REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

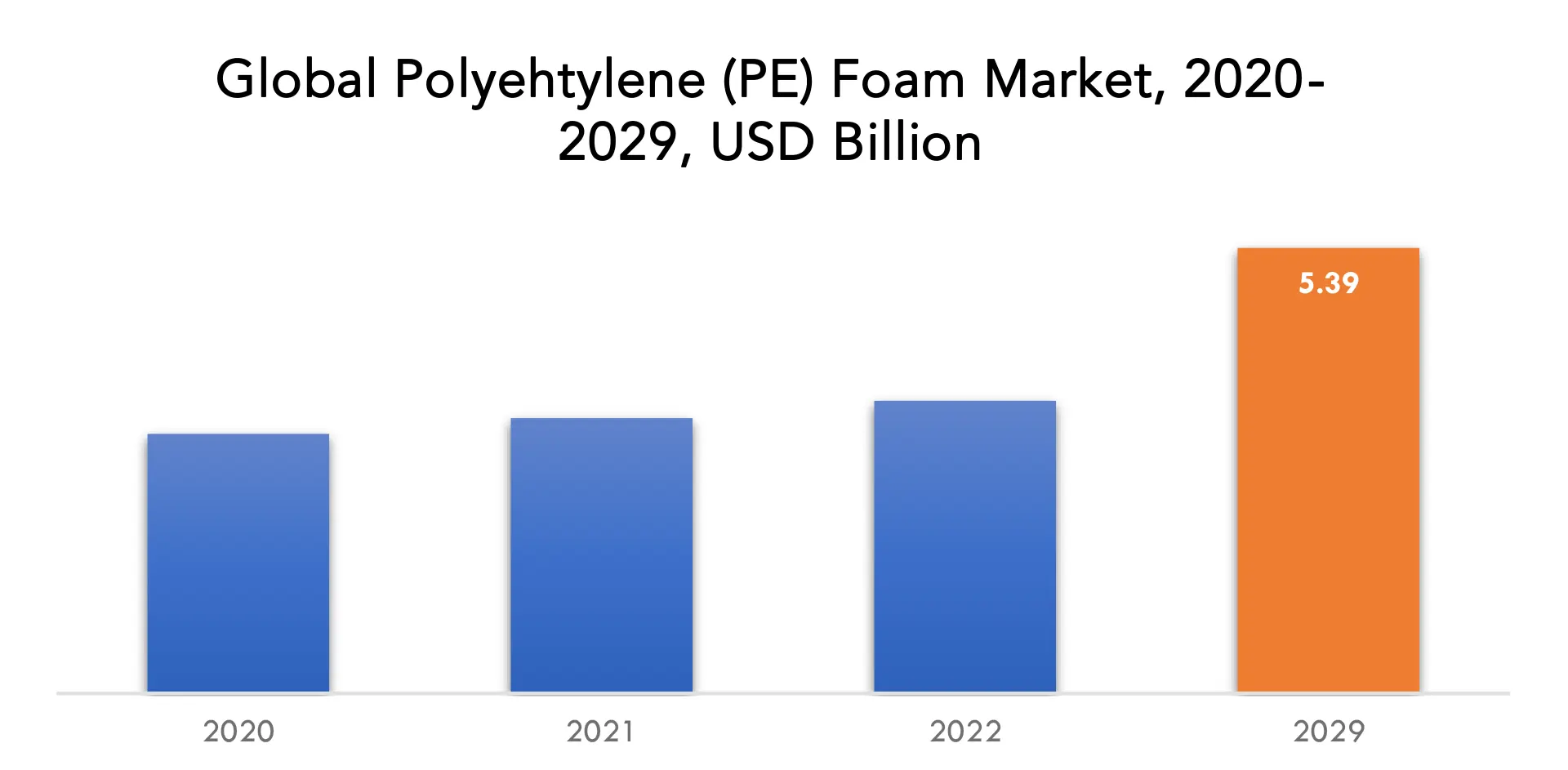

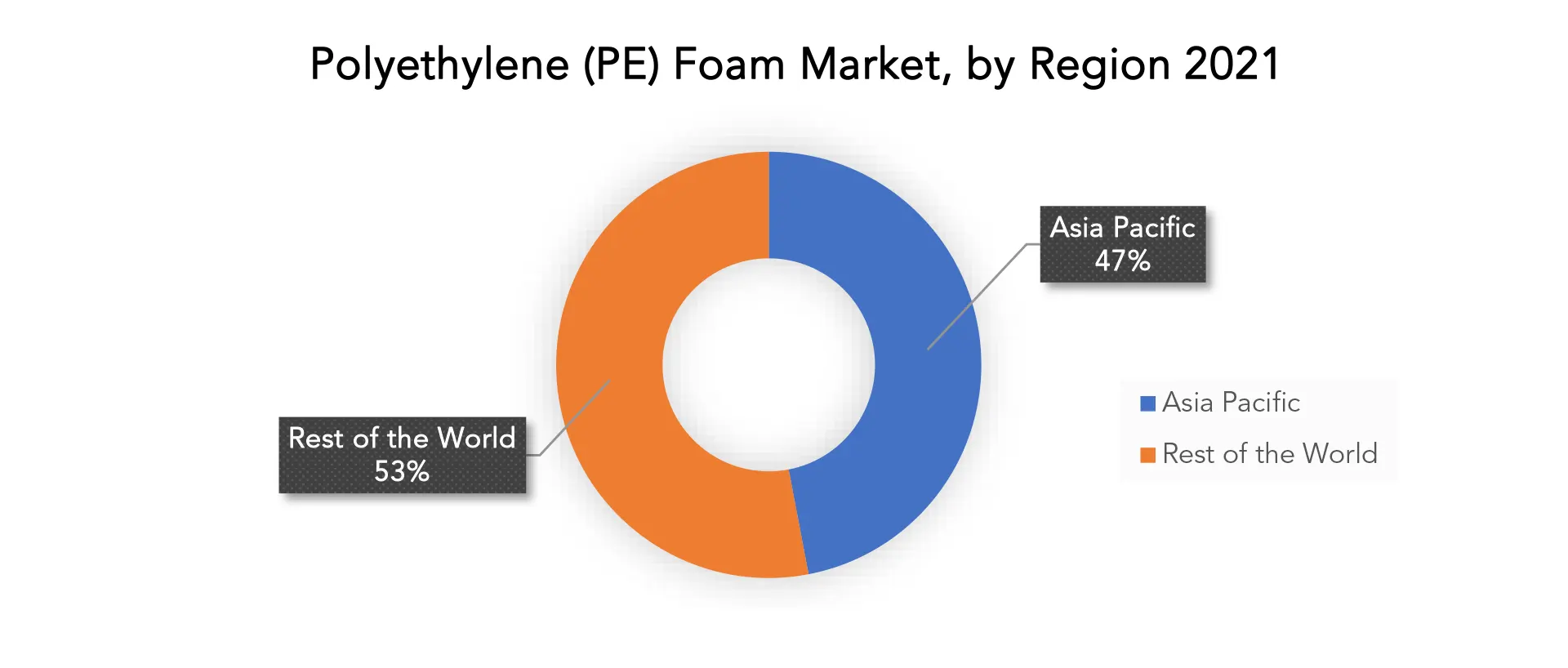

| USD 5.39 billion by 2029 | 6.19% | Asia Pacific |

| by Type | by End-Use | by Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Polyethylene (PE) foam Market Overview

The global polyethylene (PE) foam market size is expected to grow at more than 6.19% CAGR from 2020 to 2029. It is expected to reach above USD 5.39 billion by 2029 from a little above USD 3.14 billion in 2020.

Polyethylene (PE) foam is widely used in the packaging industry due to its excellent cushioning and protective properties. As e-commerce and online shopping continue to rise, the demand for polyethylene (PE) foam for packaging applications is expected to increase. Polyethylene (PE) foam is used in the construction sector for insulation, soundproofing, and sealing applications. The growth of the construction industry, particularly in emerging economies, is driving the demand for polyethylene (PE) foam. The automotive industry utilizes polyethylene (PE) foam in various applications such as gaskets, seals, insulation, and interior components. With the increasing production and sales of vehicles globally, the demand for polyethylene (PE) foam in the automotive sector is expected to grow. Polyethylene (PE) foam finds applications in consumer goods such as sports and leisure products, toys, and electronics packaging. As disposable income and consumer spending increase, the demand for these goods rises, thereby positively impacting the polyethylene (PE) foam market. Polyethylene (PE) foam is considered a more environmentally friendly alternative to some other materials, such as expanded polystyrene (EPS) foam, which has environmental concerns due to its non-biodegradable nature. Stringent regulations and growing awareness about sustainability may drive the demand for polyethylene (PE) foam as a replacement material.

Polyethylene (PE) foam is derived from petroleum-based raw materials, and its production is influenced by fluctuations in crude oil prices. Any significant volatility in raw material costs can impact the profitability of manufacturers and may pose a restraint on the market. Proper recycling and disposal of polyethylene (PE) foam can be challenging due to its low density and resilience. The lack of efficient recycling infrastructure and limited recycling options can be a restraint on the market as environmental regulations and sustainability concerns increase.

Technological advancements in manufacturing processes, such as extrusion and cross-linking techniques, can enhance the properties and performance of polyethylene (PE) foam. These advancements open doors for the development of new and improved products, expanding the application possibilities and creating opportunities for market growth. With the rising awareness of environmental issues, there is an increasing demand for sustainable packaging solutions. Polyethylene (PE) foam’s recyclability, lightweight nature, and cushioning properties make it an attractive option for eco-friendly packaging applications. The emphasis on sustainability offers opportunities for the polyethylene (PE) foam market to cater to the growing demand for sustainable packaging materials. Industries such as automotive, aerospace, and transportation are increasingly focusing on lightweight materials to improve fuel efficiency and reduce emissions. Polyethylene (PE) foam’s lightweight nature, combined with its cushioning and insulation properties, positions it as a suitable material for lightweighting applications, presenting opportunities for market expansion.

The pandemic led to significant disruptions in global supply chains due to lockdowns, travel restrictions, and reduced manufacturing activities. These disruptions, coupled with shortages of raw materials and transportation challenges, affected the availability and production of polyethylene (PE) foam products. Various industries that are significant consumers of polyethylene (PE) foam, such as automotive, construction, and packaging, experienced disruptions during the pandemic. Lockdown measures, reduced consumer spending, and halted construction activities impacted the demand for polyethylene (PE) foam products in these sectors. The healthcare sector experienced a surge in demand for medical equipment and supplies, including protective packaging materials for shipping and transportation. Polyethylene (PE) foam found applications in the packaging of medical devices, personal protective equipment (PPE), and other healthcare products, leading to increased demand in this segment. The resumption of construction projects, the recovery of automotive production, and the sustained growth of e-commerce and online retail can contribute to the market’s recovery.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion), (Square Meter) |

| Segmentation | By Type, By Density, By End-Use, By Region |

| By Type

|

|

| By Density

|

|

| By End-Use |

|

| By Region

|

|

Global Polyethylene (PE) foam Market Segment Analysis

Based on the type, market is segmented into Non-XLPE, XLPE. In 2021, XLPE foam accounted for the greatest market share in the overall PE foam market, and this market share is anticipated to hold steady over forecasted period. Chemically cross-linked PE foams, or XLPE foams, are PE foams. Due to their exceptional vibration-dampening and insulating capabilities, XLPE foams are primarily used in the packaging of fragile goods. High resistance to chemicals and moisture is another feature. Padding and other sports equipment, as well as leisure gear, frequently use XLPE foams.

Based on the density, market is segmented into LDPE, HDPE. Lower density foams are suitable for lightweight cushioning, while higher density foams provide enhanced strength and support. It is important to consider the density requirements based on the desired functionality and performance characteristics when choosing polyethylene (PE) foam for a particular application. LDPE foam has a lower density range, typically between 15 kg/m³ (kilograms per cubic meter) and 30 kg/m³. It is lightweight and offers excellent cushioning and shock absorption properties. LDPE foam is commonly used in packaging applications, such as protective packaging for fragile items and cushioning for electronics.

By end-use, market is segmented into automotive & transportation, building & construction, protective packaging, pharmaceutical, FMCG. During the projected period, the packaging segment is expected to witness significant growth in market share. PE foams find extensive application in protective packaging due to their soft texture, flexibility, durability, lightweight nature, and resilience. With a closed-cell structure, they are primarily utilized for safeguarding furniture, electronics, automotive components, and other products. These PE foams possess desirable attributes such as shock-sensitivity, waterproofing, mechanical and chemical resistance, as well as full recyclability. These factors are anticipated to drive market growth throughout the forecast period. There is a rising demand for recyclable packaging as the industry prioritizes waste recovery and recycling efforts. Currently, approximately 90% of manufactured waste PE foam is successfully recovered for use in alternative packaging solutions. The expanding demand for PE foam in the thriving packaging sector, driven by its exceptional packaging properties, will propel the market forward during the projected period.

Global Polyethylene (PE) foam Market Key Players

Key competitors from both domestic and international markets compete fiercely in the worldwide global polyethylene (PE) foam industry include Armacell, DAFA US Inc., Hira Industries LLC, JSP, PAR Group, Pregis LLC, Sealed Air, Thermotec, Wisconsin Foam Products, Zotefoams PLC.

Recent News:

- 1st February 2023: SEE announced that it had completed previously announced acquisition of Liquibox for a purchase price of USD 1.15 billion on a cash and debt-free basis.

- 9th November 2022: Zotefoams completed the acquisition of the assets and intellectual property of Refour ApS for a modest cash consideration.

Global Polyethylene (PE) foam Market Regional Analysis

The global polyethylene (PE) foam market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

The Asia-Pacific region holds a significant portion of the global polyethylene (PE) foam market, and this market is projected to experience growth in the coming years. Asia-Pacific has emerged as a prominent player in global construction expenditure, where polyethylene (PE) foam finds applications in various construction components such as pipe-in-pipe systems, doors, roofing sheets, and slabs. The construction sector extensively utilizes the desirable properties of polyethylene (PE) foam, including its excellent thermal insulation, frost resistance, and flexibility. Moreover, India has established itself as a leading nation in the manufacturing of medical equipment, witnessing a substantial increase in medical device exports over time. Polyethylene (PE) foam is often utilized for pharmaceutical packaging due to its non-toxic and latex-free nature. In the Asia-Pacific region, the pharmaceutical market is expected to be driven by countries like Japan, China, and South Korea. China and Japan, collectively contributing more than 15% to the global pharmaceutical market, play a significant role in this industry’s growth.

Key Market Segments: Global Polyethylene (PE) foam Market

Global Polyethylene (PE) foam Market by Type, 2020-2029, (USD Billion), (Square Meter)

- Non-XLPE

- XLPE

Global Polyethylene (PE) foam Market by Density, 2020-2029, (USD Billion), (Square Meter)

- LDPE

- HDPE

Global Polyethylene (PE) foam Market by End-Use, 2020-2029, (USD Billion), (Square Meter)

- Automotive & Transportation

- Building & Construction

- Protective Packaging

- Pharmaceutical

- FMCG

Global Polyethylene (PE) foam Market by Region, 2020-2029, (USD Billion), (Square Meter)

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

Important Countries in All Regions Are Covered

Who Should Buy? Or Key stakeholders

- Polyethylene (PE) foam Manufacturers

- Raw Material Provider

- Construction Industry

- Regulatory Bodies

- Research and Development Organization

- Government

- Others

Key Question Answered

- What is the expected growth rate of the polyethylene (PE) foam market over the next 7 years?

- Who are the major players in the polyethylene (PE) foam market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the polyethylene (PE) foam market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the polyethylene (PE) foam market?

- What is the current and forecasted size and growth rate of the global polyethylene (PE) foam market?

- What are the key drivers of growth in the polyethylene (PE) foam market?

- What are the distribution channels and supply chain dynamics in the polyethylene (PE) foam market?

- What are the technological advancements and innovations in the polyethylene (PE) foam market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the polyethylene (PE) foam market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the polyethylene (PE) foam market?

- What are the product offerings and specifications of leading players in the market?

- What is the pricing trend of polyethylene (PE) foam in the market and what is the impact of raw material prices on the price trend?

Exactitude Consultancy Services Key Objectives

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new market

- Enhancing brand reputation

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL POLYETHYLENE (PE) FOAM MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON POLYETHYLENE (PE) FOAM MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL POLYETHYLENE (PE) FOAM MARKET OUTLOOK

- GLOBAL POLYETHYLENE (PE) FOAM MARKET BY TYPE, 2020-2029, (USD BILLION), (SQUARE METER) 2020-2029

- NON-XLPE

- XLPE

- GLOBAL POLYETHYLENE (PE) FOAM MARKET BY DENSITY, 2020-2029, (USD BILLION), (SQUARE METER) 2020-2029

- HDPE

- LDPE

- GLOBAL POLYETHYLENE (PE) FOAM MARKET BY END-USE, 2020-2029, (USD BILLION), (SQUARE METER) 2020-2029

- AUTOMOTIVE & TRANSPORTATION

- PROTECTIVE PACKAGING

- BUILDING & CONSTRUCTION

- PHARMACEUTICAL

- FMCG

- GLOBAL POLYETHYLENE (PE) FOAM MARKET BY REGION, 2020-2029, (USD BILLION), (SQUARE METER) 2020-2029

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- ARMACELL

- DAFA US INC.

- HIRA INDUSTRIES LLC

- JSP

- PAR GROUP

- PREGIS LLC

- SEALED AIR

- THERMOTEC

- WISCONSIN FOAM PRODUCTS

- ZOTEFOAMS PLC *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL POLYETHYLENE (PE) FOAM MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 2 GLOBAL POLYETHYLENE (PE) FOAM MARKET BY TYPE (SQUARE METER) 2020-2029

TABLE 3 GLOBAL POLYETHYLENE (PE) FOAM MARKET BY DENSITY (USD BILLION) 2020-2029

TABLE 4 GLOBAL POLYETHYLENE (PE) FOAM MARKET BY DENSITY (SQUARE METER) 2020-2029

TABLE 5 GLOBAL POLYETHYLENE (PE) FOAM MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 6 GLOBAL POLYETHYLENE (PE) FOAM MARKET BY END-USE (SQUARE METER) 2020-2029

TABLE 7 GLOBAL POLYETHYLENE (PE) FOAM MARKET BY REGION (USD BILLION) 2020-2029

TABLE 8 GLOBAL POLYETHYLENE (PE) FOAM MARKET BY REGION (SQUARE METER) 2020-2029

TABLE 9 NORTH AMERICA POLYETHYLENE (PE) FOAM MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 10 NORTH AMERICA POLYETHYLENE (PE) FOAM MARKET BY COUNTRY (SQUARE METER) 2020-2029

TABLE 11 NORTH AMERICA POLYETHYLENE (PE) FOAM MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 12 NORTH AMERICA POLYETHYLENE (PE) FOAM MARKET BY TYPE (SQUARE METER) 2020-2029

TABLE 13 NORTH AMERICA POLYETHYLENE (PE) FOAM MARKET BY DENSITY (USD BILLION) 2020-2029

TABLE 14 NORTH AMERICA POLYETHYLENE (PE) FOAM MARKET BY DENSITY (SQUARE METER) 2020-2029

TABLE 15 NORTH AMERICA POLYETHYLENE (PE) FOAM MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 16 NORTH AMERICA POLYETHYLENE (PE) FOAM MARKET BY END-USE (SQUARE METER) 2020-2029

TABLE 17 US POLYETHYLENE (PE) FOAM MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 18 US POLYETHYLENE (PE) FOAM MARKET BY TYPE (SQUARE METER) 2020-2029

TABLE 19 US POLYETHYLENE (PE) FOAM MARKET BY DENSITY (USD BILLION) 2020-2029

TABLE 20 US POLYETHYLENE (PE) FOAM MARKET BY DENSITY (SQUARE METER) 2020-2029

TABLE 21 US POLYETHYLENE (PE) FOAM MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 22 US POLYETHYLENE (PE) FOAM MARKET BY END-USE (SQUARE METER) 2020-2029

TABLE 23 CANADA POLYETHYLENE (PE) FOAM MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 24 CANADA POLYETHYLENE (PE) FOAM MARKET BY TYPE (SQUARE METER) 2020-2029

TABLE 25 CANADA POLYETHYLENE (PE) FOAM MARKET BY DENSITY (USD BILLION) 2020-2029

TABLE 26 CANADA POLYETHYLENE (PE) FOAM MARKET BY DENSITY (SQUARE METER) 2020-2029

TABLE 27 CANADA POLYETHYLENE (PE) FOAM MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 28 CANADA POLYETHYLENE (PE) FOAM MARKET BY END-USE (SQUARE METER) 2020-2029

TABLE 29 MEXICO POLYETHYLENE (PE) FOAM MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 30 MEXICO POLYETHYLENE (PE) FOAM MARKET BY TYPE (SQUARE METER) 2020-2029

TABLE 31 MEXICO POLYETHYLENE (PE) FOAM MARKET BY DENSITY (USD BILLION) 2020-2029

TABLE 32 MEXICO POLYETHYLENE (PE) FOAM MARKET BY DENSITY (SQUARE METER) 2020-2029

TABLE 33 MEXICO POLYETHYLENE (PE) FOAM MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 34 MEXICO POLYETHYLENE (PE) FOAM MARKET BY END-USE (SQUARE METER) 2020-2029

TABLE 35 SOUTH AMERICA POLYETHYLENE (PE) FOAM MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 36 SOUTH AMERICA POLYETHYLENE (PE) FOAM MARKET BY COUNTRY (SQUARE METER) 2020-2029

TABLE 37 SOUTH AMERICA POLYETHYLENE (PE) FOAM MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 38 SOUTH AMERICA POLYETHYLENE (PE) FOAM MARKET BY TYPE (SQUARE METER) 2020-2029

TABLE 39 SOUTH AMERICA POLYETHYLENE (PE) FOAM MARKET BY DENSITY (USD BILLION) 2020-2029

TABLE 40 SOUTH AMERICA POLYETHYLENE (PE) FOAM MARKET BY DENSITY (SQUARE METER) 2020-2029

TABLE 41 SOUTH AMERICA POLYETHYLENE (PE) FOAM MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 42 SOUTH AMERICA POLYETHYLENE (PE) FOAM MARKET BY END-USE (SQUARE METER) 2020-2029

TABLE 43 BRAZIL POLYETHYLENE (PE) FOAM MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 44 BRAZIL POLYETHYLENE (PE) FOAM MARKET BY TYPE (SQUARE METER) 2020-2029

TABLE 45 BRAZIL POLYETHYLENE (PE) FOAM MARKET BY DENSITY (USD BILLION) 2020-2029

TABLE 46 BRAZIL POLYETHYLENE (PE) FOAM MARKET BY DENSITY (SQUARE METER) 2020-2029

TABLE 47 BRAZIL POLYETHYLENE (PE) FOAM MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 48 BRAZIL POLYETHYLENE (PE) FOAM MARKET BY END-USE (SQUARE METER) 2020-2029

TABLE 49 ARGENTINA POLYETHYLENE (PE) FOAM MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 50 ARGENTINA POLYETHYLENE (PE) FOAM MARKET BY TYPE (SQUARE METER) 2020-2029

TABLE 51 ARGENTINA POLYETHYLENE (PE) FOAM MARKET BY DENSITY (USD BILLION) 2020-2029

TABLE 52 ARGENTINA POLYETHYLENE (PE) FOAM MARKET BY DENSITY (SQUARE METER) 2020-2029

TABLE 53 ARGENTINA POLYETHYLENE (PE) FOAM MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 54 ARGENTINA POLYETHYLENE (PE) FOAM MARKET BY END-USE (SQUARE METER) 2020-2029

TABLE 55 COLOMBIA POLYETHYLENE (PE) FOAM MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 56 COLOMBIA POLYETHYLENE (PE) FOAM MARKET BY TYPE (SQUARE METER) 2020-2029

TABLE 57 COLOMBIA POLYETHYLENE (PE) FOAM MARKET BY DENSITY (USD BILLION) 2020-2029

TABLE 58 COLOMBIA POLYETHYLENE (PE) FOAM MARKET BY DENSITY (SQUARE METER) 2020-2029

TABLE 59 COLOMBIA POLYETHYLENE (PE) FOAM MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 60 COLOMBIA POLYETHYLENE (PE) FOAM MARKET BY END-USE (SQUARE METER) 2020-2029

TABLE 61 REST OF SOUTH AMERICA POLYETHYLENE (PE) FOAM MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 62 REST OF SOUTH AMERICA POLYETHYLENE (PE) FOAM MARKET BY TYPE (SQUARE METER) 2020-2029

TABLE 63 REST OF SOUTH AMERICA POLYETHYLENE (PE) FOAM MARKET BY DENSITY (USD BILLION) 2020-2029

TABLE 64 REST OF SOUTH AMERICA POLYETHYLENE (PE) FOAM MARKET BY DENSITY (SQUARE METER) 2020-2029

TABLE 65 REST OF SOUTH AMERICA POLYETHYLENE (PE) FOAM MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 66 REST OF SOUTH AMERICA POLYETHYLENE (PE) FOAM MARKET BY END-USE (SQUARE METER) 2020-2029

TABLE 67 ASIA-PACIFIC POLYETHYLENE (PE) FOAM MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 68 ASIA-PACIFIC POLYETHYLENE (PE) FOAM MARKET BY COUNTRY (SQUARE METER) 2020-2029

TABLE 69 ASIA-PACIFIC POLYETHYLENE (PE) FOAM MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 70 ASIA-PACIFIC POLYETHYLENE (PE) FOAM MARKET BY TYPE (SQUARE METER) 2020-2029

TABLE 71 ASIA-PACIFIC POLYETHYLENE (PE) FOAM MARKET BY DENSITY (USD BILLION) 2020-2029

TABLE 72 ASIA-PACIFIC POLYETHYLENE (PE) FOAM MARKET BY DENSITY (SQUARE METER) 2020-2029

TABLE 73 ASIA-PACIFIC POLYETHYLENE (PE) FOAM MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 74 ASIA-PACIFIC POLYETHYLENE (PE) FOAM MARKET BY END-USE (SQUARE METER) 2020-2029

TABLE 75 INDIA POLYETHYLENE (PE) FOAM MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 76 INDIA POLYETHYLENE (PE) FOAM MARKET BY TYPE (SQUARE METER) 2020-2029

TABLE 77 INDIA POLYETHYLENE (PE) FOAM MARKET BY DENSITY (USD BILLION) 2020-2029

TABLE 78 INDIA POLYETHYLENE (PE) FOAM MARKET BY DENSITY (SQUARE METER) 2020-2029

TABLE 79 INDIA POLYETHYLENE (PE) FOAM MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 80 INDIA POLYETHYLENE (PE) FOAM MARKET BY END-USE (SQUARE METER) 2020-2029

TABLE 81 CHINA POLYETHYLENE (PE) FOAM MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 82 CHINA POLYETHYLENE (PE) FOAM MARKET BY TYPE (SQUARE METER) 2020-2029

TABLE 83 CHINA POLYETHYLENE (PE) FOAM MARKET BY DENSITY (USD BILLION) 2020-2029

TABLE 84 CHINA POLYETHYLENE (PE) FOAM MARKET BY DENSITY (SQUARE METER) 2020-2029

TABLE 85 CHINA POLYETHYLENE (PE) FOAM MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 86 CHINA POLYETHYLENE (PE) FOAM MARKET BY END-USE (SQUARE METER) 2020-2029

TABLE 87 JAPAN POLYETHYLENE (PE) FOAM MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 88 JAPAN POLYETHYLENE (PE) FOAM MARKET BY TYPE (SQUARE METER) 2020-2029

TABLE 89 JAPAN POLYETHYLENE (PE) FOAM MARKET BY DENSITY (USD BILLION) 2020-2029

TABLE 90 JAPAN POLYETHYLENE (PE) FOAM MARKET BY DENSITY (SQUARE METER) 2020-2029

TABLE 91 JAPAN POLYETHYLENE (PE) FOAM MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 92 JAPAN POLYETHYLENE (PE) FOAM MARKET BY END-USE (SQUARE METER) 2020-2029

TABLE 93 SOUTH KOREA POLYETHYLENE (PE) FOAM MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 94 SOUTH KOREA POLYETHYLENE (PE) FOAM MARKET BY TYPE (SQUARE METER) 2020-2029

TABLE 95 SOUTH KOREA POLYETHYLENE (PE) FOAM MARKET BY DENSITY (USD BILLION) 2020-2029

TABLE 96 SOUTH KOREA POLYETHYLENE (PE) FOAM MARKET BY DENSITY (SQUARE METER) 2020-2029

TABLE 97 SOUTH KOREA POLYETHYLENE (PE) FOAM MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 98 SOUTH KOREA POLYETHYLENE (PE) FOAM MARKET BY END-USE (SQUARE METER) 2020-2029

TABLE 99 AUSTRALIA POLYETHYLENE (PE) FOAM MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 100 AUSTRALIA POLYETHYLENE (PE) FOAM MARKET BY TYPE (SQUARE METER) 2020-2029

TABLE 101 AUSTRALIA POLYETHYLENE (PE) FOAM MARKET BY DENSITY (USD BILLION) 2020-2029

TABLE 102 AUSTRALIA POLYETHYLENE (PE) FOAM MARKET BY DENSITY (SQUARE METER) 2020-2029

TABLE 103 AUSTRALIA POLYETHYLENE (PE) FOAM MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 104 AUSTRALIA POLYETHYLENE (PE) FOAM MARKET BY END-USE (SQUARE METER) 2020-2029

TABLE 105 SOUTH-EAST ASIA POLYETHYLENE (PE) FOAM MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 106 SOUTH-EAST ASIA POLYETHYLENE (PE) FOAM MARKET BY TYPE (SQUARE METER) 2020-2029

TABLE 107 SOUTH-EAST ASIA POLYETHYLENE (PE) FOAM MARKET BY DENSITY (USD BILLION) 2020-2029

TABLE 108 SOUTH-EAST ASIA POLYETHYLENE (PE) FOAM MARKET BY DENSITY (SQUARE METER) 2020-2029

TABLE 109 SOUTH-EAST ASIA POLYETHYLENE (PE) FOAM MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 110 SOUTH-EAST ASIA POLYETHYLENE (PE) FOAM MARKET BY END-USE (SQUARE METER) 2020-2029

TABLE 111 REST OF ASIA PACIFIC POLYETHYLENE (PE) FOAM MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 112 REST OF ASIA PACIFIC POLYETHYLENE (PE) FOAM MARKET BY TYPE (SQUARE METER) 2020-2029

TABLE 113 REST OF ASIA PACIFIC POLYETHYLENE (PE) FOAM MARKET BY DENSITY (USD BILLION) 2020-2029

TABLE 114 REST OF ASIA PACIFIC POLYETHYLENE (PE) FOAM MARKET BY DENSITY (SQUARE METER) 2020-2029

TABLE 115 REST OF ASIA PACIFIC POLYETHYLENE (PE) FOAM MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 116 REST OF ASIA PACIFIC POLYETHYLENE (PE) FOAM MARKET BY END-USE (SQUARE METER) 2020-2029

TABLE 117 EUROPE POLYETHYLENE (PE) FOAM MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 118 EUROPE POLYETHYLENE (PE) FOAM MARKET BY COUNTRY (SQUARE METER) 2020-2029

TABLE 119 EUROPE POLYETHYLENE (PE) FOAM MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 120 EUROPE POLYETHYLENE (PE) FOAM MARKET BY TYPE (SQUARE METER) 2020-2029

TABLE 121 EUROPE POLYETHYLENE (PE) FOAM MARKET BY DENSITY (USD BILLION) 2020-2029

TABLE 122 EUROPE POLYETHYLENE (PE) FOAM MARKET BY DENSITY (SQUARE METER) 2020-2029

TABLE 123 EUROPE POLYETHYLENE (PE) FOAM MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 124 EUROPE POLYETHYLENE (PE) FOAM MARKET BY END-USE (SQUARE METER) 2020-2029

TABLE 125 GERMANY POLYETHYLENE (PE) FOAM MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 126 GERMANY POLYETHYLENE (PE) FOAM MARKET BY TYPE (SQUARE METER) 2020-2029

TABLE 127 GERMANY POLYETHYLENE (PE) FOAM MARKET BY DENSITY (USD BILLION) 2020-2029

TABLE 128 GERMANY POLYETHYLENE (PE) FOAM MARKET BY DENSITY (SQUARE METER) 2020-2029

TABLE 129 GERMANY POLYETHYLENE (PE) FOAM MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 130 GERMANY POLYETHYLENE (PE) FOAM MARKET BY END-USE (SQUARE METER) 2020-2029

TABLE 131 UK POLYETHYLENE (PE) FOAM MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 132 UK POLYETHYLENE (PE) FOAM MARKET BY TYPE (SQUARE METER) 2020-2029

TABLE 133 UK POLYETHYLENE (PE) FOAM MARKET BY DENSITY (USD BILLION) 2020-2029

TABLE 134 UK POLYETHYLENE (PE) FOAM MARKET BY DENSITY (SQUARE METER) 2020-2029

TABLE 135 UK POLYETHYLENE (PE) FOAM MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 136 UK POLYETHYLENE (PE) FOAM MARKET BY END-USE (SQUARE METER) 2020-2029

TABLE 137 FRANCE POLYETHYLENE (PE) FOAM MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 138 FRANCE POLYETHYLENE (PE) FOAM MARKET BY TYPE (SQUARE METER) 2020-2029

TABLE 139 FRANCE POLYETHYLENE (PE) FOAM MARKET BY DENSITY (USD BILLION) 2020-2029

TABLE 140 FRANCE POLYETHYLENE (PE) FOAM MARKET BY DENSITY (SQUARE METER) 2020-2029

TABLE 141 FRANCE POLYETHYLENE (PE) FOAM MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 142 FRANCE POLYETHYLENE (PE) FOAM MARKET BY END-USE (SQUARE METER) 2020-2029

TABLE 143 ITALY POLYETHYLENE (PE) FOAM MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 144 ITALY POLYETHYLENE (PE) FOAM MARKET BY TYPE (SQUARE METER) 2020-2029

TABLE 145 ITALY POLYETHYLENE (PE) FOAM MARKET BY DENSITY (USD BILLION) 2020-2029

TABLE 146 ITALY POLYETHYLENE (PE) FOAM MARKET BY DENSITY (SQUARE METER) 2020-2029

TABLE 147 ITALY POLYETHYLENE (PE) FOAM MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 148 ITALY POLYETHYLENE (PE) FOAM MARKET BY END-USE (SQUARE METER) 2020-2029

TABLE 149 SPAIN POLYETHYLENE (PE) FOAM MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 150 SPAIN POLYETHYLENE (PE) FOAM MARKET BY TYPE (SQUARE METER) 2020-2029

TABLE 151 SPAIN POLYETHYLENE (PE) FOAM MARKET BY DENSITY (USD BILLION) 2020-2029

TABLE 152 SPAIN POLYETHYLENE (PE) FOAM MARKET BY DENSITY (SQUARE METER) 2020-2029

TABLE 153 SPAIN POLYETHYLENE (PE) FOAM MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 154 SPAIN POLYETHYLENE (PE) FOAM MARKET BY END-USE (SQUARE METER) 2020-2029

TABLE 155 RUSSIA POLYETHYLENE (PE) FOAM MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 156 RUSSIA POLYETHYLENE (PE) FOAM MARKET BY TYPE (SQUARE METER) 2020-2029

TABLE 157 RUSSIA POLYETHYLENE (PE) FOAM MARKET BY DENSITY (USD BILLION) 2020-2029

TABLE 158 RUSSIA POLYETHYLENE (PE) FOAM MARKET BY DENSITY (SQUARE METER) 2020-2029

TABLE 159 RUSSIA POLYETHYLENE (PE) FOAM MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 160 RUSSIA POLYETHYLENE (PE) FOAM MARKET BY END-USE (SQUARE METER) 2020-2029

TABLE 161 REST OF EUROPE POLYETHYLENE (PE) FOAM MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 162 REST OF EUROPE POLYETHYLENE (PE) FOAM MARKET BY TYPE (SQUARE METER) 2020-2029

TABLE 163 REST OF EUROPE POLYETHYLENE (PE) FOAM MARKET BY DENSITY (USD BILLION) 2020-2029

TABLE 164 REST OF EUROPE POLYETHYLENE (PE) FOAM MARKET BY DENSITY (SQUARE METER) 2020-2029

TABLE 165 REST OF EUROPE POLYETHYLENE (PE) FOAM MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 166 REST OF EUROPE POLYETHYLENE (PE) FOAM MARKET BY END-USE (SQUARE METER) 2020-2029

TABLE 167 MIDDLE EAST AND AFRICA POLYETHYLENE (PE) FOAM MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 168 MIDDLE EAST AND AFRICA POLYETHYLENE (PE) FOAM MARKET BY COUNTRY (SQUARE METER) 2020-2029

TABLE 169 MIDDLE EAST AND AFRICA POLYETHYLENE (PE) FOAM MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 170 MIDDLE EAST AND AFRICA POLYETHYLENE (PE) FOAM MARKET BY TYPE (SQUARE METER) 2020-2029

TABLE 171 MIDDLE EAST AND AFRICA POLYETHYLENE (PE) FOAM MARKET BY DENSITY (USD BILLION) 2020-2029

TABLE 172 MIDDLE EAST AND AFRICA POLYETHYLENE (PE) FOAM MARKET BY DENSITY (SQUARE METER) 2020-2029

TABLE 173 MIDDLE EAST AND AFRICA POLYETHYLENE (PE) FOAM MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 174 MIDDLE EAST AND AFRICA POLYETHYLENE (PE) FOAM MARKET BY END-USE (SQUARE METER) 2020-2029

TABLE 175 UAE POLYETHYLENE (PE) FOAM MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 176 UAE POLYETHYLENE (PE) FOAM MARKET BY TYPE (SQUARE METER) 2020-2029

TABLE 177 UAE POLYETHYLENE (PE) FOAM MARKET BY DENSITY (USD BILLION) 2020-2029

TABLE 178 UAE POLYETHYLENE (PE) FOAM MARKET BY DENSITY (SQUARE METER) 2020-2029

TABLE 179 UAE POLYETHYLENE (PE) FOAM MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 180 UAE POLYETHYLENE (PE) FOAM MARKET BY END-USE (SQUARE METER) 2020-2029

TABLE 181 SAUDI ARABIA POLYETHYLENE (PE) FOAM MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 182 SAUDI ARABIA POLYETHYLENE (PE) FOAM MARKET BY TYPE (SQUARE METER) 2020-2029

TABLE 183 SAUDI ARABIA POLYETHYLENE (PE) FOAM MARKET BY DENSITY (USD BILLION) 2020-2029

TABLE 184 SAUDI ARABIA POLYETHYLENE (PE) FOAM MARKET BY DENSITY (SQUARE METER) 2020-2029

TABLE 185 SAUDI ARABIA POLYETHYLENE (PE) FOAM MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 186 SAUDI ARABIA POLYETHYLENE (PE) FOAM MARKET BY END-USE (SQUARE METER) 2020-2029

TABLE 187 SOUTH AFRICA POLYETHYLENE (PE) FOAM MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 188 SOUTH AFRICA POLYETHYLENE (PE) FOAM MARKET BY TYPE (SQUARE METER) 2020-2029

TABLE 189 SOUTH AFRICA POLYETHYLENE (PE) FOAM MARKET BY DENSITY (USD BILLION) 2020-2029

TABLE 190 SOUTH AFRICA POLYETHYLENE (PE) FOAM MARKET BY DENSITY (SQUARE METER) 2020-2029

TABLE 191 SOUTH AFRICA POLYETHYLENE (PE) FOAM MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 192 SOUTH AFRICA POLYETHYLENE (PE) FOAM MARKET BY END-USE (SQUARE METER) 2020-2029

TABLE 193 REST OF MIDDLE EAST AND AFRICA POLYETHYLENE (PE) FOAM MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 194 REST OF MIDDLE EAST AND AFRICA POLYETHYLENE (PE) FOAM MARKET BY TYPE (SQUARE METER) 2020-2029

TABLE 195 REST OF MIDDLE EAST AND AFRICA POLYETHYLENE (PE) FOAM MARKET BY DENSITY (USD BILLION) 2020-2029

TABLE 196 REST OF MIDDLE EAST AND AFRICA POLYETHYLENE (PE) FOAM MARKET BY DENSITY (SQUARE METER) 2020-2029

TABLE 197 REST OF MIDDLE EAST AND AFRICA POLYETHYLENE (PE) FOAM MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 198 REST OF MIDDLE EAST AND AFRICA POLYETHYLENE (PE) FOAM MARKET BY END-USE (SQUARE METER) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL POLYETHYLENE (PE) FOAM MARKET BY TYPE, USD BILLION, 2020-2029

FIGURE 9 GLOBAL POLYETHYLENE (PE) FOAM MARKET BY DENSITY, USD BILLION, 2020-2029

FIGURE 10 GLOBAL POLYETHYLENE (PE) FOAM MARKET BY END-USE, USD BILLION, 2020-2029

FIGURE 11 GLOBAL POLYETHYLENE (PE) FOAM MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL POLYETHYLENE (PE) FOAM MARKET BY TYPE, USD BILLION, 2021

FIGURE 14 GLOBAL POLYETHYLENE (PE) FOAM MARKET BY DENSITY, USD BILLION, 2021

FIGURE 15 GLOBAL POLYETHYLENE (PE) FOAM MARKET BY END-USE, USD BILLION, 2021

FIGURE 16 GLOBAL POLYETHYLENE (PE) FOAM MARKET BY REGION, USD BILLION, 2021

FIGURE 17 NORTH AMERICA POLYETHYLENE (PE) FOAM MARKET SNAPSHOT

FIGURE 18 EUROPE POLYETHYLENE (PE) FOAM MARKET SNAPSHOT

FIGURE 19 SOUTH AMERICA POLYETHYLENE (PE) FOAM MARKET SNAPSHOT

FIGURE 20 ASIA PACIFIC POLYETHYLENE (PE) FOAM MARKET SNAPSHOT

FIGURE 21 MIDDLE EAST ASIA AND AFRICA POLYETHYLENE (PE) FOAM MARKET SNAPSHOT

FIGURE 22 MARKET SHARE ANALYSIS

FIGURE 23 ARMACELL: COMPANY SNAPSHOT

FIGURE 24 DAFA US INC.: COMPANY SNAPSHOT

FIGURE 25 HIRA INDUSTRIES LLC: COMPANY SNAPSHOT

FIGURE 26 JSP: COMPANY SNAPSHOTS

FIGURE 27 PAR GROUP: COMPANY SNAPSHOT

FIGURE 28 PREGIS LLC: COMPANY SNAPSHOT

FIGURE 29 SEALED AIR: COMPANY SNAPSHOT

FIGURE 30 THERMOTEC: COMPANY SNAPSHOT

FIGURE 31 WISCONSIN FOAM PRODUCTS: COMPANY SNAPSHOT

FIGURE 32 ZOTEFOAMS PLC: COMPANY SNAPSHOT

FAQ

Some key players operating in the global polyethylene (PE) foam market include Armacell, DAFA US Inc., Hira Industries LLC, JSP, PAR Group, Pregis LLC, Sealed Air, Thermotec, Wisconsin Foam Products, Zotefoams PLC.

Polyethylene (PE) foam is widely used in the packaging industry due to its excellent cushioning and protective properties. As e-commerce and online shopping continue to rise, the demand for polyethylene (PE) foam for packaging applications is expected to increase.

The global polyethylene (PE) foam market size was estimated at USD 3.33 billion in 2021 and is expected to reach USD 5.39 billion in 2029.

The global polyethylene (PE) foam market is expected to grow at a compound annual growth rate of 6.19% from 2022 to 2029 to reach USD 5.39 billion by 2029.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.