REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

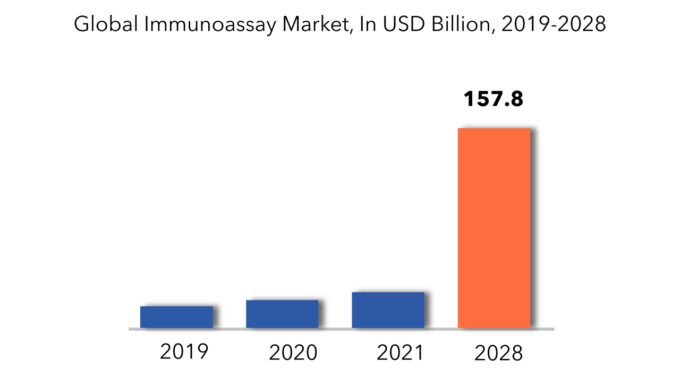

| 157.63 billion | 6.6% | North America |

| by Products | by Application | by Technology |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Immunoassay Market Overview

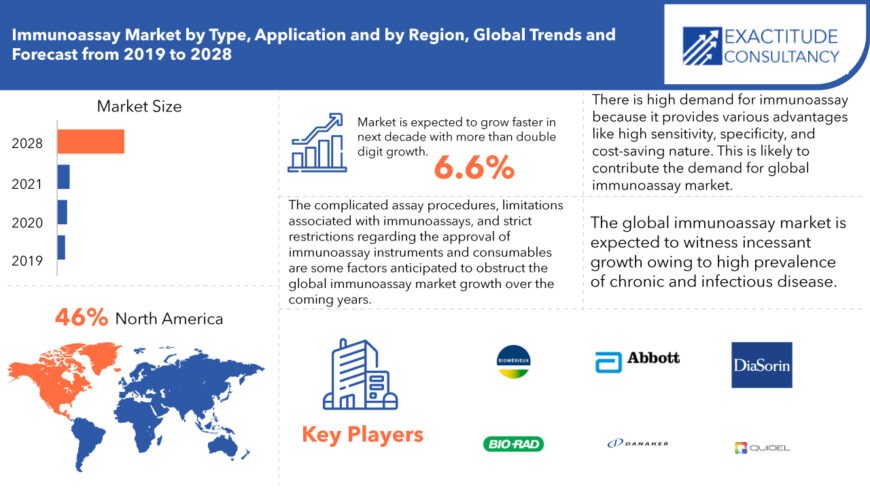

The global immunoassay market is expected to grow at 6.6% CAGR from 2019 to 2028. It is expected to reach above USD 157.63 billion by 2028 from USD 17 billion in 2019.

Immunoassay denotes a biochemical method utilized for quantifying the concentration of a specific substance, ranging from hormones and proteins to drugs and infectious agents, within a given sample. This technique relies on the interaction between an antigen, the substance under examination, and an antibody, a specialized protein designed to selectively bind with the antigen. Employing diverse assay formats such as enzyme-linked immunosorbent assay (ELISA), radioimmunoassay (RIA), or chemiluminescent immunoassay (CLIA), immunoassays facilitate both qualitative and quantitative detection of target substances by leveraging the unique specificity and affinity inherent in antigen-antibody interactions.

The burgeoning demand for immunoassay instruments and consumables within the bio-pharmaceutical industries is poised for significant growth, propelled by the expansion of these sectors. This anticipated growth trajectory is expected to bolster the market demand for immunoassay products in the foreseeable future. The heightened demand from end-users in these industries has created an opportune environment for various companies to introduce innovative products, fostering product innovation within the market. Furthermore, immunoassays find multifaceted applications across various stages within the biopharmaceutical and biotechnology sectors, encompassing product development, manufacturing, and quality control processes.

The regulatory landscape governing immunoassays spans a spectrum of national and international regulations meticulously crafted to ensure the safety, efficacy, and reliability of these diagnostic techniques. Esteemed regulatory bodies such as the Food and Drug Administration (FDA) in the United States, the European Medicines Agency (EMA) in Europe, alongside similar agencies worldwide, assume pivotal roles in establishing standards and guidelines governing the development, validation, and commercialization of immunoassay-based diagnostic tests. These regulations meticulously delineate criteria concerning assay performance, quality control protocols, manufacturing standards, and post-market surveillance obligations.

There is high demand for immunoassay kits, for testing purposes owing to surging number of COVID 19 patients over the globe. This factor is expected to steer the growth of global immunoassay market in COVID-19 outbreak. Additionally, technological advancements which rise the efficiency of Immunoassay in terms of cost and performance, including the design of immunochemical approaches that bring advantages observed with larger molecular analyses with small molecules like metabolites and toxins are likely to contribute the demand for global immunoassay market.

The global immunoassay market is crowded with established players. These players have commanding say in the market. The innovation used in global immunoassay market is proprietary and needs long term research and development planning implemented efficiently. There are few innovators which have worked in immunoassay but apart from that the market is difficult to enter for any new entrant.

Immunoassay Market Segment Analysis

Global immunoassay market is categorized by product into reagents & kits, analyzer. By application, immunoassay market is divided into infectious diseases, oncology as well as by specimen into blood, saliva, urine, and by end user into hospitals & clinics.

In 2021, the diagnostic reference laboratories segment is dominated to hold for the highest market share. The surging number of tests being carried out in diagnostic labs, growth in laboratory automation, increasing availability of infectious diseases and escalating government initiatives are projected to drive the growth of global immunoassay market over the coming years.

The recurrent purchase of kits and reagents segment is booming at a faster rate due to increasing vaccine development to notice the challenge of antimicrobial resistance pandemics, and technological advancements in ELISpot assay kits.

Additionally, there is high demand for immunoassay-based COVID-19 testing products and the cost-effectiveness of these products are likely to contribute the demand for kits and reagents segment over the assessment time.

Immunoassay Market Players

Immunoassay companies to small ones, many companies are actively working in the global immunoassay market. These key players include Danaher, Thermo Fisher Scientific, Abbott Laboratories, Siemens Healthineer, Roche, Quidel, DiaSorin, bioMérieux, Bio Rad Laboratories, Ortho Clinical Diagnostics.

Companies are mainly in the device manufacturing and they are competing closely with each other. Innovation is one of the most important and key strategy as it has to be for any healthcare related market. However, companies in the market have also opted and successfully driven inorganic growth strategies like mergers & acquisition and so on.

- In 2021, Thermo Fisher Scientific Inc. has acquired the private point-of-care molecular diagnostic company Mesa Biotech.

- In 2020, Beckman Coulter is the part of Danaher Company. This company has introduced the first high-quality and throughput assay called Access SARS-CoV-2 Antigen assay. It is developed for the COVID-19 antigen diagnosis.

Who Should Buy? Or Key Stakeholders

- Reagents & kits, analyzers manufacturers

- Immunoassay Suppliers

- Healthcare companies

- Investors

- Manufacturing companies

- End user companies

- Research institutes

- Healthcare

Immunoassay Market Regional Analysis

The global immunoassay market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

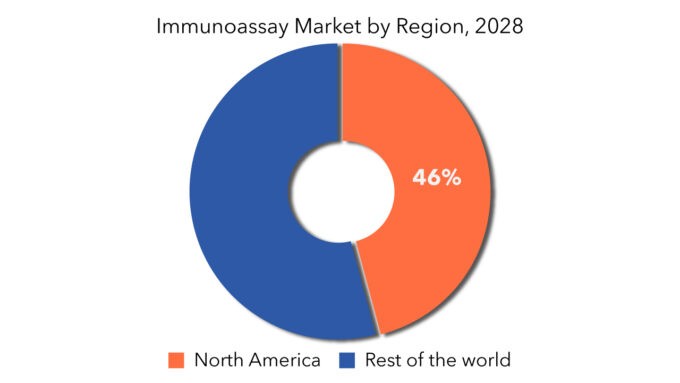

Its major share is occupied by North America, Europe and Asia Pacific region. North America shares 46% of total market. After that Rest of the World to the 54% of global market respectively.

North America dominates the market for immunoassay, and is expected to continue its stronghold for a few more years owing to contribution of government funds, increasing the number of research projects, and the increasing adoption of Immunoassay in this region.

Europe dominates the second-highest share in the immunoassay industry because of the increasing presence of big companies. Asia-pacific is projected to witness fast growth owing to surging old age population.

The Middle East & Africa immunoassay market, will see moderate growth due to the growth of the healthcare sector in this region.

Key Market Segments: Global Immunoassay Market

Global Immunoassay Market by Products, 2019-2028, (In USD Million)

- Reagents & Kits

- Elisa Reagents & Kits

- Rapid Test Reagents & Kits

- Elispot Reagents & Kits

- Western Blot Reagents & Kits

- Other Reagents & Kits

- Analyzers

- By Type

- By Purchase Mode

Global Immunoassay Market by Application, 2019-2028, (In USD Million)

- Infectious Diseases

- Oncology

Global Immunoassay Market by Technology, 2019-2028, (In USD Million)

- ELISA

- IFA

- Rapid Tests

- Radio Immunoassay

Global Immunoassay Market by Region, 2019-2028, (In USD Million)

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

Important countries in all regions are covered.

Key Question Answered

- What are the growth opportunities related to the adoption of immunoassay across major regions in the future?

- What are the new trends and advancements in the immunoassay market?

- Which product categories are expected to have highest growth rate in the immunoassay market?

- Which are the key factors driving the immunoassay market?

- What will the market growth rate, growth momentum or acceleration the market carries during the forecast period?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Immunoassay Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Global Immunoassay Market

- Global Immunoassay Market Outlook

- Global Immunoassay by PRODUCT, (USD Million)

- Reagents & Kits

- Analyzers

- Global Immunoassay Market by Application, (USD Million)

- Infectious Diseases

- Oncology

- Global Immunoassay by Technology, (USD Million)

- ELISA

- IFA

- Rapid Tests

- Radio Immunoassay

- Global Immunoassay Market by Region, (USD Million)

- Introduction

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- South-East Asia

- Rest of Asia-Pacific

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Colombia

- Rest of South America

- Middle- East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle- East and Africa

- Company Profiles* (Business Overview, Company Snapshot, Products Offered, Recent Developments)

- Danaher

- Thermo Fisher Scientific

- Abbott Laboratories

- Siemens Healthineer

- Roche

- Quidel

- DiaSorin

- bioMérieux

- Bio-Rad Laboratories

- Ortho Clinical Diagnostics

- Others *The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL IMMUNOASSAY MARKET BY PRODUCT (USD MILLIONS), 2019-2028

TABLE 2 GLOBALIMMUNOASSAY MARKET BY PRODUCT (UNITS), 2019-2028

TABLE 3 GLOBAL IMMUNOASSAY MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 4 GLOBAL IMMUNOASSAY MARKET BY APPLICATION (UNITS), 2019-2028

TABLE 5 GLOBAL IMMUNOASSAY MARKET BY TECHNOLOGY (USD MILLIONS), 2019-2028

TABLE 6 GLOBAL IMMUNOASSAY MARKET BY TECHNOLOGY (UNITS), 2019-2028

TABLE 7 GLOBAL IMMUNOASSAY MARKET BY REGION (USD MILLIONS), 2019-2028

TABLE 8 GLOBAL IMMUNOASSAY MARKET BY REGION (UNITS), 2019-2028

TABLE 9 NORTH AMERICA IMMUNOASSAY MARKET BY COUNTRY (USD MILLIONS), 2019-2028

TABLE 10 NORTH AMERICA IMMUNOASSAY MARKET BY COUNTRY (UNITS), 2019-2028

TABLE 11 NORTH AMERICA IMMUNOASSAY MARKET BY PRODUCT (USD MILLIONS), 2019-2028

TABLE 12 NORTH AMERICA IMMUNOASSAY MARKET BY PRODUCT (UNITS), 2019-2028

TABLE 13 NORTH AMERICA IMMUNOASSAY MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 14 NORTH AMERICA IMMUNOASSAY MARKET BY APPLICATION (UNITS), 2019-2028

TABLE 15 NORTH AMERICA IMMUNOASSAY MARKET BY TECHNOLOGY (USD MILLIONS), 2019-2028

TABLE 16 NORTH AMERICA IMMUNOASSAY MARKET BY TECHNOLOGY (UNITS), 2019-2028

TABLE 17 US IMMUNOASSAY MARKET BY PRODUCT (USD MILLIONS), 2019-2028

TABLE 18 US IMMUNOASSAY MARKET BY PRODUCT (UNITS), 2019-2028

TABLE 19 US IMMUNOASSAY MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 20 US IMMUNOASSAY MARKET BY APPLICATION (UNITS), 2019-2028

TABLE 21 US IMMUNOASSAY MARKET BY TECHNOLOGY (USD MILLIONS), 2019-2028

TABLE 22 US IMMUNOASSAY MARKET BY TECHNOLOGY (UNITS), 2019-2028

TABLE 23 CANADA IMMUNOASSAY MARKET BY PRODUCT (MILLIONS), 2019-2028

TABLE 24 CANADA IMMUNOASSAY MARKET BY PRODUCT (UNITS), 2019-2028

TABLE 25 CANADA IMMUNOASSAY MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 26 CANADA IMMUNOASSAY MARKET BY APPLICATION (UNITS), 2019-2028

TABLE 27 CANADA IMMUNOASSAY MARKET BY TECHNOLOGY (USD MILLIONS), 2019-2028

TABLE 28 CANADA IMMUNOASSAY MARKET BY TECHNOLOGY (UNITS), 2019-2028

TABLE 29 MEXICO IMMUNOASSAY MARKET BY PRODUCT (USD MILLIONS), 2019-2028

TABLE 30 MEXICO IMMUNOASSAY MARKET BY PRODUCT (UNITS), 2019-2028

TABLE 31 MEXICO IMMUNOASSAY MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 32 MEXICO IMMUNOASSAY MARKET BY APPLICATION (UNITS), 2019-2028

TABLE 33 MEXICO IMMUNOASSAY MARKET BY TECHNOLOGY (USD MILLIONS), 2019-2028

TABLE 34 MEXICO IMMUNOASSAY MARKET BY TECHNOLOGY (UNITS), 2019-2028

TABLE 35 SOUTH AMERICA IMMUNOASSAY MARKET BY COUNTRY (USD MILLIONS), 2019-2028

TABLE 36 SOUTH AMERICA IMMUNOASSAY MARKET BY COUNTRY (UNITS), 2019-2028

TABLE 37 SOUTH AMERICA IMMUNOASSAY MARKET BY PRODUCT (USD MILLIONS), 2019-2028

TABLE 38 SOUTH AMERICA IMMUNOASSAY MARKET BY PRODUCT (UNITS), 2019-2028

TABLE 39 SOUTH AMERICA IMMUNOASSAY MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 40 SOUTH AMERICA IMMUNOASSAY MARKET BY APPLICATION (UNITS), 2019-2028

TABLE 41 SOUTH AMERICA IMMUNOASSAY MARKET BY TECHNOLOGY (USD MILLIONS), 2019-2028

TABLE 42 SOUTH AMERICA IMMUNOASSAY MARKET BY TECHNOLOGY (UNITS), 2019-2028

TABLE 43 BRAZIL IMMUNOASSAY MARKET BY PRODUCT (USD MILLIONS), 2019-2028

TABLE 44 BRAZIL IMMUNOASSAY MARKET BY PRODUCT (UNITS), 2019-2028

TABLE 45 BRAZIL IMMUNOASSAY MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 46 BRAZIL IMMUNOASSAY MARKET BY APPLICATION (UNITS), 2019-2028

TABLE 47 BRAZIL IMMUNOASSAY MARKET BY TECHNOLOGY (USD MILLIONS), 2019-2028

TABLE 48 BRAZIL IMMUNOASSAY MARKET BY TECHNOLOGY (UNITS), 2019-2028

TABLE 49 ARGENTINA IMMUNOASSAY MARKET BY PRODUCT (USD MILLIONS), 2019-2028

TABLE 50 ARGENTINA IMMUNOASSAY MARKET BY PRODUCT (UNITS), 2019-2028

TABLE 51 ARGENTINA IMMUNOASSAY MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 52 ARGENTINA IMMUNOASSAY MARKET BY APPLICATION (UNITS), 2019-2028

TABLE 53 ARGENTINA IMMUNOASSAY MARKET BY TECHNOLOGY (USD MILLIONS), 2019-2028

TABLE 54 ARGENTINA IMMUNOASSAY MARKET BY TECHNOLOGY (UNITS), 2019-2028

TABLE 55 COLOMBIA IMMUNOASSAY MARKET BY PRODUCT (USD MILLIONS), 2019-2028

TABLE 56 COLOMBIA IMMUNOASSAY MARKET BY PRODUCT (UNITS), 2019-2028

TABLE 57 COLOMBIA IMMUNOASSAY MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 58 COLOMBIA IMMUNOASSAY MARKET BY APPLICATION (UNITS), 2019-2028

TABLE 59 COLOMBIA IMMUNOASSAY MARKET BY TECHNOLOGY (USD MILLIONS), 2019-2028

TABLE 60 COLOMBIA IMMUNOASSAY MARKET BY TECHNOLOGY (UNITS), 2019-2028

TABLE 61 REST OF SOUTH AMERICA IMMUNOASSAY MARKET BY PRODUCT (USD MILLIONS), 2019-2028

TABLE 62 REST OF SOUTH AMERICA IMMUNOASSAY MARKET BY PRODUCT (UNITS), 2019-2028

TABLE 63 REST OF SOUTH AMERICA IMMUNOASSAY MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 64 REST OF SOUTH AMERICA IMMUNOASSAY MARKET BY APPLICATION (UNITS), 2019-2028

TABLE 65 REST OF SOUTH AMERICA IMMUNOASSAY MARKET BY TECHNOLOGY (USD MILLIONS), 2019-2028

TABLE 66 REST OF SOUTH AMERICA IMMUNOASSAY MARKET BY TECHNOLOGY (UNITS), 2019-2028

TABLE 67 ASIA-PACIFIC IMMUNOASSAY MARKET BY COUNTRY (USD MILLIONS), 2019-2028

TABLE 68 ASIA-PACIFIC IMMUNOASSAY MARKET BY COUNTRY (UNITS), 2019-2028

TABLE 69 ASIA-PACIFIC IMMUNOASSAY MARKET BY PRODUCT (USD MILLIONS), 2019-2028

TABLE 70 ASIA-PACIFIC IMMUNOASSAY MARKET BY PRODUCT (UNITS), 2019-2028

TABLE 71 ASIA-PACIFIC IMMUNOASSAY MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 72 ASIA-PACIFIC IMMUNOASSAY MARKET BY APPLICATION (UNITS), 2019-2028

TABLE 73 ASIA-PACIFIC IMMUNOASSAY MARKET BY TECHNOLOGY (USD MILLIONS), 2019-2028

TABLE 74 ASIA-PACIFIC IMMUNOASSAY MARKET BY TECHNOLOGY (UNITS), 2019-2028

TABLE 75 INDIA IMMUNOASSAY MARKET BY PRODUCT (USD MILLIONS), 2019-2028

TABLE 76 INDIA IMMUNOASSAY MARKET BY PRODUCT (UNITS), 2019-2028

TABLE 77 INDIA IMMUNOASSAY MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 78 INDIA IMMUNOASSAY MARKET BY APPLICATION (UNITS), 2019-2028

TABLE 79 INDIA IMMUNOASSAY MARKET BY TECHNOLOGY (USD MILLIONS), 2019-2028

TABLE 80 INDIA IMMUNOASSAY MARKET BY TECHNOLOGY (UNITS), 2019-2028

TABLE 81 CHINA IMMUNOASSAY MARKET BY PRODUCT (USD MILLIONS), 2019-2028

TABLE 82 CHINA IMMUNOASSAY MARKET BY PRODUCT (UNITS), 2019-2028

TABLE 83 CHINA IMMUNOASSAY MARKET BY PRODUCT (UNITS), 2019-2028

TABLE 84 CHINA IMMUNOASSAY MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 85 CHINA IMMUNOASSAY MARKET BY APPLICATION (UNITS), 2019-2028

TABLE 86 CHINA IMMUNOASSAY MARKET BY TECHNOLOGY (USD MILLIONS), 2019-2028

TABLE 87 CHINA IMMUNOASSAY MARKET BY TECHNOLOGY (UNITS), 2019-2028

TABLE 88 JAPAN IMMUNOASSAY MARKET BY PRODUCT (USD MILLIONS), 2019-2028

TABLE 89 JAPAN IMMUNOASSAY MARKET BY PRODUCT (UNITS), 2019-2028

TABLE 90 JAPAN IMMUNOASSAY MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 91 JAPAN IMMUNOASSAY MARKET BY APPLICATION (UNITS), 2019-2028

TABLE 92 JAPAN IMMUNOASSAY MARKET BY TECHNOLOGY (USD MILLIONS), 2019-2028

TABLE 93 JAPAN IMMUNOASSAY MARKET BY TECHNOLOGY (UNITS), 2019-2028

TABLE 94 SOUTH KOREA IMMUNOASSAY MARKET BY PRODUCT (USD MILLIONS), 2019-2028

TABLE 95 SOUTH KOREA IMMUNOASSAY MARKET BY PRODUCT (UNITS), 2019-2028

TABLE 96 SOUTH KOREA IMMUNOASSAY MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 97 SOUTH KOREA IMMUNOASSAY MARKET BY APPLICATION (UNITS), 2019-2028

TABLE 98 SOUTH KOREA IMMUNOASSAY MARKET BY TECHNOLOGY (USD MILLIONS), 2019-2028

TABLE 99 SOUTH KOREA IMMUNOASSAY MARKET BY TECHNOLOGY (UNITS), 2019-2028

TABLE 100 AUSTRALIA IMMUNOASSAY MARKET BY PRODUCT (USD MILLIONS), 2019-2028

TABLE 101 AUSTRALIA IMMUNOASSAY MARKET BY PRODUCT (UNITS), 2019-2028

TABLE 102 AUSTRALIA IMMUNOASSAY MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 103 AUSTRALIA IMMUNOASSAY MARKET BY APPLICATION (UNITS), 2019-2028

TABLE 104 AUSTRALIA IMMUNOASSAY MARKET BY TECHNOLOGY (USD MILLIONS), 2019-2028

TABLE 105 AUSTRALIA IMMUNOASSAY MARKET BY TECHNOLOGY (UNITS), 2019-2028

TABLE 106 SOUTH EAST ASIA IMMUNOASSAY MARKET BY PRODUCT (USD MILLIONS), 2019-2028

TABLE 107 SOUTH EAST ASIA IMMUNOASSAY MARKET BY PRODUCT (UNITS), 2019-2028

TABLE 108 SOUTH EAST ASIA IMMUNOASSAY MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 109 SOUTH EAST ASIA IMMUNOASSAY MARKET BY APPLICATION (UNITS), 2019-2028

TABLE 110 SOUTH EAST ASIA IMMUNOASSAY MARKET BY TECHNOLOGY (USD MILLIONS), 2019-2028

TABLE 111 SOUTH EAST ASIA IMMUNOASSAY MARKET BY TECHNOLOGY (UNITS), 2019-2028

TABLE 112 REST OF ASIA PACIFIC IMMUNOASSAY MARKET BY PRODUCT (USD MILLIONS), 2019-2028

TABLE 113 REST OF ASIA PACIFIC IMMUNOASSAY MARKET BY PRODUCT (UNITS), 2019-2028

TABLE 114 REST OF ASIA PACIFIC IMMUNOASSAY MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 115 REST OF ASIA PACIFIC IMMUNOASSAY MARKET BY APPLICATION (UNITS), 2019-2028

TABLE 116 REST OF ASIA PACIFIC IMMUNOASSAY MARKET BY TECHNOLOGY (USD MILLIONS), 2019-2028

TABLE 117 REST OF ASIA PACIFIC IMMUNOASSAY MARKET BY TECHNOLOGY (UNITS), 2019-2028

TABLE 118 EUROPE IMMUNOASSAY MARKET BY COUNTRY (USD MILLIONS), 2019-2028

TABLE 119 EUROPE IMMUNOASSAY MARKET BY COUNTRY (UNITS), 2019-2028

TABLE 120 EUROPE IMMUNOASSAY MARKET BY PRODUCT (USD MILLIONS), 2019-2028

TABLE 121 EUROPE IMMUNOASSAY MARKET BY PRODUCT (UNITS), 2019-2028

TABLE 122 EUROPE IMMUNOASSAY MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 123 EUROPE IMMUNOASSAY MARKET BY APPLICATION (UNITS), 2019-2028

TABLE 124 EUROPE IMMUNOASSAY MARKET BY TECHNOLOGY (USD MILLIONS), 2019-2028

TABLE 125 EUROPE IMMUNOASSAY MARKET BY TECHNOLOGY (UNITS), 2019-2028

TABLE 126 GERMANY IMMUNOASSAY MARKET BY PRODUCT (USD MILLIONS), 2019-2028

TABLE 127 GERMANY IMMUNOASSAY MARKET BY PRODUCT (UNITS), 2019-2028

TABLE 128 GERMANY IMMUNOASSAY MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 129 GERMANY IMMUNOASSAY MARKET BY APPLICATION (UNITS), 2019-2028

TABLE 130 GERMANY IMMUNOASSAY MARKET BY TECHNOLOGY (USD MILLIONS), 2019-2028

TABLE 131 GERMANY IMMUNOASSAY MARKET BY TECHNOLOGY (UNITS), 2019-2028

TABLE 132 UK IMMUNOASSAY MARKET BY PRODUCT (USD MILLIONS), 2019-2028

TABLE 133 UK IMMUNOASSAY MARKET BY PRODUCT (UNITS), 2019-2028

TABLE 134 UK IMMUNOASSAY MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 135 UK IMMUNOASSAY MARKET BY APPLICATION (UNITS), 2019-2028

TABLE 136 UK IMMUNOASSAY MARKET BY TECHNOLOGY (USD MILLIONS), 2019-2028

TABLE 137 UK IMMUNOASSAY MARKET BY TECHNOLOGY (UNITS), 2019-2028

TABLE 138 FRANCE IMMUNOASSAY MARKET BY PRODUCT (USD MILLIONS), 2019-2028

TABLE 139 FRANCE IMMUNOASSAY MARKET BY PRODUCT (UNITS), 2019-2028

TABLE 140 FRANCE IMMUNOASSAY MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 141 FRANCE IMMUNOASSAY MARKET BY APPLICATION (UNITS), 2019-2028

TABLE 142 FRANCE IMMUNOASSAY MARKET BY TECHNOLOGY (USD MILLIONS), 2019-2028

TABLE 143 FRANCE IMMUNOASSAY MARKET BY TECHNOLOGY (UNITS), 2019-2028

TABLE 144 ITALY IMMUNOASSAY MARKET BY PRODUCT (USD MILLIONS), 2019-2028

TABLE 145 ITALY IMMUNOASSAY MARKET BY PRODUCT (UNITS), 2019-2028

TABLE 146 ITALY IMMUNOASSAY MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 147 ITALY IMMUNOASSAY MARKET BY APPLICATION (UNITS), 2019-2028

TABLE 148 ITALY IMMUNOASSAY MARKET BY TECHNOLOGY (USD MILLIONS), 2019-2028

TABLE 149 ITALY IMMUNOASSAY MARKET BY TECHNOLOGY (UNITS), 2019-2028

TABLE 150 SPAIN IMMUNOASSAY MARKET BY PRODUCT (USD MILLIONS), 2019-2028

TABLE 151 SPAIN IMMUNOASSAY MARKET BY PRODUCT (UNITS), 2019-2028

TABLE 152 SPAIN IMMUNOASSAY MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 153 SPAIN IMMUNOASSAY MARKET BY APPLICATION (UNITS), 2019-2028

TABLE 154 SPAIN IMMUNOASSAY MARKET BY TECHNOLOGY (USD MILLIONS), 2019-2028

TABLE 155 SPAIN IMMUNOASSAY MARKET BY TECHNOLOGY (UNITS), 2019-2028

TABLE 156 RUSSIA IMMUNOASSAY MARKET BY PRODUCT (USD MILLIONS), 2019-2028

TABLE 157 RUSSIA IMMUNOASSAY MARKET BY PRODUCT (UNITS), 2019-2028

TABLE 158 RUSSIA IMMUNOASSAY MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 159 RUSSIA IMMUNOASSAY MARKET BY APPLICATION (UNITS), 2019-2028

TABLE 160 RUSSIA IMMUNOASSAY MARKET BY TECHNOLOGY (UNITS), 2019-2028

TABLE 161 REST OF EUROPE IMMUNOASSAY MARKET BY PRODUCT (USD MILLIONS), 2019-2028

TABLE 162 REST OF EUROPE IMMUNOASSAY MARKET BY PRODUCT (UNITS), 2019-2028

TABLE 163 REST OF EUROPE IMMUNOASSAY MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 164 REST OF EUROPE IMMUNOASSAY MARKET BY APPLICATION (UNITS), 2019-2028

TABLE 165 REST OF EUROPE IMMUNOASSAY MARKET BY TECHNOLOGY (USD MILLIONS), 2019-2028

TABLE 166 REST OF EUROPE IMMUNOASSAY MARKET BY TECHNOLOGY (UNITS), 2019-2028

TABLE 167 MIDDLE EAST AND AFRICA IMMUNOASSAY MARKET BY COUNTRY (USD MILLIONS), 2019-2028

TABLE 168 MIDDLE EAST AND AFRICA IMMUNOASSAY MARKET BY COUNTRY (UNITS), 2019-2028

TABLE 169 MIDDLE EAST AND AFRICA IMMUNOASSAY MARKET BY PRODUCT (USD MILLIONS), 2019-2028

TABLE 170 MIDDLE EAST AND AFRICA IMMUNOASSAY MARKET BY PRODUCT (UNITS), 2019-2028

TABLE 171 MIDDLE EAST AND AFRICA IMMUNOASSAY MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 172 MIDDLE EAST AND AFRICA IMMUNOASSAY MARKET BY APPLICATION (UNITS), 2019-2028

TABLE 173 MIDDLE EAST AND AFRICA IMMUNOASSAY MARKET BY TECHNOLOGY (USD MILLIONS), 2019-2028

TABLE 174 MIDDLE EAST AND AFRICA IMMUNOASSAY MARKET BY TECHNOLOGY (UNITS), 2019-2028

TABLE 175 UAE IMMUNOASSAY MARKET BY PRODUCT (USD MILLIONS), 2019-2028

TABLE 176 UAE IMMUNOASSAY MARKET BY PRODUCT (UNITS), 2019-2028

TABLE 177 UAE IMMUNOASSAY MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 178 UAE IMMUNOASSAY MARKET BY APPLICATION (UNITS), 2019-2028

TABLE 179 UAE IMMUNOASSAY MARKET BY TECHNOLOGY (USD MILLIONS), 2019-2028

TABLE 180 UAE IMMUNOASSAY MARKET BY TECHNOLOGY (UNITS), 2019-2028

TABLE 181 SAUDI ARABIA IMMUNOASSAY MARKET BY PRODUCT (USD MILLIONS), 2019-2028

TABLE 182 SAUDI ARABIA IMMUNOASSAY MARKET BY PRODUCT (UNITS), 2019-2028

TABLE 183 SAUDI ARABIA IMMUNOASSAY MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 184 SAUDI ARABIA IMMUNOASSAY MARKET BY APPLICATION (UNITS), 2019-2028

TABLE 185 SAUDI ARABIA IMMUNOASSAY MARKET BY TECHNOLOGY (USD MILLIONS), 2019-2028

TABLE 186 SAUDI ARABIA IMMUNOASSAY MARKET BY TECHNOLOGY (UNITS), 2019-2028

TABLE 187 SOUTH AFRICA IMMUNOASSAY MARKET BY PRODUCT (USD MILLIONS), 2019-2028

TABLE 188 SOUTH AFRICA IMMUNOASSAY MARKET BY PRODUCT (UNITS), 2019-2028

TABLE 189 SOUTH AFRICA IMMUNOASSAY MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 190 SOUTH AFRICA IMMUNOASSAY MARKET BY APPLICATION (UNITS), 2019-2028

TABLE 191 SOUTH AFRICA IMMUNOASSAY MARKET BY TECHNOLOGY (USD MILLIONS), 2019-2028

TABLE 192 SOUTH AFRICA IMMUNOASSAY MARKET BY TECHNOLOGY (UNITS), 2019-2028

TABLE 193 REST OF MIDDLE EAST AND AFRICA IMMUNOASSAY MARKET BY PRODUCT (USD MILLIONS), 2019-2028

TABLE 194 REST OF MIDDLE EAST AND AFRICA IMMUNOASSAY MARKET BY PRODUCT (UNITS), 2019-2028

TABLE 195 REST OF MIDDLE EAST AND AFRICA IMMUNOASSAY MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 196 REST OF MIDDLE EAST AND AFRICA IMMUNOASSAY MARKET BY APPLICATION (UNITS), 2019-2028

TABLE 197 REST OF MIDDLE EAST AND AFRICA IMMUNOASSAY MARKET BY TECHNOLOGY (USD MILLIONS), 2019-2028

TABLE 198 REST OF MIDDLE EAST AND AFRICA IMMUNOASSAY MARKET BY TECHNOLOGY (UNITS), 2019-2028

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 IMMUNOASSAY MARKET BY PRODUCT, USD MILLION, 2019-2028

FIGURE 9 IMMUNOASSAY MARKET BY APPLICATION, USD MILLION, 2019-2028

FIGURE 10 IMMUNOASSAY MARKET BY TECHNOLOGY, USD MILLION, 2019-2028

FIGURE 11 IMMUNOASSAY MARKET BY REGION, USD MILLION, 2019-2028

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 IMMUNOASSAY MARKET BY PRODUCT, USD MILLION, 2019-2028

FIGURE 14 IMMUNOASSAY MARKET BY APPLICATION, USD MILLION, 2019-2028

FIGURE 15 IMMUNOASSAY MARKET BY TECHNOLOGY, USD MILLION, 2019-2028

FIGURE 16 IMMUNOASSAY MARKET BY REGION, USD MILLION, 2019-2028

FIGURE 17 FARM EQUIPMENT MARKET BY REGION 2020

FIGURE 18 MARKET SHARE ANALYSIS

FIGURE 19 DANAHER: COMPANY SNAPSHOT

FIGURE 20 THERMO FISHER SCIENTIFIC: COMPANY SNAPSHOT

FIGURE 21 ABBOOTT LABORATORIES: COMPANY SNAPSHOT

FIGURE 22 SIEMENS HEALTHINEER: COMPANY SNAPSHOT

FIGURE 23 ROCHE: COMPANY SNAPSHOT

FIGURE 24 QUIDEL: COMPANY SNAPSHOT

FIGURE 25 DIASORIN: COMPANY SNAPSHOT

FIGURE 26 BIOMÉRIEUX: COMPANY SNAPSHOT

FIGURE 27 BIO-RAD LABORATORIES CORPORATION: COMPANY SNAPSHOT

FIGURE 28 ORTHO CLINICAL DIAGNOSTICS: COMPANY SNAPSHOT

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.