REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 9.74 billion by 2029 | 18.5% | USD 9.74 billion by 2029 |

| By Application | By Market | By Process |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Molecular Breeding Market Overview

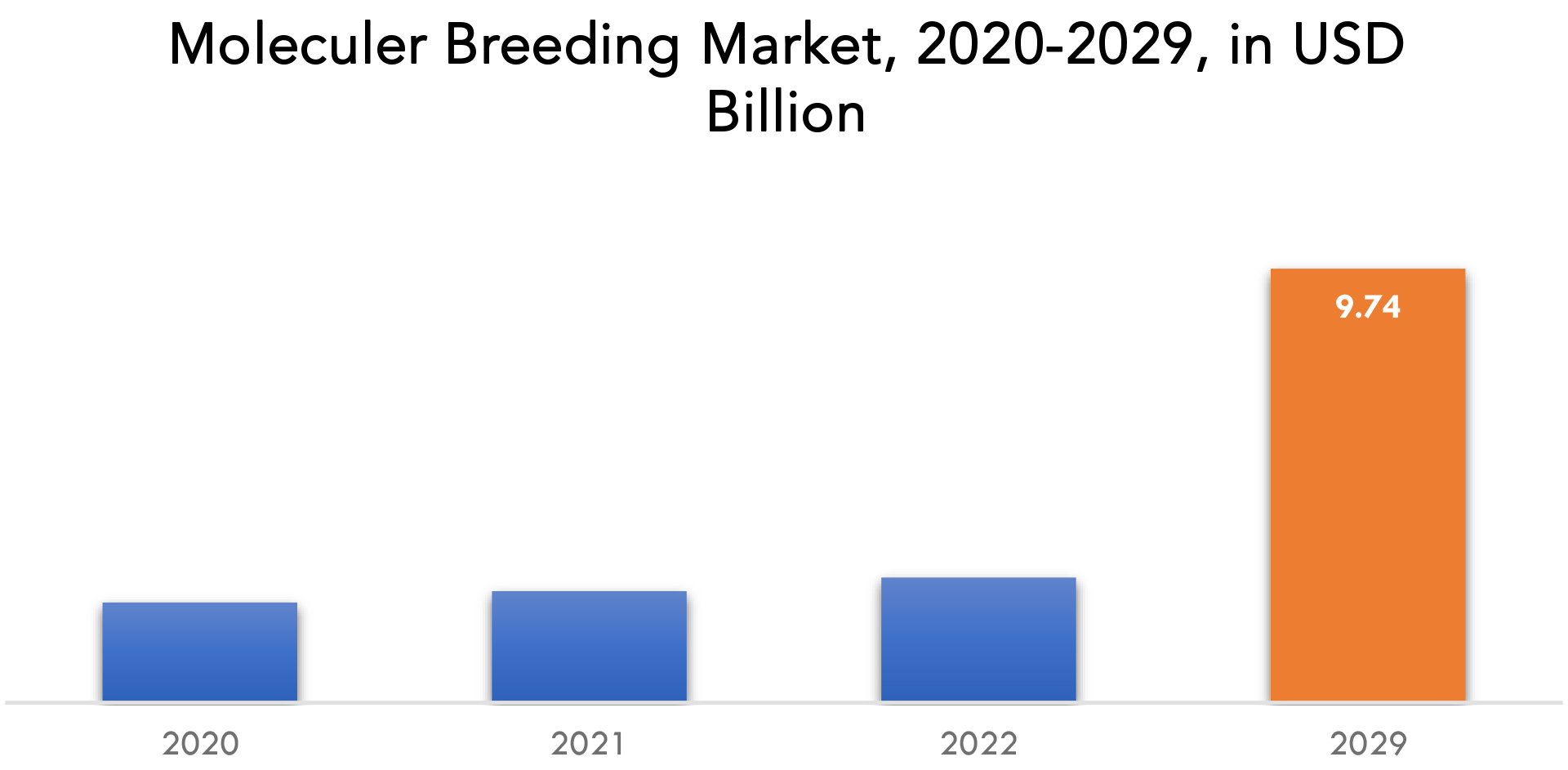

Global molecular breeding market is estimated to be USD 2.25 billion in 2020 and is projected to reach USD 9.74 billion by 2029, at a CAGR of 18.5% from 2022 to 2029.

Molecular breeding is the process of finding genetic markers linked to desired traits by employing tools like DNA sequencing and genotyping. By conventional breeding techniques or genetic engineering, these markers are then used to select plants that have the desired attribute. To use molecular biology technologies to examine and modify the genetic makeup of plants is a process known as molecular breeding, which is employed in plant breeding. Compared to conventional breeding techniques, this technology enables breeders to more rapidly and precisely choose plants with desired qualities, such as increased yields, disease resistance, and tolerance to environmental challenges.In comparison to conventional breeding techniques, molecular breeding has a number of benefits, including the capacity to select for traits that are challenging to detect, such as disease resistance genes that do not express until the plant is exposed to the pathogen. Also, it enables breeders to choose more carefully, minimizing the number of plants that must be cultivated and evaluated.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion) |

| Segmentation | By application, marker, process and region. |

| By Application

|

|

| By Market

|

|

| By Process

|

|

Due to the rising global need for food and the need to create crops that are more resilient to environmental pressures like pests and drought, the molecular breeding sector is expanding. Large-scale genetic data analysis and manipulation have also become simpler and more affordable because to developments in genomics and bioinformatics.

The Covid-19 pandemic has slowed down research and development efforts and disrupted supply chains, but it has also raised awareness of the importance of sustainable agriculture and food security, which has increased demand for molecular breeding technologies.

The pandemic’s disruption of supply chains, which impacted the availability of molecular biology instruments and reagents like DNA sequencing machines, gene editing tools, and PCR machines, has had a significant influence on the molecular breeding business. Due to this, research and development projects have been delayed, and there is a shortage of key essential inputs required for molecular breeding.

Molecular Breeding Market Segment Analysis

Molecular Breeding Market By Application is divided into Plant and Livestock.

Plant molecular breeding is a method for enhancing the genetic characteristics of plants for agricultural application by using molecular biology techniques. It entails the discovery, isolation, and manipulation of the genes in charge of critical characteristics like productivity, disease resistance, and stress tolerance.

This procedure usually begins with the discovery of desirable qualities using conventional breeding techniques, which is followed by the use of genetic markers to pinpoint the precise genes in charge of those features. Once found, these genes can be selectively cultivated into plants using advanced breeding methods such as genetic engineering.

Molecular Breeding Market By Marker is divided into Simple Sequence Repeat, Single Nucleotide Polymorphism, Expressed Sequence Tag and Others.

Microsatellites, sometimes referred to as Simple Sequence Repeat (SSR) markers, are a class of molecular markers widely employed in plant and animal breeding programme. These are small DNA sequences with repeating motifs that are dispersed across the genome and are typically 2–6 base pairs in length.

SSR markers are incredibly polymorphic, which means that they differ greatly between people or populations. They are the perfect candidates for use as molecular markers in breeding programme because of their high level of diversity, which enables researchers to detect desirable features and monitor the inheritance of particular alleles.

SNPs are a form of molecular marker that are frequently employed in plant and animal breeding programmes. The most prevalent form of genetic variation is single nucleotide variants, which occur at specific locations in the DNA sequence and are present in the majority of organisms, including humans, plants, and animals.

Molecular Breeding Market By Process is divided into Marker-assisted selection, Marker-assisted backcrossing, and QTL mapping.

In molecular breeding, the method known as marker-assisted selection (MAS) is used to discover desired features and choose individuals or groups that have those traits. Molecular markers, such as SSRs or SNPs, are used in MAS to pinpoint certain genes or genomic areas linked to the desired attributes. Identification of the desired characteristic, such as disease resistance, yield, or stress tolerance, is the first step in the MAS process. Researchers utilized molecular markers to pinpoint the precise genes or genomic regions linked to the characteristic after it has been identified.

In molecular breeding, the process of finding genomic areas linked to quantitative qualities like yield, disease resistance, or stress tolerance is known as quantitative trait loci (QTL) mapping.

Molecular Breeding Market Players

The Molecular Breeding market key players include Eurofins, Thermo Fisher Scientific, Illumina Inc., SGS, LGC Group, Danbred, Intertek, Lemnatec, Charles River, Slipstream Automation, and Fruitbreedomics.

For corporate expansion, these key leaders are implementing strategic formulations such as new product development and commercialization, commercial expansion, and distribution agreements. Moreover, these participants are substantially spending on product development, which is fueling revenue generation.

Molecular Breeding Market Recent Developments

February 2023, Eurofins Viracor LLC, part of the Eurofins network of companies, and a leader in testing for infectious disease, immunology, and allergy, announces the launch of a ground-breaking test that can assess the expansion and persistence of Chimeric Antigen Receptor T-Cell (CAR-T) therapy in patients with pre-B cell acute lymphoblastic leukemia and B cell lymphomas.

Sept. 2022, Illumina, Inc. announced the launch of the NovaSeq™ X Series (NovaSeq X and NovaSeq X Plus), new production-scale sequencers that will push the limits of what is possible with genomic medicine, enabling faster, more powerful, and more sustainable sequencing.

Who Should Buy? Or Key stakeholders

- Science and Technology

- Laborateries

- Agricultural industry

- Scientific institutes

- Government organization

- Research institutes

- Investors

- Research firms

Molecular Breeding Market Regional Analysis

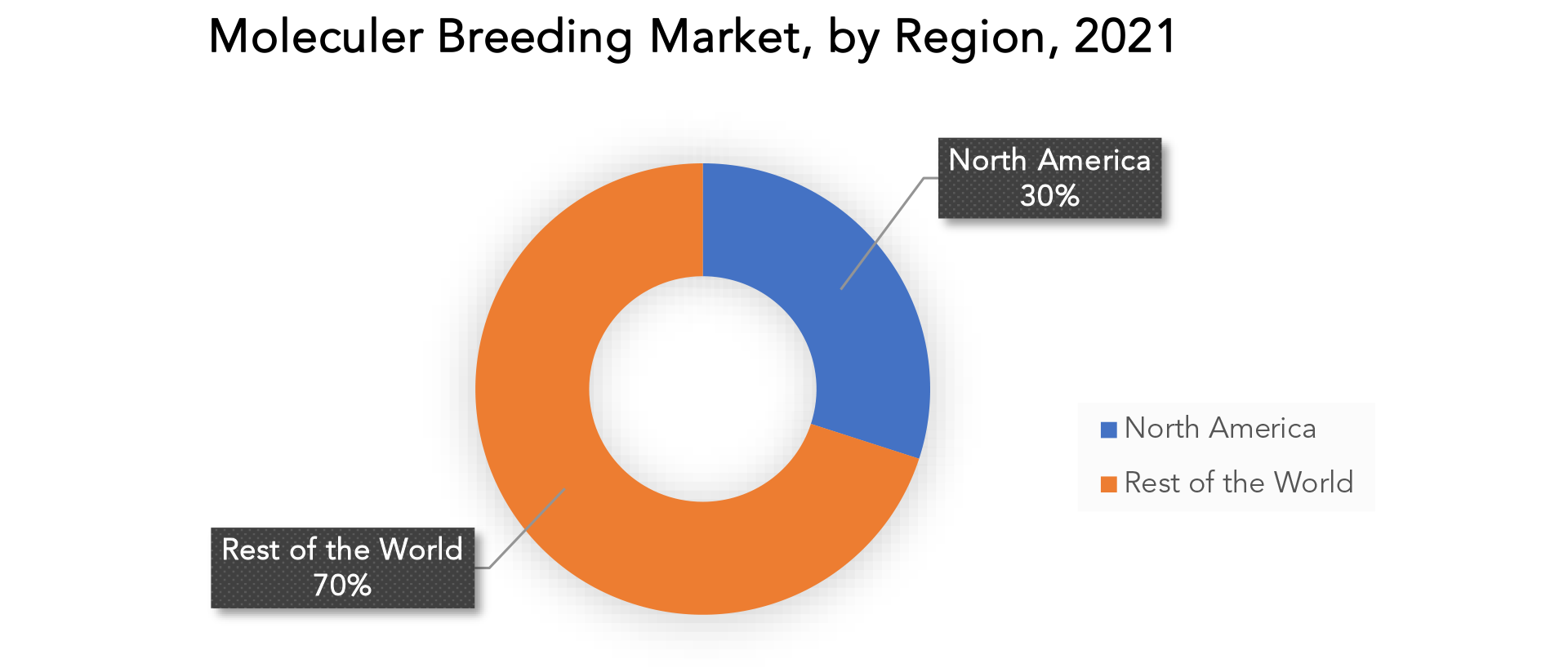

The molecular breeding market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN, and Rest of APAC

- Europe: includes the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe

- South America: includes Brazil, Argentina, and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and the Rest of MEA

North American molecular breeding market is expected to be the largest and fastest growing market during the forecast period. The need to develop crops that are more resistant to changing environmental circumstances and the rising demand for food supply will drive the growth of the molecular breeding industry in North America over the upcoming years.

The need to increase crop yields to meet the rising food demand, the desire to lessen the impact of agriculture on the environment, and the requirement to create crops that are more resistant to pests, diseases, and environmental stresses are some of the factors that are driving the demand for molecular breeding technology in North America. The molecular breeding business in North America is expanding as a result of the growing accessibility of genomics and bioinformatics technologies, which have made it simpler and more affordable to study and alter vast amounts of genetic data.

Key market segments: Molecular breeding market

Molecular Breeding Market by Application 2020-2029, (USD Billion)

- Plant

- Livestock

Molecular Breeding Market by Marker, 2020-2029, (USD Billion)

- Simple Sequence Repeat

- Single Nucleotide Polymorphism

- Expressed Sequence Tag

- Others

Molecular Breeding Market by Process, 2020-2029, (USD Billion)

- Marker-Assisted Selection

- Marker-Assisted Backcrossing

- QTL Mapping

Molecular Breeding Market by Region, 2020-2029, (USD Billion)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Key Question Answered

- What is the expected growth rate of the molecular breeding market over the next 7 years?

- Who are the major players in the molecular breeding market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, And Africa?

- How is the economic environment affecting the molecular breeding market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the molecular breeding market?

- What is the current and forecasted size and growth rate of the global molecular breeding market?

- What are the key drivers of growth in the molecular breeding market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the molecular breeding market?

- What are the technological advancements and innovations in the molecular breeding market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the molecular breeding market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the molecular breeding market?

- What are the product offerings and specifications of leading players in the market?

- What is the pricing trend of molecular breeding in the market and what is the impact of raw material prices on the price trend?

Exactitude Consultancy Services Key Objectives

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

- Others

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL MOLECULAR BREEDING MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON MOLECULAR BREEDING MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL MOLECULAR BREEDING MARKET OUTLOOK

- GLOBAL MOLECULAR BREEDING MARKET BY APPLICATION, 2020-2029, (USD BILLION)

- PLANT

- LIVESTOCK

- GLOBAL MOLECULAR BREEDING MARKET BY MARKET, 2020-2029, (USD BILLION)

- SIMPLE SEQUENCE REPEAT

- SINGLE NUCLEOTIDE POLYMORPHISM

- EXPRESSED SEQUENCE TAG

- OTHERS

- GLOBAL MOLECULAR BREEDING MARKET BY PROCESS, 2020-2029, (USD BILLION)

- MARKER-ASSISTED SELECTION

- MARKER-ASSISTED BACKCROSSING

- QTL MAPPING

- GLOBAL MOLECULAR BREEDING MARKET BY REGION, 2020-2029, (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- EUROFINS

- THERMO FISHER SCIENTIFIC

- ILLUMINA INC.

- SGS

- LGC GROUP

- DANBRED

- INTERTEK

- LEMNATEC

- CHARLES RIVER

- SLIPSTREAM AUTOMATION

- FRUITBREEDOMICS *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL MOLECULAR BREEDING MARKET BY MARKER (USD BILLION) 2020-2029

TABLE 2 GLOBAL MOLECULAR BREEDING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 3 GLOBAL MOLECULAR BREEDING MARKET BY PROCESS (USD BILLION) 2020-2029

TABLE 4 GLOBAL MOLECULAR BREEDING MARKET BY REGION (USD BILLION) 2020-2029

TABLE 5 NORTH AMERICA MOLECULAR BREEDING MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 6 NORTH AMERICA MOLECULAR BREEDING MARKET BY MARKER (USD BILLION) 2020-2029

TABLE 7 NORTH AMERICA MOLECULAR BREEDING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 8 NORTH AMERICA MOLECULAR BREEDING MARKET BY PROCESS (USD BILLION) 2020-2029

TABLE 9 US MOLECULAR BREEDING MARKET BY MARKER (USD BILLION) 2020-2029

TABLE 10 US MOLECULAR BREEDING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 11 US MOLECULAR BREEDING MARKET BY PROCESS (USD BILLION) 2020-2029

TABLE 12 CANADA MOLECULAR BREEDING MARKET BY MARKER (USD BILLION) 2020-2029

TABLE 13 CANADA MOLECULAR BREEDING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 14 CANADA MOLECULAR BREEDING MARKET BY PROCESS (USD BILLION) 2020-2029

TABLE 15 MEXICO MOLECULAR BREEDING MARKET BY MARKER (USD BILLION) 2020-2029

TABLE 16 MEXICO MOLECULAR BREEDING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 17 MEXICO MOLECULAR BREEDING MARKET BY PROCESS (USD BILLION) 2020-2029

TABLE 18 SOUTH AMERICA MOLECULAR BREEDING MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 19 SOUTH AMERICA MOLECULAR BREEDING MARKET BY MARKER (USD BILLION) 2020-2029

TABLE 20 SOUTH AMERICA MOLECULAR BREEDING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 21 SOUTH AMERICA MOLECULAR BREEDING MARKET BY PROCESS (USD BILLION) 2020-2029

TABLE 22 BRAZIL MOLECULAR BREEDING MARKET BY MARKER (USD BILLION) 2020-2029

TABLE 23 BRAZIL MOLECULAR BREEDING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 24 BRAZIL MOLECULAR BREEDING MARKET BY PROCESS (USD BILLION) 2020-2029

TABLE 25 ARGENTINA MOLECULAR BREEDING MARKET BY MARKER (USD BILLION) 2020-2029

TABLE 26 ARGENTINA MOLECULAR BREEDING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 27 ARGENTINA MOLECULAR BREEDING MARKET BY PROCESS (USD BILLION) 2020-2029

TABLE 28 COLOMBIA MOLECULAR BREEDING MARKET BY MARKER (USD BILLION) 2020-2029

TABLE 29 COLOMBIA MOLECULAR BREEDING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 30 COLOMBIA MOLECULAR BREEDING MARKET BY PROCESS (USD BILLION) 2020-2029

TABLE 31 REST OF SOUTH AMERICA MOLECULAR BREEDING MARKET BY MARKER (USD BILLION) 2020-2029

TABLE 32 REST OF SOUTH AMERICA MOLECULAR BREEDING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 33 REST OF SOUTH AMERICA MOLECULAR BREEDING MARKET BY PROCESS (USD BILLION) 2020-2029

TABLE 34 ASIA-PACIFIC MOLECULAR BREEDING MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 35 ASIA-PACIFIC MOLECULAR BREEDING MARKET BY MARKER (USD BILLION) 2020-2029

TABLE 36 ASIA-PACIFIC MOLECULAR BREEDING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 37 ASIA-PACIFIC MOLECULAR BREEDING MARKET BY PROCESS (USD BILLION) 2020-2029

TABLE 38 INDIA MOLECULAR BREEDING MARKET BY MARKER (USD BILLION) 2020-2029

TABLE 39 INDIA MOLECULAR BREEDING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 40 INDIA MOLECULAR BREEDING MARKET BY PROCESS (USD BILLION) 2020-2029

TABLE 41 CHINA MOLECULAR BREEDING MARKET BY MARKER (USD BILLION) 2020-2029

TABLE 42 CHINA MOLECULAR BREEDING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 43 CHINA MOLECULAR BREEDING MARKET BY PROCESS (USD BILLION) 2020-2029

TABLE 44 JAPAN MOLECULAR BREEDING MARKET BY MARKER (USD BILLION) 2020-2029

TABLE 45 JAPAN MOLECULAR BREEDING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 46 JAPAN MOLECULAR BREEDING MARKET BY PROCESS (USD BILLION) 2020-2029

TABLE 47 SOUTH KOREA MOLECULAR BREEDING MARKET BY MARKER (USD BILLION) 2020-2029

TABLE 48 SOUTH KOREA MOLECULAR BREEDING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 49 SOUTH KOREA MOLECULAR BREEDING MARKET BY PROCESS (USD BILLION) 2020-2029

TABLE 50 AUSTRALIA MOLECULAR BREEDING MARKET BY MARKER (USD BILLION) 2020-2029

TABLE 51 AUSTRALIA MOLECULAR BREEDING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 52 AUSTRALIA MOLECULAR BREEDING MARKET BY PROCESS (USD BILLION) 2020-2029

TABLE 53 SOUTH-EAST ASIA MOLECULAR BREEDING MARKET BY MARKER (USD BILLION) 2020-2029

TABLE 54 SOUTH-EAST ASIA MOLECULAR BREEDING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 55 SOUTH-EAST ASIA MOLECULAR BREEDING MARKET BY PROCESS (USD BILLION) 2020-2029

TABLE 56 REST OF ASIA PACIFIC MOLECULAR BREEDING MARKET BY MARKER (USD BILLION) 2020-2029

TABLE 57 REST OF ASIA PACIFIC MOLECULAR BREEDING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 58 REST OF ASIA PACIFIC MOLECULAR BREEDING MARKET BY PROCESS (USD BILLION) 2020-2029

TABLE 59 EUROPE MOLECULAR BREEDING MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 60 EUROPE MOLECULAR BREEDING MARKET BY MARKER (USD BILLION) 2020-2029

TABLE 61 EUROPE MOLECULAR BREEDING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 62 EUROPE MOLECULAR BREEDING MARKET BY PROCESS (USD BILLION) 2020-2029

TABLE 63 GERMANY MOLECULAR BREEDING MARKET BY MARKER (USD BILLION) 2020-2029

TABLE 64 GERMANY MOLECULAR BREEDING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 65 GERMANY MOLECULAR BREEDING MARKET BY PROCESS (USD BILLION) 2020-2029

TABLE 66 UK MOLECULAR BREEDING MARKET BY MARKER (USD BILLION) 2020-2029

TABLE 67 UK MOLECULAR BREEDING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 68 UK MOLECULAR BREEDING MARKET BY PROCESS (USD BILLION) 2020-2029

TABLE 69 FRANCE MOLECULAR BREEDING MARKET BY MARKER (USD BILLION) 2020-2029

TABLE 70 FRANCE MOLECULAR BREEDING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 71 FRANCE MOLECULAR BREEDING MARKET BY PROCESS (USD BILLION) 2020-2029

TABLE 72 ITALY MOLECULAR BREEDING MARKET BY MARKER (USD BILLION) 2020-2029

TABLE 73 ITALY MOLECULAR BREEDING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 74 ITALY MOLECULAR BREEDING MARKET BY PROCESS (USD BILLION) 2020-2029

TABLE 75 SPAIN MOLECULAR BREEDING MARKET BY MARKER (USD BILLION) 2020-2029

TABLE 76 SPAIN MOLECULAR BREEDING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 77 SPAIN MOLECULAR BREEDING MARKET BY PROCESS (USD BILLION) 2020-2029

TABLE 78 RUSSIA MOLECULAR BREEDING MARKET BY MARKER (USD BILLION) 2020-2029

TABLE 79 RUSSIA MOLECULAR BREEDING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 80 RUSSIA MOLECULAR BREEDING MARKET BY PROCESS (USD BILLION) 2020-2029

TABLE 81 REST OF EUROPE MOLECULAR BREEDING MARKET BY MARKER (USD BILLION) 2020-2029

TABLE 82 REST OF EUROPE MOLECULAR BREEDING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 83 REST OF EUROPE MOLECULAR BREEDING MARKET BY PROCESS (USD BILLION) 2020-2029

TABLE 84 MIDDLE EAST AND AFRICA MOLECULAR BREEDING MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 85 MIDDLE EAST AND AFRICA MOLECULAR BREEDING MARKET BY MARKER (USD BILLION) 2020-2029

TABLE 86 MIDDLE EAST AND AFRICA MOLECULAR BREEDING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 87 MIDDLE EAST AND AFRICA MOLECULAR BREEDING MARKET BY PROCESS (USD BILLION) 2020-2029

TABLE 88 UAE MOLECULAR BREEDING MARKET BY MARKER (USD BILLION) 2020-2029

TABLE 89 UAE MOLECULAR BREEDING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 90 UAE MOLECULAR BREEDING MARKET BY PROCESS (USD BILLION) 2020-2029

TABLE 91 SAUDI ARABIA MOLECULAR BREEDING MARKET BY MARKER (USD BILLION) 2020-2029

TABLE 92 SAUDI ARABIA MOLECULAR BREEDING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 93 SAUDI ARABIA MOLECULAR BREEDING MARKET BY PROCESS (USD BILLION) 2020-2029

TABLE 94 SOUTH AFRICA MOLECULAR BREEDING MARKET BY MARKER (USD BILLION) 2020-2029

TABLE 95 SOUTH AFRICA MOLECULAR BREEDING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 96 SOUTH AFRICA MOLECULAR BREEDING MARKET BY PROCESS (USD BILLION) 2020-2029

TABLE 97 REST OF MIDDLE EAST AND AFRICA MOLECULAR BREEDING MARKET BY MARKER (USD BILLION) 2020-2029

TABLE 98 REST OF MIDDLE EAST AND AFRICA MOLECULAR BREEDING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 99 REST OF MIDDLE EAST AND AFRICA MOLECULAR BREEDING MARKET BY PROCESS (USD BILLION) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL MOLECULAR BREEDING MARKET BY APPLICATION, USD BILLION, 2020-2029

FIGURE 9 GLOBAL MOLECULAR BREEDING MARKET BY MARKET, USD BILLION, 2020-2029

FIGURE 10 GLOBAL MOLECULAR BREEDING MARKET BY PROCESS, USD BILLION, 2020-2029

FIGURE 11 GLOBAL MOLECULAR BREEDING MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 12 GLOBAL MOLECULAR BREEDING MARKET BY DYNAMICS

FIGURE 13 PORTER’S FIVE FORCES MODEL

FIGURE 14 GLOBAL MOLECULAR BREEDING MARKET BY APPLICATION, USD BILLION, 2021

FIGURE 15 GLOBAL MOLECULAR BREEDING MARKET BY MARKET, USD BILLION, 2021

FIGURE 16 GLOBAL MOLECULAR BREEDING MARKET BY PROCESS, USD BILLION, 2021

FIGURE 17 GLOBAL MOLECULAR BREEDING MARKET BY REGION, USD BILLION, 2021

FIGURE 18 NORTH AMERICA MOLECULAR BREEDING MARKET SNAPSHOT

FIGURE 19 EUROPE MOLECULAR BREEDING MARKET SNAPSHOT

FIGURE 20 SOUTH AMERICA MOLECULAR BREEDING MARKET SNAPSHOT

FIGURE 21 ASIA PACIFIC MOLECULAR BREEDING MARKET SNAPSHOT

FIGURE 22 MIDDLE EAST ASIA AND AFRICA MOLECULAR BREEDING MARKET SNAPSHOT

FIGURE 23 MARKET SHARE ANALYSIS

FIGURE 24 EUROFINS: COMPANY SNAPSHOT

FIGURE 25 THERMO FISHER SCIENTIFIC: COMPANY SNAPSHOT

FIGURE 26 ILLUMINA INC.: COMPANY SNAPSHOT

FIGURE 27 SGS: COMPANY SNAPSHOT

FIGURE 28 LGC GROUP: COMPANY SNAPSHOT

FIGURE 29 DANBRED: COMPANY SNAPSHOT

FIGURE 30 INTERTEK: COMPANY SNAPSHOT

FIGURE 31 LEMNATEC: COMPANY SNAPSHOT

FIGURE 32 CHARLES RIVER: COMPANY SNAPSHOT

FIGURE 33 SLIPSTREAM AUTOMATION: COMPANY SNAPSHOT

FIGURE 34 FRUITBREEDOMICS: COMPANY SNAPSHOT

FAQ

Global molecular breeding market is estimated to be USD 2.25 billion in 2020 and is projected to reach USD 9.74 billion by 2029, at a CAGR of 18.5% from 2022 to 2029.

The need to develop crops that are more resistant to changing environmental circumstances and the rising demand for food supply will drive the growth of the molecular breeding industry in North America over the upcoming years.

The need to increase crop yields to meet the rising food demand, the desire to lessen the impact of agriculture on the environment, and the requirement to create crops that are more resistant to pests, diseases, and environmental stresses are some of the factors that are driving the demand for molecular breeding technology in North America. The molecular breeding business in North America is expanding as a result of the growing accessibility of genomics and bioinformatics technologies, which have made it simpler and more affordable to study and alter vast amounts of genetic data.

It is now possible to identify the genes responsible for desirable traits such as high yield, disease resistance, and improved quality in plants and animals with advancements in molecular biology. Breeders can use this knowledge to create new types and breeds that have these desirable characteristics. Marker-assisted selection and genomic selection are two molecular biology technologies that can speed up conventional breeding efforts. This is so that breeders can choose individuals who exhibit desirable qualities early on and employ them in subsequent breeding. The amount of time needed to create new breeds and varieties can be greatly shortened as a result.

Molecular Breeding Market By Application is divided into Plant and Livestock.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.