REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

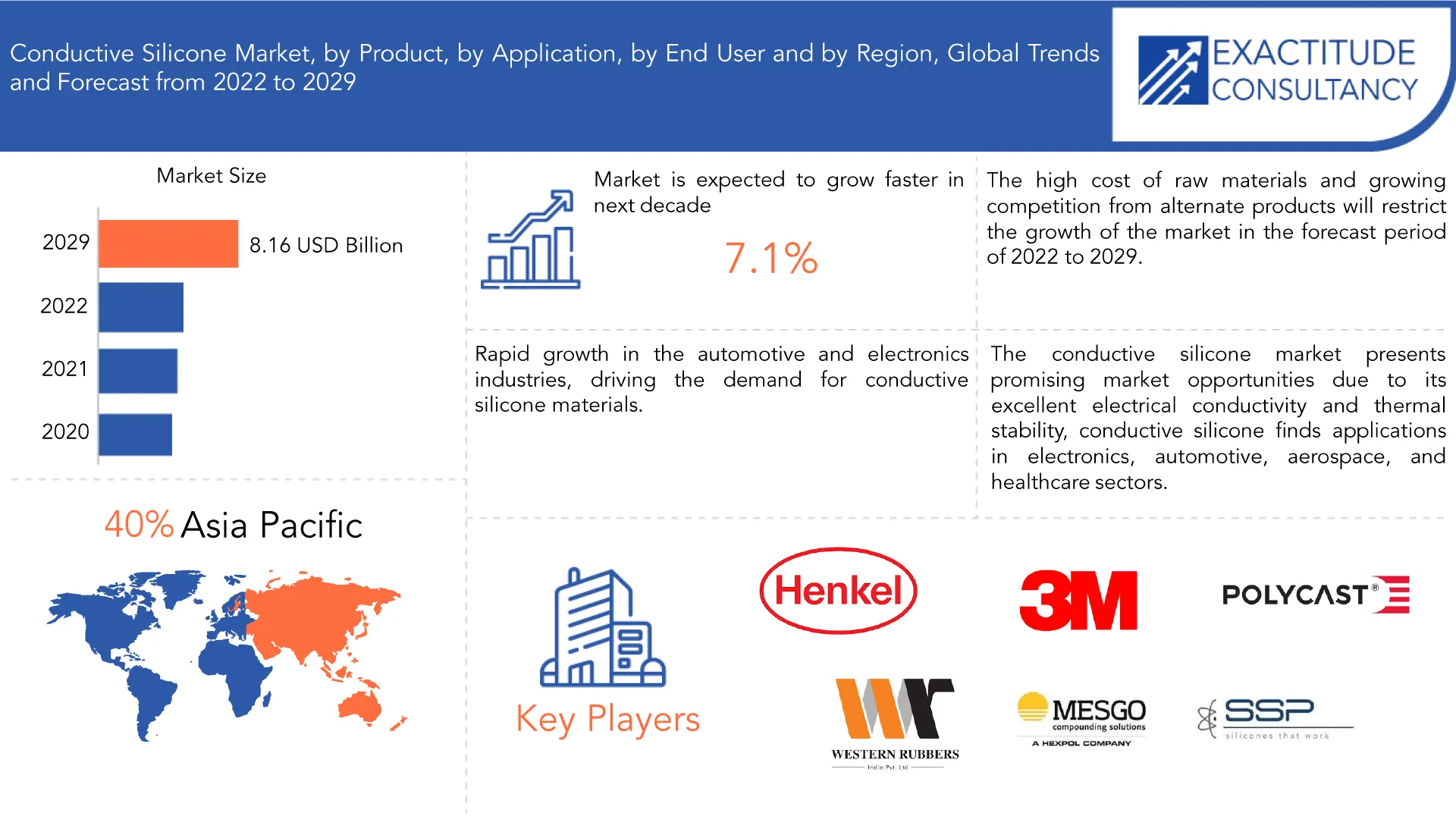

| USD 8.16 billion by 2029 | 7.1 % | Asia-Pacific |

| by Type | by Application | by End User | by Region |

|---|---|---|---|

|

|

|

|

SCOPE OF THE REPORT

Conductive Silicone Market Overview

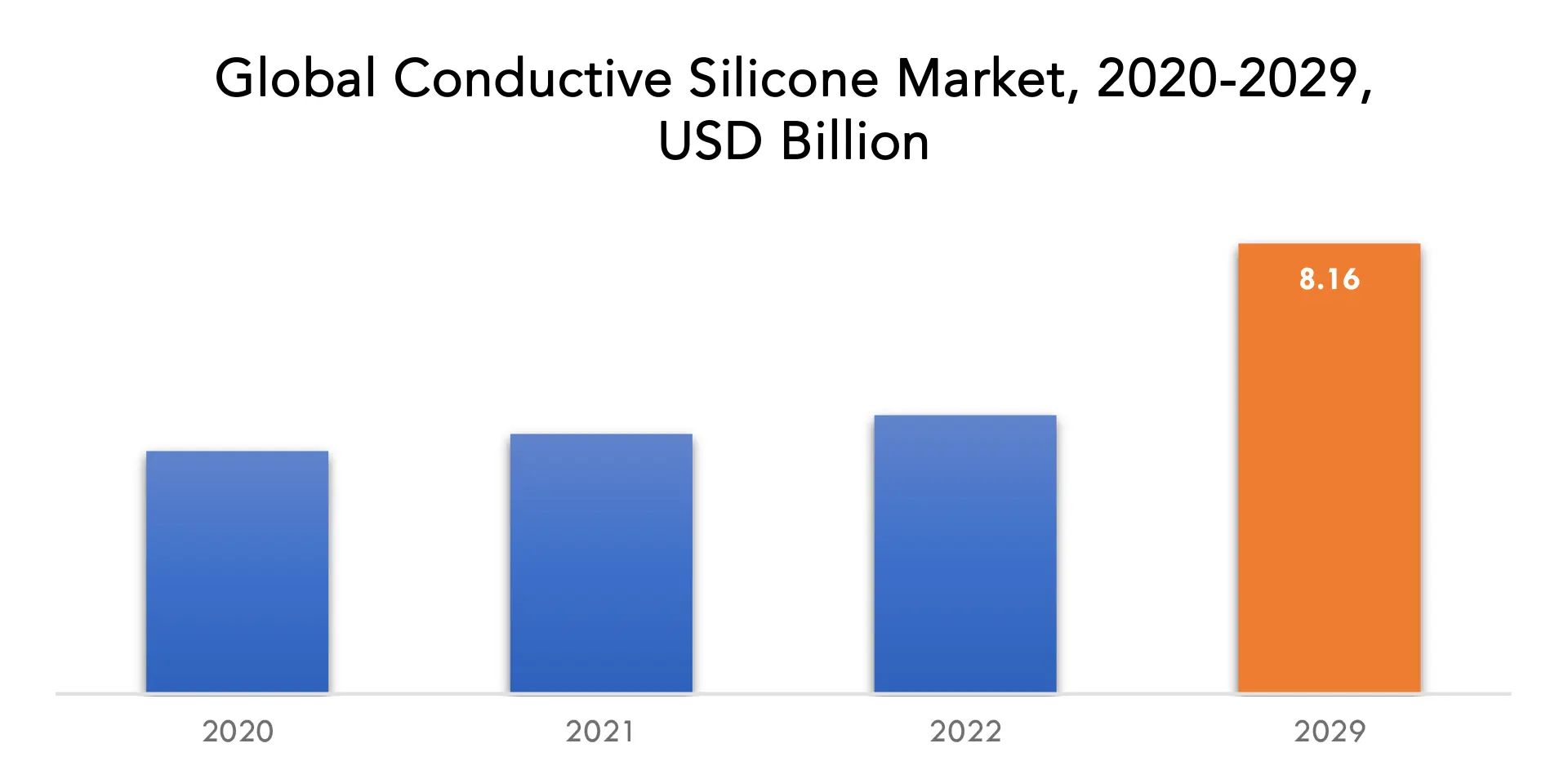

The conductive silicone market is expected to grow at 7.1 % CAGR from 2022 to 2029. It is expected to reach above USD 8.16 billion by 2029 from USD 4.40 billion in 2020.

Conductive silicone is a type of silicon material that contains carbon and has strong sensing capabilities. With compression or deformation, its electrical resistance may change. For deformation sensors, conductive silicone is a great choice. They have a number of benefits, including environmental friendliness, flexibility, ease of assembly, low-temperature processability, electrical conductivity, and moisture resistance. Conductive silicone is employed in numerous processes, including bonding, fastening, printing, coating, and others. Silicone rubbers with enhanced mechanical qualities, great flexibility, and strong elasticity are known as conductive silicone rubbers.

Over the following seven years, development is anticipated to be constrained by growing consumer knowledge of the advantages of bio-based chemicals over their synthetic counterparts. During the projection period of 2020 to 2027, the market’s expansion will also be constrained by the high cost of raw materials and escalating competition from substitute products. The expansion of the market for conductive silicone will be hampered by the rising cost of manufacturing silicones.

Highly sustainable energy methods like solar and wind power employ silicones. The performance and durability of many commercial and industrial products are improved by silicone, which plays a significant role in these products. When silicone is added to other materials, it imparts its beneficial properties that help the resulting products last longer, spread more evenly, remain flexible, and tolerate high or low humidity levels. As a result, the resource and energy consumption of the product’s containing silicone is decreased. The businesses are using a variety of growth tactics and putting a lot of money into R&D to create cutting-edge, original items. The new growth is being fueled by the rising demand. Silicones have contributed to the advancement of numerous breakthroughs and technology, including LED, electric vehicles, medical prosthetics, and renewable energy sources like wind turbines and solar panels.

As Chinese environmental regulations became more stringent, several feedstock factories were forced to close in order to comply with air quality regulations, which resulted in a lack of supplies. The main issue is how to address the shortage without harming the ecosystem. Although there is a rising need for the products, the closure of the plants has thrown the supply and demand out of balance and disrupted the easy supply chain, which has limited the expansion of the conductive silicone market.

The market for conductive silicone offers significant business opportunities due to of the material’s rising demand across numerous sectors. Conducive silicone has numerous uses in the electronics, automotive, aerospace, and medical fields thanks to its superior electrical conductivity and thermal stability. The market is growing as a result of increasing wearable device use, electric vehicle growth, and medical technology developments. The creation of novel conductive silicone formulations and the demand for trustworthy electromagnetic interference (EMI) shielding materials both contribute to the market’s expansion.

The advent of COVID-19, which the World Health Organization has classified as a pandemic, is clearly having an effect on the expansion of the world economy. The global GDP is anticipated to decrease by 3% in 2020, according to the International Monetary Fund. The economic effects of COVID-19 are anticipated to cause a drop in global trade volumes of between 13% and 32% in 2020, according to the World Trade Organization (WTO). The COVID-19 epidemic has temporarily halted the majority of industrial activity, which has had an impact on the demand for conductive silicone. The supply chain and demand were also impacted, which in turn restrained growth in 2020.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion), (Kilotons). |

| Segmentation | By Product, By Application, By End User, By Region. |

| By Product

|

|

| By Application

|

|

| By End User

|

|

| By Region

|

|

Conductive Silicone Market Segment Analysis

The conductive silicone market is segmented based on product, application and end user.

2019 saw the highest market share for silicone elastomers. Since it has been used for a number of years, liquid silicone rubber (LSR) injection molding has seen a considerable increase in usage. The surge is the result of increased demand for household goods, automobiles, wearable technology, medical devices, and baby care products.

The conductive silicone market is anticipated to have the greatest proportion of adhesives and sealants in 2019. For the new generation of solar panels, they serve as a thin semiconductor and are used for bonding in traditional solar panels. About 90% of solar cells are silicon-based. They also aid in the distribution and transmission of energy due to the boost robustness and weather resistance.

With a CAGR of 11%, the energy and power sector dominate the market for conductive silicone. According to the global silicone council, about 788,000 tons of silicone goods are bought each year for use in the energy and power sector in traditional and renewable energy sources like oil, gas and electricity, as well as solar panels and wind turbines. The installed solar photovoltaic capacity in 2015 was around 180 GW.

Conductive Silicone Market Player

The conductive silicone market key players includes Henkel AG & Co. KGAA, 3M, Polycast Industries Inc., Specialty Silicone Products, Inc., MESGO S.p.A., Jan Huei K.H. Industry Co., Ltd., Western Rubbers, Zhejiang Xinan Chemical Industrial Group Co., Ltd., Timtronics., Schlegel Electronic Materials, Inc.

Recent News:

18 April 2023: 3M Health Information Systems (HIS) announced a collaboration with Amazon Web Services (AWS) to accelerate the innovation and advancement of 3M M*Modal ambient intelligence. As part of the collaboration, 3M will use AWS Machine Learning (ML) and generative AI services, including Amazon Bedrock, Amazon Comprehend Medical and Amazon Transcribe Medical, to help expedite, refine and scale the delivery of 3M’s ambient clinical documentation and virtual assistant solutions.

02 March 2023: 3M today announced a collaboration with Guardhat, an industry-leading connected safety software company. Given the importance of connectivity as a key ingredient in safety programs, 3M is transferring its Safety Inspection Management (SIM) software to Guardhat. The transition is expected to be completed in mid-2023.

Conductive Silicone Market Regional Analysis

The conductive silicone market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

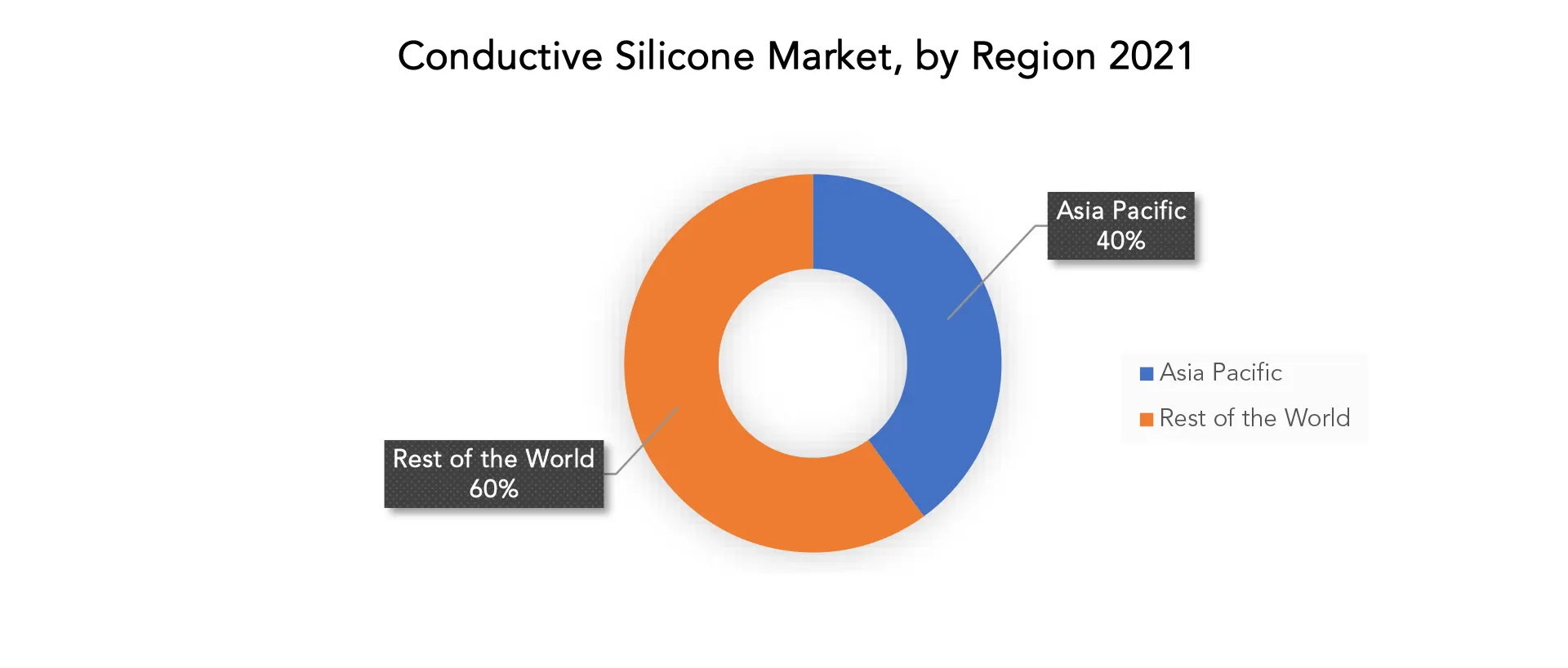

Asia-Pacific (APAC) led the conductive silicone market with a market share of 40% Followed by North America and Europe. One of the biggest and fastest-growing marketplaces worldwide is expected to remain APAC as a whole. In the upcoming years, growth is anticipated to increase in developed, large markets like China, India, Japan, and South Korea. China is leading the Asia-Pacific region in terms of conductive silicone market demand, followed by India and Japan. Other than the United States, all five of the fastest-growing regions in the power and energy industry are Asian nations, including China and India, which are largely responsible for the demand for electricity and health care investment in this region. Sales of silicones are mostly concentrated in the power and energy, industrial processes, personal care and household products, electronics, and health care industries.

Key Market Segments: Conductive Silicone Market

Conductive Silicone Market by Product, 2020-2029, (USD Billion), (Kilotons).

- Silicone Elastomers

- Silicone Resins

- Silicone Gels

- Others

Conductive Silicone Market by Application, 2020-2029, (USD Billion), (Kilotons).

- Thermal Interface Materials

- Adhesives & Sealants

- Conformal Coatings

- Encapsulates & Potting Compounds

- Electronic Circuits

- Medical Devices

- Others

Conductive Silicone Market by End User, 2020-2029, (USD Billion), (Kilotons).

- Aerospace & Defense

- Telecommunication

- Electrical & Electronics

- Medical Industry

- Automotive

- Building & Construction

- Others

Conductive Silicone Market by Region, 2020-2029, (USD Billion), (Kilotons).

- North America

- Asia Pacific

- Europe

- South America

- Middle East and Africa

Important Countries in All Regions Are Covered.

Who Should Buy? Or Key Stakeholders

- Conductive silicone manufacturers

- Conductive silicone traders, distributors, and suppliers

- End-use market participants of different segments of conductive silicones

- Government and research organizations

- Associations and industrial bodies, research and consulting firms

- R&D institutions

- Environment support agencies

- Investment banks and private equity firms

- Others

Key Question Answered

- What is the expected growth rate of the conductive silicone market over the next 7 years?

- Who are the major players in the conductive silicone market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the conductive silicone market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the conductive silicone market?

- What is the current and forecasted size and growth rate of the global conductive silicone market?

- What are the key drivers of growth in the conductive silicone market?

- What are the distribution channels and supply chain dynamics in the conductive silicone market?

- What are the technological advancements and innovations in the conductive silicone market and their impact on application development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the conductive silicone market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the conductive silicone market?

- What are the products offerings and specifications of leading players in the market?

- What is the pricing trend of conductive silicone in the market and what is the impact of raw material prices on the price trend?

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH APPLICATIONOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA PRODUCTS

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL CONDUCTIVE SILICONE OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON CONDUCTIVE SILICONE MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL CONDUCTIVE SILICONE OUTLOOK

- GLOBAL CONDUCTIVE SILICONE MARKET BY PRODUCT (USD BILLION) (KILOTONS) 2020-2029

- SILICONE ELASTOMERS

- SILICONE RESINS

- SILICONE GELS

- OTHERS

- GLOBAL CONDUCTIVE SILICONE MARKET BY APPLICATION (USD BILLION) (KILOTONS) 2020-2029

- THERMAL INTERFACE MATERIALS

- ADHESIVES & SEALANTS

- CONFORMAL COATINGS

- ENCAPSULATES & POTTING COMPOUNDS

- ELECTRONIC CIRCUITS

- MEDICAL DEVICES

- OTHERS

- GLOBAL CONDUCTIVE SILICONE MARKET BY END USER (USD BILLION) (KILOTONS) 2020-2029

- AEROSPACE & DEFENSE

- TELECOMMUNICATION

- ELECTRICAL & ELECTRONICS

- MEDICAL INDUSTRY

- AUTOMOTIVE

- BUILDING & CONSTRUCTION

- OTHERS

- GLOBAL CONDUCTIVE SILICONE MARKET BY REGION (USD BILLION) (KILOTONS) 2020-2029

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- HENKEL AG & CO. KGAA

- 3M

- POLYCAST INDUSTRIES INC.

- SPECIALTY SILICONE PRODUCTS, INC.

- MESGO S.P.A.

- JAN HUEI K.H. INDUSTRY CO., LTD.

- WESTERN RUBBERS

- ZHEJIANG XINAN CHEMICAL INDUSTRIAL GROUP CO., LTD.

- TIMTRONICS

- SCHLEGEL ELECTRONIC MATERIALS, INC.*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL CONDUCTIVE SILICONE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 2 GLOBAL CONDUCTIVE SILICONE MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 3 GLOBAL CONDUCTIVE SILICONE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 4 GLOBAL CONDUCTIVE SILICONE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 5 GLOBAL CONDUCTIVE SILICONE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 6 GLOBAL CONDUCTIVE SILICONE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 7 GLOBAL CONDUCTIVE SILICONE MARKET BY REGION (USD BILLION), 2020-2029

TABLE 8 GLOBAL CONDUCTIVE SILICONE MARKET BY REGION (KILOTONS), 2020-2029

TABLE 9 NORTH AMERICA CONDUCTIVE SILICONE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 10 NORTH AMERICA CONDUCTIVE SILICONE MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 11 NORTH AMERICA CONDUCTIVE SILICONE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 12 NORTH AMERICA CONDUCTIVE SILICONE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 13 NORTH AMERICA CONDUCTIVE SILICONE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 14 NORTH AMERICA CONDUCTIVE SILICONE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 15 NORTH AMERICA CONDUCTIVE SILICONE MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 16 NORTH AMERICA CONDUCTIVE SILICONE MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 17 US CONDUCTIVE SILICONE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 18 US CONDUCTIVE SILICONE MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 19 US CONDUCTIVE SILICONE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 20 US CONDUCTIVE SILICONE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 21 US CONDUCTIVE SILICONE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 22 US CONDUCTIVE SILICONE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 23 CANADA CONDUCTIVE SILICONE MARKET BY PRODUCT (BILLION), 2020-2029

TABLE 24 CANADA CONDUCTIVE SILICONE MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 25 CANADA CONDUCTIVE SILICONE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 26 CANADA CONDUCTIVE SILICONE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 27 CANADA CONDUCTIVE SILICONE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 28 CANADA CONDUCTIVE SILICONE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 29 MEXICO CONDUCTIVE SILICONE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 30 MEXICO CONDUCTIVE SILICONE MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 31 MEXICO CONDUCTIVE SILICONE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 32 MEXICO CONDUCTIVE SILICONE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 33 MEXICO CONDUCTIVE SILICONE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 34 MEXICO CONDUCTIVE SILICONE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 35 SOUTH AMERICA CONDUCTIVE SILICONE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 36 SOUTH AMERICA CONDUCTIVE SILICONE MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 37 SOUTH AMERICA CONDUCTIVE SILICONE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 38 SOUTH AMERICA CONDUCTIVE SILICONE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 39 SOUTH AMERICA CONDUCTIVE SILICONE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 40 SOUTH AMERICA CONDUCTIVE SILICONE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 41 SOUTH AMERICA CONDUCTIVE SILICONE MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 42 SOUTH AMERICA CONDUCTIVE SILICONE MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 43 BRAZIL CONDUCTIVE SILICONE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 44 BRAZIL CONDUCTIVE SILICONE MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 45 BRAZIL CONDUCTIVE SILICONE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 46 BRAZIL CONDUCTIVE SILICONE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 47 BRAZIL CONDUCTIVE SILICONE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 48 BRAZIL CONDUCTIVE SILICONE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 49 ARGENTINA CONDUCTIVE SILICONE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 50 ARGENTINA CONDUCTIVE SILICONE MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 51 ARGENTINA CONDUCTIVE SILICONE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 52 ARGENTINA CONDUCTIVE SILICONE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 53 ARGENTINA CONDUCTIVE SILICONE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 54 ARGENTINA CONDUCTIVE SILICONE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 55 COLOMBIA CONDUCTIVE SILICONE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 56 COLOMBIA CONDUCTIVE SILICONE MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 57 COLOMBIA CONDUCTIVE SILICONE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 58 COLOMBIA CONDUCTIVE SILICONE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 59 COLOMBIA CONDUCTIVE SILICONE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 60 COLOMBIA CONDUCTIVE SILICONE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 61 REST OF SOUTH AMERICA CONDUCTIVE SILICONE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 62 REST OF SOUTH AMERICA CONDUCTIVE SILICONE MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 63 REST OF SOUTH AMERICA CONDUCTIVE SILICONE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 64 REST OF SOUTH AMERICA CONDUCTIVE SILICONE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 65 REST OF SOUTH AMERICA CONDUCTIVE SILICONE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 66 REST OF SOUTH AMERICA CONDUCTIVE SILICONE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 67 ASIA-PACIFIC CONDUCTIVE SILICONE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 68 ASIA-PACIFIC CONDUCTIVE SILICONE MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 69 ASIA-PACIFIC CONDUCTIVE SILICONE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 70 ASIA-PACIFIC CONDUCTIVE SILICONE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 71 ASIA-PACIFIC CONDUCTIVE SILICONE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 72 ASIA-PACIFIC CONDUCTIVE SILICONE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 73 ASIA-PACIFIC CONDUCTIVE SILICONE MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 74 ASIA-PACIFIC CONDUCTIVE SILICONE MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 75 INDIA CONDUCTIVE SILICONE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 76 INDIA CONDUCTIVE SILICONE MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 77 INDIA CONDUCTIVE SILICONE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 78 INDIA CONDUCTIVE SILICONE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 79 INDIA CONDUCTIVE SILICONE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 80 INDIA CONDUCTIVE SILICONE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 81 CHINA CONDUCTIVE SILICONE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 82 CHINA CONDUCTIVE SILICONE MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 83 CHINA CONDUCTIVE SILICONE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 84 CHINA CONDUCTIVE SILICONE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 85 CHINA CONDUCTIVE SILICONE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 86 CHINA CONDUCTIVE SILICONE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 87 JAPAN CONDUCTIVE SILICONE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 88 JAPAN CONDUCTIVE SILICONE MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 89 JAPAN CONDUCTIVE SILICONE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 90 JAPAN CONDUCTIVE SILICONE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 91 JAPAN CONDUCTIVE SILICONE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 92 JAPAN CONDUCTIVE SILICONE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 93 SOUTH KOREA CONDUCTIVE SILICONE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 94 SOUTH KOREA CONDUCTIVE SILICONE MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 95 SOUTH KOREA CONDUCTIVE SILICONE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 96 SOUTH KOREA CONDUCTIVE SILICONE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 97 SOUTH KOREA CONDUCTIVE SILICONE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 98 SOUTH KOREA CONDUCTIVE SILICONE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 99 AUSTRALIA CONDUCTIVE SILICONE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 100 AUSTRALIA CONDUCTIVE SILICONE MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 101 AUSTRALIA CONDUCTIVE SILICONE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 102 AUSTRALIA CONDUCTIVE SILICONE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 103 AUSTRALIA CONDUCTIVE SILICONE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 104 AUSTRALIA CONDUCTIVE SILICONE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 105 SOUTH EAST ASIA CONDUCTIVE SILICONE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 106 SOUTH EAST ASIA CONDUCTIVE SILICONE MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 107 SOUTH EAST ASIA CONDUCTIVE SILICONE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 108 SOUTH EAST ASIA CONDUCTIVE SILICONE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 109 SOUTH EAST ASIA CONDUCTIVE SILICONE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 110 SOUTH EAST ASIA CONDUCTIVE SILICONE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 111 REST OF ASIA PACIFIC CONDUCTIVE SILICONE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 112 REST OF ASIA PACIFIC CONDUCTIVE SILICONE MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 113 REST OF ASIA PACIFIC CONDUCTIVE SILICONE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 114 REST OF ASIA PACIFIC CONDUCTIVE SILICONE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 115 REST OF ASIA PACIFIC CONDUCTIVE SILICONE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 116 REST OF ASIA PACIFIC CONDUCTIVE SILICONE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 117 EUROPE CONDUCTIVE SILICONE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 118 EUROPE CONDUCTIVE SILICONE MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 119 EUROPE CONDUCTIVE SILICONE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 120 EUROPE CONDUCTIVE SILICONE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 121 EUROPE CONDUCTIVE SILICONE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 122 EUROPE CONDUCTIVE SILICONE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 123 EUROPE CONDUCTIVE SILICONE MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 124 EUROPE CONDUCTIVE SILICONE MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 125 GERMANY CONDUCTIVE SILICONE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 126 GERMANY CONDUCTIVE SILICONE MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 127 GERMANY CONDUCTIVE SILICONE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 128 GERMANY CONDUCTIVE SILICONE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 129 GERMANY CONDUCTIVE SILICONE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 130 GERMANY CONDUCTIVE SILICONE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 131 UK CONDUCTIVE SILICONE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 132 UK CONDUCTIVE SILICONE MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 133 UK CONDUCTIVE SILICONE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 134 UK CONDUCTIVE SILICONE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 135 UK CONDUCTIVE SILICONE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 136 UK CONDUCTIVE SILICONE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 137 FRANCE CONDUCTIVE SILICONE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 138 FRANCE CONDUCTIVE SILICONE MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 139 FRANCE CONDUCTIVE SILICONE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 140 FRANCE CONDUCTIVE SILICONE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 141 FRANCE CONDUCTIVE SILICONE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 142 FRANCE CONDUCTIVE SILICONE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 143 ITALY CONDUCTIVE SILICONE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 144 ITALY CONDUCTIVE SILICONE MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 145 ITALY CONDUCTIVE SILICONE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 146 ITALY CONDUCTIVE SILICONE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 147 ITALY CONDUCTIVE SILICONE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 148 ITALY CONDUCTIVE SILICONE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 149 SPAIN CONDUCTIVE SILICONE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 150 SPAIN CONDUCTIVE SILICONE MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 151 SPAIN CONDUCTIVE SILICONE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 152 SPAIN CONDUCTIVE SILICONE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 153 SPAIN CONDUCTIVE SILICONE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 154 SPAIN CONDUCTIVE SILICONE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 155 RUSSIA CONDUCTIVE SILICONE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 156 RUSSIA CONDUCTIVE SILICONE MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 157 RUSSIA CONDUCTIVE SILICONE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 158 RUSSIA CONDUCTIVE SILICONE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 159 RUSSIA CONDUCTIVE SILICONE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 160 RUSSIA CONDUCTIVE SILICONE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 161 REST OF EUROPE CONDUCTIVE SILICONE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 162 REST OF EUROPE CONDUCTIVE SILICONE MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 163 REST OF EUROPE CONDUCTIVE SILICONE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 164 REST OF EUROPE CONDUCTIVE SILICONE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 165 REST OF EUROPE CONDUCTIVE SILICONE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 166 REST OF EUROPE CONDUCTIVE SILICONE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 167 MIDDLE EAST AND AFRICA CONDUCTIVE SILICONE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 168 MIDDLE EAST AND AFRICA CONDUCTIVE SILICONE MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 169 MIDDLE EAST AND AFRICA CONDUCTIVE SILICONE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 170 MIDDLE EAST AND AFRICA CONDUCTIVE SILICONE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 171 MIDDLE EAST AND AFRICA CONDUCTIVE SILICONE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 172 MIDDLE EAST AND AFRICA CONDUCTIVE SILICONE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 173 MIDDLE EAST AND AFRICA CONDUCTIVE SILICONE MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 174 MIDDLE EAST AND AFRICA CONDUCTIVE SILICONE MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 175 UAE CONDUCTIVE SILICONE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 176 UAE CONDUCTIVE SILICONE MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 177 UAE CONDUCTIVE SILICONE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 178 UAE CONDUCTIVE SILICONE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 179 UAE CONDUCTIVE SILICONE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 180 UAE CONDUCTIVE SILICONE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 181 SAUDI ARABIA CONDUCTIVE SILICONE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 182 SAUDI ARABIA CONDUCTIVE SILICONE MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 183 SAUDI ARABIA CONDUCTIVE SILICONE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 184 SAUDI ARABIA CONDUCTIVE SILICONE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 185 SAUDI ARABIA CONDUCTIVE SILICONE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 186 SAUDI ARABIA CONDUCTIVE SILICONE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 187 SOUTH AFRICA CONDUCTIVE SILICONE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 188 SOUTH AFRICA CONDUCTIVE SILICONE MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 189 SOUTH AFRICA CONDUCTIVE SILICONE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 190 SOUTH AFRICA CONDUCTIVE SILICONE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 191 SOUTH AFRICA CONDUCTIVE SILICONE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 192 SOUTH AFRICA CONDUCTIVE SILICONE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 193 REST OF MIDDLE EAST AND AFRICA CONDUCTIVE SILICONE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 194 REST OF MIDDLE EAST AND AFRICA CONDUCTIVE SILICONE MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 195 REST OF MIDDLE EAST AND AFRICA CONDUCTIVE SILICONE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 196 REST OF MIDDLE EAST AND AFRICA CONDUCTIVE SILICONE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 197 REST OF MIDDLE EAST AND AFRICA CONDUCTIVE SILICONE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 198 REST OF MIDDLE EAST AND AFRICA CONDUCTIVE SILICONE MARKET BY END USER (KILOTONS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL CONDUCTIVE SILICONE MARKET BY PRODUCT, USD BILLION, 2020-2029

FIGURE 9 GLOBAL CONDUCTIVE SILICONE MARKET BY END USER, USD BILLION, 2020-2029

FIGURE 10 GLOBAL CONDUCTIVE SILICONE MARKET BY APPLICATION, USD BILLION, 2020-2029

FIGURE 11 GLOBAL CONDUCTIVE SILICONE MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 12 GLOBAL CONDUCTIVE SILICONE MARKET BY PRODUCT, USD BILLION, 2021

FIGURE 13 GLOBAL CONDUCTIVE SILICONE MARKET BY END USER, USD BILLION, 2021

FIGURE 14 GLOBAL CONDUCTIVE SILICONE MARKET BY APPLICATION, USD BILLION, 2021

FIGURE 15 GLOBAL CONDUCTIVE SILICONE MARKET BY REGION, USD BILLION, 2021

FIGURE 16 PORTER’S FIVE FORCES MODEL

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 HENKEL AG & CO. KGAA: COMPANY SNAPSHOT

FIGURE 19 3M: COMPANY SNAPSHOT

FIGURE 20 POLYCAST INDUSTRIES INC.: COMPANY SNAPSHOT

FIGURE 21 SPECIALTY SILICONE PRODUCTS, INC.: COMPANY SNAPSHOT

FIGURE 22 MESGO S.P.A.: COMPANY SNAPSHOT

FIGURE 23 JAN HUEI K.H. INDUSTRY CO., LTD.: COMPANY SNAPSHOT

FIGURE 24 WESTERN RUBBERS: COMPANY SNAPSHOT

FIGURE 25 ZHEJIANG XINAN CHEMICAL INDUSTRIAL GROUP CO., LTD.: COMPANY SNAPSHOT

FIGURE 26 TIMTRONICS: COMPANY SNAPSHOT

FIGURE 27 SCHLEGEL ELECTRONIC MATERIALS, INC.: COMPANY SNAPSHOT

FAQ

The conductive silicone market is expected to grow at 7.1 % CAGR from 2022 to 2029. It is expected to reach above USD 8.16 billion by 2029 from USD 4.40 billion in 2020.

Asia Pacific held more than 40 % of the conductive silicone market revenue share in 2021 and will witness expansion in the forecast period.

Increasing demand for sustainable development and R&D and rise in investment will drive the conductive silicone market.

The conductive silicone market is anticipated to have the greatest proportion of adhesives and sealants in 2019. For the new generation of solar panels, they serve as a thin semiconductor and are used for bonding in traditional solar panels. About 90% of solar cells are silicon-based. They also aid in the distribution and transmission of energy due to the boost robustness and weather resistance.

Asia Pacific is the largest regional market for conductive silicone market

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.