Report Outlook

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 100.96 Billion by 2029 | 5.15% | Asia Pacific m |

| By Type | By End User | By Raw Material |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Global Caps & Closure Market Overview

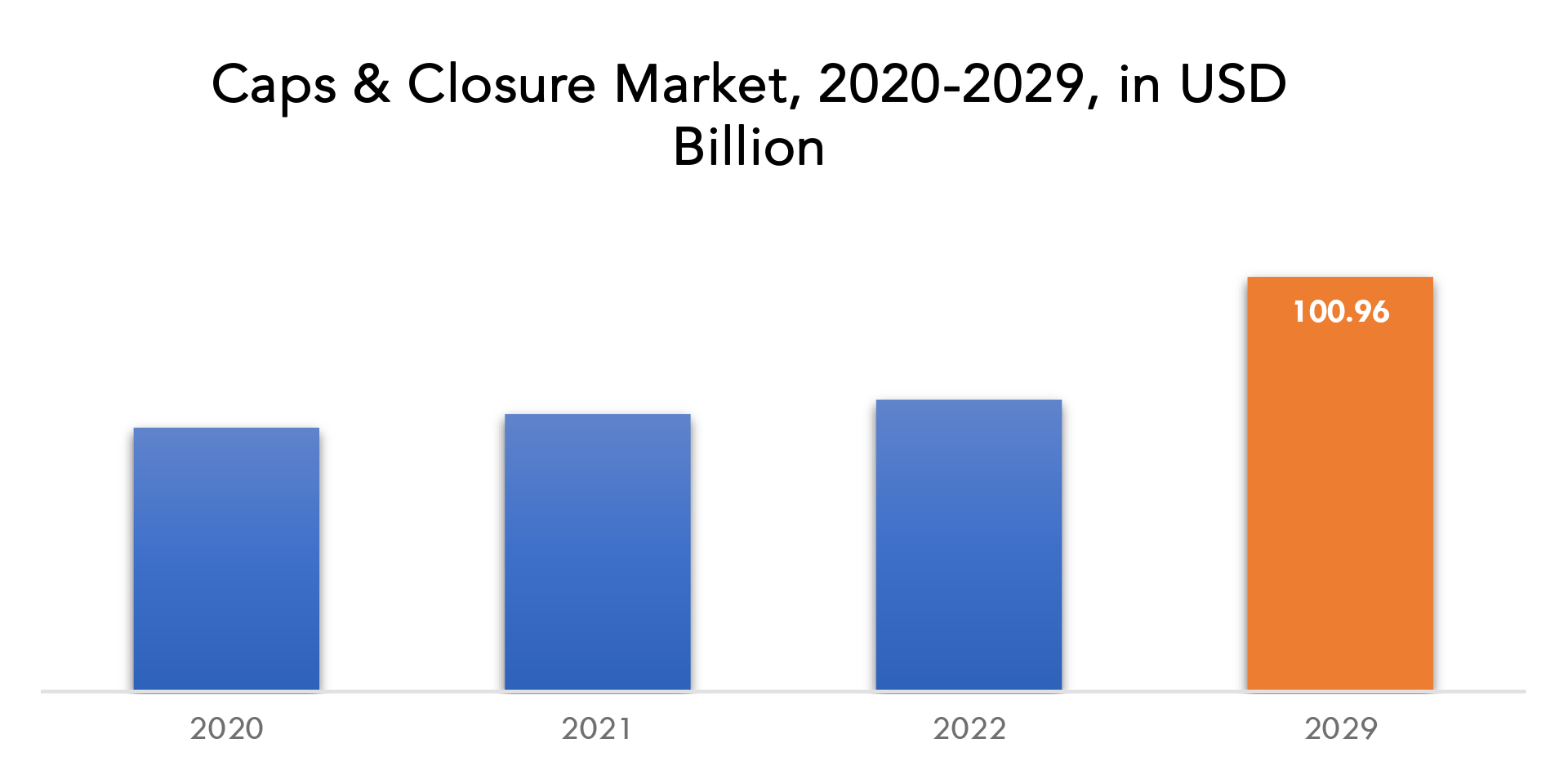

The global Caps & Closure market size is expected to grow at more than 5.15% CAGR from 2021 to 2029. It is expected to reach above USD 100.96 billion by 2029 from a little above USD 64.25 billion in 2020.

For the duration of the specified shelf life, the Caps & Closures’ main function is to keep the container closed and the contents contained. Additionally, it serves as a barrier against moisture, oxygen, dirt, and early opening of the products. Caps & Closures are frequently used in the packaging business to safeguard goods and increase their shelf life. In the market for Caps & Closures, materials like rubber, plastic, and metal are used to create the right kind of product packing.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion), (Thousand Units) |

| Segmentation | By Type, By End User, By Raw Material, By Region |

| By Type |

|

| By End User |

|

| By Raw Material |

|

| By Region |

|

Due to the increase in demand for packs that are simple to open and sustainable, rapid urbanization, and demographic patterns, Caps & Closures are in high demand. These are frequently used in the food and beverage business for alcoholic and non-alcoholic drinks. The Caps & Closures increase the shelf life of the goods, shield them from dust and moisture, and maintain a balanced level of oxygen in the packaged product. Import and export have grown in significance as a result of the rising demand for Caps & Closures. The packing sector is the main driver of the Caps & Closures market. The main goal of packaging is to extend the shelf life of foods and drinks as well as the texture, taste, and quality of other products for a long time. The covers and closures help increase the shelf life of the products and promote the brands. The worldwide market for Caps & Closures is also growing as a result of the rising demand for packaging. The market for Caps & Closures is expanding in part due to the fast-moving consumer products, cosmetics, toiletries, and pharmaceuticals. The user-friendly design, extensive customizability, and robustness of the caps and fasteners contribute to their popularity. Due to their reliable closing, binding qualities, and broad consumer appeal, Caps & Closures are anticipated to experience a significant increase in demand over the course of the forecast period. By using post-consumer resin and other recyclable materials in Caps & Closures, the major market players are stressing circular packaging. As a result, cap and closure producers are updating their recycling programs to meet sustainability targets and draw in environmentally aware consumers.

The increased use of packages without closures, such as pouches and blister packages, poses a threat to the expansion of the Caps & Closures industry. In addition to reducing material costs when compared to more conventional rigid packing techniques, these kinds of packaging also address sustainability concerns. The pouch packaging format is another choice for food and beverage packaging and is used by many FMCG businesses as a packaging innovation tool to give customers more convenience.

The COVID-19 outbreak has had a significant effect on several economic sectors. The regulatory bodies’ implementation of strict lockdowns across several regions hurt the Caps & Closures industry as well. Pharmaceuticals, cosmetics, food & beverages, household items, etc. are the main industries that use caps & closures. They are the last component used in product wrapping and in preserving its dependability. The fear of the virus spreading during this time slowed the development of the food and beverage industry, including both offline and online food chains. The market demand is being driven forward, though, by the accessibility of secure and hygienic goods.

Global Caps & Closure Market Segment Analysis

Based on the type, the market is segmented into easy-open can end, metal lug closure, peel-off closure, screw material, metal crowns, and corks. According to estimates, the metal screw closures market will present the greatest opportunities during the forecast era. Threading inside metal screw Caps & Closures makes it possible to securely seal the container. Metal screw tops and closures are typical for tonic, cough syrup, and tablet bottles. With the help of these closures, dampness and infection are kept out of the medications.

Based on the end user, the market is segmented into food & beverages, personal care, cosmetics, healthcare, automotive, household, and pharmaceuticals. As caps & closures are frequently used in the industry for bottleneck, jar neck, and container applications, the food & beverage sector will account for a sizeable portion of the market during the projection period. In the food and beverage business, these are employed to safeguard the product, improve its safety, extend its shelf life, and decrease contamination and leakage. Due to the rising demand for pharmaceutical packaging, the pharmaceutical sector commands a sizeable portion of the worldwide market for Caps & Closures. Pharmaceuticals are growing as a result of increased pharmaceutical production. Government regulations aren’t the only thing driving the development of senior-friendly, kid-resistant, and improved security features in Caps & Closures by the pharmaceutical industry.

By raw material, the market is segmented into plastic, metal, and wood. The market for plastic products has been identified as having the highest revenue percentage. Given its advantages over other materials, such as durability and affordability, plastic is the most frequently used material in the manufacturing of Caps & Closures. Plastic Caps & Closures are produced using a range of polymers, including polyethylene terephthalate (PET), polypropylene (PP), polyethylene (PE), and polyvinyl chloride. (PVC). Due to its versatility in shaping under pressure or heat, it is widely used across a range of end-use sectors. Consequently, the availability of a variety of packing options is boosting the demand for plastic products.

Global Caps & Closure Market Key Players

Key competitors from both domestic and international markets compete fiercely in the worldwide global Caps & Closure industry including Berry Plastics Corporation, Amcor Limited, Bericap GmbH Co. & Kg, Reynolds Group Holdings Limited, Guala Closures Group, Aptar Group Inc., Silgan Holdings, RPC Group PLC, Crown Holdings, Rexam PLC.

Industry Developments:

4th June 2021: BERICAP, one of the leading global manufacturers of plastic closures, has taken over Mala Verschluss-Systeme GmbH, thereby extending its product portfolio to include aluminum closures.

4th February 2020: Silgan Holdings Inc., a leading supplier of rigid packaging for consumer goods products, announced today that it has acquired Cobra Plastics, Inc. This business manufactures and sells injection-molded plastic closures for a wide variety of consumer products, with a particular focus on the aerosol overcap market.

Who Should Buy? Or Key stakeholders

- Caps & Closure Manufacturers

- Technology Support Providers

- Raw Material Providers

- Regulatory Bodies

- Research and Development Organization

- Government

- Others

Global Caps & Closure Market Regional Analysis

The global Caps & Closure market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN, and the Rest of APAC

- Europe: includes the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe

- South America: includes Brazil, Argentina, and the Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and the Rest of MEA

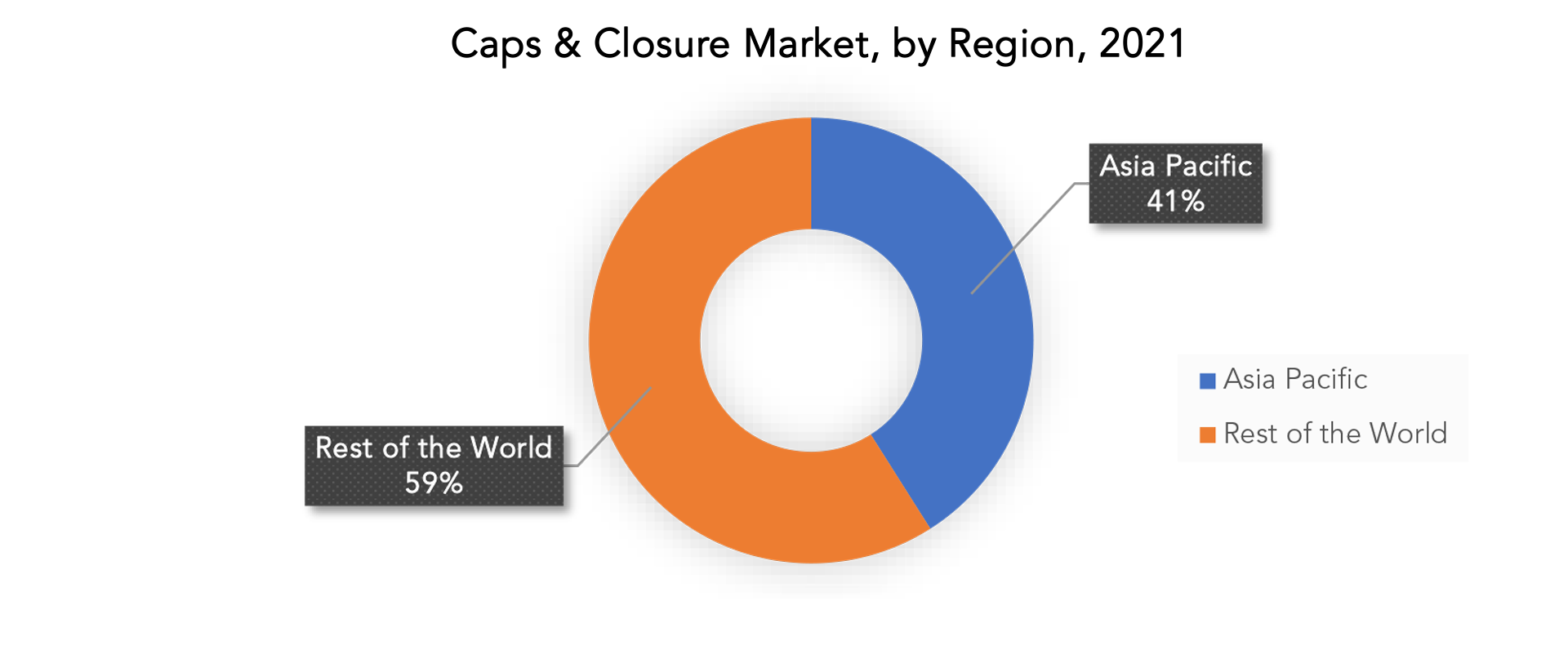

41% of the market share in 2021 was attributed to the Asia-Pacific region. The presence of highly populous countries like India and China as well as the expanding food and beverage industry are expected to be the main driving forces in the Asia-Pacific Caps & Closures market. Additionally, there will likely be a rise in the use of Caps & Closures due to the increase in demand for cosmetics and toiletries. However, North America constituted a sizable portion of global revenue in 2020 as a result of rising alcoholic and non-alcoholic beverage consumption in countries like the U.S. and Canada. The availability of novel beverage varieties in the area is likely to result in even greater demand for the region’s packaging goods.

Key Market Segments: Global Caps & Closure Market

Global Caps & Closure Market By Type, 2020-2029, (USD Billion), (Thousand Units)

- Easy-Open Can End

- Metal Lug Closure

- Peel-Off Foils

- Crew Material

- Metal Crowns

- Corks

Global Caps & Closure Market By End User, 2020-2029, (USD Billion), (Thousand Units)

- Food & Beverages

- Personal Care

- Cosmetics

- Healthcare

- Automotive

- Household

- Pharmaceuticals

Global Caps & Closure Market By Raw Material, 2020-2029, (USD Billion), (Thousand Units)

- Plastic

- Metal

- Wood

Global Caps & Closure Market By Region, 2020-2029, (USD Billion), (Thousand Units)

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered

Exactitude Consultancy Services Key Objectives

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering a new market

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the Caps & Closure market over the next 7 years?

- Who are the major players in the Caps & Closure market and what is their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the Middle East, and Africa?

- How is the economic environment affecting the Caps & Closure market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the Caps & Closure market?

- What is the current and forecasted size and growth rate of the global Caps & Closure market?

- What are the key drivers of growth in the Caps & Closure market?

- What are the distribution channels and supply chain dynamics in the Caps & Closure market?

- What are the technological advancements and innovations in the Caps & Closure market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the Caps & Closure market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the Caps & Closure market?

- What are the product offerings and specifications of leading players in the market?

- What is the pricing trend of Caps & Closure in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL CAPS & CLOSURE MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON CAPS & CLOSURE MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL CAPS & CLOSURE MARKET OUTLOOK

- GLOBAL CAPS & CLOSURE MARKET BY TYPE, 2020-2029, (USD BILLION), (THOUSAND UNITS)

- EASY-OPEN CAN END

- METAL LUG CLOSURE

- PEEL-OFF FOILS

- SCREW MATERIAL

- METAL CROWNS

- CORKS

- GLOBAL CAPS & CLOSURE MARKET BY END USER, 2020-2029, (USD BILLION), (THOUSAND UNITS)

- FOOD & BEVERAGES

- PERSONAL CARE

- COSMETICS

- HEALTHCARE

- AUTOMOTIVE

- HOUSEHOLD

- PHARMACEUTICALS

- GLOBAL CAPS & CLOSURE MARKET BY RAW MATERIAL, 2020-2029, (USD BILLION), (THOUSAND UNITS)

- PLASTIC

- METAL

- WOOD

- GLOBAL CAPS & CLOSURE MARKET BY REGION, 2020-2029, (USD BILLION), (THOUSAND UNITS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- BERRY PLASTICS CORPORATION

- AMCOR LIMITED

- BERICAP GMBH CO. & KG

- REYNOLDS GROUP HOLDINGS LIMITED

- GUALA CLOSURES GROUP

- APTAR GROUP INC.

- SILGAN HOLDINGS

- RPC GROUP PLC

- CROWN HOLDINGS

- REXAM PLC *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL CAPS & CLOSURE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 2 GLOBAL CAPS & CLOSURE MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 3 GLOBAL CAPS & CLOSURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 4 GLOBAL CAPS & CLOSURE MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 5 GLOBAL CAPS & CLOSURE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 6 GLOBAL CAPS & CLOSURE MARKET BY RAW MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 7 GLOBAL CAPS & CLOSURE MARKET BY REGION (USD BILLION) 2020-2029

TABLE 8 GLOBAL CAPS & CLOSURE MARKET BY REGION (THOUSAND UNITS) 2020-2029

TABLE 9 NORTH AMERICA CAPS & CLOSURE MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 10 NORTH AMERICA CAPS & CLOSURE MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 11 NORTH AMERICA CAPS & CLOSURE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 12 NORTH AMERICA CAPS & CLOSURE MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 13 NORTH AMERICA CAPS & CLOSURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 14 NORTH AMERICA CAPS & CLOSURE MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 15 NORTH AMERICA CAPS & CLOSURE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 16 NORTH AMERICA CAPS & CLOSURE MARKET BY RAW MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 17 US CAPS & CLOSURE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 18 US CAPS & CLOSURE MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 19 US CAPS & CLOSURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 20 US CAPS & CLOSURE MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 21 US CAPS & CLOSURE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 22 US CAPS & CLOSURE MARKET BY RAW MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 23 CANADA CAPS & CLOSURE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 24 CANADA CAPS & CLOSURE MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 25 CANADA CAPS & CLOSURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 26 CANADA CAPS & CLOSURE MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 27 CANADA CAPS & CLOSURE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 28 CANADA CAPS & CLOSURE MARKET BY RAW MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 29 MEXICO CAPS & CLOSURE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 30 MEXICO CAPS & CLOSURE MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 31 MEXICO CAPS & CLOSURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 32 MEXICO CAPS & CLOSURE MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 33 MEXICO CAPS & CLOSURE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 34 MEXICO CAPS & CLOSURE MARKET BY RAW MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 35 SOUTH AMERICA CAPS & CLOSURE MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 36 SOUTH AMERICA CAPS & CLOSURE MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 37 SOUTH AMERICA CAPS & CLOSURE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 38 SOUTH AMERICA CAPS & CLOSURE MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 39 SOUTH AMERICA CAPS & CLOSURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 40 SOUTH AMERICA CAPS & CLOSURE MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 41 SOUTH AMERICA CAPS & CLOSURE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 42 SOUTH AMERICA CAPS & CLOSURE MARKET BY RAW MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 43 BRAZIL CAPS & CLOSURE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 44 BRAZIL CAPS & CLOSURE MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 45 BRAZIL CAPS & CLOSURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 46 BRAZIL CAPS & CLOSURE MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 47 BRAZIL CAPS & CLOSURE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 48 BRAZIL CAPS & CLOSURE MARKET BY RAW MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 49 ARGENTINA CAPS & CLOSURE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 50 ARGENTINA CAPS & CLOSURE MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 51 ARGENTINA CAPS & CLOSURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 52 ARGENTINA CAPS & CLOSURE MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 53 ARGENTINA CAPS & CLOSURE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 54 ARGENTINA CAPS & CLOSURE MARKET BY RAW MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 55 COLOMBIA CAPS & CLOSURE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 56 COLOMBIA CAPS & CLOSURE MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 57 COLOMBIA CAPS & CLOSURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 58 COLOMBIA CAPS & CLOSURE MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 59 COLOMBIA CAPS & CLOSURE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 60 COLOMBIA CAPS & CLOSURE MARKET BY RAW MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 61 REST OF SOUTH AMERICA CAPS & CLOSURE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 62 REST OF SOUTH AMERICA CAPS & CLOSURE MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 63 REST OF SOUTH AMERICA CAPS & CLOSURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 64 REST OF SOUTH AMERICA CAPS & CLOSURE MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 65 REST OF SOUTH AMERICA CAPS & CLOSURE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 66 REST OF SOUTH AMERICA CAPS & CLOSURE MARKET BY RAW MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 67 ASIA-PACIFIC CAPS & CLOSURE MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 68 ASIA-PACIFIC CAPS & CLOSURE MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 69 ASIA-PACIFIC CAPS & CLOSURE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 70 ASIA-PACIFIC CAPS & CLOSURE MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 71 ASIA-PACIFIC CAPS & CLOSURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 72 ASIA-PACIFIC CAPS & CLOSURE MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 73 ASIA-PACIFIC CAPS & CLOSURE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 74 ASIA-PACIFIC CAPS & CLOSURE MARKET BY RAW MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 75 INDIA CAPS & CLOSURE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 76 INDIA CAPS & CLOSURE MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 77 INDIA CAPS & CLOSURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 78 INDIA CAPS & CLOSURE MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 79 INDIA CAPS & CLOSURE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 80 INDIA CAPS & CLOSURE MARKET BY RAW MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 81 CHINA CAPS & CLOSURE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 82 CHINA CAPS & CLOSURE MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 83 CHINA CAPS & CLOSURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 84 CHINA CAPS & CLOSURE MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 85 CHINA CAPS & CLOSURE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 86 CHINA CAPS & CLOSURE MARKET BY RAW MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 87 JAPAN CAPS & CLOSURE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 88 JAPAN CAPS & CLOSURE MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 89 JAPAN CAPS & CLOSURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 90 JAPAN CAPS & CLOSURE MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 91 JAPAN CAPS & CLOSURE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 92 JAPAN CAPS & CLOSURE MARKET BY RAW MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 93 SOUTH KOREA CAPS & CLOSURE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 94 SOUTH KOREA CAPS & CLOSURE MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 95 SOUTH KOREA CAPS & CLOSURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 96 SOUTH KOREA CAPS & CLOSURE MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 97 SOUTH KOREA CAPS & CLOSURE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 98 SOUTH KOREA CAPS & CLOSURE MARKET BY RAW MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 99 AUSTRALIA CAPS & CLOSURE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 100 AUSTRALIA CAPS & CLOSURE MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 101 AUSTRALIA CAPS & CLOSURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 102 AUSTRALIA CAPS & CLOSURE MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 103 AUSTRALIA CAPS & CLOSURE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 104 AUSTRALIA CAPS & CLOSURE MARKET BY RAW MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 105 SOUTH-EAST ASIA CAPS & CLOSURE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 106 SOUTH-EAST ASIA CAPS & CLOSURE MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 107 SOUTH-EAST ASIA CAPS & CLOSURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 108 SOUTH-EAST ASIA CAPS & CLOSURE MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 109 SOUTH-EAST ASIA CAPS & CLOSURE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 110 SOUTH-EAST ASIA CAPS & CLOSURE MARKET BY RAW MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 111 REST OF ASIA PACIFIC CAPS & CLOSURE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 112 REST OF ASIA PACIFIC CAPS & CLOSURE MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 113 REST OF ASIA PACIFIC CAPS & CLOSURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 114 REST OF ASIA PACIFIC CAPS & CLOSURE MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 115 REST OF ASIA PACIFIC CAPS & CLOSURE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 116 REST OF ASIA PACIFIC CAPS & CLOSURE MARKET BY RAW MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 117 EUROPE CAPS & CLOSURE MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 118 EUROPE CAPS & CLOSURE MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 119 EUROPE CAPS & CLOSURE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 120 EUROPE CAPS & CLOSURE MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 121 EUROPE CAPS & CLOSURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 122 EUROPE CAPS & CLOSURE MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 123 EUROPE CAPS & CLOSURE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 124 EUROPE CAPS & CLOSURE MARKET BY RAW MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 125 GERMANY CAPS & CLOSURE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 126 GERMANY CAPS & CLOSURE MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 127 GERMANY CAPS & CLOSURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 128 GERMANY CAPS & CLOSURE MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 129 GERMANY CAPS & CLOSURE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 130 GERMANY CAPS & CLOSURE MARKET BY RAW MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 131 UK CAPS & CLOSURE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 132 UK CAPS & CLOSURE MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 133 UK CAPS & CLOSURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 134 UK CAPS & CLOSURE MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 135 UK CAPS & CLOSURE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 136 UK CAPS & CLOSURE MARKET BY RAW MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 137 FRANCE CAPS & CLOSURE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 138 FRANCE CAPS & CLOSURE MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 139 FRANCE CAPS & CLOSURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 140 FRANCE CAPS & CLOSURE MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 141 FRANCE CAPS & CLOSURE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 142 FRANCE CAPS & CLOSURE MARKET BY RAW MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 143 ITALY CAPS & CLOSURE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 144 ITALY CAPS & CLOSURE MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 145 ITALY CAPS & CLOSURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 146 ITALY CAPS & CLOSURE MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 147 ITALY CAPS & CLOSURE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 148 ITALY CAPS & CLOSURE MARKET BY RAW MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 149 SPAIN CAPS & CLOSURE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 150 SPAIN CAPS & CLOSURE MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 151 SPAIN CAPS & CLOSURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 152 SPAIN CAPS & CLOSURE MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 153 SPAIN CAPS & CLOSURE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 154 SPAIN CAPS & CLOSURE MARKET BY RAW MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 155 RUSSIA CAPS & CLOSURE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 156 RUSSIA CAPS & CLOSURE MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 157 RUSSIA CAPS & CLOSURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 158 RUSSIA CAPS & CLOSURE MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 159 RUSSIA CAPS & CLOSURE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 160 RUSSIA CAPS & CLOSURE MARKET BY RAW MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 161 REST OF EUROPE CAPS & CLOSURE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 162 REST OF EUROPE CAPS & CLOSURE MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 163 REST OF EUROPE CAPS & CLOSURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 164 REST OF EUROPE CAPS & CLOSURE MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 165 REST OF EUROPE CAPS & CLOSURE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 166 REST OF EUROPE CAPS & CLOSURE MARKET BY RAW MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 167 MIDDLE EAST AND AFRICA CAPS & CLOSURE MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 168 MIDDLE EAST AND AFRICA CAPS & CLOSURE MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 169 MIDDLE EAST AND AFRICA CAPS & CLOSURE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 170 MIDDLE EAST AND AFRICA CAPS & CLOSURE MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 171 MIDDLE EAST AND AFRICA CAPS & CLOSURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 172 MIDDLE EAST AND AFRICA CAPS & CLOSURE MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 173 MIDDLE EAST AND AFRICA CAPS & CLOSURE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 174 MIDDLE EAST AND AFRICA CAPS & CLOSURE MARKET BY RAW MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 175 UAE CAPS & CLOSURE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 176 UAE CAPS & CLOSURE MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 177 UAE CAPS & CLOSURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 178 UAE CAPS & CLOSURE MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 179 UAE CAPS & CLOSURE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 180 UAE CAPS & CLOSURE MARKET BY RAW MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 181 SAUDI ARABIA CAPS & CLOSURE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 182 SAUDI ARABIA CAPS & CLOSURE MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 183 SAUDI ARABIA CAPS & CLOSURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 184 SAUDI ARABIA CAPS & CLOSURE MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 185 SAUDI ARABIA CAPS & CLOSURE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 186 SAUDI ARABIA CAPS & CLOSURE MARKET BY RAW MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 187 SOUTH AFRICA CAPS & CLOSURE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 188 SOUTH AFRICA CAPS & CLOSURE MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 189 SOUTH AFRICA CAPS & CLOSURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 190 SOUTH AFRICA CAPS & CLOSURE MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 191 SOUTH AFRICA CAPS & CLOSURE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 192 SOUTH AFRICA CAPS & CLOSURE MARKET BY RAW MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 193 REST OF MIDDLE EAST AND AFRICA CAPS & CLOSURE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 194 REST OF MIDDLE EAST AND AFRICA CAPS & CLOSURE MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 195 REST OF MIDDLE EAST AND AFRICA CAPS & CLOSURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 196 REST OF MIDDLE EAST AND AFRICA CAPS & CLOSURE MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 197 REST OF MIDDLE EAST AND AFRICA CAPS & CLOSURE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 198 REST OF MIDDLE EAST AND AFRICA CAPS & CLOSURE MARKET BY RAW MATERIAL (THOUSAND UNITS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL CAPS & CLOSURE MARKET BY TYPE, USD BILLION, 2020-2029

FIGURE 9 GLOBAL CAPS & CLOSURE MARKET BY END USER, USD BILLION, 2020-2029

FIGURE 10 GLOBAL CAPS & CLOSURE MARKET BY RAW MATERIAL, USD BILLION, 2020-2029

FIGURE 11 GLOBAL CAPS & CLOSURE MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL CAPS & CLOSURE MARKET BY TYPE, USD BILLION, 2021

FIGURE 14 GLOBAL CAPS & CLOSURE MARKET BY END USER, USD BILLION, 2021

FIGURE 15 GLOBAL CAPS & CLOSURE MARKET BY RAW MATERIAL, USD BILLION, 2021

FIGURE 16 GLOBAL CAPS & CLOSURE MARKET BY REGION, USD BILLION, 2021

FIGURE 17 NORTH AMERICA CAPS & CLOSURE MARKET SNAPSHOT

FIGURE 18 EUROPE CAPS & CLOSURE MARKET SNAPSHOT

FIGURE 19 SOUTH AMERICA CAPS & CLOSURE MARKET SNAPSHOT

FIGURE 20 ASIA PACIFIC CAPS & CLOSURE MARKET SNAPSHOT

FIGURE 21 MIDDLE EAST ASIA AND AFRICA CAPS & CLOSURE MARKET SNAPSHOT

FIGURE 22 MARKET SHARE ANALYSIS

FIGURE 23 BERRY PLASTICS CORPORATION: COMPANY SNAPSHOT

FIGURE 24 AMCOR LIMITED: COMPANY SNAPSHOT

FIGURE 25 BERICAP GMBH CO. & KG: COMPANY SNAPSHOT

FIGURE 26 REYNOLDS GROUP HOLDINGS: COMPANY SNAPSHOT S

FIGURE 27 GUALA CLOSURES GROUP: COMPANY SNAPSHOT

FIGURE 28 SILGAN HOLDINGS: COMPANY SNAPSHOT

FIGURE 29 APTAR GROUP INC.: COMPANY SNAPSHOT

FIGURE 30 RPC GROUP PLC: COMPANY SNAPSHOT

FIGURE 31 CROWN HOLDINGS: COMPANY SNAPSHOT

FIGURE 32 REXAM PLC: COMPANY SNAPSHOT

FAQ

Some key players operating in the global Caps & Closure market include Berry Plastics Corporation, Amcor Limited, Bericap GmbH Co. & Kg, Reynolds Group Holdings Limited, Guala Closures Group, Aptar Group Inc., Silgan Holdings, RPC Group PLC, Crown Holdings, Rexam PLC.

The worldwide Caps & Closures market is expanding as a result of the rising demand for packaging. The market for Caps & Closures is expanding in part thanks to fast-moving consumer products like cosmetics, toiletries, and medications.

The global Caps & Closure market size was estimated at USD 67.56 billion in 2021 and is expected to reach USD 100.96 billion in 2029.

The global Caps & Closure market is expected to grow at a compound annual growth rate of 5.15% from 2022 to 2029 to reach USD 100.96 billion by 2029.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.