELL LINE DEVELOPMENT MARKET BY END USER (USD BILLION) 2020-2029

TABLE 113 MIDDLE EAST AND AFRICA CELL LINE DEVELOPMENT MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 114 MIDDLE EAST AND AFRICA CELL LINE DEVELOPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 115 UAE CELL LINE DEVELOPMENT MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 116 UAE CELL LINE DEVELOPMENT MARKET BY END USER (USD BILLION) 2020-2029

TABLE 117 UAE CELL LINE DEVELOPMENT MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 118 UAE CELL LINE DEVELOPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 119 SAUDI ARABIA CELL LINE DEVELOPMENT MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 120 SAUDI ARABIA CELL LINE DEVELOPMENT MARKET BY END USER (USD BILLION) 2020-2029

TABLE 121 SAUDI ARABIA CELL LINE DEVELOPMENT MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 122 SAUDI ARABIA CELL LINE DEVELOPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 123 SOUTH AFRICA CELL LINE DEVELOPMENT MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 124 SOUTH AFRICA CELL LINE DEVELOPMENT MARKET BY END USER (USD BILLION) 2020-2029

TABLE 125 SOUTH AFRICA CELL LINE DEVELOPMENT MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 126 SOUTH AFRICA CELL LINE DEVELOPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 127 REST OF MIDDLE EAST AND AFRICA CELL LINE DEVELOPMENT MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 128 REST OF MIDDLE EAST AND AFRICA CELL LINE DEVELOPMENT MARKET BY END USER (USD BILLION) 2020-2029

TABLE 129 REST OF MIDDLE EAST AND AFRICA CELL LINE DEVELOPMENT MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 130 REST OF MIDDLE EAST AND AFRICA CELL LINE DEVELOPMENT MARKET BY APPLICATION (USD BILLION) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL CELL LINE DEVELOPMENT BY PRODUCT, USD BILLION, 2020-2029

FIGURE 9 GLOBAL CELL LINE DEVELOPMENT BY END USER, USD BILLION, 2020-2029

FIGURE 10 GLOBAL CELL LINE DEVELOPMENT BY APPLICATION, USD BILLION, 2020-2029

FIGURE 11 GLOBAL CELL LINE DEVELOPMENT BY SOURCE, USD BILLION, 2020-2029

FIGURE 12 GLOBAL CELL LINE DEVELOPMENT BY REGION, USD BILLION, 2020-2029

FIGURE 13 GLOBAL CELL LINE DEVELOPMENT BY PRODUCT, USD BILLION, 2021

FIGURE 14 GLOBAL CELL LINE DEVELOPMENTBY END USER, USD BILLION, 2021

FIGURE 15 GLOBAL CELL LINE DEVELOPMENTBY APPLICATION, USD BILLION, 2021

FIGURE 16 GLOBAL CELL LINE DEVELOPMENTBY SOURCE, USD BILLION, 2021

FIGURE 17 GLOBAL CELL LINE DEVELOPMENTBY REGION, USD BILLION, 2021

FIGURE 18 PORTER’S FIVE FORCES MODEL

FIGURE 19 MARKET SHARE ANALYSIS

FIGURE 20 ADVANCED INSTRUMENTS: COMPANY SNAPSHOT

FIGURE 21 LLC: COMPANY SNAPSHOT

FIGURE 22 AGC BIOLOGIES: COMPANY SNAPSHOT

FIGURE 23 CATALENT: COMPANY SNAPSHOT

FIGURE 24 CORNING INC: COMPANY SNAPSHOT

FIGURE 25 CYAGEN: COMPANY SNAPSHOT

FIGURE 26 CYTIVA: COMPANY SNAPSHOT

FIGURE 27 EUROFINS: COMPANY SNAPSHOT

FIGURE 28 SELEXIS SA: COMPANY SNAPSHOT

FIGURE 29 LONZA: COMPANY SNAPSHOT

FIGURE 30 HORIZON DISCOVERY: COMPANY SNAPSHOT

FAQ

The cell line development market is expected to grow at 10.4% CAGR from 2022 to 2029. It is expected to reach above USD 11.89billion by 2029 from USD 4.59 billion in 2020.

North America possess 34 % of the total market size of enterprise file sync and share system. It is due to the presence of constant technological developments followed by new discoveries triggering the adoption of novel procedures for bioproduction.

The market is fueled by the expanding biopharmaceutical sector, increasing demand for cancer therapies and monoclonal antibodies, and rising biosimilar production as a result of the patent expiry of branded pharmaceuticals. Over the past ten years, cancer has become more widespread as a result of changes in eating habits, a lack of physical activity, and overall changes in lifestyle. Additionally, as vaccine production increases and technology develop, there will be a greater demand for cell line creation.

Based on product, Reagents and media accounted for the largest revenue share due to increasing bio-production that requires these products from incubation to preservation. Equipment used are incubators, bioreactors, storage equipment, centrifuge, and microscopes. Bioreactors held the dominant share in the equipment segment due to its usage in large-scale manufacturing of biologics. The introduction of single-use bioreactors is a major driver contributing to the growth of the bioreactor segment over the forecast period.

Over the projection period, North America will continue to rule the cell line development market. Compared to most developed nations, the United States has a better healthcare infrastructure. The main driver of the market analyzed in the country’s growth is the existence of big players in the United States. The need for cell line development and technological developments has been boosted by the US government’s support for accelerating research in the biotechnology and biopharmaceutical industries, and higher regional growth has been facilitated by higher R&D spending. The major growth factors for this region are advanced network technology, the proliferation of mobile workforce, advanced mobile platforms and SAAS flexibility used by various companies.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.