REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

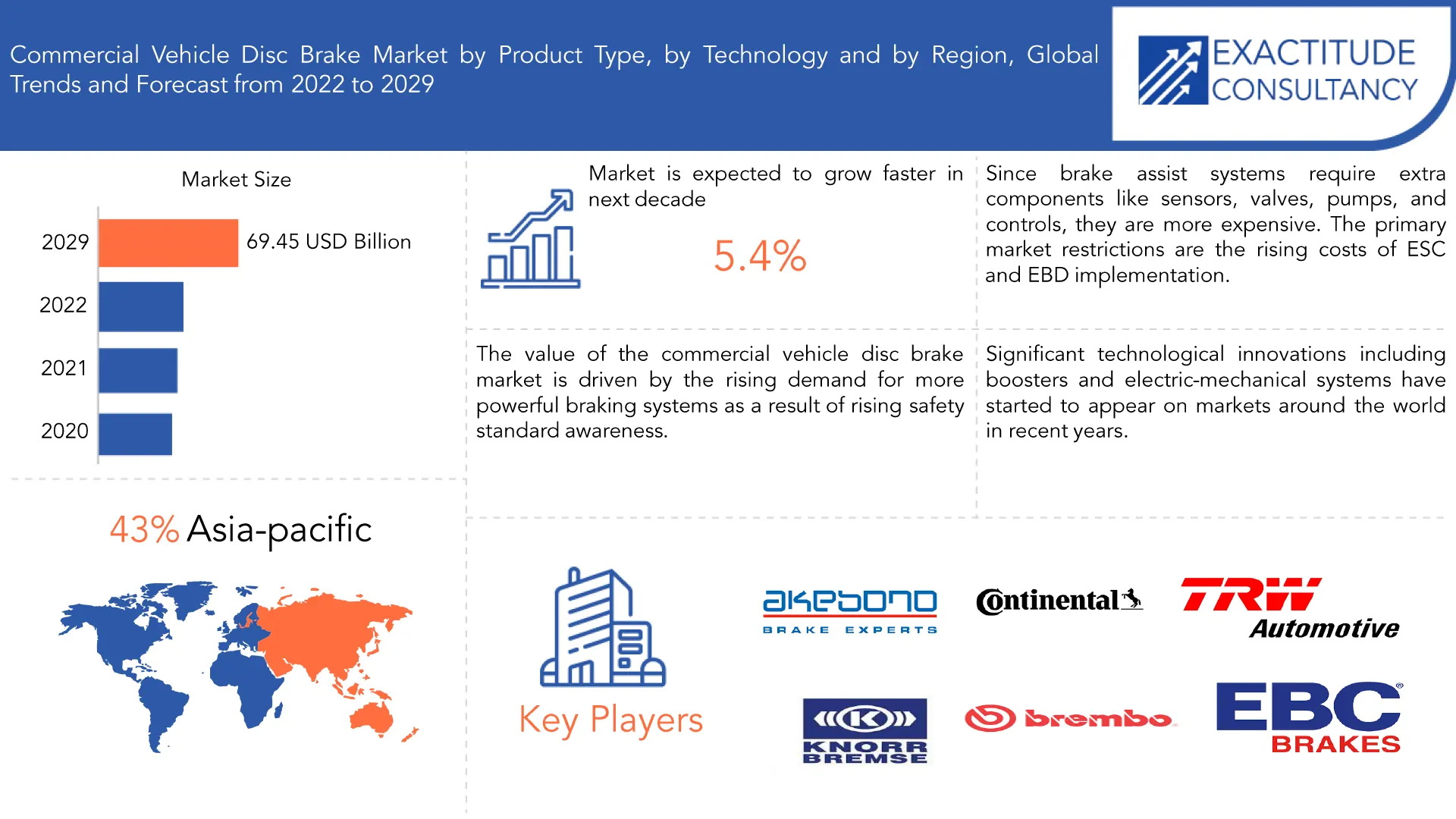

| USD 69.45 billion by 2029 | 5.4% | Asia Pacific |

| By Product Type | By Technology | By Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Commercial Vehicle Disc Brake Market Overview

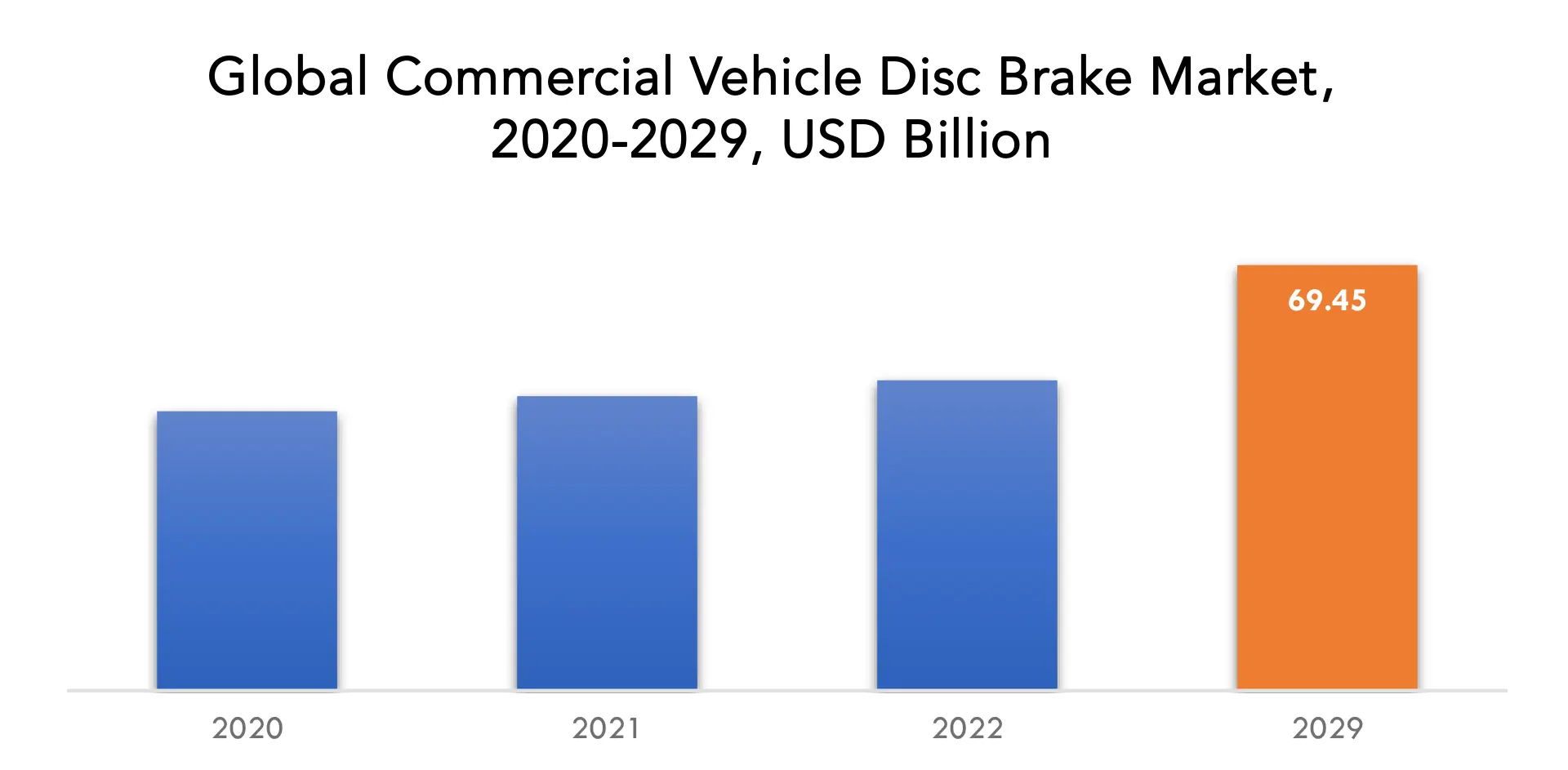

The commercial vehicle disc brake market is expected to grow at 5.4% CAGR from 2022 to 2029. It is expected to reach above USD 69.45 billion by 2029 from USD 43.26 billion in 2020.

A disc brake is a particular kind of brake that includes a disc rotor that revolves with the wheel and a stationary brake caliper assembly that is outfitted with brake pads. Disc brakes have advantages over drum brakes, including better performance without the need for additional maintenance costs for cleaning and adjusting, faster cooling, and greater capacity. Because the disc is easily cooled, disc brakes offer higher stopping performance than drum brakes. As a result, automated disc brake are more resilient to immersion and less prone to brake fade caused by overheated braking components. As a result of better ride quality and rising safety demands, auto manufacturers are increasingly using disc brakes in their vehicles.

The expansion of the automotive disc brakes market globally is primarily being driven by increased awareness of safety requirements, which is in turn pushing up demand for better technology in braking systems. The expansion of the global market is also being strongly supported by strict government laws on the minimum stopping distance, particularly in industrialized nations like the U.S. Also, the market for automobile disc brakes has been growing as a result of the tight government regulations for increasing vehicle safety around the world and the rising demand for two-wheelers. Modern technological innovations are now entering the market, including boosters and electric-mechanical systems. These developments should provide the automobile disc brakes industry with chances for future growth.

For all manufacturers, improving road safety continues to be a primary concern, and new market opportunities are anticipated. One key aspect anticipated to drive market expansion over the forecast period is the trend towards adopting electric and environmentally friendly automobiles as popular modes of transportation.

Worldwide, the pace of urbanization is increasing exponentially, which has increased the average disposable income of the urban population and enabled them to improve their quality of life. Commercial vehicles are in higher demand due to altered lifestyles, which is encouraging manufacturers to increase production in order to best serve clients. The expansion of the vehicle sector has also benefited from lower loan interest rates. Consumer behaviour towards intercity and intracity transit has changed significantly during the last few years. Global auto demand is increasing, which has positively influenced production and increased the need for dependable braking systems. For both established market players and fresh entrants, rising acceptance of electric vehicles and rising demand for high-performance and autonomous vehicles are some aspects that are anticipated to continue to create profitable business prospects. Additionally, the increasing incidence of traffic accidents has increased public awareness of the need for road safety and sped up the development of better brakes.

The whole global automotive sector supply chain was thrown off balance when COVID-19 suddenly appeared. The subsequent closure of the assembly plants disrupted production and stopped the export of Chinese components. Also, the global travel restrictions imposed by the governments of Europe, Asia, and North America have hampered opportunities for business partnerships and collaboration. People were unable to move freely from one location to another due to the pandemic. Also, the supply side of the commercial vehicle disc braking system market was impacted by the limitations of the small staff at the production site. With the lockdown being lifted, the market has started to pick up speed. Due to the manufacturers’ emphasis on cutting-edge technologies like regenerative braking and ABS, the commercial vehicle disc brake market is anticipated to expand significantly throughout the projected period.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion) (Thousand Units) |

| Segmentation | By Product Type, By Technology, By Region |

| By Product Type

|

|

| By Technology

|

|

| By Region

|

|

Commercial Vehicle Disc Brake Market Segment Analysis

Commercial vehicle disc brake market is segmented based on product type, technology, and region.

Based on product type, a significant portion of the market was made up of floating caliper. This is as a result of its lightweight and simple design, both of which help to achieve cheaper manufacturing costs. Vehicles are increasingly using floating caliper disc brakes in the automotive sector. Benefits supplied by these items, such as their straightforward features, light weight, and affordable manufacturing prices, are the main reasons promoting this market’s expansion.

Based on technology, a significant portion of the market was made up of anti-lock braking system (ABS). When braking suddenly, ABS keeps the wheels from locking up, assisting the driver in keeping the car under control and lowering the likelihood of accidents. The use of ABS in commercial vehicles has increased recently, and the disc brake industry now mostly revolves around this technology. This is due to the fact that disc brakes are more effective than conventional drum brakes at dissipating heat and offering superior stopping force, and the addition of ABS further improves their effectiveness.

Commercial Vehicle Disc Brake Market Players

The Market research report covers the analysis of Market players. Key companies profiled in the report include Akebono Brake Corporation, Continental AG, EBC Brakes, Knorr-Bremse AG, Brembo SpA, Wabco, Haldex, TRW Automotive, Hyundai Mobis, Mando Corporation

- On March 2023, Akebono Brake Corporation expanded its ProACT Ultra-Premium Disc Brake Pad line by seven new part numbers: ACT2089, ACT2115, ACT2208, ACT2232, ACT2300, ACT2304 and ACT2305. Electronic wear sensor and Premium stainless steel abutment hardware is included in the kits that require it.

- On March 2023, Continental is bringing an Advanced package to its recently upgraded ContiConnect 2.0 tire management solution that makes it possible to record additional data, including tread depth and tire condition. This marks the next step for the technology company as it progresses from pure tire monitoring to asset management, with the integrative ContiConnect platform now detailing all data on a tire’s condition and history within one system.

Who Should Buy? Or Key Stakeholders

- Research and Development Institutes

- Regulatory Authorities

- End-use Companies

- Industrial

- Potential Investors

- Automotive Industry

- Others

Commercial Vehicle Disc Brake Market Regional Analysis

The commercial vehicle disc brake market by region includes North America, Asia-Pacific (APAC), Europe, South America, And Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN, and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina, and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

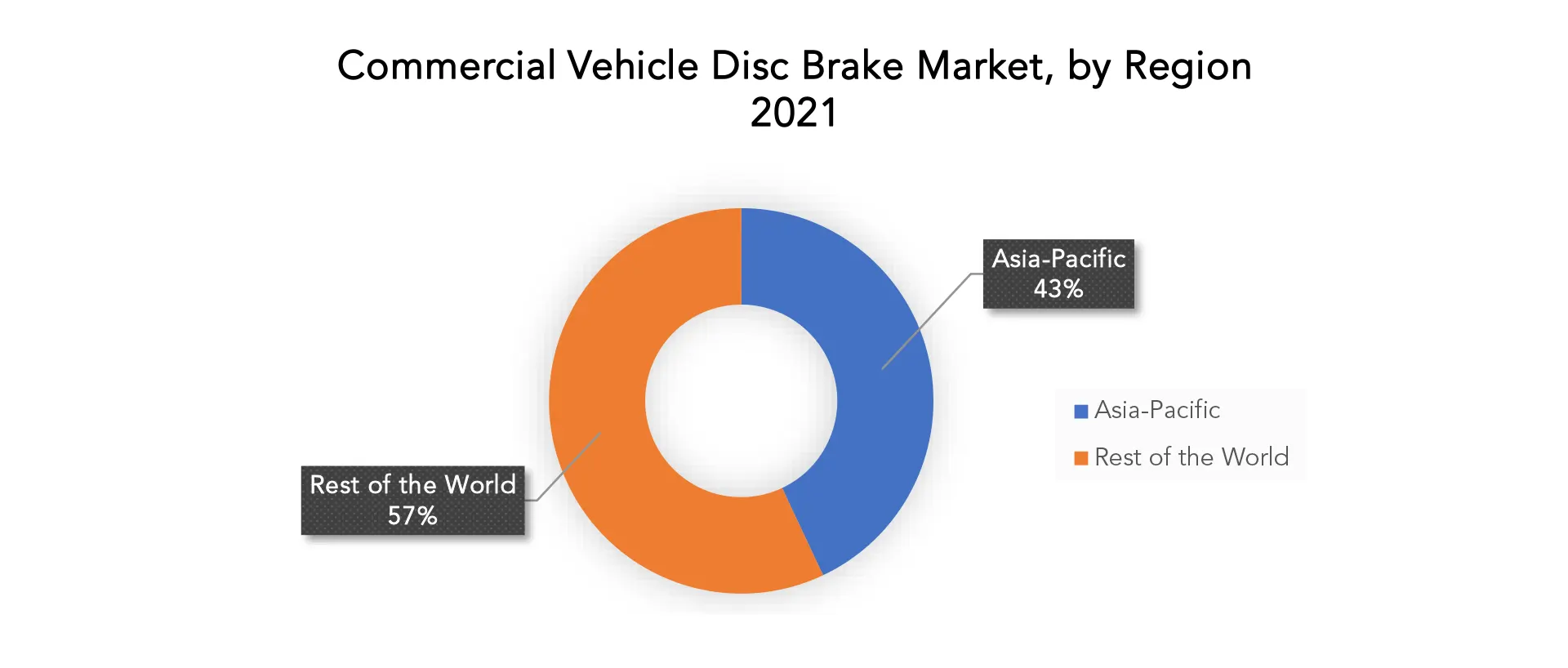

The greatest revenue share in 2021 over 43% was accounted for by Asia Pacific. Businesses in the area offer significant cost reductions because to the accessibility of cheap labour and raw supplies. In addition, the car manufacturing industry is centered on nations like China and India. It is anticipated that the market would rise as a result of the increased popularity of commercial vehicle disc braking systems and an increase in sales of luxury and premium vehicles. Also, the industry is expanding as a whole due to the rise in automotive sales and the rise in accidents.

Key Market Segments: Commercial Vehicle Disc Brake Market

Commercial Vehicle Disc Brake Market By Product Type, 2020-2029, (Usd Billion), (Thousand Units)

- Opposed Piston

- Floating Caliper

Commercial Vehicle Disc Brake Market By Technology, 2020-2029, (Usd Billion), (Thousand Units)

- Anti-Lock Braking System (ABS)

- Electronic Stability Control (ESC)

- Traction Control System (TCS)

- Electronic Brake-Force Distribution (EBD)

Commercial Vehicle Disc Brake Market By Region, 2020-2029, (Usd Billion), (Thousand Units)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives:

- Increasing sales and Market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the commercial vehicle disc brake market over the next 7 years?

- Who are the major players in the commercial vehicle disc brake market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as asia-pacific, middle east, and africa?

- How is the economic environment affecting the commercial vehicle disc brake market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the commercial vehicle disc brake market?

- What is the current and forecasted size and growth rate of the global commercial vehicle disc brake market?

- What are the key drivers of growth in the commercial vehicle disc brake market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the commercial vehicle disc brake market?

- What are the technological advancements and innovations in the commercial vehicle disc brake market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the commercial vehicle disc brake market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the commercial vehicle disc brake market?

- What are the products offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL COMMERCIAL VEHICLE DISC BRAKE MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON COMMERCIAL VEHICLE DISC BRAKE MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL COMMERCIAL VEHICLE DISC BRAKE MARKET OUTLOOK

- GLOBAL COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE, 2020-2029, (USD BILLION), (THOUSAND UNITS)

- OPPOSED PISTON

- FLOATING CALIPER

- GLOBAL COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY, 2020-2029, (USD BILLION), (THOUSAND UNITS)

- ANTI-LOCK BRAKING SYSTEM (ABS)

- ELECTRONIC STABILITY CONTROL (ESC)

- TRACTION CONTROL SYSTEM (TCS)

- ELECTRONIC BRAKE-FORCE DISTRIBUTION (EBD)

- GLOBAL COMMERCIAL VEHICLE DISC BRAKE MARKET BY REGION, 2020-2029, (USD BILLION), (THOUSAND UNITS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- AKEBONO BRAKE CORPORATION

- CONTINENTAL AG

- EBC BRAKES

- KNORR-BREMSE AG

- BREMBO SPA

- WABCO

- HALDEX

- TRW AUTOMOTIVE

- HYUNDAI MOBIS

- MANDO CORPORATION

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 2 GLOBAL COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 3 GLOBAL COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 4 GLOBAL COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 5 GLOBAL COMMERCIAL VEHICLE DISC BRAKE MARKET BY REGION (USD BILLION), 2020-2029

TABLE 6 GLOBAL COMMERCIAL VEHICLE DISC BRAKE MARKET BY REGION (THOUSAND UNITS), 2020-2029

TABLE 7 NORTH AMERICA COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 8 NORTH AMERICA COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 9 NORTH AMERICA COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 10 NORTH AMERICA COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 11 NORTH AMERICA COMMERCIAL VEHICLE DISC BRAKE MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 12 NORTH AMERICA COMMERCIAL VEHICLE DISC BRAKE MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 13 US COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 14 US COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 15 US COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 16 US COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 17 CANADA COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 18 CANADA COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 19 CANADA COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 20 CANADA COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 21 MEXICO COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 22 MEXICO COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 23 MEXICO COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 24 MEXICO COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 25 SOUTH AMERICA COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 26 SOUTH AMERICA COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 27 SOUTH AMERICA COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 28 SOUTH AMERICA COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 29 SOUTH AMERICA COMMERCIAL VEHICLE DISC BRAKE MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 30 SOUTH AMERICA COMMERCIAL VEHICLE DISC BRAKE MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 31 BRAZIL COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 32 BRAZIL COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 33 BRAZIL COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 34 BRAZIL COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 35 ARGENTINA COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 36 ARGENTINA COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 37 ARGENTINA COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 38 ARGENTINA COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 39 COLOMBIA COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 40 COLOMBIA COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 41 COLOMBIA COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 42 COLOMBIA COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 43 REST OF SOUTH AMERICA COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 44 REST OF SOUTH AMERICA COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 45 REST OF SOUTH AMERICA COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 46 REST OF SOUTH AMERICA COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 47 ASIA-PACIFIC COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 48 ASIA-PACIFIC COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 49 ASIA-PACIFIC COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 50 ASIA-PACIFIC COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 51 ASIA-PACIFIC COMMERCIAL VEHICLE DISC BRAKE MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 52 ASIA-PACIFIC COMMERCIAL VEHICLE DISC BRAKE MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 53 INDIA COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 54 INDIA COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 55 INDIA COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 56 INDIA COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 57 CHINA COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 58 CHINA COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 59 CHINA COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 60 CHINA COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 61 JAPAN COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 62 JAPAN COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 63 JAPAN COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 64 JAPAN COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 65 SOUTH KOREA COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 66 SOUTH KOREA COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 67 SOUTH KOREA COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 68 SOUTH KOREA COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 69 AUSTRALIA COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 70 AUSTRALIA COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 71 AUSTRALIA COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 72 AUSTRALIA COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 73 SOUTH EAST ASIA COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 74 SOUTH EAST ASIA COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 75 SOUTH EAST ASIA COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 76 SOUTH EAST ASIA COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 77 REST OF ASIA PACIFIC COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 78 REST OF ASIA PACIFIC COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 79 REST OF ASIA PACIFIC COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 80 REST OF ASIA PACIFIC COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 81 EUROPE COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 82 EUROPE COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 83 EUROPE COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 84 EUROPE COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 85 EUROPE COMMERCIAL VEHICLE DISC BRAKE MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 86 EUROPE COMMERCIAL VEHICLE DISC BRAKE MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 87 GERMANY COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 88 GERMANY COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 89 GERMANY COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 90 GERMANY COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 91 UK COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 92 UK COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 93 UK COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 94 UK COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 95 FRANCE COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 96 FRANCE COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 97 FRANCE COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 98 FRANCE COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 99 ITALY COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 100 ITALY COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 101 ITALY COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 102 ITALY COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 103 SPAIN COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 104 SPAIN COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 105 SPAIN COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 106 SPAIN COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 107 RUSSIA COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 108 RUSSIA COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 109 RUSSIA COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 110 RUSSIA COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 111 REST OF EUROPE COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 112 REST OF EUROPE COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 113 REST OF EUROPE COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 114 REST OF EUROPE COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 115 MIDDLE EAST AND AFRICA COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 116 MIDDLE EAST AND AFRICA COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 117 MIDDLE EAST AND AFRICA COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 118 MIDDLE EAST AND AFRICA COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 119 MIDDLE EAST AND AFRICA COMMERCIAL VEHICLE DISC BRAKE MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 120 MIDDLE EAST AND AFRICA COMMERCIAL VEHICLE DISC BRAKE MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 121 UAE COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 122 UAE COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 123 UAE COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 124 UAE COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 125 SAUDI ARABIA COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 126 SAUDI ARABIA COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 127 SAUDI ARABIA COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 128 SAUDI ARABIA COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 129 SOUTH AFRICA COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 130 SOUTH AFRICA COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 131 SOUTH AFRICA COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 132 SOUTH AFRICA COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 133 REST OF MIDDLE EAST AND AFRICA COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 134 REST OF MIDDLE EAST AND AFRICA COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 135 REST OF MIDDLE EAST AND AFRICA COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 136 REST OF MIDDLE EAST AND AFRICA COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE, USD BILLION, 2020-2029

FIGURE 9 GLOBAL COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY, USD BILLION, 2020-2029

FIGURE 10 GLOBAL COMMERCIAL VEHICLE DISC BRAKE MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL COMMERCIAL VEHICLE DISC BRAKE MARKET BY PRODUCT TYPE, USD BILLION, 2021

FIGURE 13 GLOBAL COMMERCIAL VEHICLE DISC BRAKE MARKET BY TECHNOLOGY, USD BILLION, 2021

FIGURE 14 GLOBAL COMMERCIAL VEHICLE DISC BRAKE MARKET BY REGION, USD BILLION, 2021

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 AKEBONO BRAKE CORPORATION: COMPANY SNAPSHOT

FIGURE 17 CONTINENTAL AG: COMPANY SNAPSHOT

FIGURE 18 EBC BRAKES: COMPANY SNAPSHOT

FIGURE 19 KNORR-BREMSE AG: COMPANY SNAPSHOT

FIGURE 20 BREMBO SPA: COMPANY SNAPSHOT

FIGURE 21 WABCO: COMPANY SNAPSHOT

FIGURE 22 HALDEX: COMPANY SNAPSHOT

FIGURE 23 TRW AUTOMOTIVE: COMPANY SNAPSHOT

FIGURE 24 HYUNDAI MOBIS: COMPANY SNAPSHOT

FIGURE 25 MANDO CORPORATION: COMPANY SNAPSHOT

FAQ

The commercial vehicle disc brake market is expected to grow at 5.4% CAGR from 2022 to 2029. It is expected to reach above USD 69.45 billion by 2029 from USD 43.26 billion in 2020.

Asia Pacific held more than 43% of the commercial vehicle disc brake market revenue share in 2021 and will witness expansion in the forecast period.

Other factors influencing market growth include increased demand for higher-performing cars, technological developments in electric and mechanical systems, governmental mandates to enhance vehicle safety, and high demand for disc brakes in motorcycles. Moreover, firms are investing in superior disc brake technology to manufacture lightweight disc brakes, which would further propel market expansion, due to greater awareness of safety precautions and favourable government regulation.

Due to the availability of cheap labour and raw materials, manufacturers in the Asia-Pacific area continue to dominate the market and offer significant cost reductions. The region also includes some high-potential nations, like China and India. Sales of luxury and premium vehicles are increased as a result of the rising popularity of active braking systems. The companies’ main goal is to create durable, dependable, and eco-friendly braking systems.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.