REPORT OUTLOOK

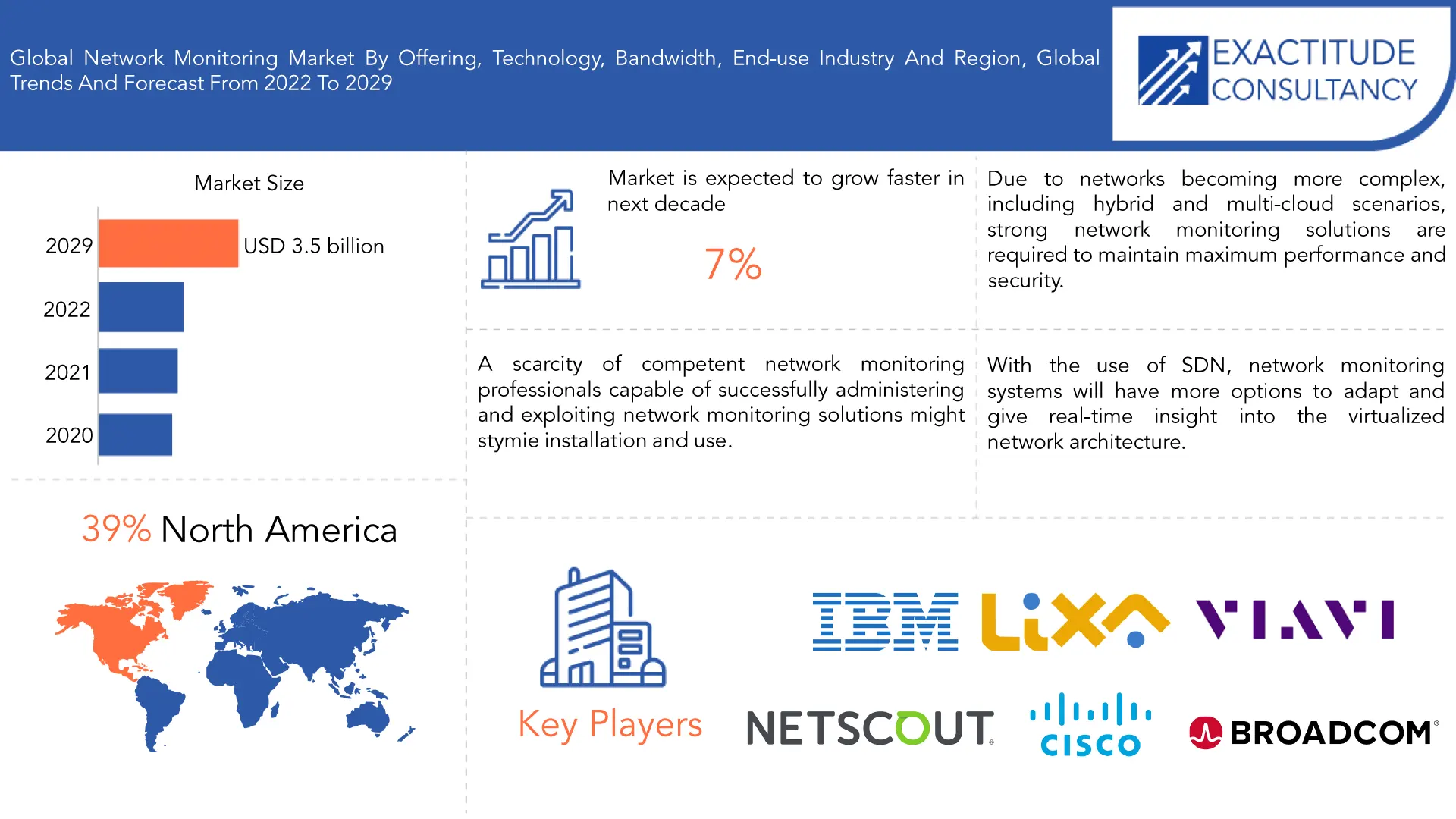

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 3.53 Billion By 2029 | 7% | North America |

| by Offering | by Bandwidth | by Technology |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Network Monitoring Market Overview

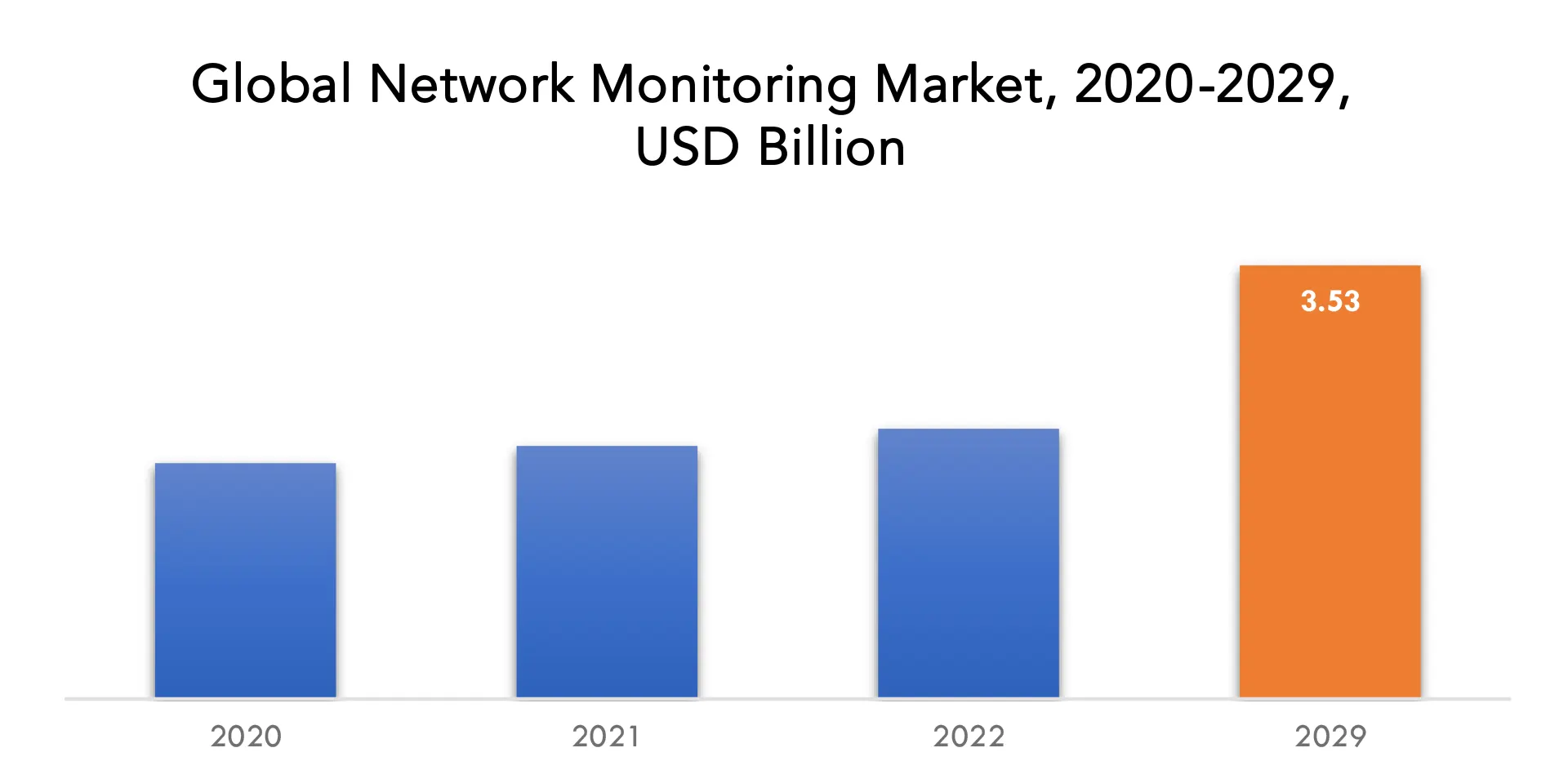

The global network monitoring market is expected to grow at 7% CAGR from 2022 to 2029. It is expected to reach above USD 3.53 billion by 2029 from USD 2.2 billion in 2022.

The growing use of video services, online gaming, and TV-on-demand has resulted in a surge in demand for high-speed data in recent years. Consumers are deploying network monitoring tools to improve performance output and migrate toward smaller, multi-fiber, and more efficient connections. Network monitoring is a sort of service provided by an observing system that watches computer networks for stoppage and data theft, and notifies the network‘s overseer if either occurs. These monitoring systems constantly evaluate vast volumes of data and filter it for any irregularities, if any exist.

Market dynamics are factors that influence stakeholder pricing and behavior. These factors provide pricing signals when the supply and demand curves for a certain commodity or service change. Market Dynamics Forces can be connected to macroeconomic and microeconomic issues. Other than pricing, demand, and supply, there are dynamic market factors. Human emotions may also impact market behavior and provide price signals. A network monitoring system continuously monitors a computer network for delayed or failed operations and alerts the network administrator through email, SMS, or other alarms in the event of outages or other problems. Network management includes network monitoring. A network monitoring system keeps an eye on the network for issues caused by overloaded or crashed servers, network connections, or other devices. Response time, availability, and uptime are commonly monitored measures, but stability and reliability metrics are gaining favor.

The global network monitoring market’s primary driving drivers are expanding. Need for robust network monitoring capabilities to ensure the smooth operation of mission-critical network infrastructure, rising demand for quick resolution of downtime concerns, rising demand for Continuous Monitoring due to increased network complexities and security concerns, and rising demand for highly reliable and scalable network monitoring equipment. Higher network downtimes experienced by service providers are one of the key concerns of network monitoring systems, as is the availability of free network traffic tools, which is presently impeding the development of the network monitoring industry.

The biggest potential of the global network monitoring market is optimizing company operations through network organization tools, primary opportunities in small and medium-sized organizations, and the emerging software-defined networking industry. The processing of large amounts of network performance data is one of the market’s primary difficulties. During the projection period, the Ethernet segment will have the greatest share of the market owing to the expansion of data centers and the increased usage of virtualization technology, which will raise the need for network monitoring equipment with greater bandwidths. Moving from low bandwidth to high bandwidth with Ethernet technology is not only cost-effective but also doable without causing any disturbance.

Due to strong technological advancement across various organizations producing enormous amounts of data, enterprises are expected to have the greatest share of the network monitoring market over the projected period. Additionally, issues within IT infrastructure drive enterprises to use virtualization technology. Increased employee flexibility, rising acceptance of techniques such as “bring your own device,” and increased use of novel Big Data solutions for operational data explosion all affect future network monitoring requirements.

| ATTRIBUTE | DETAILS |

| Study period | 2022-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2022 |

| Unit | Value (USD Billion) |

| Segmentation | By Offering, Bandwidth, Technology, End-user industry, and region. |

| By Offering |

|

| By Bandwidth |

|

| By Technology |

|

| By End-user industry |

|

| By Region |

|

Network Monitoring Market Segment Analysis

Network monitoring software programs that allow for network monitoring, analysis, and reporting. Network probes, sensors, and analyzers are examples of hardware used to capture network traffic. Network monitoring suppliers provide professional services such as deployment, consulting, and maintenance. On-premises network monitoring solutions are those that are installed and run within an organization’s own infrastructure. Cloud-based network monitoring solutions enable remote access and scalability by being hosted and provided via cloud platforms.

Businesses that operate in the IT industry or offer telecom services. Banking, Financial Services, and Insurance (BFSI), This category includes financial institutions, banks, insurance businesses, and associated services. Healthcare, Hospitals, clinics, medical institutions, and providers of healthcare services. Government and Defense, Government agencies, military forces, and public institutions. Manufacturing: Businesses that produce things or carry out industrial procedures. Retail and eCommerce: This category include retailers, online marketplaces, and eCommerce platforms. Other areas include education, energy, transportation, and media.

Traditional wired networks employ Ethernet, fiber-optic cables, or other physical connections. Wireless networks are those that use Wi-Fi, cellular networks, or other wireless technologies. Networks that include wired and wireless components are known as hybrid networks.

Network Monitoring Market Key Players

The Network Monitoring market’s key players include Gigamon, Netscout, Lixa, Viavi, IBM, Cisco, Broadcom, Corvil, Sevone, Calient, Zenoss, and Network Critical, among others.

For corporate expansion, these key leaders are implementing strategic formulations such as new product development and commercialization, commercial expansion, and distribution agreements. Moreover, these participants are substantially spending on product development, which is fueling revenue generation.

Recent Developments:

- June 2023 – DocTutorials improves PG-level NEET coaching using IBM App Connect. DocTutorials Edutech aids learning through the use of a med-tech platform that provides a wealth of video content, expert notes, faculty interactions, and an extensive question bank that helps students to apply their knowledge to real-world instances.

- April 2023 – With sophisticated automation, optimizing cloud expenses while meeting sustainability targets was a snap. As organizations began to digitize, cloud-based solutions became an integral component of their transformation strategy. However, once in the cloud, around 80% of businesses reported getting bills that were two to three times higher than expected. This constituted a considerable issue, especially given that most organizations were suffering substantial economic headwinds at the time and were seeking methods to boost revenue while decreasing operational expenses.

- April 2023 – Customers anticipated services to be provided at the speed of light while also being more accessible and customizable in today’s ultra-competitive and highly computerized environment. Employees, partners, and the whole ecosystem with which firms engaged faced the same demands. Enterprises installed new apps and infrastructure to match the shifting desires of these varied stakeholders. According to IDC, 80% of organizations believe that they have 1000 or more apps in their portfolio now.

Who Should Buy? Or Key stakeholders

- Investors

- Food and Beverage industry

- Medical Technology Companies

- Healthcare and personal care firms

- Research Organizations

- Regulatory Authorities

- Institutional & retail players

- Others

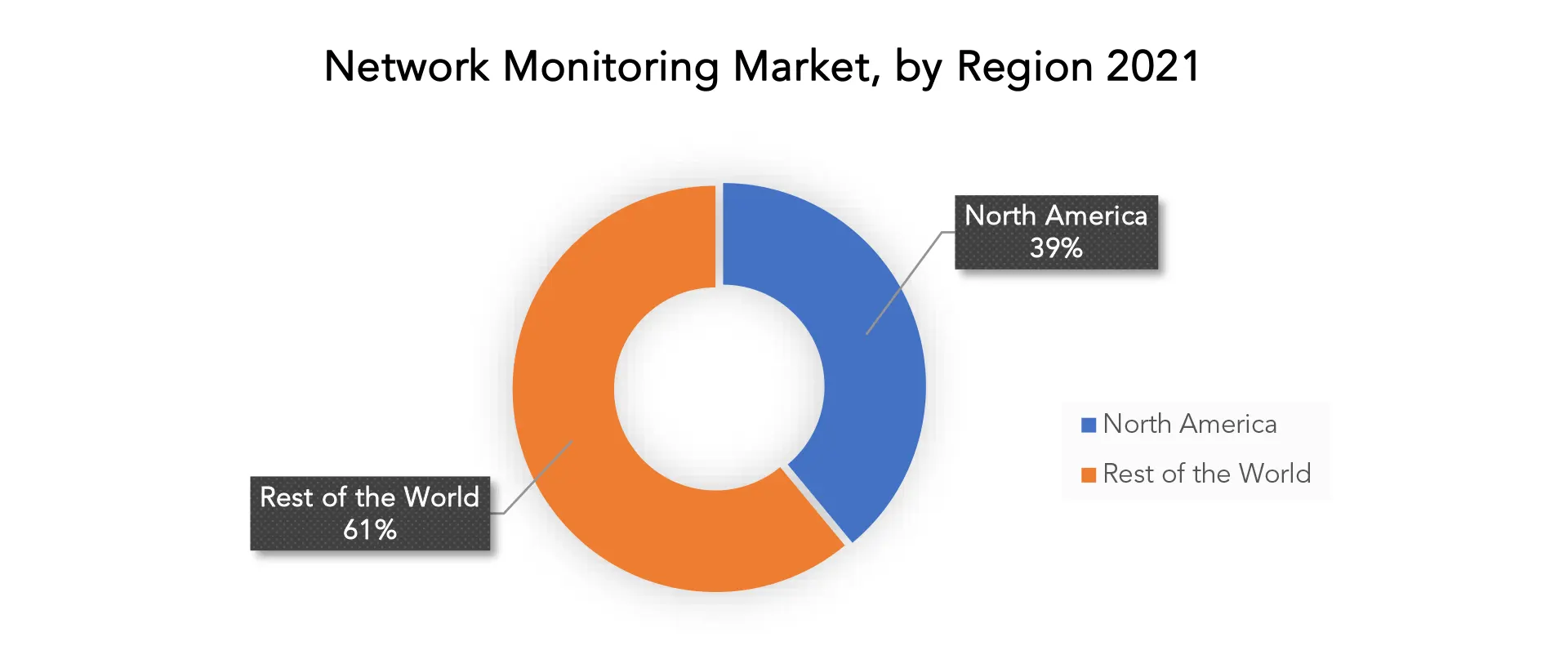

Network Monitoring Market Regional Analysis

The network monitoring market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN, and Rest of APAC

- Europe: includes the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe

- South America: includes Brazil, Argentina, and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and the Rest of MEA

North America dominates the network monitoring market due to increased IT capacity requirements and the region’s rapid adoption of new data center technologies. Due to expanding IT capacity requirements and increased adoption of new data center technologies, North America has the largest market. The market in the United States is expected to gain pace as a large number of enterprises choose cloud services to save the initial expense of creating new data centers for business continuity. In APAC, significant government efforts and investments from technologically emerging countries such as India, Japan, China, Singapore, and Australia are pushing for the creation of data centers.

Europe, which includes nations has also been a significant region in the network monitoring business. The region is dominated by IT and telecommunications firms, with a focus on data protection and security requirements. The Asia Pacific area, which includes China, Japan, India, and Australia, has seen rapid expansion in the network monitoring industry. This region’s popularity has been boosted by fast digitalization and increased acceptance of cloud-based technologies.

Network Monitoring Key Market Segments:

Network Monitoring Market by Offering, 2020-2029, (USD Billion)

- Equipment

- Software & Services

Network Monitoring Market by Bandwidth, 2020-2029, (USD Billion)

- 1&10 Gbps

- 40Gbps

- 100 Gbps

Network Monitoring Market by Technology, 2020-2029, (USD Billion)

- Ethernet

- Fiber Optics

- InfiniBand

Network Monitoring Market by End-User Industry, 2020-2029, (USD Billion)

- Enterprises

- Telecommunication & Industry

- Government Organizations

- Cloud Service Providers

Network Monitoring Market by Region, 2020-2029, (USD Billion)

- North America

- Asia Pacific

- Europe

- South America

- Middle East and Africa

Important Countries in All Regions Are Covered.

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the network monitoring market over the next 7 years?

- What are the end-user industries driving demand for the market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the Middle East, and Africa?

- How is the economic environment affecting the network monitoring market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the network monitoring market?

- What are the key drivers of growth in the network monitoring market?

- Who are the market’s major players, and what is their market share?

- What are the network monitoring market’s distribution channels and supply chain dynamics?

- What are the technological advancements and innovations in the network monitoring market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the network monitoring market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the network monitoring market?

- What are the market’s service offerings and specifications of leading players?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL NETWORK MONITORING MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON NETWORK MONITORING MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL NETWORK MONITORING MARKET OUTLOOK

- GLOBAL NETWORK MONITORING MARKET BY OFFERING, 2020-2029, (USD BILLION)

- EQUIPMENT

- SOFTWARE & SERVICES

- GLOBAL NETWORK MONITORING MARKET BY BANDWIDTH, 2020-2029, (USD BILLION)

- 1&10 GBPS

- 40GBPS

- 100 GBPS

- GLOBAL NETWORK MONITORING MARKET BY TECHNOLOGY, 2020-2029, (USD BILLION)

- ETHERNET

- FIBER OPTICS

- INFINIBAND

- GLOBAL NETWORK MONITORING MARKET BY END-USER INDUSTRY, 2020-2029, (USD BILLION)

- ENTERPRISES

- TELECOMMUNICATION & INDUSTRY

- GOVERNMENT ORGANIZATIONS

- CLOUD SERVICE PROVIDERS

- GLOBAL NETWORK MONITORING MARKET BY REGION (USD BILLION), 2020-2029

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- GINGAMON

- NETSCOUT

- LIXA

- VIAVI

- CISCO,

- BROADCOM

- CORVIL

- IBM

- CALIENT *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL NETWORK MONITORING MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 2 GLOBAL NETWORK MONITORING MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 3 GLOBAL NETWORK MONITORING MARKET BY BANDWIDTH (USD BILLION), 2020-2029

TABLE 4 GLOBAL NETWORK MONITORING MARKET BY END-USER INDUSTRY (USD BILLION), 2020-2029

TABLE 5 GLOBAL NETWORK MONITORING MARKET BY REGION (USD BILLION), 2020-2029

TABLE 6 NORTH AMERICA NETWORK MONITORING MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 7 NORTH AMERICA NETWORK MONITORING MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 8 NORTH AMERICA NETWORK MONITORING MARKET BY BANDWIDTH (USD BILLION), 2020-2029

TABLE 9 NORTH AMERICA NETWORK MONITORING MARKET BY END-USER INDUSTRY (USD BILLION), 2020-2029

TABLE 10 NORTH AMERICA NETWORK MONITORING MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 11 US NETWORK MONITORING MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 12 US NETWORK MONITORING MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 13 US NETWORK MONITORING MARKET BY BANDWIDTH (USD BILLION), 2020-2029

TABLE 14 US NETWORK MONITORING MARKET BY END-USER INDUSTRY (USD BILLION), 2020-2029

TABLE 15 CANADA NETWORK MONITORING MARKET BY OFFERING (BILLION), 2020-2029

TABLE 16 CANADA NETWORK MONITORING MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 17 CANADA NETWORK MONITORING MARKET BY BANDWIDTH (USD BILLION), 2020-2029

TABLE 18 CANADA NETWORK MONITORING MARKET BY END-USER INDUSTRY (USD BILLION), 2020-2029

TABLE 19 MEXICO NETWORK MONITORING MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 20 MEXICO NETWORK MONITORING MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 21 MEXICO NETWORK MONITORING MARKET BY BANDWIDTH (USD BILLION), 2020-2029

TABLE 22 MEXICO NETWORK MONITORING MARKET BY END-USER INDUSTRY (USD BILLION), 2020-2029

TABLE 23 SOUTH AMERICA NETWORK MONITORING MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 24 SOUTH AMERICA NETWORK MONITORING MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 25 SOUTH AMERICA NETWORK MONITORING MARKET BY BANDWIDTH (USD BILLION), 2020-2029

TABLE 26 SOUTH AMERICA NETWORK MONITORING MARKET BY END-USER INDUSTRY (USD BILLION), 2020-2029

TABLE 27 BRAZIL NETWORK MONITORING MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 28 BRAZIL NETWORK MONITORING MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 29 BRAZIL NETWORK MONITORING MARKET BY BANDWIDTH (USD BILLION), 2020-2029

TABLE 30 BRAZIL NETWORK MONITORING MARKET BY END-USER INDUSTRY (USD BILLION), 2020-2029

TABLE 31 ARGENTINA NETWORK MONITORING MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 32 ARGENTINA NETWORK MONITORING MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 33 ARGENTINA NETWORK MONITORING MARKET BY BANDWIDTH (USD BILLION), 2020-2029

TABLE 34 ARGENTINA NETWORK MONITORING MARKET BY END-USER INDUSTRY (USD BILLION), 2020-2029

TABLE 35 COLOMBIA NETWORK MONITORING MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 36 COLOMBIA NETWORK MONITORING MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 37 COLOMBIA NETWORK MONITORING MARKET BY BANDWIDTH (USD BILLION), 2020-2029

TABLE 38 COLOMBIA NETWORK MONITORING MARKET BY END-USER INDUSTRY (USD BILLION), 2020-2029

TABLE 39 REST OF SOUTH AMERICA NETWORK MONITORING MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 40 REST OF SOUTH AMERICA NETWORK MONITORING MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 41 REST OF SOUTH AMERICA NETWORK MONITORING MARKET BY BANDWIDTH (USD BILLION), 2020-2029

TABLE 42 REST OF SOUTH AMERICA NETWORK MONITORING MARKET BY END-USER INDUSTRY (USD BILLION), 2020-2029

TABLE 43 ASIA-PACIFIC NETWORK MONITORING MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 44 ASIA-PACIFIC NETWORK MONITORING MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 45 ASIA-PACIFIC NETWORK MONITORING MARKET BY BANDWIDTH (USD BILLION), 2020-2029

TABLE 46 ASIA-PACIFIC NETWORK MONITORING MARKET BY END-USER INDUSTRY (USD BILLION), 2020-2029

TABLE 47 ASIA-PACIFIC NETWORK MONITORING MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 48 INDIA NETWORK MONITORING MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 49 INDIA NETWORK MONITORING MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 50 INDIA NETWORK MONITORING MARKET BY BANDWIDTH (USD BILLION), 2020-2029

TABLE 51 INDIA NETWORK MONITORING MARKET BY END-USER INDUSTRY (USD BILLION), 2020-2029

TABLE 52 CHINA NETWORK MONITORING MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 53 CHINA NETWORK MONITORING MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 54 CHINA NETWORK MONITORING MARKET BY BANDWIDTH (USD BILLION), 2020-2029

TABLE 55 CHINA NETWORK MONITORING MARKET BY END-USER INDUSTRY (USD BILLION), 2020-2029

TABLE 56 JAPAN NETWORK MONITORING MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 57 JAPAN NETWORK MONITORING MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 58 JAPAN NETWORK MONITORING MARKET BY BANDWIDTH (USD BILLION), 2020-2029

TABLE 59 JAPAN NETWORK MONITORING MARKET BY END-USER INDUSTRY (USD BILLION), 2020-2029

TABLE 60 SOUTH KOREA NETWORK MONITORING MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 61 SOUTH KOREA NETWORK MONITORING MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 62 SOUTH KOREA NETWORK MONITORING MARKET BY BANDWIDTH (USD BILLION), 2020-2029

TABLE 63 SOUTH KOREA NETWORK MONITORING MARKET BY END-USER INDUSTRY (USD BILLION), 2020-2029

TABLE 64 AUSTRALIA NETWORK MONITORING MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 65 AUSTRALIA NETWORK MONITORING MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 66 AUSTRALIA NETWORK MONITORING MARKET BY BANDWIDTH (USD BILLION), 2020-2029

TABLE 67 AUSTRALIA NETWORK MONITORING MARKET BY END-USER INDUSTRY (USD BILLION), 2020-2029

TABLE 68 SOUTH EAST ASIA NETWORK MONITORING MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 69 SOUTH EAST ASIA NETWORK MONITORING MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 70 SOUTH EAST ASIA NETWORK MONITORING MARKET BY BANDWIDTH (USD BILLION), 2020-2029

TABLE 71 SOUTH EAST ASIA NETWORK MONITORING MARKET BY END-USER INDUSTRY (USD BILLION), 2020-2029

TABLE 72 REST OF ASIA PACIFIC NETWORK MONITORING MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 73 REST OF ASIA PACIFIC NETWORK MONITORING MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 74 REST OF ASIA PACIFIC NETWORK MONITORING MARKET BY BANDWIDTH (USD BILLION), 2020-2029

TABLE 75 REST OF ASIA PACIFIC NETWORK MONITORING MARKET BY END-USER INDUSTRY (USD BILLION), 2020-2029

TABLE 76 EUROPE NETWORK MONITORING MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 77 EUROPE NETWORK MONITORING MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 78 EUROPE NETWORK MONITORING MARKET BY BANDWIDTH (USD BILLION), 2020-2029

TABLE 79 EUROPE NETWORK MONITORING MARKET BY END-USER INDUSTRY (USD BILLION), 2020-2029

TABLE 80 EUROPE NETWORK MONITORING MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 81 GERMANY NETWORK MONITORING MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 82 GERMANY NETWORK MONITORING MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 83 GERMANY NETWORK MONITORING MARKET BY BANDWIDTH (USD BILLION), 2020-2029

TABLE 84 GERMANY NETWORK MONITORING MARKET BY END-USER INDUSTRY (USD BILLION), 2020-2029

TABLE 85 UK NETWORK MONITORING MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 86 UK NETWORK MONITORING MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 87 UK NETWORK MONITORING MARKET BY BANDWIDTH (USD BILLION), 2020-2029

TABLE 88 UK NETWORK MONITORING MARKET BY END-USER INDUSTRY (USD BILLION), 2020-2029

TABLE 89 FRANCE NETWORK MONITORING MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 90 FRANCE NETWORK MONITORING MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 91 FRANCE NETWORK MONITORING MARKET BY BANDWIDTH (USD BILLION), 2020-2029

TABLE 92 FRANCE NETWORK MONITORING MARKET BY END-USER INDUSTRY (USD BILLION), 2020-2029

TABLE 93 ITALY NETWORK MONITORING MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 94 ITALY NETWORK MONITORING MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 95 ITALY NETWORK MONITORING MARKET BY BANDWIDTH (USD BILLION), 2020-2029

TABLE 96 ITALY NETWORK MONITORING MARKET BY END-USER INDUSTRY (USD BILLION), 2020-2029

TABLE 97 SPAIN NETWORK MONITORING MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 98 SPAIN NETWORK MONITORING MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 99 SPAIN NETWORK MONITORING MARKET BY BANDWIDTH (USD BILLION), 2020-2029

TABLE 100 SPAIN NETWORK MONITORING MARKET BY END-USER INDUSTRY (USD BILLION), 2020-2029

TABLE 101 RUSSIA NETWORK MONITORING MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 102 RUSSIA NETWORK MONITORING MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 103 RUSSIA NETWORK MONITORING MARKET BY BANDWIDTH (USD BILLION), 2020-2029

TABLE 104 RUSSIA NETWORK MONITORING MARKET BY END-USER INDUSTRY (USD BILLION), 2020-2029

TABLE 105 REST OF EUROPE NETWORK MONITORING MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 106 REST OF EUROPE NETWORK MONITORING MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 107 REST OF EUROPE NETWORK MONITORING MARKET BY BANDWIDTH (USD BILLION), 2020-2029

TABLE 108 REST OF EUROPE NETWORK MONITORING MARKET BY END-USER INDUSTRY (USD BILLION), 2020-2029

TABLE 109 MIDDLE EAST AND AFRICA NETWORK MONITORING MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 110 MIDDLE EAST AND AFRICA NETWORK MONITORING MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 111 MIDDLE EAST AND AFRICA NETWORK MONITORING MARKET BY BANDWIDTH (USD BILLION), 2020-2029

TABLE 112 MIDDLE EAST AND AFRICA NETWORK MONITORING MARKET BY END-USER INDUSTRY (USD BILLION), 2020-2029

TABLE 113 MIDDLE EAST AND AFRICA NETWORK MONITORING MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 114 UAE NETWORK MONITORING MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 115 UAE NETWORK MONITORING MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 116 UAE NETWORK MONITORING MARKET BY BANDWIDTH (USD BILLION), 2020-2029

TABLE 117 UAE NETWORK MONITORING MARKET BY END-USER INDUSTRY (USD BILLION), 2020-2029

TABLE 118 SAUDI ARABIA NETWORK MONITORING MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 119 SAUDI ARABIA NETWORK MONITORING MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 120 SAUDI ARABIA NETWORK MONITORING MARKET BY BANDWIDTH (USD BILLION), 2020-2029

TABLE 121 SAUDI ARABIA NETWORK MONITORING MARKET BY END-USER INDUSTRY (USD BILLION), 2020-2029

TABLE 122 SOUTH AFRICA NETWORK MONITORING MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 123 SOUTH AFRICA NETWORK MONITORING MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 124 SOUTH AFRICA NETWORK MONITORING MARKET BY BANDWIDTH (USD BILLION), 2020-2029

TABLE 125 SOUTH AFRICA NETWORK MONITORING MARKET BY END-USER INDUSTRY (USD BILLION), 2020-2029

TABLE 126 REST OF MIDDLE EAST AND AFRICA NETWORK MONITORING MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 127 REST OF MIDDLE EAST AND AFRICA NETWORK MONITORING MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 128 REST OF MIDDLE EAST AND AFRICA NETWORK MONITORING MARKET BY BANDWIDTH (USD BILLION), 2020-2029

TABLE 129 REST OF MIDDLE EAST AND AFRICA NETWORK MONITORING MARKET BY END-USER INDUSTRY (USD BILLION), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL NETWORK MONITORING BY OFFERING, USD BILLION, 2020-2029

FIGURE 9 GLOBAL NETWORK MONITORING BY TECHNOLOGY, USD BILLION, 2020-2029

FIGURE 10 GLOBAL NETWORK MONITORING BY BANDWIDTH, USD BILLION, 2020-2029

FIGURE 11 GLOBAL NETWORK MONITORING BY END-USER INDUSTRY, USD BILLION, 2020-2029

FIGURE 12 GLOBAL NETWORK MONITORING BY REGION, USD BILLION, 2020-2029

FIGURE 13 PORTER’S FIVE FORCES MODEL

FIGURE 14 GLOBAL NETWORK MONITORING BY OFFERING, USD BILLION, 2021

FIGURE 15 GLOBAL NETWORK MONITORING BY TECHNOLOGY, USD BILLION, 2021

FIGURE 16 GLOBAL NETWORK MONITORING BY BANDWIDTH, USD BILLION, 2021

FIGURE 17 GLOBAL NETWORK MONITORING BY END-USER INDUSTRY, USD BILLION, 2021

FIGURE 18 GLOBAL NETWORK MONITORING MARKET BY REGION 2021

FIGURE 19 MARKET SHARE ANALYSIS

FIGURE 20 GIGAMON: COMPANY SNAPSHOT

FIGURE 21 NETSCOUT: COMPANY SNAPSHOT

FIGURE 22 LIXA: COMPANY SNAPSHOT

FIGURE 23 CISCO: COMPANY SNAPSHOT

FIGURE 24 BROADCOM: COMPANY SNAPSHOT

FIGURE 25 CORVIL: COMPANY SNAPSHOT

FIGURE 26 SEVONE: COMPANY SNAPSHOT

FIGURE 27 IBM: COMPANY SNAPSHOT

FIGURE 28 CALIENT: COMPANY SNAPSHOT

FIGURE 29 ZENOSS: COMPANY SNAPSHOT

FAQ

The global network monitoring market is expected to grow at 7% CAGR from 2022 to 2029. It is expected to reach above USD 3.53 billion by 2029 from USD 2.2 billion in 2022.

Consumers are deploying network monitoring tools to improve performance output and migrate toward smaller, multi-fiber, and more efficient connections. Network monitoring is a sort of service provided by an observing system that watches computer networks for stoppage and data theft, and notifies the network’s overseer if either occurs. These monitoring systems constantly evaluate vast volumes of data and filter it for any irregularities, if any exist.

Network monitoring software programs that allow for network monitoring, analysis, and reporting. Network probes, sensors, and analyzers are examples of hardware used to capture network traffic. Network monitoring suppliers provide professional services such as deployment, consulting, and maintenance. On-premises network monitoring solutions are those that are installed and run within an organization’s own infrastructure. Cloud-based network monitoring solutions enable remote access and scalability by being hosted and provided via cloud platforms.

The Markets largest share is in the North American region.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.