REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 18.15 billion by 2029 | 16 % | North America |

| By Type | By Source | By Mode Of Application |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Biopesticides Market Overview

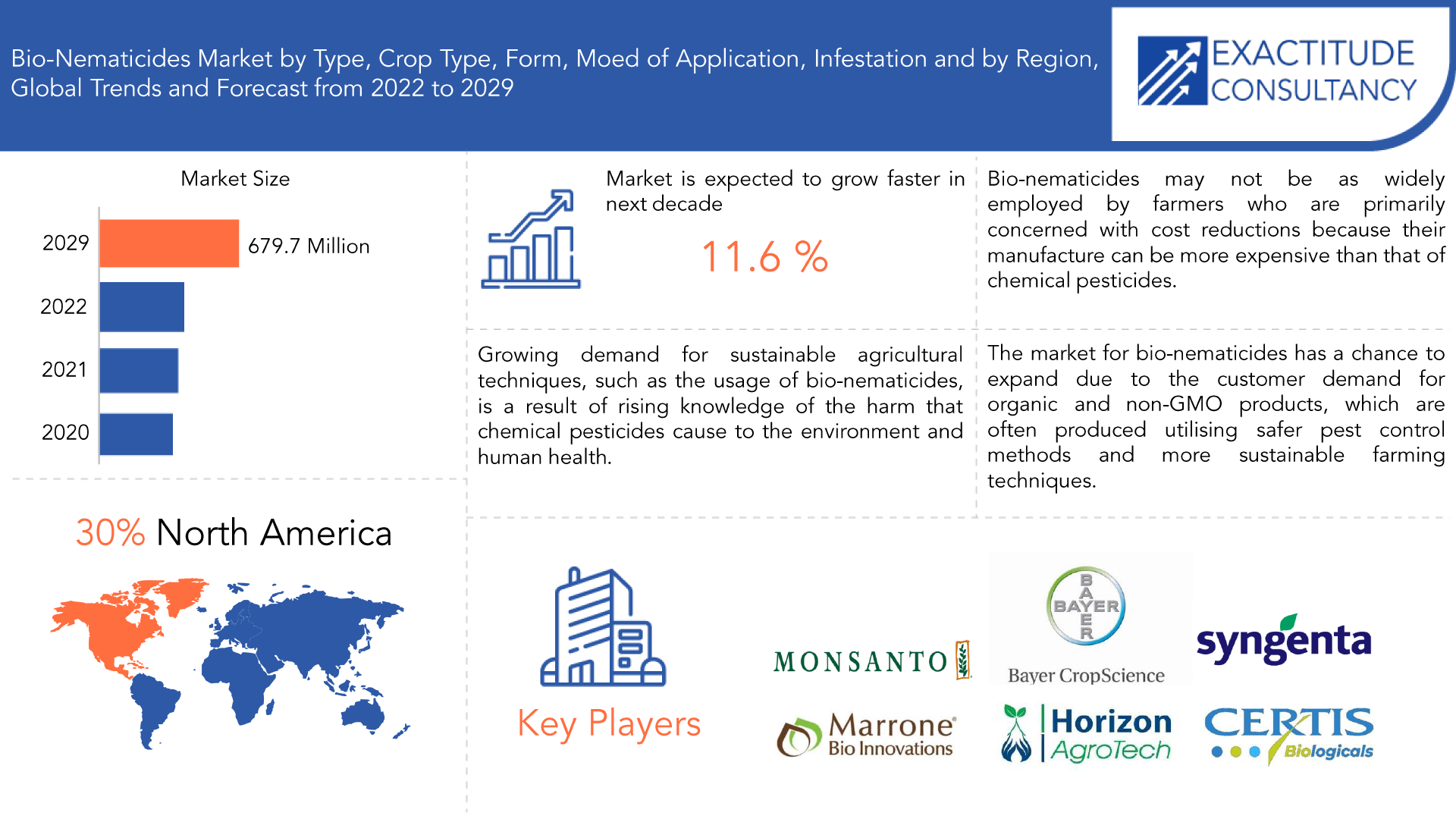

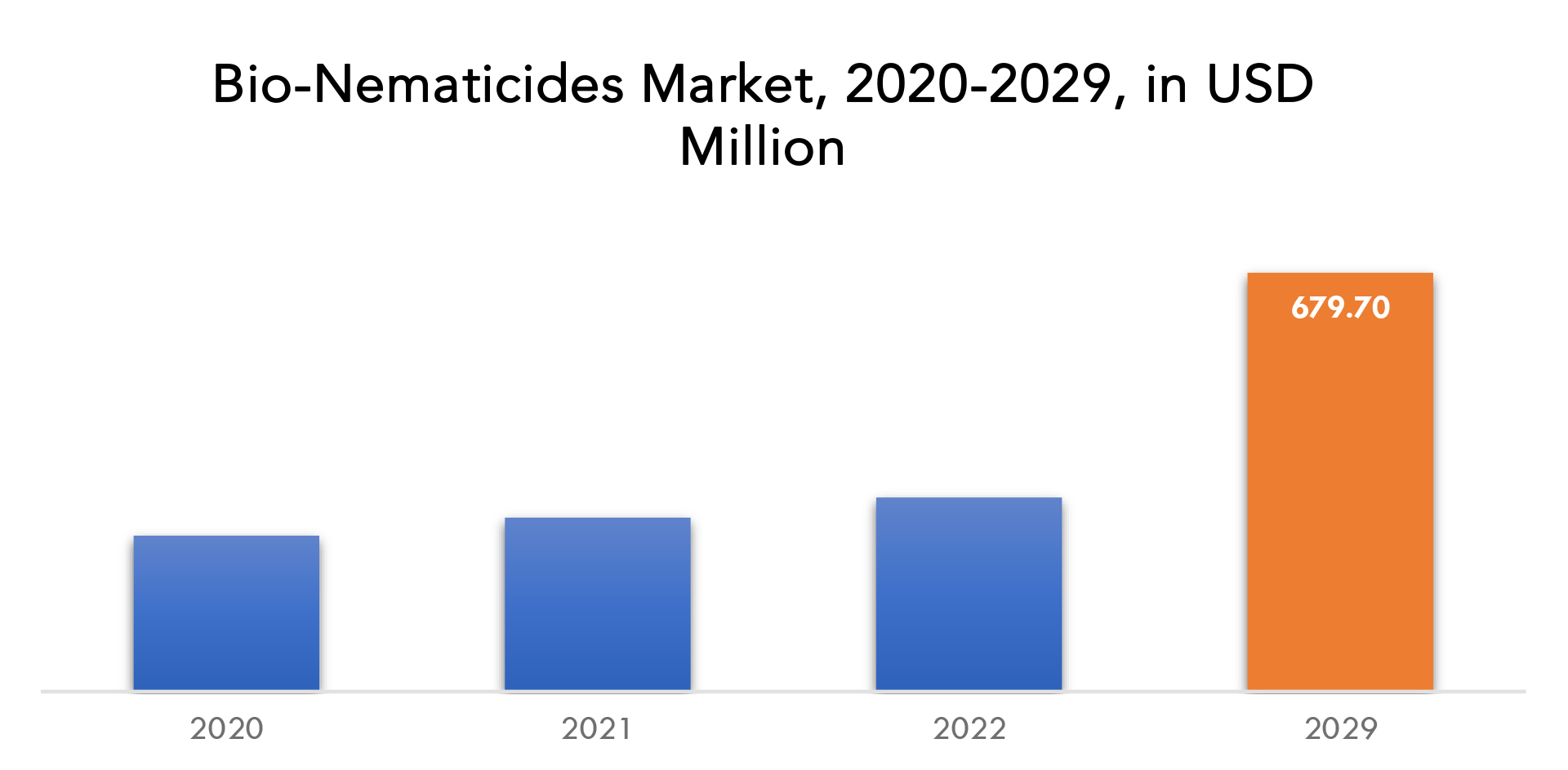

The Biopesticides market is expected to grow at 16 % CAGR from 2022 to 2029. It is expected to reach above USD 18.15 billion by 2029 from USD 6.51 billion in 2022.

Growing government initiatives to promote the use of biopesticides globally, rising investments from leading crop protection companies in the biopesticides market, rising environmental safety awareness regarding the use of biopesticides, expanding organic farming and the demand for organic food, and growing organic farming and government initiatives are some of the factors driving the growth of the Biopesticides market. Biopesticides are pesticides made from naturally occurring sources, such as plants, animals, and microorganisms (biopesticides). In agricultural practices, biopesticides are used to manage pests including nematodes, weeds, and insects as well as to improve the health and production of plants. Biopesticides don’t harm beneficial insects or other non-target creatures like animals.

| ATTRIBUTE | DETAILS |

| Study period | 2022-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2022 |

| Unit | Value (USD Billion), (Kilotons) |

| Segmentation | By Type, Source, Mode of Application, Crop, Formulation, End-user industry, and region. |

| By Type |

|

| By Source |

|

| By Mode Of Application |

|

| By Crop |

|

| By Formulation |

|

| By End-user industry |

|

| By Region |

|

Many biopesticides are capable of environmental degradation. They swiftly decay without endangering surface or groundwater. As biopesticides often function in low quantities, pollution is not a serious problem. Plants and crops are the main targets of biopesticides. In many crops, biopesticides are replacing synthetic pesticides, which has a big influence on farming and sustainable practices. The most environmentally friendly crop protection methods involve biopesticides, which promote plant development without the use of synthetic or chemical pesticides and provide no harm to people or animals. As biopesticides gain widespread acceptance in the agriculture industry, the market for them is anticipated to grow fast.

Biopesticides are regarded as the most potent, ecologically secure, and target-specific alternative to synthetic pesticides. These factors have led to its usage as a substitute for chemical pesticides in pest management programs all over the world. Biopesticides come from a variety of living creatures, including fungi, bacteria, algae, viruses, nematodes, and protozoa. In addition to promoting the sustainable expansion of agriculture, the development of biopesticide applications greatly reduces the environmental damage caused by chemically manufactured insecticide residues. Since the creation of biopesticides, a large number of products have been authorized and registered, some of which have gained significant traction in the agricultural market.

The global adoption of organic farming and food is driving an increase in the need for biological pesticides, which is driving the growth of the biopesticides industry as a whole. As consumers become more informed about the chemicals used in food production and the potential consequences of chemical residue on food, they are promoting alternatives to chemical-based agriculture. The need for biopesticides is rising as a result of this, which is pushing farmers to use organic farming. The need for biological pesticides increases along with the demand for organic food and farming on a worldwide scale, driving the growth of the biopesticides industry as a whole. In addition, the development of new technologies to boost agricultural production will fuel the need for bio fungicides.

Biopesticides Market Segment Analysis

The biopesticides market is divided into bioinsecticides, bio fungicides, bionematicides, bioherbicides, and others based on type. Throughout the anticipated period, the market is expected to be dominated by the bioinsecticides sector. Due to increased pest resistance and a rise in agricultural productivity, bioinsecticides are being utilized increasingly often. Many insect pests are known to affect plant development as well as harvested crops after they have been stored, resulting in an agricultural loss. Insect pest infestation also reduces the marketability of the crops.

There is an agricultural loss since several insect pests are known to impair plant development and crops after harvest or while they are being stored. Insect pest infestation also reduces the marketability of the crops. Regulation restrictions and the phase-out of vital active ingredients are the main causes of the need for alternate pest control methods. Bioinsecticides are so often utilized since they do not harm bugs’ natural enemies, contaminate the environment, or leave residues in goods. The ease of creating Bio is another factor that has gained adoption.

Biopesticides Market Market Players

The biopesticides market key players include BASF SE, Syngenta AG, Bayer CropScience, Marrone Bio Innovations, Novozymes, Koppert Biological Systems, Bioworks INC, Gowan Group, Sumitomo Chemical Co. Ltd., Certis USA LLC, UPL Limited, FMC Corporation, Nufarm, Isagro S.P.A, Certis Biological, Biobest NV, SOM Phytopharma India, Valent Biosciences LLC, STK Bio-Ag Technologies, Andermatt Biocontrol AG, IPL Biologicals Ltd, Vegalab S.A, Bionema.

For corporate expansion, these key leaders are implementing strategic formulations such as new product development and commercialization, commercial expansion, and distribution agreements. Moreover, these participants are substantially spending on product development, which is fueling revenue generation.

Recent Developments:

- April 2023- BASF introduced co-creations at Chinaplas 2023, driving the plastics path toward a more sustainable future. Net Zero Journey Concept House, concept pillow, electric car charging gun, wire & battery cover are all co-creations.

- March 2023 – trinamiX, a BASF company, exhibits Mobile NIR Spectroscopy Solutions for on-the-spot detection of plastics and textiles. An innovative portable device recognizes over 30 different types of plastic on the spot. A newly released solution enables on-site detection of over 15 textile materials and compositions.

Who Should Buy? Or Key stakeholders

- Investors

- Food and Beverage industry

- Medical Technology Companies

- Healthcare and personal care firms

- Research Organizations

- Regulatory Authorities

- Institutional & retail players

- Others

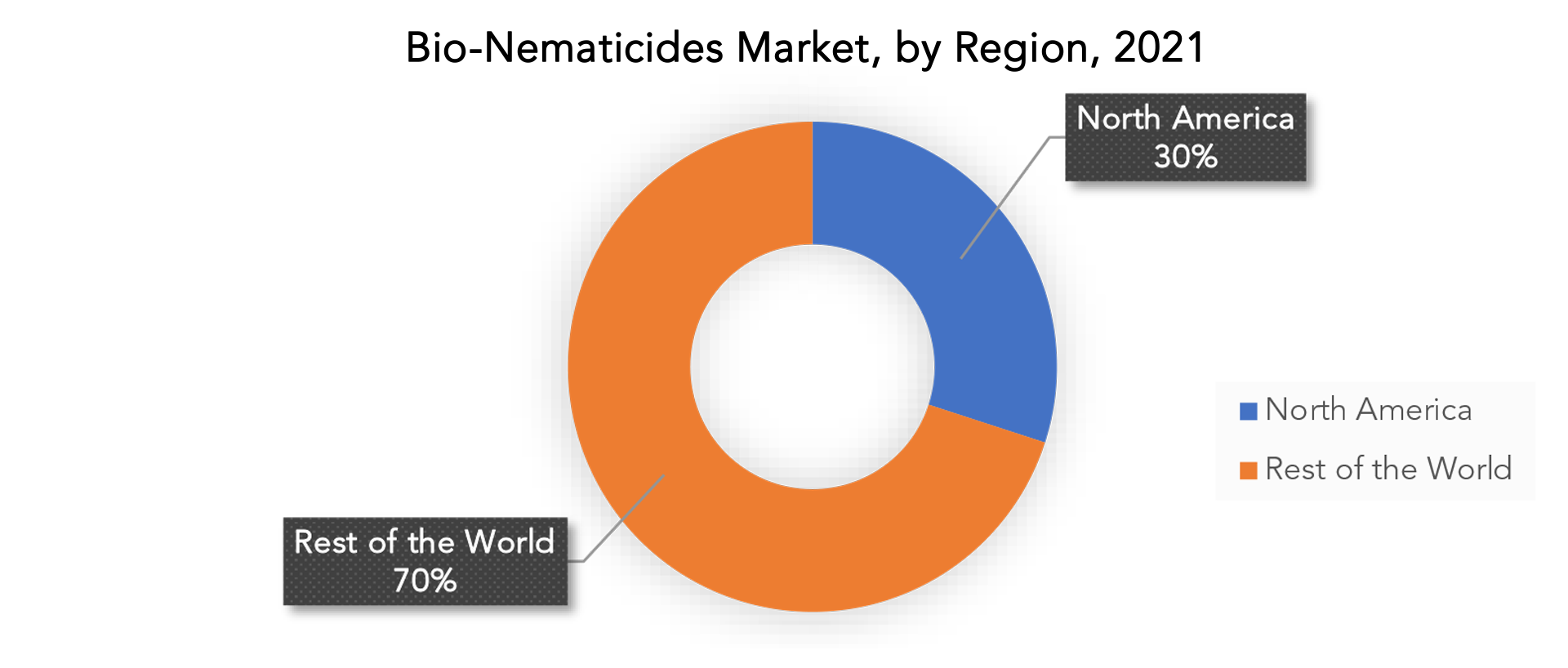

Biopesticides Market Regional AnalysisThe biopesticides market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN, and Rest of APAC

- Europe: includes the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe

- South America: includes Brazil, Argentina, and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and the Rest of MEA

In 2021, the highest market share belonged to North America. The regional market is driven by the rigorous laws and regulations governing synthetic crop protection agents that protect the environment from undesirable effects. Sales of the product in the local market are driven by the fierce search for greener agricultural inputs. The desire to achieve international export requirements is pushing farmers to utilize biological crop protection products. Rising consumer demand for organic food and concerns about residue levels in food are also encouraging farmers in this region to utilize biopesticides. Several sizable biopesticide companies may be found in the North American continent, which encourages investment and interest in biological crop protection products. Organic agricultural methods are promoted in the region by stringent government regulations and a growing organic industry. Also, when more are used in greenhouses there, the need for biopesticides in the U.S. will rise.

Due to rising biopesticide demand and expanding environmental and public health concerns, Brazil currently has the highest CAGR on the worldwide biopesticides market. Due to increased consumer knowledge of the advantages of biopesticides and an increase in product releases by the main manufacturers, China is the market leader.

Key Market Segments: Biopesticides Market

Biopesticides Market By Type, 2022-2029, (USD Billion), (Kilotons)

- Bioinsecticide

- Bio Fungicide

- Bio Nematicide

- Others

Biopesticides Market By Source, 2022-2029, (USD Billion), (Kilotons)

- Microbial

- Biochemicals

- Beneficial Insects

Biopesticides Market By Mode Of Application, 2022-2029, (USD Billion), (Kilotons)

- Foliar Application

- Seed Treatment

- Soil Treatment

- Other

Biopesticides Market By Crop, 2022-2029, (USD Billion), (Kilotons)

- Cereals

- Oilseed

- Fruits & Vegetables

Biopesticides Market By Formulation, 2022-2029, (USD Billion), (Kilotons)

- Dry

- Liquid

Biopesticides Market By End-User Industry, 2022-2029, (USD Billion), (Kilotons)

- Food & Beverages

- Agriculture

- Healthcare

- Horticulture

Biopesticides Market By Region, 2022-2029, (USD Billion), (Kilotons)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the biopesticides market over the next 7 years?

- What are the end-user industries driving demand for the market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the Middle East, and Africa?

- How is the economic environment affecting the biopesticides market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the biopesticides market?

- What are the key drivers of growth in the biopesticides market?

- Who are the market’s major players, and what is their market share?

- What are the biopesticides market’s distribution channels and supply chain dynamics?

- What are the technological advancements and innovations in the biopesticides market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the biopesticides market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the biopesticides market?

- What are the market’s product offerings/ service offerings and specifications of leading players?

- What is the pricing trend of biopesticides in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL BIOPESTICIDES MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON THE BIOPESTICIDES MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL BIOPESTICIDES MARKET OUTLOOK

- BIOPESTICIDES MARKET BY TYPE, 2022-2029, (USD BILLION), (KILOTONS)

- BIOINSECTICIDES

- BIO FUNGICIDE

- BIO NEMATICIDE

- OTHERS

- BIOPESTICIDES MARKET BY SOURCE, 2022-2029, (USD BILLION), (KILOTONS)

- MICROBIAL

- BIOCHEMICALS

- BENEFICIAL INSECTS

- BIOPESTICIDES MARKET BY MODE OF APPLICATION, 2022-2029, (USD BILLION), (KILOTONS)

- FOLIAR APPLICATION

- SEED TREATMENT

- SOIL TREATMENT

- OTHER

- BIOPESTICIDES MARKET BY CROP, 2022-2029, (USD BILLION), (KILOTONS)

- CEREALS

- OILSEED

- FRUITS & VEGETABLES

- BIOPESTICIDES MARKET BY FORMULATION, 2022-2029, (USD BILLION), (KILOTONS)

- DRY

- LIQUID

- BIOPESTICIDES MARKET BY END-USER INDUSTRY, 2022-2029, (USD BILLION), (KILOTONS)

- FOOD AND BEVERAGES

- AGRICULTURE

- HEALTHCARE

- HORTICULTURE

- GLOBAL BIOPESTICIDES MARKET BY REGION, 2022-2029, (USD BILLION), (KILOTONS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- BASF SE

- SYNGENTS AG

- BAYER CROPSCIENCE

- MARRONE BIO INNOVATIONS

- NOVOZYMES

- KOPPERT BIOLOGICAL SYSTEMS

- BIOWORKS INC

- GOWAN GROUP

- SUMITOMO CHEMICAL CO. LTD

- CERTIS USA LLC

- UPI LIMITED

- FMC CORPORATION

- NUFARM

- ISAGRO S.P.A.

- CERTIS BIOLOGICAL

- BIOBEST NV

- VALENT BIOSCIENCES LLC

- BIONEMA *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL BIOPESTICIDES MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 2 GLOBAL BIOPESTICIDES MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 3 GLOBAL BIOPESTICIDES MARKET BY MODE OF APPLICATION (USD BILLION) 2022-2029

TABLE 4 GLOBAL BIOPESTICIDES MARKET BY MODE OF APPLICATION (KILOTONS) 2022-2029

TABLE 5 GLOBAL BIOPESTICIDES MARKET BY SOURCE (USD BILLION) 2022-2029

TABLE 6 GLOBAL BIOPESTICIDES MARKET BY SOURCE (KILOTONS) 2022-2029

TABLE 7 GLOBAL BIOPESTICIDES MARKET BY END USER (USD BILLION) 2022-2029

TABLE 8 GLOBAL BIOPESTICIDES MARKET BY END USER (KILOTONS) 2022-2029

TABLE 9 GLOBAL BIOPESTICIDES MARKET BY FORMULATION (USD BILLION) 2022-2029

TABLE 10 GLOBAL BIOPESTICIDES MARKET BY FORMULATION (KILOTONS) 2022-2029

TABLE 11 GLOBAL BIOPESTICIDES MARKET BY CROP (USD BILLION) 2022-2029

TABLE 12 GLOBAL BIOPESTICIDES MARKET BY CROP (KILOTONS) 2022-2029

TABLE 13 GLOBAL BIOPESTICIDES MARKET BY REGION (USD BILLION) 2022-2029

TABLE 14 GLOBAL BIOPESTICIDES MARKET BY REGION (KILOTONS) 2022-2029

TABLE 15 NORTH AMERICA BIOPESTICIDES MARKET BY COUNTRY (USD BILLION) 2022-2029

TABLE 16 NORTH AMERICA BIOPESTICIDES MARKET BY COUNTRY (KILOTONS) 2022-2029

TABLE 17 NORTH AMERICA BIOPESTICIDES MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 18 NORTH AMERICA BIOPESTICIDES MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 19 NORTH AMERICA BIOPESTICIDES MARKET BY MODE OF APPLICATION (USD BILLION) 2022-2029

TABLE 20 NORTH AMERICA BIOPESTICIDES MARKET BY MODE OF APPLICATION (KILOTONS) 2022-2029

TABLE 21 NORTH AMERICA BIOPESTICIDES MARKET BY SOURCE (USD BILLION) 2022-2029

TABLE 22 NORTH AMERICA BIOPESTICIDES MARKET BY SOURCE (KILOTONS) 2022-2029

TABLE 23 NORTH AMERICA BIOPESTICIDES MARKET BY END USER (USD BILLION) 2022-202

TABLE 24 NORTH AMERICA BIOPESTICIDES MARKET BY END USER (KILOTONS) 2022-2029

TABLE 25 NORTH AMERICA BIOPESTICIDES MARKET BY FORMULATION (USD BILLION) 2022-2029

TABLE 26 NORTH AMERICA BIOPESTICIDES MARKET BY FORMULATION (KILOTONS) 2022-2029

TABLE 27 NORTH AMERICA BIOPESTICIDES MARKET BY CROP (USD BILLION) 2022-2029

TABLE 28 NORTH AMERICA BIOPESTICIDES MARKET BY CROP (KILOTONS) 2022-2029

TABLE 29 US BIOPESTICIDES MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 30 US BIOPESTICIDES MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 31 US BIOPESTICIDES MARKET BY MODE OF APPLICATION (USD BILLION) 2022-2029

TABLE 32 US BIOPESTICIDES MARKET BY MODE OF APPLICATION (KILOTONS) 2022-2029

TABLE 33 US BIOPESTICIDES MARKET BY SOURCE (USD BILLION) 2022-2029

TABLE 34 US BIOPESTICIDES MARKET BY SOURCE (KILOTONS) 2022-2029

TABLE 35 US BIOPESTICIDES MARKET BY END USER (USD BILLION) 2022-2029

TABLE 36 US BIOPESTICIDES MARKET BY END USER (KILOTONS) 2022-2029

TABLE 37 US BIOPESTICIDES MARKET BY FORMULATION (USD BILLION) 2022-2029

TABLE 38 US BIOPESTICIDES MARKET BY FORMULATION (KILOTONS) 2022-2029

TABLE 39 US BIOPESTICIDES MARKET BY CROP (USD BILLION) 2022-2029

TABLE 40 US BIOPESTICIDES MARKET BY CROP (KILOTONS) 2022-2029

TABLE 41 CANADA BIOPESTICIDES MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 42 CANADA BIOPESTICIDES MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 43 CANADA BIOPESTICIDES MARKET BY MODE OF APPLICATION (USD BILLION) 2022-2029

TABLE 44 CANADA BIOPESTICIDES MARKET BY MODE OF APPLICATION (KILOTONS) 2022-2029

TABLE 45 CANADA BIOPESTICIDES MARKET BY SOURCE (USD BILLION) 2022-2029

TABLE 46 CANADA BIOPESTICIDES MARKET BY SOURCE (KILOTONS) 2022-2029

TABLE 47 CANADA BIOPESTICIDES MARKET BY END USER (USD BILLION) 2022-2029

TABLE 48 CANADA BIOPESTICIDES MARKET BY END USER (KILOTONS) 2022-2029

TABLE 49 CANADA BIOPESTICIDES MARKET BY FORMULATION (USD BILLION) 2022-2029

TABLE 50 CANADA BIOPESTICIDES MARKET BY FORMULATION (KILOTONS) 2022-2029

TABLE 51 CANADA BIOPESTICIDES MARKET BY CROP (USD BILLION) 2022-2029

TABLE 52 CANADA BIOPESTICIDES MARKET BY CROP (KILOTONS) 2022-2029

TABLE 53 MEXICO BIOPESTICIDES MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 54 MEXICO BIOPESTICIDES MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 55 MEXICO BIOPESTICIDES MARKET BY MODE OF APPLICATION (USD BILLION) 2022-2029

TABLE 56 MEXICO BIOPESTICIDES MARKET BY MODE OF APPLICATION (KILOTONS) 2022-2029

TABLE 57 MEXICO BIOPESTICIDES MARKET BY SOURCE (USD BILLION) 2022-2029

TABLE 58 MEXICO BIOPESTICIDES MARKET BY SOURCE (KILOTONS) 2022-2029

TABLE 59 MEXICO BIOPESTICIDES MARKET BY END USER (USD BILLION) 2022-2029

TABLE 60 MEXICO BIOPESTICIDES MARKET BY END USER (KILOTONS) 2022-2029

TABLE 61 MEXICO BIOPESTICIDES MARKET BY FORMULATION (USD BILLION) 2022-2029

TABLE 62 MEXICO BIOPESTICIDES MARKET BY FORMULATION (KILOTONS) 2022-2029

TABLE 63 MEXICO BIOPESTICIDES MARKET BY CROP (USD BILLION) 2022-2029

TABLE 64 MEXICO BIOPESTICIDES MARKET BY CROP (KILOTONS) 2022-2029

TABLE 65 SOUTH AMERICA BIOPESTICIDES MARKET BY COUNTRY (USD BILLION) 2022-2029

TABLE 66 SOUTH AMERICA BIOPESTICIDES MARKET BY COUNTRY (KILOTONS) 2022-2029

TABLE 67 SOUTH AMERICA BIOPESTICIDES MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 68 SOUTH AMERICA BIOPESTICIDES MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 69 SOUTH AMERICA BIOPESTICIDES MARKET BY MODE OF APPLICATION (USD BILLION) 2022-2029

TABLE 70 SOUTH AMERICA BIOPESTICIDES MARKET BY MODE OF APPLICATION (KILOTONS) 2022-2029

TABLE 71 SOUTH AMERICA BIOPESTICIDES MARKET BY SOURCE (USD BILLION) 2022-2029

TABLE 72 SOUTH AMERICA BIOPESTICIDES MARKET BY SOURCE (KILOTONS) 2022-2029

TABLE 73 SOUTH AMERICA BIOPESTICIDES MARKET BY END USER (USD BILLION) 2022-2029

TABLE 74 SOUTH AMERICA BIOPESTICIDES MARKET BY END USER (KILOTONS) 2022-2029

TABLE 75 SOUTH AMERICA BIOPESTICIDES MARKET BY FORMULATION (USD BILLION) 2022-2029

TABLE 76 SOUTH AMERICA BIOPESTICIDES MARKET BY FORMULATION (KILOTONS) 2022-2029

TABLE 77 SOUTH AMERICA BIOPESTICIDES MARKET BY CROP (USD BILLION) 2022-2029

TABLE 78 SOUTH AMERICA BIOPESTICIDES MARKET BY CROP (KILOTONS) 2022-2029

TABLE 79 BRAZIL BIOPESTICIDES MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 80 BRAZIL BIOPESTICIDES MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 81 BRAZIL BIOPESTICIDES MARKET BY MODE OF APPLICATION (USD BILLION) 2022-2029

TABLE 82 BRAZIL BIOPESTICIDES MARKET BY MODE OF APPLICATION (KILOTONS) 2022-2029

TABLE 83 BRAZIL BIOPESTICIDES MARKET BY SOURCE (USD BILLION) 2022-2029

TABLE 84 BRAZIL BIOPESTICIDES MARKET BY SOURCE (KILOTONS) 2022-2029

TABLE 85 BRAZIL BIOPESTICIDES MARKET BY END USER (USD BILLION) 2022-2029

TABLE 86 BRAZIL BIOPESTICIDES MARKET BY END USER (KILOTONS) 2022-2029

TABLE 87 BRAZIL BIOPESTICIDES MARKET BY FORMULATION (USD BILLION) 2022-2029

TABLE 88 BRAZIL BIOPESTICIDES MARKET BY FORMULATION (KILOTONS) 2022-2029

TABLE 89 BRAZIL BIOPESTICIDES MARKET BY CROP (USD BILLION) 2022-2029

TABLE 90 BRAZIL BIOPESTICIDES MARKET BY CROP (KILOTONS) 2022-2029

TABLE 91 ARGENTINA BIOPESTICIDES MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 92 ARGENTINA BIOPESTICIDES MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 93 ARGENTINA BIOPESTICIDES MARKET BY MODE OF APPLICATION (USD BILLION) 2022-2029

TABLE 94 ARGENTINA BIOPESTICIDES MARKET BY MODE OF APPLICATION (KILOTONS) 2022-2029

TABLE 95 ARGENTINA BIOPESTICIDES MARKET BY SOURCE (USD BILLION) 2022-2029

TABLE 96 ARGENTINA BIOPESTICIDES MARKET BY SOURCE (KILOTONS) 2022-2029

TABLE 97 ARGENTINA BIOPESTICIDES MARKET BY END USER (USD BILLION) 2022-2029

TABLE 98 ARGENTINA BIOPESTICIDES MARKET BY END USER (KILOTONS) 2022-2029

TABLE 99 ARGENTINA BIOPESTICIDES MARKET BY FORMULATION (USD BILLION) 2022-2029

TABLE 100 ARGENTINA BIOPESTICIDES MARKET BY FORMULATION (KILOTONS) 2022-2029

TABLE 101 ARGENTINA BIOPESTICIDES MARKET BY CROP (USD BILLION) 2022-2029

TABLE 102 ARGENTINA BIOPESTICIDES MARKET BY CROP (KILOTONS) 2022-2029

TABLE 103 COLOMBIA BIOPESTICIDES MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 104 COLOMBIA BIOPESTICIDES MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 105 COLOMBIA BIOPESTICIDES MARKET BY MODE OF APPLICATION (USD BILLION) 2022-2029

TABLE 106 COLOMBIA BIOPESTICIDES MARKET BY MODE OF APPLICATION (KILOTONS) 2022-2029

TABLE 107 COLOMBIA BIOPESTICIDES MARKET BY SOURCE (USD BILLION) 2022-2029

TABLE 108 COLOMBIA BIOPESTICIDES MARKET BY SOURCE (KILOTONS) 2022-2029

TABLE 109 COLOMBIA BIOPESTICIDES MARKET BY END USER (USD BILLION) 2022-2029

TABLE 110 COLOMBIA BIOPESTICIDES MARKET BY END USER (KILOTONS) 2022-2029

TABLE 111 COLOMBIA BIOPESTICIDES MARKET BY FORMULATION (USD BILLION) 2022-2029

TABLE 112 COLOMBIA BIOPESTICIDES MARKET BY FORMULATION (KILOTONS) 2022-2029

TABLE 113 COLOMBIA BIOPESTICIDES MARKET BY CROP (USD BILLION) 2022-2029

TABLE 114 COLOMBIA BIOPESTICIDES MARKET BY CROP (KILOTONS) 2022-2029

TABLE 115 REST OF SOUTH AMERICA BIOPESTICIDES MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 116 REST OF SOUTH AMERICA BIOPESTICIDES MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 117 REST OF SOUTH AMERICA BIOPESTICIDES MARKET BY MODE OF APPLICATION (USD BILLION) 2022-2029

TABLE 118 REST OF SOUTH AMERICA BIOPESTICIDES MARKET BY MODE OF APPLICATION (KILOTONS) 2022-2029

TABLE 119 REST OF SOUTH AMERICA BIOPESTICIDES MARKET BY SOURCE (USD BILLION) 2022-2029

TABLE 120 REST OF SOUTH AMERICA BIOPESTICIDES MARKET BY SOURCE (KILOTONS) 2022-2029

TABLE 121 REST OF SOUTH AMERICA BIOPESTICIDES MARKET BY END USER (USD BILLION) 2022-2029

TABLE 122 REST OF SOUTH AMERICA BIOPESTICIDES MARKET BY END USER (KILOTONS) 2022-2029

TABLE 123 REST OF SOUTH AMERICA BIOPESTICIDES MARKET BY FORMULATION (USD BILLION) 2022-2029

TABLE 124 REST OF SOUTH AMERICA BIOPESTICIDES MARKET BY FORMULATION (KILOTONS) 2022-2029

TABLE 125 REST OF SOUTH AMERICA BIOPESTICIDES MARKET BY CROP (USD BILLION) 2022-2029

TABLE 126 REST OF SOUTH AMERICA BIOPESTICIDES MARKET BY CROP (KILOTONS) 2022-2029

TABLE 127 ASIA-PACIFIC BIOPESTICIDES MARKET BY COUNTRY (USD BILLION) 2022-2029

TABLE 128 ASIA-PACIFIC BIOPESTICIDES MARKET BY COUNTRY (KILOTONS) 2022-2029

TABLE 129 ASIA-PACIFIC BIOPESTICIDES MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 130 ASIA-PACIFIC BIOPESTICIDES MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 131 ASIA-PACIFIC BIOPESTICIDES MARKET BY MODE OF APPLICATION (USD BILLION) 2022-2029

TABLE 132 ASIA-PACIFIC BIOPESTICIDES MARKET BY MODE OF APPLICATION (KILOTONS) 2022-2029

TABLE 133 ASIA-PACIFIC BIOPESTICIDES MARKET BY SOURCE (USD BILLION) 2022-2029

TABLE 134 ASIA-PACIFIC BIOPESTICIDES MARKET BY SOURCE (KILOTONS) 2022-2029

TABLE 135 ASIA-PACIFIC BIOPESTICIDES MARKET BY END USER (USD BILLION) 2022-2029

TABLE 136 ASIA-PACIFIC BIOPESTICIDES MARKET BY END USER (KILOTONS) 2022-2029

TABLE 137 ASIA-PACIFIC BIOPESTICIDES MARKET BY FORMULATION (USD BILLION) 2022-2029

TABLE 138 ASIA-PACIFIC BIOPESTICIDES MARKET BY FORMULATION (KILOTONS) 2022-2029

TABLE 139 ASIA-PACIFIC BIOPESTICIDES MARKET BY CROP (USD BILLION) 2022-2029

TABLE 140 ASIA-PACIFIC BIOPESTICIDES MARKET BY CROP (KILOTONS) 2022-2029

TABLE 141 INDIA BIOPESTICIDES MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 142 INDIA BIOPESTICIDES MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 143 INDIA BIOPESTICIDES MARKET BY MODE OF APPLICATION (USD BILLION) 2022-2029

TABLE 144 INDIA BIOPESTICIDES MARKET BY MODE OF APPLICATION (KILOTONS) 2022-2029

TABLE 145 INDIA BIOPESTICIDES MARKET BY SOURCE (USD BILLION) 2022-2029

TABLE 146 INDIA BIOPESTICIDES MARKET BY SOURCE (KILOTONS) 2022-2029

TABLE 147 INDIA BIOPESTICIDES MARKET BY END USER (USD BILLION) 2022-2029

TABLE 148 INDIA BIOPESTICIDES MARKET BY END USER (KILOTONS) 2022-2029

TABLE 149 INDIA BIOPESTICIDES MARKET BY FORMULATION (USD BILLION) 2022-2029

TABLE 150 INDIA BIOPESTICIDES MARKET BY FORMULATION (KILOTONS) 2022-2029

TABLE 151 INDIA BIOPESTICIDES MARKET BY CROP (USD BILLION) 2022-2029

TABLE 152 INDIA BIOPESTICIDES MARKET BY CROP (KILOTONS) 2022-2029

TABLE 153 CHINA BIOPESTICIDES MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 154 CHINA BIOPESTICIDES MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 155 CHINA BIOPESTICIDES MARKET BY MODE OF APPLICATION (USD BILLION) 2022-2029

TABLE 156 CHINA BIOPESTICIDES MARKET BY MODE OF APPLICATION (KILOTONS) 2022-2029

TABLE 157 CHINA BIOPESTICIDES MARKET BY SOURCE (USD BILLION) 2022-2029

TABLE 158 CHINA BIOPESTICIDES MARKET BY SOURCE (KILOTONS) 2022-2029

TABLE 159 CHINA BIOPESTICIDES MARKET BY END USER (USD BILLION) 2022-2029

TABLE 160 CHINA BIOPESTICIDES MARKET BY END USER (KILOTONS) 2022-2029

TABLE 161 CHINA BIOPESTICIDES MARKET BY FORMULATION (USD BILLION) 2022-2029

TABLE 162 CHINA BIOPESTICIDES MARKET BY FORMULATION (KILOTONS) 2022-2029

TABLE 163 CHINA BIOPESTICIDES MARKET BY CROP (USD BILLION) 2022-2029

TABLE 164 CHINA BIOPESTICIDES MARKET BY CROP (KILOTONS) 2022-2029

TABLE 165 JAPAN BIOPESTICIDES MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 166 JAPAN BIOPESTICIDES MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 167 JAPAN BIOPESTICIDES MARKET BY MODE OF APPLICATION (USD BILLION) 2022-2029

TABLE 168 JAPAN BIOPESTICIDES MARKET BY MODE OF APPLICATION (KILOTONS) 2022-2029

TABLE 169 JAPAN BIOPESTICIDES MARKET BY SOURCE (USD BILLION) 2022-2029

TABLE 170 JAPAN BIOPESTICIDES MARKET BY SOURCE (KILOTONS) 2022-2029

TABLE 171 JAPAN BIOPESTICIDES MARKET BY END USER (USD BILLION) 2022-2029

TABLE 172 JAPAN BIOPESTICIDES MARKET BY END USER (KILOTONS) 2022-2029

TABLE 173 JAPAN BIOPESTICIDES MARKET BY FORMULATION (USD BILLION) 2022-2029

TABLE 174 JAPAN BIOPESTICIDES MARKET BY FORMULATION (KILOTONS) 2022-2029

TABLE 175 JAPAN BIOPESTICIDES MARKET BY CROP (USD BILLION) 2022-2029

TABLE 176 JAPAN BIOPESTICIDES MARKET BY CROP (KILOTONS) 2022-2029

TABLE 177 SOUTH KOREA BIOPESTICIDES MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 178 SOUTH KOREA BIOPESTICIDES MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 179 SOUTH KOREA BIOPESTICIDES MARKET BY MODE OF APPLICATION (USD BILLION) 2022-2029

TABLE 180 SOUTH KOREA BIOPESTICIDES MARKET BY MODE OF APPLICATION (KILOTONS) 2022-2029

TABLE 181 SOUTH KOREA BIOPESTICIDES MARKET BY SOURCE (USD BILLION) 2022-2029

TABLE 182 SOUTH KOREA BIOPESTICIDES MARKET BY SOURCE (KILOTONS) 2022-2029

TABLE 183 SOUTH KOREA BIOPESTICIDES MARKET BY END USER (USD BILLION) 2022-2029

TABLE 184 SOUTH KOREA BIOPESTICIDES MARKET BY END USER (KILOTONS) 2022-2029

TABLE 185 SOUTH KOREA BIOPESTICIDES MARKET BY FORMULATION (USD BILLION) 2022-2029

TABLE 186 SOUTH KOREA BIOPESTICIDES MARKET BY FORMULATION (KILOTONS) 2022-2029

TABLE 187 SOUTH KOREA BIOPESTICIDES MARKET BY CROP (USD BILLION) 2022-2029

TABLE 188 SOUTH KOREA BIOPESTICIDES MARKET BY CROP (KILOTONS) 2022-2029

TABLE 189 AUSTRALIA BIOPESTICIDES MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 190 AUSTRALIA BIOPESTICIDES MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 191 AUSTRALIA BIOPESTICIDES MARKET BY MODE OF APPLICATION (USD BILLION) 2022-2029

TABLE 192 AUSTRALIA BIOPESTICIDES MARKET BY MODE OF APPLICATION (KILOTONS) 2022-2029

TABLE 193 AUSTRALIA BIOPESTICIDES MARKET BY SOURCE (USD BILLION) 2022-2029

TABLE 194 AUSTRALIA BIOPESTICIDES MARKET BY SOURCE (KILOTONS) 2022-2029

TABLE 195 AUSTRALIA BIOPESTICIDES MARKET BY END USER (USD BILLION) 2022-2029

TABLE 196 AUSTRALIA BIOPESTICIDES MARKET BY END USER (KILOTONS) 2022-2029

TABLE 197 AUSTRALIA BIOPESTICIDES MARKET BY FORMULATION (USD BILLION) 2022-2029

TABLE 198 AUSTRALIA BIOPESTICIDES MARKET BY FORMULATION (KILOTONS) 2022-2029

TABLE 199 AUSTRALIA BIOPESTICIDES MARKET BY CROP (USD BILLION) 2022-2029

TABLE 200 AUSTRALIA BIOPESTICIDES MARKET BY CROP (KILOTONS) 2022-2029

TABLE 201 SOUTH-EAST ASIA BIOPESTICIDES MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 202 SOUTH-EAST ASIA BIOPESTICIDES MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 203 SOUTH-EAST ASIA BIOPESTICIDES MARKET BY MODE OF APPLICATION (USD BILLION) 2022-2029

TABLE 204 SOUTH-EAST ASIA BIOPESTICIDES MARKET BY MODE OF APPLICATION (KILOTONS) 2022-2029

TABLE 205 SOUTH-EAST ASIA BIOPESTICIDES MARKET BY SOURCE (USD BILLION) 2022-2029

TABLE 206 SOUTH-EAST ASIA BIOPESTICIDES MARKET BY SOURCE (KILOTONS) 2022-2029

TABLE 207 SOUTH-EAST ASIA BIOPESTICIDES MARKET BY END USER (USD BILLION) 2022-2029

TABLE 208 SOUTH-EAST ASIA BIOPESTICIDES MARKET BY END USER (KILOTONS) 2022-2029

TABLE 209 SOUTH-EAST ASIA BIOPESTICIDES MARKET BY FORMULATION (USD BILLION) 2022-2029

TABLE 210 SOUTH-EAST ASIA BIOPESTICIDES MARKET BY FORMULATION (KILOTONS) 2022-2029

TABLE 211 SOUTH-EAST ASIA BIOPESTICIDES MARKET BY CROP (USD BILLION) 2022-2029

TABLE 212 SOUTH-EAST ASIA BIOPESTICIDES MARKET BY CROP (KILOTONS) 2022-2029

TABLE 213 REST OF ASIA PACIFIC BIOPESTICIDES MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 214 REST OF ASIA PACIFIC BIOPESTICIDES MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 215 REST OF ASIA PACIFIC BIOPESTICIDES MARKET BY MODE OF APPLICATION (USD BILLION) 2022-2029

TABLE 216 REST OF ASIA PACIFIC BIOPESTICIDES MARKET BY MODE OF APPLICATION (KILOTONS) 2022-2029

TABLE 217 REST OF ASIA PACIFIC BIOPESTICIDES MARKET BY SOURCE (USD BILLION) 2022-2029

TABLE 218 REST OF ASIA PACIFIC BIOPESTICIDES MARKET BY SOURCE (KILOTONS) 2022-2029

TABLE 219 REST OF ASIA PACIFIC BIOPESTICIDES MARKET BY END USER (USD BILLION) 2022-2029

TABLE 220 REST OF ASIA PACIFIC BIOPESTICIDES MARKET BY END USER (KILOTONS) 2022-2029

TABLE 221 REST OF ASIA PACIFIC BIOPESTICIDES MARKET BY FORMULATION (USD BILLION) 2022-2029

TABLE 222 REST OF ASIA PACIFIC BIOPESTICIDES MARKET BY FORMULATION (KILOTONS) 2022-2029

TABLE 223 REST OF ASIA PACIFIC BIOPESTICIDES MARKET BY CROP (USD BILLION) 2022-2029

TABLE 224 REST OF ASIA PACIFIC BIOPESTICIDES MARKET BY CROP (KILOTONS) 2022-2029

TABLE 225 EUROPE BIOPESTICIDES MARKET BY COUNTRY (USD BILLION) 2022-2029

TABLE 226 EUROPE BIOPESTICIDES MARKET BY COUNTRY (KILOTONS) 2022-2029

TABLE 227 EUROPE BIOPESTICIDES MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 228 EUROPE BIOPESTICIDES MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 229 EUROPE BIOPESTICIDES MARKET BY MODE OF APPLICATION (USD BILLION) 2022-2029

TABLE 230 EUROPE BIOPESTICIDES MARKET BY MODE OF APPLICATION (KILOTONS) 2022-2029

TABLE 231 EUROPE BIOPESTICIDES MARKET BY SOURCE (USD BILLION) 2022-2029

TABLE 232 EUROPE BIOPESTICIDES MARKET BY SOURCE (KILOTONS) 2022-2029

TABLE 233 EUROPE BIOPESTICIDES MARKET BY END USER (USD BILLION) 2022-2029

TABLE 234 EUROPE BIOPESTICIDES MARKET BY END USER (KILOTONS) 2022-2029

TABLE 235 EUROPE BIOPESTICIDES MARKET BY FORMULATION (USD BILLION) 2022-2029

TABLE 236 ASIA-PACIFIC BIOPESTICIDES MARKET BY FORMULATION (KILOTONS) 2022-2029

TABLE 237 ASIA-PACIFIC BIOPESTICIDES MARKET BY CROP (USD BILLION) 2022-2029

TABLE 238 ASIA-PACIFIC BIOPESTICIDES MARKET BY CROP (KILOTONS) 2022-2029

TABLE 239 GERMANY BIOPESTICIDES MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 240 GERMANY BIOPESTICIDES MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 241 GERMANY BIOPESTICIDES MARKET BY MODE OF APPLICATION (USD BILLION) 2022-2029

TABLE 242 GERMANY BIOPESTICIDES MARKET BY MODE OF APPLICATION (KILOTONS) 2022-2029

TABLE 243 GERMANY BIOPESTICIDES MARKET BY SOURCE (USD BILLION) 2022-2029

TABLE 244 GERMANY BIOPESTICIDES MARKET BY SOURCE (KILOTONS) 2022-2029

TABLE 245 GERMANY BIOPESTICIDES MARKET BY END USER (USD BILLION) 2022-2029

TABLE 246 GERMANY BIOPESTICIDES MARKET BY END USER (KILOTONS) 2022-2029

TABLE 247 GERMANY BIOPESTICIDES MARKET BY FORMULATION (USD BILLION) 2022-2029

TABLE 248 GERMANY BIOPESTICIDES MARKET BY FORMULATION (KILOTONS) 2022-2029

TABLE 249 GERMANY BIOPESTICIDES MARKET BY CROP (USD BILLION) 2022-2029

TABLE 250 GERMANY BIOPESTICIDES MARKET BY CROP (KILOTONS) 2022-2029

TABLE 251 UK BIOPESTICIDES MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 252 UK BIOPESTICIDES MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 253 UK BIOPESTICIDES MARKET BY MODE OF APPLICATION (USD BILLION) 2022-2029

TABLE 254 UK BIOPESTICIDES MARKET BY MODE OF APPLICATION (KILOTONS) 2022-2029

TABLE 255 UK BIOPESTICIDES MARKET BY SOURCE (USD BILLION) 2022-2029

TABLE 256 UK BIOPESTICIDES MARKET BY SOURCE (KILOTONS) 2022-2029

TABLE 257 UK BIOPESTICIDES MARKET BY END USER (USD BILLION) 2022-2029

TABLE 258 UK BIOPESTICIDES MARKET BY END USER (KILOTONS) 2022-2029

TABLE 259 UK BIOPESTICIDES MARKET BY FORMULATION (USD BILLION) 2022-2029

TABLE 260 UK BIOPESTICIDES MARKET BY FORMULATION (KILOTONS) 2022-2029

TABLE 261 UK BIOPESTICIDES MARKET BY CROP (USD BILLION) 2022-2029

TABLE 262 UK BIOPESTICIDES MARKET BY CROP (KILOTONS) 2022-2029

TABLE 263 FRANCE BIOPESTICIDES MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 264 FRANCE BIOPESTICIDES MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 265 FRANCE BIOPESTICIDES MARKET BY MODE OF APPLICATION (USD BILLION) 2022-2029

TABLE 266 FRANCE BIOPESTICIDES MARKET BY MODE OF APPLICATION (KILOTONS) 2022-2029

TABLE 267 FRANCE BIOPESTICIDES MARKET BY SOURCE (USD BILLION) 2022-2029

TABLE 268 FRANCE BIOPESTICIDES MARKET BY SOURCE (KILOTONS) 2022-2029

TABLE 269 FRANCE BIOPESTICIDES MARKET BY END USER (USD BILLION) 2022-2029

TABLE 270 FRANCE BIOPESTICIDES MARKET BY END USER (KILOTONS) 2022-2029

TABLE 271 FRANCE BIOPESTICIDES MARKET BY FORMULATION (USD BILLION) 2022-2029

TABLE 272 FRANCE BIOPESTICIDES MARKET BY FORMULATION (KILOTONS) 2022-2029

TABLE 273 FRANCE BIOPESTICIDES MARKET BY CROP (USD BILLION) 2022-2029

TABLE 274 FRANCE BIOPESTICIDES MARKET BY CROP (KILOTONS) 2022-2029

TABLE 275 ITALY BIOPESTICIDES MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 276 ITALY BIOPESTICIDES MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 277 ITALY BIOPESTICIDES MARKET BY MODE OF APPLICATION (USD BILLION) 2022-2029

TABLE 278 ITALY BIOPESTICIDES MARKET BY MODE OF APPLICATION (KILOTONS) 2022-2029

TABLE 279 ITALY BIOPESTICIDES MARKET BY SOURCE (USD BILLION) 2022-2029

TABLE 280 ITALY BIOPESTICIDES MARKET BY SOURCE (KILOTONS) 2022-2029

TABLE 281 ITALY BIOPESTICIDES MARKET BY END USER (USD BILLION) 2022-2029

TABLE 282 ITALY BIOPESTICIDES MARKET BY END USER (KILOTONS) 2022-2029

TABLE 283 ITALY BIOPESTICIDES MARKET BY FORMULATION (USD BILLION) 2022-2029

TABLE 284 ITALY BIOPESTICIDES MARKET BY FORMULATION (KILOTONS) 2022-2029

TABLE 285 ITALY BIOPESTICIDES MARKET BY CROP (USD BILLION) 2022-2029

TABLE 286 ITALY BIOPESTICIDES MARKET BY CROP (KILOTONS) 2022-2029

TABLE 287 SPAIN BIOPESTICIDES MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 288 SPAIN BIOPESTICIDES MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 289 SPAIN BIOPESTICIDES MARKET BY MODE OF APPLICATION (USD BILLION) 2022-2029

TABLE 290 SPAIN BIOPESTICIDES MARKET BY MODE OF APPLICATION (KILOTONS) 2022-2029

TABLE 291 SPAIN BIOPESTICIDES MARKET BY SOURCE (USD BILLION) 2022-2029

TABLE 292 SPAIN BIOPESTICIDES MARKET BY SOURCE (KILOTONS) 2022-2029

TABLE 293 SPAIN BIOPESTICIDES MARKET BY END USER (USD BILLION) 2022-2029

TABLE 294 SPAIN BIOPESTICIDES MARKET BY END USER (KILOTONS) 2022-2029

TABLE 295 SPAIN BIOPESTICIDES MARKET BY FORMULATION (USD BILLION) 2022-2029

TABLE 296 SPAIN BIOPESTICIDES MARKET BY FORMULATION (KILOTONS) 2022-2029

TABLE 297 SPAIN BIOPESTICIDES MARKET BY CROP (USD BILLION) 2022-2029

TABLE 298 SPAIN BIOPESTICIDES MARKET BY CROP (KILOTONS) 2022-2029

TABLE 299 RUSSIA BIOPESTICIDES MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 300 RUSSIA BIOPESTICIDES MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 301 RUSSIA BIOPESTICIDES MARKET BY MODE OF APPLICATION (USD BILLION) 2022-2029

TABLE 302 RUSSIA BIOPESTICIDES MARKET BY MODE OF APPLICATION (KILOTONS) 2022-2029

TABLE 303 RUSSIA BIOPESTICIDES MARKET BY SOURCE (USD BILLION) 2022-2029

TABLE 304 RUSSIA BIOPESTICIDES MARKET BY SOURCE (KILOTONS) 2022-2029

TABLE 305 RUSSIA BIOPESTICIDES MARKET BY END USER (USD BILLION) 2022-2029

TABLE 306 RUSSIA BIOPESTICIDES MARKET BY END USER (KILOTONS) 2022-2029

TABLE 307 RUSSIA BIOPESTICIDES MARKET BY FORMULATION (USD BILLION) 2022-2029

TABLE 308 RUSSIA BIOPESTICIDES MARKET BY FORMULATION (KILOTONS) 2022-2029

TABLE 309 RUSSIA BIOPESTICIDES MARKET BY CROP (USD BILLION) 2022-2029

TABLE 310 RUSSIA BIOPESTICIDES MARKET BY CROP (KILOTONS) 2022-2029

TABLE 311 REST OF EUROPE BIOPESTICIDES MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 312 REST OF EUROPE BIOPESTICIDES MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 313 REST OF EUROPE BIOPESTICIDES MARKET BY MODE OF APPLICATION (USD BILLION) 2022-2029

TABLE 314 REST OF EUROPE BIOPESTICIDES MARKET BY MODE OF APPLICATION (KILOTONS) 2022-2029

TABLE 315 REST OF EUROPE BIOPESTICIDES MARKET BY SOURCE (USD BILLION) 2022-2029

TABLE 316 REST OF EUROPE BIOPESTICIDES MARKET BY SOURCE (KILOTONS) 2022-2029

TABLE 317 REST OF EUROPE BIOPESTICIDES MARKET BY END USER (USD BILLION) 2022-2029

TABLE 318 REST OF EUROPE BIOPESTICIDES MARKET BY END USER (KILOTONS) 2022-2029

TABLE 319 REST OF EUROPE BIOPESTICIDES MARKET BY FORMULATION (USD BILLION) 2022-2029

TABLE 320 REST OF EUROPE BIOPESTICIDES MARKET BY FORMULATION (KILOTONS) 2022-2029

TABLE 321 REST OF EUROPE BIOPESTICIDES MARKET BY CROP (USD BILLION) 2022-2029

TABLE 322 REST OF EUROPE BIOPESTICIDES MARKET BY CROP (KILOTONS) 2022-2029

TABLE 323 MIDDLE EAST AND AFRICA BIOPESTICIDES MARKET BY COUNTRY (USD BILLION) 2022-2029

TABLE 324 MIDDLE EAST AND AFRICA BIOPESTICIDES MARKET BY COUNTRY (KILOTONS) 2022-2029

TABLE 325 MIDDLE EAST AND AFRICA BIOPESTICIDES MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 326 MIDDLE EAST AND AFRICA BIOPESTICIDES MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 327 MIDDLE EAST AND AFRICA BIOPESTICIDES MARKET BY MODE OF APPLICATION (USD BILLION) 2022-2029

TABLE 328 MIDDLE EAST AND AFRICA BIOPESTICIDES MARKET BY MODE OF APPLICATION (KILOTONS) 2022-2029

TABLE 329 MIDDLE EAST AND AFRICA BIOPESTICIDES MARKET BY SOURCE (USD BILLION) 2022-2029

TABLE 330 MIDDLE EAST AND AFRICA BIOPESTICIDES MARKET BY SOURCE (KILOTONS) 2022-2029

TABLE 331 MIDDLE EAST AND AFRICA BIOPESTICIDES MARKET BY END USER (USD BILLION) 2022-2029

TABLE 332 MIDDLE EAST AND AFRICA BIOPESTICIDES MARKET BY END USER (KILOTONS) 2022-2029

TABLE 333 MIDDLE EAST AND AFRICA BIOPESTICIDES MARKET BY FORMULATION (USD BILLION) 2022-2029

TABLE 334 MIDDLE EAST AND AFRICA BIOPESTICIDES MARKET BY FORMULATION (KILOTONS) 2022-2029

TABLE 335 MIDDLE EAST AND AFRICA BIOPESTICIDES MARKET BY CROP (USD BILLION) 2022-2029

TABLE 336 MIDDLE EAST AND AFRICA BIOPESTICIDES MARKET BY CROP (KILOTONS) 2022-2029

TABLE 337 UAE BIOPESTICIDES MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 338 UAE BIOPESTICIDES MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 339 UAE BIOPESTICIDES MARKET BY MODE OF APPLICATION (USD BILLION) 2022-2029

TABLE 340 UAE BIOPESTICIDES MARKET BY MODE OF APPLICATION (KILOTONS) 2022-2029

TABLE 341 UAE BIOPESTICIDES MARKET BY SOURCE (USD BILLION) 2022-2029

TABLE 342 UAE BIOPESTICIDES MARKET BY SOURCE (KILOTONS) 2022-2029

TABLE 343 UAE BIOPESTICIDES MARKET BY END USER (USD BILLION) 2022-2029

TABLE 344 UAE BIOPESTICIDES MARKET BY END USER (KILOTONS) 2022-2029

TABLE 345 UAE BIOPESTICIDES MARKET BY FORMULATION (USD BILLION) 2022-2029

TABLE 346 UAE BIOPESTICIDES MARKET BY FORMULATION (KILOTONS) 2022-2029

TABLE 347 UAE BIOPESTICIDES MARKET BY CROP (USD BILLION) 2022-2029

TABLE 348 UAE BIOPESTICIDES MARKET BY CROP (KILOTONS) 2022-2029

TABLE 349 SAUDI ARABIA BIOPESTICIDES MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 350 SAUDI ARABIA BIOPESTICIDES MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 351 SAUDI ARABIA BIOPESTICIDES MARKET BY MODE OF APPLICATION (USD BILLION) 2022-2029

TABLE 352 SAUDI ARABIA BIOPESTICIDES MARKET BY MODE OF APPLICATION (KILOTONS) 2022-202

TABLE 353 SAUDI ARABIA BIOPESTICIDES MARKET BY SOURCE (USD BILLION) 2022-2029

TABLE 354 SAUDI ARABIA BIOPESTICIDES MARKET BY SOURCE (KILOTONS) 2022-2029

TABLE 355 SAUDI ARABIA BIOPESTICIDES MARKET BY END USER (USD BILLION) 2022-2029

TABLE 356 SAUDI ARABIA BIOPESTICIDES MARKET BY END USER (KILOTONS) 2022-2029

TABLE 357 SAUDI ARABIA BIOPESTICIDES MARKET BY FORMULATION (USD BILLION) 2022-2029

TABLE 358 SAUDI ARABIA BIOPESTICIDES MARKET BY FORMULATION (KILOTONS) 2022-2029

TABLE 359 SAUDI ARABIA BIOPESTICIDES MARKET BY CROP (USD BILLION) 2022-2029

TABLE 360 SAUDI ARABIA BIOPESTICIDES MARKET BY CROP (KILOTONS) 2022-2029

TABLE 361 SOUTH AFRICA BIOPESTICIDES MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 362 SOUTH AFRICA BIOPESTICIDES MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 363 SOUTH AFRICA BIOPESTICIDES MARKET BY MODE OF APPLICATION (USD BILLION) 2022-2029

TABLE 364 SOUTH AFRICA BIOPESTICIDES MARKET BY MODE OF APPLICATION (KILOTONS) 2022-2029

TABLE 365 SOUTH AFRICA BIOPESTICIDES MARKET BY SOURCE (USD BILLION) 2022-2029

TABLE 366 SOUTH AFRICA BIOPESTICIDES MARKET BY SOURCE (KILOTONS) 2022-2029

TABLE 367 SOUTH AFRICA BIOPESTICIDES MARKET BY END USER (USD BILLION) 2022-2029

TABLE 368 SOUTH AFRICA BIOPESTICIDES MARKET BY END USER (KILOTONS) 2022-2029

TABLE 369 SOUTH AFRICA BIOPESTICIDES MARKET BY FORMULATION (USD BILLION) 2022-2029

TABLE 370 SOUTH AFRICA BIOPESTICIDES MARKET BY FORMULATION (KILOTONS) 2022-202

TABLE 371 SOUTH AFRICA BIOPESTICIDES MARKET BY CROP (USD BILLION) 2022-2029

TABLE 372 SOUTH AFRICA BIOPESTICIDES MARKET BY CROP (KILOTONS) 2022-2029

TABLE 373 REST OF MIDDLE EAST AND AFRICA BIOPESTICIDES MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 374 REST OF MIDDLE EAST AND AFRICA BIOPESTICIDES MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 375 REST OF MIDDLE EAST AND AFRICA BIOPESTICIDES MARKET BY MODE OF APPLICATION (USD BILLION) 2022-2029

TABLE 376 REST OF MIDDLE EAST AND AFRICA BIOPESTICIDES MARKET BY MODE OF APPLICATION (KILOTONS) 2022-2029

TABLE 377 REST OF MIDDLE EAST AND AFRICA BIOPESTICIDES MARKET BY SOURCE (USD BILLION) 2022-2029

TABLE 378 REST OF MIDDLE EAST AND AFRICA BIOPESTICIDES MARKET BY SOURCE (KILOTONS) 2022-2029

TABLE 379 REST OF MIDDLE EAST AND AFRICA BIOPESTICIDES MARKET BY END USER (USD BILLION) 2022-2029

TABLE 380 REST OF MIDDLE EAST AND AFRICA BIOPESTICIDES MARKET BY END USER (KILOTONS) 2022-2029

TABLE 381 REST OF MIDDLE EAST AND AFRICA BIOPESTICIDES MARKET BY FORMULATION (USD BILLION) 2022-2029

TABLE 382 REST OF MIDDLE EAST AND AFRICA BIOPESTICIDES MARKET BY FORMULATION (KILOTONS) 2022-2029

TABLE 383 REST OF MIDDLE EAST AND AFRICA BIOPESTICIDES MARKET BY CROP (USD BILLION) 2022-2029

TABLE 384 REST OF MIDDLE EAST AND AFRICA BIOPESTICIDES MARKET BY CROP (KILOTONS) 2022-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL BIOPESTICIDES MARKET BY TYPE, USD BILLION, 2022-2029

FIGURE 9 GLOBAL BIOPESTICIDES MARKET BY MODE OF APPLICATION, USD BILLION, 2022-2029

FIGURE 10 GLOBAL BIOPESTICIDES MARKET BY FORMULATION, USD BILLION, 2022-2029

FIGURE 11 GLOBAL BIOPESTICIDES MARKET BY END USER, USD BILLION, 2022-2029

FIGURE 12 GLOBAL BIOPESTICIDES MARKET BY SOURCE, USD BILLION, 2022-2029

FIGURE 13 GLOBAL BIOPESTICIDES MARKET BY CROP, USD BILLION, 2022-2029

FIGURE 14 GLOBAL BIOPESTICIDES MARKET BY REGION, USD BILLION, 2022-2029

FIGURE 15 PORTER’S FIVE FORCES MODEL

FIGURE 16 GLOBAL BIOPESTICIDES MARKET BY TYPE, 2021

FIGURE 17 GLOBAL BIOPESTICIDES MARKET BY MODE OF APPLICATION, USD BILLION, 2021

FIGURE 18 GLOBAL BIOPESTICIDES MARKET BY FORMULATION, USD BILLION, 2021

FIGURE 19 GLOBAL BIOPESTICIDES MARKET BY END USER, USD BILLION, 2021

FIGURE 20 GLOBAL BIOPESTICIDES MARKET BY SOURCE, USD BILLION, 2021

FIGURE 21 GLOBAL BIOPESTICIDES MARKET BY CROP, USD BILLION, 2021

FIGURE 22 BIOPESTICIDES MARKET BY REGION, USD BILLION, 2021

FIGURE 23 MARKET SHARE ANALYSIS

FIGURE 24 BASF SE: COMPANY SNAPSHOT

FIGURE 25 SYNGENTA AG: COMPANY SNAPSHOT

FIGURE 26 BAYER CROP SCIENCE: COMPANY SNAPSHOT

FIGURE 27 MARRONE BIO INNOVATIONS: COMPANY SNAPSHOT

FIGURE 28 NOVOZYMES: COMPANY SNAPSHOT

FIGURE 29 KOPPERT BIOLOGICAL SYSTEMS: COMPANY SNAPSHOT

FIGURE 30 BIOBEST NV: COMPANY SNAPSHOT

FIGURE 31 BIOWORKS INC: COMPANY SNAPSHOT

FIGURE 32 GOWAN GROUP: COMPANY SNAPSHOT

FAQ

The Biopesticides market is expected to grow at 15.77 % CAGR from 2022 to 2029. It is expected to reach above USD 18.15 billion by 2029 from USD 6.51 billion in 2022.

Growing government initiatives to promote the use of biopesticides globally, rising investments from leading crop protection companies in the biopesticides market, rising environmental safety awareness regarding the use of biopesticides, expanding organic farming and the demand for organic food, and growing organic farming and government initiatives are some of the factors driving the growth of the Biopesticides market. Biopesticides are pesticides made from naturally occurring sources, such as plants, animals, and microorganisms (biopesticides).

Biopesticides are regarded as the most potent, ecologically secure, and target-specific alternative to synthetic pesticides. These factors have led to its usage as a substitute for chemical pesticides in pest management programs all over the world. Biopesticides come from a variety of living creatures, including fungi, bacteria, algae, viruses, nematodes, and protozoa. In addition to promoting the sustainable expansion of agriculture, the development of biopesticide applications greatly reduces the environmental damage caused by chemically manufactured insecticide residues. Since the creation of biopesticides, a large number of products have been authorized and registered, some of which have gained significant traction in the agricultural market.

The Market’s largest share is in the North American region.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.