REPORT OUTLOOK

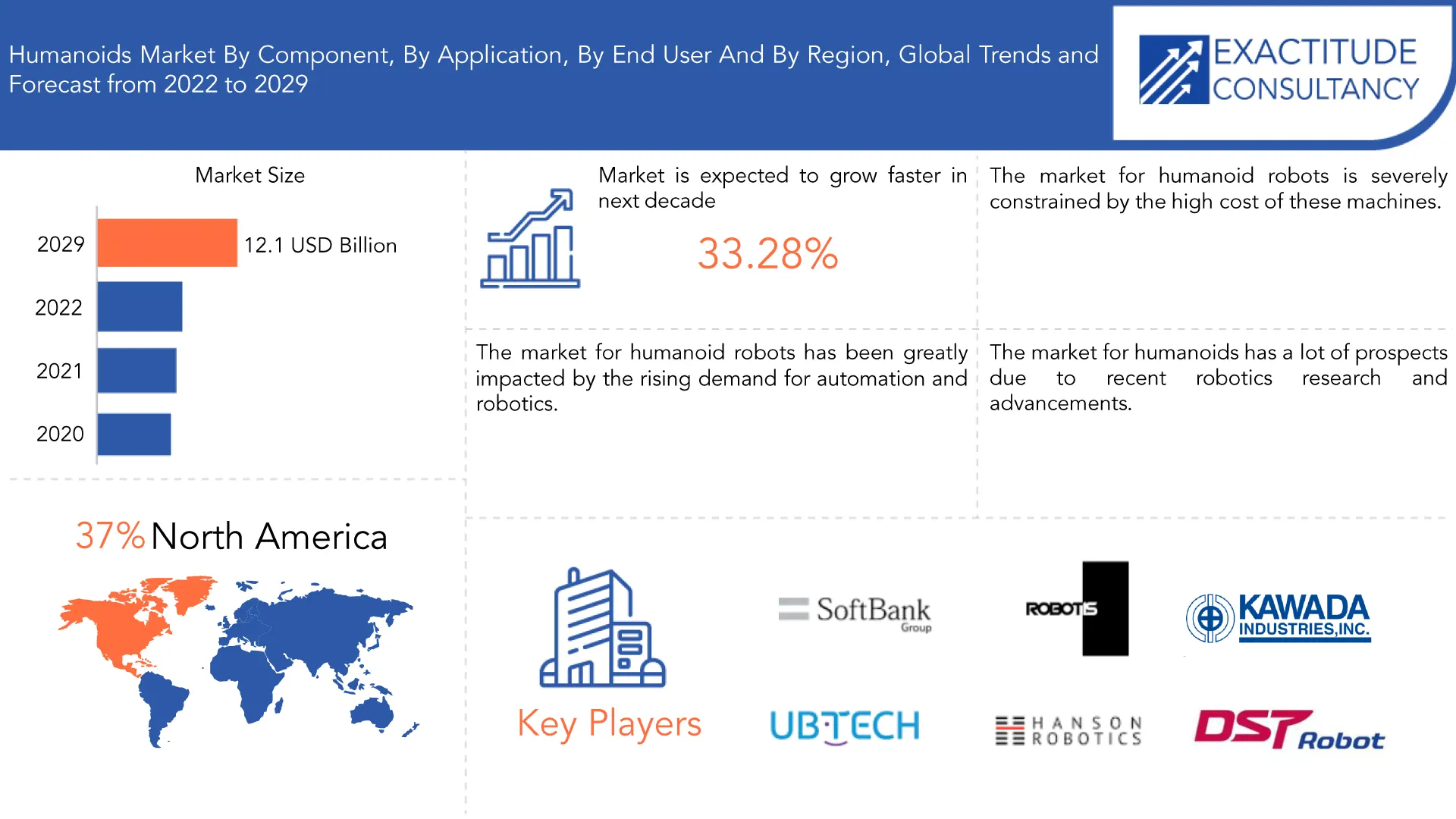

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 12.1 billion by 2029 | 33.28 % | North America |

| MARKET BY COMPONENT | MARKET BY APPLICATION | MARKET BY END USER |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Humanoids Market Overview

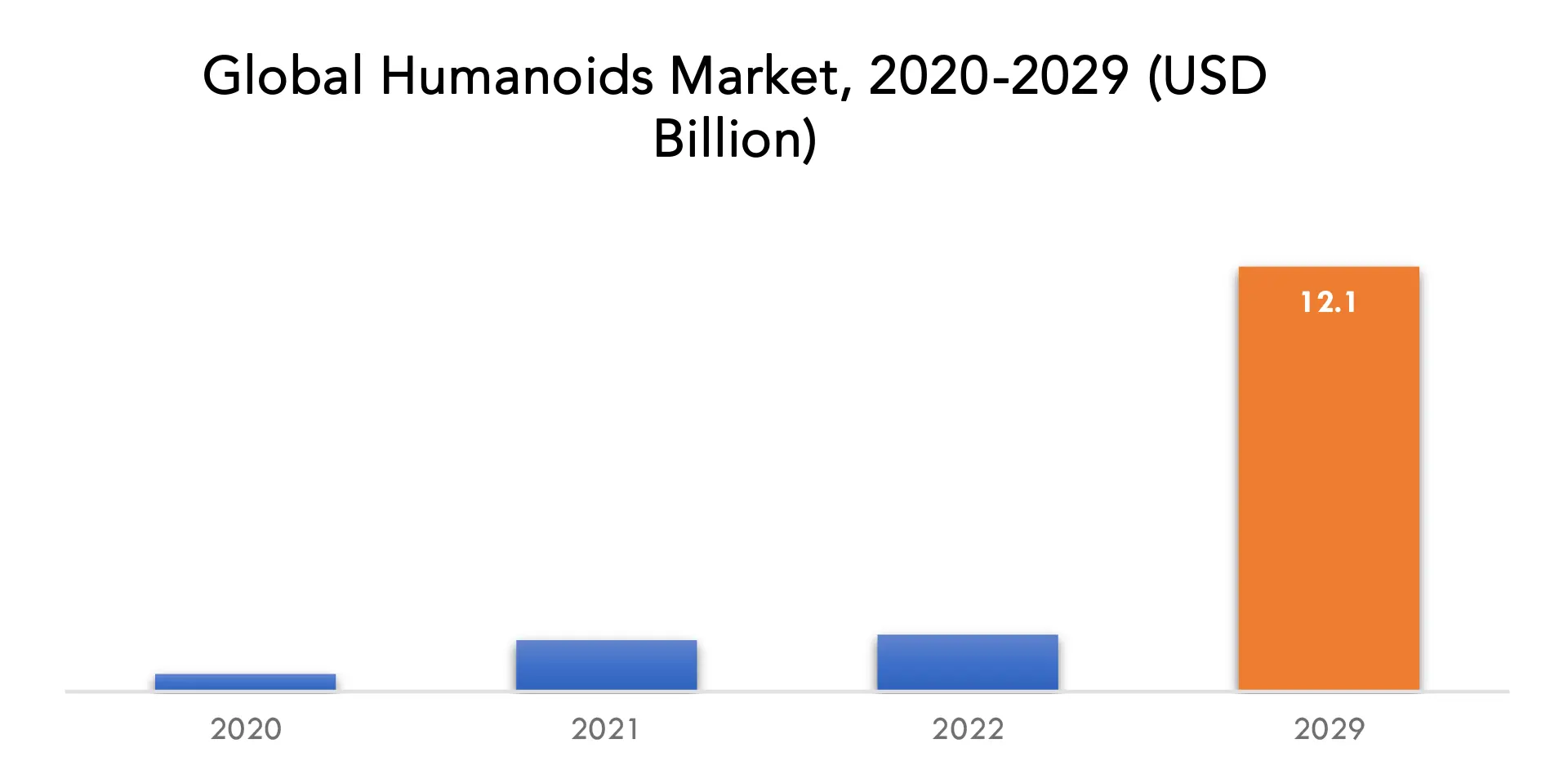

The Humanoids Market is expected to grow at 33.28 % CAGR from 2022 to 2029. It is expected to reach above USD 12.1 billion by 2029 from USD 1.462 billion in 2021.

Humanoids are robots or artificial agents that have a similar appearance to humans in terms of their body structure and movements. They are designed to interact with humans in various ways, including performing tasks that are difficult or dangerous for humans, assisting with everyday activities, and providing entertainment.

Humanoids typically have a head, torso, arms, and legs, and are often designed with advanced sensors and computational capabilities to perceive and interact with the world around them. They may also be equipped with advanced technologies such as artificial intelligence and natural language processing, which allow them to understand and respond to human commands and interactions.

One of the main goals of humanoid design is to create machines that can move and interact with the world in a more human-like manner. This often involves mimicking the complex movements and behaviors of humans, such as walking, running, and gesturing. Humanoids may also be designed with facial expressions and other nonverbal cues to help them communicate more effectively with humans.

The market for humanoid robots has been greatly impacted by the rising demand for automation and robotics. Companies are increasingly using automation to replace manual labour as they look to boost productivity and efficiency. Since they can carry out duties in a more human-like manner, humanoid robots are ideally suited for this job and are the best choice for applications requiring manual dexterity and flexibility. In industrial facilities, humanoid robots can be employed to complete jobs like assembling tiny components or handling sensitive materials, where accuracy and precision are essential.

The market for humanoid robots is severely constrained by the high cost of these machines. Due to their intricacy and sophisticated skills, humanoid robots are now more expensive than other types of robots. Because of this, they are less available to many firms and customers, especially in sectors with narrow profit margins. The high cost of humanoid robots is caused by a number of factors, including the price of materials, manufacturing, and research and development.

The market for humanoids has a lot of prospects due to recent robotics research and advancements. Humanoid robots are becoming more sophisticated, capable, and economical as technology develops new materials, sensors, and algorithms. The advancement of soft robotics is one of the most fascinating study topics. Robots are more flexible and adaptive due to soft robotics, which employs materials that can replicate the movement and suppleness of human muscles. Humanoid robots that can handle delicate jobs or communicate with people more naturally and intuitively can be created using soft robotics. The creation of sophisticated sensors and visual systems is another field of study.

The pandemic drove numerous companies to cease or scale back operations, which slowed down the creation and uptake of humanoid robots. The creation and use of humanoid robots were impacted by the global supply chain and logistics problems. The pandemic, however, also brought to light the potential of humanoid robots in the healthcare and other sectors. In order to lower the danger of infection for healthcare personnel, humanoid robots were utilised to aid medical experts in the treatment of COVID-19 patients. They were also utilised in other industries to support remote labour and sustain key services.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion), (Thousand Units) |

| Segmentation | By component, by Application, by End User |

| By Component |

|

| BY Application |

|

| By End User |

|

| By Region |

|

Humanoids market Segment Analysis

The humanoids market is segmented based on component, application and end user.

The majority of the market share for humanoids is occupied of hardware. This is due to the fact that hardware elements, including sensors and actuators, are the actual parts that give humanoid robots the ability to see and interact with their surroundings, making them crucial to the robot’s proper operation. Demand for hardware parts is anticipated to expand along with the demand for humanoid robots.

Humanoid robots are increasingly being used for security and surveillance purposes, particularly in public spaces such as airports and train stations. These robots are equipped with cameras and sensors that allow them to detect and respond to potential threats, providing an additional layer of security and surveillance. Humanoid robots are also being used for personal assistance, particularly for elderly or disabled individuals who may require additional support with daily tasks.

The market share that belongs to the industrial and commercial sector is largest. This is a result of the increasing use of humanoid robots in a variety of sectors, including manufacturing, logistics, and the automobile industry. By performing jobs like assembly, packaging, and material handling, these robots increase productivity and lower labour costs. The aerospace and defense sector also holds a significant market share, with humanoid robots being used for tasks such as inspection, maintenance, and surveillance.

Humanoids market Players

The humanoids market key players include SoftBank, Robotis, Kawada Robotics, Ubtech Robotics, Hajime Research Institute, Hanson Robotics, DST Robot Co., PAL Robotics, and Toyota Motor.

Recent Development:

January 26, 2023 : CUE was originally developed by Toyota volunteers in their free time as an AI basketball-playing robot in 2017. Since then, CUE had been steadily increasing its shooting rate and distance, and participated in the three-point shootout in the B.

March 25, 2021 : Immervision Inc. announced a new partner for JOYCE, the world’s first humanoid robot to unite the computer vision community. Hanson Robotics Limited, the creator of the renowned humanoid robot Sophia the Robot will work with Immervision’s JOYCE to further evolve machine perception to help deliver human-like vision and beyond.

Who Should Buy? Or Key stakeholders

- Humanoid robots suppliers

- Raw Materials Manufacturers

- Industrial & Commercial Sector organizations

- Research Organizations

- Investors

- Regulatory Authorities

- Others

Humanoids market Regional Analysis

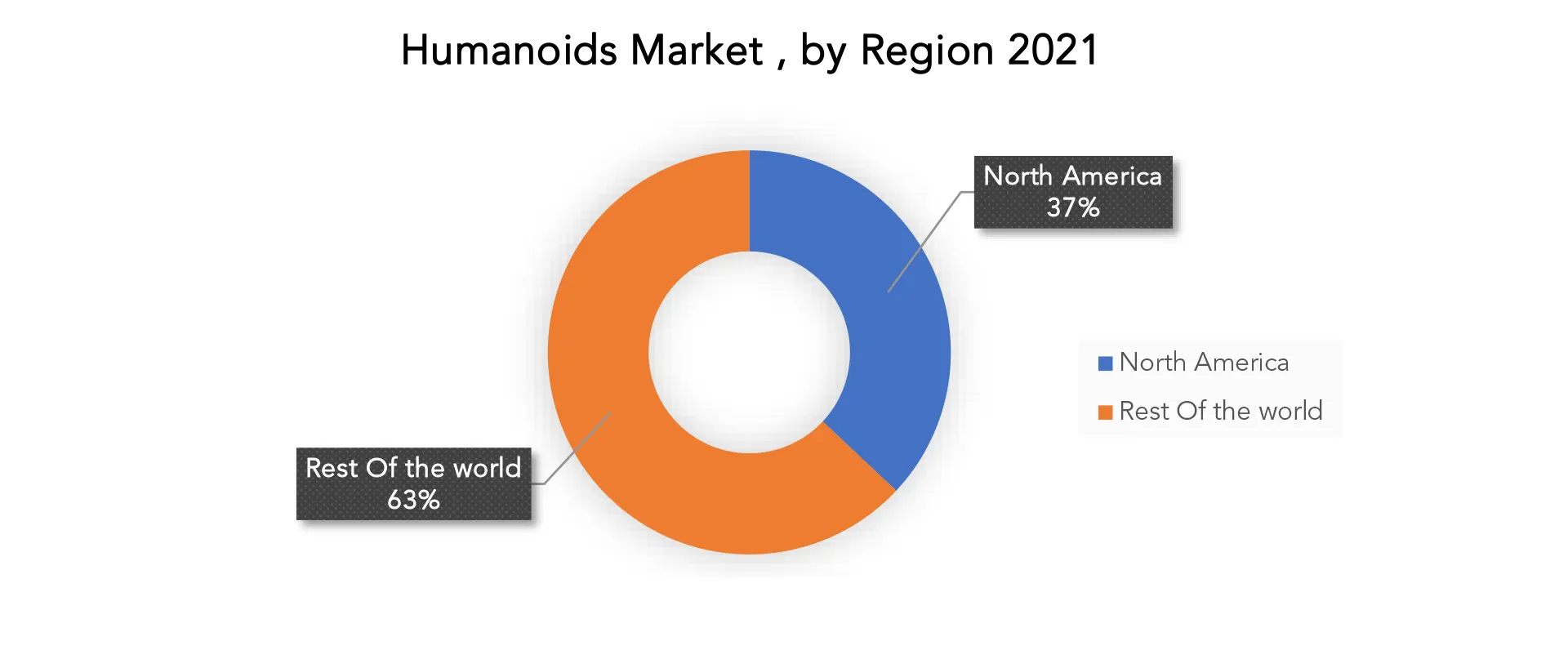

The humanoids market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

Humanoid robots are in high demand in the North American region, where they are used in several sectors including healthcare, manufacturing, and defense. The presence of well-established manufacturers and suppliers, technical developments, and the rising need for automation across various industries are the main factors driving market growth in this area. The healthcare sector in the United States contributes significantly to the country’s dominance of the North American humanoid market. In order to decrease human error and improve patient safety, humanoid robots are increasingly being deployed in healthcare settings for patient care and rehabilitation. Humanoid robots are also used by the US military and defense industry for a variety of tasks, such as surveillance, search and rescue, and bomb disposal.

Due to technology developments and an increase in demand to enhance the customer experience in China and Japan, the Asia Pacific market is anticipated to have the quickest rate of revenue growth. Other elements boosting market revenue growth include declining hardware prices and increased retail demand. For instance, Toshiba developed Junco Chihira, an extraordinarily lifelike android robot. With its built-in speech recognition technology, Junco, a full-time employee at the Tokyo tourist bureau, can react to visitor questions. A further factor driving the market’s revenue growth is the proliferation of the coronavirus, which has boosted the need for isolation and medical help.

Key Market Segments: Humanoids Market

Humanoids Market By Component, 2020-2029, (Usd Billion), (Thousand Units)

- Hardware

- Software

- Services

Humanoids Market By Application, 2020-2029, (Usd Billion), (Thousand Units)

- Security And Surveillance

- Personal Assistance

- Caregiving

Humanoids Market By End User, 2020-2029, (Usd Billion), (Thousand Units)

- Industrial & Commercial Sector

- Defense

- Healthcare

Humanoids Market By Region, 2020-2029, (Usd Billion), (Thousand Units)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Questions Answered

- What is the expected growth rate of the humanoids market over the next 7 years?

- Who are the major players in the humanoids market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the humanoids market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the humanoids market?

- What is the current and forecasted size and growth rate of the global humanoids market?

- What are the key drivers of growth in the humanoids market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the humanoids market?

- What are the technological advancements and innovations in the humanoids market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the humanoids market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the humanoids market?

- What are the product offerings and specifications of leading players in the market?

- What is the pricing trend of humanoids in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL HUMANOIDS MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON HUMANOIDS MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL HUMANOIDS MARKET OUTLOOK

- GLOBAL HUMANOIDS MARKET BY COMPONENT,2020-2029, (USD BILLION, THOUSAND UNITS)

- HARDWARE

- SOFTWARE

- SERVICES

- GLOBAL HUMANOIDS MARKET BY APPLICATION, 2020-2029, (USD BILLION, THOUSAND UNITS)

- SECURITY AND SURVEILLANCE

- PERSONAL ASSISTANCE

- CAREGIVING

- GLOBAL HUMANOIDS MARKET BY END USER, 2020-2029, (USD BILLION, THOUSAND UNITS)

- INDUSTRIAL & COMMERCIAL SECTOR

- AEROSPACE & DEFENSE

- HEALTHCARE

- GLOBAL HUMANOIDS MARKET BY REGION, 2020-2029, (USD BILLION, THOUSAND UNITS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- SOFTBANK

- ROBOTIS

- KAWADA ROBOTICS

- UBTECH ROBOTICS

- HAJIME RESEARCH INSTITUTE

- HANSON ROBOTICS

- DST ROBOT CO.

- PAL ROBOTICS

- TOYOTA MOTOR*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL HUMANOIDS MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 2 GLOBAL HUMANOIDS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 3 GLOBAL HUMANOIDS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 4 GLOBAL HUMANOIDS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 5 GLOBAL HUMANOIDS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 6 GLOBAL HUMANOIDS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 7 GLOBAL HUMANOIDS MARKET BY REGION (USD BILLION), 2020-2029

TABLE 8 GLOBAL HUMANOIDS MARKET BY REGION (THOUSAND UNITS), 2020-2029

TABLE 9 NORTH AMERICA HUMANOIDS MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 10 NORTH AMERICA HUMANOIDS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 11 NORTH AMERICA HUMANOIDS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 12 NORTH AMERICA HUMANOIDS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 13 NORTH AMERICA HUMANOIDS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 14 NORTH AMERICA HUMANOIDS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 15 NORTH AMERICA HUMANOIDS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 16 NORTH AMERICA HUMANOIDS MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 17 US HUMANOIDS MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 18 US HUMANOIDS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 19 US HUMANOIDS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 20 US HUMANOIDS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 21 US HUMANOIDS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 22 US HUMANOIDS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 23 CANADA HUMANOIDS MARKET BY COMPONENT (BILLION), 2020-2029

TABLE 24 CANADA HUMANOIDS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 25 CANADA HUMANOIDS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 26 CANADA HUMANOIDS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 27 CANADA HUMANOIDS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 28 CANADA HUMANOIDS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 29 MEXICO HUMANOIDS MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 30 MEXICO HUMANOIDS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 31 MEXICO HUMANOIDS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 32 MEXICO HUMANOIDS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 33 MEXICO HUMANOIDS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 34 MEXICO HUMANOIDS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 35 SOUTH AMERICA HUMANOIDS MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 36 SOUTH AMERICA HUMANOIDS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 37 SOUTH AMERICA HUMANOIDS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 38 SOUTH AMERICA HUMANOIDS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 39 SOUTH AMERICA HUMANOIDS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 40 SOUTH AMERICA HUMANOIDS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 41 SOUTH AMERICA HUMANOIDS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 42 SOUTH AMERICA HUMANOIDS MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 43 BRAZIL HUMANOIDS MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 44 BRAZIL HUMANOIDS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 45 BRAZIL HUMANOIDS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 46 BRAZIL HUMANOIDS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 47 BRAZIL HUMANOIDS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 48 BRAZIL HUMANOIDS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 49 ARGENTINA HUMANOIDS MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 50 ARGENTINA HUMANOIDS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 51 ARGENTINA HUMANOIDS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 52 ARGENTINA HUMANOIDS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 53 ARGENTINA HUMANOIDS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 54 ARGENTINA HUMANOIDS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 55 COLOMBIA HUMANOIDS MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 56 COLOMBIA HUMANOIDS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 57 COLOMBIA HUMANOIDS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 58 COLOMBIA HUMANOIDS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 59 COLOMBIA HUMANOIDS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 60 COLOMBIA HUMANOIDS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 61 REST OF SOUTH AMERICA HUMANOIDS MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 62 REST OF SOUTH AMERICA HUMANOIDS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 63 REST OF SOUTH AMERICA HUMANOIDS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 64 REST OF SOUTH AMERICA HUMANOIDS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 65 REST OF SOUTH AMERICA HUMANOIDS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 66 REST OF SOUTH AMERICA HUMANOIDS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 67 ASIA-PACIFIC HUMANOIDS MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 68 ASIA-PACIFIC HUMANOIDS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 69 ASIA-PACIFIC HUMANOIDS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 70 ASIA-PACIFIC HUMANOIDS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 71 ASIA-PACIFIC HUMANOIDS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 72 ASIA-PACIFIC HUMANOIDS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 73 ASIA-PACIFIC HUMANOIDS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 74 ASIA-PACIFIC HUMANOIDS MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 75 INDIA HUMANOIDS MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 76 INDIA HUMANOIDS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 77 INDIA HUMANOIDS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 78 INDIA HUMANOIDS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 79 INDIA HUMANOIDS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 80 INDIA HUMANOIDS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 81 CHINA HUMANOIDS MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 82 CHINA HUMANOIDS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 83 CHINA HUMANOIDS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 84 CHINA HUMANOIDS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 85 CHINA HUMANOIDS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 86 CHINA HUMANOIDS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 87 JAPAN HUMANOIDS MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 88 JAPAN HUMANOIDS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 89 JAPAN HUMANOIDS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 90 JAPAN HUMANOIDS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 91 JAPAN HUMANOIDS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 92 JAPAN HUMANOIDS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 93 SOUTH KOREA HUMANOIDS MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 94 SOUTH KOREA HUMANOIDS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 95 SOUTH KOREA HUMANOIDS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 96 SOUTH KOREA HUMANOIDS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 97 SOUTH KOREA HUMANOIDS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 98 SOUTH KOREA HUMANOIDS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 99 AUSTRALIA HUMANOIDS MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 100 AUSTRALIA HUMANOIDSBY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 101 AUSTRALIA HUMANOIDS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 102 AUSTRALIA HUMANOIDS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 103 AUSTRALIA HUMANOIDS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 104 AUSTRALIA HUMANOIDS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 105 SOUTH EAST ASIA HUMANOIDS MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 106 SOUTH EAST ASIA HUMANOIDSBY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 107 SOUTH EAST ASIA HUMANOIDS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 108 SOUTH EAST ASIA HUMANOIDS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 109 SOUTH EAST ASIA HUMANOIDS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 110 SOUTH EAST ASIA HUMANOIDS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 111 REST OF ASIA PACIFIC HUMANOIDS MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 112 REST OF ASIA PACIFIC HUMANOIDSBY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 113 REST OF ASIA PACIFIC HUMANOIDS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 114 REST OF ASIA PACIFIC HUMANOIDS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 115 REST OF ASIA PACIFIC HUMANOIDS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 116 REST OF ASIA PACIFIC HUMANOIDS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 117 EUROPE HUMANOIDS MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 118 EUROPE HUMANOIDS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 119 EUROPE HUMANOIDS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 120 EUROPE HUMANOIDS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 121 EUROPE HUMANOIDS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 122 EUROPE HUMANOIDS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 123 EUROPE HUMANOIDS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 124 EUROPE HUMANOIDS MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 125 GERMANY HUMANOIDS MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 126 GERMANY HUMANOIDS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 127 GERMANY HUMANOIDS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 128 GERMANY HUMANOIDS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 129 GERMANY HUMANOIDS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 130 GERMANY HUMANOIDS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 131 UK HUMANOIDS MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 132 UK HUMANOIDS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 133 UK HUMANOIDS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 134 UK HUMANOIDS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 135 UK HUMANOIDS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 136 UK HUMANOIDS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 137 FRANCE HUMANOIDS MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 138 FRANCE HUMANOIDS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 139 FRANCE HUMANOIDS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 140 FRANCE HUMANOIDS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 141 FRANCE HUMANOIDS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 142 FRANCE HUMANOIDS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 143 ITALY HUMANOIDS MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 144 ITALY HUMANOIDS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 145 ITALY HUMANOIDS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 146 ITALY HUMANOIDS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 147 ITALY HUMANOIDS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 148 ITALY HUMANOIDS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 149 SPAIN HUMANOIDS MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 150 SPAIN HUMANOIDS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 151 SPAIN HUMANOIDS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 152 SPAIN HUMANOIDS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 153 SPAIN HUMANOIDS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 154 SPAIN HUMANOIDS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 155 RUSSIA HUMANOIDS MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 156 RUSSIA HUMANOIDS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 157 RUSSIA HUMANOIDS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 158 RUSSIA HUMANOIDS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 159 RUSSIA HUMANOIDS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 160 RUSSIA HUMANOIDS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 161 REST OF EUROPE HUMANOIDS MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 162 REST OF EUROPE HUMANOIDS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 163 REST OF EUROPE HUMANOIDS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 164 REST OF EUROPE HUMANOIDS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 165 REST OF EUROPE HUMANOIDS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 166 REST OF EUROPE HUMANOIDS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 167 MIDDLE EAST AND AFRICA HUMANOIDS MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 168 MIDDLE EAST AND AFRICA HUMANOIDS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 169 MIDDLE EAST AND AFRICA HUMANOIDS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 170 MIDDLE EAST AND AFRICA HUMANOIDS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 171 MIDDLE EAST AND AFRICA HUMANOIDS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 172 MIDDLE EAST AND AFRICA HUMANOIDS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 173 MIDDLE EAST AND AFRICA HUMANOIDS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 174 MIDDLE EAST AND AFRICA HUMANOIDS MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 175 UAE HUMANOIDS MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 176 UAE HUMANOIDS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 177 UAE HUMANOIDS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 178 UAE HUMANOIDS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 179 UAE HUMANOIDS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 180 UAE HUMANOIDS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 181 SAUDI ARABIA HUMANOIDS MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 182 SAUDI ARABIA HUMANOIDS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 183 SAUDI ARABIA HUMANOIDS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 184 SAUDI ARABIA HUMANOIDS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 185 SAUDI ARABIA HUMANOIDS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 186 SAUDI ARABIA HUMANOIDS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 187 SOUTH AFRICA HUMANOIDS MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 188 SOUTH AFRICA HUMANOIDS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 189 SOUTH AFRICA HUMANOIDS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 190 SOUTH AFRICA HUMANOIDS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 191 SOUTH AFRICA HUMANOIDS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 192 SOUTH AFRICA HUMANOIDS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 193 REST OF MIDDLE EAST AND AFRICA HUMANOIDS MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 194 REST OF MIDDLE EAST AND AFRICA HUMANOIDS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 195 REST OF MIDDLE EAST AND AFRICA HUMANOIDS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 196 REST OF MIDDLE EAST AND AFRICA HUMANOIDS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 197 REST OF MIDDLE EAST AND AFRICA HUMANOIDS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 198 REST OF MIDDLE EAST AND AFRICA HUMANOIDS MARKET BY END USER (THOUSAND UNITS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL HUMANOIDS MARKET BY COMPONENT, USD BILLION, 2020-2029

FIGURE 9 GLOBAL HUMANOIDS MARKET BY APPLICATION, USD BILLION, 2020-2029

FIGURE 10 GLOBAL HUMANOIDS MARKET BY END USER, USD BILLION, 2020-2029

FIGURE 11 GLOBAL HUMANOIDS MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL HUMANOIDS MARKET BY REGION, USD BILLION, 2021

FIGURE 14 GLOBAL HUMANOIDS MARKET BY APPLICATION, USD BILLION, 2021

FIGURE 15 GLOBAL HUMANOIDS MARKET BY COMPONENT, USD BILLION, 2021

FIGURE 16 GLOBAL HUMANOIDS MARKET BY END USER, USD BILLION, 2021

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 SOFTBANK: COMPANY SNAPSHOT

FIGURE 19 ROBOTIS: COMPANY SNAPSHOT

FIGURE 20 KAWADA ROBOTICS: COMPANY SNAPSHOT

FIGURE 21 UBTECH ROBOTICS: COMPANY SNAPSHOT

FIGURE 22 HAJIME RESEARCH INSTITUTE: COMPANY SNAPSHOT

FIGURE 23 HANSON ROBOTICS.: COMPANY SNAPSHOT

FIGURE 24 DST ROBOT CO: COMPANY SNAPSHOT

FIGURE 25 PAL ROBOTICS: COMPANY SNAPSHOT

FIGURE 26 TOYOTA MOTOR: COMPANY SNAPSHOT

FAQ

The Humanoids market is expected to grow at 33.28 % CAGR from 2022 to 2029. It is expected to reach above USD 12.1 billion by 2029 from USD 1.462 billion in 2021.

North America held more than 37 % of the humanoids market revenue share in 2021 and will witness expansion in the forecast period.

The market for humanoid robots has been greatly impacted by the rising demand for automation and robotics.

The market share that belongs to the industrial and commercial sector is largest. This is a result of the increasing use of humanoid robots in a variety of sectors, including manufacturing, logistics, and the automobile industry.

Humanoid robots are in high demand in the North American region, where they are used in several sectors including healthcare, manufacturing, and defense. The presence of well-established manufacturers and suppliers, technical developments, and the rising need for automation across various industries are the main factors driving market growth in this area.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.