REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 373 million by 2029 | 5.8% | North America |

| By Type | By Portability | By Application |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Colposcopy Market Overview

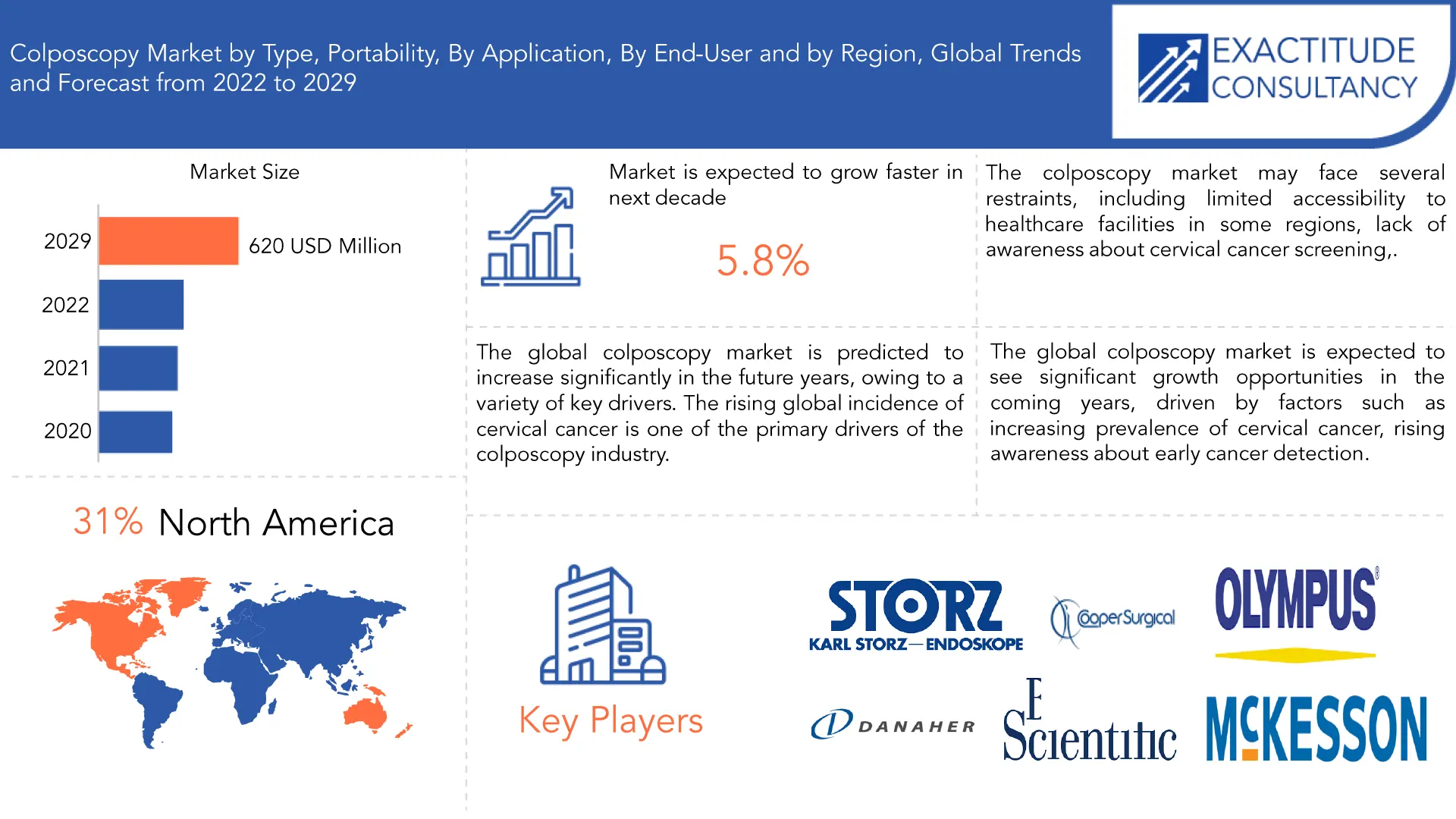

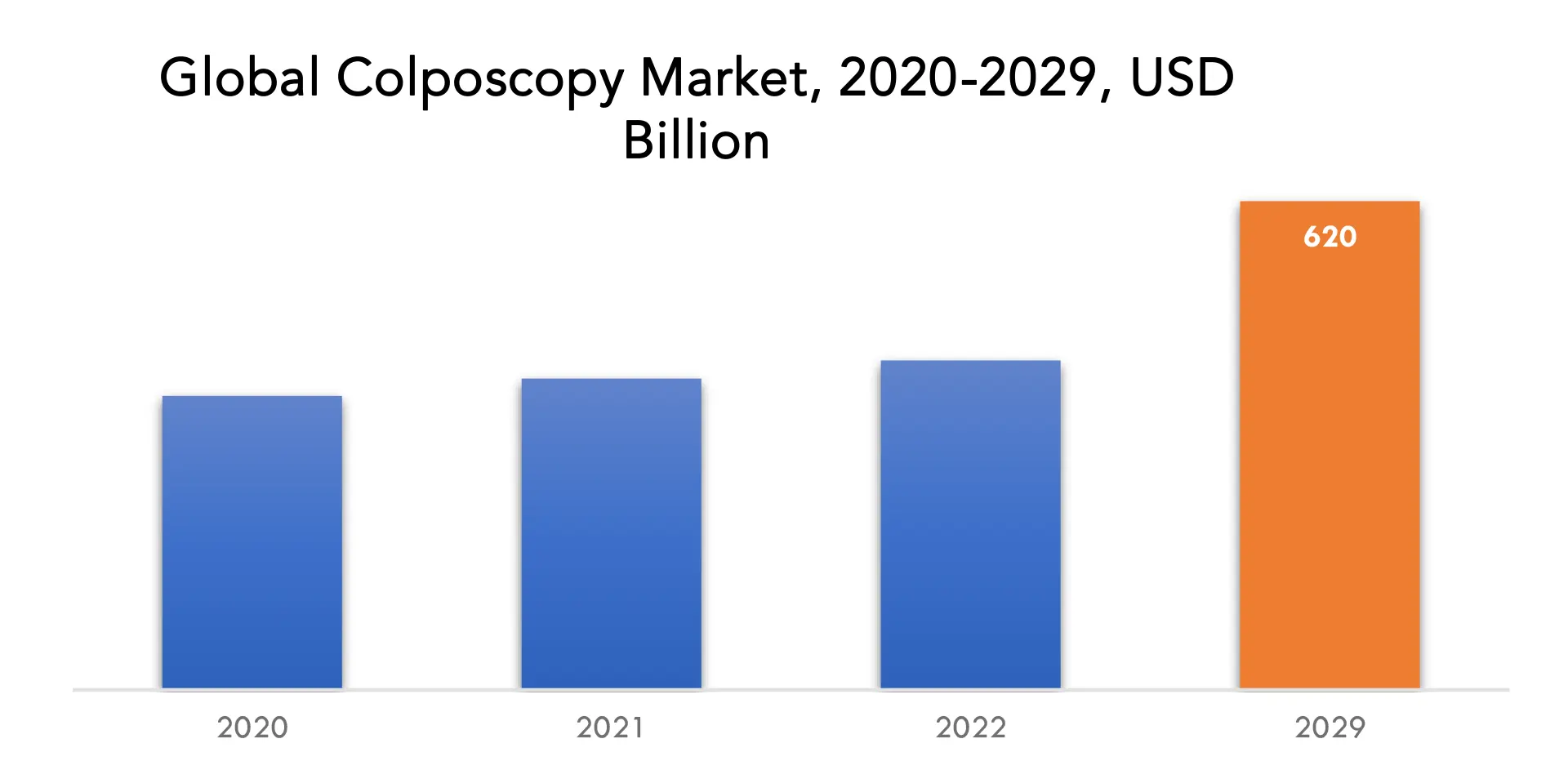

The colposcopy market is expected to grow at 5.8% CAGR from 2022 to 2029. It is expected to reach above USD 373 million by 2029 from USD 620 million in 2020.

Colposcopy is a medical treatment that looks for abnormalities in a woman’s cervix, vulva, and vagina. To observe these areas in detail, a specialized equipment called a colposcope, which is a magnifying device with a light source, is used. During the process, a healthcare expert will put a speculum into the vagina to enlarge the space and then examine the tissue with a colposcope.

Colposcopy is usually performed when a Pap smear or other cervical cancer screening test shows abnormal results. It can also be used to evaluate symptoms such as abnormal vaginal bleeding or discharge. During the procedure, the healthcare provider may take a small tissue sample for further testing, called a biopsy. Depending on the results of the colposcopy and biopsy, further treatment may be recommended, such as a cervical conization procedure to remove abnormal tissue or other cancer treatments.

Colposcopy is a common diagnostic procedure used to discover and diagnose abnormal cells in the cervix. The global colposcopy market is predicted to increase significantly in the future years, owing to a variety of key drivers. The rising global incidence of cervical cancer is one of the primary drivers of the colposcopy industry. The usage of colposcopy as a diagnostic technique is predicted to increase in tandem with the rising incidence of cervical cancer, boosting market growth.

The growing acceptance of minimally invasive surgical treatments is another driver of the colposcopy market. Colposcopy is a non-surgical diagnostic procedure that allows doctors to inspect the cervix without requiring surgery. As a result, colposcopy is increasingly being used to diagnose cervical cancer instead of more invasive procedures such as cone biopsy. This trend is predicted to continue as individuals and healthcare providers alike seek less invasive methods for cervical cancer diagnosis and treatment.

The global colposcopy market is expected to see significant growth opportunities in the coming years, driven by factors such as increasing prevalence of cervical cancer, rising awareness about early cancer detection, and technological advancements in colposcopy devices. The Asia-Pacific region is expected to witness the fastest growth, due to a large patient population and increasing healthcare expenditure.

The colposcopy market may face several restraints, including limited accessibility to healthcare facilities in some regions, lack of awareness about cervical cancer screening, and high costs associated with colposcopy procedures. Additionally, the availability of alternative screening methods such as HPV testing and Pap smear tests may affect the demand for colposcopy procedures.

The COVID-19 pandemic has had an impact on the colposcopy business because to delays in routine screening and elective treatments. As a result of the pandemic, patient loads have decreased and hospital resources have been devoted towards COVID-19 patients. The market is projected to rebound as vaccinations become available and the healthcare system recovers to pre-pandemic levels. Furthermore, there is a growing trend towards the usage of digital colposcopy technologies, which may fuel future market expansion.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Million) |

| Segmentation | By Type, By Portability, By, Application, By End-User By Region |

| By Type |

|

| By Portability |

|

| By Application |

|

| By End-User |

|

| By Region |

|

Colposcopy Market Segment Analysis

The colposcopy market is segmented based on type, portability, application, end-user and region.

In terms of type, the colposcopy market can be divided into two categories: optical and digital technologies. Optical colposcopes magnify and visualize the cervix using light and lenses, whereas digital colposcopes employ digital images and software for visualization and analysis. Digital colposcopes are becoming more popular because to enhanced features like as image recording and storage, as well as telemedicine possibilities.

Based on portability, the colposcopy market may be divided into three categories: fixed, portable, and handheld. Portable devices are more convenient for mobile screening and diagnosis than fixed devices, which are commonly utilized in hospitals and clinics. Handheld devices are less expensive and can be employed in low-resource environments, although their capabilities may be limited when compared to fixed or portable devices.

Based on application, the colposcopy market can be divided into applications, which include cervical cancer screening, abnormal cervical cell diagnosis, and genital wart identification. Because of the high incidence of cervical cancer and the increasing acceptance of early screening programmes, cervical cancer screening is the most popular application category. A key application section is the diagnosis of aberrant cervical cells, which aids in the detection of precancerous diseases.

Colposcopy Market Players

Key companies in the global market CooperSurgical Inc, Olympus Corporation, Karl Storz Gmbh & Co. KG, Danaher Corporation, Boston Scientific Corporation, Mckesson Corporation, Bovie Medical Corporation, Gynex Corporation, Wallach Surgical Devices, medline Industries Inc, sklar surgical instruments.

Recent developments:

20-12-2022: Olympus Corporation (Olympus) announced it had signed a definitive agreement to acquire London-based Odin Vision, a cloud-AI endoscopy company with a strong portfolio of commercially available computer-aided detection/diagnostic (CAD) solutions and a deep innovation pipeline of cloud-enabled applications, for up to GBP 66 million (approx. 11 billion JPY / 79 million USD) in upfront and milestone-based payments.

05-08-2023: Hologic Inc. (Nasdaq: HOLX), a global leader in women’s health, announced a partnership with drafted NFL cornerback Kelee Ringo and his mother, breast cancer survivor Tralee Hale, to educate women on the importance of prioritizing annual mammograms and other key health screenings.

Who Should Buy? Or Key stakeholders

- Hospitals

- Clinics

- Healthcare

- Research

- Investors

- Academics Research

- Others

Colposcopy Market Regional Analysis

The Colposcopy market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

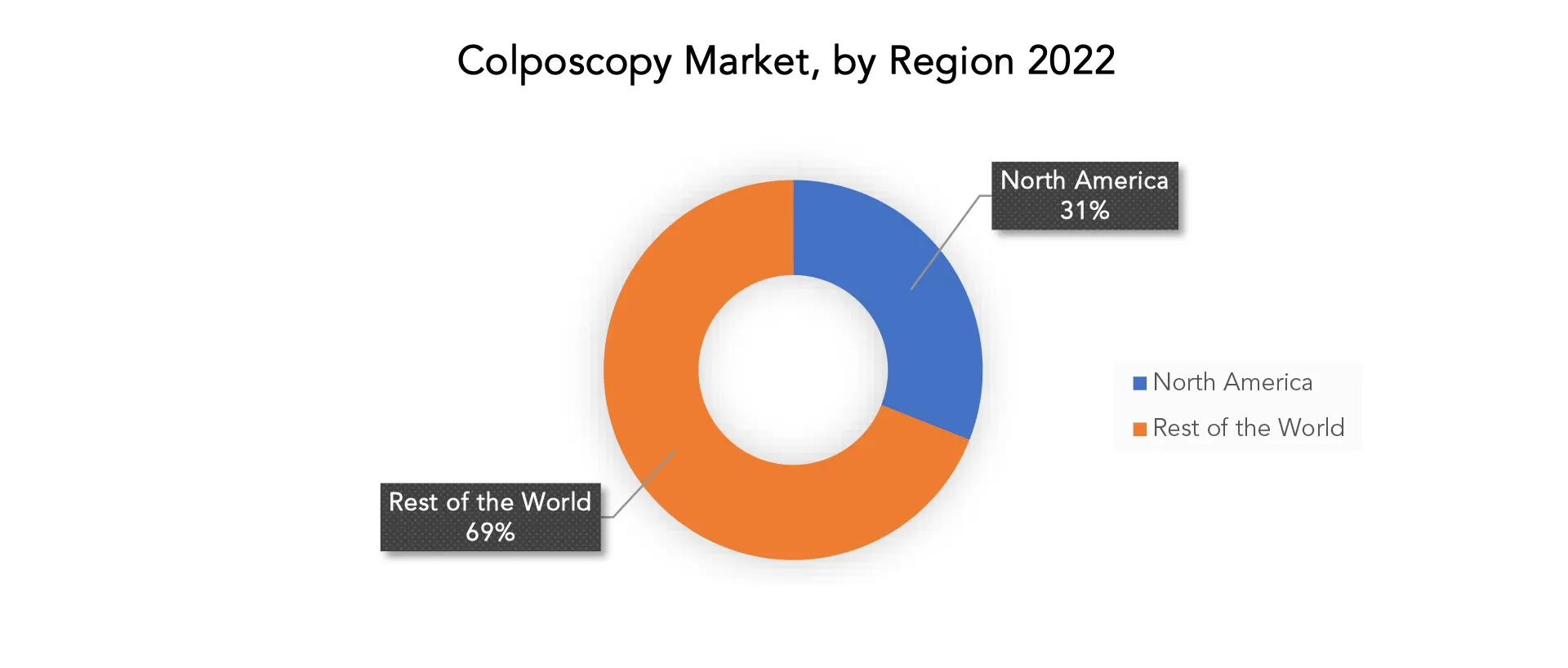

North America holds 31% of the total market share in colposcopy. The colposcopy market in North America is a growing industry focused on the diagnosis and treatment of cervical cancer. It is primarily driven by increasing awareness about the importance of cervical cancer screening, the growing incidence of HPV infections, and the development of new and advanced imaging technologies. Key players in the market include Carl Zeiss, CooperSurgical, Olympus Corporation, and Leisegang Medical. The United States is the largest market in the region, accounting for the majority of the demand for colposcopy devices and accessories.

The colposcopy market in the Asia Pacific region is expected to grow significantly in the coming years, driven by factors such as increasing awareness about cervical cancer screening, rising demand for minimally invasive diagnostic procedures, and improving healthcare infrastructure. The market is also expected to benefit from the presence of several key players in the region, such as Olympus Corporation, Carl Zeiss AG, and CooperSurgical Inc.

Key Market Segments: Colposcopy Market

Colposcopy Market by Type, 2020-2029, (USD Million)

- Optical

- Digital

Colposcopy Market by Portability, 2020-2029, (USD Million)

- Fixed

- Portable

- Handheld

Colposcopy Market by Applications, 2020-2029, (USD Million)

- Cervical Cancer Diagnostic

- Physical Examination

Colposcopy Market by End-User, 2020-2029, (USD Million)

- Hospitals

- Clinics

- Diagnostic Centers

Colposcopy Market by Region, 2020-2029, (USD Million)

- North America

- Asia Pacific

- Europe

- South America

- Middle East and Africa

Important Countries in All Regions Are Covered.

Exactitude Consultancy Application Key Objectives

- Increasing sales and market share

- Developing new Application

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the colposcopy market over the next 7 years?

- Who are the major players in the colposcopy market and what is their market share?

- What are the form industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, And Africa?

- How is the economic environment affecting the colposcopy market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the colposcopy market?

- What is the current and forecasted size and growth rate of the global colposcopy market?

- What are the key drivers of growth in the colposcopy market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the colposcopy market?

- What are the technological advancements and innovations in the colposcopy market and their impact on source development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the colposcopy market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the colposcopy market?

- What are the application offerings and specifications of leading players in the market?

- What is the pricing trend of colposcopy in the market and what is the impact of raw source prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA GENETIC MATERIALS

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL COLPOSCOPY OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON COLPOSCOPY MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL COLPOSCOPY OUTLOOK

- GLOBAL COLPOSCOPY MARKET BY TYPE (USD MILLION) 2020-2029

- OPTICAL

- DIGITAL

- GLOBAL COLPOSCOPY MARKET PORTABILITY (USD MILLION) 2020-2029

- FIXED

- PORTABLE

- HANDHELD

- GLOBAL COLPOSCOPY MARKET BY APPLICATION (USD MILLION) 2020-2029

- CERVICAL CANCER DIAGNOSTIC

- PHYSICAL EXAMINATION

- GLOBAL COLPOSCOPY MARKET BY END-USER (USD MILLION) 2020-2029

- HOSPITALS

- CLINICS

- DIAGNOSTIC CENTERS

- GLOBAL COLPOSCOPY MARKET BY REGION (USD MILLION) 2020-2029

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, TYPES OFFERED, RECENT DEVELOPMENTS)

- COOPER SURGICAL INC

- OLYMPUS CORPORATION

- KARL STORZ GMBH & CO.KG

- DANHAER SCIENTIFIC CORPORATION

- MCKESSON CORPORATION

- BOVIE MEDICAL CORPORATION

- GYNEX CORPORATION

- WALLACH SURGICAL DEVICES

- MEDLINE INDUSTRIES INC

- SKLAR SURGICAL INSTRUMENTS *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL COLPOSCOPY MARKET BY TYPE (USD MILLION) 2020-2029

TABLE 2 GLOBAL COLPOSCOPY MARKET BY END-USER (USD MILLION) 2020-2029

TABLE 3 GLOBAL COLPOSCOPY MARKET PORTABILITY (USD MILLION) 2020-2029

TABLE 4 GLOBAL COLPOSCOPY MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 5 GLOBAL COLPOSCOPY MARKET BY REGION (USD MILLION) 2020-2029

TABLE 6 NORTH AMERICA COLPOSCOPY MARKET BY COUNTRY (USD MILLION) 2020-2029

TABLE 7 NORTH AMERICA COLPOSCOPY MARKET BY TYPE (USD MILLION) 2020-2029

TABLE 8 NORTH AMERICA COLPOSCOPY MARKET BY END-USER (USD MILLION) 2020-2029

TABLE 9 NORTH AMERICA COLPOSCOPY MARKET PORTABILITY (USD MILLION) 2020-2029

TABLE 10 NORTH AMERICA COLPOSCOPY MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 11 US COLPOSCOPY MARKET BY TYPE (USD MILLION) 2020-2029

TABLE 12 US COLPOSCOPY MARKET BY END-USER (USD MILLION) 2020-2029

TABLE 13 US COLPOSCOPY MARKET PORTABILITY (USD MILLION) 2020-2029

TABLE 14 US COLPOSCOPY MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 15 CANADA COLPOSCOPY MARKET BY TYPE (USD MILLION) 2020-2029

TABLE 16 CANADA COLPOSCOPY MARKET BY END-USER (USD MILLION) 2020-2029

TABLE 17 CANADA COLPOSCOPY MARKET PORTABILITY (USD MILLION) 2020-2029

TABLE 18 CANADA COLPOSCOPY MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 19 MEXICO COLPOSCOPY MARKET BY TYPE (USD MILLION) 2020-2029

TABLE 20 MEXICO COLPOSCOPY MARKET BY END-USER (USD MILLION) 2020-2029

TABLE 21 MEXICO COLPOSCOPY MARKET PORTABILITY (USD MILLION) 2020-2029

TABLE 22 MEXICO COLPOSCOPY MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 23 SOUTH AMERICA COLPOSCOPY MARKET BY COUNTRY (USD MILLION) 2020-2029

TABLE 24 SOUTH AMERICA COLPOSCOPY MARKET BY TYPE (USD MILLION) 2020-2029

TABLE 25 SOUTH AMERICA COLPOSCOPY MARKET BY END-USER (USD MILLION) 2020-2029

TABLE 26 SOUTH AMERICA COLPOSCOPY MARKET PORTABILITY (USD MILLION) 2020-2029

TABLE 27 SOUTH AMERICA COLPOSCOPY MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 28 BRAZIL COLPOSCOPY MARKET BY TYPE (USD MILLION) 2020-2029

TABLE 29 BRAZIL COLPOSCOPY MARKET BY END-USER (USD MILLION) 2020-2029

TABLE 30 BRAZIL COLPOSCOPY MARKET PORTABILITY (USD MILLION) 2020-2029

TABLE 31 BRAZIL COLPOSCOPY MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 32 ARGENTINA COLPOSCOPY MARKET BY TYPE (USD MILLION) 2020-2029

TABLE 33 ARGENTINA COLPOSCOPY MARKET BY END-USER (USD MILLION) 2020-2029

TABLE 34 ARGENTINA COLPOSCOPY MARKET PORTABILITY (USD MILLION) 2020-2029

TABLE 35 ARGENTINA COLPOSCOPY MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 36 COLOMBIA COLPOSCOPY MARKET BY TYPE (USD MILLION) 2020-2029

TABLE 37 COLOMBIA COLPOSCOPY MARKET BY END-USER (USD MILLION) 2020-2029

TABLE 38 COLOMBIA COLPOSCOPY MARKET PORTABILITY (USD MILLION) 2020-2029

TABLE 39 COLOMBIA COLPOSCOPY MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 40 REST OF SOUTH AMERICA COLPOSCOPY MARKET BY TYPE (USD MILLION) 2020-2029

TABLE 41 REST OF SOUTH AMERICA COLPOSCOPY MARKET BY END-USER (USD MILLION) 2020-2029

TABLE 42 REST OF SOUTH AMERICA COLPOSCOPY MARKET PORTABILITY (USD MILLION) 2020-2029

TABLE 43 REST OF SOUTH AMERICA COLPOSCOPY MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 44 ASIA-PACIFIC COLPOSCOPY MARKET BY COUNTRY (USD MILLION) 2020-2029

TABLE 45 ASIA-PACIFIC COLPOSCOPY MARKET BY TYPE (USD MILLION) 2020-2029

TABLE 46 ASIA-PACIFIC COLPOSCOPY MARKET BY END-USER (USD MILLION) 2020-2029

TABLE 47 ASIA-PACIFIC COLPOSCOPY MARKET PORTABILITY (USD MILLION) 2020-2029

TABLE 48 ASIA-PACIFIC COLPOSCOPY MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 49 INDIA COLPOSCOPY MARKET BY TYPE (USD MILLION) 2020-2029

TABLE 50 INDIA COLPOSCOPY MARKET BY END-USER (USD MILLION) 2020-2029

TABLE 51 INDIA COLPOSCOPY MARKET PORTABILITY (USD MILLION) 2020-2029

TABLE 52 INDIA COLPOSCOPY MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 53 CHINA COLPOSCOPY MARKET BY TYPE (USD MILLION) 2020-2029

TABLE 54 CHINA COLPOSCOPY MARKET BY END-USER (USD MILLION) 2020-2029

TABLE 55 CHINA COLPOSCOPY MARKET PORTABILITY (USD MILLION) 2020-2029

TABLE 56 CHINA COLPOSCOPY MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 57 JAPAN COLPOSCOPY MARKET BY TYPE (USD MILLION) 2020-2029

TABLE 58 JAPAN COLPOSCOPY MARKET BY END-USER (USD MILLION) 2020-2029

TABLE 59 JAPAN COLPOSCOPY MARKET PORTABILITY (USD MILLION) 2020-2029

TABLE 60 JAPAN COLPOSCOPY MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 61 SOUTH KOREA COLPOSCOPY MARKET BY TYPE (USD MILLION) 2020-2029

TABLE 62 SOUTH KOREA COLPOSCOPY MARKET BY END-USER (USD MILLION) 2020-2029

TABLE 63 SOUTH KOREA COLPOSCOPY MARKET PORTABILITY (USD MILLION) 2020-2029

TABLE 64 SOUTH KOREA COLPOSCOPY MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 65 AUSTRALIA COLPOSCOPY MARKET BY TYPE (USD MILLION) 2020-2029

TABLE 66 AUSTRALIA COLPOSCOPY MARKET BY END-USER (USD MILLION) 2020-2029

TABLE 67 AUSTRALIA COLPOSCOPY MARKET PORTABILITY (USD MILLION) 2020-2029

TABLE 68 AUSTRALIA COLPOSCOPY MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 69 SOUTH-EAST ASIA COLPOSCOPY MARKET BY TYPE (USD MILLION) 2020-2029

TABLE 70 SOUTH-EAST ASIA COLPOSCOPY MARKET BY END-USER (USD MILLION) 2020-2029

TABLE 71 SOUTH-EAST ASIA COLPOSCOPY MARKET PORTABILITY (USD MILLION) 2020-2029

TABLE 72 SOUTH-EAST ASIA COLPOSCOPY MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 73 REST OF ASIA PACIFIC COLPOSCOPY MARKET BY TYPE (USD MILLION) 2020-2029

TABLE 74 REST OF ASIA PACIFIC COLPOSCOPY MARKET BY END-USER (USD MILLION) 2020-2029

TABLE 75 REST OF ASIA PACIFIC COLPOSCOPY MARKET PORTABILITY (USD MILLION) 2020-2029

TABLE 76 REST OF ASIA PACIFIC COLPOSCOPY MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 77 EUROPE COLPOSCOPY MARKET BY COUNTRY (USD MILLION) 2020-2029

TABLE 78 EUROPE COLPOSCOPY MARKET BY TYPE (USD MILLION) 2020-2029

TABLE 79 EUROPE COLPOSCOPY MARKET BY END-USER (USD MILLION) 2020-2029

TABLE 80 EUROPE COLPOSCOPY MARKET PORTABILITY (USD MILLION) 2020-2029

TABLE 81 EUROPE COLPOSCOPY MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 82 GERMANY COLPOSCOPY MARKET BY TYPE (USD MILLION) 2020-2029

TABLE 83 GERMANY COLPOSCOPY MARKET BY END-USER (USD MILLION) 2020-2029

TABLE 84 GERMANY COLPOSCOPY MARKET PORTABILITY (USD MILLION) 2020-2029

TABLE 85 GERMANY COLPOSCOPY MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 86 UK COLPOSCOPY MARKET BY TYPE (USD MILLION) 2020-2029

TABLE 87 UK COLPOSCOPY MARKET BY END-USER (USD MILLION) 2020-2029

TABLE 88 UK COLPOSCOPY MARKET PORTABILITY (USD MILLION) 2020-2029

TABLE 89 UK COLPOSCOPY MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 90 FRANCE COLPOSCOPY MARKET BY TYPE (USD MILLION) 2020-2029

TABLE 91 FRANCE COLPOSCOPY MARKET BY END-USER (USD MILLION) 2020-2029

TABLE 92 FRANCE COLPOSCOPY MARKET PORTABILITY (USD MILLION) 2020-2029

TABLE 93 FRANCE COLPOSCOPY MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 94 ITALY COLPOSCOPY MARKET BY TYPE (USD MILLION) 2020-2029

TABLE 95 ITALY COLPOSCOPY MARKET BY END-USER (USD MILLION) 2020-2029

TABLE 96 ITALY COLPOSCOPY MARKET PORTABILITY (USD MILLION) 2020-2029

TABLE 97 ITALY COLPOSCOPY MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 98 SPAIN COLPOSCOPY MARKET BY TYPE (USD MILLION) 2020-2029

TABLE 99 SPAIN COLPOSCOPY MARKET BY END-USER (USD MILLION) 2020-2029

TABLE 100 SPAIN COLPOSCOPY MARKET PORTABILITY (USD MILLION) 2020-2029

TABLE 101 SPAIN COLPOSCOPY MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 102 RUSSIA COLPOSCOPY MARKET BY TYPE (USD MILLION) 2020-2029

TABLE 103 RUSSIA COLPOSCOPY MARKET BY END-USER (USD MILLION) 2020-2029

TABLE 104 RUSSIA COLPOSCOPY MARKET PORTABILITY (USD MILLION) 2020-2029

TABLE 105 RUSSIA COLPOSCOPY MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 106 REST OF EUROPE COLPOSCOPY MARKET BY TYPE (USD MILLION) 2020-2029

TABLE 107 REST OF EUROPE COLPOSCOPY MARKET BY END-USER (USD MILLION) 2020-2029

TABLE 108 REST OF EUROPE COLPOSCOPY MARKET PORTABILITY (USD MILLION) 2020-2029

TABLE 109 REST OF EUROPE COLPOSCOPY MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 110 MIDDLE EAST AND AFRICA COLPOSCOPY MARKET BY COUNTRY (USD MILLION) 2020-2029

TABLE 111 MIDDLE EAST AND AFRICA COLPOSCOPY MARKET BY TYPE (USD MILLION) 2020-2029

TABLE 112 MIDDLE EAST AND AFRICA COLPOSCOPY MARKET BY END-USER (USD MILLION) 2020-2029

TABLE 113 MIDDLE EAST AND AFRICA COLPOSCOPY MARKET PORTABILITY (USD MILLION) 2020-2029

TABLE 114 MIDDLE EAST AND AFRICA COLPOSCOPY MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 115 UAE COLPOSCOPY MARKET BY TYPE (USD MILLION) 2020-2029

TABLE 116 UAE COLPOSCOPY MARKET BY END-USER (USD MILLION) 2020-2029

TABLE 117 UAE COLPOSCOPY MARKET PORTABILITY (USD MILLION) 2020-2029

TABLE 118 UAE COLPOSCOPY MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 119 SAUDI ARABIA COLPOSCOPY MARKET BY TYPE (USD MILLION) 2020-2029

TABLE 120 SAUDI ARABIA COLPOSCOPY MARKET BY END-USER (USD MILLION) 2020-2029

TABLE 121 SAUDI ARABIA COLPOSCOPY MARKET PORTABILITY (USD MILLION) 2020-2029

TABLE 122 SAUDI ARABIA COLPOSCOPY MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 123 SOUTH AFRICA COLPOSCOPY MARKET BY TYPE (USD MILLION) 2020-2029

TABLE 124 SOUTH AFRICA COLPOSCOPY MARKET BY END-USER (USD MILLION) 2020-2029

TABLE 125 SOUTH AFRICA COLPOSCOPY MARKET PORTABILITY (USD MILLION) 2020-2029

TABLE 126 SOUTH AFRICA COLPOSCOPY MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 127 REST OF MIDDLE EAST AND AFRICA COLPOSCOPY MARKET BY TYPE (USD MILLION) 2020-2029

TABLE 128 REST OF MIDDLE EAST AND AFRICA COLPOSCOPY MARKET BY END-USER (USD MILLION) 2020-2029

TABLE 129 REST OF MIDDLE EAST AND AFRICA COLPOSCOPY MARKET PORTABILITY (USD MILLION) 2020-2029

TABLE 130 REST OF MIDDLE EAST AND AFRICA COLPOSCOPY MARKET BY APPLICATION (USD MILLION) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL COLPOSCOPY MARKET BY TYPE, USD MILLION, 2020-2029

FIGURE 9 GLOBAL COLPOSCOPY MARKET BY END-USER, USD MILLION, 2020-2029

FIGURE 10 GLOBAL COLPOSCOPY MARKET BY APPLICATION, USD MILLION, 2020-2029

FIGURE 11 GLOBAL COLPOSCOPY MARKET BY GENETIC MATERIAL, USD MILLION, 2020-2029

FIGURE 12 GLOBAL COLPOSCOPY MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 13 GLOBAL COLPOSCOPY MARKET BY TYPE, USD MILLION, 2021

FIGURE 14 GLOBAL SENSOR FUSIONBY END-USER, USD MILLION, 2021

FIGURE 15 GLOBAL SENSOR FUSIONBY APPLICATION, USD MILLION, 2021

FIGURE 16 GLOBAL SENSOR FUSIONBY GENETIC MATERIAL, USD MILLION, 2021

FIGURE 17 GLOBAL SENSOR FUSIONBY REGION, USD MILLION, 2021

FIGURE 18 PORTER’S FIVE FORCES MODEL

FIGURE 19 MARKET SHARE ANALYSIS

FIGURE 20 COOPER SURGICL INC: COMPANY SNAPSHOT

FIGURE 21 OLUMPUS CORPORATION: COMPANY SNAPSHOT

FIGURE 22 KARL STORZ GMBH & CO.KG: COMPANY SNAPSHOT

FIGURE 23 DANAHER CORPORATION: COMPANY SNAPSHOT

FIGURE 24 BOSTON SCIENTIFIC CORPORATION: COMPANY SNAPSHOT

FIGURE 25 MCKESSON CORPORATION: COMPANY SNAPSHOT

FIGURE 26 BOVIE MEDICAL CORPORATION: COMPANY SNAPSHOT

FIGURE 27 GYNEX CORPORATION: COMPANY SNAPSHOT

FIGURE 28 WALLACH SURGICAL DEVICES: COMPANY SNAPSHOT

FIGURE 29 MEDLINE INDUSTRIES INC: COMPANY SNAPSHOT

FIGURE 30 SKLAR SURGICAL INSTRUMENTS: COMPANY SNAPSHOT

FAQ

The colposcopy market is expected to grow at 5.8% CAGR from 2022 to 2029. It is expected to reach above USD 373 million by 2029 from USD 620 million in 2020.

North America possess 31 % of the total market size of colposcopy market.

Colposcopy is a common diagnostic procedure used to discover and diagnose abnormal cells in the cervix. The global colposcopy market is predicted to increase significantly in the future years, owing to a variety of key drivers. The rising global incidence of cervical cancer is one of the primary drivers of the colposcopy industry. The usage of colposcopy as a diagnostic technique is predicted to increase in tandem with the rising incidence of cervical cancer, boosting market growth.

In terms of type, the colposcopy market can be divided into two categories: optical and digital technologies. Optical colposcopes magnify and visualize the cervix using light and lenses, whereas digital colposcopes employ digital images and software for visualization and analysis. Digital colposcopes are becoming more popular because to enhanced features like as image recording and storage, as well as telemedicine possibilities.

North America holds 31% of the total market share in colposcopy. The colposcopy market in North America is a growing industry focused on the diagnosis and treatment of cervical cancer. It is primarily driven by increasing awareness about the importance of cervical cancer screening, the growing incidence of HPV infections, and the development of new and advanced imaging technologies. Key players in the market include Carl Zeiss, CooperSurgical, Olympus Corporation, and Leisegang Medical. The United States is the largest market in the region, accounting for the majority of the demand for colposcopy devices and accessories.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.