REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

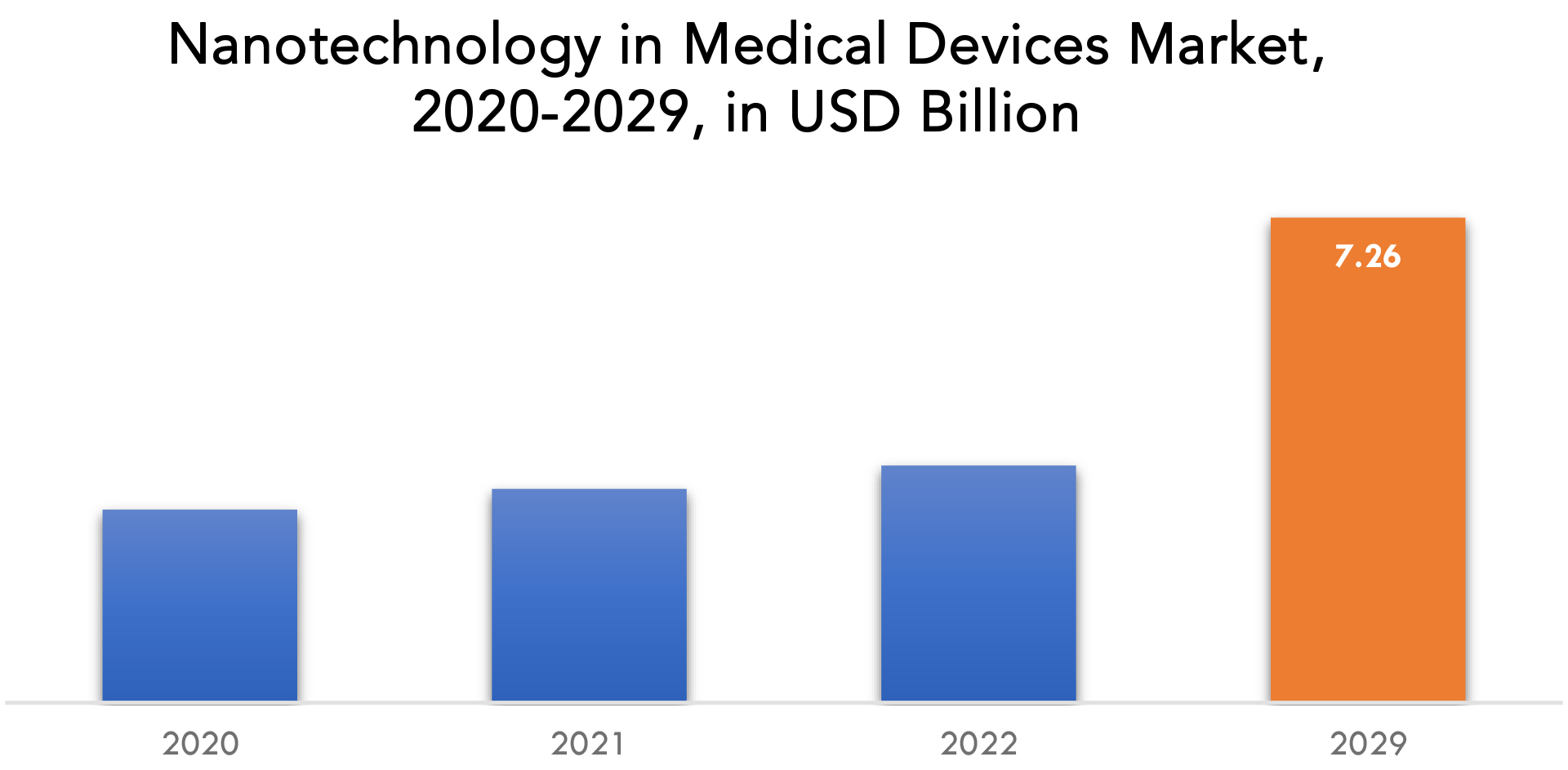

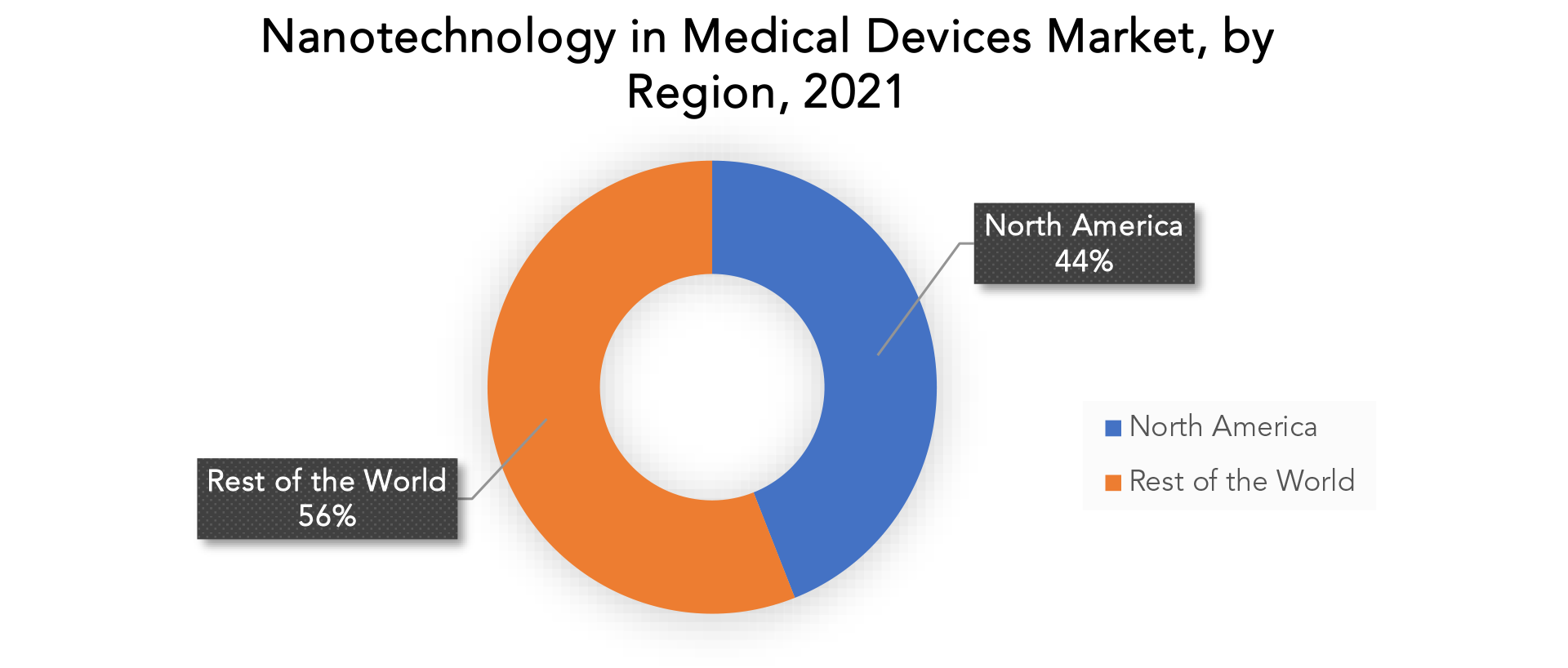

| USD 7.26 billion by 2029 | 10.78% | North America |

| By Product | By Application | By End Use |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Nanotechnology in Medical Devices Market Overview

The global nanotechnology in medical devices market size was valued at USD 2.89 billion in 2020, and projected to reach USD 7.26 billion by 2029, with a CAGR of 10.78% from 2021 to 2029.

Nanotechnology in medical devices is a growing field with immense potential. This technology involves the integration of specific atoms, molecules, or compounds into structures in order to create materials and devices with unique properties. Nanorobots can carry out cellular level repairs using this technology. Nanotechnology is being used to create new medical devices such as diagnostics, implantable devices, stents, and catheters. Nanotechnology can be used in a variety of applications, including bioassays, monitoring devices, and imaging devices. Because of the increasing adoption of innovative technological advancement, the potential for the nanotechnology market in medical devices is growing.

Nanotechnology is a new technology that has great potential for new medical devices. Nanotechnology has the potential to completely transform medicine, particularly in drug delivery, diagnostics, tissue engineering, imaging, and therapeutics. The promise among these devices is based on nanomaterials’ ability to modify or enhance physical properties that conventional materials cannot.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion) |

| Segmentation | By Product, By Application, By End Use |

| By Product

|

|

| By Application

|

|

| By End Use

|

|

| By Region

|

|

Nanotechnology is used to build innovative medical equipment such as stents, catheters, implanted devices, and diagnostics. Nanotechnology can be used in a variety of applications, including bioassays, monitoring systems, and imaging devices. The market potential for nanotechnology in medical devices is growing as people become more accepting of cutting-edge technological advancements.

The increased demand for improved precision in drug delivery is propelling the growth of nanotechnology-based medical devices. In the case of modern medicines, the body does not soak up the entire drug dose that is administered. Drugs can be administered to specific areas of the body with greater precision using nanotechnology. Thus, consistent efforts by nano healthcare technology market players to improve target specification and enhance drug release control are expected to spur the market’s growth. Government initiatives and investments are main considerations encouraging the adoption of nanotechnology in healthcare. Government spending on nanotechnology is consistently increasing. With continued government support, the market is expected to intensify in the coming years. However apart from that, the growing geriatric population is expected to drive the nano healthcare technology market.

A scarcity of skilled professionals may suppress market growth. The potential of nanotechnology in medicine has piqued the interest of a variety of stakeholders, including governments, academic researchers, and pharmaceutical companies. However, one of the major issues that hospitals and research facilities face today is a scarcity of nanotechnology experts. Because this technology field is still in its early stages, there are very few professionals to meet current needs, let alone future demands for medical applications.

Extreme weather conditions, such as electromagnetic noise, radiation, high vacuum, and high temperature, are expected to work with nanotech devices. Nanotechnology devices must meet stringent accuracy specifications for displacement, force, and response times. These new requirements add to the difficulty of compensating for or eliminating cross-sensitivities. When exposed to harsh environments, many devices lose precision and reliability. It is critical that advanced nano sensors and other devices maintain maximum autonomy so that they can operate independently and with minimal maintenance.

The current market will be augmented by nanotechnology applications in disease treatment and prevention. Nanomedicine improves human health and provides treatments for a wide range of life-threatening disorders, including Parkinson’s disease, cancer, orthopedic ailments, diabetes, Alzheimer’s disease, and lung, blood, and vascular system diseases. By 2020, there will be approximately 50 million dementia patients worldwide. This figure is expected to more than double in the next 20 years, surpassing 82 million in 2030 and 152 million in 2050. As a result, the rising prevalence of dementia is expected to increase demand for effective nanomedicine-based treatments in dementia care, propelling market growth.

Nanotechnology In Medical Devices Market Segment Analysis

The market has been segmented by product into implantable medical devices, wound care, dental filling material, and others. Due to the high strength of nanomaterials used in dental fillings, the dental filling material segment is expected to capture a significant revenue share by 2030. The materials improve the bond between dentin and biomaterials, making them more effective than conventional materials.

The nanotechnology in medical devices market is divided into hospitals, clinics, and others based on end-use. As a result of rising admissions and target indications such as oral issues, orthopedic diseases, hearing loss, and expanding disease screening initiatives, the hospitals segment is expected to exceed USD 3.7 billion by 2030. Furthermore, the availability of highly skilled healthcare professionals is driving industry trends.

Nanotechnology In Medical Devices Market Players

The global Nanotechnology In Medical Devices market is fragmented in nature with the presence of various key players such Smith & Nephew, Abbott, PerkinElmer Inc., 3M, Mitsui Chemicals, Inc., Dentsply Sirona, Thermo Fisher Scientific Inc, Starkey Hearing Technologies, AAP Implantate, ST. Jude Medical, Affymetrix, Perkinelmer along with medium and small-scale regional players operating in different parts of the world. Major companies in the market compete in terms of application development capability, product launches, and development of new technologies for product formulation.

In June 2022, Baker Heart and Diabetes Institute researchers designed and developed a novel nanoparticle drug delivery technology that can identify and treat a variety of diseases, as well as significantly improve the efficacy of an atherosclerosis treatment.

In January 2022, NaNotics LLC has formed a research partnership with the Mayo Clinic to create a NaNot that targets the soluble form of PD-L1, a tumor-generated immune inhibitor.

Who Should Buy? Or Key stakeholders

- Clinicians

- Patients

- Industry

- Regulatory Bodies

- Academic Researchers

Nanotechnology In Medical Devices Market Regional Analysis

Geographically, the Agriculture Textile market is segmented into North America, South America, Europe, APAC and MEA.

- North America: includes the US, Canada, Mexico

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

North America is expected to hold the largest share of the network security market. 44% of the market for network security software was dominated by north America in 2021. Because of advancements in healthcare infrastructure, favorable government policies, and research grants, the North American nanotechnology in medical devices market is expected to grow the most during the forecast period. Because of the region’s high per capita income, Europe was the world’s second largest nanotechnology in medical devices market. Asia Pacific is expected to grow at the fastest rate, while Latin America is expected to grow moderately in the coming years.

Key Market Segments: Nanotechnology in Medical Devices Market

Nanotechnology In Medical Devices Market By Product, 2020-2029, (Usd Billion)

- Implantable Medical Devices

- Dental Filling Material

- Wound Care

- Others

Nanotechnology In Medical Devices Market By Application, 2020-2029, (Usd Billion)

- Therapeutic Applications

- Diagnostic Applications

- Research Application

Nanotechnology In Medical Devices Market by End Use, 2020-2029, (Usd Billion)

- Hospitals

- Clinics

- Others

Nanotechnology In Medical Devices Market By Region, 2020-2029, (Usd Billion)

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the nanotechnology in medical devices market over the next 5 years?

- Who are the major players in the nanotechnology in medical devices market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the nanotechnology in medical devices market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the nanotechnology in medical devices market?

- What is the current and forecasted size and growth rate of the global nanotechnology in medical devices market?

- What are the key drivers of growth in the nanotechnology in medical devices market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the nanotechnology in medical devices market?

- What are the technological advancements and innovations in the nanotechnology in medical devices market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the nanotechnology in medical devices market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the nanotechnology in medical devices market?

- What are the service offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL NANOTECHNOLOGY IN MEDICAL DEVICES MARKET

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON NANOTECHNOLOGY IN MEDICAL DEVICES MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL NANOTECHNOLOGY IN MEDICAL DEVICES MARKET

- GLOBAL NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY PRODUCT, 2020-2029, (USD BILLION)

- IMPLANTABLE MEDICAL DEVICES

- DENTAL FILLING MATERIAL

- WOUND CARE

- OTHERS

- GLOBAL NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY APPLICATION, 2020-2029, (USD BILLION)

- THERAPEUTIC APPLICATIONS

- DIAGNOSTIC APPLICATIONS

- RESEARCH APPLICATION

- GLOBAL NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY END USE, 2020-2029, (USD BILLION)

- HOSPITALS

- CLINICS

- OTHERS

- GLOBAL NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY REGION, 2020-2029, (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

9.1 SMITH & NEPHEW

9.2 ABBOTT

9.3 PERKINELMER INC.

9.4 3M

9.5 MITSUI CHEMICALS, INC.

9.6 DENTSPLY SIRONA

9.7 THERMO FISHER SCIENTIFIC INC

9.8 STARKEY HEARING TECHNOLOGIES

9.9 AAP IMPLANTATE

9.10 ST. JUDE MEDICAL

9.11 AFFYMETRIX

9.12 PERKINELMER *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 2 GLOBAL NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 3 GLOBAL NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY END USE (USD BILLION) 2020-2029

TABLE 4 GLOBAL NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY REGION (USD BILLION) 2020-2029

TABLE 5 NORTH AMERICA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 6 NORTH AMERICA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 7 NORTH AMERICA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY END USE (USD BILLION) 2020-2029

TABLE 8 NORTH AMERICA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 9 US NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 10 US NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 11 US NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY END USE (USD BILLION) 2020-2029

TABLE 12 US NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY REGION (USD BILLION) 2020-2029

TABLE 13 CANADA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 14 CANADA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 15 CANADA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY END USE (USD BILLION) 2020-2029

TABLE 16 CANADA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY REGION (USD BILLION) 2020-2029

TABLE 17 MEXICO NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 18 MEXICO NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 19 MEXICO NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY END USE (USD BILLION) 2020-2029

TABLE 20 MEXICO NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY REGION (USD BILLION) 2020-2029

TABLE 21 SOUTH AMERICA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 22 SOUTH AMERICA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 23 SOUTH AMERICA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY END USE (USD BILLION) 2020-2029

TABLE 24 SOUTH AMERICA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 25 BRAZIL NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 26 BRAZIL NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 27 BRAZIL NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY END USE (USD BILLION) 2020-2029

TABLE 28 BRAZIL NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY REGION (USD BILLION) 2020-2029

TABLE 29 ARGENTINA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 30 ARGENTINA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 31 ARGENTINA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY END USE (USD BILLION) 2020-2029

TABLE 32 ARGENTINA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY REGION (USD BILLION) 2020-2029

TABLE 33 COLOMBIA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 34 COLOMBIA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 35 COLOMBIA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY END USE (USD BILLION) 2020-2029

TABLE 36 COLOMBIA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY REGION (USD BILLION) 2020-2029

TABLE 37 REST OF SOUTH AMERICA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 38 REST OF SOUTH AMERICA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 39 REST OF SOUTH AMERICA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY END USE (USD BILLION) 2020-2029

TABLE 40 REST OF SOUTH AMERICA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY REGION (USD BILLION) 2020-2029

TABLE 41 ASIA-PACIFIC NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 42 ASIA-PACIFIC NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 43 ASIA-PACIFIC NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY END USE (USD BILLION) 2020-2029

TABLE 44 ASIA-PACIFIC NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 45 INDIA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 46 INDIA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 47 INDIA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY END USE (USD BILLION) 2020-2029

TABLE 48 INDIA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY REGION (USD BILLION) 2020-2029

TABLE 49 CHINA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 50 CHINA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 51 CHINA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY END USE (USD BILLION) 2020-2029

TABLE 52 CHINA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY REGION (USD BILLION) 2020-2029

TABLE 53 JAPAN NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 54 JAPAN NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 55 JAPAN NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY END USE (USD BILLION) 2020-2029

TABLE 56 JAPAN NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY REGION (USD BILLION) 2020-2029

TABLE 57 SOUTH KOREA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 58 SOUTH KOREA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 59 SOUTH KOREA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY END USE (USD BILLION) 2020-2029

TABLE 60 SOUTH KOREA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY REGION (USD BILLION) 2020-2029

TABLE 61 AUSTRALIA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 62 AUSTRALIA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 63 AUSTRALIA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY END USE (USD BILLION) 2020-2029

TABLE 64 AUSTRALIA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY REGION (USD BILLION) 2020-2029

TABLE 65 SOUTH-EAST ASIA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 66 SOUTH-EAST ASIA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 67 SOUTH-EAST ASIA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY END USE (USD BILLION) 2020-2029

TABLE 68 SOUTH-EAST ASIA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY REGION (USD BILLION) 2020-2029

TABLE 69 REST OF ASIA PACIFIC NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 70 REST OF ASIA PACIFIC NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 71 REST OF ASIA PACIFIC NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY END USE (USD BILLION) 2020-2029

TABLE 72 REST OF ASIA PACIFIC NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY REGION (USD BILLION) 2020-2029

TABLE 73 EUROPE NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 74 EUROPE NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 75 EUROPE NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY END USE (USD BILLION) 2020-2029

TABLE 76 EUROPE NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 77 GERMANY NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 78 GERMANY NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 79 GERMANY NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY END USE (USD BILLION) 2020-2029

TABLE 80 GERMANY NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY REGION (USD BILLION) 2020-2029

TABLE 81 UK NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 82 UK NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 83 UK NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY END USE (USD BILLION) 2020-2029

TABLE 84 UK NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY REGION (USD BILLION) 2020-2029

TABLE 85 FRANCE NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 86 FRANCE NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 87 FRANCE NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY END USE (USD BILLION) 2020-2029

TABLE 88 FRANCE NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY REGION (USD BILLION) 2020-2029

TABLE 89 ITALY NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 90 ITALY NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 91 ITALY NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY END USE (USD BILLION) 2020-2029

TABLE 92 ITALY NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY REGION (USD BILLION) 2020-2029

TABLE 93 SPAIN NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 94 SPAIN NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 95 SPAIN NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY END USE (USD BILLION) 2020-2029

TABLE 96 SPAIN NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY REGION (USD BILLION) 2020-2029

TABLE 97 RUSSIA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 98 RUSSIA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 99 RUSSIA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY END USE (USD BILLION) 2020-2029

TABLE 100 RUSSIA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY REGION (USD BILLION) 2020-2029

TABLE 101 REST OF EUROPE NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 102 REST OF EUROPE NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 103 REST OF EUROPE NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY END USE (USD BILLION) 2020-2029

TABLE 104 REST OF EUROPE NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY REGION (USD BILLION) 2020-2029

TABLE 105 MIDDLE EAST AND AFRICA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 106 MIDDLE EAST AND AFRICA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 107 MIDDLE EAST AND AFRICA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY END USE (USD BILLION) 2020-2029

TABLE 108 MIDDLE EAST AND AFRICA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 109 UAE NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 110 UAE NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 111 UAE NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY END USE (USD BILLION) 2020-2029

TABLE 112 UAE NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY REGION (USD BILLION) 2020-2029

TABLE 113 SAUDI ARABIA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 114 SAUDI ARABIA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 115 SAUDI ARABIA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY END USE (USD BILLION) 2020-2029

TABLE 116 SAUDI ARABIA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY REGION (USD BILLION) 2020-2029

TABLE 117 SOUTH AFRICA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 118 SOUTH AFRICA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 119 SOUTH AFRICA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY END USE (USD BILLION) 2020-2029

TABLE 120 SOUTH AFRICA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY REGION (USD BILLION) 2020-2029

TABLE 121 REST OF MIDDLE EAST AND AFRICA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 122 REST OF MIDDLE EAST AND AFRICA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 123 REST OF MIDDLE EAST AND AFRICA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY END USE (USD BILLION) 2020-2029

TABLE 124 REST OF MIDDLE EAST AND AFRICA NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY REGION (USD BILLION) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY PRODUCT (USD BILLION) 2020-2029

FIGURE 9 GLOBAL NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

FIGURE 10 GLOBAL NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY END USE (USD BILLION) 2020-2029

FIGURE 11 GLOBAL NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY REGION (USD BILLION) 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY PRODUCT (USD BILLION) 2021

FIGURE 14 GLOBAL NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY APPLICATION (USD BILLION) 2021

FIGURE 15 GLOBAL NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY END USE (USD BILLION) 2021

FIGURE 16 GLOBAL NANOTECHNOLOGY IN MEDICAL DEVICES MARKET BY REGION (USD BILLION) 2021

FIGURE 17 NORTH AMERICA NANOTECHNOLOGY IN MEDICAL DEVICES MARKETSNAPSHOT

FIGURE 18 EUROPE NANOTECHNOLOGY IN MEDICAL DEVICES MARKETSNAPSHOT

FIGURE 19 SOUTH AMERICA NANOTECHNOLOGY IN MEDICAL DEVICES MARKETSNAPSHOT

FIGURE 20 ASIA PACIFIC NANOTECHNOLOGY IN MEDICAL DEVICES MARKETSNAPSHOT

FIGURE 21 MIDDLE EAST ASIA AND AFRICA NANOTECHNOLOGY IN MEDICAL DEVICES MARKETSNAPSHOT

FIGURE 22 MARKET SHARE ANALYSIS

FIGURE 23 SMITH & NEPHEW: COMPANY SNAPSHOT

FIGURE 24 ABBOTT: COMPANY SNAPSHOT

FIGURE 25 PERKINELMER INC.: COMPANY SNAPSHOT

FIGURE 26 3M: COMPANY SNAPSHOT

FIGURE 27 MITSUI CHEMICALS, INC.: COMPANY SNAPSHOT

FIGURE 28 DENTSPLY SIRONA: COMPANY SNAPSHOT

FIGURE 29 THERMO FISHER SCIENTIFIC INC: COMPANY SNAPSHOT

FIGURE 30 STARKEY HEARING TECHNOLOGIES: COMPANY SNAPSHOT

FIGURE 31 SONICWALL.COM: COMPANY SNAPSHOT

FIGURE 32 AAP IMPLANTATE: COMPANY SNAPSHOT

FIGURE 33 ST. JUDE MEDICAL: COMPANY SNAPSHOT

FIGURE 34 AFFYMETRIX: COMPANY SNAPSHOT

FIGURE 35 PERKINELMER: COMPANY SNAPSHOT

FAQ

The nanotechnology in medical devices market is expected to reach USD 3.93 billion by the end of 2023.

The dental filling material segment captured around 25% revenue share in 2021 and is estimated to reach USD 1.8 billion by 2030 due to several benefits of nanotechnology in dental fillings.

The global nanotechnology in medical devices market size was valued at USD 2.89 billion in 2020, and projected to reach USD 7.26 billion by 2029, with a CAGR of 10.78% from 2021 to 2029.

The North America dominated the global industry in 2021 and accounted for the maximum share of more than 44% of the overall revenue.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.