Report Outlook

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 34.36 billion by 2029 | 14.97% | Asia Pacific |

| By Method | By Application | By Trait | By Region |

|---|---|---|---|

|

|

|

|

SCOPE OF THE REPORT

Plant Breeding and CRISPR Plants Market Overview

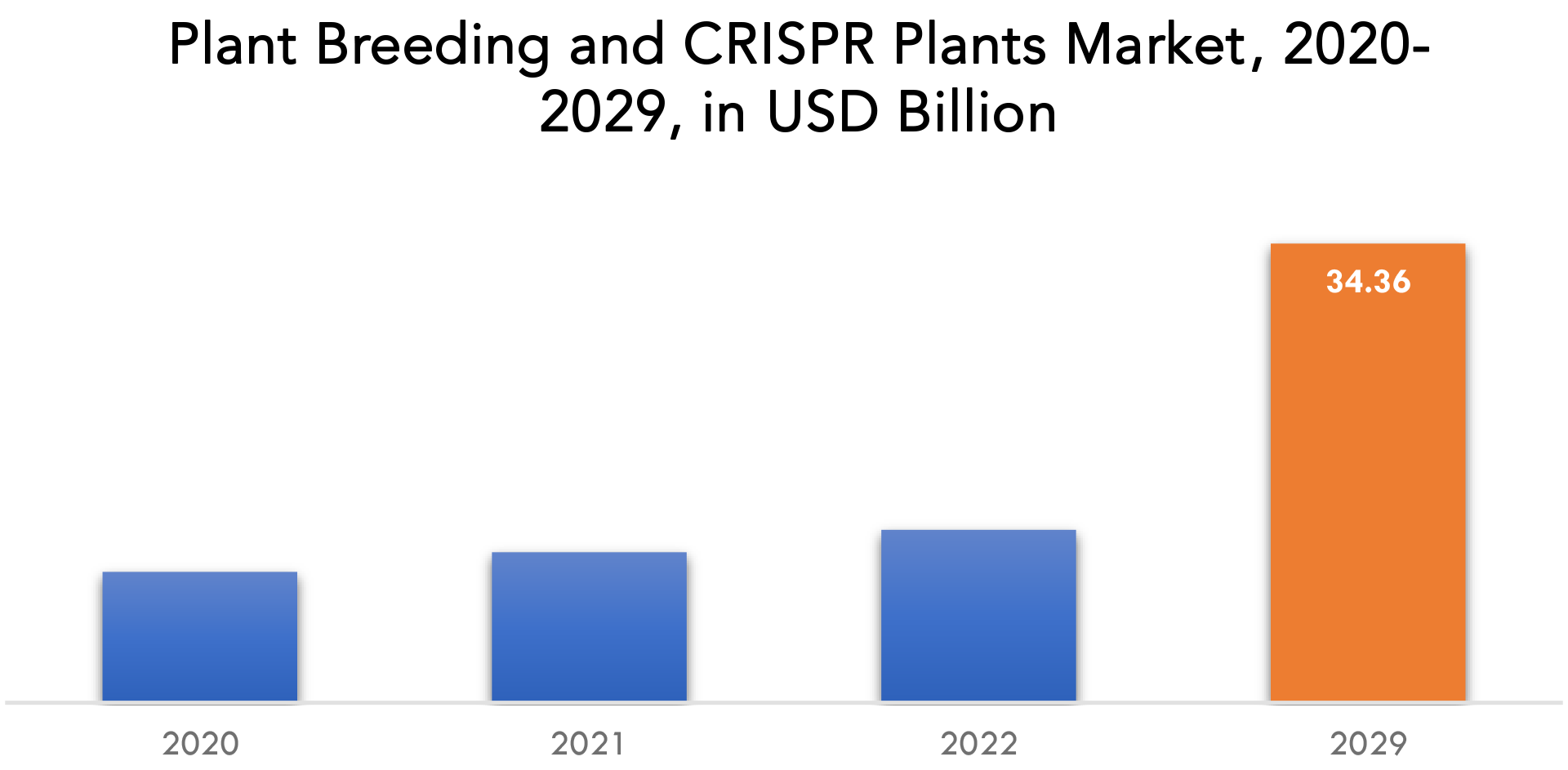

The global plant breeding and CRISPR plants market size is expected to grow at more than 14.97% CAGR from 2023 to 2029. It is expected to reach above USD 34.36 billion by 2029 from a little above USD 9.79 billion in 2022.

Plant breeding and CRISPR plants market by modifying the plant genome with the aid of molecular or conservatory tools in order to obtain the desired gene or trait, plant breeding is a method used by farmers to create new crop varieties, enhance existing ones, and increase the yield of their crops. Use of site-directed nucleases in plant breeding allows for extremely precise transformation of DNA into wanted DNA. CRISPR is a technology used in plant breeding, where a prokaryotic gene called CRISPR-CAS is used to modify the genome of the plant to produce germplasm with better and advantageous characteristics. The crop created by plant breeding or CRISPR technology possesses traits like high yield, superior quality to conventional crops, disease resistance, herbicide tolerance, climatic tolerance, and others. Additionally, crops are developed using plant breeding techniques that have a number of advantages, including superior quality, higher yields, and disease resistance. The best choice for sustainable crop production also includes plant breeding and CRISPR technology.

Climate change, rapid population growth, rising food consumption, declining biodiversity, and other factors all have an effect on crop plant productivity and production, which in turn has an impact on agricultural production. Food security, ecosystems, economic stability, and water resources are all seriously threatened by the severe global problem that is climate change. The world is also being impacted by climate change by reduced output; heat and drought in tropical areas of the world hinder crop growth and production. As a result, climate change may have an irreversible negative effect on agricultural productivity and have an impact on global food security. The development of high-yielding and resistant crop varieties against production constraints is a crucial component of plant breeding’s role in overcoming these crop plant production barriers. The effects of erratic weather that seriously damages crops are being reduced around the globe through the use of plant breeding techniques. Crops that can withstand adverse weather conditions like drought, torrential rain, and others are being created with the aid of plant breeding to help reduce crop loss. It is anticipated that the market for plant breeding will expand in the future years as a result of the rising demand for new crop varieties that are resistant to extreme climatic conditions.

| ATTRIBUTE | DETAILS |

| Study period | 2023-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2023-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion) |

| Segmentation | By Method, By Application, By Trait, By Region |

| By Method

|

|

| By Application

|

|

| By Trait

|

|

| By Region

|

|

Growing public knowledge of the unintended toxins present in plant breeding crops, which have the potential to be harmful to human health, as well as strict government regulations, are the main factors limiting the growth of plant breeding and CRISPR plants. A further factor slowing the market’s development in the anticipated period is the high cost of modern plant breeding techniques compared to traditional techniques.

Every sector in the world suffered greatly as a result of the financial crisis even as the world was going through a typical situation due to the corona virus pandemic. Companies were firing the employees as they were unable to pay their salaries due to financial difficulties. Each sector had affected by the unprecedented events that this unexpected pandemic had triggered. The government’s strict lockdown regulations caused all manufacturing facilities to stop operating, which had steadily reduced the market value of plant breeding and CRISPR plants during the outbreak. Now after first half of 2022, all the markets are recovering from the corona outbreak according to industry experts. As successful vaccination drives around the world have helped people to recover faster and helped them to avoid from getting infected, the markets are now growing in the full speed.

Plant Breeding and CRISPR Plants Market Segment Analysis

Based on the method, market is segmented into conventional and biotechnological. In terms of market share for plant breeding, the biotechnological breeding technique segment is anticipated to dominate. Due to the growing use of hybrid and molecular breeding techniques in developing nations and the expansion of the cultivation of GM crops globally, this sector has a sizable market share. The increasing adoption of genetic modification methods across a number of nations and the decreasing cost of genetic procedures, which raises demand for genetic engineering and genome editing globally, are the main drivers of this market segment’s development. Furthermore, molecular breeding is not subject to any laws or regulations, in contrast to genetic techniques, which supports the expansion of this industry.

Based on the application, market is segmented into cereals & grains, oilseed & pulse and fruits & vegetables. The largest share of the global plant breeding market is anticipated to be held by the cereals & grains sector. Due to the expanding population, there is a rising demand for grains and cereals, which is why this sector has a large market share. Additionally, the accessibility of these crops’ germplasm promotes the use of cutting-edge agricultural breeding methods. The growing demand for high-quality wheat and rice in the food industry as well as the economic significance of maize due to its applications in many different industries are pushing cereal and grain seed producers to adopt hybrid breeding techniques.

By trait, market is segmented into herbicide tolerance, disease resistance and yield improvements. In terms of market share for plant breeding, the herbicide tolerance sector is anticipated to lead. Due to strict laws governing the use of chemical pesticides and an increase in pest attacks during the early stages of germination, there is a greater demand for pesticide-tolerant seeds, which is why this section of the market holds such a significant market share. Major plant genetic companies’ growing efforts to create traits for transgenic and non-transgenic crops that can withstand herbicides are credited with the development of this market.

Plant Breeding and CRISPR Plants Market Players

Key competitors from both domestic and international markets compete fiercely in the worldwide global Plant Breeding and CRISPR Plants industry include Bayer AG, Sygneta AG, KWS Group, Corteva Agriscience, Limagrain, BASF SE, DLF Seeds A/S, Bioceres Crop Solutions, UPL Limited, Benson Hill Inc., Equinom Ltd., BioConsortia Inc., Hudson River Biotechnology.

Recent News:

- 31st January 2023: Bayer announced a partnership with French company M2i Group to supply fruit and vegetable growers around the world with pheromone-based biological crop protection products.

- 19th January 2023: Bayer and the agricultural biotech company Oerth Bio announced new collaboration seeking to develop the next generation of more sustainable crop protection products.

Who Should Buy? Or Key Stakeholders

- Plant Breeding and CRISPR Plants Providers

- Agriculture Equipment Vendors

- Government and Research Organizations

- Agricultural Consultants

- Farmers

- Investors

- Others

Plant Breeding and CRISPR Plants Market Regional Analysis

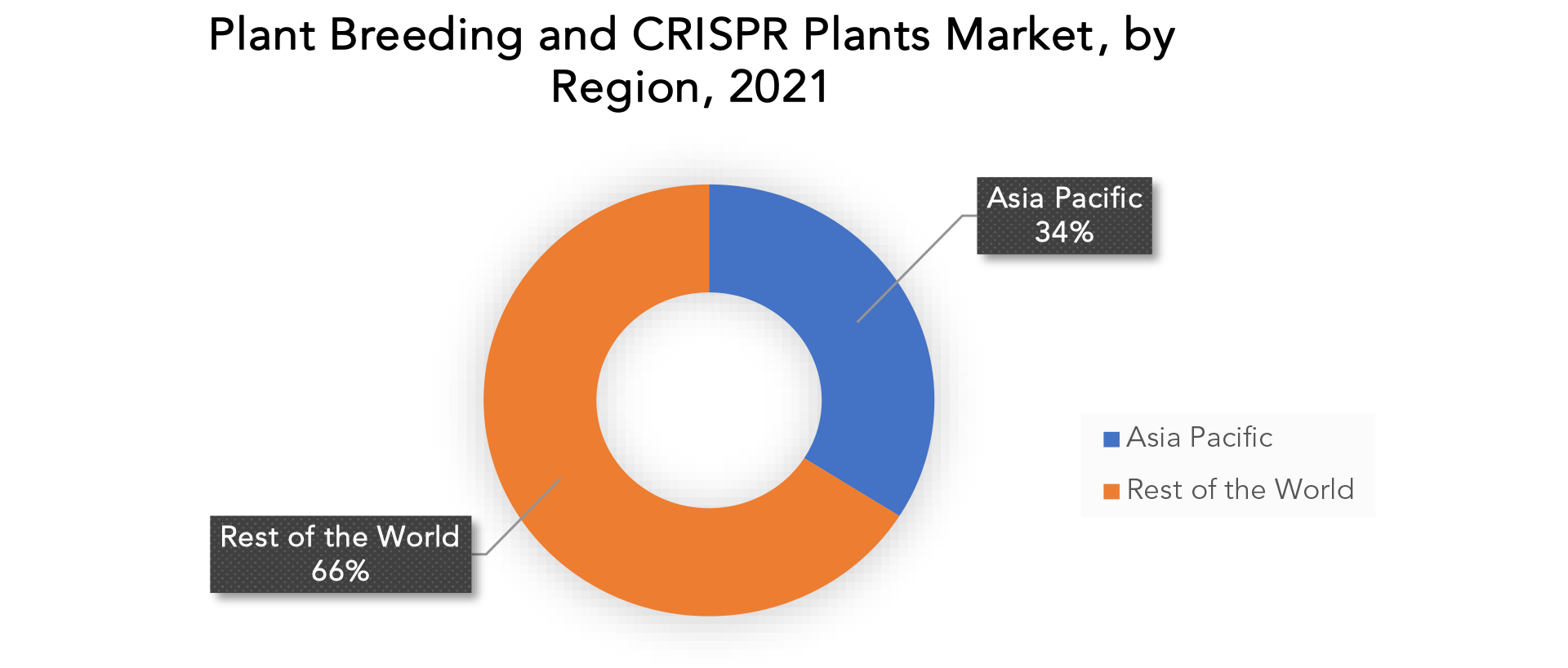

The global plant breeding and CRISPR plants market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

Asia Pacific held largest market share of plant breeding and CRISPR plants market with staggering 34 percent. In line with the expanding economic development conditions, there has been an ever-increasing demand for commercial seeds in the Asian market. Additionally, seed firms like Bayer, Monsanto, and Syngenta have been expanding their R&D facilities throughout the Asia Pacific as a result of their growing interest in capturing this potential market. While private investments have skyrocketed, public investments in plant science have been steadily declining. In addition, the expansion of the biotechnology sector in China, Japan, and India turns into a high potential for growth for the plant breeding market over the course of the forecast period.

Key Market Segments: Plant Breeding and CRISPR Plants Market

Global Plant Breeding and Crispr Plants Market By Method, 2023-2029, (USD Billion)

- Conventioanl

- Biotechnological

Global Plant Breeding and Crispr Plants Market By Application, 2023-2029, (USD Billion)

- Cereals & Grains

- Oilseed & Pulse

- Fruits & Vegetables

Global Plant Breeding and Crispr Plants Market By Trait, 2023-2029, (USD Billion)

- Herbicide Tolerance

- Disease Resistance

- Yield Improvements

Global Plant Breeding and Crispr Plants Market By Region, 2023-2029, (USD Billion)

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered

Exactitude Consultancy Services Key Objectives

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new market

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the plant breeding and CRISPR plants market over the next 7 years?

- Who are the major players in the plant breeding and CRISPR plants market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the plant breeding and CRISPR plants market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the plant breeding and CRISPR plants market?

- What is the current and forecasted size and growth rate of the global plant breeding and CRISPR Plants market?

- What are the key drivers of growth in the Plant Breeding and CRISPR Plants market?

- What are the distribution channels and supply chain dynamics in the Plant Breeding and CRISPR plants market?

- What are the technological advancements and innovations in the plant breeding and CRISPR plants market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the plant breeding and CRISPR plants market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the plant breeding and CRISPR plants market?

- What are the service offerings and specifications of leading players in the market?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Plant Breeding and CRISPR Plants Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Plant Breeding and CRISPR Plants Market

- Porter’s five forces model

- Threat from new entrants

- Threat from substitutes

- Bargaining power of suppliers

- Bargaining power of customers

- Degree of competition

- Industry value chain Analysis

- Global Plant Breeding and CRISPR Plants Market Outlook

- Global Plant Breeding and CRISPR Plants Market by Method, 2023-2029, (USD BILLION)

- Conventional

- Biotechnological

- Global Plant Breeding and CRISPR Plants Market by Application, 2023-2029, (USD BILLION)

- Cereals & Grains

- Oilseed & Pulse

- Fruits & Vegetables

- Global Plant Breeding and CRISPR Plants Market by Trait, 2023-2029, (USD BILLION)

- Herbicide Tolerance

- Disease Resistance

- Yield Improvements

- Global Plant Breeding and CRISPR Plants Market by Region, 2023-2029, (USD BILLION)

- North America

- USS

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Colombia

- Rest of South America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- India

- China

- Japan

- South Korea

- Australia

- South-East Asia

- Rest of Asia Pacific

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East and Africa

- North America

- Company Profiles*

(Business Overview, Company Snapshot, Products Offered, Recent Developments)

- Bayer AG

- Sygneta AG

- KWS Group

- Corteva Agriscience

- Limagrain

- BASF SE

- DLF Seeds A/S

- Bioceres Crop Solutions

- UPL Limited

- Benson Hill Inc.

- Equinom Ltd.

- BioConsortia Inc.

- Hudson River Biotechnology

*The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL PLANT BREEDING AND CRISPR PLANTS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 2 GLOBAL PLANT BREEDING AND CRISPR PLANTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 3 GLOBAL PLANT BREEDING AND CRISPR PLANTS MARKET BY TRAIT (USD BILLION) 2020-2029

TABLE 4 GLOBAL PLANT BREEDING AND CRISPR PLANTS MARKET BY REGION (USD BILLION) 2020-2029

TABLE 5 NORTH AMERICA PLANT BREEDING AND CRISPR PLANTS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 6 NORTH AMERICA PLANT BREEDING AND CRISPR PLANTS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 7 NORTH AMERICA PLANT BREEDING AND CRISPR PLANTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 8 NORTH AMERICA PLANT BREEDING AND CRISPR PLANTS MARKET BY TRAIT (USD BILLION) 2020-2029

TABLE 9 US PLANT BREEDING AND CRISPR PLANTS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 10 US PLANT BREEDING AND CRISPR PLANTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 11 US PLANT BREEDING AND CRISPR PLANTS MARKET BY TRAIT (USD BILLION) 2020-2029

TABLE 12 CANADA PLANT BREEDING AND CRISPR PLANTS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 13 CANADA PLANT BREEDING AND CRISPR PLANTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 14 CANADA PLANT BREEDING AND CRISPR PLANTS MARKET BY TRAIT (USD BILLION) 2020-2029

TABLE 15 MEXICO PLANT BREEDING AND CRISPR PLANTS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 16 MEXICO PLANT BREEDING AND CRISPR PLANTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 17 MEXICO PLANT BREEDING AND CRISPR PLANTS MARKET BY TRAIT (USD BILLION) 2020-2029

TABLE 18 SOUTH AMERICA PLANT BREEDING AND CRISPR PLANTS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 19 SOUTH AMERICA PLANT BREEDING AND CRISPR PLANTS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 20 SOUTH AMERICA PLANT BREEDING AND CRISPR PLANTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 21 SOUTH AMERICA PLANT BREEDING AND CRISPR PLANTS MARKET BY TRAIT (USD BILLION) 2020-2029

TABLE 22 BRAZIL PLANT BREEDING AND CRISPR PLANTS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 23 BRAZIL PLANT BREEDING AND CRISPR PLANTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 24 BRAZIL PLANT BREEDING AND CRISPR PLANTS MARKET BY TRAIT (USD BILLION) 2020-2029

TABLE 25 ARGENTINA PLANT BREEDING AND CRISPR PLANTS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 26 ARGENTINA PLANT BREEDING AND CRISPR PLANTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 27 ARGENTINA PLANT BREEDING AND CRISPR PLANTS MARKET BY TRAIT (USD BILLION) 2020-2029

TABLE 28 COLOMBIA PLANT BREEDING AND CRISPR PLANTS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 29 COLOMBIA PLANT BREEDING AND CRISPR PLANTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 30 COLOMBIA PLANT BREEDING AND CRISPR PLANTS MARKET BY TRAIT (USD BILLION) 2020-2029

TABLE 31 REST OF SOUTH AMERICA PLANT BREEDING AND CRISPR PLANTS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 32 REST OF SOUTH AMERICA PLANT BREEDING AND CRISPR PLANTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 33 REST OF SOUTH AMERICA PLANT BREEDING AND CRISPR PLANTS MARKET BY TRAIT (USD BILLION) 2020-2029

TABLE 34 ASIA-PACIFIC PLANT BREEDING AND CRISPR PLANTS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 35 ASIA-PACIFIC PLANT BREEDING AND CRISPR PLANTS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 36 ASIA-PACIFIC PLANT BREEDING AND CRISPR PLANTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 37 ASIA-PACIFIC PLANT BREEDING AND CRISPR PLANTS MARKET BY TRAIT (USD BILLION) 2020-2029

TABLE 38 INDIA PLANT BREEDING AND CRISPR PLANTS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 39 INDIA PLANT BREEDING AND CRISPR PLANTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 40 INDIA PLANT BREEDING AND CRISPR PLANTS MARKET BY TRAIT (USD BILLION) 2020-2029

TABLE 41 CHINA PLANT BREEDING AND CRISPR PLANTS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 42 CHINA PLANT BREEDING AND CRISPR PLANTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 43 CHINA PLANT BREEDING AND CRISPR PLANTS MARKET BY TRAIT (USD BILLION) 2020-2029

TABLE 44 JAPAN PLANT BREEDING AND CRISPR PLANTS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 45 JAPAN PLANT BREEDING AND CRISPR PLANTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 46 JAPAN PLANT BREEDING AND CRISPR PLANTS MARKET BY TRAIT (USD BILLION) 2020-2029

TABLE 47 SOUTH KOREA PLANT BREEDING AND CRISPR PLANTS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 48 SOUTH KOREA PLANT BREEDING AND CRISPR PLANTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 49 SOUTH KOREA PLANT BREEDING AND CRISPR PLANTS MARKET BY TRAIT (USD BILLION) 2020-2029

TABLE 50 AUSTRALIA PLANT BREEDING AND CRISPR PLANTS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 51 AUSTRALIA PLANT BREEDING AND CRISPR PLANTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 52 AUSTRALIA PLANT BREEDING AND CRISPR PLANTS MARKET BY TRAIT (USD BILLION) 2020-2029

TABLE 53 SOUTH-EAST ASIA PLANT BREEDING AND CRISPR PLANTS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 54 SOUTH-EAST ASIA PLANT BREEDING AND CRISPR PLANTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 55 SOUTH-EAST ASIA PLANT BREEDING AND CRISPR PLANTS MARKET BY TRAIT (USD BILLION) 2020-2029

TABLE 56 REST OF ASIA PACIFIC PLANT BREEDING AND CRISPR PLANTS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 57 REST OF ASIA PACIFIC PLANT BREEDING AND CRISPR PLANTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 58 REST OF ASIA PACIFIC PLANT BREEDING AND CRISPR PLANTS MARKET BY TRAIT (USD BILLION) 2020-2029

TABLE 59 EUROPE PLANT BREEDING AND CRISPR PLANTS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 60 EUROPE PLANT BREEDING AND CRISPR PLANTS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 61 EUROPE PLANT BREEDING AND CRISPR PLANTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 62 EUROPE PLANT BREEDING AND CRISPR PLANTS MARKET BY TRAIT (USD BILLION) 2020-2029

TABLE 63 GERMANY PLANT BREEDING AND CRISPR PLANTS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 64 GERMANY PLANT BREEDING AND CRISPR PLANTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 65 GERMANY PLANT BREEDING AND CRISPR PLANTS MARKET BY TRAIT (USD BILLION) 2020-2029

TABLE 66 UK PLANT BREEDING AND CRISPR PLANTS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 67 UK PLANT BREEDING AND CRISPR PLANTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 68 UK PLANT BREEDING AND CRISPR PLANTS MARKET BY TRAIT (USD BILLION) 2020-2029

TABLE 69 FRANCE PLANT BREEDING AND CRISPR PLANTS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 70 FRANCE PLANT BREEDING AND CRISPR PLANTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 71 FRANCE PLANT BREEDING AND CRISPR PLANTS MARKET BY TRAIT (USD BILLION) 2020-2029

TABLE 72 ITALY PLANT BREEDING AND CRISPR PLANTS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 73 ITALY PLANT BREEDING AND CRISPR PLANTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 74 ITALY PLANT BREEDING AND CRISPR PLANTS MARKET BY TRAIT (USD BILLION) 2020-2029

TABLE 75 SPAIN PLANT BREEDING AND CRISPR PLANTS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 76 SPAIN PLANT BREEDING AND CRISPR PLANTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 77 SPAIN PLANT BREEDING AND CRISPR PLANTS MARKET BY TRAIT (USD BILLION) 2020-2029

TABLE 78 RUSSIA PLANT BREEDING AND CRISPR PLANTS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 79 RUSSIA PLANT BREEDING AND CRISPR PLANTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 80 RUSSIA PLANT BREEDING AND CRISPR PLANTS MARKET BY TRAIT (USD BILLION) 2020-2029

TABLE 81 REST OF EUROPE PLANT BREEDING AND CRISPR PLANTS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 82 REST OF EUROPE PLANT BREEDING AND CRISPR PLANTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 83 REST OF EUROPE PLANT BREEDING AND CRISPR PLANTS MARKET BY TRAIT (USD BILLION) 2020-2029

TABLE 84 MIDDLE EAST AND AFRICA PLANT BREEDING AND CRISPR PLANTS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 85 MIDDLE EAST AND AFRICA PLANT BREEDING AND CRISPR PLANTS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 86 MIDDLE EAST AND AFRICA PLANT BREEDING AND CRISPR PLANTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 87 MIDDLE EAST AND AFRICA PLANT BREEDING AND CRISPR PLANTS MARKET BY TRAIT (USD BILLION) 2020-2029

TABLE 88 UAE PLANT BREEDING AND CRISPR PLANTS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 89 UAE PLANT BREEDING AND CRISPR PLANTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 90 UAE PLANT BREEDING AND CRISPR PLANTS MARKET BY TRAIT (USD BILLION) 2020-2029

TABLE 91 SAUDI ARABIA PLANT BREEDING AND CRISPR PLANTS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 92 SAUDI ARABIA PLANT BREEDING AND CRISPR PLANTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 93 SAUDI ARABIA PLANT BREEDING AND CRISPR PLANTS MARKET BY TRAIT (USD BILLION) 2020-2029

TABLE 94 SOUTH AFRICA PLANT BREEDING AND CRISPR PLANTS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 95 SOUTH AFRICA PLANT BREEDING AND CRISPR PLANTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 96 SOUTH AFRICA PLANT BREEDING AND CRISPR PLANTS MARKET BY TRAIT (USD BILLION) 2020-2029

TABLE 97 REST OF MIDDLE EAST AND AFRICA PLANT BREEDING AND CRISPR PLANTS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 98 REST OF MIDDLE EAST AND AFRICA PLANT BREEDING AND CRISPR PLANTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 99 REST OF MIDDLE EAST AND AFRICA PLANT BREEDING AND CRISPR PLANTS MARKET BY TRAIT (USD BILLION) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL PLANT BREEDING AND CRISPR PLANTS MARKET BY METHOD, USD BILLION, 2020-2029

FIGURE 9 GLOBAL PLANT BREEDING AND CRISPR PLANTS MARKET BY APPLICATION, USD BILLION, 2020-2029

FIGURE 10 GLOBAL PLANT BREEDING AND CRISPR PLANTS MARKET BY TRAIT, USD BILLION, 2020-2029

FIGURE 11 GLOBAL PLANT BREEDING AND CRISPR PLANTS MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL PLANT BREEDING AND CRISPR PLANTS MARKET BY METHOD, USD BILLION, 2021

FIGURE 14 GLOBAL PLANT BREEDING AND CRISPR PLANTS MARKET BY APPLICATION, USD BILLION, 2021

FIGURE 15 GLOBAL PLANT BREEDING AND CRISPR PLANTS MARKET BY TRAIT, USD BILLION, 2021

FIGURE 16 GLOBAL PLANT BREEDING AND CRISPR PLANTS MARKET BY REGION, USD BILLION, 2021

FIGURE 17 NORTH AMERICA PLANT BREEDING AND CRISPR PLANTS MARKET SNAPSHOT

FIGURE 18 EUROPE PLANT BREEDING AND CRISPR PLANTS MARKET SNAPSHOT

FIGURE 19 SOUTH AMERICA PLANT BREEDING AND CRISPR PLANTS MARKET SNAPSHOT

FIGURE 20 ASIA PACIFIC PLANT BREEDING AND CRISPR PLANTS MARKET SNAPSHOT

FIGURE 21 MIDDLE EAST ASIA AND AFRICA PLANT BREEDING AND CRISPR PLANTS MARKET SNAPSHOT

FIGURE 22 MARKET SHARE ANALYSIS

FIGURE 23 BAYER AG: COMPANY SNAPSHOT

FIGURE 24 SYGNETA AG: COMPANY SNAPSHOT

FIGURE 25 KWS GROUP: COMPANY SNAPSHOT

FIGURE 26 CORTEVA AGRISCIENCE: COMPANY SNAPSHOT

FIGURE 27 LIMAGRAIN: COMPANY SNAPSHOT

FIGURE 28 BASF SE: COMPANY SNAPSHOT

FIGURE 29 DLF SEEDS A/S: COMPANY SNAPSHOT

FIGURE 30 BIOCERES CROP SOLUTIONS: COMPANY SNAPSHOT

FIGURE 31 UPL LIMITED: COMPANY SNAPSHOT

FIGURE 32 BENSON HILL INC.: COMPANY SNAPSHOT

FIGURE 33 EQUINOM LTD.: COMPANY SNAPSHOT

FIGURE 34 BIOCONSORTIA INC.: COMPANY SNAPSHOT

FIGURE 35 HUDSON RIVER BIOTECHNOLOGY: COMPANY SNAPSHOT

FAQ

Some key players operating in the global plant breeding and CRISPR plants market include Bayer AG, Sygneta AG, KWS Group, Corteva Agriscience, Limagrain, BASF SE, DLF Seeds A/S, Bioceres Crop Solutions, UPL Limited, Benson Hill Inc., Equinom Ltd., BioConsortia Inc., Hudson River Biotechnology

The significance of sustainable crop production and the lowering cost of genomic solutions are two factors that are anticipated to propel the plant breeding and CRISPR plants market’s development.

The global plant breeding and CRISPR plants market size was estimated at USD 11.26 billion in 2021 and is expected to reach USD 34.36 billion in 2029.

The global plant breeding and CRISPR plants market is expected to grow at a compound annual growth rate of 14.97 % from 2023 to 2029 to reach USD 34.36 billion by 2029.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.