REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

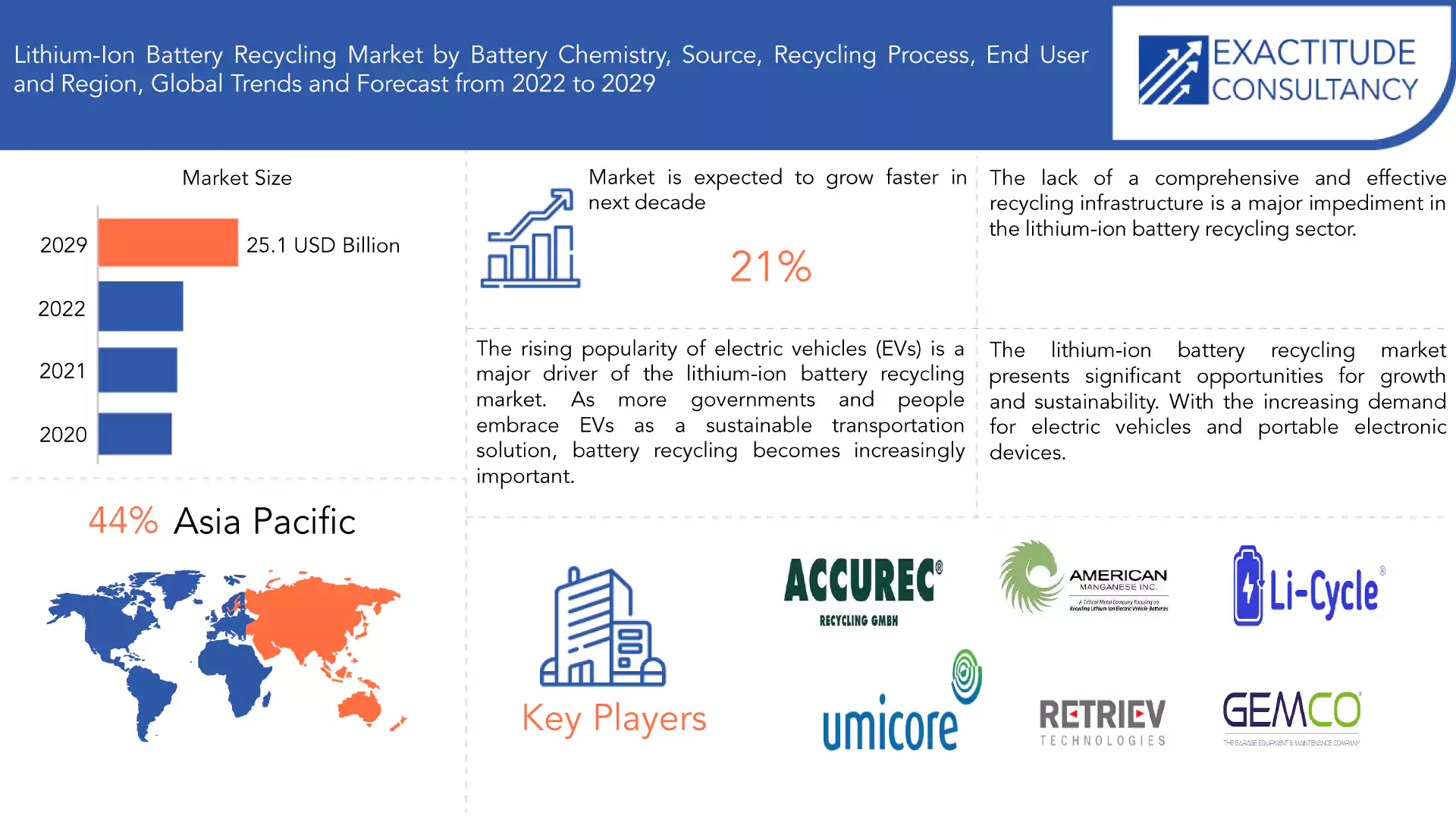

| USD 25.1 Billion By 2029 | 21% | Asia-Pacific |

| By Battery Chemistry | By Source | By Recycling Process |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Lithium-ion Battery Recycling Market Overview

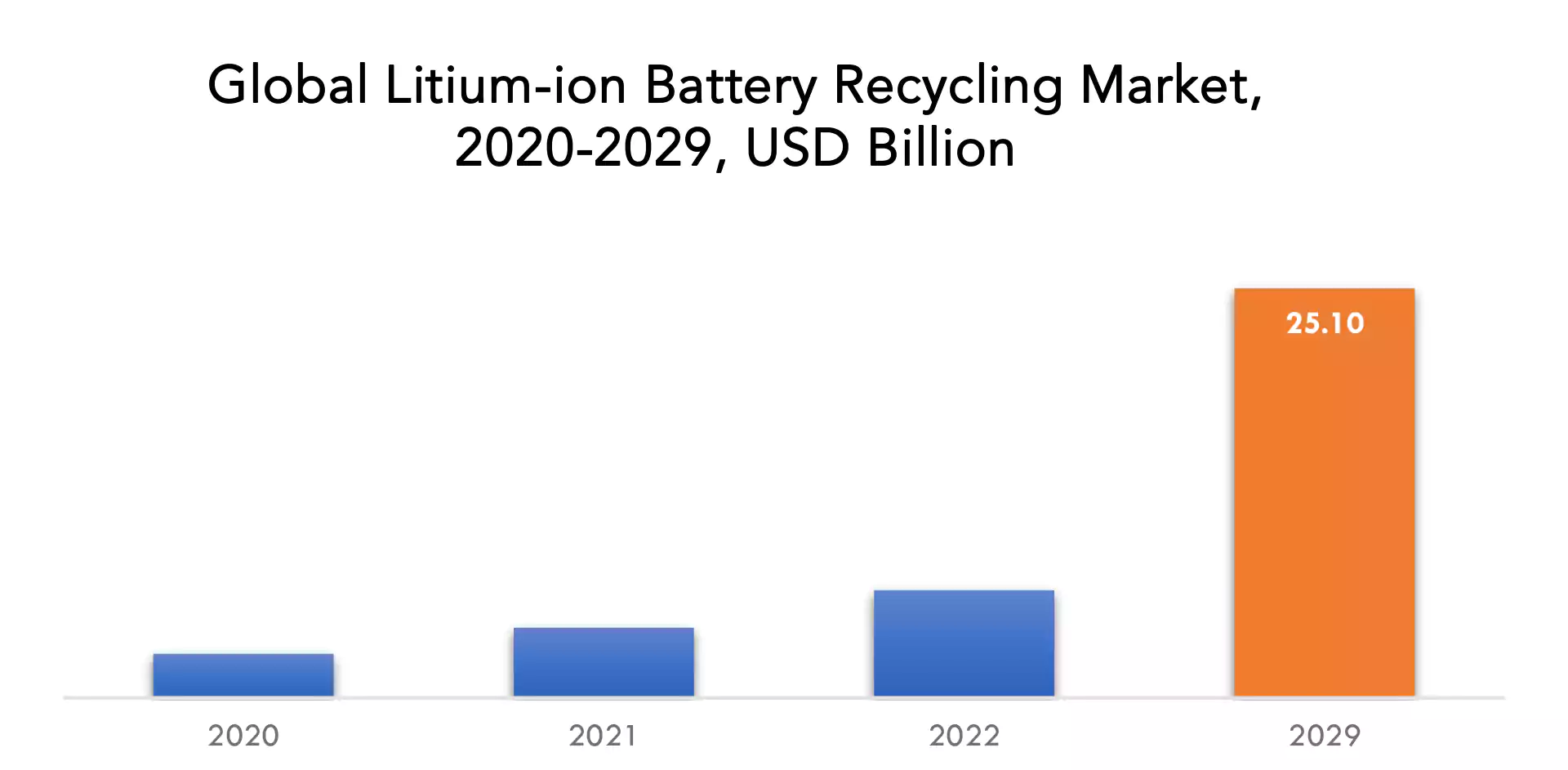

The Lithium-Ion Battery Recycling Market Is Expected to Grow At 21 % CAGR From 2022 To 2029. It Is Expected to Reach Above USD 25.1 Billion By 2029 From USD 2.7 Billion In 2020.

Recycling lithium-ion batteries is critical to mitigating the environmental impact of these ubiquitous energy storage devices. Recycling entails recovering precious materials such as lithium, cobalt, nickel, and manganese from used batteries and reusing them in the creation of new batteries. Sorting and discharging the batteries is usually the first step, followed by shredding and separating the components. The recovered materials are subsequently cleaned, processed, and reintroduced into the supply chain for battery manufacture. Recycling properly reduces the demand for new raw materials, reduces dependency on mining, and reduces the discharge of dangerous compounds into the environment.

Several organizations and initiatives have been formed to promote the recycling of lithium-ion batteries. Battery makers, electronic waste recyclers, and government-led programmes are among them. Furthermore, technological advances are being made to increase the efficiency of recycling operations, such as the development of novel technologies for battery disassembly and material recovery. The recycling infrastructure is growing to accommodate the growing volume of lithium-ion batteries nearing the end of their useful life.

The rising popularity of electric vehicles (EVs) is a major driver of the lithium-ion battery recycling market. As more governments and people embrace EVs as a sustainable transportation solution, battery recycling becomes increasingly important. Recycling lithium-ion batteries not only aids in the recovery of important metals such as lithium, cobalt, and nickel, but it also lessens the environmental impact of mining these elements from the ground. The expanding popularity of EVs, as well as the corresponding demand for lithium-ion batteries, creates a profitable market for recycling companies seeking to address the growing demand for sustainable battery disposal and resource recovery.

The lithium-ion battery recycling business is being driven by government rules and policies aimed at encouraging sustainability and decreasing technological waste. due to the environmental concerns posed by inappropriate disposal methods, many countries have adopted severe rules to ensure proper battery disposal and recycling. Governments are promoting and mandating lithium-ion battery recycling in order to promote the development of a circular economy and reduce the environmental impact of battery waste.

The lithium-ion battery recycling market presents significant opportunities for growth and sustainability. With the increasing demand for electric vehicles and portable electronic devices, the recycling of lithium-ion batteries is crucial to address environmental concerns and secure valuable resources. This market offers prospects for companies specializing in battery collection, sorting, and recycling, as well as those involved in developing innovative recycling technologies and processes.

The lack of a comprehensive and effective recycling infrastructure is a major impediment in the lithium-ion battery recycling sector. As the current infrastructure is not fully built, capacity and scalability are constrained. Furthermore, the high costs involved with recycling technology and procedures make wider adoption difficult. Lack of understanding and legal frameworks for proper lithium-ion battery disposal and recycling contribute to market restraint.

The COVID-19 pandemic has a huge impact on the Lithium-ion Battery Recycling business. Lockdowns and disrupted supply chains resulted in a temporary drop in battery output and subsequent recycling activities. However, as the world heals and industries reopen, there is a greater emphasis on ecological practices, which is fueling demand for lithium-ion battery recycling. The pandemic sparked greater awareness and investment in recycling infrastructure and technology.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion) |

| Segmentation | By Battery Chemistry, By Source, By Recycling Process, End User, By Region. |

| By Battery Chemistry |

|

| By Source |

|

| By Recycling Process |

|

| By End User |

|

| By Region |

|

Lithium-ion Battery Recycling Market Segment Analysis

The lithium-ion battery recycling market is segmented based on Battery Chemistry, Source, Recycling Process and end user.

Based on battery chemistry, the lithium-ion battery recycling market can be segmented based on different types of lithium-ion battery chemistries. These include lithium-ion phosphate, lithium-manganese oxide, lithium-nickel-cobalt aluminum oxide, lithium-nickel-manganese cobalt, and lithium-titanate oxide. Each segment represents specific battery compositions, enabling targeted recycling processes to extract valuable materials and reduce environmental impact.

Based on Source, the lithium-ion battery recycling market is segmented based on Electric Vehicles, Electronics, and Power Tools. The Electric Vehicle segment is expected to dominate the market due to the increasing adoption of electric vehicles worldwide. The Electronics segment is driven by the growing demand for portable electronic devices. The Power Tools segment is fueled by the rising use of battery-powered tools in various industries.

Based on recycling process, the lithium-ion battery recycling market can be segmented into three main processes: hydrometallurgical, physical, and pyrometallurgical. The hydrometallurgical process involves using chemical solutions to extract valuable metals. The physical process involves mechanical separation techniques. The pyrometallurgy process uses high temperatures to separate and recover metals. These segments cater to different recycling methods within the lithium-ion battery recycling industry.

Lithium-ion Battery Recycling Market Player

The Lithium-Ion Battery Recycling Market key players includes Umicore, Retriev Technologies, Li-Cycle, Gem Co,Ltd, Accurec Recycling GmbH, American Manganese Inc, Recupyl, Battery Recycling Made Easy, Fortum, Redux Recycling, Raw Materials Company Inc, Neometals.

Recent Developments:

17-04-2023: A consortium of eleven leading international organisations from industry, technology and science has today launched the first publicly available Content Guidance on the EU Battery Passport.

01-06-2023: Li-Cycle Holdings Corp. (NYSE: LICY) (“Li-Cycle” or the “Company”), an industry leader in lithium-ion battery resource recovery and the leading lithium-ion battery recycler in North America, is pleased to announce it has joined the United Nations Global Compact (“UNGC”) initiative, a voluntary leadership platform for the development, implementation and disclosure of responsible business practices.

Who Should Buy? Or Key Stakeholders

- Battery Manufacturers

- Electronic Device Manufacturers

- Automotive Industry

- Energy Storage System Companies

- Waste Management and Recycling Companies

- Government Agencies

- Research and Development

Lithium-ion Battery Recycling Market Regional Analysis

The Lithium-ion Battery Recycling market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

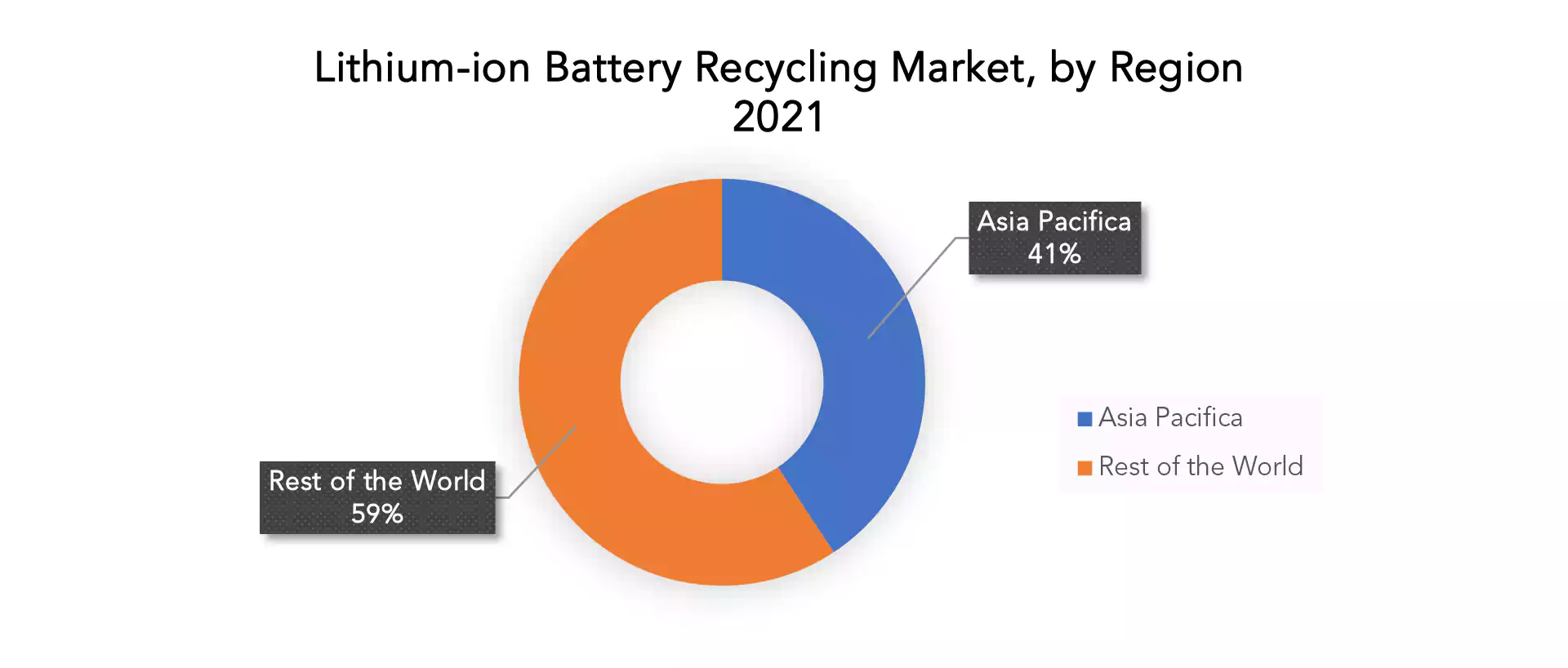

Asia Pacific held the highest market share of 44%. The Asia Pacific lithium-ion battery recycling market is expanding rapidly due to rising demand for electric vehicles and energy storage systems. Governments and industry stakeholders are concentrating on creating long-term solutions for battery disposal and precious material recovery. Strict laws, increased environmental concerns, and the creation of recycling facilities are driving the industry. The Asia Pacific lithium-ion battery recycling market, with a fast increasing electric mobility sector, provides lucrative prospects for enterprises involved in battery collection, dismantling, and material recovery.

The Lithium-ion Battery Recycling market in North America is experiencing significant growth due to the rising demand for electric vehicles and portable electronic devices. The region is witnessing the establishment of advanced recycling facilities and the implementation of stringent environmental regulations, driving the market’s expansion. This trend is expected to continue as sustainability and resource conservation become key priorities in the region’s industrial landscape.

Key Market Segments: Lithium-ion Battery Recycling Market

Lithium-ion Battery Recycling Market By Battery Chemistry, 2020-2029, (USD Billion).

- Lithium-ion Phosphate

- Lithium-Manganese Oxide

- Lithium-Nickel Cobalt Aluminum

- Lithium-Nickel Manganese Cobalt

- Lithium-Titanate Oxide

Lithium-ion Battery Recycling Market By Source, 2020-2029, (USD Billion).

- Electric Vehicle

- Electronics

- Power Tools

Lithium-ion Battery Recycling Market By Recycling Process, 2020-2029, (USD Billion).

- Hydrometallurgical Process

- Physical Process

- Pyrometallurgy Process

Lithium-ion Battery Recycling Market By End User, 2020-2029, (USD Billion).

- Automotive

- Non-Automotive

- Industrial

- Consumer Electronics

Lithium-ion Battery Recycling Market By Region, 2020-2029, (USD Billion).

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives

- Increasing sales and market share

- Developing new Source

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the lithium-ion battery recycling market over the next 7 years?

- Who are the major players in the lithium-ion battery recycling market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, And Africa?

- How is the economic environment affecting the lithium-ion battery recycling market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the lithium-ion battery recycling market?

- What is the current and forecasted size and growth rate of the global lithium-ion battery recycling market?

- What are the key drivers of growth in the lithium-ion battery recycling market?

- What are the distribution channels and supply chain dynamics in the lithium-ion battery recycling market?

- What are the technological advancements and innovations in the lithium-ion battery recycling market and their impact on material development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the lithium-ion battery recycling market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the lithium-ion battery recycling market?

- What are the service offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL LITHIUM-ION BATTERY RECYCLING MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON LITHIUM-ION BATTERY RECYCLING MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL LITHIUM-ION BATTERY RECYCLING MARKET OUTLOOK

- GLOBAL LITHIUM-ION BATTERY RECYCLING MARKET BY BATTERY CHEMISTRY (USD BILLION), 2020-2029

- LITHIUM-ION PHOSPHATE

- LITHIUM-MANGANESE-OXIDE

- LITHIUM-NICKEL-COBALT-ALUMINUM OXIDE

- LITHIUM-NICKEL-MANGANESE-COBALT

- LITHIUM-TITANATE OXIDE

- GLOBAL LITHIUM-ION BATTERY RECYCLING MARKET BY SOURCE (USD BILLION) , 2020-2029

- ELECTRIC VEHICLE

- ELECTRONICS

- POWER TOOLS

- GLOBAL LITHIUM-ION BATTERY RECYCLING MARKET BY RECYCLING PROCESS (USD BILLION) , 2020-2029

- HYDROMETALLURGICAL PROCESS

- PHYSICAL PROCESS

- PYROMETALLURGICAL PROCESS

- GLOBAL LITHIUM-ION BATTERY RECYCLING MARKET BY END USER (USD BILLION) , 2020-2029

- AUTOMOTVE

- NON-AUTOMOTIVE

- INDUSTRIAL

- CONSUMER ELECTRONICS

- GLOBAL LITHIUM-ION BATTERY RECYCLING MARKET BY REGION (USD BILLION) , 2020-2029

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- UMICORE

- RETIEV TECHNOLOGIES

- LI-CYCLE

- GEM CO.LTD

- ACCUREC GMBH

- AMERICAN MANGANESE INC

- RECUPYL

- BATTERY RECYCLING MADE EASY

- FORTUM

- REDUX RECYCLING *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL LITHIUM-ION BATTERY RECYCLING MARKET BY BATTERY CHEMISTRY (USD BILLIONS), 2020-2029

TABLE 2 GLOBAL LITHIUM-ION BATTERY RECYCLING MARKET BY SOURCE (USD BILLIONS), 2020-2029

TABLE 3 GLOBAL LITHIUM-ION BATTERY RECYCLING MARKET BY RECYCLING PROCESS (USD BILLIONS), 2020-2029

TABLE 4 GLOBAL LITHIUM-ION BATTERY RECYCLING MARKET BY END USER (USD BILLIONS), 2020-2029

TABLE 5 GLOBAL LITHIUM-ION BATTERY RECYCLING MARKET BY REGION (USD BILLIONS), 2020-2029

TABLE 6 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET BY BATTERY CHEMISTRY (USD BILLIONS), 2020-2029

TABLE 7 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET BY SOURCE (USD BILLIONS), 2020-2029

TABLE 8 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET BY RECYCLING PROCESS (USD BILLIONS), 2020-2029

TABLE 9 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET BY END USER (USD BILLIONS), 2020-2029

TABLE 10 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET BY COUNTRY (USD BILLIONS), 2020-2029

TABLE 11 US LITHIUM-ION BATTERY RECYCLING MARKET BY BATTERY CHEMISTRY (USD BILLIONS), 2020-2029

TABLE 12 US LITHIUM-ION BATTERY RECYCLING MARKET BY SOURCE (USD BILLIONS), 2020-2029

TABLE 13 US LITHIUM-ION BATTERY RECYCLING MARKET BY RECYCLING PROCESS (USD BILLIONS), 2020-2029

TABLE 14 US LITHIUM-ION BATTERY RECYCLING MARKET BY END USER (USD BILLIONS), 2020-2029

TABLE 15 CANADA LITHIUM-ION BATTERY RECYCLING MARKET BY BATTERY CHEMISTRY (BILLIONS), 2020-2029

TABLE 16 CANADA LITHIUM-ION BATTERY RECYCLING MARKET BY SOURCE (USD BILLIONS), 2020-2029

TABLE 17 CANADA LITHIUM-ION BATTERY RECYCLING MARKET BY RECYCLING PROCESS (USD BILLIONS), 2020-2029

TABLE 18 CANADA LITHIUM-ION BATTERY RECYCLING MARKET BY END USER (USD BILLIONS), 2020-2029

TABLE 19 MEXICO LITHIUM-ION BATTERY RECYCLING MARKET BY BATTERY CHEMISTRY (USD BILLIONS), 2020-2029

TABLE 20 MEXICO LITHIUM-ION BATTERY RECYCLING MARKET BY SOURCE (USD BILLIONS), 2020-2029

TABLE 21 MEXICO LITHIUM-ION BATTERY RECYCLING MARKET BY RECYCLING PROCESS (USD BILLIONS), 2020-2029

TABLE 22 MEXICO LITHIUM-ION BATTERY RECYCLING MARKET BY END USER (USD BILLIONS), 2020-2029

TABLE 23 SOUTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET BY BATTERY CHEMISTRY (USD BILLIONS), 2020-2029

TABLE 24 SOUTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET BY SOURCE (USD BILLIONS), 2020-2029

TABLE 25 SOUTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET BY RECYCLING PROCESS (USD BILLIONS), 2020-2029

TABLE 26 SOUTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET BY END USER (USD BILLIONS), 2020-2029

TABLE 27 SOUTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET BY COUNTRY (USD BILLIONS), 2020-2029

TABLE 28 BRAZIL LITHIUM-ION BATTERY RECYCLING MARKET BY BATTERY CHEMISTRY (USD BILLIONS), 2020-2029

TABLE 29 BRAZIL LITHIUM-ION BATTERY RECYCLING MARKET BY SOURCE (USD BILLIONS), 2020-2029

TABLE 30 BRAZIL LITHIUM-ION BATTERY RECYCLING MARKET BY RECYCLING PROCESS (USD BILLIONS), 2020-2029

TABLE 31 BRAZIL LITHIUM-ION BATTERY RECYCLING MARKET BY END USER (USD BILLIONS), 2020-2029

TABLE 32 ARGENTINA LITHIUM-ION BATTERY RECYCLING MARKET BY BATTERY CHEMISTRY (USD BILLIONS), 2020-2029

TABLE 33 ARGENTINA LITHIUM-ION BATTERY RECYCLING MARKET BY SOURCE (USD BILLIONS), 2020-2029

TABLE 34 ARGENTINA LITHIUM-ION BATTERY RECYCLING MARKET BY RECYCLING PROCESS (USD BILLIONS), 2020-2029

TABLE 35 ARGENTINA LITHIUM-ION BATTERY RECYCLING MARKET BY END USER (USD BILLIONS), 2020-2029

TABLE 36 COLOMBIA LITHIUM-ION BATTERY RECYCLING MARKET BY BATTERY CHEMISTRY (USD BILLIONS), 2020-2029

TABLE 37 COLOMBIA LITHIUM-ION BATTERY RECYCLING MARKET BY SOURCE (USD BILLIONS), 2020-2029

TABLE 38 COLOMBIA LITHIUM-ION BATTERY RECYCLING MARKET BY RECYCLING PROCESS (USD BILLIONS), 2020-2029

TABLE 39 COLOMBIA LITHIUM-ION BATTERY RECYCLING MARKET BY END USER (USD BILLIONS), 2020-2029

TABLE 40 REST OF SOUTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET BY BATTERY CHEMISTRY (USD BILLIONS), 2020-2029

TABLE 41 REST OF SOUTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET BY SOURCE (USD BILLIONS), 2020-2029

TABLE 42 REST OF SOUTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET BY RECYCLING PROCESS (USD BILLIONS), 2020-2029

TABLE 43 REST OF SOUTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET BY END USER (USD BILLIONS), 2020-2029

TABLE 44 ASIA-PACIFIC LITHIUM-ION BATTERY RECYCLING MARKET BY BATTERY CHEMISTRY (USD BILLIONS), 2020-2029

TABLE 45 ASIA-PACIFIC LITHIUM-ION BATTERY RECYCLING MARKET BY SOURCE (USD BILLIONS), 2020-2029

TABLE 46 ASIA-PACIFIC LITHIUM-ION BATTERY RECYCLING MARKET BY RECYCLING PROCESS (USD BILLIONS), 2020-2029

TABLE 47 ASIA-PACIFIC LITHIUM-ION BATTERY RECYCLING MARKET BY END USER (USD BILLIONS), 2020-2029

TABLE 48 ASIA-PACIFIC LITHIUM-ION BATTERY RECYCLING MARKET BY COUNTRY (USD BILLIONS), 2020-2029

TABLE 49 INDIA LITHIUM-ION BATTERY RECYCLING MARKET BY BATTERY CHEMISTRY (USD BILLIONS), 2020-2029

TABLE 50 INDIA LITHIUM-ION BATTERY RECYCLING MARKET BY SOURCE (USD BILLIONS), 2020-2029

TABLE 51 INDIA LITHIUM-ION BATTERY RECYCLING MARKET BY RECYCLING PROCESS (USD BILLIONS), 2020-2029

TABLE 52 INDIA LITHIUM-ION BATTERY RECYCLING MARKET BY END USER (USD BILLIONS), 2020-2029

TABLE 53 CHINA LITHIUM-ION BATTERY RECYCLING MARKET BY BATTERY CHEMISTRY (USD BILLIONS), 2020-2029

TABLE 54 CHINA LITHIUM-ION BATTERY RECYCLING MARKET BY SOURCE (USD BILLIONS), 2020-2029

TABLE 55 CHINA LITHIUM-ION BATTERY RECYCLING MARKET BY RECYCLING PROCESS (USD BILLIONS), 2020-2029

TABLE 56 CHINA LITHIUM-ION BATTERY RECYCLING MARKET BY END USER (USD BILLIONS), 2020-2029

TABLE 57 JAPAN LITHIUM-ION BATTERY RECYCLING MARKET BY BATTERY CHEMISTRY (USD BILLIONS), 2020-2029

TABLE 58 JAPAN LITHIUM-ION BATTERY RECYCLING MARKET BY SOURCE (USD BILLIONS), 2020-2029

TABLE 59 JAPAN LITHIUM-ION BATTERY RECYCLING MARKET BY RECYCLING PROCESS (USD BILLIONS), 2020-2029

TABLE 60 JAPAN LITHIUM-ION BATTERY RECYCLING MARKET BY END USER (USD BILLIONS), 2020-2029

TABLE 61 SOUTH KOREA LITHIUM-ION BATTERY RECYCLING MARKET BY BATTERY CHEMISTRY (USD BILLIONS), 2020-2029

TABLE 62 SOUTH KOREA LITHIUM-ION BATTERY RECYCLING MARKET BY SOURCE (USD BILLIONS), 2020-2029

TABLE 63 SOUTH KOREA LITHIUM-ION BATTERY RECYCLING MARKET BY RECYCLING PROCESS (USD BILLIONS), 2020-2029

TABLE 64 SOUTH KOREA LITHIUM-ION BATTERY RECYCLING MARKET BY END USER (USD BILLIONS), 2020-2029

TABLE 65 AUSTRALIA LITHIUM-ION BATTERY RECYCLING MARKET BY BATTERY CHEMISTRY (USD BILLIONS), 2020-2029

TABLE 66 AUSTRALIA LITHIUM-ION BATTERY RECYCLING MARKET BY SOURCE (USD BILLIONS), 2020-2029

TABLE 67 AUSTRALIA LITHIUM-ION BATTERY RECYCLING MARKET BY RECYCLING PROCESS (USD BILLIONS), 2020-2029

TABLE 68 AUSTRALIA LITHIUM-ION BATTERY RECYCLING MARKET BY END USER (USD BILLIONS), 2020-2029

TABLE 69 SOUTH EAST ASIA LITHIUM-ION BATTERY RECYCLING MARKET BY BATTERY CHEMISTRY (USD BILLIONS), 2020-2029

TABLE 70 SOUTH EAST ASIA LITHIUM-ION BATTERY RECYCLING MARKET BY SOURCE (USD BILLIONS), 2020-2029

TABLE 71 SOUTH EAST ASIA LITHIUM-ION BATTERY RECYCLING MARKET BY RECYCLING PROCESS (USD BILLIONS), 2020-2029

TABLE 72 SOUTH EAST ASIA LITHIUM-ION BATTERY RECYCLING MARKET BY END USER (USD BILLIONS), 2020-2029

TABLE 73 REST OF ASIA PACIFIC LITHIUM-ION BATTERY RECYCLING MARKET BY BATTERY CHEMISTRY (USD BILLIONS), 2020-2029

TABLE 74 REST OF ASIA PACIFIC LITHIUM-ION BATTERY RECYCLING MARKET BY SOURCE (USD BILLIONS), 2020-2029

TABLE 75 REST OF ASIA PACIFIC LITHIUM-ION BATTERY RECYCLING MARKET BY RECYCLING PROCESS (USD BILLIONS), 2020-2029

TABLE 76 REST OF ASIA PACIFIC LITHIUM-ION BATTERY RECYCLING MARKET BY END USER (USD BILLIONS), 2020-2029

TABLE 77 EUROPE LITHIUM-ION BATTERY RECYCLING MARKET BY BATTERY CHEMISTRY (USD BILLIONS), 2020-2029

TABLE 78 EUROPE LITHIUM-ION BATTERY RECYCLING MARKET BY SOURCE (USD BILLIONS), 2020-2029

TABLE 79 EUROPE LITHIUM-ION BATTERY RECYCLING MARKET BY RECYCLING PROCESS (USD BILLIONS), 2020-2029

TABLE 80 EUROPE LITHIUM-ION BATTERY RECYCLING MARKET BY END USER (USD BILLIONS), 2020-2029

TABLE 81 EUROPE LITHIUM-ION BATTERY RECYCLING MARKET BY COUNTRY (USD BILLIONS), 2020-2029

TABLE 82 GERMANY LITHIUM-ION BATTERY RECYCLING MARKET BY BATTERY CHEMISTRY (USD BILLIONS), 2020-2029

TABLE 83 GERMANY LITHIUM-ION BATTERY RECYCLING MARKET BY SOURCE (USD BILLIONS), 2020-2029

TABLE 84 GERMANY LITHIUM-ION BATTERY RECYCLING MARKET BY RECYCLING PROCESS (USD BILLIONS), 2020-2029

TABLE 85 GERMANY LITHIUM-ION BATTERY RECYCLING MARKET BY END USER (USD BILLIONS), 2020-2029

TABLE 86 UK LITHIUM-ION BATTERY RECYCLING MARKET BY BATTERY CHEMISTRY (USD BILLIONS), 2020-2029

TABLE 87 UK LITHIUM-ION BATTERY RECYCLING MARKET BY SOURCE (USD BILLIONS), 2020-2029

TABLE 88 UK LITHIUM-ION BATTERY RECYCLING MARKET BY RECYCLING PROCESS (USD BILLIONS), 2020-2029

TABLE 89 UK LITHIUM-ION BATTERY RECYCLING MARKET BY END USER (USD BILLIONS), 2020-2029

TABLE 90 FRANCE LITHIUM-ION BATTERY RECYCLING MARKET BY BATTERY CHEMISTRY (USD BILLIONS), 2020-2029

TABLE 91 FRANCE LITHIUM-ION BATTERY RECYCLING MARKET BY SOURCE (USD BILLIONS), 2020-2029

TABLE 92 FRANCE LITHIUM-ION BATTERY RECYCLING MARKET BY RECYCLING PROCESS (USD BILLIONS), 2020-2029

TABLE 93 FRANCE LITHIUM-ION BATTERY RECYCLING MARKET BY END USER (USD BILLIONS), 2020-2029

TABLE 94 ITALY LITHIUM-ION BATTERY RECYCLING MARKET BY BATTERY CHEMISTRY (USD BILLIONS), 2020-2029

TABLE 95 ITALY LITHIUM-ION BATTERY RECYCLING MARKET BY SOURCE (USD BILLIONS), 2020-2029

TABLE 96 ITALY LITHIUM-ION BATTERY RECYCLING MARKET BY RECYCLING PROCESS (USD BILLIONS), 2020-2029

TABLE 97 ITALY LITHIUM-ION BATTERY RECYCLING MARKET BY END USER (USD BILLIONS), 2020-2029

TABLE 98 SPAIN LITHIUM-ION BATTERY RECYCLING MARKET BY BATTERY CHEMISTRY (USD BILLIONS), 2020-2029

TABLE 99 SPAIN LITHIUM-ION BATTERY RECYCLING MARKET BY SOURCE (USD BILLIONS), 2020-2029

TABLE 100 SPAIN LITHIUM-ION BATTERY RECYCLING MARKET BY RECYCLING PROCESS (USD BILLIONS), 2020-2029

TABLE 101 SPAIN LITHIUM-ION BATTERY RECYCLING MARKET BY END USER (USD BILLIONS), 2020-2029

TABLE 102 RUSSIA LITHIUM-ION BATTERY RECYCLING MARKET BY BATTERY CHEMISTRY (USD BILLIONS), 2020-2029

TABLE 103 RUSSIA LITHIUM-ION BATTERY RECYCLING MARKET BY SOURCE (USD BILLIONS), 2020-2029

TABLE 104 RUSSIA LITHIUM-ION BATTERY RECYCLING MARKET BY RECYCLING PROCESS (USD BILLIONS), 2020-2029

TABLE 105 RUSSIA LITHIUM-ION BATTERY RECYCLING MARKET BY END USER (USD BILLIONS), 2020-2029

TABLE 106 REST OF EUROPE LITHIUM-ION BATTERY RECYCLING MARKET BY BATTERY CHEMISTRY (USD BILLIONS), 2020-2029

TABLE 107 REST OF EUROPE LITHIUM-ION BATTERY RECYCLING MARKET BY SOURCE (USD BILLIONS), 2020-2029

TABLE 108 REST OF EUROPE LITHIUM-ION BATTERY RECYCLING MARKET BY RECYCLING PROCESS (USD BILLIONS), 2020-2029

TABLE 109 REST OF EUROPE LITHIUM-ION BATTERY RECYCLING MARKET BY END USER (USD BILLIONS), 2020-2029

TABLE 110 MIDDLE EAST AND AFRICA LITHIUM-ION BATTERY RECYCLING MARKET BY BATTERY CHEMISTRY (USD BILLIONS), 2020-2029

TABLE 111 MIDDLE EAST AND AFRICA LITHIUM-ION BATTERY RECYCLING MARKET BY SOURCE (USD BILLIONS), 2020-2029

TABLE 112 MIDDLE EAST AND AFRICA LITHIUM-ION BATTERY RECYCLING MARKET BY RECYCLING PROCESS (USD BILLIONS), 2020-2029

TABLE 113 MIDDLE EAST AND AFRICA LITHIUM-ION BATTERY RECYCLING MARKET BY END USER (USD BILLIONS), 2020-2029

TABLE 114 MIDDLE EAST AND AFRICA LITHIUM-ION BATTERY RECYCLING MARKET BY COUNTRY (USD BILLIONS), 2020-2029

TABLE 115 UAE LITHIUM-ION BATTERY RECYCLING MARKET BY BATTERY CHEMISTRY (USD BILLIONS), 2020-2029

TABLE 116 UAE LITHIUM-ION BATTERY RECYCLING MARKET BY SOURCE (USD BILLIONS), 2020-2029

TABLE 117 UAE LITHIUM-ION BATTERY RECYCLING MARKET BY RECYCLING PROCESS (USD BILLIONS), 2020-2029

TABLE 118 UAE LITHIUM-ION BATTERY RECYCLING MARKET BY END USER (USD BILLIONS), 2020-2029

TABLE 119 SAUDI ARABIA LITHIUM-ION BATTERY RECYCLING MARKET BY BATTERY CHEMISTRY (USD BILLIONS), 2020-2029

TABLE 120 SAUDI ARABIA LITHIUM-ION BATTERY RECYCLING MARKET BY SOURCE (USD BILLIONS), 2020-2029

TABLE 121 SAUDI ARABIA LITHIUM-ION BATTERY RECYCLING MARKET BY RECYCLING PROCESS (USD BILLIONS), 2020-2029

TABLE 122 SAUDI ARABIA LITHIUM-ION BATTERY RECYCLING MARKET BY END USER (USD BILLIONS), 2020-2029

TABLE 123 SOUTH AFRICA LITHIUM-ION BATTERY RECYCLING MARKET BY BATTERY CHEMISTRY (USD BILLIONS), 2020-2029

TABLE 124 SOUTH AFRICA LITHIUM-ION BATTERY RECYCLING MARKET BY SOURCE (USD BILLIONS), 2020-2029

TABLE 125 SOUTH AFRICA LITHIUM-ION BATTERY RECYCLING MARKET BY RECYCLING PROCESS (USD BILLIONS), 2020-2029

TABLE 126 SOUTH AFRICA LITHIUM-ION BATTERY RECYCLING MARKET BY END USER (USD BILLIONS), 2020-2029

TABLE 127 REST OF MIDDLE EAST AND AFRICA LITHIUM-ION BATTERY RECYCLING MARKET BY BATTERY CHEMISTRY (USD BILLIONS), 2020-2029

TABLE 128 REST OF MIDDLE EAST AND AFRICA LITHIUM-ION BATTERY RECYCLING MARKET BY SOURCE (USD BILLIONS), 2020-2029

TABLE 129 REST OF MIDDLE EAST AND AFRICA LITHIUM-ION BATTERY RECYCLING MARKET BY RECYCLING PROCESS (USD BILLIONS), 2020-2029

TABLE 130 REST OF MIDDLE EAST AND AFRICA LITHIUM-ION BATTERY RECYCLING MARKET BY END USER (USD BILLIONS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL LITHIUM-ION BATTERY RECYCLING MARKET BY BATTERY CHEMISTRY, USD BILLION, 2020-2029

FIGURE 9 GLOBAL LITHIUM-ION BATTERY RECYCLING MARKET BY SOURCE, USD BILLION, 2020-2029

FIGURE 10 GLOBAL LITHIUM-ION BATTERY RECYCLING MARKET BY RECYCLING PROCESS, USD BILLION, 2020-2029

FIGURE 11 GLOBAL LITHIUM-ION BATTERY RECYCLING MARKET BY END USER, USD BILLION, 2020-2029

FIGURE 12 GLOBAL LITHIUM-ION BATTERY RECYCLING MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 13 PORTER’S FIVE FORCES MODEL

FIGURE 14 GLOBAL LITHIUM-ION BATTERY RECYCLING MARKET BY BATTERY CHEMISTRY, USD BILLION, 2021

FIGURE 15 GLOBAL LITHIUM-ION BATTERY RECYCLING MARKET BY SOURCE, USD BILLION, 2021

FIGURE 16 GLOBAL LITHIUM-ION BATTERY RECYCLING MARKET BY RECYCLING PROCESS, USD BILLION, 2021

FIGURE 17 GLOBAL LITHIUM-ION BATTERY RECYCLING MARKET BY END USER, USD BILLION, 2021

FIGURE 18 GLOBAL LITHIUM-ION BATTERY RECYCLING MARKET BY REGION 2021

FIGURE 19 MARKET SHARE ANALYSIS

FIGURE 20 UMICORE.: COMPANY SNAPSHOT

FIGURE 21 RETRIEV TECHNOLOGIES.: COMPANY SNAPSHOT

FIGURE 22 LI-CYCLE: COMPANY SNAPSHOT

FIGURE 23 GEM CO.LTD: COMPANY SNAPSHOT

FIGURE 24 ACCUREC RECYCLING GMBH: COMPANY SNAPSHOT

FIGURE 25 AMERICAN MANGANESE INC: COMPANY SNAPSHOT

FIGURE 26 RECUPYL.: COMPANY SNAPSHOT

FIGURE 27 BATTERY RECYCLING MADE EASY: COMPANY SNAPSHOT

FIGURE 28 FORTUM: COMPANY SNAPSHOT

FIGURE 29 REDUX RECYCLING: COMPANY SNAPSHOT

FAQ

The lithium-ion battery recycling market is expected to grow at 21 % CAGR from 2022 to 2029. It is expected to reach above USD 25.1 billion by 2029 from USD 2.7 billion in 2020.

Asia Pacific held more than 44 % of the lithium-ion battery recycling market revenue share in 2021 and will witness expansion in the forecast period.

The rising popularity of electric vehicles (EVs) is a major driver of the lithium-ion battery recycling market. As more governments and people embrace EVs as a sustainable transportation solution, battery recycling becomes increasingly important. Recycling lithium-ion batteries not only aids in the recovery of important metals such as lithium, cobalt, and nickel, but it also lessens the environmental impact of mining these elements from the ground. The expanding popularity of EVs, as well as the corresponding demand for lithium-ion batteries, creates a profitable market for recycling companies seeking to address the growing demand for sustainable battery disposal and resource recovery.

Based on battery chemistry, the lithium-ion battery recycling market can be segmented based on different types of lithium-ion battery chemistries. These include lithium-ion phosphate, lithium-manganese oxide, lithium-nickel-cobalt aluminum oxide, lithium-nickel-manganese cobalt, and lithium-titanate oxide. Each segment represents specific battery compositions, enabling targeted recycling processes to extract valuable materials and reduce environmental impact.

Asia Pacific is the largest regional market for lithium-ion battery recycling market.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.