Report Outlook

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 54.42 billion by 2029 | 6.6% | Asia Pacific |

| By Type | By Function | By Technology | By Application |

|---|---|---|---|

|

|

|

|

SCOPE OF THE REPORT

Automotive Motors Market Overview:

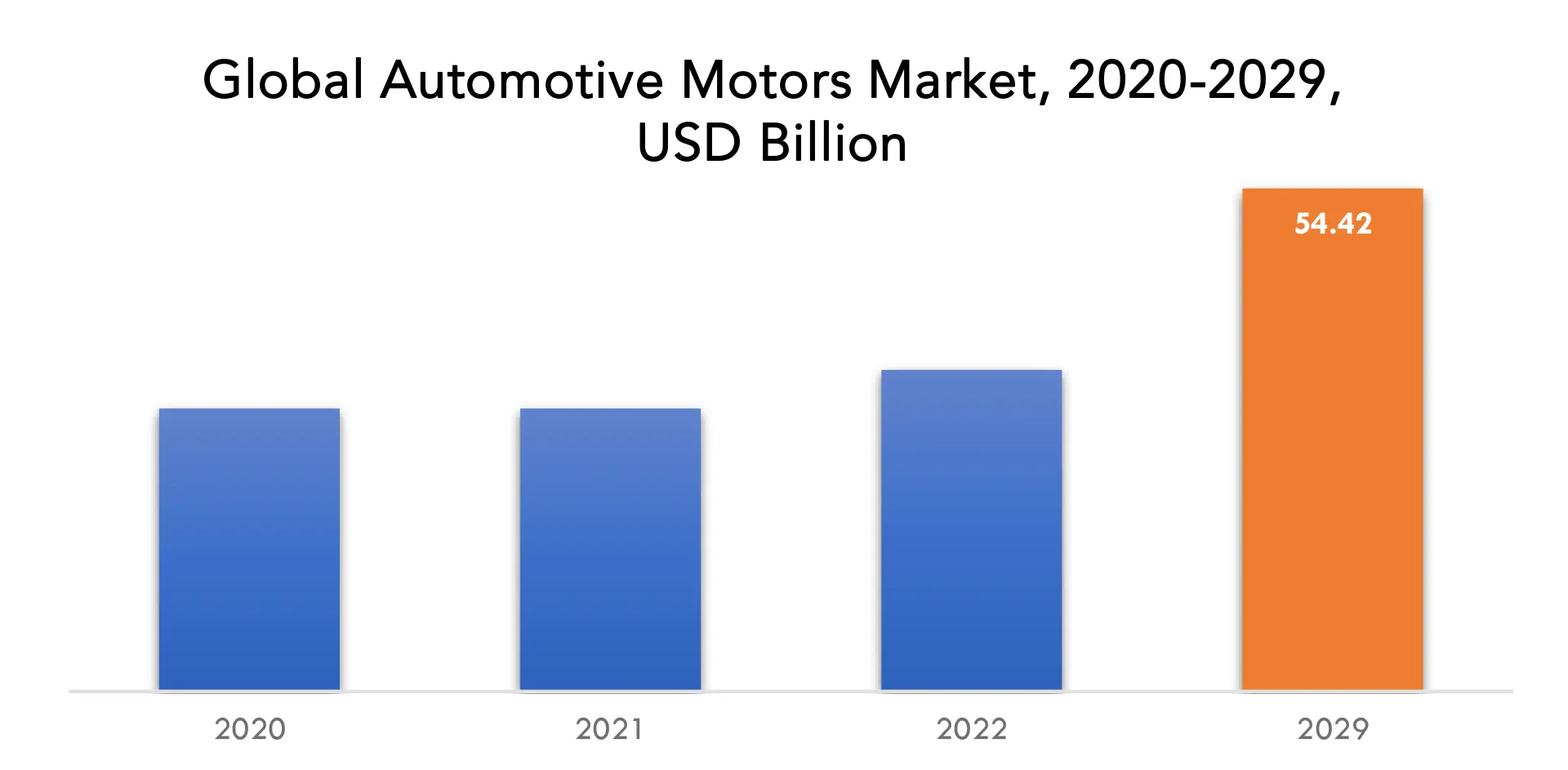

The global Automotive Motors market was valued at 34.79 billion in 2022 and is projected to reach 54.42 billion by 2029, growing at a CAGR of 6.6% from 2022 to 2029.

Many car parts, such as power window motors, battery cooling fans, power steering motors, seat cooling fans, and engine cooling fans, depend on automotive motors. The inclination of consumers for such cutting-edge features in cars is creating a favorable environment for the growth of the automotive motor market. The motors of a car are crucial for the proper operation of the car. It is present in all vehicle movements that involve continuous rotation. The most crucial component of any vehicle, the automotive motors enable the flawless execution of a variety of tasks. For the vehicles’ continuous rotation, it is very important. There are numerous ways that motors are applied in vehicles.

The changes in autonomous vehicles have been driven by the urgent need for progress in several areas, including artificial intelligence and machine learning. One of the newest trends in the luxury car market is the expansion of research and development related to the electrification of automobiles. The automotive motor market’s growth will probably increase as a result of this impact. The sales of luxury vehicles may also be boosted by the quick advancements in a number of features found in automobiles, such as autonomous emergency braking, retinal recognition, and personal voice assistance.

| ATTRIBUTE | DETAILS |

| Study period | 2022-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion) |

| Segmentation | By Type, Function, Technology, Application, and Region. |

| By Type |

|

| By Function |

|

| By Technology |

|

| By Application |

|

| By Region |

|

Automotive Motors Market Segment Analysis:

Based on type, function, technology, application, and region, the global market for automotive motors is divided into these categories.

DC brushed motors, Brushless DC motors, Stepper motors, and Traction motors are the types of automotive motors market. An internally commutated electric motor that uses an electric brush for contact and is intended to be powered by direct current is known as a brushed DC motor.

The first significant commercial use of electric power to drive mechanical energy was through brushed motors, and commercial and industrial buildings employed DC distribution networks to power motors for more than a century. By adjusting the operating voltage or the strength of the magnetic field, brushed DC motors can have their speed changed. A brushed motor’s speed and torque characteristics can be changed to produce a stable speed or speed that is inversely proportional to the mechanical load depending on how the field is connected to the power source. For electrical propulsion, cranes, paper machines, and steel rolling mills, brushed motors are still in use. An electric motor known as a brushless DC electric motor (BLDC) is one that is powered by a direct current voltage source and commutated electronically as opposed to using brushes like typical DC motors do. A brushless DC electric motor that divides a full rotation into a number of equal steps is referred to as a stepper motor, also known as a step motor or stepping motor. As long as the motor is appropriately scaled for the application in terms of torque and speed, the position of the motor can be instructed to move and hold at one of these steps without any position sensor for feedback (an open-loop controller). An electric motor used to propel a vehicle, such as a locomotive, an electric or hydrogen vehicle, or an electric multiple-unit train, is known as a traction motor. Electric railway vehicles, other electric vehicles, such as electric milk floats, trolleybuses, lifts, roller coasters, and conveyors, as well as vehicles with electrical transmission systems (diesel-electric locomotives, electric hybrid vehicles, and battery electric vehicles), all use traction motors.

PWM and DTC are the technologies of the automotive motors market. In the PWM category, which accounts for the largest share of the market. The industry is expanding due to pulse-width modulation is thought to be the greatest way to regulate the amount of power given to a load without wasting any energy. One of the key drivers of market growth is due to this. Switching devices also have very little power loss, which is another element boosting the market’s growth. While In order to directly regulate the torque of the vehicle, direct torque control technology is most frequently utilized in electric vehicles. This immediately regulates the vehicle’s torque, leading to great efficiency and less energy loss, which fuels the market’s expansion. Additionally, the major market players are well-positioned to gain from the rising popularity of electric vehicles.

On the basis of function automotive motors are subdivided into Performance, Comfort & Convenience, and Safety & Security. While PWM and DTC are the technologies of the automotive motor market. An output driver of an electronic control module can be powered down using PWM. Any number of devices can have their power controlled by it.

Automotive motors are further broken down into Alternators, ETC, Electric Parking Brake, Sun roof motors, Fuel Pump motors, ECM, Wiper, Engine Cooling Fans, HVAC, and Anti-lock Brake Systems based on their applications. The market’s largest contributor is the ETC category. ETCs improve the comfort, security, and fuel efficiency of automobiles, all of which help the market grow.

Automotive Motors Market Players:

The major players operating in the global Automotive Motors industry include the major market players are Borgwarner Inc, BÜHLER MOTOR Gmbh, Continental Ag, Denso Corporation, Inteva Products, Llc, Johnson Electric Holdings Limited, Mabuchi Motor Co., Ltd, Magna International Inc, Marelli Europe S.P.A, Meritor, Inc, Mitsuba Corporation, Nidec Corporation and Others.

Industry Development:

- 10 May 2023: BorgWarner Launched Exclusive Co-Branded Borg-Warner Trophy® Merchandise with Indianapolis Motor Speedway.

- 28 April 2023: BorgWarner Partners with the School District of the City of Pontiac to Offer Industry-First Charging System for Buses.

Who Should Buy? Or Key stakeholders

- Manufacturing

- End-Use Industries

- BFSI

- Automotive

- Manufacturing & Construction

- Regulatory Authorities

- Research Organizations

- Information Technology

- Materials & Chemicals

Automotive Motors Market Regional Analysis:

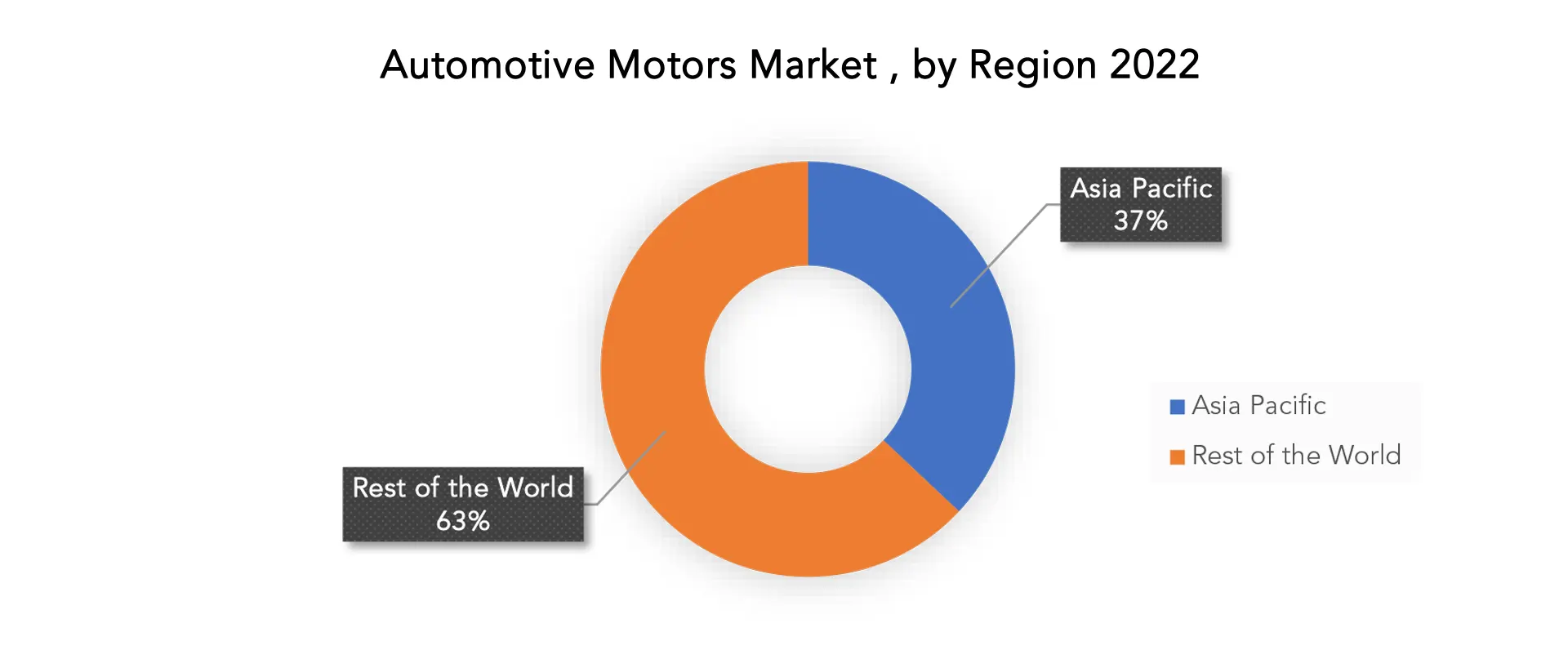

Geographically, the Automotive Motors market is segmented into North America, South America, Europe, APAC, and MEA.

- North America: includes the US, Canada, Mexico

- Europe: includes the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN, and the Rest of APAC

- South America: includes Brazil, Argentina, and the Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and the Rest of MEA

Asia Pacific is the largest market for automotive motors products. Due to the market’s infancy, state-sponsored backing, and cost benefits for OEMs, Asia Pacific has become a center for the production of automobiles. The region’s rising vehicle production and low automobile market penetration present an appealing market potential for automakers and suppliers of automotive parts and equipment. This is primarily attributable to the production increases made by automakers to deal with the surge in demand as well as to meet the standards and regulations governing fuel economy. The industry’s expansion is partly attributable to the increased attention that domestic and foreign players are paying to the Asia Pacific market. The Asia-Pacific region’s automotive and motor sector is governed by laws and regulations that support manufacturing and investment practices that are ecologically friendly. Additionally, a rise in the registration of vehicles and passenger automobiles in Asia and the Pacific opens up the rich potential for the growth of the automotive motor market.

Key Market Segments: Automotive Motors Market

Automotive Motors Market by Type, 2020-2029, (USD Billion) (Thousand Units)

- DC brushed motors

- Brushless DC motors

- Stepper motors

- Traction motors

Automotive Motors Market by Function, 2022-2029, (USD Billion) (Thousand Units)

- Performance

- Comfort & Convenience

- Safety & Security

Automotive Motors Market by Technology, 2022-2029, (USD Billion) (Thousand Units)

- Clinics & Hospitals

- Reference Labs

Automotive Motors Market by Application, 2022-2029, (USD Billion) (Thousand Units)

- Alternator

- ETC

- Electric parking brake

- Sun roof motor

- Fuel pump motor

- ECM

- Wiper motor

- Engine cooling fan

- HVAC

- Anti-lock brake system

Automotive Motors Market by Region, 2022-2029, (USD Billion) (Thousand Units)

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Important Countries in All Regions Are Covered

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered:

- What is the expected growth rate of the automotive motors market over the next 7 years?

- Who are the major players in the automotive motors market and what is their market share?

- What are the end-user industries driving demand for the market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the middle east, and Africa?

- How is the economic environment affecting the automotive motors market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the automotive motors market?

- What is the current and forecasted size and growth rate of the global automotive motors market?

- What are the key drivers of growth in the automotive motors market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the automotive motors market?

- What are the technological advancements and innovations in the automotive motors market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the automotive motors market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the automotive motors market?

- What are the services offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL AUTOMOTIVE MOTORS MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON THE AUTOMOTIVE MOTORS MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL AUTOMOTIVE MOTORS MARKET OUTLOOK

- GLOBAL AUTOMOTIVE MOTORS MARKET BY TYPE, 2020-2029, (USD BILLION) (THOUSAND UNITS)

- DC BRUSHED MOTORS

- BRUSHLESS DC MOTORS

- STEPPER MOTORS

- TRACTION MOTORS

- GLOBAL AUTOMOTIVE MOTORS MARKET BY FUNCTION, 2020-2029, (USD BILLION) (THOUSAND UNITS)

- PERFORMANCE

- COMFORT & CONVENIENCE

- SAFETY & SECURITY

- GLOBAL AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY, 2020-2029, (USD BILLION) (THOUSAND UNITS)

- PWM

- DTC

- GLOBAL AUTOMOTIVE MOTORS MARKET BY APPLICATION, 2020-2029, (USD BILLION) (THOUSAND UNITS)

- ALTERNATOR

- ETC

- ELECTRIC PARKING BREAK

- SUN ROOF MOTOR

- FUEL PUMP MOTOR

- ECM

- WIPER MOTOR

- ENGINE COOLING FAN

- HVAC

- ANTI-LOCK BRAKE SYSTEM

- GLOBAL AUTOMOTIVE MOTORS MARKET BY REGION, 2020-2029, (USD BILLION) (THOUSAND UNITS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

-

- BORGWARNER INC

- BÜHLER MOTOR GMBH

- CONTINENTAL AG

- DENSO CORPORATION

- INTEVA PRODUCTS, LLC

- JOHNSON ELECTRIC HOLDINGS LIMITED

- MABUCHI MOTOR CO., LTD

- MAGNA INTERNATIONAL INC

- MARELLI EUROPE S.P.A

- MERITOR, INC

- MITSUBA CORPORATION

- NIDEC CORPORATION

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL AUTOMOTIVE MOTORS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 2 GLOBAL AUTOMOTIVE MOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 3 GLOBAL AUTOMOTIVE MOTORS MARKET BY FUNCTION (USD BILLION) 2020-2029

TABLE 4 GLOBAL AUTOMOTIVE MOTORS MARKET BY FUNCTION (THOUSAND UNITS) 2020-2029

TABLE 5 GLOBAL AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 6 GLOBAL AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 7 GLOBAL AUTOMOTIVE MOTORS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 8 GLOBAL AUTOMOTIVE MOTORS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 9 GLOBAL AUTOMOTIVE MOTORS MARKET BY REGION (USD BILLION) 2020-2029

TABLE 10 GLOBAL AUTOMOTIVE MOTORS MARKET BY REGION (THOUSAND UNITS) 2020-2029

TABLE 11 NORTH AMERICA AUTOMOTIVE MOTORS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 12 NORTH AMERICA AUTOMOTIVE MOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 13 NORTH AMERICA AUTOMOTIVE MOTORS MARKET BY FUNCTION (USD BILLION) 2020-2029

TABLE 14 NORTH AMERICA AUTOMOTIVE MOTORS MARKET BY FUNCTION (THOUSAND UNITS) 2020-2029

TABLE 15 NORTH AMERICA AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 16 NORTH AMERICA AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 17 NORTH AMERICA AUTOMOTIVE MOTORS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 18 NORTH AMERICA AUTOMOTIVE MOTORS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 19 NORTH AMERICA AUTOMOTIVE MOTORS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 20 NORTH AMERICA AUTOMOTIVE MOTORS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 21 US AUTOMOTIVE MOTORS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 22 US AUTOMOTIVE MOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 23 US AUTOMOTIVE MOTORS MARKET BY FUNCTION (USD BILLION) 2020-2029

TABLE 24 US AUTOMOTIVE MOTORS MARKET BY FUNCTION (THOUSAND UNITS) 2020-2029

TABLE 25 US AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 26 US AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 27 US AUTOMOTIVE MOTORS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 28 US AUTOMOTIVE MOTORS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 29 CANADA AUTOMOTIVE MOTORS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 30 CANADA AUTOMOTIVE MOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 31 CANADA AUTOMOTIVE MOTORS MARKET BY FUNCTION (USD BILLION) 2020-2029

TABLE 32 CANADA AUTOMOTIVE MOTORS MARKET BY FUNCTION (THOUSAND UNITS) 2020-2029

TABLE 33 CANADA AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 34 CANADA AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 35 CANADA AUTOMOTIVE MOTORS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 36 CANADA AUTOMOTIVE MOTORS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 37 MEXICO AUTOMOTIVE MOTORS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 38 MEXICO AUTOMOTIVE MOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 39 MEXICO AUTOMOTIVE MOTORS MARKET BY FUNCTION (USD BILLION) 2020-2029

TABLE 40 MEXICO AUTOMOTIVE MOTORS MARKET BY FUNCTION (THOUSAND UNITS) 2020-2029

TABLE 41 MEXICO AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 42 MEXICO AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 43 MEXICO AUTOMOTIVE MOTORS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 44 MEXICO AUTOMOTIVE MOTORS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 45 SOUTH AMERICA AUTOMOTIVE MOTORS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 46 SOUTH AMERICA AUTOMOTIVE MOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 47 SOUTH AMERICA AUTOMOTIVE MOTORS MARKET BY FUNCTION (USD BILLION) 2020-2029

TABLE 48 SOUTH AMERICA AUTOMOTIVE MOTORS MARKET BY FUNCTION (THOUSAND UNITS) 2020-2029

TABLE 49 SOUTH AMERICA AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 50 SOUTH AMERICA AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 51 SOUTH AMERICA AUTOMOTIVE MOTORS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 52 SOUTH AMERICA AUTOMOTIVE MOTORS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 53 SOUTH AMERICA AUTOMOTIVE MOTORS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 54 SOUTH AMERICA AUTOMOTIVE MOTORS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 55 BRAZIL AUTOMOTIVE MOTORS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 56 BRAZIL AUTOMOTIVE MOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 57 BRAZIL AUTOMOTIVE MOTORS MARKET BY FUNCTION (USD BILLION) 2020-2029

TABLE 58 BRAZIL AUTOMOTIVE MOTORS MARKET BY FUNCTION (THOUSAND UNITS) 2020-2029

TABLE 59 BRAZIL AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 60 BRAZIL AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 61 BRAZIL AUTOMOTIVE MOTORS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 62 BRAZIL AUTOMOTIVE MOTORS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 63 ARGENTINA AUTOMOTIVE MOTORS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 64 ARGENTINA AUTOMOTIVE MOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 65 ARGENTINA AUTOMOTIVE MOTORS MARKET BY FUNCTION (USD BILLION) 2020-2029

TABLE 66 ARGENTINA AUTOMOTIVE MOTORS MARKET BY FUNCTION (THOUSAND UNITS) 2020-2029

TABLE 67 ARGENTINA AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 68 ARGENTINA AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 69 ARGENTINA AUTOMOTIVE MOTORS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 70 ARGENTINA AUTOMOTIVE MOTORS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 71 COLOMBIA AUTOMOTIVE MOTORS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 72 COLOMBIA AUTOMOTIVE MOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 73 COLOMBIA AUTOMOTIVE MOTORS MARKET BY FUNCTION (USD BILLION) 2020-2029

TABLE 74 COLOMBIA AUTOMOTIVE MOTORS MARKET BY FUNCTION (THOUSAND UNITS) 2020-2029

TABLE 75 COLOMBIA AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 76 COLOMBIA AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 77 COLOMBIA AUTOMOTIVE MOTORS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 78 COLOMBIA AUTOMOTIVE MOTORS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 79 REST OF SOUTH AMERICA AUTOMOTIVE MOTORS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 80 REST OF SOUTH AMERICA AUTOMOTIVE MOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 81 REST OF SOUTH AMERICA AUTOMOTIVE MOTORS MARKET BY FUNCTION (USD BILLION) 2020-2029

TABLE 82 REST OF SOUTH AMERICA AUTOMOTIVE MOTORS MARKET BY FUNCTION (THOUSAND UNITS) 2020-2029

TABLE 83 REST OF SOUTH AMERICA AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 84 REST OF SOUTH AMERICA AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 85 REST OF SOUTH AMERICA AUTOMOTIVE MOTORS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 86 REST OF SOUTH AMERICA AUTOMOTIVE MOTORS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 87 ASIA-PACIFIC AUTOMOTIVE MOTORS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 88 ASIA-PACIFIC AUTOMOTIVE MOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 89 ASIA-PACIFIC AUTOMOTIVE MOTORS MARKET BY FUNCTION (USD BILLION) 2020-2029

TABLE 90 ASIA-PACIFIC AUTOMOTIVE MOTORS MARKET BY FUNCTION (THOUSAND UNITS) 2020-2029

TABLE 91 ASIA-PACIFIC AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 92 ASIA-PACIFIC AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 93 ASIA-PACIFIC AUTOMOTIVE MOTORS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 94 ASIA-PACIFIC AUTOMOTIVE MOTORS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 95 ASIA-PACIFIC AUTOMOTIVE MOTORS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 96 ASIA-PACIFIC AUTOMOTIVE MOTORS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 97 INDIA AUTOMOTIVE MOTORS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 98 INDIA AUTOMOTIVE MOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 99 INDIA AUTOMOTIVE MOTORS MARKET BY FUNCTION (USD BILLION) 2020-2029

TABLE 100 INDIA AUTOMOTIVE MOTORS MARKET BY FUNCTION (THOUSAND UNITS) 2020-2029

TABLE 101 INDIA AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 102 INDIA AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 103 INDIA AUTOMOTIVE MOTORS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 104 INDIA AUTOMOTIVE MOTORS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 105 CHINA AUTOMOTIVE MOTORS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 106 CHINA AUTOMOTIVE MOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 107 CHINA AUTOMOTIVE MOTORS MARKET BY FUNCTION (USD BILLION) 2020-2029

TABLE 108 CHINA AUTOMOTIVE MOTORS MARKET BY FUNCTION (THOUSAND UNITS) 2020-2029

TABLE 109 CHINA AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 110 CHINA AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 111 CHINA AUTOMOTIVE MOTORS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 112 CHINA AUTOMOTIVE MOTORS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 113 JAPAN AUTOMOTIVE MOTORS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 114 JAPAN AUTOMOTIVE MOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 115 JAPAN AUTOMOTIVE MOTORS MARKET BY FUNCTION (USD BILLION) 2020-2029

TABLE 116 JAPAN AUTOMOTIVE MOTORS MARKET BY FUNCTION (THOUSAND UNITS) 2020-2029

TABLE 117 JAPAN AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 118 JAPAN AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 119 JAPAN AUTOMOTIVE MOTORS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 120 JAPAN AUTOMOTIVE MOTORS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 121 SOUTH KOREA AUTOMOTIVE MOTORS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 122 SOUTH KOREA AUTOMOTIVE MOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 123 SOUTH KOREA AUTOMOTIVE MOTORS MARKET BY FUNCTION (USD BILLION) 2020-2029

TABLE 124 SOUTH KOREA AUTOMOTIVE MOTORS MARKET BY FUNCTION (THOUSAND UNITS) 2020-2029

TABLE 125 SOUTH KOREA AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 126 SOUTH KOREA AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 127 SOUTH KOREA AUTOMOTIVE MOTORS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 128 SOUTH KOREA AUTOMOTIVE MOTORS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 129 AUSTRALIA AUTOMOTIVE MOTORS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 130 AUSTRALIA AUTOMOTIVE MOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 131 AUSTRALIA AUTOMOTIVE MOTORS MARKET BY FUNCTION (USD BILLION) 2020-2029

TABLE 132 AUSTRALIA AUTOMOTIVE MOTORS MARKET BY FUNCTION (THOUSAND UNITS) 2020-2029

TABLE 133 AUSTRALIA AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 134 AUSTRALIA AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 135 AUSTRALIA AUTOMOTIVE MOTORS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 136 AUSTRALIA AUTOMOTIVE MOTORS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 137 SOUTH-EAST ASIA AUTOMOTIVE MOTORS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 138 SOUTH-EAST ASIA AUTOMOTIVE MOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 139 SOUTH-EAST ASIA AUTOMOTIVE MOTORS MARKET BY FUNCTION (USD BILLION) 2020-2029

TABLE 140 SOUTH-EAST ASIA AUTOMOTIVE MOTORS MARKET BY FUNCTION (THOUSAND UNITS) 2020-2029

TABLE 141 SOUTH-EAST ASIA AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 142 SOUTH-EAST ASIA AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 143 SOUTH-EAST ASIA AUTOMOTIVE MOTORS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 144 SOUTH-EAST ASIA AUTOMOTIVE MOTORS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 145 REST OF ASIA PACIFIC AUTOMOTIVE MOTORS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 146 REST OF ASIA PACIFIC AUTOMOTIVE MOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 147 REST OF ASIA PACIFIC AUTOMOTIVE MOTORS MARKET BY FUNCTION (USD BILLION) 2020-2029

TABLE 148 REST OF ASIA PACIFIC AUTOMOTIVE MOTORS MARKET BY FUNCTION (THOUSAND UNITS) 2020-2029

TABLE 149 REST OF ASIA PACIFIC AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 150 REST OF ASIA PACIFIC AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 151 REST OF ASIA PACIFIC AUTOMOTIVE MOTORS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 152 REST OF ASIA PACIFIC AUTOMOTIVE MOTORS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 153 EUROPE AUTOMOTIVE MOTORS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 154 EUROPE AUTOMOTIVE MOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 155 EUROPE AUTOMOTIVE MOTORS MARKET BY FUNCTION (USD BILLION) 2020-2029

TABLE 156 EUROPE AUTOMOTIVE MOTORS MARKET BY FUNCTION (THOUSAND UNITS) 2020-2029

TABLE 157 EUROPE AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 158 EUROPE AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 159 EUROPE AUTOMOTIVE MOTORS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 160 EUROPE AUTOMOTIVE MOTORS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 161 EUROPE AUTOMOTIVE MOTORS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 162 EUROPE AUTOMOTIVE MOTORS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 163 GERMANY AUTOMOTIVE MOTORS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 164 GERMANY AUTOMOTIVE MOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 165 GERMANY AUTOMOTIVE MOTORS MARKET BY FUNCTION (USD BILLION) 2020-2029

TABLE 166 GERMANY AUTOMOTIVE MOTORS MARKET BY FUNCTION (THOUSAND UNITS) 2020-2029

TABLE 167 GERMANY AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 168 GERMANY AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 169 GERMANY AUTOMOTIVE MOTORS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 170 GERMANY AUTOMOTIVE MOTORS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 171 UK AUTOMOTIVE MOTORS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 172 UK AUTOMOTIVE MOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 173 UK AUTOMOTIVE MOTORS MARKET BY FUNCTION (USD BILLION) 2020-2029

TABLE 174 UK AUTOMOTIVE MOTORS MARKET BY FUNCTION (THOUSAND UNITS) 2020-2029

TABLE 175 UK AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 176 UK AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 177 UK AUTOMOTIVE MOTORS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 178 UK AUTOMOTIVE MOTORS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 179 FRANCE AUTOMOTIVE MOTORS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 180 FRANCE AUTOMOTIVE MOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 181 FRANCE AUTOMOTIVE MOTORS MARKET BY FUNCTION (USD BILLION) 2020-2029

TABLE 182 FRANCE AUTOMOTIVE MOTORS MARKET BY FUNCTION (THOUSAND UNITS) 2020-2029

TABLE 183 FRANCE AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 184 FRANCE AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 185 FRANCE AUTOMOTIVE MOTORS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 186 FRANCE AUTOMOTIVE MOTORS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 187 ITALY AUTOMOTIVE MOTORS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 188 ITALY AUTOMOTIVE MOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 189 ITALY AUTOMOTIVE MOTORS MARKET BY FUNCTION (USD BILLION) 2020-2029

TABLE 190 ITALY AUTOMOTIVE MOTORS MARKET BY FUNCTION (THOUSAND UNITS) 2020-2029

TABLE 191 ITALY AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 192 ITALY AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 193 ITALY AUTOMOTIVE MOTORS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 194 ITALY AUTOMOTIVE MOTORS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 195 SPAIN AUTOMOTIVE MOTORS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 196 SPAIN AUTOMOTIVE MOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 197 SPAIN AUTOMOTIVE MOTORS MARKET BY FUNCTION (USD BILLION) 2020-2029

TABLE 198 SPAIN AUTOMOTIVE MOTORS MARKET BY FUNCTION (THOUSAND UNITS) 2020-2029

TABLE 199 SPAIN AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 200 SPAIN AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 201 SPAIN AUTOMOTIVE MOTORS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 202 SPAIN AUTOMOTIVE MOTORS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 203 RUSSIA AUTOMOTIVE MOTORS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 204 RUSSIA AUTOMOTIVE MOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 205 RUSSIA AUTOMOTIVE MOTORS MARKET BY FUNCTION (USD BILLION) 2020-2029

TABLE 206 RUSSIA AUTOMOTIVE MOTORS MARKET BY FUNCTION (THOUSAND UNITS) 2020-2029

TABLE 207 RUSSIA AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 208 RUSSIA AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 209 RUSSIA AUTOMOTIVE MOTORS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 210 RUSSIA AUTOMOTIVE MOTORS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 211 REST OF EUROPE AUTOMOTIVE MOTORS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 212 REST OF EUROPE AUTOMOTIVE MOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 213 REST OF EUROPE AUTOMOTIVE MOTORS MARKET BY FUNCTION (USD BILLION) 2020-2029

TABLE 214 REST OF EUROPE AUTOMOTIVE MOTORS MARKET BY FUNCTION (THOUSAND UNITS) 2020-2029

TABLE 215 REST OF EUROPE AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 216 REST OF EUROPE AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 217 REST OF EUROPE AUTOMOTIVE MOTORS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 218 REST OF EUROPE AUTOMOTIVE MOTORS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 219 MIDDLE EAST AND AFRICA AUTOMOTIVE MOTORS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 220 MIDDLE EAST AND AFRICA AUTOMOTIVE MOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 221 MIDDLE EAST AND AFRICA AUTOMOTIVE MOTORS MARKET BY FUNCTION (USD BILLION) 2020-2029

TABLE 222 MIDDLE EAST AND AFRICA AUTOMOTIVE MOTORS MARKET BY FUNCTION (THOUSAND UNITS) 2020-2029

TABLE 223 MIDDLE EAST AND AFRICA AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 224 MIDDLE EAST AND AFRICA AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 225 MIDDLE EAST AND AFRICA AUTOMOTIVE MOTORS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 226 MIDDLE EAST AND AFRICA AUTOMOTIVE MOTORS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 227 MIDDLE EAST AND AFRICA AUTOMOTIVE MOTORS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 228 MIDDLE EAST AND AFRICA AUTOMOTIVE MOTORS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 229 UAE AUTOMOTIVE MOTORS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 230 UAE AUTOMOTIVE MOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 231 UAE AUTOMOTIVE MOTORS MARKET BY FUNCTION (USD BILLION) 2020-2029

TABLE 232 UAE AUTOMOTIVE MOTORS MARKET BY FUNCTION (THOUSAND UNITS) 2020-2029

TABLE 233 UAE AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 234 UAE AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 235 UAE AUTOMOTIVE MOTORS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 236 UAE AUTOMOTIVE MOTORS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 237 SAUDI ARABIA AUTOMOTIVE MOTORS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 238 SAUDI ARABIA AUTOMOTIVE MOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 239 SAUDI ARABIA AUTOMOTIVE MOTORS MARKET BY FUNCTION (USD BILLION) 2020-2029

TABLE 240 SAUDI ARABIA AUTOMOTIVE MOTORS MARKET BY FUNCTION (THOUSAND UNITS) 2020-2029

TABLE 241 SAUDI ARABIA AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 242 SAUDI ARABIA AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 243 SAUDI ARABIA AUTOMOTIVE MOTORS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 244 SAUDI ARABIA AUTOMOTIVE MOTORS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 245 SOUTH AFRICA AUTOMOTIVE MOTORS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 246 SOUTH AFRICA AUTOMOTIVE MOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 247 SOUTH AFRICA AUTOMOTIVE MOTORS MARKET BY FUNCTION (USD BILLION) 2020-2029

TABLE 248 SOUTH AFRICA AUTOMOTIVE MOTORS MARKET BY FUNCTION (THOUSAND UNITS) 2020-2029

TABLE 249 SOUTH AFRICA AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 250 SOUTH AFRICA AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 251 SOUTH AFRICA AUTOMOTIVE MOTORS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 252 SOUTH AFRICA AUTOMOTIVE MOTORS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 253 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE MOTORS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 254 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE MOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 255 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE MOTORS MARKET BY FUNCTION (USD BILLION) 2020-2029

TABLE 256 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE MOTORS MARKET BY FUNCTION (THOUSAND UNITS) 2020-2029

TABLE 257 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 258 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 259 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE MOTORS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 260 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE MOTORS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL AUTOMOTIVE MOTORS MARKET BY TYPE, USD BILLION, 2020-2029

FIGURE 9 GLOBAL AUTOMOTIVE MOTORS MARKET BY FUNCTION, USD BILLION, 2020-2029

FIGURE 10 GLOBAL AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY, USD BILLION, 2020-2029

FIGURE 11 GLOBAL AUTOMOTIVE MOTORS MARKET BY APPLICATION, USD BILLION, 2020-2029

FIGURE 12 GLOBAL AUTOMOTIVE MOTORS MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 13 PORTER’S FIVE FORCES MODEL

FIGURE 14 GLOBAL AUTOMOTIVE MOTORS MARKET BY TYPE, USD BILLION, 2021

FIGURE 15 GLOBAL AUTOMOTIVE MOTORS MARKET BY FUNCTION, USD BILLION, 2021

FIGURE 16 GLOBAL AUTOMOTIVE MOTORS MARKET BY TECHNOLOGY, USD BILLION, 2021

FIGURE 17 GLOBAL AUTOMOTIVE MOTORS MARKET BY APPLICATION, USD BILLION, 2021

FIGURE 18 GLOBAL AUTOMOTIVE MOTORS MARKET BY REGION, USD BILLION 2021

FIGURE 19 MARKET SHARE ANALYSIS

FIGURE 20 GE HEALTHCARE: COMPANY SNAPSHOT

FIGURE 21 AGFA-GEVAERT N.V.: COMPANY SNAPSHOT

FIGURE 22 CARESTREAM HEALTH COMPANY SNAPSHOT

FIGURE 23 ESAOTE S.P.A: COMPANY SNAPSHOT

FIGURE 24 IDEXX LABORATORIES, INC.: COMPANY SNAPSHOT

FIGURE 25 MINDRAY MEDICAL INTERNATIONAL LIMITED: COMPANY SNAPSHOT

FIGURE 26 CANON INC.: COMPANY SNAPSHOT

FIGURE 27 HESKA CORPORATION: COMPANY SNAPSHOT

FIGURE 28 SIEMENS HEALTHINEERS: COMPANY SNAPSHOT

FIGURE 29 FUJIFILM HOLDINGS CORPORATION: COMPANY SNAPSHOT

FIGURE 30 IMV TECHNOLOGIES GROUP: COMPANY SNAPSHOT

FAQ

The global automotive motors market was valued at 34.79 billion in 2022 and is projected to reach 54.42 billion by 2029, growing at a CAGR of 6.6% from 2022 to 2029

Based on Type, Function, Technology, Application, and region the automotive motors market reports divisions are broken down.

The global automotive motors market registered a CAGR of 6.6% from 2022 to 2029. The industry segment was the highest revenue contributor to the market.

Asia Pacific has emerged as a hub for the manufacturing of automobiles as a result of the market’s youth, state-sponsored support, and cost advantages for OEMs. The region’s rising vehicle production and low automobile market penetration present an appealing market potential for automakers and suppliers of automotive parts and equipment.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.