REPORT OUTLOOK

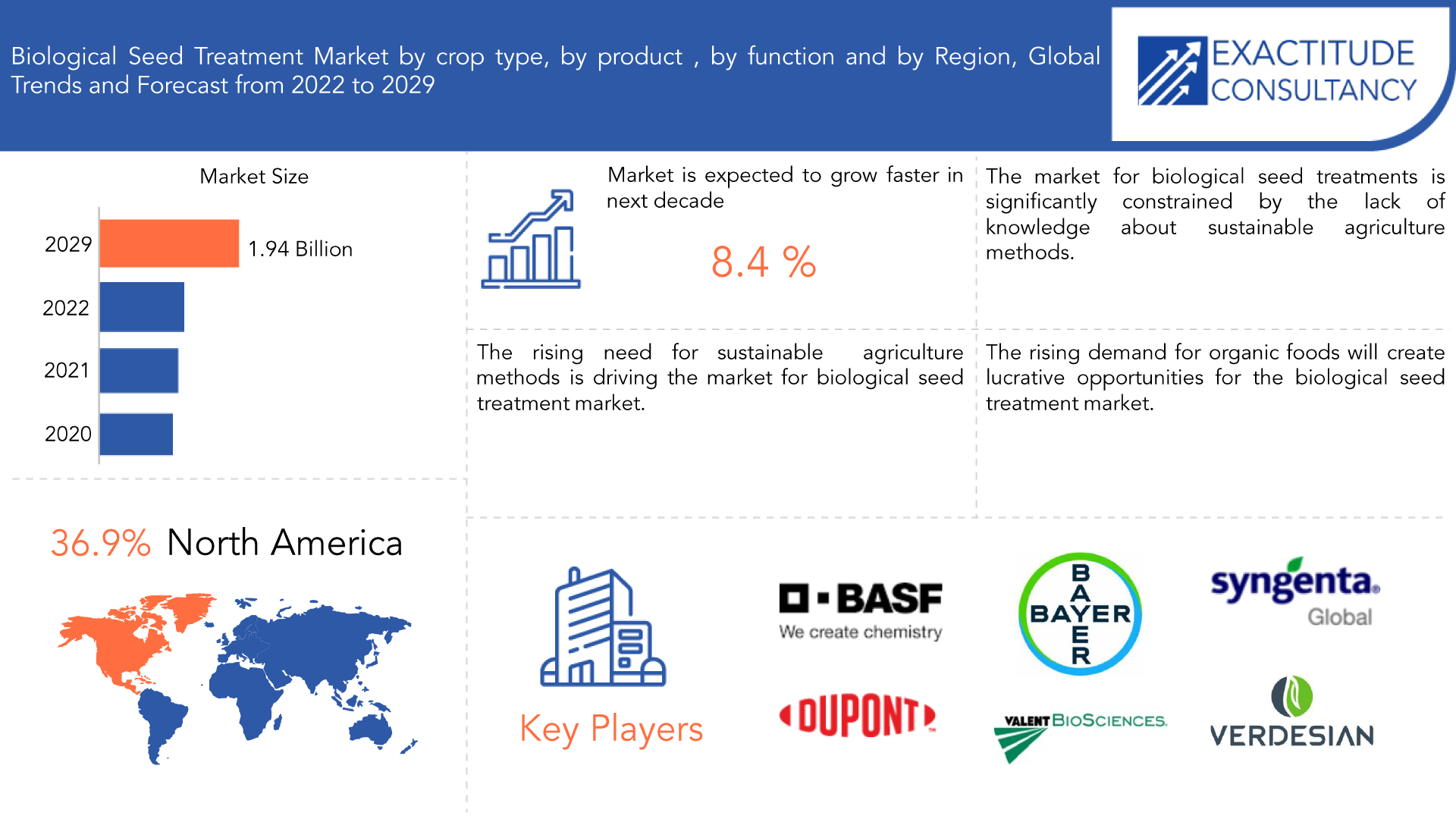

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 1.94 billion by 2029 | 8.4 % | North America |

| By Corn type | By Product | By Function |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Biological Seed Treatment market Overview

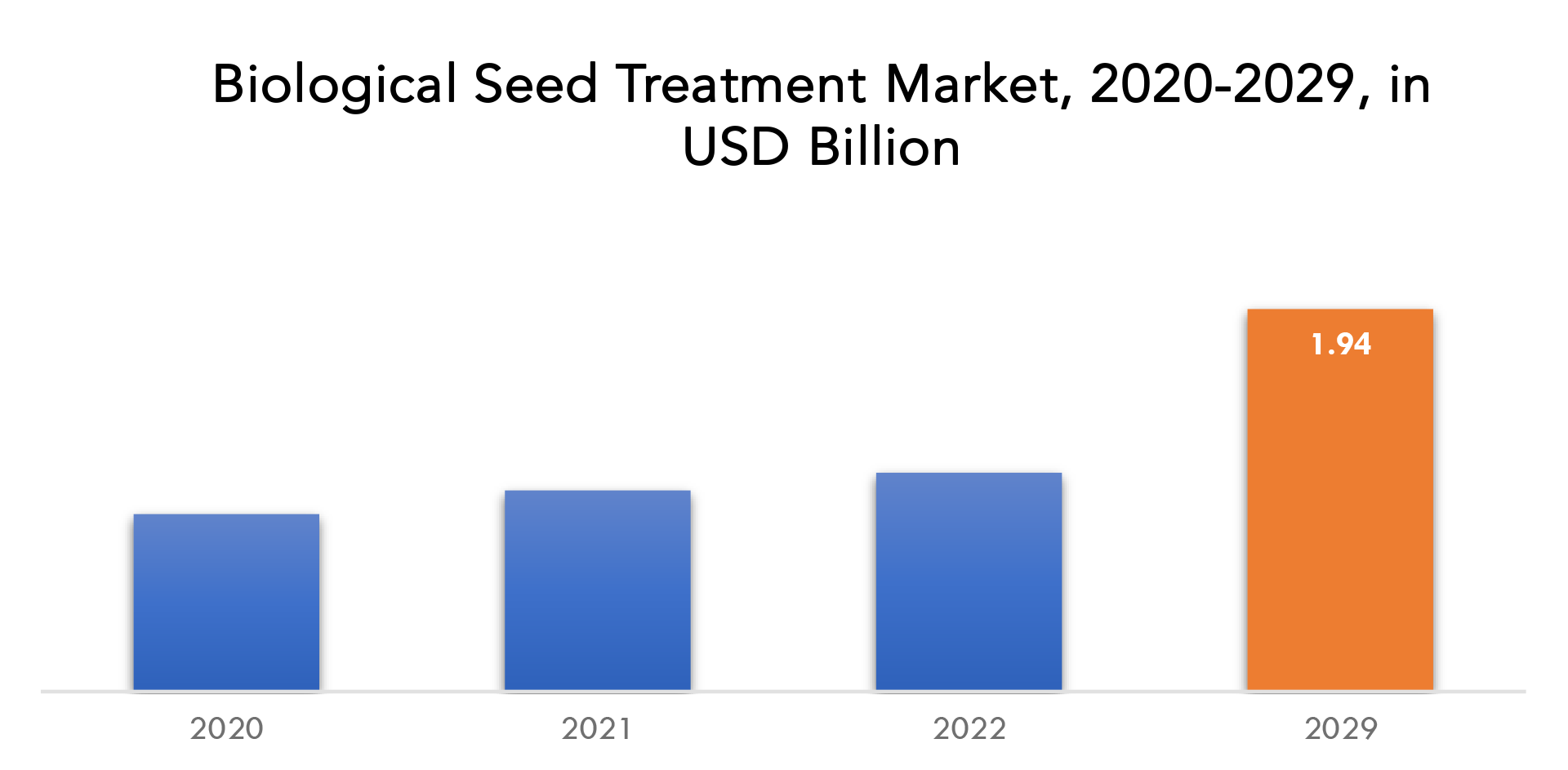

The biological seed treatment market is expected to grow at 8.4 % CAGR from 2022 to 2029. It is expected to reach above USD 1.94 billion by 2029 from USD 1.02 billion in 2021.

The technique of treating seeds with advantageous microorganisms, such as bacteria, fungus, and other microbes, in order to increase the plant’s general health and productivity is known as biological seed treatment. Different techniques, such as seed coating, seed pelleting, or seed inoculation with a microbial solution, might be used for the treatment. The fundamental objective of biological seed treatment is to create a barrier of protection around the seeds that can aid in disease prevention and encourage plant growth. These advantageous bacteria can promote plant vigor, increase production, improve plant health, and decrease dangerous soil-borne infections and pests.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion), (KILOTONS) |

| Segmentation | By crop type, by product, by function |

| By Corn type |

|

| By Product |

|

| By Function |

|

| By Region |

|

The growth of the plant, its resistance to abiotic stress, the development of the root system, and the productivity of the crop are all positively impacted by biological seed treatment. A crop treated with biological seed treatment responds to the therapy by becoming stronger and growing more effectively. The procedure increases agricultural yields while reducing biotic stress and aiding plants in their defense against diseases. The microorganisms that support plant growth enter the roots and shield the crop throughout the entire growing season. A seed treatment promotes nutrient uptake and increases the availability of plant nutrients in the root system. Due to the improved root and shoot growth, the crop’s early growth rate is maximized, increasing both the crop’s nutritional value and production yields. The usage of agrochemicals is decreased via biological seed treatment, which lowers producers’ exposure to chemicals and diminishes their environmental impact. This also restricts the soil’s possible exposure to agrochemicals.

One of the key factors propelling the market for biological seed treatment is the rising need for sustainable agriculture methods. Customers are searching for items that are produced in an environmentally responsible manner as they become more conscious of the effects that agriculture has on the environment. As they utilize less artificial pesticides and fertilizers, biological seed treatments are seen as a sustainable and environmentally friendly alternative to conventional chemical treatments. Furthermore, a lot of governments are encouraging sustainable agriculture methods through laws and policies. Additionally, a large number of food producers, retailers, and other businesses have made sustainability goals and demands of their suppliers. In order to meet the demand for crops that are produced sustainably, farmers are increasingly embracing sustainable methods, such as the use of biological seed treatments.

Biological Seed Treatment market Segment Analysis

The biological seed treatment market is segmented based on crop type, product and function.

Based on crop type, the vegetables crop segment accounted for the highest revenue share. The market is anticipated to increase throughout the projected period as a result of rising consumer interest in leading healthy lifestyles, increasing use of biopesticides for treating vegetable seeds, and rising demand for food products free of chemicals. Biological seed treatment is an effective way to protect vegetable crops from various soil-borne diseases and pests.

Based on the product, biological seed treatment market is divided into microbials, botanical and others. To get rid of the pathogens and enhance seed health, microbial therapy uses bacteria including Rhizobia, Bacillus, Pseudomonas, and Streptomyces as well as fungi like mycorrhizae, Penicillium bilaii, and Trichoderma harzianum. These are quite successful at shielding crops from pests, insects, and plant diseases as well as dehydration.

The biological seed treatment market is segmented by function into seed enhancement and seed protection. With a market share of roughly 60.3%, seed protection accounted for the majority of biological seed treatments. This is caused by the rising incidence of pests and diseases that are spread through seeds, which can affect crop yield and quality. To protect seeds from numerous infections and pests, biological agents such as fungus and bacteria are used in the seed protection process.

Biological Seed Treatment market Players

The biological seed treatment market key players include BASF SE, Bayer AG, Syngenta, DuPont, Valent BioSciences LLC, Verdesian Life Sciences, Plant Health Care plc., Precision Laboratories, LLC, Koppert Biological Systems, Italpollina S.P.A, Croda International Plc.

Recent developments

- January 30, 2023: Valent BioSciences LLC, a global leader in the discovery, development, and commercialization of highly effective, low-risk, environmentally compatible technologies and products for agriculture, public health, and forest health, announced its acquisition of FBSciences Holdings, Inc., a leader in the discovery and commercialization of naturally derived plant, soil, and climate health solutions.

- January 13, 2023: Verdesian Life Sciences announced a new biological growth enhancement liquid for all crops. Accolade, which contains Azospirillum brasilense – a well-studied, free-living, nitrogen-fixing bacteria – can increase root development and secondary lateral root systems, leading to increased nutrient uptake and higher yields.

Who Should Buy? Or Key stakeholders

- Manufacturers of Biological Seed Treatment

- Traders, distributors, and raw material suppliers

- Government and regional agencies and research organizations

- Seed producers

- Distributors and Retailers

- Raw Materials Manufacturers

- Research Organizations

- Investors

- Regulatory Authorities

- Others

Biological Seed Treatment market Regional Analysis

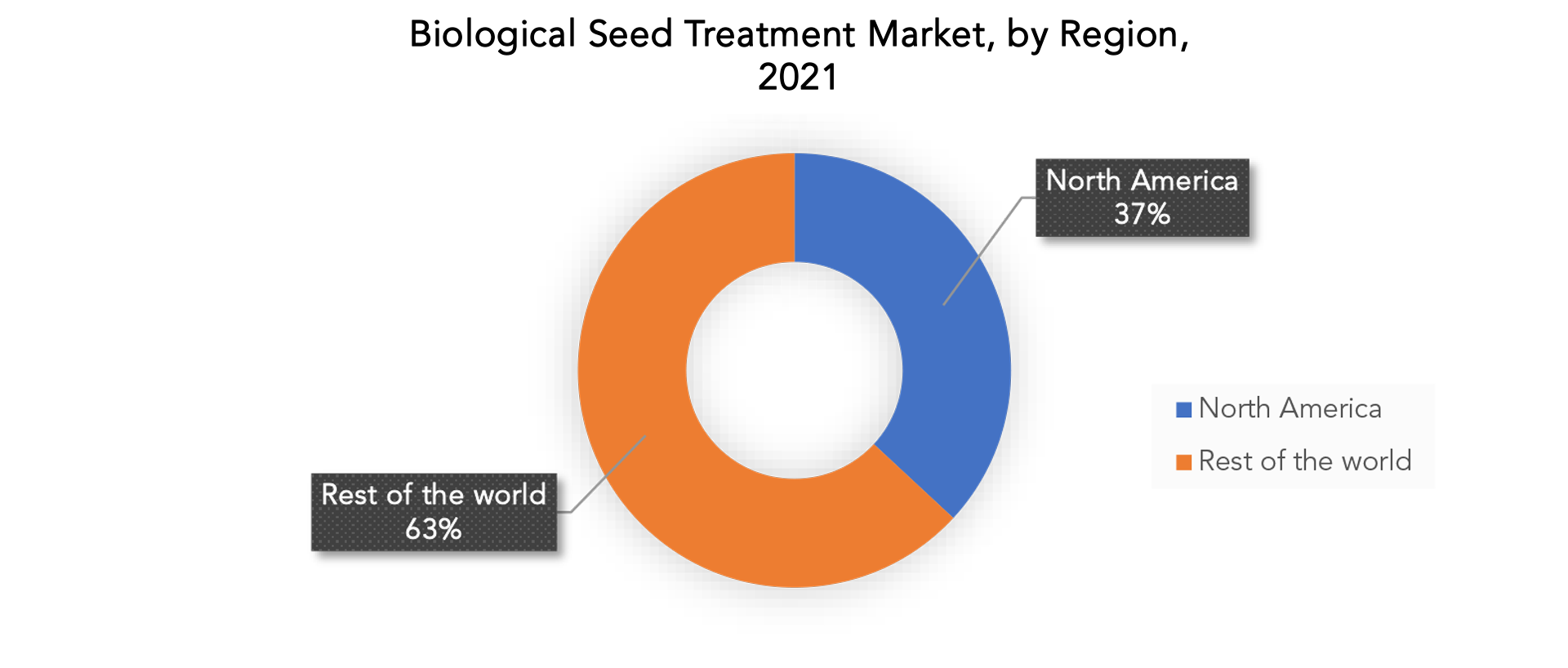

The biological seed treatment market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

The use of naturally occurring bacteria, fungus, or other biological agents to enhance the health and yield of crops makes up the fast-expanding market for biological seed treatment in North America. The market is driven by a variety of factors, such as the rising demand for environmentally friendly and sustainable agricultural methods, the requirement to use fewer chemical pesticides and fertilizers, and the growing knowledge among farmers and producers of the advantages of biological seed treatments. The need for reducing the use of chemical pesticides and fertilizers, as well as growing awareness among farmers and growers of the advantages of biological seed treatments, are some of the factors that are driving the market for biological seed treatments in North America.

The biggest market in Europe for biological seed treatment is Germany. The nation has a well-established agriculture sector and has been emphasizing sustainable farming methods for some time, which has caused the market for biological seed treatments to rise significantly. By 2030, the European Union wants 25% of its agricultural land to be used for organic farming. The need for biological seed treatment, which is regarded as a sustainable and environmentally benign alternative to chemical treatments, has increased as a result.

Key Market Segments: Biological Seed Treatment market

Biological Seed Treatment Market By Crop Type, 2020-2029, (Usd Billion), (Kilotons)

- Corn

- Wheat

- Soybean

- Cotton

- Sunflower

- Vegetable Crops

Biological Seed Treatment Market By Product, 2020-2029, (Usd Billion), (Kilotons)

- Microbials

- Botanical And Others

Biological Seed Treatment Market By Function, 2020-2029, (Usd Billion), (Kilotons)

- Seed Enhancement

- Seed Protection

Biological Seed Treatment Market By Region, 2020-2029, (Usd Billion), (Kilotons)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Questions Answered

- What is the expected growth rate of the biological seed treatment market over the next 7 years?

- Who are the major players in the biological seed treatment market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the biological seed treatment market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the biological seed treatment market?

- What is the current and forecasted size and growth rate of the global biological seed treatment market?

- What are the key drivers of growth in the biological seed treatment market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the biological seed treatment market?

- What are the technological advancements and innovations in the biological seed treatment market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the biological seed treatment market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the biological seed treatment market?

- What are the product offerings and specifications of leading players in the market?

- What is the pricing trend of biological seed treatment in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL BIOLOGICAL SEED TREATMENT MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON BIOLOGICAL SEED TREATMENT MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL BIOLOGICAL SEED TREATMENT MARKET OUTLOOK

- GLOBAL BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE, 2020-2029,(USD BILLION, KILOTONS)

- CORN

- WHEAT

- SOYBEAN

- COTTON

- SUNFLOWER

- VEGETABLE CROPS

- GLOBAL BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT, 2020-2029, (USD BILLION, KILOTONS)

- MICROBIALS

- BOTANICAL AND OTHERS

- GLOBAL BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION, 2020-2029, (USD BILLION, KILOTONS)

- SEED ENHANCEMENT

- SEED PROTECTION

- GLOBAL BIOLOGICAL SEED TREATMENT MARKET BY REGION, 2020-2029, (USD BILLION, KILOTONS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- BASF SE

- BAYER AG

- SYNGENTA

- DUPONT

- VALENT BIOSCIENCES LLC

- VERDESIAN LIFE SCIENCES

- PLANT HEALTH CARE PLC.

- PRECISION LABORATORIES, LLC

- KOPPERT BIOLOGICAL SYSTEMS

- ITALPOLLINA S.P.A

- CRODA INTERNATIONAL PLC. *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (USD BILLION), 2020-2029

TABLE 2 GLOBAL BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (KILOTONS), 2020-2029

TABLE 3 GLOBAL BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 4 GLOBAL BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 5 GLOBAL BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (USD BILLION), 2020-2029

TABLE 6 GLOBAL BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (KILOTONS), 2020-2029

TABLE 7 GLOBAL BIOLOGICAL SEED TREATMENT MARKET BY REGION (USD BILLION), 2020-2029

TABLE 8 GLOBAL BIOLOGICAL SEED TREATMENT MARKET BY REGION (KILOTONS), 2020-2029

TABLE 9 NORTH AMERICA BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (USD BILLION), 2020-2029

TABLE 10 NORTH AMERICA BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (KILOTONS), 2020-2029

TABLE 11 NORTH AMERICA BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 12 NORTH AMERICA BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 13 NORTH AMERICA BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (USD BILLION), 2020-2029

TABLE 14 NORTH AMERICA BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (KILOTONS), 2020-2029

TABLE 15 NORTH AMERICA BIOLOGICAL SEED TREATMENT MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 16 NORTH AMERICA BIOLOGICAL SEED TREATMENT MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 17 US BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (USD BILLION), 2020-2029

TABLE 18 US BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (KILOTONS), 2020-2029

TABLE 19 US BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 20 US BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 21 US BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (USD BILLION), 2020-2029

TABLE 22 US BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (KILOTONS), 2020-2029

TABLE 23 CANADA BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (BILLION), 2020-2029

TABLE 24 CANADA BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (KILOTONS), 2020-2029

TABLE 25 CANADA BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 26 CANADA BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 27 CANADA BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (USD BILLION), 2020-2029

TABLE 28 CANADA BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (KILOTONS), 2020-2029

TABLE 29 MEXICO BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (USD BILLION), 2020-2029

TABLE 30 MEXICO BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (KILOTONS), 2020-2029

TABLE 31 MEXICO BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 32 MEXICO BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 33 MEXICO BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (USD BILLION), 2020-2029

TABLE 34 MEXICO BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (KILOTONS), 2020-2029

TABLE 35 SOUTH AMERICA BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (USD BILLION), 2020-2029

TABLE 36 SOUTH AMERICA BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (KILOTONS), 2020-2029

TABLE 37 SOUTH AMERICA BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 38 SOUTH AMERICA BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 39 SOUTH AMERICA BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (USD BILLION), 2020-2029

TABLE 40 SOUTH AMERICA BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (KILOTONS), 2020-2029

TABLE 41 SOUTH AMERICA BIOLOGICAL SEED TREATMENT MARKET BY COUNTR (USD BILLION), 2020-2029

TABLE 42 SOUTH AMERICA BIOLOGICAL SEED TREATMENT MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 43 BRAZIL BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (USD BILLION), 2020-2029

TABLE 44 BRAZIL BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (KILOTONS), 2020-2029

TABLE 45 BRAZIL BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 46 BRAZIL BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 47 BRAZIL BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (USD BILLION), 2020-2029

TABLE 48 BRAZIL BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (KILOTONS), 2020-2029

TABLE 49 ARGENTINA BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (USD BILLION), 2020-2029

TABLE 50 ARGENTINA BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (KILOTONS), 2020-2029

TABLE 51 ARGENTINA BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 52 ARGENTINA BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 53 ARGENTINA BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (USD BILLION), 2020-2029

TABLE 54 ARGENTINA BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (KILOTONS), 2020-2029

TABLE 55 COLOMBIA BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (USD BILLION), 2020-2029

TABLE 56 COLOMBIA BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (KILOTONS), 2020-2029

TABLE 57 COLOMBIA BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 58 COLOMBIA BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 59 COLOMBIA BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (USD BILLION), 2020-2029

TABLE 60 COLOMBIA BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (KILOTONS), 2020-2029

TABLE 61 REST OF SOUTH AMERICA BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (USD BILLION), 2020-2029

TABLE 62 REST OF SOUTH AMERICA BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (KILOTONS), 2020-2029

TABLE 63 REST OF SOUTH AMERICA BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 64 REST OF SOUTH AMERICA BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 65 REST OF SOUTH AMERICA BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (USD BILLION), 2020-2029

TABLE 66 REST OF SOUTH AMERICA BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (KILOTONS), 2020-2029

TABLE 67 ASIA-PACIFIC BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (USD BILLION), 2020-2029

TABLE 68 ASIA-PACIFIC BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (KILOTONS), 2020-2029

TABLE 69 ASIA-PACIFIC BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 70 ASIA-PACIFIC BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 71 ASIA-PACIFIC BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (USD BILLION), 2020-2029

TABLE 72 ASIA-PACIFIC BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (KILOTONS), 2020-2029

TABLE 73 ASIA-PACIFIC BIOLOGICAL SEED TREATMENT MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 74 ASIA-PACIFIC BIOLOGICAL SEED TREATMENT MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 75 INDIA BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (USD BILLION), 2020-2029

TABLE 76 INDIA BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (KILOTONS), 2020-2029

TABLE 77 INDIA BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 78 INDIA BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 79 INDIA BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (USD BILLION), 2020-2029

TABLE 80 INDIA BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (KILOTONS), 2020-2029

TABLE 81 CHINA BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (USD BILLION), 2020-2029

TABLE 82 CHINA BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (KILOTONS), 2020-2029

TABLE 83 CHINA BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 84 CHINA BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 85 CHINA BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (USD BILLION), 2020-2029

TABLE 86 CHINA BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (KILOTONS), 2020-2029

TABLE 87 JAPAN BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (USD BILLION), 2020-2029

TABLE 88 JAPAN BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (KILOTONS), 2020-2029

TABLE 89 JAPAN BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 90 JAPAN BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 91 JAPAN BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (USD BILLION), 2020-2029

TABLE 92 JAPAN BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (KILOTONS), 2020-2029

TABLE 93 SOUTH KOREA BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (USD BILLION), 2020-2029

TABLE 94 SOUTH KOREA BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (KILOTONS), 2020-2029

TABLE 95 SOUTH KOREA BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 96 SOUTH KOREA BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 97 SOUTH KOREA BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (USD BILLION), 2020-2029

TABLE 98 SOUTH KOREA BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (KILOTONS), 2020-2029

TABLE 99 AUSTRALIA BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (USD BILLION), 2020-2029

TABLE 100 AUSTRALIA BIOLOGICAL SEED TREATMENTBY CORN TYPE (KILOTONS), 2020-2029

TABLE 101 AUSTRALIA BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 102 AUSTRALIA BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 103 AUSTRALIA BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (USD BILLION), 2020-2029

TABLE 104 AUSTRALIA BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (KILOTONS), 2020-2029

TABLE 105 SOUTH EAST ASIA BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (USD BILLION), 2020-2029

TABLE 106 SOUTH EAST ASIA BIOLOGICAL SEED TREATMENTBY CORN TYPE (KILOTONS), 2020-2029

TABLE 107 SOUTH EAST ASIA BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 108 SOUTH EAST ASIA BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 109 SOUTH EAST ASIA BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (USD BILLION), 2020-2029

TABLE 110 SOUTH EAST ASIA BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (KILOTONS), 2020-2029

TABLE 111 REST OF ASIA PACIFIC BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (USD BILLION), 2020-2029

TABLE 112 REST OF ASIA PACIFIC BIOLOGICAL SEED TREATMENTBY CORN TYPE (KILOTONS), 2020-2029

TABLE 113 REST OF ASIA PACIFIC BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 114 REST OF ASIA PACIFIC BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 115 REST OF ASIA PACIFIC BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (USD BILLION), 2020-2029

TABLE 116 REST OF ASIA PACIFIC BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (KILOTONS), 2020-2029

TABLE 117 EUROPE BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (USD BILLION), 2020-2029

TABLE 118 EUROPE BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (KILOTONS), 2020-2029

TABLE 119 EUROPE BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 120 EUROPE BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 121 EUROPE BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (USD BILLION), 2020-2029

TABLE 122 EUROPE BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (KILOTONS), 2020-2029

TABLE 123 EUROPE BIOLOGICAL SEED TREATMENT MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 124 EUROPE BIOLOGICAL SEED TREATMENT MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 125 GERMANY BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (USD BILLION), 2020-2029

TABLE 126 GERMANY BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (KILOTONS), 2020-2029

TABLE 127 GERMANY BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 128 GERMANY BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 129 GERMANY BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (USD BILLION), 2020-2029

TABLE 130 GERMANY BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (KILOTONS), 2020-2029

TABLE 131 UK BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (USD BILLION), 2020-2029

TABLE 132 UK BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (KILOTONS), 2020-2029

TABLE 133 UK BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 134 UK BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 135 UK BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (USD BILLION), 2020-2029

TABLE 136 UK BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (KILOTONS), 2020-2029

TABLE 137 FRANCE BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (USD BILLION), 2020-2029

TABLE 138 FRANCE BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (KILOTONS), 2020-2029

TABLE 139 FRANCE BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 140 FRANCE BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 141 FRANCE BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (USD BILLION), 2020-2029

TABLE 142 FRANCE BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (KILOTONS), 2020-2029

TABLE 143 ITALY BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (USD BILLION), 2020-2029

TABLE 144 ITALY BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (KILOTONS), 2020-2029

TABLE 145 ITALY BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 146 ITALY BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 147 ITALY BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (USD BILLION), 2020-2029

TABLE 148 ITALY BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (KILOTONS), 2020-2029

TABLE 149 SPAIN BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (USD BILLION), 2020-2029

TABLE 150 SPAIN BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (KILOTONS), 2020-2029

TABLE 151 SPAIN BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 152 SPAIN BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 153 SPAIN BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (USD BILLION), 2020-2029

TABLE 154 SPAIN BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (KILOTONS), 2020-2029

TABLE 155 RUSSIA BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (USD BILLION), 2020-2029

TABLE 156 RUSSIA BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (KILOTONS), 2020-2029

TABLE 157 RUSSIA BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 158 RUSSIA BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 159 RUSSIA BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (USD BILLION), 2020-2029

TABLE 160 RUSSIA BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (KILOTONS), 2020-2029

TABLE 161 REST OF EUROPE BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (USD BILLION), 2020-2029

TABLE 162 REST OF EUROPE BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (KILOTONS), 2020-2029

TABLE 163 REST OF EUROPE BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 164 REST OF EUROPE BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 165 REST OF EUROPE BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (USD BILLION), 2020-2029

TABLE 166 REST OF EUROPE BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (KILOTONS), 2020-2029

TABLE 167 MIDDLE EAST AND AFRICA BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (USD BILLION), 2020-2029

TABLE 168 MIDDLE EAST AND AFRICA BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (KILOTONS), 2020-2029

TABLE 169 MIDDLE EAST AND AFRICA BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 170 MIDDLE EAST AND AFRICA BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 171 MIDDLE EAST AND AFRICA BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (USD BILLION), 2020-2029

TABLE 172 MIDDLE EAST AND AFRICA BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (KILOTONS), 2020-2029

TABLE 173 MIDDLE EAST AND AFRICA BIOLOGICAL SEED TREATMENT MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 174 MIDDLE EAST AND AFRICA BIOLOGICAL SEED TREATMENT MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 175 UAE BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (USD BILLION), 2020-2029

TABLE 176 UAE BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (KILOTONS), 2020-2029

TABLE 177 UAE BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 178 UAE BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 179 UAE BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (USD BILLION), 2020-2029

TABLE 180 UAE BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (KILOTONS), 2020-2029

TABLE 181 SAUDI ARABIA BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (USD BILLION), 2020-2029

TABLE 182 SAUDI ARABIA BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (KILOTONS), 2020-2029

TABLE 183 SAUDI ARABIA BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 184 SAUDI ARABIA BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 185 SAUDI ARABIA BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (USD BILLION), 2020-2029

TABLE 186 SAUDI ARABIA BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (KILOTONS), 2020-2029

TABLE 187 SOUTH AFRICA BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (USD BILLION), 2020-2029

TABLE 188 SOUTH AFRICA BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (KILOTONS), 2020-2029

TABLE 189 SOUTH AFRICA BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 190 SOUTH AFRICA BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 191 SOUTH AFRICA BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (USD BILLION), 2020-2029

TABLE 192 SOUTH AFRICA BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (KILOTONS), 2020-2029

TABLE 193 REST OF MIDDLE EAST AND AFRICA BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (USD BILLION), 2020-2029

TABLE 194 REST OF MIDDLE EAST AND AFRICA BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE (KILOTONS), 2020-2029

TABLE 195 REST OF MIDDLE EAST AND AFRICA BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 196 REST OF MIDDLE EAST AND AFRICA BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 197 REST OF MIDDLE EAST AND AFRICA BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (USD BILLION), 2020-2029

TABLE 198 REST OF MIDDLE EAST AND AFRICA BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION (KILOTONS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE, USD BILLION, 2020-2029

FIGURE 9 GLOBAL BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT, USD BILLION, 2020-2029

FIGURE 10 GLOBAL BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION, USD BILLION, 2020-2029

FIGURE 11 GLOBAL BIOLOGICAL SEED TREATMENT MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL BIOLOGICAL SEED TREATMENT MARKET BY REGION, USD BILLION, 2021

FIGURE 14 GLOBAL BIOLOGICAL SEED TREATMENT MARKET BY PRODUCT, USD BILLION, 2021

FIGURE 15 GLOBAL BIOLOGICAL SEED TREATMENT MARKET BY CORN TYPE, USD BILLION, 2021

FIGURE 16 GLOBAL BIOLOGICAL SEED TREATMENT MARKET BY FUNCTION, USD BILLION, 2021

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 BASF SE: COMPANY SNAPSHOT

FIGURE 19 BAYER AG: COMPANY SNAPSHOT

FIGURE 20 SYNGENTA: COMPANY SNAPSHOT

FIGURE 21 DUPONT: COMPANY SNAPSHOT

FIGURE 22 VALENT BIOSCIENCES LLC: COMPANY SNAPSHOT

FIGURE 23 VERDESIAN LIFE SCIENCES: COMPANY SNAPSHOT

FIGURE 24 PLANT HEALTH CARE PLC: COMPANY SNAPSHOT

FIGURE 25 PRECISION LABORATORIES: COMPANY SNAPSHOT

FIGURE 26 KOPPERT BIOLOGICAL SYSTEMS : COMPANY SNAPSHOT

FIGURE 27 ITALPOLLINA S.P.A: COMPANY SNAPSHOT

FIGURE 28 CRODA INTERNATIONAL PLC.: COMPANY SNAPSHOT

FAQ

The biological seed treatment market size is expected to grow at 8.4 % CAGR from 2022 to 2029. It is expected to reach above USD 1.94 billion by 2029 from USD 1.02 billion in 2021.

North America held more than 36.9% of the biological seed treatment market revenue share in 2021 and will witness expansion in the forecast period.

One of the key factors propelling the market for biological seed treatment is the rising need for sustainable agriculture methods. Customers are searching for items that are produced in an environmentally responsible manner as they become more conscious of the effects that agriculture has on the environment.

The biological seed treatment market is segmented by function into seed enhancement and seed protection. With a market share of roughly 60.3%, seed protection accounted for the majority of biological seed treatments. This is caused by the rising incidence of pests and diseases that are spread through seeds, which can affect crop yield and quality.

The use of naturally occurring bacteria, fungus, or other biological agents to enhance the health and yield of crops makes up the fast-expanding market for biological seed treatment in North America.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.