Report Outlook

| Market Size | CAGR | Dominating Region |

|---|---|---|

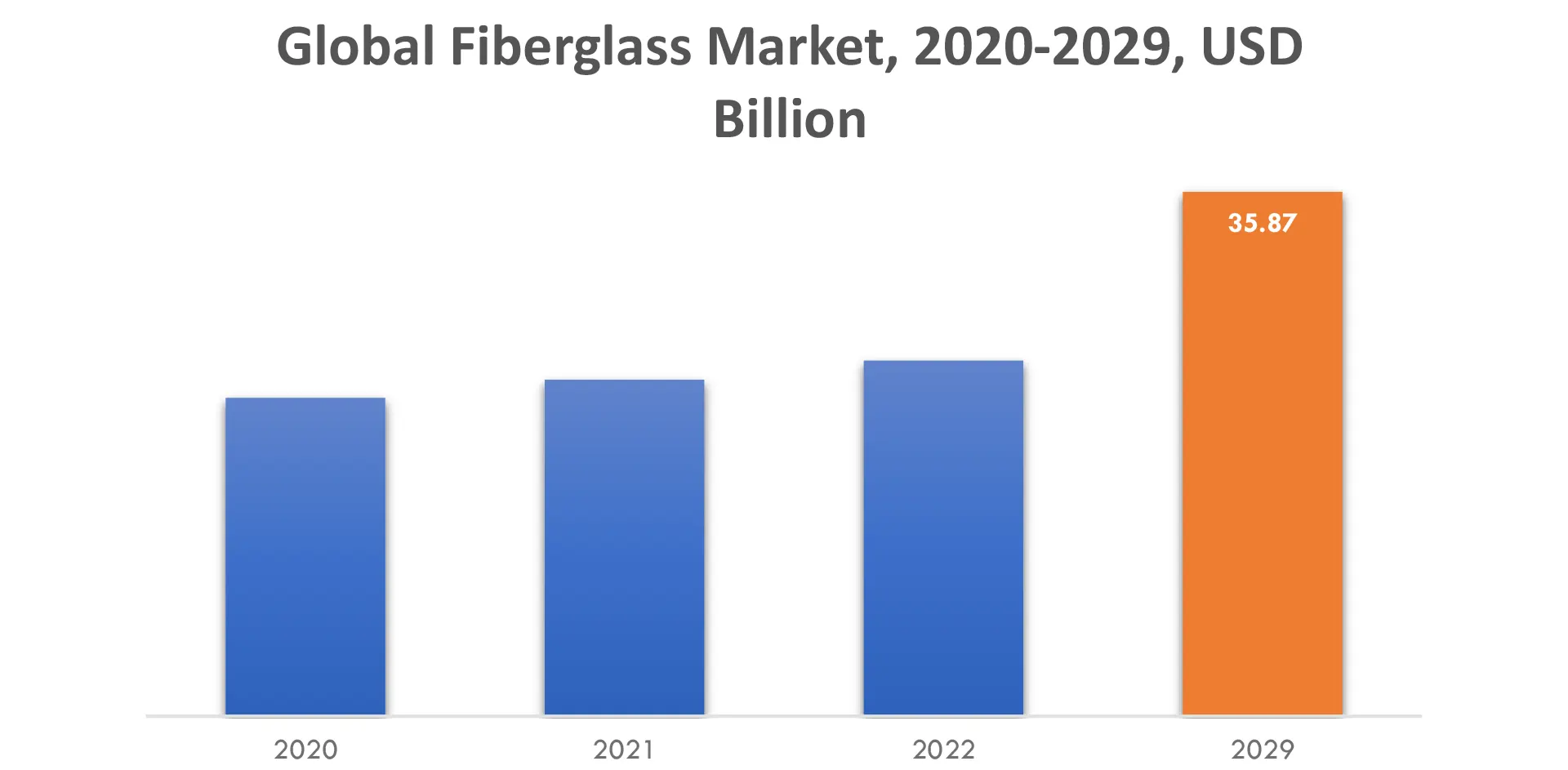

| USD 35.87 Billion by 2029 | 5.70% | Asia-Pacific |

| by Glass Type | by Product | by Application |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Fiberglass Market Overview

The fiberglass market is expected to grow at 5.70 % CAGR from 2022 to 2029. It is expected to reach above USD 35.87 Billion by 2029 from USD 21.78 Billion in 2020.

Fiberglass is a reinforced plastic material composed of thin glass fibers. It is created by melting glass and extruding it into strands, which are then woven or randomly arranged. The fibers are bound together using a resin, forming a strong and rigid composite. Fiberglass exhibits properties such as high strength-to-weight ratio, corrosion resistance, and thermal and electrical insulation capabilities. It finds applications in construction, automotive, aerospace, and electrical industries, among others.

Corrosion resistance is a significant driver for the fiberglass market. Industries that deal with corrosive environments, such as chemical processing, oil and gas, and marine, rely on fiberglass due to its excellent resistance to corrosion. Fiberglass offers a durable and long-lasting solution for equipment, tanks, pipes, and other components that are exposed to corrosive substances. Its resistance to chemical attack and degradation makes it a preferred choice over traditional materials in these industries. The demand for corrosion-resistant solutions, driven by the need for increased durability and reduced maintenance costs, contributes to the growth of the fiberglass market in these sectors.

The volatility of raw material prices poses a significant restraint for the fiberglass market. Fluctuations in the prices of key raw materials, such as glass fibers, resins, and additives, can impact the profitability and cost competitiveness of fiberglass manufacturers. These price fluctuations are influenced by factors such as supply-demand dynamics, changes in production costs, and global economic conditions. The unpredictability of raw material prices makes it challenging for companies to plan and forecast their production costs accurately. Managing and mitigating the impact of raw material price volatility requires effective procurement strategies, risk management, and close monitoring of market trends to ensure sustainable operations in the fiberglass industry.

The growing demand for sustainable and eco-friendly solutions presents a significant opportunity for the fiberglass market. As environmental concerns increase, there is a shift towards materials that have a reduced impact on the planet. Fiberglass, with its recyclability, energy-efficient production processes, and resistance to corrosion and degradation, aligns with these sustainability goals. Positioning fiberglass as a sustainable alternative to traditional materials can open up new markets and attract customers who prioritize environmental responsibility. By promoting the eco-friendly aspects of fiberglass and highlighting its recyclability, companies can capitalize on the opportunity to meet the demand for sustainable solutions and contribute to a greener future.

The COVID-19 pandemic had a profound negative impact on the fiberglass market. Global supply chains were disrupted, affecting the availability of raw materials and components necessary for fiberglass production. Construction activities slowed down as economic uncertainties and restrictions led to project cancellations. The automotive industry experienced a decline in sales and production, reducing the demand for fiberglass composites. Uncertainty and cautious spending resulted in reduced investments across various sectors. Restricted international trade and travel limitations further hindered market reach. Imbalances between supply and demand created inventory challenges. Implementing health and safety measures added operational costs and affected production efficiency. While the impact varied, the overall effect of the pandemic on the fiberglass market was significant and required adaptation to the changing market conditions.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion), (Kilotons). |

| Segmentation | By Glass Type, By Product, By Application, By Region. |

| By Glass Type |

|

| By Product |

|

| By Application |

|

| By Region |

|

Fiberglass Market Segment Analysis

E-Glass, a type of fiberglass, is expected to experience high demand due to its wide range of applications. It finds extensive use in construction for reinforcement, insulation, and roofing. The automotive industry utilizes E-Glass composites for lightweighting and improving fuel efficiency. In the electrical and electronics sector, E-Glass is sought after for its excellent electrical insulation properties. Additionally, E-Glass is essential in the wind energy industry for manufacturing wind turbine blades. The versatile nature of E-Glass drives its increasing demand across various industries.

The glass wool segment dominated the market, holding the prime share in the fiberglass industry. Glass wool, a type of fiberglass insulation material, offers excellent thermal and acoustic insulation properties. It is widely used in the construction sector for insulating walls, roofs, and floors, as well as in HVAC systems. The popularity of glass wool can be attributed to its affordability, ease of installation, and effectiveness in enhancing energy efficiency. Its wide-ranging applications and cost-effectiveness contribute to its significant market share in the fiberglass industry.

The transportation segment is expected to hold a significant share in the fiberglass market. Fiberglass materials find extensive use in various transportation applications, including automotive, aerospace, marine, and rail industries. In the automotive sector, fiberglass composites are used for lightweighting vehicles, improving fuel efficiency, and reducing emissions. In aerospace, fiberglass components offer strength and durability while reducing weight. Fiberglass is also utilized in boat construction, providing a lightweight and corrosion-resistant alternative to traditional materials. The transportation industry’s emphasis on performance, efficiency, and sustainability drives the demand for fiberglass materials, positioning the transportation segment as a key market share holder in the fiberglass industry.

Fiberglass Market Key Players

The fiberglass market key players include LANXESS, Owens Corning, 3B – The Fiberglass Comp, Shandong Fiberglass Group Corp, Taishan Fiberglass Inc., Chongqing Polycomp International Corp., Saint-Gobain Vetrotex, PFG Fiber Glass Corporation, KCC Corporation, Asahi Fiber Glass Co. Ltd.

Recent News:

June 2022 – Owens Corning and Pultron Composites signed an agreement to create a joint venture to manufacture industry-leading fiberglass rebar.

February 2021- Saint-Gobain Vetrotex developed a new sizing system, T34 a successor to their T30 product. The new T34 sizing system is developed to enable heat-cleaning operation without affecting the textile properties. According to the company the new sizing system has been able to produce excellent results without broken filaments during weaving processes.

Who Should Buy? Or Key Stakeholders

- Construction Companies

- Consumer Goods Manufacturer

- Market Research

- Research and Development Institutes

- Consulting Firms

- Venture capitalists

- Investors

- Supplier and Distributor

- Others

Fiberglass Market Regional Analysis

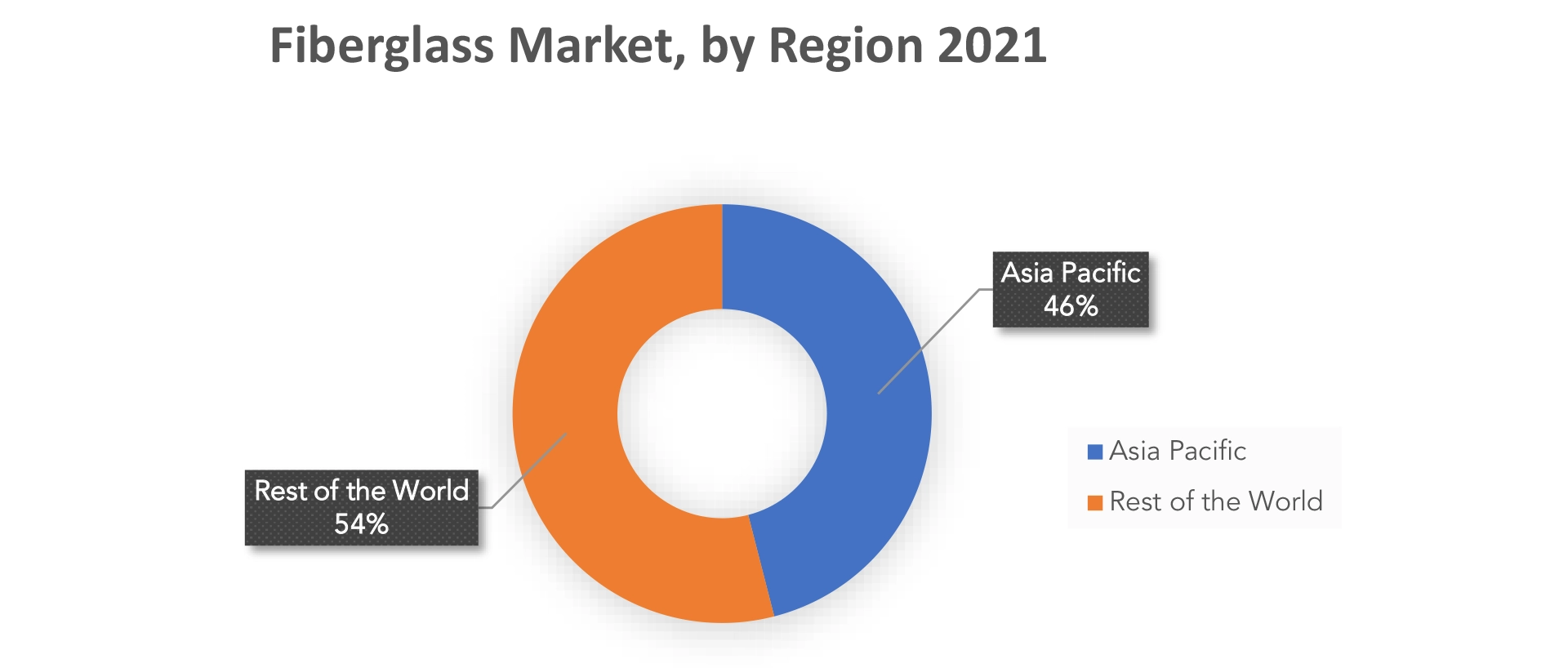

The Fiberglass market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

Asia Pacific has emerged as a dominant region, accounting for the largest share in the global fiberglass market. The region’s strong market position can be attributed to several factors. Rapid industrialization, urbanization, and infrastructure development in countries like China and India have fueled the demand for fiberglass materials in construction, automotive, and electrical industries. Additionally, the presence of major fiberglass manufacturers in Asia Pacific contributes to the region’s market dominance. Growing economies, increasing disposable incomes, and expanding manufacturing sectors further drive the demand for fiberglass products, solidifying Asia Pacific’s leading position in the global market.

North America holds a significant position in the global fiberglass market. The region’s well-developed infrastructure, robust construction industry, strong automotive manufacturing sector, and stringent regulations on energy efficiency contribute to its importance. North America is a major consumer of fiberglass materials in various applications, including construction, automotive, aerospace, and renewable energy. The presence of key market players further strengthens North America’s position in the global fiberglass market.

Key Market Segments: Fiberglass Market

Fiberglass Market by Glass Type, 2020-2029, (USD Billion), (Kilotons).

- E-Glass

- Specialty

Fiberglass Market by Product, 2020-2029, (USD Billion), (Kilotons).

- Glass Wool

- Yarns

- Roving

- Chopped Strands

Fiberglass Market by Application, 2020-2029, (USD Billion), (Kilotons).

- Transportation

- Building & Construction

- Electrical & Electronics

- Pipe & Tank

- Consumer Goods

- Wind Energy

- Construction & Infrastructure

Fiberglass Market by Region, 2020-2029, (USD Billion), (Kilotons).

- North America

- Asia Pacific

- Europe

- South America

- Middle East and Africa

Important Countries in All Regions Are Covered.

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the fiberglass market over the next 7 years?

- Who are the major players in the fiberglass market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-pacific, middle east, and Africa?

- How is the economic environment affecting the fiberglass market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the fiberglass market?

- What is the current and forecasted size and growth rate of the global fiberglass market?

- What are the key drivers of growth in the fiberglass market?

- What are the distribution channels and supply chain dynamics in the fiberglass market?

- What are the technological advancements and innovations in the fiberglass market and their impact on material development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the fiberglass market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the fiberglass market?

- What are the products offerings and specifications of leading players in the market?

- What is the pricing trend of fiberglass in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL FIBERGLASS MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON FIBERGLASS MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL FIBERGLASS MARKET OUTLOOK

- GLOBAL FIBERGLASS MARKET BY GLASS TYPE, 2020-2029, (USD BILLION), (KILOTONS)

- E-GLASS

- SPECIALTY

- GLOBAL FIBERGLASS MARKET BY PRODUCT, 2020-2029, (USD BILLION), (KILOTONS)

- GLASS WOOL

- YARNS

- ROVING

- CHOPPED STRANDS

- GLOBAL FIBERGLASS MARKET BY PRODUCT, 2020-2029, (USD BILLION), (KILOTONS)

- TRANSPORTATION

- BUILDING & CONSTRUCTION

- ELECTRICAL & ELECTRONICS

- PIPE & TANK

- CONSUMER GOODS

- WIND ENERGY

- GLOBAL FIBERGLASS MARKET BY REGION, 2020-2029, (USD BILLION), (KILOTONS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- LANXESS

- OWENS CORNING

- 3B – THE FIBERGLASS COMP

- SHANDONG FIBERGLASS GROUP CORP

- TAISHAN FIBERGLASS INC.

- CHONGQING POLYCOMP INTERNATIONAL CORP.

- SAINT-GOBAIN VETROTEX

- PFG FIBER GLASS CORPORATION

- KCC CORPORATION

- ASAHI FIBER GLASS CO. LTD. *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL FIBERGLASS MARKET BY GLASS TYPE (USD BILLION) 2020-2029

TABLE 2 GLOBAL FIBERGLASS MARKET BY GLASS TYPE (KILOTONS) 2020-2029

TABLE 3 GLOBAL FIBERGLASS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 4 GLOBAL FIBERGLASS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 5 GLOBAL FIBERGLASS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 6 GLOBAL FIBERGLASS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 7 GLOBAL FIBERGLASS MARKET BY REGION (USD BILLION) 2020-2029

TABLE 8 GLOBAL FIBERGLASS MARKET BY REGION (KILOTONS) 2020-2029

TABLE 9 NORTH AMERICA FIBERGLASS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 10 NORTH AMERICA FIBERGLASS MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 11 NORTH AMERICA FIBERGLASS MARKET BY GLASS TYPE (USD BILLION) 2020-2029

TABLE 12 NORTH AMERICA FIBERGLASS MARKET BY GLASS TYPE (KILOTONS) 2020-2029

TABLE 13 NORTH AMERICA FIBERGLASS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 14 NORTH AMERICA FIBERGLASS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 15 NORTH AMERICA FIBERGLASS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 16 NORTH AMERICA FIBERGLASS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 17 US FIBERGLASS MARKET BY GLASS TYPE (USD BILLION) 2020-2029

TABLE 18 US FIBERGLASS MARKET BY GLASS TYPE (KILOTONS) 2020-2029

TABLE 19 US FIBERGLASS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 20 US FIBERGLASS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 21 US FIBERGLASS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 22 US FIBERGLASS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 23 CANADA FIBERGLASS MARKET BY GLASS TYPE (USD BILLION) 2020-2029

TABLE 24 CANADA FIBERGLASS MARKET BY GLASS TYPE (KILOTONS) 2020-2029

TABLE 25 CANADA FIBERGLASS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 26 CANADA FIBERGLASS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 27 CANADA FIBERGLASS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 28 CANADA FIBERGLASS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 29 MEXICO FIBERGLASS MARKET BY GLASS TYPE (USD BILLION) 2020-2029

TABLE 30 MEXICO FIBERGLASS MARKET BY GLASS TYPE (KILOTONS) 2020-2029

TABLE 31 MEXICO FIBERGLASS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 32 MEXICO FIBERGLASS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 33 MEXICO FIBERGLASS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 34 MEXICO FIBERGLASS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 35 SOUTH AMERICA FIBERGLASS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 36 SOUTH AMERICA FIBERGLASS MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 37 SOUTH AMERICA FIBERGLASS MARKET BY GLASS TYPE (USD BILLION) 2020-2029

TABLE 38 SOUTH AMERICA FIBERGLASS MARKET BY GLASS TYPE (KILOTONS) 2020-2029

TABLE 39 SOUTH AMERICA FIBERGLASS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 40 SOUTH AMERICA FIBERGLASS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 41 SOUTH AMERICA FIBERGLASS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 42 SOUTH AMERICA FIBERGLASS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 43 BRAZIL FIBERGLASS MARKET BY GLASS TYPE (USD BILLION) 2020-2029

TABLE 44 BRAZIL FIBERGLASS MARKET BY GLASS TYPE (KILOTONS) 2020-2029

TABLE 45 BRAZIL FIBERGLASS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 46 BRAZIL FIBERGLASS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 47 BRAZIL FIBERGLASS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 48 BRAZIL FIBERGLASS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 49 ARGENTINA FIBERGLASS MARKET BY GLASS TYPE (USD BILLION) 2020-2029

TABLE 50 ARGENTINA FIBERGLASS MARKET BY GLASS TYPE (KILOTONS) 2020-2029

TABLE 51 ARGENTINA FIBERGLASS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 52 ARGENTINA FIBERGLASS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 53 ARGENTINA FIBERGLASS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 54 ARGENTINA FIBERGLASS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 55 COLOMBIA FIBERGLASS MARKET BY GLASS TYPE (USD BILLION) 2020-2029

TABLE 56 COLOMBIA FIBERGLASS MARKET BY GLASS TYPE (KILOTONS) 2020-2029

TABLE 57 COLOMBIA FIBERGLASS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 58 COLOMBIA FIBERGLASS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 59 COLOMBIA FIBERGLASS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 60 COLOMBIA FIBERGLASS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 61 REST OF SOUTH AMERICA FIBERGLASS MARKET BY GLASS TYPE (USD BILLION) 2020-2029

TABLE 62 REST OF SOUTH AMERICA FIBERGLASS MARKET BY GLASS TYPE (KILOTONS) 2020-2029

TABLE 63 REST OF SOUTH AMERICA FIBERGLASS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 64 REST OF SOUTH AMERICA FIBERGLASS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 65 REST OF SOUTH AMERICA FIBERGLASS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 66 REST OF SOUTH AMERICA FIBERGLASS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 67 ASIA-PACIFIC FIBERGLASS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 68 ASIA-PACIFIC FIBERGLASS MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 69 ASIA-PACIFIC FIBERGLASS MARKET BY GLASS TYPE (USD BILLION) 2020-2029

TABLE 70 ASIA-PACIFIC FIBERGLASS MARKET BY GLASS TYPE (KILOTONS) 2020-2029

TABLE 71 ASIA-PACIFIC FIBERGLASS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 72 ASIA-PACIFIC FIBERGLASS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 73 ASIA-PACIFIC FIBERGLASS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 74 ASIA-PACIFIC FIBERGLASS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 75 INDIA FIBERGLASS MARKET BY GLASS TYPE (USD BILLION) 2020-2029

TABLE 76 INDIA FIBERGLASS MARKET BY GLASS TYPE (KILOTONS) 2020-2029

TABLE 77 INDIA FIBERGLASS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 78 INDIA FIBERGLASS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 79 INDIA FIBERGLASS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 80 INDIA FIBERGLASS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 81 CHINA FIBERGLASS MARKET BY GLASS TYPE (USD BILLION) 2020-2029

TABLE 82 CHINA FIBERGLASS MARKET BY GLASS TYPE (KILOTONS) 2020-2029

TABLE 83 CHINA FIBERGLASS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 84 CHINA FIBERGLASS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 85 CHINA FIBERGLASS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 86 CHINA FIBERGLASS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 87 JAPAN FIBERGLASS MARKET BY GLASS TYPE (USD BILLION) 2020-2029

TABLE 88 JAPAN FIBERGLASS MARKET BY GLASS TYPE (KILOTONS) 2020-2029

TABLE 89 JAPAN FIBERGLASS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 90 JAPAN FIBERGLASS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 91 JAPAN FIBERGLASS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 92 JAPAN FIBERGLASS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 93 SOUTH KOREA FIBERGLASS MARKET BY GLASS TYPE (USD BILLION) 2020-2029

TABLE 94 SOUTH KOREA FIBERGLASS MARKET BY GLASS TYPE (KILOTONS) 2020-2029

TABLE 95 SOUTH KOREA FIBERGLASS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 96 SOUTH KOREA FIBERGLASS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 97 SOUTH KOREA FIBERGLASS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 98 SOUTH KOREA FIBERGLASS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 99 AUSTRALIA FIBERGLASS MARKET BY GLASS TYPE (USD BILLION) 2020-2029

TABLE 100 AUSTRALIA FIBERGLASS MARKET BY GLASS TYPE (KILOTONS) 2020-2029

TABLE 101 AUSTRALIA FIBERGLASS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 102 AUSTRALIA FIBERGLASS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 103 AUSTRALIA FIBERGLASS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 104 AUSTRALIA FIBERGLASS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 105 SOUTH-EAST ASIA FIBERGLASS MARKET BY GLASS TYPE (USD BILLION) 2020-2029

TABLE 106 SOUTH-EAST ASIA FIBERGLASS MARKET BY GLASS TYPE (KILOTONS) 2020-2029

TABLE 107 SOUTH-EAST ASIA FIBERGLASS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 108 SOUTH-EAST ASIA FIBERGLASS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 109 SOUTH-EAST ASIA FIBERGLASS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 110 SOUTH-EAST ASIA FIBERGLASS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 111 REST OF ASIA PACIFIC FIBERGLASS MARKET BY GLASS TYPE (USD BILLION) 2020-2029

TABLE 112 REST OF ASIA PACIFIC FIBERGLASS MARKET BY GLASS TYPE (KILOTONS) 2020-2029

TABLE 113 REST OF ASIA PACIFIC FIBERGLASS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 114 REST OF ASIA PACIFIC FIBERGLASS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 115 REST OF ASIA PACIFIC FIBERGLASS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 116 REST OF ASIA PACIFIC FIBERGLASS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 117 EUROPE FIBERGLASS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 118 EUROPE FIBERGLASS MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 119 EUROPE FIBERGLASS MARKET BY GLASS TYPE (USD BILLION) 2020-2029

TABLE 120 EUROPE FIBERGLASS MARKET BY GLASS TYPE (KILOTONS) 2020-2029

TABLE 121 EUROPE FIBERGLASS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 122 EUROPE FIBERGLASS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 123 EUROPE FIBERGLASS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 124 EUROPE FIBERGLASS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 125 GERMANY FIBERGLASS MARKET BY GLASS TYPE (USD BILLION) 2020-2029

TABLE 126 GERMANY FIBERGLASS MARKET BY GLASS TYPE (KILOTONS) 2020-2029

TABLE 127 GERMANY FIBERGLASS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 128 GERMANY FIBERGLASS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 129 GERMANY FIBERGLASS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 130 GERMANY FIBERGLASS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 131 UK FIBERGLASS MARKET BY GLASS TYPE (USD BILLION) 2020-2029

TABLE 132 UK FIBERGLASS MARKET BY GLASS TYPE (KILOTONS) 2020-2029

TABLE 133 UK FIBERGLASS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 134 UK FIBERGLASS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 135 UK FIBERGLASS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 136 UK FIBERGLASS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 137 FRANCE FIBERGLASS MARKET BY GLASS TYPE (USD BILLION) 2020-2029

TABLE 138 FRANCE FIBERGLASS MARKET BY GLASS TYPE (KILOTONS) 2020-2029

TABLE 139 FRANCE FIBERGLASS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 140 FRANCE FIBERGLASS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 141 FRANCE FIBERGLASS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 142 FRANCE FIBERGLASS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 143 ITALY FIBERGLASS MARKET BY GLASS TYPE (USD BILLION) 2020-2029

TABLE 144 ITALY FIBERGLASS MARKET BY GLASS TYPE (KILOTONS) 2020-2029

TABLE 145 ITALY FIBERGLASS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 146 ITALY FIBERGLASS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 147 ITALY FIBERGLASS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 148 ITALY FIBERGLASS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 149 SPAIN FIBERGLASS MARKET BY GLASS TYPE (USD BILLION) 2020-2029

TABLE 150 SPAIN FIBERGLASS MARKET BY GLASS TYPE (KILOTONS) 2020-2029

TABLE 151 SPAIN FIBERGLASS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 152 SPAIN FIBERGLASS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 153 SPAIN FIBERGLASS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 154 SPAIN FIBERGLASS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 155 RUSSIA FIBERGLASS MARKET BY GLASS TYPE (USD BILLION) 2020-2029

TABLE 156 RUSSIA FIBERGLASS MARKET BY GLASS TYPE (KILOTONS) 2020-2029

TABLE 157 RUSSIA FIBERGLASS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 158 RUSSIA FIBERGLASS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 159 RUSSIA FIBERGLASS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 160 RUSSIA FIBERGLASS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 161 REST OF EUROPE FIBERGLASS MARKET BY GLASS TYPE (USD BILLION) 2020-2029

TABLE 162 REST OF EUROPE FIBERGLASS MARKET BY GLASS TYPE (KILOTONS) 2020-2029

TABLE 163 REST OF EUROPE FIBERGLASS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 164 REST OF EUROPE FIBERGLASS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 165 REST OF EUROPE FIBERGLASS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 166 REST OF EUROPE FIBERGLASS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 167 MIDDLE EAST AND AFRICA FIBERGLASS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 168 MIDDLE EAST AND AFRICA FIBERGLASS MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 169 MIDDLE EAST AND AFRICA FIBERGLASS MARKET BY GLASS TYPE (USD BILLION) 2020-2029

TABLE 170 MIDDLE EAST AND AFRICA FIBERGLASS MARKET BY GLASS TYPE (KILOTONS) 2020-2029

TABLE 171 MIDDLE EAST AND AFRICA FIBERGLASS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 172 MIDDLE EAST AND AFRICA FIBERGLASS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 173 MIDDLE EAST AND AFRICA FIBERGLASS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 174 MIDDLE EAST AND AFRICA FIBERGLASS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 175 UAE FIBERGLASS MARKET BY GLASS TYPE (USD BILLION) 2020-2029

TABLE 176 UAE FIBERGLASS MARKET BY GLASS TYPE (KILOTONS) 2020-2029

TABLE 177 UAE FIBERGLASS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 178 UAE FIBERGLASS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 179 UAE FIBERGLASS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 180 UAE FIBERGLASS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 181 SAUDI ARABIA FIBERGLASS MARKET BY GLASS TYPE (USD BILLION) 2020-2029

TABLE 182 SAUDI ARABIA FIBERGLASS MARKET BY GLASS TYPE (KILOTONS) 2020-2029

TABLE 183 SAUDI ARABIA FIBERGLASS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 184 SAUDI ARABIA FIBERGLASS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 185 SAUDI ARABIA FIBERGLASS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 186 SAUDI ARABIA FIBERGLASS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 187 SOUTH AFRICA FIBERGLASS MARKET BY GLASS TYPE (USD BILLION) 2020-2029

TABLE 188 SOUTH AFRICA FIBERGLASS MARKET BY GLASS TYPE (KILOTONS) 2020-2029

TABLE 189 SOUTH AFRICA FIBERGLASS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 190 SOUTH AFRICA FIBERGLASS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 191 SOUTH AFRICA FIBERGLASS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 192 SOUTH AFRICA FIBERGLASS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 193 REST OF MIDDLE EAST AND AFRICA FIBERGLASS MARKET BY GLASS TYPE (USD BILLION) 2020-2029

TABLE 194 REST OF MIDDLE EAST AND AFRICA FIBERGLASS MARKET BY GLASS TYPE (KILOTONS) 2020-2029

TABLE 195 REST OF MIDDLE EAST AND AFRICA FIBERGLASS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 196 REST OF MIDDLE EAST AND AFRICA FIBERGLASS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 197 REST OF MIDDLE EAST AND AFRICA FIBERGLASS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 198 REST OF MIDDLE EAST AND AFRICA FIBERGLASS MARKET BY APPLICATION (KILOTONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL FIBERGLASS MARKET BY GLASS TYPE, USD BILLION, 2020-2029

FIGURE 9 GLOBAL FIBERGLASS MARKET BY PRODUCT, USD BILLION, 2020-2029

FIGURE 10 GLOBAL FIBERGLASS MARKET BY APPLICATION, USD BILLION, 2020-2029

FIGURE 11 GLOBAL FIBERGLASS MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL FIBERGLASS MARKET BY GLASS TYPE, USD BILLION, 2021

FIGURE 14 GLOBAL FIBERGLASS MARKET BY PRODUCT, USD BILLION, 2021

FIGURE 15 GLOBAL FIBERGLASS MARKET BY APPLICATION, USD BILLION, 2021

FIGURE 16 GLOBAL FIBERGLASS MARKET BY REGION, USD BILLION, 2021

FIGURE 17 NORTH AMERICA FIBERGLASS MARKET SNAPSHOT

FIGURE 18 EUROPE FIBERGLASS MARKET SNAPSHOT

FIGURE 19 SOUTH AMERICA FIBERGLASS MARKET SNAPSHOT

FIGURE 20 ASIA PACIFIC FIBERGLASS MARKET SNAPSHOT

FIGURE 21 MIDDLE EAST ASIA AND AFRICA FIBERGLASS MARKET SNAPSHOT

FIGURE 22 MARKET SHARE ANALYSIS

FIGURE 23 LANXESS: COMPANY SNAPSHOT

FIGURE 24 OWENS CORNING: COMPANY SNAPSHOT

FIGURE 25 3B – THE FIBERGLASS COMP: COMPANY SNAPSHOT

FIGURE 26 SHANDONG FIBERGLASS GROUP CORP: COMPANY SNAPSHOT

FIGURE 27 TAISHAN FIBERGLASS INC.: COMPANY SNAPSHOT

FIGURE 28 CHONGQING POLYCOMP INTERNATIONAL CORP.: COMPANY SNAPSHOT

FIGURE 29 SAINT-GOBAIN VETROTEX: COMPANY SNAPSHOT

FIGURE 30 PFG FIBER GLASS CORPORATION: COMPANY SNAPSHOT

FIGURE 31 KCC CORPORATION: COMPANY SNAPSHOT

FIGURE 32 ASAHI FIBER GLASS CO. LTD..: COMPANY SNAPSHOT

FAQ

The fiberglass market is expected to grow at 5.70 % CAGR from 2022 to 2029. It is expected to reach above USD 35.87 Billion by 2029 from USD 21.78 Billion in 2020.

Asia Pacific held more than 46% of the fiberglass market revenue share in 2021 and will witness expansion in the forecast period.

Fiberglass exhibits high resistance to corrosion, making it a preferred choice for applications in corrosive environments. Industries such as chemical processing, oil and gas, and marine rely on fiberglass for corrosion-resistant equipment, tanks, and pipes.

The transportation and consumer goods are major sector where the application of fiberglass has seen more.

The markets largest share is in the Asia Pacific region.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.