Report Outlook

| Market Size | CAGR | Dominating Region |

|---|---|---|

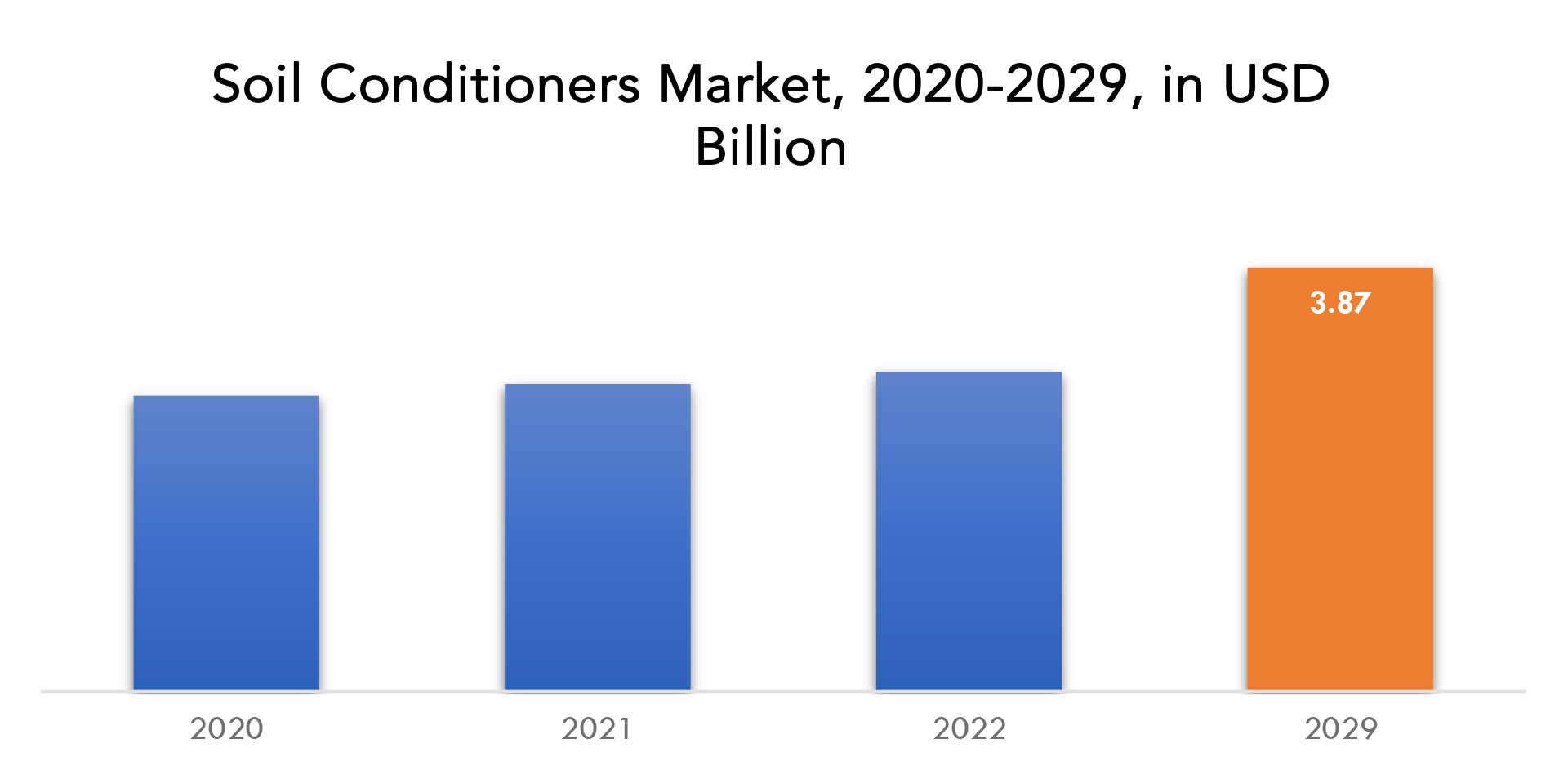

| USD 3.87 billion by 2029 | 4.1% | Asia-Pacific |

| By Product | By Solubility | By Soil Type | By Crop Type | By Region |

|---|---|---|---|---|

|

|

|

|

|

SCOPE OF THE REPORT

Soil Conditioners Market Overview

The soil conditioners market is expected to grow at 4.1% CAGR from 2023 to 2029. It is expected to reach above USD 3.87 billion by 2029 from USD 3.87 billion in 2022.

Soil conditioners are substances or products that are added to soil to improve its physical, chemical, and biological properties. They are used to enhance soil fertility, structure, and texture, and to improve water retention and aeration. Soil conditioners can be organic or inorganic and are commonly used in agriculture, landscaping, and gardening.

The soil conditioners market is expected to grow significantly in the coming years due to various factors. One of the main growth drivers is the increasing demand for food due to the rising global population. Soil conditioners help to improve soil fertility, texture, and structure, which can lead to higher crop yields and better-quality produce. Additionally, there is a growing trend towards organic farming, which has increased the demand for organic soil conditioners that can improve soil health and reduce the use of synthetic chemicals. Government initiatives and funding towards sustainable agriculture practices have also contributed to the growth of the soil conditioners market. The rise in environmental concerns related to soil degradation, erosion, and pollution has increased the need for soil conservation measures, which includes the use of soil conditioners. Moreover, technological advancements in soil conditioning products and techniques, such as the use of microbial inoculants and biochar, have also boosted the growth of the soil conditioners market. With these drivers, the soil conditioners market is expected to continue growing in the coming years, especially in developing countries where agriculture plays a vital role in the economy.

While the soil conditioners market is poised for growth, there are also several restraints that could affect its expansion. One of the main restraints is the high cost of soil conditioning products, which can be a barrier to adoption, especially for small-scale farmers. There is also a lack of standardization in the industry, which makes it difficult for consumers to determine the efficacy of different soil conditioning products. Furthermore, the use of some soil conditioners can have adverse environmental impacts, such as the potential to contribute to soil contamination and water pollution.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD BILLION), (KILOTONS) |

| Segmentation | By Product, By Solubility, By Soil Type, By Crop Type, By Region |

| By Product

|

|

| By Solubility

|

|

| By Soil Type

|

|

| By Crop Type

|

|

| By Region

|

|

The soil conditioners market presents significant growth opportunities as global agriculture enzymes faces several challenges, including climate change, soil degradation, and water scarcity. The demand for sustainable agriculture practices and eco-friendly soil management techniques has created a growing market for soil conditioners. The increasing demand for organic food, coupled with a trend towards healthy lifestyles, is driving the demand for organic soil conditioners that can enhance soil fertility without the use of synthetic chemicals. Additionally, advancements in technology and research in soil microbiology have paved the way for the development of new and innovative soil conditioning products that can address specific soil health issues.

The COVID-19 pandemic has had a mixed impact on the soil conditioners market. On one hand, disruptions to global supply chains and logistical challenges have affected the availability and delivery of soil conditioning products. The closure of manufacturing facilities and restrictions on the movement of goods and people have led to delays in the production and distribution of soil conditioners. On the other hand, the pandemic has also highlighted the importance of agriculture and food security, which has increased the demand for soil conditioners. As more people become interested in gardening and home food production, the demand for soil conditioners has increased, particularly in developed countries. Additionally, the pandemic has accelerated the adoption of precision agriculture techniques, which require the use of soil conditioners and other inputs to optimize crop yields and minimize waste. Overall, the impact of the pandemic on the soil conditioners market has been mixed, with both challenges and opportunities for growth and innovation.

Soil Conditioners Market Segment Analysis

The soil conditioners market is segmented based on product, solubility, soil type, crop type, and region.

Based on product the natural segment is the largest product segment in the soil conditioners market. Natural soil conditioners are derived from organic materials such as animal manure, compost, and peat moss. They are preferred by many farmers and gardeners due to their ability to improve soil health and fertility in a sustainable and environmentally friendly manner. Natural soil conditioners also contain essential nutrients such as nitrogen, phosphorus, and potassium, which can improve crop yields and produce healthier plants. In contrast, synthetic soil conditioners are manufactured using chemical processes and are often less preferred due to environmental concerns and potential harm to soil microbiology. While synthetic soil conditioners may offer short-term benefits, they can also harm the soil’s long-term health by reducing its natural fertility and degrading soil structure. As a result, the natural segment has a larger market share due to its perceived effectiveness and sustainable nature.

Based on solubility, the water-soluble segment is the largest segment for the soil conditioners market. Water-soluble soil conditioners dissolve in water, making them easy to apply and allowing for efficient uptake by plant roots. These products can improve soil structure, increase water-holding capacity, and enhance nutrient uptake by plants. Water-soluble soil conditioners are preferred by many farmers and gardeners due to their ease of use and effectiveness in improving crop yields. In contrast, hydrogels are less commonly used in agriculture and gardening due to their high cost and limited effectiveness in improving soil quality. Hydrogels are water-absorbent polymers that can hold large amounts of water, but they do not contribute to soil structure or nutrient content. Therefore, while hydrogels have some applications in soil conditioning, they are not as widely used or preferred as water-soluble soil conditioners.

Based on soil type, the loam segment is the largest segment for the soil conditioners market. Loam is a type of soil that is a mixture of sand, silt, and clay, with a balanced ratio of each. It is the ideal soil type for agriculture and gardening, as it provides a suitable balance of drainage, water-holding capacity, and nutrient content. Loam soils are commonly found in many regions worldwide, making them a significant target market for soil conditioners. Soil conditioners can improve the quality of loam soils by enhancing soil structure, increasing nutrient availability, and improving water-holding capacity. In contrast, sandy soils are less preferred due to their low nutrient content and poor water-holding capacity. While sand soils can benefit from soil conditioners, they are not as widely used or preferred as loam soils. Therefore, the loam segment is the largest segment for the soil conditioners market due to its ideal characteristics for agriculture and gardening.

The fruit & vegetables segment is the largest segment for the soil conditioners market. Fruits and vegetables require nutrient-rich soil for optimal growth and yield, making them a significant target market for soil conditioners. Soil conditioners can enhance soil fertility, structure, and water-holding capacity, which can improve the quality and quantity of fruit and vegetable crops. Additionally, fruits and vegetables are often high-value crops, making them a significant contributor to the overall revenue of the agricultural industry. In contrast, cereals and grains and oilseeds and pulses may require less soil conditioning as they are often grown in less nutrient-demanding soils. While they can benefit from soil conditioners, they are not as significant a target market as fruits and vegetables. Therefore, the fruits and vegetables segment is the largest segment for the soil conditioners market due to the importance of soil quality in producing high-quality and high-value fruit and vegetable crops.

Soil Conditioners Market Key Market Players

The major players in the soil conditioners market include BASF SE, Syngenta AG, The Dow Chemical Company, Solvay S.A., Yara International ASA, UPL Ltd., Evonik Industries AG, FMC Corporation, Eastman Chemical Company, and Lambent Corp.

March 15, 2023; BASF advanced innovation pipeline with integrated solutions to accelerate agriculture’s transformation. BASF presented the latest advancements in its agricultural innovation pipeline of crop protection, seeds and traits, and digital solutions. The company focused on providing much-needed solutions for farmers to overcome local and crop system-specific pest pressures, climate challenges, changing regulatory requirements, and rising consumer expectations. These solutions were aimed at helping farmers increase their crop yields, improve the quality of their produce, and reduce their environmental impact. BASF’s innovation pipeline showcased their commitment to sustainable agriculture and their efforts to develop technologies that meet the evolving needs of farmers and consumers.

March 24, 2023; BASF’s new VOZC converter technology was selected by Airbus for its A320 fleet starting in 2024. BASF was recently selected by Airbus to develop and supply a new Volatile Organic Compound/Ozone Converter (VOZC) technology for use on its A320 Family aircraft starting in 2024. The contract came after a multi-year technical competition that also took into consideration BASF’s world-class global manufacturing, supply chain, and quality capabilities. BASF worked diligently to develop and deliver this innovative technology to Airbus, meeting all technical specifications and regulatory requirements. The partnership between the two companies highlights BASF’s commitment to developing sustainable solutions that meet the evolving needs of the aerospace industry.

Who Should Buy? Or Key Stakeholders

- Investors

- Healthcare IT industries.

- Institutional & retail players.

- Investment research firms

- Manufacturing companies

- Government Institution

- Research Organizations

- Environment, Health, and Safety Professionals

- Regulatory Authorities

- Others

Soil Conditioners Market Regional Analysis

The soil conditioners market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina, and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

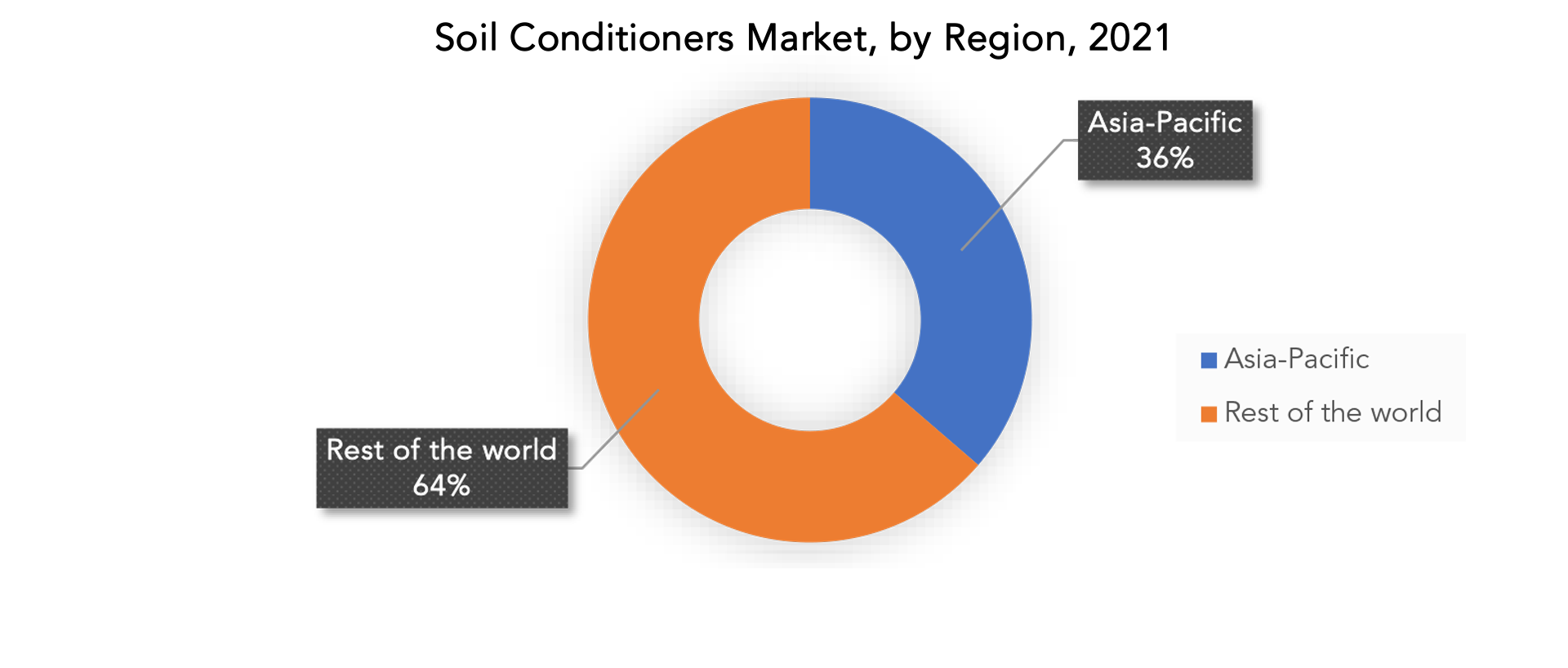

Asia-Pacific is the largest market for soil conditioners due to a combination of factors such as a rapidly growing population, a significant agriculture sector, and a well-established market for soil conditioners. With a large and growing population, demand for food and agricultural products is increasing in the region, leading to a rise in the adoption of soil conditioners to improve soil fertility and increase crop yields. Moreover, the agriculture sector is a significant contributor to the economies of many countries in the region, which has led to a large area of agricultural land, with some of the world’s largest producers of crops like rice, wheat, and vegetables. Soil conditioners are widely used to improve soil quality and increase agricultural productivity, leading to their high demand in the region. Finally, the Asia-Pacific region is home to some of the world’s largest producers and exporters of soil conditioners, ensuring that they are widely available and affordable to farmers and growers in the region.

Key Market Segments: Soil Conditioners Market

Soil Conditioners Market By Product, 2020-2029, (USD Billion), (Kilotons)

- Synthetic

- Natural

Soil Conditioners Market By Solubility, 2020-2029, (USD Billion), (Kilotons)

- Water Soluble

- Hydrogels

Soil Conditioners Market By Soil Type, 2020-2029, (USD Billion), (Kilotons)

- Loam

- Sand

Soil Conditioners Market By Crop Type, 2020-2029, (USD Billion), (Kilotons)

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

Soil Conditioners Market By Region, 2020-2029, (USD Billion), (Kilotons)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the soil conditioners market over the next 7 years?

- Who are the major players in the soil conditioners market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the soil conditioners market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the soil conditioners market?

- What is the current and forecasted size and growth rate of the global soil conditioners market?

- What are the key drivers of growth in the soil conditioners market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the soil conditioners market?

- What are the technological advancements and innovations in the soil conditioners market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the soil conditioners market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the soil conditioners market?

- What are the product applications and specifications of leading players in the market?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Soil conditioners outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 on soil conditioners market

- Porter’s five forces model

- Threat from new entrants

- Threat from substitutes

- Bargaining power of suppliers

- Bargaining power of customers

- Degree of competition

- Industry Value Chain Analysis

- Global Soil conditioners outlook

- Global Soil conditioners Market by Product (USD Billion) (Kilotons) 2020-2029

- Synthetic

- Natural

- Global Soil conditioners Market by Solubility (USD Billion) (Kilotons) 2020-2029

- Water Soluble

- Hydrogels

- Global Soil conditioners Market by Soil Type (USD Billion) (Kilotons) 2020-2029

- Loam

- Sand

- Global Soil conditioners Market by Crop Type (USD Billion) (Kilotons) 2020-2029

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Global Soil conditioners Market by Region (USD Billion) (Kilotons) 2020-2029

- NORTH AMERICA

- US

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Colombia

- Rest Of South America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- India

- China

- Japan

- South Korea

- Australia

- South-East Asia

- Rest Of Asia Pacific

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest Of Middle East and Africa

- NORTH AMERICA

- Company Profiles*

(Business Overview, Company Snapshot, Products Offered, Recent Developments)

- BASF SE

- Syngenta AG

- The Dow Chemical Company

- Solvay S.A.

- Yara International ASA

- UPL Ltd.

- Evonik Industries AG

- FMC Corporation

- Eastman Chemical Company

- Lambent Corp.

*The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL SOIL CONDITIONERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 2 GLOBAL SOIL CONDITIONERS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 3 GLOBAL SOIL CONDITIONERS MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 4 GLOBAL SOIL CONDITIONERS MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 5 GLOBAL SOIL CONDITIONERS MARKET BY SOLUBILITY (USD BILLION) 2020-2029

TABLE 6 GLOBAL SOIL CONDITIONERS MARKET BY SOLUBILITY (KILOTONS) 2020-2029

TABLE 7 GLOBAL SOIL CONDITIONERS MARKET BY SOIL TYPE (USD BILLION) 2020-2029

TABLE 8 GLOBAL SOIL CONDITIONERS MARKET BY SOIL TYPE (KILOTONS) 2020-2029

TABLE 9 GLOBAL SOIL CONDITIONERS MARKET BY REGION (USD BILLION) 2020-2029

TABLE 10 GLOBAL SOIL CONDITIONERS MARKET BY REGION (KILOTONS) 2020-2029

TABLE 11 NORTH AMERICA SOIL CONDITIONERS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 12 NORTH AMERICA SOIL CONDITIONERS MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 13 NORTH AMERICA SOIL CONDITIONERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 14 NORTH AMERICA SOIL CONDITIONERS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 15 NORTH AMERICA SOIL CONDITIONERS MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 16 NORTH AMERICA SOIL CONDITIONERS MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 17 NORTH AMERICA SOIL CONDITIONERS MARKET BY SOLUBILITY (USD BILLION) 2020-2029

TABLE 18 NORTH AMERICA SOIL CONDITIONERS MARKET BY SOLUBILITY (KILOTONS) 2020-2029

TABLE 19 NORTH AMERICA SOIL CONDITIONERS MARKET BY SOIL TYPE (USD BILLION) 2020-2029

TABLE 20 NORTH AMERICA SOIL CONDITIONERS MARKET BY SOIL TYPE (KILOTONS) 2020-2029

TABLE 21 US SOIL CONDITIONERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 22 US SOIL CONDITIONERS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 23 US SOIL CONDITIONERS MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 24 US SOIL CONDITIONERS MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 25 US SOIL CONDITIONERS MARKET BY SOLUBILITY (USD BILLION) 2020-2029

TABLE 26 US SOIL CONDITIONERS MARKET BY SOLUBILITY (KILOTONS) 2020-2029

TABLE 27 US SOIL CONDITIONERS MARKET BY SOIL TYPE (USD BILLION) 2020-2029

TABLE 28 US SOIL CONDITIONERS MARKET BY SOIL TYPE (KILOTONS) 2020-2029

TABLE 29 CANADA SOIL CONDITIONERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 30 CANADA SOIL CONDITIONERS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 31 CANADA SOIL CONDITIONERS MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 32 CANADA SOIL CONDITIONERS MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 33 CANADA SOIL CONDITIONERS MARKET BY SOLUBILITY (USD BILLION) 2020-2029

TABLE 34 CANADA SOIL CONDITIONERS MARKET BY SOLUBILITY (KILOTONS) 2020-2029

TABLE 35 CANADA SOIL CONDITIONERS MARKET BY SOIL TYPE (USD BILLION) 2020-2029

TABLE 36 CANADA SOIL CONDITIONERS MARKET BY SOIL TYPE (KILOTONS) 2020-2029

TABLE 37 MEXICO SOIL CONDITIONERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 38 MEXICO SOIL CONDITIONERS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 39 MEXICO SOIL CONDITIONERS MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 40 MEXICO SOIL CONDITIONERS MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 41 MEXICO SOIL CONDITIONERS MARKET BY SOLUBILITY (USD BILLION) 2020-2029

TABLE 42 MEXICO SOIL CONDITIONERS MARKET BY SOLUBILITY (KILOTONS) 2020-2029

TABLE 43 MEXICO SOIL CONDITIONERS MARKET BY SOIL TYPE (USD BILLION) 2020-2029

TABLE 44 MEXICO SOIL CONDITIONERS MARKET BY SOIL TYPE (KILOTONS) 2020-2029

TABLE 45 SOUTH AMERICA SOIL CONDITIONERS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 46 SOUTH AMERICA SOIL CONDITIONERS MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 47 SOUTH AMERICA SOIL CONDITIONERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 48 SOUTH AMERICA SOIL CONDITIONERS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 49 SOUTH AMERICA SOIL CONDITIONERS MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 50 SOUTH AMERICA SOIL CONDITIONERS MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 51 SOUTH AMERICA SOIL CONDITIONERS MARKET BY SOLUBILITY (USD BILLION) 2020-2029

TABLE 52 SOUTH AMERICA SOIL CONDITIONERS MARKET BY SOLUBILITY (KILOTONS) 2020-2029

TABLE 53 SOUTH AMERICA SOIL CONDITIONERS MARKET BY SOIL TYPE (USD BILLION) 2020-2029

TABLE 54 SOUTH AMERICA SOIL CONDITIONERS MARKET BY SOIL TYPE (KILOTONS) 2020-2029

TABLE 55 BRAZIL SOIL CONDITIONERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 56 BRAZIL SOIL CONDITIONERS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 57 BRAZIL SOIL CONDITIONERS MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 58 BRAZIL SOIL CONDITIONERS MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 59 BRAZIL SOIL CONDITIONERS MARKET BY SOLUBILITY (USD BILLION) 2020-2029

TABLE 60 BRAZIL SOIL CONDITIONERS MARKET BY SOLUBILITY (KILOTONS) 2020-2029

TABLE 61 BRAZIL SOIL CONDITIONERS MARKET BY SOIL TYPE (USD BILLION) 2020-2029

TABLE 62 BRAZIL SOIL CONDITIONERS MARKET BY SOIL TYPE (KILOTONS) 2020-2029

TABLE 63 ARGENTINA SOIL CONDITIONERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 64 ARGENTINA SOIL CONDITIONERS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 65 ARGENTINA SOIL CONDITIONERS MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 66 ARGENTINA SOIL CONDITIONERS MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 67 ARGENTINA SOIL CONDITIONERS MARKET BY SOLUBILITY (USD BILLION) 2020-2029

TABLE 68 ARGENTINA SOIL CONDITIONERS MARKET BY SOLUBILITY (KILOTONS) 2020-2029

TABLE 69 ARGENTINA SOIL CONDITIONERS MARKET BY SOIL TYPE (USD BILLION) 2020-2029

TABLE 70 ARGENTINA SOIL CONDITIONERS MARKET BY SOIL TYPE (KILOTONS) 2020-2029

TABLE 71 COLOMBIA SOIL CONDITIONERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 72 COLOMBIA SOIL CONDITIONERS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 73 COLOMBIA SOIL CONDITIONERS MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 74 COLOMBIA SOIL CONDITIONERS MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 75 COLOMBIA SOIL CONDITIONERS MARKET BY SOLUBILITY (USD BILLION) 2020-2029

TABLE 76 COLOMBIA SOIL CONDITIONERS MARKET BY SOLUBILITY (KILOTONS) 2020-2029

TABLE 77 COLOMBIA SOIL CONDITIONERS MARKET BY SOIL TYPE (USD BILLION) 2020-2029

TABLE 78 COLOMBIA SOIL CONDITIONERS MARKET BY SOIL TYPE (KILOTONS) 2020-2029

TABLE 79 REST OF SOUTH AMERICA SOIL CONDITIONERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 80 REST OF SOUTH AMERICA SOIL CONDITIONERS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 81 REST OF SOUTH AMERICA SOIL CONDITIONERS MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 82 REST OF SOUTH AMERICA SOIL CONDITIONERS MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 83 REST OF SOUTH AMERICA SOIL CONDITIONERS MARKET BY SOLUBILITY (USD BILLION) 2020-2029

TABLE 84 REST OF SOUTH AMERICA SOIL CONDITIONERS MARKET BY SOLUBILITY (KILOTONS) 2020-2029

TABLE 85 REST OF SOUTH AMERICA SOIL CONDITIONERS MARKET BY SOIL TYPE (USD BILLION) 2020-2029

TABLE 86 REST OF SOUTH AMERICA SOIL CONDITIONERS MARKET BY SOIL TYPE (KILOTONS) 2020-2029

TABLE 87 ASIA-PACIFIC SOIL CONDITIONERS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 88 ASIA-PACIFIC SOIL CONDITIONERS MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 89 ASIA-PACIFIC SOIL CONDITIONERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 90 ASIA-PACIFIC SOIL CONDITIONERS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 91 ASIA-PACIFIC SOIL CONDITIONERS MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 92 ASIA-PACIFIC SOIL CONDITIONERS MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 93 ASIA-PACIFIC SOIL CONDITIONERS MARKET BY SOLUBILITY (USD BILLION) 2020-2029

TABLE 94 ASIA-PACIFIC SOIL CONDITIONERS MARKET BY SOLUBILITY (KILOTONS) 2020-2029

TABLE 95 ASIA-PACIFIC SOIL CONDITIONERS MARKET BY SOIL TYPE (USD BILLION) 2020-2029

TABLE 96 ASIA-PACIFIC SOIL CONDITIONERS MARKET BY SOIL TYPE (KILOTONS) 2020- 2029

TABLE 97 INDIA SOIL CONDITIONERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 98 INDIA SOIL CONDITIONERS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 99 INDIA SOIL CONDITIONERS MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 100 INDIA SOIL CONDITIONERS MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 101 INDIA SOIL CONDITIONERS MARKET BY SOLUBILITY (USD BILLION) 2020-2029

TABLE 102 INDIA SOIL CONDITIONERS MARKET BY SOLUBILITY (KILOTONS) 2020-2029

TABLE 103 INDIA SOIL CONDITIONERS MARKET BY SOIL TYPE (USD BILLION) 2020-2029

TABLE 104 INDIA SOIL CONDITIONERS MARKET BY SOIL TYPE (KILOTONS) 2020-2029

TABLE 105 CHINA SOIL CONDITIONERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 106 CHINA SOIL CONDITIONERS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 107 CHINA SOIL CONDITIONERS MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 108 CHINA SOIL CONDITIONERS MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 109 CHINA SOIL CONDITIONERS MARKET BY SOLUBILITY (USD BILLION) 2020-2029

TABLE 110 CHINA SOIL CONDITIONERS MARKET BY SOLUBILITY (KILOTONS) 2020-2029

TABLE 111 CHINA SOIL CONDITIONERS MARKET BY SOIL TYPE (USD BILLION) 2020-2029

TABLE 112 CHINA SOIL CONDITIONERS MARKET BY SOIL TYPE (KILOTONS) 2020-2029

TABLE 113 JAPAN SOIL CONDITIONERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 114 JAPAN SOIL CONDITIONERS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 115 JAPAN SOIL CONDITIONERS MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 116 JAPAN SOIL CONDITIONERS MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 117 JAPAN SOIL CONDITIONERS MARKET BY SOLUBILITY (USD BILLION) 2020-2029

TABLE 118 JAPAN SOIL CONDITIONERS MARKET BY SOLUBILITY (KILOTONS) 2020-2029

TABLE 119 JAPAN SOIL CONDITIONERS MARKET BY SOIL TYPE (USD BILLION) 2020-2029

TABLE 120 JAPAN SOIL CONDITIONERS MARKET BY SOIL TYPE (KILOTONS) 2020-2029

TABLE 121 SOUTH KOREA SOIL CONDITIONERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 122 SOUTH KOREA SOIL CONDITIONERS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 123 SOUTH KOREA SOIL CONDITIONERS MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 124 SOUTH KOREA SOIL CONDITIONERS MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 125 SOUTH KOREA SOIL CONDITIONERS MARKET BY SOLUBILITY (USD BILLION) 2020-2029

TABLE 126 SOUTH KOREA SOIL CONDITIONERS MARKET BY SOLUBILITY (KILOTONS) 2020-2029

TABLE 127 SOUTH KOREA SOIL CONDITIONERS MARKET BY SOIL TYPE (USD BILLION) 2020-2029

TABLE 128 SOUTH KOREA SOIL CONDITIONERS MARKET BY SOIL TYPE (KILOTONS) 2020-2029

TABLE 129 AUSTRALIA SOIL CONDITIONERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 130 AUSTRALIA SOIL CONDITIONERS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 131 AUSTRALIA SOIL CONDITIONERS MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 132 AUSTRALIA SOIL CONDITIONERS MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 133 AUSTRALIA SOIL CONDITIONERS MARKET BY SOLUBILITY (USD BILLION) 2020-2029

TABLE 134 AUSTRALIA SOIL CONDITIONERS MARKET BY SOLUBILITY (KILOTONS) 2020-2029

TABLE 135 AUSTRALIA SOIL CONDITIONERS MARKET BY SOIL TYPE (USD BILLION) 2020-2029

TABLE 136 AUSTRALIA SOIL CONDITIONERS MARKET BY SOIL TYPE (KILOTONS) 2020-2029

TABLE 137 SOUTH-EAST ASIA SOIL CONDITIONERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 138 SOUTH-EAST ASIA SOIL CONDITIONERS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 139 SOUTH-EAST ASIA SOIL CONDITIONERS MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 140 SOUTH-EAST ASIA SOIL CONDITIONERS MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 141 SOUTH-EAST ASIA SOIL CONDITIONERS MARKET BY SOLUBILITY (USD BILLION) 2020-2029

TABLE 142 SOUTH-EAST ASIA SOIL CONDITIONERS MARKET BY SOLUBILITY (KILOTONS) 2020-2029

TABLE 143 SOUTH-EAST ASIA SOIL CONDITIONERS MARKET BY SOIL TYPE (USD BILLION) 2020-2029

TABLE 144 SOUTH-EAST ASIA SOIL CONDITIONERS MARKET BY SOIL TYPE (KILOTONS) 2020-2029

TABLE 145 REST OF ASIA PACIFIC SOIL CONDITIONERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 146 REST OF ASIA PACIFIC SOIL CONDITIONERS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 147 REST OF ASIA PACIFIC SOIL CONDITIONERS MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 148 REST OF ASIA PACIFIC SOIL CONDITIONERS MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 149 REST OF ASIA PACIFIC SOIL CONDITIONERS MARKET BY SOLUBILITY (USD BILLION) 2020-2029

TABLE 150 REST OF ASIA PACIFIC SOIL CONDITIONERS MARKET BY SOLUBILITY (KILOTONS) 2020-2029

TABLE 151 REST OF ASIA PACIFIC SOIL CONDITIONERS MARKET BY SOIL TYPE (USD BILLION) 2020-2029

TABLE 152 REST OF ASIA PACIFIC SOIL CONDITIONERS MARKET BY SOIL TYPE (KILOTONS) 2020-2029

TABLE 153 EUROPE SOIL CONDITIONERS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 154 EUROPE SOIL CONDITIONERS MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 155 EUROPE SOIL CONDITIONERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 156 EUROPE SOIL CONDITIONERS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 157 EUROPE SOIL CONDITIONERS MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 158 EUROPE SOIL CONDITIONERS MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 159 EUROPE SOIL CONDITIONERS MARKET BY SOLUBILITY (USD BILLION) 2020-2029

TABLE 160 EUROPE SOIL CONDITIONERS MARKET BY SOLUBILITY (KILOTONS) 2020-2029

TABLE 161 EUROPE SOIL CONDITIONERS MARKET BY SOIL TYPE (USD BILLION) 2020-2029

TABLE 162 EUROPE SOIL CONDITIONERS MARKET BY SOIL TYPE (KILOTONS) 2020-2029

TABLE 163 GERMANY SOIL CONDITIONERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 164 GERMANY SOIL CONDITIONERS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 165 GERMANY SOIL CONDITIONERS MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 166 GERMANY SOIL CONDITIONERS MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 167 GERMANY SOIL CONDITIONERS MARKET BY SOLUBILITY (USD BILLION) 2020-2029

TABLE 168 GERMANY SOIL CONDITIONERS MARKET BY SOLUBILITY (KILOTONS) 2020-2029

TABLE 169 GERMANY SOIL CONDITIONERS MARKET BY SOIL TYPE (USD BILLION) 2020-2029

TABLE 170 GERMANY SOIL CONDITIONERS MARKET BY SOIL TYPE (KILOTONS) 2020-2029

TABLE 171 UK SOIL CONDITIONERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 172 UK SOIL CONDITIONERS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 173 UK SOIL CONDITIONERS MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 174 UK SOIL CONDITIONERS MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 175 UK SOIL CONDITIONERS MARKET BY SOLUBILITY (USD BILLION) 2020-2029

TABLE 176 UK SOIL CONDITIONERS MARKET BY SOLUBILITY (KILOTONS) 2020-2029

TABLE 177 UK SOIL CONDITIONERS MARKET BY SOIL TYPE (USD BILLION) 2020-2029

TABLE 178 UK SOIL CONDITIONERS MARKET BY SOIL TYPE (KILOTONS) 2020-2029

TABLE 179 FRANCE SOIL CONDITIONERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 180 FRANCE SOIL CONDITIONERS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 181 FRANCE SOIL CONDITIONERS MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 182 FRANCE SOIL CONDITIONERS MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 183 FRANCE SOIL CONDITIONERS MARKET BY SOLUBILITY (USD BILLION) 2020-2029

TABLE 184 FRANCE SOIL CONDITIONERS MARKET BY SOLUBILITY (KILOTONS) 2020-2029

TABLE 185 FRANCE SOIL CONDITIONERS MARKET BY SOIL TYPE (USD BILLION) 2020-2029

TABLE 186 FRANCE SOIL CONDITIONERS MARKET BY SOIL TYPE (KILOTONS) 2020-2029

TABLE 187 ITALY SOIL CONDITIONERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 188 ITALY SOIL CONDITIONERS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 189 ITALY SOIL CONDITIONERS MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 190 ITALY SOIL CONDITIONERS MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 191 ITALY SOIL CONDITIONERS MARKET BY SOLUBILITY (USD BILLION) 2020-2029

TABLE 192 ITALY SOIL CONDITIONERS MARKET BY SOLUBILITY (KILOTONS) 2020-2029

TABLE 193 ITALY SOIL CONDITIONERS MARKET BY SOIL TYPE (USD BILLION) 2020-2029

TABLE 194 ITALY SOIL CONDITIONERS MARKET BY SOIL TYPE (KILOTONS) 2020-2029

TABLE 195 SPAIN SOIL CONDITIONERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 196 SPAIN SOIL CONDITIONERS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 197 SPAIN SOIL CONDITIONERS MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 198 SPAIN SOIL CONDITIONERS MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 199 SPAIN SOIL CONDITIONERS MARKET BY SOLUBILITY (USD BILLION) 2020-2029

TABLE 200 SPAIN SOIL CONDITIONERS MARKET BY SOLUBILITY (KILOTONS) 2020-2029

TABLE 201 SPAIN SOIL CONDITIONERS MARKET BY SOIL TYPE (USD BILLION) 2020-2029

TABLE 202 SPAIN SOIL CONDITIONERS MARKET BY SOIL TYPE (KILOTONS) 2020-2029

TABLE 203 RUSSIA SOIL CONDITIONERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 204 RUSSIA SOIL CONDITIONERS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 205 RUSSIA SOIL CONDITIONERS MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 206 RUSSIA SOIL CONDITIONERS MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 207 RUSSIA SOIL CONDITIONERS MARKET BY SOLUBILITY (USD BILLION) 2020-2029

TABLE 208 RUSSIA SOIL CONDITIONERS MARKET BY SOLUBILITY (KILOTONS) 2020-2029

TABLE 209 RUSSIA SOIL CONDITIONERS MARKET BY SOIL TYPE (USD BILLION) 2020-2029

TABLE 210 RUSSIA SOIL CONDITIONERS MARKET BY SOIL TYPE (KILOTONS) 2020-2029

TABLE 211 REST OF EUROPE SOIL CONDITIONERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 212 REST OF EUROPE SOIL CONDITIONERS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 213 REST OF EUROPE SOIL CONDITIONERS MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 214 REST OF EUROPE SOIL CONDITIONERS MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 215 REST OF EUROPE SOIL CONDITIONERS MARKET BY SOLUBILITY (USD BILLION) 2020-2029

TABLE 216 REST OF EUROPE SOIL CONDITIONERS MARKET BY SOLUBILITY (KILOTONS) 2020-2029

TABLE 217 REST OF EUROPE SOIL CONDITIONERS MARKET BY SOIL TYPE (USD BILLION) 2020-2029

TABLE 218 REST OF EUROPE SOIL CONDITIONERS MARKET BY SOIL TYPE (KILOTONS) 2020-2029

TABLE 219 MIDDLE EAST AND AFRICA SOIL CONDITIONERS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 220 MIDDLE EAST AND AFRICA SOIL CONDITIONERS MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 221 MIDDLE EAST AND AFRICA SOIL CONDITIONERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 222 MIDDLE EAST AND AFRICA SOIL CONDITIONERS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 223 MIDDLE EAST AND AFRICA SOIL CONDITIONERS MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 224 MIDDLE EAST AND AFRICA SOIL CONDITIONERS MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 225 MIDDLE EAST AND AFRICA SOIL CONDITIONERS MARKET BY SOLUBILITY (USD BILLION) 2020-2029

TABLE 226 MIDDLE EAST AND AFRICA SOIL CONDITIONERS MARKET BY SOLUBILITY (KILOTONS) 2020-2029

TABLE 227 MIDDLE EAST AND AFRICA SOIL CONDITIONERS MARKET BY SOIL TYPE (USD BILLION) 2020-2029

TABLE 228 MIDDLE EAST AND AFRICA SOIL CONDITIONERS MARKET BY SOIL TYPE (KILOTONS) 2020-2029

TABLE 229 UAE SOIL CONDITIONERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 230 UAE SOIL CONDITIONERS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 231 UAE SOIL CONDITIONERS MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 232 UAE SOIL CONDITIONERS MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 233 UAE SOIL CONDITIONERS MARKET BY SOLUBILITY (USD BILLION) 2020-2029

TABLE 234 UAE SOIL CONDITIONERS MARKET BY SOLUBILITY (KILOTONS) 2020-2029

TABLE 235 UAE SOIL CONDITIONERS MARKET BY SOIL TYPE (USD BILLION) 2020-2029

TABLE 236 UAE SOIL CONDITIONERS MARKET BY SOIL TYPE (KILOTONS) 2020-2029

TABLE 237 SAUDI ARABIA SOIL CONDITIONERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 238 SAUDI ARABIA SOIL CONDITIONERS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 239 SAUDI ARABIA SOIL CONDITIONERS MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 240 SAUDI ARABIA SOIL CONDITIONERS MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 241 SAUDI ARABIA SOIL CONDITIONERS MARKET BY SOLUBILITY (USD BILLION) 2020-2029

TABLE 242 SAUDI ARABIA SOIL CONDITIONERS MARKET BY SOLUBILITY (KILOTONS) 2020-2029

TABLE 243 SAUDI ARABIA SOIL CONDITIONERS MARKET BY SOIL TYPE (USD BILLION) 2020-2029

TABLE 244 SAUDI ARABIA SOIL CONDITIONERS MARKET BY SOIL TYPE (KILOTONS) 2020-2029

TABLE 245 SOUTH AFRICA SOIL CONDITIONERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 246 SOUTH AFRICA SOIL CONDITIONERS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 247 SOUTH AFRICA SOIL CONDITIONERS MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 248 SOUTH AFRICA SOIL CONDITIONERS MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 249 SOUTH AFRICA SOIL CONDITIONERS MARKET BY SOLUBILITY (USD BILLION) 2020-2029

TABLE 250 SOUTH AFRICA SOIL CONDITIONERS MARKET BY SOLUBILITY (KILOTONS) 2020-2029

TABLE 251 SOUTH AFRICA SOIL CONDITIONERS MARKET BY SOIL TYPE (USD BILLION) 2020-2029

TABLE 252 SOUTH AFRICA SOIL CONDITIONERS MARKET BY SOIL TYPE (KILOTONS) 2020-2029

TABLE 253 REST OF MIDDLE EAST AND AFRICA SOIL CONDITIONERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 254 REST OF MIDDLE EAST AND AFRICA SOIL CONDITIONERS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 255 REST OF MIDDLE EAST AND AFRICA SOIL CONDITIONERS MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 256 REST OF MIDDLE EAST AND AFRICA SOIL CONDITIONERS MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 257 REST OF MIDDLE EAST AND AFRICA SOIL CONDITIONERS MARKET BY SOLUBILITY (USD BILLION) 2020-2029

TABLE 258 REST OF MIDDLE EAST AND AFRICA SOIL CONDITIONERS MARKET BY SOLUBILITY (KILOTONS) 2020-2029

TABLE 259 REST OF MIDDLE EAST AND AFRICA SOIL CONDITIONERS MARKET BY SOIL TYPE (USD BILLION) 2020-2029

TABLE 260 REST OF MIDDLE EAST AND AFRICA SOIL CONDITIONERS MARKET BY SOIL TYPE (KILOTONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL SOIL CONDITIONERS BY SOLUBILITY, USD BILLION, 2020-2029

FIGURE 9 GLOBAL SOIL CONDITIONERS BY PRODUCT, USD BILLION, 2020-2029

FIGURE 10 GLOBAL SOIL CONDITIONERS BY SOIL TYPE, USD BILLION, 2020-2029

FIGURE 11 GLOBAL SOIL CONDITIONERS BY END-USER, USD BILLION, 2020-2029

FIGURE 12 GLOBAL SOIL CONDITIONERS BY REGION, USD BILLION, 2020-2029

FIGURE 13 GLOBAL SOIL CONDITIONERS BY SOLUBILITY, USD BILLION, 2021

FIGURE 14 GLOBAL SOIL CONDITIONERSBY PRODUCT, USD BILLION, 2021

FIGURE 15 GLOBAL SOIL CONDITIONERSBY SOIL TYPE, USD BILLION, 2021

FIGURE 16 GLOBAL SOIL CONDITIONERSBY END-USER, USD BILLION, 2021

FIGURE 17 GLOBAL SOIL CONDITIONERSBY REGION, USD BILLION, 2021

FIGURE 18 PORTER’S FIVE FORCES MODEL

FIGURE 19 MARKET SHARE ANALYSIS

FIGURE 20 BASF SE: COMPANY SNAPSHOT

FIGURE 21 SYNGENTA AG: COMPANY SNAPSHOT

FIGURE 22 THE DOW CHEMICAL COMPANY: COMPANY SNAPSHOT

FIGURE 23 SOLVAY S.A.: COMPANY SNAPSHOT

FIGURE 24 YARA INTERNATIONAL ASA: COMPANY SNAPSHOT

FIGURE 25 UPL LTD.: COMPANY SNAPSHOT

FIGURE 26 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

FIGURE 27 FMC CORPORATION: COMPANY SNAPSHOT

FIGURE 28 EASTMAN CHEMICAL COMPANY: COMPANY SNAPSHOT

FIGURE 29 LAMBENT CORP.: COMPANY SNAPSHOT

FAQ

The soil conditioners market is expected to grow at 4.1 % CAGR from 2022 to 2029. It is expected to reach above USD 3.87 billion by 2029 from USD 3.87 billion in 2020.

Asia-Pacific soil conditioners market was valued at USD 1.31 billion in 2022 and was projected to grow at a rapid rate during the forecast period of 2022-2029.

The driving forces behind the growth of the soil conditioners market include increasing demand for food and agricultural products, growing awareness about sustainable agriculture practices, and the need to improve soil fertility, structure, and water-holding capacity.

One leading application of soil conditioners is in agriculture, where they are used to improve soil health and increase crop yields. Soil conditioners help to enhance soil fertility, structure, and water-holding capacity, making it easier for crops to grow and thrive. They can also help to reduce soil erosion and nutrient runoff, which can have significant environmental benefits. Additionally, soil conditioners can help to promote sustainable agriculture practices, which can benefit both farmers and consumers.

The Asia-Pacific region is the largest regional market for soil conditioners, driven by a large and growing population, a significant agriculture sector, and a well-established market for soil conditioners. The region is home to some of the world’s largest producers and exporters of soil conditioners, ensuring their availability and affordability to farmers and growers.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.